Grundlæggende statistik

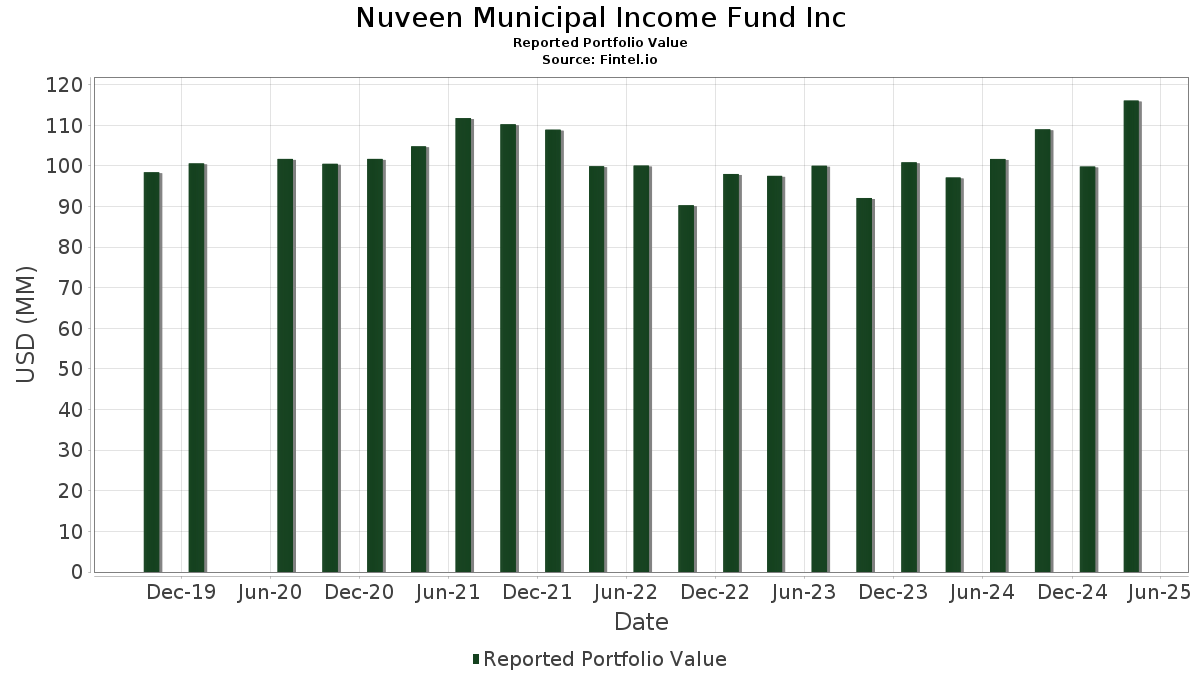

| Porteføljeværdi | $ 116.099.275 |

| Nuværende stillinger | 244 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Nuveen Municipal Income Fund Inc har afsløret 244 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 116.099.275 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Nuveen Municipal Income Fund Incs største beholdninger er North Carolina Turnpike Authority, Triangle Expressway System Revenue Bonds, Senior Lien Series 2019 (US:US65830RCQ02) , ILLINOIS ST TOLL HIGHWAY AUTH (US:US452252NP04) , City of Phoenix Civic Improvement Corp., Series 2019, RB (US:US71883MPB45) , DENVER CITY & CNTY CO ARPT REVENUE (US:US249182LV60) , and Ventana Metropolitan District, El Paso County, Colorado, General Obligation Bonds, Limited Tax Refunding and Improvement Series 2023A (US:US92276QAA40) . Nuveen Municipal Income Fund Incs nye stillinger omfatter North Carolina Turnpike Authority, Triangle Expressway System Revenue Bonds, Senior Lien Series 2019 (US:US65830RCQ02) , ILLINOIS ST TOLL HIGHWAY AUTH (US:US452252NP04) , City of Phoenix Civic Improvement Corp., Series 2019, RB (US:US71883MPB45) , DENVER CITY & CNTY CO ARPT REVENUE (US:US249182LV60) , and Ventana Metropolitan District, El Paso County, Colorado, General Obligation Bonds, Limited Tax Refunding and Improvement Series 2023A (US:US92276QAA40) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,00 | 1,0201 | 1,0201 | ||

| 0,97 | 0,9805 | 0,9805 | ||

| 0,97 | 0,9805 | 0,9805 | ||

| 0,46 | 0,4654 | 0,4654 | ||

| 0,37 | 0,3715 | 0,3715 | ||

| 0,37 | 0,3715 | 0,3715 | ||

| 0,20 | 0,2013 | 0,2013 | ||

| 0,20 | 0,2013 | 0,2013 | ||

| 1,00 | 1,0132 | 0,0252 | ||

| 1,02 | 1,0338 | 0,0225 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,10 | 0,1041 | -0,0746 | ||

| 0,04 | 0,0400 | -0,0425 | ||

| 1,98 | 2,0141 | -0,0346 | ||

| 1,98 | 2,0141 | -0,0346 | ||

| 1,20 | 1,2202 | -0,0344 | ||

| 0,65 | 0,6577 | -0,0314 | ||

| 0,65 | 0,6577 | -0,0314 | ||

| 0,91 | 0,9203 | -0,0291 | ||

| 0,46 | 0,4661 | -0,0253 | ||

| 0,94 | 0,9541 | -0,0252 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-26 for rapporteringsperioden 2025-04-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US65830RCQ02 / North Carolina Turnpike Authority, Triangle Expressway System Revenue Bonds, Senior Lien Series 2019 | 1,99 | -2,93 | 2,0172 | -0,0044 | ||

| New York Transportation Development Corporation, New York, Special Facilities Revenue Bonds, Terminal 6 John F Kennedy International Airport Redevelop / DBT (US650116HV17) | 1,98 | -4,34 | 2,0141 | -0,0346 | ||

| New York Transportation Development Corporation, New York, Special Facilities Revenue Bonds, Terminal 6 John F Kennedy International Airport Redevelop / DBT (US650116HV17) | 1,98 | -4,34 | 2,0141 | -0,0346 | ||

| US452252NP04 / ILLINOIS ST TOLL HIGHWAY AUTH | 1,93 | -2,18 | 1,9611 | 0,0106 | ||

| US71883MPB45 / City of Phoenix Civic Improvement Corp., Series 2019, RB | 1,51 | -1,89 | 1,5280 | 0,0123 | ||

| US249182LV60 / DENVER CITY & CNTY CO ARPT REVENUE | 1,40 | -1,69 | 1,4165 | 0,0143 | ||

| US92276QAA40 / Ventana Metropolitan District, El Paso County, Colorado, General Obligation Bonds, Limited Tax Refunding and Improvement Series 2023A | 1,29 | -3,15 | 1,3123 | -0,0066 | ||

| US928097AD68 / Virginia (State of) Small Business Financing Authority (Transform 66 P3), Series 2017, RB | 1,20 | -5,36 | 1,2202 | -0,0344 | ||

| US389526AG95 / FX.RT. MUNI BOND | 1,10 | -1,08 | 1,1179 | 0,0174 | ||

| US45203H5F50 / Illinois (State of) Finance Authority (OSF Healthcare System), Series 2015 A, Ref. RB | 1,09 | -1,36 | 1,1062 | 0,0145 | ||

| US452153EM73 / State of Illinois, Series 2022 C | 1,06 | -3,81 | 1,0773 | -0,0130 | ||

| US768247AZ12 / River Hall Community Development District, Series 2023 A | 1,04 | -1,88 | 1,0604 | 0,0089 | ||

| US56035DFC11 / Main Street Natural Gas Inc | 1,04 | -1,33 | 1,0586 | 0,0151 | ||

| US45470YFJ55 / Indiana Finance Authority, Series A | 1,03 | -3,00 | 1,0499 | -0,0037 | ||

| US84136FBT30 / Southeast Energy Authority A Cooperative District | 1,03 | -1,71 | 1,0494 | 0,0100 | ||

| US167593Y489 / Chicago O'Hare International Airport | 1,03 | -1,90 | 1,0478 | 0,0077 | ||

| US51218WAG50 / Lakeside Preserve Community Development District, Series 2023 | 1,03 | -2,37 | 1,0456 | 0,0033 | ||

| Idaho Health Facilities Authority, Revenue Bonds, Saint Luke's Health System Project, Series 2025A / DBT (US451295H366) | 1,02 | -3,67 | 1,0388 | -0,0105 | ||

| Idaho Health Facilities Authority, Revenue Bonds, Saint Luke's Health System Project, Series 2025A / DBT (US451295H366) | 1,02 | -3,67 | 1,0388 | -0,0105 | ||

| Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, IPS Enterprises, Inc. Projects, Refunding Series 2023A / DBT (US14054WAL90) | 1,02 | -1,83 | 1,0361 | 0,0090 | ||

| US62822EAC93 / City of Mustang Ridge, Series 2023 | 1,02 | -0,49 | 1,0338 | 0,0225 | ||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, John F Kennedy International Airport New Terminal 1 Project / DBT (US650116HM18) | 1,02 | -3,52 | 1,0307 | -0,0094 | ||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, John F Kennedy International Airport New Terminal 1 Project / DBT (US650116HM18) | 1,02 | -3,52 | 1,0307 | -0,0094 | ||

| Public Finance Authority of Wisconsin, Multifamily Housing Revenue Bonds, Promenade Apartments Project, Series 2024 / DBT (US74441XHS18) | 1,01 | -1,95 | 1,0203 | 0,0070 | ||

| Public Finance Authority of Wisconsin, Multifamily Housing Revenue Bonds, Promenade Apartments Project, Series 2024 / DBT (US74441XHS18) | 1,01 | -1,95 | 1,0203 | 0,0070 | ||

| Louisiana Public Facilities Authority, Louisiana, Revenue Bonds, Loyola University of New Orleans Project, Refunding Series 2023A / DBT (US546399RP37) | 1,00 | 1,0201 | 1,0201 | |||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Seri / DBT (US340618DT16) | 1,00 | -0,99 | 1,0159 | 0,0174 | ||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Brightline Trains Florida LLC Issue, Seri / DBT (US340618DT16) | 1,00 | -0,99 | 1,0159 | 0,0174 | ||

| US956622N831 / WEST VIRGINIA ST HOSP FIN AUTH | 1,00 | -0,99 | 1,0153 | 0,0171 | ||

| US64542RAY71 / New Hope Cultural Education Facilities Finance Corp. (CHF-Collegiate Housing College Station I, LLC-Texas A&M University), Series 2014 A, RB | 1,00 | -0,10 | 1,0132 | 0,0252 | ||

| US605360SC14 / MISSISSIPPI HOSP EQUIP & FACS AUTH REV | 0,99 | -0,90 | 1,0095 | 0,0179 | ||

| US54628CAU62 / Louisiana (State of) Local Government Environmental Facilities & Community Development Authority (Womans Foundation), Series 2017 A, Ref. RB | 0,99 | -1,98 | 1,0078 | 0,0078 | ||

| US19648FKS29 / Colorado (State of) Health Facilities Authority (CommonSpirit Health), Series 2019 A-2, RB | 0,99 | -2,55 | 1,0076 | 0,0012 | ||

| US888808HQ88 / TOBACCO SETTLEMENT FING CORP NJ | 0,99 | -2,18 | 1,0021 | 0,0048 | ||

| US26444CHC91 / Duluth Economic Development Authority, Minnesota, Health Care Facilities Revenue Bonds, Essentia Health Obligated Group, Series 2018A | 0,97 | -3,47 | 0,9882 | -0,0087 | ||

| US882667AN81 / TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE | 0,97 | -3,77 | 0,9868 | -0,0110 | ||

| Indiana Finance Authority, Student Housing Revenue Bonds, SFP-PUFW I, LLC Series 2024A / DBT (US45471FAX96) | 0,97 | -3,88 | 0,9823 | -0,0121 | ||

| Indiana Finance Authority, Student Housing Revenue Bonds, SFP-PUFW I, LLC Series 2024A / DBT (US45471FAX96) | 0,97 | -3,88 | 0,9823 | -0,0121 | ||

| California Infrastructure and Economic Development Bank, Revenue Bonds, Brightline West Passenger Rail Project, Green Bond Series 2025A / DBT (US13034A6B14) | 0,97 | 0,9805 | 0,9805 | |||

| California Infrastructure and Economic Development Bank, Revenue Bonds, Brightline West Passenger Rail Project, Green Bond Series 2025A / DBT (US13034A6B14) | 0,97 | 0,9805 | 0,9805 | |||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,96 | -4,40 | 0,9713 | -0,0170 | ||

| US60636AEN90 / Missouri Health and Educational Facilities Authority, Educational Facilities Revenue Bonds, Southwest Baptist University Project, Series 2012 | 0,95 | -4,44 | 0,9611 | -0,0177 | ||

| Sierra Vista Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Desert Heights Charter School Project, Refunding Series 2024 / DBT (US82652UAT97) | 0,94 | -5,25 | 0,9541 | -0,0252 | ||

| Sierra Vista Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Desert Heights Charter School Project, Refunding Series 2024 / DBT (US82652UAT97) | 0,94 | -5,25 | 0,9541 | -0,0252 | ||

| US97712DR739 / Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, PHW Oconomowoc, Inc Project, Series 2018 | 0,91 | -5,62 | 0,9203 | -0,0291 | ||

| US898526FR48 / TSASC, Inc., Series 2016 B, Ref. RB | 0,90 | -3,32 | 0,9173 | -0,0062 | ||

| Highland Trails Community Development District, Pasco County, Florida, Special Assessment Revenue Bonds, Assessment Area One Capital Improvement Serie / DBT (US430813AC93) | 0,87 | -2,35 | 0,8877 | 0,0028 | ||

| Highland Trails Community Development District, Pasco County, Florida, Special Assessment Revenue Bonds, Assessment Area One Capital Improvement Serie / DBT (US430813AC93) | 0,87 | -2,35 | 0,8877 | 0,0028 | ||

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 0,87 | -3,00 | 0,8872 | -0,0029 | ||

| US727810AA14 / PLATTE RVR MET DIST CO | 0,80 | -3,62 | 0,8110 | -0,0078 | ||

| US072222AG78 / Bay County, Florida, Educational Facilities Revenue Refunding Bonds, Bay Haven Charter Academy, Inc Project, Series 2013A | 0,79 | 0,00 | 0,8023 | 0,0213 | ||

| US928104QJ08 / VIRGINIA SMALL BUSINESS FINANCING AUTHORITY | 0,75 | -1,95 | 0,7651 | 0,0056 | ||

| US82846KAA97 / Silverstone Metropolitan District No 3, Series 2023, GO Bonds | 0,75 | -2,21 | 0,7634 | 0,0042 | ||

| San Francisco City and County, California, Special Tax Bonds, Community Facilities District 2016-1 Treasure Island Improvement Area 2, Series 2023A / DBT (US79773LAF94) | 0,73 | -2,52 | 0,7452 | 0,0009 | ||

| US65820YMP87 / North Carolina Medical Care Commission, Retirement Facilities First Mortgage Revenue Bonds, Southminster Project, Refunding Series 2016 | 0,69 | -0,29 | 0,7000 | 0,0171 | ||

| US30607HAA41 / Falcon Area Water and Wastewater Authority (El Paso County, Colorado), Tap Fee Revenue Bonds, Series 2022A | 0,68 | -1,32 | 0,6856 | 0,0092 | ||

| US67884XCK19 / OKLAHOMA DEVELOPMENT FINANCE AUTHORITY | 0,67 | -1,61 | 0,6828 | 0,0074 | ||

| US89217EAB74 / Woodsdale Community Development District, Pasco County, Florida, Revenue Bonds, Capital Improvement Series 2023 | 0,67 | -1,77 | 0,6780 | 0,0062 | ||

| US366761AA28 / Gary Local Public Improvement Bond Bank, Indiana, Economic Development Revenue Bonds, Drexel Foundation for Educational Excellence Project, Refunding | 0,66 | -4,91 | 0,6680 | -0,0166 | ||

| US167505QY58 / CHICAGO IL BRD OF EDU | 0,66 | -0,91 | 0,6652 | 0,0119 | ||

| US13051AGA07 / California Municipal Finance Authority, Special Tax Revenue Bonds, Bold Program, Series 2023B | 0,65 | -2,54 | 0,6615 | 0,0013 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Series 2024A-3 / DBT (US084538JH15) | 0,65 | -7,17 | 0,6577 | -0,0314 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Series 2024A-3 / DBT (US084538JH15) | 0,65 | -7,17 | 0,6577 | -0,0314 | ||

| Cobb County Development Authority, Georgia, Charter School Revenue Bonds, Northwest Classical Academy, Inc. Project, Series 2023A / DBT (US190779AH17) | 0,60 | -2,12 | 0,6091 | 0,0042 | ||

| Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Legacy Traditional Schools Projects, Series 2024 / DBT (US56681NJA63) | 0,58 | -4,30 | 0,5882 | -0,0096 | ||

| South Carolina Jobs-Economic Development Authority, Educational Facilities Revenue Bonds, Riverwalk Academy Project Series 2023A / DBT (US83704MDR43) | 0,57 | -2,40 | 0,5790 | 0,0019 | ||

| South Carolina Jobs-Economic Development Authority, Educational Facilities Revenue Bonds, Riverwalk Academy Project Series 2023A / DBT (US83704MDR43) | 0,57 | -2,40 | 0,5790 | 0,0019 | ||

| Capital Projects Finance Authority, Florida, Educational Revenue Bonds, Imagine Kissimmee Charter Academy Project, Series 2024 / DBT (US14043FAH91) | 0,56 | -2,60 | 0,5707 | 0,0001 | ||

| Capital Projects Finance Authority, Florida, Educational Revenue Bonds, Imagine Kissimmee Charter Academy Project, Series 2024 / DBT (US14043FAH91) | 0,56 | -2,60 | 0,5707 | 0,0001 | ||

| US46246SAU96 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 0,56 | -2,45 | 0,5667 | 0,0014 | ||

| US452153DB28 / ILLINOIS ST | 0,56 | -4,47 | 0,5648 | -0,0107 | ||

| US727220AC99 / PLANO TX SPL ASSMNT REVENUE | 0,55 | -2,66 | 0,5579 | 0,0002 | ||

| US74442ELE85 / PUBLIC FINANCE AUTHORITY | 0,55 | -1,80 | 0,5543 | 0,0052 | ||

| US650116GN00 / New York Transportation Development Corp | 0,55 | -2,33 | 0,5542 | 0,0024 | ||

| US79575EAP34 / Salt Verde Arizona Fc Bond | 0,54 | -1,10 | 0,5460 | 0,0094 | ||

| Palm Desert, California, Special Tax Bonds, Community Facilities District 2021-1 University Park, Series 2024 / DBT (US696627EX21) | 0,53 | -1,86 | 0,5359 | 0,0051 | ||

| US167505ZG42 / CHICAGO IL BRD OF EDU | 0,53 | -2,04 | 0,5350 | 0,0026 | ||

| US167510BJ40 / CHICAGO IL BRD OF EDU DEDICATE REGD B/E 5.75000000 | 0,53 | -2,05 | 0,5335 | 0,0030 | ||

| US45528U6X43 / Indianapolis Local Public Improvement Bond Bank | 0,52 | -2,06 | 0,5306 | 0,0036 | ||

| US52480EAN94 / Lehigh County, Pennsylvania, Revenue Bonds, Lehigh Valley Dual Language Charter School, General Purpose Authority, Series 2023 | 0,52 | -2,61 | 0,5300 | 0,0002 | ||

| US108620AG03 / Bridgewalk Community Development District, Series 2023 | 0,52 | -1,70 | 0,5288 | 0,0052 | ||

| US79771JAL35 / City & County of San Francisco, Series 2023 C | 0,52 | -3,17 | 0,5284 | -0,0031 | ||

| US154871CP00 / CENTRAL PLAINS ENERGY PROJECT | 0,52 | -4,24 | 0,5277 | -0,0087 | ||

| US50156CBR07 / Kyle, Texas, Special Assessment Revenue Bonds, Southwest Kyle Public Improvement District 1 Improvement Area 2 Project, Series 2023 | 0,51 | -2,86 | 0,5185 | -0,0008 | ||

| Public Finance Authority of Wisconsin, Revenue Bonds, Revolution Academy, Refunding Series 2023A / DBT (US74442ELK46) | 0,51 | -2,11 | 0,5183 | 0,0030 | ||

| Public Finance Authority of Wisconsin, Revenue Bonds, Revolution Academy, Refunding Series 2023A / DBT (US74442ELK46) | 0,51 | -2,11 | 0,5183 | 0,0030 | ||

| US837031YX50 / South Carolina Jobs-Economic Development Authority | 0,51 | -6,76 | 0,5181 | -0,0224 | ||

| US473644AC64 / Jefferson County Public Hospital District No. 2, Series 2023 A | 0,51 | -2,12 | 0,5164 | 0,0032 | ||

| US94222GAA76 / WATERVIEW II MET DIST CO 22A SF 4.5% 12-01-31 | 0,50 | -3,26 | 0,5126 | -0,0029 | ||

| US473318AB94 / JEFFERSON CNTY OH PORT AUTH EC REGD V/R B/E AMT 5.00000000 | 0,50 | -0,99 | 0,5106 | 0,0095 | ||

| US392274X352 / Greater Orlando Aviation Authority | 0,50 | -0,99 | 0,5102 | 0,0090 | ||

| US452153AW91 / STATE OF ILLINO 5% 3/1/2046 | 0,50 | -3,47 | 0,5091 | -0,0040 | ||

| US700387EW97 / Park Creek Metropolitan District, Colorado, Senior Limited Property Tax Supported Revenue Bonds, Series 2017A | 0,50 | -0,60 | 0,5080 | 0,0105 | ||

| US19648FAZ71 / Colorado Health Facilities Authority, Colorado, Revenue Bonds, Christian Living Neighborhoods Project, Refunding Series 2016 | 0,50 | -0,40 | 0,5079 | 0,0116 | ||

| US13080SML50 / California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center), Series 2016 A, RB | 0,50 | -0,60 | 0,5070 | 0,0101 | ||

| US45129GLJ21 / Idaho Housing and Finance Association, Nonprofit Facilities Revenue Bonds, The College of Idaho Project, Series 2023 | 0,50 | -2,16 | 0,5060 | 0,0023 | ||

| US649519DA03 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 1, Ref. RB | 0,50 | -0,60 | 0,5054 | 0,0110 | ||

| San Francisco City and County, California, Special Tax Bonds, Community Facilities District 2016-1 Treasure Island Improvement Area 2, Series 2023A / DBT (US79773LAG77) | 0,50 | -2,75 | 0,5028 | -0,0009 | ||

| US514045W666 / LANCASTER H AUT 5% 11/1/2051 | 0,50 | -2,37 | 0,5027 | 0,0013 | ||

| US852297CT50 / St. Paul (City of), MN Housing & Redevelopment Authority | 0,49 | -4,83 | 0,5011 | -0,0113 | ||

| Missouri Health and Educational Facilities Authority, Revenue Bonds, Lutheran Senior Services Projects, Series 2024A / DBT (US60635H4C08) | 0,49 | -4,46 | 0,5005 | -0,0099 | ||

| Mobile County Industrial Development Authority, Alabama, Solid Waste Disposal Revenue Bonds, AM/NS Calvert LLC Project, Series 2024B / DBT (US60733UAB70) | 0,49 | -7,05 | 0,4957 | -0,0237 | ||

| Mobile County Industrial Development Authority, Alabama, Solid Waste Disposal Revenue Bonds, AM/NS Calvert LLC Project, Series 2024B / DBT (US60733UAB70) | 0,49 | -7,05 | 0,4957 | -0,0237 | ||

| Sterling Ranch Community Authority Board, Douglas County, Colorado, Limited Tax Supported and Special Revenue Bonds, Special District 4 Subdistrict B, / DBT (US85950NAY67) | 0,48 | -4,17 | 0,4906 | -0,0081 | ||

| Vista Lago, Travis County, Texas, Special Assessment Revenue Bonds, Tessera on Lake Travis Public Improvement District Improvement Area #3 Project, Se / DBT (US507081BG15) | 0,48 | -4,94 | 0,4892 | -0,0107 | ||

| Vista Lago, Travis County, Texas, Special Assessment Revenue Bonds, Tessera on Lake Travis Public Improvement District Improvement Area #3 Project, Se / DBT (US507081BG15) | 0,48 | -4,94 | 0,4892 | -0,0107 | ||

| Columbus-Franklin County Finance Authority, Ohio, Revenue Bonds, Bridge Park G Block Project, Public Infrastructure Series 2022 / DBT (US19910RAL33) | 0,48 | -4,57 | 0,4882 | -0,0088 | ||

| Columbus-Franklin County Finance Authority, Ohio, Revenue Bonds, Bridge Park G Block Project, Public Infrastructure Series 2022 / DBT (US19910RAL33) | 0,48 | -4,57 | 0,4882 | -0,0088 | ||

| US295272AA62 / ERIE HIGHLANDS MET DIST NO 2 COLO LTD TAX GO BDS 2018 A | 0,48 | -4,58 | 0,4872 | -0,0091 | ||

| Kremmling Memorial Hospital District, Colorado, Certificates of Participation, Series 2024 / DBT (US500795AK53) | 0,48 | -3,85 | 0,4830 | -0,0055 | ||

| Kremmling Memorial Hospital District, Colorado, Certificates of Participation, Series 2024 / DBT (US500795AK53) | 0,48 | -3,85 | 0,4830 | -0,0055 | ||

| US60635HU565 / MISSOURI ST HLTH & EDUCTNL FACS AUTH | 0,47 | -5,60 | 0,4797 | -0,0144 | ||

| US650116GY64 / New York Transportation Development Corp | 0,47 | -2,71 | 0,4738 | 0,0004 | ||

| US74529JPW98 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,46 | -5,50 | 0,4719 | -0,0135 | ||

| Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, Babcock Neighborhood School Inc Project, Series 2024 / DBT (US14054WBD65) | 0,46 | -5,51 | 0,4707 | -0,0138 | ||

| Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, Babcock Neighborhood School Inc Project, Series 2024 / DBT (US14054WBD65) | 0,46 | -5,51 | 0,4707 | -0,0138 | ||

| US75087GAB86 / Raindance Metropolitan District No. 1 Non-Potable Water System | 0,46 | -7,65 | 0,4661 | -0,0253 | ||

| National Finance Authority, New Hampshire, Municipal Certificates Series 2025-1 Class A-2 / DBT (US63607WBE30) | 0,46 | 0,4654 | 0,4654 | |||

| US952866AB77 / West Globeville Metropolitan District 1, Denver, Colorado, General Obligation Limited Tax Bonds, Series 2022 | 0,45 | -6,79 | 0,4600 | -0,0205 | ||

| US67754AAF12 / OHIO ST AIR QUALITY DEV AUTH EXEMPT FACS REVENUE | 0,45 | -3,43 | 0,4582 | -0,0041 | ||

| US704676AB15 / Peak Metropolitan District No 1 | 0,43 | -5,86 | 0,4407 | -0,0153 | ||

| US36005GAZ63 / FULTON CNTY GA DEV AUTH HOSP REVENUE | 0,43 | -6,88 | 0,4405 | -0,0198 | ||

| US86182EAC21 / Stonegate Preserve Community Development District, Series 2023 | 0,42 | -1,64 | 0,4275 | 0,0041 | ||

| US4521526L09 / ILLINOIS ST | 0,42 | -3,46 | 0,4261 | -0,0028 | ||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,42 | -1,88 | 0,4242 | 0,0035 | ||

| US795576MD67 / City of Salt Lake City UT Airport Revenue | 0,41 | -3,04 | 0,4207 | -0,0013 | ||

| US167505WB81 / CHICAGO IL BRD OF EDU | 0,40 | -5,16 | 0,4108 | -0,0104 | ||

| Parkdale Community Authority, Erie County, Colorado, Limited Tax Supported Convertible Capital Appreciation Revenue Bonds, District 2, Series 2024A / DBT (US70089CAA80) | 0,40 | 2,83 | 0,4066 | 0,0216 | ||

| Parkdale Community Authority, Erie County, Colorado, Limited Tax Supported Convertible Capital Appreciation Revenue Bonds, District 2, Series 2024A / DBT (US70089CAA80) | 0,40 | 2,83 | 0,4066 | 0,0216 | ||

| US45204FNP61 / ILLINOIS ST FIN AUTH REVENUE | 0,40 | -4,53 | 0,4063 | -0,0079 | ||

| US57665NAF24 / MATCHING FUND SPL PURPOSE SECURITIZTN CORP | 0,39 | -2,50 | 0,3968 | 0,0006 | ||

| US018444CB35 / ALLENTOWN PA NEIGHBORHOOD IMPT REGD OID B/E 6.25000000 | 0,38 | -4,73 | 0,3895 | -0,0078 | ||

| California Municipal Finance Authority, Special Tax Revenue Bonds, Bold Program, Series 2024A / DBT (US13051AGS15) | 0,38 | -2,07 | 0,3850 | 0,0024 | ||

| California Municipal Finance Authority, Special Tax Revenue Bonds, Bold Program, Series 2024A / DBT (US13051AGS15) | 0,38 | -2,07 | 0,3850 | 0,0024 | ||

| Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Christwood Project, Refunding Series 2024 / DBT (US54628C3B61) | 0,37 | -7,11 | 0,3725 | -0,0171 | ||

| Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Christwood Project, Refunding Series 2024 / DBT (US54628C3B61) | 0,37 | -7,11 | 0,3725 | -0,0171 | ||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Series 2025A / DBT (US340618DZ75) | 0,37 | 0,3715 | 0,3715 | |||

| Florida Development Finance Corporation, Revenue Bonds, Brightline Florida Passenger Rail Expansion Project, Series 2025A / DBT (US340618DZ75) | 0,37 | 0,3715 | 0,3715 | |||

| Las Vegas Special Improvement District 817, Nevada, Local Improvement Revenue Bonds, Summerlin Village 29 Series 2023 / DBT (US51779BAN73) | 0,36 | -0,82 | 0,3671 | 0,0066 | ||

| Las Vegas Special Improvement District 817, Nevada, Local Improvement Revenue Bonds, Summerlin Village 29 Series 2023 / DBT (US51779BAN73) | 0,36 | -0,82 | 0,3671 | 0,0066 | ||

| US55374SAB60 / M-S-R Energy Authority | 0,35 | -3,80 | 0,3601 | -0,0042 | ||

| US613646AA65 / Montgomery County Redevelopment Authority, Pennsylvania, Special Obligation Revenue Bonds, River Pointe Project Series 2023 | 0,34 | -3,64 | 0,3495 | -0,0037 | ||

| US59261AG500 / MET TRANSPRTN AUTH NY REVENUE | 0,32 | -1,83 | 0,3266 | 0,0026 | ||

| US51265KFH68 / LAKEWOOD RANCH FL STEWARDSHIP DIST SPL ASSMNT REVENUE | 0,31 | -1,26 | 0,3181 | 0,0040 | ||

| US785138AV04 / SA Energy Acquisition Public Facilities Corporation, Texas, Gas Supply Revenue Bonds, Series 2007 | 0,30 | -0,98 | 0,3074 | 0,0051 | ||

| US79516TCR68 / Saline County Industrial Development Authority, Missouri, First Mortgage Revenue Bonds, Missouri Valley College, Series 2017 | 0,28 | -4,10 | 0,2856 | -0,0040 | ||

| US85235KAV52 / Saint Paul Park, Minnesota, Senior Housing and Health Care Revenue Bonds, Presbyterian Homes Bloomington Project, Refunding Series 2017 | 0,28 | -3,81 | 0,2828 | -0,0035 | ||

| US04052BSY10 / Arizona Industrial Development Auth. Education Rev. (Academies of Math & Science) | 0,27 | -2,87 | 0,2758 | 0,0001 | ||

| US592190QX33 / Metropolitan Nashville Airport Authority/The | 0,26 | -2,22 | 0,2688 | 0,0015 | ||

| Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024 / DBT (US472682ZR71) | 0,26 | -4,38 | 0,2663 | -0,0052 | ||

| Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024 / DBT (US472682ZR71) | 0,26 | -4,38 | 0,2663 | -0,0052 | ||

| US167510AA40 / CHICAGO IL BRD OF EDU DEDICATED CAPITAL IMPT | 0,25 | -0,78 | 0,2587 | 0,0048 | ||

| California Housing Finance Agency, California, Multifamily Housing Revenue Bonds, Power Station Block 7B, Limited Obligation Senior Series 2024L / DBT (US13034DAG97) | 0,25 | 0,80 | 0,2570 | 0,0090 | ||

| California Housing Finance Agency, California, Multifamily Housing Revenue Bonds, Power Station Block 7B, Limited Obligation Senior Series 2024L / DBT (US13034DAG97) | 0,25 | 0,80 | 0,2570 | 0,0090 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Series 2024B-1 / DBT (US084538JK44) | 0,25 | 0,40 | 0,2560 | 0,0072 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Series 2024B-1 / DBT (US084538JK44) | 0,25 | 0,40 | 0,2560 | 0,0072 | ||

| US371669AW25 / Genesee County Funding Corp. (The) | 0,25 | -2,71 | 0,2552 | -0,0003 | ||

| Atlanta Development Authority, Georgia, Revenue Bonds, Westside Gulch Area Project, Senior Series 2024A-2 / DBT (US04780NMX20) | 0,25 | -2,34 | 0,2548 | 0,0014 | ||

| Public Finance Authority, Wisconsin, Tax Increment Revenue Senior Bonds, World Center Project Series 2024A / DBT (US74448EAA29) | 0,25 | -2,72 | 0,2541 | 0,0000 | ||

| Public Finance Authority, Wisconsin, Tax Increment Revenue Senior Bonds, World Center Project Series 2024A / DBT (US74448EAA29) | 0,25 | -2,72 | 0,2541 | 0,0000 | ||

| Hamilton Bluff Community Development District, Lake Hamilton, Florida, Special Assessment Bonds, Area 1 Project, Series 2024 / DBT (US40702EAC03) | 0,25 | -3,12 | 0,2526 | -0,0008 | ||

| Allentown Neighborhood Improvement Zone Development Authority, Pennsylvania, Tax Revenue Bonds, Waterfront-30 E Allen Street Project, Subordinate Seri / DBT (US018444CF49) | 0,25 | -5,38 | 0,2507 | -0,0071 | ||

| Allentown Neighborhood Improvement Zone Development Authority, Pennsylvania, Tax Revenue Bonds, Waterfront-30 E Allen Street Project, Subordinate Seri / DBT (US018444CF49) | 0,25 | -5,38 | 0,2507 | -0,0071 | ||

| Travis County Development Authority, Texas, Contract Assessment Revenue Bonds, Bella Fortuna Public Improvement District, Series 2024 / DBT (US89441AAV98) | 0,25 | -3,15 | 0,2498 | -0,0012 | ||

| Travis County Development Authority, Texas, Contract Assessment Revenue Bonds, Bella Fortuna Public Improvement District, Series 2024 / DBT (US89441AAV98) | 0,25 | -3,15 | 0,2498 | -0,0012 | ||

| Babcock Ranch Community Independent Special District, Charlotte County, Florida, Special Assessment Bonds, 2024 Project Series 2024 / DBT (US05616KBV17) | 0,24 | -2,02 | 0,2457 | 0,0009 | ||

| Babcock Ranch Community Independent Special District, Charlotte County, Florida, Special Assessment Bonds, 2024 Project Series 2024 / DBT (US05616KBV17) | 0,24 | -2,02 | 0,2457 | 0,0009 | ||

| Ohio Housing Finance Agency, Multifamily Housing Revenue Bonds, Silver Birch of Mansfield Project, Series 2024 / DBT (US676900XJ75) | 0,24 | -4,78 | 0,2433 | -0,0053 | ||

| Ohio Housing Finance Agency, Multifamily Housing Revenue Bonds, Silver Birch of Mansfield Project, Series 2024 / DBT (US676900XJ75) | 0,24 | -4,78 | 0,2433 | -0,0053 | ||

| Valparaiso, Indiana, Exempt Facilities Revenue Bonds, Pratt Paper LLC Project, Refunding Series 2024 / DBT (US92028RAF29) | 0,24 | -5,53 | 0,2428 | -0,0075 | ||

| US66285WHF68 / North Texas Tollway Authority, Special Projects System Revenue Bonds, Convertible Capital Appreciation Series 2011C | 0,24 | -1,66 | 0,2408 | 0,0024 | ||

| Village Community Development District 15, Florida, Special Assessment Revenue Bonds, Series 2024 / DBT (US92708KAK34) | 0,24 | -3,67 | 0,2404 | -0,0017 | ||

| Village Community Development District 15, Florida, Special Assessment Revenue Bonds, Series 2024 / DBT (US92708KAK34) | 0,24 | -3,67 | 0,2404 | -0,0017 | ||

| Hess Ranch Metropolitan District 5, Parker, Colorado, Special Assessment Revenue Bonds, Special Improvement District 2, Series 2024 / DBT (US428111AC21) | 0,23 | -6,05 | 0,2374 | -0,0083 | ||

| Hess Ranch Metropolitan District 5, Parker, Colorado, Special Assessment Revenue Bonds, Special Improvement District 2, Series 2024 / DBT (US428111AC21) | 0,23 | -6,05 | 0,2374 | -0,0083 | ||

| US755783AM97 / Reagan Hospital District of Reagan County, Texas, Limited Tax Revenue Bonds, Series 2014A | 0,23 | -1,69 | 0,2360 | 0,0027 | ||

| US805462AE80 / Sawgrass Village Community Development District, Series 2023 | 0,23 | -1,69 | 0,2359 | 0,0019 | ||

| Hawaii Department of Budget and Finance, Special Purpose Revenue Bonds, Hawaii Pacific University Project, Refunding Series 2024 / DBT (US419800PV34) | 0,23 | -3,75 | 0,2346 | -0,0034 | ||

| Hawaii Department of Budget and Finance, Special Purpose Revenue Bonds, Hawaii Pacific University Project, Refunding Series 2024 / DBT (US419800PV34) | 0,23 | -3,75 | 0,2346 | -0,0034 | ||

| US34061UMA33 / Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Renaissance Charter School Income Projects, Series 2023A | 0,22 | -2,19 | 0,2269 | 0,0008 | ||

| US87539QAB59 / TANEY CNTY MO INDL DEV AUTH SALES TAX REVENUE | 0,21 | -5,33 | 0,2167 | -0,0058 | ||

| US791524CP42 / St. Louis (County of), MO Industrial Development Authority (Friendship Village West County), Series 2018 A, RB | 0,21 | -2,83 | 0,2101 | -0,0001 | ||

| Hess Ranch Metropolitan District 5, Parker, Colorado, Special Assessment Revenue Bonds, Special Improvement District 1, Series 2024A-2 / DBT (US428111AB48) | 0,20 | -1,92 | 0,2071 | 0,0015 | ||

| Hess Ranch Metropolitan District 5, Parker, Colorado, Special Assessment Revenue Bonds, Special Improvement District 1, Series 2024A-2 / DBT (US428111AB48) | 0,20 | -1,92 | 0,2071 | 0,0015 | ||

| US04110FAB13 / Arkansas Development Finance Authority, Series 2023 | 0,20 | -3,35 | 0,2058 | -0,0012 | ||

| US04110FAA30 / Arkansas Development Finance Authority, Series 2022 | 0,20 | -2,91 | 0,2032 | -0,0008 | ||

| Pennsylvania Economic Development Financing Authority, Solid Waste Disposal Revenue Bonds, Core Natural Resources Inc., Project, Series 2025 / DBT (US708692CA49) | 0,20 | 0,2013 | 0,2013 | |||

| Pennsylvania Economic Development Financing Authority, Solid Waste Disposal Revenue Bonds, Core Natural Resources Inc., Project, Series 2025 / DBT (US708692CA49) | 0,20 | 0,2013 | 0,2013 | |||

| US97712DFH44 / Wisconsin Health and Educational Facilities Authority, Wisconsin, Revenue Bonds, Dickson Hollow Project Series 2014 | 0,20 | -1,50 | 0,2010 | 0,0034 | ||

| US45201QCX07 / Illinois Educational Facilities Authority, Revenue Bonds, Field Museum of Natural History, Series 2002RMKT | 0,20 | -1,50 | 0,2006 | 0,0030 | ||

| US45203HY226 / ILLINOIS ST FIN AUTH REVENUE | 0,19 | -3,00 | 0,1975 | -0,0004 | ||

| US74529JRJ69 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0,19 | -5,05 | 0,1909 | -0,0052 | ||

| US798111GC88 / San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road Revenue Bonds, Refunding Junior Lien Series 2014B | 0,16 | 0,00 | 0,1625 | 0,0043 | ||

| US97712JEE91 / Wisconsin Health & Educational Facilities Authority | 0,15 | -7,45 | 0,1523 | -0,0073 | ||

| Hobe-Saint Lucie Conservancy District, Florida, Special Assessment Revenue Bonds, Improvement Unit 1A, Series 2024 / DBT (US434043AC97) | 0,15 | -2,61 | 0,1518 | -0,0002 | ||

| Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, KIPP Miami North Campus Project, Refunding Series 2024A / DBT (US14054WAQ87) | 0,14 | -2,07 | 0,1444 | 0,0006 | ||

| Capital Trust Authority, Florida, Educational Facilities Revenue Bonds, KIPP Miami North Campus Project, Refunding Series 2024A / DBT (US14054WAQ87) | 0,14 | -2,07 | 0,1444 | 0,0006 | ||

| US592247K742 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 0,13 | -6,67 | 0,1289 | -0,0055 | ||

| US605156AC20 / MISSION TX ECON DEV CORP REVENUE | 0,12 | 0,00 | 0,1260 | 0,0025 | ||

| Virginia Beach Development Authority, Virginia, Residential Care Facility Revenue Bonds, Westminster Canterbury on Chesapeake Bay, Series 2023A / DBT (US92774NBB55) | 0,11 | -2,65 | 0,1119 | -0,0002 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Taxable Series 2024A-1 / DBT (US084538JD01) | 0,11 | -1,80 | 0,1108 | 0,0011 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Taxable Series 2024A-1 / DBT (US084538JD01) | 0,11 | -1,80 | 0,1108 | 0,0011 | ||

| North AR-1 of Pasco Community Development District, Florida, Capital Improvement Revenue Bonds, Assessment Area 4, Series 2024 / DBT (US65725AAP93) | 0,11 | -6,96 | 0,1090 | -0,0053 | ||

| North AR-1 of Pasco Community Development District, Florida, Capital Improvement Revenue Bonds, Assessment Area 4, Series 2024 / DBT (US65725AAP93) | 0,11 | -6,96 | 0,1090 | -0,0053 | ||

| James City County Economic Development Authority, Virginia, Residential Care Facility Revenue Bonds, Williamsburg Landing Inc., Series 2024A / DBT (US47029WEG87) | 0,11 | -3,64 | 0,1086 | -0,0001 | ||

| James City County Economic Development Authority, Virginia, Residential Care Facility Revenue Bonds, Williamsburg Landing Inc., Series 2024A / DBT (US47029WEG87) | 0,11 | -3,64 | 0,1086 | -0,0001 | ||

| Oneida Indian Nation, New York, Tax Revenue Bonds, Series 2024B / DBT (US682504AC93) | 0,11 | -2,75 | 0,1078 | -0,0000 | ||

| Oneida Indian Nation, New York, Tax Revenue Bonds, Series 2024B / DBT (US682504AC93) | 0,11 | -2,75 | 0,1078 | -0,0000 | ||

| US61022CAL37 / MONONGALIA CNTY WV COMMISSION SPL DIST EXCISE TAX REVENUE | 0,10 | -43,33 | 0,1041 | -0,0746 | ||

| US90068FAZ99 / Tuscaloosa (County of), AL, AL Industrial Development Authority (Hunt Refining), Series 2019 A, Ref. IDR | 0,10 | -3,96 | 0,0991 | -0,0013 | ||

| US246388TM46 / Delaware State Health Facilities Authority | 0,10 | -5,00 | 0,0969 | -0,0024 | ||

| US38549PBG63 / Grand Forks, North Dakota, Senior Housing & Nursing Facilities Revenue Bonds, Valley Homes and Services Obligated Group, Series 2017 | 0,09 | -4,08 | 0,0963 | -0,0011 | ||

| US791524CE94 / SAINT LOUIS CNTY MO INDL DEV AUTH SENIOR LIVING FACS | 0,09 | -3,09 | 0,0960 | 0,0001 | ||

| US829566CS53 / Sioux Falls, South Dakota, Health Facilities Revenue Bonds, Dow Rummel Village Project, Series 2017 | 0,09 | -5,43 | 0,0886 | -0,0025 | ||

| US74445QAC42 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,07 | -4,41 | 0,0670 | -0,0011 | ||

| US073225AY06 / TOWNSHIP OF BAYTOWN MN | 0,06 | -4,55 | 0,0645 | -0,0013 | ||

| US11943KBW18 / BUFFALO & ERIE CNTY NY INDL LAND DEV CORP REVENUE | 0,06 | -1,69 | 0,0595 | 0,0006 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Series 2024A-2 / DBT (US084538JF58) | 0,06 | -3,51 | 0,0563 | -0,0007 | ||

| Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, Series 2024A-2 / DBT (US084538JF58) | 0,06 | -3,51 | 0,0563 | -0,0007 | ||

| US179027YM31 / Clackamas County Hospital Facility Authority | 0,05 | -5,56 | 0,0521 | -0,0021 | ||

| US04785VAP94 / Atlanta Urban Residential Finance Authority, Georgia, Multifamily Housing Revenue Bonds, Testletree Village Apartments, Series 2013A | 0,04 | -53,01 | 0,0400 | -0,0425 | ||

| US130911B337 / California Statewide Community Development Authority, Revenue Bonds, Daughters of Charity Health System, Series 2005A | 0,00 | -33,33 | 0,0022 | -0,0016 | ||

| US74445QAG55 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0003 | -0,0000 | |||

| US74445QDS66 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | 0,0000 | |||

| US74445QCA67 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | 0,0000 | |||

| US74445QCB41 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCC24 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCE89 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCD07 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCF54 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCG38 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCH11 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCJ76 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCK40 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCL23 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCM06 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0001 | -0,0000 | |||

| US74445QCN88 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 | |||

| US74445QCP37 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 | |||

| US74445QCQ10 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 | |||

| US74445QCR92 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 | |||

| US74445QCS75 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 | |||

| US74445QCT58 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 | |||

| US74445QCU22 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 | |||

| US74445QCV05 / Public Finance Authority of Wisconsin, Conference Center and Hotel Revenue Bonds, Lombard Public Facilities Corporation, Second Tier Series 2018B | 0,00 | 0,0000 | -0,0000 |