Grundlæggende statistik

| Porteføljeværdi | $ 1.303.096.841 |

| Nuværende stillinger | 652 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

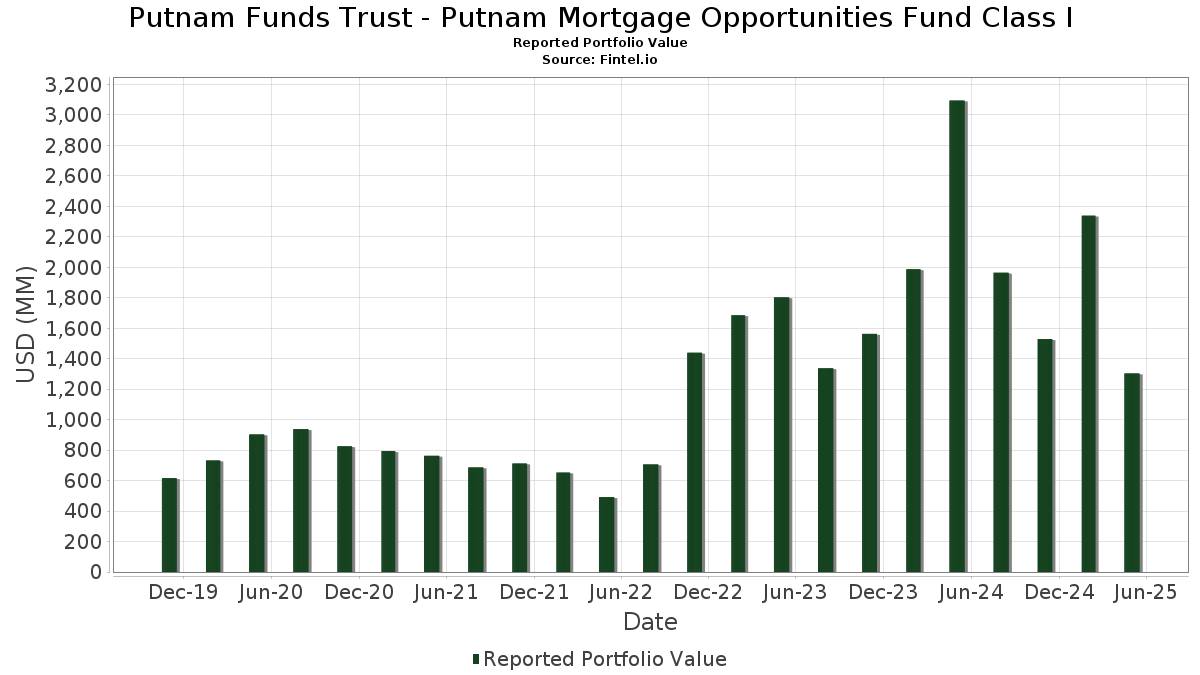

Putnam Funds Trust - Putnam Mortgage Opportunities Fund Class I har afsløret 652 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 1.303.096.841 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Putnam Funds Trust - Putnam Mortgage Opportunities Fund Class Is største beholdninger er Uniform Mortgage-Backed Security, TBA (US:US01F0526644) , Uniform Mortgage-Backed Security, TBA (US:US01F0606677) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , SHORT TERM INV FUND (US:US74676P6640) , and Ginnie Mae (US:US21H0426617) . Putnam Funds Trust - Putnam Mortgage Opportunities Fund Class Is nye stillinger omfatter Uniform Mortgage-Backed Security, TBA (US:US01F0526644) , Uniform Mortgage-Backed Security, TBA (US:US01F0606677) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Ginnie Mae (US:US21H0426617) , and Uniform Mortgage-Backed Security, TBA (US:US01F0226674) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 170,29 | 28,2265 | 36,1037 | ||

| 117,00 | 19,3926 | 19,3926 | ||

| 28,31 | 4,6922 | 3,2866 | ||

| 20,37 | 3,3757 | 2,4753 | ||

| 14,29 | 2,3693 | 2,3693 | ||

| 14,29 | 2,3693 | 2,3693 | ||

| 14,29 | 2,3693 | 2,3693 | ||

| 85,54 | 85,54 | 14,1787 | 2,2085 | |

| 13,13 | 2,1760 | 2,1760 | ||

| 13,54 | 2,2447 | 2,0978 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 117,15 | 19,4182 | -28,0667 | ||

| -47,52 | -7,8772 | -26,9021 | ||

| 3,40 | 0,5642 | -2,6116 | ||

| -0,92 | -0,1518 | -2,3965 | ||

| 3,77 | 0,6251 | -1,6196 | ||

| 3,77 | 0,6251 | -1,6196 | ||

| -3,77 | -0,6254 | -1,2508 | ||

| -6,18 | -1,0251 | -1,0251 | ||

| -6,18 | -1,0251 | -1,0251 | ||

| 0,92 | 0,1519 | -0,8602 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-07-25 for rapporteringsperioden 2025-05-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0526644 / Uniform Mortgage-Backed Security, TBA | 170,29 | -458,33 | 28,2265 | 36,1037 | |||||

| US01F0606677 / Uniform Mortgage-Backed Security, TBA | 117,15 | -54,12 | 19,4182 | -28,0667 | |||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 117,00 | 19,3926 | 19,3926 | ||||||

| US74676P6640 / SHORT TERM INV FUND | 85,54 | 23,89 | 85,54 | 23,89 | 14,1787 | 2,2085 | |||

| US21H0426617 / Ginnie Mae | 28,31 | 274,59 | 4,6922 | 3,2866 | |||||

| US01F0226674 / Uniform Mortgage-Backed Security, TBA | 20,37 | 320,68 | 3,3757 | 2,4753 | |||||

| U.S. Treasury Bills / STIV (US912797MS31) | 14,29 | 2,3693 | 2,3693 | ||||||

| U.S. Treasury Bills / STIV (US912797MS31) | 14,29 | 2,3693 | 2,3693 | ||||||

| U.S. Treasury Bills / STIV (US912797MS31) | 14,29 | 2,3693 | 2,3693 | ||||||

| US01F0506687 / Fannie Mae or Freddie Mac | 13,55 | 40,88 | 2,2465 | 0,4574 | |||||

| EWL / Edwards Lifesciences Corporation | 13,54 | 259,11 | 2,2447 | 1,6196 | |||||

| EWL / Edwards Lifesciences Corporation | 13,54 | 1.428,44 | 2,2447 | 2,0978 | |||||

| EWL / Edwards Lifesciences Corporation | 13,54 | 1.428,44 | 2,2447 | 2,0978 | |||||

| US21H0606630 / Ginnie Mae | 13,13 | 2,1760 | 2,1760 | ||||||

| US21H0526606 / Ginnie Mae | 12,91 | 0,14 | 2,1399 | -0,2578 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,91 | 8,34 | 0,8137 | 0,0281 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,91 | 8,34 | 0,8137 | 0,0281 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 4,91 | 8,34 | 0,8137 | 0,0281 | |||||

| US35564PAC23 / Freddie Mac Stacr Trust 2019-FTR1 | 4,66 | -1,35 | 0,7727 | -0,0466 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-VIS2, Class A1 / ABS-MBS (US46658DAA72) | 4,18 | -2,79 | 0,6935 | -0,0527 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-VIS2, Class A1 / ABS-MBS (US46658DAA72) | 4,18 | -2,79 | 0,6935 | -0,0527 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-VIS2, Class A1 / ABS-MBS (US46658DAA72) | 4,18 | -2,79 | 0,6935 | -0,0527 | |||||

| PRET LLC, Series 2024-NPL9, Class A1 / ABS-MBS (US74143TAA79) | 4,16 | 0,6896 | 0,6896 | ||||||

| PRET LLC, Series 2024-NPL9, Class A1 / ABS-MBS (US74143TAA79) | 4,16 | 0,6896 | 0,6896 | ||||||

| PRET LLC, Series 2024-NPL9, Class A1 / ABS-MBS (US74143TAA79) | 4,16 | 0,6896 | 0,6896 | ||||||

| J.P. Morgan Mortgage Trust, Series 2025-2, Class A11 / ABS-MBS (US46593NAY13) | 4,00 | -4,80 | 0,6636 | -0,0655 | |||||

| J.P. Morgan Mortgage Trust, Series 2025-2, Class A11 / ABS-MBS (US46593NAY13) | 4,00 | -4,80 | 0,6636 | -0,0655 | |||||

| J.P. Morgan Mortgage Trust, Series 2025-2, Class A11 / ABS-MBS (US46593NAY13) | 4,00 | -4,80 | 0,6636 | -0,0655 | |||||

| GNMA, Series 2024-64, Class QS / ABS-MBS (US38384MPK70) | 3,88 | -5,69 | 0,6423 | -0,0702 | |||||

| GNMA, Series 2024-64, Class QS / ABS-MBS (US38384MPK70) | 3,88 | -5,69 | 0,6423 | -0,0702 | |||||

| GNMA, Series 2024-64, Class QS / ABS-MBS (US38384MPK70) | 3,88 | -5,69 | 0,6423 | -0,0702 | |||||

| GNMA, Series 2024-78, Class QF / ABS-MBS (US38384NV698) | 3,83 | 0,6356 | 0,6356 | ||||||

| GNMA, Series 2024-78, Class QF / ABS-MBS (US38384NV698) | 3,83 | 0,6356 | 0,6356 | ||||||

| GNMA, Series 2024-78, Class QF / ABS-MBS (US38384NV698) | 3,83 | 0,6356 | 0,6356 | ||||||

| PRMI Securitization Trust, Series 2024-CMG1, Class A1 / ABS-O (US74275VAA26) | 3,83 | -3,31 | 0,6345 | -0,0519 | |||||

| PRMI Securitization Trust, Series 2024-CMG1, Class A1 / ABS-O (US74275VAA26) | 3,83 | -3,31 | 0,6345 | -0,0519 | |||||

| PRMI Securitization Trust, Series 2024-CMG1, Class A1 / ABS-O (US74275VAA26) | 3,83 | -3,31 | 0,6345 | -0,0519 | |||||

| PRET LLC, Series 2024-RN2, Class A1 / ABS-O (US69391YAA55) | 3,79 | -4,95 | 0,6276 | -0,0630 | |||||

| US01F0426654 / Uniform Mortgage-Backed Security, TBA | 3,77 | 0,00 | 0,6254 | 0,0000 | |||||

| US01F0426654 / Uniform Mortgage-Backed Security, TBA | 3,77 | 303,10 | 0,6254 | 0,4513 | |||||

| EWL / Edwards Lifesciences Corporation | 3,77 | -72,15 | 0,6251 | -1,6196 | |||||

| EWL / Edwards Lifesciences Corporation | 3,77 | -72,15 | 0,6251 | -1,6196 | |||||

| EWL / Edwards Lifesciences Corporation | 3,77 | 325,62 | 0,6251 | 0,4782 | |||||

| US35563XBE13 / Freddie Mac Stacr Trust 2018-HQA2 | 3,75 | -3,00 | 0,6213 | -0,0486 | |||||

| US35565LBE56 / Freddie Mac Stacr Remic Trust 2020-HQA2 | 3,62 | -1,20 | 0,6008 | -0,0352 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL5, Class A1 / ABS-MBS (US795935AA37) | 3,61 | -0,83 | 0,5978 | -0,0327 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL5, Class A1 / ABS-MBS (US795935AA37) | 3,61 | -0,83 | 0,5978 | -0,0327 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL5, Class A1 / ABS-MBS (US795935AA37) | 3,61 | -0,83 | 0,5978 | -0,0327 | |||||

| GNMA, Series 2020-62, Class ES / ABS-MBS (US38382FNL49) | 3,59 | 0,5956 | 0,5956 | ||||||

| GNMA, Series 2022-160, Class IB / ABS-MBS (US38383YSF06) | 3,57 | -3,46 | 0,5918 | -0,0494 | |||||

| GNMA, Series 2022-160, Class IB / ABS-MBS (US38383YSF06) | 3,57 | -3,46 | 0,5918 | -0,0494 | |||||

| GNMA, Series 2022-160, Class IB / ABS-MBS (US38383YSF06) | 3,57 | -3,46 | 0,5918 | -0,0494 | |||||

| CFMT LLC, Series 2024-HB13, Class M1 / ABS-O (US12530VAB18) | 3,56 | 0,42 | 0,5905 | -0,0246 | |||||

| CFMT LLC, Series 2024-HB13, Class M1 / ABS-O (US12530VAB18) | 3,56 | 0,42 | 0,5905 | -0,0246 | |||||

| CFMT LLC, Series 2024-HB13, Class M1 / ABS-O (US12530VAB18) | 3,56 | 0,42 | 0,5905 | -0,0246 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,53 | -6,24 | 0,5854 | -0,0676 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,53 | -6,24 | 0,5854 | -0,0676 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 3,53 | -6,24 | 0,5854 | -0,0676 | |||||

| US35564KFH77 / FREDDIE MAC STACR REMIC TRUST 2021-DNA3 SER 2021-DNA3 CL B2 V/R REGD 144A P/P 6.26000000 | 3,53 | -1,65 | 0,5847 | -0,0372 | |||||

| US01F0306609 / Fannie Mae or Freddie Mac | 3,40 | 1,25 | 0,5643 | -0,0610 | |||||

| US01F0306781 / UMBS TBA | 3,40 | -60,26 | 0,5642 | -2,6116 | |||||

| US35564KE708 / STACR_22-HQA3 | 3,40 | -1,42 | 0,5638 | -0,0344 | |||||

| GNMA, Series 2024-97, Class S / ABS-MBS (US38384PPU83) | 3,36 | 26,31 | 0,5563 | 0,0955 | |||||

| GNMA, Series 2022-120, Class SH / ABS-MBS (US38383TB772) | 3,35 | 0,5560 | 0,5560 | ||||||

| GNMA, Series 2022-120, Class SH / ABS-MBS (US38383TB772) | 3,35 | 0,5560 | 0,5560 | ||||||

| GNMA, Series 2022-120, Class SH / ABS-MBS (US38383TB772) | 3,35 | 0,5560 | 0,5560 | ||||||

| US38382NT316 / Government National Mortgage Association | 3,30 | 8,99 | 0,5469 | 0,0220 | |||||

| US35563MBE57 / FREDDIE MAC STACR TRUST 2019-HQA1 SER 2019-HQA1 CL B2 V/R REGD 144A P/P 13.95800000 | 3,28 | -0,15 | 0,5431 | -0,0258 | |||||

| GNMA, Series 2024-30, Class EI / ABS-MBS (US38384JPU24) | 3,18 | -5,95 | 0,5268 | -0,0590 | |||||

| GNMA, Series 2021-91, Class AI / ABS-MBS (US38382TNG57) | 3,18 | -5,61 | 0,5268 | -0,0571 | |||||

| US20754KAB70 / Fannie Mae Connecticut Avenue Securities | 3,12 | -0,64 | 0,5170 | -0,0272 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2024-3, Class AF / ABS-MBS (US61776QAH92) | 3,12 | 36,38 | 0,5163 | 0,1204 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2024-3, Class AF / ABS-MBS (US61776QAH92) | 3,12 | 36,38 | 0,5163 | 0,1204 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2024-3, Class AF / ABS-MBS (US61776QAH92) | 3,12 | 36,38 | 0,5163 | 0,1204 | |||||

| US38384CCX56 / GNMA CMO IO | 2,99 | 1,63 | 0,4962 | -0,0145 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL6, Class A1 / ABS-MBS (US79585UAA88) | 2,99 | -0,60 | 0,4961 | -0,0258 | |||||

| GS Mortgage-Backed Securities Trust, Series 2024-HE1, Class A1 / ABS-O (US36270AAA25) | 2,99 | -7,46 | 0,4959 | -0,0645 | |||||

| GS Mortgage-Backed Securities Trust, Series 2024-HE1, Class A1 / ABS-O (US36270AAA25) | 2,99 | -7,46 | 0,4959 | -0,0645 | |||||

| GS Mortgage-Backed Securities Trust, Series 2024-HE1, Class A1 / ABS-O (US36270AAA25) | 2,99 | -7,46 | 0,4959 | -0,0645 | |||||

| US17323CAS61 / COMMERCIAL MORTGAGE BACKED SECURITIES | 2,98 | 236,30 | 0,4946 | 0,3408 | |||||

| US3137G0GZ69 / CORP CMO | 2,95 | 860,59 | 0,4889 | 0,4356 | |||||

| US35564KUL15 / STACR_22-HQA1 | 2,94 | -1,31 | 0,4881 | -0,0292 | |||||

| US35564KTJ87 / Freddie Mac STACR REMIC Trust 2022-HQA1 | 2,94 | -1,14 | 0,4869 | -0,0283 | |||||

| US38383CJB72 / GNMA CMO IO | 2,87 | -0,24 | 0,4763 | -0,0232 | |||||

| US17323CAN74 / Citigroup Commercial Mortgage Trust 2015-GC27 | 2,85 | 541,67 | 0,4723 | 0,3952 | |||||

| US126192AK98 / COMM 2012-LC4 MORTGAGE TRUST COMM 2012-LC4 D | 2,80 | 68,51 | 0,4640 | 0,1759 | |||||

| US20754BAB71 / Connecticut Avenue Securities Trust 2022-R02 | 2,79 | -0,46 | 0,4629 | -0,0235 | |||||

| US92939FAX78 / WFRBS COMMERCIAL MORTGAGE TRUST 2014-C21 WFRBS 2014-C21 B | 2,77 | 29,65 | 0,4595 | 0,0887 | |||||

| GNMA, Series 2023-114, Class SK / ABS-MBS (US38384EAH80) | 2,68 | -1,04 | 0,4436 | -0,0252 | |||||

| GNMA, Series 2023-114, Class SK / ABS-MBS (US38384EAH80) | 2,68 | -1,04 | 0,4436 | -0,0252 | |||||

| GNMA, Series 2023-114, Class SK / ABS-MBS (US38384EAH80) | 2,68 | -1,04 | 0,4436 | -0,0252 | |||||

| US20754DAF42 / CORP CMO | 2,67 | -0,97 | 0,4422 | -0,0249 | |||||

| GNMA, Series 2024-51, Class HS / ABS-MBS (US38384KTQ49) | 2,66 | -4,89 | 0,4415 | -0,0440 | |||||

| GNMA, Series 2024-51, Class HS / ABS-MBS (US38384KTQ49) | 2,66 | -4,89 | 0,4415 | -0,0440 | |||||

| GNMA, Series 2024-51, Class HS / ABS-MBS (US38384KTQ49) | 2,66 | -4,89 | 0,4415 | -0,0440 | |||||

| US12631DBG79 / COMMERCIAL MORTGAGE BACKED SECURITIES | 2,60 | -0,27 | 0,4309 | -0,0210 | |||||

| US52523KBH68 / Lehman XS Trust 2006-17 | 2,56 | 3,39 | 0,4250 | -0,0049 | |||||

| US00002MAB54 / A&D Mortgage Trust 2023-NQM4 | 2,54 | -5,43 | 0,4218 | -0,0446 | |||||

| US38384EAG08 / GNMA CMO IO | 2,54 | -2,49 | 0,4212 | -0,0307 | |||||

| GNMA, Series 2022-128, Class SH / ABS-MBS (US38383T8J57) | 2,54 | 0,4203 | 0,4203 | ||||||

| GNMA, Series 2022-128, Class SH / ABS-MBS (US38383T8J57) | 2,54 | 0,4203 | 0,4203 | ||||||

| US38383FDA84 / Government National Mortgage Association, Series 2021-214, Class AI | 2,50 | -1,19 | 0,4147 | -0,0242 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,49 | -5,06 | 0,4133 | -0,0421 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,49 | -5,06 | 0,4133 | -0,0421 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2,49 | -5,06 | 0,4133 | -0,0421 | |||||

| US61767FBF71 / Morgan Stanley Capital I Trust, Series 2016-UB11, Class C | 2,49 | 0,77 | 0,4129 | -0,0158 | |||||

| GNMA, Series 2024-126, Class LS / ABS-MBS (US38384UYD52) | 2,47 | 7,66 | 0,4100 | 0,0117 | |||||

| GNMA, Series 2024-126, Class LS / ABS-MBS (US38384UYD52) | 2,47 | 7,66 | 0,4100 | 0,0117 | |||||

| GNMA, Series 2024-126, Class LS / ABS-MBS (US38384UYD52) | 2,47 | 7,66 | 0,4100 | 0,0117 | |||||

| US46643AAG85 / JPMBB Commercial Mortgage Securities Trust, Series 2014-C23, Class D | 2,45 | 16,69 | 0,4069 | 0,0422 | |||||

| GNMA, Series 2024-30, Class WS / ABS-MBS (US38384JKZ65) | 2,40 | 7,53 | 0,3975 | 0,0108 | |||||

| GNMA, Series 2024-30, Class WS / ABS-MBS (US38384JKZ65) | 2,40 | 7,53 | 0,3975 | 0,0108 | |||||

| GNMA, Series 2024-30, Class WS / ABS-MBS (US38384JKZ65) | 2,40 | 7,53 | 0,3975 | 0,0108 | |||||

| US3137FR6Y26 / Freddie Mac REMICS | 2,40 | -3,35 | 0,3971 | -0,0326 | |||||

| US38383MD542 / GNMA CMO IO | 2,36 | -3,47 | 0,3918 | -0,0326 | |||||

| US3136BDTS75 / Fannie Mae REMICS | 2,30 | 0,48 | 0,3816 | -0,0156 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,29 | 0,3794 | 0,3794 | ||||||

| GNMA, Series 2024-4, Class ES / ABS-MBS (US38384HW383) | 2,29 | -0,48 | 0,3790 | -0,0193 | |||||

| GNMA, Series 2024-4, Class ES / ABS-MBS (US38384HW383) | 2,29 | -0,48 | 0,3790 | -0,0193 | |||||

| GNMA, Series 2024-4, Class ES / ABS-MBS (US38384HW383) | 2,29 | -0,48 | 0,3790 | -0,0193 | |||||

| US38383VWY00 / GNMA CMO IO | 2,28 | -10,38 | 0,3779 | -0,0631 | |||||

| US38382M4V86 / Government National Mortgage Association | 2,26 | -1,09 | 0,3747 | -0,0215 | |||||

| US38383VWQ75 / GNMA CMO IO | 2,26 | 36,01 | 0,3739 | 0,0863 | |||||

| SOP / DIR (N/A) | 2,25 | 0,3722 | 0,3722 | ||||||

| US20754BAF85 / CAS_22-R02 | 2,24 | -0,97 | 0,3714 | -0,0208 | |||||

| US3137H9F465 / Freddie Mac REMICS | 2,23 | -2,15 | 0,3701 | -0,0255 | |||||

| GNMA, Series 2024-30, Class SU / ABS-MBS (US38384JRW61) | 2,23 | 9,71 | 0,3689 | 0,0172 | |||||

| GNMA, Series 2024-30, Class SU / ABS-MBS (US38384JRW61) | 2,23 | 9,71 | 0,3689 | 0,0172 | |||||

| US38382WZF75 / GNMA CMO IO | 2,22 | -5,90 | 0,3675 | -0,0409 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,22 | -2,93 | 0,3673 | -0,0285 | |||||

| US38382LNV98 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2020-173 MI | 2,21 | -4,33 | 0,3660 | -0,0341 | |||||

| US38383CCM01 / Government National Mortgage Association, Series 2021-176, Class IA | 2,21 | -6,25 | 0,3655 | -0,0423 | |||||

| US12624QAT04 / COMM 2012-CCRE4 MORTGAGE TRUST SER 2012-CR4 CL AM REGD 3.25100000 | 2,20 | 0,3649 | 0,3649 | ||||||

| US46639EAN13 / COMMERCIAL MORTGAGE BACKED SECURITIES | 2,18 | 0,83 | 0,3613 | -0,0135 | |||||

| US94989WBB28 / Wells Fargo Commercial Mortgage Trust | 2,17 | 88,51 | 0,3592 | 0,1599 | |||||

| US36253GAK85 / GS Mortgage Securities Trust 2014-GC24 | 2,16 | -0,42 | 0,3573 | -0,0180 | |||||

| GNMA, Series 2021-197, Class BI / ABS-MBS (US38383DPT99) | 2,14 | -3,82 | 0,3548 | -0,0311 | |||||

| GNMA, Series 2021-197, Class BI / ABS-MBS (US38383DPT99) | 2,14 | -3,82 | 0,3548 | -0,0311 | |||||

| GNMA, Series 2021-197, Class BI / ABS-MBS (US38383DPT99) | 2,14 | -3,82 | 0,3548 | -0,0311 | |||||

| US35563GAB59 / Freddie Mac Multifamily Structured Credit Risk | 2,13 | -0,79 | 0,3530 | -0,0192 | |||||

| US38382XBY04 / GNMA, Series 2021-149, Class CI | 2,09 | 0,3470 | 0,3470 | ||||||

| US12630BAE83 / Commercial Mortgage Trust, Series 2013-CR13, Class D | 2,09 | 64,95 | 0,3457 | 0,1264 | |||||

| US36253BAY92 / GS Mortgage Securities Trust 2014-GC22 | 2,07 | 0,44 | 0,3437 | -0,0142 | |||||

| US35564KRN18 / Freddie Mac Structured Agency Credit Risk Debt Notes | 2,06 | -0,34 | 0,3410 | -0,0169 | |||||

| US38382DQA09 / GNMA CMO IO | 2,05 | -1,25 | 0,3398 | -0,0201 | |||||

| GNMA, Series 2024-197, Class SC / ABS-MBS (US38385BBW90) | 2,05 | -1,68 | 0,3392 | -0,0217 | |||||

| US362257AA51 / GSAA Home Equity Trust 2006-17 | 2,01 | -0,10 | 0,3337 | -0,0157 | |||||

| US3136BL6M73 / FNMA CMO IO | 2,01 | -3,04 | 0,3332 | -0,0261 | |||||

| Station Place Securitization Trust, Series 2024-10, Class A / ABS-MBS (US85779PAA21) | 2,01 | -0,10 | 0,3330 | -0,0156 | |||||

| Station Place Securitization Trust, Series 2024-10, Class A / ABS-MBS (US85779PAA21) | 2,01 | -0,10 | 0,3330 | -0,0156 | |||||

| Station Place Securitization Trust, Series 2024-10, Class A / ABS-MBS (US85779PAA21) | 2,01 | -0,10 | 0,3330 | -0,0156 | |||||

| GNMA, Series 2023-13, Class SB / ABS-MBS (US38383HMT31) | 1,99 | -11,21 | 0,3297 | -0,0586 | |||||

| GNMA, Series 2023-13, Class SB / ABS-MBS (US38383HMT31) | 1,99 | -11,21 | 0,3297 | -0,0586 | |||||

| US38383MBY30 / GNMA CMO IO | 1,96 | -13,07 | 0,3241 | -0,2162 | |||||

| GNMA, Series 2023-152, Class SL / ABS-MBS (US38384DXW28) | 1,95 | -7,02 | 0,3227 | -0,0404 | |||||

| GNMA, Series 2023-152, Class SL / ABS-MBS (US38384DXW28) | 1,95 | -7,02 | 0,3227 | -0,0404 | |||||

| GNMA, Series 2023-152, Class SL / ABS-MBS (US38384DXW28) | 1,95 | -7,02 | 0,3227 | -0,0404 | |||||

| GNMA, Series 2023-56, Class AS / ABS-MBS (US38383XS703) | 1,94 | -4,94 | 0,3219 | -0,0324 | |||||

| GNMA, Series 2023-56, Class AS / ABS-MBS (US38383XS703) | 1,94 | -4,94 | 0,3219 | -0,0324 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,92 | -3,56 | 0,3189 | -0,0269 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,92 | -3,56 | 0,3189 | -0,0269 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,92 | -3,56 | 0,3189 | -0,0269 | |||||

| US38383M3L04 / GNMA CMO IO | 1,90 | -6,36 | 0,3146 | -0,0368 | |||||

| US92540CAA53 / Verus Securitization Trust 2023-INV3 | 1,86 | -3,93 | 0,3083 | -0,0274 | |||||

| Station Place Securitization Trust, Series 2024-5, Class A / ABS-MBS (US85778YAA47) | 1,86 | -0,05 | 0,3075 | -0,0143 | |||||

| GNMA, Series 2024-4, Class GI / ABS-MBS (US38384HZX96) | 1,85 | -2,73 | 0,3067 | -0,0231 | |||||

| GNMA, Series 2024-4, Class AS / ABS-MBS (US38384HXC77) | 1,82 | -10,07 | 0,3020 | -0,0492 | |||||

| US46643PBK57 / JPMBB Commercial Mortgage Securities Trust 2014-C25 | 1,82 | 0,28 | 0,3015 | -0,0131 | |||||

| Station Place Securitization Trust, Series 2024-2, Class A / ABS-MBS (US85770KAA25) | 1,81 | 0,00 | 0,2994 | -0,0138 | |||||

| US38382KPP20 / Government National Mortgage Association | 1,81 | -4,55 | 0,2993 | -0,0285 | |||||

| US46639NAX93 / JPMBB Commercial Mortgage Securities Trust, Series 2013-C12, Class D | 1,79 | 62,91 | 0,2972 | 0,1064 | |||||

| US61765LAC46 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C24, Class D | 1,77 | -0,45 | 0,2934 | -0,0149 | |||||

| A&D Mortgage Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US00039GAA76) | 1,76 | -8,49 | 0,2915 | -0,0417 | |||||

| A&D Mortgage Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US00039GAA76) | 1,76 | -8,49 | 0,2915 | -0,0417 | |||||

| A&D Mortgage Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US00039GAA76) | 1,76 | -8,49 | 0,2915 | -0,0417 | |||||

| US02149FAK03 / Alternative Loan Trust 2006-43CB | 1,76 | -2,12 | 0,2915 | -0,0200 | |||||

| US38382LAV36 / GNMA CMO IO | 1,76 | -15,45 | 0,2911 | -0,0692 | |||||

| US17321RAM88 / Citigroup Commercial Mortgage Trust 2013-GC17 | 1,75 | -3,68 | 0,2908 | -0,0250 | |||||

| US38376VQP57 / Government National Mortgage Association | 1,74 | -0,74 | 0,2882 | -0,0155 | |||||

| PRET LLC, Series 2025-NPL4, Class A1 / ABS-MBS (US74136UAA34) | 1,73 | 0,2875 | 0,2875 | ||||||

| PRET LLC, Series 2025-NPL4, Class A1 / ABS-MBS (US74136UAA34) | 1,73 | 0,2875 | 0,2875 | ||||||

| PRET LLC, Series 2025-NPL4, Class A1 / ABS-MBS (US74136UAA34) | 1,73 | 0,2875 | 0,2875 | ||||||

| US3136BDYC68 / FANNIE MAE REMICS FNR 2021-3 IB | 1,71 | 3,07 | 0,2840 | -0,0042 | |||||

| GNMA, Series 2021-182, Class TI / ABS-MBS (US38383CAC47) | 1,71 | -3,66 | 0,2835 | -0,0243 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-10, Class A11 / ABS-MBS (US46658LAX91) | 1,70 | -12,31 | 0,2824 | -0,0544 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-10, Class A11 / ABS-MBS (US46658LAX91) | 1,70 | -12,31 | 0,2824 | -0,0544 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-10, Class A11 / ABS-MBS (US46658LAX91) | 1,70 | -12,31 | 0,2824 | -0,0544 | |||||

| US38381XK399 / GNMA CMO IO | 1,69 | 0,06 | 0,2801 | -0,0126 | |||||

| US30711XDY76 / Fannie Mae Connecticut Avenue Securities | 1,68 | -2,21 | 0,2793 | -0,0193 | |||||

| US38383VYA06 / GNMA CMO IO | 1,68 | -6,74 | 0,2778 | -0,0336 | |||||

| US12527DAG51 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,68 | 0,84 | 0,2777 | -0,0104 | |||||

| US12634NAY40 / Csail 2015-C2 Commercial Mortgage Trust | 1,64 | -0,49 | 0,2713 | -0,0139 | |||||

| US35564KYW34 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,63 | -1,40 | 0,2695 | -0,0163 | |||||

| US12515DAU81 / CD 2017-CD4 Mortgage Trust | 1,62 | 6,39 | 0,2678 | 0,0044 | |||||

| US38382MFM64 / GNMA CMO IO | 1,61 | 2,10 | 0,2663 | -0,0064 | |||||

| US251513AZ08 / Deutsche Alt-B Securities Mortgage Loan Trust Series 2006-AB4 | 1,59 | -3,63 | 0,2641 | -0,0224 | |||||

| US95000LAJ26 / Wells Fargo & Company | 1,59 | 20,41 | 0,2640 | 0,0347 | |||||

| US07401AAX54 / CORP CMO | 1,59 | -0,81 | 0,2639 | -0,0145 | |||||

| US20755CAF59 / CORP CMO | 1,58 | -0,38 | 0,2622 | -0,0131 | |||||

| GNMA, Series 2023-14, Class BS / ABS-MBS (US38383VHN10) | 1,57 | -3,09 | 0,2602 | -0,0206 | |||||

| GNMA, Series 2023-14, Class BS / ABS-MBS (US38383VHN10) | 1,57 | -3,09 | 0,2602 | -0,0206 | |||||

| GNMA, Series 2023-14, Class BS / ABS-MBS (US38383VHN10) | 1,57 | -3,09 | 0,2602 | -0,0206 | |||||

| US12624QBA04 / COMM MORTGAGE TRUST COMM 2012 CR4 B 144A | 1,55 | 0,00 | 0,2564 | -0,0118 | |||||

| US61690QAH20 / MORGAN STANLEY BANK OF AMERICA MERRILL LYNCH TRUST MSBAM 2015-C23 B | 1,54 | 0,46 | 0,2548 | -0,0104 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,54 | 0,2546 | 0,2546 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,54 | 0,2546 | 0,2546 | ||||||

| US35563WBE30 / STACR Trust 2018-DNA3 | 1,52 | -1,88 | 0,2514 | -0,0165 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 1,49 | -5,93 | 0,2470 | -0,0277 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 1,49 | -5,93 | 0,2470 | -0,0277 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 1,49 | -5,93 | 0,2470 | -0,0277 | |||||

| US3136BFES88 / Fannie Mae REMICS | 1,48 | -3,83 | 0,2459 | -0,0215 | |||||

| US3136BAZZ06 / FNMA CMO IO | 1,48 | -3,08 | 0,2451 | -0,0194 | |||||

| US95003CBU36 / Wells Fargo Commercial Mortgage Trust | 1,47 | -4,74 | 0,2432 | -0,0239 | |||||

| GNMA, Series 2024-11, Class S / ABS-MBS (US38384G3V02) | 1,47 | -9,11 | 0,2431 | -0,0366 | |||||

| GNMA, Series 2024-11, Class S / ABS-MBS (US38384G3V02) | 1,47 | -9,11 | 0,2431 | -0,0366 | |||||

| GNMA, Series 2023-101, Class HS / ABS-MBS (US38384CBH16) | 1,45 | 3,41 | 0,2411 | -0,0028 | |||||

| RCO VIII Mortgage LLC, Series 2025-3, Class A1 / ABS-MBS (US74939GAA31) | 1,45 | 0,2409 | 0,2409 | ||||||

| RCO VIII Mortgage LLC, Series 2025-3, Class A1 / ABS-MBS (US74939GAA31) | 1,45 | 0,2409 | 0,2409 | ||||||

| RCO VIII Mortgage LLC, Series 2025-3, Class A1 / ABS-MBS (US74939GAA31) | 1,45 | 0,2409 | 0,2409 | ||||||

| GNMA, Series 2023-84, Class DS / ABS-MBS (US38384AN585) | 1,45 | -1,16 | 0,2399 | -0,0139 | |||||

| HTAP Trust, Series 2024-1, Class A / ABS-O (US40445NAA63) | 1,44 | -1,03 | 0,2391 | -0,0136 | |||||

| HTAP Trust, Series 2024-1, Class A / ABS-O (US40445NAA63) | 1,44 | -1,03 | 0,2391 | -0,0136 | |||||

| HTAP Trust, Series 2024-1, Class A / ABS-O (US40445NAA63) | 1,44 | -1,03 | 0,2391 | -0,0136 | |||||

| US12595EAN58 / COMM 2017-COR2 D 3% 09/10/2050 144A | 1,44 | 0,07 | 0,2388 | -0,0107 | |||||

| SOP / DIR (N/A) | 1,43 | 0,2375 | 0,2375 | ||||||

| US3136BDFP82 / FNMA CMO IO | 1,42 | -2,86 | 0,2361 | -0,0182 | |||||

| US38383FHC05 / Government National Mortgage Association | 1,42 | -1,18 | 0,2357 | -0,0137 | |||||

| GNMA, Series 2024-7, Class SA / ABS-MBS (US38384GL818) | 1,41 | -0,64 | 0,2331 | -0,0124 | |||||

| GNMA, Series 2024-7, Class SA / ABS-MBS (US38384GL818) | 1,41 | -0,64 | 0,2331 | -0,0124 | |||||

| GNMA, Series 2024-7, Class SA / ABS-MBS (US38384GL818) | 1,41 | -0,64 | 0,2331 | -0,0124 | |||||

| US38382VKU25 / Government National Mortgage Association | 1,40 | -2,92 | 0,2318 | -0,0180 | |||||

| GNMA, Series 2024-4, Class IG / ABS-MBS (US38384HZW14) | 1,39 | -2,53 | 0,2303 | -0,0168 | |||||

| GNMA, Series 2024-4, Class IG / ABS-MBS (US38384HZW14) | 1,39 | -2,53 | 0,2303 | -0,0168 | |||||

| US35563FAB76 / FHLMC Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M2 | 1,38 | -2,06 | 0,2285 | -0,0155 | |||||

| US12591KAG04 / COMM 2013-CCRE12 Mortgage Trust | 1,37 | 0,29 | 0,2271 | -0,0097 | |||||

| Verus Securitization Trust, Series 2024-4, Class A1 / ABS-MBS (US92540GAA67) | 1,35 | 0,2231 | 0,2231 | ||||||

| US38383WDC73 / GNMA CMO IO | 1,33 | -2,57 | 0,2201 | -0,0162 | |||||

| US61762DAZ42 / MSBAM 13-C9 B 3.708% 05-15-46/04-15-23 | 1,32 | -3,92 | 0,2195 | -0,0196 | |||||

| GNMA, Series 2024-186 / ABS-MBS (US38384XVG59) | 1,32 | -5,93 | 0,2182 | -0,0245 | |||||

| GNMA, Series 2024-186 / ABS-MBS (US38384XVG59) | 1,32 | -5,93 | 0,2182 | -0,0245 | |||||

| GNMA, Series 2024-186 / ABS-MBS (US38384XVG59) | 1,32 | -5,93 | 0,2182 | -0,0245 | |||||

| GNMA, Series 2023-13, Class SL / ABS-MBS (US38383HLR83) | 1,31 | -7,15 | 0,2175 | -0,0276 | |||||

| GNMA, Series 2023-13, Class SL / ABS-MBS (US38383HLR83) | 1,31 | -7,15 | 0,2175 | -0,0276 | |||||

| GNMA, Series 2023-13, Class SL / ABS-MBS (US38383HLR83) | 1,31 | -7,15 | 0,2175 | -0,0276 | |||||

| US38375UXD70 / GNMA CMO IO | 1,30 | -21,36 | 0,2150 | -0,0709 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,29 | -8,87 | 0,2146 | -0,0316 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,29 | -8,87 | 0,2146 | -0,0316 | |||||

| US90276XAC92 / UBS Commercial Mortgage Trust 2018-C11 | 1,29 | 4,87 | 0,2142 | 0,0004 | |||||

| US12429EAN76 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,29 | -0,39 | 0,2134 | -0,0106 | |||||

| US92937EAJ38 / WFRBS Commercial Mortgage Trust, Series 2013-C11, Class D | 1,29 | 0,63 | 0,2132 | -0,0085 | |||||

| US38381XX509 / GNMA, Series 2019-103, Class SC | 1,27 | -5,70 | 0,2111 | -0,0231 | |||||

| US61762MBC47 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class D | 1,26 | -0,08 | 0,2090 | -0,0097 | |||||

| US61762MBC47 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class D | 1,26 | -0,08 | 0,2090 | -0,0097 | |||||

| US126378AG33 / CORP CMO | 1,26 | -2,48 | 0,2090 | -0,0151 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,26 | 0,2081 | 0,2081 | ||||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US61775UAA60) | 1,23 | -8,53 | 0,2045 | -0,0294 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US61775UAA60) | 1,23 | -8,53 | 0,2045 | -0,0294 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US61775UAA60) | 1,23 | -8,53 | 0,2045 | -0,0294 | |||||

| US38383Y5C24 / GNMA CMO IO | 1,22 | -5,99 | 0,2030 | -0,0229 | |||||

| US92938CAJ62 / WFRBS Commercial Mortgage Trust 2013-C15 | 1,22 | -37,45 | 0,2016 | -0,1356 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,22 | -9,26 | 0,2015 | -0,0307 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,22 | -9,26 | 0,2015 | -0,0307 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1,22 | -9,26 | 0,2015 | -0,0307 | |||||

| US35564KBE82 / FHLMC STACR REMIC Trust, Series 2021-DNA1, Class B2 | 1,21 | -0,90 | 0,2014 | -0,0112 | |||||

| SOP / DIR (N/A) | 1,21 | 0,2010 | 0,2010 | ||||||

| GNMA, Series 2024-4, Class GS / ABS-MBS (US38384HYW23) | 1,21 | -10,03 | 0,2009 | -0,0325 | |||||

| GNMA, Series 2024-4, Class GS / ABS-MBS (US38384HYW23) | 1,21 | -10,03 | 0,2009 | -0,0325 | |||||

| GNMA, Series 2024-4, Class GS / ABS-MBS (US38384HYW23) | 1,21 | -10,03 | 0,2009 | -0,0325 | |||||

| GNMA, Series 2024-4, Class NS / ABS-MBS (US38384HZZ45) | 1,21 | -5,99 | 0,2005 | -0,0227 | |||||

| GNMA, Series 2024-4, Class NS / ABS-MBS (US38384HZZ45) | 1,21 | -5,99 | 0,2005 | -0,0227 | |||||

| US12630DAE40 / Commercial Mortgage Trust, Series 2014-CR14, Class D | 1,21 | -0,25 | 0,2002 | -0,0097 | |||||

| US38382TD275 / GNMA CMO IO | 1,21 | -11,07 | 0,1999 | -0,0351 | |||||

| US61690QAS84 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C23 | 1,18 | -1,91 | 0,1957 | -0,0129 | |||||

| US38382RRX88 / Government National Mortgage Association | 1,16 | -3,97 | 0,1923 | -0,0173 | |||||

| US12591VAK70 / Commercial Mortgage Trust, Series 2014-CR16, Class C | 1,15 | 0,00 | 0,1914 | -0,0086 | |||||

| US38382QAM24 / GNMA CMO IO | 1,14 | -4,91 | 0,1894 | -0,0189 | |||||

| GNMA, Series 2022-10, Class GI / ABS-MBS (US38383GGP00) | 1,14 | -0,61 | 0,1894 | -0,0098 | |||||

| US35564XBE04 / Freddie Mac STACR 2019-HQA3 | 1,13 | -0,70 | 0,1880 | -0,0100 | |||||

| US38384DEX12 / GNMA CMO IO | 1,12 | -7,57 | 0,1863 | -0,0245 | |||||

| US38380FYN04 / GNMA CMO IO | 1,12 | -0,89 | 0,1849 | -0,0102 | |||||

| US12591YBD67 / COMM 2014-UBS3 MORTGAGE TRUST COMM 2014-UBS3 AM | 1,11 | -15,99 | 0,1847 | -0,0453 | |||||

| US12635FAZ71 / CSAIL 2015-C3 Commercial Mortgage Trust | 1,11 | -0,09 | 0,1844 | -0,0086 | |||||

| GNMA, Series 2023-173, Class ES / ABS-MBS (US38384GDP28) | 1,11 | -16,99 | 0,1839 | -0,0478 | |||||

| GNMA, Series 2023-173, Class ES / ABS-MBS (US38384GDP28) | 1,11 | -16,99 | 0,1839 | -0,0478 | |||||

| GNMA, Series 2023-173, Class ES / ABS-MBS (US38384GDP28) | 1,11 | -16,99 | 0,1839 | -0,0478 | |||||

| US38383VL975 / GNMA CMO IO | 1,11 | 2,31 | 0,1836 | -0,0041 | |||||

| US12630DBD57 / Commercial Mortgage Trust, Series 2014-CR14, Class C | 1,10 | 79,84 | 0,1818 | 0,0760 | |||||

| US05492JAE29 / BARCLAYS COMMERCIAL MORTGAGE CSTR 11/15/2052 144A | 1,08 | 50,84 | 0,1786 | 0,0547 | |||||

| US20753DAB47 / Fannie Mae Connecticut Avenue Securities | 1,07 | -1,11 | 0,1779 | -0,0103 | |||||

| US45276NAC56 / Imperial Fund Mortgage Trust 2022-NQM4 | 1,07 | -1,83 | 0,1775 | -0,0117 | |||||

| GNMA, Series 2023-35, Class ES / ABS-MBS (US38383VK647) | 1,06 | 0,66 | 0,1761 | -0,0069 | |||||

| GNMA, Series 2023-35, Class ES / ABS-MBS (US38383VK647) | 1,06 | 0,66 | 0,1761 | -0,0069 | |||||

| GNMA, Series 2023-35, Class ES / ABS-MBS (US38383VK647) | 1,06 | 0,66 | 0,1761 | -0,0069 | |||||

| US50204VAA89 / LHOME Mortgage Trust 2023-RTL4 | 1,06 | -0,75 | 0,1750 | -0,0094 | |||||

| US92939HBB06 / WFRBS Commercial Mortgage Trust 2014-C23 | 1,05 | 0,86 | 0,1748 | -0,0065 | |||||

| US36253GAS12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,05 | 13,54 | 0,1738 | 0,0137 | |||||

| BBCMS Mortgage Trust, Series 2025-C32, Class XA / ABS-MBS (US07337AAJ51) | 1,05 | -2,97 | 0,1737 | -0,0134 | |||||

| BBCMS Mortgage Trust, Series 2025-C32, Class XA / ABS-MBS (US07337AAJ51) | 1,05 | -2,97 | 0,1737 | -0,0134 | |||||

| BBCMS Mortgage Trust, Series 2025-C32, Class XA / ABS-MBS (US07337AAJ51) | 1,05 | -2,97 | 0,1737 | -0,0134 | |||||

| US61762XAC11 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C12, Class D | 1,04 | 0,58 | 0,1726 | -0,0069 | |||||

| US20753MAE84 / CORP CMO | 1,04 | -3,79 | 0,1725 | -0,0149 | |||||

| US12631DAG88 / COMM 2014-CCRE17 Mortgage Trust | 1,02 | -0,29 | 0,1688 | -0,0084 | |||||

| US94989NAL10 / Wells Fargo Commercial Mortgage Trust 2015-C30 | 1,01 | 0,30 | 0,1674 | -0,0072 | |||||

| US08161BAA17 / BENCHMARK 2018-B3 Mortgage Trust | 1,01 | 1,51 | 0,1669 | -0,0051 | |||||

| US43730GAE17 / Home RE 2022-1 Ltd | 1,00 | -1,38 | 0,1665 | -0,0101 | |||||

| US46641JAE64 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,99 | 0,51 | 0,1649 | -0,0066 | |||||

| US3136B6HD87 / FNMA CMO IO | 0,99 | -1,10 | 0,1634 | -0,0093 | |||||

| US00002DAA72 / A&D Mortgage Trust 2023-NQM2 | 0,97 | -8,47 | 0,1614 | -0,0230 | |||||

| US21H0506640 / Ginnie Mae | 0,97 | 0,1608 | 0,1608 | ||||||

| US35565WBE12 / Freddie Mac STACR REMIC Trust 2020-DNA3 | 0,97 | -2,22 | 0,1607 | -0,0113 | |||||

| UBS Commercial Mortgage Trust, Series 2017-C1, Class D / ABS-MBS (US90276EAN76) | 0,96 | 1,92 | 0,1585 | -0,0041 | |||||

| UBS Commercial Mortgage Trust, Series 2017-C1, Class D / ABS-MBS (US90276EAN76) | 0,96 | 1,92 | 0,1585 | -0,0041 | |||||

| UBS Commercial Mortgage Trust, Series 2017-C1, Class D / ABS-MBS (US90276EAN76) | 0,96 | 1,92 | 0,1585 | -0,0041 | |||||

| US20753ACF93 / Connecticut Avenue Securities Trust, Series 2023-R03, Class 2B1 | 0,95 | -0,73 | 0,1579 | -0,0084 | |||||

| US3136BHDU00 / FNMA CMO IO | 0,95 | -3,27 | 0,1572 | -0,0127 | |||||

| CAFL Issuer LLC, Series 2023-RTL1, Class A1 / ABS-MBS (US124762AA38) | 0,93 | 0,1547 | 0,1547 | ||||||

| CAFL Issuer LLC, Series 2023-RTL1, Class A1 / ABS-MBS (US124762AA38) | 0,93 | 0,1547 | 0,1547 | ||||||

| CAFL Issuer LLC, Series 2023-RTL1, Class A1 / ABS-MBS (US124762AA38) | 0,93 | 0,1547 | 0,1547 | ||||||

| US06541UCB08 / BANK 2020-BNK30 | 0,93 | -4,90 | 0,1543 | -0,0154 | |||||

| US3136BHEL91 / FNMA CMO IO | 0,93 | 0,00 | 0,1535 | -0,0070 | |||||

| Cascade Funding Mortgage Trust, Series 2025-HB16, Class M3 / ABS-MBS (US12531BAD01) | 0,92 | 0,1533 | 0,1533 | ||||||

| Cascade Funding Mortgage Trust, Series 2025-HB16, Class M3 / ABS-MBS (US12531BAD01) | 0,92 | 0,1533 | 0,1533 | ||||||

| Cascade Funding Mortgage Trust, Series 2025-HB16, Class M3 / ABS-MBS (US12531BAD01) | 0,92 | 0,1533 | 0,1533 | ||||||

| US45290BAA70 / IMPRL 23-NQM1 A1 144A 5.941% 02-25-68/01-01-27 | 0,92 | -5,44 | 0,1528 | -0,0163 | |||||

| US01F0406698 / UMBS TBA | 0,92 | -83,16 | 0,1519 | -0,8602 | |||||

| US38382YRN57 / GNMA CMO IO | 0,91 | -12,20 | 0,1516 | -0,0289 | |||||

| GNMA, Series 2021-H08 / ABS-MBS (US38380Q2G66) | 0,91 | -12,19 | 0,1505 | -0,0288 | |||||

| US38382HLM06 / GNMA CMO IO | 0,91 | -1,41 | 0,1504 | -0,0092 | |||||

| US35564LBE65 / CORP CMO | 0,90 | -1,65 | 0,1486 | -0,0095 | |||||

| Benchmark Mortgage Trust, Series 2024-V11, Class XA / ABS-MBS (US081921BA52) | 0,89 | -5,92 | 0,1475 | -0,0166 | |||||

| Benchmark Mortgage Trust, Series 2024-V11, Class XA / ABS-MBS (US081921BA52) | 0,89 | -5,92 | 0,1475 | -0,0166 | |||||

| Benchmark Mortgage Trust, Series 2024-V11, Class XA / ABS-MBS (US081921BA52) | 0,89 | -5,92 | 0,1475 | -0,0166 | |||||

| US38383CCY49 / GNMA CMO IO | 0,89 | -4,00 | 0,1474 | -0,0131 | |||||

| US30711XCY85 / CORP CMO | 0,89 | -2,63 | 0,1471 | -0,0110 | |||||

| US61762DAL55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,89 | 4,36 | 0,1470 | -0,0003 | |||||

| US01F0326664 / Uniform Mortgage-Backed Security, TBA | 0,89 | -200,00 | 0,1469 | 0,2939 | |||||

| EWL / Edwards Lifesciences Corporation | 0,89 | -76,50 | 0,1469 | -0,4782 | |||||

| EWL / Edwards Lifesciences Corporation | 0,89 | -9,41 | 0,1469 | -0,2158 | |||||

| EWL / Edwards Lifesciences Corporation | 0,89 | -76,50 | 0,1469 | -0,4782 | |||||

| US38382RPZ54 / GNMA CMO IO | 0,89 | -10,24 | 0,1468 | -0,0242 | |||||

| US35565JBE01 / Freddie Mac STACR REMIC Trust 2020-HQA | 0,88 | -1,01 | 0,1456 | -0,0083 | |||||

| Cascade Funding Mortgage Trust, Series 2025-HB16, Class M2 / ABS-MBS (US12531BAC28) | 0,88 | 0,1452 | 0,1452 | ||||||

| Cascade Funding Mortgage Trust, Series 2025-HB16, Class M2 / ABS-MBS (US12531BAC28) | 0,88 | 0,1452 | 0,1452 | ||||||

| US12634NBA54 / Csail 2015-C2 Commercial Mortgage Trust | 0,87 | -1,58 | 0,1444 | -0,0090 | |||||

| US3136BNSV95 / Fannie Mae REMICS | 0,87 | -2,14 | 0,1442 | -0,0100 | |||||

| US95002MAY57 / Wells Fargo Commercial Mortgage Trust, Series 2019-C52, Class XA | 0,87 | -6,47 | 0,1439 | -0,0171 | |||||

| PRPM Trust, Series 2024-NQM2, Class A1 / ABS-MBS (US74448PAA75) | 0,87 | -4,09 | 0,1438 | -0,0130 | |||||

| PRPM Trust, Series 2024-NQM2, Class A1 / ABS-MBS (US74448PAA75) | 0,87 | -4,09 | 0,1438 | -0,0130 | |||||

| PRPM Trust, Series 2024-NQM2, Class A1 / ABS-MBS (US74448PAA75) | 0,87 | -4,09 | 0,1438 | -0,0130 | |||||

| US35565EAE23 / CORP CMO | 0,87 | -0,23 | 0,1438 | -0,0069 | |||||

| SOP / DIR (N/A) | 0,86 | 0,1423 | 0,1423 | ||||||

| J.P. Morgan Mortgage Trust, Series 2024-HE2, Class A1 / ABS-O (US46593HAA68) | 0,86 | -12,21 | 0,1419 | -0,0271 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-HE2, Class A1 / ABS-O (US46593HAA68) | 0,86 | -12,21 | 0,1419 | -0,0271 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-HE2, Class A1 / ABS-O (US46593HAA68) | 0,86 | -12,21 | 0,1419 | -0,0271 | |||||

| US3137FJK993 / FHLMC CMO IO | 0,85 | 0,00 | 0,1411 | -0,0064 | |||||

| US05492JAC62 / BARCLAYS COMMERCIAL MORTGAGE 2019-C5 E 2.5% 11/15/2052 144A | 0,85 | 33,86 | 0,1409 | 0,0308 | |||||

| US12591RAE09 / COMM 2014-CCRE15 D MTG TR CSTR 02/10/2047 144A | 0,85 | -0,82 | 0,1403 | -0,0077 | |||||

| US12625FBA30 / COMM 2013-CCRE7 Mortgage Trust | 0,84 | -0,24 | 0,1399 | -0,0067 | |||||

| HOMES Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US40390TAA88) | 0,84 | -8,07 | 0,1398 | -0,0192 | |||||

| HOMES Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US40390TAA88) | 0,84 | -8,07 | 0,1398 | -0,0192 | |||||

| HOMES Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US40390TAA88) | 0,84 | -8,07 | 0,1398 | -0,0192 | |||||

| US200474AG96 / COMM 2015-LC19 Mortgage Trust | 0,84 | -0,24 | 0,1391 | -0,0068 | |||||

| US12634NAZ15 / Csail 2015-C2 Commercial Mortgage Trust | 0,84 | -1,06 | 0,1388 | -0,0081 | |||||

| GNMA, Series 2024-32 / ABS-MBS (US38381J2J58) | 0,83 | -1,89 | 0,1379 | -0,0092 | |||||

| GNMA, Series 2024-32 / ABS-MBS (US38381J2J58) | 0,83 | -1,89 | 0,1379 | -0,0092 | |||||

| US38383RD384 / GNMA CMO IO | 0,82 | -9,05 | 0,1367 | -0,0206 | |||||

| US12592KBE38 / Commercial Mortgage Trust, Series 2014-UBS5, Class AM | 0,81 | -3,90 | 0,1350 | -0,0120 | |||||

| BANK5, Series 2024-5YR10, Class XA / ABS-MBS (US06604AAH77) | 0,80 | -4,56 | 0,1320 | -0,0127 | |||||

| US026932AC79 / CORP CMO | 0,80 | -1,61 | 0,1319 | -0,0083 | |||||

| US12668RAA68 / CORP CMO | 0,79 | -2,10 | 0,1314 | -0,0090 | |||||

| BANK, Series 2024-BNK48, Class XA / ABS-MBS (US06541GAN79) | 0,79 | -2,83 | 0,1308 | -0,0101 | |||||

| BANK, Series 2024-BNK48, Class XA / ABS-MBS (US06541GAN79) | 0,79 | -2,83 | 0,1308 | -0,0101 | |||||

| BANK, Series 2024-BNK48, Class XA / ABS-MBS (US06541GAN79) | 0,79 | -2,83 | 0,1308 | -0,0101 | |||||

| US92939FAY51 / WFRBS Commercial Mortgage Trust 2014-C21 | 0,78 | -0,13 | 0,1287 | -0,0060 | |||||

| US61767YBE95 / Morgan Stanley Capital I Trust, Series 2018-H3, Class C | 0,77 | -1,16 | 0,1277 | -0,0073 | |||||

| PFP Ltd., Series 2022-9, Class AS / ABS-CBDO (US69291QAC96) | 0,77 | -0,13 | 0,1276 | -0,0060 | |||||

| PFP Ltd., Series 2022-9, Class AS / ABS-CBDO (US69291QAC96) | 0,77 | -0,13 | 0,1276 | -0,0060 | |||||

| PFP Ltd., Series 2022-9, Class AS / ABS-CBDO (US69291QAC96) | 0,77 | -0,13 | 0,1276 | -0,0060 | |||||

| US3136BGJ364 / FNMA CMO IO | 0,76 | 0,26 | 0,1257 | -0,0054 | |||||

| US92936CAY57 / WFRBS 2011-C4 E 5.248784% 6/44 | 0,76 | 2,72 | 0,1252 | -0,0023 | |||||

| BMO Mortgage Trust, Series 2024-5C6, Class XA / ABS-MBS (US05593QAD60) | 0,75 | -6,13 | 0,1244 | -0,0142 | |||||

| US36252HAL50 / GS Mortgage Securities Trust, Series 2017-GS5, Class D | 0,73 | -24,82 | 0,1211 | -0,0473 | |||||

| US08162DAR98 / Benchmark 2019-B13 Mortgage Trust | 0,73 | 3,42 | 0,1204 | -0,0014 | |||||

| US12593QBK58 / Commercial Mortgage Trust, Series 2015-CR26, Class D | 0,71 | -0,84 | 0,1181 | -0,0064 | |||||

| US17324DAY04 / Citigroup Commercial Mortgage Trust, Series 2015-P1, Class C | 0,70 | 1,59 | 0,1166 | -0,0034 | |||||

| US46643PAN06 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,70 | -2,09 | 0,1164 | -0,0079 | |||||

| US94989WAZ05 / Wells Fargo Commercial Mortgage Trust 2015-C31 | 0,69 | 0,73 | 0,1148 | -0,0044 | |||||

| US61760RAS13 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,69 | 2,23 | 0,1140 | -0,0026 | |||||

| US17322MBA36 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,68 | 1,49 | 0,1130 | -0,0035 | |||||

| US92938CAL19 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,68 | 6,76 | 0,1127 | 0,0022 | |||||

| CIM Trust, Series 2024-R1, Class A1 / ABS-MBS (US17179VAA89) | 0,68 | -4,37 | 0,1126 | -0,0105 | |||||

| CIM Trust, Series 2024-R1, Class A1 / ABS-MBS (US17179VAA89) | 0,68 | -4,37 | 0,1126 | -0,0105 | |||||

| CIM Trust, Series 2024-R1, Class A1 / ABS-MBS (US17179VAA89) | 0,68 | -4,37 | 0,1126 | -0,0105 | |||||

| CDSCMBX / DCR (N/A) | 0,67 | 0,1118 | 0,1118 | ||||||

| SOP / DIR (N/A) | 0,67 | 0,1115 | 0,1115 | ||||||

| SOP / DIR (N/A) | 0,67 | 0,1115 | 0,1115 | ||||||

| SOP / DIR (N/A) | 0,67 | 0,1115 | 0,1115 | ||||||

| SOP / DIR (N/A) | 0,67 | 0,1112 | 0,1112 | ||||||

| US91528JAA88 / UNLOK_23-1 | 0,67 | -1,19 | 0,1107 | -0,0065 | |||||

| US38383AA956 / Government National Mortgage Association | 0,64 | -3,74 | 0,1068 | -0,0092 | |||||

| US30711XEJ90 / Fannie Mae Connecticut Avenue Securities | 0,64 | -3,16 | 0,1068 | -0,0087 | |||||

| US61761DAH52 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,64 | 0,63 | 0,1053 | -0,0042 | |||||

| US35563FAA93 / FHLMC, Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M1 | 0,63 | -31,44 | 0,1042 | -0,0547 | |||||

| US38382YRQ88 / GNMA CMO IO | 0,63 | -13,28 | 0,1041 | -0,0213 | |||||

| US12515GAG29 / CD 2017-CD3 Mortgage Trust | 0,62 | 5,07 | 0,1032 | 0,0005 | |||||

| US16678XAB01 / CORP CMO | 0,62 | -2,05 | 0,1031 | -0,0069 | |||||

| US30711XDB73 / Fannie Mae Connecticut Avenue Securities | 0,62 | -1,74 | 0,1028 | -0,0067 | |||||

| US38380LSF12 / GNMA CMO IO | 0,62 | -10,03 | 0,1027 | -0,0166 | |||||

| US95000TAC09 / WELLS FARGO COML MTG TR 2017-RB1 D 3.401% 03/15/2050 | 0,62 | 7,48 | 0,1025 | 0,0026 | |||||

| US07335CAT18 / Barclays Commercial Mortgage Trust, Series 2019-C4, Class D | 0,62 | 1,64 | 0,1025 | -0,0030 | |||||

| OIS / DIR (N/A) | 0,62 | 0,1025 | 0,1025 | ||||||

| OIS / DIR (N/A) | 0,62 | 0,1025 | 0,1025 | ||||||

| US06540JBM36 / BANK 2020-BNK26 | 0,60 | -7,56 | 0,0994 | -0,0130 | |||||

| US61767EAK01 / Morgan Stanley Bank of America Merrill Lynch Trust 2017-C34 | 0,60 | 1,87 | 0,0992 | -0,0027 | |||||

| US46590TAD72 / JPMDB Commercial Mortgage Securities Trust 2017-C5 | 0,60 | 0,00 | 0,0987 | -0,0046 | |||||

| US69380CAC29 / PFP 2023-10 Ltd | 0,59 | -0,17 | 0,0986 | -0,0046 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,59 | -5,11 | 0,0986 | -0,0100 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,59 | -5,11 | 0,0986 | -0,0100 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,59 | -5,11 | 0,0986 | -0,0100 | |||||

| US95002EAA55 / Wells Fargo Commercial Mortgage Trust, Series 2020-C55, Class D | 0,59 | 2,42 | 0,0984 | -0,0020 | |||||

| US17318UAH77 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,59 | 3,68 | 0,0980 | -0,0010 | |||||

| US90276XBA28 / UBS Commercial Mortgage Trust 2018-C11 | 0,59 | 0,69 | 0,0974 | -0,0037 | |||||

| CAFL Issuer LP, Series 2025-RRTL1, Class M1 / ABS-MBS (US124760AC38) | 0,58 | 0,0967 | 0,0967 | ||||||

| CAFL Issuer LP, Series 2025-RRTL1, Class M1 / ABS-MBS (US124760AC38) | 0,58 | 0,0967 | 0,0967 | ||||||

| CAFL Issuer LP, Series 2025-RRTL1, Class M1 / ABS-MBS (US124760AC38) | 0,58 | 0,0967 | 0,0967 | ||||||

| US38382J3Q72 / GNMA CMO IO | 0,58 | -4,13 | 0,0964 | -0,0088 | |||||

| US20754NAR61 / FANNIE MAE CAS CAS 2022 R06 1B2 144A | 0,57 | -1,72 | 0,0951 | -0,0060 | |||||

| US12631DAJ28 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,57 | -0,35 | 0,0948 | -0,0048 | |||||

| US3137G0MY21 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,57 | -1,21 | 0,0948 | -0,0056 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,56 | -11,13 | 0,0928 | -0,0162 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,56 | -11,13 | 0,0928 | -0,0162 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,56 | -11,13 | 0,0928 | -0,0162 | |||||

| US61765LAE02 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,56 | 0,18 | 0,0927 | -0,0042 | |||||

| US94989WAD92 / WELLS FARGO COMMERCIAL MORTGAGE TRUS SER 2015-C31 CL E V/R REGD 144A P/P 4.60752400 | 0,56 | 3,16 | 0,0920 | -0,0013 | |||||

| US3137F8RM73 / Freddie Mac REMICS | 0,55 | -2,81 | 0,0919 | -0,0070 | |||||

| US20753DAF50 / CORP CMO | 0,55 | -1,43 | 0,0917 | -0,0056 | |||||

| US3136BFWT69 / FNMA CMO IO | 0,55 | -1,79 | 0,0911 | -0,0060 | |||||

| US35563KBE91 / CORP CMO | 0,54 | -1,28 | 0,0897 | -0,0052 | |||||

| US3137FTBB22 / Freddie Mac REMICS | 0,54 | -3,06 | 0,0894 | -0,0071 | |||||

| US08162PAG63 / BENCHMARK 2018-B1 Mortgage Trust | 0,53 | -7,64 | 0,0883 | -0,0117 | |||||

| US20753YAF97 / Connecticut Avenue Securities Trust 2022-R04 | 0,53 | -1,12 | 0,0882 | -0,0051 | |||||

| US3136BF4A89 / FNMA CMO IO | 0,52 | -0,38 | 0,0865 | -0,0043 | |||||

| US61761DAS18 / Morgan Stanley Bank of America Merrill Lynch Trust 2012-C6 | 0,52 | 0,97 | 0,0865 | -0,0031 | |||||

| US46590LAE20 / JPMDB Commercial Mortgage Securities Trust 2016-C2 | 0,52 | 6,54 | 0,0864 | 0,0015 | |||||

| US36198EBB02 / GS Mortgage Securities Trust, Series 2013-GC13, Class D | 0,52 | 0,00 | 0,0864 | -0,0040 | |||||

| US61764PAN24 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C19, Class D | 0,51 | 0,00 | 0,0848 | -0,0038 | |||||

| US08162PBB67 / BENCHMARK 2018-B1 Mortgage Trust | 0,51 | -3,78 | 0,0844 | -0,0073 | |||||

| US3136BJDG71 / FNMA CMO IO | 0,51 | -2,87 | 0,0842 | -0,0065 | |||||

| Chase Home Lending Mortgage Trust, Series 2025-3, Class A11 / ABS-MBS (US16160MAX11) | 0,50 | 0,0833 | 0,0833 | ||||||

| Chase Home Lending Mortgage Trust, Series 2025-3, Class A11 / ABS-MBS (US16160MAX11) | 0,50 | 0,0833 | 0,0833 | ||||||

| Chase Home Lending Mortgage Trust, Series 2025-3, Class A11 / ABS-MBS (US16160MAX11) | 0,50 | 0,0833 | 0,0833 | ||||||

| US05493NAA00 / BDS 2021-FL9 Ltd | 0,50 | -0,20 | 0,0824 | -0,0039 | |||||

| US55286MAA80 / MFA 2023-NQM3 TRUST SER 2023-NQM3 CL A1 V/R REGD 144A P/P 0.00000000 | 0,49 | -5,93 | 0,0817 | -0,0091 | |||||

| US38380LQD81 / GNMA CMO IO | 0,49 | -16,98 | 0,0811 | -0,0212 | |||||

| US61690YBZ43 / Morgan Stanley Capital I Trust 2016-BNK2 | 0,49 | 2,54 | 0,0805 | -0,0015 | |||||

| US08162BAJ17 / Benchmark Mortgage Trust, Series 2019-B11, Class D | 0,48 | 3,23 | 0,0795 | -0,0011 | |||||

| US12631DBE22 / COMM 2014-CCRE17 Mortgage Trust | 0,48 | -1,25 | 0,0789 | -0,0047 | |||||

| US12667GY983 / CORP CMO | 0,47 | -1,66 | 0,0787 | -0,0050 | |||||

| US3136BDZL58 / Fannie Mae REMICS | 0,47 | -2,49 | 0,0780 | -0,0057 | |||||

| US61690FAS20 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C22 | 0,47 | -52,58 | 0,0777 | -0,0865 | |||||

| US06540TAP57 / BANK 2018-BNK11 | 0,46 | 1,32 | 0,0761 | -0,0025 | |||||

| US90269GAQ47 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,46 | -3,59 | 0,0759 | -0,0064 | |||||

| US61767EAU82 / Morgan Stanley Bank of America Merrill Lynch Trust 2017-C34 | 0,45 | 3,18 | 0,0753 | -0,0011 | |||||

| US38383CNQ95 / GNMA CMO IO | 0,45 | -1,76 | 0,0741 | -0,0047 | |||||

| US46639NAC56 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,43 | -0,69 | 0,0717 | -0,0038 | |||||

| SOP / DIR (N/A) | 0,43 | 0,0715 | 0,0715 | ||||||

| US20048EAG61 / Commercial Mortgage Trust | 0,43 | 3,16 | 0,0705 | -0,0011 | |||||

| US3137H0SA70 / FHLMC CMO IO | 0,42 | -4,54 | 0,0699 | -0,0066 | |||||

| US46639YAC12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,41 | 860,47 | 0,0686 | 0,0610 | |||||

| US07335CAV63 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,41 | 6,19 | 0,0684 | 0,0009 | |||||

| US38376RK474 / GNMA CMO IO | 0,40 | -12,23 | 0,0666 | -0,0129 | |||||

| US46635TBA97 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,40 | 4,70 | 0,0666 | 0,0001 | |||||

| US04285CAD39 / Arroyo Mortgage Trust 2020-1 | 0,39 | -0,26 | 0,0648 | -0,0033 | |||||

| US61691EBF16 / Morgan Stanley Capital I Trust 2016-UBS12 | 0,38 | 1,05 | 0,0637 | -0,0022 | |||||

| US46642NBJ46 / JPMBB Commercial Mortgage Securities Trust | 0,38 | 0,53 | 0,0633 | -0,0027 | |||||

| US36249KAL44 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,38 | 0,53 | 0,0629 | -0,0025 | |||||

| US38382LDU26 / GNMA CMO IO | 0,38 | -2,58 | 0,0628 | -0,0046 | |||||

| US12659LAD47 / CORP CMO | 0,38 | 0,80 | 0,0624 | -0,0023 | |||||

| US46590TAL98 / JPMDB Commercial Mortgage Securities Trust, Series 2017-C5, Class C | 0,38 | 1,08 | 0,0622 | -0,0023 | |||||

| US30711XCR35 / CORP CMO | 0,37 | -2,66 | 0,0607 | -0,0045 | |||||

| US38376RF847 / GNMA CMO IO | 0,37 | -13,10 | 0,0606 | -0,0123 | |||||

| US3136BF3U52 / FNMA CMO IO | 0,36 | -1,90 | 0,0601 | -0,0040 | |||||

| US92873AAA60 / VOLT XCIV LLC 2.2395% 02/27/2051 144A | 0,36 | -55,87 | 0,0593 | -0,0811 | |||||

| US36252SAA50 / GS MORTGAGE SECURITIES TRUST 3% 02/10/2052 144A | 0,36 | 0,28 | 0,0591 | -0,0025 | |||||

| US61764PBZ45 / Morgan Stanley Bank of America Merrill Lynch Trust 2014 C19 | 0,33 | -3,47 | 0,0555 | -0,0046 | |||||

| US38380LC278 / GNMA CMO IO | 0,33 | -6,20 | 0,0553 | -0,0063 | |||||

| CDSCMBX / DCR (N/A) | 0,33 | 0,0552 | 0,0552 | ||||||

| US95000CBJ18 / Wells Fargo Commercial Mortgage Trust 2016-NXS5 | 0,33 | 4,44 | 0,0547 | 0,0000 | |||||

| US46642NBK19 / JPMBB Commercial Mortgage Securities Trust 2014-C22 | 0,33 | 1,24 | 0,0542 | -0,0019 | |||||

| US17325HBT05 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,32 | 2,21 | 0,0537 | -0,0013 | |||||

| US38382AAJ43 / GNMA CMO IO | 0,32 | -7,51 | 0,0531 | -0,0070 | |||||

| US38382EFD40 / Government National Mortgage Association | 0,32 | -4,26 | 0,0523 | -0,0048 | |||||

| US38375U3K46 / GNMA CMO IO | 0,31 | -4,86 | 0,0520 | -0,0051 | |||||

| US61762XAE76 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,31 | 0,32 | 0,0513 | -0,0021 | |||||

| US3622EUAD88 / GSAA Home Equity Trust, Series 2007-2, Class AF4A | 0,31 | -5,21 | 0,0513 | -0,0052 | |||||

| US38382BDZ31 / GNMA CMO IO | 0,31 | -4,05 | 0,0512 | -0,0046 | |||||

| US12515BAR96 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,31 | 4,78 | 0,0510 | 0,0000 | |||||

| US12529TAZ66 / Cantor Commercial Real Estate Lending 2019-CF3 | 0,30 | -5,64 | 0,0500 | -0,0053 | |||||

| US38383RBN61 / Government National Mortgage Association | 0,30 | -5,08 | 0,0497 | -0,0049 | |||||

| US12597BAC37 / CSAIL 2019-C17 Commercial Mortgage Trust | 0,30 | 4,18 | 0,0496 | -0,0002 | |||||

| US38380LY983 / GNMA CMO IO | 0,29 | -9,29 | 0,0487 | -0,0074 | |||||

| GS Mortgage-Backed Securities Trust, Series 2024-RPL4, Class A1 / ABS-MBS (US362948AA98) | 0,29 | -2,66 | 0,0486 | -0,0037 | |||||

| US12598JAC53 / CSMC 2021-RPL7 Trust | 0,29 | -3,64 | 0,0483 | -0,0043 | |||||

| US38380LWX71 / GNMA CMO IO | 0,29 | -15,74 | 0,0479 | -0,0117 | |||||

| US61759FAU57 / CORP CMO | 0,28 | -4,38 | 0,0471 | -0,0045 | |||||

| US12515GAH02 / CD 2017-CD3 Mortgage Trust | 0,28 | 11,46 | 0,0468 | 0,0027 | |||||

| US362341Z285 / ASSET BACKED SECURITY | 0,28 | -1,77 | 0,0461 | -0,0030 | |||||

| OIS / DIR (N/A) | 0,28 | 0,0460 | 0,0460 | ||||||

| OIS / DIR (N/A) | 0,28 | 0,0460 | 0,0460 | ||||||

| US3137G0HZ50 / CORP CMO | 0,26 | -1,53 | 0,0428 | -0,0027 | |||||

| US3137G0HM48 / CORP CMO | 0,26 | -2,29 | 0,0425 | -0,0030 | |||||

| US38382UZC88 / GNMA CMO IO | 0,26 | -6,25 | 0,0423 | -0,0049 | |||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 0,25 | -3,80 | 0,0421 | -0,0037 | |||||

| US61762DBB64 / MSBAM 2013 - C9 C 4.2117% 5/46 | 0,25 | 2,49 | 0,0410 | -0,0008 | |||||

| US12591QAW24 / Commercial Mortgage Trust, Series 2014-UBS4, Class C | 0,24 | -2,83 | 0,0399 | -0,0030 | |||||

| US465968AM74 / JPMCC Commercial Mortgage Securities Trust 2017-JP7 | 0,24 | 5,78 | 0,0395 | 0,0004 | |||||

| US12626GAT04 / COMM MORTGAGE TRUST COMM 2013 LC13 D 144A | 0,24 | -0,84 | 0,0392 | -0,0022 | |||||

| US38382YKW20 / GNMA CMO IO | 0,22 | -9,39 | 0,0368 | -0,0058 | |||||

| US12592GAG82 / Commercial Mortgage Trust, Series 2014-CR19, Class D | 0,22 | -0,92 | 0,0359 | -0,0020 | |||||

| US12591YBH71 / Commercial Mortgage Trust, Series 2014-UBS3, Class C | 0,22 | 0,00 | 0,0357 | -0,0017 | |||||

| US94988QAU58 / Wells Fargo Commercial Mortgage Trust 2013-LC12 | 0,22 | -0,46 | 0,0357 | -0,0019 | |||||

| US46639JAK60 / JP Morgan Chase Commercial Mortgage Securities Trust 2013-C10 | 0,22 | -55,94 | 0,0357 | -0,0491 | |||||

| US590212AD82 / Merrill Lynch Mortgage Investors Trust, Series 2006-HE3, Class A4 | 0,20 | -0,99 | 0,0334 | -0,0019 | |||||

| US12515GAM96 / CD Mortgage Trust, Series 2017-CD3, Class D | 0,20 | -3,47 | 0,0323 | -0,0028 | |||||

| US12630BBF40 / Comm 2013-CCRE13 Mortgage Trust | 0,19 | -4,00 | 0,0319 | -0,0029 | |||||

| US07386HWZ09 / CORP CMO | 0,19 | -3,65 | 0,0307 | -0,0026 | |||||

| US46639YAX58 / JP Morgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class D | 0,18 | -6,19 | 0,0302 | -0,0035 | |||||

| US17323YAJ82 / Citigroup Commercial Mortgage Trust 2015-GC31 | 0,18 | -37,50 | 0,0299 | -0,0201 | |||||

| US02146QAD51 / CORP CMO | 0,17 | -0,60 | 0,0274 | -0,0015 | |||||

| US3622NAAE07 / CORP CMO | 0,16 | -0,61 | 0,0271 | -0,0013 | |||||

| US38376RWX06 / GNMA CMO IO | 0,16 | -24,19 | 0,0271 | -0,0103 | |||||

| US3137FNKD17 / Freddie Mac REMICS | 0,16 | -1,87 | 0,0260 | -0,0019 | |||||

| US38380LNF66 / GNMA CMO IO | 0,16 | -17,55 | 0,0258 | -0,0069 | |||||

| US38376RQP46 / GNMA CMO IO | 0,15 | -24,63 | 0,0255 | -0,0097 | |||||

| CDSCMBX / DCR (N/A) | 0,15 | 0,0255 | 0,0255 | ||||||

| SOP / DIR (N/A) | 0,15 | 0,0254 | 0,0254 | ||||||

| US12592PBL67 / Commercial Mortgage Trust, Series 2014-UBS6, Class D | 0,14 | -8,28 | 0,0240 | -0,0033 | |||||

| US38376REB87 / GNMA CMO IO | 0,14 | -15,06 | 0,0234 | -0,0055 | |||||

| US02146QAC78 / CORP CMO | 0,14 | -2,10 | 0,0232 | -0,0016 | |||||

| US17322YAM21 / Citigroup Commercial Mortgage Trust 2014-GC25 | 0,13 | 0,76 | 0,0221 | -0,0009 | |||||

| US17312EAE68 / Citigroup Mortgage Loan Trust, Inc. | 0,12 | -1,60 | 0,0205 | -0,0012 | |||||

| US86361HAB06 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR7 A1BG | 0,12 | -2,46 | 0,0198 | -0,0015 | |||||

| US38379EW992 / GNMA CMO IO | 0,12 | -0,83 | 0,0197 | -0,0011 | |||||

| US61762MBG50 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,11 | 13,68 | 0,0180 | 0,0014 | |||||

| US38376RTH92 / GNMA CMO IO | 0,09 | -14,81 | 0,0153 | -0,0035 | |||||

| US38376RZM14 / GNMA CMO IO | 0,09 | -21,24 | 0,0149 | -0,0047 | |||||

| US61761DAW20 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,08 | 0,00 | 0,0139 | -0,0005 | |||||

| US46634SAR67 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,08 | 1,33 | 0,0127 | -0,0005 | |||||

| US3137HANZ52 / FHLMC CMO IO | 0,08 | 5,56 | 0,0126 | 0,0001 | |||||

| US38379NRH79 / GNMA CMO IO | 0,08 | 0,00 | 0,0126 | -0,0005 | |||||

| CDSCMBX / DCR (N/A) | 0,08 | 0,0125 | 0,0125 | ||||||

| US07386HYW59 / BEAR STEARNS ALT A TRUST BALTA 2005 10 11A1 | 0,07 | -4,00 | 0,0121 | -0,0009 | |||||

| US38376RT301 / GNMA CMO IO | 0,07 | -13,58 | 0,0117 | -0,0023 | |||||

| US38378PFQ63 / GNMA CMO IO | 0,07 | -2,90 | 0,0111 | -0,0009 | |||||

| US38376RDU77 / GNMA CMO IO | 0,06 | -30,43 | 0,0108 | -0,0052 | |||||

| US38379P4V69 / GNMA CMO IO | 0,06 | -3,23 | 0,0100 | -0,0008 | |||||

| US38375UB255 / GNMA CMO IO | 0,06 | -6,45 | 0,0097 | -0,0010 | |||||

| CDSCMBX / DCR (N/A) | 0,06 | 0,0097 | 0,0097 | ||||||

| US38375UK256 / GNMA CMO IO | 0,06 | -12,12 | 0,0096 | -0,0019 | |||||

| US38380UMS95 / Government National Mortgage Association | 0,06 | 1,82 | 0,0093 | -0,0003 | |||||

| US38380LAD55 / GNMA CMO IO | 0,04 | -7,14 | 0,0065 | -0,0008 | |||||

| US38378U8K60 / GNMA CMO IO | 0,03 | -19,05 | 0,0058 | -0,0016 | |||||

| US3136AP4N93 / FNMA CMO IO | 0,03 | -2,86 | 0,0057 | -0,0004 | |||||

| US38375UYG92 / GNMA CMO IO | 0,03 | -10,53 | 0,0057 | -0,0010 | |||||

| US46640LAS16 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,03 | 0,00 | 0,0057 | -0,0002 | |||||

| CDSCMBX / DCR (N/A) | 0,03 | 0,0055 | 0,0055 | ||||||

| US92922F4W51 / CORP CMO | 0,03 | 0,00 | 0,0053 | -0,0002 | |||||

| US46631QAT94 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,03 | -8,82 | 0,0053 | -0,0007 | |||||

| CDSCMBX / DCR (N/A) | 0,03 | 0,0051 | 0,0051 | ||||||

| US38376RFK77 / GNMA CMO IO | 0,03 | -21,05 | 0,0051 | -0,0016 | |||||

| US38376RF359 / GNMA CMO IO | 0,03 | -14,71 | 0,0049 | -0,0011 | |||||

| US38376RYA84 / GNMA CMO IO | 0,03 | -15,15 | 0,0047 | -0,0011 | |||||

| US30711XBQ60 / CORP CMO | 0,03 | 0,00 | 0,0047 | -0,0003 | |||||

| US94988XAC02 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,03 | 0,00 | 0,0045 | -0,0003 | |||||

| US126694M969 / CORP CMO | 0,02 | 0,00 | 0,0039 | -0,0002 | |||||

| US38379T5K14 / GNMA CMO IO | 0,02 | -4,17 | 0,0038 | -0,0004 | |||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0038 | 0,0038 | ||||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0038 | 0,0038 | ||||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0038 | 0,0038 | ||||||

| US38376RX683 / GNMA CMO IO | 0,02 | -8,33 | 0,0038 | -0,0005 | |||||

| US86362XAP33 / CORP CMO | 0,02 | 0,00 | 0,0033 | -0,0002 | |||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0032 | 0,0032 | ||||||

| US38375UQB97 / GNMA CMO IO | 0,02 | -10,53 | 0,0029 | -0,0006 | |||||

| US45661KAD28 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2006 AR11 2A1 | 0,02 | -5,88 | 0,0028 | -0,0002 | |||||

| US362348AS37 / ASSET BACKED SECURITY | 0,02 | -6,25 | 0,0026 | -0,0002 | |||||

| US38378JL269 / GNMA CMO IO | 0,01 | -7,69 | 0,0021 | -0,0002 | |||||

| US38376RV786 / GNMA CMO IO | 0,01 | -14,29 | 0,0021 | -0,0004 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0020 | 0,0020 | ||||||

| US38379LL461 / GNMA CMO IO | 0,01 | 0,00 | 0,0019 | -0,0000 | |||||

| US38375UG460 / GNMA CMO IO | 0,01 | -9,09 | 0,0018 | -0,0002 | |||||

| US35563PES48 / Seasoned Credit Risk Transfer Trust Series 2018-1 | 0,01 | -98,46 | 0,0017 | -0,1108 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0015 | 0,0015 | ||||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0015 | 0,0015 | ||||||

| US38376RJ807 / GNMA CMO IO | 0,01 | -20,00 | 0,0014 | -0,0004 | |||||

| US38379LX920 / GNMA CMO IO | 0,01 | 0,00 | 0,0014 | -0,0001 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0013 | 0,0013 | ||||||

| US38380LYU15 / GNMA CMO IO | 0,01 | -14,29 | 0,0011 | -0,0002 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0011 | 0,0011 | ||||||

| US38376R4R42 / GNMA CMO IO | 0,01 | 0,00 | 0,0010 | -0,0001 | |||||

| US38375UZV50 / GNMA CMO IO | 0,01 | 0,00 | 0,0010 | -0,0001 | |||||

| US38376R2Q86 / GNMA CMO IO | 0,01 | -16,67 | 0,0009 | -0,0002 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0009 | 0,0009 | ||||||

| US35563PCF45 / Seasoned Credit Risk Transfer Trust Series 2017-3 | 0,01 | -98,68 | 0,0008 | -0,0648 | |||||

| US3136ARFT00 / FNMA CMO IO | 0,00 | -20,00 | 0,0008 | -0,0001 | |||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0006 | 0,0006 | ||||||

| US38376RCL87 / GNMA CMO IO | 0,00 | -25,00 | 0,0006 | -0,0002 | |||||

| US38378A3Y53 / GNMA CMO IO | 0,00 | 0,00 | 0,0005 | -0,0000 | |||||

| US38376RA632 / GNMA CMO IO | 0,00 | 0,00 | 0,0005 | -0,0001 | |||||

| US38379YFF07 / GNMA CMO IO | 0,00 | -33,33 | 0,0005 | -0,0001 | |||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0005 | 0,0005 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0005 | 0,0005 | ||||||

| US38376RAQ92 / GNMA CMO IO | 0,00 | 0,00 | 0,0004 | -0,0001 | |||||

| US38376RJY36 / GNMA CMO IO | 0,00 | -50,00 | 0,0003 | -0,0001 | |||||

| US38376RJW79 / GNMA CMO IO | 0,00 | 0,00 | 0,0003 | -0,0001 | |||||

| US38376RJH03 / GNMA CMO IO | 0,00 | 0,00 | 0,0002 | -0,0001 | |||||

| US38376RAF38 / GNMA CMO IO | 0,00 | 0,00 | 0,0002 | -0,0001 | |||||

| US38376RFF82 / GNMA CMO IO | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US38376RJK32 / GNMA CMO IO | 0,00 | 0,00 | 0,0002 | -0,0001 | |||||

| US38376RJD98 / GNMA CMO IO | 0,00 | 0,00 | 0,0002 | -0,0001 | |||||

| US38376RHE99 / GNMA CMO IO | 0,00 | 0,0001 | -0,0000 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOP / DIR (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOP / DIR (N/A) | -0,01 | -0,0020 | -0,0020 | ||||||

| OIS / DIR (N/A) | -0,07 | -0,0113 | -0,0113 | ||||||

| OIS / DIR (N/A) | -0,07 | -0,0113 | -0,0113 | ||||||

| OIS / DIR (N/A) | -0,07 | -0,0113 | -0,0113 | ||||||

| SOP / DIR (N/A) | -0,11 | -0,0181 | -0,0181 | ||||||

| CDSCMBX / DCR (N/A) | -0,13 | -0,0220 | -0,0220 | ||||||

| CDSCMBX / DCR (N/A) | -0,15 | -0,0242 | -0,0242 | ||||||

| OIS / DIR (N/A) | -0,15 | -0,0251 | -0,0251 | ||||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | -0,27 | -0,0452 | -0,0452 | ||||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | -0,27 | -0,0452 | -0,0452 | ||||||

| U.S. Treasury 10 Year Ultra Bonds / DIR (N/A) | -0,27 | -0,0452 | -0,0452 | ||||||

| SOP / DIR (N/A) | -0,30 | -0,0501 | -0,0501 | ||||||

| CDSCMBX / DCR (N/A) | -0,38 | -0,0637 | -0,0637 | ||||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0,46 | -0,0769 | -0,0769 | ||||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0,46 | -0,0769 | -0,0769 | ||||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0,46 | -0,0769 | -0,0769 | ||||||

| OIS / DIR (N/A) | -0,63 | -0,1048 | -0,1048 | ||||||

| OIS / DIR (N/A) | -0,63 | -0,1048 | -0,1048 | ||||||

| SOP / DIR (N/A) | -0,70 | -0,1167 | -0,1167 | ||||||

| US01F0326664 / Uniform Mortgage-Backed Security, TBA | -0,89 | 0,00 | -0,1469 | 0,0000 | |||||

| US01F0326664 / Uniform Mortgage-Backed Security, TBA | -0,89 | -201,14 | -0,1469 | -0,3099 | |||||

| EWL / Edwards Lifesciences Corporation | -0,92 | -106,76 | -0,1518 | -2,3965 | |||||

| OIS / DIR (N/A) | -1,60 | -0,2649 | -0,2649 | ||||||

| OIS / DIR (N/A) | -1,60 | -0,2649 | -0,2649 | ||||||

| SOP / DIR (N/A) | -2,08 | -0,3448 | -0,3448 | ||||||

| US01F0426654 / Uniform Mortgage-Backed Security, TBA | -3,77 | -200,00 | -0,6254 | -1,2508 | |||||

| OIS / DIR (N/A) | -6,18 | -1,0251 | -1,0251 | ||||||

| OIS / DIR (N/A) | -6,18 | -1,0251 | -1,0251 | ||||||

| US01F0526644 / Uniform Mortgage-Backed Security, TBA | -47,52 | -146,46 | -7,8772 | -26,9021 | |||||

| US01F0526644 / Uniform Mortgage-Backed Security, TBA | -47,52 | 0,00 | -7,8772 | 0,0000 |