Grundlæggende statistik

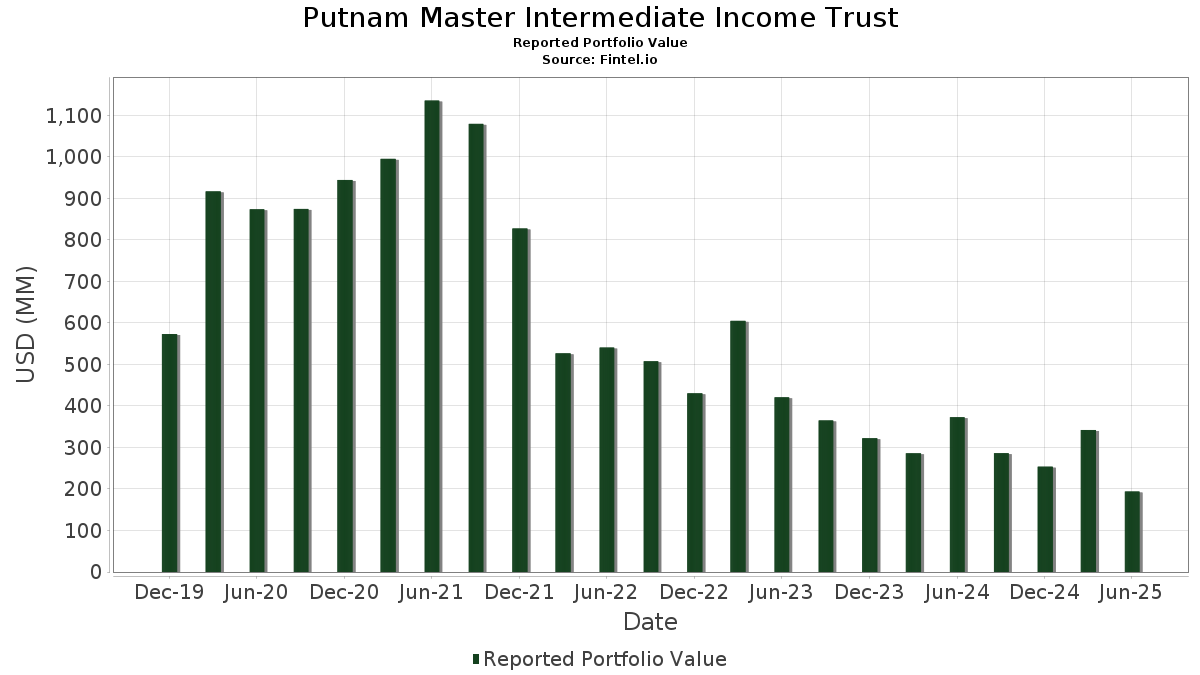

| Porteføljeværdi | $ 193.935.642 |

| Nuværende stillinger | 771 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Putnam Master Intermediate Income Trust har afsløret 771 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 193.935.642 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Putnam Master Intermediate Income Trusts største beholdninger er Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , SHORT TERM INV FUND (US:US74676P6640) , Ginnie Mae (US:US21H0526788) , Franklin Templeton ETF Trust - Franklin Ultra Short Bond ETF (US:FLUD) , and Uniform Mortgage-Backed Security, TBA (US:US01F0606750) . Putnam Master Intermediate Income Trusts nye stillinger omfatter Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Ginnie Mae (US:US21H0526788) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Ginnie Mae (US:US21H0506723) , and Ginnie Mae (US:US21H0426799) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 10,00 | 5,9914 | 5,3923 | ||

| 3,93 | 2,3547 | 2,3547 | ||

| 0,17 | 4,18 | 2,5053 | 0,8906 | |

| 1,29 | 0,7704 | 0,7704 | ||

| 1,07 | 0,6415 | 0,6415 | ||

| 1,00 | 0,5996 | 0,5996 | ||

| 0,85 | 0,5094 | 0,5094 | ||

| 1,66 | 0,9938 | 0,4977 | ||

| 0,82 | 0,4904 | 0,4904 | ||

| 0,80 | 0,4765 | 0,4765 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 4,07 | 2,4357 | -10,9646 | ||

| 1,98 | 1,98 | 1,1886 | -2,3856 | |

| 0,90 | 0,5395 | -1,6832 | ||

| 2,87 | 1,7209 | -1,1660 | ||

| -2,87 | -1,7196 | -1,1624 | ||

| -0,93 | -0,5572 | -1,1445 | ||

| 9,18 | 9,18 | 5,5023 | -0,4774 | |

| -0,63 | -0,3752 | -0,3752 | ||

| -0,55 | -0,3271 | -0,3271 | ||

| 0,56 | 0,3345 | -0,2466 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 10,00 | 914,10 | 5,9914 | 5,3923 | |||||

| US74676P6640 / SHORT TERM INV FUND | 9,18 | -7,10 | 9,18 | -7,09 | 5,5023 | -0,4774 | |||

| US21H0526788 / Ginnie Mae | 5,01 | 0,97 | 3,0008 | -0,0124 | |||||

| FLUD / Franklin Templeton ETF Trust - Franklin Ultra Short Bond ETF | 0,17 | 56,52 | 4,18 | 56,65 | 2,5053 | 0,8906 | |||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 4,07 | -81,57 | 2,4357 | -10,9646 | |||||

| US21H0506723 / Ginnie Mae | 3,93 | 2,3547 | 2,3547 | ||||||

| US21H0426799 / Ginnie Mae | 2,87 | -39,56 | 1,7209 | -1,1660 | |||||

| US74680A8696 / SHORT TERM INV FUND | 1,98 | -66,43 | 1,98 | -66,44 | 1,1886 | -2,3856 | |||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 1,66 | 103,19 | 0,9938 | 0,4977 | |||||

| US3137G0HZ50 / CORP CMO | 1,33 | -1,92 | 0,7961 | -0,0230 | |||||

| U.S. Treasury Bills / STIV (US912797MS31) | 1,29 | 0,7704 | 0,7704 | ||||||

| US30711XCH52 / CORP CMO | 1,17 | -3,63 | 0,7010 | -0,0330 | |||||

| US02146QAD51 / CORP CMO | 1,17 | -1,60 | 0,6982 | -0,0181 | |||||

| US52523KBH68 / Lehman XS Trust 2006-17 | 1,09 | 5,32 | 0,6526 | 0,0270 | |||||

| OIS / DIR (N/A) | 1,07 | 0,6415 | 0,6415 | ||||||

| US105756CC23 / Brazilian Government International Bond | 1,00 | 0,5996 | 0,5996 | ||||||

| Mizuho Bank Ltd. / STIV (US60710TA431) | 1,00 | 0,00 | 0,5993 | -0,0058 | |||||

| EW / Edwards Lifesciences Corporation | 0,98 | 8,89 | 0,5873 | 0,0478 | |||||

| US19688JAC18 / CORP CMO | 0,98 | 0,21 | 0,5859 | -0,0041 | |||||

| EW / Edwards Lifesciences Corporation | 0,90 | -75,40 | 0,5395 | -1,6832 | |||||

| US01F0306781 / UMBS TBA | 0,87 | 1,76 | 0,5186 | 0,0017 | |||||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 0,85 | 0,5094 | 0,5094 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,85 | -0,12 | 0,5092 | -0,0053 | |||||

| US3137FWKE98 / FHLMC CMO IO | 0,84 | -3,33 | 0,5039 | -0,0225 | |||||

| US46647PDW32 / JPMorgan Chase & Co | 0,84 | -0,12 | 0,5021 | -0,0057 | |||||

| US35563GAB59 / Freddie Mac Multifamily Structured Credit Risk | 0,82 | -0,84 | 0,4937 | -0,0088 | |||||

| ABN AMRO Funding USA LLC / STIV (US00084BW345) | 0,82 | 0,4904 | 0,4904 | ||||||

| US35565XBE94 / CORP CMO | 0,81 | -0,74 | 0,4841 | -0,0079 | |||||

| US35563XBE13 / Freddie Mac Stacr Trust 2018-HQA2 | 0,81 | -0,49 | 0,4830 | -0,0072 | |||||

| Canadian Imperial Bank of Commerce / STIV (US13606DEU28) | 0,80 | 0,00 | 0,4796 | -0,0044 | |||||

| AU3FN0029609 / AAI Ltd | 0,80 | 0,4765 | 0,4765 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,80 | -10,07 | 0,4764 | -0,0589 | |||||

| US87264ABV61 / T-Mobile USA Inc | 0,79 | 1,28 | 0,4760 | 0,0015 | |||||

| Panama Government Bond / DBT (US698299BX19) | 0,78 | 2,91 | 0,4665 | 0,0091 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 0,75 | 0,4494 | 0,4494 | ||||||

| DNB Bank ASA / STIV (US23345HPE26) | 0,75 | 0,4494 | 0,4494 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,75 | 0,4491 | 0,4491 | ||||||

| 62939LU72 / NRW Bank | 0,75 | 0,4490 | 0,4490 | ||||||

| NRW Bank / STIV (US62939LX201) | 0,74 | 0,4443 | 0,4443 | ||||||

| GNMA, Series 2020-96, Class KS / ABS-MBS (US38382GU912) | 0,73 | 3,38 | 0,4403 | 0,0106 | |||||

| USP5015VAQ97 / REPUBLIC OF GUATEMALA 6.600000% 06/13/2036 | 0,71 | 0,85 | 0,4265 | -0,0004 | |||||

| US38382RPL68 / GNMA CMO IO | 0,71 | -2,34 | 0,4258 | -0,0144 | |||||

| XS2287912450 / Verisure Midholding AB | 0,71 | 9,30 | 0,4226 | 0,0321 | |||||

| CQP Holdco LP, First Lien, Initial CME Term Loan / LON (US12657QAE35) | 0,69 | 0,29 | 0,4148 | -0,0028 | |||||

| US38383AQC17 / GNMA CMO IO | 0,68 | 14,00 | 0,4103 | 0,0474 | |||||

| US38382WBR79 / GNMA CMO IO | 0,68 | 1,50 | 0,4066 | 0,0023 | |||||

| USP75744AL92 / PARAGUAY | 0,67 | 73,45 | 0,4033 | 0,1681 | |||||

| US3136BCLU21 / FNMA CMO IO | 0,66 | -1,64 | 0,3963 | -0,0108 | |||||

| US77586RAK68 / Romanian Government International Bond | 0,66 | 0,3941 | 0,3941 | ||||||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 0,66 | -1,20 | 0,3936 | -0,0084 | |||||

| USP3699PGK77 / Costa Rica Government International Bond | 0,64 | 96,91 | 0,3828 | 0,1866 | |||||

| US900123DJ66 / Turkey Government International Bond | 0,63 | 93,27 | 0,3792 | 0,1811 | |||||

| US61747YFA82 / Morgan Stanley | 0,62 | 0,32 | 0,3720 | -0,0022 | |||||

| US30711XCR35 / CORP CMO | 0,61 | -2,57 | 0,3633 | -0,0133 | |||||

| US35563PMX41 / Seasoned Credit Risk Transfer Trust Series 2019-4 | 0,61 | 1,51 | 0,3632 | 0,0017 | |||||

| US3137H1X689 / FHLMC CMO IO | 0,60 | -3,06 | 0,3601 | -0,0154 | |||||

| US38382TD275 / GNMA CMO IO | 0,60 | -8,17 | 0,3573 | -0,0356 | |||||

| A&D Mortgage Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US00039GAA76) | 0,59 | -8,10 | 0,3535 | -0,0348 | |||||

| US168863DZ80 / Chile Government International Bond | 0,59 | 1,03 | 0,3532 | 0,0005 | |||||

| US3137G0GZ69 / CORP CMO | 0,57 | -2,88 | 0,3434 | -0,0139 | |||||

| US35565MBE30 / CORP CMO | 0,57 | -0,70 | 0,3408 | -0,0056 | |||||

| US195325EL56 / Colombia Government International Bond | 0,56 | 0,00 | 0,3378 | -0,0033 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 0,56 | 0,18 | 0,3348 | -0,0024 | |||||

| XS2064786754 / Ivory Coast Government International Bond | 0,56 | -41,87 | 0,3345 | -0,2466 | |||||

| GNMA, Series 2024-186 / ABS-MBS (US38384XVG59) | 0,54 | -2,86 | 0,3265 | -0,0126 | |||||

| US17312EAE68 / Citigroup Mortgage Loan Trust, Inc. | 0,54 | -0,55 | 0,3247 | -0,0047 | |||||

| XS2010026305 / Hungary Government International Bond | 0,53 | 168,34 | 0,3205 | 0,1999 | |||||

| US38383FDA84 / Government National Mortgage Association, Series 2021-214, Class AI | 0,53 | -1,87 | 0,3153 | -0,0091 | |||||

| US20753VBE74 / Connecticut Avenue Securities Trust 2020-SBT1 | 0,52 | -0,38 | 0,3140 | -0,0048 | |||||

| XS0240295575 / Iraq International Bond | 0,52 | 36,15 | 0,3096 | 0,0801 | |||||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,51 | -3,58 | 0,3070 | -0,0146 | |||||

| US38383VL975 / GNMA CMO IO | 0,51 | 5,82 | 0,3055 | 0,0141 | |||||

| US88167AAR23 / Teva Pharmaceutical Finance Netherlands III BV | 0,51 | 1,60 | 0,3050 | 0,0019 | |||||

| US63861CAE93 / Nationstar Mortgage Holdings Inc | 0,51 | 1,60 | 0,3045 | 0,0019 | |||||

| US38382RRP54 / GNMA CMO IO | 0,51 | -2,32 | 0,3030 | -0,0101 | |||||

| GNMA, Series 2020-13, Class AI / ABS-MBS (US38382CCP41) | 0,50 | -3,28 | 0,3011 | -0,0134 | |||||

| US61690FAS20 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C22 | 0,50 | 0,40 | 0,2995 | -0,0016 | |||||

| US501797AL82 / L Brands Inc | 0,50 | 2,47 | 0,2987 | 0,0042 | |||||

| US49272YAB92 / Kevlar SpA | 0,49 | 1,24 | 0,2935 | 0,0007 | |||||

| USP3579ECB13 / Dominican Republic International Bond | 0,49 | 46,99 | 0,2926 | 0,0915 | |||||

| BBD.A / Bombardier Inc. | 0,48 | 4,54 | 0,2905 | 0,0101 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,48 | -3,03 | 0,2881 | -0,0118 | |||||

| US01741RAL69 / Allegheny Technologies, Inc. | 0,48 | 2,78 | 0,2878 | 0,0053 | |||||

| Jefferson Capital Holdings LLC / DBT (US472481AB63) | 0,48 | -0,63 | 0,2854 | -0,0046 | |||||

| US87724RAJ14 / Taylor Morrison Communities Inc | 0,48 | 3,71 | 0,2850 | 0,0074 | |||||

| THC / Tenet Healthcare Corporation | 0,47 | 2,17 | 0,2822 | 0,0028 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 0,47 | 2,41 | 0,2802 | 0,0040 | |||||

| US00914AAT97 / AIR LEASE CORPORATION | 0,47 | 0,43 | 0,2790 | -0,0014 | |||||

| White Cap Supply Holdings LLC, First Lien, CME Term Loan, C / LON (US96350TAH32) | 0,46 | 0,2784 | 0,2784 | ||||||

| XS2366832496 / Benin Government International Bond | 0,46 | -21,26 | 0,2780 | -0,0781 | |||||

| US71713UAW27 / Pharmacia LLC | 0,46 | 0,00 | 0,2767 | -0,0023 | |||||

| US83283WAE30 / Smyrna Ready Mix Concrete LLC | 0,46 | 1,10 | 0,2766 | 0,0006 | |||||

| US49461MAA80 / Kinetik Holdings LP | 0,46 | 2,00 | 0,2751 | 0,0025 | |||||

| XS1807300105 / KazMunayGas National Co JSC | 0,45 | 2,02 | 0,2721 | 0,0027 | |||||

| US69331CAJ71 / PG&E Corp | 0,45 | -0,88 | 0,2713 | -0,0048 | |||||

| US78419CAD65 / SG Commercial Mortgage Securities Trust 2016-C5 | 0,45 | 0,45 | 0,2684 | -0,0013 | |||||

| US06051GLC14 / BANK OF AMERICA CORP | 0,45 | 0,22 | 0,2682 | -0,0022 | |||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAE84) | 0,45 | 0,2682 | 0,2682 | ||||||

| US1248EPCQ45 / CCO Holdings LLC / CCO Holdings Capital Corp | 0,45 | 76,59 | 0,2667 | 0,1140 | |||||

| XS2580269426 / Serbia International Bond | 0,44 | 0,91 | 0,2666 | 0,0004 | |||||

| US3137FVT288 / FHLMC CMO IO | 0,44 | -10,71 | 0,2654 | -0,0345 | |||||

| US36253GAK85 / GS Mortgage Securities Trust 2014-GC24 | 0,44 | 0,68 | 0,2646 | -0,0008 | |||||

| AES Andes SA / DBT (US00111VAD91) | 0,44 | 90,04 | 0,2631 | 0,1229 | |||||

| XS2571923007 / Romanian Government International Bond | 0,44 | 2,10 | 0,2624 | 0,0026 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 0,44 | -5,42 | 0,2614 | -0,0177 | |||||

| US94989VAD10 / Wells Fargo Commercial Mortgage Trust 2015-NXS3 | 0,44 | 0,46 | 0,2608 | -0,0016 | |||||

| US927804GB45 / Virginia Electric & Power Co | 0,43 | 1,41 | 0,2590 | 0,0009 | |||||

| US366651AG25 / Gartner Inc | 0,43 | 0,94 | 0,2566 | -0,0001 | |||||

| US925650AC72 / VICI Properties LP | 0,43 | 1,43 | 0,2563 | 0,0011 | |||||

| US3137FTQF70 / FHLMC CMO IO | 0,43 | -1,84 | 0,2557 | -0,0071 | |||||

| US12629NAJ46 / COMM 2015-DC1 Mortgage Trust | 0,43 | -1,16 | 0,2554 | -0,0057 | |||||

| XS1953057061 / Egypt Government International Bond | 0,42 | 5,49 | 0,2539 | 0,0112 | |||||

| US95000U3E14 / Wells Fargo & Co. | 0,42 | 0,48 | 0,2537 | -0,0011 | |||||

| US04010LBE20 / Ares Capital Corp. | 0,42 | 0,24 | 0,2536 | -0,0022 | |||||

| US718172DA46 / Philip Morris International Inc | 0,42 | 0,72 | 0,2528 | -0,0001 | |||||

| Hyundai Capital America / DBT (US44891ADG94) | 0,42 | 1,20 | 0,2524 | 0,0008 | |||||

| US91087BAR15 / Mexican Government International Bond | 0,42 | -26,96 | 0,2522 | -0,0960 | |||||

| US29278NAG88 / Energy Transfer Operating LP | 0,42 | 1,45 | 0,2517 | 0,0006 | |||||

| GTLS.PRB / Chart Industries, Inc. - Preferred Stock | 0,42 | 0,2509 | 0,2509 | ||||||

| SOP / DIR (N/A) | 0,42 | 0,2497 | 0,2497 | ||||||

| US12515DAU81 / CD 2017-CD4 Mortgage Trust | 0,42 | 1,46 | 0,2497 | 0,0011 | |||||

| US12591VAK70 / Commercial Mortgage Trust, Series 2014-CR16, Class C | 0,42 | 0,48 | 0,2496 | -0,0014 | |||||

| US455780BX36 / Indonesia Government International Bond | 0,41 | 0,74 | 0,2466 | -0,0008 | |||||

| FCFS / FirstCash Holdings, Inc. | 0,41 | 2,24 | 0,2464 | 0,0030 | |||||

| Waste Pro USA, Inc. / DBT (US94107JAC71) | 0,41 | 722,00 | 0,2463 | 0,2159 | |||||

| US20754BAB71 / Connecticut Avenue Securities Trust 2022-R02 | 0,41 | 0,25 | 0,2453 | -0,0017 | |||||

| DIRECTV Financing LLC, First Lien, 2024 Refinancing CME Term Loan, B / LON (US25460HAD44) | 0,41 | -1,92 | 0,2450 | -0,0070 | |||||

| US00206RGL06 / AT&T Inc | 0,41 | 0,74 | 0,2447 | -0,0007 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0,41 | 260,18 | 0,2443 | 0,1758 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0,41 | 462,50 | 0,2430 | 0,1991 | |||||

| US03027XAX84 / AMERICAN TOWER CORP SR UNSECURED 01/27 2.75 | 0,40 | 0,76 | 0,2399 | -0,0003 | |||||

| US12532BAD91 / CFCRE Commercial Mortgage Trust 2016-C7 | 0,40 | 0,76 | 0,2393 | -0,0004 | |||||

| US94989WAS61 / Wells Fargo Commercial Mortgage Trust 2015-C31 | 0,40 | 0,25 | 0,2381 | -0,0015 | |||||

| US35640YAL11 / CORP. NOTE | 0,39 | 0,51 | 0,2360 | -0,0008 | |||||

| US3137HANZ52 / FHLMC CMO IO | 0,39 | 3,97 | 0,2358 | 0,0067 | |||||

| LSTAR Commercial Mortgage Trust, Series 2017-5, Class A5 / ABS-MBS (US54910TAJ16) | 0,39 | 0,78 | 0,2338 | -0,0007 | |||||

| XS2580270275 / Serbia International Bond | 0,39 | 2,36 | 0,2337 | 0,0029 | |||||

| Petronas Capital Ltd. / DBT (US716743AV14) | 0,39 | 1,57 | 0,2324 | 0,0016 | |||||

| HRI / Herc Holdings Inc. | 0,39 | 0,2324 | 0,2324 | ||||||

| US38382LDU26 / GNMA CMO IO | 0,39 | -1,53 | 0,2322 | -0,0059 | |||||

| US715638DF60 / Peruvian Government International Bond | 0,39 | 2,12 | 0,2314 | 0,0027 | |||||

| US30711XBQ60 / CORP CMO | 0,38 | -2,29 | 0,2306 | -0,0075 | |||||

| US73928RAB24 / Power Finance Corp Ltd | 0,38 | 0,79 | 0,2299 | -0,0001 | |||||

| BANK, Series 2024-BNK48, Class XA / ABS-MBS (US06541GAN79) | 0,38 | -2,34 | 0,2248 | -0,0076 | |||||

| US060335AB23 / Banijay Entertainment SASU | 0,37 | 0,81 | 0,2240 | -0,0002 | |||||

| XS2010028939 / Republic of Armenia International Bond | 0,37 | 90,77 | 0,2232 | 0,1050 | |||||

| US38382LMH14 / GNMA CMO IO | 0,37 | -7,27 | 0,2219 | -0,0196 | |||||

| US3137FYLH76 / FHLMC CMO IO | 0,37 | 0,83 | 0,2192 | -0,0000 | |||||

| XS1319820897 / Southern Gas Corridor CJSC | 0,37 | 0,55 | 0,2188 | -0,0013 | |||||

| US35563PCF45 / Seasoned Credit Risk Transfer Trust Series 2017-3 | 0,36 | -3,96 | 0,2187 | -0,0112 | |||||

| Philippines Government Bond / DBT (US718286DG92) | 0,36 | 0,83 | 0,2175 | -0,0004 | |||||

| Carnival Corp., First Lien, 2025 Repricing Advance CME Term Loan / LON (XAP2121YAY40) | 0,36 | 0,2165 | 0,2165 | ||||||

| XS1602130947 / LEVI STRAUSS 3.375 3/27 | 0,36 | 9,12 | 0,2156 | 0,0165 | |||||

| US08263DAA46 / Benteler International AG | 0,36 | 0,28 | 0,2146 | -0,0016 | |||||

| US38382QX212 / GNMA CMO IO | 0,36 | -1,10 | 0,2145 | -0,0049 | |||||

| US3137FUAM68 / Freddie Mac REMICS | 0,35 | -1,40 | 0,2103 | -0,0055 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0,35 | 2,67 | 0,2073 | 0,0033 | |||||

| AAdvantage Loyalty IP Ltd., First Lien, CME Term Loan / LON (US02376CBS35) | 0,35 | 0,2069 | 0,2069 | ||||||

| Bulgaria Government Bond / DBT (XS2890420834) | 0,34 | 11,40 | 0,2051 | 0,0192 | |||||

| Cloud Software Group, Inc., First Lien, Initial Dollar CME Term Loan, B / LON (US88632NBF69) | 0,34 | 0,2049 | 0,2049 | ||||||

| XS2335148024 / Constellium SE | 0,34 | 12,21 | 0,2042 | 0,0204 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 0,34 | 3,98 | 0,2038 | 0,0058 | |||||

| US576485AF30 / Matador Resources Co | 0,34 | 0,59 | 0,2036 | -0,0005 | |||||

| XAC0787FAB85 / Bausch + Lomb Corp | 0,34 | 0,2014 | 0,2014 | ||||||

| US12592LBP67 / COMM 2014-CCRE20 Mortgage Trust | 0,33 | -0,60 | 0,1982 | -0,0032 | |||||

| XS2706258436 / Energo-Pro A/S | 0,32 | 0,31 | 0,1929 | -0,0010 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAF33) | 0,32 | 0,1905 | 0,1905 | ||||||

| Benchmark Mortgage Trust, Series 2024-V10, Class XA / ABS-MBS (US08163UAD19) | 0,31 | -3,98 | 0,1887 | -0,0093 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,31 | 4,33 | 0,1880 | 0,0063 | |||||

| XS2582981952 / Transnet SOC Ltd | 0,31 | 1,64 | 0,1862 | 0,0012 | |||||

| US3136B66Y43 / FNMA CMO IO | 0,31 | -0,32 | 0,1856 | -0,0022 | |||||

| XS2231188876 / Vmed O2 UK Financing I PLC | 0,31 | 13,19 | 0,1852 | 0,0198 | |||||

| US38382WSM00 / GNMA CMO IO | 0,31 | 1,66 | 0,1843 | 0,0010 | |||||

| BANK5, Series 2024-5YR10, Class XA / ABS-MBS (US06604AAH77) | 0,31 | -4,08 | 0,1837 | -0,0095 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBL81) | 0,31 | 1,33 | 0,1829 | 0,0003 | |||||

| SOP / DIR (N/A) | 0,31 | 0,1828 | 0,1828 | ||||||

| US38382FGP36 / GNMA CMO IO | 0,30 | -4,46 | 0,1798 | -0,0104 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 0,30 | 2,75 | 0,1792 | 0,0027 | |||||

| ECPG / Encore Capital Group, Inc. | 0,30 | 0,1786 | 0,1786 | ||||||

| XS2360598630 / Republic of Cameroon International Bond | 0,30 | 8,06 | 0,1773 | 0,0121 | |||||

| XS2113615228 / Gabon Government International Bond | 0,30 | 1,72 | 0,1770 | 0,0015 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0,29 | 50,00 | 0,1764 | 0,0577 | |||||

| US3137FJK993 / FHLMC CMO IO | 0,29 | 3,55 | 0,1754 | 0,0046 | |||||

| US3136AWLE51 / FNMA CMO IO | 0,29 | 0,69 | 0,1744 | -0,0010 | |||||

| US76774LAC19 / Ritchie Bros Holdings Inc | 0,29 | 0,35 | 0,1741 | -0,0009 | |||||

| USP3579EBV85 / Dominican Republic International Bond | 0,29 | 0,70 | 0,1721 | -0,0007 | |||||

| US61762MBC47 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class D | 0,29 | 2,14 | 0,1717 | 0,0024 | |||||

| US257867BA88 / Rr Donnelley & Sons Bond | 0,29 | 43,94 | 0,1709 | 0,0509 | |||||

| US83001AAD46 / Six Flags Entertainment Corp | 0,28 | 2,17 | 0,1694 | 0,0023 | |||||

| US32052MAE12 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2006 AA6 2A1 | 0,28 | -2,45 | 0,1674 | -0,0061 | |||||

| US35564KFH77 / FREDDIE MAC STACR REMIC TRUST 2021-DNA3 SER 2021-DNA3 CL B2 V/R REGD 144A P/P 6.26000000 | 0,28 | 1,09 | 0,1668 | -0,0001 | |||||

| US61767FBF71 / Morgan Stanley Capital I Trust, Series 2016-UB11, Class C | 0,28 | 0,73 | 0,1659 | -0,0001 | |||||

| US12592GAG82 / Commercial Mortgage Trust, Series 2014-CR19, Class D | 0,28 | -30,30 | 0,1658 | -0,0743 | |||||

| US17323CAN74 / Citigroup Commercial Mortgage Trust 2015-GC27 | 0,27 | -4,53 | 0,1644 | -0,0093 | |||||

| Protective Life Global Funding / DBT (US74368CBV54) | 0,27 | 0,74 | 0,1644 | -0,0006 | |||||

| BMO Mortgage Trust, Series 2024-5C6, Class XA / ABS-MBS (US05593QAD60) | 0,27 | -5,52 | 0,1642 | -0,0114 | |||||

| US3137G0HM48 / CORP CMO | 0,27 | -2,50 | 0,1641 | -0,0055 | |||||

| SOP / DIR (N/A) | 0,27 | 0,1640 | 0,1640 | ||||||

| US842587DS35 / Southern Co. (The) | 0,27 | 0,75 | 0,1622 | -0,0000 | |||||

| US857691AH24 / Station Casinos LLC | 0,27 | 4,30 | 0,1601 | 0,0050 | |||||

| IRB Holding Corp., First Lien, 2024 Second Replacement CME Term Loan, B / LON (US44988LAL18) | 0,27 | 0,1591 | 0,1591 | ||||||

| FR001400F2R8 / Air France-KLM | 0,26 | 9,09 | 0,1585 | 0,0121 | |||||

| US94989QBA76 / Wells Fargo Commercial Mortgage Trust 2015-SG1 | 0,26 | 0,38 | 0,1581 | -0,0005 | |||||

| US92840VAH50 / VISTRA OPERATIONS CO LLC 4.375% 05/01/2029 144A | 0,26 | 2,73 | 0,1578 | 0,0025 | |||||

| US227046AB51 / Crocs Inc | 0,26 | 1,95 | 0,1567 | 0,0017 | |||||

| GNMA, Series 2024-4, Class IG / ABS-MBS (US38384HZW14) | 0,26 | -1,14 | 0,1565 | -0,0032 | |||||

| US3136B1S470 / FNMA CMO IO | 0,26 | 1,56 | 0,1561 | 0,0010 | |||||

| US91087BAM28 / Mexico Government International Bond | 0,26 | 0,1559 | 0,1559 | ||||||

| US428102AE79 / Hess Midstream Operations LP | 0,26 | 1,97 | 0,1557 | 0,0019 | |||||

| US36198EAP07 / GS MTG SECS TR 2013-GC13 AS CSTR 07/10/2046 144A | 0,26 | -7,19 | 0,1547 | -0,0140 | |||||

| Montenegro Government Bond / DBT (XS3037625400) | 0,26 | 10,30 | 0,1540 | 0,0129 | |||||

| MPT Operating Partnership LP / MPT Finance Corp. / DBT (US55342UAQ76) | 0,26 | 62,03 | 0,1538 | 0,0582 | |||||

| US50205BAA17 / CORP CMO | 0,25 | -0,78 | 0,1528 | -0,0021 | |||||

| CSTM / Constellium SE | 0,25 | 4,10 | 0,1524 | 0,0046 | |||||

| US577081BF84 / Mattel Inc | 0,25 | 1,20 | 0,1523 | 0,0002 | |||||

| CDI / DCR (N/A) | 0,25 | 0,1522 | 0,1522 | ||||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0,25 | 0,40 | 0,1522 | -0,0004 | |||||

| US69007TAB08 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0,25 | 1,20 | 0,1521 | 0,0004 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,25 | 32,63 | 0,1516 | 0,0366 | |||||

| Sinclair Television Group, Inc. / DBT (US829259BH26) | 0,25 | 31,25 | 0,1515 | 0,0350 | |||||

| US03674XAS53 / ANTERO RESOURCES CORP 5.375% 03/01/2030 144A | 0,25 | 2,45 | 0,1508 | 0,0023 | |||||

| GNMA, Series 2024-32 / ABS-MBS (US38381J2J58) | 0,25 | -2,34 | 0,1502 | -0,0051 | |||||

| US200474BF05 / COMM Mortgage Trust | 0,25 | 0,40 | 0,1497 | -0,0008 | |||||

| US71654QDB59 / Petroleos Mexicanos | 0,25 | 33,33 | 0,1491 | 0,0365 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0,25 | 0,1485 | 0,1485 | ||||||

| US3137FQNN92 / FHLMC CMO IO | 0,25 | 0,82 | 0,1482 | -0,0000 | |||||

| US201723AR41 / Commercial Metals Co | 0,25 | 2,07 | 0,1475 | 0,0012 | |||||

| US35566ABE82 / CORP CMO | 0,25 | 1,24 | 0,1470 | 0,0002 | |||||

| US836205BC70 / Republic of South Africa Government International Bond | 0,25 | 3,38 | 0,1468 | 0,0029 | |||||

| SOP / DIR (N/A) | 0,25 | 0,1468 | 0,1468 | ||||||

| US38380YYA71 / GNMA CMO IO | 0,24 | -2,40 | 0,1467 | -0,0051 | |||||

| US61765TAM53 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C25 | 0,24 | 1,67 | 0,1457 | 0,0008 | |||||

| US36264FAL58 / GSK Consumer Healthcare Capital US LLC | 0,24 | 1,26 | 0,1449 | 0,0003 | |||||

| US35563FAB76 / FHLMC Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M2 | 0,24 | -1,23 | 0,1447 | -0,0034 | |||||

| US12591YBD67 / COMM 2014-UBS3 MORTGAGE TRUST COMM 2014-UBS3 AM | 0,24 | -10,41 | 0,1446 | -0,0182 | |||||

| Phoenix Newco, Inc., First Lien, Sixth Amendment CME Term Loan / LON (US71911KAE47) | 0,24 | 0,00 | 0,1441 | -0,0014 | |||||

| US12769GAB68 / Caesars Entertainment, Inc. | 0,24 | 2,13 | 0,1440 | 0,0017 | |||||

| BANK5, Series 2024-5YR7, Class XA / ABS-MBS (US06211UBR59) | 0,24 | -5,88 | 0,1440 | -0,0105 | |||||

| US279158AS81 / Ecopetrol SA | 0,24 | -56,67 | 0,1423 | -0,1888 | |||||

| Cogent Communications Group LLC / Cogent Finance, Inc. / DBT (US19240WAB54) | 0,24 | 0,1418 | 0,1418 | ||||||

| Nouryon Finance BV, First Lien, Term Loan, B / LON (N/A) | 0,24 | 0,1418 | 0,1418 | ||||||

| US38382RPZ54 / GNMA CMO IO | 0,24 | -1,67 | 0,1418 | -0,0036 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 0,24 | 0,00 | 0,1412 | -0,0015 | |||||

| US90276GAY89 / UBS Commercial Mortgage Trust 2017-C3 | 0,23 | 1,30 | 0,1402 | 0,0008 | |||||

| US38382GXV93 / GNMA CMO IO | 0,23 | 6,39 | 0,1402 | 0,0076 | |||||

| US12631DAG88 / COMM 2014-CCRE17 Mortgage Trust | 0,23 | -2,11 | 0,1394 | -0,0043 | |||||

| Chobani LLC, First Lien, 2025 New CME Term Loan / LON (US17026YAK55) | 0,23 | 0,1381 | 0,1381 | ||||||

| US389376AZ77 / Gray Television Inc | 0,23 | 5,56 | 0,1371 | 0,0061 | |||||

| US38382FGY43 / GNMA CMO IO | 0,23 | -1,31 | 0,1355 | -0,0035 | |||||

| GA Global Funding Trust / DBT (US36143L2N47) | 0,22 | 0,45 | 0,1346 | -0,0007 | |||||

| Benchmark Mortgage Trust, Series 2024-V11, Class XA / ABS-MBS (US081921BA52) | 0,22 | -5,08 | 0,1346 | -0,0085 | |||||

| US38381W6R40 / GNMA CMO IO | 0,22 | 2,28 | 0,1342 | 0,0011 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2024-5C1, Class XA / ABS-MBS (US95003VAD01) | 0,22 | -5,91 | 0,1338 | -0,0096 | |||||

| US38382FGR91 / GNMA CMO IO | 0,22 | 0,91 | 0,1329 | -0,0001 | |||||

| US126281BD56 / CSAIL 2015-C1 Commercial Mortgage Trust | 0,22 | -3,95 | 0,1316 | -0,0064 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAR33) | 0,22 | 2,34 | 0,1316 | 0,0020 | |||||

| US12592KBE38 / Commercial Mortgage Trust, Series 2014-UBS5, Class AM | 0,22 | -3,96 | 0,1307 | -0,0069 | |||||

| US87264ACA16 / T-MOBILE USA INC 2.05% 02/15/2028 | 0,22 | 1,40 | 0,1303 | 0,0003 | |||||

| Caesars Entertainment, Inc., First Lien, CME Term Loan, B1 / LON (US12768EAH99) | 0,22 | 0,1303 | 0,1303 | ||||||

| US12668AEV35 / CORP CMO | 0,22 | -2,26 | 0,1300 | -0,0037 | |||||

| Aris Water Holdings LLC / DBT (US04041NAA00) | 0,22 | 0,1299 | 0,1299 | ||||||

| US38381XK399 / GNMA CMO IO | 0,22 | -1,37 | 0,1299 | -0,0029 | |||||

| US045054AJ25 / Ashtead Capital Inc | 0,22 | 1,41 | 0,1299 | 0,0007 | |||||

| US103304BV23 / BOYD GAMING CORP 4.75% 06/15/2031 144A | 0,22 | 3,86 | 0,1293 | 0,0037 | |||||

| TEX / Terex Corporation | 0,22 | 270,69 | 0,1292 | 0,0939 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 0,21 | 3,38 | 0,1284 | 0,0027 | |||||

| US928668BN15 / VOLKSWAGEN GROUP AMER FIN LLC 1.625% 11/24/2027 144A | 0,21 | 1,42 | 0,1283 | 0,0004 | |||||

| US06051GGC78 / Bank of America Corp | 0,21 | 0,47 | 0,1283 | -0,0006 | |||||

| Aviation Capital Group LLC / DBT (US05369AAQ40) | 0,21 | 0,95 | 0,1282 | 0,0001 | |||||

| US31556PAB31 / Fertitta Entertainment LLC, Term Loan B | 0,21 | 0,1282 | 0,1282 | ||||||

| Zegona Finance plc / DBT (US98927UAA51) | 0,21 | 0,47 | 0,1282 | -0,0002 | |||||

| US88947EAU47 / Toll Brothers Finance Corp | 0,21 | 1,91 | 0,1280 | 0,0011 | |||||

| MSI / Motorola Solutions, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,47 | 0,1279 | -0,0005 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0,21 | 1,43 | 0,1277 | 0,0002 | |||||

| McAfee Corp., First Lien, CME Term Loan, B1 / LON (US57906HAF47) | 0,21 | 0,1277 | 0,1277 | ||||||

| US401494AX79 / GOVERNMENT BOND | 0,21 | 0,1276 | 0,1276 | ||||||

| US210385AB64 / CONSTELLATION ENERGY GENERATION | 0,21 | 0,95 | 0,1271 | -0,0003 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,21 | 0,48 | 0,1269 | -0,0008 | |||||

| US00135TAD63 / AIB Group PLC | 0,21 | 0,00 | 0,1268 | -0,0009 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 0,21 | 1,93 | 0,1267 | 0,0013 | |||||

| US264399DK95 / Duke Energy Corp 6.000% Senior Notes 12/01/28 | 0,21 | 0,48 | 0,1266 | -0,0005 | |||||

| RHP Hotel Properties LP / RHP Finance Corp. / DBT (US749571AK15) | 0,21 | 2,94 | 0,1264 | 0,0025 | |||||

| Athene Global Funding / DBT (US04685A3Q28) | 0,21 | 0,48 | 0,1263 | -0,0004 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAC64) | 0,21 | 0,96 | 0,1263 | 0,0002 | |||||

| US00973RAL78 / Aker BP ASA | 0,21 | 0,48 | 0,1262 | -0,0005 | |||||

| US77289KAA34 / Rockcliff Energy II LLC | 0,21 | 3,45 | 0,1261 | 0,0027 | |||||

| US87612GAE17 / Targa Resources Corp | 0,21 | 0,48 | 0,1261 | -0,0005 | |||||

| Miter Brands Acquisition Holdco, Inc. / MIWD Borrower LLC / DBT (US60672JAA79) | 0,21 | 3,45 | 0,1261 | 0,0031 | |||||

| US30040WAT53 / Eversource Energy | 0,21 | 0,48 | 0,1261 | -0,0007 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0,21 | 5,53 | 0,1259 | 0,0065 | |||||

| Rocket Cos., Inc. / DBT (US77311WAB72) | 0,21 | 0,1258 | 0,1258 | ||||||

| US45827MAA53 / Intelligent Packaging Ltd Finco Inc / Intelligent Packaging Ltd Co-Issuer LLC | 0,21 | 2,94 | 0,1258 | 0,0021 | |||||

| STX / Seagate Technology Holdings plc | 0,21 | 0,00 | 0,1257 | -0,0010 | |||||

| US30190AAC80 / F&G Annuities & Life Inc | 0,21 | 0,48 | 0,1256 | -0,0007 | |||||

| US09739DAD21 / Boise Cascade Co | 0,21 | 2,96 | 0,1254 | 0,0023 | |||||

| US64952WFD02 / NEW YORK LIFE GLOBAL FUNDING 144A LIFE SR SEC 1ST LIEN 4.9% 06-13-28 | 0,21 | 0,97 | 0,1254 | -0,0004 | |||||

| US12634NAY40 / Csail 2015-C2 Commercial Mortgage Trust | 0,21 | 0,00 | 0,1252 | -0,0016 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0,21 | 0,00 | 0,1252 | -0,0008 | |||||

| US44701QBE17 / Huntsman International LLC | 0,21 | -1,42 | 0,1251 | -0,0026 | |||||

| OneSky Flight LLC / DBT (US68278CAA36) | 0,21 | 65,08 | 0,1249 | 0,0484 | |||||

| US12803RAA23 / CaixaBank SA | 0,21 | 0,00 | 0,1246 | -0,0009 | |||||

| Beach Acquisition Bidco LLC / DBT (US07337JAC18) | 0,21 | 0,1245 | 0,1245 | ||||||

| US038522AQ17 / Aramark Services Inc | 0,21 | 1,47 | 0,1242 | 0,0006 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 0,21 | 0,49 | 0,1242 | -0,0008 | |||||

| Acrisure LLC / Acrisure Finance, Inc. / DBT (US00489LAL71) | 0,21 | 1,48 | 0,1239 | 0,0007 | |||||

| XS2602742285 / Jordan Government International Bond | 0,21 | 2,50 | 0,1232 | 0,0019 | |||||

| US46641JAE64 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,21 | 0,99 | 0,1232 | 0,0001 | |||||

| US74166MAE66 / PRIME SECSRVC BRW / FINANC | 0,21 | 0,00 | 0,1231 | -0,0011 | |||||

| Filtration Group Corp., First Lien, 2025 Incremental Dollar CME Term Loan / LON (US31732FAV85) | 0,21 | 0,1231 | 0,1231 | ||||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0,21 | 0,99 | 0,1231 | -0,0001 | |||||

| Clydesdale Acquisition Holdings, Inc. / DBT (US18972EAD76) | 0,21 | 64,00 | 0,1231 | 0,0469 | |||||

| US146869AL63 / Carvana Co. | 0,21 | 0,1230 | 0,1230 | ||||||

| US00928QAT85 / Aircastle Ltd | 0,20 | -0,49 | 0,1228 | -0,0013 | |||||

| Novelis Corp. / DBT (US670001AL04) | 0,20 | 158,23 | 0,1227 | 0,0748 | |||||

| Phoenix Guarantor, Inc., First Lien, CME Term Loan, B5 / LON (US71913BAK89) | 0,20 | 0,50 | 0,1221 | -0,0003 | |||||

| US71568QAE70 / Perusahaan Listrik Negara PT | 0,20 | 0,50 | 0,1221 | -0,0002 | |||||

| US11134LAH24 / Broadcom Corp / Broadcom Cayman Finance Ltd | 0,20 | 0,50 | 0,1220 | -0,0006 | |||||

| Chobani LLC / Chobani Finance Corp., Inc. / DBT (US17027NAC65) | 0,20 | 0,1219 | 0,1219 | ||||||

| US12636LAY65 / CSAIL Commercial Mortgage Trust, Series 2016-C5, Class A5 | 0,20 | -4,69 | 0,1218 | -0,0071 | |||||

| Scientific Games Holdings LP, First Lien, 2024 Refinancing Dollar CME Term Loan / LON (US80875CAE75) | 0,20 | 0,50 | 0,1216 | -0,0009 | |||||

| IHS / IHS Holding Limited | 0,20 | 1,51 | 0,1213 | 0,0008 | |||||

| US64072UAK88 / CSC Holdings, LLC, Term Loan | 0,20 | 3,59 | 0,1212 | 0,0027 | |||||

| Pertamina Hulu Energi PT / DBT (US74448WAA27) | 0,20 | 0,1211 | 0,1211 | ||||||

| Quikrete Holdings, Inc., First Lien, CME Term Loan, B2 / LON (US74839XAK54) | 0,20 | 1,00 | 0,1211 | -0,0004 | |||||

| US48020RAB15 / Jones Deslauriers Insurance Management Inc | 0,20 | 1,01 | 0,1208 | -0,0001 | |||||

| US35563WBE30 / STACR Trust 2018-DNA3 | 0,20 | 0,50 | 0,1206 | -0,0007 | |||||

| US026932AC79 / CORP CMO | 0,20 | -1,97 | 0,1198 | -0,0036 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0,20 | 1,02 | 0,1195 | -0,0002 | |||||

| US105756CF53 / Brazilian Government International Bond | 0,20 | 2,06 | 0,1191 | 0,0011 | |||||

| WEC US Holdings, Inc., First Lien, Initial CME Term Loan / LON (US92943LAC46) | 0,20 | 0,1191 | 0,1191 | ||||||

| US948565AD85 / Weekley Homes LLC / Weekley Finance Corp | 0,20 | 2,06 | 0,1191 | 0,0012 | |||||

| US12635QBL32 / COMM 2015-CCRE27 Mortgage Trust | 0,20 | 0,51 | 0,1189 | -0,0004 | |||||

| Alliant Holdings Intermediate LLC, First Lien, Initial CME Term Loan / LON (US01881UAM71) | 0,20 | 0,51 | 0,1188 | -0,0004 | |||||

| US71677HAL96 / PetSmart, Inc., Term Loan B | 0,20 | 0,00 | 0,1186 | -0,0008 | |||||

| US55759VAB45 / MADISON IAQ LLC | 0,20 | 0,51 | 0,1185 | -0,0000 | |||||

| US23329PAB67 / DNB Bank ASA | 0,20 | 0,1184 | 0,1184 | ||||||

| US893647BS53 / TransDigm Inc | 0,20 | 1,55 | 0,1182 | 0,0006 | |||||

| US89177JAB44 / Towd Point Mortgage Trust 2019-2 | 0,20 | 0,00 | 0,1170 | -0,0010 | |||||

| US71643VAB18 / Petroleos Mexicanos | 0,20 | 5,98 | 0,1170 | 0,0053 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAG86) | 0,20 | 0,1170 | 0,1170 | ||||||

| US95000CBJ18 / Wells Fargo Commercial Mortgage Trust 2016-NXS5 | 0,19 | 4,30 | 0,1168 | 0,0042 | |||||

| US38381YWU45 / GNMA CMO IO | 0,19 | -3,00 | 0,1163 | -0,0047 | |||||

| EMRLD Borrower LP, First Lien, Second Amendment Incremental CME Term Loan / LON (US26872NAD12) | 0,19 | 0,1162 | 0,1162 | ||||||

| BBCMS Mortgage Trust, Series 2024-C26, Class XA / ABS-MBS (US05555AAF21) | 0,19 | -2,03 | 0,1160 | -0,0037 | |||||

| US02146BAA44 / CORP CMO | 0,19 | -3,52 | 0,1154 | -0,0055 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0,19 | 0,1145 | 0,1145 | ||||||

| US38381XBN57 / GNMA CMO IO | 0,19 | -3,06 | 0,1143 | -0,0043 | |||||

| Ambipar Lux SARL / DBT (US02319WAB72) | 0,19 | -7,80 | 0,1136 | -0,0105 | |||||

| US20754BAF85 / CAS_22-R02 | 0,19 | 0,00 | 0,1126 | -0,0013 | |||||

| CommScope, Inc., First Lien, Initial CME Term Loan / LON (N/A) | 0,19 | 0,1124 | 0,1124 | ||||||

| SUN / Sunoco LP - Limited Partnership | 0,19 | 49,60 | 0,1122 | 0,0364 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0,19 | 0,1118 | 0,1118 | ||||||

| US61767YBE95 / Morgan Stanley Capital I Trust, Series 2018-H3, Class C | 0,19 | 0,54 | 0,1116 | -0,0006 | |||||

| US35563PKR90 / CORP CMO | 0,19 | -37,16 | 0,1116 | -0,0675 | |||||

| Flash Charm, Inc., First Lien, CME Term Loan, B2 / LON (US45168RAT05) | 0,19 | 0,1116 | 0,1116 | ||||||

| Fortress Intermediate 3, Inc., First Lien, Initial CME Term Loan / LON (US34966LAB09) | 0,19 | 0,1110 | 0,1110 | ||||||

| US12667GZ303 / CORP CMO | 0,18 | -2,13 | 0,1108 | -0,0034 | |||||

| US46643ABL61 / JPMBB Commercial Mortgage Securities Trust 2014-C23 | 0,18 | -2,13 | 0,1103 | -0,0039 | |||||

| XHR LP / DBT (US98372MAE57) | 0,18 | 438,24 | 0,1100 | 0,0892 | |||||

| BBCMS Mortgage Trust, Series 2025-C32, Class XA / ABS-MBS (US07337AAJ51) | 0,18 | -2,16 | 0,1089 | -0,0032 | |||||

| US513075BW03 / Lamar Media Corp | 0,18 | 0,1089 | 0,1089 | ||||||

| US61762DAG60 / Morgan Stanley Bank of America Merrill Lynch Trust 2013-C9 | 0,18 | 1,12 | 0,1081 | 0,0002 | |||||

| US12527DAG51 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,18 | 0,56 | 0,1078 | -0,0001 | |||||

| Medline Borrower LP, First Lien, Dollar Incremental CME Term Loan / LON (US58503UAF03) | 0,18 | 0,1078 | 0,1078 | ||||||

| US12629NAH89 / COMM 2015-DC1 Mortgage Trust | 0,18 | 25,17 | 0,1075 | 0,0209 | |||||

| Hunter Douglas, Inc., First Lien, CME Term Loan, B1 / LON (XAN8137FAE06) | 0,18 | 0,1073 | 0,1073 | ||||||

| US94989XBC83 / Wells Fargo Commercial Mortgage Trust, Series 2015-NXS4, Class A4 | 0,18 | 0,57 | 0,1062 | -0,0007 | |||||

| US46640LAN29 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,18 | 0,57 | 0,1058 | -0,0006 | |||||

| US61762XAC11 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C12, Class D | 0,18 | 2,92 | 0,1056 | 0,0016 | |||||

| Quikrete Holdings, Inc. / DBT (US74843PAB67) | 0,18 | 3,55 | 0,1052 | 0,0027 | |||||

| Endo Finance Holdings, Inc., First Lien, 2024 Refinancing CME Term Loan / LON (US29280UAD54) | 0,17 | 0,1047 | 0,1047 | ||||||

| US35563KBE91 / CORP CMO | 0,17 | -0,57 | 0,1046 | -0,0013 | |||||

| US94989TBB98 / Wells Fargo Commercial Mortgage Trust 2015-LC22 | 0,17 | 0,58 | 0,1044 | -0,0007 | |||||

| US023608AQ57 / Ameren Corp | 0,17 | 1,17 | 0,1037 | -0,0001 | |||||

| US46591ABG94 / JPMDB Commercial Mortgage Securities Trust 2018-C8 | 0,17 | 2,40 | 0,1025 | 0,0014 | |||||

| USP1850NAA92 / Braskem Idesa SAPI | 0,17 | -9,14 | 0,1016 | -0,0114 | |||||

| US75114HAA59 / CORP CMO | 0,17 | 0,60 | 0,1013 | -0,0008 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0,17 | 0,1013 | 0,1013 | ||||||

| XS2278994418 / BENIN INTL GOV BOND 4.875000% 01/19/2032 | 0,17 | 11,26 | 0,1012 | 0,0097 | |||||

| WestJet Loyalty LP, First Lien, Initial CME Term Loan / LON (XAC9763HAB33) | 0,17 | 3,70 | 0,1010 | 0,0027 | |||||

| US92939FAY51 / WFRBS Commercial Mortgage Trust 2014-C21 | 0,17 | 0,00 | 0,1010 | -0,0010 | |||||

| US38375UG460 / GNMA CMO IO | 0,17 | -9,73 | 0,1006 | -0,0115 | |||||

| SOP / DIR (N/A) | 0,17 | 0,1003 | 0,1003 | ||||||

| US38380CH714 / GNMA CMO IO | 0,17 | -3,47 | 0,1003 | -0,0047 | |||||

| US38379BNA25 / GNMA CMO IO | 0,17 | 0,00 | 0,1003 | -0,0008 | |||||

| US12592XBG07 / COMM 15-CR22 B FRN 03-10-48/03-12-25 | 0,17 | -2,34 | 0,1001 | -0,0035 | |||||

| US38380XSS70 / GNMA CMO IO | 0,17 | -3,49 | 0,0995 | -0,0049 | |||||

| US36257UAN72 / GS Mortgage Securities Trust 2019-GC42 | 0,17 | -5,17 | 0,0991 | -0,0065 | |||||

| US02146QAC78 / CORP CMO | 0,17 | -0,60 | 0,0991 | -0,0019 | |||||

| US07336AAG22 / BBCMS Mortgage Trust 2022-C14 | 0,16 | -3,55 | 0,0981 | -0,0045 | |||||

| US12620BAR15 / CPM Holdings, Inc. 2023 Term Loan | 0,16 | -0,61 | 0,0979 | -0,0016 | |||||

| US46643ABK88 / JPMBB Commercial Mortgage Securities Trust | 0,16 | -2,99 | 0,0975 | -0,0039 | |||||

| US95002MAY57 / Wells Fargo Commercial Mortgage Trust, Series 2019-C52, Class XA | 0,16 | -4,73 | 0,0968 | -0,0058 | |||||

| McGraw-Hill Education, Inc. / DBT (US58064LAA26) | 0,16 | 3,92 | 0,0957 | 0,0025 | |||||

| SOP / DIR (N/A) | 0,16 | 0,0950 | 0,0950 | ||||||

| US46634SAM70 / JP MORGAN CHASE COMMERCIAL MOR JPMCC 2012 C6 E 144A | 0,16 | 0,00 | 0,0941 | -0,0010 | |||||

| US02146BAB27 / CORP CMO | 0,16 | -4,32 | 0,0934 | -0,0048 | |||||

| US06541UCB08 / BANK 2020-BNK30 | 0,15 | -4,35 | 0,0927 | -0,0052 | |||||

| US43730VAE83 / CORP CMO | 0,15 | 0,00 | 0,0917 | -0,0010 | |||||

| Seagate Data Storage Technology Pte. Ltd. / DBT (US81180LAA35) | 0,15 | 0,0914 | 0,0914 | ||||||

| U1AI34 / Under Armour, Inc. - Depositary Receipt (Common Stock) | 0,15 | 0,0912 | 0,0912 | ||||||

| SNOWD / Snowflake Inc. - Depositary Receipt (Common Stock) | 0,15 | 31,03 | 0,0912 | 0,0210 | |||||

| US12591KAG04 / COMM 2013-CCRE12 Mortgage Trust | 0,15 | 0,68 | 0,0895 | -0,0005 | |||||

| US12667GY983 / CORP CMO | 0,15 | -1,99 | 0,0888 | -0,0029 | |||||

| US89115A2V36 / Toronto-Dominion Bank/The | 0,15 | 0,68 | 0,0881 | -0,0008 | |||||

| US61759FAU57 / CORP CMO | 0,15 | -1,35 | 0,0876 | -0,0025 | |||||

| US65249BAA70 / News Corp | 0,14 | -42,80 | 0,0861 | -0,0652 | |||||

| Seagate HDD Cayman / DBT (US81180WBL46) | 0,14 | 16,39 | 0,0852 | 0,0108 | |||||

| US3617LNR973 / GII30 | 0,14 | -1,40 | 0,0850 | -0,0019 | |||||

| US35564LBE65 / CORP CMO | 0,14 | 0,00 | 0,0846 | -0,0007 | |||||

| US36253GAS12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,14 | 53,85 | 0,0844 | 0,0289 | |||||

| US91282CAY75 / UST NOTES 0.625% 11/30/2027 | 0,14 | 1,45 | 0,0841 | 0,0001 | |||||

| US85205TAR14 / Spirit AeroSystems Inc | 0,14 | 0,0834 | 0,0834 | ||||||

| US90932LAH06 / United Airlines Inc | 0,14 | 246,15 | 0,0815 | 0,0594 | |||||

| US61762MBC47 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class D | 0,14 | 0,75 | 0,0812 | -0,0002 | |||||

| US38379V6K50 / GNMA CMO IO | 0,14 | 0,00 | 0,0809 | -0,0014 | |||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 0,13 | 0,0800 | 0,0800 | ||||||

| Standard Building Solutions, Inc. / DBT (US853191AA25) | 0,13 | 2,31 | 0,0799 | 0,0012 | |||||

| US097023CM50 / Boing Company (The) 2.70%, Due 02/01/2027 | 0,13 | 0,76 | 0,0798 | -0,0001 | |||||

| US38379LL461 / GNMA CMO IO | 0,13 | 3,13 | 0,0795 | 0,0018 | |||||

| CDSCMBX / DCR (N/A) | 0,13 | 0,0792 | 0,0792 | ||||||

| TK Elevator Midco GmbH, First Lien, CME Term Loan, B1 / LON (XAD9000BAJ17) | 0,13 | 0,0791 | 0,0791 | ||||||

| US46645LAY39 / JPMBB Commercial Mortgage Securities Trust 2016-C1 | 0,13 | 0,00 | 0,0784 | -0,0004 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,13 | 420,00 | 0,0783 | 0,0630 | |||||

| US30711XDN12 / CORP CMO | 0,13 | -2,29 | 0,0771 | -0,0023 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-9, Class A11 / ABS-MBS (US46593DAX57) | 0,13 | -9,86 | 0,0770 | -0,0090 | |||||

| US38375U6A37 / GNMA CMO IO | 0,13 | -9,22 | 0,0769 | -0,0089 | |||||

| US35564MBE49 / FREDDIE MAC STACR TRUST 2019-HQA2 SER 2019-HQA2 CL B2 V/R REGD 144A P/P 13.07275000 | 0,13 | 0,79 | 0,0769 | -0,0002 | |||||

| US46640LAS16 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,13 | 0,00 | 0,0765 | -0,0004 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0,13 | 17,59 | 0,0763 | 0,0105 | |||||

| US16678XAB01 / CORP CMO | 0,13 | -1,55 | 0,0763 | -0,0019 | |||||

| US38376RA632 / GNMA CMO IO | 0,13 | -16,11 | 0,0752 | -0,0151 | |||||

| Beach Acquisition Bidco LLC / DBT (XS3109433477) | 0,12 | 0,0747 | 0,0747 | ||||||

| XAC0787FAG72 / BAUSCH + LOMB CORP | 0,12 | 0,00 | 0,0745 | -0,0007 | |||||

| US3136B5A545 / FNMA CMO IO | 0,12 | 1,64 | 0,0744 | -0,0000 | |||||

| MSTRD / Strategy Inc - Depositary Receipt (Common Stock) | 0,12 | 23,00 | 0,0740 | 0,0133 | |||||

| D1LR34 / Digital Realty Trust, Inc. - Depositary Receipt (Common Stock) | 0,12 | 6,03 | 0,0739 | 0,0036 | |||||

| U.S. Treasury 10 Year Ultra Notes / DIR (N/A) | 0,12 | 0,0734 | 0,0734 | ||||||

| US92938CAL19 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,12 | -26,22 | 0,0728 | -0,0264 | |||||

| Stonex Escrow Issuer LLC / DBT (US86189AAA79) | 0,12 | 0,0727 | 0,0727 | ||||||

| US531229AQ58 / CONV. NOTE | 0,12 | 10,00 | 0,0726 | 0,0056 | |||||

| BANK5, Series 2024-5YR12, Class XA / ABS-MBS (US06644XBM74) | 0,12 | -4,72 | 0,0725 | -0,0047 | |||||

| SOP / DIR (N/A) | 0,12 | 0,0717 | 0,0717 | ||||||

| US38382BH894 / GNMA CMO IO | 0,12 | -4,03 | 0,0717 | -0,0037 | |||||

| US377320AA45 / Glatfelter Corp | 0,12 | 0,0716 | 0,0716 | ||||||

| US38378GHA94 / GNMA CMO IO | 0,12 | -3,25 | 0,0716 | -0,0030 | |||||

| US89364MCA09 / TRANSDIGM INC | 0,12 | 0,00 | 0,0712 | -0,0005 | |||||

| US57767XAA81 / Mav Acquisition Corp | 0,12 | 2,63 | 0,0706 | 0,0014 | |||||

| US38378HK703 / GNMA CMO IO | 0,12 | -0,85 | 0,0706 | -0,0011 | |||||

| US94989NAL10 / Wells Fargo Commercial Mortgage Trust 2015-C30 | 0,12 | 0,00 | 0,0705 | -0,0008 | |||||

| US92939HBB06 / WFRBS Commercial Mortgage Trust 2014-C23 | 0,12 | 0,86 | 0,0703 | -0,0004 | |||||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 0,12 | 0,86 | 0,0702 | -0,0005 | |||||

| US3136B07G54 / FNMA CMO IO | 0,12 | -0,85 | 0,0700 | -0,0008 | |||||

| US55024UAF66 / Lumentum Holdings Inc | 0,12 | 12,62 | 0,0696 | 0,0068 | |||||

| US3136ANRR02 / FNMA CMO IO | 0,11 | -7,38 | 0,0683 | -0,0058 | |||||

| US902252AB17 / Tyler Technologies Inc | 0,11 | 0,91 | 0,0665 | -0,0001 | |||||

| SOP / DIR (N/A) | 0,11 | 0,0661 | 0,0661 | ||||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 0,11 | 6,86 | 0,0658 | 0,0039 | |||||

| ITRI / Itron, Inc. | 0,11 | 0,0658 | 0,0658 | ||||||

| US538034BA63 / CONV. NOTE | 0,11 | 11,22 | 0,0655 | 0,0057 | |||||

| D2AS34 / DoorDash, Inc. - Depositary Receipt (Common Stock) | 0,11 | 0,0651 | 0,0651 | ||||||

| Flutter Financing BV, First Lien, 2024 Refinancing CME Term Loan, B / LON (XAN3313EAG51) | 0,11 | 0,0648 | 0,0648 | ||||||

| US89383JAA60 / Transocean Poseidon Ltd | 0,11 | 0,00 | 0,0646 | -0,0001 | |||||

| US12635FAT12 / CSAIL 2015-C3 Commercial Mortgage Trust | 0,11 | 0,0643 | 0,0643 | ||||||

| US12625FBA30 / COMM 2013-CCRE7 Mortgage Trust | 0,11 | -2,75 | 0,0640 | -0,0021 | |||||

| D1EX34 / DexCom, Inc. - Depositary Receipt (Common Stock) | 0,11 | 4,95 | 0,0638 | 0,0026 | |||||

| US86361HAB06 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR7 A1BG | 0,11 | -1,85 | 0,0637 | -0,0022 | |||||

| US94988QAU58 / Wells Fargo Commercial Mortgage Trust 2013-LC12 | 0,11 | 0,00 | 0,0636 | -0,0010 | |||||

| US35563MBE57 / FREDDIE MAC STACR TRUST 2019-HQA1 SER 2019-HQA1 CL B2 V/R REGD 144A P/P 13.95800000 | 0,10 | 0,97 | 0,0628 | -0,0001 | |||||

| US46590XAN66 / CORP. NOTE | 0,10 | 1,96 | 0,0627 | 0,0004 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 0,10 | 0,00 | 0,0624 | -0,0010 | |||||

| US3136ARFT00 / FNMA CMO IO | 0,10 | -6,54 | 0,0604 | -0,0047 | |||||

| US362348AS37 / ASSET BACKED SECURITY | 0,10 | -0,99 | 0,0601 | -0,0014 | |||||

| PPL Capital Funding, Inc. / DBT (US69352PAS20) | 0,10 | -3,88 | 0,0597 | -0,0027 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 0,10 | 0,0596 | 0,0596 | ||||||

| US85205TAN00 / Spirit AeroSystems Inc | 0,10 | -1,01 | 0,0592 | -0,0009 | |||||

| US3622NAAE07 / CORP CMO | 0,10 | -3,00 | 0,0587 | -0,0024 | |||||

| SOP / DIR (N/A) | 0,10 | 0,0586 | 0,0586 | ||||||

| US30711XCY85 / CORP CMO | 0,10 | -3,03 | 0,0579 | -0,0022 | |||||

| US29786AAN63 / CONV. NOTE | 0,10 | 1,06 | 0,0572 | 0,0000 | |||||

| E2XA34 / Exact Sciences Corporation - Depositary Receipt (Common Stock) | 0,09 | 6,82 | 0,0568 | 0,0031 | |||||

| Ahead DB Holdings LLC, First Lien, CME Term Loan, B3 / LON (US00866HAH84) | 0,09 | 0,0563 | 0,0563 | ||||||

| Waystar Technologies, Inc., First Lien, Initial CME Term Loan / LON (US63939WAM55) | 0,09 | 0,0555 | 0,0555 | ||||||

| US143658BV39 / CONV. NOTE | 0,09 | 31,43 | 0,0554 | 0,0130 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 0,09 | 0,0551 | 0,0551 | ||||||

| US94419LAP67 / CONV. NOTE | 0,09 | 16,88 | 0,0541 | 0,0072 | |||||

| PG Polaris BidCo SARL, First Lien, Initial CME Term Loan / LON (US91728NAB55) | 0,09 | 0,00 | 0,0537 | -0,0005 | |||||

| Glatfelter Corp., First Lien, CME Term Loan / LON (US89458XAB38) | 0,09 | 0,0528 | 0,0528 | ||||||

| CLF / Cleveland-Cliffs Inc. | 0,09 | -10,42 | 0,0520 | -0,0061 | |||||

| US61762MBG50 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,09 | 14,67 | 0,0519 | 0,0064 | |||||

| US46643AAG85 / JPMBB Commercial Mortgage Securities Trust, Series 2014-C23, Class D | 0,09 | -1,15 | 0,0516 | -0,0014 | |||||

| US94989WBB28 / Wells Fargo Commercial Mortgage Trust | 0,09 | 0,0515 | 0,0515 | ||||||

| SOP / DIR (N/A) | 0,09 | 0,0514 | 0,0514 | ||||||

| US428102AF45 / Hess Midstream Operations LP | 0,09 | 2,41 | 0,0512 | 0,0008 | |||||

| US3434125080 / FLUOR CORP PC 6.5% PERP | 0,08 | 23,53 | 0,0504 | 0,0092 | |||||

| US911365BN33 / United Rentals North America Inc | 0,08 | 3,70 | 0,0504 | 0,0012 | |||||

| US38380LAD55 / GNMA CMO IO | 0,08 | -9,78 | 0,0503 | -0,0059 | |||||

| US95041AAB44 / WELLTOWER OP LLC | 0,08 | 0,00 | 0,0498 | -0,0005 | |||||

| US737446AT14 / CONV. NOTE | 0,08 | 60,78 | 0,0494 | 0,0183 | |||||

| US02043QAB32 / CONV. NOTE | 0,08 | 12,50 | 0,0491 | 0,0051 | |||||

| US00971TAL52 / CONV. NOTE | 0,08 | -1,22 | 0,0489 | -0,0007 | |||||

| O2NS34 / ON Semiconductor Corporation - Depositary Receipt (Common Stock) | 0,08 | 6,58 | 0,0489 | 0,0029 | |||||

| Banijay Entertainment SAS, First Lien, CME Term Loan, B3 / LON (XAF6456UAE38) | 0,08 | 0,0484 | 0,0484 | ||||||

| L1YV34 / Live Nation Entertainment, Inc. - Depositary Receipt (Common Stock) | 0,08 | 5,26 | 0,0483 | 0,0019 | |||||

| US61764PBZ45 / Morgan Stanley Bank of America Merrill Lynch Trust 2014 C19 | 0,08 | -13,04 | 0,0483 | -0,0076 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,08 | 2,56 | 0,0483 | 0,0007 | |||||

| US69007TAG94 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0,08 | 1,27 | 0,0482 | 0,0003 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,08 | 0,0478 | 0,0478 | ||||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,08 | 0,0473 | 0,0473 | ||||||

| D1DG34 / Datadog, Inc. - Depositary Receipt (Common Stock) | 0,08 | 9,86 | 0,0472 | 0,0039 | |||||

| US82452JAD19 / SHIFT4 PAYMENTS INC | 0,08 | 5,48 | 0,0464 | 0,0022 | |||||

| RHP Hotel Properties LP / RHP Finance Corp. / DBT (US749571AL97) | 0,08 | 0,0463 | 0,0463 | ||||||

| Quikrete Holdings, Inc. / DBT (US74843PAA84) | 0,08 | 2,67 | 0,0462 | 0,0005 | |||||

| US3137ASB788 / FHLMC CMO IO | 0,08 | -3,75 | 0,0462 | -0,0023 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0,08 | -22,68 | 0,0453 | -0,0136 | |||||

| N2TN34 / Nutanix, Inc. - Depositary Receipt (Common Stock) | 0,07 | 7,25 | 0,0449 | 0,0026 | |||||

| US38375UF884 / GNMA CMO IO | 0,07 | -8,64 | 0,0446 | -0,0044 | |||||

| US40637HAF64 / CONV. NOTE | 0,07 | -10,84 | 0,0444 | -0,0059 | |||||

| SOP / DIR (N/A) | 0,07 | 0,0444 | 0,0444 | ||||||

| US38378JL673 / GNMA CMO IO | 0,07 | -3,95 | 0,0440 | -0,0022 | |||||

| US38379PE947 / GNMA CMO IO | 0,07 | -5,19 | 0,0440 | -0,0027 | |||||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 0,07 | -5,26 | 0,0436 | -0,0028 | |||||

| N2ET34 / Cloudflare, Inc. - Depositary Receipt (Common Stock) | 0,07 | 0,0428 | 0,0428 | ||||||

| XS2066744231 / Carnival PLC | 0,07 | 2,90 | 0,0427 | 0,0005 | |||||

| Integer Holdings Corp. / DBT (US45826HAC34) | 0,07 | 3,03 | 0,0413 | 0,0008 | |||||

| US46590XAL01 / JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc. | 0,07 | -68,08 | 0,0411 | -0,0881 | |||||

| US38376R4R42 / GNMA CMO IO | 0,07 | -6,85 | 0,0408 | -0,0037 | |||||

| US08265TAD19 / CONV. NOTE | 0,07 | 4,62 | 0,0408 | 0,0012 | |||||

| TransDigm, Inc. / DBT (US893647BV82) | 0,07 | 3,08 | 0,0404 | 0,0005 | |||||

| HRI / Herc Holdings Inc. | 0,07 | 1,54 | 0,0400 | 0,0005 | |||||

| US41161PLQ45 / CORP CMO | 0,07 | -7,04 | 0,0399 | -0,0034 | |||||

| OSIS / OSI Systems, Inc. | 0,07 | 11,86 | 0,0399 | 0,0037 | |||||

| US819047AB70 / CONVERTIBLE ZERO | 0,07 | 15,79 | 0,0399 | 0,0051 | |||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 0,07 | 1,54 | 0,0398 | 0,0001 | |||||

| Hess Midstream Operations LP / DBT (US428102AH01) | 0,07 | 1,54 | 0,0396 | 0,0000 | |||||

| US38376RUG90 / GNMA CMO IO | 0,07 | -16,67 | 0,0394 | -0,0081 | |||||

| US92922F4V78 / CORP CMO | 0,07 | -2,99 | 0,0390 | -0,0020 | |||||

| PRGS / Progress Software Corporation | 0,07 | 10,17 | 0,0390 | 0,0032 | |||||

| M2KS34 / MKS Inc. - Depositary Receipt (Common Stock) | 0,06 | 10,34 | 0,0386 | 0,0031 | |||||

| BOX / Box, Inc. | 0,06 | 8,47 | 0,0384 | 0,0021 | |||||

| US665531AJ80 / CONV. NOTE | 0,06 | -1,56 | 0,0382 | -0,0008 | |||||

| US38376MSQ14 / GNMA CMO IO | 0,06 | -7,35 | 0,0381 | -0,0035 | |||||

| MTH / Meritage Homes Corporation | 0,06 | 0,00 | 0,0379 | -0,0006 | |||||

| US46644YAU47 / JPMBB Commercial Mortgage Securities Trust 2015-C31 | 0,06 | -67,71 | 0,0377 | -0,0786 | |||||

| US38375UZV50 / GNMA CMO IO | 0,06 | -15,07 | 0,0375 | -0,0067 | |||||

| CHEF / The Chefs' Warehouse, Inc. | 0,06 | 12,73 | 0,0374 | 0,0037 | |||||

| US38376RFK77 / GNMA CMO IO | 0,06 | -18,42 | 0,0374 | -0,0089 | |||||

| BLDR / Builders FirstSource, Inc. | 0,06 | 0,0371 | 0,0371 | ||||||

| JH North America Holdings, Inc. / DBT (US46593WAB19) | 0,06 | 0,0366 | 0,0366 | ||||||

| US02146QAA13 / CORP CMO | 0,06 | 0,00 | 0,0362 | -0,0005 | |||||

| Clarios Global LP, First Lien, Amendment No. 6 Dollar CME Term Loan / LON (XAC8000CAP86) | 0,06 | 0,0360 | 0,0360 | ||||||

| US38379B6E35 / GNMA CMO IO | 0,06 | -1,64 | 0,0360 | -0,0014 | |||||

| US38376RTH92 / GNMA CMO IO | 0,06 | -17,14 | 0,0353 | -0,0073 | |||||

| US38376R2Q86 / GNMA CMO IO | 0,06 | -20,55 | 0,0351 | -0,0092 | |||||

| US516544AB96 / CONV. NOTE | 0,06 | -10,77 | 0,0351 | -0,0043 | |||||

| US38379EAL65 / GNMA CMO IO | 0,06 | 1,79 | 0,0347 | 0,0003 | |||||

| US703343AG80 / Patrick Industries Inc | 0,06 | 5,66 | 0,0338 | 0,0016 | |||||

| US05493NAA00 / BDS 2021-FL9 Ltd | 0,06 | -48,62 | 0,0338 | -0,0326 | |||||

| Rivian Automotive, Inc. / DBT (US76954AAB98) | 0,06 | 5,66 | 0,0336 | 0,0010 | |||||

| US38380LJK08 / GNMA CMO IO | 0,06 | -11,29 | 0,0334 | -0,0045 | |||||

| CDSCMBX / DCR (N/A) | 0,05 | 0,0327 | 0,0327 | ||||||

| US05464CAB72 / CONV. NOTE | 0,05 | 5,88 | 0,0326 | 0,0014 | |||||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 0,05 | -3,57 | 0,0326 | -0,0016 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,05 | 0,0316 | 0,0316 | ||||||

| COIN / Coinbase Global, Inc. - Depositary Receipt (Common Stock) | 0,05 | 44,44 | 0,0314 | 0,0093 | |||||

| ACA / Arcosa, Inc. | 0,05 | 2,00 | 0,0311 | 0,0004 | |||||

| US38378HVU75 / GNMA CMO IO | 0,05 | -5,56 | 0,0311 | -0,0017 | |||||

| US3136A1D440 / FNMA CMO IO | 0,05 | -1,96 | 0,0302 | -0,0010 | |||||

| US126192AL71 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,05 | 4,17 | 0,0302 | 0,0008 | |||||

| R2GE34 / Repligen Corporation - Depositary Receipt (Common Stock) | 0,05 | 2,08 | 0,0298 | 0,0002 | |||||

| 5290 / Vertex Corporation | 0,05 | -18,33 | 0,0295 | -0,0073 | |||||

| HAE / Haemonetics Corporation | 0,05 | 4,35 | 0,0293 | 0,0010 | |||||

| US92339LAA08 / VERDE PURCHASER LLC 10.5% 11/30/2030 144A | 0,05 | 2,13 | 0,0292 | 0,0004 | |||||

| SOP / DIR (N/A) | 0,05 | 0,0289 | 0,0289 | ||||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 0,05 | 0,0284 | 0,0284 | ||||||

| SOP / DIR (N/A) | 0,05 | 0,0280 | 0,0280 | ||||||

| WESCO Distribution, Inc. / DBT (US95081QAS30) | 0,05 | 2,22 | 0,0279 | 0,0005 | |||||

| US589889AA22 / Merit Medical Systems Inc | 0,05 | -8,00 | 0,0278 | -0,0027 | |||||

| US09061GAK76 / CONV. NOTE | 0,05 | 0,00 | 0,0277 | -0,0002 | |||||

| US38376R2S43 / GNMA CMO IO | 0,05 | -9,80 | 0,0277 | -0,0036 | |||||

| SOP / DIR (N/A) | 0,05 | 0,0276 | 0,0276 | ||||||

| AVNT / Avient Corporation | 0,05 | 2,27 | 0,0272 | 0,0002 | |||||

| SOP / DIR (N/A) | 0,05 | 0,0272 | 0,0272 | ||||||

| US38376RC877 / GNMA CMO IO | 0,04 | -16,98 | 0,0270 | -0,0054 | |||||

| SOP / DIR (N/A) | 0,04 | 0,0269 | 0,0269 | ||||||

| B2UR34 / Burlington Stores, Inc. - Depositary Receipt (Common Stock) | 0,04 | 0,00 | 0,0264 | -0,0008 | |||||

| PSN / Parsons Corporation | 0,04 | 4,88 | 0,0262 | 0,0014 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,04 | 0,00 | 0,0260 | -0,0000 | |||||

| US38376RV786 / GNMA CMO IO | 0,04 | -17,65 | 0,0257 | -0,0057 | |||||

| US46639YAX58 / JP Morgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class D | 0,04 | -10,64 | 0,0256 | -0,0031 | |||||

| US38376RNL68 / GNMA CMO IO | 0,04 | -14,29 | 0,0254 | -0,0044 | |||||

| SOP / DIR (N/A) | 0,04 | 0,0250 | 0,0250 | ||||||

| US852234AK99 / CONV. NOTE | 0,04 | 2,50 | 0,0247 | 0,0001 | |||||

| US38376RYA84 / GNMA CMO IO | 0,04 | -13,04 | 0,0243 | -0,0037 | |||||

| US38378GNB04 / GNMA CMO IO | 0,04 | 0,00 | 0,0236 | -0,0005 | |||||

| SOP / DIR (N/A) | 0,04 | 0,0232 | 0,0232 | ||||||

| US38376RAE62 / GNMA CMO IO | 0,04 | -9,52 | 0,0228 | -0,0030 | |||||

| US38376RSF46 / GNMA CMO IO | 0,04 | -11,63 | 0,0228 | -0,0032 | |||||

| CDSCMBX / DCR (N/A) | 0,04 | 0,0222 | 0,0222 | ||||||

| CDSCMBX / DCR (N/A) | 0,04 | 0,0221 | 0,0221 | ||||||

| HRI / Herc Holdings Inc. | 0,04 | 0,0219 | 0,0219 | ||||||

| WK / Workiva Inc. | 0,04 | 0,00 | 0,0217 | -0,0003 | |||||

| Adient Global Holdings Ltd. / DBT (US00687YAD76) | 0,04 | 9,38 | 0,0215 | 0,0016 | |||||

| US38376RNT94 / GNMA CMO IO | 0,03 | -5,56 | 0,0209 | -0,0012 | |||||

| US38375UPZ74 / GNMA CMO IO | 0,03 | -17,07 | 0,0206 | -0,0046 | |||||

| US07386HYW59 / BEAR STEARNS ALT A TRUST BALTA 2005 10 11A1 | 0,03 | -2,86 | 0,0205 | -0,0012 | |||||

| SOP / DIR (N/A) | 0,03 | 0,0204 | 0,0204 | ||||||

| Verde Purchaser LLC, First Lien, Second Refinancing CME Term Loan / LON (US92338TAB26) | 0,03 | 0,00 | 0,0199 | -0,0001 | |||||

| US3617LELG72 / GII30 | 0,03 | 0,00 | 0,0199 | -0,0004 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0,03 | 0,0195 | 0,0195 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0,03 | 0,0193 | 0,0193 | ||||||

| US94988XAC02 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,03 | 6,67 | 0,0192 | 0,0006 | |||||

| HCXY / Hercules Capital, Inc. - Corporate Bond/Note | 0,03 | -3,12 | 0,0192 | -0,0005 | |||||

| US38379LX920 / GNMA CMO IO | 0,03 | -8,82 | 0,0188 | -0,0023 | |||||

| US38375UYG92 / GNMA CMO IO | 0,03 | -11,43 | 0,0187 | -0,0029 | |||||

| US38376RFF82 / GNMA CMO IO | 0,03 | -14,71 | 0,0180 | -0,0032 | |||||

| US453204AD18 / CONV. NOTE | 0,03 | 7,41 | 0,0180 | 0,0014 | |||||

| XS1493296500 / Spectrum Brands, Inc. | 0,03 | 0,0175 | 0,0175 | ||||||

| US38375UK256 / GNMA CMO IO | 0,03 | -12,50 | 0,0172 | -0,0025 | |||||

| SOP / DIR (N/A) | 0,03 | 0,0169 | 0,0169 | ||||||

| US46639YAC12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,03 | 0,00 | 0,0168 | -0,0002 | |||||

| SOP / DIR (N/A) | 0,03 | 0,0167 | 0,0167 | ||||||

| OIS / DIR (N/A) | 0,03 | 0,0161 | 0,0161 | ||||||

| CDSCMBX / DCR (N/A) | 0,03 | 0,0159 | 0,0159 | ||||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0,03 | 0,0155 | 0,0155 | ||||||

| US3617K4U964 / GII30 | 0,02 | -4,00 | 0,0150 | -0,0002 | |||||

| US3617K4U881 / GII30 | 0,02 | 0,00 | 0,0145 | -0,0002 | |||||

| US31398PJU49 / FNMA CMO IO | 0,02 | 4,35 | 0,0144 | 0,0001 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0142 | 0,0142 | ||||||

| US38376RHE99 / GNMA CMO IO | 0,02 | -17,86 | 0,0140 | -0,0033 | |||||

| US3136A9C486 / FNMA CMO IO | 0,02 | 0,00 | 0,0135 | -0,0004 | |||||

| US38376RJK32 / GNMA CMO IO | 0,02 | -24,14 | 0,0134 | -0,0043 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0132 | 0,0132 | ||||||

| US30711XDY76 / Fannie Mae Connecticut Avenue Securities | 0,02 | 0,00 | 0,0128 | -0,0003 | |||||

| DTRS / DIR (N/A) | 0,02 | 0,0128 | 0,0128 | ||||||

| US61915RAN61 / CORP CMO | 0,02 | -8,70 | 0,0127 | -0,0014 | |||||

| US977852AD45 / CONV. NOTE | 0,02 | 16,67 | 0,0127 | 0,0015 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0125 | 0,0125 | ||||||

| American Airlines, Inc., First Lien, 2025 Incremental CME Term Loan / LON (US02376CBT18) | 0,02 | 0,0121 | 0,0121 | ||||||

| SOP / DIR (N/A) | 0,02 | 0,0117 | 0,0117 | ||||||

| SOP / DIR (N/A) | 0,02 | 0,0116 | 0,0116 | ||||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0116 | 0,0116 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,02 | 0,0111 | 0,0111 | ||||||

| OIS / DIR (N/A) | 0,02 | 0,0110 | 0,0110 | ||||||

| US38375BM666 / GNMA CMO IO | 0,02 | 0,00 | 0,0109 | -0,0006 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0107 | 0,0107 | ||||||

| SOP / DIR (N/A) | 0,02 | 0,0106 | 0,0106 | ||||||

| US3617K4VB00 / GII30 | 0,02 | 0,00 | 0,0103 | -0,0002 | |||||

| US3140JUFY52 / FN30 | 0,02 | 0,00 | 0,0100 | -0,0002 | |||||

| US38376RF359 / GNMA CMO IO | 0,02 | -16,67 | 0,0095 | -0,0019 | |||||

| US3140JS4K28 / FN30 | 0,02 | -16,67 | 0,0093 | -0,0020 | |||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0093 | 0,0093 | ||||||

| US3137ALYB93 / FHLMC CMO IO | 0,02 | -6,25 | 0,0092 | -0,0006 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,02 | 0,0092 | 0,0092 | ||||||

| JH North America Holdings, Inc. / DBT (US46593WAA36) | 0,02 | 0,0091 | 0,0091 | ||||||

| SOP / DIR (N/A) | 0,01 | 0,0082 | 0,0082 | ||||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0081 | 0,0081 | ||||||

| US46631QAT94 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,01 | -7,14 | 0,0079 | -0,0007 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0078 | 0,0078 | ||||||

| US097023CN34 / Boeing Co/The | 0,01 | 0,00 | 0,0078 | 0,0001 | |||||

| US38379LWF92 / GNMA CMO IO | 0,01 | -14,29 | 0,0074 | -0,0015 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0073 | 0,0073 | ||||||

| US3617LEPL22 / GII30 | 0,01 | -8,33 | 0,0072 | -0,0002 | |||||

| US3140JXZG65 / FN30 | 0,01 | 0,00 | 0,0065 | -0,0001 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,01 | 0,0061 | 0,0061 | ||||||

| Euro-Bobl / DIR (DE000F1NGF61) | 0,01 | 0,0061 | 0,0061 | ||||||

| US3136FEMW97 / FNMA CMO IO | 0,01 | 0,00 | 0,0060 | -0,0004 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,01 | 0,0056 | 0,0056 | ||||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0046 | 0,0046 | ||||||

| SOP / DIR (N/A) | 0,01 | 0,0044 | 0,0044 | ||||||

| US15089QAP90 / Celanese US Holdings LLC | 0,01 | -93,00 | 0,0044 | -0,0565 | |||||

| US3137AUD483 / FHLMC CMO IO | 0,01 | -12,50 | 0,0042 | -0,0008 | |||||

| IRS / DIR (N/A) | 0,01 | 0,0034 | 0,0034 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,01 | 0,0031 | 0,0031 | ||||||

| US3136FCZ907 / FNMA CMO IO | 0,00 | 0,00 | 0,0026 | -0,0002 | |||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0023 | 0,0023 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0021 | 0,0021 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0017 | 0,0017 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0016 | 0,0016 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0015 | 0,0015 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0015 | 0,0015 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0014 | 0,0014 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0012 | 0,0012 | ||||||

| US3140JKL870 / FN30 | 0,00 | -50,00 | 0,0012 | -0,0000 | |||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0011 | 0,0011 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0010 | 0,0010 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0010 | 0,0010 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0009 | 0,0009 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0008 | 0,0008 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0008 | 0,0008 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0005 | 0,0005 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0004 | 0,0004 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0004 | 0,0004 | ||||||

| SOP / DIR (N/A) | 0,00 | 0,0003 | 0,0003 | ||||||

| US31325UPS95 / FHLMC CMO IO | 0,00 | 0,0003 | -0,0002 | ||||||

| US38380FAU03 / GNMA CMO IO | 0,00 | -100,00 | 0,0002 | -0,0005 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| US88631FAA66 / COLLATERALIZED DEBT OBLIGATION | 0,00 | 0,0000 | 0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| OIS / DIR (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0002 | -0,0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0002 | -0,0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0003 | -0,0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0003 | -0,0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0004 | -0,0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0004 | -0,0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0004 | -0,0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0005 | -0,0005 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0005 | -0,0005 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0006 | -0,0006 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0009 | -0,0009 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0011 | -0,0011 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0011 | -0,0011 | ||||||

| SOP / DIR (N/A) | -0,00 | -0,0012 | -0,0012 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0012 | -0,0012 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0013 | -0,0013 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0014 | -0,0014 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0015 | -0,0015 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0015 | -0,0015 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0016 | -0,0016 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0017 | -0,0017 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0018 | -0,0018 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0018 | -0,0018 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0025 | -0,0025 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0026 | -0,0026 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0027 | -0,0027 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0037 | -0,0037 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0038 | -0,0038 | ||||||

| OIS / DIR (N/A) | -0,01 | -0,0047 | -0,0047 | ||||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0,01 | -0,0048 | -0,0048 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0052 | -0,0052 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0060 | -0,0060 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0062 | -0,0062 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0062 | -0,0062 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0066 | -0,0066 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0067 | -0,0067 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0076 | -0,0076 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0076 | -0,0076 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0081 | -0,0081 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0087 | -0,0087 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0089 | -0,0089 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0090 | -0,0090 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,02 | -0,0101 | -0,0101 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,02 | -0,0149 | -0,0149 | ||||||

| IRS / DIR (N/A) | -0,03 | -0,0157 | -0,0157 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,03 | -0,0174 | -0,0174 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,03 | -0,0194 | -0,0194 | ||||||

| CDSCMBX / DCR (N/A) | -0,03 | -0,0206 | -0,0206 | ||||||

| OIS / DIR (N/A) | -0,04 | -0,0251 | -0,0251 | ||||||

| OIS / DIR (N/A) | -0,05 | -0,0281 | -0,0281 | ||||||

| CDSCMBX / DCR (N/A) | -0,05 | -0,0313 | -0,0313 | ||||||

| CDSCMBX / DCR (N/A) | -0,05 | -0,0324 | -0,0324 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,06 | -0,0359 | -0,0359 | ||||||

| IRS / DIR (N/A) | -0,07 | -0,0395 | -0,0395 | ||||||

| CDSCMBX / DCR (N/A) | -0,07 | -0,0417 | -0,0417 | ||||||

| SOP / DIR (N/A) | -0,20 | -0,1189 | -0,1189 | ||||||

| OIS / DIR (N/A) | -0,55 | -0,3271 | -0,3271 | ||||||

| OIS / DIR (N/A) | -0,63 | -0,3752 | -0,3752 | ||||||

| EW / Edwards Lifesciences Corporation | -0,93 | -194,80 | -0,5572 | -1,1445 | |||||

| EW / Edwards Lifesciences Corporation | -2,87 | 208,83 | -1,7196 | -1,1624 |