Grundlæggende statistik

| Porteføljeværdi | $ 28.033.418.092 |

| Nuværende stillinger | 6.192 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

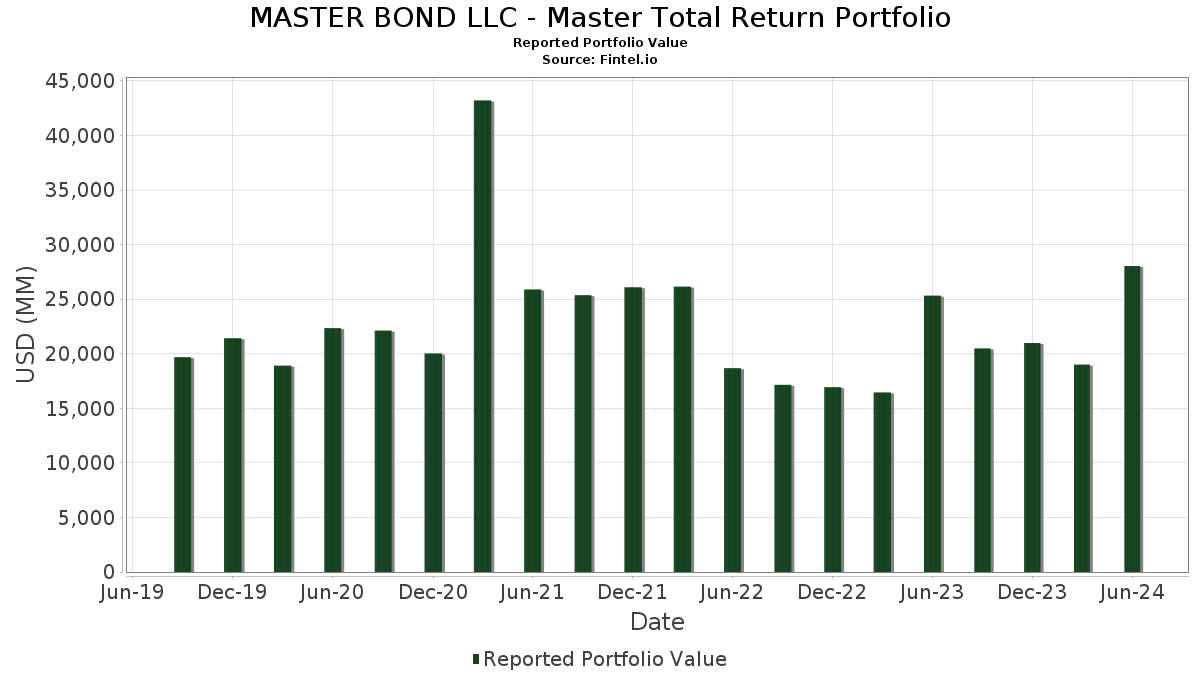

MASTER BOND LLC - Master Total Return Portfolio har afsløret 6.192 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 28.033.418.092 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). MASTER BOND LLC - Master Total Return Portfolios største beholdninger er Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , and BlackRock Liquidity Funds: T-Fund, Institutional Shares (US:US09248U7182) . MASTER BOND LLC - Master Total Return Portfolios nye stillinger omfatter Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , Edwards Lifesciences Corporation (US:EW) , and Edwards Lifesciences Corporation (US:EW) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 772,86 | 4,0978 | 6,4274 | ||

| 402,80 | 2,1357 | 5,3649 | ||

| 772,86 | 4,0978 | 4,1066 | ||

| -1,66 | -0,0088 | 3,7966 | ||

| 61,47 | 0,3259 | 3,7915 | ||

| 434,02 | 2,3012 | 2,3100 | ||

| 198,64 | 1,0532 | 1,7017 | ||

| 73,56 | 0,3900 | 1,2032 | ||

| 146,67 | 0,7777 | 1,1145 | ||

| 167,81 | 0,8897 | 0,8897 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -439,38 | -2,3296 | -6,4274 | ||

| -63,52 | -0,3368 | -4,4345 | ||

| -1,66 | -0,0088 | -2,3100 | ||

| -609,06 | -3,2293 | -2,2134 | ||

| -122,76 | -0,6509 | -2,0317 | ||

| -122,31 | -0,6485 | -0,8150 | ||

| -1,67 | -0,0088 | -0,7865 | ||

| 468,33 | 468,33 | 2,4831 | -0,7121 | |

| -4,83 | -0,0256 | -0,6117 | ||

| -3,24 | -0,0172 | -0,5945 |

13F og Fondsarkivering

Denne formular blev indsendt den 2024-08-26 for rapporteringsperioden 2024-06-28. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| EW / Edwards Lifesciences Corporation | 772,86 | 0,00 | 4,0978 | 0,0000 | |||||

| EW / Edwards Lifesciences Corporation | 772,86 | 0,00 | 4,0978 | 0,0000 | |||||

| EW / Edwards Lifesciences Corporation | 772,86 | -46.686,14 | 4,0978 | 4,1066 | |||||

| EW / Edwards Lifesciences Corporation | 772,86 | -275,90 | 4,0978 | 6,4274 | |||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 468,33 | -25,02 | 468,33 | -25,02 | 2,4831 | -0,7121 | |||

| EW / Edwards Lifesciences Corporation | 434,02 | -26.261,42 | 2,3012 | 2,3100 | |||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 402,80 | -166,13 | 2,1357 | 5,3649 | |||||

| US21H0526788 / Ginnie Mae | 198,64 | -262,41 | 1,0532 | 1,7017 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 167,81 | 0,8897 | 0,8897 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 167,81 | 0,8897 | 0,8897 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 167,81 | 0,8897 | 0,8897 | ||||||

| US3132DWBP77 / UMBS | 149,80 | 0,7942 | 0,7942 | ||||||

| EW / Edwards Lifesciences Corporation | 146,67 | -330,91 | 0,7777 | 1,1145 | |||||

| US3140XBNR72 / Fannie Mae Pool | 138,57 | -3,63 | 0,7347 | -0,0009 | |||||

| US91282CCS89 / United States Treasury Note/Bond | 134,86 | -0,37 | 0,7151 | 0,0226 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 121,90 | 0,6463 | 0,6463 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 121,90 | 0,6463 | 0,6463 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 121,90 | 0,6463 | 0,6463 | ||||||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 110,54 | 0,00 | 0,5861 | 0,0000 | |||||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 110,54 | 0,00 | 0,5861 | 0,0000 | |||||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 110,54 | -10,58 | 0,5861 | -0,0767 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 110,44 | -20,08 | 0,5856 | -0,1214 | |||||

| US91282CGR60 / United States Treasury Note/Bond | 103,56 | 0,5491 | 0,5491 | ||||||

| US91282CAH43 / United States Treasury Note/Bond | 100,23 | 0,51 | 0,5314 | 0,0213 | |||||

| EU000A3K4DY4 / European Union | 97,71 | 146,70 | 0,5180 | 0,3154 | |||||

| US91282CHK09 / United States Treasury Note/Bond | 96,60 | -0,41 | 0,5122 | 0,0159 | |||||

| US91282CGA36 / United States Treasury Note/Bond | 96,32 | -0,06 | 0,5107 | 0,0177 | |||||

| US91282CGT27 / United States Treasury Note/Bond | 95,33 | -0,30 | 0,5055 | 0,0163 | |||||

| US91282CFY21 / TREASURY NOTE | 90,49 | -0,53 | 0,4798 | 0,0144 | |||||

| US91282CHM64 / U.S. Treasury Notes | 90,48 | -0,28 | 0,4797 | 0,0156 | |||||

| US91282CCE93 / United States Treasury Note/Bond | 90,32 | 483,01 | 0,4789 | 0,3929 | |||||

| US3140XFK675 / Uniform Mortgage-Backed Securities | 90,11 | -2,98 | 0,4778 | 0,0026 | |||||

| US91282CHV63 / TREASURY NOTE | 89,43 | 0,4742 | 0,4742 | ||||||

| US912810TT51 / United States Treasury Note/Bond | 88,16 | -3,11 | 0,4674 | 0,0020 | |||||

| US912810SF66 / Us Treasury Bond | 87,73 | -2,85 | 0,4652 | 0,0032 | |||||

| US91282CCY57 / UNITED STATES TREASURY NOTE 1.25000000 | 86,20 | 0,16 | 0,4570 | 0,0168 | |||||

| US91282CJL63 / UST NOTES 4.875% 11/30/2025 | 85,22 | 0,4519 | 0,4519 | ||||||

| US91282CJB81 / United States Treasury Note/Bond | 84,72 | 0,4492 | 0,4492 | ||||||

| BE0000358672 / BELGIUM KINGDOM EUR 144A LIFE/REG S 3.3% 06-22-54 | 84,34 | 22,43 | 0,4472 | 0,0948 | |||||

| US912810QC53 / United States Treas Bds Bond | 83,89 | -2,07 | 0,4448 | 0,0066 | |||||

| US91282CFW64 / United States Treasury Note/Bond | 83,67 | 0,4436 | 0,4436 | ||||||

| US91282CFZ95 / TREASURY NOTE | 82,09 | -0,29 | 0,4353 | 0,0141 | |||||

| US3132DVMD46 / Freddie Mac Pool | 81,36 | -3,38 | 0,4314 | 0,0006 | |||||

| US91282CHF14 / United States Treasury Note/Bond | 81,02 | -0,55 | 0,4296 | 0,0128 | |||||

| US21H0226710 / GNII II 2.5% 07/01/2050 #TBA | 80,19 | 38,19 | 0,4252 | 0,1140 | |||||

| US91282CEV90 / United States Treasury Note/Bond | 79,98 | 0,4240 | 0,4240 | ||||||

| US91282CCJ80 / United States Treasury Note/Bond | 77,21 | 0,61 | 0,4094 | 0,0168 | |||||

| US3132DWA522 / UMBS Freddie Mac Pool | 75,00 | -3,05 | 0,3977 | 0,0019 | |||||

| US91282CCB54 / UST NOTES 1.625% 05/15/2031 | 74,81 | -0,41 | 0,3966 | 0,0124 | |||||

| US01F0306781 / UMBS TBA | 73,56 | -148,50 | 0,3900 | 1,2032 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 72,86 | -3,15 | 0,3863 | 0,0015 | |||||

| US912810SA79 / United States Treas Bds Bond | 72,55 | -2,72 | 0,3847 | 0,0032 | |||||

| US912810RZ30 / United States Treas Bds Bond | 69,67 | -2,70 | 0,3694 | 0,0031 | |||||

| US912810RK60 / United States Treas Bds Bond | 68,01 | -2,45 | 0,3606 | 0,0039 | |||||

| US912828ZS21 / UST NOTES 0.5% 05/31/2027 | 66,74 | 0,61 | 0,3538 | 0,0145 | |||||

| US91282CEU18 / United States Treasury Note/Bond | 62,31 | -23,67 | 0,3304 | -0,0872 | |||||

| US25278XAM11 / Diamondback Energy Inc. | 62,22 | -0,32 | 0,3299 | 0,0106 | |||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 61,47 | 0,00 | 0,3259 | 0,0000 | |||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 61,47 | -109,51 | 0,3259 | 3,7915 | |||||

| US912810TN81 / United States Treasury Note/Bond | 60,89 | -3,12 | 0,3228 | 0,0013 | |||||

| United States Treasury Note/Bond / DBT (US91282CJZ59) | 60,42 | -65,22 | 0,3203 | -0,5683 | |||||

| United States Treasury Note/Bond / DBT (US91282CJZ59) | 60,42 | -65,22 | 0,3203 | -0,5683 | |||||

| United States Treasury Note/Bond / DBT (US91282CJZ59) | 60,42 | -65,22 | 0,3203 | -0,5683 | |||||

| US21H0606713 / Ginnie Mae | 58,41 | 249,42 | 0,3097 | 0,2201 | |||||

| US912810TR95 / United States Treasury Note/Bond | 57,29 | -3,14 | 0,3038 | 0,0012 | |||||

| US31418DV742 / Fannie Mae Pool | 56,70 | -2,28 | 0,3006 | 0,0038 | |||||

| MX0MGO0000U2 / Mexican Bonos | 55,36 | 588,37 | 0,2935 | 0,2539 | |||||

| US36179WLQ95 / Ginnie Mae II Pool | 52,61 | -3,41 | 0,2789 | 0,0003 | |||||

| US87264ABF12 / CORP. NOTE | 52,16 | 76,50 | 0,2765 | 0,1254 | |||||

| Bank of America Corp / DBT (US06051GMA49) | 51,53 | -31,44 | 0,2732 | -0,1113 | |||||

| Bank of America Corp / DBT (US06051GMA49) | 51,53 | -31,44 | 0,2732 | -0,1113 | |||||

| Bank of America Corp / DBT (US06051GMA49) | 51,53 | -31,44 | 0,2732 | -0,1113 | |||||

| US31418D6B37 / Fannie Mae Pool | 50,90 | -2,59 | 0,2699 | 0,0026 | |||||

| US912828ZN34 / United States Treasury Note/Bond | 50,24 | 0,61 | 0,2664 | 0,0109 | |||||

| US3133KLUA33 / Freddie Mac Pool | 49,57 | -3,27 | 0,2628 | 0,0007 | |||||

| US3140XGWN54 / FN FS1552 | 49,51 | -2,61 | 0,2625 | 0,0024 | |||||

| US25278XAR08 / Diamondback Energy Inc | 49,18 | -0,78 | 0,2607 | 0,0072 | |||||

| US36179V4U15 / Ginnie Mae II Pool | 48,65 | -3,39 | 0,2579 | 0,0003 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 47,81 | 0,2535 | 0,2535 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 47,81 | 0,2535 | 0,2535 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 47,81 | 0,2535 | 0,2535 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 47,34 | -2,88 | 0,2510 | 0,0016 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 47,34 | -2,88 | 0,2510 | 0,0016 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 47,34 | -2,88 | 0,2510 | 0,0016 | |||||

| US91282CGB19 / United States Treasury Note/Bond | 46,80 | -0,57 | 0,2481 | 0,0074 | |||||

| US21H0626778 / Ginnie Mae | 46,56 | -2.673,85 | 0,2469 | 0,2565 | |||||

| US3132DVL604 / Freddie Mac Pool | 46,06 | -2,86 | 0,2442 | 0,0017 | |||||

| US31418EAA82 / Fannie Mae Pool | 45,88 | -0,83 | 0,2433 | 0,0066 | |||||

| MX0MGO0000H9 / Mexican Bonos | 45,11 | -16,75 | 0,2392 | -0,0380 | |||||

| US3132DVL521 / UMBS | 44,57 | -3,33 | 0,2363 | 0,0005 | |||||

| US25278XAN93 / Diamondback Energy Inc | 44,39 | -0,31 | 0,2354 | 0,0076 | |||||

| US226373AT56 / Crestwood Midstream Partners LP | 44,16 | -0,24 | 0,2341 | 0,0077 | |||||

| US3132DVMA07 / FNCL UMBS 3.0 SD7553 03-01-52 | 43,60 | -3,06 | 0,2312 | 0,0011 | |||||

| US912810SW99 / United States Treasury Note/Bond | 42,51 | -31,17 | 0,2254 | -0,0600 | |||||

| US3132DVMB89 / FNCL UMBS 2.5 SD7554 04-01-52 | 42,36 | -3,06 | 0,2246 | 0,0011 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 42,28 | 0,2241 | 0,2241 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 42,28 | 0,2241 | 0,2241 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 42,28 | 0,2241 | 0,2241 | ||||||

| US031162DQ06 / Amgen Inc | 41,79 | 7,95 | 0,2215 | 0,0235 | |||||

| US912810QH41 / United States Treas Bds Bond | 41,24 | -1,87 | 0,2186 | 0,0037 | |||||

| FR001400FTH3 / FRANCE (GOVT OF) /EUR/ REGD 3.00000000 | 39,98 | -40,13 | 0,2120 | -0,1296 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 39,17 | -0,61 | 0,2077 | 0,0061 | |||||

| US31418ECG35 / FNCT UMBS 2.0 MA4570 03-01-42 | 39,07 | -2,80 | 0,2072 | 0,0015 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 38,42 | 0,2037 | 0,2037 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 38,42 | 0,2037 | 0,2037 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 38,42 | 0,2037 | 0,2037 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 38,21 | 0,2026 | 0,2026 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 38,21 | 0,2026 | 0,2026 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 38,21 | 0,2026 | 0,2026 | ||||||

| US912810TL26 / TREASURY BOND | 37,91 | -3,11 | 0,2010 | 0,0009 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 37,40 | 0,1983 | 0,1983 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 37,40 | 0,1983 | 0,1983 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 37,40 | 0,1983 | 0,1983 | ||||||

| Barclays Mortgage Loan Trust 2023-NQM3 / ABS-MBS (US06744FAA21) | 37,26 | -3,68 | 0,1975 | -0,0003 | |||||

| Barclays Mortgage Loan Trust 2023-NQM3 / ABS-MBS (US06744FAA21) | 37,26 | -3,68 | 0,1975 | -0,0003 | |||||

| Barclays Mortgage Loan Trust 2023-NQM3 / ABS-MBS (US06744FAA21) | 37,26 | -3,68 | 0,1975 | -0,0003 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 36,98 | 153,35 | 0,1961 | 0,1214 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 36,98 | 153,35 | 0,1961 | 0,1214 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 36,98 | 153,35 | 0,1961 | 0,1214 | |||||

| US404119CA57 / HCA Inc | 36,98 | 3,28 | 0,1961 | 0,0129 | |||||

| US912810RD28 / United States Treas Bds Bond | 36,78 | -2,29 | 0,1950 | 0,0024 | |||||

| US06051GLS65 / Bank of America Corp | 36,45 | -13,70 | 0,1933 | -0,0228 | |||||

| US91282CAL54 / United States Treasury Note/Bond | 36,42 | 0,52 | 0,1931 | 0,0078 | |||||

| US912810QL52 / United States Treas Bds Bond | 36,42 | -1,79 | 0,1931 | 0,0034 | |||||

| US912810RC45 / United States Treas Bds Bond | 36,16 | -2,31 | 0,1917 | 0,0024 | |||||

| US38141GYN86 / Goldman Sachs Group Inc/The | 35,61 | -5,07 | 0,1888 | -0,0031 | |||||

| HCA Inc / DBT (US404119CT49) | 35,30 | 132,76 | 0,1872 | 0,1096 | |||||

| HCA Inc / DBT (US404119CT49) | 35,30 | 132,76 | 0,1872 | 0,1096 | |||||

| HCA Inc / DBT (US404119CT49) | 35,30 | 132,76 | 0,1872 | 0,1096 | |||||

| US91087BAV27 / United Mexican States | 35,25 | 9.452,85 | 0,1869 | 0,1850 | |||||

| US912810TM09 / United States Treasury Note/Bond | 34,87 | -2,16 | 0,1849 | 0,0026 | |||||

| US3132DQUP98 / Uniform Mortgage-Backed Securities | 34,63 | -3,65 | 0,1836 | -0,0003 | |||||

| US61747YFD22 / Morgan Stanley | 33,91 | 37,28 | 0,1798 | 0,0534 | |||||

| US912810RH32 / United States Treas Bds Bond | 33,41 | -2,42 | 0,1771 | 0,0020 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 33,25 | 0,1763 | 0,1763 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 33,25 | 0,1763 | 0,1763 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 33,25 | 0,1763 | 0,1763 | ||||||

| US912810SJ88 / United States Treas Bds Bond | 33,23 | -3,07 | 0,1762 | 0,0008 | |||||

| US912810QN19 / United Sates Treasury Bond Bond | 33,22 | -60,75 | 0,1761 | -0,2568 | |||||

| US009703AA74 / AJAXM_21-G | 33,04 | -2,71 | 0,1752 | 0,0015 | |||||

| US36179VSF84 / Ginnie Mae II Pool | 32,99 | -3,42 | 0,1749 | 0,0002 | |||||

| US912810RX81 / United States Treas Bds Bond | 32,79 | -2,62 | 0,1738 | 0,0016 | |||||

| US225401AU28 / Credit Suisse Group AG | 31,66 | 264,30 | 0,1679 | 0,1234 | |||||

| US92763MAA36 / Viper Energy Partners LP 5.375% 11/01/2027 144A | 31,59 | 0,25 | 0,1675 | 0,0063 | |||||

| US36179XND48 / Ginnie Mae II Pool | 31,35 | 0,1662 | 0,1662 | ||||||

| US91282CJG78 / U.S. Treasury Notes | 31,21 | -0,78 | 0,1655 | 0,0046 | |||||

| United States Treasury Note/Bond / DBT (US912810TZ12) | 30,59 | 0,1622 | 0,1622 | ||||||

| United States Treasury Note/Bond / DBT (US912810TZ12) | 30,59 | 0,1622 | 0,1622 | ||||||

| United States Treasury Note/Bond / DBT (US912810TZ12) | 30,59 | 0,1622 | 0,1622 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 30,27 | 0,1605 | 0,1605 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 30,27 | 0,1605 | 0,1605 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 30,27 | 0,1605 | 0,1605 | ||||||

| US3132DNAY94 / Federal Home Loan Mortgage Corp. | 29,76 | -3,45 | 0,1578 | 0,0001 | |||||

| Barclays Mortgage Loan Trust 2024-NQM3 / ABS-MBS (US066941AA35) | 29,70 | 0,1575 | 0,1575 | ||||||

| Barclays Mortgage Loan Trust 2024-NQM3 / ABS-MBS (US066941AA35) | 29,70 | 0,1575 | 0,1575 | ||||||

| Barclays Mortgage Loan Trust 2024-NQM3 / ABS-MBS (US066941AA35) | 29,70 | 0,1575 | 0,1575 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 29,54 | 0,1566 | 0,1566 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 29,54 | 0,1566 | 0,1566 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 29,54 | 0,1566 | 0,1566 | ||||||

| US38141GA468 / Goldman Sachs Group Inc/The | 29,41 | -31,74 | 0,1560 | -0,0645 | |||||

| US3140QST681 / Uniform Mortgage-Backed Securities | 29,37 | -1,94 | 0,1557 | 0,0025 | |||||

| US85207UAK16 / Sprint Corp | 29,25 | -0,54 | 0,1551 | 0,0046 | |||||

| CML St Regis Aspen / LON (000000000) | 28,96 | 0,1536 | 0,1536 | ||||||

| CML St Regis Aspen / LON (000000000) | 28,96 | 0,1536 | 0,1536 | ||||||

| CML St Regis Aspen / LON (000000000) | 28,96 | 0,1536 | 0,1536 | ||||||

| US36179WDR60 / Ginnie Mae II Pool | 28,63 | -3,79 | 0,1518 | -0,0004 | |||||

| FREED CORP 4A2 / DBT (000000000) | 28,50 | 0,1511 | 0,1511 | ||||||

| FREED CORP 4A2 / DBT (000000000) | 28,50 | 0,1511 | 0,1511 | ||||||

| FREED CORP 4A2 / DBT (000000000) | 28,50 | 0,1511 | 0,1511 | ||||||

| US91282CEE75 / United States Treasury Note/Bond | 28,40 | -0,18 | 0,1506 | 0,0050 | |||||

| US031162DU18 / Amgen Inc | 28,17 | -15,15 | 0,1493 | -0,0205 | |||||

| US3140XMTG19 / Fannie Mae Pool | 27,84 | -4,01 | 0,1476 | -0,0008 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 27,45 | 0,1456 | 0,1456 | ||||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 27,45 | 0,1456 | 0,1456 | ||||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 27,45 | 0,1456 | 0,1456 | ||||||

| US01F0204713 / UMBS 15YR TBA(REG B) 2.0 UMBS TBA 07-01-35 | 27,43 | -1.580,83 | 0,1454 | 0,1552 | |||||

| US6174468L62 / Morgan Stanley | 27,20 | -14,93 | 0,1442 | -0,0194 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 27,19 | 2.190,23 | 0,1441 | 0,1381 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 27,19 | 2.190,23 | 0,1441 | 0,1381 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 27,19 | 2.190,23 | 0,1441 | 0,1381 | |||||

| US00206RLV23 / AT&T Inc | 27,13 | -5,88 | 0,1439 | -0,0036 | |||||

| US3133KNCZ42 / FREDDIE MAC POOL UMBS P#RA6388 2.50000000 | 26,74 | -3,14 | 0,1418 | 0,0005 | |||||

| US3140QMZQ00 / Uniform Mortgage-Backed Securities | 25,96 | -2,99 | 0,1377 | 0,0008 | |||||

| US44331MAB54 / HR Ottawa LP | 25,76 | 1,49 | 0,1366 | 0,0067 | |||||

| LNG / Cheniere Energy, Inc. | 25,61 | 80,87 | 0,1358 | 0,0634 | |||||

| LNG / Cheniere Energy, Inc. | 25,61 | 80,87 | 0,1358 | 0,0634 | |||||

| LNG / Cheniere Energy, Inc. | 25,61 | 80,87 | 0,1358 | 0,0634 | |||||

| US378272BP27 / Glencore Funding LLC | 25,38 | 189,04 | 0,1346 | 0,0897 | |||||

| US91087BAM28 / Mexico Government International Bond | 25,22 | -1,38 | 0,1337 | 0,0029 | |||||

| US912810QQ40 / United States Treas Bds Bond | 25,21 | -1,75 | 0,1337 | 0,0024 | |||||

| US912828Z948 / United States Treasury Note/Bond | 25,10 | -0,17 | 0,1331 | 0,0045 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 25,04 | -1,28 | 0,1328 | 0,0030 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 25,04 | -1,28 | 0,1328 | 0,0030 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 25,04 | -1,28 | 0,1328 | 0,0030 | |||||

| US36179W5B07 / Government National Mortgage Association | 24,83 | -3,68 | 0,1317 | -0,0002 | |||||

| US009692AA28 / Ajax Mortgage Loan Trust 2023-A | 24,65 | -4,11 | 0,1307 | -0,0008 | |||||

| US36179V4W70 / GNMA | 24,46 | -3,77 | 0,1297 | -0,0003 | |||||

| US75513ECW93 / RTX CORP SR UNSEC 6.1% 03-15-34 | 24,37 | -1,11 | 0,1292 | 0,0031 | |||||

| US925650AD55 / VICI Properties LP | 24,25 | 762,34 | 0,1286 | 0,1135 | |||||

| US3140Q8DP77 / Uniform Mortgage-Backed Securities | 24,21 | -3,22 | 0,1284 | 0,0004 | |||||

| L1HX34 / L3Harris Technologies, Inc. - Depositary Receipt (Common Stock) | 24,17 | 78,54 | 0,1282 | 0,0589 | |||||

| L1HX34 / L3Harris Technologies, Inc. - Depositary Receipt (Common Stock) | 24,17 | 78,54 | 0,1282 | 0,0589 | |||||

| L1HX34 / L3Harris Technologies, Inc. - Depositary Receipt (Common Stock) | 24,17 | 78,54 | 0,1282 | 0,0589 | |||||

| US912810TB44 / T 1 7/8 11/15/51 | 24,16 | -3,09 | 0,1281 | 0,0006 | |||||

| US785592AX43 / Sabine Pass Liquefaction LLC | 23,87 | 77,94 | 0,1266 | 0,0541 | |||||

| US009926AA42 / Ajax Mortgage Loan Trust 2023-C | 23,68 | -2,41 | 0,1255 | 0,0014 | |||||

| US912810QW18 / United States Treas Bds Bond | 23,62 | -1,92 | 0,1252 | 0,0020 | |||||

| US785592AS57 / SABINE PASS LIQUEFACTION LLC SR SECURED 03/27 5 | 23,61 | -7,98 | 0,1252 | -0,0061 | |||||

| US912810RB61 / United States Treas Bds Bond | 23,52 | -2,27 | 0,1247 | 0,0016 | |||||

| US38141GYB49 / Goldman Sachs Group Inc/The | 23,34 | -40,42 | 0,1238 | -0,0766 | |||||

| US00971FAA93 / AJAX Mortgage Loan Trust | 23,28 | -35,89 | 0,1234 | -0,0623 | |||||

| BRSTNCNTF1Q6 / Brazil Notas do Tesouro Nacional Serie F | 23,02 | 0,1220 | 0,1220 | ||||||

| US3140QLN440 / Fannie Mae Pool | 22,67 | -3,03 | 0,1202 | 0,0006 | |||||

| US92343VGN82 / Verizon Communications Inc | 22,51 | -57,23 | 0,1193 | -0,1499 | |||||

| US912810TD00 / United States Treasury Note/Bond | 22,47 | -3,15 | 0,1191 | 0,0004 | |||||

| US404119BT57 / HCA Inc | 22,46 | 1,62 | 0,1191 | 0,0060 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 22,44 | 0,1190 | 0,1190 | ||||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 22,44 | 0,1190 | 0,1190 | ||||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 22,44 | 0,1190 | 0,1190 | ||||||

| US3140QLZ824 / Fannie Mae Pool | 22,33 | -3,41 | 0,1184 | 0,0001 | |||||

| US01F0626717 / Uniform Mortgage-Backed Security, TBA | 22,08 | 36,44 | 0,1171 | 0,0303 | |||||

| US912810TF57 / TREASURY BOND | 22,05 | -2,13 | 0,1169 | 0,0017 | |||||

| US694308JN86 / PACIFIC GAS and ELECTRIC CO 4.95% 07/01/2050 | 21,89 | -15,28 | 0,1161 | -0,0161 | |||||

| US3140QNN990 / Uniform Mortgage-Backed Securities | 21,83 | -3,21 | 0,1158 | 0,0004 | |||||

| LANDSEA HOMES 4A2 SEN NOTES / DBT (000000000) | 21,76 | 0,1154 | 0,1154 | ||||||

| LANDSEA HOMES 4A2 SEN NOTES / DBT (000000000) | 21,76 | 0,1154 | 0,1154 | ||||||

| LANDSEA HOMES 4A2 SEN NOTES / DBT (000000000) | 21,76 | 0,1154 | 0,1154 | ||||||

| WESTBAY 4A2 NOTES / DBT (000000000) | 21,60 | 0,1145 | 0,1145 | ||||||

| WESTBAY 4A2 NOTES / DBT (000000000) | 21,60 | 0,1145 | 0,1145 | ||||||

| WESTBAY 4A2 NOTES / DBT (000000000) | 21,60 | 0,1145 | 0,1145 | ||||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 21,45 | -13,94 | 0,1138 | -0,0138 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 21,45 | -13,94 | 0,1138 | -0,0138 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 21,45 | -13,94 | 0,1138 | -0,0138 | |||||

| US913017CY37 / United Technologies Corp | 21,37 | -39,48 | 0,1133 | -0,0673 | |||||

| US26884LAG41 / EQT Corp | 21,32 | 79,38 | 0,1130 | 0,0522 | |||||

| US3140QNEL25 / Uniform Mortgage-Backed Securities | 21,31 | -3,22 | 0,1130 | 0,0003 | |||||

| US361841AR08 / GLP Capital LP / GLP Financing II Inc | 21,29 | 52,96 | 0,1129 | 0,0417 | |||||

| US36179W7J15 / Ginnie Mae II Pool | 21,27 | -3,48 | 0,1128 | 0,0000 | |||||

| MX0MGO0001F1 / Mexican Bonos | 21,15 | -31,06 | 0,1121 | -0,0448 | |||||

| US502431AQ20 / L3Harris Technologies Inc | 20,96 | -8,68 | 0,1112 | -0,0063 | |||||

| US46654CAH88 / J.P. Morgan Mortgage Trust 2021-INV7 | 20,84 | -2,82 | 0,1105 | 0,0008 | |||||

| US13063DGE22 / California (State of), Series 2018, Ref. GO Bonds | 20,83 | -2,93 | 0,1104 | 0,0007 | |||||

| US3140QM4G63 / Fannie Mae Pool | 20,82 | -3,25 | 0,1104 | 0,0003 | |||||

| US3140QANL03 / Fannie Mae Pool | 20,75 | -4,37 | 0,1100 | -0,0010 | |||||

| US58403YBA38 / Med Trust 2021-MDLN | 20,43 | 0,15 | 0,1083 | 0,0040 | |||||

| US16412XAG07 / CHENIERE CORP CHRISTI HD SR SECURED 06/27 5.125 | 20,23 | -7,84 | 0,1073 | -0,0050 | |||||

| US912810TC27 / United States Treasury Note/Bond | 20,22 | -2,07 | 0,1072 | 0,0016 | |||||

| US3132DMYM18 / Freddie Mac Pool | 19,86 | -3,73 | 0,1053 | -0,0002 | |||||

| US24703TAE64 / Dell International LLC / EMC Corp | 19,74 | 4,18 | 0,1047 | 0,0077 | |||||

| US05608UAA60 / BX TR 2022-GPA A TSFR1M+221.5 10/15/2039 144A | 19,70 | -0,91 | 0,1045 | 0,0027 | |||||

| US30303M8K14 / Meta Platforms Inc | 19,70 | 120,42 | 0,1044 | 0,0587 | |||||

| US68389XBV64 / ORACLE CORP SR UNSECURED 04/30 2.95 | 19,54 | 0,1036 | 0,1036 | ||||||

| US337932AH00 / FirstEnergy Corp | 19,48 | 115,51 | 0,1033 | 0,0570 | |||||

| US91087BAG59 / Mexico Government International Bond | 19,46 | -4,60 | 0,1032 | -0,0012 | |||||

| US26884LAL36 / EQT Corporation | 19,45 | 146,15 | 0,1031 | 0,0627 | |||||

| US00971BAA89 / AJAXM_22-B: A1 | 19,42 | -4,64 | 0,1030 | -0,0012 | |||||

| RMIT_21-3 / ABS-O (000000000) | 19,37 | 0,1027 | 0,1027 | ||||||

| RMIT_21-3 / ABS-O (000000000) | 19,37 | 0,1027 | 0,1027 | ||||||

| RMIT_21-3 / ABS-O (000000000) | 19,37 | 0,1027 | 0,1027 | ||||||

| US925650AB99 / VICI Properties LP | 19,28 | 0,37 | 0,1022 | 0,0040 | |||||

| US46647PBJ49 / JPMorgan Chase & Co | 19,14 | 756,67 | 0,1015 | 0,0903 | |||||

| US009723AA54 / Ajax Mortgage Loan Trust 2021-D | 19,12 | -3,57 | 0,1014 | -0,0001 | |||||

| US3133KMW843 / Freddie Mac Pool | 19,07 | -2,14 | 0,1011 | 0,0014 | |||||

| KSL Commercial Mortgage Trust 2023-HT / ABS-MBS (US48268TAL61) | 19,02 | -0,50 | 0,1008 | 0,0031 | |||||

| KSL Commercial Mortgage Trust 2023-HT / ABS-MBS (US48268TAL61) | 19,02 | -0,50 | 0,1008 | 0,0031 | |||||

| KSL Commercial Mortgage Trust 2023-HT / ABS-MBS (US48268TAL61) | 19,02 | -0,50 | 0,1008 | 0,0031 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 18,99 | 0,1007 | 0,1007 | ||||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 18,99 | 0,1007 | 0,1007 | ||||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 18,99 | 0,1007 | 0,1007 | ||||||

| US3140QA4A56 / Fannie Mae Pool | 18,83 | -4,78 | 0,0998 | -0,0013 | |||||

| US64035DAJ54 / Nelnet Student Loan Trust 2021-A | 18,78 | 0,39 | 0,0995 | 0,0039 | |||||

| GWT 2024-WLF2 / ABS-MBS (US362414AA28) | 18,76 | 0,0995 | 0,0995 | ||||||

| GWT 2024-WLF2 / ABS-MBS (US362414AA28) | 18,76 | 0,0995 | 0,0995 | ||||||

| GWT 2024-WLF2 / ABS-MBS (US362414AA28) | 18,76 | 0,0995 | 0,0995 | ||||||

| US054989AD07 / BAT CAPITAL CORP 7.081000% 08/02/2053 | 18,59 | 9,84 | 0,0986 | 0,0120 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 18,58 | 0,0985 | 0,0985 | ||||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 18,58 | 0,0985 | 0,0985 | ||||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 18,58 | 0,0985 | 0,0985 | ||||||

| US3140QLN366 / Fannie Mae Pool | 18,53 | -2,21 | 0,0983 | 0,0013 | |||||

| US009740AA95 / Ajax Mortgage Loan Trust 2021-E | 18,48 | -2,07 | 0,0980 | 0,0014 | |||||

| US66775VAB18 / Northwest Pipeline LLC | 18,40 | -0,20 | 0,0975 | 0,0032 | |||||

| US11135FBF71 / Broadcom, Inc. | 18,38 | -12,96 | 0,0974 | -0,0106 | |||||

| US3132XCSC08 / Federal Home Loan Mortgage Corp. | 18,35 | -4,19 | 0,0973 | -0,0007 | |||||

| US3140XGTV18 / Federal National Mortgage Association | 18,34 | -3,74 | 0,0972 | -0,0002 | |||||

| US15032DAR26 / Cedar Funding VI CLO Ltd | 18,31 | 0,13 | 0,0971 | 0,0035 | |||||

| US61747YFF79 / Morgan Stanley | 17,96 | 22,96 | 0,0952 | 0,0205 | |||||

| US16411QAK76 / CORP. NOTE | 17,88 | -17,61 | 0,0948 | -0,0162 | |||||

| Navient Private Education Refi Loan Trust 2024-A / ABS-O (US63943CAA99) | 17,88 | 0,0948 | 0,0948 | ||||||

| Navient Private Education Refi Loan Trust 2024-A / ABS-O (US63943CAA99) | 17,88 | 0,0948 | 0,0948 | ||||||

| Navient Private Education Refi Loan Trust 2024-A / ABS-O (US63943CAA99) | 17,88 | 0,0948 | 0,0948 | ||||||

| US009695AA58 / AJAXM_22-A | 17,86 | -6,53 | 0,0947 | -0,0030 | |||||

| Onemain Financial Issuance Trust 2024-1 / ABS-O (US68269NAA00) | 17,86 | 0,0947 | 0,0947 | ||||||

| Onemain Financial Issuance Trust 2024-1 / ABS-O (US68269NAA00) | 17,86 | 0,0947 | 0,0947 | ||||||

| Onemain Financial Issuance Trust 2024-1 / ABS-O (US68269NAA00) | 17,86 | 0,0947 | 0,0947 | ||||||

| US912810SS87 / T 1 5/8 11/15/50 | 17,80 | -24,14 | 0,0944 | -0,0257 | |||||

| TVC DSCR_21-1: A / ABS-MBS (000000000) | 17,77 | 0,0942 | 0,0942 | ||||||

| TVC DSCR_21-1: A / ABS-MBS (000000000) | 17,77 | 0,0942 | 0,0942 | ||||||

| TVC DSCR_21-1: A / ABS-MBS (000000000) | 17,77 | 0,0942 | 0,0942 | ||||||

| US3132DMRK35 / Freddie Mac Pool | 17,70 | -3,06 | 0,0938 | 0,0004 | |||||

| US912810SU34 / United States Treasury Note/Bond | 17,69 | -3,06 | 0,0938 | 0,0004 | |||||

| US03674XAQ97 / Antero Resources Corp | 17,67 | 0,12 | 0,0937 | 0,0034 | |||||

| US912828X885 / United States Treasury Note/Bond | 17,59 | 0,08 | 0,0933 | 0,0034 | |||||

| US36179WQA98 / Government National Mortgage Association | 17,57 | -3,52 | 0,0932 | -0,0000 | |||||

| US29444UBU97 / 3.9% 15 Apr 2032 | 17,53 | 176,86 | 0,0929 | 0,0605 | |||||

| US02209SBM44 / ALTRIA GROUP INC 3.4% 02/04/2041 | 17,50 | 54,29 | 0,0928 | 0,0348 | |||||

| US9128282R06 / United States Treasury Note/Bond | 17,45 | 0,07 | 0,0925 | 0,0033 | |||||

| US3132DVLP84 / FR SD7534 | 17,36 | -3,55 | 0,0921 | -0,0000 | |||||

| US26884LAF67 / EQT Corp. | 17,33 | -9,51 | 0,0919 | -0,0061 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 17,30 | 0,0917 | 0,0917 | ||||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 17,30 | 0,0917 | 0,0917 | ||||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 17,30 | 0,0917 | 0,0917 | ||||||

| BX Commercial Mortgage Trust 2024-MDHS / ABS-MBS (US12433BAA52) | 17,24 | 0,0914 | 0,0914 | ||||||

| BX Commercial Mortgage Trust 2024-MDHS / ABS-MBS (US12433BAA52) | 17,24 | 0,0914 | 0,0914 | ||||||

| BX Commercial Mortgage Trust 2024-MDHS / ABS-MBS (US12433BAA52) | 17,24 | 0,0914 | 0,0914 | ||||||

| VICI / VICI Properties Inc. | 17,23 | 1,66 | 0,0913 | 0,0015 | |||||

| US3140XFGT26 / Fannie Mae Pool | 17,18 | -3,47 | 0,0911 | 0,0000 | |||||

| US87612BBS07 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 17,10 | 3,41 | 0,0907 | 0,0061 | |||||

| US83012KAA51 / Sixth Street CLO XIX Ltd | 17,01 | 0,19 | 0,0902 | 0,0033 | |||||

| DAVIDSON HOMES PREF EQUITY / EP (000000000) | 0,02 | 17,00 | 0,0901 | 0,0901 | |||||

| DAVIDSON HOMES PREF EQUITY / EP (000000000) | 0,02 | 17,00 | 0,0901 | 0,0901 | |||||

| DAVIDSON HOMES PREF EQUITY / EP (000000000) | 0,02 | 17,00 | 0,0901 | 0,0901 | |||||

| US55354GAH39 / MSCI Inc | 16,98 | 16,53 | 0,0900 | 0,0148 | |||||

| VICI / VICI Properties Inc. | 16,95 | 0,00 | 0,0899 | 0,0000 | |||||

| VICI / VICI Properties Inc. | 16,95 | -11,25 | 0,0899 | -0,0078 | |||||

| VICI / VICI Properties Inc. | 16,95 | 0,00 | 0,0899 | 0,0000 | |||||

| US61747YED31 / Morgan Stanley | 16,94 | 5,33 | 0,0898 | 0,0075 | |||||

| US22550L2M24 / Credit Suisse AG/New York NY | 16,79 | 14,81 | 0,0890 | 0,0142 | |||||

| US00287YCY32 / ABBVIE INC 4.55% 03/15/2035 | 16,74 | 47,75 | 0,0888 | 0,0308 | |||||

| US26243EAA91 / Dryden 53 CLO Ltd | 16,73 | -1,77 | 0,0887 | 0,0016 | |||||

| Palmer Square Loan Funding 2022-3 Ltd / ABS-CBDO (US69690CAQ69) | 16,63 | 0,03 | 0,0882 | 0,0031 | |||||

| Palmer Square Loan Funding 2022-3 Ltd / ABS-CBDO (US69690CAQ69) | 16,63 | 0,03 | 0,0882 | 0,0031 | |||||

| Palmer Square Loan Funding 2022-3 Ltd / ABS-CBDO (US69690CAQ69) | 16,63 | 0,03 | 0,0882 | 0,0031 | |||||

| US36270GAJ04 / GS MTG SECS CORP TR 2023-SHIP 7.68138% 09/15/2038 144A | 16,62 | -0,98 | 0,0881 | 0,0023 | |||||

| US3132DMSG14 / Freddie Mac Pool | 16,61 | -3,02 | 0,0881 | 0,0004 | |||||

| US3140X82G19 / Fannie Mae Pool | 16,59 | -4,48 | 0,0880 | -0,0009 | |||||

| US893045AE41 / Trans-Allegheny Interstate Line Co | 16,59 | 0,14 | 0,0880 | 0,0032 | |||||

| VERSA NETWORKS INC / EP (000000000) | 4,12 | 16,51 | 0,0876 | 0,0876 | |||||

| VERSA NETWORKS INC / EP (000000000) | 4,12 | 16,51 | 0,0876 | 0,0876 | |||||

| VERSA NETWORKS INC / EP (000000000) | 4,12 | 16,51 | 0,0876 | 0,0876 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 16,46 | -38,28 | 0,0873 | -0,0492 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 16,46 | -38,28 | 0,0873 | -0,0492 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 16,46 | -38,28 | 0,0873 | -0,0492 | |||||

| US3132DWBB81 / FHLG 30YR 2% 03/01/2051# | 16,33 | -2,59 | 0,0866 | 0,0008 | |||||

| US698299BF03 / Panama Government International Bond | 16,32 | 1,35 | 0,0865 | 0,0041 | |||||

| US452151LF83 / ILLINOIS ST | 16,29 | -6,82 | 0,0864 | -0,0031 | |||||

| US30227FAN06 / Extended Stay America Trust | 16,24 | -0,95 | 0,0861 | 0,0022 | |||||

| US3132DMRR87 / Freddie Mac Pool | 16,13 | -3,33 | 0,0855 | 0,0002 | |||||

| US62928CAA09 / NGPL PipeCo LLC | 16,11 | 19,28 | 0,0854 | 0,0163 | |||||

| COREWEAVE SENIOR / LON (000000000) | 16,03 | 0,0850 | 0,0850 | ||||||

| COREWEAVE SENIOR / LON (000000000) | 16,03 | 0,0850 | 0,0850 | ||||||

| COREWEAVE SENIOR / LON (000000000) | 16,03 | 0,0850 | 0,0850 | ||||||

| BRSTNCNTF212 / Brazil Notas do Tesouro Nacional Serie F | 15,96 | 0,0846 | 0,0846 | ||||||

| US52476DAA54 / LMAT_21-GS2 | 15,82 | -3,51 | 0,0839 | 0,0000 | |||||

| US01F0424758 / Fannie Mae or Freddie Mac | 15,73 | 145,57 | 0,0834 | 0,0490 | |||||

| US30326MAA36 / FS RIALTO | 15,72 | 0,42 | 0,0833 | 0,0033 | |||||

| US06744JAA43 / Barclays Mortgage Trust 2021-NPL1 | 15,71 | -18,69 | 0,0833 | -0,0155 | |||||

| US12657XAA63 / Credit Suisse Mortgage Capital Certificates, Series 2021-JR1, Class A1 | 15,66 | -8,25 | 0,0830 | -0,0043 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 15,64 | 0,0830 | 0,0830 | ||||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 15,64 | 0,0830 | 0,0830 | ||||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 15,64 | 0,0830 | 0,0830 | ||||||

| US925650AC72 / VICI Properties LP | 15,56 | 192,57 | 0,0825 | 0,0553 | |||||

| US3132DNTW38 / FHLG 30YR 5% 08/01/2052#SD1465 | 15,53 | -2,50 | 0,0823 | 0,0009 | |||||

| US404121AH82 / HCA Inc | 15,52 | -0,23 | 0,0823 | 0,0027 | |||||

| US3140XFM408 / Fannie Mae Pool | 15,51 | -3,97 | 0,0822 | -0,0004 | |||||

| US3140QSQK01 / Fannie Mae Pool | 15,38 | -3,92 | 0,0816 | -0,0003 | |||||

| US3133KYWH88 / Freddie Mac Pool | 15,35 | -2,33 | 0,0814 | 0,0010 | |||||

| US3132DMKJ35 / Freddie Mac Pool | 15,35 | -3,41 | 0,0814 | 0,0001 | |||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 15,29 | 0,0811 | 0,0811 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 15,29 | 0,0811 | 0,0811 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 15,29 | 0,0811 | 0,0811 | ||||||

| AREIT 2024-CRE9 Ltd / ABS-CBDO (US00193AAA25) | 15,17 | 0,0804 | 0,0804 | ||||||

| AREIT 2024-CRE9 Ltd / ABS-CBDO (US00193AAA25) | 15,17 | 0,0804 | 0,0804 | ||||||

| AREIT 2024-CRE9 Ltd / ABS-CBDO (US00193AAA25) | 15,17 | 0,0804 | 0,0804 | ||||||

| US3132DPVE59 / Freddie Mac Pool | 15,14 | -3,92 | 0,0803 | -0,0003 | |||||

| MCM 2021-VFN1: NOTE CMO/WHOLE / ABS-MBS (000000000) | 15,13 | 0,0802 | 0,0802 | ||||||

| MCM 2021-VFN1: NOTE CMO/WHOLE / ABS-MBS (000000000) | 15,13 | 0,0802 | 0,0802 | ||||||

| MCM 2021-VFN1: NOTE CMO/WHOLE / ABS-MBS (000000000) | 15,13 | 0,0802 | 0,0802 | ||||||

| US36179WG449 / G2SF 3.0 MA7419 06-20-51 | 15,12 | -3,55 | 0,0801 | -0,0000 | |||||

| US785592AV86 / Sabine Pass Liquefaction LLC | 14,93 | -40,82 | 0,0792 | -0,0499 | |||||

| BX 2024-PALM / ABS-MBS (US05612UAA07) | 14,93 | 0,0792 | 0,0792 | ||||||

| BX 2024-PALM / ABS-MBS (US05612UAA07) | 14,93 | 0,0792 | 0,0792 | ||||||

| BX 2024-PALM / ABS-MBS (US05612UAA07) | 14,93 | 0,0792 | 0,0792 | ||||||

| US29444UBE55 / Equinix, Inc. | 14,86 | -7,68 | 0,0788 | -0,0036 | |||||

| US29444UBH86 / Equinix Inc | 14,81 | 95,89 | 0,0785 | 0,0398 | |||||

| US26884LAN91 / EQT CORP 3.625% 05/15/2031 144A | 14,80 | 112,66 | 0,0785 | 0,0429 | |||||

| US3132DM7D19 / Uniform Mortgage-Backed Securities | 14,77 | -3,13 | 0,0783 | 0,0003 | |||||

| US3132DMR493 / Freddie Mac Pool | 14,76 | -4,66 | 0,0783 | -0,0009 | |||||

| HILTON GARDEN INN WAIKIKI 05/31/29 / LON (000000000) | 14,75 | 0,0782 | 0,0782 | ||||||

| HILTON GARDEN INN WAIKIKI 05/31/29 / LON (000000000) | 14,75 | 0,0782 | 0,0782 | ||||||

| HILTON GARDEN INN WAIKIKI 05/31/29 / LON (000000000) | 14,75 | 0,0782 | 0,0782 | ||||||

| US00287YAR09 / AbbVie Inc | 14,70 | -1,98 | 0,0779 | 0,0012 | |||||

| US009691AA45 / Ajax Mortgage Loan Trust 2023-B | 14,63 | -6,95 | 0,0776 | -0,0029 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 14,61 | -2,95 | 0,0775 | 0,0004 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 14,61 | -2,95 | 0,0775 | 0,0004 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 14,61 | -2,95 | 0,0775 | 0,0004 | |||||

| US29444UBS42 / EQUINIX INC 2.5% 05/15/2031 | 14,58 | 659,27 | 0,0773 | 0,0674 | |||||

| US92343VFX73 / Verizon Communications Inc | 14,54 | 650,98 | 0,0771 | 0,0672 | |||||

| US67707EAU82 / OHA Credit Funding 2 LTD | 14,45 | 0,01 | 0,0766 | 0,0027 | |||||

| US3140QRWZ23 / Fannie Mae Pool | 14,44 | -2,64 | 0,0766 | 0,0007 | |||||

| DREAM FINDERS HOMES INC / EP (000000000) | 0,02 | 14,44 | 0,0766 | 0,0766 | |||||

| DREAM FINDERS HOMES INC / EP (000000000) | 0,02 | 14,44 | 0,0766 | 0,0766 | |||||

| DREAM FINDERS HOMES INC / EP (000000000) | 0,02 | 14,44 | 0,0766 | 0,0766 | |||||

| US92564RAE53 / VICI PROPERTIES / NOTE 4.125% 08/15/2030 144A | 14,42 | 0,02 | 0,0765 | 0,0027 | |||||

| AGL Core CLO 2 Ltd / ABS-CBDO (US001200AJ39) | 14,39 | 0,0763 | 0,0763 | ||||||

| AGL Core CLO 2 Ltd / ABS-CBDO (US001200AJ39) | 14,39 | 0,0763 | 0,0763 | ||||||

| AGL Core CLO 2 Ltd / ABS-CBDO (US001200AJ39) | 14,39 | 0,0763 | 0,0763 | ||||||

| US00206RMN97 / AT&T Inc | 14,38 | -9,08 | 0,0763 | -0,0047 | |||||

| US55819BAW00 / Madison Park Funding XVIII Ltd | 14,36 | -1,47 | 0,0761 | 0,0016 | |||||

| US3140QEJX19 / Federal National Mortgage Association | 14,34 | -3,49 | 0,0760 | 0,0000 | |||||

| US87264ACY91 / T-Mobile USA Inc | 14,28 | -29,31 | 0,0757 | -0,0276 | |||||

| US91087BAR15 / Mexican Government International Bond | 14,09 | 0,0747 | 0,0747 | ||||||

| US16411QAN16 / CORPORATE BONDS | 14,06 | 50,61 | 0,0745 | 0,0268 | |||||

| US3140XCGT94 / Fannie Mae Pool | 14,05 | -4,57 | 0,0745 | -0,0008 | |||||

| US12434AAA60 / BX Commercial Mortgage Trust 2021-NWM | 14,02 | 0,16 | 0,0743 | 0,0027 | |||||

| US16412XAL91 / Cheniere Corpus Christi Holdings LLC | 14,01 | -2,67 | 0,0743 | 0,0006 | |||||

| HNG HOSPITALITY OFFSHORE LP / EC (000000000) | 13,87 | 14,01 | 0,0743 | 0,0743 | |||||

| HNG HOSPITALITY OFFSHORE LP / EC (000000000) | 13,87 | 14,01 | 0,0743 | 0,0743 | |||||

| HNG HOSPITALITY OFFSHORE LP / EC (000000000) | 13,87 | 14,01 | 0,0743 | 0,0743 | |||||

| US33883PAC14 / Flatiron CLO 21 Ltd | 13,99 | 0,17 | 0,0742 | 0,0027 | |||||

| US87612BBU52 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 13,98 | -1,89 | 0,0741 | 0,0012 | |||||

| US16411QAG64 / Cheniere Energy Partners LP | 13,96 | -37,36 | 0,0740 | -0,0400 | |||||

| US785592AZ90 / Sabine Pass Liquefaction LLC | 13,91 | -1,45 | 0,0738 | 0,0015 | |||||

| DK Trust 2024-SPBX / ABS-MBS (US23346LAN82) | 13,90 | -0,06 | 0,0737 | 0,0025 | |||||

| DK Trust 2024-SPBX / ABS-MBS (US23346LAN82) | 13,90 | -0,06 | 0,0737 | 0,0025 | |||||

| DK Trust 2024-SPBX / ABS-MBS (US23346LAN82) | 13,90 | -0,06 | 0,0737 | 0,0025 | |||||

| US3140QM4F80 / Fannie Mae Pool | 13,88 | -2,75 | 0,0736 | 0,0006 | |||||

| US3140QNE650 / Uniform Mortgage-Backed Securities | 13,88 | -3,32 | 0,0736 | 0,0001 | |||||

| US3140XFGS43 / Fannie Mae Pool | 13,78 | -3,29 | 0,0730 | 0,0002 | |||||

| BATBC / British American Tobacco Bangladesh Company Limited | 13,77 | 214,67 | 0,0730 | 0,0506 | |||||

| BATBC / British American Tobacco Bangladesh Company Limited | 13,77 | 214,67 | 0,0730 | 0,0506 | |||||

| BATBC / British American Tobacco Bangladesh Company Limited | 13,77 | 214,67 | 0,0730 | 0,0506 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 13,76 | -68,47 | 0,0730 | -0,1503 | |||||

| US133434AB69 / Cameron LNG LLC | 13,72 | -1,05 | 0,0727 | 0,0018 | |||||

| US37046US851 / General Motors Financial Co Inc | 13,63 | 0,0722 | 0,0722 | ||||||

| US37046US851 / General Motors Financial Co Inc | 13,63 | 0,0722 | 0,0722 | ||||||

| US37046US851 / General Motors Financial Co Inc | 13,63 | 0,0722 | 0,0722 | ||||||

| US3132CWSB18 / Freddie Mac Pool | 13,62 | -4,57 | 0,0722 | -0,0008 | |||||

| US3140QSAX95 / Fannie Mae Pool | 13,47 | -2,16 | 0,0714 | 0,0010 | |||||

| US009703AC31 / AJAX Mortgage Loan Trust | 13,37 | 6,42 | 0,0709 | 0,0066 | |||||

| US35564CGD39 / Seasoned Loans Structured Transaction Trust Series 2020-2 | 13,32 | -10,22 | 0,0706 | -0,0053 | |||||

| US361841AQ25 / GLP Capital LP / GLP Financing II Inc | 13,29 | 0,48 | 0,0704 | 0,0028 | |||||

| 30064K105 / Exacttarget, Inc. | 13,23 | 0,0701 | 0,0701 | ||||||

| 30064K105 / Exacttarget, Inc. | 13,23 | 0,0701 | 0,0701 | ||||||

| 30064K105 / Exacttarget, Inc. | 13,23 | 0,0701 | 0,0701 | ||||||

| US3133KRB861 / Freddie Mac Pool | 13,17 | -3,46 | 0,0698 | 0,0000 | |||||

| US38141GYA65 / Goldman Sachs Group Inc/The | 13,16 | 515,96 | 0,0698 | 0,0574 | |||||

| SoFi Personal Loan Trust 2024-1 / ABS-O (US83407RAA32) | 13,10 | 0,0695 | 0,0695 | ||||||

| SoFi Personal Loan Trust 2024-1 / ABS-O (US83407RAA32) | 13,10 | 0,0695 | 0,0695 | ||||||

| SoFi Personal Loan Trust 2024-1 / ABS-O (US83407RAA32) | 13,10 | 0,0695 | 0,0695 | ||||||

| US22546QAP28 / Credit Suisse AG/New York NY | 13,07 | 0,47 | 0,0693 | 0,0027 | |||||

| CSMC 2022-NQM6 Trust / ABS-MBS (US12663YAM03) | 13,01 | -9,73 | 0,0690 | -0,0047 | |||||

| CSMC 2022-NQM6 Trust / ABS-MBS (US12663YAM03) | 13,01 | -9,73 | 0,0690 | -0,0047 | |||||

| CSMC 2022-NQM6 Trust / ABS-MBS (US12663YAM03) | 13,01 | -9,73 | 0,0690 | -0,0047 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 12,93 | -0,49 | 0,0685 | 0,0021 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 12,93 | -0,49 | 0,0685 | 0,0021 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 12,93 | -0,49 | 0,0685 | 0,0021 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 12,92 | 0,35 | 0,0685 | 0,0026 | |||||

| US87612BBQ41 / CORPORATE BONDS | 12,91 | -13,18 | 0,0684 | -0,0076 | |||||

| US3140QMJZ82 / Fannie Mae Pool | 12,86 | -2,97 | 0,0682 | 0,0004 | |||||

| LBA Trust 2024-BOLT / ABS-MBS (US50177BAA52) | 12,79 | 0,0678 | 0,0678 | ||||||

| LBA Trust 2024-BOLT / ABS-MBS (US50177BAA52) | 12,79 | 0,0678 | 0,0678 | ||||||

| LBA Trust 2024-BOLT / ABS-MBS (US50177BAA52) | 12,79 | 0,0678 | 0,0678 | ||||||

| US22550L2K67 / Credit Suisse AG/New York NY | 12,71 | 18,13 | 0,0674 | 0,0124 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 12,70 | 0,0673 | 0,0673 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 12,70 | 0,0673 | 0,0673 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 12,70 | 0,0673 | 0,0673 | ||||||

| US3140QRBU64 / Fannie Mae Pool | 12,67 | -2,29 | 0,0672 | 0,0008 | |||||

| US3140QMMP63 / Federal National Mortgage Association | 12,65 | -3,45 | 0,0671 | 0,0000 | |||||

| US78474NAA00 / SOFI PERS LN TR 2023 1 | 12,64 | 0,0670 | 0,0670 | ||||||

| US3133KJUF73 / Freddie Mac Pool | 12,61 | -4,02 | 0,0669 | -0,0004 | |||||

| US595620AY17 / MidAmerican Energy Co | 12,60 | 0,0668 | 0,0668 | ||||||

| US87666YAA55 / Taubman Centers Commercial Mortgage Trust 2022-DPM | 12,56 | 7,43 | 0,0666 | 0,0068 | |||||

| EIS GROUP INC LOAN/TERM / LON (000000000) | 12,52 | 0,0664 | 0,0664 | ||||||

| EIS GROUP INC LOAN/TERM / LON (000000000) | 12,52 | 0,0664 | 0,0664 | ||||||

| EIS GROUP INC LOAN/TERM / LON (000000000) | 12,52 | 0,0664 | 0,0664 | ||||||

| US36179XBQ88 / GNMA | 12,52 | -3,86 | 0,0664 | -0,0002 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 12,51 | 0,0663 | 0,0663 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 12,51 | 0,0663 | 0,0663 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 12,51 | 0,0663 | 0,0663 | ||||||

| US361841AL38 / GLP Capital LP / GLP Financing II Inc | 12,42 | 2,39 | 0,0658 | 0,0038 | |||||

| US031162CU27 / AMGEN INC REGD 2.45000000 | 12,40 | 19,57 | 0,0657 | 0,0178 | |||||

| US3132DMRT44 / Freddie Mac Pool | 12,34 | -4,10 | 0,0654 | -0,0004 | |||||

| US92763MAB19 / Viper Energy Partners LP | 12,28 | -0,37 | 0,0651 | 0,0021 | |||||

| US33767BAC37 / FIRSTENERGY TRANSMISSION SR UNSECURED 144A 04/49 4.55 | 12,27 | 55,11 | 0,0651 | 0,0246 | |||||

| US06051GJL41 / Bank of America Corp | 12,26 | 500,69 | 0,0650 | 0,0546 | |||||

| US69047QAA04 / Ovintiv Inc | 12,25 | 84,17 | 0,0650 | 0,0309 | |||||

| CML Hyatt Lost Pines / LON (000000000) | 12,20 | 0,0647 | 0,0647 | ||||||

| CML Hyatt Lost Pines / LON (000000000) | 12,20 | 0,0647 | 0,0647 | ||||||

| CML LA QUINTA RESORT / LON (000000000) | 12,20 | 0,0647 | 0,0647 | ||||||

| CML LA QUINTA RESORT / LON (000000000) | 12,20 | 0,0647 | 0,0647 | ||||||

| CML LA QUINTA RESORT / LON (000000000) | 12,20 | 0,0647 | 0,0647 | ||||||

| CML Hyatt Lost Pines / LON (000000000) | 12,20 | 0,0647 | 0,0647 | ||||||

| US46647PBL94 / JPMorgan Chase & Co | 12,19 | 225,98 | 0,0646 | 0,0455 | |||||

| EU000A3K4DT4 / European Union | 12,14 | -5,29 | 0,0644 | -0,0012 | |||||

| US402562AA06 / Gulf Stream Meridian | 12,10 | 0,23 | 0,0641 | 0,0024 | |||||

| US68389XBJ37 / Oracle Corp | 12,00 | 273,58 | 0,0636 | 0,0472 | |||||

| US36179WTY48 / Ginnie Mae II Pool | 11,99 | -3,55 | 0,0635 | -0,0000 | |||||

| US78445QAE17 / SLM Private Education Loan Trust 2010-C | 11,98 | -6,95 | 0,0635 | -0,0023 | |||||

| US010392FM53 / Alabama Power Co. | 11,96 | 37,53 | 0,0634 | 0,0189 | |||||

| US912828YU85 / United States Treasury Note/Bond | 11,95 | -87,49 | 0,0634 | -0,4253 | |||||

| US3140QEBM36 / Federal National Mortgage Association | 11,87 | -3,42 | 0,0629 | 0,0001 | |||||

| US785592AM87 / Sabine Pass Liquefaction Llc Note Callable M/w Bond | 11,86 | -61,85 | 0,0629 | -0,0961 | |||||

| US3140QELS95 / Federal National Mortgage Association | 11,85 | -3,39 | 0,0628 | 0,0001 | |||||

| US716973AG71 / Pfizer Investment Enterprises Pte Ltd | 11,84 | -27,96 | 0,0628 | -0,0213 | |||||

| US26884LAM19 / EQT CORP 3.125% 05/15/2026 144A | 11,82 | 80,51 | 0,0627 | 0,0292 | |||||

| US26884LAQ23 / EQT Corp. | 11,79 | 19,75 | 0,0625 | 0,0121 | |||||

| US31418DXJ61 / FN MA4280 | 11,77 | -2,61 | 0,0624 | 0,0006 | |||||

| US3140QNE577 / Uniform Mortgage-Backed Securities | 11,77 | -2,86 | 0,0624 | 0,0004 | |||||

| US404119BQ19 / Hca Healthcare, Bond | 11,77 | -0,05 | 0,0624 | 0,0022 | |||||

| US22822VAT89 / CROWN CASTLE INTL CORP SR UNSECURED 01/31 2.25 | 11,77 | -13,90 | 0,0624 | -0,0075 | |||||

| US3140QEBK79 / Federal National Mortgage Association | 11,75 | -2,93 | 0,0623 | 0,0004 | |||||

| US3140QGKA45 / Fannie Mae Pool | 11,73 | -4,32 | 0,0622 | -0,0005 | |||||

| US05523RAD98 / BAE Systems PLC | 11,73 | -14,57 | 0,0622 | -0,0080 | |||||

| US92564RAL96 / VICI Properties LP / VICI Note Co., Inc. | 11,72 | 0,43 | 0,0621 | 0,0024 | |||||

| EQT / EQT Corporation | 11,65 | 80,76 | 0,0618 | 0,0288 | |||||

| EQT / EQT Corporation | 11,65 | 80,76 | 0,0618 | 0,0288 | |||||

| EQT / EQT Corporation | 11,65 | 80,76 | 0,0618 | 0,0288 | |||||

| US82666TAC36 / Signal Peak CLO 1 LTD | 11,60 | -0,09 | 0,0615 | 0,0021 | |||||

| PRET 2024-NPL1 LLC / ABS-O (US69381VAA35) | 11,58 | -15,62 | 0,0614 | -0,0088 | |||||

| PRET 2024-NPL1 LLC / ABS-O (US69381VAA35) | 11,58 | -15,62 | 0,0614 | -0,0088 | |||||

| PRET 2024-NPL1 LLC / ABS-O (US69381VAA35) | 11,58 | -15,62 | 0,0614 | -0,0088 | |||||

| US3140QEBL52 / Federal National Mortgage Association | 11,58 | -2,92 | 0,0614 | 0,0004 | |||||

| US366651AG25 / Gartner Inc | 11,58 | 0,0614 | 0,0614 | ||||||

| US00206RDJ86 / AT&T Inc | 11,58 | 16,28 | 0,0614 | 0,0105 | |||||

| US38141GXR00 / Goldman Sachs Group Inc/The | 11,54 | 0,29 | 0,0612 | 0,0023 | |||||

| Angel Oak Mortgage Trust 2023-7 / ABS-MBS (US03466DAA00) | 11,54 | -1,70 | 0,0612 | 0,0011 | |||||

| Angel Oak Mortgage Trust 2023-7 / ABS-MBS (US03466DAA00) | 11,54 | -1,70 | 0,0612 | 0,0011 | |||||

| Angel Oak Mortgage Trust 2023-7 / ABS-MBS (US03466DAA00) | 11,54 | -1,70 | 0,0612 | 0,0011 | |||||

| US3140X83A30 / Fannie Mae Pool | 11,51 | -4,21 | 0,0610 | -0,0004 | |||||

| US3132DQGA85 / Freddie Mac Pool | 11,42 | -5,02 | 0,0605 | -0,0010 | |||||

| US3140QM4E16 / Fannie Mae Pool | 11,41 | -3,19 | 0,0605 | 0,0002 | |||||

| US893574AH62 / Transcontinental Gas Pipe Line Co LLC | 11,32 | -0,82 | 0,0600 | 0,0016 | |||||

| US3133KRCJ14 / Freddie Mac Pool | 11,32 | -2,82 | 0,0600 | 0,0004 | |||||

| US874060AX48 / Takeda Pharmaceutical Co Ltd | 11,29 | 20,27 | 0,0599 | 0,0118 | |||||

| US92564RAJ41 / VICI Properties, LP/VICI Note Company, Inc. | 11,29 | 0,13 | 0,0598 | 0,0022 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 11,27 | -7,22 | 0,0597 | -0,0024 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 11,27 | -7,22 | 0,0597 | -0,0024 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 11,27 | -7,22 | 0,0597 | -0,0024 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 11,26 | 52,82 | 0,0597 | 0,0220 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 11,26 | 52,82 | 0,0597 | 0,0220 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 11,26 | 52,82 | 0,0597 | 0,0220 | |||||

| US06745CAA80 / BARC_22-RPL1 | 11,20 | -5,92 | 0,0594 | -0,0015 | |||||

| US3140XHHS99 / Fannie Mae Pool | 11,19 | -2,64 | 0,0593 | 0,0005 | |||||

| US03332PAA57 / Anchorage Capital Clo 17 Ltd | 11,15 | 0,28 | 0,0591 | 0,0022 | |||||

| US3140X7CB30 / FNMA POOL FM3665 FN 09/49 FIXED VAR | 11,12 | -3,41 | 0,0590 | 0,0001 | |||||

| US92564RAD70 / VICI PROPERTIES / NOTE 3.75% 02/15/2027 144A | 11,09 | 1,11 | 0,0588 | 0,0027 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AB13) | 11,09 | -1,46 | 0,0588 | 0,0012 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AB13) | 11,09 | -1,46 | 0,0588 | 0,0012 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AB13) | 11,09 | -1,46 | 0,0588 | 0,0012 | |||||

| US718286CP01 / Philippine Government International Bond | 11,06 | -0,48 | 0,0586 | 0,0018 | |||||

| US345397D674 / FORD MOTOR CREDIT CO LLC SR UNSEC 7.122% 11-07-33 | 11,01 | 0,68 | 0,0584 | 0,0024 | |||||

| US3140QEP895 / Fannie Mae Pool | 10,99 | -5,23 | 0,0583 | -0,0011 | |||||

| US05875CAB00 / TWIN RIVER WORLDWIDE HLDGS INC | 10,96 | 0,84 | 0,0581 | 0,0025 | |||||

| US3132DM7F66 / Uniform Mortgage-Backed Securities | 10,96 | -3,04 | 0,0581 | 0,0003 | |||||

| US37046US851 / General Motors Financial Co Inc | 10,95 | 0,0581 | 0,0581 | ||||||

| US37046US851 / General Motors Financial Co Inc | 10,95 | 0,0581 | 0,0581 | ||||||

| US37046US851 / General Motors Financial Co Inc | 10,95 | 0,0581 | 0,0581 | ||||||

| US072024NV09 / BAY AREA CA TOLL AUTH TOLL BRIDGE REVENUE | 10,94 | -1,73 | 0,0580 | 0,0011 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 10,94 | -4,31 | 0,0580 | -0,0005 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 10,94 | -4,31 | 0,0580 | -0,0005 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 10,94 | -4,31 | 0,0580 | -0,0005 | |||||

| US3140XFRT07 / Uniform Mortgage-Backed Securities | 10,92 | -3,08 | 0,0579 | 0,0003 | |||||

| US375558AX11 / Gilead Sciences Inc | 10,92 | -3,11 | 0,0579 | 0,0002 | |||||

| US3140QNNU23 / Fannie Mae Pool | 10,92 | -2,84 | 0,0579 | 0,0004 | |||||

| US404119BS74 / Hca Inc Bond | 10,89 | 28,51 | 0,0577 | 0,0144 | |||||

| US404280DR76 / HSBC Holdings PLC | 10,89 | 97,82 | 0,0577 | 0,0259 | |||||

| US64034QAC24 / Nelnet Student Loan Trust | 10,82 | 0,07 | 0,0574 | 0,0021 | |||||

| US03674XAS53 / ANTERO RESOURCES CORP 5.375% 03/01/2030 144A | 10,80 | 0,77 | 0,0572 | 0,0024 | |||||

| US3140XLEB04 / Fannie Mae Pool | 10,79 | -4,04 | 0,0572 | -0,0003 | |||||

| US3140XFGB18 / Fannie Mae Pool | 10,79 | -2,91 | 0,0572 | 0,0004 | |||||

| PRET 2024-NPL2 LLC / ABS-O (US74142BAA70) | 10,75 | -6,52 | 0,0570 | -0,0018 | |||||

| PRET 2024-NPL2 LLC / ABS-O (US74142BAA70) | 10,75 | -6,52 | 0,0570 | -0,0018 | |||||

| PRET 2024-NPL2 LLC / ABS-O (US74142BAA70) | 10,75 | -6,52 | 0,0570 | -0,0018 | |||||

| US38141GXM13 / Goldman Sachs Group Inc/The | 10,74 | 72,70 | 0,0569 | 0,0251 | |||||

| US718286CC97 / Philippine Government International Bond | 10,67 | -0,17 | 0,0566 | 0,0019 | |||||

| US30328DAA19 / FS Rialto 2022-FL6 Issuer LLC | 10,65 | -0,29 | 0,0565 | 0,0018 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 10,65 | -0,78 | 0,0564 | 0,0016 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 10,65 | -0,78 | 0,0564 | 0,0016 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 10,65 | -0,78 | 0,0564 | 0,0016 | |||||

| US87612GAA94 / Targa Resources Corp | 10,57 | -1,37 | 0,0560 | 0,0012 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AC95) | 10,52 | -0,34 | 0,0558 | 0,0018 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AC95) | 10,52 | -0,34 | 0,0558 | 0,0018 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AC95) | 10,52 | -0,34 | 0,0558 | 0,0018 | |||||

| US05526DBK00 / BAT Capital Corp. | 10,51 | 7,65 | 0,0557 | 0,0058 | |||||

| US3140QMH804 / Fannie Mae Pool | 10,50 | -2,98 | 0,0556 | 0,0003 | |||||

| US3140QSA764 / Fannie Mae Pool | 10,46 | -2,72 | 0,0555 | 0,0005 | |||||

| US92343VCQ59 / Verizon Communications Inc | 10,41 | 172,42 | 0,0552 | 0,0357 | |||||

| US3133KQWT92 / Freddie Mac Pool | 10,41 | -5,37 | 0,0552 | -0,0011 | |||||

| US6174468U61 / MORGAN STANLEY 1.794%/VAR 02/13/2032 | 10,40 | -49,25 | 0,0552 | -0,0497 | |||||

| US61744YAP34 / Morgan Stanley | 10,39 | 10,47 | 0,0551 | 0,0066 | |||||

| US172967NG21 / Citigroup Inc | 10,36 | -27,92 | 0,0549 | -0,0186 | |||||

| US3140QGJ992 / Fannie Mae Pool | 10,28 | -3,91 | 0,0545 | -0,0002 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 10,22 | -1,10 | 0,0542 | 0,0013 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 10,22 | -1,10 | 0,0542 | 0,0013 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 10,22 | -1,10 | 0,0542 | 0,0013 | |||||

| Port of Beaumont Navigation District / DBT (US73360CAS35) | 10,21 | 0,0541 | 0,0541 | ||||||

| Port of Beaumont Navigation District / DBT (US73360CAS35) | 10,21 | 0,0541 | 0,0541 | ||||||

| Port of Beaumont Navigation District / DBT (US73360CAS35) | 10,21 | 0,0541 | 0,0541 | ||||||

| US378272AY43 / Glencore Funding LLC 2.50%, Due 09/01/2030 | 10,21 | 37,37 | 0,0541 | 0,0112 | |||||

| US68389XBF15 / Oracle Corp. | 10,21 | -14,59 | 0,0541 | -0,0070 | |||||

| US912810QE10 / United States Treas Bds Bond | 10,18 | -1,95 | 0,0540 | 0,0009 | |||||

| LESSEN INC SR VR 144A NT 28 / DBT (000000000) | 10,15 | 0,0538 | 0,0538 | ||||||

| LESSEN INC SR VR 144A NT 28 / DBT (000000000) | 10,15 | 0,0538 | 0,0538 | ||||||

| LESSEN INC SR VR 144A NT 28 / DBT (000000000) | 10,15 | 0,0538 | 0,0538 | ||||||

| US361841AK54 / GLP Capital LP / GLP Financing II Inc | 10,13 | 23,16 | 0,0537 | 0,0116 | |||||

| US46647PBU93 / JPMorgan Chase & Co | 10,10 | 239,01 | 0,0535 | 0,0363 | |||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 10,10 | 0,0535 | 0,0535 | ||||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 10,10 | 0,0535 | 0,0535 | ||||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 10,10 | 0,0535 | 0,0535 | ||||||

| US31418DTP77 / Fannie Mae Pool | 10,09 | -2,25 | 0,0535 | 0,0007 | |||||

| US36179XQR07 / Ginnie Mae II Pool | 10,09 | -4,54 | 0,0535 | -0,0006 | |||||

| US76243NAA46 / RREF 2012 LT1 LLC | 10,08 | -0,11 | 0,0534 | 0,0018 | |||||

| US64035GAC33 / Nelnet Student Loan Trust 2021-C | 10,07 | -0,02 | 0,0534 | 0,0019 | |||||

| BlueMountain CLO 2018-3 Ltd / ABS-CBDO (US09630AAS50) | 10,04 | 0,26 | 0,0532 | 0,0020 | |||||

| BlueMountain CLO 2018-3 Ltd / ABS-CBDO (US09630AAS50) | 10,04 | 0,26 | 0,0532 | 0,0020 | |||||

| BlueMountain CLO 2018-3 Ltd / ABS-CBDO (US09630AAS50) | 10,04 | 0,26 | 0,0532 | 0,0020 | |||||

| PROJECT MONTELENA / DBT (000000000) | 10,03 | 0,0532 | 0,0532 | ||||||

| PROJECT MONTELENA / DBT (000000000) | 10,03 | 0,0532 | 0,0532 | ||||||

| PROJECT MONTELENA / DBT (000000000) | 10,03 | 0,0532 | 0,0532 | ||||||

| US3132DMX756 / Federal Home Loan Mortgage Corp. | 10,03 | -3,52 | 0,0532 | -0,0000 | |||||

| US3140XKHJ20 / Fannie Mae Pool | 9,99 | -3,60 | 0,0530 | -0,0000 | |||||

| US68389XCA19 / Oracle Corp | 9,94 | 23,60 | 0,0527 | 0,0116 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-RTL4 / ABS-MBS (US79584CAA99) | 9,94 | 0,92 | 0,0527 | 0,0023 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-RTL4 / ABS-MBS (US79584CAA99) | 9,94 | 0,92 | 0,0527 | 0,0023 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-RTL4 / ABS-MBS (US79584CAA99) | 9,94 | 0,92 | 0,0527 | 0,0023 | |||||

| US3132DMUR41 / Freddie Mac Pool | 9,92 | -3,95 | 0,0526 | -0,0002 | |||||

| US466330AN72 / JP Morgan Chase Commercial Mortgage Securities Corp | 9,91 | 0,11 | 0,0526 | 0,0019 | |||||

| US3140XBG953 / Fannie Mae Pool | 9,91 | -4,64 | 0,0525 | -0,0006 | |||||

| Rogers Communications Inc / DBT (US775109DF56) | 9,89 | -14,67 | 0,0524 | -0,0069 | |||||

| Rogers Communications Inc / DBT (US775109DF56) | 9,89 | -14,67 | 0,0524 | -0,0069 | |||||

| Rogers Communications Inc / DBT (US775109DF56) | 9,89 | -14,67 | 0,0524 | -0,0069 | |||||

| US161175BV50 / Charter Communications Operating LLC / Charter Communications Operating Capital | 9,88 | 22,41 | 0,0524 | 0,0111 | |||||

| US3132DQQ587 / Freddie Mac Pool | 9,87 | -2,30 | 0,0523 | 0,0007 | |||||

| US00249XAA63 / ADMT 2023-NQM5 A1 7.049% 11/25/2068 144A | 9,87 | -2,62 | 0,0523 | 0,0005 | |||||

| US85207UAJ43 / Sprint Corp | 9,79 | -57,65 | 0,0519 | -0,0663 | |||||

| US17327CAQ69 / Citigroup Inc | 9,78 | -50,46 | 0,0519 | -0,0491 | |||||

| US12660TAA07 / CSMC 2022 LION | 9,78 | 1,13 | 0,0519 | 0,0024 | |||||

| US3133KPKT48 / Freddie Mac Pool | 9,78 | -4,72 | 0,0518 | -0,0007 | |||||

| US22550L2H39 / Credit Suisse AG/New York NY | 9,78 | 0,42 | 0,0518 | 0,0020 | |||||

| US3133KNDA81 / Federal Home Loan Mortgage Corp. | 9,75 | -3,82 | 0,0517 | -0,0002 | |||||

| US12658XAC11 / Credit Suisse Mortgage Capital Certificates | 9,73 | 0,03 | 0,0516 | 0,0018 | |||||

| US43789KAA07 / Homeward Opportunities Fund Trust 2022-1 | 9,73 | -2,91 | 0,0516 | 0,0003 | |||||

| US3132DV6T70 / Freddie Mac Pool | 9,69 | -2,11 | 0,0514 | 0,0007 | |||||

| US3140QSFD86 / Fannie Mae Pool | 9,65 | -2,29 | 0,0512 | 0,0006 | |||||

| US62912XAF15 / NGPL PipeCo LLC | 9,63 | 0,26 | 0,0511 | 0,0019 | |||||

| BX Commercial Mortgage Trust 2024-XL4 / ABS-MBS (US05611VAG68) | 9,62 | -1,76 | 0,0510 | 0,0009 | |||||

| BX Commercial Mortgage Trust 2024-XL4 / ABS-MBS (US05611VAG68) | 9,62 | -1,76 | 0,0510 | 0,0009 | |||||

| BX Commercial Mortgage Trust 2024-XL4 / ABS-MBS (US05611VAG68) | 9,62 | -1,76 | 0,0510 | 0,0009 | |||||

| US3140QNEK42 / Uniform Mortgage-Backed Securities | 9,60 | -2,29 | 0,0509 | 0,0006 | |||||

| US92343VFR06 / Verizon Communications Inc | 9,57 | -0,30 | 0,0508 | 0,0016 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 9,55 | -42,70 | 0,0507 | -0,0346 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 9,55 | -42,70 | 0,0507 | -0,0346 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 9,55 | -42,70 | 0,0507 | -0,0346 | |||||

| US77341DAA54 / Rockford Tower CLO 2017-3 Ltd | 9,55 | -17,82 | 0,0506 | -0,0088 | |||||

| US12516WAA99 / CENT Trust 2023-CITY | 9,53 | -0,49 | 0,0505 | 0,0015 | |||||

| MCM 2021-VFN1: CERT CMO/WHOLE / ABS-MBS (000000000) | 9,53 | 0,0505 | 0,0505 | ||||||

| MCM 2021-VFN1: CERT CMO/WHOLE / ABS-MBS (000000000) | 9,53 | 0,0505 | 0,0505 | ||||||

| MCM 2021-VFN1: CERT CMO/WHOLE / ABS-MBS (000000000) | 9,53 | 0,0505 | 0,0505 | ||||||

| CML LAKE TAHOE RESORT HOTEL 10-26 / LON (000000000) | 9,52 | 0,0505 | 0,0505 | ||||||

| CML LAKE TAHOE RESORT HOTEL 10-26 / LON (000000000) | 9,52 | 0,0505 | 0,0505 | ||||||

| CML LAKE TAHOE RESORT HOTEL 10-26 / LON (000000000) | 9,52 | 0,0505 | 0,0505 | ||||||

| US78108YAL65 / RR 1 LLC | 9,51 | 0,12 | 0,0504 | 0,0018 | |||||

| US455780CQ75 / Indonesia Government International Bond | 9,45 | -0,91 | 0,0501 | 0,0013 | |||||

| CONTINUUM ENERGY PTE LTD / DBT (000000000) | 9,41 | 0,0499 | 0,0499 | ||||||

| CONTINUUM ENERGY PTE LTD / DBT (000000000) | 9,41 | 0,0499 | 0,0499 | ||||||

| CONTINUUM ENERGY PTE LTD / DBT (000000000) | 9,41 | 0,0499 | 0,0499 | ||||||

| US172967MY46 / Citigroup Inc | 9,41 | 0,0499 | 0,0499 | ||||||

| US37045XAS53 / General Motors Financial Co., Inc. | 9,32 | -11,31 | 0,0494 | -0,0043 | |||||

| US31418DTQ50 / Fannie Mae Pool | 9,31 | -2,50 | 0,0494 | 0,0005 | |||||

| US912810QK79 / United States Treas Bds Bond | 9,29 | -1,74 | 0,0493 | 0,0009 | |||||

| US3140XGPU70 / Fannie Mae Pool | 9,29 | -3,06 | 0,0493 | 0,0002 | |||||

| BXMT / Blackstone Mortgage Trust, Inc. | 0,53 | 9,29 | 0,0492 | 0,0492 | |||||

| US95000U3E14 / Wells Fargo & Co. | 9,27 | -37,71 | 0,0492 | -0,0270 | |||||

| US37046US851 / General Motors Financial Co Inc | 9,25 | 0,0490 | 0,0490 | ||||||

| US37046US851 / General Motors Financial Co Inc | 9,25 | 0,0490 | 0,0490 | ||||||

| US37046US851 / General Motors Financial Co Inc | 9,25 | 0,0490 | 0,0490 | ||||||

| US193051AQ27 / Cold Storage Trust 2020-ICE5 | 9,24 | -0,16 | 0,0490 | 0,0016 | |||||

| US3133L8GG48 / Freddie Mac Pool | 9,19 | -4,17 | 0,0487 | -0,0003 | |||||

| US715638DT64 / Peruvian Government International Bond | 9,19 | -1,72 | 0,0487 | 0,0009 | |||||

| US26444HAN17 / DUKE ENERGY FLORIDA LLC | 9,18 | 19,25 | 0,0487 | 0,0093 | |||||

| US465979AA00 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2022-NXSS | 9,17 | 7,39 | 0,0486 | 0,0049 | |||||

| US281020AN70 / EDISON INTERNATIONAL SR UNSECURED 06/27 5.75 | 9,16 | -0,43 | 0,0486 | 0,0015 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 9,14 | -5,62 | 0,0485 | -0,0011 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 9,14 | -5,62 | 0,0485 | -0,0011 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 9,14 | -5,62 | 0,0485 | -0,0011 | |||||

| US30303M8R66 / META PLATFORMS INC | 9,11 | 54,84 | 0,0483 | 0,0182 | |||||

| US20030NDW83 / Comcast Corp | 9,09 | -18,95 | 0,0482 | -0,0092 | |||||

| US3132D9B869 / Freddie Mac Pool | 9,09 | -4,80 | 0,0482 | -0,0006 | |||||

| X / United States Steel Corporation | 0,24 | 772,54 | 9,08 | 709,18 | 0,0481 | 0,0424 | |||

| US172967NU15 / CITIGROUP INC REGD V/R 4.91000000 | 8,99 | 67,72 | 0,0477 | 0,0202 | |||||

| US3140XFGW54 / Fannie Mae Pool | 8,93 | -2,94 | 0,0473 | 0,0003 | |||||

| US054980AA58 / BDS 2022-FL11 LLC | 8,92 | -0,07 | 0,0473 | 0,0016 | |||||

| US03027XBS80 / American Tower Corp | 8,92 | -0,03 | 0,0473 | 0,0016 | |||||

| Octagon Investment Partners 39 Ltd / ABS-CBDO (US67592CAN65) | 8,92 | 0,10 | 0,0473 | 0,0017 | |||||

| Octagon Investment Partners 39 Ltd / ABS-CBDO (US67592CAN65) | 8,92 | 0,10 | 0,0473 | 0,0017 | |||||

| Octagon Investment Partners 39 Ltd / ABS-CBDO (US67592CAN65) | 8,92 | 0,10 | 0,0473 | 0,0017 | |||||

| US61747YFH36 / Morgan Stanley | 8,91 | -30,96 | 0,0472 | -0,0188 | |||||

| College Ave Student Loans Trust 2024-A / ABS-O (US19424RAB42) | 8,91 | -1,80 | 0,0472 | 0,0008 | |||||

| College Ave Student Loans Trust 2024-A / ABS-O (US19424RAB42) | 8,91 | -1,80 | 0,0472 | 0,0008 | |||||

| College Ave Student Loans Trust 2024-A / ABS-O (US19424RAB42) | 8,91 | -1,80 | 0,0472 | 0,0008 | |||||

| US03027XBG43 / American Tower Corp | 8,90 | 77,38 | 0,0472 | 0,0215 | |||||

| US548661DU82 / LOWE S COS INC SR UNSECURED 04/30 4.5 | 8,85 | -0,75 | 0,0469 | 0,0013 | |||||

| ARES Commercial Mortgage Trust 2024-IND / ABS-MBS (US03990DAA54) | 8,84 | 0,0469 | 0,0469 | ||||||

| ARES Commercial Mortgage Trust 2024-IND / ABS-MBS (US03990DAA54) | 8,84 | 0,0469 | 0,0469 | ||||||

| ARES Commercial Mortgage Trust 2024-IND / ABS-MBS (US03990DAA54) | 8,84 | 0,0469 | 0,0469 | ||||||

| US11135FBK66 / BROADCOM INC 3.419% 04/15/2033 144A | 8,81 | 357,05 | 0,0467 | 0,0369 | |||||

| US3140XFGV71 / Fannie Mae Pool | 8,79 | -3,02 | 0,0466 | 0,0002 | |||||

| US31418DUF76 / FANNIE MAE POOL FN MA4181 | 8,79 | -2,17 | 0,0466 | 0,0006 | |||||

| CML Trigrams / LON (000000000) | 8,78 | 0,0465 | 0,0465 | ||||||

| CML Trigrams / LON (000000000) | 8,78 | 0,0465 | 0,0465 | ||||||

| CML Trigrams / LON (000000000) | 8,78 | 0,0465 | 0,0465 | ||||||

| SPLT_23-1 / ABS-MBS (000000000) | 8,74 | 0,0464 | 0,0464 | ||||||

| SPLT_23-1 / ABS-MBS (000000000) | 8,74 | 0,0464 | 0,0464 | ||||||

| SPLT_23-1 / ABS-MBS (000000000) | 8,74 | 0,0464 | 0,0464 | ||||||

| US06051GJF72 / Bank of America Corp. | 8,69 | 349,77 | 0,0461 | 0,0361 | |||||

| US3140XGPQ68 / FN FS1330 | 8,69 | -4,16 | 0,0461 | -0,0003 | |||||

| US03881JAA43 / Arbor Realty Commercial Real Estate Notes 2022-FL2 Ltd | 8,69 | 0,07 | 0,0461 | 0,0017 | |||||

| US009733AA45 / Ajax Mortgage Loan Trust 2021-C | 8,69 | -7,90 | 0,0461 | -0,0022 | |||||

| US68389XCE31 / Oracle Corp | 8,64 | 0,0458 | 0,0458 | ||||||

| US009723AC11 / Ajax Mortgage Loan Trust 2021-D | 8,63 | 4,80 | 0,0457 | 0,0036 | |||||

| US449652AA40 / ILPT Commercial Mortgage Trust 2022-LPF2 | 8,63 | 2,22 | 0,0457 | 0,0026 | |||||

| US12434AAC27 / BX Commercial Mortgage Trust 2021-NWM | 8,62 | 0,06 | 0,0457 | 0,0016 | |||||

| US694308KK29 / Pacific Gas and Electric Co | 8,61 | 94,60 | 0,0456 | 0,0228 | |||||

| US3133L8JQ92 / Freddie Mac Pool | 8,60 | -4,35 | 0,0456 | -0,0004 | |||||

| US760942BA98 / Uruguay Government International Bond | 8,58 | -2,43 | 0,0455 | 0,0005 | |||||

| US761713BB19 / Reynolds American Inc | 8,57 | 81,36 | 0,0454 | 0,0213 | |||||

| US893574AM57 / Transcontinental Gas Pipe Line Co. LLC | 8,55 | -20,74 | 0,0454 | -0,0099 | |||||

| US03027XBW92 / American Tower Corp | 8,53 | 0,0452 | 0,0452 | ||||||

| XS2459127739 / Cassia 2022-1 SRL | 8,52 | -0,14 | 0,0452 | 0,0015 | |||||

| FWD Group Holdings Ltd / DBT (US30332TAB89) | 8,49 | -12,06 | 0,0450 | -0,0044 | |||||

| FWD Group Holdings Ltd / DBT (US30332TAB89) | 8,49 | -12,06 | 0,0450 | -0,0044 | |||||

| FWD Group Holdings Ltd / DBT (US30332TAB89) | 8,49 | -12,06 | 0,0450 | -0,0044 | |||||

| US009733AC01 / Ajax Mortgage Loan Trust 2021-C | 8,48 | 7,78 | 0,0449 | 0,0047 | |||||

| US677415CU30 / Ohio Power Co., Series R | 8,46 | -4,82 | 0,0449 | -0,0006 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 8,44 | 0,0447 | 0,0447 | ||||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 8,44 | 0,0447 | 0,0447 | ||||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 8,44 | 0,0447 | 0,0447 | ||||||

| US95763PND95 / Western Mortgage Reference Notes Series 2021-CL2 | 8,43 | -0,28 | 0,0447 | 0,0014 | |||||

| SONDER HOLDINGS, INC. / DBT (000000000) | 8,40 | 0,0445 | 0,0445 | ||||||

| SONDER HOLDINGS, INC. / DBT (000000000) | 8,40 | 0,0445 | 0,0445 | ||||||

| SONDER HOLDINGS, INC. / DBT (000000000) | 8,40 | 0,0445 | 0,0445 | ||||||

| US3132DVLU79 / Freddie Mac Pool | 8,38 | -3,51 | 0,0444 | 0,0000 | |||||

| US281020AW79 / EDISON INTERNATIONAL | 8,37 | -18,88 | 0,0444 | -0,0084 | |||||

| US78449VAB27 / SMB Private Education Loan Trust 2020-PT-A | 8,37 | -5,98 | 0,0444 | -0,0012 | |||||

| US69047QAD43 / Ovintiv Inc | 8,36 | 0,0443 | 0,0443 | ||||||

| US3140QFNP04 / Federal National Mortgage Association | 8,36 | -3,44 | 0,0443 | 0,0000 | |||||

| US52608JAA34 / Lendmark Funding Trust 2022-1 | 8,34 | 0,25 | 0,0442 | 0,0017 | |||||

| COMM 2024-WCL1 MORTGAGE TRUST / ABS-MBS (US20047DAA28) | 8,33 | 0,0442 | 0,0442 | ||||||

| COMM 2024-WCL1 MORTGAGE TRUST / ABS-MBS (US20047DAA28) | 8,33 | 0,0442 | 0,0442 | ||||||

| COMM 2024-WCL1 MORTGAGE TRUST / ABS-MBS (US20047DAA28) | 8,33 | 0,0442 | 0,0442 | ||||||

| US716973AE24 / Pfizer Investment Enterprises Pte Ltd | 8,32 | -43,30 | 0,0441 | -0,0310 | |||||

| US3133BUJD01 / Freddie Mac Pool | 8,29 | -3,02 | 0,0440 | 0,0002 | |||||

| US92258DAA54 / Velocity Commercial Capital Loan Trust 2021-4 | 8,27 | -0,82 | 0,0438 | 0,0012 | |||||

| US77340GAL59 / Rockford Tower CLO 2017-2 Ltd | 8,27 | 0,02 | 0,0438 | 0,0016 | |||||

| US172967MS77 / Citigroup Inc | 8,26 | 66,70 | 0,0438 | 0,0172 | |||||

| US133434AC43 / Cameron LNG LLC | 8,24 | -2,14 | 0,0437 | 0,0006 | |||||

| US92343VEA89 / Verizon Communications Inc | 8,22 | 535,16 | 0,0436 | 0,0370 | |||||

| US12547DAA46 / CIFC Funding Ltd | 8,22 | 27,33 | 0,0436 | 0,0106 | |||||

| US05526DBF15 / BAT Capital Corp | 8,21 | 85,16 | 0,0435 | 0,0208 | |||||

| AMT / American Tower Corporation | 8,18 | 1,33 | 0,0434 | 0,0021 | |||||

| US05610DAA00 / BX_23-DELC | 8,18 | -0,99 | 0,0434 | 0,0011 | |||||

| US3140QM3K84 / Fannie Mae Pool | 8,18 | -2,63 | 0,0433 | 0,0004 | |||||

| US3132CWTB09 / Freddie Mac Pool | 8,16 | -5,07 | 0,0432 | -0,0007 | |||||

| US724479AP57 / Pitney Bowes Inc | 8,14 | 3,45 | 0,0431 | 0,0029 | |||||

| US161175CA05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 8,07 | -1,39 | 0,0428 | 0,0009 | |||||

| US40443NAC48 / Spectacle Gary Holdings LLC 2021 Term Loan B | 8,07 | -1,65 | 0,0428 | 0,0008 | |||||

| US009703AB57 / AJAX Mortgage Loan Trust | 8,05 | 1,03 | 0,0427 | 0,0019 | |||||

| US92564RAH84 / VICI PROPERTIES LP/VICI NOTE CO | 8,03 | 0,19 | 0,0426 | 0,0016 | |||||

| Florida Development Finance Corp / DBT (US340618DK07) | 8,02 | 0,0425 | 0,0425 | ||||||

| Florida Development Finance Corp / DBT (US340618DK07) | 8,02 | 0,0425 | 0,0425 | ||||||

| Florida Development Finance Corp / DBT (US340618DK07) | 8,02 | 0,0425 | 0,0425 | ||||||

| US38141GWL49 / GOLDMAN SACHS GROUP INC SR UNSECURED 06/28 VAR | 8,02 | 150,39 | 0,0425 | 0,0240 | |||||

| BX Trust 2024-PAT / ABS-MBS (US05612FAE51) | 8,02 | -0,07 | 0,0425 | 0,0015 | |||||

| BX Trust 2024-PAT / ABS-MBS (US05612FAE51) | 8,02 | -0,07 | 0,0425 | 0,0015 | |||||

| BX Trust 2024-PAT / ABS-MBS (US05612FAE51) | 8,02 | -0,07 | 0,0425 | 0,0015 | |||||

| US92343VFL36 / Verizon Communications Inc | 8,01 | 22,09 | 0,0425 | 0,0061 | |||||

| Foundry JV Holdco LLC / DBT (US350930AB92) | 7,99 | 0,0424 | 0,0424 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AB92) | 7,99 | 0,0424 | 0,0424 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AB92) | 7,99 | 0,0424 | 0,0424 | ||||||

| US193051AA74 / Cold Storage Trust 2020-ICE5 | 7,98 | -0,15 | 0,0423 | 0,0014 | |||||

| Bain Capital Credit CLO 2024-2 Ltd / ABS-CBDO (US056921AA71) | 7,93 | 0,0421 | 0,0421 | ||||||

| Bain Capital Credit CLO 2024-2 Ltd / ABS-CBDO (US056921AA71) | 7,93 | 0,0421 | 0,0421 | ||||||

| Bain Capital Credit CLO 2024-2 Ltd / ABS-CBDO (US056921AA71) | 7,93 | 0,0421 | 0,0421 | ||||||

| US43732VAL09 / HOME PARTNERS OF AMERICA 2021-2 TRUST HPA 2021-2 F | 7,92 | 1,47 | 0,0420 | 0,0021 | |||||

| US04009AAL44 / ARES LII CLO Ltd | 7,91 | -0,03 | 0,0420 | 0,0015 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAL98) | 7,91 | 0,0419 | 0,0419 | ||||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAL98) | 7,91 | 0,0419 | 0,0419 | ||||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAL98) | 7,91 | 0,0419 | 0,0419 | ||||||

| US38143U8H71 / Goldman Sachs Group Inc/The | 7,89 | 4.802,48 | 0,0418 | 0,0410 | |||||

| US38141GYM04 / Goldman Sachs Group Inc/The | 7,89 | 8,35 | 0,0418 | 0,0043 | |||||

| US61747YEH45 / Morgan Stanley | 7,89 | 310,89 | 0,0418 | 0,0320 | |||||

| US3140QFZC62 / Fannie Mae Pool | 7,88 | -4,67 | 0,0418 | -0,0005 | |||||

| US00141YAA38 / AIG CLO, Series 2021-1A, Class A | 7,88 | 0,0418 | 0,0418 | ||||||

| SOLV / Solventum Corporation | 7,88 | 37,29 | 0,0418 | 0,0124 | |||||

| SOLV / Solventum Corporation | 7,88 | 37,29 | 0,0418 | 0,0124 | |||||

| SOLV / Solventum Corporation | 7,88 | 37,29 | 0,0418 | 0,0124 | |||||

| US36270DAA63 / GS Mortgage Securities Corp. Trust, Series 2022-AGSS, Class A | 7,86 | -6,21 | 0,0417 | -0,0012 | |||||

| US455780CW44 / Indonesia Government International Bond | 7,86 | -4,32 | 0,0417 | -0,0004 | |||||

| Gracie Point International Funding 2024-1 LLC / ABS-O (US38410KAA79) | 7,85 | 0,13 | 0,0416 | 0,0015 | |||||

| Gracie Point International Funding 2024-1 LLC / ABS-O (US38410KAA79) | 7,85 | 0,13 | 0,0416 | 0,0015 | |||||

| Gracie Point International Funding 2024-1 LLC / ABS-O (US38410KAA79) | 7,85 | 0,13 | 0,0416 | 0,0015 | |||||

| US10373QBT67 / BP Capital Markets America, Inc. | 7,84 | 301,95 | 0,0416 | 0,0316 | |||||

| US651639AY25 / Newmont Corp | 7,84 | 39,78 | 0,0415 | 0,0129 | |||||

| US95000U3H45 / Wells Fargo & Co | 7,81 | -77,29 | 0,0414 | -0,1345 | |||||

| US00971FAC59 / AJAX Mortgage Loan Trust | 7,81 | -19,19 | 0,0414 | -0,0080 | |||||

| US87612BBG68 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 7,79 | -27,66 | 0,0413 | -0,0138 | |||||

| US755931AA01 / Ready Capital Mortgage Financing LLC, Series 2022-FL10, Class A | 7,77 | -14,54 | 0,0412 | -0,0053 | |||||

| US161636AA34 / Chase Mortgage Finance Trust Series 2007-S6 | 7,76 | -0,09 | 0,0411 | 0,0014 | |||||

| US404119CC14 / HCA Inc | 7,74 | 136,50 | 0,0410 | 0,0230 | |||||

| Anchorage Capital CLO 7 Ltd / ABS-CBDO (US03328TBU88) | 7,68 | 0,0407 | 0,0407 | ||||||

| Anchorage Capital CLO 7 Ltd / ABS-CBDO (US03328TBU88) | 7,68 | 0,0407 | 0,0407 | ||||||

| Anchorage Capital CLO 7 Ltd / ABS-CBDO (US03328TBU88) | 7,68 | 0,0407 | 0,0407 | ||||||

| BANK5 Trust 2024-5YR6 / ABS-MBS (US066043AB64) | 7,68 | 0,0407 | 0,0407 | ||||||

| BANK5 Trust 2024-5YR6 / ABS-MBS (US066043AB64) | 7,68 | 0,0407 | 0,0407 | ||||||

| BANK5 Trust 2024-5YR6 / ABS-MBS (US066043AB64) | 7,68 | 0,0407 | 0,0407 | ||||||

| US3140X8XE23 / Fannie Mae Pool | 7,66 | -3,31 | 0,0406 | 0,0001 | |||||

| US26442CBK99 / Duke Energy Carolinas LLC | 7,66 | -3,65 | 0,0406 | -0,0001 | |||||

| US74333EAG70 / PROGRESS RESIDENTIAL 2021-SFR4 PROG 2021-SFR4 F | 7,65 | 1,06 | 0,0405 | 0,0018 | |||||

| US00120BAA89 / AGL CLO 12 Ltd | 7,65 | 0,01 | 0,0405 | 0,0014 | |||||

| BX Commercial Mortgage Trust 2023-XL3 / ABS-MBS (US12434GAG01) | 7,64 | -0,60 | 0,0405 | 0,0012 | |||||

| BX Commercial Mortgage Trust 2023-XL3 / ABS-MBS (US12434GAG01) | 7,64 | -0,60 | 0,0405 | 0,0012 | |||||

| BX Commercial Mortgage Trust 2023-XL3 / ABS-MBS (US12434GAG01) | 7,64 | -0,60 | 0,0405 | 0,0012 | |||||

| US75513EBZ34 / RAYTHEON TECHNOLOGIES CORP | 7,63 | -0,61 | 0,0405 | 0,0012 | |||||