Grundlæggende statistik

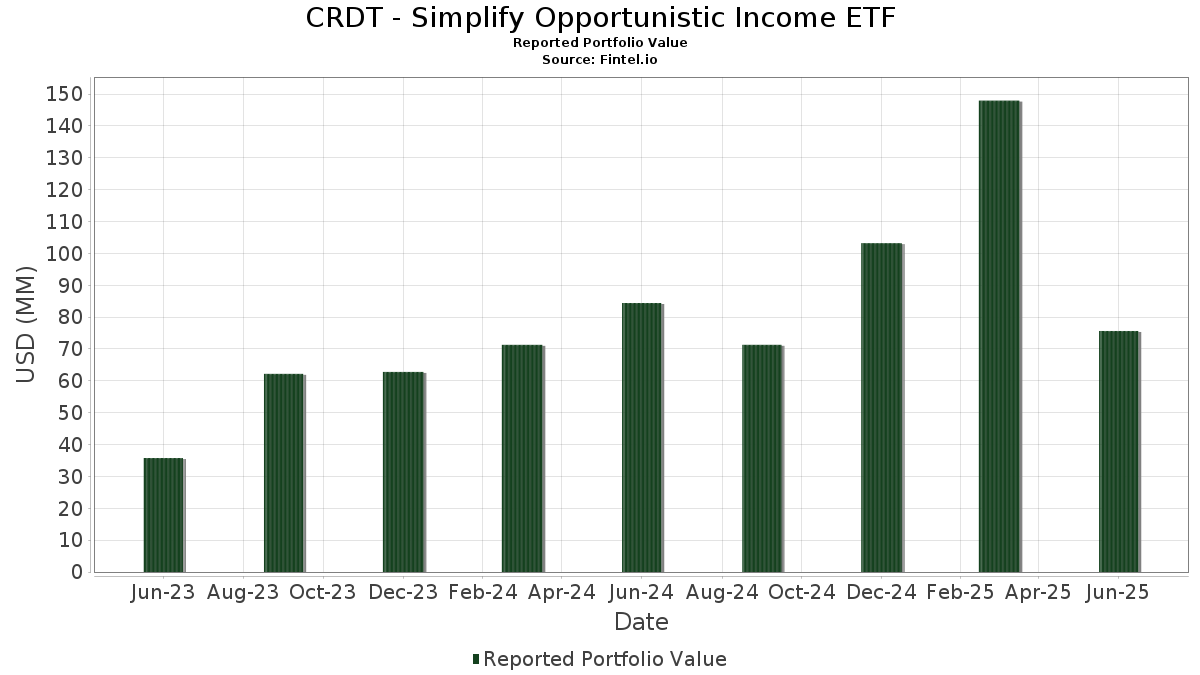

| Porteføljeværdi | $ 75.650.833 |

| Nuværende stillinger | 78 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

CRDT - Simplify Opportunistic Income ETF har afsløret 78 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 75.650.833 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). CRDT - Simplify Opportunistic Income ETFs største beholdninger er NEW RESIDENTIAL INVESTMENT CORP SER D 7%/VAR PFD PERP (US:US64828T7063) , Rithm Capital Corp. - Preferred Stock (US:RITM.PRC) , New York Cmnty Bancorp Inc Bond (US:US649445AC78) , Centurytel Inc Senior Notes-p 7.6% 09/15/39 (US:US156700AM80) , and Chimera Investment Corporation - Preferred Stock (US:CIM.PRB) . CRDT - Simplify Opportunistic Income ETFs nye stillinger omfatter New York Cmnty Bancorp Inc Bond (US:US649445AC78) , Centurytel Inc Senior Notes-p 7.6% 09/15/39 (US:US156700AM80) , New Economy Assets Phase 1 Sponsor LLC (US:US643821AB76) , Navient Private Education Refi Loan Trust 2021-B, Series 2021-BA, Class R (US:US63942LAC63) , and Energy Transfer Operating LP (US:US29278NAE31) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 5,84 | 7,4797 | 7,4797 | ||

| 4,67 | 5,9819 | 5,9819 | ||

| 2,33 | 2,9913 | 2,9913 | ||

| 1,96 | 2,5161 | 2,5161 | ||

| 1,32 | 1,6933 | 1,6933 | ||

| 1,17 | 1,5005 | 1,5005 | ||

| 0,11 | 2,69 | 3,4530 | 1,4963 | |

| 0,11 | 2,69 | 3,4437 | 1,4809 | |

| 1,15 | 1,4792 | 1,4792 | ||

| 1,01 | 1,2909 | 1,2909 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,41 | 0,5260 | -2,7354 | ||

| 0,09 | 0,79 | 1,0127 | -2,0853 | |

| 0,08 | 0,54 | 0,6890 | -0,8234 | |

| 0,06 | 1,18 | 1,5168 | -0,6317 | |

| -0,45 | -0,5780 | -0,5780 | ||

| 0,77 | 0,9845 | -0,4181 | ||

| 0,50 | 0,6407 | -0,3643 | ||

| 0,14 | 1,60 | 2,0555 | -0,1414 | |

| 0,01 | 0,0191 | -0,0993 | ||

| 0,01 | 0,03 | 0,0423 | -0,0791 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Bill / DBT (US912797QW07) | 5,84 | 7,4797 | 7,4797 | ||||||

| United States Treasury Bill / DBT (US912797QL42) | 4,67 | 5,9819 | 5,9819 | ||||||

| US64828T7063 / NEW RESIDENTIAL INVESTMENT CORP SER D 7%/VAR PFD PERP | 0,11 | 39,72 | 2,69 | 38,51 | 3,4530 | 1,4963 | |||

| RITM.PRC / Rithm Capital Corp. - Preferred Stock | 0,11 | 41,19 | 2,69 | 37,72 | 3,4437 | 1,4809 | |||

| Zayo Issuer LLC / ABS-O (US98919WAE30) | 2,57 | 1,62 | 3,2965 | 0,7510 | |||||

| PennyMac Corp / DBT (US70932AAH68) | 2,33 | 2,9913 | 2,9913 | ||||||

| Uniti Fiber Abs Issuer Llc / ABS-O (US91326EAC93) | 2,07 | 1,42 | 2,6533 | 0,6000 | |||||

| Government National Mortgage Association / ABS-MBS (US38385C4J45) | 1,96 | 2,5161 | 2,5161 | ||||||

| US649445AC78 / New York Cmnty Bancorp Inc Bond | 1,89 | -3,08 | 2,4233 | 0,4611 | |||||

| US156700AM80 / Centurytel Inc Senior Notes-p 7.6% 09/15/39 | 1,85 | 8,05 | 2,3732 | 0,6485 | |||||

| CIM.PRB / Chimera Investment Corporation - Preferred Stock | 0,07 | 0,00 | 1,83 | 2,30 | 2,3405 | 0,5449 | |||

| ALLO Issuer LLC / ABS-O (US01983KAS33) | 1,75 | 1,57 | 2,2453 | 0,5101 | |||||

| US643821AB76 / New Economy Assets Phase 1 Sponsor LLC | 1,61 | 0,31 | 2,0591 | 0,4481 | |||||

| US63942LAC63 / Navient Private Education Refi Loan Trust 2021-B, Series 2021-BA, Class R | 1,61 | -6,09 | 2,0572 | 0,3381 | |||||

| RITM / Rithm Capital Corp. | 0,14 | -25,52 | 1,60 | -26,56 | 2,0555 | -0,1414 | |||

| Global Atlantic Fin Co / DBT (US37959GAG29) | 1,56 | 50,38 | 2,0049 | 0,9587 | |||||

| Elmwood CLO XII Ltd / ABS-CBDO (US29003CAJ80) | 1,53 | -9,36 | 1,9607 | 0,2623 | |||||

| Multifamily Connecticut Avenue Securities Trust 2025-01 / ABS-MBS (US62549CAC55) | 1,32 | 1,6933 | 1,6933 | ||||||

| Radnor Re 2024-1 Ltd / ABS-MBS (US75049AAC62) | 1,19 | -0,08 | 1,5229 | 0,3268 | |||||

| NLY / Annaly Capital Management, Inc. | 0,06 | -40,20 | 1,18 | -44,62 | 1,5168 | -0,6317 | |||

| Point Securitization Trust 2025-1 / ABS-O (US73072DAC56) | 1,17 | 1,5005 | 1,5005 | ||||||

| US29278NAE31 / Energy Transfer Operating LP | 1,15 | 1,4792 | 1,4792 | ||||||

| US337930AD30 / Flagstar Bancorp Inc | 1,04 | 0,00 | 1,3281 | 0,2853 | |||||

| Hertz Vehicle Financing III LLC / ABS-O (US42806MDE66) | 1,01 | 1,2909 | 1,2909 | ||||||

| Anchorage Capital CLO 19 Ltd / ABS-CBDO (US03328KAA25) | 1,00 | 1,93 | 1,2860 | 0,2956 | |||||

| Milford Park CLO Ltd / ABS-CBDO (US59967DAG34) | 0,99 | 1,2647 | 1,2647 | ||||||

| Green Lakes Park CLO LLC / ABS-CBDO (US39310AAN00) | 0,98 | -0,91 | 1,2540 | 0,2609 | |||||

| Apidos CLO XLIII Ltd / ABS-CBDO (US03770JAJ97) | 0,95 | 1,2205 | 1,2205 | ||||||

| US377320AA45 / Glatfelter Corp | 0,94 | 1,2072 | 1,2072 | ||||||

| AMSR 2024-SFR2 Trust / ABS-O (US00179UAE82) | 0,94 | 1,08 | 1,2025 | 0,2690 | |||||

| US31769PAB67 / Assured Guaranty Municipal Holdings Inc | 0,93 | 1,09 | 1,1913 | 0,2661 | |||||

| Invitation Homes 2024-SFR1 Trust / ABS-O (US46188DAL29) | 0,92 | 3,48 | 1,1827 | 0,2849 | |||||

| GoldenTree Loan Management US CLO 16 Ltd / ABS-CBDO (US38123JAC45) | 0,91 | -9,21 | 1,1634 | 0,1580 | |||||

| Office Properties Income Trust / DBT (US67623CAG42) | 0,83 | 2,09 | 1,0629 | 0,2462 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-FIG5 / ABS-O (US79582MAE12) | 0,81 | -5,05 | 1,0362 | 0,1796 | |||||

| Chase Auto Credit Linked Notes Series 2025-1 / ABS-O (US46591HCX61) | 0,80 | 1,0284 | 1,0284 | ||||||

| AGNC / AGNC Investment Corp. | 0,09 | -73,25 | 0,79 | -74,35 | 1,0127 | -2,0853 | |||

| US69917BAE20 / Parallel 2020-1 Ltd | 0,79 | 1,0074 | 1,0074 | ||||||

| US500255AQ76 / Kohls Corp 6.875% Notes 12/15/37 | 0,77 | -44,91 | 0,9845 | -0,4181 | |||||

| BBCMS Mortgage Trust 2025-C32 / ABS-MBS (US07337AAV89) | 0,72 | -5,61 | 0,9269 | 0,1563 | |||||

| CIM / Chimera Investment Corporation | 0,05 | -27,83 | 0,71 | -22,05 | 0,9068 | -0,0054 | |||

| United States Treasury Bill / DBT (US912797QH30) | 0,70 | 0,8932 | 0,8932 | ||||||

| US534187BN88 / Lincoln National Corp | 0,69 | -15,80 | 0,8885 | 0,0606 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4G58) | 0,60 | -10,55 | 0,7718 | 0,0940 | |||||

| US 5YR NOTE (CBT) / DIR (000000000) | 0,58 | 0,7453 | 0,7453 | ||||||

| TWO / Two Harbors Investment Corp. | 0,05 | 71,77 | 0,57 | 38,41 | 0,7349 | 0,3183 | |||

| Huntington Bank Auto Credit-Linked Notes Series 2024-2 / ABS-O (US44644NAL38) | 0,56 | -10,11 | 0,7184 | 0,0916 | |||||

| AGNCL / AGNC Investment Corp. - Preferred Stock | 0,02 | 0,55 | 0,7024 | 0,7024 | |||||

| QVCGP / QVC Group Inc. - Preferred Stock | 0,08 | 34,33 | 0,54 | -64,27 | 0,6890 | -0,8234 | |||

| US056732AM27 / Bahamas Government International Bond | 0,53 | 2,11 | 0,6817 | 0,1568 | |||||

| US42806MBG33 / Hertz Vehicle Financing LLC, Series 2022-4A, Class D | 0,50 | -50,05 | 0,6407 | -0,3643 | |||||

| MFAN / MFA Financial, Inc. - Corporate Bond/Note | 0,02 | 0,00 | 0,50 | -0,80 | 0,6368 | 0,1326 | |||

| Wells Fargo Commercial Mortgage Trust 2024-5C2 / ABS-MBS (US95003UAM27) | 0,49 | -1,61 | 0,6291 | 0,1277 | |||||

| Apidos Clo Lii / ABS-CBDO (US03771QAC78) | 0,46 | -7,40 | 0,5945 | 0,0917 | |||||

| US698299BV52 / Panama Government International Bond | 0,46 | 4,57 | 0,5873 | 0,1466 | |||||

| Benchmark 2019-B9 Mortgage Trust / ABS-MBS (US08160JBA43) | 0,46 | -15,50 | 0,5870 | 0,0414 | |||||

| RILYZ / B. Riley Financial, Inc. - Corporate Bond/Note | 0,07 | 0,00 | 0,46 | -28,37 | 0,5862 | -0,0561 | |||

| Goodgreen 2024-1 Ltd / ABS-O (US38217YAC84) | 0,46 | 0,22 | 0,5853 | 0,1276 | |||||

| CIM.PRC / Chimera Investment Corporation - Preferred Stock | 0,02 | 0,00 | 0,45 | 0,22 | 0,5784 | 0,1254 | |||

| Huntington Bank Auto Credit-Linked Notes Series 2025-1 / ABS-O (US446438TA12) | 0,45 | -10,22 | 0,5750 | 0,0730 | |||||

| Benchmark 2021-B25 Mortgage Trust / ABS-MBS (US08163DAL10) | 0,41 | 0,73 | 0,5315 | 0,1181 | |||||

| USU0551UAB99 / Azul Investments LLP | 0,41 | -87,35 | 0,5260 | -2,7354 | |||||

| TWO.PRA / Two Harbors Investment Corp. - Preferred Stock | 0,02 | 0,00 | 0,38 | -7,09 | 0,4874 | 0,0760 | |||

| US35910EAC84 / Frontier Issuer, LLC 11.5%, Due 08/20/2053 | 0,32 | -0,63 | 0,4045 | 0,0850 | |||||

| US55292WAA80 / MC Brazil Downstream Trading SARL | 0,31 | -4,04 | 0,3969 | 0,0723 | |||||

| PRET 2025-NPL6 LLC / ABS-O (US740936AA73) | 0,25 | 0,3203 | 0,3203 | ||||||

| Magnetite 50 Ltd / ABS-CBDO (US55956NAC11) | 0,24 | 0,3139 | 0,3139 | ||||||

| USP7807HAT25 / Petroleos de Venezuela SA | 0,23 | -8,03 | 0,2945 | 0,0438 | |||||

| FBRT.PRE / Franklin BSP Realty Trust, Inc. - Preferred Stock | 0,01 | 0,00 | 0,23 | -0,44 | 0,2928 | 0,0622 | |||

| VINTY HLDG 5 SA NPV / EC (000000000) | 110,07 | 0,10 | 0,1337 | 0,1337 | |||||

| US541056AA53 / Logan Merger Sub Inc | 0,07 | -22,34 | 0,0937 | -0,0017 | |||||

| USD CALL VERSUS HKD PUT / DFE (000000000) | 0,07 | 0,0923 | 0,0923 | ||||||

| DIAMOND SPORTS N 01/03/28 / LON (US25277EAB83) | 0,06 | 0,00 | 0,0735 | 0,0159 | |||||

| DSG TOPCO PRIVATE EQUITY / EC (000000000) | 0,00 | 0,04 | 0,0529 | 0,0529 | |||||

| QVCGA / QVC Group Inc. | 0,01 | -98,00 | 0,03 | -72,50 | 0,0423 | -0,0791 | |||

| US05502FAC23 / Azul Investments LLP | 0,01 | -88,03 | 0,0191 | -0,0993 | |||||

| US33616CAC47 / First Republic Bank/CA | 0,01 | 0,00 | 0,0072 | 0,0016 | |||||

| GOL FINANCE SA ESCROW / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US ULTRA BOND CBT / DIR (000000000) | -0,45 | -0,5780 | -0,5780 |