Grundlæggende statistik

| Porteføljeværdi | $ 6.526.871.159 |

| Nuværende stillinger | 1.637 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

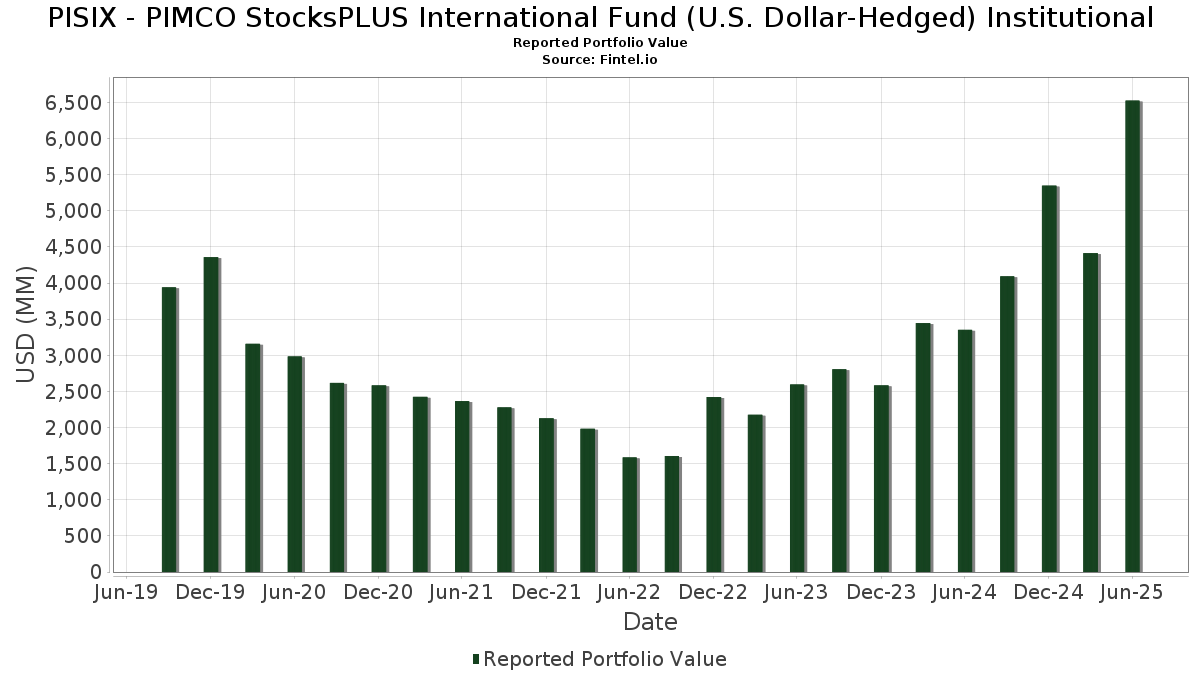

PISIX - PIMCO StocksPLUS International Fund (U.S. Dollar-Hedged) Institutional har afsløret 1.637 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 6.526.871.159 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). PISIX - PIMCO StocksPLUS International Fund (U.S. Dollar-Hedged) Institutionals største beholdninger er Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , UMBS TBA (US:US01F0406854) , and PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) . PISIX - PIMCO StocksPLUS International Fund (U.S. Dollar-Hedged) Institutionals nye stillinger omfatter Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , UMBS TBA (US:US01F0406854) , and PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 742,10 | 23,3606 | 23,3606 | ||

| 742,10 | 23,3606 | 23,3606 | ||

| 540,21 | 17,0052 | 16,4550 | ||

| 153,36 | 4,8275 | 7,3410 | ||

| 308,50 | 9,7113 | 5,6454 | ||

| 246,29 | 7,7530 | 3,4766 | ||

| 98,86 | 3,1119 | 1,9136 | ||

| 55,21 | 1,7380 | 1,7380 | ||

| 55,21 | 1,7380 | 1,7380 | ||

| 47,87 | 1,5068 | 1,5068 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -104,42 | -3,2870 | -8,8120 | ||

| 134,20 | 4,2244 | -1,8529 | ||

| -39,86 | -1,2547 | -1,2547 | ||

| 50,18 | 1,5797 | -0,9991 | ||

| 79,64 | 2,5071 | -0,8379 | ||

| 2,50 | 0,0788 | -0,8247 | ||

| 1,89 | 0,0595 | -0,3409 | ||

| 1,89 | 0,0595 | -0,3409 | ||

| -6,48 | -0,2041 | -0,2041 | ||

| 0,19 | 0,0060 | -0,1983 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-29 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| CITIGROUP REPO REPO 5807 / RA (000000000) | 742,10 | 23,3606 | 23,3606 | |||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 742,10 | 23,3606 | 23,3606 | |||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 540,21 | 3.405,34 | 17,0052 | 16,4550 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 308,50 | 170,90 | 9,7113 | 5,6454 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 246,29 | 85,86 | 7,7530 | 3,4766 | ||

| US01F0406854 / UMBS TBA | 153,36 | -372,06 | 4,8275 | 7,3410 | ||

| US72202G3801 / PIMCO ST FLOATING NAV PORT IV MUTUAL FUND | 134,20 | -28,74 | 4,2244 | -1,8529 | ||

| US01F0426811 / UMBS TBA | 124,80 | 101,30 | 3,9286 | 1,0132 | ||

| US01F0506844 / UMBS TBA | 98,86 | 287,95 | 3,1119 | 1,9136 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 79,64 | -14,99 | 2,5071 | -0,8379 | ||

| TSY INFL IX N/B 07/34 1.875 / DBT (US91282CLE92) | 71,35 | 0,17 | 2,2459 | -0,0527 | ||

| TSY INFL IX N/B 07/34 1.875 / DBT (US91282CLE92) | 71,35 | 0,17 | 2,2459 | -0,0527 | ||

| NDDUEAFE TRS EQUITY FEDL01+51 *BULLET* M / DE (000000000) | 55,21 | 1,7380 | 1,7380 | |||

| NDDUEAFE TRS EQUITY FEDL01+51 *BULLET* M / DE (000000000) | 55,21 | 1,7380 | 1,7380 | |||

| US01F0306864 / FNMA 30YR TBA 3.0% AUG 20 TO BE ANNOUNCED 3.00000000 | 50,18 | -13,23 | 1,5797 | -0,9991 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 47,87 | 1,5068 | 1,5068 | |||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 47,87 | 1,5068 | 1,5068 | |||

| US21H0406817 / Ginnie Mae | 46,49 | 1,4634 | 1,4634 | |||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 45,79 | 6,77 | 1,4413 | 0,0575 | ||

| TSY INFL IX N/B 04/29 2.125 / DBT (US91282CKL45) | 32,70 | 0,72 | 1,0294 | -0,0183 | ||

| TSY INFL IX N/B 04/29 2.125 / DBT (US91282CKL45) | 32,70 | 0,72 | 1,0294 | -0,0183 | ||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 31,78 | -2,25 | 1,0005 | -0,0488 | ||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 31,78 | -2,25 | 1,0005 | -0,0488 | ||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 29,20 | 0,9192 | 0,9192 | |||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 29,20 | 0,9192 | 0,9192 | |||

| US21H0506723 / Ginnie Mae | 28,32 | 187,85 | 0,8916 | 0,3570 | ||

| FNMA POOL BM7581 FN 09/31 VARIABLE / ABS-MBS (US3140JCM768) | 26,06 | 0,82 | 0,8203 | -0,0138 | ||

| FNMA POOL BM7581 FN 09/31 VARIABLE / ABS-MBS (US3140JCM768) | 26,06 | 0,82 | 0,8203 | -0,0138 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 19,77 | 0,6223 | 0,6223 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 19,77 | 0,6223 | 0,6223 | |||

| US21H0506806 / GNMA | 18,49 | 97,71 | 0,5820 | 0,2481 | ||

| 4020 / Saudi Real Estate Company | 16,28 | 1,48 | 0,5126 | -0,0052 | ||

| 4020 / Saudi Real Estate Company | 16,28 | 1,48 | 0,5126 | -0,0052 | ||

| FCT / Fincantieri S.p.A. | 16,14 | 9,88 | 0,5080 | 0,0340 | ||

| FCT / Fincantieri S.p.A. | 16,14 | 9,88 | 0,5080 | 0,0340 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 16,05 | 0,5051 | 0,5051 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 16,05 | 0,5051 | 0,5051 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 15,77 | 0,4963 | 0,4963 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 15,77 | 0,4963 | 0,4963 | |||

| CNQ / Canadian Natural Resources Limited | 15,63 | 0,4921 | 0,4921 | |||

| CNQ / Canadian Natural Resources Limited | 15,63 | 0,4921 | 0,4921 | |||

| US9128285J52 / United States Treasury Note/Bond | 15,02 | 0,27 | 0,4729 | -0,0106 | ||

| USP78024AG45 / Peruvian Government International Bond | 14,48 | 7,60 | 0,4559 | 0,0215 | ||

| FED HM LN PC POOL RJ0137 FR 12/53 FIXED 5 / ABS-MBS (US3142GQEK49) | 14,27 | -1,26 | 0,4492 | -0,0172 | ||

| FED HM LN PC POOL RJ0137 FR 12/53 FIXED 5 / ABS-MBS (US3142GQEK49) | 14,27 | -1,26 | 0,4492 | -0,0172 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 14,01 | 1,00 | 0,4410 | -0,0066 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 14,01 | 1,00 | 0,4410 | -0,0066 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 B A3 / ABS-O (US65481DAD49) | 13,95 | 0,22 | 0,4393 | -0,0101 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 B A3 / ABS-O (US65481DAD49) | 13,95 | 0,22 | 0,4393 | -0,0101 | ||

| AMERICAN EXPRESS CREDIT ACCOUN AMXCA 2024 3 A / ABS-MBS (US02589BAE02) | 13,77 | 0,33 | 0,4334 | -0,0095 | ||

| AMERICAN EXPRESS CREDIT ACCOUN AMXCA 2024 3 A / ABS-MBS (US02589BAE02) | 13,77 | 0,33 | 0,4334 | -0,0095 | ||

| US70069FAF45 / PARK PLACE SECURITIES INC PPSI 2004 WCW1 M4 | 13,73 | 0,54 | 0,4323 | -0,0085 | ||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 13,45 | 0,32 | 0,4235 | -0,0092 | ||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 13,45 | 0,32 | 0,4235 | -0,0092 | ||

| 5831 / Shizuoka Financial Group,Inc. | 13,40 | 0,4217 | 0,4217 | |||

| 5831 / Shizuoka Financial Group,Inc. | 13,40 | 0,4217 | 0,4217 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 13,11 | 0,4127 | 0,4127 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 13,11 | 0,4127 | 0,4127 | |||

| SYNCHRONY CARD ISSUANCE TRUST SYNIT 2024 A2 A / ABS-MBS (US87166PAN15) | 13,10 | 0,18 | 0,4123 | -0,0096 | ||

| FNMA POOL BS9867 FN 11/30 FIXED 5.3 / ABS-MBS (US3140LL6D83) | 13,04 | 0,66 | 0,4106 | -0,0076 | ||

| FNMA POOL BS9867 FN 11/30 FIXED 5.3 / ABS-MBS (US3140LL6D83) | 13,04 | 0,66 | 0,4106 | -0,0076 | ||

| HERTZ VEHICLE FINANCING LLC HERTZ 2024 1A A 144A / ABS-O (US42806MCK36) | 12,60 | 0,21 | 0,3968 | -0,0091 | ||

| HERTZ VEHICLE FINANCING LLC HERTZ 2024 1A A 144A / ABS-O (US42806MCK36) | 12,60 | 0,21 | 0,3968 | -0,0091 | ||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 12,57 | 0,3958 | 0,3958 | |||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 12,50 | 0,3933 | 0,3933 | |||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 12,13 | 449,93 | 0,3817 | 0,3106 | ||

| CDX IG44 5Y ICE / DCR (EZPF6RHH0ZV8) | 12,13 | 449,93 | 0,3817 | 0,3106 | ||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 11,87 | -5,18 | 0,3736 | -0,0303 | ||

| TOYOTA AUTO RECEIVABLES OWNER TAOT 2024 C A3 / ABS-O (US89237QAD25) | 11,66 | 0,12 | 0,3672 | -0,0088 | ||

| TOYOTA AUTO RECEIVABLES OWNER TAOT 2024 C A3 / ABS-O (US89237QAD25) | 11,66 | 0,12 | 0,3672 | -0,0088 | ||

| US21H0406734 / Ginnie Mae | 11,61 | 0,3653 | 0,3653 | |||

| ZAG000125980 / Republic of South Africa Government Bond | 11,48 | 8,29 | 0,3615 | 0,0193 | ||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 11,36 | 0,3576 | 0,3576 | |||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 11,36 | 0,3576 | 0,3576 | |||

| CHASE ISSUANCE TRUST CHAIT 2024 A2 A / ABS-MBS (US161571HW79) | 11,31 | 0,80 | 0,3560 | -0,0060 | ||

| CHASE ISSUANCE TRUST CHAIT 2024 A2 A / ABS-MBS (US161571HW79) | 11,31 | 0,80 | 0,3560 | -0,0060 | ||

| US83612QAD07 / SVHE 2007-NS1 A4 1ML+30 1/37 | 11,13 | -3,74 | 0,3503 | -0,0228 | ||

| US05522RDH84 / BA Credit Card Trust | 11,12 | 0,02 | 0,3501 | -0,0088 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 B A2A / ABS-O (US65481DAB82) | 11,06 | -13,73 | 0,3482 | -0,0656 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 B A2A / ABS-O (US65481DAB82) | 11,06 | -13,73 | 0,3482 | -0,0656 | ||

| US05377RFV15 / AESOP_22-5A | 10,89 | -0,40 | 0,3427 | -0,0100 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 10,88 | 0,3425 | 0,3425 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 10,88 | 0,3425 | 0,3425 | |||

| US78485KAE55 / STWD 2022-FL3 Ltd | 10,74 | -0,03 | 0,3381 | -0,0086 | ||

| MERRION SQUARE RESIDENTIAL MERRI 2024 1A A 144A / ABS-MBS (XS2844411921) | 10,54 | 5,26 | 0,3316 | 0,0086 | ||

| US40430KAH41 / HASC 2006-OPT4 M1 | 10,30 | -2,84 | 0,3243 | -0,0179 | ||

| US576339DJ15 / MASTER CR CARD TR II 23-2A A SOFR30A+85 01/21/2027 144A | 10,30 | -0,19 | 0,3241 | -0,0088 | ||

| XS2404260213 / Aurium CLO IV DAC | 10,25 | 4,90 | 0,3227 | 0,0073 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 10,14 | 8,57 | 0,3191 | 0,0178 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 10,14 | 8,57 | 0,3191 | 0,0178 | ||

| ALBACORE EURO CLO ALBAC 1A AR 144A / ABS-CBDO (XS2368816109) | 9,88 | 8,78 | 0,3109 | 0,0179 | ||

| ALBACORE EURO CLO ALBAC 1A AR 144A / ABS-CBDO (XS2368816109) | 9,88 | 8,78 | 0,3109 | 0,0179 | ||

| FANNIE MAE FNR 2024 77 FM / ABS-MBS (US3136BTRF25) | 9,75 | -13,32 | 0,3068 | -0,0561 | ||

| FANNIE MAE FNR 2024 77 FM / ABS-MBS (US3136BTRF25) | 9,75 | -13,32 | 0,3068 | -0,0561 | ||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 9,74 | 0,81 | 0,3065 | -0,0052 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 3 A3 / ABS-O (US14319GAD34) | 9,70 | 0,05 | 0,3055 | -0,0075 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 3 A3 / ABS-O (US14319GAD34) | 9,70 | 0,05 | 0,3055 | -0,0075 | ||

| NDDUEAFE TRS EQUITY FEDL01+24 BPS / DE (000000000) | 9,69 | 0,3051 | 0,3051 | |||

| NDDUEAFE TRS EQUITY FEDL01+24 BPS / DE (000000000) | 9,69 | 0,3051 | 0,3051 | |||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 9,68 | 0,91 | 0,3048 | -0,0048 | ||

| CBRE SVCS INC / DBT (US12610BUA87) | 9,67 | 0,3043 | 0,3043 | |||

| CBRE SVCS INC / DBT (US12610BUA87) | 9,67 | 0,3043 | 0,3043 | |||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 9,66 | 1,08 | 0,3041 | -0,0043 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 9,66 | 1,08 | 0,3041 | -0,0043 | ||

| NDDUEAFE TRS EQUITY FEDL01+34.5 SOG / DE (000000000) | 9,65 | 0,3037 | 0,3037 | |||

| NDDUEAFE TRS EQUITY FEDL01+34.5 SOG / DE (000000000) | 9,65 | 0,3037 | 0,3037 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUF79) | 9,48 | 0,2985 | 0,2985 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUF79) | 9,48 | 0,2985 | 0,2985 | |||

| US43710XAE85 / HOME EQUITY LOAN TRUST HELT 2007 FRE1 2AV4 | 9,48 | 0,32 | 0,2985 | -0,0066 | ||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 9,41 | 0,2962 | 0,2962 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 9,41 | 0,2962 | 0,2962 | |||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 9,40 | -0,01 | 0,2959 | -0,0075 | ||

| FNMA POOL BZ2582 FN 12/29 FIXED 4.3 / ABS-MBS (US3140NW2Q77) | 9,39 | 1,02 | 0,2956 | -0,0044 | ||

| FNMA POOL BZ2582 FN 12/29 FIXED 4.3 / ABS-MBS (US3140NW2Q77) | 9,39 | 1,02 | 0,2956 | -0,0044 | ||

| LUGO FUNDING DAC 05/66 1 / ABS-MBS (XS2930538397) | 9,08 | 4,58 | 0,2859 | 0,0057 | ||

| LUGO FUNDING DAC 05/66 1 / ABS-MBS (XS2930538397) | 9,08 | 4,58 | 0,2859 | 0,0057 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 8,91 | 0,2806 | 0,2806 | |||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 8,91 | 0,2806 | 0,2806 | |||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/28 5.45 / DBT (US04020EAL11) | 8,61 | 0,2709 | 0,2709 | |||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/28 5.45 / DBT (US04020EAL11) | 8,61 | 0,2709 | 0,2709 | |||

| US17309MAF05 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 WFH2 M2 | 8,54 | -4,87 | 0,2689 | -0,0209 | ||

| US75406WAE12 / RESIDENTIAL ASSET SECURITIES C RASC 2006 KS6 M1 | 8,39 | -4,74 | 0,2640 | -0,0201 | ||

| XS2405128823 / Sculptor European CLO V DAC | 8,35 | -4,77 | 0,2628 | -0,0201 | ||

| XS2683120211 / Avon Finance No.4 PLC | 8,32 | 0,93 | 0,2619 | -0,0041 | ||

| RFR USD SOFR/3.50000 12/18/24-30Y CME / DIR (EZ4089K4KC85) | 8,09 | 42,11 | 0,2548 | 0,0710 | ||

| US17181KAA88 / CIM Trust 2023-R2 | 8,04 | -2,86 | 0,2532 | -0,0140 | ||

| CAPITAL FOUR US CLO C4US 2022 1A AR 144A / ABS-CBDO (US14016CAN65) | 8,03 | -0,06 | 0,2528 | -0,0065 | ||

| CAPITAL FOUR US CLO C4US 2022 1A AR 144A / ABS-CBDO (US14016CAN65) | 8,03 | -0,06 | 0,2528 | -0,0065 | ||

| FNMA POOL BS9669 FN 10/28 FIXED 4.72 / ABS-MBS (US3140LLW723) | 7,86 | 0,32 | 0,2474 | -0,0054 | ||

| FNMA POOL BS9669 FN 10/28 FIXED 4.72 / ABS-MBS (US3140LLW723) | 7,86 | 0,32 | 0,2474 | -0,0054 | ||

| US36244KAE55 / GSAMP TRUST 2006-HE3 GSAMP 2006-HE3 A2D | 7,76 | -6,62 | 0,2442 | -0,0239 | ||

| US00217VAC46 / AREIT CRE TRUST AREIT 2022 CRE7 AS 144A | 7,47 | -0,15 | 0,2351 | -0,0063 | ||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 7,21 | 0,12 | 0,2270 | -0,0054 | ||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 7,21 | 0,12 | 0,2270 | -0,0054 | ||

| US46625SAF39 / JP Morgan Mortgage Acquisition Trust, Series 2006-HE2, Class M1 | 7,16 | 0,39 | 0,2254 | -0,0048 | ||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 7,05 | 1,21 | 0,2220 | -0,0029 | ||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 7,05 | 1,21 | 0,2220 | -0,0029 | ||

| XS2404665460 / BNPP AM EURO CLO 2019 BV SER 2019-1A CL AR V/R REGD 144A P/P /EUR/ 0.82000000 | 7,04 | 8,71 | 0,2216 | 0,0126 | ||

| TOWD POINT MORTGAGE FUNDING TPMF 2024 GR6A A1 144A / ABS-MBS (XS2799791848) | 7,01 | -0,51 | 0,2208 | -0,0067 | ||

| TOWD POINT MORTGAGE FUNDING TPMF 2024 GR6A A1 144A / ABS-MBS (XS2799791848) | 7,01 | -0,51 | 0,2208 | -0,0067 | ||

| US17330VAA44 / CMLTI_22-A | 7,01 | -2,19 | 0,2205 | -0,0106 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 3 A2A / ABS-O (US14319GAB77) | 7,00 | -26,92 | 0,2203 | -0,0887 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 3 A2A / ABS-O (US14319GAB77) | 7,00 | -26,92 | 0,2203 | -0,0887 | ||

| US55284JAC36 / MF1 2022-FL8 Ltd | 6,99 | -0,60 | 0,2199 | -0,0069 | ||

| US00217VAA89 / AREIT 2022-CRE7 LLC | 6,94 | -10,77 | 0,2184 | -0,0325 | ||

| OCEAN TRAILS CLO OCTR 2020 8A ARR / ABS-CBDO (US67514UAU51) | 6,91 | 0,16 | 0,2175 | -0,0051 | ||

| OCEAN TRAILS CLO OCTR 2020 8A ARR / ABS-CBDO (US67514UAU51) | 6,91 | 0,16 | 0,2175 | -0,0051 | ||

| US902613AP31 / UBS Group AG | 6,84 | 0,56 | 0,2154 | -0,0042 | ||

| US45670EAA10 / IndyMac IMSC Mortgage Loan Trust 2007-AR2 | 6,84 | -5,00 | 0,2152 | -0,0170 | ||

| CARLYLE GLOBAL MARKET STRATEGI CGMSE 2025 1A A1 144A / ABS-CBDO (XS3065225669) | 6,83 | 0,2151 | 0,2151 | |||

| ARES CLO LTD ARES 2015 2A AR3 144A / ABS-CBDO (US04015GAX79) | 6,82 | 0,16 | 0,2147 | -0,0050 | ||

| ARES CLO LTD ARES 2015 2A AR3 144A / ABS-CBDO (US04015GAX79) | 6,82 | 0,16 | 0,2147 | -0,0050 | ||

| US57643LMA16 / MASTR Asset Backed Securities Trust 2006-AM1 | 6,80 | -3,96 | 0,2140 | -0,0144 | ||

| US68389FKR46 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2006 1 M1 | 6,79 | -4,38 | 0,2138 | -0,0154 | ||

| VOLKSWAGEN AUTO LEASE TRUST VWALT 2024 A A2A / ABS-O (US92866EAB56) | 6,76 | -26,55 | 0,2128 | -0,0842 | ||

| VOLKSWAGEN AUTO LEASE TRUST VWALT 2024 A A2A / ABS-O (US92866EAB56) | 6,76 | -26,55 | 0,2128 | -0,0842 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 6,68 | 0,2101 | 0,2101 | |||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 6,68 | 0,2101 | 0,2101 | |||

| WOODWARD CAPITAL MANAGEMENT RCKT 2025 CES6 A1A 144A / ABS-MBS (US748949AA22) | 6,63 | 0,2088 | 0,2088 | |||

| WOODWARD CAPITAL MANAGEMENT RCKT 2025 CES6 A1A 144A / ABS-MBS (US748949AA22) | 6,63 | 0,2088 | 0,2088 | |||

| US40431JAA16 / HSI Asset Securitization Corp Trust 2007-OPT1 | 6,59 | -1,14 | 0,2074 | -0,0077 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 INV1 A1 144A / ABS-MBS (US92540FAA84) | 6,58 | -7,36 | 0,2070 | -0,0220 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 INV1 A1 144A / ABS-MBS (US92540FAA84) | 6,58 | -7,36 | 0,2070 | -0,0220 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A B 144A / ABS-CBDO (US92338VAC54) | 6,57 | -0,62 | 0,2068 | -0,0065 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A B 144A / ABS-CBDO (US92338VAC54) | 6,57 | -0,62 | 0,2068 | -0,0065 | ||

| MX0SGO0000M6 / Mexican Udibonos | 6,43 | 12,01 | 0,2025 | 0,0172 | ||

| FNMA POOL BZ1029 FN 06/29 FIXED 4.93 / ABS-MBS (US3140NVEB95) | 6,42 | 0,25 | 0,2020 | -0,0046 | ||

| CORDATUS CLO PLC CORDA 24A A 144A / ABS-CBDO (XS2511416906) | 6,41 | 4,67 | 0,2019 | 0,0041 | ||

| CORDATUS CLO PLC CORDA 24A A 144A / ABS-CBDO (XS2511416906) | 6,41 | 4,67 | 0,2019 | 0,0041 | ||

| SEQUOIA MORTGAGE TRUST SEMT 2024 HYB1 A1A 144A / ABS-MBS (US81749EAA38) | 6,41 | -10,87 | 0,2016 | -0,0303 | ||

| SEQUOIA MORTGAGE TRUST SEMT 2024 HYB1 A1A 144A / ABS-MBS (US81749EAA38) | 6,41 | -10,87 | 0,2016 | -0,0303 | ||

| US86358ETJ54 / STRUCTURED ASSET INVESTMENT LO SAIL 2005 5 M4 | 6,36 | -5,12 | 0,2001 | -0,0161 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 6,29 | 0,1981 | 0,1981 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 6,29 | 0,1981 | 0,1981 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 6,29 | 0,1979 | 0,1979 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 6,29 | 0,1979 | 0,1979 | |||

| NDDUEAFE TRS EQUITY SOFR+0 MYI / DE (000000000) | 6,28 | 0,1978 | 0,1978 | |||

| NDDUEAFE TRS EQUITY SOFR+0 MYI / DE (000000000) | 6,28 | 0,1978 | 0,1978 | |||

| US64831HAM51 / New Residential Mortgage Loan Trust 2023-NQM1 | 6,20 | -7,44 | 0,1952 | -0,0210 | ||

| US52607MAA71 / LENDMARK FUNDING TRUST 21-1A A 1.9% 11/20/2031 144A | 6,07 | 0,60 | 0,1910 | -0,0036 | ||

| PRETIUM MORTGAGE CREDIT PARTNE PRET 2024 NPL7 A1 144A / ABS-MBS (US74136TAA60) | 5,98 | -2,26 | 0,1881 | -0,0092 | ||

| PRETIUM MORTGAGE CREDIT PARTNE PRET 2024 NPL7 A1 144A / ABS-MBS (US74136TAA60) | 5,98 | -2,26 | 0,1881 | -0,0092 | ||

| US00764MGH43 / Aegis Asset Backed Securities Trust Mortgage Pass-Through Ctfs Ser 2005-4 | 5,91 | -3,15 | 0,1861 | -0,0109 | ||

| RFR USD SOFR/2.75000 06/21/23-30Y CME / DIR (EZM2L9TGLT92) | 5,89 | 0,87 | 0,1853 | -0,0030 | ||

| RFR USD SOFR/2.75000 06/21/23-30Y CME / DIR (EZM2L9TGLT92) | 5,89 | 0,87 | 0,1853 | -0,0030 | ||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 5,73 | -3,00 | 0,1803 | -0,0103 | ||

| US362341BT57 / GSAMP TRUST GSAMP 2005 HE3 M4 | 5,67 | -3,16 | 0,1784 | -0,0104 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 5,63 | 0,1774 | 0,1774 | |||

| US38141GZS64 / GOLDMAN SACHS GROUP INC SR UNSECURED 03/28 VAR | 5,61 | -0,18 | 0,1765 | -0,0048 | ||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LUZ20) | 5,60 | -0,09 | 0,1762 | -0,0046 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2019 15A A1R 144A / ABS-CBDO (US04942MAN48) | 5,55 | -13,07 | 0,1747 | -0,0313 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2019 15A A1R 144A / ABS-CBDO (US04942MAN48) | 5,55 | -13,07 | 0,1747 | -0,0313 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 3 A3 / ABS-O (US80287LAC37) | 5,53 | -0,47 | 0,1740 | -0,0052 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 3 A3 / ABS-O (US80287LAC37) | 5,53 | -0,47 | 0,1740 | -0,0052 | ||

| PEP01000C5I0 / BONOS DE TESORERIA | 5,48 | 7,13 | 0,1726 | 0,0075 | ||

| US05522RDG02 / BA Credit Card Trust | 5,42 | -0,04 | 0,1708 | -0,0044 | ||

| SAGB / Republic of South Africa Government Bond | 5,37 | 6,27 | 0,1691 | 0,0060 | ||

| ARES CLO LTD ARES 2013 2A AR3 144A / ABS-CBDO (US00190YBP97) | 5,31 | 0,44 | 0,1670 | -0,0035 | ||

| US02582JJZ49 / American Express Credit Account Master Trust 2023-1 | 5,23 | -0,04 | 0,1646 | -0,0042 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 2A A1R 144A / ABS-CBDO (US05684RAL69) | 5,20 | 0,10 | 0,1636 | -0,0040 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2021 2A A1R 144A / ABS-CBDO (US05684RAL69) | 5,20 | 0,10 | 0,1636 | -0,0040 | ||

| BANK OF INDUSTRY LIMITED 2024 EUR TERM LOAN B1 / LON (BA000BY62) | 5,15 | 9,02 | 0,1621 | 0,0097 | ||

| BANK OF INDUSTRY LIMITED 2024 EUR TERM LOAN B1 / LON (BA000BY62) | 5,15 | 9,02 | 0,1621 | 0,0097 | ||

| US12661GAA76 / CSMC 2021-RPL3 Trust | 5,14 | -3,33 | 0,1618 | -0,0098 | ||

| US81375WHJ80 / CREDIT BASED ASSET SERVICING A CBASS 2006 CB1 AF3 | 5,09 | -0,18 | 0,1604 | -0,0043 | ||

| US00443PAD15 / ACE SECURITIES CORP. ACE 2007 HE2 A2C | 5,06 | -1,11 | 0,1593 | -0,0059 | ||

| US87229WAS08 / TCI SYMPHONY CLO TSYMP 2016 1A BR2 144A | 5,03 | 0,46 | 0,1584 | -0,0032 | ||

| DIAMETER CAPITAL CLO DCLO 2024 6A A1 144A / ABS-CBDO (US25255UAA07) | 5,02 | 0,16 | 0,1579 | -0,0037 | ||

| DIAMETER CAPITAL CLO DCLO 2024 6A A1 144A / ABS-CBDO (US25255UAA07) | 5,02 | 0,16 | 0,1579 | -0,0037 | ||

| XS2391578239 / Ares European CLO XII DAC | 5,00 | 6,73 | 0,1573 | 0,0062 | ||

| US06738ECE32 / Barclays PLC | 5,00 | 1,69 | 0,1572 | -0,0013 | ||

| TIKEHAU CLO IX DAC TIKEH 9A AR 144A / ABS-CBDO (XS2931965672) | 4,95 | 8,87 | 0,1558 | 0,0091 | ||

| TIKEHAU CLO IX DAC TIKEH 9A AR 144A / ABS-CBDO (XS2931965672) | 4,95 | 8,87 | 0,1558 | 0,0091 | ||

| AIMCO AIMCO 2015 AA AR3 144A / ABS-CBDO (US00900LAY02) | 4,91 | 0,14 | 0,1545 | -0,0037 | ||

| US1266735Z13 / COUNTRYWIDE ASSET BACKED CERTI CWL 2005 8 M6 | 4,90 | 0,16 | 0,1543 | -0,0036 | ||

| US75115YAA73 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QO1 A1 | 4,90 | -4,86 | 0,1542 | -0,0119 | ||

| US576449AB88 / MASTR Asset-Backed Securities Trust, Series 2006-HE4, Class A2 | 4,81 | -2,00 | 0,1513 | -0,0070 | ||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A3 / ABS-O (US448973AD90) | 4,74 | -0,02 | 0,1493 | -0,0038 | ||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A3 / ABS-O (US448973AD90) | 4,74 | -0,02 | 0,1493 | -0,0038 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 HYB2 A1 144A / ABS-MBS (US67118RAA68) | 4,69 | -4,58 | 0,1476 | -0,0110 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 HYB2 A1 144A / ABS-MBS (US67118RAA68) | 4,69 | -4,58 | 0,1476 | -0,0110 | ||

| VOLKSWAGEN GROUP OF AM / DBT (US92866BU298) | 4,68 | 0,1473 | 0,1473 | |||

| VOLKSWAGEN GROUP OF AM / DBT (US92866BU298) | 4,68 | 0,1473 | 0,1473 | |||

| CVC CORDATUS OPPORTUNITY LOAN COLFR 1A BR 144A / ABS-CBDO (XS3020835685) | 4,66 | 9,08 | 0,1467 | 0,0089 | ||

| CVC CORDATUS OPPORTUNITY LOAN COLFR 1A BR 144A / ABS-CBDO (XS3020835685) | 4,66 | 9,08 | 0,1467 | 0,0089 | ||

| US31418CSG05 / Fannie Mae Pool | 4,64 | -4,49 | 0,1461 | -0,0107 | ||

| US16159RAC97 / Chase Home Lending Mortgage Trust 2023-RPL2 | 4,62 | -1,75 | 0,1453 | -0,0063 | ||

| US92922F7Q56 / WaMu Mortgage Pass-Through Certificates Series 2005-AR17 Trust | 4,55 | -0,29 | 0,1431 | -0,0040 | ||

| US59023AAC09 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 MLN1 A2B | 4,54 | -11,49 | 0,1430 | -0,0226 | ||

| INVESCO EURO CLO INVSC 3A AR / ABS-CBDO (XS2867986593) | 4,53 | 8,85 | 0,1425 | 0,0083 | ||

| INVESCO EURO CLO INVSC 3A AR / ABS-CBDO (XS2867986593) | 4,53 | 8,85 | 0,1425 | 0,0083 | ||

| RFR USD SOFR/3.00000 06/21/23-10Y CME / DIR (EZVCRM3XZB08) | 4,53 | -37,97 | 0,1425 | -0,0930 | ||

| RFR USD SOFR/3.00000 06/21/23-10Y CME / DIR (EZVCRM3XZB08) | 4,53 | -37,97 | 0,1425 | -0,0930 | ||

| US78445QAE17 / SLM Private Education Loan Trust 2010-C | 4,52 | -3,93 | 0,1423 | -0,0095 | ||

| US52522CAE30 / LEHMAN XS TRUST LXS 2006 14N 2A | 4,52 | -1,20 | 0,1423 | -0,0054 | ||

| FNMA POOL BZ2331 FN 08/30 FIXED 4.86 / ABS-MBS (US3140NWSV86) | 4,52 | 0,51 | 0,1421 | -0,0029 | ||

| FNMA POOL BZ2331 FN 08/30 FIXED 4.86 / ABS-MBS (US3140NWSV86) | 4,52 | 0,51 | 0,1421 | -0,0029 | ||

| US87241EAQ89 / TCW CLO 2019-1 AMR Ltd | 4,51 | 0,24 | 0,1419 | -0,0032 | ||

| BINOM SECURITIZATION TRUST BINOM 2022 INV1 A1 144A / ABS-MBS (US090975AA18) | 4,47 | -4,12 | 0,1406 | -0,0097 | ||

| BINOM SECURITIZATION TRUST BINOM 2022 INV1 A1 144A / ABS-MBS (US090975AA18) | 4,47 | -4,12 | 0,1406 | -0,0097 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 4,44 | 0,1398 | 0,1398 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 4,44 | 0,1398 | 0,1398 | |||

| US05377RHL15 / Avis Budget Rental Car Funding AESOP LLC | 4,42 | 0,18 | 0,1392 | -0,0032 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 6 A11 144A / ABS-MBS (US161931AP54) | 4,42 | -15,06 | 0,1390 | -0,0288 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 6 A11 144A / ABS-MBS (US161931AP54) | 4,42 | -15,06 | 0,1390 | -0,0288 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2025 N1 B 144A / ABS-O (US14688XAD93) | 4,40 | 0,43 | 0,1384 | -0,0029 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2025 N1 B 144A / ABS-O (US14688XAD93) | 4,40 | 0,43 | 0,1384 | -0,0029 | ||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 4,37 | 4,08 | 0,1374 | 0,0020 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 4,35 | 0,1370 | 0,1370 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 4,35 | 0,1370 | 0,1370 | |||

| US48251JAN37 / KKR FINANCIAL CLO LTD KKR 18 BR 144A | 4,31 | 0,16 | 0,1358 | -0,0032 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 4,31 | 50,28 | 0,1357 | 0,0431 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 4,31 | 50,28 | 0,1357 | 0,0431 | ||

| US46149MAA45 / Invesco CLO Ltd., Series 2021-2A, Class A | 4,31 | 0,1356 | 0,1356 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 4,23 | 0,1332 | 0,1332 | |||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 4,20 | -5,92 | 0,1322 | -0,0119 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 4,20 | -5,92 | 0,1322 | -0,0119 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 4,18 | 0,1317 | 0,1317 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 4,18 | 0,1317 | 0,1317 | |||

| FNMA POOL BS9613 FN 10/28 FIXED 4.77 / ABS-MBS (US3140LLVF52) | 4,08 | 0,30 | 0,1283 | -0,0028 | ||

| FNMA POOL BS9613 FN 10/28 FIXED 4.77 / ABS-MBS (US3140LLVF52) | 4,08 | 0,30 | 0,1283 | -0,0028 | ||

| US41164YAB74 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2007 4 2A1 | 4,05 | -0,93 | 0,1274 | -0,0044 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2023 RPL3 A1 144A / ABS-MBS (US161927AC22) | 4,03 | -2,14 | 0,1269 | -0,0060 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 4,00 | 0,1259 | 0,1259 | |||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 3,99 | 0,13 | 0,1255 | -0,0030 | ||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 3,99 | 0,13 | 0,1255 | -0,0030 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBK30) | 3,98 | 1,04 | 0,1254 | -0,0018 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBK30) | 3,98 | 1,04 | 0,1254 | -0,0018 | ||

| VOYA CLO LTD VOYA 2019 2A AR 144A / ABS-CBDO (US92917RAL33) | 3,98 | -1,27 | 0,1252 | -0,0048 | ||

| VOYA CLO LTD VOYA 2019 2A AR 144A / ABS-CBDO (US92917RAL33) | 3,98 | -1,27 | 0,1252 | -0,0048 | ||

| XS2373706519 / Carlyle Euro CLO 2019-2 DAC | 3,95 | 8,40 | 0,1244 | 0,0068 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 10A AV 144A / ABS-CBDO (US03332AAA88) | 3,94 | 1,05 | 0,1239 | -0,0018 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 10A AV 144A / ABS-CBDO (US03332AAA88) | 3,94 | 1,05 | 0,1239 | -0,0018 | ||

| US85855CAB63 / Stellantis Finance US Inc | 3,89 | 1,41 | 0,1224 | -0,0013 | ||

| US19424WAB37 / COLLEGE AVE STUDENT LOANS 2021-C LLC CASL 2021-C A2 | 3,86 | -2,72 | 0,1215 | -0,0065 | ||

| US962166BY91 / Weyerhaeuser Co | 3,79 | 1,26 | 0,1194 | -0,0015 | ||

| HENLEY FUNDING LTD. HNLY 7A AR / ABS-CBDO (XS2874094274) | 3,77 | 8,72 | 0,1185 | 0,0068 | ||

| HENLEY FUNDING LTD. HNLY 7A AR / ABS-CBDO (XS2874094274) | 3,77 | 8,72 | 0,1185 | 0,0068 | ||

| US86358EDG89 / STRUCTURED ASSET INVESTMENT LO SAIL 2003 BC9 2A | 3,71 | -11,29 | 0,1168 | -0,0182 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 3,71 | 0,1168 | 0,1168 | |||

| 37 CAPITAL CLO LTD PUTNM 2021 1A AR 144A / ABS-CBDO (US88430TAQ40) | 3,70 | 0,11 | 0,1166 | -0,0028 | ||

| SYMPHONY CLO LTD SYMP 2020 22A A1AR 144A / ABS-CBDO (US87167GCH11) | 3,70 | -0,08 | 0,1166 | -0,0030 | ||

| SYMPHONY CLO LTD SYMP 2020 22A A1AR 144A / ABS-CBDO (US87167GCH11) | 3,70 | -0,08 | 0,1166 | -0,0030 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL1 A1A 144A / ABS-MBS (US16159MAA45) | 3,70 | -2,99 | 0,1164 | -0,0066 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL1 A1A 144A / ABS-MBS (US16159MAA45) | 3,70 | -2,99 | 0,1164 | -0,0066 | ||

| ATLX TRUST ATLX 2024 RPL1 A1 144A / ABS-MBS (US049915AA90) | 3,69 | -1,71 | 0,1161 | -0,0050 | ||

| ATLX TRUST ATLX 2024 RPL1 A1 144A / ABS-MBS (US049915AA90) | 3,69 | -1,71 | 0,1161 | -0,0050 | ||

| NDDUEAFE TRS EQUITY FEDL01+36 JPM / DE (000000000) | 3,67 | 0,1154 | 0,1154 | |||

| NDDUEAFE TRS EQUITY FEDL01+36 JPM / DE (000000000) | 3,67 | 0,1154 | 0,1154 | |||

| SCE.PRK / SCE Trust V - Preferred Security | 3,64 | 0,36 | 0,1145 | -0,0024 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 3,64 | 0,36 | 0,1145 | -0,0024 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 1 A3 / ABS-O (US36268GAD79) | 3,62 | -0,06 | 0,1139 | -0,0030 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 1 A3 / ABS-O (US36268GAD79) | 3,62 | -0,06 | 0,1139 | -0,0030 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 3,61 | 0,1135 | 0,1135 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 3,61 | 0,1135 | 0,1135 | |||

| TOWD POINT MORTGAGE TRUST TPMT 2024 CES3 A1 144A / ABS-MBS (US89183EAA91) | 3,60 | -8,43 | 0,1132 | -0,0135 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 CES3 A1 144A / ABS-MBS (US89183EAA91) | 3,60 | -8,43 | 0,1132 | -0,0135 | ||

| US61747YEC57 / Morgan Stanley | 3,59 | 0,93 | 0,1130 | -0,0018 | ||

| US65536MAE75 / NOMURA HOME EQUITY LOAN INC NHELI 2006 HE2 M1 | 3,59 | -2,61 | 0,1130 | -0,0059 | ||

| US92539XAA28 / Verus Securitization Trust 2023-6 | 3,57 | -7,83 | 0,1122 | -0,0126 | ||

| FED HM LN PC POOL RJ0049 FR 10/53 FIXED 5 / ABS-MBS (US3142GQBT84) | 3,56 | -2,01 | 0,1120 | -0,0052 | ||

| FED HM LN PC POOL RJ0049 FR 10/53 FIXED 5 / ABS-MBS (US3142GQBT84) | 3,56 | -2,01 | 0,1120 | -0,0052 | ||

| US75405WAG78 / RESIDENTIAL ASSET SECURITIES C RASC 2005 KS10 M3 | 3,54 | -6,02 | 0,1116 | -0,0101 | ||

| US41162DAD12 / HarborView Mortgage Loan Trust 2006-12 | 3,54 | -1,88 | 0,1115 | -0,0050 | ||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2025 1A B 144A / ABS-CBDO (XS2999624070) | 3,54 | 9,22 | 0,1115 | 0,0068 | ||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2025 1A B 144A / ABS-CBDO (XS2999624070) | 3,54 | 9,22 | 0,1115 | 0,0068 | ||

| XS2309452766 / GRIFFITH PARK CLO GRIPK 1A A1RA 144A | 3,54 | -15,00 | 0,1114 | -0,0229 | ||

| US39539GAA04 / GREENPOINT MORTGAGE FUNDING TR GPMF 2006 OH1 A1 | 3,52 | -1,01 | 0,1109 | -0,0039 | ||

| US70069FBV85 / PARK PLACE SECURITIES INC PPSI 2004 WHQ1 M5 | 3,50 | 0,32 | 0,1101 | -0,0024 | ||

| US842587DE49 / Southern Co. (The), Series A | 3,48 | 1,52 | 0,1095 | -0,0011 | ||

| REPUBLIC OF PANAMA EUR TERM LOAN 2 / LON (BA000HCH9) | 3,43 | 9,44 | 0,1080 | 0,0068 | ||

| REPUBLIC OF PANAMA EUR TERM LOAN 2 / LON (BA000HCH9) | 3,43 | 9,44 | 0,1080 | 0,0068 | ||

| MX0SGO0000K0 / Mexican Udibonos | 3,42 | 11,64 | 0,1078 | 0,0088 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 3,38 | 0,1064 | 0,1064 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 3,38 | 0,1064 | 0,1064 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP BOA / DCR (EZ2BLZ4YH9B3) | 3,38 | 0,1063 | 0,1063 | |||

| US74143JAA97 / PRET 2021-RN3 LLC | 3,36 | -4,11 | 0,1058 | -0,0073 | ||

| MX0MGO0001F1 / Mexican Bonos | 3,34 | -1,65 | 0,1052 | -0,0045 | ||

| US86361HAB06 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR7 A1BG | 3,32 | -2,36 | 0,1044 | -0,0052 | ||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 3,29 | 0,61 | 0,1036 | -0,0019 | ||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 3,29 | 0,61 | 0,1036 | -0,0019 | ||

| US14686TAC27 / CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P2 A3 144A | 3,26 | -22,45 | 0,1028 | -0,0331 | ||

| MOUNTAIN VIEW CLO MVEW 2022 1A A1R 144A / ABS-CBDO (US62432UAN19) | 3,20 | 0,06 | 0,1009 | -0,0025 | ||

| US61744CXN19 / MSAC 2006-WMC1 M1 | 3,20 | 0,88 | 0,1008 | -0,0016 | ||

| OZLM LTD OZLM 2014 9A A1A4 144A / ABS-CBDO (US67109KBG85) | 3,20 | -24,31 | 0,1006 | -0,0357 | ||

| OZLM LTD OZLM 2014 9A A1A4 144A / ABS-CBDO (US67109KBG85) | 3,20 | -24,31 | 0,1006 | -0,0357 | ||

| MX0MGO000102 / Mexican Bonos | 3,17 | -8,06 | 0,0998 | -0,0115 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 NQM9 A1 144A / ABS-MBS (US67119DAA63) | 3,14 | -6,96 | 0,0989 | -0,0101 | ||

| WISE CLO LTD WYZE 2025 2A B 144A / ABS-CBDO (US97720BAC46) | 3,13 | 0,26 | 0,0985 | -0,0022 | ||

| WISE CLO LTD WYZE 2025 2A B 144A / ABS-CBDO (US97720BAC46) | 3,13 | 0,26 | 0,0985 | -0,0022 | ||

| US55283QAA22 / MFA 2021-RPL1 Trust | 3,12 | -4,30 | 0,0982 | -0,0070 | ||

| US83611MKZ04 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 1 A5 | 3,11 | -5,18 | 0,0979 | -0,0080 | ||

| US55285WAA71 / MFA Trust, Series 2023-NQM2, Class A1 | 3,11 | -3,51 | 0,0979 | -0,0061 | ||

| US36361UAQ31 / GALLATIN LOAN MANAGEMENT, LLC GALL 2017 1A B1R 144A | 3,11 | -0,06 | 0,0978 | -0,0025 | ||

| US749241AA33 / RALI Series 2007-QH9 Trust | 3,10 | -1,93 | 0,0977 | -0,0044 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 5 A1 144A / ABS-MBS (US92540HAA41) | 3,09 | -9,71 | 0,0972 | -0,0131 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 5 A1 144A / ABS-MBS (US92540HAA41) | 3,09 | -9,71 | 0,0972 | -0,0131 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 3,09 | 0,52 | 0,0972 | -0,0019 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 3,09 | 0,52 | 0,0972 | -0,0019 | ||

| ALBACORE EURO CLO ALBAC 4A AR 144A / ABS-CBDO (XS2861758642) | 3,07 | 9,15 | 0,0965 | 0,0059 | ||

| ALBACORE EURO CLO ALBAC 4A AR 144A / ABS-CBDO (XS2861758642) | 3,07 | 9,15 | 0,0965 | 0,0059 | ||

| ZAG000077470 / Republic of South Africa Government Bond | 3,06 | 7,29 | 0,0963 | 0,0043 | ||

| US36267FAE88 / GLS AUTO SELECT RECEIVABLES TR GSAR 2023 1A A3 144A | 3,06 | -0,42 | 0,0963 | -0,0028 | ||

| AVOCA STATIC CLO AVOST 1A AR 144A / ABS-CBDO (XS2935873880) | 3,05 | 0,66 | 0,0960 | -0,0018 | ||

| AVOCA STATIC CLO AVOST 1A AR 144A / ABS-CBDO (XS2935873880) | 3,05 | 0,66 | 0,0960 | -0,0018 | ||

| US3133KQPE07 / Freddie Mac Pool | 3,05 | -0,33 | 0,0960 | -0,0027 | ||

| US55379AAC80 / M360 2021-CRE3 Ltd | 3,05 | -0,07 | 0,0960 | -0,0025 | ||

| COLT FUNDING LLC COLT 2024 3 A1 144A / ABS-MBS (US19688VAA89) | 3,05 | -7,62 | 0,0959 | -0,0105 | ||

| COLT FUNDING LLC COLT 2024 3 A1 144A / ABS-MBS (US19688VAA89) | 3,05 | -7,62 | 0,0959 | -0,0105 | ||

| US67117PAA12 / OBX Trust, Series 2023-NQM3, Class A1 | 3,04 | -5,50 | 0,0958 | -0,0081 | ||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RD17) | 3,03 | 0,0954 | 0,0954 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 3,02 | 0,0952 | 0,0952 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 3,02 | 0,0952 | 0,0952 | |||

| FNMA POOL BS9073 FN 07/30 FIXED 4.54 / ABS-MBS (US3140LLCK58) | 3,01 | 0,67 | 0,0947 | -0,0017 | ||

| FNMA POOL BS9073 FN 07/30 FIXED 4.54 / ABS-MBS (US3140LLCK58) | 3,01 | 0,67 | 0,0947 | -0,0017 | ||

| LCM LTD PARTNERSHIP LCM 31A AR 144A / ABS-CBDO (US50201QAL86) | 3,00 | 0,20 | 0,0945 | -0,0022 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2024 F A1A 144A / ABS-O (US83207VAA61) | 2,95 | -2,92 | 0,0930 | -0,0052 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2024 F A1A 144A / ABS-O (US83207VAA61) | 2,95 | -2,92 | 0,0930 | -0,0052 | ||

| US92925CDA71 / WaMu Mortgage Pass-Through Certificates Series 2006-AR3 Trust | 2,94 | -2,97 | 0,0926 | -0,0052 | ||

| US452152GS43 / Illinois, General Obligation Bonds, Taxable Build America Bonds | 2,94 | -1,41 | 0,0926 | -0,0037 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 2,94 | -25,20 | 0,0926 | -0,0343 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 2,94 | -25,20 | 0,0926 | -0,0343 | ||

| US542512AD07 / Long Beach Mortgage Loan Trust 2006-11 | 2,94 | -0,84 | 0,0924 | -0,0031 | ||

| US75970JAF30 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 1 AF3 | 2,92 | -10,94 | 0,0920 | -0,0139 | ||

| FNMA POOL BW2319 FN 08/52 FIXED 4.5 / ABS-MBS (US3140MTSH72) | 2,92 | -4,30 | 0,0919 | -0,0065 | ||

| FNMA POOL BW2319 FN 08/52 FIXED 4.5 / ABS-MBS (US3140MTSH72) | 2,92 | -4,30 | 0,0919 | -0,0065 | ||

| US12598JAC53 / CSMC 2021-RPL7 Trust | 2,89 | -3,44 | 0,0910 | -0,0056 | ||

| NDDUEAFE TRS EQUITY FEDL01+35 GST / DE (000000000) | 2,88 | 0,0907 | 0,0907 | |||

| NDDUEAFE TRS EQUITY FEDL01+35 GST / DE (000000000) | 2,88 | 0,0907 | 0,0907 | |||

| NDDUEAFE TRS EQUITY FEDL01+32 JPM / DE (000000000) | 2,88 | 0,0906 | 0,0906 | |||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 2,84 | 0,92 | 0,0894 | -0,0014 | ||

| US751153AA50 / RALI SERIES 2006-QO10 TRUST RALI 2006-QO10 A1 | 2,83 | -3,51 | 0,0891 | -0,0056 | ||

| CIM TRUST CIM 2024 R1 A1 144A / ABS-MBS (US17179VAA89) | 2,82 | -4,22 | 0,0886 | -0,0062 | ||

| US03072SVS12 / AMERIQUEST MORTGAGE SECURITIES AMSI 2004 R10 M2 | 2,79 | 0,50 | 0,0879 | -0,0018 | ||

| PRP ADVISORS, LLC PRPM 2025 RCF1 A1 144A / ABS-MBS (US74390RAA14) | 2,78 | -4,27 | 0,0876 | -0,0062 | ||

| PRP ADVISORS, LLC PRPM 2025 RCF1 A1 144A / ABS-MBS (US74390RAA14) | 2,78 | -4,27 | 0,0876 | -0,0062 | ||

| FREDDIE MAC FHR 5549 BF / ABS-MBS (US3137HLS527) | 2,77 | 0,0872 | 0,0872 | |||

| FREDDIE MAC FHR 5549 BF / ABS-MBS (US3137HLS527) | 2,77 | 0,0872 | 0,0872 | |||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 2,74 | 0,0864 | 0,0864 | |||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 2,74 | 0,0864 | 0,0864 | |||

| US69547UAC27 / PAID_23-6 | 2,65 | -8,80 | 0,0835 | -0,0103 | ||

| US93364EAA29 / WaMu Asset-Backed Certificates WaMu Series 2007-HE3 Trust | 2,65 | -2,51 | 0,0833 | -0,0043 | ||

| PRKCM TRUST PRKCM 2024 HOME1 A1 144A / ABS-MBS (US69391XAA72) | 2,64 | -10,46 | 0,0833 | -0,0121 | ||

| PRKCM TRUST PRKCM 2024 HOME1 A1 144A / ABS-MBS (US69391XAA72) | 2,64 | -10,46 | 0,0833 | -0,0121 | ||

| US780097BG51 / NatWest Group PLC | 2,63 | 0,81 | 0,0827 | -0,0014 | ||

| US12668UAG67 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 3 2A3 | 2,60 | -2,11 | 0,0819 | -0,0039 | ||

| NDDUEAFE TRS EQUITY FEDL01+28 CBK / DE (000000000) | 2,58 | 0,0812 | 0,0812 | |||

| TRT061124T11 / Turkey Government Bond | 2,58 | -2,72 | 0,0812 | -0,0044 | ||

| R2037 / South Africa - Sovereign or Government Agency Debt | 2,55 | 8,41 | 0,0803 | 0,0044 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,52 | 0,08 | 0,0795 | -0,0019 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2,52 | 0,08 | 0,0795 | -0,0019 | ||

| TRT061124T11 / Turkey Government Bond | 2,51 | -2,26 | 0,0790 | -0,0039 | ||

| BRSTNCLTN7Z6 / BRAZIL LTN BRL 0.0% 07-01-25 | 2,50 | -91,07 | 0,0788 | -0,8247 | ||

| US95000U2S19 / Wells Fargo & Co | 2,50 | 0,97 | 0,0787 | -0,0012 | ||

| XS2350015942 / CARLYLE GLOBAL MARKET STRATEGI CGMSE 2017 3A A1R 144A | 2,46 | -11,55 | 0,0774 | -0,0123 | ||

| US673919AL09 / OBX Trust, Series 2023-NQM5, Class A1A | 2,39 | -6,98 | 0,0751 | -0,0077 | ||

| FNMA POOL BZ0976 FN 05/29 FIXED 4.85 / ABS-MBS (US3140NVCN51) | 2,38 | 0,30 | 0,0749 | -0,0017 | ||

| FNMA POOL BZ0976 FN 05/29 FIXED 4.85 / ABS-MBS (US3140NVCN51) | 2,38 | 0,30 | 0,0749 | -0,0017 | ||

| RFR USD SOFR/3.00000 03/19/25-5Y CME / DIR (EZ9JNZJCQVZ3) | 2,38 | -26,90 | 0,0748 | -0,0301 | ||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2024 1A BR 144A / ABS-CBDO (XS3040415286) | 2,36 | 9,25 | 0,0744 | 0,0046 | ||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2024 1A BR 144A / ABS-CBDO (XS3040415286) | 2,36 | 9,25 | 0,0744 | 0,0046 | ||

| CROSS MORTGAGE TRUST CROSS 2024 H2 A1 144A / ABS-MBS (US22757BAA26) | 2,36 | -9,24 | 0,0742 | -0,0096 | ||

| ANGEL OAK MORTGAGE TRUST AOMT 2024 2 A1 144A / ABS-MBS (US034942AA08) | 2,35 | -3,81 | 0,0740 | -0,0048 | ||

| ANGEL OAK MORTGAGE TRUST AOMT 2024 2 A1 144A / ABS-MBS (US034942AA08) | 2,35 | -3,81 | 0,0740 | -0,0048 | ||

| STRATTON MORTGAGE FUNDING PLC STRA 2024 1A A 144A / ABS-MBS (XS2728570248) | 2,35 | 0,17 | 0,0739 | -0,0017 | ||

| STRATTON MORTGAGE FUNDING PLC STRA 2024 1A A 144A / ABS-MBS (XS2728570248) | 2,35 | 0,17 | 0,0739 | -0,0017 | ||

| XS1794675931 / Fairfax Financial Holdings Ltd | 2,34 | 10,05 | 0,0738 | 0,0051 | ||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 1 A11 144A / ABS-MBS (US17332CBX39) | 2,34 | -9,47 | 0,0737 | -0,0098 | ||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2024 1 A11 144A / ABS-MBS (US17332CBX39) | 2,34 | -9,47 | 0,0737 | -0,0098 | ||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 2,32 | -5,30 | 0,0731 | -0,0060 | ||

| US83406TAB89 / SoFi Professional Loan Program 2020-ATrust | 2,32 | -7,27 | 0,0731 | -0,0077 | ||

| RAD CLO LTD RAD 2019 4A AR 144A / ABS-CBDO (US749984AA83) | 2,31 | -16,29 | 0,0728 | -0,0164 | ||

| RAD CLO LTD RAD 2019 4A AR 144A / ABS-CBDO (US749984AA83) | 2,31 | -16,29 | 0,0728 | -0,0164 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 2,31 | 0,04 | 0,0728 | -0,0018 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 2,31 | 0,04 | 0,0728 | -0,0018 | ||

| US715638BE14 / Peruvian Government International Bond | 2,28 | -15,63 | 0,0719 | -0,0155 | ||

| US93935LAB45 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2006 AR8 2A | 2,28 | -0,91 | 0,0719 | -0,0025 | ||

| US80287DAC11 / SDART 23-6 A3 5.93% 07-17-28/07-15-26 | 2,28 | -9,57 | 0,0716 | -0,0096 | ||

| XS1725823469 / MADISON PARK EURO FUNDING CADOG 10A A1 144A | 2,27 | 6,62 | 0,0715 | 0,0027 | ||

| US12666BAA35 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 22 1A | 2,26 | -0,57 | 0,0712 | -0,0022 | ||

| CZECH / Czech Republic Government Bond | 2,26 | 9,86 | 0,0712 | 0,0048 | ||

| NDDUEAFE TRS EQUITY FEDL01+30 ULO / DE (000000000) | 2,26 | 0,0711 | 0,0711 | |||

| NDDUEAFE TRS EQUITY FEDL01+30 ULO / DE (000000000) | 2,26 | 0,0711 | 0,0711 | |||

| US55275NAE13 / MARM 2006-0A2 2A1 | 2,25 | 7,30 | 0,0708 | 0,0032 | ||

| CARLYLE EURO CLO CGMSE 2019 2A A2EB 144A / ABS-CBDO (XS2373707327) | 2,25 | 8,33 | 0,0708 | 0,0038 | ||

| US126650DJ69 / CVS Health Corp | 2,24 | 1,64 | 0,0704 | -0,0006 | ||

| US054561AJ49 / AXA EQUITABLE HOLDINGS I SR UNSECURED 04/28 4.35 | 2,23 | 0,68 | 0,0702 | -0,0013 | ||

| PRKCM TRUST PRKCM 2024 AFC1 A1 144A / ABS-MBS (US69380WAA27) | 2,22 | -11,64 | 0,0700 | -0,0112 | ||

| PRKCM TRUST PRKCM 2024 AFC1 A1 144A / ABS-MBS (US69380WAA27) | 2,22 | -11,64 | 0,0700 | -0,0112 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 2,21 | 0,23 | 0,0697 | -0,0016 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 2,21 | 0,23 | 0,0697 | -0,0016 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/28 5.05 / DBT (US928668CP53) | 2,21 | 0,64 | 0,0697 | -0,0013 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 1 A2A / ABS-O (US14318WAB37) | 2,20 | -44,72 | 0,0694 | -0,0593 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 1 A2A / ABS-O (US14318WAB37) | 2,20 | -44,72 | 0,0694 | -0,0593 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVF74) | 2,20 | 0,0691 | 0,0691 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVF74) | 2,20 | 0,0691 | 0,0691 | |||

| US654744AB77 / Nissan Motor Co Ltd | 2,19 | 0,46 | 0,0689 | -0,0014 | ||

| NDDUEAFE TRS EQUITY FEDL01+32 ULO / DE (000000000) | 2,18 | 0,0685 | 0,0685 | |||

| US17310UAB89 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AR1 A2 | 2,18 | -2,55 | 0,0685 | -0,0036 | ||

| GCAT GCAT 2024 NQM2 A1 144A / ABS-MBS (US36831CAA09) | 2,17 | -10,17 | 0,0682 | -0,0096 | ||

| US67448GAA13 / OBX 23-NQM4 A1 144A 6.113% 03-25-63/05-25-27 | 2,16 | -6,80 | 0,0682 | -0,0068 | ||

| NDDUEAFE TRS EQUITY FEDL01+47 CBK / DE (000000000) | 2,16 | 0,0681 | 0,0681 | |||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 2,16 | 0,47 | 0,0680 | -0,0014 | ||

| US22846FAE88 / CROWN POINT CLO LTD CRNPT 2021 10A B 144A | 2,16 | 0,33 | 0,0678 | -0,0015 | ||

| US14686TAD00 / Carvana Auto Receivables Trust, Series 2023-P2, Class A4 | 2,15 | -0,19 | 0,0676 | -0,0019 | ||

| PRP ADVISORS, LLC PRPM 2024 RPL1 A1 144A / ABS-MBS (US69380XAA00) | 2,12 | -3,42 | 0,0667 | -0,0041 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 3A A3 / ABS-O (US30165AAC99) | 2,10 | -0,28 | 0,0662 | -0,0019 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 3A A3 / ABS-O (US30165AAC99) | 2,10 | -0,28 | 0,0662 | -0,0019 | ||

| US89289EBA10 / TRALEE CDO LTD TRAL 2019 6A AJR 144A | 2,10 | -0,05 | 0,0662 | -0,0017 | ||

| US59022QAC69 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 HE5 A2B | 2,10 | -1,36 | 0,0662 | -0,0026 | ||

| FNMA POOL CB7320 FN 09/53 FIXED 4.5 / ABS-MBS (US3140QTD220) | 2,10 | -0,33 | 0,0660 | -0,0019 | ||

| FCT / Fincantieri S.p.A. | 2,09 | 1,90 | 0,0658 | -0,0004 | ||

| FCT / Fincantieri S.p.A. | 2,09 | 1,90 | 0,0658 | -0,0004 | ||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 2,09 | -2,84 | 0,0658 | -0,0036 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,08 | 1,62 | 0,0653 | -0,0006 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2,08 | 1,62 | 0,0653 | -0,0006 | ||

| US61753NAA81 / MORGAN STANLEY CAPITAL INC MSAC 2007 NC2 A1 144A | 2,06 | -0,34 | 0,0648 | -0,0019 | ||

| ONSLOW BAY FINANCIAL LLC OBX 2024 NQM8 A1 144A / ABS-MBS (US67119CAA80) | 2,06 | -7,76 | 0,0647 | -0,0072 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 2 A2A 144A / ABS-O (US17331XAB73) | 2,04 | -47,91 | 0,0644 | -0,0623 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 2 A2A 144A / ABS-O (US17331XAB73) | 2,04 | -47,91 | 0,0644 | -0,0623 | ||

| R2032 / South Africa - Corporate Bond/Note | 2,04 | 7,52 | 0,0643 | 0,0030 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8B93) | 2,04 | 0,29 | 0,0643 | -0,0014 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8B93) | 2,04 | 0,29 | 0,0643 | -0,0014 | ||

| US74333QAA31 / Progress Residential Trust, Series 2021-SFR9, Class A | 2,02 | 2,07 | 0,0637 | -0,0003 | ||

| US81377AAE29 / SECURITIZED ASSET BACKED RECEI SABR 2006 HE2 A2D | 2,02 | -0,59 | 0,0637 | -0,0020 | ||

| US48275EAA47 / KREF 2022-FL3 Ltd | 2,00 | -13,57 | 0,0630 | -0,0117 | ||

| HPS CORPORATE LENDING FU SR UNSECURED 04/32 5.95 / DBT (US40440VAK17) | 1,99 | 0,0627 | 0,0627 | |||

| HPS CORPORATE LENDING FU SR UNSECURED 04/32 5.95 / DBT (US40440VAK17) | 1,99 | 0,0627 | 0,0627 | |||

| TOYOTA AUTO RECEIVABLES OWNER TAOT 2024 C A2A / ABS-O (US89237QAB68) | 1,95 | -29,35 | 0,0613 | -0,0276 | ||

| TOYOTA AUTO RECEIVABLES OWNER TAOT 2024 C A2A / ABS-O (US89237QAB68) | 1,95 | -29,35 | 0,0613 | -0,0276 | ||

| US03512TAF84 / AngloGold Ashanti Holdings PLC | 1,91 | 1,17 | 0,0601 | -0,0008 | ||

| US05552CAA27 / BINOM Securitization Trust 2022-RPL1 | 1,89 | -1,71 | 0,0596 | -0,0026 | ||

| CDX IG43 5Y ICE / DCR (EZ10N17RBN04) | 1,89 | -84,76 | 0,0595 | -0,3409 | ||

| CDX IG43 5Y ICE / DCR (EZ10N17RBN04) | 1,89 | -84,76 | 0,0595 | -0,3409 | ||

| PRETIUM MORTGAGE CREDIT PARTNE PRET 2024 RN2 A1 144A / ABS-MBS (US69391YAA55) | 1,89 | -2,73 | 0,0595 | -0,0032 | ||

| US55275NAA90 / MASTR Adjustable Rate Mortgages Trust 2006-OA2 | 1,89 | 0,16 | 0,0594 | -0,0014 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,88 | 1,08 | 0,0592 | -0,0008 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1,88 | 1,08 | 0,0592 | -0,0008 | ||

| AMERICREDIT AUTOMOBILE RECEIVA AMCAR 2024 1 A2A / ABS-O (US023947AB05) | 1,87 | -36,55 | 0,0589 | -0,0363 | ||

| US28504DAB91 / Electricite de France SA | 1,85 | 0,32 | 0,0584 | -0,0013 | ||

| US30331GAC50 / FHF Trust 2023-1 | 1,85 | -23,30 | 0,0583 | -0,0196 | ||

| US12481QAC96 / CBAM 2018-5 Ltd | 1,82 | -24,47 | 0,0573 | -0,0205 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,81 | 0,33 | 0,0571 | -0,0012 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,81 | 0,33 | 0,0571 | -0,0012 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 1,80 | 0,0567 | 0,0567 | |||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 1,80 | 0,0567 | 0,0567 | |||

| PROLOGIS LP SR UNSECURED 01/35 5 / DBT (US74340XCN93) | 1,80 | 0,73 | 0,0567 | -0,0010 | ||

| PROLOGIS LP SR UNSECURED 01/35 5 / DBT (US74340XCN93) | 1,80 | 0,73 | 0,0567 | -0,0010 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES4 A1A 144A / ABS-MBS (US74939FAA57) | 1,79 | -8,15 | 0,0564 | -0,0066 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES4 A1A 144A / ABS-MBS (US74939FAA57) | 1,79 | -8,15 | 0,0564 | -0,0066 | ||

| US3133KR3E22 / FED HM LN PC POOL RA9797 FR 09/53 FIXED 5 | 1,79 | -1,92 | 0,0564 | -0,0025 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 R1 A1 144A / ABS-MBS (US924926AA67) | 1,77 | -5,49 | 0,0559 | -0,0047 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 R1 A1 144A / ABS-MBS (US924926AA67) | 1,77 | -5,49 | 0,0559 | -0,0047 | ||

| FIRST HELP FINANCIAL LLC FHF 2024 3A A2 144A / ABS-O (US30339EAB48) | 1,77 | -11,48 | 0,0559 | -0,0088 | ||

| FIRST HELP FINANCIAL LLC FHF 2024 3A A2 144A / ABS-O (US30339EAB48) | 1,77 | -11,48 | 0,0559 | -0,0088 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVE00) | 1,77 | 0,0557 | 0,0557 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVE00) | 1,77 | 0,0557 | 0,0557 | |||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 1,73 | 54,89 | 0,0544 | 0,0184 | ||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 1,73 | 54,89 | 0,0544 | 0,0184 | ||

| US65535HAS85 / Nomura Holdings Inc | 1,72 | 1,77 | 0,0543 | -0,0004 | ||

| PRP ADVISORS, LLC PRPM 2024 RPL3 A1 144A / ABS-MBS (US69381LAA52) | 1,72 | -2,87 | 0,0543 | -0,0030 | ||

| PRP ADVISORS, LLC PRPM 2024 RPL3 A1 144A / ABS-MBS (US69381LAA52) | 1,72 | -2,87 | 0,0543 | -0,0030 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,72 | 1,36 | 0,0540 | -0,0006 | ||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1,72 | 1,36 | 0,0540 | -0,0006 | ||

| US12670FAA84 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 9 1A | 1,70 | -0,81 | 0,0537 | -0,0018 | ||

| FNMA POOL BS9220 FN 08/30 FIXED 4.72 / ABS-MBS (US3140LLG627) | 1,70 | 0,18 | 0,0535 | -0,0013 | ||

| FNMA POOL BS9220 FN 08/30 FIXED 4.72 / ABS-MBS (US3140LLG627) | 1,70 | 0,18 | 0,0535 | -0,0013 | ||

| US59024JAA43 / Merrill Lynch Alternative Note Asset Trust Series 2007-OAR3 | 1,70 | -4,39 | 0,0535 | -0,0039 | ||

| NDDUEAFE TRS EQUITY SOFR+28 MYI / DE (000000000) | 1,69 | 0,0532 | 0,0532 | |||

| NDDUEAFE TRS EQUITY SOFR+28 MYI / DE (000000000) | 1,69 | 0,0532 | 0,0532 | |||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | 1,68 | 0,0529 | 0,0529 | |||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | 1,68 | 0,0529 | 0,0529 | |||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A2A / ABS-O (US448973AB35) | 1,68 | -35,65 | 0,0529 | -0,0314 | ||

| HYUNDAI AUTO RECEIVABLES TRUST HART 2024 A A2A / ABS-O (US448973AB35) | 1,68 | -35,65 | 0,0529 | -0,0314 | ||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2024 2A B 144A / ABS-CBDO (XS2865669522) | 1,65 | 8,83 | 0,0520 | 0,0030 | ||

| US74923GAC78 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QA1 A3 | 1,65 | -1,73 | 0,0519 | -0,0022 | ||

| US542514NE09 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2005 WL2 M4 | 1,63 | -1,39 | 0,0514 | -0,0020 | ||

| US842400FZ13 / Southern California Edison Co. Bond 4.65% Due 10/1/2043 | 1,62 | -3,40 | 0,0510 | -0,0031 | ||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADA25) | 1,61 | 0,00 | 0,0508 | -0,0013 | ||

| HYUNDAI CAPITAL AMERICA HYUNDAI CAPITAL AMERICA / DBT (US44891ADA25) | 1,61 | 0,00 | 0,0508 | -0,0013 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 9A AV 144A / ABS-CBDO (US03330HAA59) | 1,61 | -9,32 | 0,0506 | -0,0066 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,60 | 1,01 | 0,0505 | -0,0008 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,60 | 1,01 | 0,0505 | -0,0008 | ||

| NDDUEAFE TRS EQUITY FEDL01+28 MEI / DE (000000000) | 1,60 | 0,0504 | 0,0504 | |||

| NDDUEAFE TRS EQUITY FEDL01+28 MEI / DE (000000000) | 1,60 | 0,0504 | 0,0504 | |||

| FREDDIE MAC FHR 5557 FM / ABS-MBS (US3137HLZ217) | 1,60 | 0,0504 | 0,0504 | |||

| FREDDIE MAC FHR 5557 FM / ABS-MBS (US3137HLZ217) | 1,60 | 0,0504 | 0,0504 | |||

| US52522EAA73 / Lehman XS Trust, Series 2006-7, Class 1A1A | 1,59 | -0,88 | 0,0499 | -0,0017 | ||

| US40430MAC10 / HSI ASSET SECURITIZATION CORPO HASC 2006 WMC1 A2 | 1,56 | -2,13 | 0,0492 | -0,0024 | ||

| US36190GAE89 / GSMSC Pass-Through Trust 2009-4R | 1,55 | -1,71 | 0,0488 | -0,0021 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 01/30 5.35 / DBT (US46849LVE81) | 1,54 | 0,78 | 0,0486 | -0,0008 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 01/30 5.35 / DBT (US46849LVE81) | 1,54 | 0,78 | 0,0486 | -0,0008 | ||

| US12666SAA69 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 BC5 1A | 1,52 | -2,87 | 0,0480 | -0,0027 | ||

| US78436TAD81 / SBALT 2023-A A4 | 1,52 | -0,46 | 0,0479 | -0,0014 | ||

| US35729TAA07 / Fremont Home Loan Trust, Series 2006-C, Class 1A1 | 1,52 | -0,79 | 0,0477 | -0,0016 | ||

| US42806MBS70 / Hertz Vehicle Financing III LLC | 1,51 | -0,13 | 0,0475 | -0,0013 | ||

| 37 CAPITAL CLO LTD PUTNM 2022 1A A1R 144A / ABS-CBDO (US88429PAU66) | 1,50 | 0,13 | 0,0473 | -0,0011 | ||

| 37 CAPITAL CLO LTD PUTNM 2022 1A A1R 144A / ABS-CBDO (US88429PAU66) | 1,50 | 0,13 | 0,0473 | -0,0011 | ||

| US040104MX65 / ARGENT MORTGAGE LOAN TRUST 2005-W1 SER 2005-W1 CL A1 V/R REGD 2.18800000 | 1,49 | -2,36 | 0,0470 | -0,0023 | ||

| US00442JAA25 / ACE Securities Corp Home Equity Loan Trust Series 2007-ASAP1 | 1,48 | -1,60 | 0,0466 | -0,0019 | ||

| US71429MAC91 / Perrigo Finance Unlimited Co | 1,48 | 2,86 | 0,0465 | 0,0002 | ||

| US35104AAB44 / FOURSIGHT CAPITAL AUTOMOBILE RECEIVABLES TRUST 202 FCRT 2023-2 A2 | 1,45 | -26,60 | 0,0456 | -0,0181 | ||

| US12663TAA79 / CSMC_22-RPL4 | 1,44 | -3,23 | 0,0452 | -0,0027 | ||

| US130685C814 / California (State of) Public Works Board (California State University), Series 2010 B-2, RB | 1,42 | -0,07 | 0,0448 | -0,0012 | ||

| US06738EBD67 / Barclays PLC | 1,41 | 0,71 | 0,0445 | -0,0008 | ||

| US78449CAB46 / SMB PRIVATE EDUCATION LOAN TRU SMB 2022 C A1B 144A | 1,41 | -5,49 | 0,0445 | -0,0037 | ||

| FANNIE MAE FNR 2025 54 FM / ABS-MBS (US3136BWNW23) | 1,40 | 0,0441 | 0,0441 | |||

| US939346AA00 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-AR9 Trust | 1,40 | -3,79 | 0,0440 | -0,0029 | ||

| US96041AAC09 / WESTLAKE AUTOMOBILE RECEIVABLES TRUST 2023-4 SER 2023-4A CL A2 REGD 144A P/P 6.23000000 | 1,39 | -62,08 | 0,0439 | -0,0746 | ||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 1,38 | 0,0435 | 0,0435 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 1,38 | 0,0435 | 0,0435 | |||

| TRALEE CDO LTD TRAL 2019 6A A1RR 144A / ABS-CBDO (US89289EBL74) | 1,38 | -17,15 | 0,0435 | -0,0103 | ||

| TRALEE CDO LTD TRAL 2019 6A A1RR 144A / ABS-CBDO (US89289EBL74) | 1,38 | -17,15 | 0,0435 | -0,0103 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 CES2 A1A 144A / ABS-MBS (US89182JAA97) | 1,38 | -9,29 | 0,0433 | -0,0057 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 CES2 A1A 144A / ABS-MBS (US89182JAA97) | 1,38 | -9,29 | 0,0433 | -0,0057 | ||

| US694308JM04 / PACIFIC GAS and ELECTRIC CO 4.55% 07/01/2030 | 1,37 | 0,89 | 0,0430 | -0,0007 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 1,36 | 100,15 | 0,0428 | 0,0209 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 1,36 | 100,15 | 0,0428 | 0,0209 | ||

| US55336VBQ23 / MPLX LP | 1,36 | 1,65 | 0,0428 | -0,0004 | ||

| XS2304366656 / HARVEST CLO HARVT 16A ARR 144A | 1,34 | -6,87 | 0,0423 | -0,0042 | ||

| US87264ACQ67 / T-Mobile USA Inc | 1,32 | 1,85 | 0,0416 | -0,0003 | ||

| US3140JANZ71 / FNMA POOL BM5807 FN 04/48 FIXED VAR | 1,31 | -1,87 | 0,0414 | -0,0019 | ||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 1,31 | -2,46 | 0,0413 | -0,0021 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 1,31 | -0,15 | 0,0412 | -0,0011 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 1,31 | -0,15 | 0,0412 | -0,0011 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,30 | 1,24 | 0,0410 | -0,0005 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1,30 | 1,24 | 0,0410 | -0,0005 | ||

| CDX HY44 5Y ICE / DCR (000000000) | 1,30 | 0,0408 | 0,0408 | |||

| CDX HY44 5Y ICE / DCR (000000000) | 1,30 | 0,0408 | 0,0408 | |||

| US362334LJ15 / GSAMP TRUST GSAMP 2006 HE2 M1 | 1,30 | -21,41 | 0,0408 | -0,0124 | ||

| US23246BAK70 / Countrywide Asset-Backed Certificates | 1,29 | -2,71 | 0,0408 | -0,0022 | ||

| CHASE AUTO OWNER TRUST CHAOT 2024 1A A2 144A / ABS-O (US16144BAB45) | 1,28 | -54,67 | 0,0402 | -0,0507 | ||

| CHASE AUTO OWNER TRUST CHAOT 2024 1A A2 144A / ABS-O (US16144BAB45) | 1,28 | -54,67 | 0,0402 | -0,0507 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 4 A1 144A / ABS-MBS (US92540GAA67) | 1,25 | -9,22 | 0,0394 | -0,0051 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 4 A1 144A / ABS-MBS (US92540GAA67) | 1,25 | -9,22 | 0,0394 | -0,0051 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 1 A2A / ABS-O (US36268GAB14) | 1,22 | -52,63 | 0,0385 | -0,0448 | ||

| GM FINANCIAL CONSUMER AUTOMOBI GMCAR 2024 1 A2A / ABS-O (US36268GAB14) | 1,22 | -52,63 | 0,0385 | -0,0448 | ||

| US17313QAL23 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 10 22AA | 1,20 | -3,84 | 0,0378 | -0,0025 | ||

| US45660LXN45 / RESIDENTIAL ASSET SECURITIZATI RAST 2005 A10 A4 | 1,18 | -0,84 | 0,0372 | -0,0013 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 1,18 | 0,0371 | 0,0371 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 1,18 | 0,0371 | 0,0371 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PQ48) | 1,16 | 0,0366 | 0,0366 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PQ48) | 1,16 | 0,0366 | 0,0366 | |||

| US16412XAJ46 / Cheniere Corpus Christi Holdings LLC | 1,16 | 0,96 | 0,0365 | -0,0005 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 12A A1 144A / ABS-CBDO (US03332DAA28) | 1,15 | -0,26 | 0,0362 | -0,0010 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 12A A1 144A / ABS-CBDO (US03332DAA28) | 1,15 | -0,26 | 0,0362 | -0,0010 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,14 | 0,71 | 0,0360 | -0,0006 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,14 | 0,71 | 0,0360 | -0,0006 | ||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 1,14 | 0,62 | 0,0358 | -0,0007 | ||

| US362341JL40 / GSAA HOME EQUITY TRUST GSAA 2005 10 M5 | 1,12 | -24,70 | 0,0352 | -0,0127 | ||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,12 | -8,07 | 0,0352 | -0,0041 | ||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 1,12 | -8,07 | 0,0352 | -0,0041 | ||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 1,12 | 0,63 | 0,0351 | -0,0006 | ||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 1,12 | 0,63 | 0,0351 | -0,0006 | ||

| US03065UAB52 / Americredit Automobile Receivables Trust 2023-2 | 1,11 | -58,31 | 0,0350 | -0,0510 | ||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 1,11 | 5,82 | 0,0349 | 0,0011 | ||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 1,11 | 5,82 | 0,0349 | 0,0011 | ||

| BOF URSA FUNDING BVABS 2024 SN1 A3 144A / ABS-O (US072926AC22) | 1,10 | -0,36 | 0,0348 | -0,0010 | ||

| BOF URSA FUNDING BVABS 2024 SN1 A3 144A / ABS-O (US072926AC22) | 1,10 | -0,36 | 0,0348 | -0,0010 | ||

| US14688EAC30 / CRVNA_23-P1 | 1,08 | -29,61 | 0,0341 | -0,0156 | ||

| US86360UAC09 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR6 1A3 | 1,08 | -1,37 | 0,0341 | -0,0014 | ||

| US81375WEG78 / SECURITIZED ASSET BACKED RECEI SABR 2005 FR2 M3 | 1,07 | -1,47 | 0,0337 | -0,0013 | ||

| 317U7IQA6 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 1,07 | 0,0336 | 0,0336 | |||

| US76110HZE25 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2004 QA4 CB1 | 1,07 | -1,57 | 0,0336 | -0,0014 | ||

| US59981TAC99 / MILL CITY MORTGAGE LOAN TRUST 2019-GS2 SER 2019-GS2 CL A1 V/R REGD 144A P/P 2.75000000 | 1,07 | -9,36 | 0,0335 | -0,0044 | ||

| US23371DAG97 / DAE Funding LLC | 1,06 | 0,95 | 0,0333 | -0,0005 | ||

| US03329TAG94 / Anchorage Credit Funding 4 Ltd. | 1,05 | 2,75 | 0,0330 | 0,0001 | ||

| US74143FAA75 / PRET_21-RN2 | 1,05 | -8,33 | 0,0329 | -0,0039 | ||

| REACH FINANCIAL LLC REACH 2024 1A A 144A / ABS-O (US75526PAA93) | 1,05 | -40,96 | 0,0329 | -0,0242 | ||

| REACH FINANCIAL LLC REACH 2024 1A A 144A / ABS-O (US75526PAA93) | 1,05 | -40,96 | 0,0329 | -0,0242 | ||

| US61747YEV39 / Morgan Stanley | 1,04 | 0,10 | 0,0328 | -0,0008 | ||

| US74923HAK77 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QS4 3A1 | 1,03 | -3,48 | 0,0323 | -0,0020 | ||

| VICI PROPERTIES LP SR UNSECURED 04/35 5.625 / DBT (US925650AK98) | 1,01 | 1,41 | 0,0318 | -0,0003 | ||

| VICI PROPERTIES LP SR UNSECURED 04/35 5.625 / DBT (US925650AK98) | 1,01 | 1,41 | 0,0318 | -0,0003 | ||

| US89177XAA54 / TOWD POINT MORTGAGE TRUST 2019-HY3 SER 2019-HY3 CL A1A V/R REGD 144A P/P 2.70800000 | 1,01 | -8,88 | 0,0317 | -0,0040 | ||

| MF1 MULTIFAMILY HOUSING MORTGA MF1 2024 FL14 A 144A / ABS-CBDO (US55416AAA79) | 1,00 | 0,30 | 0,0316 | -0,0007 | ||

| MF1 MULTIFAMILY HOUSING MORTGA MF1 2024 FL14 A 144A / ABS-CBDO (US55416AAA79) | 1,00 | 0,30 | 0,0316 | -0,0007 | ||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 1,00 | 0,10 | 0,0316 | -0,0008 | ||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 1,00 | 0,10 | 0,0316 | -0,0008 | ||

| VICI PROPERTIES LP SR UNSECURED 11/31 5.125 / DBT (US925650AH69) | 1,00 | 1,42 | 0,0315 | -0,0003 | ||

| VICI PROPERTIES LP SR UNSECURED 11/31 5.125 / DBT (US925650AH69) | 1,00 | 1,42 | 0,0315 | -0,0003 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 1,00 | 0,0313 | 0,0313 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 1,00 | 0,0313 | 0,0313 | |||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,99 | -2,17 | 0,0313 | -0,0015 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,99 | -2,17 | 0,0313 | -0,0015 | ||

| NDDUEAFE TRS EQUITY SOFR+29 MYI / DE (000000000) | 0,98 | 0,0309 | 0,0309 | |||

| NDDUEAFE TRS EQUITY SOFR+29 MYI / DE (000000000) | 0,98 | 0,0309 | 0,0309 | |||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 2 A 144A / ABS-O (US694961AA13) | 0,98 | -17,73 | 0,0308 | -0,0076 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 2 A 144A / ABS-O (US694961AA13) | 0,98 | -17,73 | 0,0308 | -0,0076 | ||

| US00774MAW55 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0,95 | 1,38 | 0,0300 | -0,0003 | ||

| XS2303818954 / TAURUS CMBS TAURS 2021 UK1A A 144A | 0,95 | 6,37 | 0,0300 | 0,0011 | ||

| US694308JW85 / Pacific Gas and Electric Co | 0,95 | 0,96 | 0,0299 | -0,0004 | ||

| FCT / Fincantieri S.p.A. | 0,94 | 0,0297 | 0,0297 | |||

| FCT / Fincantieri S.p.A. | 0,94 | 0,0297 | 0,0297 | |||

| 60AU / InterContinental Hotels Group PLC - Corporate Bond/Note | 0,94 | 9,59 | 0,0295 | 0,0019 | ||

| US842400HS51 / Southern California Edison Co. | 0,94 | 0,00 | 0,0295 | -0,0007 | ||

| US92539TAA16 / Verus Securitization Trust, Series 2023-4, Class A1 | 0,92 | -11,51 | 0,0291 | -0,0046 | ||

| CDX HY43 5Y ICE / DCR (EZ4J83TSRL27) | 0,91 | -40,75 | 0,0288 | -0,0210 | ||

| CDX HY43 5Y ICE / DCR (EZ4J83TSRL27) | 0,91 | -40,75 | 0,0288 | -0,0210 | ||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 0,91 | 0,77 | 0,0287 | -0,0005 | ||

| MARS INC SR UNSECURED 144A 03/35 5.2 / DBT (US571676BA26) | 0,91 | 0,77 | 0,0287 | -0,0005 | ||

| US23246LAA70 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 BC3 1A | 0,91 | -1,73 | 0,0286 | -0,0012 | ||

| US07386HUJ84 / BEAR STEARNS ALT A TRUST BALTA 2005 5 22A1 | 0,91 | -3,10 | 0,0286 | -0,0016 | ||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0,91 | 2,26 | 0,0285 | -0,0001 | ||

| US46651QAA58 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-FL12 | 0,91 | -1,84 | 0,0285 | -0,0013 | ||

| MORGAN STANLEY RESIDENTIAL MOR MSRM 2024 RPL1 A1 / ABS-MBS (US61776YAA73) | 0,90 | -2,16 | 0,0285 | -0,0014 | ||

| MORGAN STANLEY RESIDENTIAL MOR MSRM 2024 RPL1 A1 / ABS-MBS (US61776YAA73) | 0,90 | -2,16 | 0,0285 | -0,0014 | ||

| WESTLAKE AUTOMOBILE RECEIVABLE WLAKE 2024 1A A3 144A / ABS-O (US96043RAD98) | 0,90 | -0,22 | 0,0284 | -0,0008 | ||

| WESTLAKE AUTOMOBILE RECEIVABLE WLAKE 2024 1A A3 144A / ABS-O (US96043RAD98) | 0,90 | -0,22 | 0,0284 | -0,0008 | ||

| US46625HRY89 / JPMorgan Chase & Co. | 0,89 | 0,45 | 0,0281 | -0,0006 | ||

| US83207DAB47 / SMB 23-C A1B 144A (SOFR30A+155) FRN 11-15-52/10-17-33 | 0,89 | -5,84 | 0,0279 | -0,0025 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797MH75) | 0,88 | 0,0278 | 0,0278 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797MH75) | 0,88 | 0,0278 | 0,0278 | |||

| MX0SGO0000F0 / Mexican Udibonos | 0,87 | 11,34 | 0,0275 | 0,0022 | ||

| ACHV ABS TRUST ACHV 2025 1PL B 144A / ABS-O (US00112MAB28) | 0,86 | -13,43 | 0,0272 | -0,0050 | ||

| ACHV ABS TRUST ACHV 2025 1PL B 144A / ABS-O (US00112MAB28) | 0,86 | -13,43 | 0,0272 | -0,0050 | ||

| US466309AA90 / JP Morgan Alternative Loan Trust | 0,86 | -3,26 | 0,0271 | -0,0016 | ||

| US36183XQ869 / GNMA POOL AL2279 GN 03/45 FIXED 3.5 | 0,85 | -1,74 | 0,0267 | -0,0012 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2018 6A A 144A / ABS-CBDO (US03330LAA61) | 0,84 | -6,84 | 0,0266 | -0,0026 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2018 6A A 144A / ABS-CBDO (US03330LAA61) | 0,84 | -6,84 | 0,0266 | -0,0026 | ||

| US53946PAA84 / LoanCore 2022-CRE7 Issuer Ltd | 0,82 | -5,53 | 0,0258 | -0,0022 | ||

| RFR USD SOFR/3.00000 06/21/23-7Y CME / DIR (EZWF2F56KP17) | 0,82 | -57,33 | 0,0258 | -0,0361 | ||

| RFR USD SOFR/3.00000 06/21/23-7Y CME / DIR (EZWF2F56KP17) | 0,82 | -57,33 | 0,0258 | -0,0361 | ||

| US81375WFU53 / SECURITIZED ASSET BACKED RECEI SABR 2005 FR5 M1 | 0,79 | -7,80 | 0,0250 | -0,0028 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,78 | 0,0246 | 0,0246 | |||

| US43732VAT35 / Home Partners of America 2021-2 Trust | 0,78 | -4,79 | 0,0244 | -0,0019 | ||

| US03290AAA88 / Anchorage Credit Funding Ltd. | 0,75 | 1,21 | 0,0237 | -0,0003 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,75 | -4,60 | 0,0235 | -0,0018 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,75 | -4,60 | 0,0235 | -0,0018 | ||

| FCT / Fincantieri S.p.A. | 0,72 | 1,12 | 0,0228 | -0,0003 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 2A A2 144A / ABS-O (US78397XAB01) | 0,72 | -42,36 | 0,0226 | -0,0176 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 2A A2 144A / ABS-O (US78397XAB01) | 0,72 | -42,36 | 0,0226 | -0,0176 | ||

| US46628MAG15 / JP Morgan Mortgage Acquisition Trust 2006-CW1 | 0,71 | -6,71 | 0,0223 | -0,0022 | ||

| AMERICAN HOMES 4 RENT SR UNSECURED 06/30 4.95 / DBT (US02666TAK34) | 0,71 | 0,0223 | 0,0223 | |||

| AMERICAN HOMES 4 RENT SR UNSECURED 06/30 4.95 / DBT (US02666TAK34) | 0,71 | 0,0223 | 0,0223 | |||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES1 A1A 144A / ABS-MBS (US749424AA57) | 0,69 | -10,22 | 0,0216 | -0,0031 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES1 A1A 144A / ABS-MBS (US749424AA57) | 0,69 | -10,22 | 0,0216 | -0,0031 | ||

| CREDICORP CAPITAL SOCIED LOCAL GOVT G 144A 03/45 9.7 / DBT (US224939AB41) | 0,68 | 0,0213 | 0,0213 | |||

| CREDICORP CAPITAL SOCIED LOCAL GOVT G 144A 03/45 9.7 / DBT (US224939AB41) | 0,68 | 0,0213 | 0,0213 | |||

| US033295AA45 / Anchorage Credit Funding 14 Ltd., Series 2021-14A, Class A | 0,65 | -0,31 | 0,0205 | -0,0006 | ||

| US912810SD19 / United States Treas Bds Bond | 0,65 | -2,71 | 0,0204 | -0,0011 | ||

| US3140QSDY42 / FNMA POOL CB6418 FN 05/53 FIXED 5 | 0,64 | -1,99 | 0,0202 | -0,0009 | ||

| PRETIUM MORTGAGE CREDIT PARTNE PRET 2024 RPL1 A1 144A / ABS-MBS (US693989AA39) | 0,63 | -3,51 | 0,0199 | -0,0012 | ||

| PRETIUM MORTGAGE CREDIT PARTNE PRET 2024 RPL1 A1 144A / ABS-MBS (US693989AA39) | 0,63 | -3,51 | 0,0199 | -0,0012 | ||

| SBNA AUTO LEASE TRUST SBALT 2024 B A2 144A / ABS-O (US78437VAC46) | 0,63 | -50,28 | 0,0198 | -0,0210 | ||

| SBNA AUTO LEASE TRUST SBALT 2024 B A2 144A / ABS-O (US78437VAC46) | 0,63 | -50,28 | 0,0198 | -0,0210 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0,62 | 0,0197 | 0,0197 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0,62 | 0,0197 | 0,0197 | |||

| PRESTIGE AUTO RECEIVABLES TRUS PART 2024 1A A2 144A / ABS-O (US74113QAC50) | 0,62 | -63,18 | 0,0196 | -0,0350 | ||

| PRESTIGE AUTO RECEIVABLES TRUS PART 2024 1A A2 144A / ABS-O (US74113QAC50) | 0,62 | -63,18 | 0,0196 | -0,0350 | ||

| US64032PAA03 / Nelnet Student Loan Trust, Series 2023-AA, Class AFL | 0,62 | -8,31 | 0,0195 | -0,0023 | ||

| F+G GLOBAL FUNDING SECURED 144A 01/30 5.875 / DBT (US30321L2J09) | 0,62 | 1,15 | 0,0194 | -0,0003 | ||

| F+G GLOBAL FUNDING SECURED 144A 01/30 5.875 / DBT (US30321L2J09) | 0,62 | 1,15 | 0,0194 | -0,0003 | ||

| US61744CKP04 / Morgan Stanley ABS Capital I Inc Trust 2005-HE1 | 0,62 | -2,53 | 0,0194 | -0,0010 | ||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 0,61 | -0,16 | 0,0192 | -0,0005 | ||

| GLP CAPITAL LP / FIN II GLP CAPITAL LP / FIN II / DBT (US361841AT63) | 0,60 | 1,36 | 0,0188 | -0,0002 | ||

| GLP CAPITAL LP / FIN II GLP CAPITAL LP / FIN II / DBT (US361841AT63) | 0,60 | 1,36 | 0,0188 | -0,0002 | ||

| US86360WAB81 / STRUCTURED ASSET INVESTMENT LO SAIL 2006 4 A2 | 0,60 | -1,97 | 0,0188 | -0,0009 | ||

| US345397A860 / Ford Motor Credit Co LLC | 0,59 | 1,21 | 0,0185 | -0,0002 | ||

| CRB SECURITIZATION TRUST CRB 2023 1 A 144A / ABS-O (US12670DAA37) | 0,58 | -46,34 | 0,0182 | -0,0166 | ||

| CRB SECURITIZATION TRUST CRB 2023 1 A 144A / ABS-O (US12670DAA37) | 0,58 | -46,34 | 0,0182 | -0,0166 | ||

| US64032PAB85 / Nelnet Student Loan Trust 2023-A | 0,57 | -8,08 | 0,0179 | -0,0021 | ||

| US00252FAK75 / AAMES MORTGAGE INVESTMENT TRUS AMIT 2004 1 M6 | 0,56 | -30,96 | 0,0177 | -0,0086 | ||

| US542514NT77 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2005 3 1A | 0,56 | -2,27 | 0,0177 | -0,0008 | ||

| US36267FAC23 / GLS Auto Select Receivables Trust 2023-1 | 0,56 | -63,45 | 0,0176 | -0,0318 | ||

| US70069FCY16 / Park Place Securities Inc Asset-Backed Pass-Through Certificates Series 2004-MHQ | 0,56 | -10,88 | 0,0175 | -0,0026 | ||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 0,56 | 0,0175 | 0,0175 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 0,56 | 0,0175 | 0,0175 | |||

| US76088TAA97 / RPM 22-3 A 144A 5.38% 11-25-30 | 0,55 | -43,73 | 0,0174 | -0,0143 | ||

| US404280CH04 / HSBC Holdings PLC | 0,55 | 1,67 | 0,0173 | -0,0001 | ||

| US3137B66E61 / FREDDIE MAC FHR 4273 PF | 0,55 | -3,02 | 0,0172 | -0,0010 | ||

| US12667GDA85 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 J3 1A1 | 0,54 | -1,10 | 0,0170 | -0,0006 | ||

| US61750SAA06 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE8 A1 | 0,52 | -1,89 | 0,0164 | -0,0007 | ||

| US76088LAA61 / RPM_21-2A | 0,52 | -13,42 | 0,0163 | -0,0030 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,51 | 1,40 | 0,0159 | -0,0002 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,51 | 1,40 | 0,0159 | -0,0002 | ||

| BOFA AUTO TRUST BAAT 2024 1A A3 144A / ABS-O (US09709AAC62) | 0,50 | -0,20 | 0,0159 | -0,0004 | ||

| BOFA AUTO TRUST BAAT 2024 1A A3 144A / ABS-O (US09709AAC62) | 0,50 | -0,20 | 0,0159 | -0,0004 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 01/35 5.35 / DBT (US30225VAT44) | 0,50 | 1,41 | 0,0159 | -0,0002 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 01/35 5.35 / DBT (US30225VAT44) | 0,50 | 1,41 | 0,0159 | -0,0002 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 1A A3 144A / ABS-O (US78435VAC63) | 0,50 | 0,00 | 0,0158 | -0,0004 | ||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2024 1A A2 144A / ABS-O (US55286TAB17) | 0,50 | -36,49 | 0,0156 | -0,0096 | ||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2024 1A A2 144A / ABS-O (US55286TAB17) | 0,50 | -36,49 | 0,0156 | -0,0096 | ||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 0,50 | 0,40 | 0,0156 | -0,0003 | ||

| US3140XH5X18 / UMBS, 30 Year | 0,49 | -2,77 | 0,0155 | -0,0008 | ||

| US70069FAZ09 / ASSET BACKED SECURITY | 0,49 | -7,34 | 0,0155 | -0,0016 | ||

| US38122NB769 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/46 FIXED 3 | 0,49 | -13,25 | 0,0155 | -0,0028 | ||

| RFR USD SOFR/4.0535* 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,49 | 0,0154 | 0,0154 | |||

| RFR USD SOFR/4.0535* 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,49 | 0,0154 | 0,0154 | |||

| US12668BB774 / Alternative Loan Trust 2006-OA3 | 0,49 | -4,71 | 0,0153 | -0,0012 | ||

| US690353RQ28 / Overseas Private Investment Corp (OPIC) | 0,48 | -7,10 | 0,0153 | -0,0016 | ||

| US76089EAA10 / RESEARCH DRIVEN PAGAYA MOTOR A RPM 2022 1A A 144A | 0,47 | -12,08 | 0,0149 | -0,0025 | ||

| TRICOLOR AUTO SECURITIZATION T TAST 2024 1A A 144A / ABS-O (US89616LAA08) | 0,47 | -43,34 | 0,0149 | -0,0120 | ||

| TRICOLOR AUTO SECURITIZATION T TAST 2024 1A A 144A / ABS-O (US89616LAA08) | 0,47 | -43,34 | 0,0149 | -0,0120 | ||

| US14686RAA05 / Carvana Auto Receivables Trust 2023-N3 | 0,47 | -52,43 | 0,0148 | -0,0171 | ||

| US91681EAA29 / UPSTART PASS THROUGH TRUST UPSPT 2022 ST3 A 144A | 0,46 | -16,97 | 0,0145 | -0,0034 | ||

| 952NPKII9 / CREDIT SUISSE GROUP AG COCO JR SUB 144A | 0,44 | 0,00 | 0,0140 | -0,0004 | ||

| RFR USD SOFR/4.04638 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,44 | 0,0140 | 0,0140 | |||

| RFR USD SOFR/4.04638 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,44 | 0,0140 | 0,0140 | |||