Grundlæggende statistik

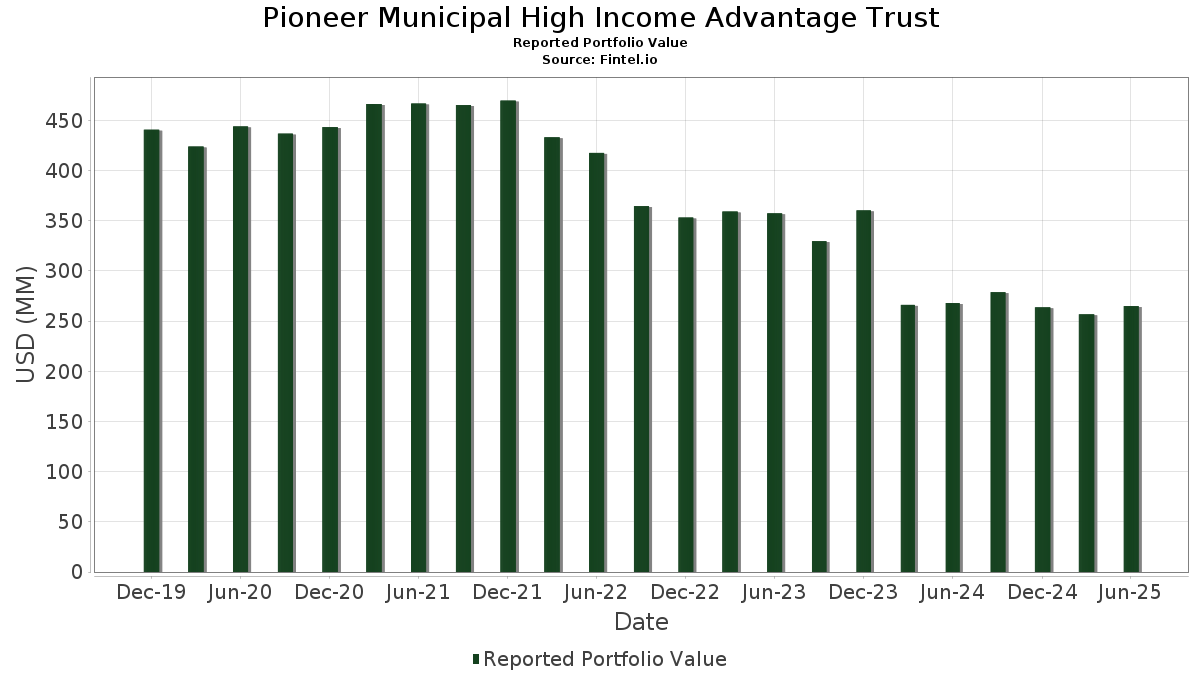

| Porteføljeværdi | $ 264.986.420 |

| Nuværende stillinger | 117 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Pioneer Municipal High Income Advantage Trust har afsløret 117 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 264.986.420 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Pioneer Municipal High Income Advantage Trusts største beholdninger er BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , Puerto Rico Commonwealth Aqueduct & Sewer Authority (PR:US745160SJ13) , Arkansas Development Finance Authority, Series 2022 (US:US04110FAA30) , MASSACHUSETTS ST DEV FIN AGY (US:US57583FZE41) , and Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB (US:US74529JPX71) . Pioneer Municipal High Income Advantage Trusts nye stillinger omfatter BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , Puerto Rico Commonwealth Aqueduct & Sewer Authority (PR:US745160SJ13) , Arkansas Development Finance Authority, Series 2022 (US:US04110FAA30) , MASSACHUSETTS ST DEV FIN AGY (US:US57583FZE41) , and Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB (US:US74529JPX71) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 9,31 | 4,5729 | 4,4607 | ||

| 9,67 | 4,7494 | 3,1538 | ||

| 9,67 | 4,7494 | 3,1538 | ||

| 5,59 | 2,7469 | 2,7469 | ||

| 4,63 | 2,2741 | 2,2741 | ||

| 5,26 | 2,5833 | 1,2785 | ||

| 2,41 | 1,1817 | 1,1817 | ||

| 2,14 | 1,0514 | 1,0514 | ||

| 1,95 | 0,9553 | 0,9553 | ||

| 1,93 | 0,9497 | 0,9497 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 7,26 | 3,5645 | -1,0688 | ||

| 4,43 | 2,1757 | -1,0290 | ||

| 3,53 | 1,7342 | -0,9567 | ||

| 0,68 | 0,3323 | -0,2938 | ||

| 0,37 | 0,1801 | -0,0799 | ||

| 5,57 | 2,7367 | -0,0467 | ||

| 0,87 | 0,4276 | -0,0297 | ||

| 0,92 | 0,4503 | -0,0267 | ||

| 0,92 | 0,4503 | -0,0267 | ||

| 1,73 | 0,8490 | -0,0243 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-27 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 12,22 | -3,57 | 6,0014 | 0,0387 | ||

| US745160SJ13 / Puerto Rico Commonwealth Aqueduct & Sewer Authority | 11,17 | -3,37 | 5,4882 | 0,0463 | ||

| US04110FAA30 / Arkansas Development Finance Authority, Series 2022 | 9,93 | -2,52 | 4,8767 | 0,0834 | ||

| Louisiana Public Facilities Authority / DBT (US546399SZ00) | 9,67 | 185,25 | 4,7494 | 3,1538 | ||

| Louisiana Public Facilities Authority / DBT (US546399SZ00) | 9,67 | 185,25 | 4,7494 | 3,1538 | ||

| New York Transportation Development Corp / DBT (US650116HW99) | 9,31 | 3.812,18 | 4,5729 | 4,4607 | ||

| US57583FZE41 / MASSACHUSETTS ST DEV FIN AGY | 9,14 | -4,55 | 4,4888 | -0,0172 | ||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 7,26 | -26,29 | 3,5645 | -1,0688 | ||

| US442349GA89 / City of Houston | 6,57 | -1,01 | 3,2281 | 0,1036 | ||

| US74514L3P07 / PUERTO RICO CMWLTH | 5,79 | -1,63 | 2,8429 | 0,0740 | ||

| Montgomery County Higher Education and Health Authority / DBT (US613603M713) | 5,59 | 2,7469 | 2,7469 | |||

| US13080SMK77 / California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2016A | 5,57 | -5,78 | 2,7367 | -0,0467 | ||

| US74529JPW98 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 5,26 | 78,70 | 2,5833 | 1,2785 | ||

| US888806AD82 / TOBACCO SETTLEMENT REVENUE MGM REGD N/C OID B/E ETM 6.37500000 | 4,97 | -1,09 | 2,4419 | 0,0763 | ||

| New York Transportation Development Corp / DBT (US650116HS87) | 4,63 | 2,2741 | 2,2741 | |||

| US74514L3N58 / PUERTO RICO CMWLTH | 4,49 | -2,90 | 2,2030 | 0,0290 | ||

| US46246SAE54 / Iowa (State of) Finance Authority (Alcoa, Inc.), Series 2012, RB | 4,43 | -34,96 | 2,1757 | -1,0290 | ||

| US79739GRM05 / San Diego County Regional Airport Authority | 4,07 | -2,12 | 1,9979 | 0,0423 | ||

| North Carolina Medical Care Commission / DBT (US65820YTG16) | 4,02 | -4,70 | 1,9726 | -0,0105 | ||

| US882667AN81 / TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE | 3,53 | -41,84 | 1,7342 | -0,9567 | ||

| US167505YB63 / CHICAGO IL BOE 5% 12/1/2047 | 3,45 | -2,62 | 1,6950 | 0,0269 | ||

| Michigan Finance Authority / DBT (US59447NBC92) | 3,10 | -3,01 | 1,5217 | 0,0187 | ||

| Michigan Finance Authority / DBT (US59447NBC92) | 3,10 | -3,01 | 1,5217 | 0,0187 | ||

| US39237QBH74 / GREATER TEXAS CULTURAL EDU FAC REGD V/R B/E 9.00000000 | 3,05 | 0,00 | 1,4979 | 0,0627 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAA97) | 3,00 | 20,69 | 1,4725 | 0,3033 | ||

| US70917S6Y49 / Pennsylvania (State of) Higher Educational Facilities Authority (University of Pennsylvania Health), Series 2019, RB | 2,79 | -5,81 | 1,3704 | -0,0236 | ||

| Greater Texas Cultural Education Facilities Finance Corp / DBT (US39237QBU85) | 2,51 | -0,44 | 1,2318 | 0,0460 | ||

| US38122NB843 / GOLDEN ST TOBACCO SECURITIZATI REGD ZCP OID B/E 0.00000000 | 2,41 | 1,1817 | 1,1817 | |||

| US928097AC85 / Virginia Small Business Financing Authority, Private Activity Revenue Bonds, Transform 66 P3 Project, Senior Lien Series 2017 | 2,36 | -4,80 | 1,1584 | -0,0076 | ||

| US13016NCT90 / California (County of), CA Tobacco Securitization Agency (Stanislaus County Tobacco Funding Corp.), Series 2006 A, RB | 2,33 | -3,03 | 1,1467 | 0,0138 | ||

| US62947YAE14 / NEW YORK CNTYS NY TOBACCO TRUST IV | 2,33 | -3,12 | 1,1458 | 0,0129 | ||

| California Educational Facilities Authority / DBT (US130179XC33) | 2,29 | -2,89 | 1,1226 | 0,0154 | ||

| US71780CAF77 / Philadelphia Authority for Industrial Development, Pennsylvania, Revenue Bonds, Mariana Bracetti Academy Project, Taxable Series 2020B | 2,27 | -1,99 | 1,1155 | 0,0249 | ||

| US74514L3M75 / PUERTO RICO CMWLTH | 2,26 | -3,63 | 1,1079 | 0,0068 | ||

| Metropolitan Transportation Authority / DBT (US59261A4H71) | 2,14 | 1,0514 | 1,0514 | |||

| Public Finance Authority / DBT (US74442PF754) | 2,03 | -3,06 | 0,9965 | 0,0114 | ||

| US59261AG500 / MET TRANSPRTN AUTH NY REVENUE | 2,01 | -1,90 | 0,9874 | 0,0232 | ||

| US739247AA20 / PWR CNTY ID INDL DEV CORP SOL REGD B/E AMT 6.45000000 | 2,01 | 0,00 | 0,9850 | 0,0413 | ||

| US67759YAX58 / STATE OF OHIO | 2,00 | 0,00 | 0,9823 | 0,0408 | ||

| US13080SVN16 / CALIFORNIA STWD CMNTYS DEV AUTH REVENUE | 1,96 | -3,84 | 0,9606 | 0,0035 | ||

| Commonwealth of Massachusetts / DBT (US57582TDG40) | 1,95 | 0,9553 | 0,9553 | |||

| Commonwealth of Massachusetts / DBT (US57582TDE91) | 1,93 | 0,9497 | 0,9497 | |||

| Ohio Housing Finance Agency / DBT (US67756Q8A87) | 1,87 | 0,05 | 0,9178 | 0,0389 | ||

| State of Maryland / DBT (US574193WY05) | 1,85 | 0,9078 | 0,9078 | |||

| US167505TK28 / Chicago (City of), IL Board of Education, Series 2017 H, GO Bonds | 1,83 | -3,42 | 0,9008 | 0,0069 | ||

| US718903RP49 / Phoenix Industrial Development Authority, Arizona, Multi-Family Housing Revenue Bonds, 3rd and Indian Road Assisted Living Project, Series 2016 | 1,82 | 1,56 | 0,8961 | 0,0506 | ||

| US888805CF30 / TOBACCO SETTLEMENT AUTH IA TOBACCO SETTLEMENT REVENUE | 1,80 | -2,96 | 0,8843 | 0,0114 | ||

| Massachusetts Development Finance Agency / DBT (US57585BCX47) | 1,73 | -6,85 | 0,8490 | -0,0243 | ||

| Massachusetts Development Finance Agency / DBT (US57585BCX47) | 1,73 | -6,85 | 0,8490 | -0,0243 | ||

| State of California / DBT (US13063ELV64) | 1,72 | 0,8464 | 0,8464 | |||

| State of California / DBT (US13063ELV64) | 1,72 | 0,8464 | 0,8464 | |||

| New York Transportation Development Corp / DBT (US650116HA79) | 1,72 | -3,10 | 0,8444 | 0,0093 | ||

| New York Transportation Development Corp / DBT (US650116HM18) | 1,71 | -2,90 | 0,8397 | 0,0113 | ||

| Washington State Housing Finance Commission / DBT (US93978LJP22) | 1,69 | 0,8313 | 0,8313 | |||

| Washington State Housing Finance Commission / DBT (US93978LJP22) | 1,69 | 0,8313 | 0,8313 | |||

| US238560AA48 / DAVID ELLIS ACADEMY WEST MI REGD B/E 5.25000000 | 1,69 | -2,71 | 0,8280 | 0,0128 | ||

| US613609K888 / Montgomery County Industrial Development Authority | 1,68 | -4,05 | 0,8262 | 0,0012 | ||

| US592250DN11 / Metropolitan Pier & Exposition Authority | 1,62 | -5,08 | 0,7979 | -0,0073 | ||

| US130493CL10 / CALIFORNIA MUNICIPAL FINANCE AUTHORITY | 1,52 | -2,44 | 0,7474 | 0,0137 | ||

| US041806AN03 / Arlington Higher Education Finance Corp. (Universal Academy), Series 2014 A, RB | 1,47 | -1,80 | 0,7238 | 0,0179 | ||

| US04108WCD20 / ARKANSAS ST DEV FIN AUTH INDL DEV REVENUE | 1,47 | 1,24 | 0,7229 | 0,0390 | ||

| US628077CV98 / Muskingum (County of), OH (Genesis Healthcare System), Series 2013, RB | 1,42 | -5,28 | 0,6967 | -0,0080 | ||

| Capital Projects Finance Authority/FL / DBT (US140427CN34) | 1,40 | -2,84 | 0,6897 | 0,0094 | ||

| Capital Projects Finance Authority/FL / DBT (US140427CN34) | 1,40 | -2,84 | 0,6897 | 0,0094 | ||

| US517845NQ23 / LAS VEGAS VLY NV WTR DIST | 1,30 | 0,6390 | 0,6390 | |||

| Puerto Rico Industrial Development Co / DBT (US745211LM22) | 1,29 | -2,27 | 0,6359 | 0,0127 | ||

| Chicago O'Hare International Airport / DBT (US1675934T61) | 1,28 | -1,53 | 0,6303 | 0,0168 | ||

| Colorado Educational & Cultural Facilities Authority / DBT (US19645URH94) | 1,24 | -2,36 | 0,6085 | 0,0113 | ||

| New Jersey Educational Facilities Authority / DBT (US646067KL11) | 1,23 | 0,6046 | 0,6046 | |||

| US167505WB81 / CHICAGO IL BRD OF EDU | 1,10 | -3,43 | 0,5402 | 0,0042 | ||

| US167505RM02 / CHICAGO IL BRD OF EDU | 1,03 | -1,91 | 0,5053 | 0,0121 | ||

| US041806AM20 / ARLINGTON TX HGR EDU FIN CORP REGD OID B/E 7.00000000 | 1,00 | 0,00 | 0,4920 | 0,0206 | ||

| US167486E397 / CHICAGO IL | 1,00 | 0,4917 | 0,4917 | |||

| United States Treasury Bill / DBT (US912797QH30) | 1,00 | 0,4891 | 0,4891 | |||

| US45506DF832 / INDIANA ST FIN AUTH REVENUE REGD OID B/E 5.12500000 | 1,00 | -0,90 | 0,4890 | 0,0164 | ||

| Florida Development Finance Corp / DBT (US340618DV61) | 0,98 | -4,76 | 0,4821 | -0,0026 | ||

| Indiana Finance Authority / DBT (US45506EPA54) | 0,97 | 0,4774 | 0,4774 | |||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 0,95 | 0,4647 | 0,4647 | |||

| Florida Development Finance Corp / DBT (US340618DT16) | 0,92 | -9,58 | 0,4503 | -0,0267 | ||

| Florida Development Finance Corp / DBT (US340618DT16) | 0,92 | -9,58 | 0,4503 | -0,0267 | ||

| US442349FZ40 / City of Houston | 0,91 | -0,98 | 0,4450 | 0,0143 | ||

| US165588DL52 / Chester (County of), PA Industrial Development Authority (Collegium Charter School), Series 2017 A, RB | 0,90 | -4,25 | 0,4427 | -0,0005 | ||

| US406511AC98 / HAM LAKE MN CHRT SCH LEASE REV REGD B/E 5.00000000 | 0,89 | -2,31 | 0,4357 | 0,0084 | ||

| US95737TEU60 / WESTCHESTER CNTY NY LOCAL DEV CORP REVENUE | 0,87 | -10,40 | 0,4276 | -0,0297 | ||

| New Jersey Educational Facilities Authority / DBT (US646067KE77) | 0,83 | 0,4056 | 0,4056 | |||

| US928104PX01 / Virginia Small Business Financing Authority | 0,82 | -4,96 | 0,4050 | -0,0032 | ||

| US71780CAM29 / PHILADELPHIA PA AUTH FOR INDL REGD B/E 5.00000000 | 0,81 | -4,14 | 0,3984 | -0,0000 | ||

| Washington State Housing Finance Commission / DBT (US93978LJM90) | 0,79 | 0,3888 | 0,3888 | |||

| US50825CAC55 / Lake (County of), FL (Imagine South Lake Charter School Program) | 0,73 | -5,83 | 0,3573 | -0,0064 | ||

| North Carolina Medical Care Commission / DBT (US65821DZV62) | 0,73 | 0,3565 | 0,3565 | |||

| Lynchburg Economic Development Authority / DBT (US55123TBT88) | 0,72 | 0,3541 | 0,3541 | |||

| City of Venice FL / DBT (US922687AE82) | 0,71 | -6,09 | 0,3484 | -0,0070 | ||

| City of Venice FL / DBT (US922687AE82) | 0,71 | -6,09 | 0,3484 | -0,0070 | ||

| City of Valparaiso IN / DBT (US92028RAF29) | 0,70 | -6,67 | 0,3440 | -0,0092 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAB70) | 0,68 | -49,17 | 0,3323 | -0,2938 | ||

| Mida Mountain Village Public Infrastructure District / DBT (US59561UAD28) | 0,60 | -2,91 | 0,2957 | 0,0042 | ||

| Washington State Housing Finance Commission / DBT (US93978LJN73) | 0,55 | 0,2722 | 0,2722 | |||

| Knox County Health Educational & Housing Facility Board / DBT (US499526BK61) | 0,54 | -2,33 | 0,2675 | 0,0050 | ||

| US153457AX48 / CENTRL FALLS RI DETENTION FAC CORP DETENTION FAC REVENUE | 0,54 | 0,00 | 0,2662 | 0,0111 | ||

| US59334GAM96 / Miami-Dade County Industrial Development Authority | 0,54 | -3,75 | 0,2649 | 0,0014 | ||

| California School Finance Authority / DBT (US130591BP42) | 0,54 | -5,46 | 0,2642 | -0,0035 | ||

| New Jersey Educational Facilities Authority / DBT (US646067KM93) | 0,53 | 0,2608 | 0,2608 | |||

| Massachusetts Development Finance Agency / DBT (US57585BKB35) | 0,51 | 0,2525 | 0,2525 | |||

| US71780CAC47 / PHILADELPHIA PA AUTH FOR INDL REGD OID B/E 5.50000000 | 0,48 | -2,82 | 0,2371 | 0,0036 | ||

| US041806XD73 / ARLINGTON TX HGR EDU FIN CORP REGD B/E 5.45000000 | 0,46 | -6,90 | 0,2255 | -0,0070 | ||

| Capital Trust Authority / DBT (US14054WBR51) | 0,46 | -4,40 | 0,2244 | -0,0003 | ||

| Allentown Commercial and Industrial Development Authority / DBT (US01843AAN63) | 0,44 | -4,52 | 0,2185 | -0,0007 | ||

| Stamford Housing Authority / DBT (US852640AL54) | 0,39 | 0,1897 | 0,1897 | |||

| US412236AA92 / HARDIN MT TAX INCR INDL INFRAS REGD OID B/E 6.25000000 | 0,37 | -33,70 | 0,1801 | -0,0799 | ||

| Mida Mountain Village Public Infrastructure District / DBT (US59561UAA88) | 0,36 | -4,75 | 0,1776 | -0,0009 | ||

| Massachusetts Development Finance Agency / DBT (US57585BCW63) | 0,36 | -1,65 | 0,1762 | 0,0044 | ||

| US74514L3T29 / PUERTO RICO CMWLTH | 0,28 | -2,41 | 0,1396 | 0,0026 | ||

| U.S. TREASURY BOND / DIR (000000000) | 0,24 | 0,1155 | 0,1155 | |||

| U.S. TREASURY BOND / DIR (000000000) | 0,24 | 0,1155 | 0,1155 | |||

| North Carolina Medical Care Commission / DBT (US65820YTP15) | 0,21 | -5,02 | 0,1023 | -0,0009 | ||

| US594569CX12 / MICHIGAN ST PUBLIC EDUCTNL FAC REGD B/E 7.00000000 | 0,21 | 0,00 | 0,1008 | 0,0042 | ||

| US45204FEP62 / ILLINOIS ST FIN AUTH REVENUE REGD V/R B/E 4.00000000 | 0,00 | -62,50 | 0,0018 | -0,0022 |