Grundlæggende statistik

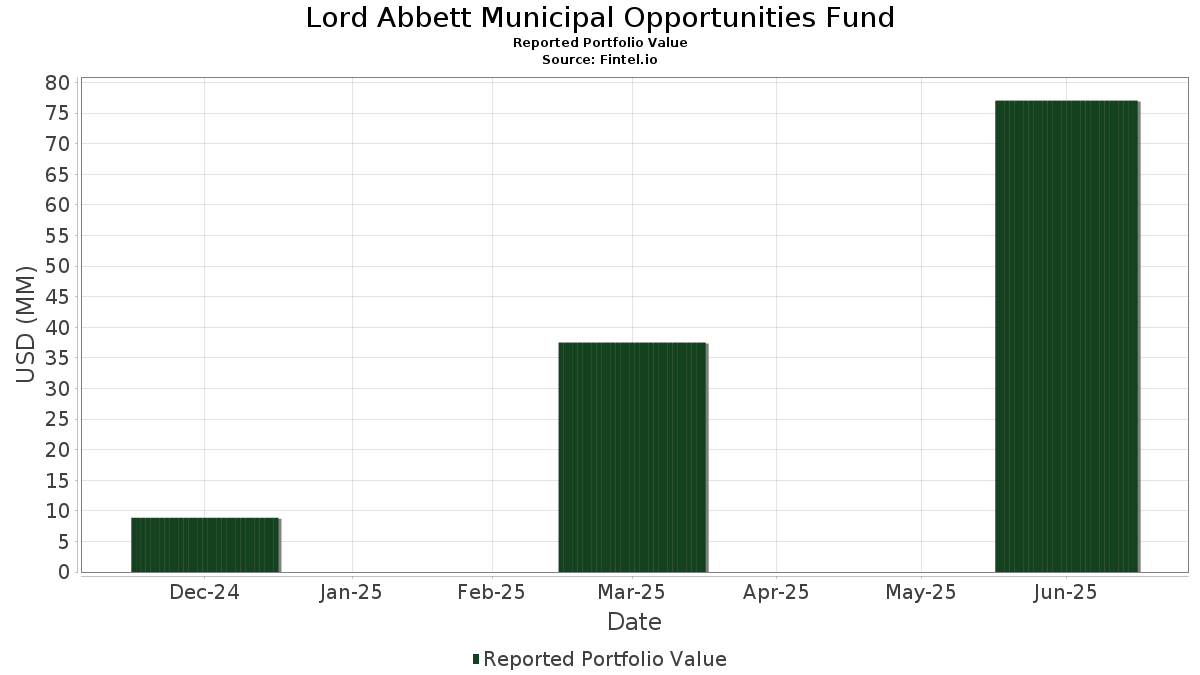

| Porteføljeværdi | $ 77.065.718 |

| Nuværende stillinger | 69 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Lord Abbett Municipal Opportunities Fund har afsløret 69 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 77.065.718 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Lord Abbett Municipal Opportunities Funds største beholdninger er TOBACCO SETTLEMENT FING CORP VA (US:US88880NAU37) , NORMAN OK REGL HOSP AUTH HOSP REVENUE (US:US656178EG11) , Reno (City of), NV (ReTRAC - Reno Transportation Rail Access Corridor), Series 2018 C, Ref. RB (US:US759861EJ20) , County of Washington, Ohio, Hospital Facilities Revenue Bonds, Series 2022 (US:US938154DX60) , and The Industrial Development Authority of the City of Saint Louis, Missouri, Development Financing Revenue Bonds, Ballpark Village Development Project, (US:US85236BAC63) . Lord Abbett Municipal Opportunities Funds nye stillinger omfatter TOBACCO SETTLEMENT FING CORP VA (US:US88880NAU37) , NORMAN OK REGL HOSP AUTH HOSP REVENUE (US:US656178EG11) , Reno (City of), NV (ReTRAC - Reno Transportation Rail Access Corridor), Series 2018 C, Ref. RB (US:US759861EJ20) , County of Washington, Ohio, Hospital Facilities Revenue Bonds, Series 2022 (US:US938154DX60) , and The Industrial Development Authority of the City of Saint Louis, Missouri, Development Financing Revenue Bonds, Ballpark Village Development Project, (US:US85236BAC63) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 4,76 | 7,5652 | 7,5652 | ||

| 3,01 | 4,7740 | 4,7740 | ||

| 4,44 | 7,0464 | 4,7217 | ||

| 1,80 | 2,8561 | 2,8561 | ||

| 1,50 | 2,3762 | 2,3762 | ||

| 1,49 | 2,3680 | 2,3680 | ||

| 1,49 | 2,3603 | 2,3603 | ||

| 1,29 | 2,0487 | 2,0487 | ||

| 1,28 | 2,0282 | 2,0282 | ||

| 1,12 | 1,7800 | 1,7800 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 5,31 | 8,4313 | -8,9345 | ||

| 1,02 | 1,6150 | -5,0606 | ||

| 2,03 | 3,2299 | -3,4456 | ||

| 1,62 | 2,5713 | -2,5953 | ||

| 1,53 | 2,4315 | -2,4382 | ||

| 1,23 | 1,9566 | -2,1721 | ||

| 1,12 | 1,7844 | -1,8952 | ||

| 0,95 | 1,5062 | -1,6801 | ||

| 0,94 | 1,4871 | -1,5944 | ||

| 0,93 | 1,4813 | -1,4544 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-28 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| OKLAHOMA ST TURNPIKE AUTH / DBT (US679111E913) | 5,31 | -2,62 | 8,4313 | -8,9345 | ||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 4,76 | 7,5652 | 7,5652 | |||

| SOUTHEAST ENERGY AUTH COOPERATIVE DIST AL ENERGY SUPPLY REVE / DBT (US84136HBC60) | 4,44 | 508,50 | 7,0464 | 4,7217 | ||

| Haymeadow Metropolitan District No 1 / DBT (US42089FAA03) | 3,65 | 123,99 | 5,7999 | 0,6055 | ||

| Florida Higher Educational Facilities Financing Authority / DBT (US42982GAC24) | 3,01 | 4,7740 | 4,7740 | |||

| US88880NAU37 / TOBACCO SETTLEMENT FING CORP VA | 2,47 | 219,79 | 3,9272 | 1,4642 | ||

| Public Finance Authority / DBT (US74446DAN84) | 2,10 | 95,98 | 3,3279 | -0,0790 | ||

| ORANGE CNTY FL HLTH FACS AUTH REVENUE / DBT (US68450LJQ95) | 2,03 | -2,96 | 3,2299 | -3,4456 | ||

| New Hope Cultural Education Facilities Finance Corp / DBT (US64542PGQ28) | 1,99 | 71,28 | 3,1648 | -0,5415 | ||

| Public Finance Authority / DBT (US74442PD445) | 1,80 | 2,8561 | 2,8561 | |||

| Arizona Industrial Development Authority / DBT (US04052EBV92) | 1,62 | -0,19 | 2,5713 | -2,5953 | ||

| Berks County Municipal Authority/The / DBT (US084538JK44) | 1,54 | 84,69 | 2,4538 | -0,2100 | ||

| US656178EG11 / NORMAN OK REGL HOSP AUTH HOSP REVENUE | 1,53 | 0,13 | 2,4315 | -2,4382 | ||

| Louisiana Public Facilities Authority / DBT (US546399US39) | 1,50 | 2,3762 | 2,3762 | |||

| Hobe-St Lucie Conservancy District / DBT (US434043AC97) | 1,49 | 2,3680 | 2,3680 | |||

| Black Desert Public Infrastructure District / DBT (US09204TAA97) | 1,49 | 2,3603 | 2,3603 | |||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US88035PMF26) | 1,29 | 2,0487 | 2,0487 | |||

| New Jersey Economic Development Authority / DBT (US64578TAB08) | 1,28 | 2,0282 | 2,0282 | |||

| State of Nevada Department of Business & Industry / DBT (US641455AB65) | 1,23 | -4,94 | 1,9566 | -2,1721 | ||

| Mida Mountain Village Public Infrastructure District / DBT (US59561UAD28) | 1,13 | 776,74 | 1,7976 | 1,3863 | ||

| California Public Finance Authority / DBT (US13057GAP46) | 1,12 | -2,69 | 1,7844 | -1,8952 | ||

| US759861EJ20 / Reno (City of), NV (ReTRAC - Reno Transportation Rail Access Corridor), Series 2018 C, Ref. RB | 1,12 | 1,7800 | 1,7800 | |||

| Pennsylvania Higher Educational Facilities Authority / DBT (US70917TTU50) | 1,05 | 1,6726 | 1,6726 | |||

| US938154DX60 / County of Washington, Ohio, Hospital Facilities Revenue Bonds, Series 2022 | 1,04 | 1,6488 | 1,6488 | |||

| City of Chicago IL / DBT (US167486U724) | 1,03 | 1,6400 | 1,6400 | |||

| Public Finance Authority / DBT (US74442PP662) | 1,03 | 1,6334 | 1,6334 | |||

| ORANGE CNTY FL HLTH FACS AUTH REVENUE / DBT (US68450LJQ95) | 1,02 | -51,50 | 1,6150 | -5,0606 | ||

| Development Authority of Cobb County/The / DBT (US190782AS19) | 1,01 | 1,6013 | 1,6013 | |||

| Vail Home Partners Corp / DBT (US91879VAC28) | 1,00 | 1,5917 | 1,5917 | |||

| Illinois Finance Authority / DBT (US45204FN270) | 0,97 | 1,5429 | 1,5429 | |||

| US85236BAC63 / The Industrial Development Authority of the City of Saint Louis, Missouri, Development Financing Revenue Bonds, Ballpark Village Development Project, | 0,97 | 12,53 | 1,5419 | -1,2076 | ||

| Capital Projects Finance Authority/FL / DBT (US14043HAE27) | 0,97 | 1,5406 | 1,5406 | |||

| Mobile County Industrial Development Authority / DBT (US60733UAA97) | 0,96 | 1,5255 | 1,5255 | |||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 0,95 | -5,20 | 1,5062 | -1,6801 | ||

| US57584XPY12 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 0,94 | 1,4886 | 1,4886 | |||

| Grapevine Wash Local District / DBT (US38860EAA64) | 0,94 | -3,21 | 1,4871 | -1,5944 | ||

| US130493BZ15 / CALIFORNIA ST MUNI FIN AUTH COPS | 0,93 | 1,19 | 1,4813 | -1,4544 | ||

| US82170KAG22 / Shelby County Health Educational & Housing Facilities Board | 0,90 | 1,4342 | 1,4342 | |||

| Mida Cormont Public Infrastructure District / DBT (US59561JAB17) | 0,81 | 1,2945 | 1,2945 | |||

| US11861MBM73 / BUCKS CNTY PA INDL DEV AUTH HOSP REVENUE | 0,78 | 1,2356 | 1,2356 | |||

| Cleveland-Cuyahoga County Port Authority / DBT (US18610RCG74) | 0,78 | 164,51 | 1,2318 | 0,2962 | ||

| STC Metropolitan District No 2 / DBT (US85780TBD46) | 0,76 | 1,2075 | 1,2075 | |||

| US165579GJ62 / Chester County Health & Education Facilities | 0,76 | 0,40 | 1,2057 | -1,2032 | ||

| Mida Cormont Public Infrastructure District / DBT (US59561JAA34) | 0,74 | 1,1815 | 1,1815 | |||

| New Hampshire Business Finance Authority / DBT (US63607WBF05) | 0,74 | -3,42 | 1,1690 | -1,2560 | ||

| US82706TAE10 / Silicon Valley Tobacco Securitization Authority (Santa Clara), Series 2007 A, RB | 0,71 | -2,07 | 1,1267 | -1,1820 | ||

| Wolf Creek Infrastructure Financing District No 1 / DBT (US977695AA31) | 0,69 | -1,99 | 1,0972 | -1,1470 | ||

| Public Finance Authority / DBT (US74442PB613) | 0,57 | -0,70 | 0,8979 | -0,9177 | ||

| California Public Finance Authority / DBT (US13057TAA97) | 0,52 | -0,19 | 0,8223 | -0,8289 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97671VCU70) | 0,52 | 0,8183 | 0,8183 | |||

| US546282H726 / Louisiana (State of) Local Government Environmental Facilities & Community Development Authority, Series 2015 A, Ref. RB | 0,49 | 0,7712 | 0,7712 | |||

| Florida Development Finance Corp / DBT (US340618DY01) | 0,48 | -7,57 | 0,7563 | -0,8847 | ||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US88035JZP01) | 0,42 | -2,08 | 0,6747 | -0,7053 | ||

| NEW YORK ST DORM AUTH ST PERSONAL INCOME TAX REVENUE / DBT (US88035JZM79) | 0,41 | -2,59 | 0,6573 | -0,6966 | ||

| MARYLAND ST HLTH & HGR EDUCTNL FACS AUTH REVENUE / DBT (US88035JZR66) | 0,41 | -2,88 | 0,6441 | -0,6848 | ||

| US61543RAS58 / MUNI ORIG ISSUE DISC | 0,37 | 15,09 | 0,5826 | -0,4307 | ||

| US165579GL19 / CHESTER CNTY PA HLTH & EDU FACS AUTH | 0,31 | 0,4970 | 0,4970 | |||

| US649519DD42 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 3, Ref. RB | 0,30 | 0,00 | 0,4768 | -0,4817 | ||

| Public Finance Authority / DBT (US74442PD361) | 0,28 | -0,72 | 0,4381 | -0,4467 | ||

| California Public Finance Authority / DBT (US13057GAQ29) | 0,27 | -3,91 | 0,4296 | -0,4659 | ||

| Florida Development Finance Corp / DBT (US340618DK07) | 0,25 | -6,42 | 0,3951 | -0,4500 | ||

| US45204EUH97 / Illinois Finance Authority Revenue (Benedictine University) | 0,25 | -0,80 | 0,3949 | -0,4018 | ||

| US165579GM91 / Chester County Health & Education Facilities Authority | 0,24 | -4,40 | 0,3800 | -0,4189 | ||

| US04108WCF77 / ARKANSAS ST DEV FIN AUTH INDL DEV REVENUE | 0,22 | -1,82 | 0,3446 | -0,3582 | ||

| US83704EAD67 / SOUTH CAROLINA JOBS-ECON DEV AUTH | 0,21 | -1,87 | 0,3340 | -0,3488 | ||

| US130923BM69 / California (State of) Statewide Finance Authority (Pooled Tobacco Securitization), Series 2006 A, RB | 0,12 | -3,94 | 0,1949 | -0,2106 | ||

| US697528AT45 / Palomar Pomerado Health System, California, Revenue Bonds, Refunding Series 2016 | 0,09 | -3,30 | 0,1411 | -0,1516 | ||

| US74514L4C84 / PUERTO RICO CMWLTH | 0,00 | 0,00 | 0,0020 | -0,0019 | ||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | -0,01 | -0,0189 | -0,0189 |