Grundlæggende statistik

| Porteføljeværdi | $ 364.193.371 |

| Nuværende stillinger | 565 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

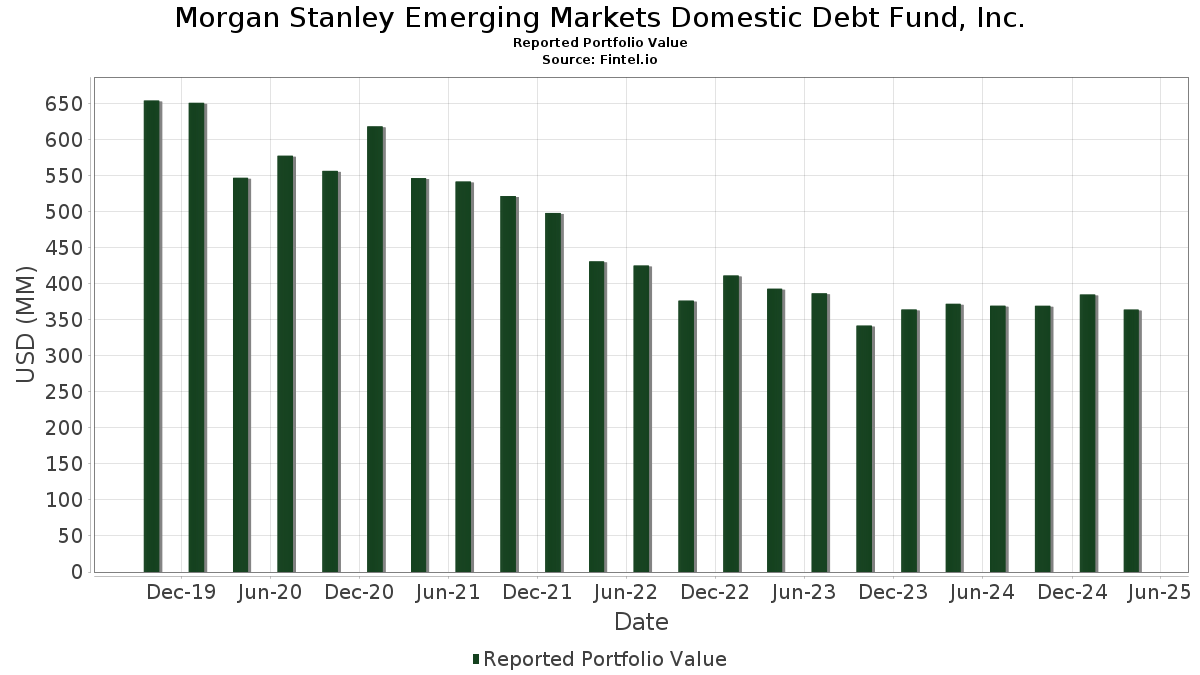

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. har afsløret 565 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 364.193.371 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.s største beholdninger er Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio (US:US61747C5250) , Mexican Bonos (MX:MX0MGO0000J5) , Republic of South Africa Government Bond (ZA:ZAG000125980) , Serbia Treasury Bonds (RS:RSMFRSD86176) , and Mexican Bonos (MX:MX0MGO0000H9) . Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.s nye stillinger omfatter Mexican Bonos (MX:MX0MGO0000J5) , Republic of South Africa Government Bond (ZA:ZAG000125980) , Serbia Treasury Bonds (RS:RSMFRSD86176) , Mexican Bonos (MX:MX0MGO0000H9) , and South Africa - Corporate Bond/Note (ZA:R2035) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 9,89 | 2,9145 | 2,9145 | ||

| 9,84 | 2,8996 | 2,4826 | ||

| 5,52 | 1,6255 | 1,6255 | ||

| 19,69 | 19,69 | 5,8042 | 1,5137 | |

| 4,85 | 1,4301 | 1,0347 | ||

| 3,28 | 0,9656 | 0,9656 | ||

| 3,20 | 0,9422 | 0,9422 | ||

| 7,74 | 2,2812 | 0,9184 | ||

| 2,16 | 0,6370 | 0,6370 | ||

| 2,09 | 0,6153 | 0,6153 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 11,83 | 3,4864 | -4,6254 | ||

| 7,48 | 2,2040 | -4,6188 | ||

| 0,77 | 0,2270 | -1,7162 | ||

| 1,71 | 0,5037 | -1,2873 | ||

| 0,60 | 0,1782 | -1,0276 | ||

| 0,32 | 0,0939 | -1,0053 | ||

| 9,56 | 2,8180 | -0,9165 | ||

| 0,72 | 0,2112 | -0,8483 | ||

| 0,45 | 0,1329 | -0,6360 | ||

| 7,95 | 2,3422 | -0,4640 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-26 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C5250 / Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio | 19,69 | 38,56 | 19,69 | 38,57 | 5,8042 | 1,5137 | |||

| Republic of Poland Government Bond / DBT (PL0000117024) | 13,46 | 12,25 | 3,9673 | 0,3473 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 11,83 | -55,98 | 3,4864 | -4,6254 | |||||

| Uzbek Industrial and Construction Bank ATB / DBT (XS2855478496) | 11,20 | -0,87 | 3,3020 | -0,1097 | |||||

| U.S. Treasury Bills / STIV (US912797QH30) | 9,89 | 2,9145 | 2,9145 | ||||||

| MX0MGO0000J5 / Mexican Bonos | 9,84 | 612,38 | 2,8996 | 2,4826 | |||||

| ZAG000125980 / Republic of South Africa Government Bond | 9,56 | -22,71 | 2,8180 | -0,9165 | |||||

| RSMFRSD86176 / Serbia Treasury Bonds | 8,22 | 8,57 | 2,4238 | 0,1371 | |||||

| XS2170852847 / Synlab Bondco PLC | 7,95 | -14,51 | 2,3422 | -0,4640 | |||||

| MX0MGO0000H9 / Mexican Bonos | 7,74 | 60,66 | 2,2812 | 0,9184 | |||||

| R2035 / South Africa - Corporate Bond/Note | 7,48 | -66,92 | 2,2040 | -4,6188 | |||||

| AMGB1129A332 / Republic of Armenia Treasury Bonds | 6,66 | 3,39 | 1,9626 | 0,0185 | |||||

| SB12AGO34 / Peru - Corporate Bond/Note | 6,64 | -13,55 | 1,9570 | -0,3616 | |||||

| TH062303M604 / Thailand Government Bond | 6,43 | 4,76 | 1,8938 | 0,0422 | |||||

| PEP01000C2Z1 / Peru Government Bond | 6,38 | 31,02 | 1,8811 | 0,4104 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 6,15 | 28,91 | 1,8140 | 0,3727 | |||||

| MYBMY1900052 / Malaysia Government Bond | 5,68 | 5,46 | 1,6727 | 0,0483 | |||||

| PTPP / PT PP (Persero) Tbk | 5,52 | 1,6255 | 1,6255 | ||||||

| COL17CT03672 / Colombian TES | 5,42 | 0,39 | 1,5981 | -0,0325 | |||||

| IDG000013509 / Indonesia Treasury Bond | 5,20 | -1,03 | 1,5330 | -0,0536 | |||||

| PTPP / PT PP (Persero) Tbk | 4,85 | 270,38 | 1,4301 | 1,0347 | |||||

| RO4KELYFLVK4 / Romania Government Bond | 4,66 | 10,45 | 1,3740 | 0,0998 | |||||

| Paraguay Government International Bond / DBT (US699149AP51) | 4,64 | -4,59 | 1,3673 | -0,1005 | |||||

| US25714RCZ55 / Dominican Republic International Bond | 4,46 | 4,55 | 1,3149 | 0,0267 | |||||

| R2044 / South Africa - Sovereign or Government Agency Debt | 4,45 | -3,10 | 1,3102 | -0,0746 | |||||

| XS2701167442 / Republic of Uzbekistan International Bond | 4,38 | -1,60 | 1,2911 | -0,0528 | |||||

| Albanian Government Bond / DBT (AL000A3L0YB0) | 4,35 | 11,96 | 1,2833 | 0,1091 | |||||

| IDG000015207 / Indonesia Treasury Bond | 4,34 | -0,76 | 1,2780 | -0,0411 | |||||

| IDG000020801 / Indonesia Treasury Bond | 4,24 | -1,05 | 1,2501 | -0,0439 | |||||

| IDG000020900 / INDONESIA GOV'T | 4,02 | -1,47 | 1,1842 | -0,0467 | |||||

| MX0MGO000102 / Mexican Bonos | 3,98 | 11,04 | 1,1741 | 0,0910 | |||||

| XS2655862014 / EUROPE ASIA INVESTMENT FINANCE | 3,97 | -0,90 | 1,1695 | -0,0390 | |||||

| MX0MGO0000U2 / Mexican Bonos | 3,92 | 53,04 | 1,1559 | 0,3923 | |||||

| IDG000011701 / Indonesia Treasury Bond | 3,89 | -1,52 | 1,1476 | -0,0459 | |||||

| XS1303929894 / Ukraine Government International Bond | 3,82 | 11,04 | 1,1267 | 0,0876 | |||||

| XS1151974877 / Ethiopia International Bond | 3,73 | 2,45 | 1,0988 | -0,0000 | |||||

| IDG000013806 / Indonesia Treasury Bond | 3,60 | -0,85 | 1,0619 | -0,0350 | |||||

| MX0MGO0001E4 / Mexican Bonos | 3,51 | 11,39 | 1,0350 | 0,0832 | |||||

| Development Bank of Kazakhstan JSC / DBT (US48129VAC00) | 3,51 | -1,49 | 1,0350 | -0,0410 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 3,28 | 0,9656 | 0,9656 | ||||||

| Republic of Poland Government Bond / DBT (PL0000116851) | 3,20 | 0,9422 | 0,9422 | ||||||

| XS1953916290 / Republic of Uzbekistan Bond | 3,17 | 3,29 | 0,9348 | 0,0079 | |||||

| Albanian Government Bond / DBT (AL000A3LTAW4) | 2,86 | 11,56 | 0,8421 | 0,0688 | |||||

| COL17CT03490 / Colombian TES | 2,84 | -3,13 | 0,8383 | -0,0482 | |||||

| Nigeria OMO Bill / STIV (NGO2Z2705258) | 2,78 | -1,42 | 0,8182 | -0,0322 | |||||

| Itau BBA International PLC / SN (XS2742662955) | 2,51 | -2,10 | 0,7411 | -0,0343 | |||||

| Sri Lanka Government Bonds / DBT (LKB00428J159) | 2,50 | 0,20 | 0,7373 | -0,0163 | |||||

| Nigeria OMO Bill / STIV (NGO8A0710250) | 2,43 | -31,38 | 0,7149 | -0,3521 | |||||

| Montenegro Government International Bond / DBT (XS3037625319) | 2,16 | 0,6370 | 0,6370 | ||||||

| COL17CT03862 / Colombia TES | 2,09 | 0,6153 | 0,6153 | ||||||

| AMGN60294284 / Republic of Armenia Treasury Bonds | 2,01 | 2,55 | 0,5937 | 0,0007 | |||||

| COL17CT02914 / Colombian TES | 1,91 | 0,32 | 0,5631 | -0,0120 | |||||

| Honduras Government International Bond / DBT (USP5178RAE82) | 1,78 | 0,5237 | 0,5237 | ||||||

| XS2023698553 / Banque Centrale de Tunisie International Bond | 1,75 | 8,71 | 0,5153 | 0,0298 | |||||

| XS2189251031 / Uzbek Industrial and Construction Bank ATB via Daryo Finance BV | 1,75 | -7,07 | 0,5152 | -0,0527 | |||||

| US71654QDH20 / Petroleos Mexicanos | 1,72 | -0,06 | 0,5055 | -0,0128 | |||||

| XS2436897081 / Dominican Republic International Bond | 1,71 | 2,70 | 0,5043 | 0,0013 | |||||

| R2037 / South Africa - Sovereign or Government Agency Debt | 1,71 | -71,21 | 0,5037 | -1,2873 | |||||

| TH062303I602 / Thailand Government Bond | 1,70 | 5,06 | 0,5022 | 0,0124 | |||||

| European Bank for Reconstruction & Development / DBT (XS2800009578) | 1,67 | -0,12 | 0,4935 | -0,0125 | |||||

| COL17CT03771 / Colombian TES | 1,59 | -2,57 | 0,4690 | -0,0240 | |||||

| RO1J9H39WKT4 / ROMANIA GOVERNMENT BOND /RON/ REGD SER 5Y 4.25000000 | 1,57 | 12,38 | 0,4627 | 0,0410 | |||||

| Sri Lanka Government Bonds / DBT (LKB01534I155) | 1,48 | 0,4359 | 0,4359 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 1,46 | 0,4310 | 0,4310 | ||||||

| Albanian Government Bond / DBT (AL000A3L0PN3) | 1,35 | 10,55 | 0,3987 | 0,0294 | |||||

| IDG000013202 / Indonesia Treasury Bond | 1,34 | -0,89 | 0,3948 | -0,0132 | |||||

| TH0623X3T603 / Thailand Government Bond | 1,33 | 6,76 | 0,3911 | 0,0158 | |||||

| Suriname Government International Bond / DBT (USP68788AC53) | 1,27 | 1.094,34 | 0,3732 | 0,3411 | |||||

| Ipoteka-Bank ATIB / DBT (XS2808393370) | 1,24 | 1,88 | 0,3669 | -0,0018 | |||||

| IDG000021809 / INDONESIA GOV'T | 1,23 | 0,3619 | 0,3619 | ||||||

| TRT051033T12 / TURKIYE GOVERNMENT BOND 26.200000% 10/05/2033 | 1,19 | -52,19 | 0,3507 | -0,4003 | |||||

| USP06518AH06 / Bahamas Government International Bond | 1,19 | 0,3497 | 0,3497 | ||||||

| Paraguay Government International Bond / DBT (USP75744AP07) | 1,18 | -4,60 | 0,3486 | -0,0256 | |||||

| XS2286298711 / Benin Government International Bond | 1,16 | -28,09 | 0,3413 | -0,1446 | |||||

| US25714PER55 / Dominican Republic Central Bank Notes | 1,15 | -27,94 | 0,3377 | -0,1422 | |||||

| National Bank of Uzbekistan / DBT (XS2853544802) | 1,11 | 0,27 | 0,3266 | -0,0070 | |||||

| Sri Lanka Government Bonds / DBT (LKB00832L158) | 1,06 | 0,3124 | 0,3124 | ||||||

| US31574FAB31 / Fideicomiso PA Costera | 1,05 | -2,96 | 0,3091 | -0,0171 | |||||

| Suriname Government International Bond / DBT (USP68788AD37) | 1,01 | 17,01 | 0,2982 | 0,0372 | |||||

| AMGB3029A522 / Republic of Armenia Treasury Bonds | 1,01 | 4,58 | 0,2964 | 0,0062 | |||||

| US25714RDA95 / Dominican Republic Central Bank Notes | 1,00 | 4,05 | 0,2959 | 0,0047 | |||||

| MYBMY2200023 / Malaysia Government Bond | 0,99 | 4,96 | 0,2931 | 0,0070 | |||||

| Benin Government International Bond / DBT (XS2759982064) | 0,99 | -49,44 | 0,2922 | -0,2995 | |||||

| USP7807HAR68 / Petroleos de Venezuela SA | 0,97 | -8,49 | 0,2861 | -0,0340 | |||||

| 88WE / Angolan Government International Bond | 0,96 | 0,2836 | 0,2836 | ||||||

| ROZBOC49U096 / Romania Government Bond | 0,94 | 8,91 | 0,2774 | 0,0164 | |||||

| AMGB3129A504 / Republic of Armenia Treasury Bonds | 0,93 | 4,60 | 0,2750 | 0,0057 | |||||

| Montenegro Government International Bond / DBT (XS2779850630) | 0,93 | -1,90 | 0,2732 | -0,0121 | |||||

| Sri Lanka Government Bonds / DBT (LKB00730J158) | 0,93 | 225,70 | 0,2727 | 0,1869 | |||||

| Albanian Government Bond / DBT (AL000A3L7VG0) | 0,90 | 13,49 | 0,2654 | 0,0258 | |||||

| LB356A / Thailand Government Bond | 0,89 | 5,06 | 0,2634 | 0,0066 | |||||

| US486661AF87 / Kazakhstan Government International Bond | 0,87 | -9,49 | 0,2559 | -0,0338 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,86 | 0,2529 | 0,2529 | ||||||

| TRT190728T18 / Turkey Government Bond | 0,85 | -37,58 | 0,2514 | -0,1609 | |||||

| US486661AF87 / Kazakhstan Government International Bond | 0,85 | -5,02 | 0,2514 | -0,0195 | |||||

| USP48864AQ80 / Barbados Government International Bond | 0,82 | 0,2403 | 0,2403 | ||||||

| HU0000404165 / Hungary Government Bond | 0,79 | 8,53 | 0,2328 | 0,0133 | |||||

| US25714WBR34 / Dominican Republic International Bond | 0,77 | -88,04 | 0,2270 | -1,7162 | |||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,76 | 0,2232 | 0,2232 | ||||||

| USP3579ECS48 / Dominican Republic Government Bond | 0,72 | -79,60 | 0,2112 | -0,8483 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,71 | 0,2103 | 0,2103 | ||||||

| COL17CT03748 / Colombian TES | 0,67 | -4,04 | 0,1960 | -0,0133 | |||||

| Bahamas Government International Bond / DBT (USP06518AC19) | 0,63 | 0,1865 | 0,1865 | ||||||

| Bono Del Tesoro Nacional Capitalizable en Pesos / DBT (AR0647336129) | 0,63 | 0,1851 | 0,1851 | ||||||

| XS1796266754 / Ivory Coast Government International Bond | 0,62 | 0,81 | 0,1836 | -0,0028 | |||||

| Nigeria OMO Bill / STIV (NGO7A3009256) | 0,60 | -84,88 | 0,1782 | -1,0276 | |||||

| US486661AF87 / Kazakhstan Government International Bond | 0,59 | -10,08 | 0,1737 | -0,0242 | |||||

| RO7P95F9FNY6 / Romania Government Bond | 0,58 | 10,44 | 0,1718 | 0,0126 | |||||

| XS2360598630 / Republic of Cameroon International Bond | 0,57 | 39,85 | 0,1667 | 0,0445 | |||||

| European Bank for Reconstruction & Development / DBT (XS2778917190) | 0,55 | -19,32 | 0,1612 | -0,0435 | |||||

| Nigeria OMO Bill / STIV (NGO2A1908252) | 0,54 | -2,35 | 0,1594 | -0,0076 | |||||

| Albanian Government Bond / DBT (AL000A4D54G1) | 0,51 | 0,1504 | 0,1504 | ||||||

| XS2278994418 / BENIN INTL GOV BOND 4.875000% 01/19/2032 | 0,49 | 4,05 | 0,1438 | 0,0021 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,48 | 0,1425 | 0,1425 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0,48 | 0,1425 | 0,1425 | ||||||

| Long: SMIBCD2G9 IRS CNY R F 2.41520 II4158990221101 CCPNDF / Short: SMIBCD2G9 IRS CNY P V 00MCNRR II1754630221101 CCPNDF / DIR (000000000) | 0,48 | 0,1408 | 0,1408 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,48 | 0,1401 | 0,1401 | ||||||

| XS2199272662 / Jordan Government International Bond | 0,47 | 0,1378 | 0,1378 | ||||||

| ARARGE520718 / Argentina Treasury Bill 05/28/2020 TBLM | 0,46 | 0,1357 | 0,1357 | ||||||

| ARARGE520718 / Argentina Treasury Bill 05/28/2020 TBLM | 0,46 | 0,1355 | 0,1355 | ||||||

| XS1819680528 / Angolan Government International Bond | 0,46 | 0,1351 | 0,1351 | ||||||

| Nigeria OMO Bill / STIV (NGO9Y2005251) | 0,45 | -82,33 | 0,1329 | -0,6360 | |||||

| Long: SMICNN3T4 IRS CNY R F 2.44000 II9341860231030 CCPNDF / Short: SMICNN3T4 IRS CNY P V 00MCNRR II5115910231030 CCPNDF / DIR (000000000) | 0,45 | 0,1320 | 0,1320 | ||||||

| TRT061124T11 / Turkey Government Bond | 0,44 | -41,11 | 0,1311 | -0,0967 | |||||

| TRT061124T11 / Turkey Government Bond | 0,44 | -73,71 | 0,1311 | -0,3789 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,44 | 0,1289 | 0,1289 | ||||||

| Albanian Government Bond / DBT (AL000A3LUHP1) | 0,44 | 10,35 | 0,1289 | 0,0092 | |||||

| Long: SMIC2U4Y9 IRS PLN R F 5.26100 II8535980230607 CCPVANILLA / Short: SMIC2U4Y9 IRS PLN P V 06MWIBOR II0989910230607 CCPVANILLA / DIR (000000000) | 0,42 | 0,1232 | 0,1232 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0,40 | 0,1180 | 0,1180 | ||||||

| XS0559237796 / Lebanon Government International Bond | 0,39 | 8,56 | 0,1160 | 0,0066 | |||||

| XS1419879686 / Lebanon Government International Bond | 0,39 | 539,34 | 0,1152 | 0,0967 | |||||

| Suriname Government International Bond / DBT (US86886PAD42) | 0,39 | 22,78 | 0,1146 | 0,0190 | |||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0,39 | 0,1140 | 0,1140 | ||||||

| US922646AS37 / Venezuela Government International Bond | 0,38 | -25,69 | 0,1118 | -0,0423 | |||||

| Long: SMICBXDX5 IRS CNY R F 2.29400 II0336000230817 CCPNDF / Short: SMICBXDX5 IRS CNY P V 00MCNRR II1617930230817 CCPNDF / DIR (000000000) | 0,35 | 0,1018 | 0,1018 | ||||||

| XS1577950311 / Jordan Government International Bond | 0,34 | 0,1006 | 0,1006 | ||||||

| Suriname Government International Bond / DBT (US86886PAD42) | 0,33 | 2,85 | 0,0960 | 0,0004 | |||||

| USP7807HAT25 / Petroleos de Venezuela SA | 0,32 | -3,31 | 0,0947 | -0,0056 | |||||

| PEP01000C5I0 / BONOS DE TESORERIA | 0,32 | -91,52 | 0,0939 | -1,0053 | |||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0,31 | 0,0925 | 0,0925 | ||||||

| US486661AF87 / Kazakhstan Government International Bond | 0,31 | -5,74 | 0,0920 | -0,0080 | |||||

| XS0250882478 / Lebanon Government International Bond | 0,31 | 67,21 | 0,0902 | 0,0349 | |||||

| Albanian Government Bond / DBT (AL000A3L71M8) | 0,29 | 18,62 | 0,0866 | 0,0118 | |||||

| XS2270576700 / Montenegro Government International Bond | 0,29 | 10,77 | 0,0850 | 0,0063 | |||||

| USP5015VAQ97 / REPUBLIC OF GUATEMALA 6.600000% 06/13/2036 | 0,28 | 0,0836 | 0,0836 | ||||||

| Long: SMIC3N8R5 IRS THB R F 2.68100 II8882140230614 CCPNDFOIS / Short: SMIC3N8R5 IRS THB P V 00MTHOR II7343900230614 CCPNDFOIS / DIR (000000000) | 0,28 | 0,0824 | 0,0824 | ||||||

| USP17625AB33 / Venezuela Government International Bond | 0,28 | -18,42 | 0,0824 | -0,0210 | |||||

| COL17CT03813 / Colombian TES | 0,27 | -4,63 | 0,0793 | -0,0057 | |||||

| Long: SMID6N7M2 IRS INR R F 6.25600 II8975710240312 CCPNDFOIS / Short: SMID6N7M2 IRS INR P V 00MMIBOR II0474720240312 CCPNDFOIS / DIR (000000000) | 0,27 | 0,0782 | 0,0782 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,26 | 0,0765 | 0,0765 | ||||||

| AMGN36294269 / Republic of Armenia Treasury Bonds | 0,26 | 2,79 | 0,0761 | 0,0001 | |||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0,26 | 0,0756 | 0,0756 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,26 | 0,0756 | 0,0756 | ||||||

| HU0000404991 / Hungary Government Bond | 0,25 | 7,36 | 0,0733 | 0,0033 | |||||

| Long: SMIDPXG31 IRS CZK R F 3.76250 II3853300240709 CCPVANILLA / Short: SMIDPXG31 IRS CZK P V 06MPRIBR II7227720240709 CCPVANILLA / DIR (000000000) | 0,25 | 0,0725 | 0,0725 | ||||||

| Nigeria OMO Bill / STIV (NGO6Z1706258) | 0,24 | -38,85 | 0,0722 | -0,0484 | |||||

| US29766LAA44 / Federal Democratic Republic of Ethiopia | 0,24 | 2,52 | 0,0720 | -0,0001 | |||||

| US25714RCY80 / Dominican Republic Central Bank Notes | 0,24 | 2,58 | 0,0705 | 0,0001 | |||||

| Nigeria OMO Bill / STIV (NGO7Z1006251) | 0,24 | -1,66 | 0,0699 | -0,0029 | |||||

| GHGGOG069915 / Ghana Government Bond | 0,24 | 0,0695 | 0,0695 | ||||||

| GHGGOG069964 / Ghana Government Bond | 0,23 | 43,75 | 0,0681 | 0,0195 | |||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,23 | 0,0674 | 0,0674 | ||||||

| US486661AF87 / Kazakhstan Government International Bond | 0,23 | -3,02 | 0,0664 | -0,0039 | |||||

| Paraguay Government International Bond / DBT (US699149BX76) | 0,22 | 0,0656 | 0,0656 | ||||||

| Albanian Government Bond / DBT (AL000A3L1EF1) | 0,22 | 13,02 | 0,0641 | 0,0061 | |||||

| XS0294364954 / Petroleos de Venezuela SA | 0,22 | -4,44 | 0,0635 | -0,0046 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,21 | 0,0633 | 0,0633 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,21 | 0,0631 | 0,0631 | ||||||

| VENZ / Venezuela Government International Bond | 0,21 | -12,66 | 0,0613 | -0,0105 | |||||

| Long: SMIDBS3T4 IRS PLN R F 5.42250 II0312810240416 CCPVANILLA / Short: SMIDBS3T4 IRS PLN P V 06MWIBOR II9702840240416 CCPVANILLA / DIR (000000000) | 0,20 | 0,0603 | 0,0603 | ||||||

| Montenegro Government International Bond / DBT (US857305AA45) | 0,20 | -1,95 | 0,0595 | -0,0026 | |||||

| Mongolia Government International Bond / DBT (US60937LAJ44) | 0,19 | 0,0569 | 0,0569 | ||||||

| Mongolia Government International Bond / DBT (USY6142NAJ73) | 0,19 | 0,0569 | 0,0569 | ||||||

| GHGGOG069972 / Ghana Government Bond | 0,19 | 161,11 | 0,0555 | 0,0337 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,19 | 0,0553 | 0,0553 | ||||||

| Benin Government International Bond / DBT (XS2976334222) | 0,18 | 0,0540 | 0,0540 | ||||||

| Bono Del Tesoro Nacional Capitalizable en Pesos / DBT (AR0071678673) | 0,18 | 0,0536 | 0,0536 | ||||||

| Bono Del Tesoro Nacional Capitalizable en Pesos / DBT (AR0071678673) | 0,18 | 0,0536 | 0,0536 | ||||||

| GHGGOG069956 / Ghana Government Bond | 0,17 | 95,45 | 0,0508 | 0,0241 | |||||

| GHGGOG069923 / Ghana Government Bond | 0,17 | 0,0494 | 0,0494 | ||||||

| Long: SMIDAWFA4 IRS THB R F 2.69500 II2598940240409 CCPNDFOIS / Short: SMIDAWFA4 IRS THB P V 00MTHOR II2022370240409 CCPNDFOIS / DIR (000000000) | 0,17 | 0,0490 | 0,0490 | ||||||

| Long: SMIC3MUR2 IRS PLN R F 5.16100 II9099980230614 CCPVANILLA / Short: SMIC3MUR2 IRS PLN P V 06MWIBOR II0634960230614 CCPVANILLA / DIR (000000000) | 0,17 | 0,0487 | 0,0487 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,16 | 0,0483 | 0,0483 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,16 | 0,0479 | 0,0479 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,15 | 0,0455 | 0,0455 | ||||||

| PURCHASED UZS / SOLD USD / DFE (000000000) | 0,15 | 0,0453 | 0,0453 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,15 | 0,0441 | 0,0441 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,15 | 0,0435 | 0,0435 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,14 | 0,0427 | 0,0427 | ||||||

| Long: SMIE8X7C8 IRS INR R F 5.95100 II4488470241205 CCPNDFOIS / Short: SMIE8X7C8 IRS INR P V 00MMIBOR II1010300241205 CCPNDFOIS / DIR (000000000) | 0,14 | 0,0425 | 0,0425 | ||||||

| GHGGOG069949 / Ghana Government Bond | 0,14 | 88,16 | 0,0424 | 0,0191 | |||||

| Ghana Cocoa Bond / DBT (GHGCMB071664) | 0,14 | 23,48 | 0,0419 | 0,0072 | |||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,14 | 0,0413 | 0,0413 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,14 | 0,0404 | 0,0404 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,14 | 0,0398 | 0,0398 | ||||||

| GHGGOG070004 / Ghana Government Bond | 0,13 | 43,96 | 0,0387 | 0,0112 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,13 | 0,0387 | 0,0387 | ||||||

| Ghana Cocoa Bond / DBT (GHGCMB071656) | 0,13 | 25,24 | 0,0381 | 0,0069 | |||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,13 | 0,0373 | 0,0373 | ||||||

| XS0493540297 / Lebanon Government International Bond | 0,12 | 313,33 | 0,0368 | 0,0275 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,12 | 0,0362 | 0,0362 | ||||||

| US917288BL51 / Uruguay Government International Bond | 0,12 | 4,31 | 0,0358 | 0,0007 | |||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0,12 | 0,0357 | 0,0357 | ||||||

| Long: SMIE9EN64 IRS INR R F 5.93300 II8957110241210 CCPNDFOIS / Short: SMIE9EN64 IRS INR P V 00MMIBOR II8841860241210 CCPNDFOIS / DIR (000000000) | 0,12 | 0,0347 | 0,0347 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,12 | 0,0343 | 0,0343 | ||||||

| US86886PAC68 / Suriname Government International Bond | 0,12 | -3,36 | 0,0341 | -0,0021 | |||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,11 | 0,0335 | 0,0335 | ||||||

| XS2443892950 / Dominican Republic International Bond | 0,11 | 2,78 | 0,0328 | -0,0000 | |||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0,11 | 0,0317 | 0,0317 | ||||||

| Albanian Treasury Bill / STIV (AL000A4D7SN1) | 0,10 | 0,0308 | 0,0308 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,10 | 0,0299 | 0,0299 | ||||||

| USP97475AN08 / Venezuela Government International Bond | 0,10 | -3,85 | 0,0297 | -0,0018 | |||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0,10 | 0,0296 | 0,0296 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,10 | 0,0292 | 0,0292 | ||||||

| Long: SMIE40BJ4 IRS HUF R F 6.86500 II7821710241028 CCPVANILLA / Short: SMIE40BJ4 IRS HUF P V 06MBUBOR II1554170241028 CCPVANILLA / DIR (000000000) | 0,10 | 0,0292 | 0,0292 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,10 | 0,0292 | 0,0292 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,10 | 0,0288 | 0,0288 | ||||||

| PURCHASED COP / SOLD USD / DFE (000000000) | 0,10 | 0,0286 | 0,0286 | ||||||

| Long: SMIE4XCV4 IRS INR R F 6.28000 II9991010241105 CCPNDFOIS / Short: SMIE4XCV4 IRS INR P V 00MMIBOR II1935740241105 CCPNDFOIS / DIR (000000000) | 0,10 | 0,0280 | 0,0280 | ||||||

| XS0944226637 / Lebanon Government International Bond | 0,09 | -51,55 | 0,0279 | -0,0309 | |||||

| ANZ / ANZ Group Holdings Limited | 0,09 | 0,0275 | 0,0275 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,09 | 0,0274 | 0,0274 | ||||||

| XS0859367194 / Lebanon Government International Bond | 0,09 | 666,67 | 0,0271 | 0,0234 | |||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0,09 | 0,0265 | 0,0265 | ||||||

| USP7807HAQ85 / Petroleos de Venezuela SA | 0,09 | -2,20 | 0,0264 | -0,0012 | |||||

| Sri Lanka Government Bonds / DBT (LKB02033F013) | 0,09 | 0,0262 | 0,0262 | ||||||

| GHGGOG070020 / Ghana Government Bond | 0,09 | 0,0257 | 0,0257 | ||||||

| Long: SMIDJYME5 IRS PLN R F 5.02000 II3258760240603 CCPVANILLA / Short: SMIDJYME5 IRS PLN P V 06MWIBOR II3732740240603 CCPVANILLA / DIR (000000000) | 0,08 | 0,0250 | 0,0250 | ||||||

| Long: SMIC3H6U3 IRS CZK R F 3.95500 II0979030230613 CCPVANILLA / Short: SMIC3H6U3 IRS CZK P V 06MPRIBO II1030750230613 CCPVANILLA / DIR (000000000) | 0,08 | 0,0249 | 0,0249 | ||||||

| GHGGOG069931 / Ghana Government Bond | 0,08 | 0,0246 | 0,0246 | ||||||

| Long: SMICS5EB5 IRS CNY R F 2.39250 II0415680231122 CCPNDF / Short: SMICS5EB5 IRS CNY P V 00MCNRR II9872020231122 CCPNDF / DIR (000000000) | 0,08 | 0,0245 | 0,0245 | ||||||

| Long: SMIEF2688 IRS THB R F 1.95800 II7785150250123 CCPNDFOIS / Short: SMIEF2688 IRS THB P V 00MTHOR II9259420250123 CCPNDFOIS / DIR (000000000) | 0,08 | 0,0236 | 0,0236 | ||||||

| PURCHASED COP / SOLD USD / DFE (000000000) | 0,08 | 0,0234 | 0,0234 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,08 | 0,0227 | 0,0227 | ||||||

| Long: SMIDZXVP4 IRS INR R F 5.93600 II0490560240926 CCPNDFOIS / Short: SMIDZXVP4 IRS INR P V 00MMIBOR II4554010240926 CCPNDFOIS / DIR (000000000) | 0,08 | 0,0222 | 0,0222 | ||||||

| Long: SMIEDMUQ9 IRS BRL R F 15.23000 II6200730250114 CCPNDFPREDISWA / Short: SMIEDMUQ9 IRS BRL P V 00MBRCDI II5662540250114 CCPNDFPREDISWA / DIR (000000000) | 0,07 | 0,0221 | 0,0221 | ||||||

| Long: SMIE0UJG0 IRS INR R F 6.02550 II9392750241003 CCPNDFOIS / Short: SMIE0UJG0 IRS INR P V 00MMIBOR II3658910241003 CCPNDFOIS / DIR (000000000) | 0,07 | 0,0218 | 0,0218 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,07 | 0,0217 | 0,0217 | ||||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0,07 | 0,0216 | 0,0216 | ||||||

| Albanian Government Bond / DBT (AL000A4D6JW3) | 0,07 | 0,0215 | 0,0215 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,07 | 0,0210 | 0,0210 | ||||||

| Long: SMICA0SC8 IRS CNY R F 2.47900 II1769110230802 CCPNDF / Short: SMICA0SC8 IRS CNY P V 00MCNRR II4755710230802 CCPNDF / DIR (000000000) | 0,07 | 0,0207 | 0,0207 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,07 | 0,0206 | 0,0206 | ||||||

| TRT081128T15 / TURKIYE GOVERNMENT BOND 31.080000% 11/08/2028 | 0,07 | -22,73 | 0,0203 | -0,0065 | |||||

| XS0217249126 / Venezuela Government International Bond | 0,07 | -29,90 | 0,0203 | -0,0091 | |||||

| USP17625AD98 / Venezuela Government International Bond | 0,07 | -9,46 | 0,0200 | -0,0025 | |||||

| USP17625AE71 / Venezuela Government International Bond | 0,07 | -6,94 | 0,0199 | -0,0020 | |||||

| USP97475AJ95 / Venezuela Government International Bond | 0,07 | -1,49 | 0,0196 | -0,0007 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,07 | 0,0196 | 0,0196 | ||||||

| Long: SMIELEXV4 IRS INR R F 5.95300 II8621940250305 CCPNDFOIS / Short: SMIELEXV4 IRS INR P V 00MMIBOR II0565860250305 CCPNDFOIS / DIR (000000000) | 0,06 | 0,0190 | 0,0190 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0,06 | 0,0190 | 0,0190 | ||||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0,06 | 0,0183 | 0,0183 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,06 | 0,0180 | 0,0180 | ||||||

| XS0294367205 / Petroleos de Venezuela SA | 0,06 | -3,23 | 0,0177 | -0,0012 | |||||

| Long: SMIED9US4 IRS KRW R F 2.72500 II8067530250113 CCPVANILLA / Short: SMIED9US4 IRS KRW P V 03MKSDA II6831630250113 CCPVANILLA / DIR (000000000) | 0,06 | 0,0176 | 0,0176 | ||||||

| Long: SMICV2PV2 IRS CNY R F 2.35000 II0156780231213 CCPNDF / Short: SMICV2PV2 IRS CNY P V 00MCNRR II6733690231213 CCPNDF / DIR (000000000) | 0,06 | 0,0175 | 0,0175 | ||||||

| Long: SMIEK6SV8 IRS INR R F 6.02000 II5470790250225 CCPNDFOIS / Short: SMIEK6SV8 IRS INR P V 00MMIBOR II1579690250225 CCPNDFOIS / DIR (000000000) | 0,06 | 0,0174 | 0,0174 | ||||||

| Long: SMIC3H765 IRS CZK R F 3.96230 II4910350230613 CCPVANILLA / Short: SMIC3H765 IRS CZK P V 06MPRIBO II4845380230613 CCPVANILLA / DIR (000000000) | 0,06 | 0,0173 | 0,0173 | ||||||

| Long: SMIEFTDM0 IRS INR R F 6.07300 II0630370250129 CCPNDFOIS / Short: SMIEFTDM0 IRS INR P V 00MMIBOR II1191710250129 CCPNDFOIS / DIR (000000000) | 0,06 | 0,0173 | 0,0173 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,06 | 0,0169 | 0,0169 | ||||||

| GHGGOG069998 / Ghana Government Bond | 0,06 | 143,48 | 0,0168 | 0,0096 | |||||

| Long: SMIEJXL55 IRS MXN R F 8.41950 II3403450250221 CCPOIS / Short: SMIEJXL55 IRS MXN P V 00MTIEF II9908650250221 CCPOIS / DIR (000000000) | 0,06 | 0,0168 | 0,0168 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,06 | 0,0165 | 0,0165 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0,05 | 0,0161 | 0,0161 | ||||||

| XS1052421150 / LEBANESE REP MED TERM NTS 144A 5.8% 04/14/2020 REGS | 0,05 | 80,00 | 0,0161 | 0,0068 | |||||

| Long: SMIE8NW57 IRS INR R F 6.00500 II7882860241204 CCPNDFOIS / Short: SMIE8NW57 IRS INR P V 00MMIBOR II0778150241204 CCPNDFOIS / DIR (000000000) | 0,05 | 0,0159 | 0,0159 | ||||||

| Long: SMID88R41 IRS CNY R F 2.12250 II3842900240320 CCPNDF / Short: SMID88R41 IRS CNY P V 00MCNRR II1315000240320 CCPNDF / DIR (000000000) | 0,05 | 0,0158 | 0,0158 | ||||||

| PURCHASED USD / SOLD COP / DFE (000000000) | 0,05 | 0,0154 | 0,0154 | ||||||

| Long: SMIDK1X29 IRS CNY R F 2.02800 II7080430240604 CCPNDF / Short: SMIDK1X29 IRS CNY P V 00MCNRR II2621000240604 CCPNDF / DIR (000000000) | 0,05 | 0,0150 | 0,0150 | ||||||

| Long: SMICA0VP5 IRS CZK R F 4.15000 II9561050230802 CCPVANILLA / Short: SMICA0VP5 IRS CZK P V 06MPRIBO II5816920230802 CCPVANILLA / DIR (000000000) | 0,05 | 0,0150 | 0,0150 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,05 | 0,0145 | 0,0145 | ||||||

| USP7807HAP03 / Petroleos de Venezuela SA | 0,05 | 2,13 | 0,0144 | -0,0001 | |||||

| TRT130733T17 / Turkey Government Bond | 0,05 | -75,27 | 0,0138 | -0,0424 | |||||

| USP17625AA59 / Venezuela Government International Bond | 0,05 | -11,76 | 0,0135 | -0,0020 | |||||

| Long: SMIDXRZ91 IRS INR R F 5.91250 II7818740240911 CCPNDFOIS / Short: SMIDXRZ91 IRS INR P V 00MMIBOR II4342060240911 CCPNDFOIS / DIR (000000000) | 0,05 | 0,0134 | 0,0134 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,05 | 0,0133 | 0,0133 | ||||||

| Long: SMIELK0W4 IRS BRL R F 14.78250 II2608560250305 CCPNDFPREDISWA / Short: SMIELK0W4 IRS BRL P V 00MBRCDI II0278900250305 CCPNDFPREDISWA / DIR (000000000) | 0,04 | 0,0128 | 0,0128 | ||||||

| Long: SMIED1QZ0 IRS KRW R F 2.60000 II3617720250110 CCPVANILLA / Short: SMIED1QZ0 IRS KRW P V 03MKSDA II5726240250110 CCPVANILLA / DIR (000000000) | 0,04 | 0,0127 | 0,0127 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,04 | 0,0126 | 0,0126 | ||||||

| BMIEEG9E2 / DFE (000000000) | 0,04 | 0,0125 | 0,0125 | ||||||

| VEZM / REPUBLIC OF VENEZUELA SR UNSECURED REGS 12/20 6 | 0,04 | -8,89 | 0,0123 | -0,0015 | |||||

| Long: SMIER14U0 IRS KRW R F 2.50700 II3900830250404 CCPVANILLA / Short: SMIER14U0 IRS KRW P V 03MKSDA II5296560250404 CCPVANILLA / DIR (000000000) | 0,04 | 0,0122 | 0,0122 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,04 | 0,0121 | 0,0121 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,04 | 0,0121 | 0,0121 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,04 | 0,0118 | 0,0118 | ||||||

| USP17625AC16 / Venezuela Government International Bond | 0,04 | -9,09 | 0,0118 | -0,0016 | |||||

| PDVSA / Petroleos de Venezuela SA | 0,04 | 0,00 | 0,0118 | -0,0003 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,04 | 0,0116 | 0,0116 | ||||||

| Long: SMIEHH9N7 IRS CNY R F 1.50200 II1320420250212 CCPNDF / Short: SMIEHH9N7 IRS CNY P V 00MCNRR II3167640250212 CCPNDF / DIR (000000000) | 0,04 | 0,0112 | 0,0112 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0,04 | 0,0112 | 0,0112 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,04 | 0,0110 | 0,0110 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0,04 | 0,0107 | 0,0107 | ||||||

| Long: SMICA0V83 IRS CZK R F 3.96000 II0125270230802 CCPVANILLA / Short: SMICA0V83 IRS CZK P V 06MPRIBO II3012340230802 CCPVANILLA / DIR (000000000) | 0,04 | 0,0104 | 0,0104 | ||||||

| GHGGOG070012 / Ghana Government Bond | 0,03 | 0,0103 | 0,0103 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,03 | 0,0100 | 0,0100 | ||||||

| XS0793155911 / Lebanon Government International Bond | 0,03 | 6,67 | 0,0097 | 0,0004 | |||||

| PURCHASED USD / SOLD COP / DFE (000000000) | 0,03 | 0,0093 | 0,0093 | ||||||

| XS1586230309 / Lebanon Government International Bond | 0,03 | 7,14 | 0,0091 | 0,0005 | |||||

| Long: SMIEALQB2 IRS INR R F 6.06900 II2191200241218 CCPNDFOIS / Short: SMIEALQB2 IRS INR P V 00MMIBOR II5519740241218 CCPNDFOIS / DIR (000000000) | 0,03 | 0,0090 | 0,0090 | ||||||

| Long: SMID6Q3V9 IRS CLP R F 4.78500 II2941390240312 CCPNDFCAMARAPR / Short: SMID6Q3V9 IRS CLP P V 06MCLICP II9908410240312 CCPNDFCAMARAPR / DIR (000000000) | 0,03 | 0,0089 | 0,0089 | ||||||

| Long: SMIEDFPS6 IRS KRW R F 2.71750 II6204650250114 CCPVANILLA / Short: SMIEDFPS6 IRS KRW P V 03MKSDA II3299990250114 CCPVANILLA / DIR (000000000) | 0,03 | 0,0086 | 0,0086 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0,03 | 0,0081 | 0,0081 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0,03 | 0,0080 | 0,0080 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,03 | 0,0079 | 0,0079 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,03 | 0,0079 | 0,0079 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,03 | 0,0078 | 0,0078 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,03 | 0,0077 | 0,0077 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,03 | 0,0077 | 0,0077 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,03 | 0,0076 | 0,0076 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,02 | 0,0072 | 0,0072 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0,02 | 0,0071 | 0,0071 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0070 | 0,0070 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,02 | 0,0068 | 0,0068 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0,02 | 0,0068 | 0,0068 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,02 | 0,0068 | 0,0068 | ||||||

| US922646BL74 / Venezuela Government International Bond | 0,02 | 10,00 | 0,0068 | 0,0004 | |||||

| Long: SMIELEU88 IRS CNY R F 1.57700 II6372870250305 CCPNDF / Short: SMIELEU88 IRS CNY P V 00MCNRR II8010560250305 CCPNDF / DIR (000000000) | 0,02 | 0,0068 | 0,0068 | ||||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0,02 | 0,0068 | 0,0068 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0,02 | 0,0066 | 0,0066 | ||||||

| Long: SMIED9SS7 IRS KRW R F 2.71000 II6587330250113 CCPVANILLA / Short: SMIED9SS7 IRS KRW P V 03MKSDA II4558690250113 CCPVANILLA / DIR (000000000) | 0,02 | 0,0064 | 0,0064 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,02 | 0,0064 | 0,0064 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0064 | 0,0064 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,02 | 0,0063 | 0,0063 | ||||||

| Albanian Government Bond / DBT (AL000A3L7AH2) | 0,02 | 0,0063 | 0,0063 | ||||||

| Long: SMIEEULF4 IRS KRW R F 2.60000 II3990120250122 CCPVANILLA / Short: SMIEEULF4 IRS KRW P V 03MKSDA II5080110250122 CCPVANILLA / DIR (000000000) | 0,02 | 0,0061 | 0,0061 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,02 | 0,0060 | 0,0060 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,02 | 0,0060 | 0,0060 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,02 | 0,0058 | 0,0058 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,02 | 0,0058 | 0,0058 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,02 | 0,0057 | 0,0057 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,02 | 0,0055 | 0,0055 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,02 | 0,0054 | 0,0054 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,02 | 0,0053 | 0,0053 | ||||||

| Long: SMIED1UF9 IRS KRW R F 2.61000 II3563110250110 CCPVANILLA / Short: SMIED1UF9 IRS KRW P V 03MKSDA II9202960250110 CCPVANILLA / DIR (000000000) | 0,02 | 0,0052 | 0,0052 | ||||||

| PURCHASED USD / SOLD COP / DFE (000000000) | 0,02 | 0,0051 | 0,0051 | ||||||

| Long: SMIDWWQV2 IRS CNY R F 1.72500 II5220990240904 CCPNDF / Short: SMIDWWQV2 IRS CNY P V 00MCNRR II6033860240904 CCPNDF / DIR (000000000) | 0,02 | 0,0050 | 0,0050 | ||||||

| XS1419879504 / Lebanon Government International Bond | 0,02 | 0,0049 | 0,0049 | ||||||

| EURO-BUXL 30Y BND JUN25 / DIR (000000000) | 0,02 | 0,0048 | 0,0048 | ||||||

| Long: SMIEQSGT2 IRS INR R F 5.78120 II7602440250403 CCPNDFOIS / Short: SMIEQSGT2 IRS INR P V 00MMIBOR II8511660250403 CCPNDFOIS / DIR (000000000) | 0,02 | 0,0048 | 0,0048 | ||||||

| Long: SMIERHF66 IRS ZAR R F 7.70890 II1093560250408 CCPVANILLA / Short: SMIERHF66 IRS ZAR P V 03MJIBAR II6600770250408 CCPVANILLA / DIR (000000000) | 0,02 | 0,0047 | 0,0047 | ||||||

| XS1313647841 / Lebanon Government International Bond | 0,01 | 0,0044 | 0,0044 | ||||||

| XS1720803326 / Lebanon Government International Bond | 0,01 | 0,0043 | 0,0043 | ||||||

| Long: SMIDBFDQ7 IRS HUF R F 6.74125 II0077260240412 CCPVANILLA / Short: SMIDBFDQ7 IRS HUF P V 06MBUBOR II9656140240412 CCPVANILLA / DIR (000000000) | 0,01 | 0,0042 | 0,0042 | ||||||

| Long: SMIET4V08 IRS HUF R F 6.15000 II0212920250417 CCPVANILLA / Short: SMIET4V08 IRS HUF P V 06MBUBOR II5063860250417 CCPVANILLA / DIR (000000000) | 0,01 | 0,0042 | 0,0042 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0,01 | 0,0041 | 0,0041 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0041 | 0,0041 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0,01 | 0,0038 | 0,0038 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,01 | 0,0038 | 0,0038 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,01 | 0,0038 | 0,0038 | ||||||

| PURCHASED USD / SOLD COP / DFE (000000000) | 0,01 | 0,0037 | 0,0037 | ||||||

| Long: SMIES6CM7 IRS INR R F 5.70400 II4099590250411 CCPNDFOIS / Short: SMIES6CM7 IRS INR P V 00MMIBOR II9592400250411 CCPNDFOIS / DIR (000000000) | 0,01 | 0,0034 | 0,0034 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,01 | 0,0034 | 0,0034 | ||||||

| Long: SMIDC7RT3 IRS HUF R F 6.92000 II8222640240418 CCPVANILLA / Short: SMIDC7RT3 IRS HUF P V 06MBUBOR II3322430240418 CCPVANILLA / DIR (000000000) | 0,01 | 0,0032 | 0,0032 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0031 | 0,0031 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0031 | 0,0031 | ||||||

| XS1196417569 / Lebanon Government International Bond | 0,01 | -61,54 | 0,0030 | -0,0051 | |||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0,01 | 0,0029 | 0,0029 | ||||||

| PURCHASED USD / SOLD KZT / DFE (000000000) | 0,01 | 0,0029 | 0,0029 | ||||||

| XS0859366899 / Lebanon Government International Bond | 0,01 | 12,50 | 0,0027 | 0,0001 | |||||

| XS1586230051 / Lebanon Government International Bond | 0,01 | 12,50 | 0,0027 | 0,0001 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,01 | 0,0026 | 0,0026 | ||||||

| Long: SMIEGHUB0 IRS KRW R F 2.56500 II8518960250205 CCPVANILLA / Short: SMIEGHUB0 IRS KRW P V 03MKSDA II6071940250205 CCPVANILLA / DIR (000000000) | 0,01 | 0,0026 | 0,0026 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0026 | 0,0026 | ||||||

| PURCHASED PLN / SOLD EUR / DFE (000000000) | 0,01 | 0,0023 | 0,0023 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,01 | 0,0023 | 0,0023 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0,01 | 0,0022 | 0,0022 | ||||||

| XS1586230481 / Lebanon Government International Bond | 0,01 | -68,18 | 0,0022 | -0,0046 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0022 | 0,0022 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0,01 | 0,0020 | 0,0020 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0020 | 0,0020 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0019 | 0,0019 | ||||||

| Long: SMIESUPV0 IRS SGD R F 1.95700 II3090240250416 CCPOIS / Short: SMIESUPV0 IRS SGD P V 00MSORA II0365810250416 CCPOIS / DIR (000000000) | 0,01 | 0,0018 | 0,0018 | ||||||

| Long: SMIELEWR4 IRS CNY R F 1.55480 II8892290250305 CCPNDF / Short: SMIELEWR4 IRS CNY P V 00MCNRR II1997020250305 CCPNDF / DIR (000000000) | 0,01 | 0,0015 | 0,0015 | ||||||

| XS1419879769 / Lebanon Government International Bond | 0,00 | 0,0015 | 0,0015 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0013 | 0,0013 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0010 | 0,0010 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0010 | 0,0010 | ||||||

| PURCHASED UYU / SOLD USD / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | ||||||

| Long: SMIERGUG9 IRS ILS R F 3.87750 II1336350250408 CCPVANILLA / Short: SMIERGUG9 IRS ILS P V 03MTELBO II9254650250408 CCPVANILLA / DIR (000000000) | 0,00 | 0,0008 | 0,0008 | ||||||

| Long: SMIEGKYP8 IRS CNY R F 1.45800 II2954630250205 CCPNDF / Short: SMIEGKYP8 IRS CNY P V 00MCNRR II6910860250205 CCPNDF / DIR (000000000) | 0,00 | 0,0008 | 0,0008 | ||||||

| XS1396347566 / Lebanon Government International Bond | 0,00 | 0,0008 | 0,0008 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0007 | 0,0007 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0007 | 0,0007 | ||||||

| PURCHASED MYR / SOLD USD / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | ||||||

| PURCHASED USD / SOLD CLP / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0006 | 0,0006 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,00 | 0,0006 | 0,0006 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0005 | 0,0005 | ||||||

| PURCHASED CZK / SOLD EUR / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0003 | 0,0003 | ||||||

| Long: SMIE9ZXF6 IRS CNY R F 1.43500 II8453150241213 CCPNDF / Short: SMIE9ZXF6 IRS CNY P V 00MCNRR II6011370241213 CCPNDF / DIR (000000000) | 0,00 | 0,0002 | 0,0002 | ||||||

| PURCHASED TRY / SOLD USD / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | ||||||

| Long: BMIEUGCW0 IRS PLN R V 06MWIBOR II7804940250429 CCPVANILLA / Short: BMIEUGCW0 IRS PLN P F 4.26550 II3097570250429 CCPVANILLA / DIR (000000000) | 0,00 | 0,0002 | 0,0002 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,00 | 0,0001 | 0,0001 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,00 | 0,0001 | 0,0001 | ||||||

| Long: SMICLB3M7 IRS CZK R F 4.33000 II5201470231012 CCPVANILLA / Short: SMICLB3M7 IRS CZK P V 06MPRIBO II7300180231012 CCPVANILLA / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| PURCHASED EGP / SOLD USD / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0000 | -0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0000 | -0,0000 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | -0,00 | -0,0001 | -0,0001 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0001 | -0,0001 | ||||||

| PURCHASED USD / SOLD PEN / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0001 | -0,0001 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,00 | -0,0001 | -0,0001 | ||||||

| Long: BMICACCZ8 IRS CLP R V 06MCLICP II2807670230803 CCPNDFCAMARAPR / Short: BMICACCZ8 IRS CLP P F 5.23150 II1855280230803 CCPNDFCAMARAPR / DIR (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| PURCHASED PEN / SOLD USD / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0001 | -0,0001 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0001 | -0,0001 | ||||||

| Long: SMIEU06B8 IRS BRL R F 13.52000 II7297860250424 CCPNDFPREDISWA / Short: SMIEU06B8 IRS BRL P V 00MBRCDI II8902400250424 CCPNDFPREDISWA / DIR (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0002 | -0,0002 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0002 | -0,0002 | ||||||

| PURCHASED CLP / SOLD USD / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | -0,00 | -0,0003 | -0,0003 | ||||||

| PURCHASED USD / SOLD PEN / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0003 | -0,0003 | ||||||

| EURO-BUND FUTURE JUN25 / DIR (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| PURCHASED EUR / SOLD RON / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0005 | -0,0005 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0005 | -0,0005 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,00 | -0,0005 | -0,0005 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | -0,00 | -0,0005 | -0,0005 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0005 | -0,0005 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0006 | -0,0006 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0006 | -0,0006 | ||||||

| PURCHASED EUR / SOLD RON / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0007 | -0,0007 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0007 | -0,0007 | ||||||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | -0,00 | -0,0008 | -0,0008 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0009 | -0,0009 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0009 | -0,0009 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0009 | -0,0009 | ||||||

| PURCHASED USD / SOLD PEN / DFE (000000000) | -0,00 | -0,0010 | -0,0010 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -0,00 | -0,0010 | -0,0010 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,00 | -0,0011 | -0,0011 | ||||||

| US 2YR NOTE (CBT) JUN25 / DIR (000000000) | -0,00 | -0,0011 | -0,0011 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0012 | -0,0012 | ||||||

| Long: SMIEU6567 IRS COP R F 8.24000 II1206990250425 CCPNDFOIS / Short: SMIEU6567 IRS COP P V 00MCPIBR II0742160250425 CCPNDFOIS / DIR (000000000) | -0,00 | -0,0013 | -0,0013 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0013 | -0,0013 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0016 | -0,0016 | ||||||

| PURCHASED USD / SOLD EGP / DFE (000000000) | -0,01 | -0,0016 | -0,0016 | ||||||

| PURCHASED USD / SOLD EGP / DFE (000000000) | -0,01 | -0,0016 | -0,0016 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,01 | -0,0017 | -0,0017 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0018 | -0,0018 | ||||||

| PURCHASED USD / SOLD KZT / DFE (000000000) | -0,01 | -0,0020 | -0,0020 | ||||||

| PURCHASED PEN / SOLD USD / DFE (000000000) | -0,01 | -0,0021 | -0,0021 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,01 | -0,0021 | -0,0021 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0022 | -0,0022 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0022 | -0,0022 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0022 | -0,0022 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0023 | -0,0023 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,01 | -0,0024 | -0,0024 | ||||||

| Long: BMIEGHUE4 IRS KRW R V 03MKSDA II4385290250205 CCPVANILLA / Short: BMIEGHUE4 IRS KRW P F 2.63000 II9618390250205 CCPVANILLA / DIR (000000000) | -0,01 | -0,0025 | -0,0025 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0026 | -0,0026 | ||||||

| PURCHASED USD / SOLD KZT / DFE (000000000) | -0,01 | -0,0026 | -0,0026 | ||||||

| Long: BMIEUBRP0 IRS PLN R V 06MWIBOR II6015360250428 CCPVANILLA / Short: BMIEUBRP0 IRS PLN P F 4.30978 II3283260250428 CCPVANILLA / DIR (000000000) | -0,01 | -0,0027 | -0,0027 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0027 | -0,0027 | ||||||

| PURCHASED USD / SOLD KZT / DFE (000000000) | -0,01 | -0,0027 | -0,0027 | ||||||

| EURO-SCHATZ FUT JUN25 / DIR (000000000) | -0,01 | -0,0030 | -0,0030 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0031 | -0,0031 | ||||||

| US 10YR ULTRA FUT JUN25 / DIR (000000000) | -0,01 | -0,0032 | -0,0032 | ||||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | -0,01 | -0,0032 | -0,0032 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0032 | -0,0032 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0034 | -0,0034 | ||||||

| PURCHASED USD / SOLD THB / DFE (000000000) | -0,01 | -0,0036 | -0,0036 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0,01 | -0,0041 | -0,0041 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,02 | -0,0047 | -0,0047 | ||||||

| Long: BMIED1UC6 IRS KRW R V 03MKSDA II1729090250110 CCPVANILLA / Short: BMIED1UC6 IRS KRW P F 2.70000 II6783750250110 CCPVANILLA / DIR (000000000) | -0,02 | -0,0048 | -0,0048 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -0,02 | -0,0048 | -0,0048 | ||||||

| PURCHASED USD / SOLD KZT / DFE (000000000) | -0,02 | -0,0050 | -0,0050 | ||||||

| PURCHASED KZT / SOLD USD / DFE (000000000) | -0,02 | -0,0050 | -0,0050 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,02 | -0,0055 | -0,0055 | ||||||

| Long: BMIEEULM9 IRS KRW R V 03MKSDA II8476810250122 CCPVANILLA / Short: BMIEEULM9 IRS KRW P F 2.68500 II8316010250122 CCPVANILLA / DIR (000000000) | -0,02 | -0,0055 | -0,0055 | ||||||

| BMIEEG9R3 / DFE (000000000) | -0,02 | -0,0056 | -0,0056 | ||||||

| Long: SMIEQQRF4 IRS THB R F 1.40630 II6436970250403 CCPNDFOIS / Short: SMIEQQRF4 IRS THB P V 00MTHOR II8581460250403 CCPNDFOIS / DIR (000000000) | -0,02 | -0,0059 | -0,0059 | ||||||

| Long: BMIED9T15 IRS KRW R V 03MKSDA II0755040250113 CCPVANILLA / Short: BMIED9T15 IRS KRW P F 2.79200 II4904470250113 CCPVANILLA / DIR (000000000) | -0,02 | -0,0059 | -0,0059 | ||||||

| Long: BMIESGWB7 IRS PLN R V 06MWIBOR II1995750250414 CCPVANILLA / Short: BMIESGWB7 IRS PLN P F 4.33500 II2443260250414 CCPVANILLA / DIR (000000000) | -0,02 | -0,0061 | -0,0061 | ||||||

| Long: BMICJJBN2 IRS CLP R V 06MCLICP II1678990230929 CCPNDFCAMARAPR / Short: BMICJJBN2 IRS CLP P F 5.56000 II8596790230929 CCPNDFCAMARAPR / DIR (000000000) | -0,02 | -0,0064 | -0,0064 | ||||||

| PURCHASED USD / SOLD THB / DFE (000000000) | -0,02 | -0,0064 | -0,0064 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,02 | -0,0067 | -0,0067 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,02 | -0,0068 | -0,0068 | ||||||

| US 10YR NOTE (CBT)JUN25 / DIR (000000000) | -0,03 | -0,0074 | -0,0074 | ||||||

| US LONG BOND(CBT) JUN25 / DIR (000000000) | -0,03 | -0,0075 | -0,0075 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,03 | -0,0075 | -0,0075 | ||||||

| Long: BMIEDFPW7 IRS KRW R V 03MKSDA II2534720250114 CCPVANILLA / Short: BMIEDFPW7 IRS KRW P F 2.79250 II1318920250114 CCPVANILLA / DIR (000000000) | -0,03 | -0,0079 | -0,0079 | ||||||

| BMIEEG5T3 / DFE (000000000) | -0,03 | -0,0082 | -0,0082 | ||||||

| PURCHASED EUR / SOLD PLN / DFE (000000000) | -0,03 | -0,0087 | -0,0087 | ||||||

| Long: SMIE45WJ0 IRS BRL R F 12.74500 II2392350241029 CCPNDFPREDISWA / Short: SMIE45WJ0 IRS BRL P V 00MBRCDI II0971360241029 CCPNDFPREDISWA / DIR (000000000) | -0,03 | -0,0088 | -0,0088 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,03 | -0,0089 | -0,0089 | ||||||

| PURCHASED COP / SOLD USD / DFE (000000000) | -0,03 | -0,0093 | -0,0093 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,03 | -0,0096 | -0,0096 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,03 | -0,0097 | -0,0097 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,03 | -0,0101 | -0,0101 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,04 | -0,0106 | -0,0106 | ||||||

| PURCHASED KZT / SOLD USD / DFE (000000000) | -0,04 | -0,0110 | -0,0110 | ||||||

| Long: BMIED1R22 IRS KRW R V 03MKSDA II0233650250110 CCPVANILLA / Short: BMIED1R22 IRS KRW P F 2.69000 II5113140250110 CCPVANILLA / DIR (000000000) | -0,04 | -0,0117 | -0,0117 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,04 | -0,0127 | -0,0127 | ||||||

| PURCHASED PLN / SOLD EUR / DFE (000000000) | -0,04 | -0,0127 | -0,0127 | ||||||

| PURCHASED USD / SOLD TRY / DFE (000000000) | -0,04 | -0,0128 | -0,0128 | ||||||

| Long: SMIDS1J19 IRS BRL R F 11.65000 II7295340240723 CCPNDFPREDISWA / Short: SMIDS1J19 IRS BRL P V 00MBRCDI II7033010240723 CCPNDFPREDISWA / DIR (000000000) | -0,05 | -0,0133 | -0,0133 | ||||||

| PURCHASED KZT / SOLD USD / DFE (000000000) | -0,05 | -0,0139 | -0,0139 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,05 | -0,0146 | -0,0146 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,05 | -0,0146 | -0,0146 | ||||||

| PURCHASED USD / SOLD BRL / DFE (000000000) | -0,05 | -0,0148 | -0,0148 | ||||||

| PURCHASED EUR / SOLD PLN / DFE (000000000) | -0,05 | -0,0148 | -0,0148 | ||||||

| Long: BMIED9UW5 IRS KRW R V 03MKSDA II5533050250113 CCPVANILLA / Short: BMIED9UW5 IRS KRW P F 2.80500 II0104130250113 CCPVANILLA / DIR (000000000) | -0,06 | -0,0163 | -0,0163 | ||||||

| EURO-BOBL FUTURE JUN25 / DIR (000000000) | -0,06 | -0,0166 | -0,0166 | ||||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | -0,06 | -0,0169 | -0,0169 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,06 | -0,0173 | -0,0173 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,06 | -0,0184 | -0,0184 | ||||||

| PURCHASED USD / SOLD THB / DFE (000000000) | -0,06 | -0,0185 | -0,0185 | ||||||

| PURCHASED USD / SOLD NGN / DFE (000000000) | -0,07 | -0,0205 | -0,0205 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,07 | -0,0213 | -0,0213 | ||||||

| Long: SMIDF5EE1 IRS BRL R F 10.77500 II2314850240508 CCPNDFPREDISWA / Short: SMIDF5EE1 IRS BRL P V 00MBRCDI II4303920240508 CCPNDFPREDISWA / DIR (000000000) | -0,07 | -0,0214 | -0,0214 | ||||||

| PURCHASED USD / SOLD BRL / DFE (000000000) | -0,08 | -0,0230 | -0,0230 | ||||||

| PURCHASED USD / SOLD KZT / DFE (000000000) | -0,08 | -0,0232 | -0,0232 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,08 | -0,0233 | -0,0233 | ||||||

| PURCHASED PLN / SOLD EUR / DFE (000000000) | -0,08 | -0,0235 | -0,0235 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,08 | -0,0236 | -0,0236 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0,08 | -0,0240 | -0,0240 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,08 | -0,0241 | -0,0241 | ||||||

| PURCHASED USD / SOLD INR / DFE (000000000) | -0,08 | -0,0241 | -0,0241 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0,08 | -0,0243 | -0,0243 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,09 | -0,0256 | -0,0256 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,10 | -0,0285 | -0,0285 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,10 | -0,0293 | -0,0293 | ||||||

| PURCHASED USD / SOLD INR / DFE (000000000) | -0,11 | -0,0310 | -0,0310 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,11 | -0,0338 | -0,0338 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,12 | -0,0356 | -0,0356 | ||||||

| PURCHASED USD / SOLD COP / DFE (000000000) | -0,12 | -0,0365 | -0,0365 | ||||||

| PURCHASED USD / SOLD MYR / DFE (000000000) | -0,13 | -0,0385 | -0,0385 | ||||||

| PURCHASED USD / SOLD THB / DFE (000000000) | -0,13 | -0,0388 | -0,0388 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,13 | -0,0393 | -0,0393 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,15 | -0,0432 | -0,0432 | ||||||

| PURCHASED USD / SOLD BRL / DFE (000000000) | -0,16 | -0,0469 | -0,0469 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,17 | -0,0502 | -0,0502 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,20 | -0,0575 | -0,0575 | ||||||

| PURCHASED USD / SOLD MYR / DFE (000000000) | -0,20 | -0,0603 | -0,0603 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,21 | -0,0607 | -0,0607 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,21 | -0,0608 | -0,0608 | ||||||

| PURCHASED USD / SOLD MYR / DFE (000000000) | -0,22 | -0,0657 | -0,0657 | ||||||

| Long: SMIDL5Z19 IRS BRL R F 11.17500 II5661860240611 CCPNDFPREDISWA / Short: SMIDL5Z19 IRS BRL P V 00MBRCDI II6500670240611 CCPNDFPREDISWA / DIR (000000000) | -0,23 | -0,0670 | -0,0670 | ||||||

| PURCHASED USD / SOLD MYR / DFE (000000000) | -0,23 | -0,0679 | -0,0679 | ||||||

| Long: SMID0D3N2 IRS BRL R F 9.88250 II9865320240123 CCPNDFPREDISWA / Short: SMID0D3N2 IRS BRL P V 00MBRCDI II7570960240123 CCPNDFPREDISWA / DIR (000000000) | -0,24 | -0,0703 | -0,0703 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,24 | -0,0705 | -0,0705 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,24 | -0,0708 | -0,0708 | ||||||

| SWAP STAND. CHARTER BANK BOCOC / STIV (000000000) | Short | -0,30 | -0,30 | -0,0884 | -0,0884 | ||||

| Long: SMIDJ6KP3 IRS BRL R F 10.64750 II9659610240528 CCPNDFPREDISWA / Short: SMIDJ6KP3 IRS BRL P V 00MBRCDI II9314970240528 CCPNDFPREDISWA / DIR (000000000) | -0,32 | -0,0936 | -0,0936 | ||||||

| SWAP BNP PARIBAS BOC / STIV (000000000) | Short | -0,32 | -0,32 | -0,0943 | -0,0943 | ||||

| Long: SMICXCRW4 IRS BRL R F 9.69500 II8293490240102 CCPNDFPREDISWA / Short: SMICXCRW4 IRS BRL P V 00MBRCDI II4717140240102 CCPNDFPREDISWA / DIR (000000000) | -0,34 | -0,1009 | -0,1009 | ||||||

| Long: SMID9EQT3 IRS BRL R F 10.54250 II6106360240328 CCPNDFPREDISWA / Short: SMID9EQT3 IRS BRL P V 00MBRCDI II8746360240328 CCPNDFPREDISWA / DIR (000000000) | -0,35 | -0,1043 | -0,1043 | ||||||

| SWAP JP MORGAN BOC / STIV (000000000) | Short | -0,40 | -0,40 | -0,1179 | -0,1179 | ||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,44 | -0,1282 | -0,1282 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,44 | -0,1311 | -0,1311 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,50 | -0,1475 | -0,1475 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,50 | -0,1480 | -0,1480 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,55 | -0,1609 | -0,1609 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,60 | -0,1754 | -0,1754 | ||||||

| SWAPS BARCLAYS BOC / STIV (000000000) | Short | -1,29 | -1,29 | -0,3802 | -0,3802 | ||||

| SWAP CITIBANK BOC / STIV (000000000) | Short | -1,47 | -1,47 | -0,4331 | -0,4331 |