Grundlæggende statistik

| Porteføljeværdi | $ 162.138.775 |

| Nuværende stillinger | 247 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

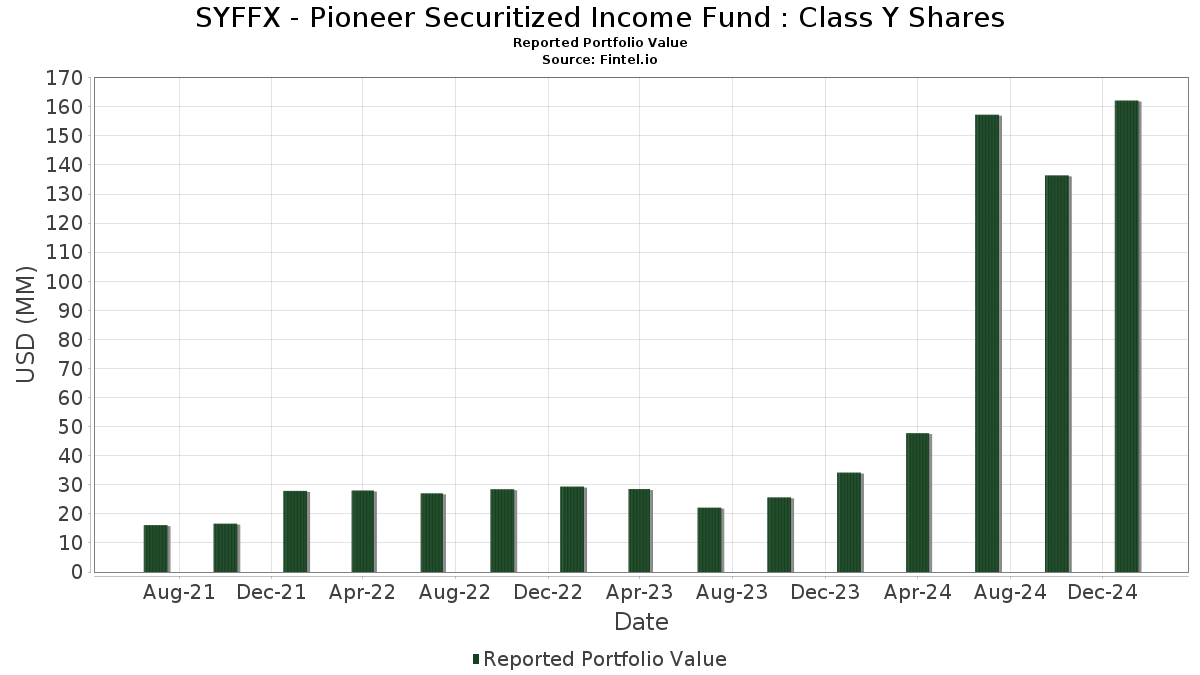

SYFFX - Pioneer Securitized Income Fund : Class Y Shares har afsløret 247 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 162.138.775 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). SYFFX - Pioneer Securitized Income Fund : Class Y Sharess største beholdninger er Uniform Mortgage-Backed Security, TBA (US:US01F0626220) , Uniform Mortgage-Backed Security, TBA (US:US01F0606263) , Connecticut Avenue Securities Trust, Series 2022-R01, Class 1B2 (US:US20754LAJ89) , CAS_22-R02 (US:US20754BAJ08) , and FHLMC STACR REMIC Trust, Series 2021-DNA5, Class B2 (US:US35564KJB61) . SYFFX - Pioneer Securitized Income Fund : Class Y Sharess nye stillinger omfatter Uniform Mortgage-Backed Security, TBA (US:US01F0626220) , Uniform Mortgage-Backed Security, TBA (US:US01F0606263) , Connecticut Avenue Securities Trust, Series 2022-R01, Class 1B2 (US:US20754LAJ89) , CAS_22-R02 (US:US20754BAJ08) , and CORP CMO (US:US35565EAE23) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 13,99 | 9,1595 | 9,1595 | ||

| 2,39 | 1,5676 | 1,5676 | ||

| 2,10 | 1,3778 | 1,3778 | ||

| 1,87 | 1,2228 | 1,2228 | ||

| 1,79 | 1,1727 | 1,1727 | ||

| 1,59 | 1,0399 | 1,0399 | ||

| 1,54 | 1,0086 | 1,0086 | ||

| 1,50 | 0,9803 | 0,9803 | ||

| 2,12 | 1,3855 | 0,9253 | ||

| 1,10 | 0,7203 | 0,7203 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,52 | 1,6483 | -1,2394 | ||

| 5,84 | 3,8268 | -0,8714 | ||

| 1,28 | 0,8407 | -0,7464 | ||

| 2,13 | 1,3957 | -0,4493 | ||

| 0,19 | 0,1215 | -0,3515 | ||

| 2,31 | 1,5120 | -0,2979 | ||

| 2,15 | 1,4112 | -0,2906 | ||

| 1,79 | 1,1724 | -0,2392 | ||

| 1,86 | 1,2160 | -0,2353 | ||

| 1,62 | 1,0618 | -0,2163 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-03-25 for rapporteringsperioden 2025-01-31. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| United States Treasury Bill / DBT (US912797NG83) | 13,99 | 9,1595 | 9,1595 | |||

| US01F0626220 / Uniform Mortgage-Backed Security, TBA | 5,84 | 293,73 | 3,8268 | -0,8714 | ||

| US01F0606263 / Uniform Mortgage-Backed Security, TBA | 2,52 | 175,88 | 1,6483 | -1,2394 | ||

| United States Treasury Bill / DBT (US912797NJ23) | 2,39 | 1,5676 | 1,5676 | |||

| US20754LAJ89 / Connecticut Avenue Securities Trust, Series 2022-R01, Class 1B2 | 2,31 | 0,74 | 1,5120 | -0,2979 | ||

| US20754BAJ08 / CAS_22-R02 | 2,23 | 44,09 | 1,4597 | 0,2371 | ||

| FS Rialto 2024-FL9 Issuer LLC / ABS-CBDO (US30338WAL37) | 2,15 | 0,00 | 1,4112 | -0,2906 | ||

| US35564KJB61 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class B2 | 2,13 | 426,17 | 1,3957 | -0,4493 | ||

| US35565EAE23 / CORP CMO | 2,12 | 263,40 | 1,3855 | 0,9253 | ||

| Exeter Automobile Receivables Trust 2025-1 / ABS-O (US30167MAG24) | 2,10 | 1,3778 | 1,3778 | |||

| Morgan Stanley Residential Mortgage Loan Trust 2023-NQM1 / ABS-MBS (US61775VAF31) | 1,87 | 1,2228 | 1,2228 | |||

| Connecticut Avenue Securities Trust 2024-R04 / ABS-MBS (US20753GAG64) | 1,86 | 1,03 | 1,2160 | -0,2353 | ||

| Exeter Automobile Receivables Trust 2024-3 / ABS-O (US30165AAG04) | 1,83 | 29,99 | 1,1981 | 0,0865 | ||

| US20754RAJ59 / Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2 | 1,82 | 17,48 | 1,1890 | -0,0314 | ||

| US35564PAC23 / Freddie Mac Stacr Trust 2019-FTR1 | 1,79 | 1,1727 | 1,1727 | |||

| MF1 2024-FL15 / ABS-CBDO (US58003MAA45) | 1,79 | 0,17 | 1,1724 | -0,2392 | ||

| US20754DAJ63 / Connecticut Avenue Securities Trust 2022-R05 | 1,65 | 0,86 | 1,0787 | -0,2117 | ||

| GLS Auto Receivables Issuer Trust 2024-3 / ABS-O (US37989AAN46) | 1,62 | 0,19 | 1,0618 | -0,2163 | ||

| BX Commercial Mortgage Trust 2024-SLCT / ABS-MBS (US12433JAQ31) | 1,59 | 1,0399 | 1,0399 | |||

| US20754AAJ25 / Connecticut Avenue Securities Trust 2021-R03 | 1,59 | 89,94 | 1,0392 | 0,3790 | ||

| LHOME Mortgage Trust 2024-RTL3 / ABS-MBS (US50205GAA04) | 1,54 | 1,0086 | 1,0086 | |||

| Exeter Automobile Receivables Trust 2024-5 / ABS-O (US30165BAH69) | 1,54 | 10,57 | 1,0074 | -0,0916 | ||

| Connecticut Avenue Securities Trust 2024-R01 / ABS-MBS (US20753UAJ97) | 1,51 | 35,30 | 0,9917 | 0,1072 | ||

| Exeter Automobile Receivables Trust 2024-4 / ABS-O (US30166UAG58) | 1,50 | 1,08 | 0,9821 | -0,1900 | ||

| MFRA 2024-NQM3 Trust / ABS-MBS (US55287GAE26) | 1,50 | 0,9803 | 0,9803 | |||

| HTL Commercial Mortgage Trust 2024-T53 / ABS-MBS (US404300AG03) | 1,35 | 0,07 | 0,8835 | -0,1817 | ||

| GLS Auto Select Receivables Trust 2024-1 / ABS-O (US37988XAE58) | 1,29 | -0,15 | 0,8480 | -0,1759 | ||

| US01F0526230 / Uniform Mortgage-Backed Security, TBA | 1,28 | 156,09 | 0,8407 | -0,7464 | ||

| US20754WAC91 / CORP CMO | 1,27 | 0,32 | 0,8321 | -0,1681 | ||

| US30168AAG76 / Exeter Automobile Receivables Trust 2022-6 | 1,22 | 0,00 | 0,8018 | -0,1653 | ||

| GLS Auto Receivables Issuer Trust 2024-2 / ABS-O (US37964VAG23) | 1,20 | 0,50 | 0,7838 | -0,1568 | ||

| Prestige Auto Receivables Trust 2024-2 / ABS-O (US74113SAE72) | 1,18 | 0,25 | 0,7739 | -0,1570 | ||

| FIGRE Trust 2024-HE3 / ABS-O (US31684GAA04) | 1,15 | -4,63 | 0,7560 | -0,2001 | ||

| Verus Securitization Trust 2024-2 / ABS-MBS (US92539UAE01) | 1,11 | 0,36 | 0,7256 | -0,1465 | ||

| US35565JBE01 / Freddie Mac STACR REMIC Trust 2020-HQA | 1,10 | 1,38 | 0,7233 | -0,1369 | ||

| United States Treasury Bill / DBT (US912797NF01) | 1,10 | 0,7203 | 0,7203 | |||

| Veros Auto Receivables Trust 2024-1 / ABS-O (US92512WAC10) | 1,08 | 112,38 | 0,7082 | 0,3058 | ||

| US30167JAG94 / Exeter Automobile Receivables Trust | 1,04 | 1,26 | 0,6839 | -0,1309 | ||

| US92539TAE38 / Verus Securitization Trust 2023-4 | 1,04 | 0,29 | 0,6802 | -0,1379 | ||

| Connecticut Avenue Securities Trust 2024-R04 / ABS-MBS (US20753GAC50) | 1,01 | 0,20 | 0,6590 | -0,1344 | ||

| PEAC Solutions Receivables 2024-2 LLC / ABS-O (US69392BAE65) | 0,98 | 0,31 | 0,6406 | -0,1299 | ||

| Connecticut Avenue Securities Trust 2024-R06 / ABS-MBS (US20755RAA32) | 0,95 | -3,55 | 0,6241 | -0,1559 | ||

| Prestige Auto Receivables Trust 2024-2 / ABS-O (US74113SAF48) | 0,95 | -0,11 | 0,6219 | -0,1290 | ||

| Imperial Fund Mortgage Trust 2023-NQM1 / ABS-MBS (US45290BAE92) | 0,94 | -0,11 | 0,6169 | -0,1276 | ||

| Verus Securitization Trust 2023-8 / ABS-MBS (US92540DAE58) | 0,93 | 0,86 | 0,6120 | -0,1200 | ||

| United States Treasury Bill / DBT (US912797MJ32) | 0,90 | 0,5892 | 0,5892 | |||

| MF1 2024-FL16 / ABS-CBDO (US55287EAA55) | 0,85 | 0,59 | 0,5586 | -0,1111 | ||

| US20754KAJ07 / CAS_21-R02 | 0,83 | 0,12 | 0,5468 | -0,1114 | ||

| LHOME Mortgage Trust 2024-RTL1 / ABS-MBS (US50205DAA72) | 0,83 | 135,23 | 0,5429 | 0,2646 | ||

| US35564KCP21 / STACR 2021-HQA1 B2 | 0,83 | 4,56 | 0,5406 | -0,0829 | ||

| Santander Bank Auto Credit-Linked Notes Series 2024-A / ABS-O (US80290CCN20) | 0,83 | 0,73 | 0,5405 | -0,1066 | ||

| HOMES 2024-NQM1 Trust / ABS-MBS (US40390TAE01) | 0,82 | -0,12 | 0,5400 | -0,1123 | ||

| US35563PKR90 / CORP CMO | 0,81 | 192,81 | 0,5335 | 0,3139 | ||

| Connecticut Avenue Securities Trust 2024-R06 / ABS-MBS (US20755RAC97) | 0,81 | 0,50 | 0,5288 | -0,1055 | ||

| BRAVO Residential Funding Trust 2024-NQM5 / ABS-MBS (US105925AF85) | 0,79 | 0,5169 | 0,5169 | |||

| US35563FAC59 / FHLMC, Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class B1 | 0,78 | 187,41 | 0,5087 | 0,2948 | ||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAA79) | 0,77 | 0,13 | 0,5048 | -0,1033 | ||

| US05608RAJ41 / BX Trust | 0,76 | 0,40 | 0,4995 | -0,1001 | ||

| Lendbuzz Securitization Trust 2024-3 / ABS-O (US52609YAD31) | 0,74 | 0,68 | 0,4873 | -0,0970 | ||

| US35564ACC36 / STACR Trust 2018-HRP2 | 0,73 | 0,14 | 0,4792 | -0,0982 | ||

| US35563PJQ37 / Seasoned Credit Risk Transfer Trust Series 2019-1 | 0,73 | 178,24 | 0,4776 | 0,2703 | ||

| Ascent Career Funding Trust 2024-1 / ABS-O (US04363LAA44) | 0,72 | -8,15 | 0,4726 | -0,1475 | ||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4H32) | 0,72 | -9,76 | 0,4724 | -0,1592 | ||

| US35564KBE82 / FHLMC STACR REMIC Trust, Series 2021-DNA1, Class B2 | 0,72 | 3,45 | 0,4721 | -0,0783 | ||

| Amur Equipment Finance Receivables XIV LLC / ABS-O (US03238BAF04) | 0,71 | 0,28 | 0,4637 | -0,0944 | ||

| Verus Securitization Trust 2024-3 / ABS-MBS (US92540MAE57) | 0,70 | 1,30 | 0,4608 | -0,0878 | ||

| US80290CAL81 / Santander Bank NA - SBCLN | 0,70 | 0,14 | 0,4588 | -0,0934 | ||

| United States Treasury Bill / DBT (US912797MM60) | 0,70 | 0,4567 | 0,4567 | |||

| BRAVO Residential Funding Trust 2023-NQM7 / ABS-MBS (US10569HAE45) | 0,69 | 0,4532 | 0,4532 | |||

| BAMLL Commercial Mortgage Securities Trust 2024-NASH / ABS-MBS (US05555CAG69) | 0,69 | 0,44 | 0,4521 | -0,0911 | ||

| Connecticut Avenue Securities Trust 2024-R05 / ABS-MBS (US20754XAG88) | 0,69 | 0,73 | 0,4497 | -0,0887 | ||

| US80290CAV63 / Santander Bank Auto Credit-Linked Notes Series 2022-A | 0,69 | -0,87 | 0,4493 | -0,0975 | ||

| CFMT 2024-HB15 LLC / ABS-MBS (US15723AAF84) | 0,68 | 6,46 | 0,4429 | -0,0594 | ||

| BX Commercial Mortgage Trust 2024-AIRC / ABS-MBS (US12433CAA36) | 0,66 | 0,45 | 0,4350 | -0,0871 | ||

| Vista Point Securitization Trust 2024-CES1 / ABS-MBS (US92839HAA41) | 0,66 | -8,68 | 0,4342 | -0,1396 | ||

| COLT 2024-4 Mortgage Loan Trust / ABS-MBS (US19688WAE84) | 0,66 | -0,15 | 0,4335 | -0,0897 | ||

| MCR 2024-TWA Mortgage Trust / ABS-MBS (US582923AD06) | 0,66 | 0,92 | 0,4332 | -0,0846 | ||

| Ascent Career Funding Trust 2024-1 / ABS-O (US04363LAB27) | 0,65 | 0,00 | 0,4275 | -0,0882 | ||

| Oportun Issuance Trust 2024-2 / ABS-O (US68377KAC18) | 0,65 | 0,62 | 0,4237 | -0,0848 | ||

| US35563XBE13 / Freddie Mac Stacr Trust 2018-HQA2 | 0,64 | 0,63 | 0,4181 | -0,0828 | ||

| US35565GAE70 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,63 | 1,62 | 0,4117 | -0,0771 | ||

| Verus Securitization Trust 2023-6 / ABS-MBS (US92539XAE40) | 0,62 | -0,16 | 0,4082 | -0,0848 | ||

| BRAVO Residential Funding Trust 2024-NQM5 / ABS-MBS (US105925AE11) | 0,62 | 1,64 | 0,4073 | -0,0754 | ||

| NMEF Funding 2024-A LLC / ABS-O (US62919UAD54) | 0,62 | 0,16 | 0,4053 | -0,0820 | ||

| US48275EAA47 / KREF 2022-FL3 Ltd | 0,60 | -0,83 | 0,3938 | -0,0853 | ||

| Kinetic Advantage Master Owner Trust / ABS-O (US49462DAD12) | 0,57 | 0,35 | 0,3720 | -0,0756 | ||

| Connecticut Avenue Securities Trust 2024-R02 / ABS-MBS (US20754GAJ94) | 0,56 | 2,18 | 0,3687 | -0,0658 | ||

| US924934AF96 / VERUS SECURITIZATION TRUST 2023-5 VERUS 2023-5 B2 | 0,56 | 1,08 | 0,3662 | -0,0710 | ||

| Verus Securitization Trust 2023-7 / ABS-MBS (US92539YAE23) | 0,56 | 1,45 | 0,3660 | -0,0688 | ||

| CFMT 2024-HB14 LLC / ABS-MBS (US12530XAD30) | 0,56 | 4,90 | 0,3651 | -0,0548 | ||

| Equify ABS 2024-1 LLC / ABS-O (US29445TAA60) | 0,55 | -13,77 | 0,3611 | -0,1444 | ||

| US784033AL62 / SCF Equipment Leasing LLC, Series 2022-1A, Class E | 0,55 | 1,30 | 0,3585 | -0,0682 | ||

| CFMT 2024-HB13 LLC / ABS-O (US12530VAD73) | 0,55 | 7,89 | 0,3584 | -0,0428 | ||

| US04047AAG94 / ARIVO ACCEPTANCE AUTO LOAN RECEIVABLES TRUST 2021-1 SER 2021-1A CL D REGD 144A P/P 5.83000000 | 0,55 | 0,74 | 0,3581 | -0,0704 | ||

| Santander Bank Auto Credit-Linked Notes Series 2023-B / ABS-O (US80290CCE21) | 0,55 | -10,49 | 0,3579 | -0,1242 | ||

| US46654ACD90 / JP Morgan Mortgage Trust 2021-10 | 0,55 | -1,09 | 0,3574 | -0,0783 | ||

| Harvest SBA Loan Trust 2024-1 / ABS-O (US41756NAA72) | 0,54 | 0,3515 | 0,3515 | |||

| BRAVO Residential Funding Trust 2024-NQM2 / ABS-MBS (US10569KAE73) | 0,54 | 0,94 | 0,3512 | -0,0685 | ||

| Verus Securitization Trust 2023-INV3 / ABS-MBS (US92540CAE75) | 0,53 | 0,56 | 0,3500 | -0,0696 | ||

| US20754DAF42 / CORP CMO | 0,53 | -0,19 | 0,3468 | -0,0722 | ||

| Freddie Mac STACR REMIC Trust 2024-HQA2 / ABS-MBS (US35564NEC39) | 0,53 | 0,57 | 0,3439 | -0,0686 | ||

| Connecticut Avenue Securities Trust 2024-R02 / ABS-MBS (US20754GAF72) | 0,52 | 0,58 | 0,3430 | -0,0680 | ||

| Verus Securitization Trust 2024-5 / ABS-MBS (US92540HAE62) | 0,52 | 0,97 | 0,3415 | -0,0661 | ||

| AREIT 2024-CRE9 Ltd / ABS-CBDO (US00193AAA25) | 0,52 | 0,00 | 0,3407 | -0,0702 | ||

| LHOME Mortgage Trust 2024-RTL2 / ABS-MBS (US50205JAA43) | 0,52 | 0,39 | 0,3387 | -0,0684 | ||

| US89616BAF13 / Tricolor Auto Securitization Trust 2022-1 | 0,52 | 3,41 | 0,3381 | -0,0563 | ||

| BSPRT 2024-FL11 Issuer LLC / ABS-CBDO (US05613RAA68) | 0,51 | 0,59 | 0,3353 | -0,0669 | ||

| MCR 2024-TWA Mortgage Trust / ABS-MBS (US582923AF53) | 0,51 | 0,40 | 0,3316 | -0,0666 | ||

| US60510MAT53 / Mission Lane Credit Card Master Trust | 0,50 | -0,40 | 0,3300 | -0,0695 | ||

| FHF Issuer Trust 2024-3 / ABS-O (US30339EAE86) | 0,50 | 0,3299 | 0,3299 | |||

| Santander Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US80280BAE83) | 0,50 | 0,3270 | 0,3270 | |||

| US35564TBE91 / Freddie Mac STACR Trust 2019-DNA3 | 0,50 | 0,61 | 0,3266 | -0,0646 | ||

| US32059FAL31 / First Investors Auto Owner Trust 2021-1 | 0,50 | 1,02 | 0,3251 | -0,0631 | ||

| NMEF Funding 2024-A LLC / ABS-O (US62919UAE38) | 0,49 | 2,07 | 0,3238 | -0,0586 | ||

| US35564KQC61 / Freddie Mac STACR REMIC Trust 2022-DNA1 | 0,49 | 0,61 | 0,3216 | -0,0644 | ||

| Blue Owl Asset Leasing Trust 2024-1 LLC / ABS-O (US095921AE26) | 0,48 | 1,49 | 0,3134 | -0,0586 | ||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 0,48 | -3,26 | 0,3116 | -0,0764 | ||

| A&D Mortgage Trust 2024-NQM5 / ABS-MBS (US00039KAG58) | 0,47 | 31,84 | 0,3093 | 0,0259 | ||

| A&D Mortgage Trust 2023-NQM4 / ABS-MBS (US00002MAE93) | 0,46 | 1,09 | 0,3041 | -0,0588 | ||

| Ally Bank Auto Credit-Linked Notes Series 2024-A / ABS-O (US02007G2A07) | 0,46 | -10,33 | 0,3015 | -0,1037 | ||

| Bellemeade Re Ltd / ABS-MBS (US078915AB15) | 0,46 | 0,22 | 0,2988 | -0,0610 | ||

| Connecticut Avenue Securities Trust 2024-R03 / ABS-MBS (US207941AB18) | 0,44 | 0,69 | 0,2860 | -0,0562 | ||

| Westgate Resorts 2024-1 LLC / ABS-O (US96034KAD54) | 0,43 | -6,54 | 0,2815 | -0,0812 | ||

| US67578XAD03 / Octane Receivables Trust 2022-2 | 0,43 | -0,23 | 0,2788 | -0,0582 | ||

| US14686GAE61 / Carvana Auto Receivables Trust 2022-N1 | 0,41 | -25,85 | 0,2708 | -0,1694 | ||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MBF41) | 0,41 | 0,24 | 0,2691 | -0,0547 | ||

| US01F0626303 / FNCL 6.5 UMBS TBA 03-01-53 | 0,41 | 0,2680 | 0,2680 | |||

| Lendbuzz Securitization Trust 2024-2 / ABS-O (US525920AC82) | 0,41 | -0,24 | 0,2677 | -0,0554 | ||

| MFA 2024-NQM2 Trust / ABS-MBS (US58004JAE29) | 0,41 | 0,25 | 0,2658 | -0,0539 | ||

| US78474PAG28 / STAR Trust, Series 2022-SFR3, Class D | 0,40 | 0,50 | 0,2617 | -0,0524 | ||

| US704100AF33 / PAWNEEE EQUIPMENT RECEIVABLES SERIES 2021-1 LLC SER 2021-1 CL E REGD 144A P/P 5.21000000 | 0,40 | 1,02 | 0,2589 | -0,0506 | ||

| Trafigura Securitisation Finance PLC / ABS-O (US892725AZ52) | 0,39 | 0,25 | 0,2585 | -0,0523 | ||

| PRPM 2023-NQM2 Trust / ABS-MBS (US74390KAC27) | 0,39 | 1,83 | 0,2559 | -0,0470 | ||

| US35565ABE91 / Freddie Mac STACR Trust 2019-DNA4 | 0,39 | 1,30 | 0,2557 | -0,0485 | ||

| Mercury Financial Credit Card Master Trust / ABS-O (US58940BBB18) | 0,39 | 0,52 | 0,2529 | -0,0512 | ||

| Cartiga Asset Finance Trust 2023-1 LLC / ABS-O (US14677YAB48) | 0,38 | -0,52 | 0,2482 | -0,0531 | ||

| BDS 2024-FL13 LLC / ABS-CBDO (US05555MAA71) | 0,38 | 0,53 | 0,2468 | -0,0493 | ||

| Stream Innovations 2024-1 Issuer Trust / ABS-O (US86324CAB72) | 0,38 | 1,90 | 0,2464 | -0,0459 | ||

| US04047EAD85 / Arivo Acceptance Auto Loan Receivables Trust 2022-1 | 0,37 | 2,20 | 0,2438 | -0,0442 | ||

| US65254BAA98 / Newtek Small Business Loan Trust 2021-1 | 0,37 | -7,05 | 0,2422 | -0,0718 | ||

| Connecticut Avenue Securities Trust 2024-R06 / ABS-MBS (US20755RAB15) | 0,37 | -31,28 | 0,2418 | -0,1831 | ||

| Radnor Re 2024-1 Ltd / ABS-MBS (US75049AAB89) | 0,36 | 0,28 | 0,2381 | -0,0481 | ||

| US362929AF88 / GLS Auto Receivables Issuer Trust 2023-4 | 0,36 | -0,27 | 0,2381 | -0,0495 | ||

| US20754CAF68 / CORP CMO | 0,36 | 0,2370 | 0,2370 | |||

| BRAVO Residential Funding Trust 2024-NQM3 / ABS-MBS (US10569LAE56) | 0,36 | 0,84 | 0,2362 | -0,0464 | ||

| US959926AG18 / WALKE 23-2 D 144A 7.01% 11-15-28 | 0,36 | 0,28 | 0,2359 | -0,0482 | ||

| US09229CAB54 / Blackbird Capital Aircraft, Series 2021-1A, Class B | 0,35 | -0,28 | 0,2307 | -0,0484 | ||

| Oportun Funding Trust 2024-3 / ABS-O (US68377NAC56) | 0,35 | 0,29 | 0,2298 | -0,0465 | ||

| US63875FAL04 / Natixis Commercial Mortgage Securities Trust | 0,35 | 1,75 | 0,2283 | -0,0424 | ||

| US05369LAF40 / AVID AUTOMOBILE RECEIVABLES TRUST 2021-1 SER 2021-1 CL F REGD 144A P/P 5.16000000 | 0,35 | 1,47 | 0,2266 | -0,0427 | ||

| US96042XAG07 / Westlake Automobile Receivables Trust 2023-1 | 0,34 | 0,00 | 0,2219 | -0,0456 | ||

| Saluda Grade Alternative Mortgage Trust 2023-FIG4 / ABS-O (US79581UAA25) | 0,34 | -4,52 | 0,2215 | -0,0585 | ||

| Bayview Opportunity Master Fund VII Trust 2024-CAR1F / ABS-O (US07336MAA99) | 0,34 | -13,44 | 0,2196 | -0,0866 | ||

| US67571BAD55 / Octane Receivables Trust 2023-1 | 0,32 | 0,00 | 0,2120 | -0,0433 | ||

| US75050KAB26 / Radnor RE Ltd., Series 2023-1, Class M1B | 0,31 | -0,32 | 0,2038 | -0,0430 | ||

| Triangle Re 2023-1 Ltd / ABS-MBS (US89589AAB52) | 0,31 | -0,65 | 0,2015 | -0,0429 | ||

| Purchasing Power Funding 2024-A LLC / ABS-O (US745935AE61) | 0,31 | 0,33 | 0,2002 | -0,0407 | ||

| US55286UAA07 / MFA 2023-RTL2 Trust | 0,31 | 0,00 | 0,2002 | -0,0408 | ||

| US35564KGS24 / FHLMC Structured Agency Credit Risk Debt Notes, Series 2021-HQA2, Class B2 | 0,31 | 4,45 | 0,1999 | -0,0311 | ||

| THPT 2023-THL Mortgage Trust / ABS-MBS (US87252LAG05) | 0,31 | 0,00 | 0,1998 | -0,0417 | ||

| US26982AAG94 / Eagle RE 2021-2 Ltd | 0,30 | 0,00 | 0,1966 | -0,0410 | ||

| US43731QAJ76 / Home Partners of America Trust, Series 2019-1, Class E | 0,30 | 0,34 | 0,1958 | -0,0396 | ||

| Radnor Re 2024-1 Ltd / ABS-MBS (US75049AAA07) | 0,30 | -27,38 | 0,1946 | -0,1291 | ||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,30 | -2,32 | 0,1934 | -0,0459 | ||

| Continental Finance Credit Card ABS Master Trust / ABS-O (US66981PAQ19) | 0,29 | 0,1904 | 0,1904 | |||

| US44931KAJ60 / ICG US CLO 2016-1 LTD SER 2016-1A CL DRR V/R REGD 144A P/P 0.00000000 | 0,29 | 9,06 | 0,1894 | -0,0203 | ||

| US46657FAA30 / JP Morgan Mortgage Trust 2023-HE2 | 0,29 | -9,78 | 0,1876 | -0,0631 | ||

| Purchasing Power Funding 2024-A LLC / ABS-O (US745935AD88) | 0,28 | 0,35 | 0,1862 | -0,0379 | ||

| US35563PLU11 / Seasoned Credit Risk Transfer Trust Series 2019-3 | 0,27 | -4,32 | 0,1744 | -0,0455 | ||

| US75575TAC71 / Ready Capital Mortgage Financing 2021-FL6 LLC | 0,26 | 0,39 | 0,1703 | -0,0336 | ||

| US35563GAB59 / Freddie Mac Multifamily Structured Credit Risk | 0,26 | 1,57 | 0,1694 | -0,0320 | ||

| BHG Securitization Trust 2024-1CON / ABS-O (US08862HAC60) | 0,25 | 0,00 | 0,1668 | -0,0343 | ||

| Golub Capital Partners Short Duration 2022-1 / ABS-CBDO (US38179FAY79) | 0,25 | -0,40 | 0,1649 | -0,0345 | ||

| US55282XAJ90 / MF1 Multifamily Housing Mortgage Loan Trust | 0,25 | 1,22 | 0,1632 | -0,0313 | ||

| US67515YAE23 / OCEAN TRAILS CLO IX SERIES:20-9A CLASS: ER | 0,25 | 2,89 | 0,1632 | -0,0286 | ||

| Post Road Equipment Finance 2024-1 LLC / ABS-O (US737473AF57) | 0,25 | 0,81 | 0,1624 | -0,0326 | ||

| Tricolor Auto Securitization Trust 2024-2 / ABS-O (US89616PAD50) | 0,25 | 1,65 | 0,1623 | -0,0302 | ||

| US26982EAC03 / Eagle RE Ltd., Series 2023-1, Class M1B | 0,25 | -0,40 | 0,1621 | -0,0340 | ||

| ACM Auto Trust 2024-2 / ABS-O (US00461WAC55) | 0,25 | 0,41 | 0,1619 | -0,0327 | ||

| Hilton Grand Vacations Trust 2024-2 / ABS-O (US43283JAD81) | 0,25 | -8,21 | 0,1614 | -0,0507 | ||

| Libra Solutions 2024-1 LLC / ABS-O (US53161XAB73) | 0,25 | 0,00 | 0,1609 | -0,0333 | ||

| Crockett Partners Equipment Co IIA LLC / ABS-O (US22689LAC90) | 0,24 | -3,61 | 0,1576 | -0,0393 | ||

| US08860FAB40 / BHG Securitization Trust 2023-A | 0,24 | 0,00 | 0,1556 | -0,0322 | ||

| SCF Equipment Leasing 2024-1 LLC / ABS-O (US783896AF01) | 0,23 | -0,43 | 0,1538 | -0,0321 | ||

| US46591HBM16 / J.P. Morgan Wealth Management | 0,23 | 0,86 | 0,1535 | -0,0305 | ||

| US693984AE63 / PRKCM 2023-AFC3 Trust | 0,23 | 0,1510 | 0,1510 | |||

| US89180GAE98 / Towd Point Mortgage Trust, Series 2022-SJ1, Class B1 | 0,23 | -2,16 | 0,1485 | -0,0342 | ||

| US70473AAA60 / PEAR 2023-1 LLC | 0,22 | -4,39 | 0,1431 | -0,0376 | ||

| US62890MAD65 / NMEF Funding 2022-B LLC | 0,21 | 1,42 | 0,1408 | -0,0261 | ||

| Ready Capital Mortgage Financing 2023-FL11 LLC / ABS-CBDO (US75575RAE71) | 0,21 | 0,48 | 0,1386 | -0,0275 | ||

| GLS Auto Receivables Issuer Trust 2024-2 / ABS-O (US37964VAF40) | 0,21 | 0,00 | 0,1368 | -0,0280 | ||

| US66981PAK49 / Continental Finance Credit Card ABS Master Trust | 0,21 | 0,98 | 0,1362 | -0,0258 | ||

| US078777AF67 / Bellemeade RE Ltd., Series 2021-3A, Class B1 | 0,21 | 0,00 | 0,1360 | -0,0281 | ||

| US30167FAF99 / Exeter Automobile Receivables Trust 2022-5 | 0,21 | 0,49 | 0,1350 | -0,0271 | ||

| Auxilior Term Funding 2023-1 LLC / ABS-O (US05335JAF03) | 0,21 | 0,99 | 0,1348 | -0,0263 | ||

| US89600HAE99 / TRIANGLE RE 2021-3 LTD SER 2021-3 CL M2 V/R REGD 144A P/P 3.79867000 | 0,21 | -0,49 | 0,1345 | -0,0283 | ||

| US75050KAA43 / Radnor RE Ltd., Series 2023-1, Class M1A | 0,20 | -17,14 | 0,1334 | -0,0608 | ||

| US63873VAN38 / Natixis Commercial Mortgage Securities Trust 2019-FAME | 0,20 | -6,98 | 0,1310 | -0,0389 | ||

| US92259LAR96 / Velocity Commercial Capital Loan Trust, Series 2020-1, Class M5 | 0,20 | -14,29 | 0,1300 | -0,0529 | ||

| US43730GAE17 / Home RE 2022-1 Ltd | 0,20 | -0,51 | 0,1280 | -0,0275 | ||

| US74333TAQ22 / PROGRESS RESIDENTIAL TRUST 2021-SFR8 4.005% 09/17/2038 144A | 0,19 | 4,32 | 0,1269 | -0,0193 | ||

| US12530QAD88 / CFMT 2023-H12 LLC | 0,19 | 2,75 | 0,1231 | -0,0212 | ||

| Prestige Auto Receivables Trust 2023-2 / ABS-O (US74113VAJ98) | 0,19 | 0,00 | 0,1229 | -0,0254 | ||

| Saluda Grade Alternative Mortgage Trust 2024-RTL4 / ABS-MBS (US79584CAA99) | 0,19 | 0,54 | 0,1221 | -0,0244 | ||

| US48128U2R90 / JPMorgan Chase Bank NA-CACLN, Series 2021-2, Class F | 0,19 | -69,06 | 0,1215 | -0,3515 | ||

| Huntington Bank Auto Credit-Linked Notes Series 2024-1 / ABS-O (US44644NAC39) | 0,19 | -11,06 | 0,1215 | -0,0431 | ||

| US74113RAL33 / Prestige Auto Receivables Trust 2022-1 | 0,18 | -0,56 | 0,1177 | -0,0247 | ||

| US36266XAE04 / GLS Auto Receivables Issuer Trust 2023-1 | 0,18 | 0,00 | 0,1173 | -0,0244 | ||

| US69145BAC00 / OXFORD FINANCE FUNDING TRUST OXFIN 2022 1A B 144A | 0,18 | -2,19 | 0,1172 | -0,0276 | ||

| Bayview Opportunity Master Fund VII 2024-EDU1 LLC / ABS-O (US07336PAD69) | 0,17 | -2,79 | 0,1141 | -0,0273 | ||

| Saluda Grade Alternative Mortgage Trust 2024-RTL5 / ABS-MBS (US795935AA37) | 0,17 | 0,59 | 0,1125 | -0,0223 | ||

| Verus Securitization Trust 2024-1 / ABS-MBS (US92540EAE32) | 0,17 | 0,1118 | 0,1118 | |||

| PFP 2024-11 Ltd / ABS-CBDO (US69291WAA09) | 0,17 | 0,00 | 0,1088 | -0,0225 | ||

| US35563PES48 / Seasoned Credit Risk Transfer Trust Series 2018-1 | 0,16 | -5,26 | 0,1063 | -0,0293 | ||

| GCAT 2024-NQM1 Trust / ABS-MBS (US36169HAE36) | 0,16 | 0,00 | 0,1053 | -0,0214 | ||

| US89615BAF22 / TRICOLOR AUTO SECURITIZATION TRUST SER 2021-1A CL F REGD 144A P/P 5.08000000 | 0,16 | -52,41 | 0,1037 | -0,1588 | ||

| Onity Loan Investment Trust 2024-HB2 / ABS-MBS (US68278DAD57) | 0,16 | 1,29 | 0,1034 | -0,0192 | ||

| BHG Securitization Trust 2023-B / ABS-O (US08862GAC87) | 0,16 | -0,64 | 0,1027 | -0,0214 | ||

| US62890QAD79 / NMEF Funding LLC, Series 2023-A, Class C | 0,15 | 0,00 | 0,1013 | -0,0209 | ||

| US92838TAD37 / Vista Point Securitization Trust | 0,15 | -0,65 | 0,1010 | -0,0216 | ||

| US67389JAE82 / Oaktown Re VII Ltd., Series 2021-2, Class B1 | 0,15 | -0,65 | 0,1001 | -0,0209 | ||

| FIGRE Trust 2023-HE3 / ABS-O (US31684CAA99) | 0,15 | -9,04 | 0,0995 | -0,0318 | ||

| HILT COMMERCIAL MORTGAGE TRUST 2024-ORL / ABS-MBS (US403956AG02) | 0,15 | 0,68 | 0,0976 | -0,0197 | ||

| US452761AF62 / IMPERIAL FUND MORTGAGE TRUST 2021-NQM2 SER 2021-NQM2 CL B2 V/R REGD 144A P/P 4.32748600 | 0,15 | -1,33 | 0,0970 | -0,0218 | ||

| US78449RAN52 / SLG Office Trust 2021-OVA | 0,14 | 3,01 | 0,0903 | -0,0150 | ||

| US64829NAJ37 / New Residential Mortgage Loan Trust 2017-4 | 0,14 | -2,88 | 0,0885 | -0,0216 | ||

| Auxilior Term Funding 2023-1 LLC / ABS-O (US05335JAE38) | 0,13 | 0,79 | 0,0836 | -0,0164 | ||

| Santander Drive Auto Receivables Trust 2024-1 / ABS-O (US80288AAE29) | 0,10 | 1,00 | 0,0662 | -0,0133 | ||

| US04047JAC99 / Arivo Acceptance Auto Loan Receivables Trust 2022-2 | 0,10 | 3,09 | 0,0657 | -0,0113 | ||

| J.P. Morgan Chase Commercial Mortgage Securities Trust 2024-OMNI / ABS-MBS (US46593JAG94) | 0,10 | 1,02 | 0,0650 | -0,0124 | ||

| US74333QAN51 / Progress Residential Trust, Series 2021-SFR9, Class F | 0,09 | 5,62 | 0,0618 | -0,0093 | ||

| US36168AAB52 / GCAT Trust, Series 2021-CM1, Class M1 | 0,09 | -1,09 | 0,0600 | -0,0131 | ||

| ACM Auto Trust 2024-1 / ABS-O (US00161CAA62) | 0,09 | -46,39 | 0,0585 | -0,0729 | ||

| US69548BAA70 / PAID_23-3 | 0,07 | -44,78 | 0,0489 | -0,0571 | ||

| US33852FBA30 / Flagstar Mortgage Trust, Series 2021-4, Class AX1 | 0,07 | -2,94 | 0,0434 | -0,0110 | ||

| US379928AJ30 / GLS Auto Receivables Issuer Trust 2023-2 | 0,07 | 0,00 | 0,0432 | -0,0089 | ||

| US11042WAA45 / IAGLN 8 3/8 11/15/28 | 0,06 | -6,25 | 0,0397 | -0,0109 | ||

| US30768WAC29 / Farmer Mac Agricultural Real Estate Trust, Series 2021-1, Class B | 0,06 | -1,67 | 0,0387 | -0,0089 | ||

| US46654ABS78 / JP Morgan Mortgage Trust, Series 2021-10, Class AX1 | 0,05 | 4,35 | 0,0315 | -0,0053 | ||

| US44590HBJ41 / Hundred Acre Wood Trust, Series 2021-INV1, Class AX1 | 0,05 | -2,08 | 0,0314 | -0,0070 | ||

| US46592TBS15 / JP Morgan Mortgage Trust, Series 2021-8, Class AX1 | 0,04 | 0,00 | 0,0265 | -0,0051 | ||

| US76970HAF55 / RMF Buyout Issuance Trust 2022-HB1 | 0,04 | -7,32 | 0,0253 | -0,0074 | ||

| US90932VAA35 / United Airlines Pass Through Trust | 0,03 | -3,33 | 0,0195 | -0,0049 | ||

| US40390GAB41 / HOA FUNDING LLC - HOA SER 2021-1A CL B REGD 144A P/P 7.43200000 | 0,02 | -40,00 | 0,0118 | -0,0119 | ||

| US69548JAA07 / PAID_23-1 | 0,01 | -85,71 | 0,0050 | -0,0342 | ||

| 2 YEAR U.S. TREASURY NOTE / DIR (000000000) | 0,01 | 0,0049 | 0,0049 | |||

| 5 YEAR U.S TREASURY NOTE / DIR (000000000) | -0,03 | -0,0181 | -0,0181 |