Grundlæggende statistik

| Porteføljeværdi | $ 992.627.098 |

| Nuværende stillinger | 393 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

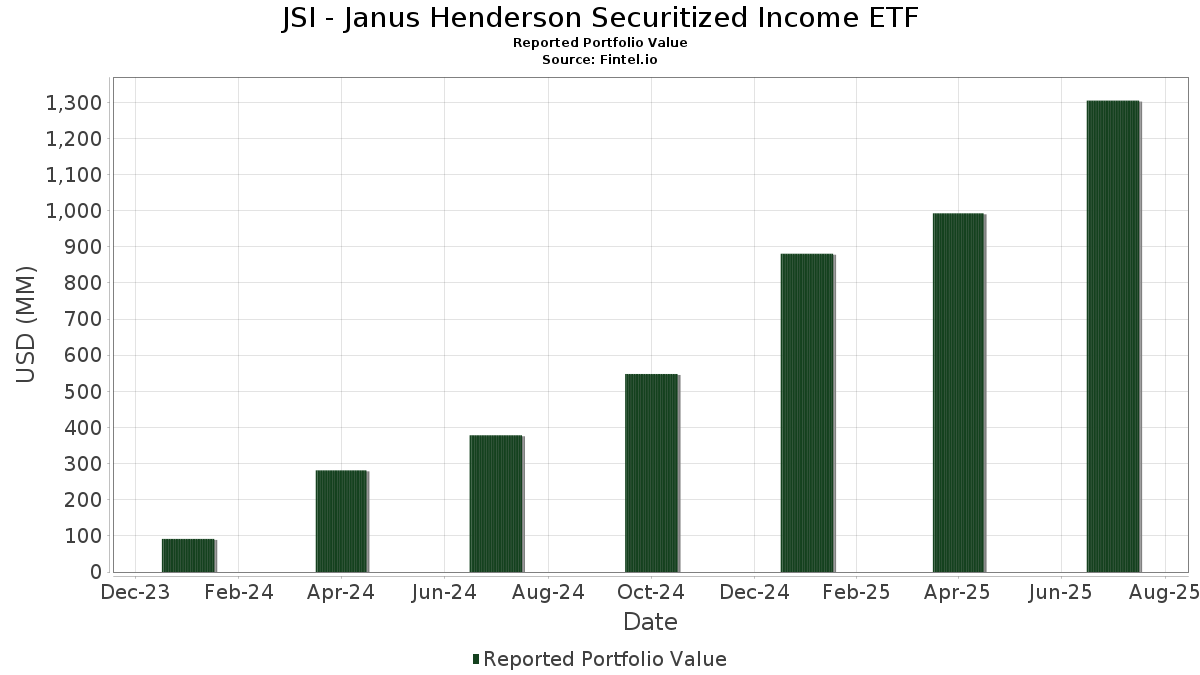

JSI - Janus Henderson Securitized Income ETF har afsløret 393 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 992.627.098 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). JSI - Janus Henderson Securitized Income ETFs største beholdninger er FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE (US:US01F0526560) , Uniform Mortgage-Backed Security, TBA (US:US01F0626550) , Uniform Mortgage-Backed Security, TBA (US:US01F0506505) , Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , and Uniform Mortgage-Backed Security, TBA (US:US01F0326581) . JSI - Janus Henderson Securitized Income ETFs nye stillinger omfatter FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE (US:US01F0526560) , Uniform Mortgage-Backed Security, TBA (US:US01F0626550) , Uniform Mortgage-Backed Security, TBA (US:US01F0506505) , Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , and Uniform Mortgage-Backed Security, TBA (US:US01F0326581) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 95,59 | 13,8232 | 12,3292 | ||

| 59,90 | 8,6613 | 8,9571 | ||

| 57,83 | 8,3630 | 6,2714 | ||

| 32,29 | 32,30 | 4,6707 | 4,6707 | |

| 56,10 | 8,1122 | 3,9891 | ||

| 26,82 | 3,8781 | 3,8781 | ||

| 16,68 | 2,4117 | 2,4117 | ||

| 22,23 | 3,2144 | 2,0043 | ||

| 13,20 | 1,9091 | 1,9091 | ||

| 11,50 | 1,6630 | 1,6630 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -37,04 | -5,3559 | -6,1616 | ||

| 0,00 | 0,00 | -4,9227 | ||

| 1,62 | 0,2341 | -0,8459 | ||

| 6,26 | 0,9046 | -0,2504 | ||

| 2,91 | 0,4212 | -0,2481 | ||

| 5,05 | 0,7304 | -0,2447 | ||

| 4,22 | 0,6098 | -0,2310 | ||

| 3,77 | 0,5447 | -0,1943 | ||

| 4,71 | 0,6814 | -0,1869 | ||

| 0,67 | 0,0963 | -0,1806 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-20 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0526560 / FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE | 95,59 | 2.512,52 | 13,8232 | 12,3292 | |||||

| US01F0626550 / Uniform Mortgage-Backed Security, TBA | 59,90 | -8.372,93 | 8,6613 | 8,9571 | |||||

| US01F0506505 / Uniform Mortgage-Backed Security, TBA | 57,83 | 1.028,67 | 8,3630 | 6,2714 | |||||

| US01F0606594 / Uniform Mortgage-Backed Security, TBA | 56,10 | 455,44 | 8,1122 | 3,9891 | |||||

| Janus Henderson Cash Liquidity Fund LLC / STIV (N/A) | 32,29 | 32,30 | 4,6707 | 4,6707 | |||||

| US01F0326581 / Uniform Mortgage-Backed Security, TBA | 26,82 | 3,8781 | 3,8781 | ||||||

| US01F0306526 / FNMA TBA 30YR 3.0% MAY 20 TO BE ANNOUNCED 3.00000000 | 22,23 | 649,93 | 3,2144 | 2,0043 | |||||

| FHLMC STACR REMIC Trust, Series 2025-HQA1, Class M2 / ABS-MBS (US35564NHA46) | 16,68 | 2,4117 | 2,4117 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 13,20 | 1,9091 | 1,9091 | ||||||

| Tricolor Auto Securitization Trust, Series 2025-1A, Class C / ABS-O (US89617CAC55) | 11,50 | 1,6630 | 1,6630 | ||||||

| RCKT Mortgage Trust, Series 2025-CES1, Class A1A / ABS-MBS (US749427AA88) | 7,69 | 1,1124 | 1,1124 | ||||||

| US46591HAG56 / Chase Mortgage Reference Notes 2020-CL1 | 6,77 | 0,9786 | 0,9786 | ||||||

| BX Trust, Series 2024-CNYN, Class D / ABS-MBS (US05612HAG65) | 6,70 | 351,15 | 0,9682 | 0,6980 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2023-RTL3, Class A1 / ABS-MBS (US79583YAA29) | 6,28 | 0,9082 | 0,9082 | ||||||

| PRET Trust, Series 2025-RPL1, Class A1 / ABS-MBS (US69392FAA57) | 6,26 | -1,40 | 0,9046 | -0,2504 | |||||

| US20754AAB98 / Fannie Mae Connecticut Avenue Securities | 6,23 | 147,44 | 0,9014 | 0,4429 | |||||

| NRM FHT1 Excess Owner LLC, Series 2025-FHT1, Class A / ABS-MBS (US64832EAA73) | 5,98 | 0,8642 | 0,8642 | ||||||

| US30334RAG92 / FS 2023-4SZN D VAR 11/10/2027 144A | 5,86 | 68,45 | 0,8470 | 0,2140 | |||||

| KRE Commercial Mortgage Trust, Series 2025-AIP4, Class A / ABS-MBS (US50077KAA60) | 5,83 | 0,8437 | 0,8437 | ||||||

| FHLMC STACR REMIC Trust, Series 2025-HQA1, Class M1 / ABS-MBS (US35564NGZ06) | 5,77 | 0,8344 | 0,8344 | ||||||

| Homeward Opportunities Fund Trust, Series 2025-RRTL1, Class A1 / ABS-MBS (US437919AA10) | 5,65 | 0,8164 | 0,8164 | ||||||

| RCKT Mortgage Trust, Series 2025-CES4, Class A1A / ABS-O (US74937YAA64) | 5,61 | 0,8115 | 0,8115 | ||||||

| PRET LLC, Series 2025-NPL4, Class A1 / ABS-MBS (US74136UAA34) | 5,43 | 0,7852 | 0,7852 | ||||||

| Carvana Auto Receivables Trust, Series 2025-P1, Class N / ABS-O (US14689MAH34) | 5,42 | 0,7842 | 0,7842 | ||||||

| US35564KMH94 / Freddie Mac Structured Agency Credit Risk Debt Notes | 5,29 | 32,92 | 0,7650 | 0,0406 | |||||

| US14687GAF28 / Carvana Auto Receivables Trust | 5,26 | 0,7602 | 0,7602 | ||||||

| US05609VAN55 / BX Commercial Mortgage Trust, Series 2021-VOLT, Class E | 5,24 | 8,69 | 0,7578 | -0,1198 | |||||

| ABL, Series 2024-RTL1, Class A2 / ABS-MBS (US00092EAB48) | 5,16 | 137,79 | 0,7463 | 0,3512 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-CES1, Class A1B / ABS-MBS (US46658CAB72) | 5,10 | 220,74 | 0,7381 | 0,4483 | |||||

| NRM FNT1 Excess LLC, Series 2024-FNT1, Class A / ABS-O (US62956YAA73) | 5,05 | -5,71 | 0,7304 | -0,2447 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5,03 | 0,7273 | 0,7273 | ||||||

| US46591HAH30 / Chase Mortgage Reference Notes 2020-CL1 | 4,89 | 0,7068 | 0,7068 | ||||||

| Atlas Warehouse Lending Co. LP / DBT (US049463AE27) | 4,87 | 0,21 | 0,7035 | -0,1803 | |||||

| BX Commercial Mortgage Trust, Series 2024-MF, Class D / ABS-MBS (US05612EAG35) | 4,71 | -1,20 | 0,6814 | -0,1869 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2023-FIG4, Class A / ABS-O (US79581UAA25) | 4,71 | 470,79 | 0,6810 | 0,5306 | |||||

| Lendbuzz Securitization Trust, Series 2024-2A, Class C / ABS-O (US525920AD65) | 4,69 | 204,35 | 0,6788 | 0,3980 | |||||

| OnDeck Asset Securitization IV LLC, Series 2025-1A, Class B / ABS-O (US68237DAB91) | 4,50 | 0,6513 | 0,6513 | ||||||

| Great Wolf Trust, Series 2024-WOLF, Class D / ABS-MBS (US39152MAG06) | 4,39 | -1,46 | 0,6354 | -0,1762 | |||||

| US44148JAC36 / Hotwire Funding LLC | 4,31 | 0,6236 | 0,6236 | ||||||

| Sotheby's Artfi Master Trust, Series 2024-1A, Class C / ABS-O (US83589CAD02) | 4,26 | -0,56 | 0,6155 | -0,1638 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2024-A, Class E / ABS-O (US80290CCM47) | 4,22 | -8,71 | 0,6098 | -0,2310 | |||||

| COOPR Residential Mortgage Trust, Series 2025-CES1, Class A1A / ABS-MBS (US12596SAA15) | 4,14 | 0,5984 | 0,5984 | ||||||

| US05608WAL81 / BX Trust | 4,13 | -0,96 | 0,5967 | -0,1618 | |||||

| US35564KJP57 / Freddie Mac STACR REMIC Trust 2021-HQA3 | 4,10 | 84,29 | 0,5923 | 0,1876 | |||||

| BX Commercial Mortgage Trust, Series 2024-BIO2, Class D / ABS-MBS (US05613GAG73) | 3,97 | 27,84 | 0,5739 | 0,0087 | |||||

| RCKT Mortgage Trust, Series 2024-CES9, Class A1B / ABS-MBS (US749426AB88) | 3,82 | -3,41 | 0,5524 | -0,1676 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2024-A, Class F / ABS-O (US80290CCN20) | 3,77 | -7,22 | 0,5447 | -0,1943 | |||||

| US79582AAA51 / Saluda Grade Alternative Mortgage Trust, Series 2023-FIG3, Class A | 3,76 | 0,5431 | 0,5431 | ||||||

| LHOME Mortgage Trust, Series 2024-RTL5, Class A2 / ABS-MBS (US50205WAB37) | 3,75 | -0,21 | 0,5419 | -0,1417 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 3,72 | 208,71 | 0,5384 | 0,3188 | |||||

| FREMF Mortgage Trust, Series 2023-K511, Class C / ABS-MBS (US30334FAG54) | 3,71 | 2,60 | 0,5361 | -0,1218 | |||||

| BMP, Series 2024-MF23, Class D / ABS-MBS (US05593JAG58) | 3,69 | 2,50 | 0,5340 | -0,1218 | |||||

| US01F0426571 / Uniform Mortgage-Backed Security, TBA | 3,52 | 0,5088 | 0,5088 | ||||||

| PRPM LLC, Series 2025-2, Class A1 / ABS-MBS (US69382HAA32) | 3,44 | 0,4970 | 0,4970 | ||||||

| US20754RAF38 / Connecticut Avenue Securities Trust 2021-R01 | 3,43 | -1,18 | 0,4954 | -0,1356 | |||||

| Affirm Asset Securitization Trust, Series 2024-A, Class 1C / ABS-O (US00834BAH06) | 3,41 | 350,79 | 0,4929 | 0,3553 | |||||

| Homeward Opportunities Fund Trust, Series 2024-RTL1, Class A2 / ABS-MBS (US43789FAB94) | 3,40 | -0,50 | 0,4915 | -0,1305 | |||||

| RCKT Mortgage Trust, Series 2024-CES8, Class A1A / ABS-MBS (US749421AA19) | 3,36 | 482,01 | 0,4866 | 0,3813 | |||||

| SCG Commercial Mortgage Trust, Series 2025-DLFN, Class E / ABS-MBS (US78398EAJ47) | 3,32 | 0,4800 | 0,4800 | ||||||

| RCKT Mortgage Trust, Series 2025-CES2, Class A1B / ABS-O (US74942BAB71) | 3,28 | 0,4737 | 0,4737 | ||||||

| Tricolor Auto Securitization Trust, Series 2025-1A, Class D / ABS-O (US89617CAD39) | 3,23 | 0,4676 | 0,4676 | ||||||

| Huntington Bank Auto Credit-Linked Notes, Series 2025-1, Class C / ABS-O (US446438SZ71) | 3,23 | 0,4669 | 0,4669 | ||||||

| Galaxy Senior Participation Interest Trust 1 / ABS-MBS (US362922AA49) | 3,21 | 0,00 | 0,4641 | -0,1201 | |||||

| FIGRE Trust, Series 2024-HE3, Class C / ABS-O (US31684GAC69) | 3,18 | -4,74 | 0,4593 | -0,1478 | |||||

| US90357PAV67 / US Bank NA | 3,18 | 523,77 | 0,4591 | 0,3664 | |||||

| RCKT Mortgage Trust, Series 2024-CES7, Class A1A / ABS-MBS (US749414AA67) | 3,13 | -4,80 | 0,4528 | -0,1460 | |||||

| LHOME Mortgage Trust, Series 2024-RTL4, Class A2 / ABS-MBS (US50205PAB85) | 3,13 | -0,45 | 0,4519 | -0,1195 | |||||

| FHLMC STACR REMIC Trust, Series 2024-DNA3, Class M2 / ABS-MBS (US35564NFA63) | 3,11 | 111,14 | 0,4494 | 0,1813 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2024-MGP, Class C11 / ABS-MBS (US95003TAE38) | 3,09 | 0,00 | 0,4473 | -0,1157 | |||||

| Homeward Opportunities Fund Trust, Series 2024-RTL1, Class A1 / ABS-MBS (US43789FAA12) | 3,08 | -0,36 | 0,4457 | -0,1174 | |||||

| LHOME Mortgage Trust, Series 2024-RTL3, Class A1 / ABS-MBS (US50205GAA04) | 3,07 | -0,03 | 0,4445 | -0,1152 | |||||

| US05608RAN52 / BX TR 2021-ARIA 1ML+259.35 10/15/2036 144A | 3,04 | -1,52 | 0,4391 | -0,1223 | |||||

| BX Trust, Series 2024-VLT4, Class E / ABS-MBS (US05612TAJ43) | 3,01 | -0,36 | 0,4353 | -0,1147 | |||||

| FHLMC STACR REMIC Trust, Series 2024-HQA1, Class M2 / ABS-MBS (US35564NCA90) | 3,00 | -1,35 | 0,4336 | -0,1196 | |||||

| SoFi Consumer Loan Program Trust, Series 2025-1, Class D / ABS-O (US83406YAD31) | 2,99 | 0,4329 | 0,4329 | ||||||

| Connecticut Avenue Securities Trust, Series 2024-R05, Class 2M2 / ABS-MBS (US20754XAC74) | 2,99 | -0,96 | 0,4319 | -0,1170 | |||||

| US30227FAN06 / Extended Stay America Trust | 2,93 | -3,62 | 0,4234 | -0,1298 | |||||

| US78485GAQ73 / STWD Trust 2021-FLWR | 2,91 | -20,78 | 0,4212 | -0,2481 | |||||

| US056083AN88 / BXP Trust 2017-GM | 2,87 | 0,84 | 0,4154 | -0,1031 | |||||

| FHF Issuer Trust, Series 2025-1A, Class C / ABS-O (US30340RAE62) | 2,87 | 0,4145 | 0,4145 | ||||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL6, Class A1 / ABS-MBS (US79585UAA88) | 2,83 | -0,18 | 0,4094 | -0,1070 | |||||

| Finance of America Structured Securities Trust, Series 2024-S3, Class A1 / ABS-MBS (US31739WAB81) | 2,78 | -1,21 | 0,4021 | -0,1102 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2025-VTT, Class D / ABS-MBS (US94990GAG47) | 2,76 | 0,3996 | 0,3996 | ||||||

| Connecticut Avenue Securities Trust, Series 2025-R03, Class 2M1 / ABS-MBS (US20754VAB36) | 2,76 | 0,3988 | 0,3988 | ||||||

| Finance of America Structured Securities Trust, Series 2025-S1, Class A1 / ABS-MBS (US31741BAB09) | 2,75 | 0,3979 | 0,3979 | ||||||

| BX Trust, Series 2025-ROIC, Class E / ABS-MBS (US05593VAN38) | 2,74 | 0,3963 | 0,3963 | ||||||

| Exeter Automobile Receivables Trust, Series 2024-3A, Class E / ABS-O (US30165AAG04) | 2,73 | 113,96 | 0,3946 | 0,1624 | |||||

| Lendbuzz Securitization Trust, Series 2024-2A, Class B / ABS-O (US525920AC82) | 2,72 | 0,55 | 0,3940 | -0,0992 | |||||

| New Residential Mortgage Loan Trust, Series 2024-RTL1, Class A2 / ABS-MBS (US64831PAB13) | 2,70 | -0,30 | 0,3909 | -0,1026 | |||||

| RCKT Mortgage Trust, Series 2024-CES5, Class A1B / ABS-MBS (US74938KAB35) | 2,67 | -5,35 | 0,3868 | -0,1275 | |||||

| US12482HAL87 / CAMB Commercial Mortgage Trust 2019-LIFE | 2,65 | 9,70 | 0,3828 | -0,0565 | |||||

| US55316VAL80 / MHC Commercial Mortgage Trust 2021-MHC | 2,64 | -0,94 | 0,3812 | -0,1032 | |||||

| BX Trust, Series 2024-BIO, Class C / ABS-MBS (US05612AAJ51) | 2,60 | -0,50 | 0,3765 | -0,0999 | |||||

| Lendbuzz Securitization Trust, Series 2024-1A, Class C / ABS-O (US525935AD43) | 2,59 | -0,27 | 0,3745 | -0,0983 | |||||

| Fora Financial Asset Securitization LLC, Series 2024-1A, Class A / ABS-O (US34512PAA21) | 2,52 | -0,16 | 0,3644 | -0,0950 | |||||

| WB Commercial Mortgage Trust, Series 2024-HQ, Class C / ABS-MBS (US92943PAE16) | 2,52 | -0,32 | 0,3640 | -0,0956 | |||||

| Affirm Asset Securitization Trust, Series 2024-X1, Class C / ABS-O (US00834XAC39) | 2,51 | -0,48 | 0,3636 | -0,0963 | |||||

| Sandstone Peak III Ltd., Series 2024-1A, Class C / ABS-CBDO (US799928AJ54) | 2,51 | -1,22 | 0,3624 | -0,0994 | |||||

| Zais CLO 11 Ltd., Series 2018-11A, Class BR / ABS-CBDO (US98887YAQ08) | 2,50 | 0,00 | 0,3622 | -0,0938 | |||||

| BX Commercial Mortgage Trust, Series 2024-GPA3, Class C / ABS-MBS (US123910AE11) | 2,50 | 264,87 | 0,3620 | 0,2371 | |||||

| BPR Trust, Series 2024-PMDW, Class D / ABS-MBS (US05592VAJ35) | 2,49 | -2,73 | 0,3607 | -0,1062 | |||||

| US62475WAC91 / MTN Commercial Mortgage Trust | 2,49 | -0,08 | 0,3605 | -0,0937 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2024-1CHI, Class C / ABS-MBS (US95003PAE16) | 2,49 | -0,76 | 0,3605 | -0,0967 | |||||

| US35564KQZ56 / FHLMC STACR REMIC Trust, Series 2022-DNA1, Class B2 | 2,49 | -1,66 | 0,3601 | -0,1009 | |||||

| Wingspire Equipment Finance LLC, Series 2024-1A, Class D / ABS-O (US97415AAE29) | 2,48 | -0,68 | 0,3583 | -0,0959 | |||||

| US19260MAA45 / Coinstar Funding LLC Series 2017-1 | 2,46 | 0,3563 | 0,3563 | ||||||

| EFMT, Series 2025-CES1, Class A1B / ABS-MBS (US26846VAB09) | 2,46 | 0,3563 | 0,3563 | ||||||

| US44422PBW14 / HUDSONS BAY SIMON JV TRUST HBCT 2015 HB10 B10 144A | 2,41 | 1,05 | 0,3483 | -0,0855 | |||||

| Brean Asset-Backed Securities Trust, Series 2024-RM8, Class A2 / ABS-MBS (US10637YAB11) | 2,36 | 1,77 | 0,3417 | -0,0810 | |||||

| Citigroup Commercial Mortgage Trust, Series 2021-PRM2, Class G / ABS-MBS (US17291HAS31) | 2,35 | -1,92 | 0,3405 | -0,0965 | |||||

| Reach Abs Trust, Series 2024-1A, Class C / ABS-O (US75526PAC59) | 2,35 | -0,38 | 0,3400 | -0,0896 | |||||

| LHOME Mortgage Trust, Series 2024-RTL1, Class A1 / ABS-MBS (US50205DAA72) | 2,33 | 44,89 | 0,3366 | 0,0441 | |||||

| US85236WCQ78 / SREIT Trust 2021-MFP2 | 2,31 | -0,81 | 0,3345 | -0,0900 | |||||

| Vontive Mortgage Trust, Series 2025-RTL1, Class A1 / ABS-MBS (US928884AA35) | 2,30 | 0,3327 | 0,3327 | ||||||

| US35564KPP83 / Freddie Mac STACR REMIC Trust 2021-HQA4 | 2,30 | -0,99 | 0,3319 | -0,0901 | |||||

| US20754AAF03 / Fannie Mae Connecticut Avenue Securities | 2,28 | -1,56 | 0,3291 | -0,0917 | |||||

| PRPM LLC / ABS-MBS (US69392NAA81) | 2,27 | 0,3286 | 0,3286 | ||||||

| Compass Datacenters Issuer II LLC, Series 2024-2A, Class B1 / ABS-O (US20469AAE91) | 2,24 | 1,17 | 0,3246 | -0,0793 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-2, Class C / ABS-O (US44644NAJ81) | 2,24 | -11,49 | 0,3232 | -0,1365 | |||||

| Finance of America Structured Securities Trust, Series 2024-S2, Class A1 / ABS-O (US31739VAA26) | 2,20 | -0,86 | 0,3175 | -0,0857 | |||||

| US056083AL23 / BXP_17-GM | 2,20 | 134,26 | 0,3175 | 0,1468 | |||||

| ACHM Mortgage Trust, Series 2024-HE1, Class B / ABS-O (US00449TAB17) | 2,16 | -5,90 | 0,3116 | -0,1054 | |||||

| US68373BAC54 / OPEN TR 2023-AIR TSFR1M+383.799 10/15/2028 144A | 2,08 | 417,46 | 0,3002 | 0,2270 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-FIG5, Class B / ABS-O (US79582MAB72) | 2,06 | -3,66 | 0,2973 | -0,0912 | |||||

| US05608KAJ97 / BX COMMERCIAL MORTGAGE TRUST 2021-VINO BX 2021-VINO E | 2,05 | -0,87 | 0,2958 | -0,0798 | |||||

| US35564KKK42 / Freddie Mac STACR REMIC Trust 2021-HQA3 | 2,03 | -1,64 | 0,2942 | -0,0823 | |||||

| Post Road Equipment Finance LLC, Series 2025-1A, Class E / ABS-O (US73747LAF58) | 2,03 | 103,20 | 0,2936 | 0,1115 | |||||

| US53218DAG34 / Life Mortgage Trust US | 2,02 | -5,42 | 0,2928 | -0,0970 | |||||

| Mission Lane Credit Card Master Trust, Series 2023-B, Class C / ABS-O (US60510MAV00) | 2,01 | -1,13 | 0,2904 | -0,0794 | |||||

| Libra Solutions LLC, Series 2024-1A, Class A / ABS-O (US53161XAA90) | 2,01 | 2,14 | 0,2901 | -0,0675 | |||||

| BAMLL Re-REMIC Trust, Series 2025-FRR5, Class E736 / ABS-MBS (US05494BAJ61) | 2,00 | -1,57 | 0,2899 | -0,0808 | |||||

| Reach ABS Trust, Series 2025-1A, Class C / ABS-O (US75525PAC68) | 2,00 | -0,35 | 0,2889 | -0,0760 | |||||

| US383931AD41 / Gracie Point International Funding, Series 2023-1A, Class D | 1,99 | -1,04 | 0,2883 | -0,0784 | |||||

| CONE Trust, Series 2024-DFW1, Class A / ABS-MBS (US20682AAA88) | 1,99 | -0,99 | 0,2879 | -0,0783 | |||||

| BX Commercial Mortgage Trust, Series 2024-WPT, Class D / ABS-MBS (US05612JAG22) | 1,98 | -1,20 | 0,2859 | -0,0784 | |||||

| US05609RAS31 / BX 2021-BXMF 1ML+359.02 10/15/2026 144A | 1,97 | -2,91 | 0,2849 | -0,0845 | |||||

| US12659VAJ98 / CREDIT SUISSE MORTGAGE TRUST | 1,96 | -0,81 | 0,2839 | -0,0765 | |||||

| GWT, Series 2024-WLF2, Class E / ABS-MBS (US362414AJ37) | 1,96 | -1,66 | 0,2834 | -0,0794 | |||||

| US476681AA97 / Jersey Mike's Funding | 1,96 | 0,2828 | 0,2828 | ||||||

| US53218DAJ72 / LIFE MORTGAGE TRUST US SER 2022-BMR2 CL D V/R REGD 144A P/P 3.34191000 | 1,95 | 26,02 | 0,2823 | 0,0002 | |||||

| Alterna Funding III LLC, Series 2024-1A, Class B / ABS-O (US02157JAC99) | 1,94 | -4,89 | 0,2810 | -0,0909 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-1, Class C / ABS-O (US44644NAC39) | 1,94 | -12,89 | 0,2806 | -0,1248 | |||||

| US00092CAD48 / ACHV ABS TRUST 2023-4CP | 1,92 | -0,93 | 0,2769 | -0,0751 | |||||

| US44422PBN15 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL A10 REGD 144A P/P 4.15450000 | 1,91 | 1,38 | 0,2759 | -0,0668 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIR2, Class C / ABS-MBS (US05613QAE08) | 1,90 | -4,94 | 0,2754 | -0,0894 | |||||

| US78457JAQ58 / SMRT 2022-MINI SOFR30A+330 01/15/2024 144A | 1,90 | -1,09 | 0,2753 | -0,0750 | |||||

| US12636GAA94 / COMM 2016-667M Mortgage Trust | 1,88 | 0,81 | 0,2713 | -0,0675 | |||||

| RCKT Mortgage Trust, Series 2024-CES8, Class A1B / ABS-MBS (US749421AB91) | 1,87 | -3,85 | 0,2710 | -0,0839 | |||||

| FHF Issuer Trust, Series 2024-2A, Class D / ABS-O (US30336NAJ00) | 1,86 | 0,76 | 0,2694 | -0,0672 | |||||

| US35564KRN18 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,86 | 0,2689 | 0,2689 | ||||||

| FIGRE Trust, Series 2023-HE3, Class A / ABS-O (US31684CAA99) | 1,82 | 0,2638 | 0,2638 | ||||||

| Santander Bank Auto Credit-Linked Notes, Series 2023-B, Class E / ABS-O (US80290CCE21) | 1,82 | -13,24 | 0,2635 | -0,1189 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL5, Class D / ABS-MBS (US05612GAG82) | 1,79 | -5,69 | 0,2590 | -0,0868 | |||||

| US20755CAF59 / CORP CMO | 1,79 | -2,08 | 0,2584 | -0,0738 | |||||

| US05609JAL61 / BXHPP TRUST 2021-FILM BXHPP 2021-FILM C | 1,76 | -4,66 | 0,2543 | -0,0815 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2025-VTT, Class E / ABS-MBS (US94990GAJ85) | 1,74 | 0,2520 | 0,2520 | ||||||

| Vertical Bridge Holdings LLC, Series 2020-2A, Class B / ABS-O (US92535VAG77) | 1,73 | 0,70 | 0,2503 | -0,0625 | |||||

| Business Jet Securities LLC, Series 2024-1A, Class B / ABS-O (US12327CAB00) | 1,72 | -4,60 | 0,2492 | -0,0797 | |||||

| Gracie Point International Funding LLC, Series 2024-1A, Class B / ABS-O (US38410KAB52) | 1,71 | -1,22 | 0,2469 | -0,0677 | |||||

| Brean Asset-Backed Securities Trust, Series 2024-RM9, Class A1 / ABS-MBS (US10638DAA81) | 1,70 | 0,00 | 0,2460 | -0,0637 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL5, Class A1 / ABS-MBS (US795935AA37) | 1,65 | -0,36 | 0,2390 | -0,0629 | |||||

| CarMax Auto Owner Trust, Series 2024-1, Class D / ABS-O (US14318WAH07) | 1,64 | -0,18 | 0,2376 | -0,0621 | |||||

| US01F0406516 / Uniform Mortgage-Backed Security, TBA | 1,62 | -38,83 | 0,2341 | -0,8459 | |||||

| US35564KNS41 / Freddie Mac STACR REMIC Trust 2021-HQA4 | 1,61 | -0,99 | 0,2322 | -0,0630 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-B, Class E / ABS-O (US02007G4F75) | 1,59 | -11,44 | 0,2306 | -0,0971 | |||||

| Hotwire Funding LLC, Series 2024-1A, Class C / ABS-O (US44148JAM18) | 1,58 | 1,09 | 0,2285 | -0,0561 | |||||

| US12530MAA36 / CF Hippolyta LLC, Series 2020-1, Class A1 | 1,58 | 0,77 | 0,2282 | -0,0569 | |||||

| MVW LLC, Series 2025-1A, Class C / ABS-O (US627924AC74) | 1,56 | 0,2255 | 0,2255 | ||||||

| ExteNet Issuer LLC, Series 2024-1A, Class C / ABS-O (US30227XAL55) | 1,55 | -1,33 | 0,2247 | -0,0621 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-B, Class F / ABS-O (US02007G4G58) | 1,55 | -10,23 | 0,2235 | -0,0898 | |||||

| Tricolor Auto Securitization Trust, Series 2024-1A, Class D / ABS-O (US89616LAD47) | 1,54 | -1,41 | 0,2226 | -0,0616 | |||||

| Arivo Acceptance Auto Loan Receivables Trust, Series 2024-1A, Class B / ABS-O (US039943AB13) | 1,54 | -0,39 | 0,2221 | -0,0586 | |||||

| VB-S1 Issuer LLC-VBTEL, Series 2024-1A, Class D / ABS-O (US91823ABE01) | 1,53 | 0,20 | 0,2213 | -0,0566 | |||||

| Brex Commercial Charge Card Master Trust, Series 2024-1, Class A2 / ABS-O (US05601DAF06) | 1,52 | 0,26 | 0,2196 | -0,0560 | |||||

| United Auto Credit Securitization Trust, Series 2024-1, Class C / ABS-O (US90945DAC48) | 1,52 | -0,72 | 0,2192 | -0,0588 | |||||

| DC Trust, Series 2024-HLTN, Class C / ABS-MBS (US24022FAG54) | 1,51 | -0,98 | 0,2184 | -0,0592 | |||||

| CALI Mortgage Trust, Series 2019-101C, Class B / ABS-MBS (US129890AG44) | 1,50 | 0,20 | 0,2176 | -0,0558 | |||||

| OnDeck Asset Securitization IV LLC, Series 2025-1A, Class C / ABS-O (US68237DAC74) | 1,50 | 0,2172 | 0,2172 | ||||||

| US48128U2S73 / JPMorgan Chase Bank NA - CACLN | 1,49 | -22,82 | 0,2148 | -0,1355 | |||||

| US05608RAL96 / BX Trust | 1,48 | -1,27 | 0,2141 | -0,0588 | |||||

| TSC SPV Funding LLC, Series 2024-1A, Class A2 / ABS-O (US898912AA85) | 1,48 | 0,41 | 0,2140 | -0,0544 | |||||

| JW Commercial Mortgage Trust, Series 2024-MRCO, Class C / ABS-MBS (US46657XAE67) | 1,48 | -1,47 | 0,2137 | -0,0594 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R05, Class 2M1 / ABS-MBS (US20754XAB91) | 1,46 | 0,2114 | 0,2114 | ||||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL6, Class A2 / ABS-MBS (US79585UAB61) | 1,45 | -0,55 | 0,2104 | -0,0558 | |||||

| Foundation Finance Trust, Series 2024-1A, Class D / ABS-O (US349941AD65) | 1,45 | -5,48 | 0,2097 | -0,0696 | |||||

| US53218CAL46 / Life 2021-BMR Mortgage Trust | 1,44 | -13,16 | 0,2082 | -0,0936 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-2, Class D / ABS-O (US44644NAK54) | 1,43 | -11,27 | 0,2061 | -0,0863 | |||||

| RCKT Mortgage Trust, Series 2024-CES6, Class A1B / ABS-O (US749410AB29) | 1,42 | -5,26 | 0,2059 | -0,0677 | |||||

| RITM.PRD / Rithm Capital Corp. - Preferred Stock | 1,41 | -1,33 | 0,2046 | -0,0564 | |||||

| LHOME Mortgage Trust, Series 2024-RTL3, Class A2 / ABS-MBS (US50205GAB86) | 1,41 | -0,70 | 0,2042 | -0,0546 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2025-1, Class D / ABS-O (US446438TA12) | 1,40 | 0,2018 | 0,2018 | ||||||

| HLF / Herbalife Ltd. | 1,39 | 13,06 | 0,2017 | -0,0230 | |||||

| BAMLL Re-REMIC Trust, Series 2025-FRR5, Class EK86 / ABS-MBS (US05494BBJ52) | 1,37 | 10,64 | 0,1987 | -0,0272 | |||||

| US00091XAD93 / ACHV ABS TRUST 2023-1PL ACHV 2023-1PL D | 1,36 | 0,1960 | 0,1960 | ||||||

| US12530MAC91 / CF Hippolyta LLC, Series 2020-1, Class B1 | 1,35 | 0,67 | 0,1952 | -0,0488 | |||||

| RAM LLC, Series 2024-1, Class A / ABS-O (US751313AA57) | 1,33 | 986,89 | 0,1919 | 0,1695 | |||||

| US60510MAT53 / Mission Lane Credit Card Master Trust | 1,28 | -0,62 | 0,1852 | -0,0494 | |||||

| BAMLL Re-REMIC Trust, Series 2025-FRR5, Class EK73 / ABS-MBS (US05494BAW72) | 1,28 | 5,98 | 0,1845 | -0,0347 | |||||

| Bayview Opportunity Master Fund VII LLC, Series 2024-CAR1, Class D / ABS-O (US07336QAD43) | 1,28 | -12,31 | 0,1845 | -0,0803 | |||||

| US05608VAL09 / BX Trust, Series 2021-MFM1, Class E | 1,27 | -0,39 | 0,1839 | -0,0485 | |||||

| BX Trust, Series 2024-CNYN, Class C / ABS-MBS (US05612HAE18) | 1,26 | -1,26 | 0,1815 | -0,0500 | |||||

| Janus Henderson Cash Collateral Fund LLC / STIV (N/A) | 1,25 | 0,1805 | 0,1805 | ||||||

| US36485MAL37 / Garda World Security Corp | 1,25 | -2,88 | 0,1803 | -0,0534 | |||||

| COMM Mortgage Trust, Series 2024-WCL1, Class D / ABS-MBS (US20047DAG97) | 1,24 | -0,32 | 0,1797 | -0,0473 | |||||

| COMM Mortgage Trust, Series 2024-WCL1, Class C / ABS-MBS (US20047DAE40) | 1,24 | -0,56 | 0,1792 | -0,0478 | |||||

| FHF Issuer Trust, Series 2024-2A, Class C / ABS-O (US30336NAG60) | 1,24 | 0,41 | 0,1788 | -0,0455 | |||||

| FHF Issuer Trust, Series 2024-1A, Class B / ABS-O (US31568AAC09) | 1,22 | -0,49 | 0,1770 | -0,0469 | |||||

| US35564KKL25 / FHLMC STACR REMIC Trust, Series 2021-HQA3, Class B2 | 1,21 | -2,35 | 0,1746 | -0,0504 | |||||

| VB-S1 Issuer LLC-VBTEL, Series 2024-1A, Class F / ABS-O (US91823ABG58) | 1,20 | 0,00 | 0,1736 | -0,0450 | |||||

| FIGRE Trust, Series 2024-HE1, Class C / ABS-O (US31684HAC43) | 1,20 | -5,14 | 0,1735 | -0,0566 | |||||

| US35042RAD89 / Foundation Finance Trust 2023-2 | 1,19 | 0,1727 | 0,1727 | ||||||

| US78485GAL86 / SREIT TRUST | 1,19 | 0,1724 | 0,1724 | ||||||

| LHOME Mortgage Trust, Series 2024-RTL2, Class A2 / ABS-MBS (US50205JAB26) | 1,19 | -1,00 | 0,1714 | -0,0466 | |||||

| US62475WAG06 / MTN Commercial Mortgage Trust 2022-LPFL | 1,17 | 0,09 | 0,1690 | -0,0436 | |||||

| US26210YAA47 / DROP Mortgage Trust, Series 2021-FILE, Class A | 1,16 | -2,93 | 0,1680 | -0,0498 | |||||

| US20754KAF84 / Fannie Mae Connecticut Avenue Securities | 1,16 | 60,22 | 0,1679 | 0,0359 | |||||

| FIGRE Trust, Series 2025-PF1, Class A / ABS-MBS (US316922AA11) | 1,15 | 0,1662 | 0,1662 | ||||||

| Connecticut Avenue Securities, Series 2025-R01, Class 1M2 / ABS-MBS (US20755JAC71) | 1,05 | 0,1513 | 0,1513 | ||||||

| OnDeck Asset Securitization Trust IV LLC, Series 2024-1A, Class B / ABS-O (US67118NAB38) | 1,03 | 1,38 | 0,1492 | -0,0360 | |||||

| FHF Issuer Trust, Series 2024-1A, Class C / ABS-O (US31568AAD81) | 1,03 | -0,19 | 0,1491 | -0,0391 | |||||

| US53218CAJ99 / LIFE 2021-BMR MTG TR 21-BMR E 1ML+185.6 03/15/2036 144A | 1,03 | -12,52 | 0,1486 | -0,0652 | |||||

| Reach ABS Trust, Series 2024-2A, Class D / ABS-O (US75525HAD26) | 1,03 | -2,65 | 0,1486 | -0,0436 | |||||

| US35564KND71 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,03 | -1,63 | 0,1484 | -0,0414 | |||||

| OnDeck Asset Securitization Trust IV LLC, Series 2024-1A, Class C / ABS-O (US67118NAC11) | 1,02 | -0,78 | 0,1480 | -0,0398 | |||||

| United Auto Credit Securitization Trust, Series 2024-1, Class D / ABS-O (US90945DAD21) | 1,02 | 0,00 | 0,1472 | -0,0381 | |||||

| US69362QAA76 / PRPM LLC, Series 2021-11, Class A1 | 1,02 | -3,61 | 0,1470 | -0,0450 | |||||

| Compass Datacenters Issuer II LLC, Series 2024-1A, Class A2 / ABS-O (US20469AAB52) | 1,01 | 2,33 | 0,1461 | -0,0336 | |||||

| SBNA Auto Receivables Trust, Series 2024-A, Class E / ABS-O (US78437PAH64) | 1,01 | 1,41 | 0,1457 | -0,0352 | |||||

| US55316VAN47 / MHC Commercial Mortgage Trust, Series 2021-MHC, Class G | 1,01 | 0,10 | 0,1454 | -0,0376 | |||||

| CPC Asset Securitization III LLC, Series 2024-1A, Class D / ABS-O (US126203AD03) | 1,00 | 0,00 | 0,1446 | -0,0374 | |||||

| PRET Trust, Series 2025-RPL2, Class A1 / ABS-MBS (US69392LAA26) | 1,00 | 0,1443 | 0,1443 | ||||||

| BX Trust, Series 2024-VLT4, Class D / ABS-MBS (US05612TAG04) | 0,98 | -2,39 | 0,1421 | -0,0411 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIR2, Class D / ABS-MBS (US05613QAG55) | 0,95 | -5,68 | 0,1370 | -0,0458 | |||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | 0,95 | 0,1368 | 0,1368 | ||||||

| FIGRE Trust, Series 2025-HE2, Class A / ABS-O (US31684KAA16) | 0,95 | 0,1367 | 0,1367 | ||||||

| US20754KAB70 / Fannie Mae Connecticut Avenue Securities | 0,94 | -1,05 | 0,1360 | -0,0370 | |||||

| Towd Point Mortgage Trust, Series 2024-CES2, Class A1B / ABS-O (US89182JAB70) | 0,92 | -8,48 | 0,1327 | -0,0498 | |||||

| US882925AB67 / Theorem Funding Trust 2022-3 | 0,92 | -1,40 | 0,1325 | -0,0367 | |||||

| Bayview Opportunity Master Fund VII LLC, Series 2024-CAR1, Class E / ABS-O (US07336QAE26) | 0,91 | -12,68 | 0,1315 | -0,0580 | |||||

| US57109LAD55 / Marlette Funding Trust 2023-2 | 0,91 | -0,55 | 0,1310 | -0,0349 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2024-B, Class G / ABS-O (US80280BAG32) | 0,90 | 0,11 | 0,1306 | -0,0335 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2024-B, Class F / ABS-O (US80280BAF58) | 0,90 | 0,11 | 0,1305 | -0,0336 | |||||

| Crockett Partners Equipment Co. IIA LLC, Series 2024-1C, Class C / ABS-O (US22689LAC90) | 0,89 | -3,14 | 0,1293 | -0,0389 | |||||

| Finance of America Structured Securities Trust, Series 2024-S1, Class A1 / ABS-O (US31740RAB69) | 0,89 | -2,09 | 0,1289 | -0,0369 | |||||

| US55316PAN78 / MKT 2020-525M MTG TR CSTR 02/12/2040 144A | 0,88 | 5,39 | 0,1274 | -0,0248 | |||||

| FIGRE Trust, Series 2024-HE4, Class C / ABS-O (US31684UAC53) | 0,86 | 0,1248 | 0,1248 | ||||||

| Crockett Partners Equipment Co. IIA LLC, Series 2024-1C, Class B / ABS-O (US22689LAB18) | 0,86 | -4,97 | 0,1245 | -0,0404 | |||||

| BX Commercial Mortgage Trust, Series 2024-BRBK, Class A / ABS-MBS (US05613NAA54) | 0,85 | -1,17 | 0,1226 | -0,0334 | |||||

| BX Commercial Mortgage Trust, Series 2024-BRBK, Class B / ABS-MBS (US05613NAG25) | 0,84 | -1,52 | 0,1217 | -0,0339 | |||||

| Bayview Opportunity Master Fund VII LLC, Series 2024-EDU1, Class C / ABS-O (US07336PAC86) | 0,83 | -2,80 | 0,1205 | -0,0355 | |||||

| Bayview Opportunity Master Fund VII LLC, Series 2024-EDU1, Class D / ABS-O (US07336PAD69) | 0,83 | 91,49 | 0,1205 | 0,0412 | |||||

| US46591HAK68 / Chase Mortgage Reference Notes 2020-CL1 | 0,82 | -2,73 | 0,1188 | -0,0349 | |||||

| RCKT Mortgage Trust, Series 2024-CES1, Class A1B / ABS-O (US749424AB31) | 0,81 | -8,55 | 0,1177 | -0,0443 | |||||

| Westgate Resorts LLC, Series 2024-1A, Class C / ABS-O (US96034KAC71) | 0,80 | -6,66 | 0,1155 | -0,0404 | |||||

| Westgate Resorts LLC, Series 2024-1A, Class D / ABS-O (US96034KAD54) | 0,80 | -6,34 | 0,1155 | -0,0398 | |||||

| US44422PBY79 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL C10 V/R REGD 144A P/P 5.44700000 | 0,79 | -0,38 | 0,1142 | -0,0301 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R03, Class 2M2 / ABS-MBS (US207941AB18) | 0,79 | -1,62 | 0,1139 | -0,0317 | |||||

| AMCX / AMC Networks Inc. | 0,78 | -3,73 | 0,1122 | -0,0345 | |||||

| Connecticut Avenue Securities Trust, Series 2025-R03, Class 2M2 / ABS-MBS (US20754VAC19) | 0,77 | 0,1114 | 0,1114 | ||||||

| Exeter Automobile Receivables Trust, Series 2024-1A, Class E / ABS-O (US30167PAG54) | 0,77 | -0,26 | 0,1106 | -0,0290 | |||||

| Prosper Marketplace Issuance Trust, Series 2024-1A, Class C / ABS-O (US74363CAC38) | 0,76 | -0,13 | 0,1096 | -0,0286 | |||||

| US12516WAC55 / CENT 23-CITY B 144A (TSFR1M+315) FRN 09-15-28 | 0,75 | -0,13 | 0,1082 | -0,0282 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-1, Class D / ABS-O (US44644NAD12) | 0,74 | -12,65 | 0,1069 | -0,0473 | |||||

| Towd Point Mortgage Trust, Series 2024-CES1, Class A1B / ABS-O (US89183CAB19) | 0,74 | -7,06 | 0,1066 | -0,0379 | |||||

| Sierra Timeshare Receivables Funding LLC, Series 2024-3A, Class D / ABS-O (US82653BAD55) | 0,72 | -16,49 | 0,1040 | -0,0528 | |||||

| CyrusOne Data Centers Issuer I LLC, Series 2024-1A, Class A2 / ABS-O (US23284BAF13) | 0,71 | -0,42 | 0,1026 | -0,0271 | |||||

| Marlette Funding Trust, Series 2023-1A, Class D / ABS-O (US57110PAD33) | 0,71 | -0,98 | 0,1025 | -0,0278 | |||||

| Affirm Asset Securitization Trust, Series 2024-A, Class D / ABS-O (US00834BAD91) | 0,70 | -0,85 | 0,1017 | -0,0273 | |||||

| Great Wolf Trust, Series 2024-WOLF, Class C / ABS-MBS (US39152MAE57) | 0,70 | -1,00 | 0,1005 | -0,0273 | |||||

| NetCredit Combined Receivables LLC, Series 2024-A, Class A / ABS-O (US64113EAA73) | 0,69 | -31,15 | 0,1005 | -0,0832 | |||||

| US20754RAB24 / Connecticut Avenue Securities Trust 2021-R01 | 0,69 | -3,77 | 0,0998 | -0,0309 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-A, Class F / ABS-O (US02007GZ973) | 0,68 | -11,82 | 0,0983 | -0,0419 | |||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0,04 | 0,00 | 0,67 | -12,55 | 0,0968 | -0,0425 | |||

| LHOME Mortgage Trust, Series 2022-RTL3, Class A1 / ABS-MBS (US50204UAA07) | 0,67 | -56,25 | 0,0963 | -0,1806 | |||||

| Sierra Timeshare Receivables Funding LLC, Series 2024-2A, Class D / ABS-O (US82650DAD49) | 0,63 | -14,84 | 0,0913 | -0,0437 | |||||

| Gracie Point International Funding LLC, Series 2024-1A, Class D / ABS-O (US38410KAD19) | 0,60 | -0,17 | 0,0867 | -0,0226 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R06, Class 1M2 / ABS-MBS (US20755RAC97) | 0,58 | 0,0834 | 0,0834 | ||||||

| US643821AA93 / New Economy Assets Phase 1 Sponsor LLC, Series 2021-1, Class A1 | 0,57 | 0,88 | 0,0830 | -0,0207 | |||||

| Rain City Mortgage Trust, Series 2024-RTL1, Class A2 / ABS-MBS (US75079KAB98) | 0,56 | 0,00 | 0,0814 | -0,0211 | |||||

| BX Trust, Series 2022-FOX2, Class E / ABS-MBS (US05610AAJ79) | 0,55 | -3,50 | 0,0797 | -0,0244 | |||||

| Mello Warehouse Securitization Trust, Series 2024-1, Class F / ABS-MBS (US58553FAF27) | 0,53 | -2,20 | 0,0771 | -0,0222 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-A, Class E / ABS-O (US02007GZ890) | 0,53 | -12,15 | 0,0765 | -0,0331 | |||||

| Blue Bridge Funding LLC, Series 2023-1A, Class C / ABS-O (US09531MAC47) | 0,52 | 1,16 | 0,0758 | -0,0186 | |||||

| US87332PAA84 / TYSN 2023-CRNR A VAR 12/10/2038 144A | 0,52 | 0,19 | 0,0757 | -0,0195 | |||||

| US57108UAB08 / Marlette Funding Trust 2023-4 | 0,52 | 0,19 | 0,0754 | -0,0194 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R01, Class 1M2 / ABS-MBS (US20753UAB61) | 0,52 | -0,95 | 0,0752 | -0,0205 | |||||

| Upstart Securitization Trust, Series 2023-3, Class B / ABS-O (US91684MAB90) | 0,52 | -0,77 | 0,0750 | -0,0202 | |||||

| Lendbuzz Securitization Trust, Series 2024-1A, Class B / ABS-O (US525935AC69) | 0,51 | 0,00 | 0,0739 | -0,0191 | |||||

| Bayview Opportunity Master Fund VII Trust, Series 2024-SN1, Class D / ABS-O (US072926AF52) | 0,51 | -0,39 | 0,0737 | -0,0195 | |||||

| LAD Auto Receivables Trust, Series 2024-1A, Class D / ABS-O (US501689AG80) | 0,51 | 0,39 | 0,0736 | -0,0189 | |||||

| WB Commercial Mortgage Trust, Series 2024-HQ, Class D / ABS-MBS (US92943PAG63) | 0,51 | 1,40 | 0,0736 | -0,0177 | |||||

| Ally Auto Receivables Trust, Series 2024-1, Class D / ABS-O (US02008FAG90) | 0,51 | 1,00 | 0,0733 | -0,0180 | |||||

| BHG Securitization Trust, Series 2024-1CON, Class B / ABS-O (US08862HAB87) | 0,51 | 0,00 | 0,0733 | -0,0189 | |||||

| Exeter Automobile Receivables Trust, Series 2024-1A, Class D / ABS-O (US30167PAF71) | 0,51 | 0,00 | 0,0733 | -0,0190 | |||||

| Bridgecrest Lending Auto Securitization Trust, Series 2024-1, Class D / ABS-O (US107933AF08) | 0,51 | -0,39 | 0,0732 | -0,0193 | |||||

| Tricolor Auto Securitization Trust, Series 2024-1A, Class C / ABS-O (US89616LAC63) | 0,50 | -0,59 | 0,0730 | -0,0194 | |||||

| Affirm Asset Securitization Trust, Series 2024-A, Class C / ABS-O (US00834BAC19) | 0,50 | -0,40 | 0,0727 | -0,0191 | |||||

| Affirm Asset Securitization Trust, Series 2024-A, Class 1D / ABS-O (US00834BAJ61) | 0,50 | -0,79 | 0,0726 | -0,0195 | |||||

| Amur Equipment Finance Receivables XIV LLC, Series 2024-2A, Class E / ABS-O (US03238BAF04) | 0,50 | -0,40 | 0,0726 | -0,0192 | |||||

| FIGRE Trust, Series 2024-HE3, Class A / ABS-O (US31684GAA04) | 0,50 | 0,0725 | 0,0725 | ||||||

| BX Commercial Mortgage Trust, Series 2023-VLT3, Class C / ABS-MBS (US05611GAE44) | 0,50 | -0,60 | 0,0722 | -0,0193 | |||||

| Gracie Point International Funding LLC, Series 2024-1A, Class C / ABS-O (US38410KAC36) | 0,50 | -1,20 | 0,0717 | -0,0197 | |||||

| US449652AJ58 / ILPT COML MTG TR 2022-LPF2 TSFR1M+594 10/15/2039 144A | 0,49 | -1,79 | 0,0714 | -0,0200 | |||||

| Luxury Lease Partners Auto Lease Trust, Series 2024-4, Class A / ABS-O (US55068XAA81) | 0,48 | -18,14 | 0,0699 | -0,0377 | |||||

| Post Road Equipment Finance LLC, Series 2024-1A, Class E / ABS-O (US737473AF57) | 0,47 | 1,08 | 0,0676 | -0,0167 | |||||

| PRPM LLC, Series 2024-1, Class A1 / ABS-MBS (US693972AA95) | 0,44 | -1,12 | 0,0639 | -0,0176 | |||||

| RAM LLC, Series 2024-1, Class B / ABS-O (US751313AB31) | 0,44 | -0,68 | 0,0639 | -0,0169 | |||||

| US30227FAL40 / Extended Stay America Trust | 0,43 | -3,40 | 0,0617 | -0,0186 | |||||

| US36267FAL22 / GLS Auto Select Receivables Trust 2023-1 | 0,42 | 0,00 | 0,0614 | -0,0159 | |||||

| US46591HAJ95 / Chase Mortgage Reference Notes 2020-CL1 | 0,41 | -3,29 | 0,0596 | -0,0181 | |||||

| Post Road Equipment Finance LLC, Series 2024-1A, Class D / ABS-O (US737473AE82) | 0,41 | -0,24 | 0,0594 | -0,0155 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-A, Class G / ABS-O (US02007G2A07) | 0,41 | -11,33 | 0,0590 | -0,0246 | |||||

| US67181DAB73 / Oak Street Investment Grade Net Lease Fund Series 2020-1 | 0,41 | -1,45 | 0,0589 | -0,0164 | |||||

| Hudsons Bay Simon JV Trust, Series 2015-HB7, Class C7 / ABS-MBS (US44422PBE16) | 0,40 | -0,25 | 0,0583 | -0,0153 | |||||

| US20754EAF25 / Connecticut Avenue Securities Trust, Series 2023-R06, Class 1B1 | 0,39 | -1,76 | 0,0566 | -0,0160 | |||||

| US74390NAC65 / Prosper Marketplace Issuance Trust Series 2023-1A, Class B | 0,39 | -22,42 | 0,0565 | -0,0352 | |||||

| FHLMC STACR REMIC Trust, Series 2024-DNA1, Class M2 / ABS-MBS (US35564NBA00) | 0,38 | -0,52 | 0,0556 | -0,0149 | |||||

| Amur Equipment Finance Receivables XIII LLC, Series 2024-1A, Class E / ABS-O (US03237CAF95) | 0,38 | 2,40 | 0,0556 | -0,0128 | |||||

| BAMLL Re-REMIC Trust, Series 2024-FRR4, Class E / ABS-MBS (US05493VAJ35) | 0,38 | 1,60 | 0,0551 | -0,0132 | |||||

| US74935WAA27 / RCKT MORTGAGE TRUST 2023-CES1 | 0,38 | -10,21 | 0,0547 | -0,0222 | |||||

| BAMLL Re-REMIC Trust, Series 2024-FRR4, Class F / ABS-MBS (US05493VAL80) | 0,38 | 1,62 | 0,0547 | -0,0129 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2023-B, Class D / ABS-O (US80290CCD48) | 0,37 | -12,26 | 0,0528 | -0,0229 | |||||

| US98162JAA43 / Worldwide Plaza Trust 2017-WWP | 0,36 | -4,00 | 0,0521 | -0,0162 | |||||

| Pear LLC, Series 2024-1, Class A / ABS-O (US704933AA80) | 0,33 | -12,20 | 0,0480 | -0,0208 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R02, Class 1M2 / ABS-MBS (US20754GAE08) | 0,33 | -1,49 | 0,0478 | -0,0132 | |||||

| LHOME Mortgage Trust, Series 2024-RTL2, Class A1 / ABS-MBS (US50205JAA43) | 0,33 | 0,00 | 0,0470 | -0,0123 | |||||

| Dext ABS LLC, Series 2023-2, Class D / ABS-O (US25216CAE03) | 0,32 | 5,25 | 0,0465 | -0,0091 | |||||

| CE / Celanese Corporation | 0,01 | 0,00 | 0,32 | -37,33 | 0,0461 | -0,0466 | |||

| 3 Month SOFR / DIR (N/A) | 0,31 | 0,0452 | 0,0452 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,31 | 0,0451 | 0,0451 | ||||||

| Surgery Center Holdings, Inc. / DBT (US86881WAF95) | 0,31 | 0,00 | 0,0447 | -0,0116 | |||||

| BX Commercial Mortgage Trust, Series 2024-MF, Class C / ABS-MBS (US05612EAE86) | 0,31 | -0,97 | 0,0445 | -0,0121 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 0,30 | 0,0437 | 0,0437 | ||||||

| Luxury Lease Partners Auto Lease Trust, Series 2024-4, Class B / ABS-O (US55068XAB64) | 0,30 | 0,00 | 0,0436 | -0,0112 | |||||

| 3 Month SOFR / DIR (N/A) | 0,30 | 0,0436 | 0,0436 | ||||||

| US46591HBZ29 / Chase Mortgage Finance Corp | 0,30 | -1,00 | 0,0429 | -0,0116 | |||||

| US75576AAA16 / READYCAP LENDING SMALL BUSINESS LOAN TRUST 2023-3 | 0,28 | -8,31 | 0,0400 | -0,0149 | |||||

| 3 months SOFR / DIR (N/A) | 0,27 | 0,0386 | 0,0386 | ||||||

| Reach ABS Trust, Series 2024-2A, Class A / ABS-O (US75525HAA86) | 0,26 | -22,39 | 0,0377 | -0,0234 | |||||

| CP EF Asset Securitization II LLC, Series 2023-1A, Class B / ABS-O (US224092AB28) | 0,25 | -0,78 | 0,0368 | -0,0099 | |||||

| Affirm Asset Securitization Trust, Series 2023-B, Class 1D / ABS-O (US00792FAJ75) | 0,25 | -1,57 | 0,0364 | -0,0100 | |||||

| Affirm Asset Securitization Trust, Series 2023-B, Class 1C / ABS-O (US00792FAH10) | 0,25 | -0,79 | 0,0364 | -0,0097 | |||||

| Affirm Asset Securitization Trust, Series 2023-X1, Class C / ABS-O (US00834KAC18) | 0,25 | -0,40 | 0,0363 | -0,0097 | |||||

| BHG Securitization Trust, Series 2024-1CON, Class A / ABS-O (US08862HAA05) | 0,25 | -20,26 | 0,0360 | -0,0207 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2024-B, Class E / ABS-O (US80280BAE83) | 0,25 | -1,20 | 0,0358 | -0,0098 | |||||

| Pawneee Equipment Receivables LLC, Series 2022-1, Class D / ABS-O (US70410DAF50) | 0,25 | 1,23 | 0,0357 | -0,0087 | |||||

| CP EF Asset Securitization II LLC, Series 2023-1A, Class C / ABS-O (US224092AC01) | 0,25 | 1,24 | 0,0356 | -0,0087 | |||||

| CHDN / Churchill Downs Incorporated | 0,00 | 0,24 | 0,0352 | 0,0352 | |||||

| FIGRE Trust, Series 2024-HE4, Class B / ABS-O (US31684UAB70) | 0,24 | -4,37 | 0,0349 | -0,0110 | |||||

| US05609JAJ16 / BXHPP Trust 2021-FILM | 0,23 | -4,18 | 0,0332 | -0,0104 | |||||

| US23284BAC81 / CyrusOne Data Centers Issuer I | 0,22 | -4,39 | 0,0316 | -0,0099 | |||||

| 3 Month SOFR / DIR (N/A) | 0,21 | 0,0302 | 0,0302 | ||||||

| Auxilior Term Funding LLC, Series 2023-1A, Class E / ABS-O (US05335JAF03) | 0,20 | 1,49 | 0,0296 | -0,0071 | |||||

| Blue Bridge Funding LLC, Series 2023-1A, Class B / ABS-O (US09531MAB63) | 0,20 | 0,00 | 0,0294 | -0,0075 | |||||

| US224092AA45 / CP EF Asset Securitization II LLC | 0,20 | -20,16 | 0,0293 | -0,0168 | |||||

| US80281HAC88 / Santander Consumer Auto Receivables Trust 2021-C | 0,20 | -26,64 | 0,0291 | -0,0207 | |||||

| BX Trust, Series 2022-FOX2, Class D / ABS-MBS (US05610AAG31) | 0,19 | -3,00 | 0,0281 | -0,0085 | |||||

| US05608KAG58 / BX Commercial Mortgage Trust 2021-VINO | 0,17 | -0,57 | 0,0251 | -0,0067 | |||||

| US20268WAB00 / CBSLT 2021 AGS B 144A | 0,16 | -3,55 | 0,0237 | -0,0072 | |||||

| US20267VAC19 / CBSLT 2017 AGS B 144A | 0,16 | 3,33 | 0,0224 | -0,0051 | |||||

| US96033EAD04 / Westgate Resorts Series 2023-1A, Class D | 0,15 | -6,10 | 0,0224 | -0,0076 | |||||

| US23284BAE48 / CyrusOne Data Centers Issuer I | 0,15 | -49,67 | 0,0218 | -0,0328 | |||||

| Affirm Asset Securitization Trust, Series 2023-X1, Class B / ABS-O (US00834KAB35) | 0,15 | -40,24 | 0,0217 | -0,0241 | |||||

| US44422PBC59 / Hudsons Bay Simon JV Trust | 0,14 | 0,0200 | 0,0200 | ||||||

| US38374LL256 / Government National Mortgage Association | 0,11 | -4,35 | 0,0160 | -0,0050 | |||||

| US96034JAD81 / Westgate Resorts LLC, Series 2022-1A, Class D | 0,11 | -16,54 | 0,0153 | -0,0079 | |||||

| US Bank NA, Series 2023-1, Class C / ABS-O (US90357PAW41) | 0,11 | -17,97 | 0,0152 | -0,0082 | |||||

| US20267TAC62 / Commonbond Student Loan Trust 2016-A | 0,10 | 1,02 | 0,0144 | -0,0035 | |||||

| US20267UAC36 / Commonbond Student Loan Trust 2016-B | 0,10 | 2,06 | 0,0144 | -0,0034 | |||||

| US20267XAC74 / CBSLT_18-CGS | 0,10 | -12,04 | 0,0138 | -0,0059 | |||||

| US44422PAU66 / HBCT_15-HB7 | 0,10 | 0,0137 | 0,0137 | ||||||

| US80290CBX11 / SANTANDER BANK AUTO CREDIT-LINKED NOTES SERIES 2023-A | 0,08 | -29,41 | 0,0123 | -0,0094 | |||||

| US35633KAD81 / FREED ABS Trust, Series 2022-1FP, Class D | 0,08 | -31,15 | 0,0123 | -0,0101 | |||||

| US20268MAD83 / Commonbond Student Loan Trust 2018-BGS | 0,08 | 2,63 | 0,0113 | -0,0026 | |||||

| US35564KHE29 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class M2 | 0,07 | -9,76 | 0,0107 | -0,0044 | |||||

| US91681NAC83 / Upstart Securitization Trust | 0,07 | -63,24 | 0,0099 | -0,0239 | |||||

| ACHV ABS Trust, Series 2024-1PL, Class C / ABS-O (US00092BAC81) | 0,04 | -50,59 | 0,0062 | -0,0094 | |||||

| US90355FAA66 / USASF SERVICING LLC 3.98% 04/15/2025 | 0,03 | -39,13 | 0,0041 | -0,0043 | |||||

| US80290CAS35 / Santander Bank Auto Credit-Linked Notes Series 2022-A | 0,02 | -79,22 | 0,0025 | -0,0117 | |||||

| ETRS / DE (N/A) | 0,01 | 0,0012 | 0,0012 | ||||||

| ETRS / DE (N/A) | 0,01 | 0,0011 | 0,0011 | ||||||

| ETRS / DE (N/A) | 0,01 | 0,0008 | 0,0008 | ||||||

| JBBB / Janus Detroit Street Trust - Janus Henderson B-BBB CLO ETF | 0,00 | -100,00 | 0,00 | -100,00 | -4,9227 | ||||

| S&P 500 E-mini Index / DE (N/A) | -0,00 | -0,0002 | -0,0002 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | -0,01 | -0,0011 | -0,0011 | ||||||

| 100 oz Gold / DCO (N/A) | -0,01 | -0,0011 | -0,0011 | ||||||

| Light Sweet Crude Oil / DCO (N/A) | -0,01 | -0,0019 | -0,0019 | ||||||

| S&P 500 E-mini Index / DE (N/A) | -0,02 | -0,0028 | -0,0028 | ||||||

| 100 oz Gold / DCO (N/A) | -0,03 | -0,0037 | -0,0037 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | -0,03 | -0,0043 | -0,0043 | ||||||

| Light Sweet Crude Oil / DCO (N/A) | -0,21 | -0,0306 | -0,0306 | ||||||

| U.S. Treasury 10 Year Notes / DIR (N/A) | -0,24 | -0,0344 | -0,0344 | ||||||

| U.S. Treasury 10 Year Ultra Bond / DIR (N/A) | -0,59 | -0,0852 | -0,0852 | ||||||

| US01F0226591 / FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 | -37,04 | -1.977,19 | -5,3559 | -6,1616 |