Grundlæggende statistik

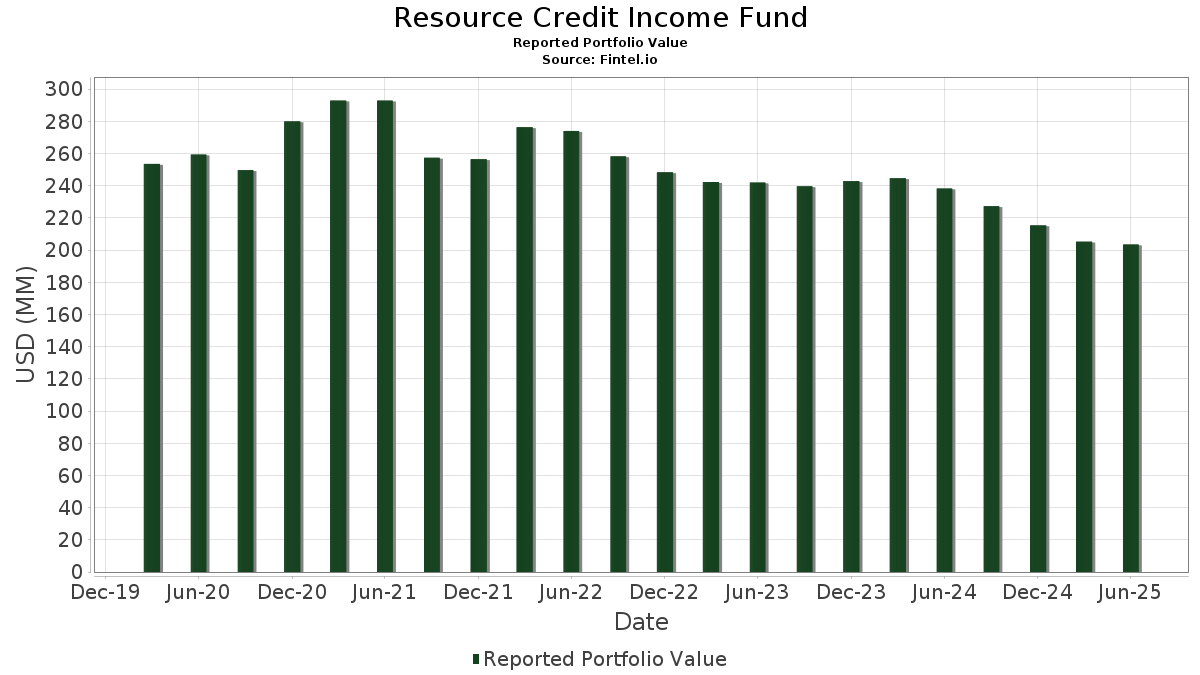

| Porteføljeværdi | $ 203.499.756 |

| Nuværende stillinger | 108 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Resource Credit Income Fund har afsløret 108 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 203.499.756 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Resource Credit Income Funds største beholdninger er US BANK MMDA (US:8AMMF0JA0) , Upstream Rehabilitation, Inc., Second Lien Term Loan (US:US91678HAE27) , Opportunistic Credit Interval Fund (US:US68390R1059) , Copper Property CTL Pass Through Trust (US:CPPTL) , and Accurate Background, LLC, Term Loan (US:00444BAB5) . Resource Credit Income Funds nye stillinger omfatter Upstream Rehabilitation, Inc., Second Lien Term Loan (US:US91678HAE27) , Accurate Background, LLC, Term Loan (US:00444BAB5) , Mount Logan Funding 2018-1 LP (US:US62188AAC53) , 8th Avenue Food & Provisions, Inc., Second Lien Term Loan (US:US28253PAD15) , and Arrow Purchaser Inc Term Loan (US:US00160KAB70) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 19,09 | 18,68 | 9,1664 | 9,1664 | |

| 14,27 | 14,27 | 7,0010 | 3,8094 | |

| 31,42 | 7,65 | 3,7524 | 3,7524 | |

| 6,11 | 6,11 | 2,9967 | 2,9967 | |

| 5,80 | 2,8486 | 2,8486 | ||

| 8,65 | 4,79 | 2,3482 | 2,3482 | |

| 4,64 | 2,2772 | 2,2772 | ||

| 4,57 | 2,2417 | 2,2417 | ||

| 4,56 | 2,2355 | 2,2355 | ||

| 4,48 | 2,1991 | 2,1991 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,11 | 0,94 | 0,4593 | -0,5093 | |

| 0,14 | 0,0688 | -0,2332 | ||

| 0,52 | 0,2538 | -0,1104 | ||

| 5,07 | 2,4866 | -0,1033 | ||

| 2,66 | 1,3043 | -0,0930 | ||

| 0,32 | 3,96 | 1,9427 | -0,0561 | |

| 0,59 | 0,2905 | -0,0521 | ||

| 0,71 | 0,3491 | -0,0403 | ||

| 3,42 | 1,6768 | -0,0396 | ||

| 0,12 | 1,16 | 0,5673 | -0,0379 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-29 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Tree Line Credit Strategies LP / EC (N/A) | 19,09 | 18,68 | 9,1664 | 9,1664 | |||||

| 8AMMF0JA0 / US BANK MMDA | 14,27 | 116,39 | 14,27 | 116,41 | 7,0010 | 3,8094 | |||

| BlackRock Global Credit Opportunities Fund, LP / EC (N/A) | 31,42 | 7,65 | 3,7524 | 3,7524 | |||||

| Pennfoster / EP (N/A) | 6,11 | 6,11 | 2,9967 | 2,9967 | |||||

| Money Transfer Acquisition Inc., First Lien Term Loan / LON (N/A) | 5,80 | 2,8486 | 2,8486 | ||||||

| US91678HAE27 / Upstream Rehabilitation, Inc., Second Lien Term Loan | 5,07 | -5,29 | 2,4866 | -0,1033 | |||||

| Monroe Capital Private Credit Fund III LP / EC (N/A) | 8,65 | 4,79 | 2,3482 | 2,3482 | |||||

| Marvel APS, Delayed Draw Term Loan / LON (N/A) | 4,64 | 2,2772 | 2,2772 | ||||||

| Next Flight Ventures, First Lien Term Loan / LON (N/A) | 4,57 | 2,2417 | 2,2417 | ||||||

| Phillips Feed Service, Inc., First Lien Term Loan / LON (N/A) | 4,56 | 2,2355 | 2,2355 | ||||||

| American Academy Holdings, LLC, Second Lien Term Loan / LON (N/A) | 4,48 | 2,1991 | 2,1991 | ||||||

| Diamanti, Inc., Subordinated Note / LON (N/A) | 4,47 | 2,1947 | 2,1947 | ||||||

| US68390R1059 / Opportunistic Credit Interval Fund | 0,36 | 0,00 | 4,21 | 1,13 | 2,0672 | 0,0508 | |||

| Fulcrum US Holdings, Inc., First Lien Term Loan / LON (N/A) | 4,00 | 1,9629 | 1,9629 | ||||||

| CPPTL / Copper Property CTL Pass Through Trust | 0,32 | 0,00 | 3,96 | -4,12 | 1,9427 | -0,0561 | |||

| Newbury Franklin Industrials, LLC, First Lien Term Loan / LON (N/A) | 3,91 | 1,9197 | 1,9197 | ||||||

| Florida Food Products LLC, Second Lien Term Loan / LON (N/A) | 3,68 | 1,8065 | 1,8065 | ||||||

| Hunter Point Capital Structured Notes Issuer, LLC, Subordinated Delayed Draw Notes / LON (N/A) | 3,63 | 1,7796 | 1,7796 | ||||||

| Kofax, Inc., Second Lien Term Loan / LON (N/A) | 3,62 | 1,7764 | 1,7764 | ||||||

| Riddell Inc., First Lien Term Loan / LON (76566PAB6) | 3,42 | -3,64 | 1,6768 | -0,0396 | |||||

| Ancile Solutions, Inc., First Lien Term Loan / LON (N/A) | 3,32 | 1,6275 | 1,6275 | ||||||

| DCert Buyer, Inc. First Amendment Term Loan Refinancing, Second Lien Term Loan / LON (N/A) | 3,16 | 1,5524 | 1,5524 | ||||||

| 00444BAB5 / Accurate Background, LLC, Term Loan | 2,89 | 0,56 | 1,4161 | 0,0269 | |||||

| Precisely Software Incorporated, Second Lien Term Loan / LON (N/A) | 2,79 | 1,3713 | 1,3713 | ||||||

| Cor Leonis Limited, Revolver / LON (N/A) | 2,78 | 1,3665 | 1,3665 | ||||||

| US62188AAC53 / Mount Logan Funding 2018-1 LP | 2,66 | -7,93 | 1,3043 | -0,0930 | |||||

| Spectrio, First Lien Term Loan / LON (N/A) | 2,57 | 1,2610 | 1,2610 | ||||||

| US28253PAD15 / 8th Avenue Food & Provisions, Inc., Second Lien Term Loan | 2,50 | 8,03 | 1,2274 | 0,1066 | |||||

| SouthStreet Securities Holdings, Inc., First Lien Term Loan / LON (N/A) | 2,41 | 1,1825 | 1,1825 | ||||||

| Ivanti Software, Inc., Second Lien Initial Term Loan / LON (N/A) | 2,33 | 1,1416 | 1,1416 | ||||||

| BetaNXT, Inc., First Lien Term Loan / LON (N/A) | 2,24 | 1,1007 | 1,1007 | ||||||

| American Academy Holdings, LLC, First Lien Term Loan / LON (N/A) | 2,19 | 1,0765 | 1,0765 | ||||||

| EJF CRT 2024-R1 LLC / ABS-MBS (US282930AA49) | 2,04 | -2,81 | 1,0034 | -0,0151 | |||||

| GSO Credit Alpha Fund II LP / EC (N/A) | 16,81 | 2,03 | 0,9984 | 0,9984 | |||||

| US00160KAB70 / Arrow Purchaser Inc Term Loan | 2,00 | 7,59 | 0,9809 | 0,0815 | |||||

| US846425AQ94 / SPANISH BROADCASTING SYSTEM INC 144A 9.750000% 03/01/2026 | 1,98 | 2,43 | 0,9735 | 0,0358 | |||||

| Lucky Bucks Holdings LLC, Subordinated Note / LON (N/A) | 1,94 | 0,9513 | 0,9513 | ||||||

| PhyNet Dermatology LLC, First Lien Term Loan / LON (N/A) | 1,91 | 0,9382 | 0,9382 | ||||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), First Lien Term Loan / LON (N/A) | 1,89 | 0,9256 | 0,9256 | ||||||

| Middle West Spirits Holdings, LLC, First Lien Term Loan / LON (N/A) | 1,88 | 0,9231 | 0,9231 | ||||||

| VTX Intermediate Holdings, Inc., Second Lien Term Loan / LON (N/A) | 1,88 | 0,9206 | 0,9206 | ||||||

| BrightPet, First Lien Term Loan / LON (N/A) | 1,86 | 0,9113 | 0,9113 | ||||||

| Epic Staffing Group, First Lien Term Loan / LON (N/A) | 1,75 | 0,8610 | 0,8610 | ||||||

| Dun & Bradstreet Holdings, Inc., First Lien Term Loan / LON (N/A) | 1,68 | 0,8251 | 0,8251 | ||||||

| Aperture Dodge 18 LLC / EC (N/A) | 2,05 | 1,66 | 0,8133 | 0,8133 | |||||

| Material Handling Systems, Inc., First Lien Term Loan / LON (N/A) | 1,49 | 0,7327 | 0,7327 | ||||||

| Accurate Background, LLC, First Lien Term Loan / LON (N/A) | 1,46 | 0,7159 | 0,7159 | ||||||

| Phoenix Finance, Inc., Second Lien Term Loan / LON (N/A) | 1,34 | 0,6598 | 0,6598 | ||||||

| EBSC Holdings LLC, Preferred / EP (N/A) | 1,13 | 1,29 | 0,6341 | 0,6341 | |||||

| CVC European Mid-Market Solutions Fund / EC (N/A) | 14,51 | 1,27 | 0,6238 | 0,6238 | |||||

| PocketWatch, Inc., First Lien Term Loan / LON (N/A) | 1,21 | 0,5932 | 0,5932 | ||||||

| PMP OPCO, LLC, First Lien Term Loan / LON (N/A) | 1,18 | 0,5810 | 0,5810 | ||||||

| Colonnade Intermediate, LLC, Delayed Draw Term Loan / LON (N/A) | 1,18 | 0,5794 | 0,5794 | ||||||

| CION / CION Investment Corporation | 0,12 | 0,00 | 1,16 | -7,52 | 0,5673 | -0,0379 | |||

| VTX Intermediate Holdings, Inc., First Lien Term Loan / LON (N/A) | 1,14 | 0,5603 | 0,5603 | ||||||

| Spectrio, Delayed Draw Term Loan / LON (N/A) | 1,07 | 0,5260 | 0,5260 | ||||||

| White Oak Equipment Finance 1, LLC / (N/A) | 1,03 | 0,5041 | 0,5041 | ||||||

| Next Flight Ventures, Delayed Draw Term Loan / LON (N/A) | 0,97 | 0,4776 | 0,4776 | ||||||

| WHF / WhiteHorse Finance, Inc. | 0,11 | -48,23 | 0,94 | -53,25 | 0,4593 | -0,5093 | |||

| GreenPark Infrastructure, LLC Series M-1 / EC (N/A) | 0,00 | 0,88 | 0,4311 | 0,4311 | |||||

| Franklin BSP Capital Corporation / EC (N/A) | 0,06 | 0,84 | 0,4139 | 0,4139 | |||||

| Phoenix Finance, Inc., First Lien Term Loan / LON (N/A) | 0,83 | 0,4091 | 0,4091 | ||||||

| EJF Financial Debt Strategies Fund LP / EP (N/A) | 0,75 | 0,81 | 0,3961 | 0,3961 | |||||

| US89289UAY47 / Tralee CLO II, Ltd. | 0,74 | -7,16 | 0,3628 | -0,0230 | |||||

| VORTEX OPCO, LLC, First Lien Term Loan (First Out) / LON (G9158TAC4) | 0,72 | -2,30 | 0,3551 | -0,0032 | |||||

| VORTEX OPCO, LLC, First Lien Term Loan (Second Out) / LON (G9158TAD2) | 0,71 | -7,16 | 0,3503 | -0,0216 | |||||

| US67591QAC06 / Octagon Investment Partners 36, Ltd. | 0,71 | -11,57 | 0,3491 | -0,0403 | |||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), Delayed Draw Term Loan / LON (N/A) | 0,62 | 0,3033 | 0,3033 | ||||||

| US13875JAJ25 / Canyon Capital CLO 2014-1, Ltd. | 0,60 | -9,26 | 0,2936 | -0,0257 | |||||

| US67590ABM36 / Octagon Investment Partners XIV, Ltd. | 0,59 | -16,41 | 0,2905 | -0,0521 | |||||

| Vortex Opco, LLC / DBT (US92905YAA64) | 0,52 | -31,25 | 0,2538 | -0,1104 | |||||

| Pelham S2K SBIC II, L.P. / EC (N/A) | 0,51 | 0,51 | 0,2503 | 0,2503 | |||||

| BrightPet, Revolver / LON (N/A) | 0,51 | 0,2480 | 0,2480 | ||||||

| American Academy Holdings, LLC, Delayed Draw Term Loan / LON (N/A) | 0,44 | 0,2136 | 0,2136 | ||||||

| SouthStreet Securities Holdings, Inc., Warrants / (N/A) | 0,40 | 0,1960 | 0,1960 | ||||||

| Phoenix Aviation Capital LLC, Preferred / EP (N/A) | 0,43 | 0,36 | 0,1785 | 0,1785 | |||||

| DeltaDx Limited, LP - Barri/Dolex / LON (N/A) | 0,36 | 0,1759 | 0,1759 | ||||||

| Middle West Spirits Holdings, LLC, Preferred / EP (N/A) | 0,35 | 0,34 | 0,1690 | 0,1690 | |||||

| Great Lakes Funding II LLC, Series A / EC (N/A) | 0,55 | 0,33 | 0,1637 | 0,1637 | |||||

| PTMN / BCP Investment Corp. | 0,03 | 0,00 | 0,32 | -12,60 | 0,1567 | -0,0205 | |||

| Ivanti Security Holdings LLC, NewCo First Lien Term Loan / LON (N/A) | 0,31 | 0,1498 | 0,1498 | ||||||

| American Academy Holdings. Inc., Common Units / EC (N/A) | 0,00 | 0,27 | 0,1309 | 0,1309 | |||||

| DxTx Pain and Spine LLC, Common Units / EC (N/A) | 0,10 | 0,23 | 0,1139 | 0,1139 | |||||

| JMP Credit Advisors CLO V, Ltd. / ABS-CBDO (466271AD5) | 0,22 | 18,09 | 0,1094 | 0,0180 | |||||

| Princeton Medspa Partners, LLC / EP (N/A) | 0,28 | 0,20 | 0,0990 | 0,0990 | |||||

| GreenPark Infrastructure, LLC Series A / EP (N/A) | 0,00 | 0,20 | 0,0981 | 0,0981 | |||||

| American Academy Holdings. Inc., Preferred Units / EP (N/A) | 0,09 | 0,16 | 0,0802 | 0,0802 | |||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), Revolver / LON (N/A) | 0,16 | 0,0791 | 0,0791 | ||||||

| US46647XAD12 / JMP Credit Advisors Clo IV, Ltd. | 0,16 | -1,24 | 0,0783 | 0,0001 | |||||

| Needle Holdings LLC, First Lien Term Loan / LON (63988HAH9) | 0,14 | -77,53 | 0,0688 | -0,2332 | |||||

| Phoenix Aviation Capital LLC, Common Stock / EC (N/A) | 0,00 | 0,14 | 0,0673 | 0,0673 | |||||

| NFV Co-Pilot, Inc. / EC (N/A) | 0,00 | 0,12 | 0,0606 | 0,0606 | |||||

| Colonnade Intermediate, LLC, First Lien Term Loan / LON (N/A) | 0,12 | 0,0604 | 0,0604 | ||||||

| Colonnade Intermediate, LLC, First Lien Term Loan / LON (N/A) | 0,12 | 0,0604 | 0,0604 | ||||||

| Incora Top Holdco LLC / EC (45338U101) | 0,01 | 0,00 | 0,09 | -42,59 | 0,0459 | -0,0326 | |||

| US80316QAA13 / Saranac CLO VII, Ltd. | 0,06 | -41,28 | 0,0318 | -0,0211 | |||||

| Next Flight Ventures / EC (N/A) | 0,00 | 0,02 | 0,0121 | 0,0121 | |||||

| VTX Holdings, LLC / EC (N/A) | 0,93 | 0,02 | 0,0109 | 0,0109 | |||||

| CEC Entertainment, Inc. / EC (N/A) | 0,24 | 0,01 | 0,0064 | 0,0064 | |||||

| CEC Entertainment, Inc. / EC (N/A) | 0,24 | 0,01 | 0,0064 | 0,0064 | |||||

| AIP Capital, LLC / EC (N/A) | 0,00 | 0,01 | 0,0061 | 0,0061 | |||||

| Middle West Spirits Holdings, LLC, Common Stock / EC (N/A) | 0,00 | 0,01 | 0,0027 | 0,0027 | |||||

| PhyNet Dermatology LLC, Delayed Draw Term Loan / LON (N/A) | 0,01 | 0,0025 | 0,0025 | ||||||

| US89289UBA51 / Tralee CLO II, Ltd. | 0,00 | 0,0001 | 0,0000 | ||||||

| Middle West Spirits Holdings, LLC, Revolver / LON (N/A) | 0,00 | 0,0000 | 0,0000 | ||||||

| Diamanti, Inc., Class A / (N/A) | 0,00 | 0,0000 | 0,0000 | ||||||

| Princeton Medspa Partners, LLC / DE (N/A) | 0,28 | 0,00 | 0,0000 | 0,0000 | |||||

| JoAnn Inc. / EC (N/A) | 1,57 | 0,00 | 0,0000 | 0,0000 | |||||

| US609ESCAB48 / MONITRONICS INTERNATIONAL, INC 04/20 FIXED 9.125 | 0,00 | 0,0000 | 0,0000 | ||||||

| Dun & Bradstreet Holdings, Inc., Revolver / LON (N/A) | 0,00 | 0,0000 | 0,0000 | ||||||

| Princeton Medspa Partners, LLC / DE (N/A) | 0,28 | 0,00 | 0,0000 | 0,0000 | |||||

| Riddell Inc., Delayed Draw Term Loan / LON (76566PAC4) | -0,00 | -0,0007 | -0,0007 | ||||||

| Newbury Franklin Industrials, LLC, Delayed Draw Term Loan / LON (N/A) | -0,01 | -0,0038 | -0,0038 | ||||||

| PMP OPCO, LLC, Revolver / LON (N/A) | -0,01 | -0,0038 | -0,0038 | ||||||

| PMP OPCO, LLC, Delayed Draw Term Loan / LON (N/A) | -0,04 | -0,0187 | -0,0187 |