Grundlæggende statistik

| Porteføljeværdi | $ 209.013.926 |

| Nuværende stillinger | 95 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

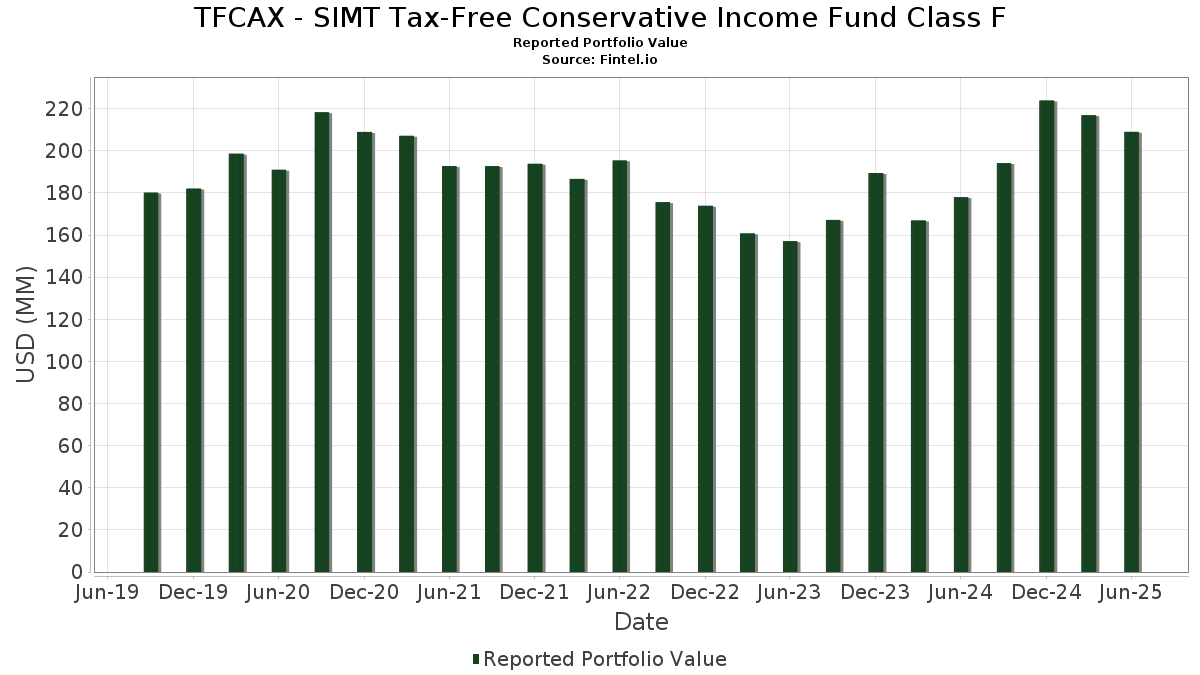

TFCAX - SIMT Tax-Free Conservative Income Fund Class F har afsløret 95 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 209.013.926 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). TFCAX - SIMT Tax-Free Conservative Income Fund Class Fs største beholdninger er IOWA ST FIN AUTH MIDWESTERN ECON DEV REVENUE (US:US46246XAD66) , SAINT LUCIE CNTY FL POLL CONTROL REVENUE DV&DP (US:US792070BH64) , Oregon State Facilities Authority DV&DP (US:US68608JXF38) , NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE (US:US64972GC444) , and Harris County Cultural Education Facilities Finance Corp (US:US414009PV67) . TFCAX - SIMT Tax-Free Conservative Income Fund Class Fs nye stillinger omfatter IOWA ST FIN AUTH MIDWESTERN ECON DEV REVENUE (US:US46246XAD66) , SAINT LUCIE CNTY FL POLL CONTROL REVENUE DV&DP (US:US792070BH64) , Oregon State Facilities Authority DV&DP (US:US68608JXF38) , NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE (US:US64972GC444) , and Harris County Cultural Education Facilities Finance Corp (US:US414009PV67) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 6,30 | 3,0184 | 2,7515 | ||

| 5,00 | 2,3957 | 2,3957 | ||

| 5,00 | 2,3956 | 2,3956 | ||

| 4,80 | 2,2997 | 2,2997 | ||

| 4,78 | 2,2878 | 2,2878 | ||

| 4,20 | 2,0123 | 2,0123 | ||

| 4,15 | 1,9883 | 1,9883 | ||

| 4,70 | 2,2518 | 1,7261 | ||

| 3,55 | 1,7015 | 1,7015 | ||

| 3,06 | 1,4668 | 1,4668 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 4,67 | 2,2351 | -0,1669 | ||

| 1,75 | 0,8384 | -0,1101 | ||

| 0,88 | 0,4216 | -0,0432 | ||

| 1,03 | 0,4935 | -0,0424 | ||

| 2,75 | 1,3152 | -0,0033 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-28 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US46246XAD66 / IOWA ST FIN AUTH MIDWESTERN ECON DEV REVENUE | 7,50 | 0,00 | 3,5933 | 0,0364 | ||

| WANAQUE BORO NJ BOROUGH OF WANAQUE NJ / DBT (US933680EQ96) | 7,35 | -0,27 | 3,5225 | 0,0262 | ||

| US792070BH64 / SAINT LUCIE CNTY FL POLL CONTROL REVENUE DV&DP | 7,10 | 0,00 | 3,4017 | 0,0345 | ||

| US68608JXF38 / Oregon State Facilities Authority DV&DP | 6,30 | 950,00 | 3,0184 | 2,7515 | ||

| LINCOLN NEBRASKA ELECTRIC MUNI COMMERCIAL PAPER / DBT (US53427TGY01) | 5,00 | 2,3957 | 2,3957 | |||

| PENNSYLVANIA ST HGR EDUCTNL FA PENNSYLVANIA HIGHER EDUCATIONAL FACILITIES AUTHORI / DBT (US70917TSY81) | 5,00 | 2,3956 | 2,3956 | |||

| US64972GC444 / NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE | 4,80 | 2,2997 | 2,2997 | |||

| US414009PV67 / Harris County Cultural Education Facilities Finance Corp | 4,78 | 2,2878 | 2,2878 | |||

| US362848RR67 / City of Gainesville FL Utilities System Revenue | 4,70 | 370,00 | 2,2518 | 1,7261 | ||

| US64966LCP40 / New York (City of), NY, Series 2013 D4, GO Bonds | 4,67 | -13,61 | 2,2351 | -0,1669 | ||

| US19648FVP60 / COLORADO HEALTH FACS AUTH VAR Due 5/15/2062 | 4,50 | 0,00 | 2,1560 | 0,0218 | ||

| US60528ABX19 / Mississippi Business Finance Corp. (Chevron USA, Inc.), Series 2010 G, RB | 4,23 | 182,00 | 2,0266 | 1,2380 | ||

| ROSWELL GA DEV AUTH REVENUE ROSWELL DEVELOPMENT AUTHORITY / DBT (US77853AAA16) | 4,20 | 2,0123 | 2,0123 | |||

| MASSACHUSETTS BAY TRANSPORTATION A MUNI COMMERCIAL PAPER / DBT (US57559JAY91) | 4,15 | 1,9883 | 1,9883 | |||

| US485106CP13 / KS SPL OBLG VAR-E | 4,10 | 0,00 | 1,9644 | 0,0199 | ||

| US837151WN58 / SC PUB SVC 19A SF WFRN 01-01-36/ML/BUS | 3,90 | 0,00 | 1,8685 | 0,0189 | ||

| SCHODACK NY CENTRL SCH DIST SCHODACK CENTRAL SCHOOL DISTRICT / DBT (US806891KM87) | 3,85 | -0,21 | 1,8451 | 0,0145 | ||

| NORTH CAROLINA ST GRANT ANTICI STATE OF NORTH CAROLINA / DBT (US658268EX17) | 3,55 | 1,7015 | 1,7015 | |||

| US74934RQJ85 / RBC MUNI PRODUCTS INC TRUST | 3,50 | 0,00 | 1,6769 | 0,0170 | ||

| US83756CW353 / SOUTH DAKOTA ST HSG DEV AUTH SOUTH DAKOTA HOUSING DEVELOPMENT AUTHORITY | 3,31 | 0,00 | 1,5859 | 0,0161 | ||

| CLACKAMAS & WASHINGTON CNTYS O CLACKAMAS & WASHINGTON COUNTIES SCHOOL DISTRICT NO / DBT (US178882QL38) | 3,06 | 1,4668 | 1,4668 | |||

| UNIVERSITY OF TEXAS REVENUE FINANC MUNI COMMERCIAL PAPER / DBT (US91514TAF12) | 3,00 | 1,4376 | 1,4376 | |||

| UNIVERSITY OF TEXAS MUNI COMMERICAL PAPER / DBT (US91514CPH87) | 3,00 | 1,4375 | 1,4375 | |||

| AUSTIN TX (CITY OF) MUNI COMMERCIAL PAPER / DBT (US05248NXK17) | 3,00 | 1,4375 | 1,4375 | |||

| UNIVERSITY OF TEXAS MUNI COMMERCIAL PAPER / DBT (US91514CME83) | 3,00 | 0,00 | 1,4373 | 0,0144 | ||

| US837031F323 / SOUTH CAROLINA ST JOBS-ECON DE SOUTH CAROLINA JOBS-ECONOMIC DEVELOPMENT AUTHORITY | 3,00 | 0,00 | 1,4373 | 0,0146 | ||

| US45200F6G90 / ILLINOIS ST FIN AUTH REVENUE | 3,00 | 1,4373 | 1,4373 | |||

| EGG HARBOR TWP NJ TOWNSHIP OF EGG HARBOR NJ / DBT (US282305HW43) | 2,85 | -0,24 | 1,3664 | 0,0108 | ||

| WATERFORD MI SCH DIST WATERFORD SCHOOL DISTRICT/MI / DBT (US941468D317) | 2,85 | -0,45 | 1,3647 | 0,0078 | ||

| US83756CD692 / SOUTH DAKOTA ST HSG DEV AUTH SOUTH DAKOTA HOUSING DEVELOPMENT AUTHORITY | 2,75 | -1,26 | 1,3152 | -0,0033 | ||

| NEW YORK NY CITY OF NEW YORK NY / DBT (US64966SMP82) | 2,70 | 1,2936 | 1,2936 | |||

| MASS WATER RESOURCES AUT MUNI COMMERCIAL PAPER / DBT (US57604YBJ38) | 2,60 | 1,2458 | 1,2458 | |||

| PENNSYLVANIA ST HGR EDUCTNL FA PENNSYLVANIA HIGHER EDUCATIONAL FACILITIES AUTHORI / DBT (US70917TSU69) | 2,60 | 1,2457 | 1,2457 | |||

| US64987DV688 / NEW YORK ST HSG FIN AGY NEW YORK STATE HOUSING FINANCE AGENCY | 2,50 | 0,00 | 1,1978 | 0,0121 | ||

| MET TRANSPRTN AUTH NY REVENUE METROPOLITAN TRANSPORTATION AUTHORITY / DBT (US59261AX281) | 2,50 | 38,89 | 1,1978 | 0,1528 | ||

| US60528ABM53 / Mississippi Business Finance Corp | 2,40 | 328,57 | 1,1499 | 0,8554 | ||

| US97689QNE25 / WISCONSIN ST HSG & ECON DEV AU WISCONSIN HOUSING & ECONOMIC DEVELOPMENT AUTHORITY | 2,32 | 0,00 | 1,1115 | 0,0113 | ||

| US196632BH51 / Colorado Springs (City of), CO, Series 2006 B, VRD RB | 2,30 | 0,00 | 1,1020 | 0,0112 | ||

| WARREN MI CONSOL SCH DIST WARREN CONSOLIDATED SCHOOLS / DBT (US935341S403) | 2,19 | -0,45 | 1,0484 | 0,0059 | ||

| DIST OF COLUMBIA INCOME TAX SE DISTRICT OF COLUMBIA INCOME TAX REVENUE / DBT (US25477GXS91) | 2,04 | 0,9785 | 0,9785 | |||

| US303823LR74 / Fairfax County Industrial Development Authority, Virginia Health Care | 1,96 | 0,00 | 0,9367 | 0,0095 | ||

| US917572TV13 / UTAH ST WTR FIN AGY REVENUE UTAH WATER FINANCE AGENCY | 1,85 | 0,00 | 0,8888 | 0,0090 | ||

| US71884SAC44 / Phoenix Industrial Development Authority, Arizona, Health Care Facilities Revenue Bonds, Mayo Clinic, Series 2014B | 1,80 | 800,00 | 0,8624 | 0,7385 | ||

| US88033SVX97 / TENDER OPTION BOND TRUST RECEIPTS / CTFS VARIOUS STATES | 1,77 | 0,00 | 0,8480 | 0,0086 | ||

| US882723H770 / State of Texas | 1,75 | -12,50 | 0,8384 | -0,1101 | ||

| US46246WAD83 / IOWA ST FIN AUTH POLL CONTROLF IOWA FINANCE AUTHORITY | 1,60 | 0,00 | 0,7666 | 0,0078 | ||

| US93978TTF65 / WASHINGTON ST HSG FIN COMMISSI WASHSG 12/46 ADJUSTABLE VAR | 1,58 | 0,00 | 0,7594 | 0,0077 | ||

| NEW HAMPSHIRE ST HSG FIN AUTH NEW HAMPSHIRE HOUSING FINANCE AUTHORITY / DBT (US64469D4P36) | 1,55 | -0,06 | 0,7426 | 0,0067 | ||

| MESA AZ UTILITY SYS REVENUE CITY OF MESA AZ UTILITY SYSTEM REVENUE / DBT (US5905452S79) | 1,53 | 0,7347 | 0,7347 | |||

| PLANO TX INDEP SCH DIST PLANO INDEPENDENT SCHOOL DISTRICT / DBT (US727199D730) | 1,52 | -0,59 | 0,7282 | 0,0033 | ||

| US790103AG04 / ST JAMES PARISH LA REV VAR-NUCSTEEL LA-SER B-1 | 1,50 | 0,00 | 0,7187 | 0,0073 | ||

| US98521YAA73 / YAVAPAI CNTY AZ INDL DEV AUTH INDUSTRIAL DEVELOPMENT AUTHORITY OF THE COUNTY OF | 1,50 | 0,00 | 0,7187 | 0,0073 | ||

| US20775CZF49 / CT HFA MTG 16B4 Q=WF V7 | 1,41 | 0,00 | 0,6732 | 0,0068 | ||

| US97689QCF19 / WI HSG and EDA HO 2016 C Q=RC V7 | 1,40 | 0,00 | 0,6708 | 0,0068 | ||

| US353187BT38 / FRANKLIN COUNTY OHIO HOSPITAL FACILITIES REVENUE NATIONWIDE CHILDREN'S HOSPITAL | 1,40 | 0,00 | 0,6708 | 0,0068 | ||

| HOUSTON TX INDEP SCH DIST HOUSTON INDEPENDENT SCHOOL DISTRICT / DBT (US442403RD52) | 1,39 | 0,6683 | 0,6683 | |||

| DU PAGE CNTY IL FOREST PRESERV DUPAGE COUNTY FOREST PRESERVE DISTRICT / DBT (US262651VF63) | 1,31 | -0,61 | 0,6267 | 0,0027 | ||

| MAPLEWOOD TWP NJ TOWNSHIP OF MAPLEWOOD NJ / DBT (US565624NG47) | 1,30 | -0,31 | 0,6242 | 0,0046 | ||

| MASSACHUSETTS BAY TRANSPORTATION A MUNI COMMERICAL PAPER / DBT (US57559GBP37) | 1,30 | 0,6228 | 0,6228 | |||

| LEANDER TX INDEP SCH DIST LEANDER INDEPENDENT SCHOOL DISTRICT / DBT (US521841N932) | 1,27 | 0,6070 | 0,6070 | |||

| LA PLATA CNTY CO SCH DIST #9-R DURANGO SCHOOL DISTRICT NO 9-R / DBT (US503768NA73) | 1,26 | -0,55 | 0,6031 | 0,0028 | ||

| COOK CNTY IL CMNTY CONSOL SCHD COOK COUNTY COMMUNITY CONSOLIDATED SCHOOL DISTRICT / DBT (US213669KR40) | 1,25 | -0,48 | 0,5965 | 0,0028 | ||

| KAREGNONDI WTR AUTH MI KAREGNONDI WATER AUTHORITY / DBT (US48563UCB52) | 1,19 | -0,58 | 0,5715 | 0,0026 | ||

| GLENDALE AZ WTR & SWR REVENUE CITY OF GLENDALE AZ WATER & SEWER REVENUE / DBT (US378352RY62) | 1,15 | 0,5511 | 0,5511 | |||

| WYOMING ST CMNTY DEV AUTH HSG WYOMING COMMUNITY DEVELOPMENT AUTHORITY / DBT (US98322QTB31) | 1,11 | 0,00 | 0,5318 | 0,0054 | ||

| LOUISIANA ST PUBLIC FACS AUTH LOUISIANA PUBLIC FACILITIES AUTHORITY / DBT (US546395W675) | 1,10 | 0,00 | 0,5270 | 0,0053 | ||

| US60528ABW36 / MISSISSIPPI ST BUSINESS FIN CO REGD V/R B/E 1.60000000 | 1,10 | 0,00 | 0,5270 | 0,0053 | ||

| US57419PRX95 / MARYLAND ST CMNTY DEV ADMIN DE MARYLAND COMMUNITY DEVELOPMENT ADMINISTRATION | 1,07 | 0,00 | 0,5127 | 0,0052 | ||

| TENNESSEE HSG DEV AGY RSDL FIN TENNESSEE HOUSING DEVELOPMENT AGENCY / DBT (US88046KPP56) | 1,03 | -8,85 | 0,4935 | -0,0424 | ||

| UNIV OF N TEXAS UNIV REVENUE UNIVERSITY OF NORTH TEXAS SYSTEM / DBT (US914729XB93) | 1,02 | 0,4871 | 0,4871 | |||

| HONEOYE FALLS-LIMA NY CENTRL S HONEOYE FALLS-LIMA CENTRAL SCHOOL DISTRICT / DBT (US438209MJ48) | 1,01 | 0,4834 | 0,4834 | |||

| MOUNT HOLLY TWP NJ TOWNSHIP OF MOUNT HOLLY NJ / DBT (US621545HT21) | 1,00 | -0,20 | 0,4797 | 0,0038 | ||

| OSSINING TOWN NY TOWN OF OSSINING NY / DBT (US688562FC60) | 1,00 | -0,40 | 0,4796 | 0,0032 | ||

| UNIVERSITY OF TEXAS MUNI COMMERCIAL PAPER / DBT (US91514YFR99) | 1,00 | 0,4792 | 0,4792 | |||

| UNIVERSITY OF TEXAS MUNI COMMERCIAL PAPER / DBT (US91514CMN82) | 1,00 | 0,10 | 0,4791 | 0,0049 | ||

| JANESVILLE WI SCH DIST JANESVILLE SCHOOL DISTRICT / DBT (US470878NE52) | 0,96 | -0,41 | 0,4614 | 0,0024 | ||

| NEW YORK CITY NY HSG DEV CORP NEW YORK CITY HOUSING DEVELOPMENT CORP / DBT (US64972KKK06) | 0,95 | 0,4552 | 0,4552 | |||

| HAMILTON OH CITY OF HAMILTON OH / DBT (US407756P829) | 0,92 | -0,22 | 0,4423 | 0,0033 | ||

| HALEDON NJ BOROUGH OF HALEDON NJ / DBT (US405540EZ45) | 0,90 | -0,22 | 0,4318 | 0,0034 | ||

| US956622P406 / West Virginia Hospital Finance Authority, Revenue Bonds, West Virginia University Health System Obligated Group, Refunding Variable Rate Series 2018C | 0,88 | -10,20 | 0,4216 | -0,0432 | ||

| KENTUCKY ST PUBLIC ENERGY AUTH KENTUCKY PUBLIC ENERGY AUTHORITY / DBT (US74440DFD12) | 0,83 | -0,36 | 0,3976 | 0,0029 | ||

| MANASQUAN NJ BOROUGH OF MANASQUAN NJ / DBT (US561773BN16) | 0,80 | -0,25 | 0,3840 | 0,0028 | ||

| POMPTON LAKES BORO NJ BOROUGH OF POMPTON LAKES NJ / DBT (US732233DB43) | 0,71 | 0,3380 | 0,3380 | |||

| ESSEX CNTY NJ IMPT AUTH ESSEX COUNTY IMPROVEMENT AUTHORITY / DBT (US296807MM90) | 0,66 | 0,3160 | 0,3160 | |||

| NEW MEXICO ST MTGE FIN AUTH MF NEW MEXICO MORTGAGE FINANCE AUTHORITY / DBT (US64719HEP10) | 0,64 | 0,3068 | 0,3068 | |||

| MIAMISBURG OH CITY OF MIAMISBURG OH / DBT (US593864MK43) | 0,60 | -0,33 | 0,2884 | 0,0023 | ||

| NEW HAMPSHIRE ST STATE OF NEW HAMPSHIRE / DBT (US64468FCA30) | 0,55 | 0,2631 | 0,2631 | |||

| US677632N986 / OHIO ST UNIV OHIO STATE UNIVERSITY/THE | 0,47 | 0,00 | 0,2276 | 0,0023 | ||

| US88035DJD84 / TENDER OPTION BOND TRUST RECEI TENDER OPTION BOND TRUST RECEIPTS/CERTIFICATES | 0,40 | 0,00 | 0,1916 | 0,0019 | ||

| CONROE TX INDEP SCH DIST CONROE INDEPENDENT SCHOOL DISTRICT / DBT (US2084184R15) | 0,38 | -0,52 | 0,1822 | 0,0010 | ||

| BUCKEYE AZ EXCISE TAX REVENUE CITY OF BUCKEYE AZ EXCISE TAX REVENUE / DBT (US118087DV48) | 0,36 | 0,1715 | 0,1715 | |||

| US018106JW57 / ALLEN TX INDEP SCH DIST | 0,32 | -0,31 | 0,1529 | 0,0007 | ||

| PENNSYLVANIA ST HSG FIN AGY SF PENNSYLVANIA HOUSING FINANCE AGENCY / DBT (US70879QS612) | 0,25 | 0,1215 | 0,1215 | |||

| PORT WASHINGTON-SAUKVILLE WI S PORT WASHINGTON-SAUKVILLE SCHOOL DISTRICT/WI / DBT (US735587JQ11) | 0,20 | 0,0973 | 0,0973 | |||

| US88034UNN45 / TENDER OPTION BOND TRUST RECEI TENDER OPTION BOND TRUST RECEIPTS/CERTIFICATES | 0,10 | 0,00 | 0,0455 | 0,0005 |