Grundlæggende statistik

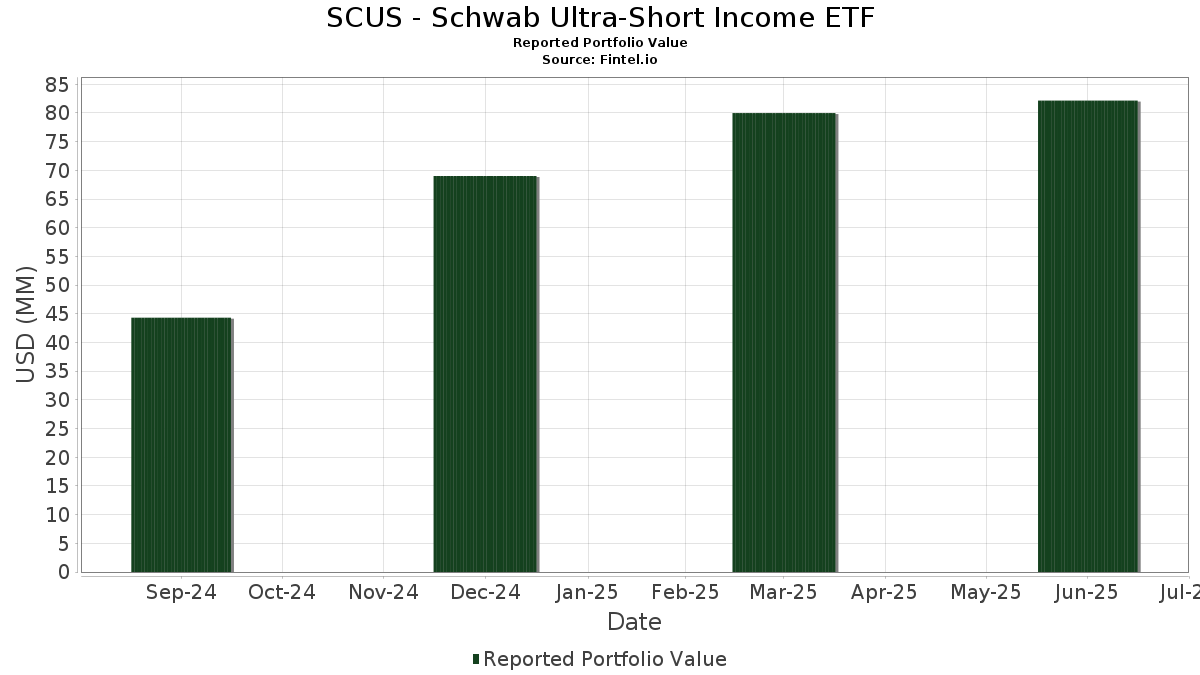

| Porteføljeværdi | $ 82.153.551 |

| Nuværende stillinger | 112 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

SCUS - Schwab Ultra-Short Income ETF har afsløret 112 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 82.153.551 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). SCUS - Schwab Ultra-Short Income ETFs største beholdninger er Morgan Stanley (US:US6174468V45) , Macquarie Bank Ltd. (AU:US55607KXN17) , Canadian Imperial Bank of Commerce (CA:US13607LWT69) , Bank of Montreal (CA:US06368LC537) , and Toyota Motor Corp (JP:US892331AP43) . SCUS - Schwab Ultra-Short Income ETFs nye stillinger omfatter Morgan Stanley (US:US6174468V45) , Macquarie Bank Ltd. (AU:US55607KXN17) , Canadian Imperial Bank of Commerce (CA:US13607LWT69) , Bank of Montreal (CA:US06368LC537) , and Toyota Motor Corp (JP:US892331AP43) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,69 | 3,2339 | 3,2339 | ||

| 2,49 | 2,9957 | 2,9957 | ||

| 2,40 | 2,8875 | 2,8875 | ||

| 2,40 | 2,8870 | 2,8870 | ||

| 2,30 | 2,7680 | 2,7680 | ||

| 2,17 | 2,6118 | 2,6118 | ||

| 1,97 | 2,3695 | 2,3695 | ||

| 1,70 | 2,0460 | 2,0460 | ||

| 1,50 | 1,8047 | 1,8047 | ||

| 1,50 | 1,8039 | 1,8039 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,31 | 0,3687 | -0,8308 | ||

| 2,00 | 2,4063 | -0,0758 | ||

| 1,50 | 1,8048 | -0,0590 | ||

| 1,99 | 2,3939 | -0,0491 | ||

| 1,00 | 1,2034 | -0,0391 | ||

| 1,00 | 1,2032 | -0,0384 | ||

| 1,00 | 1,2033 | -0,0382 | ||

| 1,00 | 1,2031 | -0,0381 | ||

| 1,00 | 1,2027 | -0,0380 | ||

| 1,00 | 1,2031 | -0,0380 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-25 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 2,69 | 3,2339 | 3,2339 | |||

| TRI-PARTY CITIGROUP GLOBAL MAR / RA (000000000) | 2,49 | 2,9957 | 2,9957 | |||

| TRI-PARTY FICC BNY/XISS/FICC / RA (000000000) | 2,40 | 2,8875 | 2,8875 | |||

| TRI-PARTY WELLS FARGO SECURITI / RA (000000000) | 2,40 | 2,8870 | 2,8870 | |||

| TRI-PARTY BOASI - BOFA SECURIT / RA (000000000) | 2,30 | 2,7680 | 2,7680 | |||

| TotalEnergies Capital SA / STIV (US89152EXH60) | 2,17 | 2,6118 | 2,6118 | |||

| 69033MD95 / OVERSEA CHINESE BANKING | 2,00 | 0,05 | 2,4063 | -0,0758 | ||

| SWED A / Swedbank AB (publ) | 1,99 | 1,07 | 2,3939 | -0,0491 | ||

| Pricoa Short Term Funding LLC / STIV (US74154EY362) | 1,97 | 2,3695 | 2,3695 | |||

| Royal Bank of Canada/New York NY / STIV (US78015JG433) | 1,70 | 2,0460 | 2,0460 | |||

| WESTPAC BKING CORP N / STIV (US96130AZC51) | 1,50 | -0,07 | 1,8048 | -0,0590 | ||

| TRI-PARTY BARCLAYS BANK PLC/XI / RA (000000000) | 1,50 | 1,8047 | 1,8047 | |||

| STI / Solidion Technology, Inc. | 1,50 | 1,8039 | 1,8039 | |||

| Barton Capital SA / STIV (US06945LV136) | 1,49 | 1,15 | 1,7976 | -0,0362 | ||

| US40434RXQ00 / HSBC USA Inc | 1,45 | 1,12 | 1,7396 | -0,0347 | ||

| Matchpoint Finance PLC / STIV (US57666AU180) | 1,40 | 1,6842 | 1,6842 | |||

| Atlantic Asset Securitization LLC / STIV (US04821TVB87) | 1,39 | 1,09 | 1,6757 | -0,0340 | ||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 1,29 | 1,10 | 1,5529 | -0,0318 | ||

| US6174468V45 / Morgan Stanley | 1,19 | 1,4267 | 1,4267 | |||

| DGZ / DB Gold Short ETN | 1,11 | 1,3339 | 1,3339 | |||

| Falcon Asset Funding LLC / STIV (US30608HBS31) | 1,10 | 1,3235 | 1,3235 | |||

| AU3FN0029609 / AAI Ltd | 1,08 | 1,3017 | 1,3017 | |||

| Credit Industriel et Commercial/New York / STIV (US22536WKJ44) | 1,00 | 1,2041 | 1,2041 | |||

| Mizuho Bank Ltd/New York NY / STIV (US60710TQ619) | 1,00 | 1,2035 | 1,2035 | |||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 1,00 | -0,10 | 1,2034 | -0,0391 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1,00 | 0,00 | 1,2033 | -0,0382 | ||

| STI / Solidion Technology, Inc. | 1,00 | 0,00 | 1,2032 | -0,0384 | ||

| SVENSKA HANDELSBANKEN AB / STIV (US86959THP49) | 1,00 | 0,00 | 1,2031 | -0,0381 | ||

| Greyshoe Issuing Trust / DBT (US39808XAA72) | 1,00 | 0,00 | 1,2031 | -0,0380 | ||

| MUFG Bank Ltd/New York NY / STIV (US55381BGY83) | 1,00 | 1,2029 | 1,2029 | |||

| LLOYDS BANK CORPORATE / STIV (US53947B2H22) | 1,00 | 0,00 | 1,2027 | -0,0380 | ||

| US55607KXN17 / Macquarie Bank Ltd. | 0,99 | 1,03 | 1,1862 | -0,0249 | ||

| Podium Funding Trust / STIV (US73044DZA70) | 0,98 | 1,1796 | 1,1796 | |||

| Schlumberger Holdings Corp / DBT (US806851AL54) | 0,96 | 1,1585 | 1,1585 | |||

| TORONTO DOMINION BK / STIV (US89115BWH94) | 0,90 | 0,00 | 1,0830 | -0,0348 | ||

| CREDIT AGRICOLE CORP + INVT BK / STIV (US22536JKV60) | 0,90 | 1,0829 | 1,0829 | |||

| Keep Memory Alive / DBT (US487437AA34) | 0,90 | 0,00 | 1,0828 | -0,0342 | ||

| Bennington Stark Capital Co LLC / STIV (US08224LU201) | 0,90 | 1,0825 | 1,0825 | |||

| Mizuho Bank Ltd/New York NY / STIV (US60710TE235) | 0,89 | 0,00 | 1,0709 | -0,0338 | ||

| MetLife Short Term Funding LLC / STIV (US59157UA261) | 0,82 | 0,9826 | 0,9826 | |||

| Lloyds Bank Corporate Markets PLC/New York NY / STIV (US53948BB994) | 0,78 | 0,9373 | 0,9373 | |||

| US13607LWT69 / Canadian Imperial Bank of Commerce | 0,74 | 0,8895 | 0,8895 | |||

| DNB Bank ASA / STIV (US2332K0VN98) | 0,73 | 1,11 | 0,8787 | -0,0179 | ||

| Falcon Asset Funding LLC / STIV (US30608HBK05) | 0,61 | 0,7341 | 0,7341 | |||

| US06368LC537 / Bank of Montreal | 0,61 | 0,7320 | 0,7320 | |||

| US892331AP43 / Toyota Motor Corp | 0,61 | -0,17 | 0,7290 | -0,0243 | ||

| US718172CU19 / Philip Morris International Inc | 0,60 | 0,00 | 0,7231 | -0,0239 | ||

| US30231GAT94 / Exxon Mobil Cor Bond | 0,60 | 0,34 | 0,7165 | -0,0201 | ||

| US20030NBS99 / Comcast Corp | 0,60 | 0,51 | 0,7163 | -0,0196 | ||

| US437076BM30 / Home Depot Inc/The | 0,59 | 0,17 | 0,7156 | -0,0205 | ||

| US036752AR45 / Anthem Inc | 0,59 | 0,85 | 0,7114 | -0,0168 | ||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 0,59 | 0,7108 | 0,7108 | |||

| BNS / The Bank of Nova Scotia | 0,59 | 0,68 | 0,7107 | -0,0172 | ||

| US91159HHU77 / US Bancorp | 0,55 | 0,18 | 0,6608 | -0,0195 | ||

| US86787EBB20 / Truist Bank | 0,55 | 0,18 | 0,6606 | -0,0198 | ||

| US459200JZ55 / International Business Machines Corp | 0,53 | 0,00 | 0,6436 | -0,0194 | ||

| US806851AG69 / Schlumberger Holdings Corp | 0,53 | 0,19 | 0,6364 | -0,0191 | ||

| US828807DP98 / Simon Property Group LP | 0,53 | 0,96 | 0,6338 | -0,0135 | ||

| US61747YEZ43 / Morgan Stanley | 0,53 | 0,00 | 0,6336 | -0,0204 | ||

| National Australia Bank Ltd/New York / DBT (US63253QAF19) | 0,53 | -0,19 | 0,6328 | -0,0205 | ||

| US00287YAY59 / AbbVie Inc | 0,52 | 0,19 | 0,6316 | -0,0180 | ||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,52 | 0,6200 | 0,6200 | |||

| US63743HFK32 / National Rural Utilities Cooperative Finance Corp. | 0,51 | -0,20 | 0,6118 | -0,0205 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,50 | 0,6041 | 0,6041 | |||

| ANTX / AN2 Therapeutics, Inc. | 0,50 | 0,20 | 0,6036 | -0,0174 | ||

| Mainbeach Funding LLC / STIV (US56037BW429) | 0,50 | 1,02 | 0,5967 | -0,0121 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,49 | 1,02 | 0,5943 | -0,0123 | ||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 0,49 | 1,04 | 0,5864 | -0,0126 | ||

| US0641598K52 / Bank of Nova Scotia/The | 0,48 | 1,05 | 0,5813 | -0,0121 | ||

| US86562MCH16 / Sumitomo Mitsui Financial Group Inc | 0,48 | 0,84 | 0,5811 | -0,0131 | ||

| TotalEnergies Capital SA / STIV (US89152EXA18) | 0,47 | 0,5703 | 0,5703 | |||

| US693475AX33 / PNC Financial Services Group Inc/The | 0,47 | 0,65 | 0,5624 | -0,0138 | ||

| US40434RXQ00 / HSBC USA Inc | 0,43 | 0,93 | 0,5209 | -0,0109 | ||

| US38145GAH39 / The Goldman Sachs Bond | 0,43 | 0,5199 | 0,5199 | |||

| US78016EZQ33 / Royal Bank of Canada | 0,41 | 0,73 | 0,4991 | -0,0111 | ||

| US98389BAU44 / Xcel Energy Inc | 0,39 | 302,04 | 0,4747 | 0,3530 | ||

| US55608PBS20 / Macquarie Bank Ltd. | 0,39 | 0,4718 | 0,4718 | |||

| US718172BT54 / Philip Morris International Inc | 0,37 | 0,27 | 0,4461 | -0,0122 | ||

| US960413AT94 / Westlake Chemical Corp. | 0,35 | 0,29 | 0,4229 | -0,0116 | ||

| NATIXIS N Y BRH INSTL CTF DEP / STIV (US63873TBG22) | 0,35 | 0,00 | 0,4214 | -0,0138 | ||

| LMA-Americas LLC / STIV (US53944QX136) | 0,33 | 1,24 | 0,3925 | -0,0080 | ||

| Canadian Imperial Bank of Commerce/New York NY / STIV (US13606DEU28) | 0,31 | 0,3732 | 0,3732 | |||

| US20030NBW02 / Comcast Corp New 01/15/2027 2.350 Call 10/15/2026 100.000 Bond | 0,31 | -68,32 | 0,3687 | -0,8308 | ||

| US375558BF95 / Gilead Sciences Inc | 0,30 | 0,33 | 0,3652 | -0,0106 | ||

| US29444UBQ85 / EQUINIX INC 1.45% 05/15/2026 | 0,29 | 0,69 | 0,3511 | -0,0086 | ||

| Liberty Street Funding LLC / STIV (US53127TWV15) | 0,27 | 0,76 | 0,3212 | -0,0066 | ||

| US92564RAJ41 / VICI Properties, LP/VICI Note Company, Inc. | 0,22 | 0,2684 | 0,2684 | |||

| TORONTO DOMINION BK / STIV (US89115DEK81) | 0,22 | 0,00 | 0,2647 | -0,0086 | ||

| US025816CS64 / American Express Co | 0,22 | 0,2637 | 0,2637 | |||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,21 | 0,48 | 0,2527 | -0,0079 | ||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,20 | 1,00 | 0,2452 | -0,0050 | ||

| Cabot Trail Funding LLC / STIV (US12710GUB49) | 0,20 | 1,02 | 0,2403 | -0,0049 | ||

| US855244AQ29 / Starbucks Corp | 0,15 | 0,00 | 0,1863 | -0,0056 | ||

| US25746UCE73 / Dominion Energy Inc | 0,15 | 0,00 | 0,1803 | -0,0053 | ||

| US501044DC24 / Kroger Co/The | 0,15 | 0,68 | 0,1795 | -0,0052 | ||

| US126650CU24 / CVS Health Corp | 0,15 | 0,00 | 0,1777 | -0,0047 | ||

| US92564RAD70 / VICI PROPERTIES / NOTE 3.75% 02/15/2027 144A | 0,15 | 0,1777 | 0,1777 | |||

| US68389XBM65 / Oracle Corp. | 0,15 | 0,68 | 0,1772 | -0,0046 | ||

| US00206RML32 / AT&T Inc | 0,15 | 1,38 | 0,1769 | -0,0042 | ||

| TORONTO DOMINION BK / STIV (US89115DJP24) | 0,15 | 0,00 | 0,1745 | -0,0057 | ||

| US29444UBK16 / Equinix Inc | 0,14 | 0,73 | 0,1672 | -0,0039 | ||

| US87264ABU88 / T-Mobile USA Inc | 0,13 | 0,79 | 0,1540 | -0,0042 | ||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 0,13 | 0,00 | 0,1524 | -0,0044 | ||

| US47233JAG31 / Jefferies Group LLC / Jefferies Group Capital Finance Inc | 0,13 | 0,80 | 0,1517 | -0,0036 | ||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0,13 | 0,81 | 0,1507 | -0,0042 | ||

| US458140AS90 / Intel Corp | 0,12 | 0,00 | 0,1503 | -0,0044 | ||

| US11135FBB67 / Broadcom Inc | 0,12 | 0,81 | 0,1497 | -0,0042 | ||

| US11134LAH24 / Broadcom Corp / Broadcom Cayman Finance Ltd | 0,12 | 0,81 | 0,1495 | -0,0040 | ||

| US126650DF48 / CVS Health Corporation 3.00%, due 08/15/2026 | 0,12 | 0,1480 | 0,1480 | |||

| US42824CBK45 / Hewlett Packard Enterprise Co | 0,12 | 0,83 | 0,1474 | -0,0036 | ||

| US92343VGG32 / Verizon Communications Inc | 0,12 | 0,83 | 0,1472 | -0,0036 | ||

| BANK OF AMERICA / STIV (US06051WSS43) | 0,10 | 0,00 | 0,1203 | -0,0040 |