Grundlæggende statistik

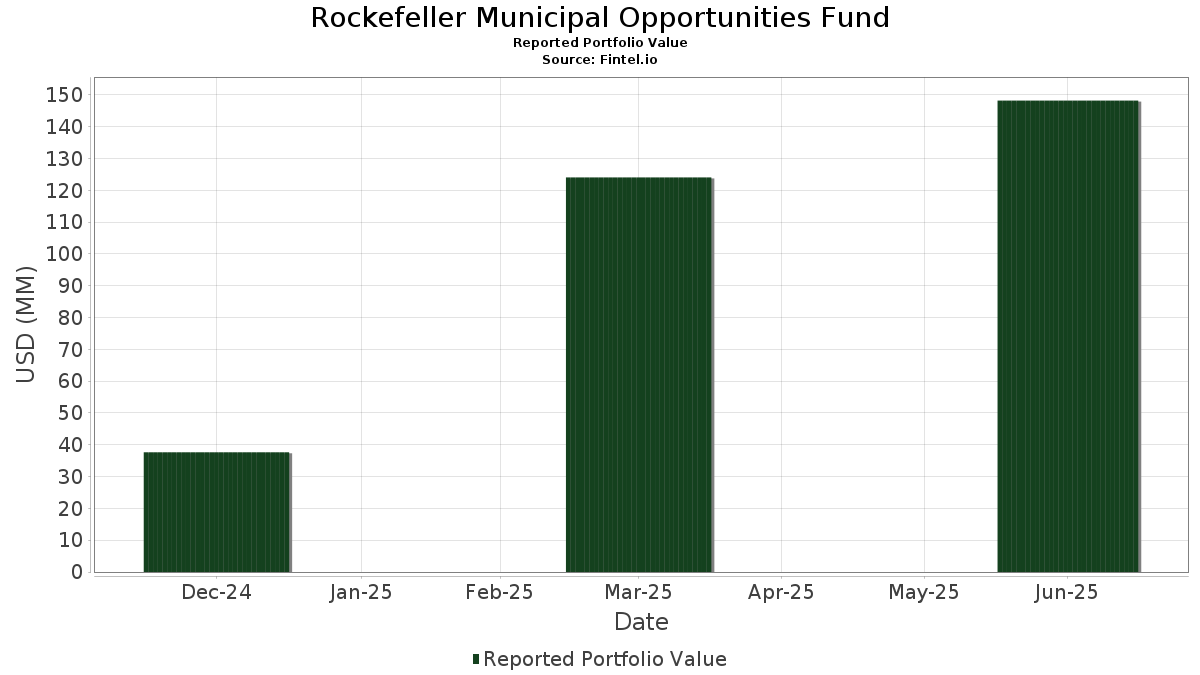

| Porteføljeværdi | $ 148.193.891 |

| Nuværende stillinger | 160 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Rockefeller Municipal Opportunities Fund har afsløret 160 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 148.193.891 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Rockefeller Municipal Opportunities Funds største beholdninger er BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , SOUTH CAROLINA ST JOBS-ECON DEV AUTH ECON DEV REVENUE (US:US837031WQ28) , NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE (US:US650116AQ94) , Miami-Dade (County of), FL Expressway Authority, Series 2010 A, Ref. RB (US:US59334KFW36) , and RICHMOND HOSPITAL AUTHORITY (US:US764791BB42) . Rockefeller Municipal Opportunities Funds nye stillinger omfatter BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , SOUTH CAROLINA ST JOBS-ECON DEV AUTH ECON DEV REVENUE (US:US837031WQ28) , NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE (US:US650116AQ94) , Miami-Dade (County of), FL Expressway Authority, Series 2010 A, Ref. RB (US:US59334KFW36) , and RICHMOND HOSPITAL AUTHORITY (US:US764791BB42) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,62 | 2,4783 | 2,4783 | ||

| 3,18 | 2,1739 | 2,1739 | ||

| 3,12 | 2,1332 | 2,1332 | ||

| 3,11 | 2,1285 | 2,1285 | ||

| 2,42 | 1,6580 | 1,6580 | ||

| 2,30 | 1,5734 | 1,5734 | ||

| 2,28 | 1,5597 | 1,5597 | ||

| 2,16 | 1,4756 | 1,4756 | ||

| 2,03 | 1,3862 | 1,3862 | ||

| 2,02 | 1,3826 | 1,3826 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,34 | 2,2856 | -0,7996 | ||

| 2,48 | 1,6950 | -0,6908 | ||

| 2,35 | 1,6075 | -0,6466 | ||

| 2,37 | 1,6173 | -0,6284 | ||

| 2,47 | 1,6909 | -0,5548 | ||

| 2,40 | 1,6428 | -0,4947 | ||

| 2,01 | 1,3711 | -0,4191 | ||

| 1,65 | 1,1268 | -0,3939 | ||

| 1,78 | 1,2189 | -0,3828 | ||

| 1,60 | 1,0931 | -0,3449 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-01 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| New York City Transitional Finance Authority / DBT (US64972JGW27) | 3,62 | 2,4783 | 2,4783 | |||

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 3,34 | -3,27 | 2,2856 | -0,7996 | ||

| US837031WQ28 / SOUTH CAROLINA ST JOBS-ECON DEV AUTH ECON DEV REVENUE | 3,18 | 2,1739 | 2,1739 | |||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035PJW95) | 3,12 | 2,1332 | 2,1332 | |||

| Columbus Regional Airport Authority / DBT (US199546DC38) | 3,11 | 2,1285 | 2,1285 | |||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 3,02 | 110,45 | 2,0651 | 0,7840 | ||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035MA709) | 2,48 | -7,26 | 1,6950 | -0,6908 | ||

| Missouri Housing Development Commission / DBT (US60637GJJ94) | 2,47 | -1,71 | 1,6909 | -0,5548 | ||

| Capital Projects Finance Authority/FL / DBT (US14043HAE27) | 2,42 | 1,6580 | 1,6580 | |||

| California Public Finance Authority / DBT (US13057GAY52) | 2,40 | 0,33 | 1,6428 | -0,4947 | ||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035MB954) | 2,37 | -5,96 | 1,6173 | -0,6284 | ||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035MLM54) | 2,35 | -6,89 | 1,6075 | -0,6466 | ||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035MZ409) | 2,30 | 1,5734 | 1,5734 | |||

| San Francisco City & County Airport Comm-San Francisco International Airport / DBT (US79766DXP94) | 2,28 | 1,5597 | 1,5597 | |||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035PK230) | 2,16 | 1,4756 | 1,4756 | |||

| Sierra Vista Industrial Development Authority / DBT (US82652UBA97) | 2,10 | 5,32 | 1,4350 | -0,3434 | ||

| STC Metropolitan District No 2 / DBT (US85780TBD46) | 2,03 | 1,3862 | 1,3862 | |||

| Kenton County Airport Board / DBT (US491026WK27) | 2,02 | 1,3826 | 1,3826 | |||

| US650116AQ94 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 2,01 | 0,00 | 1,3711 | -0,4191 | ||

| US59334KFW36 / Miami-Dade (County of), FL Expressway Authority, Series 2010 A, Ref. RB | 2,01 | 74,96 | 1,3710 | 0,3471 | ||

| Pennsylvania Housing Finance Agency / DBT (US70879QV913) | 2,00 | 1,3669 | 1,3669 | |||

| Jordanelle Ridge Public Infrastructure District No 2 / DBT (US480790AC87) | 1,99 | 1,3623 | 1,3623 | |||

| Upper Illinois River Valley Development Authority / DBT (US91588XAQ97) | 1,99 | 1,3580 | 1,3580 | |||

| Arizona Industrial Development Authority / DBT (US04052BTR59) | 1,96 | 1,3411 | 1,3411 | |||

| New Hope Cultural Education Facilities Finance Corp / DBT (US64542UHF49) | 1,78 | -0,67 | 1,2189 | -0,3828 | ||

| City of Buda TX / DBT (US118829AC47) | 1,65 | -3,29 | 1,1268 | -0,3939 | ||

| US764791BB42 / RICHMOND HOSPITAL AUTHORITY | 1,60 | -0,75 | 1,0931 | -0,3449 | ||

| Port of Greater Cincinnati Development Authority / DBT (US73419RAE27) | 1,51 | 1,0355 | 1,0355 | |||

| Ohio Housing Finance Agency / DBT (US676900XS74) | 1,51 | 1,0299 | 1,0299 | |||

| US73358XHF24 / Port Authority of New York & New Jersey | 1,50 | 1,0267 | 1,0267 | |||

| US452252JT71 / Illinois State Toll Highway Authority | 1,50 | 1,0262 | 1,0262 | |||

| US25755AAE10 / Dominion Water & Sanitation District | 1,41 | 0,9622 | 0,9622 | |||

| US67759YAN76 / Ohio State, Private Activity Bonds, Portsmouth Gateway Group, LLC - Borrower, Portsmouth Bypass Project, Series 2015 | 1,40 | 0,9578 | 0,9578 | |||

| US544525A816 / Los Angeles Department of Water | 1,30 | 0,8890 | 0,8890 | |||

| City of Kalispell MT / DBT (US48343AAA07) | 1,25 | 0,8553 | 0,8553 | |||

| New York City Housing Development Corp / DBT (US64972KKG93) | 1,24 | 0,8457 | 0,8457 | |||

| Delaware State Economic Development Authority / DBT (US246372BJ49) | 1,24 | 0,8445 | 0,8445 | |||

| V-Dana Community Development District / DBT (US91822RAP01) | 1,19 | -3,57 | 0,8143 | -0,2879 | ||

| Public Finance Authority / DBT (US74442PL455) | 1,15 | 2,60 | 0,7835 | -0,2129 | ||

| US83704MCA27 / South Carolina Jobs-Economic Development Authority | 1,12 | 0,7628 | 0,7628 | |||

| US38122NB843 / GOLDEN ST TOBACCO SECURITIZATI REGD ZCP OID B/E 0.00000000 | 1,06 | -1,49 | 0,7251 | -0,2363 | ||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 1,05 | -3,67 | 0,7182 | -0,2555 | ||

| Maricopa County Industrial Development Authority / DBT (US56681MAL37) | 1,03 | 0,7052 | 0,7052 | |||

| US60636AHJ51 / Missouri Health and Educational Facilities Authority, Educational Facilities Revenue Bonds, Kansas City University of Medicine and Biosciences, Series | 1,03 | 0,69 | 0,7010 | -0,2085 | ||

| City of Marion IL Sales Tax Revenue / DBT (US569498AB42) | 1,01 | 0,00 | 0,6930 | -0,2122 | ||

| Ohio Housing Finance Agency / DBT (US676900XN87) | 1,01 | -2,22 | 0,6924 | -0,2320 | ||

| County of Denton TX / DBT (US24880GAN97) | 1,01 | 2,33 | 0,6906 | -0,1905 | ||

| Gas Worx Community Development District / DBT (US367200AD48) | 1,01 | 0,6896 | 0,6896 | |||

| STC Metropolitan District No 2 / DBT (US85780TBE29) | 1,01 | 0,6891 | 0,6891 | |||

| Haymeadow Metropolitan District No 1 / DBT (US42089FAA03) | 1,01 | 0,40 | 0,6888 | -0,2069 | ||

| Tech Ridge Public Infrastructure District / DBT (US878296AA00) | 1,01 | 0,6883 | 0,6883 | |||

| US890585BU59 / TOPEKA KS HLTH CARE FACS REVENUE | 1,01 | 0,6882 | 0,6882 | |||

| City of Granbury TX / DBT (US385065AD93) | 1,00 | 0,6871 | 0,6871 | |||

| Oregon State Facilities Authority / DBT (US68607AAR23) | 1,00 | 0,6871 | 0,6871 | |||

| City of Granbury TX / DBT (US385065AC11) | 1,00 | 0,6867 | 0,6867 | |||

| Sojourn at Idlewild Metropolitan District / DBT (US83408GAA67) | 1,00 | 0,6861 | 0,6861 | |||

| Stamford Housing Authority / DBT (US852640AK71) | 1,00 | -2,24 | 0,6856 | -0,2297 | ||

| Florida Higher Educational Facilities Financing Authority / DBT (US42982GAC24) | 1,00 | 0,6851 | 0,6851 | |||

| New York Transportation Development Corp / DBT (US650116HQ22) | 1,00 | 0,6842 | 0,6842 | |||

| Wakara Ridge Public Infrastructure District / DBT (US930814AA69) | 1,00 | -0,50 | 0,6838 | -0,2137 | ||

| Pinery Commercial Metropolitan District No 2 / DBT (US72330FAA49) | 0,97 | -3,49 | 0,6618 | -0,2331 | ||

| Mirabelle Metropolitan District No 2 / DBT (US60458HAX17) | 0,97 | -3,50 | 0,6609 | -0,2334 | ||

| Massachusetts Development Finance Agency / DBT (US57585BCX47) | 0,96 | 65,35 | 0,6598 | 0,1390 | ||

| Soleil Hills Public Infrastructure District No 1 / DBT (US834201AA31) | 0,96 | -3,14 | 0,6540 | -0,2276 | ||

| Ohio Housing Finance Agency / DBT (US676900XJ75) | 0,95 | -4,15 | 0,6485 | -0,2344 | ||

| California Municipal Finance Authority / DBT (US13051EAH36) | 0,95 | -4,35 | 0,6472 | -0,2363 | ||

| City of Buda TX / DBT (US118829AF77) | 0,95 | -3,08 | 0,6468 | -0,2239 | ||

| Langley South Community Development District / DBT (US515816AC07) | 0,94 | -3,58 | 0,6453 | -0,2285 | ||

| New York Transportation Development Corp / DBT (US650116HS87) | 0,94 | 0,6430 | 0,6430 | |||

| Public Finance Authority / DBT (US74442EMS62) | 0,94 | -2,60 | 0,6396 | -0,2178 | ||

| Public Finance Authority / DBT (US74442EML10) | 0,93 | -5,27 | 0,6391 | -0,2421 | ||

| Public Finance Authority / DBT (US74442PN923) | 0,93 | -3,31 | 0,6389 | -0,2237 | ||

| City of Reno NV / DBT (US759865CF30) | 0,93 | -4,13 | 0,6351 | -0,2295 | ||

| US299351AG13 / EVANSVILLE IN MF HSG REVENUE REGD B/E 5.45000000 | 0,92 | 0,33 | 0,6322 | -0,1903 | ||

| California Public Finance Authority / DBT (US13057GAQ29) | 0,90 | 0,6165 | 0,6165 | |||

| US82706TAE10 / Silicon Valley Tobacco Securitization Authority (Santa Clara), Series 2007 A, RB | 0,89 | -2,10 | 0,6063 | -0,2023 | ||

| US64542UFL35 / NEW HOPE CULTURAL ED | 0,88 | 0,6014 | 0,6014 | |||

| US19648DAD12 / CO HIGH PERFORMANCE TRANSPRTN ENTERPRISE REVENUE | 0,88 | -1,90 | 0,6013 | -0,1990 | ||

| Lompoc Unified School District / DBT (US541772LS61) | 0,87 | 0,5946 | 0,5946 | |||

| US590250AC03 / Merrillville, Indiana, Economic Development Revenue Bonds, Belvedere Housing Project, Series 2016 | 0,86 | 0,5894 | 0,5894 | |||

| New Hope Cultural Education Facilities Finance Corp / DBT (US64542UHG22) | 0,84 | -3,68 | 0,5724 | -0,2036 | ||

| Mida Cormont Public Infrastructure District / DBT (US59561JAB17) | 0,81 | 0,5573 | 0,5573 | |||

| Creekwalk Marketplace Business Improvement District / DBT (US225515AJ42) | 0,81 | -4,35 | 0,5568 | -0,2030 | ||

| US506309AB92 / Lafayette (City of), IN | 0,81 | -1,22 | 0,5531 | -0,1776 | ||

| Arizona Industrial Development Authority / DBT (US04052JDD63) | 0,75 | 0,5133 | 0,5133 | |||

| Desert Edge Public Infrastructure District No 1 / DBT (US250391AA71) | 0,75 | 0,5114 | 0,5114 | |||

| City of Apple Valley MN / DBT (US03800RBL96) | 0,74 | 0,5092 | 0,5092 | |||

| California Municipal Finance Authority / DBT (US13051EAJ91) | 0,74 | -5,46 | 0,5089 | -0,1940 | ||

| Stamford Housing Authority / DBT (US852640AL54) | 0,73 | -3,58 | 0,4979 | -0,1767 | ||

| US57584YQJ19 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 0,71 | 1,00 | 0,4858 | -0,1425 | ||

| Weems Neighborhood Metropolitan District / DBT (US948572AA06) | 0,70 | 0,4803 | 0,4803 | |||

| US13048VUP11 / CALIFORNIA ST MUNI FIN AUTH REVENUE | 0,69 | -3,36 | 0,4728 | -0,1657 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAM27) | 0,68 | 1,95 | 0,4638 | -0,1305 | ||

| US920286AA93 / VALPARAISO IN MF HSG REVENUE | 0,66 | -3,11 | 0,4485 | -0,1552 | ||

| Red Barn Metropolitan District / DBT (US75633SAC98) | 0,65 | 1,55 | 0,4476 | -0,1277 | ||

| City of Las Vegas NV Special Improvement District No 613 / DBT (US51779CAN56) | 0,62 | -3,55 | 0,4271 | -0,1507 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97671VCU70) | 0,62 | 0,4227 | 0,4227 | |||

| Mida Cormont Public Infrastructure District / DBT (US59561JAA34) | 0,62 | 0,4209 | 0,4209 | |||

| City of Eagan MN / DBT (US26940AAC99) | 0,60 | -3,87 | 0,4081 | -0,1454 | ||

| Public Finance Authority / DBT (US74439YGG08) | 0,59 | 0,4049 | 0,4049 | |||

| US774223BX84 / Rockville Mayor and Council, Maryland, Economic Development Revenue Bonds, Series 2017B | 0,58 | 0,3933 | 0,3933 | |||

| US744396HF27 / Public Finance Authority | 0,57 | -2,56 | 0,3902 | -0,1329 | ||

| Maricopa County Industrial Development Authority / DBT (US56681MAK53) | 0,53 | 0,3597 | 0,3597 | |||

| Public Finance Authority / DBT (US74448GAA76) | 0,50 | 0,3430 | 0,3430 | |||

| Capital Projects Finance Authority/FL / DBT (US14043HAD44) | 0,50 | 0,3429 | 0,3429 | |||

| Vail Home Partners Corp / DBT (US91879VAB45) | 0,50 | 0,3420 | 0,3420 | |||

| Pennsylvania Housing Finance Agency / DBT (US70879QV830) | 0,50 | 0,3420 | 0,3420 | |||

| New Hampshire Business Finance Authority / DBT (US644684HH85) | 0,50 | 0,3411 | 0,3411 | |||

| California Municipal Finance Authority / DBT (US13048V3G18) | 0,50 | 0,3405 | 0,3405 | |||

| US664556CE52 / Northeastern Pennsylvania Hospital & Educational Authority Revenue (Wilkes University Project) | 0,49 | 0,20 | 0,3361 | -0,1022 | ||

| US83704MBZ86 / South Carolina Jobs-Economic Development Authority | 0,47 | 0,3242 | 0,3242 | |||

| Capital Trust Authority / DBT (US14054WBR51) | 0,45 | -6,40 | 0,3104 | -0,1218 | ||

| US220245WR10 / CITY OF CORPUS CHRISTI TX UTILITY SYSTEM REVENUE | 0,45 | 0,3078 | 0,3078 | |||

| Build NYC Resource Corp / DBT (US12008EWE21) | 0,44 | -6,17 | 0,3019 | -0,1184 | ||

| Superstition Vistas Community Facilities District No 2 / DBT (US86852CAF86) | 0,43 | 0,2952 | 0,2952 | |||

| US19648FJA30 / COLORADO HEALTH 5% 9/15/2053 | 0,41 | 163,64 | 0,2779 | 0,1399 | ||

| US59324PEC95 / CITY OF MIAMI BEACH FL STORMWATER REVENUE | 0,40 | 0,2758 | 0,2758 | |||

| US72177PBU30 / Pima County Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Champion Schools Project, Series 2017 | 0,36 | -0,28 | 0,2463 | -0,0768 | ||

| Arizona Industrial Development Authority / DBT (US04052JDE47) | 0,35 | 0,2400 | 0,2400 | |||

| City of Eagan MN / DBT (US26940AAB17) | 0,33 | -2,91 | 0,2286 | -0,0794 | ||

| Clinton County Capital Resource Corp / DBT (US187469AG68) | 0,29 | -4,00 | 0,1974 | -0,0710 | ||

| US650116AV89 / New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment), Series 2016 A, RB | 0,27 | -1,09 | 0,1855 | -0,0600 | ||

| US13016NBY94 / CALIFORNIA CNTY CA TOBACCO SEC CASGEN 06/42 FIXED OID 6 | 0,27 | -13,03 | 0,1827 | -0,0919 | ||

| City of Eagan MN / DBT (US26940AAA34) | 0,24 | -1,22 | 0,1664 | -0,0536 | ||

| Superstition Vistas Community Facilities District No 2 / DBT (US86852CAE12) | 0,24 | 0,1659 | 0,1659 | |||

| US012432BR01 / ALBANY NY CAPITAL RESOURCE CORP | 0,24 | 0,00 | 0,1642 | -0,0501 | ||

| US650116AR77 / New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment), Series 2016 A, RB | 0,22 | -2,63 | 0,1525 | -0,0516 | ||

| US50376FAF45 / La Paz Cnty Ariz Ed Fac Lease Rev Charter Sch Solutions Bond | 0,22 | -4,87 | 0,1473 | -0,0552 | ||

| US130923AR65 / CALIFORNIA ST STWD FING AUTH TOBACCO SETTLEMENT | 0,21 | 0,00 | 0,1405 | -0,0430 | ||

| Sedgwick County Public Building Commission / DBT (US81533PLJ74) | 0,20 | 0,00 | 0,1369 | -0,0418 | ||

| US452252KQ14 / ILLINOIS STATE TOLL HIGHWAY AUTHORITY | 0,20 | 0,1368 | 0,1368 | |||

| US67759YAQ08 / OHIO ST PRIVATE ACTIVITY REVENUE | 0,17 | -4,44 | 0,1178 | -0,0430 | ||

| US682004EG74 / Omaha Public Power District Nebraska City Station Unit 2 | 0,14 | 0,00 | 0,0958 | -0,0293 | ||

| US13080SEW08 / California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center), Series 2014, RB | 0,14 | -2,86 | 0,0932 | -0,0318 | ||

| US87638RFS13 / TARRANT CNTY TX CULTURAL EDU FACS FIN CORP RETMNT FAC REVENU | 0,14 | 0,00 | 0,0923 | -0,0282 | ||

| US506309AA10 / Lafayette (City of), IN | 0,13 | 0,00 | 0,0871 | -0,0263 | ||

| US917393CV01 / County of Utah UT | 0,13 | 0,0856 | 0,0856 | |||

| Public Finance Authority / DBT (US744396GD87) | 0,12 | -5,43 | 0,0836 | -0,0322 | ||

| US97671VBG95 / Wisconsin Health & Educational Facilities Authority | 0,12 | -0,85 | 0,0802 | -0,0257 | ||

| US04780NJK46 / ATLANTA DEVELOPMENT AUTHORITY THE | 0,12 | 0,00 | 0,0787 | -0,0241 | ||

| US349507BS14 / FORT WORTH TX SPL TAX REVENUE | 0,11 | 0,0718 | 0,0718 | |||

| US696507UL46 / PALM BEACH CNTY FL HLTH FACS AUTH REVENUE | 0,10 | 0,00 | 0,0688 | -0,0212 | ||

| US051177BS15 / Augusta GA Airport Revenue | 0,10 | 0,00 | 0,0684 | -0,0209 | ||

| US574218XZ12 / MARYLAND ST HLTH & HGR EDUCTNL FACS AUTH REVENUE | 0,10 | 0,00 | 0,0684 | -0,0209 | ||

| US13033L4N45 / California Health Facilities Financing Authority, Revenue Bonds, Providence Health & Services, Series 2014B | 0,10 | -1,00 | 0,0684 | -0,0211 | ||

| US44816RAS13 / HUTCHINSON KS HOSP FACS REVENUE | 0,08 | -1,20 | 0,0564 | -0,0184 | ||

| US95581QAH20 / WEST SHORE PA AREA AUTH REVENUE | 0,07 | 0,00 | 0,0479 | -0,0147 | ||

| US593211EW15 / Miami Beach (City of), FL Health Facilities Authority (Mount Sinai Medical Center), Series 2014, Ref. RB | 0,07 | 250,00 | 0,0479 | 0,0300 | ||

| US60637AEB44 / Missouri Health and Educational Facilities Authority, Health Facilities Revenue Bonds, CoxHealth, Series 2013A | 0,06 | -1,54 | 0,0438 | -0,0142 | ||

| US982674KF96 / Wyandotte (County of) & Kansas City (City of), KS Unified Government, Series 2014 A, RB | 0,05 | -1,82 | 0,0375 | -0,0116 | ||

| US626207H312 / FX.RT. MUNI BOND | 0,05 | 0,0342 | 0,0342 | |||

| US60637AGN63 / Missouri Health and Educational Facilities Authority, Health Facilities Revenue Bonds, Mercy Health, Series 2014F | 0,05 | 0,00 | 0,0342 | -0,0104 | ||

| Douglas County Sanitary & Improvement District No 608 / DBT (US25940PAC86) | 0,05 | 0,00 | 0,0310 | -0,0098 | ||

| US57420VLP66 / Maryland Economic Development Corporation, Student Housing Revenue Bonds, Salisbury University Project, Refunding Series 2013 | 0,03 | -33,33 | 0,0205 | -0,0197 | ||

| US656178DN70 / Norman Regional Hospital Authority | 0,03 | 0,00 | 0,0192 | -0,0059 | ||

| US24918EDN76 / Denver Health and Hospitals Authority, Colorado, Healthcare Revenue Bonds, Series 2014A | 0,03 | 4,17 | 0,0171 | -0,0051 | ||

| US625914JA57 / Municipal Energy Agency of Nebraska, Series 2013 A, Ref. RB | 0,03 | 0,00 | 0,0171 | -0,0052 | ||

| US13080SEX80 / California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center), Series 2014, RB | 0,02 | -4,00 | 0,0168 | -0,0055 | ||

| US49126PFA30 / Kentucky (State of) Economic Development Finance Authority (Next Generation Kentucky Information Highway), Series 2015 A, RB | 0,02 | 0,00 | 0,0137 | -0,0042 | ||

| US514045H972 / LANCASTER CNTY PA HOSP AUTH REGD B/E 5.00000000 | 0,02 | 0,0137 | 0,0137 |