Grundlæggende statistik

| Porteføljeværdi | $ 686.991.864 |

| Nuværende stillinger | 351 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

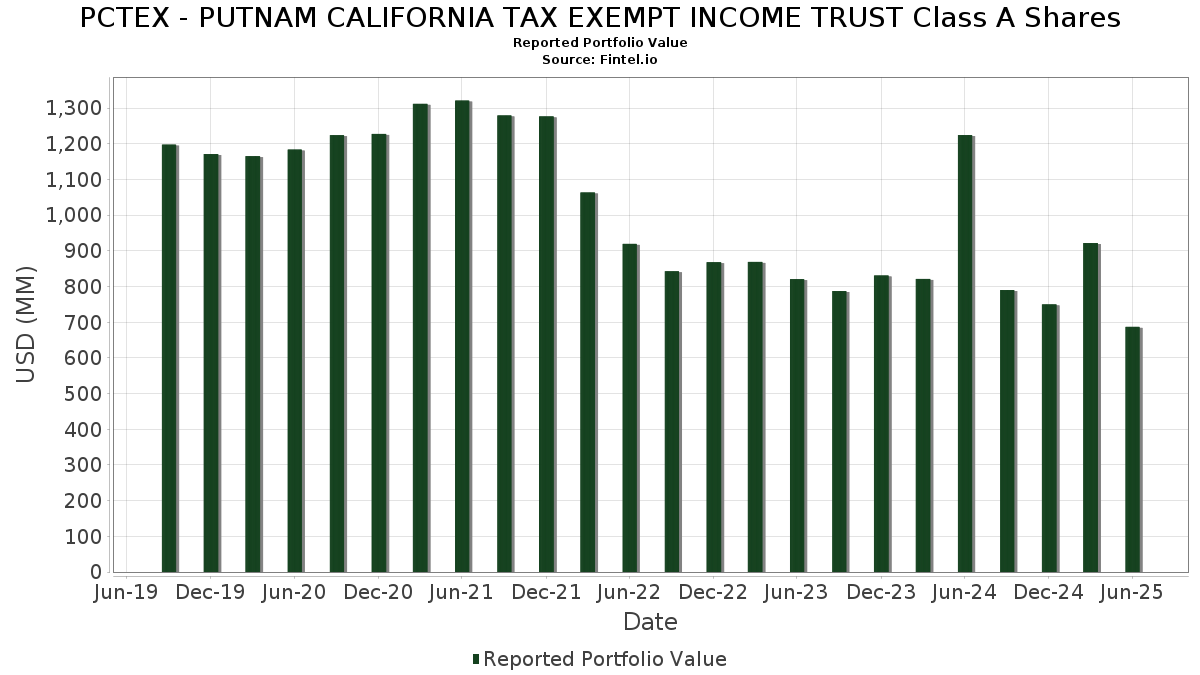

PCTEX - PUTNAM CALIFORNIA TAX EXEMPT INCOME TRUST Class A Shares har afsløret 351 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 686.991.864 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). PCTEX - PUTNAM CALIFORNIA TAX EXEMPT INCOME TRUST Class A Sharess største beholdninger er California Community Choice Financing Authority (US:US13013JAX46) , Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Subordinate Lien Series 2018A (US:US544445ER62) , Freddie Mac Multifamily ML Certificates (US:US30309HAA59) , California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, Poseidon Resources Channelside LP Desalination Project, Series 2012 (US:US13054WAC10) , and City of Los Angeles, Series 2022 G (US:US544445C649) . PCTEX - PUTNAM CALIFORNIA TAX EXEMPT INCOME TRUST Class A Sharess nye stillinger omfatter California Community Choice Financing Authority (US:US13013JAX46) , Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Subordinate Lien Series 2018A (US:US544445ER62) , Freddie Mac Multifamily ML Certificates (US:US30309HAA59) , California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, Poseidon Resources Channelside LP Desalination Project, Series 2012 (US:US13054WAC10) , and City of Los Angeles, Series 2022 G (US:US544445C649) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,76 | 0,4097 | 0,4097 | ||

| 2,02 | 0,2996 | 0,2996 | ||

| 1,53 | 0,2268 | 0,2268 | ||

| 1,29 | 0,1922 | 0,1922 | ||

| 1,18 | 0,1756 | 0,1756 | ||

| 1,17 | 0,1732 | 0,1732 | ||

| 1,06 | 0,1569 | 0,1569 | ||

| 1,03 | 0,1531 | 0,1531 | ||

| 0,99 | 0,1474 | 0,1474 | ||

| 0,97 | 0,1444 | 0,1444 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 4,69 | 4,69 | 0,6973 | -0,9041 | |

| 9,50 | 1,4110 | -0,6281 | ||

| 2,14 | 0,3178 | -0,1424 | ||

| 8,88 | 1,3193 | -0,1288 | ||

| 0,69 | 0,1026 | -0,1264 | ||

| -0,64 | -0,0952 | -0,0952 | ||

| 5,04 | 0,7486 | -0,0452 | ||

| 4,02 | 0,5967 | -0,0425 | ||

| 2,44 | 0,3625 | -0,0281 | ||

| 0,13 | 0,0187 | -0,0279 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| California State Public Works Board / DBT (US13068XJU46) | 11,83 | -0,66 | 1,7569 | 0,0492 | |||||

| US13013JAX46 / California Community Choice Financing Authority | 11,64 | -0,56 | 1,7287 | 0,0500 | |||||

| US544445ER62 / Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Subordinate Lien Series 2018A | 9,92 | -1,68 | 1,4731 | 0,0264 | |||||

| US30309HAA59 / Freddie Mac Multifamily ML Certificates | 9,54 | -1,24 | 1,4170 | 0,0316 | |||||

| US13054WAC10 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, Poseidon Resources Channelside LP Desalination Project, Series 2012 | 9,50 | -33,19 | 1,4110 | -0,6281 | |||||

| US544445C649 / City of Los Angeles, Series 2022 G | 9,01 | -2,59 | 1,3380 | 0,0118 | |||||

| US888804CT68 / TOBACCO SECURITIZATION AUTH ST TOBGEN 06/48 FIXED 5 | 8,88 | -12,03 | 1,3193 | -0,1288 | |||||

| New Hampshire Business Finance Authority, Series 2024-4, Class ACA / DBT (US63607WBB90) | 8,32 | -3,85 | 1,2368 | -0,0052 | |||||

| US797299PX62 / San Diego Public Facilities Financing Authority | 8,32 | -3,55 | 1,2359 | -0,0014 | |||||

| California Community Choice Financing Authority, Series 2024 H / DBT (US13013JFW18) | 8,05 | -1,17 | 1,1953 | 0,0276 | |||||

| US15722TKU42 / Chabot-Las Positas Community College District, Series C | 7,39 | -2,75 | 1,0980 | 0,0077 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US130489AB36) | 7,24 | -0,74 | 1,0749 | 0,0291 | |||||

| US55374SAC44 / M-S-R CA ENERGY AUTH GAS REVENUE | 7,18 | -0,60 | 1,0665 | 0,0305 | |||||

| San Diego Housing Authority, Inc., Series 2024 E / DBT (US79728FLL30) | 7,11 | -1,85 | 1,0570 | 0,0171 | |||||

| US544532EC48 / LA DEP OF WTR & PWR 22A SF 5.0% 07-01-46 | 7,10 | -1,20 | 1,0550 | 0,0240 | |||||

| US79771KEC62 / FX.RT. MUNI BOND | 7,10 | -3,71 | 1,0542 | -0,0029 | |||||

| US13081KAX81 / California (State of) Statewide Communities Development Authority (Methodist Hospital of Sothern California), Series 2018; RB | 7,04 | -1,44 | 1,0457 | 0,0213 | |||||

| US13059TGL70 / California School Finance Authority | 6,75 | -4,15 | 1,0022 | -0,0074 | |||||

| US13049YFQ98 / CALIFORNIA ST MUNI FIN AUTH STUDENT HSG REVENUE | 6,74 | -3,64 | 1,0020 | -0,0022 | |||||

| US870462UG13 / SWEETWATER CA UNION HIGH SCH DIST | 6,71 | -2,23 | 0,9968 | 0,0123 | |||||

| Northern California Energy Authority, Series 2024 / DBT (US664840AL93) | 6,31 | -0,58 | 0,9375 | 0,0268 | |||||

| US130493CL10 / CALIFORNIA MUNICIPAL FINANCE AUTHORITY | 6,11 | -0,08 | 0,9074 | 0,0305 | |||||

| US13063D4D74 / CALIFORNIA ST | 5,82 | -2,13 | 0,8651 | 0,0115 | |||||

| US13048VG510 / California Municipal Finance Authority | 5,76 | -1,72 | 0,8552 | 0,0149 | |||||

| US544532FW92 / Los Angeles Department of Water & Power | 5,73 | -1,93 | 0,8512 | 0,0131 | |||||

| US010869JP19 / ALAMEDA CA CORRIDOR TRANSPRTN AUTH REVENUE | 5,59 | -1,04 | 0,8306 | 0,0201 | |||||

| California Community Choice Financing Authority, Series 2024 F / DBT (US13013JFR23) | 5,31 | -0,28 | 0,7896 | 0,0251 | |||||

| US54241AAU79 / Long Beach (City of), CA Bond Finance Authority, Series 2007 A, RB | 5,29 | 0,08 | 0,7860 | 0,0276 | |||||

| US126292BB63 / CSCDA Community Improvement Authority | 5,24 | -5,38 | 0,7790 | -0,0159 | |||||

| Los Angeles Housing Authority, Series 2024 A / DBT (US544562CP48) | 5,19 | 0,58 | 0,7717 | 0,0308 | |||||

| US126292AW10 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 5,19 | -4,09 | 0,7707 | -0,0051 | |||||

| US13049YCJ82 / California (State of) Municipal Finance Authority (CHF-Riverside I, LLC - UCR Dundee-Glasgow Student Housing) | 5,18 | -1,24 | 0,7690 | 0,0172 | |||||

| US13059TFH77 / California (State of) School Finance Authority (Green Dot Public Schools), Series 2018 A, RB | 5,05 | -4,38 | 0,7499 | -0,0074 | |||||

| US13013FAU84 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 5,04 | -8,95 | 0,7486 | -0,0452 | |||||

| US38122ND906 / Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Revenue Bonds, Series 2022A-1 | 4,93 | -2,63 | 0,7322 | 0,0060 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US130483GQ70) | 4,91 | 0,74 | 0,7300 | 0,0303 | |||||

| US13035ADC09 / California Infrastructure & Economic Development Bank | 4,86 | -5,06 | 0,7219 | -0,0124 | |||||

| US13016NEC48 / CALIFORNIA CNTY TOB STL - KERN COUNTY | 4,84 | -1,93 | 0,7185 | 0,0111 | |||||

| US389526AG95 / FX.RT. MUNI BOND | 4,70 | -1,61 | 0,6979 | 0,0129 | |||||

| US74676P6640 / SHORT TERM INV FUND | 4,69 | -57,95 | 4,69 | -57,96 | 0,6973 | -0,9041 | |||

| US797661YG47 / San Francisco Bay Area Rapid Transit District, California, General Obligation Bonds, Election of 2016, Green Series 2019B-1 | 4,67 | -1,52 | 0,6935 | 0,0134 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4,64 | -0,30 | 0,6887 | 0,0217 | |||||

| US13032USL34 / CALIFORNIA ST HLTH FACS FING AUTH REVENUE | 4,59 | -3,06 | 0,6826 | 0,0026 | |||||

| US79766DLB37 / VAR.RT.MUNI NOTE NT | 4,50 | 0,00 | 0,6693 | 0,0230 | |||||

| US13034AD230 / California (State of) Infrastructure & Economic Development Bank, Series 2019, Ref. VRD RB | 4,50 | 0,63 | 0,6689 | 0,0270 | |||||

| US13033DAC92 / California Housing Finance, Class A | 4,32 | -0,64 | 0,6425 | 0,0181 | |||||

| US45571LDP94 / Indio Finance Authority | 4,29 | -1,72 | 0,6368 | 0,0111 | |||||

| US13048VLA43 / CALIFORNIA ST MUNI FIN AUTH REVENUE | 4,28 | -7,24 | 0,6360 | -0,0260 | |||||

| City of Los Angeles, Series 2018 A-1 / DBT (US544582WX32) | 4,24 | -1,26 | 0,6306 | 0,0140 | |||||

| US84049MCC01 / South Tahoe Joint Powers Financing Authority, Series 2023, RB | 4,23 | -1,72 | 0,6278 | 0,0109 | |||||

| US130179UX07 / California Educational Facilities Authority, Revenue Bonds, University of the Pacific, Series 2023 | 4,09 | -1,52 | 0,6070 | 0,0118 | |||||

| US13013FAF18 / California Community Housing Agency | 4,02 | -9,85 | 0,5967 | -0,0425 | |||||

| US797661YZ28 / SAN FRANCISCO CA BAY AREA RAPID TRANSIT DIST | 3,74 | -0,66 | 0,5552 | 0,0155 | |||||

| US84049MCB28 / FX.RT. MUNI BOND | 3,72 | -1,74 | 0,5532 | 0,0096 | |||||

| California Statewide Communities Development Authority, Series 2025 A / DBT (US13079PA296) | 3,70 | 0,60 | 0,5497 | 0,0221 | |||||

| Moreland School District, Series 2024 B / DBT (US616794YD91) | 3,67 | -2,11 | 0,5450 | 0,0074 | |||||

| US13033DAE58 / CALIFORNIA HSG FIN AGY MUNI CTFS | 3,60 | -2,70 | 0,5348 | 0,0040 | |||||

| US773747ER70 / FX.RT. MUNI BOND | 3,44 | -0,29 | 0,5106 | 0,0162 | |||||

| US13048TS204 / California (State of) Municipal Finance Authority (Community Medical Centers), Series 2017 A, Ref. RB | 3,40 | -0,18 | 0,5053 | 0,0164 | |||||

| US13048VMW53 / FX.RT. MUNI BOND | 3,39 | -0,35 | 0,5043 | 0,0155 | |||||

| California Housing Finance Agency, Series 2024 L / DBT (US13034DAG97) | 3,31 | 0,46 | 0,4918 | 0,0191 | |||||

| US542433WZ68 / LONG BEACH CA UNIF SCH DIST | 3,30 | -3,76 | 0,4910 | -0,0017 | |||||

| US13081KAW09 / CALIFORNIA ST STWD CMNTYS DEV AUTH HOSP REVENUE | 3,28 | -2,41 | 0,4872 | 0,0051 | |||||

| US669096XU87 / FX.RT. MUNI BOND | 3,12 | -2,01 | 0,4629 | 0,0067 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13048VV394) | 3,05 | -3,54 | 0,4536 | -0,0004 | |||||

| US612289UT31 / MONTEBELLO UNIF SD-B | 3,03 | -2,95 | 0,4499 | 0,0022 | |||||

| US417123EH54 / Hartnell Community College District/CA | 2,97 | -0,13 | 0,4413 | 0,0147 | |||||

| US13059TFV61 / CALIFORNIA SCH FIN AUTH SCH FAC REVENUE | 2,95 | -6,31 | 0,4388 | -0,0134 | |||||

| US13080SSD70 / CALIFORNIA STWD CMNTYS DEV AUTH REVENUE | 2,86 | -8,26 | 0,4243 | -0,0222 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13049SGD09) | 2,80 | 5,74 | 0,4159 | 0,0361 | |||||

| US13058TKC35 / California School Finance Authority | 2,79 | -4,16 | 0,4139 | -0,0032 | |||||

| US13058TKA78 / FX.RT. MUNI BOND | 2,79 | -3,23 | 0,4138 | 0,0008 | |||||

| US13033DAA37 / California (State of) Housing Finance Agency, Series 2019 A-1, RB | 2,76 | 0,69 | 0,4100 | 0,0168 | |||||

| California Community Choice Financing Authority, Series 2025 B / DBT (US13013JGF75) | 2,76 | 0,4097 | 0,4097 | ||||||

| US126292AD39 / CSCDA Community Improvement Authority | 2,73 | -2,99 | 0,4056 | 0,0019 | |||||

| Folsom Ranch Financing Authority, Series 2024 / DBT (US344414HD26) | 2,66 | -5,63 | 0,3957 | -0,0093 | |||||

| US13032USK50 / CALIFORNIA ST HLTH FACS FING AUTH REVENUE | 2,64 | -2,44 | 0,3923 | 0,0041 | |||||

| US74514L3M75 / PUERTO RICO CMWLTH | 2,62 | 0,77 | 0,3897 | 0,0163 | |||||

| US738855N352 / FX.RT. MUNI BOND | 2,59 | -1,52 | 0,3848 | 0,0075 | |||||

| US12574TAB35 / FX.RT. MUNI BOND | 2,53 | -4,32 | 0,3753 | -0,0035 | |||||

| US13080SGV07 / California Statewide Communities Development Authority | 2,51 | -1,53 | 0,3732 | 0,0072 | |||||

| US796844MZ81 / County of San Bernardino CA 5.00% 09/01/2033 | 2,50 | -0,20 | 0,3720 | 0,0121 | |||||

| US13034AW305 / CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE | 2,44 | -10,40 | 0,3625 | -0,0281 | |||||

| Los Angeles Housing Authority, Series 2024 C / DBT (US544562CR04) | 2,42 | 2,46 | 0,3593 | 0,0206 | |||||

| California Statewide Communities Development Authority, Series 2024 / DBT (US13077ERX03) | 2,36 | -2,60 | 0,3505 | 0,0030 | |||||

| US797669ZG63 / San Francisco Bay Area Rapid Transit District, California, Sales Tax Revenue Bonds, Series 2019A | 2,33 | -0,72 | 0,3459 | 0,0095 | |||||

| US13035ADA43 / California Infrastructure & Economic Development Bank, Series 2022 B | 2,28 | -4,49 | 0,3382 | -0,0038 | |||||

| US13054WAP23 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, San Diego County Water Authoriity Desalination Project Pipeline, Ref | 2,27 | -1,26 | 0,3378 | 0,0074 | |||||

| US46360TEW99 / City of Irvine CA | 2,27 | -1,90 | 0,3375 | 0,0053 | |||||

| US13081KAV26 / California (State of) Statewide Communities Development Authority (Methodist Hospital of Southern California) | 2,22 | -1,16 | 0,3295 | 0,0076 | |||||

| US126292AR25 / CSCDA Community Improvement Authority | 2,21 | -3,54 | 0,3280 | -0,0003 | |||||

| US13058TPF11 / FX.RT. MUNI BOND | 2,18 | -7,01 | 0,3235 | -0,0123 | |||||

| US418338AB53 / HASTINGS CAMPUS HSG FIN AUTH CA CAMPUS HSG REVENUE | 2,14 | -33,32 | 0,3178 | -0,1424 | |||||

| US13058TPW44 / California School Finance Authority | 2,14 | -4,72 | 0,3178 | -0,0043 | |||||

| US13054WAQ06 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, San Diego County Water Authoriity Desalination Project Pipeline, Ref | 2,12 | -2,03 | 0,3155 | 0,0046 | |||||

| US901047GD60 / Tustin CA Community Facilities District Special Tax Revenue | 2,11 | -0,05 | 0,3131 | 0,0106 | |||||

| US13080SUG73 / CALIFORNIA STWD CMNTYS DEV AUTH REVENUE | 2,10 | -2,69 | 0,3114 | 0,0023 | |||||

| California Municipal Finance Authority, Series 2024 / DBT (US130497AY62) | 2,08 | -3,03 | 0,3096 | 0,0014 | |||||

| US304194FD02 / FAIRFIELD -A | 2,08 | -4,11 | 0,3087 | -0,0021 | |||||

| US417123EJ11 / Hartnell Community College District/CA | 2,07 | -0,38 | 0,3082 | 0,0095 | |||||

| US126292BG50 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 2,07 | -5,21 | 0,3081 | -0,0056 | |||||

| US55374SAD27 / M-S-R Energy Authority, Series 2009 B, RB | 2,06 | -0,53 | 0,3056 | 0,0090 | |||||

| US169511XB39 / Chino Community Facilities District, Series 2022 | 2,04 | -1,50 | 0,3026 | 0,0061 | |||||

| US612289UR74 / MONTEBELLO CA USD AGM 22B SF 5.0% 08-01-44 | 2,03 | -2,36 | 0,3011 | 0,0034 | |||||

| Los Angeles Department of Water & Power, Series 2025 A / DBT (US544532PU27) | 2,02 | 0,2996 | 0,2996 | ||||||

| US798712DC68 / SLO CO FING AUTH | 2,01 | -1,56 | 0,2991 | 0,0056 | |||||

| California Infrastructure & Economic Development Bank, Series 2024 A / DBT (US13034A5K22) | 2,01 | -1,67 | 0,2979 | 0,0053 | |||||

| US126292AF86 / CSCDA Community Improvement Authority | 2,00 | -4,45 | 0,2966 | -0,0032 | |||||

| US76913AKY81 / Riverside County CA Redevelopment Successor Agency Tax Allocation Revenue | 2,00 | -1,48 | 0,2964 | 0,0058 | |||||

| US776192SE72 / FX.RT. MUNI BOND | 1,98 | -3,42 | 0,2937 | 0,0001 | |||||

| City of Rancho Cordova, Series 2024 / DBT (US75211RRM15) | 1,96 | -1,81 | 0,2906 | 0,0048 | |||||

| US797355Q560 / San Diego Unified School District, San Diego County, California, General Obligation Bonds, Refunding Series 2012R-2 | 1,95 | -1,81 | 0,2902 | 0,0048 | |||||

| US13080SML50 / California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center), Series 2016 A, RB | 1,92 | -4,15 | 0,2852 | -0,0021 | |||||

| US13051AGB89 / CALIFORNIA ST MUNI FIN AUTH SPL TAX REVENUE | 1,91 | -2,95 | 0,2837 | 0,0015 | |||||

| California Statewide Communities Development Authority, Series 2024 B-1 / DBT (US13080SU932) | 1,90 | -1,61 | 0,2816 | 0,0052 | |||||

| US13032USH22 / FX.RT. MUNI BOND | 1,87 | -0,11 | 0,2774 | 0,0092 | |||||

| US13059TGZ66 / FX.RT. MUNI BOND | 1,85 | -5,80 | 0,2751 | -0,0068 | |||||

| US13059TCP21 / FX.RT. MUNI BOND | 1,83 | -0,16 | 0,2721 | 0,0089 | |||||

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign, Series 2024 B / DBT (US120827EG13) | 1,81 | -4,74 | 0,2687 | -0,0037 | |||||

| US126292AE12 / CSCDA Community Improvement Authority | 1,79 | -1,38 | 0,2656 | 0,0055 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13049SGC26) | 1,79 | -2,88 | 0,2654 | 0,0015 | |||||

| US255650EA72 / FX.RT. MUNI BOND | 1,74 | -2,80 | 0,2583 | 0,0018 | |||||

| US283839F609 / EL RANCHO CA UNIF SCH DIST | 1,66 | -2,18 | 0,2469 | 0,0032 | |||||

| US169511XA55 / Chino Community Facilities District, Series 2022 | 1,66 | -1,43 | 0,2462 | 0,0050 | |||||

| California Statewide Communities Development Authority, Series 2024 B-1 / DBT (US13080SV278) | 1,66 | -2,53 | 0,2460 | 0,0023 | |||||

| US626905JE45 / Murrieta Valley Unified School District Public Financing Authority (Election of 2006), Series 2008, GO Bonds | 1,64 | 2,50 | 0,2435 | 0,0142 | |||||

| US169511WZ16 / Chino Community Facilities District, Series 2022 | 1,63 | -1,27 | 0,2425 | 0,0054 | |||||

| Corona Community Facilities District, Series 2024 / DBT (US219680HE83) | 1,60 | -1,78 | 0,2381 | 0,0041 | |||||

| Corona Community Facilities District, Series 2024 / DBT (US219680HF58) | 1,60 | -1,85 | 0,2370 | 0,0038 | |||||

| US452641LM33 / Imperial Community College District | 1,57 | -2,85 | 0,2329 | 0,0014 | |||||

| City of Rancho Cordova, Series 2024 / DBT (US75211RRL32) | 1,55 | -1,65 | 0,2307 | 0,0043 | |||||

| US452641LL59 / Imperial Community College District | 1,55 | -3,19 | 0,2297 | 0,0005 | |||||

| California Health Facilities Financing Authority, Series 2024 B / DBT (US13032UK724) | 1,54 | -1,97 | 0,2294 | 0,0035 | |||||

| US13059THH59 / California School Finance Authority, Series 2022 A | 1,54 | -2,47 | 0,2289 | 0,0023 | |||||

| US13059TCT43 / CALIFORNIA SCH FIN AUTH SCH FAC REVENUE | 1,53 | -2,55 | 0,2274 | 0,0021 | |||||

| River Islands Public Financing Authority, Series 2024 / DBT (US76827QKX06) | 1,53 | -2,68 | 0,2270 | 0,0019 | |||||

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign, Series 2024 B / DBT (US120827ED81) | 1,53 | 0,2268 | 0,2268 | ||||||

| US924397DX75 / FX.RT. MUNI BOND | 1,50 | -0,20 | 0,2236 | 0,0074 | |||||

| US68423PA837 / Orange County Community Facilities District, Series 2023 A | 1,50 | -2,28 | 0,2225 | 0,0026 | |||||

| California Health Facilities Financing Authority, Series 2024 B / DBT (US13032UK807) | 1,48 | -3,90 | 0,2196 | -0,0011 | |||||

| US777870T970 / City of Roseville CA | 1,48 | -4,27 | 0,2196 | -0,0019 | |||||

| City of Fontana, Series 2024 / DBT (US344630N207) | 1,48 | -3,34 | 0,2195 | 0,0002 | |||||

| US13080SSJ41 / California (State of) Statewide Communities Development Authority (California Baptist University), Series 2017 A, Ref. RB | 1,47 | -3,42 | 0,2184 | -0,0000 | |||||

| California Health Facilities Financing Authority, Series 2024 B / DBT (US13032UL300) | 1,47 | -4,12 | 0,2177 | -0,0016 | |||||

| US400652AA19 / Port Authority of Guam, Series 2018 A, RB | 1,46 | -3,00 | 0,2163 | 0,0011 | |||||

| US13034AQ869 / CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE | 1,45 | -10,50 | 0,2153 | -0,0171 | |||||

| US13059TCD90 / California (State of) School Finance Authority (Green Dot Public Schools), Series 2015 A, RB | 1,45 | -3,47 | 0,2152 | 0,0000 | |||||

| US13059TBZ12 / California (State of) School Finance Authority (KIPP LA), Series 2015 A, RB | 1,45 | -3,47 | 0,2150 | -0,0002 | |||||

| US13016NHB38 / California County Tobacco Securitization Agency | 1,44 | -6,60 | 0,2144 | -0,0074 | |||||

| US13059TDC09 / FX.RT. MUNI BOND | 1,44 | -0,14 | 0,2140 | 0,0070 | |||||

| California School Finance Authority, Series 2024 A / DBT (US13059TJS96) | 1,43 | 43,30 | 0,2129 | 0,0694 | |||||

| US13048VMV70 / FX.RT. MUNI BOND | 1,42 | 0,35 | 0,2109 | 0,0080 | |||||

| US530319SE30 / LIBERTY CA UNION HIGH SCH DIST | 1,35 | -2,32 | 0,2003 | 0,0022 | |||||

| California School Finance Authority, Series 2024 A / DBT (US13058TUL24) | 1,35 | -5,68 | 0,2000 | -0,0048 | |||||

| US79772ADM62 / SAN FRANCISCO-REF | 1,35 | -1,68 | 0,1999 | 0,0035 | |||||

| US77539HCS76 / MUNI. ZERO | 1,34 | 0,83 | 0,1986 | 0,0084 | |||||

| US12574UAA25 / CMFA SPL FIN AGY VII CA ESSENTIAL HSG REVENUE | 1,32 | -3,65 | 0,1959 | -0,0005 | |||||

| US13080SWP54 / California (State of) Statewide Communities Development Authority (Lancer Educational Student Housing), Series 2019, RB | 1,31 | -5,34 | 0,1950 | -0,0039 | |||||

| US13058TSQ49 / FX.RT. MUNI BOND | 1,30 | 0,31 | 0,1932 | 0,0072 | |||||

| California Statewide Communities Development Authority, Series 2025 A / DBT (US13078YWH43) | 1,29 | 0,1922 | 0,1922 | ||||||

| US13051AAT51 / California Municipal Finance Authority | 1,27 | -3,35 | 0,1884 | 0,0001 | |||||

| US777870WA02 / Roseville, California, Special Tax Bonds, Community Facilities District 1 Westpark, Refunding Series 2015 | 1,25 | -0,32 | 0,1858 | 0,0059 | |||||

| US13059TCQ04 / CALIFORNIA SCH FIN AUTH SCH FAC REVENUE | 1,25 | -0,16 | 0,1858 | 0,0062 | |||||

| California Municipal Finance Authority, Series 2024 / DBT (US13051AJK51) | 1,25 | -1,73 | 0,1856 | 0,0032 | |||||

| City of Fontana, Series 2024 / DBT (US344630M704) | 1,25 | -1,03 | 0,1854 | 0,0045 | |||||

| US26362DBU19 / City of Dublin, Series 2023 | 1,25 | -1,50 | 0,1853 | 0,0037 | |||||

| Riverside Unified School District, Series 2024 / DBT (US769069U605) | 1,24 | -3,21 | 0,1840 | 0,0005 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13049SGB43) | 1,23 | -2,54 | 0,1826 | 0,0017 | |||||

| California Infrastructure & Economic Development Bank, Series 2024 B / DBT (US13035ADW62) | 1,22 | -5,06 | 0,1813 | -0,0032 | |||||

| US13051ABK34 / California Municipal Finance Authority | 1,20 | -7,95 | 0,1789 | -0,0089 | |||||

| Temescal Valley Water District, Series 2024 / DBT (US87975CBW01) | 1,20 | -3,77 | 0,1782 | -0,0006 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13048V2U11) | 1,20 | -6,33 | 0,1782 | -0,0055 | |||||

| US79773NAD03 / City & County of San Francisco, Series 2022 A | 1,20 | -3,31 | 0,1780 | 0,0003 | |||||

| US79772ADL89 / Special Tax Refunding Bonds (Mission Bay South) Series 2023 | 1,20 | -1,40 | 0,1777 | 0,0037 | |||||

| US802309NP52 / FX.RT. MUNI BOND | 1,19 | -1,08 | 0,1762 | 0,0041 | |||||

| City of Long Beach, Series 2025 / DBT (US542426DT50) | 1,18 | 0,1756 | 0,1756 | ||||||

| Folsom Ranch Financing Authority, Series 2024 / DBT (US344414HC43) | 1,18 | -4,15 | 0,1750 | -0,0012 | |||||

| Temescal Valley Water District, Series 2024 / DBT (US87975CBX83) | 1,17 | -2,91 | 0,1737 | 0,0011 | |||||

| City of Long Beach, Series 2025 / DBT (US542426DU24) | 1,17 | 0,1732 | 0,1732 | ||||||

| City of Fontana, Series 2024 / DBT (US344630M969) | 1,16 | -2,36 | 0,1722 | 0,0019 | |||||

| US509632LF06 / FX.RT. MUNI BOND | 1,11 | 0,18 | 0,1647 | 0,0061 | |||||

| US317078EV12 / City of Fillmore, Series 2023 | 1,10 | -1,43 | 0,1641 | 0,0033 | |||||

| US79772ADK07 / Special Tax Refunding Bonds (Mission Bay South) Series 2023 | 1,10 | -1,53 | 0,1628 | 0,0032 | |||||

| US542411GH09 / Long Beach CA Community College District GO | 1,08 | 1,98 | 0,1611 | 0,0085 | |||||

| US79772ADN46 / SAN FRANCISCO-REF | 1,07 | -1,93 | 0,1586 | 0,0025 | |||||

| US169511VL39 / FX.RT. MUNI BOND | 1,07 | -3,45 | 0,1584 | 0,0000 | |||||

| City of Long Beach, Series 2025 / DBT (US542426DS77) | 1,06 | 0,1569 | 0,1569 | ||||||

| US79772ADP93 / SAN FRANCISCO-REF | 1,06 | -2,31 | 0,1568 | 0,0017 | |||||

| US13034AV232 / CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE | 1,05 | -8,52 | 0,1564 | -0,0086 | |||||

| US509632LD57 / FX.RT. MUNI BOND | 1,05 | 0,19 | 0,1558 | 0,0057 | |||||

| Riverside Unified School District, Series 2024 / DBT (US769069U522) | 1,04 | -2,25 | 0,1550 | 0,0019 | |||||

| City of Long Beach, Series 2025 / DBT (US542426DV07) | 1,03 | 0,1531 | 0,1531 | ||||||

| US13012RAS85 / California Community College Financing Authority, Orange Coast Properties LLC - Orange Coast College Project | 1,03 | -0,19 | 0,1528 | 0,0049 | |||||

| US76913AKX09 / Riverside County CA Redevelopment Successor Agency Tax Allocation Revenue | 1,02 | -0,68 | 0,1520 | 0,0043 | |||||

| US13069BAM81 / California Enterprise Development Authority | 1,02 | -0,39 | 0,1510 | 0,0046 | |||||

| City of Fontana, Series 2024 / DBT (US344630M886) | 1,01 | -2,13 | 0,1502 | 0,0021 | |||||

| San Francisco City & County Airport Comm-San Francisco International Airport, Series 2024 A / DBT (US79766DWX38) | 1,01 | -2,23 | 0,1501 | 0,0018 | |||||

| US13059TFG94 / California School Finance Authority Revenue (Green Dot Public Schools Obligated Group) | 1,01 | -0,59 | 0,1499 | 0,0043 | |||||

| US13059TFT16 / California (State of) School Finance Authority (Kipp Socal Public Schools), Series 2019 A, RB | 1,01 | -1,27 | 0,1499 | 0,0033 | |||||

| California Enterprise Development Authority, Series 2024 A / DBT (US13069BBC90) | 1,00 | -1,57 | 0,1488 | 0,0029 | |||||

| US463612JY84 / IRVINE CALIF UNI SCH DIST SPL TAX CFD #09-1 | 1,00 | -0,60 | 0,1488 | 0,0043 | |||||

| US777870VZ61 / Roseville, California, Special Tax Bonds, Community Facilities District 1 Westpark, Refunding Series 2015 | 1,00 | -0,40 | 0,1487 | 0,0046 | |||||

| US1301784X10 / CALIFORNIA EDUCATIONAL FACILIT CASEDU 10/35 FIXED 5 | 1,00 | 5,38 | 0,1486 | 0,0124 | |||||

| US463612KV27 / Irvine Unified School District | 1,00 | -0,60 | 0,1482 | 0,0042 | |||||

| Los Angeles Housing Authority, Series 2024 B / DBT (US544562CQ21) | 1,00 | 1,22 | 0,1478 | 0,0067 | |||||

| US13058TKB51 / California School Finance Authority | 0,99 | -1,09 | 0,1477 | 0,0035 | |||||

| Root Creek Water District, Series 2025 / DBT (US77664AAP75) | 0,99 | 0,1474 | 0,1474 | ||||||

| California Municipal Finance Authority, Series 2024 / DBT (US13048VS820) | 0,99 | -5,71 | 0,1471 | -0,0035 | |||||

| California Health Facilities Financing Authority, Series 2024 B / DBT (US13032UL227) | 0,99 | -3,90 | 0,1465 | -0,0006 | |||||

| US7778705C63 / City of Roseville, Series 2023 | 0,99 | -2,48 | 0,1464 | 0,0014 | |||||

| California Municipal Finance Authority, Series 2025 A / DBT (US13051EAF79) | 0,98 | -2,00 | 0,1460 | 0,0022 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13051AGT97) | 0,98 | -3,93 | 0,1454 | -0,0007 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13048V2T48) | 0,98 | -5,52 | 0,1450 | -0,0032 | |||||

| US13058TRE28 / California School Finance Authority | 0,97 | -4,33 | 0,1445 | -0,0014 | |||||

| Root Creek Water District, Series 2025 / DBT (US77664AAM45) | 0,97 | 0,1444 | 0,1444 | ||||||

| US13058TPU87 / CALIFORNIA ST SCH FIN AUTH CHRT SCH REVENUE | 0,97 | -2,90 | 0,1444 | 0,0009 | |||||

| California Infrastructure & Economic Development Bank, Series 2024 B / DBT (US13035ADX46) | 0,97 | -5,47 | 0,1438 | -0,0032 | |||||

| US79727QCA40 / FX.RT. MUNI BOND | 0,97 | 0,00 | 0,1435 | 0,0049 | |||||

| US13077EKQ25 / FX.RT. MUNI BOND | 0,96 | -4,10 | 0,1425 | -0,0011 | |||||

| US68304NCE76 / Ontario, California, Special Tax Bonds, Community Facilities District 53 Tevelde Facilities, Series 2021 | 0,95 | -5,17 | 0,1416 | -0,0026 | |||||

| US13058TTB60 / FX.RT. MUNI BOND | 0,95 | -7,49 | 0,1413 | -0,0062 | |||||

| California Municipal Finance Authority, Series 2025 A / DBT (US13051EAH36) | 0,95 | -4,35 | 0,1406 | -0,0014 | |||||

| US13051AAS78 / California Municipal Finance Authority | 0,94 | -2,49 | 0,1394 | 0,0014 | |||||

| California Municipal Finance Authority, Series 2025 A / DBT (US13051EAJ91) | 0,93 | -5,49 | 0,1382 | -0,0030 | |||||

| US13049SFG49 / CALIFORNIA ST MUNI FIN AUTH MOBILE HOME PARK REVENUE | 0,92 | -1,29 | 0,1365 | 0,0029 | |||||

| California Municipal Finance Authority, Series 2024 / DBT (US13051AHF84) | 0,91 | -1,52 | 0,1350 | 0,0027 | |||||

| US13051ABJ60 / California Municipal Finance Authority | 0,91 | -7,16 | 0,1349 | -0,0055 | |||||

| Moreno Valley Unified School District, Series 2025 / DBT (US616874WA73) | 0,90 | 0,1335 | 0,1335 | ||||||

| US13013FAR55 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 0,89 | -4,62 | 0,1318 | -0,0016 | |||||

| US777870N932 / FX.RT. MUNI BOND | 0,87 | -3,98 | 0,1292 | -0,0007 | |||||

| US13012RAL33 / FX.RT. MUNI BOND | 0,86 | 0,23 | 0,1285 | 0,0047 | |||||

| US13059THA07 / FX.RT. MUNI BOND | 0,86 | -4,97 | 0,1279 | -0,0021 | |||||

| US7778705B80 / City of Roseville, Series 2023 | 0,85 | -1,73 | 0,1265 | 0,0022 | |||||

| US13012RAP47 / California Community College Financing Authority Revenue (NCCD-Orange Coast Properties LLC) | 0,83 | 0,00 | 0,1234 | 0,0043 | |||||

| US55374SAA87 / MSR ENERGY | 0,82 | -0,49 | 0,1215 | 0,0036 | |||||

| US13049SFH22 / FX.RT. MUNI BOND | 0,81 | -1,33 | 0,1210 | 0,0026 | |||||

| US31350ACU07 / Federal Home Loan Mortgage Corp. Multifamily Housing Revenue | 0,81 | -2,30 | 0,1198 | 0,0014 | |||||

| US13016NGB47 / California County Tobacco Securitization Agency | 0,80 | -3,13 | 0,1195 | 0,0003 | |||||

| California Municipal Finance Authority, Series 2024 / DBT (US13051AHG67) | 0,79 | -1,63 | 0,1167 | 0,0022 | |||||

| City of Long Beach, Series 2025 / DBT (US542426DW89) | 0,77 | 0,1143 | 0,1143 | ||||||

| US13016NGV01 / FX.RT. MUNI BOND | 0,77 | -1,92 | 0,1142 | 0,0019 | |||||

| US344630WZ78 / FONTANA CA SPL TAX | 0,76 | -3,54 | 0,1133 | 0,0000 | |||||

| US13058TMH04 / FX.RT. MUNI BOND | 0,76 | -6,18 | 0,1128 | -0,0033 | |||||

| California Municipal Finance Authority, Series 2024 / DBT (US13051AJJ88) | 0,76 | -1,69 | 0,1126 | 0,0021 | |||||

| US924397FG25 / City of Vernon CA Electric System Revenue | 0,76 | -2,45 | 0,1125 | 0,0012 | |||||

| US79773JBG13 / City & County of San Francisco CA Community Facilities District No 2016-1 | 0,75 | -3,72 | 0,1115 | -0,0004 | |||||

| California Municipal Finance Authority, Series 2025 B / DBT (US13051AMQ84) | 0,75 | 0,1112 | 0,1112 | ||||||

| US7778705A08 / City of Roseville, Series 2023 | 0,74 | -1,60 | 0,1100 | 0,0021 | |||||

| Hesperia Unified School District, Series 2015-1 / DBT (US428063EA50) | 0,74 | 0,1096 | 0,1096 | ||||||

| City of Corona, Series 2024 / DBT (US219680HD01) | 0,73 | -1,74 | 0,1090 | 0,0020 | |||||

| US13080SSH84 / CALIFORNIA STWD CMNTYS DEV AUTH REVENUE | 0,73 | 0,00 | 0,1085 | 0,0037 | |||||

| California Municipal Finance Authority, Series 2024 / DBT (US13051AHH41) | 0,73 | -3,83 | 0,1083 | -0,0004 | |||||

| US79743ACU51 / SAN DIEGO CNTY CA SPL TAX 20A SF 4.0% 09-01-50 | 0,73 | -3,45 | 0,1081 | 0,0001 | |||||

| US13048VWS32 / California Municipal Finance Authority | 0,73 | -1,76 | 0,1078 | 0,0018 | |||||

| Hemet Unified School District, Series 2025 / DBT (US423540MX81) | 0,73 | 0,1077 | 0,1077 | ||||||

| US13059TGY91 / FX.RT. MUNI BOND | 0,72 | -2,97 | 0,1069 | 0,0006 | |||||

| Riverside Unified School District, Series 2024 / DBT (US769069U456) | 0,69 | -2,54 | 0,1026 | 0,0010 | |||||

| US5868104C46 / Menifee Union School District | 0,69 | -56,77 | 0,1026 | -0,1264 | |||||

| California Enterprise Development Authority, Series 2024 A / DBT (US13069BBB18) | 0,68 | -0,59 | 0,1003 | 0,0028 | |||||

| US417123EG71 / Hartnell Community College District/CA | 0,66 | 0,61 | 0,0981 | 0,0039 | |||||

| US651784UU28 / City of Newport Beach CA | 0,66 | -1,49 | 0,0980 | 0,0020 | |||||

| US40065BCQ41 / Guam (Territory of), Series 2019, GO Bonds | 0,65 | 0,62 | 0,0970 | 0,0039 | |||||

| US776192SD99 / FX.RT. MUNI BOND | 0,65 | -2,69 | 0,0969 | 0,0007 | |||||

| Temescal Valley Water District, Series 2024 / DBT (US87975CBU45) | 0,64 | -0,93 | 0,0950 | 0,0023 | |||||

| US13051AAR95 / FX.RT. MUNI BOND | 0,64 | 0,79 | 0,0944 | 0,0039 | |||||

| US13012RAN98 / California (State of) Community College Financing Authority (NCCD - Orange Coast Properties LLC - Orange Coast College) | 0,63 | 0,16 | 0,0929 | 0,0033 | |||||

| US13051AGA07 / California Municipal Finance Authority, Special Tax Revenue Bonds, Bold Program, Series 2023B | 0,62 | -2,06 | 0,0917 | 0,0013 | |||||

| California Municipal Finance Authority, Series 2025 / DBT (US13051AMC98) | 0,61 | -1,13 | 0,0909 | 0,0022 | |||||

| US156753PQ28 / MUNI. ZERO | 0,61 | -4,53 | 0,0908 | -0,0010 | |||||

| Temescal Valley Water District, Series 2024 / DBT (US87975CBV28) | 0,61 | -1,78 | 0,0901 | 0,0015 | |||||

| US13016NGT54 / FX.RT. MUNI BOND | 0,60 | -1,32 | 0,0891 | 0,0019 | |||||

| US13051ABH05 / California Municipal Finance Authority | 0,59 | -2,94 | 0,0883 | 0,0004 | |||||

| US542433QM20 / MUNI. ZERO | 0,59 | 0,17 | 0,0883 | 0,0031 | |||||

| U.S. Treasury Bills / STIV (US912797MS31) | 0,59 | 0,0882 | 0,0882 | ||||||

| California Municipal Finance Authority, Series 2024 / DBT (US13051AHE10) | 0,59 | -0,84 | 0,0875 | 0,0024 | |||||

| Root Creek Water District, Series 2025 / DBT (US77664AAK88) | 0,58 | 0,0859 | 0,0859 | ||||||

| US344630WX21 / FONTANA CA SPL TAX | 0,58 | -1,37 | 0,0856 | 0,0018 | |||||

| US13049RBR66 / California Municipal Finance Authority | 0,57 | -4,87 | 0,0841 | -0,0014 | |||||

| US13059THD46 / California School Finance Authority | 0,56 | -3,11 | 0,0834 | 0,0003 | |||||

| US651784UT54 / City of Newport Beach CA | 0,56 | -0,18 | 0,0833 | 0,0028 | |||||

| US13049RBS40 / California Municipal Finance Authority | 0,55 | -5,33 | 0,0820 | -0,0016 | |||||

| US156753PP45 / MUNI. ZERO | 0,55 | -4,05 | 0,0811 | -0,0005 | |||||

| US156753PN96 / MUNI. ZERO | 0,54 | -3,57 | 0,0803 | -0,0001 | |||||

| US344630WW48 / FONTANA CFD #85 | 0,54 | 0,37 | 0,0797 | 0,0030 | |||||

| US13034AK334 / Refunding RB (Performing Arts Center of Los Angeles Cnty) Series 2020 | 0,52 | -0,19 | 0,0769 | 0,0026 | |||||

| US786071RB89 / City of Sacramento | 0,52 | -5,85 | 0,0766 | -0,0019 | |||||

| US76913AKQ57 / MUNI STEP UP BOND | 0,51 | -0,39 | 0,0764 | 0,0023 | |||||

| US13012RAU32 / California Community College Financing Authority Revenue (NCCD-Orange Coast Properties LLC) | 0,51 | -0,78 | 0,0757 | 0,0021 | |||||

| US776192SC17 / FX.RT. MUNI BOND | 0,51 | -1,55 | 0,0756 | 0,0016 | |||||

| US13049YCH27 / California Municipal Finance Authority Student Housing Revenue (CHF-Riverside I LLC) | 0,50 | -0,79 | 0,0750 | 0,0020 | |||||

| US13069BAP13 / California Enterprise Development Authority | 0,50 | -0,99 | 0,0741 | 0,0018 | |||||

| Eastern Municipal Water District, Series 2025 / DBT (US27627M5S24) | 0,50 | 0,0736 | 0,0736 | ||||||

| US773747FL91 / ROCKLIN CA SPL TAX | 0,49 | -0,41 | 0,0722 | 0,0023 | |||||

| US773747FM74 / City of Rocklin CA | 0,49 | -0,21 | 0,0721 | 0,0023 | |||||

| US79743ACT88 / SAN DIEGO CNTY CA SPL TAX 20A SF 4.0% 09-01-45 | 0,48 | -2,86 | 0,0707 | 0,0005 | |||||

| US542411GG26 / MUNI. ZERO | 0,47 | 1,94 | 0,0702 | 0,0038 | |||||

| US777870F847 / FX.RT. MUNI BOND | 0,47 | -0,42 | 0,0702 | 0,0021 | |||||

| California Educational Facilities Authority, Series 2015 / DBT (US130179YC24) | 0,47 | 0,0700 | 0,0700 | ||||||

| US13080SWN07 / California (State of) Statewide Communities Development Authority (Lancer Educational Student Housing), Series 2019, RB | 0,47 | -1,68 | 0,0697 | 0,0012 | |||||

| California Municipal Finance Authority, Series 2025 / DBT (US13051AMW52) | 0,47 | 0,0692 | 0,0692 | ||||||

| US13080SWL41 / California Statewide Communities Development Authority | 0,46 | -12,99 | 0,0688 | -0,0074 | |||||

| Root Creek Water District, Series 2025 / DBT (US77664AAL61) | 0,46 | 0,0680 | 0,0680 | ||||||

| US13077EKP42 / FX.RT. MUNI BOND | 0,45 | -1,94 | 0,0675 | 0,0011 | |||||

| US13058TMG21 / FX.RT. MUNI BOND | 0,44 | -5,93 | 0,0661 | -0,0017 | |||||

| US924397FF42 / City of Vernon CA Electric System Revenue | 0,44 | -2,23 | 0,0651 | 0,0008 | |||||

| US169511VK55 / FX.RT. MUNI BOND | 0,44 | -2,89 | 0,0650 | 0,0004 | |||||

| US13059THC62 / CALIFORNIA SCH FIN AUTH SCH FAC REVENUE | 0,43 | -0,46 | 0,0646 | 0,0019 | |||||

| US75211RGR21 / RANCHO CORDOVA SNRDG ANATOLIA CFD 03-1 4.0% 09-01-27 | 0,43 | 0,23 | 0,0637 | 0,0023 | |||||

| US802309NS91 / FX.RT. MUNI BOND | 0,43 | -2,73 | 0,0635 | 0,0005 | |||||

| US130179GT50 / California Educational Facilities Authority | 0,43 | 0,00 | 0,0634 | 0,0021 | |||||

| US255650EC39 / FX.RT. MUNI BOND | 0,42 | 0,95 | 0,0631 | 0,0029 | |||||

| US13034AW222 / CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE | 0,42 | -2,98 | 0,0629 | 0,0002 | |||||

| US13058TTA87 / FX.RT. MUNI BOND | 0,42 | -7,30 | 0,0624 | -0,0025 | |||||

| California Municipal Finance Authority, Series 2024 / DBT (US13051AJH23) | 0,41 | -0,97 | 0,0610 | 0,0016 | |||||

| US13063DZZ40 / FX.RT. MUNI BOND | 0,40 | -3,39 | 0,0594 | 0,0001 | |||||

| US463612JD48 / Irvine CA Unified School District Community Facilities District No. 09-1 Special Tax Revenue | 0,40 | -0,50 | 0,0591 | 0,0017 | |||||

| U.S. Treasury Bills / STIV (US912797QP55) | 0,39 | 0,0586 | 0,0586 | ||||||

| US13069BAR78 / California Enterprise Development Authority | 0,39 | -2,00 | 0,0585 | 0,0009 | |||||

| US13058TMF48 / FX.RT. MUNI BOND | 0,39 | -3,69 | 0,0583 | -0,0002 | |||||

| US13080SWM24 / California (State of) Statewide Communities Development Authority (Lancer Educational Student Housing), Series 2019, RB | 0,38 | -0,26 | 0,0568 | 0,0018 | |||||

| Riverside Unified School District, Series 2024 / DBT (US769069U373) | 0,38 | -2,08 | 0,0561 | 0,0009 | |||||

| US777870P267 / FX.RT. MUNI BOND | 0,38 | -4,33 | 0,0560 | -0,0005 | |||||

| California Municipal Finance Authority, Series 2024 A / DBT (US13051AGS15) | 0,37 | -2,62 | 0,0554 | 0,0006 | |||||

| US13016NEY67 / California County Tobacco Securitization Agency | 0,37 | -2,37 | 0,0551 | 0,0006 | |||||

| US255650DZ33 / FX.RT. MUNI BOND | 0,37 | -2,41 | 0,0543 | 0,0006 | |||||

| US13016NGS71 / FX.RT. MUNI BOND | 0,35 | -0,86 | 0,0516 | 0,0013 | |||||

| US802309NM22 / FX.RT. MUNI BOND | 0,32 | 0,00 | 0,0472 | 0,0017 | |||||

| US13080SRU05 / California Statewide Communities Development Authority | 0,32 | -0,32 | 0,0471 | 0,0015 | |||||

| US13016NGX66 / FX.RT. MUNI BOND | 0,30 | -1,94 | 0,0450 | 0,0007 | |||||

| US13016NEX84 / California County Tobacco Securitization Agency | 0,28 | -2,43 | 0,0419 | 0,0005 | |||||

| US13016NEW02 / California County Tobacco Securitization Agency | 0,26 | -2,26 | 0,0387 | 0,0005 | |||||

| US651784UQ16 / FX.RT. MUNI BOND | 0,26 | 1,19 | 0,0382 | 0,0018 | |||||

| US651784UR98 / FX.RT. MUNI BOND | 0,26 | 1,19 | 0,0380 | 0,0018 | |||||

| US13049RBQ83 / California Municipal Finance Authority | 0,25 | -3,49 | 0,0371 | 0,0001 | |||||

| US344630WV64 / FONTANA CFD #85 | 0,24 | 0,84 | 0,0359 | 0,0016 | |||||

| US802309NL49 / FX.RT. MUNI BOND | 0,23 | 0,89 | 0,0338 | 0,0013 | |||||

| US13016NFU37 / FX.RT. MUNI BOND | 0,22 | -1,34 | 0,0329 | 0,0007 | |||||

| US797330AP29 / San Diego Tobacco Settlement Revenue Funding Corporation, California, Tobacco Settlement Bonds, Subordinate Series 2018C | 0,22 | -40,81 | 0,0326 | -0,0206 | |||||

| US13058TJZ49 / FX.RT. MUNI BOND | 0,22 | -0,46 | 0,0320 | 0,0010 | |||||

| US651784US71 / City of Newport Beach CA | 0,20 | 1,51 | 0,0301 | 0,0015 | |||||

| US463612JE21 / IRVINE CA UNIF SCH DIST SPL TA IRVEDU 09/47 FIXED 5 | 0,19 | -0,52 | 0,0283 | 0,0008 | |||||

| US13016NFY58 / FX.RT. MUNI BOND | 0,19 | -2,11 | 0,0277 | 0,0004 | |||||

| US255650DY67 / FX.RT. MUNI BOND | 0,17 | 0,00 | 0,0252 | 0,0009 | |||||

| US13016NHA54 / California County Tobacco Securitization Agency | 0,14 | -36,89 | 0,0211 | -0,0112 | |||||

| US13016NFB55 / California County Tobacco Securitization Agency | 0,13 | -61,23 | 0,0187 | -0,0279 | |||||

| US13016NFT63 / FX.RT. MUNI BOND | 0,10 | -1,00 | 0,0147 | 0,0004 | |||||

| US13016NFV10 / FX.RT. MUNI BOND | 0,10 | -1,02 | 0,0144 | 0,0003 | |||||

| US13016NFZ24 / FX.RT. MUNI BOND | 0,09 | -3,16 | 0,0138 | 0,0002 | |||||

| US13016NGA63 / FX.RT. MUNI BOND | 0,09 | -2,13 | 0,0137 | 0,0001 | |||||

| California Educational Facilities Authority, Series 2015 / DBT (US130179YB41) | 0,03 | 0,0045 | 0,0045 | ||||||

| U.S. Treasury Ultra Bonds / DIR (N/A) | -0,64 | -0,0952 | -0,0952 |