Grundlæggende statistik

| Porteføljeværdi | $ 148.234.778 |

| Nuværende stillinger | 49 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

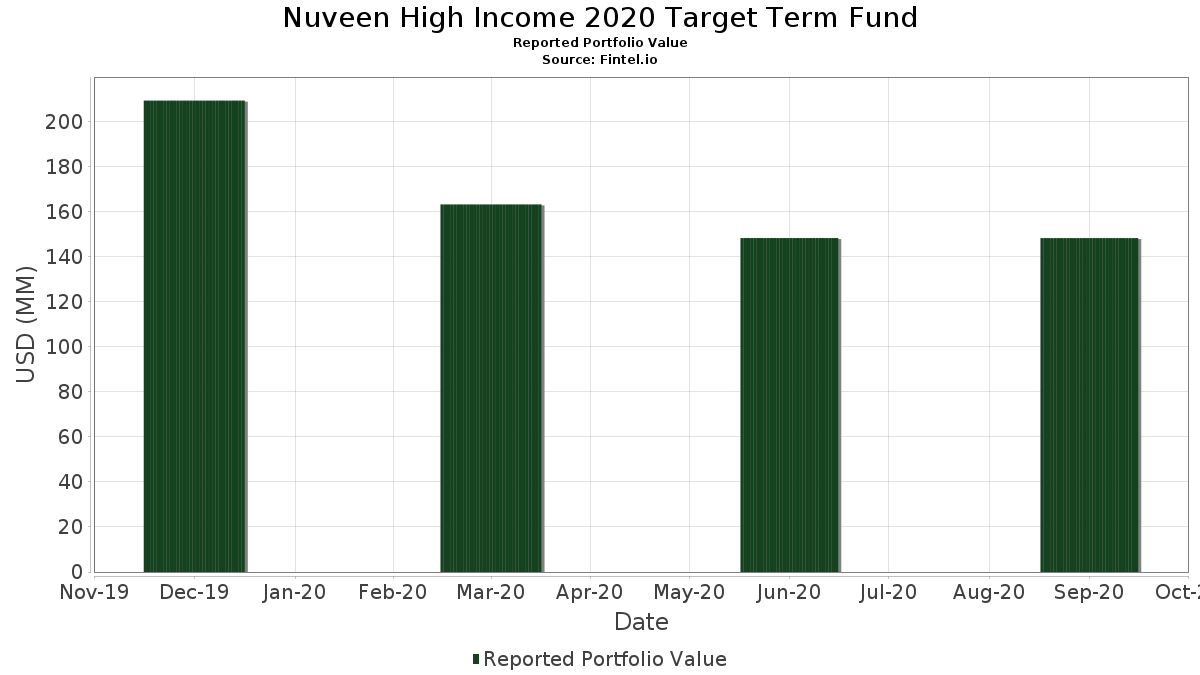

Nuveen High Income 2020 Target Term Fund har afsløret 49 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 148.234.778 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Nuveen High Income 2020 Target Term Funds største beholdninger er CASH MGMT BILL 0.000000% 10/27/2020 (US:US9127964K26) , Ford Motor Credit Co LLC (US:US345397YS67) , Jupiter Securitization Co LLC (US:4820P2K12) , Limited Brands, Inc. 6.625% Senior Notes 04/01/21 (US:US532716AT46) , and CIT GROUP INC SR UNSECURED 03/21 4.125 (US:US125581GV41) . Nuveen High Income 2020 Target Term Funds nye stillinger omfatter CASH MGMT BILL 0.000000% 10/27/2020 (US:US9127964K26) , Ford Motor Credit Co LLC (US:US345397YS67) , Jupiter Securitization Co LLC (US:4820P2K12) , Limited Brands, Inc. 6.625% Senior Notes 04/01/21 (US:US532716AT46) , and CIT GROUP INC SR UNSECURED 03/21 4.125 (US:US125581GV41) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 22,10 | 14,6902 | 14,6902 | ||

| 4,00 | 2,6590 | 2,6590 | ||

| 3,00 | 1,9942 | 1,9942 | ||

| 3,00 | 1,9942 | 1,9942 | ||

| 3,00 | 1,9942 | 1,9942 | ||

| 3,00 | 1,9942 | 1,9942 | ||

| 3,00 | 1,9941 | 1,9941 | ||

| 3,00 | 1,9941 | 1,9941 | ||

| 3,00 | 1,9941 | 1,9941 | ||

| 3,00 | 1,9941 | 1,9941 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,49 | 0,3229 | -3,3000 | ||

| 0,91 | 0,6073 | -0,6556 | ||

| 3,13 | 2,0833 | -0,0407 | ||

| 3,40 | 2,2626 | -0,0392 | ||

| 2,51 | 1,6682 | -0,0295 | ||

| 3,98 | 2,6488 | -0,0195 | ||

| 3,42 | 2,2701 | -0,0151 | ||

| 2,52 | 1,6723 | -0,0145 | ||

| 1,50 | 0,9985 | -0,0144 | ||

| 1,25 | 0,8340 | -0,0104 |

13F og Fondsarkivering

Denne formular blev indsendt den 2020-11-27 for rapporteringsperioden 2020-09-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US9127964K26 / CASH MGMT BILL 0.000000% 10/27/2020 | 22,10 | 14,6902 | 14,6902 | |||

| US345397YS67 / Ford Motor Credit Co LLC | 7,49 | 0,63 | 4,9794 | 0,0069 | ||

| 4820P2K12 / Jupiter Securitization Co LLC | 4,00 | 2,6590 | 2,6590 | |||

| US532716AT46 / Limited Brands, Inc. 6.625% Senior Notes 04/01/21 | 3,98 | -0,25 | 2,6488 | -0,0195 | ||

| US125581GV41 / CIT GROUP INC SR UNSECURED 03/21 4.125 | 3,42 | -0,15 | 2,2701 | -0,0151 | ||

| US64110LAE65 / Netflix, Inc. Bond | 3,40 | -1,22 | 2,2626 | -0,0392 | ||

| US988498AG64 / Yum! Brands Inc 3.875% Senior Notes 11/01/20 | 3,17 | 0,03 | 2,1083 | -0,0093 | ||

| US526057CK83 / Lennar Corp | 3,13 | -1,45 | 2,0833 | -0,0407 | ||

| Old Line Funding LLC / STIV (67983TK54) | 3,00 | 1,9942 | 1,9942 | |||

| 30229AK65 / Exxon Mobil Corp | 3,00 | 0,03 | 1,9942 | -0,0086 | ||

| Columbia Funding Co LLC / STIV (19767CK70) | 3,00 | 1,9942 | 1,9942 | |||

| Bennington Stark Capital Co LLC / STIV (08224LKD7) | 3,00 | 1,9942 | 1,9942 | |||

| NRW Bank / STIV (62939LKD0) | 3,00 | 1,9942 | 1,9942 | |||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 3,00 | 1,9941 | 1,9941 | |||

| Lloyds Bank PLC / STIV (53943RKD0) | 3,00 | 1,9941 | 1,9941 | |||

| 12619TKD5 / CRC Funding LLC | 3,00 | 1,9941 | 1,9941 | |||

| Cornell University / STIV (21920NKF8) | 3,00 | 1,9941 | 1,9941 | |||

| Corp Andina de Fomento / STIV (2198X2KE8) | 3,00 | 1,9940 | 1,9940 | |||

| Kells Funding LLC / STIV (PPEF0C5R0) | 3,00 | 1,9940 | 1,9940 | |||

| Private Export Funding Corp / STIV (7426M2KW0) | 3,00 | 1,9939 | 1,9939 | |||

| 22533TKU9 / Credit Agricole Corporate and Investment Bank/New York | 3,00 | 0,07 | 1,9939 | -0,0087 | ||

| MetLife Short Term Funding LLC / STIV (59157TKW2) | 3,00 | 1,9939 | 1,9939 | |||

| Crown Point Capital Co LLC / STIV (2284K0KN4) | 3,00 | 1,9939 | 1,9939 | |||

| Thunder Bay Funding LLC / STIV (88602TKS1) | 3,00 | 1,9939 | 1,9939 | |||

| Manhattan Asset Funding Co LLC / STIV (56274LKU7) | 3,00 | 1,9939 | 1,9939 | |||

| Halkin Finance LLC / STIV (40588LKU2) | 3,00 | 1,9939 | 1,9939 | |||

| 39021UKU9 / GREAT BRDGE CPTL CO LL | 3,00 | 0,07 | 1,9939 | -0,0084 | ||

| Sheffield Receivables Co LLC / STIV (82124LKS0) | 3,00 | 1,9938 | 1,9938 | |||

| Ciesco LLC / STIV (17177LKW3) | 3,00 | 1,9938 | 1,9938 | |||

| US85571BAP04 / Starwood Property Trust Inc | 3,00 | 1,70 | 1,9929 | 0,0239 | ||

| US63938CAA62 / Navient Corp | 2,87 | 0,42 | 1,9078 | -0,0014 | ||

| US745867AV39 / PulteGroup Inc | 2,52 | -0,40 | 1,6723 | -0,0145 | ||

| US900123BH29 / Turkey Government International Bond | 2,51 | -1,26 | 1,6682 | -0,0295 | ||

| US910047AG49 / United Airlines Holdings Inc | 2,51 | 1,01 | 1,6660 | 0,0085 | ||

| AVOL / Park Aerospace Holdings Ltd | 2,36 | 0,90 | 1,5720 | 0,0064 | ||

| US71654QAX07 / Petroleos Mexicanos | 2,27 | 1,11 | 1,5088 | 0,0095 | ||

| US02005NBG43 / Ally Financial Inc | 2,03 | -0,10 | 1,3522 | -0,0079 | ||

| US12553NK204 / Cigna Corporation | 2,00 | 1,3295 | 1,3295 | |||

| US247361ZM39 / Delta Air Lines Inc | 1,99 | 2,47 | 1,3244 | 0,0251 | ||

| US296464AA84 / Eskom Holdings SOC Ltd | 1,95 | 2,52 | 1,2967 | 0,0258 | ||

| US00928QAM33 / Aircastle Ltd Senior Notes 9.75% 08/01/2018 | 1,81 | 1,06 | 1,2019 | 0,0067 | ||

| US06739GBP37 / Barclays Bank Plc 5.140% Lower Tier 2 Notes 10/14/20 | 1,50 | -0,92 | 0,9985 | -0,0144 | ||

| US65412AAA07 / Nigeria Government International Bond | 1,25 | -0,79 | 0,8340 | -0,0104 | ||

| US37247DAN66 / Genworth Finl Inc Fixed Rt Senior Notes 7.2% 02/15/2021 | 1,00 | 7,49 | 0,6681 | 0,0435 | ||

| 94XL / Gold Fields Orogen Holdings BVI Ltd | 1,00 | -0,50 | 0,6632 | -0,0061 | ||

| US059613AC35 / Banco Nacional de Costa Rica | 0,91 | -51,69 | 0,6073 | -0,6556 | ||

| US85748R0096 / Dreyfus Institutional Preferred Government Plus Money Market Fund | 0,49 | -91,06 | 0,3229 | -3,3000 | ||

| US38869PAK03 / Graphic Packaging Intl 4.75% 04/15/21 | 0,45 | -0,44 | 0,3014 | -0,0030 | ||

| US74153QAH56 / Pride Intl Inc Del Fixed Rt Notes 6.875% 08/15/2020 | 0,11 | -5,83 | 0,0755 | -0,0047 |