Grundlæggende statistik

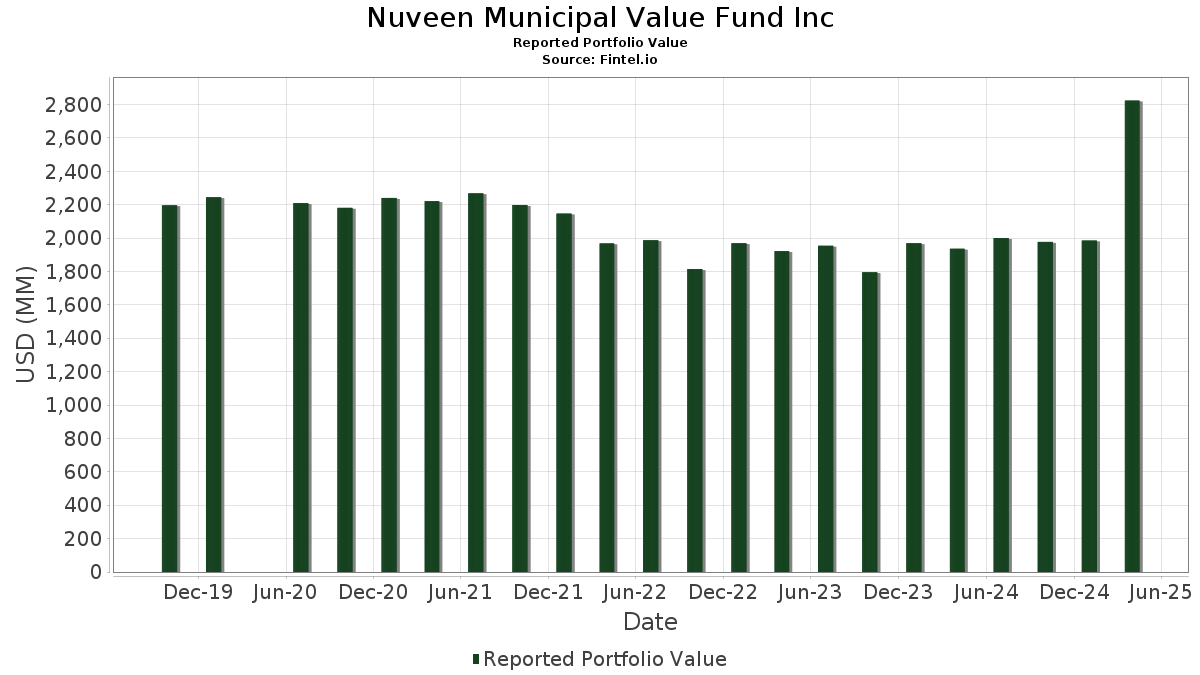

| Porteføljeværdi | $ 2.823.102.914 |

| Nuværende stillinger | 650 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Nuveen Municipal Value Fund Inc har afsløret 650 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 2.823.102.914 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Nuveen Municipal Value Fund Incs største beholdninger er BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C (US:US646136ET42) , Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Convention and Entertainment Project, Series 2001B (US:US44237NAZ50) , New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C (US:US646136EV97) , and County of Broward FL Tourist Development Tax Revenue (US:US115085AX05) . Nuveen Municipal Value Fund Incs nye stillinger omfatter BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C (US:US646136ET42) , Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Convention and Entertainment Project, Series 2001B (US:US44237NAZ50) , New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C (US:US646136EV97) , and County of Broward FL Tourist Development Tax Revenue (US:US115085AX05) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 15,51 | 0,8294 | 0,8294 | ||

| 15,51 | 0,8294 | 0,8294 | ||

| 15,51 | 0,8294 | 0,8294 | ||

| 15,50 | 0,8288 | 0,8288 | ||

| 15,50 | 0,8288 | 0,8288 | ||

| 15,50 | 0,8288 | 0,8288 | ||

| 14,49 | 0,7749 | 0,7749 | ||

| 14,49 | 0,7749 | 0,7749 | ||

| 14,49 | 0,7749 | 0,7749 | ||

| 14,18 | 0,7584 | 0,7584 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 5,18 | 0,2769 | -0,8286 | ||

| 5,18 | 0,2769 | -0,8286 | ||

| 5,18 | 0,2769 | -0,8286 | ||

| 12,42 | 0,6640 | -0,5655 | ||

| 4,44 | 0,2373 | -0,5230 | ||

| 4,44 | 0,2373 | -0,5230 | ||

| 4,44 | 0,2373 | -0,5230 | ||

| 2,83 | 0,1512 | -0,3938 | ||

| 2,83 | 0,1512 | -0,3938 | ||

| 2,83 | 0,1512 | -0,3938 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-26 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 31,80 | -19,95 | 1,7007 | -0,3657 | |||||

| US646136ET42 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 24,33 | -0,63 | 1,3010 | 0,0276 | |||||

| US44237NAZ50 / Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Convention and Entertainment Project, Series 2001B | 20,89 | 0,00 | 1,1170 | 0,0306 | |||||

| US646136EV97 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 20,21 | -1,16 | 1,0808 | 0,0171 | |||||

| US115085AX05 / County of Broward FL Tourist Development Tax Revenue | 20,03 | -6,92 | 1,0710 | -0,0481 | |||||

| US26822LDX91 / E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B | 19,15 | -0,45 | 1,0240 | 0,0236 | |||||

| US64972HZ211 / New York City Transitional Finance Authority, New York, Building Aid Revenue Bonds, Fiscal 2019 Subseries S-3A | 17,95 | -1,53 | 0,9599 | 0,0117 | |||||

| US62620HEP38 / Municipal Electric Authority of Georgia, Plant Vogtle Units 3 & 4 Project M Bonds, Series 2022A | 17,73 | -2,14 | 0,9481 | 0,0058 | |||||

| US62620HDH21 / Municipal Electric Authority of Georgia | 17,02 | -1,99 | 0,9099 | 0,0069 | |||||

| Massachusetts State, General Obligation Bonds, Consolidated Series 2024B / DBT (US57582R8A79) | 15,51 | 0,8294 | 0,8294 | ||||||

| Massachusetts State, General Obligation Bonds, Consolidated Series 2024B / DBT (US57582R8A79) | 15,51 | 0,8294 | 0,8294 | ||||||

| Massachusetts State, General Obligation Bonds, Consolidated Series 2024B / DBT (US57582R8A79) | 15,51 | 0,8294 | 0,8294 | ||||||

| New York State Dormitory Authority, Personal Income Tax Revenue Bonds, General Purpose Series 2025A / DBT (US64990KGZ03) | 15,50 | 0,8288 | 0,8288 | ||||||

| New York State Dormitory Authority, Personal Income Tax Revenue Bonds, General Purpose Series 2025A / DBT (US64990KGZ03) | 15,50 | 0,8288 | 0,8288 | ||||||

| New York State Dormitory Authority, Personal Income Tax Revenue Bonds, General Purpose Series 2025A / DBT (US64990KGZ03) | 15,50 | 0,8288 | 0,8288 | ||||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025H-1 / DBT (US64972JTG30) | 14,49 | 0,7749 | 0,7749 | ||||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025H-1 / DBT (US64972JTG30) | 14,49 | 0,7749 | 0,7749 | ||||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025H-1 / DBT (US64972JTG30) | 14,49 | 0,7749 | 0,7749 | ||||||

| US592247K411 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 14,34 | -5,18 | 0,7667 | -0,0198 | |||||

| US44237NBC56 / Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Convention and Entertainment Project, Series 2001B | 14,33 | -0,65 | 0,7664 | 0,0161 | |||||

| Greater Orlando Aviation Authority, Florida, Airport Facilities Revenue Bonds, Priority Subordinate Series 2024 / DBT (US392275FH13) | 14,18 | 0,7584 | 0,7584 | ||||||

| Greater Orlando Aviation Authority, Florida, Airport Facilities Revenue Bonds, Priority Subordinate Series 2024 / DBT (US392275FH13) | 14,18 | 0,7584 | 0,7584 | ||||||

| Greater Orlando Aviation Authority, Florida, Airport Facilities Revenue Bonds, Priority Subordinate Series 2024 / DBT (US392275FH13) | 14,18 | 0,7584 | 0,7584 | ||||||

| US74446HAD17 / Wisconsin (State of) Public Finance Authority (American Dream at Meadowlands), Series 2017, RB | 13,93 | 56,23 | 0,7447 | 0,2810 | |||||

| Dormitory Authority of the State of New York, State Sales Tax Revenue Bonds, Series 2024B / DBT (US64990AWV33) | 13,78 | 248,77 | 0,7370 | 0,5314 | |||||

| Dormitory Authority of the State of New York, State Sales Tax Revenue Bonds, Series 2024B / DBT (US64990AWV33) | 13,78 | 248,77 | 0,7370 | 0,5314 | |||||

| Dormitory Authority of the State of New York, State Sales Tax Revenue Bonds, Series 2024B / DBT (US64990AWV33) | 13,78 | 248,77 | 0,7370 | 0,5314 | |||||

| US455280M463 / Indianapolis Local Public Improvement Bond Bank, Indiana, Series 1999E | 13,70 | 0,46 | 0,7328 | 0,0233 | |||||

| US93974AMT87 / Washington State, Motor Vehicle Fuel Tax General Obligation Bonds, Series 2002-03C | 13,59 | -0,34 | 0,7268 | 0,0175 | |||||

| Los Angeles, California, Wastewater System Revenue Bonds, Subordinate Series 2025A / DBT (US53945CMC19) | 13,38 | 0,7154 | 0,7154 | ||||||

| Los Angeles, California, Wastewater System Revenue Bonds, Subordinate Series 2025A / DBT (US53945CMC19) | 13,38 | 0,7154 | 0,7154 | ||||||

| US74529JRH04 / Puerto Rico Sales Tax Financing Corp., Series 2019 A-2, RB | 13,28 | -5,24 | 0,7100 | -0,0188 | |||||

| US592247K825 / MET PIER & EXPOSITION AUTH IL DEDICATED ST TAX REVENUE | 13,19 | -7,46 | 0,7056 | -0,0361 | |||||

| US592247K742 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 13,01 | -6,62 | 0,6956 | -0,0290 | |||||

| US592247L658 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 12,95 | -9,61 | 0,6925 | -0,0526 | |||||

| US26822LDY74 / E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B | 12,88 | -0,68 | 0,6886 | 0,0143 | |||||

| US79574CFR97 / Salt River Project Agricultural Improvement & Power District | 12,42 | -47,47 | 0,6640 | -0,5655 | |||||

| Jefferson Public Building Authority, Georgia, Revenue Bonds, School District of the City of Jefferson Project, Series 2025 / DBT (US47407RME70) | 12,16 | 0,6506 | 0,6506 | ||||||

| Jefferson Public Building Authority, Georgia, Revenue Bonds, School District of the City of Jefferson Project, Series 2025 / DBT (US47407RME70) | 12,16 | 0,6506 | 0,6506 | ||||||

| Jefferson Public Building Authority, Georgia, Revenue Bonds, School District of the City of Jefferson Project, Series 2025 / DBT (US47407RME70) | 12,16 | 0,6506 | 0,6506 | ||||||

| US93978HFX89 / WASHINGTON ST HLTH CARE FACS AUTH | 12,00 | -0,02 | 0,6418 | 0,0174 | |||||

| US799038DK71 / San Mateo County Community College District, California, General Obligation Bonds, Series 2006A | 11,87 | 0,06 | 0,6350 | 0,0177 | |||||

| US649519DA03 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 1, Ref. RB | 11,70 | -0,50 | 0,6259 | 0,0141 | |||||

| US720175UG18 / Piedmont Municipal Power Agency, South Carolina, Electric Revenue Bonds, Series 2004A-2 | 11,61 | 1,30 | 0,6207 | 0,0247 | |||||

| New York Transportation Development Corporation, New York, Special Facilities Revenue Bonds, Terminal 6 John F Kennedy International Airport Redevelop / DBT (US650116HT60) | 11,56 | -3,99 | 0,6184 | -0,0081 | |||||

| New York Transportation Development Corporation, New York, Special Facilities Revenue Bonds, Terminal 6 John F Kennedy International Airport Redevelop / DBT (US650116HT60) | 11,56 | -3,99 | 0,6184 | -0,0081 | |||||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Series 2025A / DBT (US340618DZ75) | 10,98 | 0,5872 | 0,5872 | ||||||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Series 2025A / DBT (US340618DZ75) | 10,98 | 0,5872 | 0,5872 | ||||||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Series 2025A / DBT (US340618DZ75) | 10,98 | 0,5872 | 0,5872 | ||||||

| Omaha Public Power District, Nebraska, Electric System Revenue Bonds, Series 2024C / DBT (US682001NJ73) | 10,86 | 0,5809 | 0,5809 | ||||||

| Omaha Public Power District, Nebraska, Electric System Revenue Bonds, Series 2024C / DBT (US682001NJ73) | 10,86 | 0,5809 | 0,5809 | ||||||

| Omaha Public Power District, Nebraska, Electric System Revenue Bonds, Series 2024C / DBT (US682001NJ73) | 10,86 | 0,5809 | 0,5809 | ||||||

| US592643BQ24 / Metropolitan Washington Airports Authority, Virginia, Dulles Toll Road Revenue Bonds, Dulles Metrorail Capital Appreciation, Second Senior Lien Series | 10,65 | -1,50 | 0,5697 | 0,0072 | |||||

| Main Street Natural Gas Inc., Georgia, Gas Supply Revenue Bonds, Series 2025A / DBT (US56035DJZ69) | 10,56 | 0,5649 | 0,5649 | ||||||

| Main Street Natural Gas Inc., Georgia, Gas Supply Revenue Bonds, Series 2025A / DBT (US56035DJZ69) | 10,56 | 0,5649 | 0,5649 | ||||||

| Main Street Natural Gas Inc., Georgia, Gas Supply Revenue Bonds, Series 2025A / DBT (US56035DJZ69) | 10,56 | 0,5649 | 0,5649 | ||||||

| Triborough Bridge and Tunnel Authority, New York, Sales Tax Revenue Bonds, MTA Bridges & Tunnels, TBTA Capital Lockbox-City Sales Tax, Series 2024A-1 / DBT (US896035DF67) | 10,46 | 0,5595 | 0,5595 | ||||||

| Triborough Bridge and Tunnel Authority, New York, Sales Tax Revenue Bonds, MTA Bridges & Tunnels, TBTA Capital Lockbox-City Sales Tax, Series 2024A-1 / DBT (US896035DF67) | 10,46 | 0,5595 | 0,5595 | ||||||

| Triborough Bridge and Tunnel Authority, New York, Sales Tax Revenue Bonds, MTA Bridges & Tunnels, TBTA Capital Lockbox-City Sales Tax, Series 2024A-1 / DBT (US896035DF67) | 10,46 | 0,5595 | 0,5595 | ||||||

| US44237NBA90 / Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Convention and Entertainment Project, Series 2001B | 10,45 | -0,27 | 0,5589 | 0,0139 | |||||

| Aurora, Colorado, Water Revenue Bonds, First Lien Series 2024 / DBT (US051595DD55) | 10,41 | -3,18 | 0,5566 | -0,0026 | |||||

| Aurora, Colorado, Water Revenue Bonds, First Lien Series 2024 / DBT (US051595DD55) | 10,41 | -3,18 | 0,5566 | -0,0026 | |||||

| Aurora, Colorado, Water Revenue Bonds, First Lien Series 2024 / DBT (US051595DD55) | 10,41 | -3,18 | 0,5566 | -0,0026 | |||||

| US79574CFM01 / Salt River Project Agricultural Improvement & Power District | 10,36 | 0,5543 | 0,5543 | ||||||

| Dormitory Authority of the State of New York, State Sales Tax Revenue Bonds, Series 2024A / DBT (US64990AUJ23) | 10,33 | 0,5527 | 0,5527 | ||||||

| Dormitory Authority of the State of New York, State Sales Tax Revenue Bonds, Series 2024A / DBT (US64990AUJ23) | 10,33 | 0,5527 | 0,5527 | ||||||

| Dormitory Authority of the State of New York, State Sales Tax Revenue Bonds, Series 2024A / DBT (US64990AUJ23) | 10,33 | 0,5527 | 0,5527 | ||||||

| US413890FZ28 / Harris County-Houston Sports Authority, Texas, Revenue Bonds, Junior Lien Series 2001H | 10,12 | 0,55 | 0,5412 | 0,0177 | |||||

| US679111WS90 / Oklahoma State Turnpike Authority, Turnpike System Revenue Bonds, Second Senior Series 2017A | 10,06 | -0,66 | 0,5378 | 0,0112 | |||||

| US66285WCB00 / North Texas Tollway Authority, System Revenue Bonds, Refunding First Tier, Series 2008D | 10,04 | -1,45 | 0,5368 | 0,0070 | |||||

| Pennsylvania Housing Finance Agency, Single Family Mortgage Revenue Bonds, Social Series 2024-146A / DBT (US70879QXU20) | 9,91 | -1,54 | 0,5301 | 0,0065 | |||||

| Pennsylvania Housing Finance Agency, Single Family Mortgage Revenue Bonds, Social Series 2024-146A / DBT (US70879QXU20) | 9,91 | -1,54 | 0,5301 | 0,0065 | |||||

| Pennsylvania Housing Finance Agency, Single Family Mortgage Revenue Bonds, Social Series 2024-146A / DBT (US70879QXU20) | 9,91 | -1,54 | 0,5301 | 0,0065 | |||||

| US592247GA27 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 1994B | 9,86 | -2,17 | 0,5271 | 0,0030 | |||||

| US795576MB02 / City of Salt Lake City UT Airport Revenue | 9,72 | -3,10 | 0,5197 | -0,0019 | |||||

| US594615JG28 / Michigan State Building Authority, Revenue Bonds, Facilities Program, Refunding Series 2015-I | 9,62 | -0,70 | 0,5144 | 0,0105 | |||||

| US744387AD35 / Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs Utilities, Series 2008 | 9,35 | -2,43 | 0,4999 | 0,0016 | |||||

| Conroe Independent School District, Montgomery County, Texas, General Obligation Bonds, School Building Series 2025 / DBT (US2084185M19) | 9,14 | -4,25 | 0,4885 | -0,0077 | |||||

| Conroe Independent School District, Montgomery County, Texas, General Obligation Bonds, School Building Series 2025 / DBT (US2084185M19) | 9,14 | -4,25 | 0,4885 | -0,0077 | |||||

| US54811BXV88 / Lower Colorado River Authority | 9,09 | -2,48 | 0,4861 | 0,0013 | |||||

| US64763HKF19 / New Orleans Aviation Board, Louisiana, General Airport Revenue Bonds, North Terminal Project, Series 2017A | 9,05 | -1,15 | 0,4840 | 0,0078 | |||||

| US759911XW53 / Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties, Illinois, General Obligation Bonds, Series 2003A | 8,96 | -3,33 | 0,4793 | -0,0029 | |||||

| US49126PEQ90 / Kentucky (State of) Economic Development Finance Authority (Next Generation Kentucky Information Highway), Series 2015 A, RB | 8,94 | 0,34 | 0,4779 | 0,0146 | |||||

| US033262AV80 / ANCHORAGE MUNICIPLITY | 8,83 | -3,04 | 0,4723 | -0,0015 | |||||

| New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2024CC / DBT (US64613CGK80) | 8,68 | 0,4643 | 0,4643 | ||||||

| New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2024CC / DBT (US64613CGK80) | 8,68 | 0,4643 | 0,4643 | ||||||

| New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2024CC / DBT (US64613CGK80) | 8,68 | 0,4643 | 0,4643 | ||||||

| US517704GL01 / Las Vegas Convention and Visitors Authority, Nevada, Revenue Bonds, Series 2018C | 8,64 | -2,10 | 0,4621 | 0,0030 | |||||

| US59261AG435 / MET TRANSPRTN AUTH NY REVENUE | 8,35 | -1,96 | 0,4468 | 0,0035 | |||||

| US720175UH90 / Piedmont Municipal Power Agency, South Carolina, Electric Revenue Bonds, Series 2004A-2 | 8,35 | 1,43 | 0,4463 | 0,0183 | |||||

| US26822LDV36 / E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B | 8,28 | -0,04 | 0,4426 | 0,0120 | |||||

| US650116AQ94 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 8,27 | 0,00 | 0,4423 | 0,0121 | |||||

| US914399SC56 / University of Maine, System Revenue Bonds, Series 2022 | 8,20 | -1,68 | 0,4383 | 0,0047 | |||||

| US89602N7R94 / Triborough Bridge and Tunnel Authority, New York, General Purpose Revenue Bonds, MTA Bridges & Tunnels, Series 2017A | 8,14 | -1,82 | 0,4355 | 0,0040 | |||||

| US155048EG20 / Central Puget Sound Regional Transit Authority | 8,07 | -6,37 | 0,4318 | -0,0167 | |||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025D / DBT (US64972JNR58) | 8,03 | -3,63 | 0,4297 | -0,0040 | |||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025D / DBT (US64972JNR58) | 8,03 | -3,63 | 0,4297 | -0,0040 | |||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025D / DBT (US64972JNR58) | 8,03 | -3,63 | 0,4297 | -0,0040 | |||||

| US66285WSR87 / North Texas Tollway Authority | 8,02 | 0,4291 | 0,4291 | ||||||

| US837151RT83 / South Carolina Public Service Authority Santee Cooper Revenue Obligations, Refunding Series 2016B | 7,99 | -0,70 | 0,4273 | 0,0088 | |||||

| US93974AMS05 / Washington State, Motor Vehicle Fuel Tax General Obligation Bonds, Series 2002-03C | 7,93 | -0,06 | 0,4239 | 0,0114 | |||||

| US736742G929 / City of Portland OR Sewer System Revenue | 7,78 | -2,88 | 0,4163 | -0,0006 | |||||

| Port Authority of New York and New Jersey, Consolidated Revenue Bonds, Two Hundred Forty-Fourth Series 2024 / DBT (US73358XMG42) | 7,74 | -3,21 | 0,4140 | -0,0020 | |||||

| Port Authority of New York and New Jersey, Consolidated Revenue Bonds, Two Hundred Forty-Fourth Series 2024 / DBT (US73358XMG42) | 7,74 | -3,21 | 0,4140 | -0,0020 | |||||

| US44237NBB73 / Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Convention and Entertainment Project, Series 2001B | 7,72 | -0,41 | 0,4128 | 0,0096 | |||||

| US726008CY91 / Placer Union High School District, Placer County, California, General Obligation Bonds, Series 2004C | 7,55 | -0,07 | 0,4038 | 0,0108 | |||||

| Black Belt Energy Gas District, Alabama, Gas Project Revenue Bonds, Prepay BP PLC, Series 2024D / DBT (US09182TEN37) | 7,38 | -1,38 | 0,3947 | 0,0054 | |||||

| Black Belt Energy Gas District, Alabama, Gas Project Revenue Bonds, Prepay BP PLC, Series 2024D / DBT (US09182TEN37) | 7,38 | -1,38 | 0,3947 | 0,0054 | |||||

| US592250DN11 / Metropolitan Pier & Exposition Authority | 7,38 | -7,16 | 0,3944 | -0,0188 | |||||

| US646136XJ58 / New Jersey (State of) Transportation Trust Fund Authority, Series 2010 A, RB | 7,34 | -0,61 | 0,3924 | 0,0084 | |||||

| US759911TU44 / Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties, Illinois, General Obligation Bonds, Series 2002A | 7,07 | -1,70 | 0,3783 | 0,0040 | |||||

| US74529JQF56 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 7,07 | -3,52 | 0,3781 | -0,0031 | |||||

| US67884XCN57 / Oklahoma (State of) Development Finance Authority (OU Medicine), Series 2018 B, RB | 7,07 | -1,46 | 0,3778 | 0,0048 | |||||

| US89602HEP82 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH PAYROLL MOBILITY TAX | 7,00 | -1,85 | 0,3744 | 0,0034 | |||||

| Triborough Bridge and Tunnel Authority, New York, Payroll Mobility Tax Bonds, MTA Bridges and Tunnels, Senior Lien Green Climate Bond Certified Series / DBT (US89602HHH30) | 6,98 | -2,46 | 0,3731 | 0,0010 | |||||

| Triborough Bridge and Tunnel Authority, New York, Payroll Mobility Tax Bonds, MTA Bridges and Tunnels, Senior Lien Green Climate Bond Certified Series / DBT (US89602HHH30) | 6,98 | -2,46 | 0,3731 | 0,0010 | |||||

| Triborough Bridge and Tunnel Authority, New York, Payroll Mobility Tax Bonds, MTA Bridges and Tunnels, Senior Lien Green Climate Bond Certified Series / DBT (US89602HHH30) | 6,98 | -2,46 | 0,3731 | 0,0010 | |||||

| US491397AT25 / KENTUCKY PUB TRANSPRTN INFRASTRUCTURE AUTH TOLL REVENUE | 6,81 | -1,86 | 0,3641 | 0,0033 | |||||

| US836753KB84 / South Broward Hospital District, Florida, Hospital Revenue Bonds, Refunding Series 2015 | 6,80 | -1,00 | 0,3637 | 0,0063 | |||||

| Miami-Dade County, Florida, Water and Sewer System Revenue Bonds, Series 2024A / DBT (US59334DNX83) | 6,78 | -2,84 | 0,3628 | -0,0004 | |||||

| Miami-Dade County, Florida, Water and Sewer System Revenue Bonds, Series 2024A / DBT (US59334DNX83) | 6,78 | -2,84 | 0,3628 | -0,0004 | |||||

| Miami-Dade County, Florida, Water and Sewer System Revenue Bonds, Series 2024A / DBT (US59334DNX83) | 6,78 | -2,84 | 0,3628 | -0,0004 | |||||

| US05921PCG28 / BALTIMORE MD CONVENTION CENTER HOTEL REVENUE | 6,37 | -2,61 | 0,3407 | 0,0004 | |||||

| Triborough Bridge and Tunnel Authority, New York, General Revenue Bonds, MTA Bridges & Tunnels, Series 2024A-1 / DBT (US89602RLU76) | 6,36 | -3,27 | 0,3401 | -0,0019 | |||||

| Triborough Bridge and Tunnel Authority, New York, General Revenue Bonds, MTA Bridges & Tunnels, Series 2024A-1 / DBT (US89602RLU76) | 6,36 | -3,27 | 0,3401 | -0,0019 | |||||

| Triborough Bridge and Tunnel Authority, New York, General Revenue Bonds, MTA Bridges & Tunnels, Series 2024A-1 / DBT (US89602RLU76) | 6,36 | -3,27 | 0,3401 | -0,0019 | |||||

| US5946952V99 / MICHIGAN ST TRUNK LINE | 6,34 | -4,76 | 0,3390 | -0,0072 | |||||

| US79766DMT36 / San Francisco CA City & County International Airport Revenue | 6,32 | -2,20 | 0,3382 | 0,0019 | |||||

| US896035BE11 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH SALES TAX REVENUE | 6,24 | -2,35 | 0,3339 | 0,0013 | |||||

| US64577BTR59 / New Jersey Economic Development Authority | 6,24 | -1,08 | 0,3336 | 0,0055 | |||||

| US196711UW38 / COLORADO ST COPS | 6,18 | -2,14 | 0,3304 | 0,0020 | |||||

| US592247K908 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 6,06 | -8,02 | 0,3240 | -0,0186 | |||||

| US6459165F04 / New Jersey Economic Development Authority, School Facilities Construction Bonds, Series 2005N-1 | 6,03 | -0,84 | 0,3226 | 0,0061 | |||||

| US13032URP56 / California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Series 2018A | 5,95 | -1,51 | 0,3183 | 0,0040 | |||||

| US74529JPU33 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 5,87 | -2,08 | 0,3141 | 0,0021 | |||||

| Southeast Energy Authority, Alabama, Revenue Bonds, Cooperative District Energy Supply Series 2025A / DBT (US84136HBC60) | 5,87 | -2,31 | 0,3137 | 0,0014 | |||||

| Southeast Energy Authority, Alabama, Revenue Bonds, Cooperative District Energy Supply Series 2025A / DBT (US84136HBC60) | 5,87 | -2,31 | 0,3137 | 0,0014 | |||||

| Southeast Energy Authority, Alabama, Revenue Bonds, Cooperative District Energy Supply Series 2025A / DBT (US84136HBC60) | 5,87 | -2,31 | 0,3137 | 0,0014 | |||||

| US79575EAS72 / Salt Verde Arizona Fc Bond | 5,83 | -3,50 | 0,3116 | -0,0024 | |||||

| New York Transportation Development Corporation, New York, Special Facilities Revenue Bonds, Terminal 6 John F Kennedy International Airport Redevelop / DBT (US650116HU34) | 5,76 | -6,54 | 0,3082 | -0,0125 | |||||

| New York Transportation Development Corporation, New York, Special Facilities Revenue Bonds, Terminal 6 John F Kennedy International Airport Redevelop / DBT (US650116HU34) | 5,76 | -6,54 | 0,3082 | -0,0125 | |||||

| New York Transportation Development Corporation, New York, Special Facilities Revenue Bonds, Terminal 6 John F Kennedy International Airport Redevelop / DBT (US650116HU34) | 5,76 | -6,54 | 0,3082 | -0,0125 | |||||

| US59335KFB89 / Miami-Dade County, FL Seaport Rev. Refg. | 5,74 | -1,49 | 0,3072 | 0,0039 | |||||

| US93976AEH14 / WASHINGTON ST CONVENTION CENTER PUBLIC FACS DIST | 5,70 | -3,00 | 0,3047 | -0,0008 | |||||

| Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Series 2024C / DBT (US709225KY11) | 5,68 | -2,71 | 0,3036 | 0,0001 | |||||

| Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Series 2024C / DBT (US709225KY11) | 5,68 | -2,71 | 0,3036 | 0,0001 | |||||

| Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Series 2024C / DBT (US709225KY11) | 5,68 | -2,71 | 0,3036 | 0,0001 | |||||

| US88285ADU97 / TEXAS WTR DEV BRD ST WTR IMPLEMENTATION REVENUE FUND | 5,67 | -3,44 | 0,3030 | -0,0022 | |||||

| US167501XG55 / Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1999A | 5,63 | -0,41 | 0,3009 | 0,0071 | |||||

| US882667AU25 / Texas Private Activity Bond Surface Transportation Corp. | 5,61 | -1,68 | 0,3001 | 0,0032 | |||||

| US59447TQ306 / WAYNE COUNTY MI SF 4.0% 11-01-55 | 5,60 | -2,79 | 0,2995 | -0,0002 | |||||

| US6262075F76 / Municipal Electric Authority of Georgia | 5,59 | -1,52 | 0,2989 | 0,0037 | |||||

| US837151RS01 / South Carolina Public Service Authority Santee Cooper Revenue Obligations, Refunding Series 2016B | 5,50 | -0,85 | 0,2944 | 0,0057 | |||||

| US592247L328 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 5,49 | -9,18 | 0,2936 | -0,0209 | |||||

| US882762AP26 / Texas Turnpike Authority, Central Texas Turnpike System Revenue Bonds, First Tier Series 2002A | 5,44 | 0,61 | 0,2909 | 0,0097 | |||||

| US880541J659 / TN ST 5% 5/1/2040 | 5,41 | -3,06 | 0,2895 | -0,0010 | |||||

| US254845PZ79 / District of Columbia Water and Sewer Authority, Public Utility Revenue Bonds, Senior Lien Series 2018B | 5,35 | -1,40 | 0,2863 | 0,0039 | |||||

| Triborough Bridge and Tunnel Authority, New York, Real Estate Transfer Tax Revenue Bonds, MTA Bridges and Tunnels, TBTA Capital Lockbox Fund, Series 2 / DBT (US896032BB41) | 5,34 | -2,77 | 0,2857 | -0,0001 | |||||

| Triborough Bridge and Tunnel Authority, New York, Real Estate Transfer Tax Revenue Bonds, MTA Bridges and Tunnels, TBTA Capital Lockbox Fund, Series 2 / DBT (US896032BB41) | 5,34 | -2,77 | 0,2857 | -0,0001 | |||||

| Triborough Bridge and Tunnel Authority, New York, Real Estate Transfer Tax Revenue Bonds, MTA Bridges and Tunnels, TBTA Capital Lockbox Fund, Series 2 / DBT (US896032BB41) | 5,34 | -2,77 | 0,2857 | -0,0001 | |||||

| Michigan Hospital Finance Authority, Revenue Bonds, Ascension Health Senior Credit Group, Refunding & Project Series 2010F-6 / DBT (US59465HWM41) | 5,32 | -0,52 | 0,2844 | 0,0063 | |||||

| Michigan Hospital Finance Authority, Revenue Bonds, Ascension Health Senior Credit Group, Refunding & Project Series 2010F-6 / DBT (US59465HWM41) | 5,32 | -0,52 | 0,2844 | 0,0063 | |||||

| Michigan Hospital Finance Authority, Revenue Bonds, Ascension Health Senior Credit Group, Refunding & Project Series 2010F-6 / DBT (US59465HWM41) | 5,32 | -0,52 | 0,2844 | 0,0063 | |||||

| US93976AET51 / WASHINGTON ST CONVENTION CENTER PUBLIC FACS DIST | 5,29 | -7,35 | 0,2830 | -0,0141 | |||||

| US452152P213 / State of Illinois | 5,28 | -1,44 | 0,2825 | 0,0037 | |||||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, John F Kennedy International Airport New Terminal 1 Project / DBT (US650116HM18) | 5,27 | -3,55 | 0,2818 | -0,0024 | |||||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, John F Kennedy International Airport New Terminal 1 Project / DBT (US650116HM18) | 5,27 | -3,55 | 0,2818 | -0,0024 | |||||

| US650116CP93 / New York Transportation Development Corp. (Delta Air Lines, Inc. LaGuardia Airport Terminal C&D Redevelopment), Series 2018, RB | 5,27 | -1,99 | 0,2817 | 0,0021 | |||||

| US944514H761 / DETROIT METROPOLITAN WAYNE COUNTY AIRPORT AGM 5.25% 12-01-48 | 5,25 | -3,58 | 0,2809 | -0,0024 | |||||

| Massachusetts State, General Obligation Bonds, Consolidated Series 2024I / DBT (US57582TCE01) | 5,18 | -75,64 | 0,2769 | -0,8286 | |||||

| Massachusetts State, General Obligation Bonds, Consolidated Series 2024I / DBT (US57582TCE01) | 5,18 | -75,64 | 0,2769 | -0,8286 | |||||

| Massachusetts State, General Obligation Bonds, Consolidated Series 2024I / DBT (US57582TCE01) | 5,18 | -75,64 | 0,2769 | -0,8286 | |||||

| US882854Q477 / TEXAS ST WTR DEV BRD | 5,16 | -1,94 | 0,2759 | 0,0022 | |||||

| US154690BG50 / Central Ohio Transit Authority, Ohio, General Obligation Bonds, Capital Facilities Limited Tax Series 2023 | 5,15 | -2,24 | 0,2754 | 0,0014 | |||||

| US16772PDK93 / CHICAGO IL TRANSIT AUTH SALES REGD B/E BAM 5.00000000 | 5,14 | -1,65 | 0,2749 | 0,0031 | |||||

| US521841GY69 / Leander Independent School District, Williamson and Travis Counties, Texas, General Obligation Bonds, Refunding Series 2015A | 5,14 | -0,41 | 0,2747 | 0,0064 | |||||

| US833102A301 / SNOHOMISH CO WA PUD #1 21A SF 5.0% 12-01-51 | 5,13 | -1,56 | 0,2742 | 0,0033 | |||||

| US89602HAB33 / Triborough Bridge & Tunnel Authority | 5,12 | -2,01 | 0,2736 | 0,0020 | |||||

| US64971XU971 / New York City Transitional Finance Authority Future Tax Secured Revenue | 5,12 | -2,14 | 0,2736 | 0,0016 | |||||

| US452252PQ68 / ILL ST TOLL 5% 1/1/2045 | 5,11 | -2,65 | 0,2733 | 0,0003 | |||||

| US167510AA40 / CHICAGO IL BRD OF EDU DEDICATED CAPITAL IMPT | 5,10 | -0,84 | 0,2725 | 0,0052 | |||||

| US650116FQ40 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 5,06 | -2,88 | 0,2704 | -0,0004 | |||||

| US51771FAT30 / LAS VEGAS NV CONVENTION & VISITORS AUTH CONVENTION CTR EXPAN | 5,05 | -2,15 | 0,2701 | 0,0016 | |||||

| US167505QY58 / CHICAGO IL BRD OF EDU | 5,04 | -0,90 | 0,2695 | 0,0050 | |||||

| Pennsylvania Housing Finance Agency, Single Family Mortgage Revenue Bonds, Social Series 2024-145A / DBT (US70879QWK56) | 4,97 | -1,76 | 0,2655 | 0,0026 | |||||

| Pennsylvania Housing Finance Agency, Single Family Mortgage Revenue Bonds, Social Series 2024-145A / DBT (US70879QWK56) | 4,97 | -1,76 | 0,2655 | 0,0026 | |||||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 4,90 | -4,35 | 0,2622 | -0,0044 | |||||

| US167505RM02 / CHICAGO IL BRD OF EDU | 4,87 | -2,23 | 0,2602 | 0,0013 | |||||

| US088365MB49 / Bexar County Hospital District, Texas, Certificates of Obligation, Series 2023 | 4,86 | -2,06 | 0,2599 | 0,0018 | |||||

| Black Belt Energy Gas District, Alabama, Gas Project Revenue Bonds, Series 2024C / DBT (US09182TDU88) | 4,85 | -1,38 | 0,2594 | 0,0035 | |||||

| Black Belt Energy Gas District, Alabama, Gas Project Revenue Bonds, Series 2024C / DBT (US09182TDU88) | 4,85 | -1,38 | 0,2594 | 0,0035 | |||||

| Black Belt Energy Gas District, Alabama, Gas Project Revenue Bonds, Series 2024C / DBT (US09182TDU88) | 4,85 | -1,38 | 0,2594 | 0,0035 | |||||

| US346914NM27 / Fort Bend County Municipal Utility District 50, Texas, General Obligation Bonds, Series 2018A | 4,84 | -6,60 | 0,2587 | -0,0107 | |||||

| New Jersey Health Care Facilities Financing Authority, Revenue Bonds, Inspira Health Obligated Group Issue, Series 2024A / DBT (US645790UP94) | 4,68 | 0,2502 | 0,2502 | ||||||

| New Jersey Health Care Facilities Financing Authority, Revenue Bonds, Inspira Health Obligated Group Issue, Series 2024A / DBT (US645790UP94) | 4,68 | 0,2502 | 0,2502 | ||||||

| New Jersey Health Care Facilities Financing Authority, Revenue Bonds, Inspira Health Obligated Group Issue, Series 2024A / DBT (US645790UP94) | 4,68 | 0,2502 | 0,2502 | ||||||

| Harris County-Houston Sports Authority, Texas, Revenue Bonds, Refunding Second Lien Series 2024B / DBT (US413890JA31) | 4,68 | -2,85 | 0,2501 | -0,0002 | |||||

| Harris County-Houston Sports Authority, Texas, Revenue Bonds, Refunding Second Lien Series 2024B / DBT (US413890JA31) | 4,68 | -2,85 | 0,2501 | -0,0002 | |||||

| Harris County-Houston Sports Authority, Texas, Revenue Bonds, Refunding Second Lien Series 2024B / DBT (US413890JA31) | 4,68 | -2,85 | 0,2501 | -0,0002 | |||||

| Hutto, Texas, Certificates of Obligation Bonds, Combination Tax & Waterworks & Sewer System Revenue Series 2024 / DBT (US448474ZS80) | 4,68 | -3,61 | 0,2501 | -0,0023 | |||||

| Hutto, Texas, Certificates of Obligation Bonds, Combination Tax & Waterworks & Sewer System Revenue Series 2024 / DBT (US448474ZS80) | 4,68 | -3,61 | 0,2501 | -0,0023 | |||||

| US66285WWC62 / North Texas Tollway Authority | 4,66 | -3,06 | 0,2491 | -0,0008 | |||||

| US592247FZ86 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 1994B | 4,62 | -1,39 | 0,2471 | 0,0033 | |||||

| Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Refunding Series 2024A / DBT (US592647NG28) | 4,62 | -2,98 | 0,2471 | -0,0006 | |||||

| Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Refunding Series 2024A / DBT (US592647NG28) | 4,62 | -2,98 | 0,2471 | -0,0006 | |||||

| US19668QLB94 / Colorado State, Building Excellent Schools Today, Certificates of Participation, Series 2018N | 4,61 | -1,79 | 0,2465 | 0,0024 | |||||

| Dormitory Authority of the State of New York, Revenue Bonds, White Plains Hospital, Series 2024 / DBT (US65000B7Y87) | 4,59 | -2,81 | 0,2456 | -0,0002 | |||||

| Dormitory Authority of the State of New York, Revenue Bonds, White Plains Hospital, Series 2024 / DBT (US65000B7Y87) | 4,59 | -2,81 | 0,2456 | -0,0002 | |||||

| Dormitory Authority of the State of New York, Revenue Bonds, White Plains Hospital, Series 2024 / DBT (US65000B7Y87) | 4,59 | -2,81 | 0,2456 | -0,0002 | |||||

| US68450LGQ23 / Orange County Health Facilities Authority | 4,59 | -4,30 | 0,2455 | -0,0040 | |||||

| US880065BQ97 / Temple, Texas, General Obligation Bonds, Combination Tax and Revenue Series 2022B | 4,55 | -3,52 | 0,2434 | -0,0020 | |||||

| Salt Lake City, Utah, Public Utilities Revenue Bonds, Series 2025 / DBT (US795604DV62) | 4,53 | -2,58 | 0,2423 | 0,0004 | |||||

| Salt Lake City, Utah, Public Utilities Revenue Bonds, Series 2025 / DBT (US795604DV62) | 4,53 | -2,58 | 0,2423 | 0,0004 | |||||

| Salt Lake City, Utah, Public Utilities Revenue Bonds, Series 2025 / DBT (US795604DV62) | 4,53 | -2,58 | 0,2423 | 0,0004 | |||||

| US91417K2N07 / University of Colorado, Enterprise System Revenue Bonds, Series 2018B | 4,50 | -0,90 | 0,2405 | 0,0045 | |||||

| Metropolitan Atlanta Rapid Transit Authority, Georgia, Sales Tax Revenue Bonds, Green Series 2025A / DBT (US591746BZ47) | 4,45 | 0,2379 | 0,2379 | ||||||

| Metropolitan Atlanta Rapid Transit Authority, Georgia, Sales Tax Revenue Bonds, Green Series 2025A / DBT (US591746BZ47) | 4,45 | 0,2379 | 0,2379 | ||||||

| US574296DQ95 / Maryland Stadium Authority, Revenue Bonds, Baltimore City Public Schools Construction & Revitalization Program, Series 2018A | 4,44 | -0,91 | 0,2375 | 0,0044 | |||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025E / DBT (US64972JPT96) | 4,44 | -69,64 | 0,2373 | -0,5230 | |||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025E / DBT (US64972JPT96) | 4,44 | -69,64 | 0,2373 | -0,5230 | |||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025E / DBT (US64972JPT96) | 4,44 | -69,64 | 0,2373 | -0,5230 | |||||

| US97710BW737 / Wisconsin (State of) Health & Educational Facilities Authority (Mercy Alliance), Series 2012, RB | 4,41 | 0,07 | 0,2361 | 0,0066 | |||||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Seri / DBT (US340618DV61) | 4,41 | -3,27 | 0,2359 | -0,0013 | |||||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Seri / DBT (US340618DV61) | 4,41 | -3,27 | 0,2359 | -0,0013 | |||||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Seri / DBT (US340618DV61) | 4,41 | -3,27 | 0,2359 | -0,0013 | |||||

| Public Energy Authority of Kentucky, Gas Supply Revenue Bonds, Refunding Series 2024B / DBT (US74440DFC39) | 4,41 | -1,59 | 0,2356 | 0,0028 | |||||

| Public Energy Authority of Kentucky, Gas Supply Revenue Bonds, Refunding Series 2024B / DBT (US74440DFC39) | 4,41 | -1,59 | 0,2356 | 0,0028 | |||||

| Public Energy Authority of Kentucky, Gas Supply Revenue Bonds, Refunding Series 2024B / DBT (US74440DFC39) | 4,41 | -1,59 | 0,2356 | 0,0028 | |||||

| US45528UZK05 / Indianapolis Local Public Improvement Bond Bank | 4,26 | -2,02 | 0,2281 | 0,0016 | |||||

| US55374SAJ96 / M-S-R ENERGY AUTHORITY | 4,22 | -3,81 | 0,2256 | -0,0025 | |||||

| US13032UXG83 / California Health Facilities Financing Authority | 4,22 | -0,78 | 0,2255 | 0,0044 | |||||

| US956510BY62 / West Virginia Parkways Authority | 4,18 | -3,73 | 0,2234 | -0,0024 | |||||

| US362848UJ05 / GAINESVILLE FL UTIL SYS REV 17A 5.0% 10-01-36 | 4,10 | -1,32 | 0,2194 | 0,0031 | |||||

| US59334KFW36 / Miami-Dade (County of), FL Expressway Authority, Series 2010 A, Ref. RB | 4,10 | -19,84 | 0,2191 | -0,0468 | |||||

| US65820FAF45 / North Carolina (State of) Department of Transportation (I-77 HOT Lanes), Series 2015, RB | 4,08 | -0,51 | 0,2183 | 0,0049 | |||||

| US223093MN21 / Covina-Valley Unified School District, Los Angeles County, California, General Obligation Bonds, Series 2003B | 4,04 | 0,15 | 0,2161 | 0,0062 | |||||

| US491214AW21 / Kentucky Bond Development Corp | 4,03 | -1,35 | 0,2156 | 0,0031 | |||||

| US62620HDQ20 / Municipal Electric Authority of Georgia | 4,03 | -1,59 | 0,2153 | 0,0025 | |||||

| US452252LX55 / Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Senior Lien Series 2016B | 4,01 | -0,74 | 0,2146 | 0,0043 | |||||

| US928097AB03 / VIRGINIA SMALL BUSINESS FING AUTH PRIV ACTIVITY REVENUE SR | 3,99 | -3,34 | 0,2133 | -0,0014 | |||||

| US93976AEJ79 / Washington State Convention Center Public Facilities District, Lodging Tax Revenue Bonds, Refunding Subordinate Series2021B Exchange Purchase | 3,99 | -8,60 | 0,2132 | -0,0137 | |||||

| US545845EA31 / Loudon, Tennessee, Water and Sewer Revenue Bonds, Series 2023 | 3,98 | -3,85 | 0,2126 | -0,0024 | |||||

| US64972GTD69 / New York City Water & Sewer System | 3,97 | -2,50 | 0,2125 | 0,0005 | |||||

| US56042RQX34 / Maine Health and Higher Educational Facilities Authority Revenue Bonds, MaineHealth Issue, Series 2018A | 3,96 | -23,81 | 0,2117 | -0,0586 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, McLeod Health Project, Series 2024 / DBT (US837032CT69) | 3,93 | -2,38 | 0,2102 | 0,0008 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, McLeod Health Project, Series 2024 / DBT (US837032CT69) | 3,93 | -2,38 | 0,2102 | 0,0008 | |||||

| Pasadena Economic Development Corporation, Harris County, Texas, Sales Tax Revenue Bonds, Series 2023 / DBT (US702318AX41) | 3,92 | -2,17 | 0,2098 | 0,0012 | |||||

| Pasadena Economic Development Corporation, Harris County, Texas, Sales Tax Revenue Bonds, Series 2023 / DBT (US702318AX41) | 3,92 | -2,17 | 0,2098 | 0,0012 | |||||

| Pasadena Economic Development Corporation, Harris County, Texas, Sales Tax Revenue Bonds, Series 2023 / DBT (US702318AX41) | 3,92 | -2,17 | 0,2098 | 0,0012 | |||||

| US196711RN75 / Colorado State, Certificates of Participation, Rural Series 2018A | 3,91 | -1,71 | 0,2089 | 0,0022 | |||||

| US88880NAU37 / TOBACCO SETTLEMENT FING CORP VA | 3,90 | -8,10 | 0,2088 | -0,0122 | |||||

| US64990FA384 / New York State Dormitory Authority | 3,86 | -3,86 | 0,2064 | -0,0024 | |||||

| US837151WZ88 / SOUTH CAROLINA ST PUB | 3,83 | -3,11 | 0,2047 | -0,0008 | |||||

| South Carolina Public Service Authority, Santee Cooper Revenue Obligations, Refunding Series 2024B / DBT (US8371514Y20) | 3,78 | 0,2021 | 0,2021 | ||||||

| South Carolina Public Service Authority, Santee Cooper Revenue Obligations, Refunding Series 2024B / DBT (US8371514Y20) | 3,78 | 0,2021 | 0,2021 | ||||||

| South Carolina Public Service Authority, Santee Cooper Revenue Obligations, Refunding Series 2024B / DBT (US8371514Y20) | 3,78 | 0,2021 | 0,2021 | ||||||

| US254842BB27 / District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2006A | 3,74 | -5,91 | 0,2001 | -0,0067 | |||||

| US483195D591 / Kalamazoo County, Michigan, General Obligation Bonds, Limitied Tax Series 2022 | 3,72 | -3,55 | 0,1990 | -0,0017 | |||||

| US26822LGV09 / E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Refunding Series 2006B | 3,72 | 0,68 | 0,1988 | 0,0067 | |||||

| Metropolitan Government of Nashville-Davidson County Health and Educational Facilities Board, Tennessee, Revenue Bonds, Vanderbilt University, Refundi / DBT (US592029CZ34) | 3,71 | -3,59 | 0,1984 | -0,0017 | |||||

| Metropolitan Government of Nashville-Davidson County Health and Educational Facilities Board, Tennessee, Revenue Bonds, Vanderbilt University, Refundi / DBT (US592029CZ34) | 3,71 | -3,59 | 0,1984 | -0,0017 | |||||

| US45203HS459 / Illinois Finance Authority, Revenue Bonds, Rush University Medical Center Obligated Group, Series 2015B | 3,70 | -0,22 | 0,1979 | 0,0050 | |||||

| NHYM / Nushares ETF Trust - Nuveen High Yield Municipal Income ETF | 0,15 | 3,67 | 0,1963 | 0,1963 | |||||

| US38122NB843 / GOLDEN ST TOBACCO SECURITIZATI REGD ZCP OID B/E 0.00000000 | 3,66 | -8,36 | 0,1958 | -0,0120 | |||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KA61) | 3,62 | -5,11 | 0,1938 | -0,0049 | |||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KA61) | 3,62 | -5,11 | 0,1938 | -0,0049 | |||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KA61) | 3,62 | -5,11 | 0,1938 | -0,0049 | |||||

| US19648FKT02 / COLORADO ST HLTH FACS AUTH HOSP REVENUE | 3,59 | -4,21 | 0,1921 | -0,0029 | |||||

| US64966QQF09 / City of New York NY | 3,59 | -2,15 | 0,1920 | 0,0011 | |||||

| US592247J926 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 3,57 | -4,36 | 0,1912 | -0,0032 | |||||

| US249182RT50 / City & County of Denver CO Airport System Revenue | 3,55 | -2,90 | 0,1899 | -0,0003 | |||||

| US646140CT89 / NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE | 3,55 | -4,95 | 0,1898 | -0,0044 | |||||

| US795576JC22 / SALT LAKE CITY UT ARPT REVENUE | 3,54 | -2,02 | 0,1893 | 0,0014 | |||||

| Gainesville, Florida, Utilities System Revenue Bonds, Series 2019A / DBT (US362848VL42) | 3,53 | -2,27 | 0,1889 | 0,0009 | |||||

| Gainesville, Florida, Utilities System Revenue Bonds, Series 2019A / DBT (US362848VL42) | 3,53 | -2,27 | 0,1889 | 0,0009 | |||||

| Gainesville, Florida, Utilities System Revenue Bonds, Series 2019A / DBT (US362848VL42) | 3,53 | -2,27 | 0,1889 | 0,0009 | |||||

| US167560VF56 / CHICAGO IL MET WTR RECLAMATION DIST GREATER CHICAGO | 3,53 | -4,23 | 0,1888 | -0,0030 | |||||

| US13048VCD82 / California Municipal Finance Authority | 3,48 | -0,74 | 0,1861 | 0,0037 | |||||

| US13080SMK77 / California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2016A | 3,41 | -3,04 | 0,1824 | -0,0006 | |||||

| US196711UZ68 / COLORADO ST COPS | 3,40 | -2,52 | 0,1820 | 0,0004 | |||||

| Pittsburgh Water and Sewer Authority, Pennsylvania, Water and Sewer System Revenue Bonds, First Lien Series 2025A / DBT (US725304ZP72) | 3,40 | -2,64 | 0,1817 | 0,0002 | |||||

| Pittsburgh Water and Sewer Authority, Pennsylvania, Water and Sewer System Revenue Bonds, First Lien Series 2025A / DBT (US725304ZP72) | 3,40 | -2,64 | 0,1817 | 0,0002 | |||||

| Crowley Independent School District, Tarrant and Johnson Counties, Texas, General Obligation Bonds, School Building Series 2024 / DBT (US228130LE84) | 3,40 | -4,34 | 0,1816 | -0,0030 | |||||

| Crowley Independent School District, Tarrant and Johnson Counties, Texas, General Obligation Bonds, School Building Series 2024 / DBT (US228130LE84) | 3,40 | -4,34 | 0,1816 | -0,0030 | |||||

| Crowley Independent School District, Tarrant and Johnson Counties, Texas, General Obligation Bonds, School Building Series 2024 / DBT (US228130LE84) | 3,40 | -4,34 | 0,1816 | -0,0030 | |||||

| Colorado Bridge and Tunnel Enterprise, Colorado, Senior Infrastructure Revenue Bonds, Series 2025A / DBT (US19633TBA88) | 3,39 | 0,1812 | 0,1812 | ||||||

| Colorado Bridge and Tunnel Enterprise, Colorado, Senior Infrastructure Revenue Bonds, Series 2025A / DBT (US19633TBA88) | 3,39 | 0,1812 | 0,1812 | ||||||

| Colorado Bridge and Tunnel Enterprise, Colorado, Senior Infrastructure Revenue Bonds, Series 2025A / DBT (US19633TBA88) | 3,39 | 0,1812 | 0,1812 | ||||||

| 6444 / Sanden Corporation | 3,37 | -2,32 | 0,1800 | 0,0007 | |||||

| 6444 / Sanden Corporation | 3,37 | -2,32 | 0,1800 | 0,0007 | |||||

| 6444 / Sanden Corporation | 3,37 | -2,32 | 0,1800 | 0,0007 | |||||

| US60637AEA60 / MISSOURI ST HLTH & EDUCTNL FACS AUTH HLTH FACS REVENUE | 3,36 | -3,17 | 0,1794 | -0,0008 | |||||

| US71885JAC36 / Industrial Development Authority of the City of Phoenix (The) | 3,35 | 0,1791 | 0,1791 | ||||||

| US59447TSM61 / Michigan (State of) Finance Authority (Charter County of Wayne Criminal Justice Center), Series 2018, RB | 3,35 | -1,53 | 0,1791 | 0,0022 | |||||

| Greenwood Independent School District, Midland County, Texas, School Building Bonds, Series 2024 / DBT (US397370KJ58) | 3,34 | -4,55 | 0,1786 | -0,0034 | |||||

| Greenwood Independent School District, Midland County, Texas, School Building Bonds, Series 2024 / DBT (US397370KJ58) | 3,34 | -4,55 | 0,1786 | -0,0034 | |||||

| Greenwood Independent School District, Midland County, Texas, School Building Bonds, Series 2024 / DBT (US397370KJ58) | 3,34 | -4,55 | 0,1786 | -0,0034 | |||||

| US623040FV90 / MOUNT SAN ANTONIO CA CMNTY CLG DIST | 3,30 | -1,17 | 0,1763 | 0,0028 | |||||

| US650116CN46 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 3,28 | -1,83 | 0,1752 | 0,0016 | |||||

| US727220AB17 / City of Plano | 3,21 | 0,1719 | 0,1719 | ||||||

| Harris County, Texas, General Obligation Bonds, Permanent Improvement Series 2024 / DBT (US4140054E56) | 3,20 | -4,51 | 0,1710 | -0,0032 | |||||

| Harris County, Texas, General Obligation Bonds, Permanent Improvement Series 2024 / DBT (US4140054E56) | 3,20 | -4,51 | 0,1710 | -0,0032 | |||||

| Harris County, Texas, General Obligation Bonds, Permanent Improvement Series 2024 / DBT (US4140054E56) | 3,20 | -4,51 | 0,1710 | -0,0032 | |||||

| US368497HP13 / Geisinger Authority (Geisinger Health System), Series 2017 A-1, Ref. RB | 3,15 | -1,38 | 0,1687 | 0,0024 | |||||

| Hillsborough County Industrial Development Authority, Florida, Health System Revenue Bonds, BayCare Health System Series 2024C / DBT (US43233KAU88) | 3,14 | -2,87 | 0,1681 | -0,0002 | |||||

| Hillsborough County Industrial Development Authority, Florida, Health System Revenue Bonds, BayCare Health System Series 2024C / DBT (US43233KAU88) | 3,14 | -2,87 | 0,1681 | -0,0002 | |||||

| Hillsborough County Industrial Development Authority, Florida, Health System Revenue Bonds, BayCare Health System Series 2024C / DBT (US43233KAU88) | 3,14 | -2,87 | 0,1681 | -0,0002 | |||||

| US353202FL33 / Franklin Cnty Ohio Rev Rev Bds Callable Bond | 3,11 | -5,50 | 0,1662 | -0,0049 | |||||

| Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Lifebridge Health Issue Series 2023 / DBT (US57421CGJ71) | 3,07 | -2,20 | 0,1641 | 0,0009 | |||||

| Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Lifebridge Health Issue Series 2023 / DBT (US57421CGJ71) | 3,07 | -2,20 | 0,1641 | 0,0009 | |||||

| Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Lifebridge Health Issue Series 2023 / DBT (US57421CGJ71) | 3,07 | -2,20 | 0,1641 | 0,0009 | |||||

| NUMI / Nushares ETF Trust - Nuveen Municipal Income ETF | 0,12 | 3,07 | 0,1640 | 0,1640 | |||||

| US59261AG351 / MET TRANSPRTN AUTH NY REVENUE | 3,06 | -3,41 | 0,1635 | -0,0011 | |||||

| US59334PKY24 / MIAMI-DADE STAX 5% 7/1/2051 | 3,06 | -2,80 | 0,1635 | -0,0001 | |||||

| US880558JT90 / Tennessee State School Bond Authority, Higher Educational Facilities Second Program Bonds, Series 2017A | 3,04 | -0,85 | 0,1628 | 0,0031 | |||||

| US709224K576 / Pennsylvania (State of) Turnpike Commission, Series 2018 A-2, RB | 3,04 | -2,15 | 0,1627 | 0,0010 | |||||

| Hutto, Texas, Certificates of Obligation Bonds, Combination Tax & Waterworks & Sewer System Revenue Series 2024 / DBT (US448474ZR08) | 3,04 | -3,19 | 0,1623 | -0,0007 | |||||

| Hutto, Texas, Certificates of Obligation Bonds, Combination Tax & Waterworks & Sewer System Revenue Series 2024 / DBT (US448474ZR08) | 3,04 | -3,19 | 0,1623 | -0,0007 | |||||

| US64613CBM91 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 3,03 | -7,45 | 0,1621 | -0,0082 | |||||

| US75282KAA43 / Range View Estates Metropolitan District, Mead, Weld County, Colorado, Limited Tax General Obligation Bonds, Series 2020A | 3,03 | 0,1621 | 0,1621 | ||||||

| US74529JPW98 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 3,02 | -5,39 | 0,1616 | -0,0045 | |||||

| US61204KLQ21 / Montana Facility Finance Authority, Revenue Bonds, Billings Clinic Obligated Group, Series 2018A | 3,02 | -2,05 | 0,1613 | 0,0011 | |||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025H-1 / DBT (US64972JTF56) | 3,00 | 0,1606 | 0,1606 | ||||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025H-1 / DBT (US64972JTF56) | 3,00 | 0,1606 | 0,1606 | ||||||

| New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal Series 2025H-1 / DBT (US64972JTF56) | 3,00 | 0,1606 | 0,1606 | ||||||

| US89602N3D45 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH REVENUES | 3,00 | -0,27 | 0,1605 | 0,0040 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Ascension Health Alliance Senior Credit Group, Series 2016A / DBT (US97712JMC44) | 3,00 | -0,60 | 0,1603 | 0,0034 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Ascension Health Alliance Senior Credit Group, Series 2016A / DBT (US97712JMC44) | 3,00 | -0,60 | 0,1603 | 0,0034 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Ascension Health Alliance Senior Credit Group, Series 2016A / DBT (US97712JMC44) | 3,00 | -0,60 | 0,1603 | 0,0034 | |||||

| Lamar Consolidated Independent School District, Fort Bend County, Texas, General Obligation Bonds, Schoolhouse Refunding Series 2024 / DBT (US513174Q394) | 2,99 | -2,35 | 0,1599 | 0,0006 | |||||

| Lamar Consolidated Independent School District, Fort Bend County, Texas, General Obligation Bonds, Schoolhouse Refunding Series 2024 / DBT (US513174Q394) | 2,99 | -2,35 | 0,1599 | 0,0006 | |||||

| Lamar Consolidated Independent School District, Fort Bend County, Texas, General Obligation Bonds, Schoolhouse Refunding Series 2024 / DBT (US513174Q394) | 2,99 | -2,35 | 0,1599 | 0,0006 | |||||

| US65000BJV18 / New York State Dormitory Authority, Series 2017 A | 2,99 | -1,87 | 0,1598 | 0,0014 | |||||

| US167505RD03 / Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, Series 2016B | 2,98 | -1,29 | 0,1596 | 0,0023 | |||||

| US65830UAE29 / North Carolina Turnpike Authority | 2,96 | -1,33 | 0,1583 | 0,0023 | |||||

| US5946952U17 / MICHIGAN ST TRUNK LINE | 2,96 | -4,74 | 0,1581 | -0,0033 | |||||

| Harris County Cultural Education Facilities Finance Corporation, Texas, Hospital Revenue Bonds, Memorial Hermann Health System, Series 2024C / DBT (US414009SP62) | 2,94 | -0,78 | 0,1571 | 0,0031 | |||||

| Harris County Cultural Education Facilities Finance Corporation, Texas, Hospital Revenue Bonds, Memorial Hermann Health System, Series 2024C / DBT (US414009SP62) | 2,94 | -0,78 | 0,1571 | 0,0031 | |||||

| Harris County Cultural Education Facilities Finance Corporation, Texas, Hospital Revenue Bonds, Memorial Hermann Health System, Series 2024C / DBT (US414009SP62) | 2,94 | -0,78 | 0,1571 | 0,0031 | |||||

| US649519FF71 / New York Liberty Development Corporation, New York, Liberty Revenue Bonds, Secured by Port Authority Consolidated Bonds, Refunding Series 1WTC-2021 | 2,94 | -4,74 | 0,1571 | -0,0033 | |||||

| San Francisco Airport Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2024A / DBT (US79766DWW54) | 2,91 | -4,31 | 0,1557 | -0,0025 | |||||

| San Francisco Airport Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2024A / DBT (US79766DWW54) | 2,91 | -4,31 | 0,1557 | -0,0025 | |||||

| San Francisco Airport Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2024A / DBT (US79766DWW54) | 2,91 | -4,31 | 0,1557 | -0,0025 | |||||

| US956876LJ34 / West Wilson Utility District, Wilson County, Tennessee, Water Revenue Bonds, Improvement Series 2022 | 2,91 | -4,93 | 0,1556 | -0,0036 | |||||

| California Health Facilities Financing Authority, Revenue Bonds, Adventist Health System/West, Series 2024A / DBT (US13032UU715) | 2,90 | -5,04 | 0,1551 | -0,0038 | |||||

| California Health Facilities Financing Authority, Revenue Bonds, Adventist Health System/West, Series 2024A / DBT (US13032UU715) | 2,90 | -5,04 | 0,1551 | -0,0038 | |||||

| US93976ABJ07 / Washington State Convention Center Public Facilities District | 2,89 | -5,09 | 0,1545 | -0,0038 | |||||

| US544445J347 / City of Los Angeles, Series 2022 I | 2,86 | -3,97 | 0,1527 | -0,0019 | |||||

| US57583U6R41 / Massachusetts Development Finance Agency, Revenue Bonds, Boston Medical Center Issue, Green Bonds, Series 2015D | 2,85 | -0,59 | 0,1525 | 0,0033 | |||||

| New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2024CC / DBT (US64613CGH51) | 2,83 | -73,01 | 0,1512 | -0,3938 | |||||

| New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2024CC / DBT (US64613CGH51) | 2,83 | -73,01 | 0,1512 | -0,3938 | |||||

| New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2024CC / DBT (US64613CGH51) | 2,83 | -73,01 | 0,1512 | -0,3938 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, Novant Health Group, Series 2024A / DBT (US837032CB51) | 2,79 | -2,83 | 0,1490 | -0,0001 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, Novant Health Group, Series 2024A / DBT (US837032CB51) | 2,79 | -2,83 | 0,1490 | -0,0001 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, Novant Health Group, Series 2024A / DBT (US837032CB51) | 2,79 | -2,83 | 0,1490 | -0,0001 | |||||

| US956622T879 / WEST VIRGINIA ST HOSP FIN AUTH | 2,78 | -1,31 | 0,1486 | 0,0022 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, Novant Health Group, Series 2024A / DBT (US837032CD18) | 2,78 | -2,66 | 0,1485 | 0,0001 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, Novant Health Group, Series 2024A / DBT (US837032CD18) | 2,78 | -2,66 | 0,1485 | 0,0001 | |||||

| South Carolina Jobs-Economic Development Authority, Health Care Facilities Revenue Bonds, Novant Health Group, Series 2024A / DBT (US837032CD18) | 2,78 | -2,66 | 0,1485 | 0,0001 | |||||

| US544525T402 / LOS ANGELES CA DEPT OF WTR & PWR WTRWKS REVENUE | 2,77 | -4,49 | 0,1479 | -0,0027 | |||||

| US05921PCB31 / Baltimore, Maryland, Convention Center Hotel Revenue Bonds, Refunding Series 2017 | 2,76 | -0,43 | 0,1474 | 0,0034 | |||||

| US646136X712 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2015AA | 2,75 | -0,47 | 0,1473 | 0,0033 | |||||

| US57584XNZ05 / Massachusetts Development Finance Agency, Revenue Bonds, Dana-Farber Cancer Institute Issue, Series 2016N | 2,73 | -2,47 | 0,1460 | 0,0004 | |||||

| Board of Regents of the University of Texas System, Revenue Financing System Bonds, Series 2024B / DBT (US91514AMR31) | 2,73 | -2,19 | 0,1458 | 0,0008 | |||||

| Board of Regents of the University of Texas System, Revenue Financing System Bonds, Series 2024B / DBT (US91514AMR31) | 2,73 | -2,19 | 0,1458 | 0,0008 | |||||

| Board of Regents of the University of Texas System, Revenue Financing System Bonds, Series 2024B / DBT (US91514AMR31) | 2,73 | -2,19 | 0,1458 | 0,0008 | |||||

| US058827EY88 / Baltic School District No 49-1 5.250%, Due 12/01/2047 | 2,73 | -1,59 | 0,1457 | 0,0017 | |||||

| New Jersey Health Care Facilities Financing Authority, Revenue Bonds, Inspira Health Obligated Group Issue, Series 2024A / DBT (US645790UR50) | 2,71 | -5,83 | 0,1451 | -0,0048 | |||||

| New Jersey Health Care Facilities Financing Authority, Revenue Bonds, Inspira Health Obligated Group Issue, Series 2024A / DBT (US645790UR50) | 2,71 | -5,83 | 0,1451 | -0,0048 | |||||

| US64989KLE46 / NEW YORK ST PWR AUTH REVENUE | 2,70 | -29,59 | 0,1443 | -0,0551 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Ascension Health Alliance Senior Credit Group, Series 2016A / DBT (US97712JMD27) | 2,66 | -7,65 | 0,1421 | -0,0076 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Ascension Health Alliance Senior Credit Group, Series 2016A / DBT (US97712JMD27) | 2,66 | -7,65 | 0,1421 | -0,0076 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Ascension Health Alliance Senior Credit Group, Series 2016A / DBT (US97712JMD27) | 2,66 | -7,65 | 0,1421 | -0,0076 | |||||

| US797002CJ97 / San Bruno Park School District, San Mateo County, California, General Obligation Bonds, Series 2000B | 2,64 | 0,76 | 0,1409 | 0,0049 | |||||

| US74440DEC48 / KENTUCKY ST PUBLIC ENERGY AUTH REGD V/R B/E 5.25000000 | 2,62 | -1,21 | 0,1401 | 0,0022 | |||||

| US251237WV19 / Detroit, Michigan, Senior Lien Sewerage Disposal System Revenue Bonds, Series 2001B | 2,60 | -0,91 | 0,1391 | 0,0026 | |||||

| US414009KD15 / Harris County Cultural Education Facilities Finance Corporation, Texas, Revenue Bonds, Houston Methodist Hospital System, Series 2015 | 2,58 | -3,81 | 0,1379 | -0,0015 | |||||

| San Antonio, Texas, Electric and Gas Systems Revenue Bonds, Refunding New Series 2024B / DBT (US79625GKP71) | 2,57 | -2,47 | 0,1373 | 0,0004 | |||||

| San Antonio, Texas, Electric and Gas Systems Revenue Bonds, Refunding New Series 2024B / DBT (US79625GKP71) | 2,57 | -2,47 | 0,1373 | 0,0004 | |||||

| San Antonio, Texas, Electric and Gas Systems Revenue Bonds, Refunding New Series 2024B / DBT (US79625GKP71) | 2,57 | -2,47 | 0,1373 | 0,0004 | |||||

| US612043KS72 / Montana Facility Finance Authority, Healthcare Facility Revenue Bonds, Kalispell Regional Medical Center, Series 2018B | 2,55 | -1,28 | 0,1363 | 0,0020 | |||||

| US613603G525 / MONTGOMERY CNTY PA HGR EDU & HLTH AUTH | 2,53 | -7,01 | 0,1355 | -0,0062 | |||||

| Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024 / DBT (US472682ZS54) | 2,51 | -4,52 | 0,1345 | -0,0025 | |||||

| Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024 / DBT (US472682ZS54) | 2,51 | -4,52 | 0,1345 | -0,0025 | |||||

| Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024 / DBT (US472682ZS54) | 2,51 | -4,52 | 0,1345 | -0,0025 | |||||

| US362762MM51 / Gainesville and Hall County Hospital Authority, Georgia, Revenue Anticipation Certificates, Northeast Georgia Health Services Inc, Series 2017B | 2,51 | -1,76 | 0,1344 | 0,0014 | |||||

| US93976ACG58 / Washington State Convention Center Public Facilities District, Lodging Tax Revenue Bonds, Series 2018 | 2,50 | -10,91 | 0,1337 | -0,0123 | |||||

| US345105HL76 / Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, Refunding Series 2013A | 2,49 | -2,20 | 0,1332 | 0,0007 | |||||

| US709221VZ52 / PENNSYLVANIA ST TURNPIKE COMMISSION OIL FRANCHISE TAX REVENU | 2,47 | -3,25 | 0,1322 | -0,0007 | |||||

| US05921PCF45 / BALTIMORE MD CONVENTION CENTER HOTEL REVENUE | 2,45 | -3,05 | 0,1310 | -0,0004 | |||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KF58) | 2,44 | 0,1305 | 0,1305 | ||||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KF58) | 2,44 | 0,1305 | 0,1305 | ||||||

| US12008KAH59 / Build NYC Resource Corporation, New York, Revenue Bonds, Family Life Academy Charter School, Series 2020C-1 | 2,44 | -5,28 | 0,1305 | -0,0035 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Marshfield Clinic Health System Inc Series 2024A / DBT (US97712JKM44) | 2,43 | -1,78 | 0,1301 | 0,0013 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Marshfield Clinic Health System Inc Series 2024A / DBT (US97712JKM44) | 2,43 | -1,78 | 0,1301 | 0,0013 | |||||

| Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Marshfield Clinic Health System Inc Series 2024A / DBT (US97712JKM44) | 2,43 | -1,78 | 0,1301 | 0,0013 | |||||

| Louisiana Publics Facilities Authority, Louisiana, Revenue Bonds, I-10 Calcasieu River Bridge Public-Private Partnership Project, Senior Lien Series 2 / DBT (US546399SY35) | 2,42 | -3,36 | 0,1294 | -0,0009 | |||||

| Louisiana Publics Facilities Authority, Louisiana, Revenue Bonds, I-10 Calcasieu River Bridge Public-Private Partnership Project, Senior Lien Series 2 / DBT (US546399SY35) | 2,42 | -3,36 | 0,1294 | -0,0009 | |||||

| US682004EL69 / OMAHA PUB PWR DIST NEB ELEC REV | 2,42 | -0,04 | 0,1293 | 0,0035 | |||||

| US593211FN07 / Miami Beach Health Facilities Authority | 2,40 | -3,93 | 0,1282 | -0,0016 | |||||

| US574296DP13 / Maryland Stadium Authority, Revenue Bonds, Baltimore City Public Schools Construction & Revitalization Program, Series 2018A | 2,39 | -0,75 | 0,1277 | 0,0026 | |||||

| US973405AD53 / Windler Public Improvement Authority | 2,39 | -2,69 | 0,1276 | 0,0000 | |||||

| Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Refunding Series 2024A / DBT (US592647NF45) | 2,34 | -3,62 | 0,1254 | -0,0012 | |||||

| Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Refunding Series 2024A / DBT (US592647NF45) | 2,34 | -3,62 | 0,1254 | -0,0012 | |||||

| Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Refunding Series 2024A / DBT (US592647NF45) | 2,34 | -3,62 | 0,1254 | -0,0012 | |||||

| US13054WAP23 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, San Diego County Water Authoriity Desalination Project Pipeline, Ref | 2,33 | -1,36 | 0,1244 | 0,0017 | |||||

| US346914NK60 / Fort Bend County Municipal Utility District 50, Texas, General Obligation Bonds, Series 2018A | 2,32 | -6,20 | 0,1239 | -0,0046 | |||||

| Tolles Career and Technical Center, Madison, Franklin, Delaware, Fayette, and Union Counties, Ohio, Certificates of Participation, School Facilities P / DBT (US889493AX01) | 2,30 | -2,04 | 0,1232 | 0,0008 | |||||

| Tolles Career and Technical Center, Madison, Franklin, Delaware, Fayette, and Union Counties, Ohio, Certificates of Participation, School Facilities P / DBT (US889493AX01) | 2,30 | -2,04 | 0,1232 | 0,0008 | |||||

| Tolles Career and Technical Center, Madison, Franklin, Delaware, Fayette, and Union Counties, Ohio, Certificates of Participation, School Facilities P / DBT (US889493AX01) | 2,30 | -2,04 | 0,1232 | 0,0008 | |||||

| US442349BT26 / Houston, Texas, Airport System Revenue Bonds, Refunding & Subordinate Lien Series 2018B | 2,30 | -1,79 | 0,1232 | 0,0012 | |||||

| US250740AB37 / Detroit Academy of Arts and Sciences, Michigan, Public School Academy Revenue Bonds, Refunding Series 2013 | 2,30 | -3,96 | 0,1231 | -0,0016 | |||||

| US888808HT28 / TOBACCO SETTLEMENT FING CORP NJ | 2,30 | -3,24 | 0,1230 | -0,0006 | |||||

| Galveston, Texas, Wharves and Terminal First Lien Revenue Bonds, Series 2024A / DBT (US364568JY21) | 2,30 | -1,79 | 0,1230 | 0,0012 | |||||

| Galveston, Texas, Wharves and Terminal First Lien Revenue Bonds, Series 2024A / DBT (US364568JY21) | 2,30 | -1,79 | 0,1230 | 0,0012 | |||||

| US36005GAX16 / Fulton County Development Authority, Georgia, Hospital Revenue Bonds, Wellstar Health System, Inc Project, Series 2017A | 2,27 | -1,69 | 0,1212 | 0,0013 | |||||

| US623040FW73 / Mt. San Antonio (City of), CA Community College District (Election 2008), Series 2013 A, GO Bonds | 2,23 | -2,19 | 0,1193 | 0,0006 | |||||

| US88256CEX39 / Texas Mun Gas Acqus Bond | 2,23 | -0,54 | 0,1190 | 0,0026 | |||||

| San Francisco Airport Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2024A / DBT (US79766DWX38) | 2,22 | -3,39 | 0,1188 | -0,0008 | |||||

| San Francisco Airport Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2024A / DBT (US79766DWX38) | 2,22 | -3,39 | 0,1188 | -0,0008 | |||||

| US20775DVQ23 / Connecticut State Health & Educational Facilities Authority, Series E | 2,19 | -3,69 | 0,1173 | -0,0012 | |||||

| US15141GAS12 / Centennial Water & Sanitation District | 2,19 | -1,31 | 0,1172 | 0,0017 | |||||

| US507081BD83 / LAGO VISTA TEX SPL ASSMT REV | 2,19 | 0,1169 | 0,1169 | ||||||

| US612289LM88 / Montebello Unified School District, Los Angeles County, California, General Obligation Bonds, Election 1998 Series 2004 | 2,18 | 0,37 | 0,1165 | 0,0036 | |||||

| Southern California Public Power Authority, California, Revenue Bonds, Clean Energy Project Revenue Bonds, Series 2024A / DBT (US84247PND95) | 2,16 | -1,10 | 0,1154 | 0,0019 | |||||

| Southern California Public Power Authority, California, Revenue Bonds, Clean Energy Project Revenue Bonds, Series 2024A / DBT (US84247PND95) | 2,16 | -1,10 | 0,1154 | 0,0019 | |||||

| Southern California Public Power Authority, California, Revenue Bonds, Clean Energy Project Revenue Bonds, Series 2024A / DBT (US84247PND95) | 2,16 | -1,10 | 0,1154 | 0,0019 | |||||

| US646136X977 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2015AA | 2,15 | -0,46 | 0,1151 | 0,0026 | |||||

| Oklahoma Water Resources Board, Oklahoma, State Loan Program Revenue Bonds, Series 2024C / DBT (US67920Q5M62) | 2,14 | -5,81 | 0,1143 | -0,0038 | |||||

| Oklahoma Water Resources Board, Oklahoma, State Loan Program Revenue Bonds, Series 2024C / DBT (US67920Q5M62) | 2,14 | -5,81 | 0,1143 | -0,0038 | |||||

| US720424D234 / Pierce County School District 10, Tacoma, Washington, General Obligation Bonds, Series 2020B | 2,13 | -3,66 | 0,1140 | -0,0011 | |||||

| US167560VE81 / Metropolitan Water Reclamation District of Greater Chicago (Green Bonds), Series 2021 A, GO Bonds | 2,13 | -2,65 | 0,1138 | 0,0001 | |||||

| Metropolitan Transportation Authority, New York, Dedicated Tax Fund Bonds, Green Series 2024A / DBT (US59260XCF33) | 2,13 | -3,58 | 0,1136 | -0,0010 | |||||

| Metropolitan Transportation Authority, New York, Dedicated Tax Fund Bonds, Green Series 2024A / DBT (US59260XCF33) | 2,13 | -3,58 | 0,1136 | -0,0010 | |||||

| US45471ANY46 / Indiana Finance Authority, Hospital Revenue Bonds, Indiana Unversity Health Obligation Group, Refunding 2015A | 2,10 | -3,68 | 0,1121 | -0,0011 | |||||

| US592190QD78 / Metropolitan Nashville Airport Authority, Tennessee, Airport Improvement Revenue Bonds, Series 2022A | 2,08 | -2,80 | 0,1114 | -0,0001 | |||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KB45) | 2,06 | -5,20 | 0,1101 | -0,0029 | |||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KB45) | 2,06 | -5,20 | 0,1101 | -0,0029 | |||||

| Illinois State, General Obligation Bonds, May Series 2024B / DBT (US452153KB45) | 2,06 | -5,20 | 0,1101 | -0,0029 | |||||

| Garland, Dallas, Collin and Rockwell Counties, Texas, Electric Utility System Revenue Bonds, Refunding Series 2024 / DBT (US366133UG94) | 2,06 | -2,28 | 0,1100 | 0,0005 | |||||

| Garland, Dallas, Collin and Rockwell Counties, Texas, Electric Utility System Revenue Bonds, Refunding Series 2024 / DBT (US366133UG94) | 2,06 | -2,28 | 0,1100 | 0,0005 | |||||

| Garland, Dallas, Collin and Rockwell Counties, Texas, Electric Utility System Revenue Bonds, Refunding Series 2024 / DBT (US366133UG94) | 2,06 | -2,28 | 0,1100 | 0,0005 | |||||

| US542691EV87 / LONG ISLAND NY PWR AUTH ELEC SYS REVENUE | 2,03 | -2,78 | 0,1086 | -0,0001 | |||||

| US612043KU29 / Montana Facility Finance Authority, Healthcare Facility Revenue Bonds, Kalispell Regional Medical Center, Series 2018B | 2,03 | -1,17 | 0,1086 | 0,0017 | |||||

| New York City Housing Development Corporation, New York, Multi-Family Mortgage Revenue Bonds, 8 Spruce Street, Class F Series 2024 / DBT (US64966TGX63) | 2,02 | -0,93 | 0,1083 | 0,0019 | |||||

| New York City Housing Development Corporation, New York, Multi-Family Mortgage Revenue Bonds, 8 Spruce Street, Class F Series 2024 / DBT (US64966TGX63) | 2,02 | -0,93 | 0,1083 | 0,0019 | |||||

| New York City Housing Development Corporation, New York, Multi-Family Mortgage Revenue Bonds, 8 Spruce Street, Class F Series 2024 / DBT (US64966TGX63) | 2,02 | -0,93 | 0,1083 | 0,0019 | |||||

| US709235XF74 / Pennsylvania State University, Series 2016 A, RB | 2,02 | -1,17 | 0,1082 | 0,0017 | |||||

| US759861DS38 / Reno, Nevada, Subordinate Lien Sales Tax Revenue Refunding Bonds, ReTrac-Reno Transporation Rail Access Corridor Project, Series 2018A | 2,02 | -0,93 | 0,1080 | 0,0020 | |||||

| US542691BV15 / Long Island Power Authority, New York, Electric System General Revenue Bonds, Series 2018 | 2,01 | -1,76 | 0,1076 | 0,0011 | |||||

| US454898TX53 / Indiana (State of) Municipal Power Agency, Series 2016 A, Ref. RB | 2,01 | -1,28 | 0,1076 | 0,0016 | |||||

| Burbank-Glendale-Pasadena Airport Authority, California, Airport Revenue Bonds, Senior Series 2024B / DBT (US120827ED81) | 2,01 | -2,00 | 0,1076 | 0,0008 | |||||

| Burbank-Glendale-Pasadena Airport Authority, California, Airport Revenue Bonds, Senior Series 2024B / DBT (US120827ED81) | 2,01 | -2,00 | 0,1076 | 0,0008 | |||||

| Burbank-Glendale-Pasadena Airport Authority, California, Airport Revenue Bonds, Senior Series 2024B / DBT (US120827ED81) | 2,01 | -2,00 | 0,1076 | 0,0008 | |||||

| US56042RQZ81 / Maine Health and Higher Educational Facilities Authority Revenue Bonds, MaineHealth Issue, Series 2018A | 2,01 | -0,69 | 0,1073 | 0,0022 | |||||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, New Terminal 1 John F Kennedy International Airport Project / DBT (US650116HA79) | 2,01 | -2,72 | 0,1073 | 0,0000 | |||||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, New Terminal 1 John F Kennedy International Airport Project / DBT (US650116HA79) | 2,01 | -2,72 | 0,1073 | 0,0000 | |||||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, New Terminal 1 John F Kennedy International Airport Project / DBT (US650116HA79) | 2,01 | -2,72 | 0,1073 | 0,0000 | |||||

| US249189DP38 / DENVER CO CONVENTION CENTER HOTEL AUTH REVENUE | 2,00 | -1,33 | 0,1070 | 0,0015 | |||||

| US491214AX04 / Kentucky Bond Development Corporation, Transient Room Tax Revenue Bonds, Lexington Center Corporation Project, Series 2018A | 2,00 | -1,24 | 0,1069 | 0,0016 | |||||

| US59447TUH49 / Michigan (State of) Finance Authority (Henry Ford Health System), Series 2019 A, RB | 2,00 | -2,40 | 0,1067 | 0,0004 | |||||

| US167723HE83 / CHICAGO IL TRANSIT AUTH CAPITAL GRANT RECPTS REVENUE | 1,97 | -2,53 | 0,1052 | 0,0002 | |||||

| US928097AA20 / Virginia Small Business Financing Authority (Transform 66 P3 Project), Series 2017, RB | 1,97 | -2,43 | 0,1052 | 0,0003 | |||||

| US68609TF295 / OREGON ST REGD B/E 4.00000000 | 1,97 | -2,43 | 0,1052 | 0,0003 | |||||

| US594615LQ71 / Michigan State Building Authority, Revenue Bonds, Facilities Program, Refunding Series 2023II | 1,97 | -4,33 | 0,1052 | -0,0018 | |||||

| US05921PBY43 / Baltimore, Maryland, Convention Center Hotel Revenue Bonds, Refunding Series 2017 | 1,96 | -0,41 | 0,1047 | 0,0025 | |||||

| US213248CN51 / County of Cook IL Sales Tax Revenue | 1,94 | -3,14 | 0,1040 | -0,0005 | |||||

| US413890EV23 / Harris County-Houston Sports Authority, Texas, Revenue Bonds, Capital Appreciation Refunding Senior Lien Series 2014A | 1,94 | -6,32 | 0,1039 | -0,0039 | |||||

| Mobile County Industrial Development Authority, Alabama, Solid Waste Disposal Revenue Bonds, AM/NS Calvert LLC Project, Series 2024A / DBT (US60733UAA97) | 1,90 | -6,08 | 0,1016 | -0,0037 | |||||

| Mobile County Industrial Development Authority, Alabama, Solid Waste Disposal Revenue Bonds, AM/NS Calvert LLC Project, Series 2024A / DBT (US60733UAA97) | 1,90 | -6,08 | 0,1016 | -0,0037 | |||||

| Mobile County Industrial Development Authority, Alabama, Solid Waste Disposal Revenue Bonds, AM/NS Calvert LLC Project, Series 2024A / DBT (US60733UAA97) | 1,90 | -6,08 | 0,1016 | -0,0037 | |||||

| US13016NFC39 / MUNI. ZERO | 1,90 | -4,43 | 0,1015 | -0,0018 | |||||

| US65830RBL24 / North Carolina Turnpike Authority, Triangle Expressway System Revenue Bonds, Refunding Senior Lien Series 2017 | 1,89 | -0,68 | 0,1010 | 0,0021 | |||||

| California Health Facilities Financing Authority, Revenue Bonds, Adventist Health System/West, Series 2024A / DBT (US13032UU558) | 1,88 | 0,1006 | 0,1006 | ||||||

| California Health Facilities Financing Authority, Revenue Bonds, Adventist Health System/West, Series 2024A / DBT (US13032UU558) | 1,88 | 0,1006 | 0,1006 | ||||||

| Louisiana Publics Facilities Authority, Louisiana, Revenue Bonds, I-10 Calcasieu River Bridge Public-Private Partnership Project, Senior Lien Series 2 / DBT (US546399SZ00) | 1,88 | -4,08 | 0,1005 | -0,0014 | |||||

| Louisiana Publics Facilities Authority, Louisiana, Revenue Bonds, I-10 Calcasieu River Bridge Public-Private Partnership Project, Senior Lien Series 2 / DBT (US546399SZ00) | 1,88 | -4,08 | 0,1005 | -0,0014 | |||||

| US956622R717 / WEST VIRGINIA ST HOSP FIN AUTH WVSMED 01/34 FIXED 5 | 1,87 | -1,06 | 0,1002 | 0,0017 | |||||

| US688031FJ74 / County of Osceola FL Transportation Revenue | 1,86 | -27,22 | 0,0993 | -0,0334 | |||||

| US38546WCS70 / Grand Forks, North Dakota, Health Care System Revenue Bonds, Altru Health System Obligated Group, Series 2017A | 1,82 | -1,67 | 0,0974 | 0,0010 | |||||

| Adams and Weld Counties School District 27J, Brighton, Colorado, General Obligation Bonds, Series 2024A / DBT (US005518YT60) | 1,82 | -3,24 | 0,0974 | -0,0005 | |||||

| Adams and Weld Counties School District 27J, Brighton, Colorado, General Obligation Bonds, Series 2024A / DBT (US005518YT60) | 1,82 | -3,24 | 0,0974 | -0,0005 | |||||

| Adams and Weld Counties School District 27J, Brighton, Colorado, General Obligation Bonds, Series 2024A / DBT (US005518YT60) | 1,82 | -3,24 | 0,0974 | -0,0005 | |||||

| US67884XCG07 / Oklahoma Development Finance Authority, Health System Revenue Bonds, OU Medicine Project, Series 2018B | 1,81 | -0,88 | 0,0967 | 0,0018 | |||||

| US154871CL95 / Central Plains Energy Project | 1,81 | -1,90 | 0,0967 | 0,0009 | |||||

| US93878YAV11 / Washington Metropolitan Area Transit Authority, District of Columbia, Dedicated Revenue Bonds, Series 2020A | 1,81 | -2,80 | 0,0966 | -0,0001 | |||||

| US452152G881 / ILLINOIS ST | 1,80 | -0,88 | 0,0963 | 0,0018 | |||||

| US91754TC768 / Utah Charter School Finance Authority | 1,79 | 0,0957 | 0,0957 | ||||||

| US16514PAE97 / Chesapeake Bay Bridge and Tunnel District, Virginia, General Resolution Revenue Bonds, First Tier Series 2016 | 1,79 | -1,33 | 0,0956 | 0,0014 | |||||