Grundlæggende statistik

| Porteføljeværdi | $ 424.055.165 |

| Nuværende stillinger | 244 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

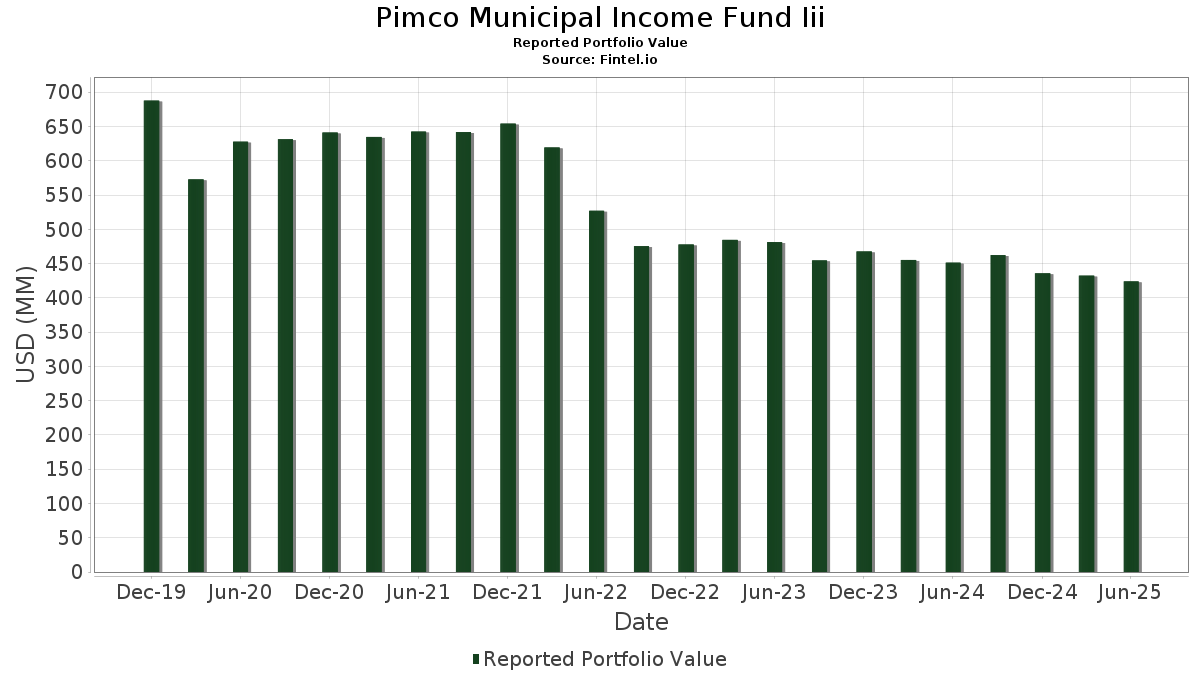

Pimco Municipal Income Fund Iii har afsløret 244 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 424.055.165 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Pimco Municipal Income Fund Iiis største beholdninger er Salt Verde Arizona Fc Bond (US:US79575EAS72) , AFFORDABLE HSG OPPORTUNITIES 07/37 1 (US:US00826SAJ96) , Illinois State, General Obligation Bonds, November Series 2017D (US:US452152P965) , MUNI ELEC AUTH OF GEORGIA MELPWR 07/60 FIXED 5 (US:US626207H494) , and New York State Thruway Authority (US:US650010CB54) . Pimco Municipal Income Fund Iiis nye stillinger omfatter Salt Verde Arizona Fc Bond (US:US79575EAS72) , AFFORDABLE HSG OPPORTUNITIES 07/37 1 (US:US00826SAJ96) , Illinois State, General Obligation Bonds, November Series 2017D (US:US452152P965) , MUNI ELEC AUTH OF GEORGIA MELPWR 07/60 FIXED 5 (US:US626207H494) , and New York State Thruway Authority (US:US650010CB54) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,70 | 1,5250 | 1,5250 | ||

| 3,00 | 1,2378 | 1,2378 | ||

| 2,81 | 1,1605 | 1,1605 | ||

| 2,63 | 1,0869 | 1,0869 | ||

| 2,60 | 1,0728 | 1,0728 | ||

| 2,60 | 1,0719 | 1,0719 | ||

| 2,56 | 1,0556 | 1,0556 | ||

| 2,55 | 1,0521 | 1,0521 | ||

| 2,53 | 1,0438 | 1,0438 | ||

| 2,52 | 1,0411 | 1,0411 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,13 | 0,0544 | -0,1516 | ||

| 0,24 | 0,0979 | -0,1073 | ||

| 1,41 | 0,5801 | -0,0894 | ||

| 0,07 | 0,0268 | -0,0595 | ||

| 3,95 | 1,6280 | -0,0462 | ||

| 1,21 | 0,5009 | -0,0423 | ||

| 3,68 | 1,5166 | -0,0333 | ||

| 2,31 | 0,9533 | -0,0305 | ||

| 0,68 | 0,2803 | -0,0193 | ||

| 2,20 | 0,9097 | -0,0171 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-29 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US79575EAS72 / Salt Verde Arizona Fc Bond | 12,10 | -1,01 | 4,9906 | 0,1778 | ||

| US00826SAJ96 / AFFORDABLE HSG OPPORTUNITIES 07/37 1 | 9,77 | 0,23 | 4,0307 | 0,1918 | ||

| US452152P965 / Illinois State, General Obligation Bonds, November Series 2017D | 7,31 | 0,21 | 3,0178 | 0,1430 | ||

| US626207H494 / MUNI ELEC AUTH OF GEORGIA MELPWR 07/60 FIXED 5 | 6,75 | 0,42 | 2,7864 | 0,1378 | ||

| US650010CB54 / New York State Thruway Authority | 5,13 | -1,21 | 2,1167 | 0,0712 | ||

| US513174L916 / LAMAR CONSOLIDATED INDEPENDENT SCHOOL DISTRICT PSF-GTD 5.0% 02-15-53 | 4,98 | -1,99 | 2,0547 | 0,0540 | ||

| US56682HCQ02 / Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, Series 2019A | 4,95 | 40,38 | 2,0413 | 0,6533 | ||

| FED HM LN PC POOL WE6111 FR 01/40 FIXED 3.8 / ABS-MBS (US3132YBYG55) | 4,61 | -0,97 | 1,9009 | 0,0686 | ||

| US368497HQ95 / GEISINGER PA AUTH HLTH SYS REV GEIMED 02/47 FIXED 4 | 4,55 | -4,38 | 1,8753 | 0,0033 | ||

| US5946952Z04 / MICHIGAN ST TRUNK LINE | 4,49 | -5,15 | 1,8528 | -0,0121 | ||

| US235241WS11 / DALLAS TX AREA RAPID TRANSIT SALES TAX REVENUE | 4,36 | -4,60 | 1,7990 | -0,0009 | ||

| US64971XQM38 / NEW YORK CITY NY TRANSITIONALFIN AUTH REVENUE | 4,20 | 51,17 | 1,7347 | 0,6391 | ||

| NORTH CAROLINA ST TURNPIKE AUT 01/58 5 / DBT (US65830RDA41) | 4,06 | 87,70 | 1,6744 | 0,8229 | ||

| US7599114B36 / REGL TRANSPRTN AUTH-B | 4,01 | -0,55 | 1,6557 | 0,0666 | ||

| US888808HT28 / TOBACCO SETTLEMENT FING CORP NJ | 3,95 | -7,18 | 1,6280 | -0,0462 | ||

| US29414WAA62 / EP TUSCANY ZARAGOSA PFC TX | 3,94 | 0,54 | 1,6253 | 0,0822 | ||

| US74529JRL16 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 3,89 | -4,26 | 1,6042 | 0,0046 | ||

| LA VEGA TX INDEP SCH DIST LGASCD 02/49 OID 4 / DBT (US505156QY85) | 3,70 | 1,5250 | 1,5250 | |||

| US118217DA38 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 3,68 | -6,61 | 1,5166 | -0,0333 | ||

| US546475SN50 / LA GAS FUEL TAX-C-REF | 3,64 | -2,65 | 1,5011 | 0,0289 | ||

| US167505WB81 / CHICAGO IL BRD OF EDU | 3,63 | -3,94 | 1,4996 | 0,0097 | ||

| US812643RZ92 / SEATTLE WA MUNI LIGHT PWR RE SEAPWR 01/46 FIXED 4 | 3,61 | -3,37 | 1,4908 | 0,0180 | ||

| FORT BEND CNTY TX PUB FAC CORP FBCDEV 03/48 FIXED 5 / DBT (US34687KAV61) | 3,46 | -1,57 | 1,4262 | 0,0431 | ||

| US567410BF12 / MARICOPA CNTY AZ SCH DIST 83 MAREDU 10/44 FIXED 4 | 3,31 | -2,65 | 1,3646 | 0,0264 | ||

| TEXAS ST DEPT OF HSG CMNTY A TXSSFH 01/56 FIXED 5.75 / DBT (US882750D335) | 3,29 | 0,46 | 1,3559 | 0,0673 | ||

| US838810EF28 / S MIAMI FL HLTH FACS AUTH SMIMED 08/47 FIXED 4 | 3,20 | -4,34 | 1,3192 | 0,0027 | ||

| US46246SAU96 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 3,12 | 0,51 | 1,2892 | 0,0648 | ||

| US70868YAZ25 / Pennsylvania Economic Development Financing Authority | 3,11 | -2,35 | 1,2851 | 0,0289 | ||

| FLORIDA ST DEV FIN CORP FLSDEV 07/38 FIXED 5 / DBT (US340618DP93) | 3,08 | -5,12 | 1,2706 | -0,0078 | ||

| US74529JQG30 / Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT | 3,07 | -2,91 | 1,2685 | 0,0216 | ||

| US46246SAV79 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 3,06 | 0,53 | 1,2634 | 0,0634 | ||

| US31222TAS24 / Fayette County Hospital Authority, Georgia, Revenue Anticipation Certificates, Piedmont Healthcare, Inc Project, Series 2016A | 3,00 | -0,46 | 1,2386 | 0,0508 | ||

| US462466ET69 / IOWA ST FIN AUTH HLTH FACS REVENUE | 3,00 | 1,2378 | 1,2378 | |||

| US888809BG44 / TOBACCO SETTLEMENT FING CORP RI | 2,97 | -0,83 | 1,2273 | 0,0458 | ||

| US88256CEX39 / Texas Mun Gas Acqus Bond | 2,95 | -0,57 | 1,2155 | 0,0488 | ||

| US64985TCU34 / New York State Urban Development Corp. (Bidding Group 3), Series 2021, Ref. RB | 2,90 | -3,97 | 1,1968 | 0,0072 | ||

| US45204EL970 / ILLINOIS ST FIN AUTH REVENUE | 2,86 | -1,99 | 1,1813 | 0,0306 | ||

| TEXAS WTR DEV BRD REVENUE TXSWTR 10/47 FIXED 4.125 / DBT (US88285AFX19) | 2,81 | 1,1605 | 1,1605 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 2,69 | -4,24 | 1,1079 | 0,0033 | ||

| FLORIDA ST TURNPIKE AUTH TURNP FL DEPT OF TRANSPRT B / DBT (US343137TF28) | 2,63 | 1,0869 | 1,0869 | |||

| FED HM LN PC POOL WE5057 FR 01/40 FIXED 3.85 / ABS-MBS (US3132YATN88) | 2,63 | -0,72 | 1,0857 | 0,0418 | ||

| US60637AMW98 / MISSOURI ST HLTH EDUCTNL FAC MOSMED 11/48 FIXED 4 | 2,60 | -2,58 | 1,0734 | 0,0217 | ||

| US45204FAH82 / ILLINOIS ST FIN AUTH REVENUE | 2,60 | 1,0728 | 1,0728 | |||

| SAN ANTONIO TX ELEC GAS REVE SANUTL 02/49 FIXED 5.25 / DBT (US79625GKN24) | 2,60 | 1,0719 | 1,0719 | |||

| BELLWOOD SENIOR HOUSING FIXED TERM LOAN / LON (BA000DPQ4) | 2,59 | -1,00 | 1,0675 | 0,0384 | ||

| US63607WAG96 / NATIONAL FIN AUTH NH MUNI CTFS NFADEV 07/36 FIXED OID 4.837 | 2,59 | -1,37 | 1,0672 | 0,0345 | ||

| FEDERAL HOME LOAN MTGE CORP MF FEDMFH 11/42 ADJUSTABLE VAR / DBT (US31350ADR68) | 2,58 | -1,87 | 1,0629 | 0,0290 | ||

| US74444UAC62 / PUBLIC FIN AUTH WI PROJ REVENU PUBFIN 01/50 FIXED OID 7 | 2,57 | -1,65 | 1,0603 | 0,0316 | ||

| SOUTH CAROLINA ST PUBLIC SVC A SCSUTL 12/50 FIXED 5.25 / DBT (US8371515T26) | 2,56 | 1,0556 | 1,0556 | |||

| PHILADELPHIA PA AUTH FOR INDL PHIMED 07/54 ADJUSTABLE VAR / DBT (US717901CC45) | 2,55 | 1,0521 | 1,0521 | |||

| OHIO ST HSG FIN AGY RSDL MTGE OHSHSG 09/45 FIXED 4.55 / DBT (US67756UCG13) | 2,53 | -1,17 | 1,0459 | 0,0359 | ||

| JEFFERSON CNTY AL SWR REVENUE JEFFERSON CO WARRANTS / DBT (US472682ZR71) | 2,53 | 1,0438 | 1,0438 | |||

| INDIANA ST FIN AUTH HLTH SYS R INSMED 10/57 ADJUSTABLE VAR / DBT (US45470YGG08) | 2,52 | 1,0411 | 1,0411 | |||

| US373695AZ83 / Gerald R Ford International Airport Authority | 2,49 | -1,70 | 1,0288 | 0,0297 | ||

| CHICAGO IL O HARE INTERNATIONA CHICAGO A AMT REV / DBT (US1675934R06) | 2,49 | 1,0281 | 1,0281 | |||

| US74514L4C84 / PUERTO RICO CMWLTH | 2,48 | 1,64 | 1,0233 | 0,0619 | ||

| NEW HAMPSHIRE ST HLTH EDU FA NHSMED 08/55 FIXED OID 5 / DBT (US64461XMG78) | 2,47 | 1,0188 | 1,0188 | |||

| NEW YORK ST TRANS 06/60 5.125 / DBT (US650116GZ30) | 2,46 | -2,31 | 1,0142 | 0,0233 | ||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 2,45 | -3,73 | 1,0129 | 0,0088 | ||

| US546399CP91 / LOUISIANA PUB FACS AUTH REVENUE | 2,44 | -2,94 | 1,0071 | 0,0168 | ||

| DOWNTOWN REVITALIZATION PUBLIC DTRFAC 06/43 FIXED 5.25 / DBT (US26118TAT79) | 2,43 | 1,0026 | 1,0026 | |||

| CALIFORNIA HSG FIN AGY LTD OBL CASMFH 03/53 ADJUSTABLE VAR / DBT (US13034DAJ37) | 2,43 | 0,75 | 1,0009 | 0,0528 | ||

| US59447TV751 / MI FIN AUTH-UNREFD | 2,40 | -2,00 | 0,9887 | 0,0256 | ||

| US55374SAF74 / MSR ENERGY | 2,39 | -0,62 | 0,9873 | 0,0392 | ||

| US64971X4D74 / NEW YORK CITY NY TRANSITIONAL FIN AUTH REVENUE | 2,38 | -1,89 | 0,9830 | 0,0266 | ||

| US976595FU76 / WISCONSIN CENTER DIST WI TAX R WISGEN 12/45 ZEROCPNOID 0 | 2,38 | 4,57 | 0,9828 | 0,0857 | ||

| US19648FMB75 / Colorado Health Facilities Authority, Colorado, Revenue Bonds, SCL Health System, Refunding Series 2019B | 2,36 | -2,04 | 0,9729 | 0,0251 | ||

| FAIRHAVEN GLEN FIXED TAX EXEMPT CONSTRUCTIONA / DBT (BA00061X0) | 2,32 | 0,56 | 0,9586 | 0,0488 | ||

| US896035BF85 / Triborough Bridge and Tunnel Authority, New York, Sales Tax Revenue Bonds, MTA Bridges & Tunnels, TBTA Capital Lockbox-City Sales Tax, Series 2022A | 2,31 | -7,49 | 0,9533 | -0,0305 | ||

| US088365GS48 / Bexar County Hospital District, Texas, Certificates of Obligation, Series 2018 | 2,28 | -2,77 | 0,9399 | 0,0168 | ||

| US646136EX53 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 2,25 | 1,58 | 0,9298 | 0,0561 | ||

| US59334DLG78 / MIAMI DADE CNTY FL WTR SWR R MIAUTL 10/48 FIXED 4 | 2,22 | 0,9143 | 0,9143 | |||

| US513174H880 / LAMAR TX ISD 4% 2/15/2048 | 2,21 | -4,90 | 0,9130 | -0,0033 | ||

| US95308RXB04 / West Harris County Regional Water Authority, Texas, Water System Revenue Bonds, Refunding Series 2021. | 2,20 | -6,33 | 0,9097 | -0,0171 | ||

| HURST EULESS BEDFORD TX INDEP HURSCD 08/50 FIXED OID 4 / DBT (US447819KL64) | 2,18 | -6,00 | 0,8993 | -0,0137 | ||

| US717817UM02 / Philadelphia (City of), PA, Series 2017 B, Ref. RB | 2,16 | -1,77 | 0,8926 | 0,0251 | ||

| NEW HOPE CULTURAL ED FACS FIN NHPFAC 11/40 FIXED 5 / DBT (US64542UHA51) | 2,04 | -3,19 | 0,8398 | 0,0115 | ||

| US677525WS29 / Ohio Air Quality Development Authority | 2,02 | 0,25 | 0,8346 | 0,0399 | ||

| ILLINOIS ST ILLINOIS ST B / DBT (US452153KF58) | 2,02 | 0,8318 | 0,8318 | |||

| US452152Y215 / ILLINOIS ST ILS 05/37 FIXED OID 4.625 | 2,01 | -0,20 | 0,8283 | 0,0359 | ||

| NEW YORK ST TRANSPRTN DEV CORP NYTTRN 12/54 FIXED 5.25 / DBT (US650116HT60) | 2,00 | -3,19 | 0,8265 | 0,0112 | ||

| US74447GAB68 / PUBLIC FIN AUTH WI HLTHCARE SYS REVENUE | 2,00 | -2,20 | 0,8263 | 0,0199 | ||

| US25483VA534 / DIST OF COLUMBIA REVENUE | 1,99 | -0,35 | 0,8231 | 0,0346 | ||

| US613520PB50 / MONTGOMERY CNTY OH HOSP REVENUE | 1,95 | -4,50 | 0,8056 | 0,0002 | ||

| US12008ETY22 / Build NYC Resource Corp. | 1,95 | -3,80 | 0,8052 | 0,0064 | ||

| US531127CM87 / New York Liberty Development Corp. (Goldman Sachs Headquarters), Series 2007, RB | 1,93 | -1,02 | 0,7980 | 0,0282 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 1,92 | -1,94 | 0,7906 | 0,0210 | ||

| US882667AN81 / TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE | 1,91 | -3,68 | 0,7892 | 0,0073 | ||

| BBRA 7.215 06/02/59 / DBT (955KSCII7) | 1,90 | 0,7839 | 0,7839 | |||

| US00826SAK69 / AFFORDABLE HSG OPPORTUNITIES T 07/37 7.12 | 1,86 | 0,11 | 0,7683 | 0,0355 | ||

| JEFFERSON CNTY MO INDL DEV AUT JFFMFH 02/43 FIXED 4.45 / DBT (US473157BP91) | 1,84 | -0,33 | 0,7577 | 0,0320 | ||

| US51771FCF18 / Las Vegas Convention & Visitors Authority, Series A | 1,84 | -1,98 | 0,7572 | 0,0198 | ||

| CANTON OH CITY SCH DIST CANSCD 12/50 FIXED 5.5 / DBT (US138447ET02) | 1,82 | -1,73 | 0,7516 | 0,0215 | ||

| US97712JEQ22 / Wisconsin Health & Educational Facilities Authority | 1,80 | -4,05 | 0,7435 | 0,0036 | ||

| FAIRHAVEN GLEN TAXABLE CONSTRUCT / DBT (BA00061Z5) | 1,80 | 0,00 | 0,7427 | 0,0337 | ||

| US59335KFA07 / MIAMI-DADE CNTY FL SEAPORT REVENUE | 1,80 | -4,06 | 0,7419 | 0,0035 | ||

| US56042RYH91 / Maine Health & Higher Educational Facilities Authority | 1,74 | -5,01 | 0,7199 | -0,0034 | ||

| US88285ADS42 / TEXAS WTR DEV BRD ST WTR IMPLE TXSWTR 10/48 FIXED 4.875 | 1,72 | -1,60 | 0,7092 | 0,0215 | ||

| US254764KC60 / DISTRICT COLUMBIA HOSP REV | 1,70 | -0,41 | 0,7023 | 0,0291 | ||

| US34440PBY60 / Folsom Cordova Unified School District | 1,68 | -3,83 | 0,6949 | 0,0049 | ||

| US19648FKT02 / COLORADO ST HLTH FACS AUTH HOSP REVENUE | 1,68 | -5,20 | 0,6915 | -0,0050 | ||

| US613603F873 / MONTGOMERY CNTY PA HGR EDU & HLTH AUTH | 1,62 | -3,41 | 0,6674 | 0,0080 | ||

| US67884XCK19 / OKLAHOMA DEVELOPMENT FINANCE AUTHORITY | 1,58 | -2,53 | 0,6525 | 0,0132 | ||

| KENTUCKY ST MUNI ENERGY AGY PW KMEPWR 01/55 FIXED 5 / DBT (US491499AU37) | 1,52 | -1,17 | 0,6273 | 0,0212 | ||

| US43233AFD37 / HILLSBOROUGH CNTY FL INDL DEVAUTH HOSP REVENUE | 1,52 | -3,38 | 0,6260 | 0,0074 | ||

| US74514L3N58 / PUERTO RICO CMWLTH | 1,51 | -2,83 | 0,6240 | 0,0110 | ||

| US452152Y629 / ILLINOIS ST ILS 05/41 FIXED 5 | 1,51 | -0,79 | 0,6240 | 0,0236 | ||

| US87638QSE07 / TARRANT CNTY TX CULTURAL EDU FACS FIN CORP HOSP REVENUE | 1,48 | -3,08 | 0,6112 | 0,0091 | ||

| US790103AV70 / SAINT JAMES PARISH LA REVENUE | 1,45 | -1,09 | 0,5983 | 0,0206 | ||

| US45470CAG42 / Indiana Finance Authority | 1,43 | -0,21 | 0,5888 | 0,0256 | ||

| US13080SMK77 / California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2016A | 1,42 | -4,64 | 0,5853 | -0,0004 | ||

| US10604PAF09 / BRAZORIA CNTY TX INDL DEV CORP SOLID WST DISP FACS REVENUE | 1,41 | -17,29 | 0,5801 | -0,0894 | ||

| US20775DTQ50 / Connecticut Health & Educational Fac. Auth. Rev. (Sacred Heart University) | 1,38 | -2,47 | 0,5705 | 0,0121 | ||

| US16080TAG04 / Charlotte County Industrial Development Authority/FL | 1,37 | 33,33 | 0,5648 | 0,1606 | ||

| US04108WCF77 / ARKANSAS ST DEV FIN AUTH INDL DEV REVENUE | 1,36 | -1,67 | 0,5594 | 0,0164 | ||

| US66285WWC62 / North Texas Tollway Authority | 1,34 | -3,31 | 0,5544 | 0,0071 | ||

| US93978HXF71 / Washington Health Care Facilities Authority | 1,34 | -0,52 | 0,5534 | 0,0222 | ||

| US54473EWP59 / LOS ANGELES CNTY CA PUBLIC WKS FING AUTH LEASE REVENUE | 1,34 | -6,64 | 0,5509 | -0,0124 | ||

| IRONDALE AL PUBLIC BLDG AUTH L IRONDALE PUB BLDG / DBT (US463034AN86) | 1,32 | -4,41 | 0,5454 | 0,0009 | ||

| MARYLAND ST MDS 06/39 FIXED 5 / DBT (US574193XJ29) | 1,32 | 0,5445 | 0,5445 | |||

| US60637AWK41 / Health & Educational Facilities Authority of the State of Missouri, Series 2023 | 1,30 | -4,07 | 0,5350 | 0,0028 | ||

| US759861EK92 / RENO NV SALES TAX REVENUE RENGEN 07/58 ZEROCPNOID 0 | 1,26 | 4,72 | 0,5217 | 0,0462 | ||

| US92810PAV31 / VIRGINIA ST SMALL BUSINESS FIN VIRGINIA SMALL BUSINESS FINANCING AUTHORITY | 1,26 | -2,56 | 0,5187 | 0,0106 | ||

| LOWER COLORADO RIVER TX AUTH R LWCGEN 05/41 FIXED 5 / DBT (US54811GR931) | 1,26 | 0,5186 | 0,5186 | |||

| US25755AAE10 / Dominion Water & Sanitation District | 1,26 | -0,16 | 0,5183 | 0,0227 | ||

| US41753TAA79 / HARVEST CROSSING MET DIST 12/52 7.25 | 1,26 | 1,46 | 0,5179 | 0,0304 | ||

| US19650TAA79 / COLORADO INTL CTR MET DIST NO CO MET DIST #7 | 1,24 | 2,99 | 0,5126 | 0,0373 | ||

| US64613CEH79 / New Jersey Transportation Trust Fund Authority, Series 2023 BB | 1,24 | -1,36 | 0,5098 | 0,0164 | ||

| ORANGE CNTY FL HLTH FACS AUTH ORAMED 10/43 FIXED 5 / DBT (US68450LJK26) | 1,23 | -1,83 | 0,5091 | 0,0142 | ||

| US888808HG07 / Tobacco Settlement Financing Corp., Series 2018 A, Ref. RB | 1,23 | -0,48 | 0,5090 | 0,0209 | ||

| US167593F728 / CHICAGO IL O'HARE INTERNATIONAL ARPT REVENUE | 1,23 | -1,60 | 0,5079 | 0,0155 | ||

| WEST VIRGINIA ST ECON DEV AUTH WVSDEV 01/55 ADJUSTABLE VAR / DBT (US95648VBU26) | 1,22 | -0,41 | 0,5053 | 0,0212 | ||

| US16876QBL23 / Children's Trust Fund, Puerto Rico, Tobacco Settlement Asset-Backed Bonds, Series 2008A | 1,21 | -11,97 | 0,5009 | -0,0423 | ||

| US592647MD06 / METROPOLITAN WASHINGTON AIRPORTS AUTHORITY AVIATION REVENUE | 1,21 | 0,5008 | 0,5008 | |||

| US74514L3R62 / PUERTO RICO CMWLTH | 1,21 | 0,83 | 0,5001 | 0,0269 | ||

| US649519DV40 / NEW YORK ST LIBERTY DEV CORP LIBERTY REVENUE | 1,20 | -3,76 | 0,4961 | 0,0040 | ||

| US129729AC37 / Calhoun County Navigation Industrial Development Authority | 1,20 | 1,69 | 0,4960 | 0,0304 | ||

| LAUREL WOOD APARTMENTS FIXED DELAYED DRAW TERM LOAN 2 / ABS-MBS (BA000LT17) | 1,20 | 0,4951 | 0,4951 | |||

| US033262AW63 / ANCHORAGE AK SOL WST SVCS REVE MUNICIPALITY OF ANCHORAGE AK SOLID WASTE SERVICES | 1,20 | -1,57 | 0,4933 | 0,0148 | ||

| MOBILE CNTY AL INDL DEV AUTH S MOBPOL 06/54 FIXED 5 / DBT (US60733UAA97) | 1,15 | 0,4735 | 0,4735 | |||

| OHIO ST HSG FIN AGY RSDL MTGE OHSHSG 09/44 FIXED 4.35 / DBT (US67756Q6T96) | 1,14 | -1,47 | 0,4691 | 0,0144 | ||

| US74442PJV85 / Wisconsin (State of) Public Finance Authority (Maryland Proton Treatment Center), Series 2018 A-1, RB | 1,12 | 0,00 | 0,4642 | 0,0211 | ||

| ERIE CNTY NY INDL DEV AGY MF H ERIMFH 02/41 FIXED OID 4.25 / DBT (US29508TAA07) | 1,12 | -1,84 | 0,4637 | 0,0129 | ||

| US38611TCC99 / GRAND PARKWAY TRANSPRTN CORP TX SYS TOLL REVENUE | 1,11 | 0,4594 | 0,4594 | |||

| FLORIDA DEV FIN CORP 08/55 4.5 / DBT (US34061QCV77) | 1,11 | -6,66 | 0,4575 | -0,0101 | ||

| US67754AAF12 / OHIO ST AIR QUALITY DEV AUTH EXEMPT FACS REVENUE | 1,11 | -2,46 | 0,4575 | 0,0099 | ||

| US914639LF43 / UNIV OF NEBRASKA NE FACS CORP | 1,11 | -7,67 | 0,4568 | -0,0157 | ||

| ILLINOIS ST FIN AUTH REVENUE ILSGEN 11/34 FIXED 5 / DBT (US45204FYL39) | 1,08 | 0,4452 | 0,4452 | |||

| INLIVIAN NC MF TAX EXEMPT MTGE INLMFH 06/41 FIXED 4.45 / DBT (US45753EAB92) | 1,07 | -0,46 | 0,4423 | 0,0184 | ||

| SOUTHEAST REGL MGMT DIST TX SERGEN 04/49 FIXED OID 4.25 / DBT (US841493DB21) | 1,06 | -5,28 | 0,4370 | -0,0036 | ||

| US23503CBH97 / Dallas Fort Worth International Airport, Series 2022, RB | 1,06 | -1,21 | 0,4367 | 0,0147 | ||

| HALIFAX FL HOSP MED CTR HALIFAX HOSP MED CTR / DBT (US405815LL32) | 1,06 | -5,64 | 0,4354 | -0,0053 | ||

| US717908AM97 / PHILADELPHIA PA AUTH FOR INDL DEV MF REVENUE | 1,04 | 11,53 | 0,4274 | 0,0616 | ||

| US45528U6X43 / Indianapolis Local Public Improvement Bond Bank | 1,04 | -1,90 | 0,4271 | 0,0115 | ||

| SOUTHEAST ENERGY AUTHORITY A C SEEPWR 01/56 ADJUSTABLE VAR / DBT (US84136HBC60) | 1,02 | -2,02 | 0,4213 | 0,0108 | ||

| US9384292B27 / Beaverton School District 48J, Washington and Multnomah Counties, Oregon, General Obligation Bonds, Series 2022B | 1,02 | -2,12 | 0,4200 | 0,0103 | ||

| FORT WORTH TX WTR SWR REVENU FTWUTL 02/49 FIXED 5 / DBT (US3495155X01) | 1,02 | 0,4200 | 0,4200 | |||

| US61022CAB54 / Monongalia County Commission, West Virginia, Special District Excise Tax Revenue, University Town Centre Economic Opportunity Development District, Re | 1,01 | -0,30 | 0,4164 | 0,0175 | ||

| US60636VDD64 / Missouri Development Finance Board, Series 2022 | 1,01 | -1,85 | 0,4159 | 0,0116 | ||

| INDIANAPOLIS IN LOCAL PUBLIC I INPBBK 01/53 FIXED 5 / DBT (US45528VAV18) | 1,01 | -2,61 | 0,4155 | 0,0082 | ||

| US187145JT58 / MUNI ORIG ISSUE DISC | 1,00 | 0,00 | 0,4141 | 0,0188 | ||

| MISSISSIPPI DEV BK SPL OBLIG MSSDEV 06/50 FIXED OID 5 / DBT (US60534XT551) | 1,00 | 0,4126 | 0,4126 | |||

| US74442PTF26 / PUBLIC FIN AUTH WI REVENUE | 1,00 | -3,95 | 0,4111 | 0,0025 | ||

| US59447TYG20 / Michigan Finance Authority, Michigan, Revenue Bonds, Trinity Health Credit Group, Refunding Series 2016MI | 0,98 | -1,70 | 0,4058 | 0,0117 | ||

| ARLINGTON TX HGR EDU FIN CORP ARLEDU 08/49 FIXED OID 4.125 / DBT (US041807LQ97) | 0,98 | 0,4029 | 0,4029 | |||

| US57582RSK31 / MASSACHUSETTS ST MAS 05/40 FIXED 4 | 0,97 | -0,82 | 0,4016 | 0,0151 | ||

| US57584XD571 / Massachusetts (State of) Development Finance Agency (Emerson College), Series 2016 A, RB | 0,97 | -2,90 | 0,4006 | 0,0067 | ||

| MIAMI DADE CNTY FL AVIATION RE MIATRN 10/34 FIXED 5 / DBT (US59333P7L69) | 0,97 | 0,4005 | 0,4005 | |||

| US584283GY54 / Medford Hospital Facilities Authority | 0,95 | -2,77 | 0,3905 | 0,0070 | ||

| US3137HA4G89 / FRETE 2023-ML15 TRUST FREDDIE MAC MULTIFAMILY ML CERTIFICATES | 0,94 | -3,28 | 0,3892 | 0,0048 | ||

| US599772AA88 / Military Installation Development Authority | 0,93 | -0,64 | 0,3842 | 0,0150 | ||

| VALDOSTA LOWNDES CNTY GA HOS VALMED 10/49 FIXED OID 4.125 / DBT (US919112GJ58) | 0,91 | -3,08 | 0,3771 | 0,0055 | ||

| US38611TDQ76 / Grand Parkway Transportation Corp. | 0,91 | -3,69 | 0,3771 | 0,0035 | ||

| US79739GNW23 / San Diego (County of), CA Regional Airport Authority, Series 2021 B, RB | 0,91 | -4,40 | 0,3768 | 0,0003 | ||

| US04781GAC50 / ATLANTA GA DEV AUTH SENIOR HLT ATLMED 01/35 FIXED OID 6.75 | 0,91 | 30,00 | 0,3755 | 0,0998 | ||

| BALDWIN CNTY AL INDL DEV AUTH BLWPOL 06/55 ADJUSTABLE VAR / DBT (US05786PAA12) | 0,91 | 0,3747 | 0,3747 | |||

| LAUREL WOOD APARTMENTS FIXED DELAYED DRAW TERM LOAN / ABS-MBS (BA000LSQ3) | 0,90 | 0,3713 | 0,3713 | |||

| CROWFOOT VLY RANCH MET DIST 2 CVRDEV 12/49 FIXED OID 4.25 / DBT (US22802CAV90) | 0,88 | -6,27 | 0,3642 | -0,0065 | ||

| US59465MQ659 / Michigan Housing Development Authority, Rental Housing Revenue Bonds, Series 2015A | 0,88 | -0,34 | 0,3633 | 0,0154 | ||

| US677525WB93 / OHIO ST AIR QUALITY DEV AUTH | 0,88 | 0,23 | 0,3631 | 0,0170 | ||

| EVERMAN TX INDEP SCH DIST EVESCD 02/49 FIXED OID 4 / DBT (US300371W565) | 0,88 | 0,3626 | 0,3626 | |||

| US44244CB220 / HOUSTON TX UTIL 0% 11/15/2049 | 0,86 | -5,18 | 0,3549 | -0,0025 | ||

| NATIONAL FIN AUTH NH MUNI CTFS NFADEV 01/41 ADJUSTABLE VAR / DBT (US63607WBD56) | 0,85 | -2,07 | 0,3522 | 0,0092 | ||

| FREDDIE MAC MULTIFAMILY FRETE 2024 ML26 B / ABS-MBS (US35834CAB72) | 0,84 | -0,71 | 0,3470 | 0,0133 | ||

| US72177MTP22 / PIMA CNTY ARIZ INDL DEV 07/55 5 | 0,84 | 0,00 | 0,3466 | 0,0157 | ||

| COLORADO ST HLTH FACS AUTH REV COSMED 12/55 FIXED 5.125 / DBT (US19648FZK38) | 0,83 | -3,60 | 0,3430 | 0,0032 | ||

| US64972GF413 / New York City Municipal Water Finance Authority | 0,83 | -2,48 | 0,3411 | 0,0071 | ||

| US88285ABJ60 / TEXAS WTR DEV BRD ST WTR IMPLEMENTATION REVENUE FUND | 0,80 | -2,32 | 0,3305 | 0,0074 | ||

| ARIZONA ST INDL DEV AUTH SENIO AZSNUR 01/59 INTERAPREC VAR / DBT (US04052TDE29) | 0,78 | -0,51 | 0,3216 | 0,0129 | ||

| US938429Y351 / WASHINGTON CNTY OR SCH DIST 06/48 0 | 0,76 | -1,42 | 0,3153 | 0,0098 | ||

| VANCOUVER WA HSG AUTH MF REVEN VANMFH 12/39 FIXED OID 4.125 / DBT (US92162PAL94) | 0,75 | -1,44 | 0,3107 | 0,0098 | ||

| US46247SCZ56 / IOWA ST FIN AUTH REVENUE IASGEN 01/42 FIXED OID 8 | 0,75 | -2,97 | 0,3099 | 0,0051 | ||

| US362848RR67 / City of Gainesville FL Utilities System Revenue | 0,73 | 0,3012 | 0,3012 | |||

| US745392KL33 / PULASKI CNTY AR HOSP REVENUE PULMED 03/53 FIXED 5.25 | 0,72 | -1,91 | 0,2968 | 0,0079 | ||

| OGDEN CITY UT REDEV AGY SALES OGDDEV 01/53 FIXED 5 / DBT (US67629TAT34) | 0,71 | -1,39 | 0,2936 | 0,0095 | ||

| ARIZONA ST INDL DEV AUTH SENIO AZSNUR 01/59 FIXED 5.125 / DBT (US04052TDC62) | 0,69 | 0,73 | 0,2856 | 0,0146 | ||

| US56682HCK32 / Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, Series 2017A | 0,68 | -5,93 | 0,2814 | -0,0043 | ||

| US92810PAY79 / VIRGINIA ST SMALL BUSINESS FIN VASHGR 07/61 ZEROCPNOID 0 | 0,68 | -10,66 | 0,2803 | -0,0193 | ||

| US939783WQ55 / WASHINGTON ST HSG FIN COMMISSION | 0,67 | -3,47 | 0,2755 | 0,0033 | ||

| US45204E6D56 / Illinois (State of) Finance Authority (Lutheran Communities Obligated Group), Series 2019 A, Ref. RB | 0,66 | -2,96 | 0,2709 | 0,0044 | ||

| US74442PSG18 / PUBLIC FIN AUTH WI REVENUE | 0,65 | -2,27 | 0,2666 | 0,0060 | ||

| US79467BBL80 / Sales Tax Securitization Corporation, Illinois, Sales Tax Securitzation Bonds, Series 2018A | 0,60 | -2,76 | 0,2469 | 0,0044 | ||

| COOK CNTY SCH DIST 28 IL COKSCD 12/50 FIXED OID 5 / DBT (US213381AF35) | 0,60 | 0,2465 | 0,2465 | |||

| US592250AR51 / MET PIER & EXPOSITION AUTH IL REVENUE | 0,60 | -5,55 | 0,2463 | -0,0023 | ||

| US744387AD35 / Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs Utilities, Series 2008 | 0,59 | 0,00 | 0,2427 | 0,0109 | ||

| MIAMI DADE CNTY FL HSG FIN AUT MIAMFH 03/46 FIXED 4.88 / DBT (US593344BZ64) | 0,58 | -2,84 | 0,2403 | 0,0041 | ||

| PUBLIC FIN AUTH WI REVENUE PUBGEN 11/36 FIXED 5 / DBT (US74442PJ715) | 0,54 | 0,19 | 0,2215 | 0,0106 | ||

| US74442PRQ09 / PUBLIC FIN AUTH WI REVENUE | 0,53 | 0,2176 | 0,2176 | |||

| US575930VL30 / Massachusetts Housing Finance Agency, Housing Bonds, Series 2003H | 0,52 | -0,19 | 0,2166 | 0,0098 | ||

| US3132YBXM33 / FED HM LN PC POOL WE6084 FR 02/40 FIXED 4.9 | 0,52 | -0,96 | 0,2126 | 0,0075 | ||

| WARREN CNTY KY HOSP REVENUE WARMED 04/49 FIXED 5.25 / DBT (US934864CN71) | 0,51 | 0,2102 | 0,2102 | |||

| US87638RJD08 / TARRANT CNTY TX CULTURAL EDU F TAREDU 11/47 FIXED 6.75 | 0,51 | -1,17 | 0,2092 | 0,0075 | ||

| INLIVIAN NC MF REVENUE INLMFH 02/43 FIXED 5.05 / DBT (US45753CAV90) | 0,51 | 0,2090 | 0,2090 | |||

| FALCON PK DELAYED DRAW TERM LOAN 2 / DBT (948TTQII6) | 0,50 | 0,00 | 0,2063 | 0,0094 | ||

| SOUTH DAKOTA ST HSG DEV AUTH SDSHSG 11/45 FIXED OID 4.5 / DBT (US83756LBQ77) | 0,48 | -1,84 | 0,1985 | 0,0055 | ||

| FREDDIE MAC MULTIFAMILY FRETE 2024 ML27 BUS / ABS-MBS (US35833XAA46) | 0,48 | -1,23 | 0,1984 | 0,0066 | ||

| US81685AAA79 / Senac South Metropolitan District No 1 | 0,48 | -2,24 | 0,1980 | 0,0050 | ||

| CLIFTON TX HGR EDU FIN CORP ED CLIEDU 02/42 FIXED OID 4.375 / DBT (US187145VL84) | 0,48 | 0,1978 | 0,1978 | |||

| INDIANAPOLIS IN MF HSG REVENUE INPMFH 07/56 ADJUSTABLE VAR / DBT (US45528TBF03) | 0,47 | -2,87 | 0,1958 | 0,0036 | ||

| CALIFORNIA ST INFRASTRUCTURE CASDEV 01/65 ADJUST OID VAR / DBT (US13034A6B14) | 0,47 | -5,20 | 0,1956 | -0,0013 | ||

| INDIANA ST HSG CMNTY DEV AUT INSMFH 07/56 ADJUSTABLE VAR / DBT (US45506CAP23) | 0,47 | -2,67 | 0,1952 | 0,0036 | ||

| US57420VRK16 / Maryland Economic Development Corp. | 0,46 | -0,44 | 0,1889 | 0,0081 | ||

| KISSIMMEE FL CAPITAL IMPT REVE KISSIMMEE REV A / DBT (US497813CM56) | 0,44 | -3,95 | 0,1811 | 0,0013 | ||

| NEW YORK ST DORM AUTH ST PERSO NYSGEN 02/47 FIXED 4 / DBT (US64990KFM09) | 0,44 | -3,96 | 0,1806 | 0,0013 | ||

| US97712D7E06 / WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE | 0,42 | -0,48 | 0,1727 | 0,0070 | ||

| US792909FM03 / Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Fairview Health Services, Series 2017A | 0,39 | -1,26 | 0,1618 | 0,0053 | ||

| FREDDIE MAC MULTIFAMILY FRETE 2024 ML25 BCA / ABS-MBS (US30339BAB09) | 0,38 | -0,78 | 0,1588 | 0,0060 | ||

| US88423EAC75 / Third Creek Metropolitan District No. 1, Limited Tax | 0,37 | -5,08 | 0,1546 | -0,0009 | ||

| MULTIFAMILY MORTGAGE BONDS MFMB 2025 16FN PT / DBT (US264469AC10) | 0,35 | 0,1452 | 0,1452 | |||

| US594751AM15 / MICHIGAN TOBACCO SETTLEMENT FINANCE AUTHORITY | 0,35 | -11,31 | 0,1426 | -0,0108 | ||

| US38122NB843 / GOLDEN ST TOBACCO SECURITIZATI REGD ZCP OID B/E 0.00000000 | 0,27 | -1,49 | 0,1094 | 0,0033 | ||

| US45470DAA54 / INDIANA ST FIN AUTH EXEMPT FAC INSGEN 03/39 FIXED OID 7 | 0,25 | -3,52 | 0,1023 | 0,0013 | ||

| LAUREL WOOD APARTMENTS FIXED DELAYED DRAW TERM LOAN 1 / ABS-MBS (BA000LT25) | 0,24 | 0,0999 | 0,0999 | |||

| PASSAIC CNTY NJ IMPT AUTH CHRT PASEDU 07/40 FIXED OID 4.5 / DBT (US70275QAL77) | 0,24 | -1,23 | 0,0992 | 0,0031 | ||

| US16876QBM06 / THE CHILDRENS TRUST FUND PR TOBACCO SETTLEMENT REVENUE | 0,24 | -54,42 | 0,0979 | -0,1073 | ||

| US88256CAT62 / TEXAS ST MUNI GAS ACQUISITION TXSUTL 12/26 FIXED 5.25 | 0,15 | -0,65 | 0,0633 | 0,0027 | ||

| US03469KAG85 / ANGELINA NECHES RIVER AUTH I ANGDEV 12/45 FIXED 12 | 0,13 | -74,90 | 0,0544 | -0,1516 | ||

| FAIRHAVEN GLEN FIXED TAX EXEMPT CONSTRUCTIONB / DBT (BA00061T9) | 0,10 | 0,00 | 0,0413 | 0,0019 | ||

| US03469KAB98 / Angelina & Neches River Authority | 0,07 | -70,32 | 0,0268 | -0,0595 | ||

| ESC NASSAU CNTY N Y IN 01/58 5 / DBT (000000000) | 0,04 | 0,0180 | 0,0180 | |||

| US040523AF98 / ARIZONA ST INDL DEV AUTH ECON DEV REVENUE | 0,04 | 0,00 | 0,0149 | 0,0007 | ||

| US45204EA650 / ILLINOIS ST FIN AUTH REVENUE | 0,01 | 0,00 | 0,0030 | 0,0001 | ||

| US38543PAF53 / GRAND FORKS CNTY ND | 0,00 | 0,0000 | 0,0000 | |||

| US57585AAE01 / Massachusetts Development Finance Agency, Health Care Facility Revenue Bonds, Adventcare Project, Series 2010 | 0,00 | 0,0000 | 0,0000 |