Grundlæggende statistik

| Porteføljeværdi | $ 241.527.486 |

| Nuværende stillinger | 95 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

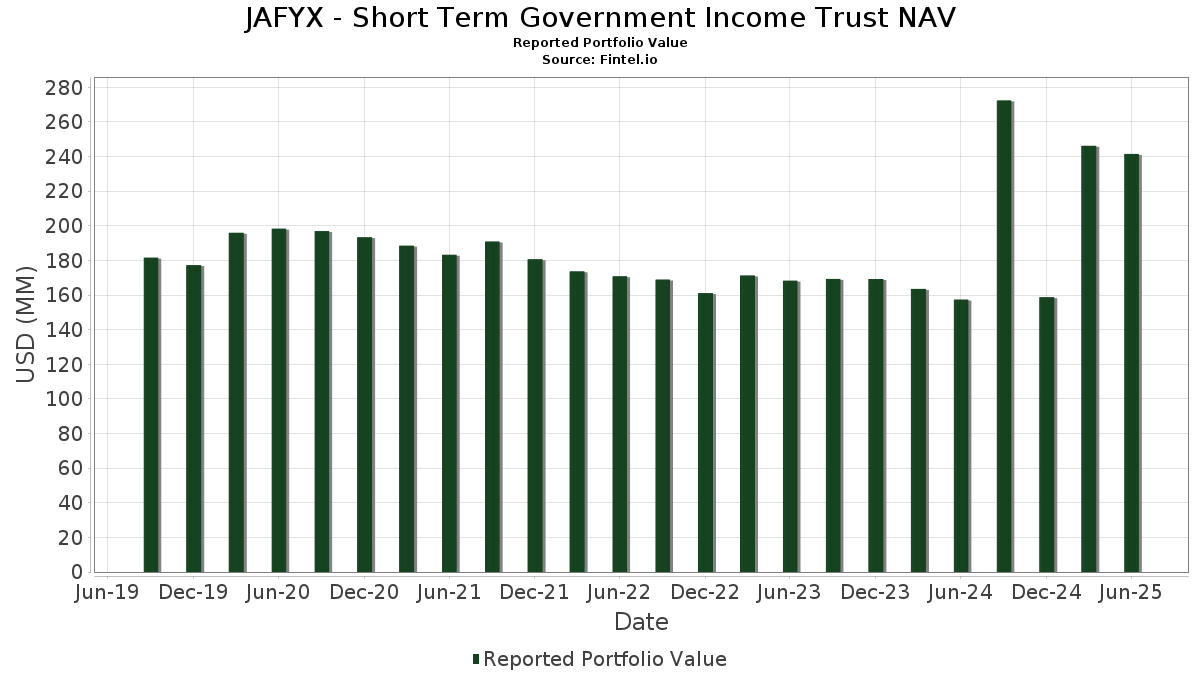

JAFYX - Short Term Government Income Trust NAV har afsløret 95 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 241.527.486 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). JAFYX - Short Term Government Income Trust NAVs største beholdninger er Federal Farm Credit Banks Funding Corp (US:US3133EMMT62) , Federal National Mortgage Association (US:US3135G0Q225) , FHLB 2.75% 3/25/27 (US:US3130ARAB76) , Federal Farm Credit Banks Funding Corp (US:US3133ENHC75) , and Federal Home Loan Mortgage Corp (US:US3134GW4C78) . JAFYX - Short Term Government Income Trust NAVs nye stillinger omfatter Federal Farm Credit Banks Funding Corp (US:US3133EMMT62) , Federal National Mortgage Association (US:US3135G0Q225) , FHLB 2.75% 3/25/27 (US:US3130ARAB76) , Federal Farm Credit Banks Funding Corp (US:US3133ENHC75) , and Federal Home Loan Mortgage Corp (US:US3134GW4C78) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 68,10 | 27,9650 | 27,9650 | ||

| 38,17 | 15,6752 | 15,6752 | ||

| 14,28 | 5,8659 | 5,8659 | ||

| 2,02 | 0,8292 | 0,8292 | ||

| 1,00 | 0,4116 | 0,4116 | ||

| 0,04 | 0,39 | 0,1589 | 0,1589 | |

| 13,46 | 5,5253 | 0,0953 | ||

| 10,01 | 4,1102 | 0,0727 | ||

| 8,72 | 3,5822 | 0,0614 | ||

| 5,72 | 2,3475 | 0,0588 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,51 | 0,2091 | -0,8143 | ||

| 0,35 | 0,1432 | -0,0150 | ||

| 0,43 | 0,1748 | -0,0136 | ||

| 0,44 | 0,1826 | -0,0133 | ||

| 0,38 | 0,1568 | -0,0122 | ||

| 0,53 | 0,2166 | -0,0108 | ||

| 0,29 | 0,1211 | -0,0099 | ||

| 0,39 | 0,1604 | -0,0093 | ||

| 0,35 | 0,1433 | -0,0088 | ||

| 0,32 | 0,1326 | -0,0086 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-28 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UNITED STATES TREASURY NOTE/BO 05/28 3.75 / DBT (US91282CND91) | 68,10 | 27,9650 | 27,9650 | ||||||

| UNITED STATES TREASURY NOTE/BO 04/30 3.875 / DBT (US91282CMZ13) | 38,17 | 15,6752 | 15,6752 | ||||||

| UNITED STATES TREASURY NOTE/BO 04/27 3.75 / DBT (US91282CMY48) | 14,28 | 5,8659 | 5,8659 | ||||||

| AGM.A / Federal Agricultural Mortgage Corporation | 13,46 | 0,22 | 5,5253 | 0,0953 | |||||

| FEDERAL HOME LOAN BANKS BONDS 03/29 4.5 / DBT (US3130B5J666) | 10,01 | 0,27 | 4,1102 | 0,0727 | |||||

| FEDERAL FARM CREDIT BANKS FUND BONDS 03/30 4.33 / DBT (US3133ER7E54) | 9,98 | -0,12 | 4,0984 | 0,0569 | |||||

| AGM.A / Federal Agricultural Mortgage Corporation | 8,72 | 0,21 | 3,5822 | 0,0614 | |||||

| US3133EMMT62 / Federal Farm Credit Banks Funding Corp | 5,72 | 1,03 | 2,3475 | 0,0588 | |||||

| AGM.A / Federal Agricultural Mortgage Corporation | 5,43 | 0,04 | 2,2296 | 0,0346 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 5,01 | 0,62 | 2,0572 | 0,0438 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4,99 | 0,34 | 2,0485 | 0,0380 | |||||

| FEDERAL HOME LOAN BANKS UNSECURED 03/27 4 / DBT (US3130B5K649) | 4,02 | 0,22 | 1,6487 | 0,0285 | |||||

| FEDERAL FARM CREDIT BANKS FUND BONDS 03/31 4.9 / DBT (US3133ETAF40) | 3,51 | 0,52 | 1,4426 | 0,0287 | |||||

| US3135G0Q225 / Federal National Mortgage Association | 3,41 | 0,50 | 1,4007 | 0,0280 | |||||

| FEDERAL FARM CREDIT BANKS FUND BONDS 03/30 4.47 / DBT (US3133ER5U15) | 3,01 | 0,23 | 1,2377 | 0,0211 | |||||

| FEDERAL HOME LOAN BANKS BONDS 02/30 4.5 / DBT (US3130B5EQ71) | 3,00 | 0,10 | 1,2323 | 0,0201 | |||||

| US3130ARAB76 / FHLB 2.75% 3/25/27 | 2,55 | 0,39 | 1,0458 | 0,0198 | |||||

| FEDERAL FARM CREDIT BANKS FUND BONDS 01/29 4.6 / DBT (US3133ERVH11) | 2,50 | 0,12 | 1,0256 | 0,0165 | |||||

| FEDERAL HOME LOAN BANKS BONDS 09/29 4.15 / DBT (US3130B2WG66) | 2,47 | -0,12 | 1,0155 | 0,0139 | |||||

| UNITED STATES TREASURY NOTE/BO 05/30 4 / DBT (US91282CNG23) | 2,02 | 0,8292 | 0,8292 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,00 | 0,10 | 0,8214 | 0,0130 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,00 | 0,40 | 0,8206 | 0,0157 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,99 | -0,05 | 0,8185 | 0,0118 | |||||

| US3133ENHC75 / Federal Farm Credit Banks Funding Corp | 1,94 | 0,73 | 0,7949 | 0,0176 | |||||

| US3134GW4C78 / Federal Home Loan Mortgage Corp | 1,92 | 0,89 | 0,7885 | 0,0187 | |||||

| US3130AL5A81 / FEDERAL HOME LOAN BANKS 0.90000000 | 1,90 | 0,79 | 0,7817 | 0,0177 | |||||

| US3133G6UP82 / UMBS, 15 Year | 1,06 | -1,76 | 0,4367 | -0,0012 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,02 | -2,68 | 0,4174 | -0,0051 | |||||

| UNITED STATES TREASURY NOTE/BO 05/27 3.875 / DBT (US91282CNE74) | 1,00 | 0,4116 | 0,4116 | ||||||

| LOS ANGELES UNIFIED SCHOOL DIS LOSSCD 09/25 FIXED 1.54 / DBT (US544646XT49) | 0,99 | 0,81 | 0,4083 | 0,0092 | |||||

| COUNTY OF ORANGE FL SALES TAX ORAGEN 01/26 FIXED 2.28 / DBT (US684515RD39) | 0,99 | 0,51 | 0,4068 | 0,0083 | |||||

| US13063DRD20 / CALIFORNIA ST | 0,98 | 0,41 | 0,4017 | 0,0075 | |||||

| CITY OF NEW YORK NY NYC 10/26 FIXED 1.99 / DBT (US64966QEJ58) | 0,97 | 0,41 | 0,3995 | 0,0079 | |||||

| US977100HA74 / WISCONSIN ST GEN FUND ANNUAL A WISGEN 05/28 FIXED 2.299 | 0,86 | 0,71 | 0,3516 | 0,0078 | |||||

| US3132DPM547 / FR SD2180 | 0,79 | -1,13 | 0,3245 | 0,0011 | |||||

| US3140J8JG93 / Federal National Mortgage Association | 0,53 | -6,23 | 0,2166 | -0,0108 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,52 | -3,74 | 0,2117 | -0,0048 | |||||

| UNITED STATES TREASURY NOTE/BO 06/29 4.25 / DBT (US91282CKX82) | 0,51 | -79,88 | 0,2091 | -0,8143 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,51 | -2,69 | 0,2084 | -0,0025 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,49 | -5,58 | 0,2020 | -0,0086 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,46 | -3,34 | 0,1904 | -0,0034 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,45 | -3,40 | 0,1865 | -0,0039 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,45 | -3,43 | 0,1851 | -0,0036 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,45 | -2,62 | 0,1835 | -0,0019 | |||||

| US3138ETYA83 / UMBS, 15 Year | 0,44 | -8,26 | 0,1826 | -0,0133 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,43 | -4,84 | 0,1782 | -0,0059 | |||||

| US3138EQZ708 / Fannie Mae Pool | 0,43 | -8,60 | 0,1748 | -0,0136 | |||||

| US3140J7UA12 / UMBS, 15 Year | 0,42 | -5,19 | 0,1729 | -0,0066 | |||||

| US3132CWA797 / Freddie Mac Pool | 0,39 | -6,92 | 0,1604 | -0,0093 | |||||

| JH COLLATERAL / STIV (N/A) | 0,04 | 0,39 | 0,1589 | 0,1589 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,38 | -8,63 | 0,1568 | -0,0122 | |||||

| US3140J9MN80 / Fannie Mae Pool | 0,35 | -7,20 | 0,1433 | -0,0088 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,35 | -11,00 | 0,1432 | -0,0150 | |||||

| US3138ER5X45 / Fannie Mae Pool | 0,32 | -7,74 | 0,1326 | -0,0086 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,29 | -8,98 | 0,1211 | -0,0099 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,29 | -6,49 | 0,1183 | -0,0065 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,21 | -7,79 | 0,0877 | -0,0061 | |||||

| US31347AVZ47 / FEDERAL HOME LOAN MORTGAGE CORP 2.464% 05/01/2045 FHA | 0,20 | -1,50 | 0,0811 | 0,0002 | |||||

| US31419AP433 / Fannie Mae 6.50 01/01/2039 | 0,18 | -3,85 | 0,0723 | -0,0015 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,15 | -6,21 | 0,0623 | -0,0031 | |||||

| US3138EJWY06 / Fannie Mae Pool | 0,13 | -14,19 | 0,0549 | -0,0078 | |||||

| US3140X42G00 / FNMA 15YR 3% 09/01/2034#FM1674 | 0,12 | -3,28 | 0,0486 | -0,0012 | |||||

| US38380PV766 / GNMA, Series 2020-120 | 0,11 | -5,17 | 0,0455 | -0,0016 | |||||

| US3140QBAP37 / Fannie Mae Pool | 0,10 | -2,88 | 0,0417 | -0,0008 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2020 170 IO / ABS-MBS (US38380RGN44) | 0,10 | -1,03 | 0,0395 | 0,0001 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2020 137 IO / ABS-MBS (US38380P4X99) | 0,08 | -1,27 | 0,0321 | 0,0000 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2022 53 IO / ABS-MBS (US38381E3Q91) | 0,08 | -1,30 | 0,0314 | -0,0002 | |||||

| US38380P2F02 / GNMA, Series 2020-118 | 0,07 | -16,87 | 0,0284 | -0,0053 | |||||

| US 2YR NOTE CBT 0925 / DIR (US91282CKV27) | 0,06 | 0,0242 | 0,0242 | ||||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 46 IO / ABS-MBS (US38379U7Q30) | 0,04 | 0,00 | 0,0169 | 0,0000 | |||||

| US38380JMW52 / GNMA, Series 2018-9 | 0,04 | 0,00 | 0,0157 | -0,0001 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2020 119 IO / ABS-MBS (US38380PY570) | 0,03 | -2,94 | 0,0139 | -0,0000 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 20 IO / ABS-MBS (US38379U6A96) | 0,03 | -2,94 | 0,0139 | -0,0001 | |||||

| US38380RE719 / Ginnie Mae II | 0,03 | 0,00 | 0,0117 | 0,0000 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 124 IO / ABS-MBS (US38379RW580) | 0,02 | -4,17 | 0,0098 | 0,0000 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 74 IO / ABS-MBS (US38379RZB22) | 0,02 | -4,76 | 0,0082 | -0,0006 | |||||

| US38379RPH02 / Government National Mortgage Association | 0,02 | -5,26 | 0,0078 | -0,0001 | |||||

| US38379RSQ73 / Government National Mortgage Association | 0,02 | 0,00 | 0,0071 | -0,0000 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 140 IO / ABS-MBS (US38379R4P55) | 0,02 | -5,88 | 0,0068 | -0,0001 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 89 IO / ABS-MBS (US38379RZH91) | 0,02 | -6,25 | 0,0065 | -0,0001 | |||||

| US38378BE477 / Government National Mortgage Association | 0,01 | 0,00 | 0,0051 | 0,0000 | |||||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 109 IO / ABS-MBS (US38379RG989) | 0,01 | 0,00 | 0,0043 | -0,0001 | |||||

| US31385FRK48 / FN 09/30 FIXED 8 | 0,00 | 0,0001 | -0,0000 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,00 | 0,0001 | -0,0000 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,00 | 0,0000 | -0,0000 | ||||||

| US31385CWR05 / UMBS | 0,00 | 0,0000 | -0,0000 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | -0,0000 | ||||||

| US31385K3Y96 / Fannie Mae Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | -0,0000 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | -0,0000 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | -0,0000 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,00 | 0,0000 | -0,0000 | ||||||

| US31374F3T48 / FN 313210 | 0,00 | 0,0000 | -0,0000 | ||||||

| US31287RQL68 / FHLG 30YR 7% 04/01/2032# | 0,00 | 0,0000 | -0,0000 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | -0,0000 |