Grundlæggende statistik

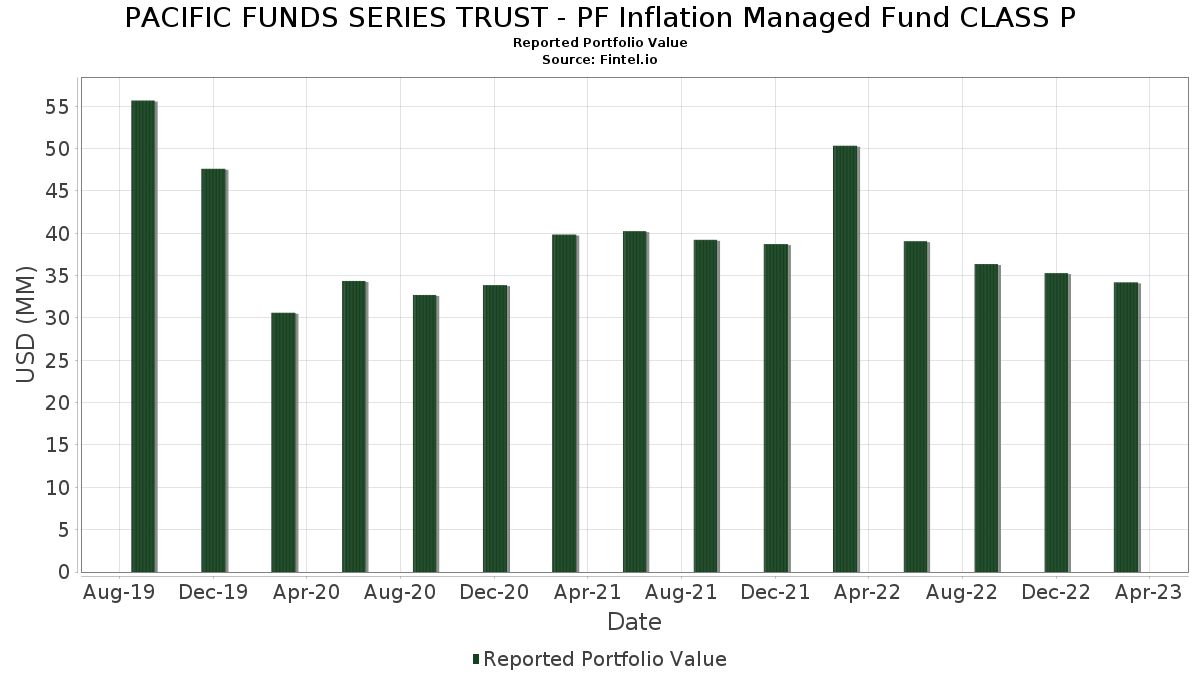

| Porteføljeværdi | $ 34.203.227 |

| Nuværende stillinger | 144 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

PACIFIC FUNDS SERIES TRUST - PF Inflation Managed Fund CLASS P har afsløret 144 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 34.203.227 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). PACIFIC FUNDS SERIES TRUST - PF Inflation Managed Fund CLASS Ps største beholdninger er United States Treasury Inflation Indexed Bonds (US:US912828Y388) , United States Treasury Inflation Indexed Bonds (US:US9128283R96) , United States Treasury Inflation Indexed Bonds (US:US9128285W63) , United States Treasury Inflation Indexed Bonds (US:US9128282L36) , and United States Treasury Inflation Indexed Bonds (US:US9128286N55) . PACIFIC FUNDS SERIES TRUST - PF Inflation Managed Fund CLASS Ps nye stillinger omfatter United States Treasury Inflation Indexed Bonds (US:US912828Y388) , United States Treasury Inflation Indexed Bonds (US:US9128283R96) , United States Treasury Inflation Indexed Bonds (US:US9128285W63) , United States Treasury Inflation Indexed Bonds (US:US9128282L36) , and United States Treasury Inflation Indexed Bonds (US:US9128286N55) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,69 | 2,0479 | 2,0479 | ||

| 0,40 | 1,1912 | 1,1912 | ||

| 0,40 | 1,1912 | 1,1912 | ||

| 0,69 | 2,0572 | 0,9580 | ||

| 0,27 | 0,8038 | 0,8038 | ||

| 3,99 | 11,9038 | 0,6277 | ||

| 0,19 | 0,5712 | 0,5712 | ||

| 0,01 | 0,0234 | 0,5334 | ||

| 0,10 | 0,3072 | 0,3434 | ||

| 0,01 | 0,0208 | 0,3290 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -1,27 | -3,7959 | -4,5851 | ||

| 1,75 | 5,2273 | -1,1539 | ||

| -0,16 | -0,4923 | -0,3682 | ||

| -0,05 | -0,1382 | -0,3152 | ||

| -0,06 | -0,1927 | -0,2645 | ||

| -0,06 | -0,1738 | -0,2456 | ||

| -0,04 | -0,1263 | -0,2152 | ||

| 0,00 | 0,0033 | -0,2059 | ||

| -0,04 | -0,1333 | -0,2050 | ||

| -0,07 | -0,1986 | -0,1986 |

13F og Fondsarkivering

Denne formular blev indsendt den 2023-05-10 for rapporteringsperioden 2023-03-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 3,99 | 3,32 | 11,9038 | 0,6277 | |||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 2,38 | -1,82 | 7,0974 | 0,0218 | |||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 1,81 | 3,56 | 5,3896 | 0,2934 | |||||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 1,78 | 2,88 | 5,3283 | 0,2593 | |||||

| US9128286N55 / United States Treasury Inflation Indexed Bonds | 1,75 | -19,84 | 5,2273 | -1,1539 | |||||

| US912828WU04 / United States Treasury Inflation Indexed Bonds | 1,48 | 1,72 | 4,4266 | 0,1664 | |||||

| US912810RF75 / United States Treasury Inflation Indexed Bonds | 1,34 | 4,75 | 4,0146 | 0,2626 | |||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 1,31 | 4,13 | 3,9172 | 0,2355 | |||||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 1,18 | 4,69 | 3,5347 | 0,2295 | |||||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 1,16 | 2,85 | 3,4536 | 0,1662 | |||||

| US912828YL86 / United States Treasury Inflation Indexed Bonds | 1,03 | 1,89 | 3,0608 | 0,1181 | |||||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 0,98 | 5,72 | 2,9237 | 0,2171 | |||||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 0,96 | 2,58 | 2,8520 | 0,1310 | |||||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 0,92 | 4,41 | 2,7609 | 0,1739 | |||||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 0,90 | 5,01 | 2,6930 | 0,1841 | |||||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 0,87 | 4,32 | 2,5949 | 0,1600 | |||||

| US91282CAQ42 / USTN TII 0.125% 10/15/2025 | 0,78 | 2,36 | 2,3350 | 0,1015 | |||||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 0,69 | 83,24 | 2,0572 | 0,9580 | |||||

| US01F0426407 / Uniform Mortgage-Backed Security, TBA | 0,69 | 2,0479 | 2,0479 | ||||||

| US912828N712 / United States Treasury Inflation Indexed Bonds | 0,68 | 2,27 | 2,0218 | 0,0862 | |||||

| IT0005410912 / Italy Buoni Poliennali Del Tesoro | 0,67 | 3,06 | 2,0128 | 0,0990 | |||||

| US912828ZJ22 / United States Treasury Inflation Indexed Bonds | 0,67 | 2,12 | 2,0106 | 0,0821 | |||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 0,62 | 5,65 | 1,8441 | 0,1372 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 0,55 | 3,94 | 1,6553 | 0,0958 | |||||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 0,55 | 2,43 | 1,6347 | 0,0731 | |||||

| US912828XL95 / United States Treasury Inflation Indexed Bonds | 0,50 | 2,25 | 1,4924 | 0,0636 | |||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 0,46 | 6,05 | 1,3635 | 0,1049 | |||||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 0,45 | 4,63 | 1,3524 | 0,0874 | |||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0,45 | 7,69 | 1,3391 | 0,1215 | |||||

| US912828H458 / United States Treasury Inflation Indexed Bonds | 0,43 | 2,13 | 1,2881 | 0,0534 | |||||

| US01F0506430 / FNMA 30YR TBA(REG A) | 0,40 | 1,1912 | 1,1912 | ||||||

| US313384ET22 / Federal Home Loan Bank (FHLB) | 0,40 | 1,1912 | 1,1912 | ||||||

| US912810FS25 / United States Treasury Inflation Indexed Bonds | 0,32 | 1,89 | 0,9681 | 0,0387 | |||||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 0,31 | 4,76 | 0,9215 | 0,0594 | |||||

| US01F0306450 / Uniform Mortgage-Backed Security, TBA | 0,27 | 0,8038 | 0,8038 | ||||||

| US912828S505 / United States Treasury Inflation Indexed Bonds | 0,24 | 2,56 | 0,7181 | 0,0331 | |||||

| US01F0406441 / Uniform Mortgage-Backed Security, TBA | 0,19 | 0,5712 | 0,5712 | ||||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 0,19 | -0,79 | 0,19 | -0,53 | 0,5651 | 0,0075 | |||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 0,16 | 8,16 | 0,4761 | 0,0445 | |||||

| FR0011427848 / French Republic Government Bond OAT | 0,13 | 0,76 | 0,3997 | 0,0137 | |||||

| FR0013519253 / French Republic Government Bond OAT | 0,12 | 2,48 | 0,3720 | 0,0160 | |||||

| US912810FQ68 / United States Treas Bds Treas Bond | 0,12 | 3,54 | 0,3514 | 0,0198 | |||||

| XS1968576568 / TOWD POINT MORTGAGE FUNDING TPMF 2019 GR4A A1 144A | 0,12 | -7,94 | 0,3490 | -0,0207 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 0,12 | 4,55 | 0,3457 | 0,0227 | |||||

| IT0005387052 / Italy Buoni Poliennali Del Tesoro | 0,12 | 5,50 | 0,3456 | 0,0258 | |||||

| FR001400AQH0 / FRANCE (GOVT OF) /EUR/ REGD SER OATE 0.10000000 | 0,11 | 4,59 | 0,3406 | 0,0209 | |||||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 0,10 | 0,3075 | 0,3075 | ||||||

| IRS EUR / DIR (000000000) | 0,10 | -950,00 | 0,3072 | 0,3434 | |||||

| US05401AAF84 / Avolon Holdings Funding Ltd | 0,10 | 2,11 | 0,2907 | 0,0108 | |||||

| IRS IFS USD / DIR (000000000) | 0,08 | 971,43 | 0,2268 | 0,2059 | |||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 0,07 | 2,82 | 0,2192 | 0,0107 | |||||

| IRS IFS USD / DIR (000000000) | 0,07 | 1.700,00 | 0,2172 | 0,2026 | |||||

| DGZ / DB Gold Short ETN | 0,06 | 1.275,00 | 0,1658 | 0,1536 | |||||

| US38380LJY02 / Government National Mortgage Association | 0,05 | -2,13 | 0,1385 | -0,0007 | |||||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 0,04 | 7,69 | 0,1265 | 0,0106 | |||||

| IRS EUR / DIR (000000000) | 0,03 | 15,38 | 0,0924 | 0,0206 | |||||

| EURO-BUND / DIR (000000000) | 0,03 | -207,69 | 0,0840 | 0,1621 | |||||

| IRS USD / DIR (000000000) | 0,03 | -550,00 | 0,0823 | 0,0823 | |||||

| IRS IFS USD / DIR (000000000) | 0,02 | 64,29 | 0,0696 | 0,0262 | |||||

| IRS IFS USD / DIR (000000000) | 0,02 | -23,08 | 0,0608 | -0,0110 | |||||

| IRS IFS USD / DIR (000000000) | 0,02 | 50,00 | 0,0471 | 0,0178 | |||||

| IRS IFS EUR / DIR (000000000) | 0,01 | -35,00 | 0,0401 | -0,0198 | |||||

| US31396WLX29 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0395 | -0,0001 | |||||

| 2 YEAR US TREASURY NOTE / DIR (000000000) | 0,01 | -57,69 | 0,0340 | -0,0378 | |||||

| TRS TSY INFL IX N/B / DE (000000000) | 0,01 | -61,54 | 0,0324 | 0,0331 | |||||

| IRS IFS USD / DIR (000000000) | 0,01 | -61,54 | 0,0323 | -0,0395 | |||||

| IRS IFS USD / DIR (000000000) | 0,01 | -65,38 | 0,0289 | -0,0429 | |||||

| IRS IFS EUR / DIR (000000000) | 0,01 | -65,38 | 0,0269 | -0,0448 | |||||

| US060505FL38 / Bank of America Corp | 0,01 | 12,50 | 0,0269 | 0,0011 | |||||

| US31396WTU08 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0259 | 0,0001 | |||||

| IRS IFS USD / DIR (000000000) | 0,01 | -104,02 | 0,0234 | 0,5334 | |||||

| IRS IFS USD / DIR (000000000) | 0,01 | -73,08 | 0,0228 | -0,0490 | |||||

| TRS TSY INFL IX N/B / DE (000000000) | 0,01 | -73,08 | 0,0226 | -0,0492 | |||||

| US31395B6R90 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0211 | 0,0002 | |||||

| TRS TSY INFL IX N/B / DE (000000000) | 0,01 | -105,71 | 0,0208 | 0,3290 | |||||

| Ultra 10-Year US Treasury Note / DIR (000000000) | 0,01 | -76,92 | 0,0189 | 0,0189 | |||||

| IRS IFS USD / DIR (000000000) | 0,01 | -76,92 | 0,0183 | -0,0535 | |||||

| TRS TSY INFL IX N/B / DE (000000000) | 0,01 | -80,77 | 0,0176 | 0,0168 | |||||

| IRS IFS USD / DIR (000000000) | 0,01 | -80,77 | 0,0160 | -0,0558 | |||||

| TRS TSY INFL IX N/B / DE (000000000) | 0,01 | -150,00 | 0,0151 | 0,0472 | |||||

| IRS USD / DIR (000000000) | 0,00 | -88,46 | 0,0117 | -0,0601 | |||||

| IRS IFS EUR / DIR (000000000) | 0,00 | 0,00 | 0,0102 | 0,0009 | |||||

| IRS NZD / DIR (000000000) | 0,00 | -88,46 | 0,0098 | -0,0620 | |||||

| IRS EUR / DIR (000000000) | 0,00 | -102,44 | 0,0074 | 0,2471 | |||||

| US31396PMC22 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0060 | -0,0000 | |||||

| IRS IFS EUR / DIR (000000000) | 0,00 | -96,15 | 0,0047 | -0,0671 | |||||

| GB00H240B223 / LME Nickel Base Metal | 0,00 | -98,59 | 0,0033 | -0,2059 | |||||

| CBOT 5 YEAR US TREASURY NOTE / DIR (000000000) | 0,00 | -100,00 | 0,0023 | -0,0695 | |||||

| USD/EUR FORWARD / DFE (000000000) | 0,00 | -100,00 | 0,0021 | -0,0019 | |||||

| US466247PW76 / JP Morgan Mortgage Trust 2005-A3 | 0,00 | -100,00 | 0,0013 | -0,0042 | |||||

| US313398VT33 / FSPC T-35 A V/R 9/25/31 1.84800000 | 0,00 | 0,0011 | 0,0000 | ||||||

| DGZ / DB Gold Short ETN | 0,00 | -100,00 | 0,0008 | -0,0710 | |||||

| SWOP IRS USD / DIR (000000000) | 0,00 | -100,00 | 0,0003 | 0,1153 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,00 | -100,00 | 0,0003 | 0,0003 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0,00 | -100,00 | -0,0000 | -0,0718 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -100,00 | -0,0001 | -0,0719 | |||||

| US63906EB929 / NatWest Markets PLC | -0,00 | -100,00 | -0,0002 | -0,0720 | |||||

| SWOP IRS USD / DIR (000000000) | -0,00 | -100,00 | -0,0002 | -0,0012 | |||||

| 10 YEAR US TREASURY NOTE / DIR (000000000) | -0,00 | -100,00 | -0,0003 | -0,0721 | |||||

| 10 YEAR US TREASURY NOTE / DIR (000000000) | -0,00 | -100,00 | -0,0004 | -0,0722 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -100,00 | -0,0006 | -0,0724 | |||||

| IRS IFS USD / DIR (000000000) | -0,00 | -100,00 | -0,0008 | -0,0726 | |||||

| IRS USD / DIR (000000000) | -0,00 | -100,00 | -0,0011 | 0,0304 | |||||

| IRS IFS USD / DIR (000000000) | -0,00 | -100,00 | -0,0012 | -0,0730 | |||||

| EURO-BUND / DIR (000000000) | -0,00 | -100,00 | -0,0019 | -0,0957 | |||||

| EURO-BUND / DIR (000000000) | -0,00 | -100,00 | -0,0023 | -0,0741 | |||||

| GB00H240B223 / LME Nickel Base Metal | -0,00 | -100,00 | -0,0026 | 0,1708 | |||||

| DGZ / DB Gold Short ETN | -0,00 | -103,85 | -0,0033 | -0,0033 | |||||

| DGZ / DB Gold Short ETN | -0,00 | -97,78 | -0,0034 | 0,1307 | |||||

| IRS IFS EUR / DIR (000000000) | -0,00 | -111,11 | -0,0040 | -0,0314 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -96,55 | -0,0048 | 0,0820 | |||||

| IRS EUR / DIR (000000000) | -0,00 | -103,85 | -0,0054 | -0,0054 | |||||

| AUST 3YR BOND / DIR (000000000) | -0,00 | -107,69 | -0,0061 | -0,0779 | |||||

| IRS EUR / DIR (000000000) | -0,00 | -120,00 | -0,0065 | -0,0382 | |||||

| USD/GBP FORWARD / DFE (000000000) | -0,00 | -107,69 | -0,0084 | -0,0802 | |||||

| IRS EUR / DIR (000000000) | -0,00 | 50,00 | -0,0116 | -0,0035 | |||||

| IRS IFS EUR / DIR (000000000) | -0,00 | -500,00 | -0,0127 | -0,0184 | |||||

| IRS IFS USD / DIR (000000000) | -0,00 | -115,38 | -0,0140 | -0,0858 | |||||

| EURO-BOBL / DIR (000000000) | -0,01 | -80,77 | -0,0173 | 0,0612 | |||||

| SHORT EURO-BTP / DIR (000000000) | -0,01 | -123,08 | -0,0185 | -0,0903 | |||||

| IRS EUR / DIR (000000000) | -0,01 | -161,54 | -0,0258 | -0,0657 | |||||

| IRS IFS EUR / DIR (000000000) | -0,01 | -130,77 | -0,0262 | -0,0980 | |||||

| EURO-OAT / DIR (000000000) | -0,01 | -85,48 | -0,0269 | 0,1548 | |||||

| EURO-BUXL 30Y BND / DIR (000000000) | -0,01 | -134,62 | -0,0284 | -0,1002 | |||||

| IRS EUR / DIR (000000000) | -0,01 | -242,86 | -0,0306 | -0,0521 | |||||

| IRS EUR / DIR (000000000) | -0,01 | 400,00 | -0,0309 | -0,0230 | |||||

| IRS IFS USD / DIR (000000000) | -0,01 | -146,15 | -0,0368 | -0,1086 | |||||

| US ULTRA TREASURY BOND / DIR (000000000) | -0,01 | -150,00 | -0,0396 | -0,1114 | |||||

| IRS IFS USD / DIR (000000000) | -0,01 | -285,71 | -0,0406 | -0,0630 | |||||

| CBOT 10 Year US Treasury Note / DIR (000000000) | -0,02 | -165,38 | -0,0522 | -0,1240 | |||||

| IRS IFS USD / DIR (000000000) | -0,02 | -169,23 | -0,0553 | -0,1271 | |||||

| IRS USD / DIR (000000000) | -0,02 | -284,62 | -0,0728 | -0,1132 | |||||

| EUR/USD FORWARD / DFE (000000000) | -0,02 | -192,31 | -0,0735 | -0,1453 | |||||

| IRS EUR / DIR (000000000) | -0,03 | -192,59 | -0,0763 | -0,1563 | |||||

| EURO-BTP / DIR (000000000) | -0,03 | 250,00 | -0,0845 | -0,0603 | |||||

| JPN 10Y BOND(OSE) / DIR (000000000) | -0,04 | -240,00 | -0,1263 | -0,2152 | |||||

| IRS IFS EUR / DIR (000000000) | -0,04 | -269,23 | -0,1333 | -0,2050 | |||||

| IRS IFS USD / DIR (000000000) | -0,05 | -176,67 | -0,1382 | -0,3152 | |||||

| CBOT US Treasure Bond / DIR (000000000) | -0,05 | 1.666,67 | -0,1602 | -0,1488 | |||||

| IRS EUR / DIR (000000000) | -0,05 | 1.250,00 | -0,1639 | -0,1508 | |||||

| EURO-SCHATZ / DIR (000000000) | -0,06 | -323,08 | -0,1738 | -0,2456 | |||||

| IRS IFS USD / DIR (000000000) | -0,06 | -346,15 | -0,1927 | -0,2645 | |||||

| DGZ / DB Gold Short ETN | -0,07 | -353,85 | -0,1986 | -0,1986 | |||||

| IRS EUR / DIR (000000000) | -0,16 | 290,48 | -0,4923 | -0,3682 | |||||

| US912828B253 / United States Treasury Inflation Indexed Bonds | -1,27 | -570,74 | -3,7959 | -4,5851 |