Grundlæggende statistik

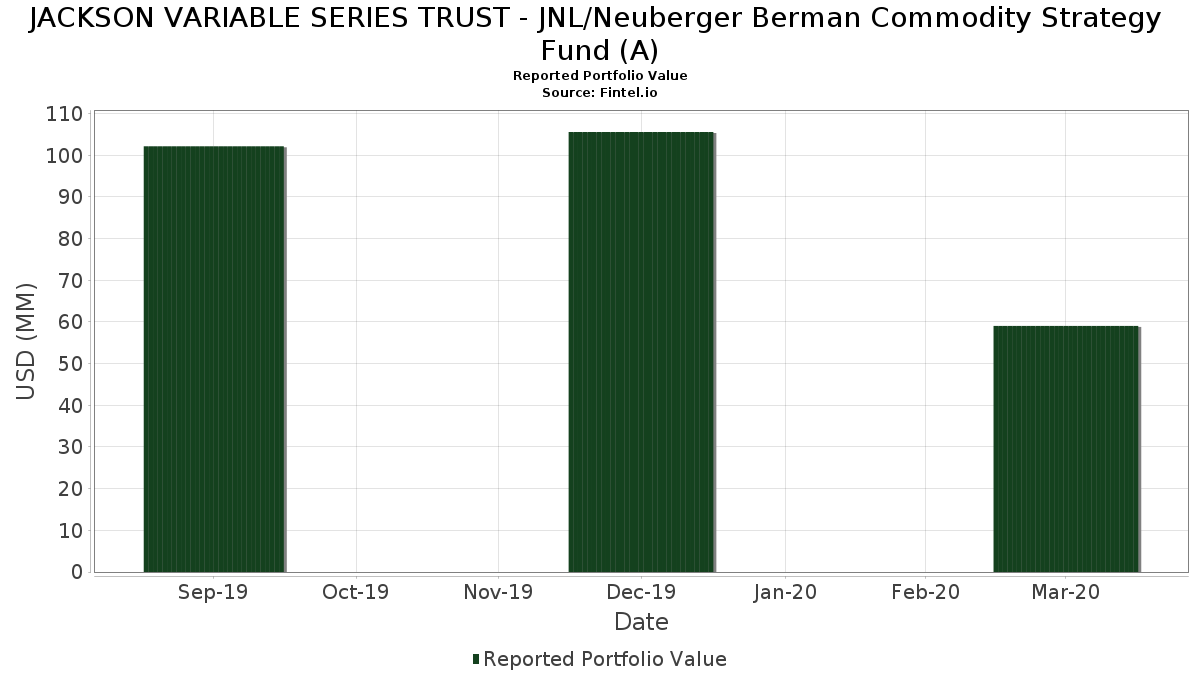

| Porteføljeværdi | $ 59.057.922 |

| Nuværende stillinger | 75 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

JACKSON VARIABLE SERIES TRUST - JNL/Neuberger Berman Commodity Strategy Fund (A) har afsløret 75 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 59.057.922 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). JACKSON VARIABLE SERIES TRUST - JNL/Neuberger Berman Commodity Strategy Fund (A)s største beholdninger er JNL Government Money Market Fund (US:46628D437) , JNL Government Money Market Fund (US:46628D437) , Morgan Stanley (US:US6174468K89) , AT&T Inc (US:US00206RDV15) , and Verizon Communications Inc (US:US92343VDX91) . JACKSON VARIABLE SERIES TRUST - JNL/Neuberger Berman Commodity Strategy Fund (A)s nye stillinger omfatter Morgan Stanley (US:US6174468K89) , AT&T Inc (US:US00206RDV15) , Verizon Communications Inc (US:US92343VDX91) , Cvs Health Corp (variable) Bond (US:US126650DD99) , and HSBC Holdings PLC (GB:US404280BQ12) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 18,32 | 18,32 | 24,2705 | 14,4238 | |

| 2,46 | 3,2620 | 3,2620 | ||

| 1,34 | 1,7769 | 1,7769 | ||

| 1,15 | 1,5175 | 1,5175 | ||

| 0,92 | 1,2197 | 1,2197 | ||

| 0,85 | 1,1280 | 1,1280 | ||

| 2,38 | 3,1481 | 0,8972 | ||

| 2,07 | 2,7380 | 0,7812 | ||

| 2,27 | 3,0027 | 0,7702 | ||

| 1,86 | 2,4593 | 0,7193 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -1,48 | -1,9661 | -1,9661 | ||

| -1,18 | -1,5571 | -1,5571 | ||

| -0,89 | -1,1747 | -1,1747 | ||

| -0,87 | -1,1531 | -1,1531 | ||

| -0,78 | -1,0359 | -1,0359 | ||

| 0,38 | 0,5092 | -1,0221 | ||

| 0,34 | 0,4551 | -0,9888 | ||

| -0,65 | -0,8636 | -0,8636 | ||

| -0,60 | -0,7932 | -0,7932 | ||

| -0,56 | -0,7472 | -0,7472 |

13F og Fondsarkivering

Denne formular blev indsendt den 2020-05-28 for rapporteringsperioden 2020-03-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 46628D437 / JNL Government Money Market Fund | 18,32 | 146,48 | 18,32 | 146,47 | 24,2705 | 14,4238 | |||

| 46628D437 / JNL Government Money Market Fund | 7,43 | -31,42 | 7,43 | -31,41 | 9,8467 | -0,0783 | |||

| US6174468K89 / Morgan Stanley | 2,46 | 3,2620 | 3,2620 | ||||||

| US00206RDV15 / AT&T Inc | 2,38 | -3,30 | 3,1481 | 0,8972 | |||||

| US92343VDX91 / Verizon Communications Inc | 2,27 | -7,02 | 3,0027 | 0,7702 | |||||

| US126650DD99 / Cvs Health Corp (variable) Bond | 2,07 | -3,28 | 2,7380 | 0,7812 | |||||

| US404280BQ12 / HSBC Holdings PLC | 1,86 | -2,26 | 2,4593 | 0,7193 | |||||

| US07274NAC74 / Bayer US Finance II LLC | 1,82 | -6,18 | 2,4129 | 0,6348 | |||||

| US38141GWU48 / Goldman Sachs Group (variable) Bond | 1,82 | -31,36 | 2,4128 | -0,0173 | |||||

| US00287YBN85 / AbbVie Inc | 1,76 | -6,89 | 2,3292 | 0,5997 | |||||

| US55336VBG41 / MPLX LP | 1,63 | -4,29 | 2,1607 | 0,6005 | |||||

| US341081FW23 / Florida Power & Light Co | 1,49 | -1,52 | 1,9767 | 0,5893 | |||||

| US14042RFJ59 / Capital One NA | 1,36 | 10,67 | 1,8012 | 0,6760 | |||||

| US41284VAA08 / Harley-Davidson Financial Services, Inc. | 1,35 | 0,00 | 1,7898 | 0,5525 | |||||

| US55660CAG33 / Madison Avenue Trust 2013-650M | 1,34 | 1,7769 | 1,7769 | ||||||

| US64952WDJ99 / New York Life Global Funding | 1,30 | -4,05 | 1,7273 | 0,4828 | |||||

| US38013TAC53 / GM Financial Automobile Leasing Trust 2019-3 | 1,26 | -6,52 | 1,6717 | 0,4353 | |||||

| US80283LAU70 / Santander UK PLC | 1,19 | -0,34 | 1,5705 | 0,4813 | |||||

| US89114QCF37 / Toronto-Dominion Bank/The | 1,15 | 1,5175 | 1,5175 | ||||||

| US571748BK77 / Marsh & McLennan Cos., Inc. | 1,06 | -0,09 | 1,4036 | 0,4319 | |||||

| US92347YAB02 / Verizon Owner Trust 2019-A | 0,98 | -1,70 | 1,3025 | 0,3863 | |||||

| US233851DV31 / Daimler Finance North America LLC | 0,96 | 3,45 | 1,2706 | 0,4215 | |||||

| US125523AB67 / Cigna Corp | 0,95 | -36,14 | 1,2642 | -0,1041 | |||||

| US94988J5M53 / Wells Fargo Bank NA | 0,92 | 1,2197 | 1,2197 | ||||||

| US58989VAA26 / VAR.RT. CORP. BONDS | 0,85 | 1,1280 | 1,1280 | ||||||

| US110122CF35 / Bristol-Myers Squibb Co | 0,81 | -2,54 | 1,0666 | 0,3094 | |||||

| US64034WAA36 / Navient Student Loan Trust 2019-7 | 0,73 | -8,26 | 0,9720 | 0,2393 | |||||

| US34528DAC74 / Ford Credit Auto Lease Trust 2019-B | 0,72 | -3,74 | 0,9553 | 0,2684 | |||||

| US14040HBM60 / Capital One Financial Corp Variable Rate 03/09/2022 Bond | 0,67 | -27,91 | 0,8941 | 0,0375 | |||||

| US68902VAC19 / Otis Worldwide Corp | 0,51 | 0,6761 | 0,6761 | ||||||

| US98162YAB92 / WORLD OMNI AUTO RECEIVABLES TRUST 2019-A WOART 2019-A A2 | 0,46 | -31,86 | 0,6159 | -0,0081 | |||||

| US89231AAB70 / Toyota Auto Receivables Owner Trust, Series 2018-C, Class A2A | 0,43 | -38,23 | 0,5749 | -0,0679 | |||||

| US05565EAV74 / BMW US Capital LLC | 0,41 | 0,5484 | 0,5484 | ||||||

| US961214EK56 / Westpac Banking Corp | 0,39 | 0,5138 | 0,5138 | ||||||

| US90331HPG29 / US Bank NA/Cincinnati OH | 0,38 | -77,02 | 0,5092 | -1,0221 | |||||

| US05565QDE52 / BPLN F 09/16/21 | 0,37 | -3,69 | 0,4842 | 0,1371 | |||||

| US20030NCW92 / Comcast Corp. | 0,34 | -78,24 | 0,4551 | -0,9888 | |||||

| US36257AAC53 / GM Financial Automobile Leasing Trust 2019-2 | 0,33 | -29,22 | 0,4338 | 0,0104 | |||||

| US90290EAB56 / USAA AUTO OWNER TRUST 2019-1 USAOT 2019-1 A2 | 0,33 | -18,25 | 0,4333 | 0,0663 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0,32 | 9,59 | 0,4242 | 0,4242 | |||||

| US92348AAB17 / VERIZON OWNER TRUST 2019-C SER 2019-C CL A1B V/R REGD 2.14363000 | 0,29 | 0,3896 | 0,3896 | ||||||

| US31680YAC12 / Fifth Third Auto Trust 2019-1 | 0,29 | -29,95 | 0,3854 | 0,0061 | |||||

| US34533FAB76 / Ford Credit Auto Owner Trust, Series 2019-A, Class A2A | 0,27 | -29,14 | 0,3519 | 0,0093 | |||||

| US14913Q2P38 / Caterpillar Financial Services Corp | 0,22 | -71,54 | 0,2950 | -0,4195 | |||||

| US00138CAE84 / AIG Global Funding | 0,18 | -0,54 | 0,2444 | 0,0747 | |||||

| US34531EAD85 / Ford Credit Auto Owner Trust, Series 2017-A, Class A3 | 0,15 | -60,53 | 0,1997 | -0,1489 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0,15 | -49,32 | 0,1962 | 0,1962 | |||||

| US92348NAA54 / Verizon Owner Trust, Series 2017-1A, Class A | 0,14 | -70,13 | 0,1872 | -0,2459 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | 0,09 | -68,15 | 0,1233 | 0,1233 | |||||

| US00206RFY36 / AT&T Inc | 0,07 | -4,29 | 0,0898 | 0,0253 | |||||

| FUTURE - CASH SETTLED / DCO (N/A) | -0,03 | -109,25 | -0,0359 | -0,0359 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,03 | -109,93 | -0,0388 | -0,0388 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,03 | -111,30 | -0,0444 | -0,0444 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,04 | -111,99 | -0,0472 | -0,0472 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,04 | -113,70 | -0,0536 | -0,0536 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,04 | -114,38 | -0,0567 | -0,0567 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,08 | -126,03 | -0,1018 | -0,1018 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,08 | -128,77 | -0,1126 | -0,1126 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,14 | -146,92 | -0,1816 | -0,1816 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,19 | -164,73 | -0,2512 | -0,2512 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,19 | -166,44 | -0,2581 | -0,2581 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,30 | -202,05 | -0,3956 | -0,3956 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,32 | -209,59 | -0,4253 | -0,4253 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,32 | -210,27 | -0,4276 | -0,4276 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,33 | -214,38 | -0,4425 | -0,4425 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,38 | -229,45 | -0,5014 | -0,5014 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,43 | -247,60 | -0,5723 | -0,5723 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,56 | -292,81 | -0,7472 | -0,7472 | |||||

| FUTURE - CASH SETTLED / DCO (N/A) | -0,60 | -304,79 | -0,7932 | -0,7932 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,65 | -322,95 | -0,8636 | -0,8636 | |||||

| FUTURE - CASH SETTLED / DCO (N/A) | -0,78 | -367,47 | -1,0359 | -1,0359 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,87 | -397,95 | -1,1531 | -1,1531 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -0,89 | -403,42 | -1,1747 | -1,1747 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -1,18 | -502,40 | -1,5571 | -1,5571 | |||||

| FUTURE - PHYSICALLY DELIVERED / DCO (N/A) | -1,48 | -607,88 | -1,9661 | -1,9661 |