Grundlæggende statistik

| Porteføljeværdi | $ 339.141.762 |

| Nuværende stillinger | 206 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

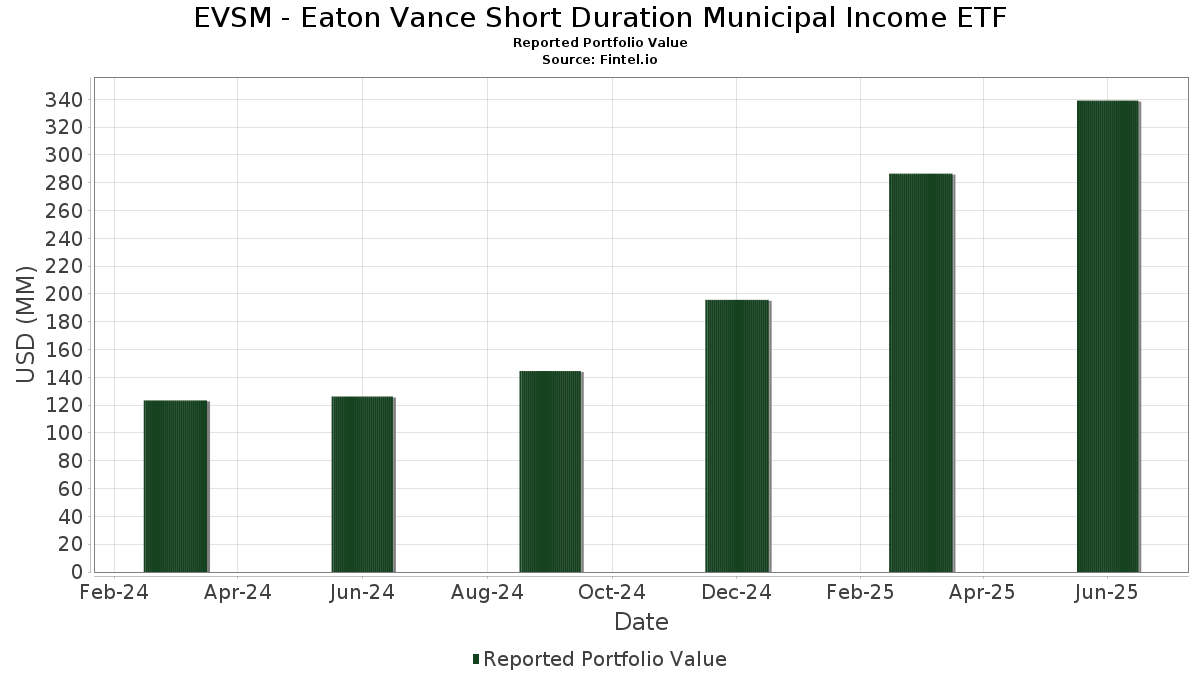

EVSM - Eaton Vance Short Duration Municipal Income ETF har afsløret 206 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 339.141.762 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). EVSM - Eaton Vance Short Duration Municipal Income ETFs største beholdninger er BURKE CNTY GA DEV AUTH POLL CONTROL REVENUE (US:US121342MW66) , Mississippi Business Finance Corp (US:US60528AAT16) , Gulf Coast Industrial Development Authority (ExxonMobil), Series 2012, VRD RB (US:US402207AD61) , Detroit City School District, Wayne County, Michigan, Unlimited Tax School Building and Site Improvement Bonds, Series 2001A (US:US251129ZY14) , and DENVER CITY & CNTY CO ARPT REV CITY & COUNTY OF DENVER CO AIRPORT SYSTEM REVENUE (US:US249182LE46) . EVSM - Eaton Vance Short Duration Municipal Income ETFs nye stillinger omfatter BURKE CNTY GA DEV AUTH POLL CONTROL REVENUE (US:US121342MW66) , Mississippi Business Finance Corp (US:US60528AAT16) , Gulf Coast Industrial Development Authority (ExxonMobil), Series 2012, VRD RB (US:US402207AD61) , Detroit City School District, Wayne County, Michigan, Unlimited Tax School Building and Site Improvement Bonds, Series 2001A (US:US251129ZY14) , and DENVER CITY & CNTY CO ARPT REV CITY & COUNTY OF DENVER CO AIRPORT SYSTEM REVENUE (US:US249182LE46) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,22 | 0,9594 | 0,9594 | ||

| 3,19 | 0,9489 | 0,9489 | ||

| 3,01 | 0,8967 | 0,8967 | ||

| 3,00 | 0,8931 | 0,8931 | ||

| 3,00 | 0,8931 | 0,8931 | ||

| 2,74 | 0,8143 | 0,8143 | ||

| 2,69 | 0,8006 | 0,8006 | ||

| 2,54 | 0,7574 | 0,7574 | ||

| 2,52 | 0,7510 | 0,7510 | ||

| 2,52 | 0,7504 | 0,7504 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,15 | 2,15 | 0,6391 | -0,4012 | |

| 1,00 | 0,2978 | -0,3942 | ||

| 2,00 | 0,5954 | -0,2697 | ||

| 2,03 | 0,6052 | -0,2302 | ||

| 4,50 | 1,3396 | -0,2176 | ||

| 3,30 | 0,9824 | -0,1596 | ||

| 3,12 | 0,9279 | -0,1530 | ||

| 2,95 | 0,8774 | -0,1474 | ||

| 2,74 | 0,8165 | -0,1474 | ||

| 3,00 | 0,8931 | -0,1451 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-22 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US121342MW66 / BURKE CNTY GA DEV AUTH POLL CONTROL REVENUE | 4,50 | 0,00 | 1,3396 | -0,2176 | |||||

| US60528AAT16 / Mississippi Business Finance Corp | 3,50 | 16,67 | 1,0419 | 0,0038 | |||||

| Ohio Water Development Authority, Series 2024 C / DBT (US67766WQ212) | 3,30 | 32,00 | 0,9824 | 0,1173 | |||||

| US402207AD61 / Gulf Coast Industrial Development Authority (ExxonMobil), Series 2012, VRD RB | 3,30 | 0,00 | 0,9824 | -0,1596 | |||||

| US251129ZY14 / Detroit City School District, Wayne County, Michigan, Unlimited Tax School Building and Site Improvement Bonds, Series 2001A | 3,22 | 0,9594 | 0,9594 | ||||||

| New York State Dormitory Authority, Series 2025 2-A / DBT (US64985SBZ56) | 3,19 | 0,9489 | 0,9489 | ||||||

| US249182LE46 / DENVER CITY & CNTY CO ARPT REV CITY & COUNTY OF DENVER CO AIRPORT SYSTEM REVENUE | 3,12 | -0,19 | 0,9279 | -0,1530 | |||||

| University of North Carolina at Chapel Hill, Series 2012 B / DBT (US914713U750) | 3,01 | 0,8967 | 0,8967 | ||||||

| US362848RR67 / City of Gainesville FL Utilities System Revenue | 3,00 | 0,00 | 0,8931 | -0,1451 | |||||

| US46246K5E87 / IOWA ST FIN AUTH REVENUE | 3,00 | 0,8931 | 0,8931 | ||||||

| US64972GC857 / NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY | 3,00 | 50,00 | 0,8931 | 0,2010 | |||||

| US91425MAZ05 / UNIV OF DELAWARE DE REVENUE UNIHGR 11/35 ADJUSTABLE VAR | 3,00 | 0,8931 | 0,8931 | ||||||

| US914455QU73 / University of Michigan Revenue | 2,99 | -0,03 | 0,8888 | -0,1445 | |||||

| US89658HVD96 / Trinity River Authority Central Regional Wastewater System Revenue | 2,95 | -0,47 | 0,8774 | -0,1474 | |||||

| US594615FM32 / Michigan State Building Authority | 2,94 | 0,00 | 0,8748 | -0,1421 | |||||

| US452227SC63 / ILLINOIS ST SALES TAX REVENUE | 2,92 | 0,14 | 0,8705 | -0,1401 | |||||

| Parish of St John the Baptist, Series 2017 C / DBT (US79020FBB13) | 2,89 | 0,52 | 0,8603 | -0,1345 | |||||

| US74514L3G08 / PUERTO RICO CMWLTH | 2,78 | -0,61 | 0,8267 | -0,1403 | |||||

| South Carolina Jobs-Economic Development Authority, Series 2024 A / DBT (US837032BJ96) | 2,75 | 0,84 | 0,8199 | -0,1253 | |||||

| Massachusetts Development Finance Agency, Series 2025 A-1 / DBT (US57585BGT98) | 2,74 | -1,54 | 0,8165 | -0,1474 | |||||

| Connecticut State Health & Educational Facilities Authority, Series 2025 B-1 / DBT (US20775DZS43) | 2,74 | 0,8143 | 0,8143 | ||||||

| City of Springfield IL, Series 2024 / DBT (US850578UA12) | 2,71 | 0,59 | 0,8063 | -0,1253 | |||||

| US59261AJ579 / Metropolitan Transportation Authority | 2,70 | -0,22 | 0,8036 | -0,1328 | |||||

| Western Michigan University, Series 2025 A / DBT (US958638ZV37) | 2,69 | 0,8006 | 0,8006 | ||||||

| US155048DC25 / Central Puget Sound WA Regional Transit Authority Sales & Use Tax Revenue | 2,64 | -0,41 | 0,7869 | -0,1318 | |||||

| New Jersey Turnpike Authority, Series 2024 A / DBT (US646140FN82) | 2,64 | -0,19 | 0,7852 | -0,1291 | |||||

| California Municipal Finance Authority, Series 2024 A-1 / DBT (US130483HC75) | 2,63 | -0,68 | 0,7824 | -0,1333 | |||||

| US414009JU58 / Harris County Cultural Education Facilities Finance Corp | 2,62 | -0,46 | 0,7801 | -0,1310 | |||||

| US64990FFZ27 / NEW YORK ST DORM AUTH ST PERSONAL INCOME TAX REVENUE | 2,60 | -0,04 | 0,7745 | -0,1260 | |||||

| US452152Q203 / ILLINOIS ST | 2,59 | -0,35 | 0,7710 | -0,1281 | |||||

| US09182TCR68 / Black Belt Energy Gas District, Series 2023 D-1 | 2,59 | 0,08 | 0,7695 | -0,1245 | |||||

| US416489UE08 / HARTFORD CNTY CT MET DIST | 2,56 | 0,00 | 0,7626 | -0,1237 | |||||

| Providence St Joseph Health Obligated Group / DBT (US743820AG70) | 2,54 | 0,7574 | 0,7574 | ||||||

| US45204FEH47 / ILLINOIS ST FIN AUTH REVENUE | 2,53 | -0,31 | 0,7540 | -0,1251 | |||||

| US56035DDH26 / MAIN STR NAT GA 4% 07/01/2052 MT | 2,52 | 0,12 | 0,7514 | -0,1211 | |||||

| Bergen County Improvement Authority (The), Series 2025 A / DBT (US083773EC11) | 2,52 | 0,7510 | 0,7510 | ||||||

| US96634RAU68 / Whiting (City of), IN (BP Products North America), Series 2019, Ref. RB | 2,52 | -0,39 | 0,7509 | -0,1253 | |||||

| Northside Independent School District, Series 2020 / DBT (US66702RR794) | 2,52 | 0,7504 | 0,7504 | ||||||

| University of Illinois, Series 2016 A / DBT (US914353N297) | 2,51 | -0,36 | 0,7487 | -0,1245 | |||||

| Missouri State Environmental Improvement & Energy Resources Authority, Series 2008 / DBT (US606907BK86) | 2,51 | 0,7463 | 0,7463 | ||||||

| US944514TH16 / Wayne County Airport Authority | 2,51 | -0,28 | 0,7459 | -0,1235 | |||||

| US882723F618 / State of Texas | 2,50 | 0,7452 | 0,7452 | ||||||

| US4072722B80 / County of Hamilton OH | 2,50 | 0,7442 | 0,7442 | ||||||

| US521841MM57 / Leander TX Independent School District GO | 2,49 | 0,81 | 0,7410 | -0,1135 | |||||

| US7178238L53 / Philadelphia Gas Works Co | 2,47 | -0,48 | 0,7346 | -0,1234 | |||||

| US419792LM62 / HI ST 5% 10/1/2030 | 2,46 | -0,36 | 0,7319 | -0,1218 | |||||

| US207758N418 / CONNECTICUT ST -A-REV | 2,40 | -0,54 | 0,7145 | -0,1207 | |||||

| Oklahoma Development Finance Authority, Series 2016 D / DBT (US67884FQ416) | 2,35 | 0,04 | 0,6983 | -0,1131 | |||||

| West Virginia Economic Development Authority, Series 2025 / DBT (US95648VBV09) | 2,32 | 0,6910 | 0,6910 | ||||||

| US13050RAA05 / California (State of) Municipal Finance Authority (United Airlines, Inc.), Series 2019, Ref. RB | 2,28 | -1,08 | 0,6794 | -0,1189 | |||||

| Development Authority of Monroe County (The), Series 2008, Class 1 / DBT (US610530FZ58) | 2,23 | -0,36 | 0,6639 | -0,1109 | |||||

| University of Colorado Hospital Authority, Series 2024 B / DBT (US914183BX50) | 2,23 | 1,04 | 0,6634 | -0,0999 | |||||

| University of Wisconsin Hospitals & Clinics, Series 2024 B / DBT (US915260FU29) | 2,18 | 0,23 | 0,6495 | -0,1037 | |||||

| North Carolina Medical Care Commission, Series 2025 B / DBT (US65821DZV62) | 2,16 | 0,6418 | 0,6418 | ||||||

| US09248U8412 / BlackRock Liquidity Funds: MuniCash, Institutional Shares | 2,15 | -28,58 | 2,15 | -28,61 | 0,6391 | -0,4012 | |||

| Indiana Finance Authority, Series 2025 D-1 / DBT (US45470YGD76) | 2,13 | 0,6352 | 0,6352 | ||||||

| US19648FXD13 / COLORADO HEALTH 5% MT | 2,12 | -0,66 | 0,6304 | -0,1070 | |||||

| New Jersey Higher Education Student Assistance Authority, Series 2025-1B / DBT (US646080YQ88) | 2,09 | 0,6224 | 0,6224 | ||||||

| US19645R5V95 / Colorado Educational & Cultural Facilities Authority Revenue (University of Denver) | 2,07 | 0,10 | 0,6170 | -0,0995 | |||||

| US542691GD61 / LONG ISLAND NY PWR AUTH ELEC SYS REVENUE | 2,06 | -0,48 | 0,6138 | -0,1030 | |||||

| Dallas Independent School District, Series 2025 A-2 / DBT (US235308Q486) | 2,06 | -0,72 | 0,6120 | -0,1045 | |||||

| US167486F873 / FX.RT. MUNI BOND | 2,04 | -0,20 | 0,6078 | -0,1001 | |||||

| US574193PS10 / State of Maryland | 2,03 | -15,78 | 0,6052 | -0,2302 | |||||

| US64966L4N85 / New York NY GO | 2,02 | -0,25 | 0,6022 | -0,0997 | |||||

| Colorado Housing and Finance Authority, Series 2025 F-2 / DBT (US19648GE996) | 2,02 | 0,6004 | 0,6004 | ||||||

| US610530FE20 / Development Authority of Monroe County/The | 2,01 | 1,00 | 0,5993 | -0,0907 | |||||

| US158862CD22 / Chandler Industrial Development Authority | 2,01 | 0,40 | 0,5987 | -0,0944 | |||||

| Colorado Housing and Finance Authority, Series 2025 E-2 / DBT (US19648GXF44) | 2,01 | 0,90 | 0,5982 | -0,0909 | |||||

| US114894WA26 / BROWARD CNTY FL ARPT SYS REVEN REGD B/E AMT 5.00000000 | 2,01 | -0,30 | 0,5970 | -0,0990 | |||||

| US607167DX82 / Mobile Industrial Development Board, Alabama, Pollution Control Revenue Refunding Bonds, Alabama Power Company Barry Plan, Series 2008 | 2,00 | -0,05 | 0,5958 | -0,0972 | |||||

| US735389WK02 / Port of Seattle | 2,00 | 0,00 | 0,5958 | -0,0969 | |||||

| US92812WLB80 / VIRGINIA ST HSG DEV AUTH | 2,00 | 0,05 | 0,5957 | -0,0967 | |||||

| US64971XKS61 / New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Subordinate Fiscal 2019 Subseries C-4 | 2,00 | -20,00 | 0,5954 | -0,2697 | |||||

| US709222DS94 / PENNSYLVANIA ST TURNPIKE COMMISSION REGISTRATION FEE REVENUE | 2,00 | -0,15 | 0,5944 | -0,0975 | |||||

| New York City Housing Development Corp., Series 2024 F-2 / DBT (US64972KGU34) | 1,99 | -0,20 | 0,5939 | -0,0978 | |||||

| Florida Development Finance Corp., Series 2024 A / DBT (US34061XAG79) | 1,99 | 0,5935 | 0,5935 | ||||||

| US26822LDS07 / E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B | 1,99 | 0,81 | 0,5924 | -0,0905 | |||||

| US01728A5V46 / Allegheny County Hospital Development Authority | 1,98 | -0,40 | 0,5887 | -0,0983 | |||||

| US45204EES37 / ILLINOIS ST FIN AUTH REVENUE | 1,95 | -0,41 | 0,5801 | -0,0971 | |||||

| US79467BCR42 / Sales Tax Securitization Corp. | 1,89 | -0,63 | 0,5626 | -0,0957 | |||||

| Fort Bend Independent School District, Series 2025 B / DBT (US346843WS00) | 1,88 | 0,5591 | 0,5591 | ||||||

| US645780FR36 / New Jersey Economic Development Authority | 1,84 | 1,94 | 0,5477 | -0,0767 | |||||

| US78689HKT22 / SAGINAW VY ST UNIV MICH REV | 1,78 | -0,22 | 0,5301 | -0,0873 | |||||

| US59259N5P44 / MET TRANSPRTN AUTH NY DEDICATED TAX FUND | 1,77 | -0,28 | 0,5269 | -0,0873 | |||||

| US605155BQ24 / MISSION TX ECON DEV CORP SOL WST DISP REVENUE | 1,75 | 75,18 | 0,5211 | 0,1751 | |||||

| US91425MDV63 / University of Delaware Revenue VRDO | 1,70 | 0,5061 | 0,5061 | ||||||

| US13068XHB82 / CALIFORNIA ST PUBLIC WKS BRD LEASE REVENUE | 1,68 | 0,12 | 0,5012 | -0,0806 | |||||

| New York State Housing Finance Agency, Series 2024 B-2 / DBT (US649870PG14) | 1,65 | -0,30 | 0,4898 | -0,0812 | |||||

| Tarrant County Cultural Education Facilities Finance Corp., Series 2024 B / DBT (US87638THP12) | 1,62 | -0,18 | 0,4821 | -0,0792 | |||||

| City of Minneapolis MN, Series 2025 / DBT (US603695JP37) | 1,60 | 0,19 | 0,4768 | -0,0765 | |||||

| US914378GQ18 / UNIV OF KENTUCKY KY GEN RECPTS | 1,60 | 0,00 | 0,4761 | -0,0775 | |||||

| Washington State University, Series 2025 / DBT (US940094FL46) | 1,60 | 0,82 | 0,4752 | -0,0725 | |||||

| Metropolitan Pier & Exposition Authority, Series 2024 A / DBT (US592250FW91) | 1,59 | -0,31 | 0,4741 | -0,0786 | |||||

| Triborough Bridge & Tunnel Authority, Series 2025 A / DBT (US89602HHY62) | 1,58 | 0,25 | 0,4718 | -0,0752 | |||||

| US56035DFT46 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 1,58 | 0,45 | 0,4700 | -0,0737 | |||||

| New Jersey Educational Facilities Authority, Series A-1 / DBT (US646067KD94) | 1,57 | 0,4682 | 0,4682 | ||||||

| US73358XJV55 / PORT NY NJ 5% 12/1/2027 @ | 1,56 | 0,06 | 0,4654 | -0,0751 | |||||

| US73358XJU72 / Port Authority of New York & New Jersey | 1,54 | -0,19 | 0,4577 | -0,0752 | |||||

| El Paso County Hospital District, Series 2024 / DBT (US283590HM21) | 1,52 | -0,26 | 0,4511 | -0,0747 | |||||

| US19648FJJ49 / Colorado Health Facilities Authority | 1,51 | -0,72 | 0,4500 | -0,0770 | |||||

| Clairton Municipal Authority, Series 2024 B / DBT (US179630DD77) | 1,51 | -0,40 | 0,4493 | -0,0751 | |||||

| Hawaii Housing Finance & Development Corp., Series 2024 / DBT (US41981PCG46) | 1,51 | 0,47 | 0,4493 | -0,0707 | |||||

| US79623PQQ18 / SAN ANTONIO TX CITY OF SAN ANTONIO TX | 1,50 | -0,13 | 0,4471 | -0,0730 | |||||

| Michigan Finance Authority, Series 2024 A-1 / DBT (US59447T5Q25) | 1,50 | -0,46 | 0,4470 | -0,0750 | |||||

| US64972GCQ55 / New York (City of), NY Municipal Water Finance Authority | 1,50 | 0,4465 | 0,4465 | ||||||

| Chandler Industrial Development Authority, Series 2019 / DBT (US158862CE05) | 1,50 | 0,4457 | 0,4457 | ||||||

| New York State Housing Finance Agency, Series 2014 A / DBT (US64987JY622) | 1,49 | 0,27 | 0,4430 | -0,0706 | |||||

| Clifton Higher Education Finance Corp., Series 2019 / DBT (US187145KF36) | 1,48 | 0,41 | 0,4416 | -0,0696 | |||||

| US45203EAG44 / ILLINOIS ST FIN AUTH WTR FAC R ILLINOIS FINANCE AUTHORITY | 1,47 | -0,34 | 0,4387 | -0,0728 | |||||

| Wisconsin Housing & Economic Development Authority, Series 2024 B / DBT (US9769045G32) | 1,36 | 0,07 | 0,4046 | -0,0655 | |||||

| US606092LT98 / MISSOURI JT MUNI ELEC UTILITY COMMISSION PWR PROJ REVENUE | 1,36 | -0,51 | 0,4044 | -0,0682 | |||||

| City of Minneapolis MN, Series 2025 / DBT (US603695JQ10) | 1,36 | 0,44 | 0,4037 | -0,0635 | |||||

| South Carolina Public Service Authority, Series 2025 B / DBT (US8371515Z85) | 1,34 | 0,07 | 0,3979 | -0,0641 | |||||

| Chicago O'Hare International Airport, Series 2024 F / DBT (US1675937Q95) | 1,33 | 0,08 | 0,3963 | -0,0642 | |||||

| US79467BCS25 / Sales Tax Securitization Corp. | 1,33 | -0,45 | 0,3944 | -0,0661 | |||||

| US60637AKS05 / MISSOURI ST HLTH & EDUCTNL FAC HEALTH & EDUCATIONAL FACILITIES AUTHORITY OF THE S | 1,32 | -0,08 | 0,3940 | -0,0643 | |||||

| US62620HBB78 / MUNI ELEC AUTH OF GA | 1,31 | 0,3886 | 0,3886 | ||||||

| US23503CDH79 / DALLAS-FORT WORTH TX INTERNATIONAL ARPT REVENUE | 1,30 | 0,00 | 0,3874 | -0,0631 | |||||

| US70914PE577 / PENNSYLVANIA ST REGD B/E 5.00000000 | 1,29 | -0,39 | 0,3842 | -0,0641 | |||||

| US64971PKB03 / NEW YORK CITY NY INDL DEV AGY NYCDEV 03/31 FIXED 4 | 1,29 | -0,62 | 0,3829 | -0,0652 | |||||

| US23503CCK18 / Dallas Fort Worth International Airport, Series 2023B | 1,26 | -0,63 | 0,3743 | -0,0637 | |||||

| Lambertson Farms Metropolitan District No. 1, Series 2024 A / DBT (US513305AH54) | 1,25 | -0,16 | 0,3719 | -0,0611 | |||||

| Ohio Higher Educational Facility Commission / DBT (US67756DT894) | 1,25 | 0,24 | 0,3718 | -0,0591 | |||||

| US88255QBH11 / Texas Municipal Gas Acquisition & Supply Corp II | 1,24 | -0,16 | 0,3694 | -0,0606 | |||||

| US167505SU19 / CHICAGO IL BRD OF EDU | 1,20 | -0,25 | 0,3582 | -0,0592 | |||||

| US386442WP87 / GRAND RIVER OK DAM AUTH REVENUE | 1,20 | -0,33 | 0,3563 | -0,0590 | |||||

| Oklahoma County Finance Authority, Series 2025 / DBT (US67868UKE28) | 1,15 | 0,3427 | 0,3427 | ||||||

| Energy Northwest, Series 2020A / DBT (US29270C3K97) | 1,14 | 0,79 | 0,3404 | -0,0522 | |||||

| New York State Energy Research & Development Authority, Series 2004 B / DBT (US649845JB19) | 1,13 | 0,3372 | 0,3372 | ||||||

| City of Lone Tree CO, Series 2024 / DBT (US542341AC62) | 1,13 | -0,35 | 0,3358 | -0,0557 | |||||

| US65830RBH12 / NORTH CAROLINA TURNPIKE AUTHORITY | 1,12 | -0,09 | 0,3336 | -0,0545 | |||||

| US64966LU257 / City of New York NY | 1,12 | 0,00 | 0,3334 | -0,0542 | |||||

| US60637ASW35 / MISSOURI ST HLTH EDUCTNL FAC MOSMED 07/26 FIXED 4 | 1,11 | -0,09 | 0,3310 | -0,0544 | |||||

| Casino Reinvestment Development Authority, Inc., Series 2024 A / DBT (US14760RBE09) | 1,10 | 0,92 | 0,3278 | -0,0499 | |||||

| Triborough Bridge & Tunnel Authority, Series 2025 A / DBT (US896032AD16) | 1,08 | 0,28 | 0,3206 | -0,0512 | |||||

| New Hampshire Health and Education Facilities Authority Act, Series 2017 A / DBT (US64461XCF06) | 1,08 | 0,09 | 0,3203 | -0,0517 | |||||

| Detroit Downtown Development Authority, Series 2024 / DBT (US251135HE20) | 1,07 | 0,56 | 0,3194 | -0,0498 | |||||

| US613520MQ56 / County of Montgomery | 1,07 | -0,28 | 0,3193 | -0,0529 | |||||

| US709207DH47 / Pennsylvania Public School Building Authority Lease Revenue (School District of Philadelphia) | 1,07 | -0,28 | 0,3192 | -0,0531 | |||||

| Virgin Islands Transportation & Infrastructure Corp., Series 2025 / DBT (US927686AE58) | 1,07 | 0,3187 | 0,3187 | ||||||

| US13013JDD54 / California Community Choice Financing Authority | 1,07 | -0,47 | 0,3177 | -0,0533 | |||||

| Port Authority of New York & New Jersey, Series 248 / DBT (US73358XPE66) | 1,06 | 0,3157 | 0,3157 | ||||||

| Main Street Natural Gas, Inc., Series 2025 A / DBT (US56035DJT00) | 1,06 | 0,66 | 0,3157 | -0,0489 | |||||

| US717883VW99 / PHILADELPHIA PA SCH DIST | 1,06 | 0,19 | 0,3155 | -0,0503 | |||||

| Detroit Downtown Development Authority, Series 2024 / DBT (US251135HD47) | 1,06 | 0,28 | 0,3153 | -0,0503 | |||||

| California Health Facilities Financing Authority, Series 2024 A / DBT (US13032UT402) | 1,06 | 0,00 | 0,3142 | -0,0512 | |||||

| US214165LW07 / COOK CO SD#87 | 1,05 | 0,00 | 0,3132 | -0,0509 | |||||

| Warner Robins Housing Authority Resident Council Corp., Series 2024 / DBT (US934604AM12) | 1,05 | 0,00 | 0,3119 | -0,0507 | |||||

| US592250FH25 / Metropolitan Pier & Exposition Authority | 1,04 | -0,29 | 0,3091 | -0,0513 | |||||

| US66285WM783 / N TX TOLLWAY AUTH REVENUE | 1,04 | -0,19 | 0,3084 | -0,0506 | |||||

| New York City Housing Development Corp., Series 2024 D / DBT (US64966TGV08) | 1,02 | 0,89 | 0,3050 | -0,0464 | |||||

| US20774Y3P05 / CONNECTICUT ST HLTH & EDUCTNL REGD N/C B/E 5.00000000 | 1,02 | -0,39 | 0,3039 | -0,0507 | |||||

| Board of Governors of Colorado State University System, Series 2023 A-2 / DBT (US196707V676) | 1,02 | -0,87 | 0,3037 | -0,0526 | |||||

| US575896SY24 / Massachusetts Port Authority | 1,02 | -0,29 | 0,3030 | -0,0503 | |||||

| US709224QL60 / Pennsylvania Turnpike Commission Revenue | 1,02 | 0,00 | 0,3028 | -0,0494 | |||||

| US93978PPU56 / WASHINGTON ST HSG FIN COMMISSI REGD V/R B/E 5.00000000 | 1,02 | -0,29 | 0,3028 | -0,0503 | |||||

| US130536LT02 / CALIFORNIA ST POLL CONTROL FIN AUTH SOL WST DISP REVENUE | 1,02 | 0,20 | 0,3025 | -0,0485 | |||||

| North Carolina Housing Finance Agency, Series 55 C / DBT (US65820BBB18) | 1,01 | 0,00 | 0,3021 | -0,0489 | |||||

| US232769MQ97 / CYPRESS-FAIRBANKS TX INDEP SCH REGD N/C B/E PSF-GTD 5.00000000 | 1,01 | -0,59 | 0,3018 | -0,0509 | |||||

| US167562SK45 / CHICAGO IL MIDWAY ARPT REVENUE | 1,01 | -0,59 | 0,3008 | -0,0508 | |||||

| US254764JQ75 / District of Columbia | 1,01 | -0,39 | 0,3008 | -0,0502 | |||||

| US708692BF45 / Pa Ecodev Fa Ws Bond DBT | 1,01 | 0,80 | 0,3006 | -0,0459 | |||||

| Municipal Electric Authority of Georgia, Series 2024 A / DBT (US62620HJD52) | 1,01 | -0,49 | 0,3006 | -0,0505 | |||||

| New York City Housing Development Corp., Series 2025 C-2 / DBT (US64972KLH67) | 1,01 | 0,2998 | 0,2998 | ||||||

| US88285ACL08 / TEXAS WTR DEV BRD ST WTR IMPLEMENTATION REVENUE FUND | 1,01 | -0,59 | 0,2995 | -0,0507 | |||||

| California State Public Works Board, Series 2024 B / DBT (US13068XLH07) | 1,01 | 0,00 | 0,2993 | -0,0488 | |||||

| US110331QS72 / BRISTOL VA | 1,00 | -0,40 | 0,2986 | -0,0500 | |||||

| Bergen County Improvement Authority (The), Series 2024 / DBT (US083773EB38) | 1,00 | -0,30 | 0,2985 | -0,0496 | |||||

| City of Quincy MA, Series 2024 / DBT (US748508Y691) | 1,00 | -0,50 | 0,2980 | -0,0502 | |||||

| US45506CBL00 / Indiana Housing & Community Development Authority | 1,00 | -0,30 | 0,2979 | -0,0492 | |||||

| Hudson County Improvement Authority, Series 2024 B-1 / DBT (US443728GJ30) | 1,00 | -0,40 | 0,2978 | -0,0497 | |||||

| US74445MAG42 / PFA WI SD WSTE 1.53% SER A-3 9/1/2027 MT @ | 1,00 | 0,2978 | 0,2978 | ||||||

| US74445MAF68 / PUBLIC FIN AUTH WI SOL WST DIS REGD V/R B/E AMT 1.45000000 | 1,00 | 0,2978 | 0,2978 | ||||||

| US45505RBN44 / INDIANA ST FIN AUTH ECON DEV R REGD V/R B/E AMT 1.40000000 | 1,00 | -49,97 | 0,2978 | -0,3942 | |||||

| US46246YAB83 / MUNI PUT BOND ACT | 1,00 | -0,10 | 0,2974 | -0,0489 | |||||

| E-470 Public Highway Authority, Series 2024 B / DBT (US26822LMX90) | 0,99 | -0,60 | 0,2960 | -0,0504 | |||||

| US414009RN24 / Harris County Cultural Education Facilities Finance Corp. | 0,95 | 0,00 | 0,2818 | -0,0458 | |||||

| Connecticut State Health & Educational Facilities Authority, Series 2024 A / DBT (US20775DYC00) | 0,89 | -0,45 | 0,2661 | -0,0445 | |||||

| DuPage County Forest Preserve District, Series 2025 / DBT (US262651VH20) | 0,87 | -0,12 | 0,2581 | -0,0422 | |||||

| City of Hamilton OH, Series 2024 / DBT (US407756P829) | 0,84 | -0,36 | 0,2494 | -0,0413 | |||||

| Kentucky State Property & Building Commission, Series A / DBT (US49151F4R82) | 0,82 | 0,61 | 0,2448 | -0,0382 | |||||

| City of Philadelphia, Series 2025 C / DBT (US717813C565) | 0,82 | 0,2446 | 0,2446 | ||||||

| Casino Reinvestment Development Authority, Inc., Series 2024 A / DBT (US14760RBD26) | 0,82 | 0,74 | 0,2436 | -0,0374 | |||||

| Public Finance Authority, Series 2025 A / DBT (US74439YFK29) | 0,81 | 0,87 | 0,2422 | -0,0368 | |||||

| State of Connecticut, Series 2025 A / DBT (US20772KZV42) | 0,81 | 0,2414 | 0,2414 | ||||||

| Shelby County Health Educational & Housing Facilities Board, Series 2024 B / DBT (US821691AC66) | 0,79 | -0,25 | 0,2341 | -0,0389 | |||||

| Connecticut State Higher Education Supplement Loan Authority, Series 2025 B-2 / DBT (US207743YR04) | 0,76 | 0,2250 | 0,2250 | ||||||

| New York State Housing Finance Agency, Series 2024 A-2 / DBT (US649870NG32) | 0,75 | -0,13 | 0,2232 | -0,0364 | |||||

| Development Authority of Burke County (The), Series 2012-2 / DBT (US121342QN22) | 0,75 | 0,00 | 0,2218 | -0,0362 | |||||

| City of Cleveland OH, Series 2025 A / DBT (US186352TQ34) | 0,65 | 0,1936 | 0,1936 | ||||||

| New Caney Independent School District, Series 2018 / DBT (US643154LB13) | 0,61 | 0,33 | 0,1823 | -0,0289 | |||||

| Massachusetts Educational Financing Authority, Series 2024 B / DBT (US57563RTZ28) | 0,60 | 0,50 | 0,1792 | -0,0281 | |||||

| County Square Redevelopment Corp., Series 2025 / DBT (US22259PBW59) | 0,55 | 0,92 | 0,1640 | -0,0251 | |||||

| Oregon State Lottery, Series 2025 A / DBT (US68607V6C40) | 0,55 | 0,1638 | 0,1638 | ||||||

| US658203X251 / NORTH CAROLINA ST MUNI PWR AGY 1 CATAWBA ELEC REVENUE | 0,54 | -0,37 | 0,1593 | -0,0266 | |||||

| Main Street Natural Gas, Inc., Series 2025 A / DBT (US56035DJS27) | 0,53 | 0,57 | 0,1571 | -0,0245 | |||||

| Public Finance Authority, Series 2025 A / DBT (US74439YFH99) | 0,51 | 0,98 | 0,1527 | -0,0232 | |||||

| US9769044P40 / WISCONSIN ST HSG & ECON DEV AUTH HSG REVENUE | 0,50 | 0,00 | 0,1492 | -0,0244 | |||||

| US64966LLS87 / New York (City of), NY, Series 2014 I-2, VRD GO Bonds | 0,50 | 0,00 | 0,1488 | -0,0242 | |||||

| Development Authority of Burke County (The), Series 2013-1 / DBT (US121342QL65) | 0,50 | -0,60 | 0,1485 | -0,0249 | |||||

| Colorado Science and Technology Park Metropolitan District No. 1, Series 2024 A / DBT (US19658CAH16) | 0,42 | -0,71 | 0,1256 | -0,0212 | |||||

| Public Finance Authority, Series 2025 A / DBT (US74439YFD85) | 0,40 | 0,00 | 0,1202 | -0,0195 | |||||

| New York State Dormitory Authority, Series 2024 / DBT (US65000B8A92) | 0,38 | 0,00 | 0,1141 | -0,0188 | |||||

| State of Alaska International Airports System, Series 2025 A / DBT (US011842UW98) | 0,37 | 0,00 | 0,1115 | -0,0179 | |||||

| Colorado Science and Technology Park Metropolitan District No. 1, Series 2024 A / DBT (US19658CAG33) | 0,37 | 0,00 | 0,1114 | -0,0183 | |||||

| New York State Dormitory Authority, Series 2024 / DBT (US65000B7H54) | 0,21 | 0,47 | 0,0639 | -0,0099 |