Grundlæggende statistik

| Porteføljeværdi | $ 162.448.158 |

| Nuværende stillinger | 137 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

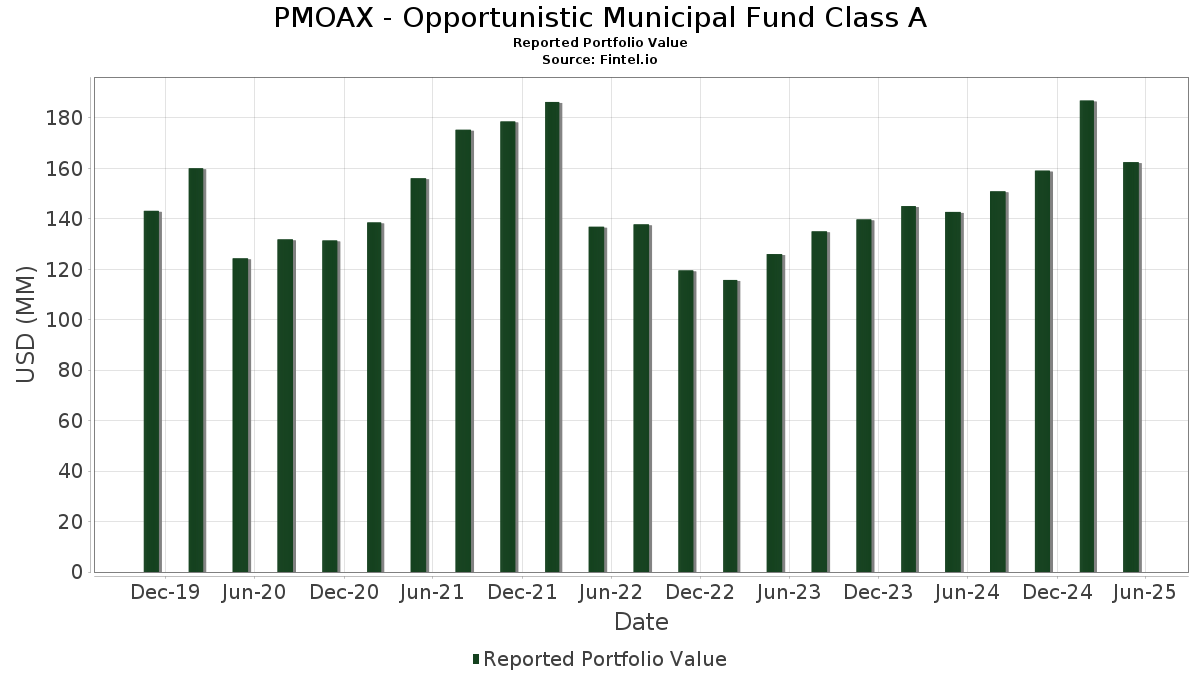

PMOAX - Opportunistic Municipal Fund Class A har afsløret 137 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 162.448.158 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). PMOAX - Opportunistic Municipal Fund Class As største beholdninger er Lower Alabama Gas District (The), Series 2016 A, RB (US:US547804AE44) , Los Angeles CA Department of Water & Power Revenue VRDO (US:US544495DL50) , SAINT JAMES PARISH LA REVENUE (US:US790103AW53) , Navajo Nation (US:US639185AQ02) , and Tender Option Bond Trust Receipts/Certificates (US:US88033MQP58) . PMOAX - Opportunistic Municipal Fund Class As nye stillinger omfatter Lower Alabama Gas District (The), Series 2016 A, RB (US:US547804AE44) , Los Angeles CA Department of Water & Power Revenue VRDO (US:US544495DL50) , SAINT JAMES PARISH LA REVENUE (US:US790103AW53) , Navajo Nation (US:US639185AQ02) , and Tender Option Bond Trust Receipts/Certificates (US:US88033MQP58) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 4,66 | 2,8198 | 2,8198 | ||

| 2,27 | 1,3718 | 1,3718 | ||

| 3,26 | 1,9694 | 1,2221 | ||

| 1,99 | 1,2020 | 1,2020 | ||

| 1,99 | 1,2018 | 1,2018 | ||

| 1,82 | 1,0994 | 1,0994 | ||

| 1,54 | 0,9328 | 0,9328 | ||

| 1,52 | 0,9197 | 0,9197 | ||

| 0,99 | 0,6010 | 0,6010 | ||

| 0,98 | 0,5949 | 0,5949 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,42 | 0,2536 | -1,3663 | ||

| 0,40 | 0,2420 | -0,8555 | ||

| 2,18 | 1,3191 | -0,4715 | ||

| 0,00 | 0,02 | 0,0103 | -0,2878 | |

| 3,47 | 2,1012 | -0,2792 | ||

| 0,30 | 0,1815 | -0,2229 | ||

| 0,10 | 0,0605 | -0,1186 | ||

| 0,00 | 0,0000 | -0,0668 | ||

| 0,00 | 0,0002 | -0,0662 | ||

| 3,32 | 2,0083 | -0,0330 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-07-25 for rapporteringsperioden 2025-05-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| California Public Finance Authority / DBT (US13057GAP46) | 4,66 | 2,8198 | 2,8198 | ||||||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 4,36 | -4,49 | 2,6368 | 0,1320 | |||||

| Atlanta Development Authority/The / DBT (US04780NMX20) | 4,02 | -2,95 | 2,4320 | 0,1588 | |||||

| New Hope Cultural Education Facilities Finance Corp / DBT (US64542PGQ28) | 3,76 | -10,34 | 2,2771 | -0,0267 | |||||

| California Public Finance Authority / DBT (US13057TAA97) | 3,63 | 2,77 | 2,1981 | 0,2582 | |||||

| Atlanta Development Authority/The / DBT (US04780NMY03) | 3,47 | -19,92 | 2,1012 | -0,2792 | |||||

| US547804AE44 / Lower Alabama Gas District (The), Series 2016 A, RB | 3,42 | -6,10 | 2,0665 | 0,0701 | |||||

| US544495DL50 / Los Angeles CA Department of Water & Power Revenue VRDO | 3,32 | -10,75 | 2,0083 | -0,0330 | |||||

| New York State Dormitory Authority / DBT (US65000B4Y15) | 3,26 | 139,16 | 1,9694 | 1,2221 | |||||

| US790103AW53 / SAINT JAMES PARISH LA REVENUE | 3,21 | -2,67 | 1,9446 | 0,1321 | |||||

| Oneida Indian Nation of New York / DBT (US682504AC93) | 3,16 | -3,84 | 1,9102 | 0,1087 | |||||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAC80) | 3,07 | -1,45 | 1,8548 | 0,1472 | |||||

| Florida Development Finance Corp / DBT (US340618DT16) | 2,82 | -8,66 | 1,7037 | 0,0115 | |||||

| Mobile County Industrial Development Authority / DBT (US60733UAB70) | 2,71 | -8,68 | 1,6364 | 0,0104 | |||||

| US639185AQ02 / Navajo Nation | 2,51 | -0,44 | 1,5206 | 0,1354 | |||||

| US88033MQP58 / Tender Option Bond Trust Receipts/Certificates | 2,37 | -7,86 | 1,4328 | 0,0223 | |||||

| US73360CAD65 / Port Beaumont Navigation District | 2,33 | -8,72 | 1,4066 | 0,0088 | |||||

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 2,29 | -5,37 | 1,3870 | 0,0575 | |||||

| US130179TN44 / CALIFORNIA ST EDUCTNL FACS AUTH REVENUE | 2,27 | 1,3718 | 1,3718 | ||||||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 2,18 | -33,19 | 1,3191 | -0,4715 | |||||

| US04108WCE03 / ARKANSAS DEVELOPMENT FINANCE AUTHORITY | 2,14 | -2,55 | 1,2968 | 0,0901 | |||||

| US34061XAF96 / Florida Development Finance Corp | 2,03 | -0,88 | 1,2254 | 0,1038 | |||||

| New York State Dormitory Authority / DBT (US65000B7X05) | 2,00 | -4,08 | 1,2102 | 0,0660 | |||||

| Florida Development Finance Corp / DBT (US34061XAG79) | 1,99 | -1,58 | 1,2042 | 0,0941 | |||||

| West Virginia Economic Development Authority / DBT (US95648VBU26) | 1,99 | 1,2020 | 1,2020 | ||||||

| Pennsylvania Economic Development Financing Authority / DBT (US708692CA49) | 1,99 | 1,2018 | 1,2018 | ||||||

| US90068FAZ99 / Tuscaloosa (County of), AL, AL Industrial Development Authority (Hunt Refining), Series 2019 A, Ref. IDR | 1,97 | -3,62 | 1,1913 | 0,0697 | |||||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZR71) | 1,82 | 1,0994 | 1,0994 | ||||||

| US547804AF19 / Lower Alabama Gas District, Alabama, Gas Project Revenue Bonds, Series 2016A | 1,76 | -4,82 | 1,0638 | 0,0498 | |||||

| Philadelphia Authority for Industrial Development / DBT (US717901CA88) | 1,74 | -9,47 | 1,0523 | -0,0023 | |||||

| US608327AA04 / MOHEGAN TRIBAL CT FIN AUTH | 1,71 | -0,06 | 1,0361 | 0,0958 | |||||

| Puerto Rico Industrial Tourist Educational Medical & Environmental Control Facilities Financing Authority / DBT (US74528LAC54) | 1,65 | -6,64 | 0,9959 | 0,0281 | |||||

| City of Houston TX Airport System Revenue / DBT (US442349HY56) | 1,54 | 0,9328 | 0,9328 | ||||||

| US37255MAE57 / George L Smith II Congress Center Authority | 1,53 | -1,48 | 0,9245 | 0,0732 | |||||

| New Jersey Economic Development Authority / DBT (US64578TAB08) | 1,52 | 0,9197 | 0,9197 | ||||||

| Mida Mountain Village Public Infrastructure District / DBT (US59561UAD28) | 1,51 | -4,02 | 0,9110 | 0,0499 | |||||

| US452153FL81 / ILLINOIS ST | 1,47 | -4,05 | 0,8893 | 0,0484 | |||||

| US531127AC24 / New York Liberty Development Corp. (Goldman Sachs Headquarters), Series 2005, Ref. RB | 1,45 | -3,97 | 0,8771 | 0,0485 | |||||

| US48342YAP60 / Kalispell, Montana, Housing and Healthcare Facilities Revenue Bonds, Immanuel Lutheran Corporation, Series 2017A | 1,39 | 1,53 | 0,8426 | 0,0898 | |||||

| Mida Mountain Village Public Infrastructure District / DBT (US59561UAA88) | 1,39 | -7,08 | 0,8419 | 0,0199 | |||||

| Village Community Development District No 15 / DBT (US92708KAK34) | 1,37 | -8,58 | 0,8315 | 0,0067 | |||||

| US959321AB63 / WESTERN REGL OFF-TRACK BETTING CORP REVENUE | 1,29 | -6,99 | 0,7809 | 0,0192 | |||||

| US13054WAP23 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, San Diego County Water Authoriity Desalination Project Pipeline, Ref | 1,26 | -2,70 | 0,7622 | 0,0513 | |||||

| New York Transportation Development Corp / DBT (US650116GW09) | 1,25 | 133,58 | 0,7575 | 0,4633 | |||||

| US650116GY64 / New York Transportation Development Corp | 1,15 | -2,70 | 0,6977 | 0,0472 | |||||

| US67482LAA70 / Ocean Highway & Port Authority | 1,15 | -7,56 | 0,6960 | 0,0133 | |||||

| US225513AA84 / Creekside Village Metropolitan District, Series 2019 A, GO Bonds | 1,15 | -6,74 | 0,6945 | 0,0187 | |||||

| US13054WBD83 / California Pollution Control Financing Authority | 1,14 | -4,92 | 0,6900 | 0,0318 | |||||

| Palm Beach County Health Facilities Authority / DBT (US696507VT62) | 1,11 | -2,47 | 0,6687 | 0,0467 | |||||

| Virginia Beach Development Authority / DBT (US92774NBC39) | 1,09 | -3,98 | 0,6578 | 0,0365 | |||||

| US64972JBY38 / New York City Transitional Finance Authority | 1,08 | -5,17 | 0,6546 | 0,0284 | |||||

| US650116CW45 / New York Transportation Development Corp. | 1,07 | -2,64 | 0,6461 | 0,0436 | |||||

| US162410DR24 / Chattanooga Health Educational & Housing Facility Board | 1,05 | -0,38 | 0,6375 | 0,0573 | |||||

| US34061XAE22 / FLORIDA ST DEV FIN CORP SOL WST DISP REVENUE | 1,03 | -2,47 | 0,6205 | 0,0436 | |||||

| US650116GP57 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 1,03 | -4,30 | 0,6201 | 0,0320 | |||||

| US64613CEH79 / New Jersey Transportation Trust Fund Authority, Series 2023 BB | 1,02 | -5,20 | 0,6178 | 0,0267 | |||||

| US649852AT75 / MUNI PUT BOND ACT | 1,02 | -3,59 | 0,6178 | 0,0363 | |||||

| US130923BH74 / California (State of) Statewide Finance Authority (Pooled Tobacco Securitization), Series 2002, RB | 1,02 | -0,10 | 0,6176 | 0,0571 | |||||

| US010869JS57 / Alameda Corridor Transportation Authority | 1,02 | -4,14 | 0,6169 | 0,0333 | |||||

| US204730BL82 / Compton, California, Sewer Revenue Bonds, Series 2009 | 1,02 | -0,10 | 0,6163 | 0,0570 | |||||

| US650116CN46 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 1,01 | -2,33 | 0,6084 | 0,0433 | |||||

| US88034NML54 / Tender Option Bond Trust Receipts/Certificates | 1,00 | -6,09 | 0,6067 | 0,0203 | |||||

| Florida Development Finance Corp / DBT (US34061QCU94) | 1,00 | -3,19 | 0,6064 | 0,0381 | |||||

| US708686DZ05 / Pennsylvania (State of) Economic Development Financing Authority (National Gypson Co.), Series 2014, Ref. RB | 1,00 | -0,10 | 0,6053 | 0,0559 | |||||

| Public Finance Authority / DBT (US74439YFV83) | 0,99 | 0,6010 | 0,6010 | ||||||

| US04110FAA30 / Arkansas Development Finance Authority, Series 2022 | 0,99 | -4,24 | 0,6008 | 0,0315 | |||||

| US838530RG05 / South Jersey Port Corporation, New Jersey, Marine Terminal Revenue Bonds, Subordinate Series 2017B | 0,99 | -2,65 | 0,5998 | 0,0408 | |||||

| New Hampshire Health and Education Facilities Authority Act / DBT (US64461XGY58) | 0,99 | -9,99 | 0,5996 | -0,0051 | |||||

| County of Hamilton OH / DBT (US4072722W28) | 0,98 | 0,5949 | 0,5949 | ||||||

| Public Finance Authority / DBT (US74448EAA29) | 0,98 | -5,30 | 0,5947 | 0,0250 | |||||

| US04108WCD20 / ARKANSAS ST DEV FIN AUTH INDL DEV REVENUE | 0,98 | -1,51 | 0,5914 | 0,0471 | |||||

| US2510935F31 / City of Detroit MI | 0,98 | -4,13 | 0,5902 | 0,0321 | |||||

| US74444VAL45 / Public Finance Authority | 0,97 | -4,52 | 0,5884 | 0,0295 | |||||

| US899530BA68 / TULSA COUNTY INDUSTRIAL AUTHORITY | 0,97 | -4,06 | 0,5858 | 0,0317 | |||||

| US18611HAA32 / Cleveland-Cuyahoga County Port Authority | 0,96 | -7,60 | 0,5814 | 0,0103 | |||||

| US54628CDX74 / Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Westlake Chemical Corporation Projects, Refund | 0,95 | -2,47 | 0,5731 | 0,0398 | |||||

| Port of Beaumont Navigation District / DBT (US73360CAQ78) | 0,95 | -7,80 | 0,5721 | 0,0092 | |||||

| City of Wichita KS / DBT (US967249RP03) | 0,94 | -7,94 | 0,5686 | 0,0088 | |||||

| US63607WAC82 / NATIONAL FIN AUTH NH MUNI CTFS | 0,93 | -3,92 | 0,5640 | 0,0314 | |||||

| US759151BW25 / Regional Transportation District | 0,93 | -6,57 | 0,5597 | 0,0162 | |||||

| US514045J200 / Lancaster (County of), PA Hospital Authority (Landis Homes Retirement Community), Series 2015, Ref. RB | 0,92 | -7,69 | 0,5595 | 0,0101 | |||||

| US425099AA66 / City of Henderson KY | 0,91 | -8,87 | 0,5534 | 0,0026 | |||||

| US67754AAE47 / OHIO ST AIR QUALITY DEV AUTH EXEMPT FACS REVENUE | 0,88 | -10,68 | 0,5315 | -0,0080 | |||||

| US650110AC39 / NEW YORK ST TRANSPRTN DEV CORP EXEMPT FAC REVENUE | 0,87 | -5,74 | 0,5265 | 0,0199 | |||||

| US442349FZ40 / City of Houston | 0,87 | -9,13 | 0,5240 | 0,0007 | |||||

| Tarrant County Cultural Education Facilities Finance Corp / DBT (US87638QTK57) | 0,84 | -10,83 | 0,5086 | -0,0084 | |||||

| US54628CER97 / LOUISIANA ST LOCAL GOVT ENVRNMNTL FACS & CMNTY DEV AUTH REVE | 0,83 | -2,24 | 0,5014 | 0,0363 | |||||

| US59211SAA78 / MET GOVT NASHVILLE & DAVIDSON CNTY TN INDL DEV BRD SPL ASSMN | 0,81 | -9,01 | 0,4891 | 0,0015 | |||||

| US96634RAV42 / City of Whiting IN | 0,77 | -9,76 | 0,4640 | -0,0028 | |||||

| US591874AB81 / Metropolitan Development and Housing Agency (Fifth + Broadway Development), Series 2018, RB | 0,75 | -1,44 | 0,4559 | 0,0366 | |||||

| Public Finance Authority / DBT (US74439YFZ97) | 0,75 | 0,4521 | 0,4521 | ||||||

| US54628CJB90 / Louisiana (State of) Local Government Environmental Facilities & Community Development Authority (St. Mary Parish Gomesa), Series 2019, RB | 0,74 | -7,82 | 0,4498 | 0,0074 | |||||

| US928104NX29 / Virginia Small Business Financing Authority | 0,74 | -6,00 | 0,4456 | 0,0154 | |||||

| Public Finance Authority / DBT (US74439YGC93) | 0,73 | 0,4403 | 0,4403 | ||||||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035MJW64) | 0,69 | -12,37 | 0,4203 | -0,0146 | |||||

| US16752QAB41 / Chicago (City of), IL (Diversey/Narragansett), Series 2006, COP | 0,69 | 0,00 | 0,4190 | 0,0389 | |||||

| US88035GWF17 / Tender Option Bond Trust Receipts/Certificates | 0,68 | -14,77 | 0,4121 | -0,0265 | |||||

| US18611HAB15 / Cleveland-Cuyahoga County Port Authority | 0,68 | -8,27 | 0,4098 | 0,0046 | |||||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035JKU50) | 0,59 | 18,95 | 0,3569 | 0,0847 | |||||

| US960735AS70 / CITY OF WESTMINSTER MD | 0,59 | -2,17 | 0,3556 | 0,0263 | |||||

| US88034YTB64 / Tender Option Bond Trust Receipts/Certificates | 0,53 | -10,29 | 0,3222 | -0,0037 | |||||

| Tender Option Bond Trust Receipts/Certificates / DBT (US88035MJY21) | 0,52 | -13,71 | 0,3126 | -0,0160 | |||||

| US837031WN96 / SOUTH CAROLINA ST JOBS-ECON DEV AUTH ECON DEV REVENUE | 0,51 | 2,40 | 0,3106 | 0,0354 | |||||

| US54628CES70 / LOUISIANA ST LOCAL GOVT ENVRNMNTL FACS & CMNTY DEV AUTH REVE | 0,51 | -2,30 | 0,3089 | 0,0219 | |||||

| US67662LAC54 / Oglala Sioux Tribe | 0,50 | 0,20 | 0,3006 | 0,0285 | |||||

| Port of Beaumont Navigation District / DBT (US73360CAR51) | 0,47 | -9,46 | 0,2841 | -0,0006 | |||||

| US88256CEX39 / Texas Mun Gas Acqus Bond | 0,46 | -1,08 | 0,2788 | 0,0232 | |||||

| US442349GA89 / City of Houston | 0,43 | -9,03 | 0,2620 | 0,0003 | |||||

| US97671VBN47 / WISCONSIN HEALTH & EDUCATIONAL FACILITIES AUTHORITY | 0,42 | -8,28 | 0,2551 | 0,0032 | |||||

| US130179SD70 / CALIFORNIA ST EDUCTNL FACS AUTH REVENUE | 0,42 | -85,80 | 0,2536 | -1,3663 | |||||

| US544495DY71 / LA CA DWAP 02A5 Q=BA V1 | 0,40 | -80,00 | 0,2420 | -0,8555 | |||||

| US574296DR78 / Maryland Stadium Authority | 0,38 | -11,42 | 0,2301 | -0,0057 | |||||

| US83704DAM83 / South Carolina Jobs-Economic Development Authority | 0,30 | 0,00 | 0,1815 | 0,0168 | |||||

| US735220AT28 / Port Arthur (Port of), TX Navigation District | 0,30 | -50,00 | 0,1815 | -0,2229 | |||||

| US97671VBM63 / Wisconsin Health & Educational Facilities Authority | 0,28 | -2,46 | 0,1688 | 0,0122 | |||||

| US74514L3T29 / PUERTO RICO CMWLTH | 0,26 | -4,85 | 0,1548 | 0,0076 | |||||

| Arizona Industrial Development Authority / DBT (US04052TDF93) | 0,20 | -3,86 | 0,1209 | 0,0068 | |||||

| US505207AK62 / La Verne Public Financing Authority | 0,17 | 0,00 | 0,1001 | 0,0093 | |||||

| US83704DAL01 / South Carolina Jobs-Economic Development Authority | 0,15 | 0,00 | 0,0907 | 0,0084 | |||||

| SUB / iShares Trust - iShares Short-Term National Muni Bond ETF | 0,00 | 0,00 | 0,11 | -0,94 | 0,0641 | 0,0059 | |||

| US56042BBU08 / Finance Authority of Maine | 0,10 | -69,33 | 0,0605 | -0,1186 | |||||

| US74514L3N58 / PUERTO RICO CMWLTH | 0,09 | -11,54 | 0,0562 | -0,0011 | |||||

| US74514L3P07 / PUERTO RICO CMWLTH | 0,09 | -9,80 | 0,0561 | -0,0003 | |||||

| US74514L3R62 / PUERTO RICO CMWLTH | 0,09 | -4,26 | 0,0545 | 0,0028 | |||||

| US74514L3M75 / PUERTO RICO CMWLTH | 0,07 | -7,59 | 0,0446 | 0,0011 | |||||

| US74514L3F25 / PUERTO RICO CMWLTH | 0,06 | 0,00 | 0,0348 | 0,0031 | |||||

| HYMB / SPDR Series Trust - SPDR Nuveen ICE High Yield Municipal Bond ETF | 0,00 | 0,00 | 0,04 | -4,65 | 0,0251 | 0,0011 | |||

| SHYD / VanEck ETF Trust - VanEck Short High Yield Muni ETF | 0,00 | 0,00 | 0,02 | 0,00 | 0,0136 | 0,0010 | |||

| HYD / VanEck ETF Trust - VanEck High Yield Muni ETF | 0,00 | -96,70 | 0,02 | -96,87 | 0,0103 | -0,2878 | |||

| US072024XV98 / Bay Area Toll Authority | 0,00 | 0,00 | 0,0018 | -0,0000 | |||||

| US74514L3K10 / PUERTO RICO CMWLTH | 0,00 | 0,0002 | 0,0000 | ||||||

| US74514L3H80 / PUERTO RICO CMWLTH | 0,00 | -100,00 | 0,0002 | -0,0662 | |||||

| JMST / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Municipal Income ETF | 0,00 | 0,00 | 0,00 | 0,0002 | 0,0000 | ||||

| US74514L3G08 / PUERTO RICO CMWLTH | 0,00 | 0,0001 | 0,0000 | ||||||

| US74514L3J47 / PUERTO RICO CMWLTH | 0,00 | -100,00 | 0,0000 | -0,0668 | |||||

| US25461PAC77 / State of Nevada Department of Business & Industry | 0,00 | 0,0000 | 0,0000 | ||||||

| US54640TAE91 / FX.RT. MUNI BOND | 0,00 | 0,0000 | 0,0000 |