Grundlæggende statistik

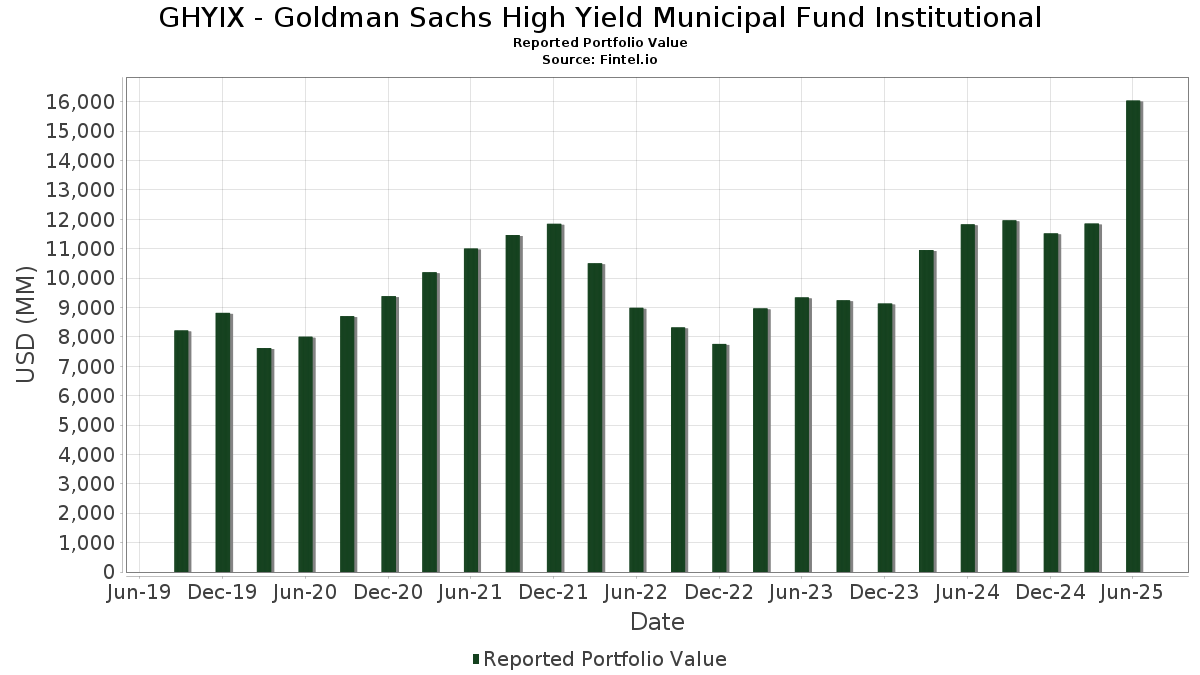

| Porteføljeværdi | $ 16.037.546.469 |

| Nuværende stillinger | 4.666 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

GHYIX - Goldman Sachs High Yield Municipal Fund Institutional har afsløret 4.666 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 16.037.546.469 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). GHYIX - Goldman Sachs High Yield Municipal Fund Institutionals største beholdninger er Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB (US:US74529JPX71) , BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT (US:US74529JQG30) , Puerto Rico Sales Tax Financing Corp., Series 2019 A-2, RB (US:US74529JRH04) , and City of Detroit MI (US:US251093S844) . GHYIX - Goldman Sachs High Yield Municipal Fund Institutionals nye stillinger omfatter Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB (US:US74529JPX71) , BUCKEYE OH TOBACCO SETTLEMENT FING AUTH (US:US118217CZ97) , Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT (US:US74529JQG30) , Puerto Rico Sales Tax Financing Corp., Series 2019 A-2, RB (US:US74529JRH04) , and City of Detroit MI (US:US251093S844) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 32,52 | 0,2778 | 0,2249 | ||

| 32,52 | 0,2778 | 0,2249 | ||

| 32,52 | 0,2778 | 0,2249 | ||

| 24,48 | 0,2091 | 0,2091 | ||

| 24,48 | 0,2091 | 0,2091 | ||

| 23,40 | 0,1999 | 0,1999 | ||

| 23,40 | 0,1999 | 0,1999 | ||

| 23,40 | 0,1999 | 0,1999 | ||

| 22,29 | 0,1904 | 0,1904 | ||

| 22,29 | 0,1904 | 0,1904 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 13,17 | 0,1125 | -0,3309 | ||

| 13,17 | 0,1125 | -0,3309 | ||

| 13,17 | 0,1125 | -0,3309 | ||

| 52,71 | 0,4503 | -0,2444 | ||

| 52,71 | 0,4503 | -0,2444 | ||

| 52,71 | 0,4503 | -0,2444 | ||

| 15,56 | 0,1329 | -0,2237 | ||

| 15,56 | 0,1329 | -0,2237 | ||

| 3,08 | 0,0264 | -0,1738 | ||

| 3,08 | 0,0264 | -0,1738 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 180,25 | -6,17 | 1,5399 | -0,0523 | ||

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 132,36 | 0,59 | 1,1307 | 0,0402 | ||

| US74529JQG30 / Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT | 119,99 | -2,85 | 1,0250 | 0,0014 | ||

| Florida Development Finance Corp / DBT (US340618DK07) | 110,72 | -2,27 | 0,9459 | 0,0069 | ||

| Florida Development Finance Corp / DBT (US340618DK07) | 110,72 | -2,27 | 0,9459 | 0,0069 | ||

| Florida Development Finance Corp / DBT (US340618DK07) | 110,72 | -2,27 | 0,9459 | 0,0069 | ||

| US74529JRH04 / Puerto Rico Sales Tax Financing Corp., Series 2019 A-2, RB | 97,28 | -8,13 | 0,8310 | -0,0466 | ||

| US251093S844 / City of Detroit MI | 83,13 | -2,78 | 0,7102 | 0,0015 | ||

| US646136EY37 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 76,52 | 1,50 | 0,6537 | 0,0289 | ||

| US64542PGC32 / New Hope Cultural Education Facilities Finance Corporation, Texas, Senior Living Revenue Bonds, Sanctuary LTC LLC Project, Series 2021A-1 | 69,94 | 9,49 | 0,5975 | 0,0681 | ||

| US167505RD03 / Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, Series 2016B | 61,64 | -1,18 | 0,5266 | 0,0096 | ||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 61,43 | 1,81 | 0,5248 | 0,0247 | ||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 61,43 | 1,81 | 0,5248 | 0,0247 | ||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 61,43 | 1,81 | 0,5248 | 0,0247 | ||

| US88880NAW92 / Tobacco Settlement Financing Corp/VA | 59,86 | -6,59 | 0,5114 | -0,0197 | ||

| US646136EZ02 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 58,67 | 1,13 | 0,5012 | 0,0204 | ||

| US74529JPW98 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 55,72 | -4,38 | 0,4760 | -0,0069 | ||

| US167505QY58 / CHICAGO IL BRD OF EDU | 54,85 | -0,37 | 0,4686 | 0,0123 | ||

| Florida Development Finance Corp / DBT (US340618DZ75) | 54,80 | 44,11 | 0,4682 | 0,1530 | ||

| Florida Development Finance Corp / DBT (US340618DZ75) | 54,80 | 44,11 | 0,4682 | 0,1530 | ||

| Southeast Alabama Gas Supply District/The / DBT (US84131TBT88) | 52,71 | -37,12 | 0,4503 | -0,2444 | ||

| Southeast Alabama Gas Supply District/The / DBT (US84131TBT88) | 52,71 | -37,12 | 0,4503 | -0,2444 | ||

| Southeast Alabama Gas Supply District/The / DBT (US84131TBT88) | 52,71 | -37,12 | 0,4503 | -0,2444 | ||

| US45734TAD63 / Inland Empire Tobacco Securitization Authority, Series 2007 C-1, RB | 50,51 | -3,50 | 0,4315 | -0,0023 | ||

| US74526QLY60 / Puerto Rico Electric Power Authority Revenue Bonds | 50,05 | -1,86 | 0,4276 | 0,0049 | ||

| US140536AD51 / Capital Trust Agency Inc. (University Bridge, LLC Student Housing), Series 2018 A, RB | 49,58 | -21,30 | 0,4235 | -0,0986 | ||

| US368497FC28 / GEISINGER PA AUTH HLTH SYS REV GEIMED 05/37 FLOATING VAR | 49,56 | 0,17 | 0,4234 | 0,0133 | ||

| US549310WE66 / Lucas (County of), OH (ProMedica Healthcare System), Series 2018 A, Ref. RB | 48,20 | -4,25 | 0,4118 | -0,0054 | ||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 47,85 | -3,92 | 0,4088 | -0,0040 | ||

| US93976ABG67 / Washington (State of) Convention Center Public Facilities District, Series 2018, RB | 46,77 | 12,78 | 0,3995 | 0,0558 | ||

| US745160SJ13 / Puerto Rico Commonwealth Aqueduct & Sewer Authority | 45,38 | 7,07 | 0,3877 | 0,0364 | ||

| US649519DA03 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 1, Ref. RB | 44,62 | 5,32 | 0,3811 | 0,0300 | ||

| US74514L3R62 / PUERTO RICO CMWLTH | 42,24 | 0,90 | 0,3609 | 0,0139 | ||

| US74514L3P07 / PUERTO RICO CMWLTH | 41,43 | -1,99 | 0,3540 | 0,0036 | ||

| US592643BQ24 / Metropolitan Washington Airports Authority, Virginia, Dulles Toll Road Revenue Bonds, Dulles Metrorail Capital Appreciation, Second Senior Lien Series | 39,32 | -1,11 | 0,3359 | 0,0064 | ||

| US74446EAB20 / Public Finance Authority (American Dream at Meadowlands), Series 2017, RB | 38,66 | 0,00 | 0,3303 | 0,0099 | ||

| US882667AN81 / TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE | 36,53 | -23,62 | 0,3121 | -0,0843 | ||

| New York State Dormitory Authority / DBT (US64990KHB26) | 34,62 | 32,92 | 0,2957 | 0,0799 | ||

| New York State Dormitory Authority / DBT (US64990KHB26) | 34,62 | 32,92 | 0,2957 | 0,0799 | ||

| New York State Dormitory Authority / DBT (US64990KHB26) | 34,62 | 32,92 | 0,2957 | 0,0799 | ||

| US254842BB27 / District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2006A | 33,61 | -1,98 | 0,2871 | 0,0029 | ||

| US74447DAG25 / PUBLIC FIN AUTH WI HOTEL REVENUE | 33,16 | -1,46 | 0,2833 | 0,0044 | ||

| US646136WH02 / New Jersey Transportation Trust Fund Authority Transportation Program Revenue | 33,15 | 1,13 | 0,2832 | 0,0115 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZR71) | 32,52 | 409,89 | 0,2778 | 0,2249 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZR71) | 32,52 | 409,89 | 0,2778 | 0,2249 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZR71) | 32,52 | 409,89 | 0,2778 | 0,2249 | ||

| US74514L3T29 / PUERTO RICO CMWLTH | 31,95 | -1,80 | 0,2730 | 0,0033 | ||

| Atlanta Development Authority/The / DBT (US04780NMY03) | 31,68 | 1,83 | 0,2706 | 0,0128 | ||

| Atlanta Development Authority/The / DBT (US04780NMY03) | 31,68 | 1,83 | 0,2706 | 0,0128 | ||

| Atlanta Development Authority/The / DBT (US04780NMY03) | 31,68 | 1,83 | 0,2706 | 0,0128 | ||

| US646136WG29 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 31,51 | 1,50 | 0,2691 | 0,0119 | ||

| US67884XCN57 / Oklahoma (State of) Development Finance Authority (OU Medicine), Series 2018 B, RB | 31,26 | -2,10 | 0,2670 | 0,0024 | ||

| US118217DA38 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 31,22 | -6,59 | 0,2667 | -0,0103 | ||

| US649519DD42 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 3, Ref. RB | 29,54 | -0,22 | 0,2524 | 0,0070 | ||

| Florida Development Finance Corp / DBT (US340618DT16) | 29,18 | -8,49 | 0,2493 | -0,0150 | ||

| US113807BP55 / Brooklyn Arena Local Development Corp. (Barclays Center), Series 2016 A, Ref. RB | 29,12 | 49,65 | 0,2488 | 0,0875 | ||

| US608327AA04 / MOHEGAN TRIBAL CT FIN AUTH | 28,33 | -0,03 | 0,2420 | 0,0072 | ||

| US01728A3Z77 / Allegheny County Hospital Development Authority, Pennsylvania, Revenue Bonds, Allegheny Health Network Obligated Group Issue, Series 2018A | 28,00 | -6,15 | 0,2392 | -0,0081 | ||

| US249271GV36 / Denver City and County, Colorado, Special Facilities Airport Revenue Bonds, United Airlines, Inc Project, Refunding Series 2017 | 27,98 | -18,10 | 0,2391 | -0,0441 | ||

| US45204EJ412 / Illinois (State of) Finance Authority (Roosevelt University), Series 2019 A, RB | 27,25 | 71,92 | 0,2328 | 0,1014 | ||

| Dallas Independent School District / DBT (US235308U355) | 27,21 | -7,46 | 0,2325 | -0,0112 | ||

| Dallas Independent School District / DBT (US235308U355) | 27,21 | -7,46 | 0,2325 | -0,0112 | ||

| Dallas Independent School District / DBT (US235308U355) | 27,21 | -7,46 | 0,2325 | -0,0112 | ||

| US93976ABH41 / Washington State Convention Center Public Facilities District | 27,13 | -9,50 | 0,2318 | -0,0167 | ||

| US439241AA80 / Hoover Industrial Development Board | 26,47 | 0,28 | 0,2261 | 0,0074 | ||

| US882667BX54 / Texas Private Activity Bond Surface Transportation Corp | 26,45 | -2,35 | 0,2260 | 0,0015 | ||

| US73358SAA15 / Port of Beaumont Industrial Development Authority | 26,10 | -2,47 | 0,2230 | 0,0012 | ||

| US13016NFC39 / MUNI. ZERO | 26,00 | -6,85 | 0,2221 | -0,0092 | ||

| Berks County Municipal Authority/The / DBT (US084538JH15) | 26,00 | 11,38 | 0,2221 | 0,0286 | ||

| US56035DEE85 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 25,95 | -0,06 | 0,2217 | 0,0065 | ||

| US899661EK49 / TULSA OK MUNI ARPT TRUST TRUSTEES | 25,68 | -0,17 | 0,2193 | 0,0062 | ||

| Florida Development Finance Corp / DBT (US340618DY01) | 25,39 | 0,96 | 0,2169 | 0,0085 | ||

| Florida Development Finance Corp / DBT (US340618DY01) | 25,39 | 0,96 | 0,2169 | 0,0085 | ||

| Florida Development Finance Corp / DBT (US340618DY01) | 25,39 | 0,96 | 0,2169 | 0,0085 | ||

| US19648FVS00 / Colorado Health Facilities Authority | 24,99 | -2,14 | 0,2135 | 0,0018 | ||

| US59447TM263 / MICHIGAN ST FIN AUTH REVENUE | 24,82 | -4,31 | 0,2120 | -0,0029 | ||

| Louisiana Public Facilities Authority / DBT (US546399SY35) | 24,48 | 0,2091 | 0,2091 | |||

| Louisiana Public Facilities Authority / DBT (US546399SY35) | 24,48 | 0,2091 | 0,2091 | |||

| US55374SAJ96 / M-S-R ENERGY AUTHORITY | 24,28 | -0,61 | 0,2074 | 0,0050 | ||

| US74526QVX77 / Puerto Rico (Commonwealth of) Electric Power Authority, Series 2010 XX, RB | 24,04 | -1,58 | 0,2053 | 0,0029 | ||

| US605156AC20 / MISSION TX ECON DEV CORP REVENUE | 23,98 | 3,00 | 0,2049 | 0,0119 | ||

| Metropolitan Transportation Authority / DBT (US59261A2H99) | 23,75 | -5,06 | 0,2029 | -0,0044 | ||

| Florida Development Finance Corp / DBT (US340618DU88) | 23,64 | -9,45 | 0,2020 | -0,0144 | ||

| Florida Development Finance Corp / DBT (US340618DU88) | 23,64 | -9,45 | 0,2020 | -0,0144 | ||

| Florida Development Finance Corp / DBT (US340618DU88) | 23,64 | -9,45 | 0,2020 | -0,0144 | ||

| US17877SAQ57 / CITYPLACE FL CDD SPL ASSMNT RE CTYDEV 05/46 INT APROID VAR | 23,58 | -1,77 | 0,2015 | 0,0025 | ||

| Florida Higher Educational Facilities Financing Authority / DBT (US42982GAC24) | 23,40 | 0,1999 | 0,1999 | |||

| Florida Higher Educational Facilities Financing Authority / DBT (US42982GAC24) | 23,40 | 0,1999 | 0,1999 | |||

| Florida Higher Educational Facilities Financing Authority / DBT (US42982GAC24) | 23,40 | 0,1999 | 0,1999 | |||

| US082149AA32 / BENLOCH RANCH 10 12/51 | 23,09 | -1,85 | 0,1972 | 0,0023 | ||

| US57584YQJ19 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 22,99 | 0,94 | 0,1964 | 0,0076 | ||

| US650116AV89 / New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment), Series 2016 A, RB | 22,60 | -1,48 | 0,1930 | 0,0030 | ||

| US186347AC47 / CLEVELAND OH ARPT SPL REVENUE | 22,51 | -0,06 | 0,1923 | 0,0056 | ||

| US74514L4C84 / PUERTO RICO CMWLTH | 22,51 | 1,61 | 0,1923 | 0,0087 | ||

| US745160TH48 / PUERTO RICO CMWLTH AQUEDUCT &SWR AUTH REVENUE | 22,41 | -30,27 | 0,1914 | -0,0749 | ||

| Northampton County General Purpose Authority / DBT (US66353RDJ05) | 22,29 | 0,1904 | 0,1904 | |||

| Northampton County General Purpose Authority / DBT (US66353RDJ05) | 22,29 | 0,1904 | 0,1904 | |||

| Northampton County General Purpose Authority / DBT (US66353RDJ05) | 22,29 | 0,1904 | 0,1904 | |||

| US2322655C81 / Cuyahoga (County of). OH, Series 2010, RB | 21,60 | -33,81 | 0,1845 | -0,0859 | ||

| US267045GX49 / Dutchess County Local Development Corporation, New York, Revenue Bonds, Health Quest Systems, Inc Project, Series 2016B | 21,49 | -4,23 | 0,1836 | -0,0024 | ||

| California Community Choice Financing Authority / DBT (US13013JEP75) | 21,13 | 0,1805 | 0,1805 | |||

| US649519DC68 / NEW YORK ST LIBERTY DEV CORP LIBERTY REVENUE | 21,09 | -0,26 | 0,1802 | 0,0049 | ||

| US13080SEX80 / California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center), Series 2014, RB | 20,87 | 51,55 | 0,1783 | 0,0641 | ||

| US167505WB81 / CHICAGO IL BRD OF EDU | 20,80 | -3,88 | 0,1777 | -0,0017 | ||

| US74526QEN88 / Puerto Rico Elec Pwr Auth Bond | 20,63 | -1,57 | 0,1762 | 0,0025 | ||

| US167505QP42 / CHICAGO IL BRD OF EDU | 20,13 | -0,05 | 0,1719 | 0,0051 | ||

| US64578CAH43 / New Jersey (State of) Economic Development Authority (Continental Airlines, Inc.), Series 1999, RB | 19,97 | -0,07 | 0,1706 | 0,0050 | ||

| US74446DAC20 / Public Finance Authority (Million Air Two LLC General Aviation Facilities), Series 2017, Ref. RB | 19,87 | -3,55 | 0,1697 | -0,0010 | ||

| US64972GYZ17 / NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE | 19,80 | 419,82 | 0,1692 | 0,1367 | ||

| US167505WC64 / CHICAGO IL BRD OF EDU | 19,79 | -4,12 | 0,1691 | -0,0020 | ||

| US838530RH87 / SOUTH JERSEY NJ PORT CORP | 19,71 | -0,01 | 0,1684 | 0,0050 | ||

| US67756CFD56 / OH Hosp Rev Bonds (Univ Hosp Hlth Sys) Ser 2021A | 19,50 | -9,75 | 0,1666 | -0,0125 | ||

| US646136WK31 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 19,46 | -0,86 | 0,1662 | 0,0036 | ||

| US888809AJ91 / TOBACCO SETTLEMENT FING CORP R TOBGEN 06/52 ZEROCPNOID 0 | 19,39 | -1,93 | 0,1657 | 0,0018 | ||

| Philadelphia Authority for Industrial Development / DBT (US71781XGW74) | 19,16 | 4,37 | 0,1637 | 0,0115 | ||

| Philadelphia Authority for Industrial Development / DBT (US71781XGW74) | 19,16 | 4,37 | 0,1637 | 0,0115 | ||

| Philadelphia Authority for Industrial Development / DBT (US71781XGW74) | 19,16 | 4,37 | 0,1637 | 0,0115 | ||

| Southeast Energy Authority A Cooperative District / DBT (US84136HBT95) | 19,08 | -0,46 | 0,1630 | 0,0041 | ||

| Southeast Energy Authority A Cooperative District / DBT (US84136HBT95) | 19,08 | -0,46 | 0,1630 | 0,0041 | ||

| Southeast Energy Authority A Cooperative District / DBT (US84136HBT95) | 19,08 | -0,46 | 0,1630 | 0,0041 | ||

| US345105GT12 / FOOTHILL ESTRN TRANSPRTN CORRI FOOTRN 01/53 ADJ CNVFIX 3.95 | 18,94 | -3,28 | 0,1618 | -0,0005 | ||

| Rhode Island Health and Educational Building Corp / DBT (US762244MJ71) | 18,83 | -14,82 | 0,1609 | -0,0224 | ||

| Rhode Island Health and Educational Building Corp / DBT (US762244MJ71) | 18,83 | -14,82 | 0,1609 | -0,0224 | ||

| Rhode Island Health and Educational Building Corp / DBT (US762244MJ71) | 18,83 | -14,82 | 0,1609 | -0,0224 | ||

| US45734TAF12 / Inland Empire Tobacco Securitization Authority, Series 2007 D, RB | 18,66 | -18,44 | 0,1594 | -0,0302 | ||

| Colorado Educational & Cultural Facilities Authority / DBT (US19645UTS32) | 18,59 | 0,1588 | 0,1588 | |||

| Colorado Educational & Cultural Facilities Authority / DBT (US19645UTS32) | 18,59 | 0,1588 | 0,1588 | |||

| Colorado Educational & Cultural Facilities Authority / DBT (US19645UTS32) | 18,59 | 0,1588 | 0,1588 | |||

| US928097AD68 / Virginia (State of) Small Business Financing Authority (Transform 66 P3), Series 2017, RB | 18,59 | -5,04 | 0,1588 | -0,0034 | ||

| US26444CHF23 / DULUTH MN ECON DEV AUTH HLTH CARE FACS REVENUE | 18,46 | -1,96 | 0,1577 | 0,0016 | ||

| US36829QAA31 / GDB DEBT RECOVERY AUTH OF CMWLTH PUERTO RICO | 18,40 | -2,04 | 0,1572 | 0,0015 | ||

| Colorado School of Mines / DBT (US19658QJA67) | 18,27 | -8,42 | 0,1561 | -0,0093 | ||

| Colorado School of Mines / DBT (US19658QJA67) | 18,27 | -8,42 | 0,1561 | -0,0093 | ||

| US167501XG55 / Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1999A | 18,13 | 2,44 | 0,1549 | 0,0082 | ||

| US11121HAB96 / Brixton Park Improvement Association No 1 | 18,08 | -14,37 | 0,1545 | -0,0205 | ||

| US650116CZ75 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 18,07 | 36,93 | 0,1543 | 0,0450 | ||

| US167593X986 / Chicago O'Hare International Airport | 18,00 | -12,86 | 0,1538 | -0,0174 | ||

| US74514L3J47 / PUERTO RICO CMWLTH | 17,92 | -1,83 | 0,1531 | 0,0018 | ||

| US46246SAU96 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 17,90 | 0,49 | 0,1529 | 0,0053 | ||

| US646136EX53 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 17,87 | 1,59 | 0,1527 | 0,0069 | ||

| US592250BF05 / Met Pier & Exposition Auth Il Proj Bds Callable Bond | 17,86 | -14,45 | 0,1526 | -0,0204 | ||

| Massachusetts Development Finance Agency / DBT (US57585BBJ61) | 17,82 | -0,41 | 0,1522 | 0,0039 | ||

| Massachusetts Development Finance Agency / DBT (US57585BBJ61) | 17,82 | -0,41 | 0,1522 | 0,0039 | ||

| Massachusetts Development Finance Agency / DBT (US57585BBJ61) | 17,82 | -0,41 | 0,1522 | 0,0039 | ||

| US13080SEW08 / California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center), Series 2014, RB | 17,82 | -2,79 | 0,1522 | 0,0003 | ||

| US64966ML981 / GO Bonds Fiscal 2019 Series D | 17,56 | 0,1500 | 0,1500 | |||

| New Hampshire Business Finance Authority / DBT (US63608TAC45) | 17,45 | -0,25 | 0,1491 | 0,0041 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAC45) | 17,45 | -0,25 | 0,1491 | 0,0041 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAC45) | 17,45 | -0,25 | 0,1491 | 0,0041 | ||

| Public Finance Authority / DBT (US74443DLV19) | 17,39 | -0,26 | 0,1486 | 0,0041 | ||

| Public Finance Authority / DBT (US74443DLV19) | 17,39 | -0,26 | 0,1486 | 0,0041 | ||

| Public Finance Authority / DBT (US74443DLV19) | 17,39 | -0,26 | 0,1486 | 0,0041 | ||

| US74514L3N58 / PUERTO RICO CMWLTH | 17,34 | -2,82 | 0,1481 | 0,0003 | ||

| US56035DBW11 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 17,34 | -3,74 | 0,1481 | -0,0012 | ||

| Louisiana Public Facilities Authority / DBT (US546399TA40) | 17,29 | -3,91 | 0,1477 | -0,0014 | ||

| Louisiana Public Facilities Authority / DBT (US546399TA40) | 17,29 | -3,91 | 0,1477 | -0,0014 | ||

| Louisiana Public Facilities Authority / DBT (US546399TA40) | 17,29 | -3,91 | 0,1477 | -0,0014 | ||

| Commonwealth of Massachusetts / DBT (US57582R5Q58) | 16,97 | -45,90 | 0,1449 | -0,1150 | ||

| Commonwealth of Massachusetts / DBT (US57582R5Q58) | 16,97 | -45,90 | 0,1449 | -0,1150 | ||

| Commonwealth of Massachusetts / DBT (US57582R5Q58) | 16,97 | -45,90 | 0,1449 | -0,1150 | ||

| US74166AAA07 / Prime Healthcare Foundation, Inc., Series B | 16,84 | -1,97 | 0,1439 | 0,0015 | ||

| New York Transportation Development Corp / DBT (US650116HA79) | 16,78 | -3,57 | 0,1433 | -0,0009 | ||

| New York Transportation Development Corp / DBT (US650116HA79) | 16,78 | -3,57 | 0,1433 | -0,0009 | ||

| New York Transportation Development Corp / DBT (US650116HA79) | 16,78 | -3,57 | 0,1433 | -0,0009 | ||

| US13016NCV47 / California County Tobacco Securitization Agency | 16,47 | -6,13 | 0,1407 | -0,0047 | ||

| US93976ACL44 / WASHINGTON ST CONVENTION CENTER PUBLIC FACS DIST | 16,45 | -5,32 | 0,1406 | -0,0035 | ||

| US04052HBK68 / Arizona Industrial Development Authority | 16,44 | -4,09 | 0,1404 | -0,0016 | ||

| US37255MAF23 / George L Smith II Congress Center Authority | 16,30 | -4,08 | 0,1393 | -0,0016 | ||

| US167510AA40 / CHICAGO IL BRD OF EDU DEDICATED CAPITAL IMPT | 16,23 | -0,81 | 0,1386 | 0,0030 | ||

| US04110FAA30 / Arkansas Development Finance Authority, Series 2022 | 16,20 | -2,18 | 0,1384 | 0,0011 | ||

| New York Transportation Development Corp / DBT (US650116HS87) | 16,19 | -4,63 | 0,1383 | -0,0024 | ||

| New York Transportation Development Corp / DBT (US650116HS87) | 16,19 | -4,63 | 0,1383 | -0,0024 | ||

| New York Transportation Development Corp / DBT (US650116HS87) | 16,19 | -4,63 | 0,1383 | -0,0024 | ||

| Tulsa Municipal Airport Trust Trustees/OK / DBT (US899661EM05) | 15,93 | 0,1361 | 0,1361 | |||

| Tulsa Municipal Airport Trust Trustees/OK / DBT (US899661EM05) | 15,93 | 0,1361 | 0,1361 | |||

| Tulsa Municipal Airport Trust Trustees/OK / DBT (US899661EM05) | 15,93 | 0,1361 | 0,1361 | |||

| Illinois Finance Authority / DBT (US45204FZN85) | 15,93 | 1,22 | 0,1360 | 0,0056 | ||

| Illinois Finance Authority / DBT (US45204FZN85) | 15,93 | 1,22 | 0,1360 | 0,0056 | ||

| Illinois Finance Authority / DBT (US45204FZN85) | 15,93 | 1,22 | 0,1360 | 0,0056 | ||

| US167505TK28 / Chicago (City of), IL Board of Education, Series 2017 H, GO Bonds | 15,69 | 1,40 | 0,1340 | 0,0058 | ||

| US74514L4G98 / Commonwealth of Puerto Rico | 15,56 | -0,37 | 0,1330 | 0,0035 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZS54) | 15,56 | -63,84 | 0,1329 | -0,2237 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZS54) | 15,56 | -63,84 | 0,1329 | -0,2237 | ||

| US55374SAC44 / M-S-R CA ENERGY AUTH GAS REVENUE | 15,48 | -0,61 | 0,1322 | 0,0032 | ||

| Triborough Bridge & Tunnel Authority Sales Tax Revenue / DBT (US896035DH24) | 15,46 | 0,1321 | 0,1321 | |||

| Triborough Bridge & Tunnel Authority Sales Tax Revenue / DBT (US896035DH24) | 15,46 | 0,1321 | 0,1321 | |||

| Triborough Bridge & Tunnel Authority Sales Tax Revenue / DBT (US896035DH24) | 15,46 | 0,1321 | 0,1321 | |||

| State of Hawaii Department of Budget & Finance / DBT (US419800PR22) | 15,43 | -4,78 | 0,1318 | -0,0025 | ||

| State of Hawaii Department of Budget & Finance / DBT (US419800PR22) | 15,43 | -4,78 | 0,1318 | -0,0025 | ||

| State of Hawaii Department of Budget & Finance / DBT (US419800PR22) | 15,43 | -4,78 | 0,1318 | -0,0025 | ||

| Chicago O'Hare International Airport / DBT (US1675934T61) | 15,42 | 0,1317 | 0,1317 | |||

| Chicago O'Hare International Airport / DBT (US1675934T61) | 15,42 | 0,1317 | 0,1317 | |||

| Chicago O'Hare International Airport / DBT (US1675934T61) | 15,42 | 0,1317 | 0,1317 | |||

| US987388DT95 / Yosemite Community College District, California, General Obligation Bonds, Capital Appreciation, Election 2004, Series 2010D | 15,35 | -1,60 | 0,1311 | 0,0019 | ||

| US018444AY55 / ALLENTOWN PA NEIGHBORHOOD IMPTZONE DEV AUTH TAX REV | 15,32 | -0,02 | 0,1309 | 0,0039 | ||

| Metropolitan Transportation Authority / DBT (US59261AX281) | 15,30 | 0,1307 | 0,1307 | |||

| Metropolitan Transportation Authority / DBT (US59261AX281) | 15,30 | 0,1307 | 0,1307 | |||

| Metropolitan Transportation Authority / DBT (US59261AX281) | 15,30 | 0,1307 | 0,1307 | |||

| US296110GD59 / ESCAMBIA CNTY FL HLTH FACS AUTH | 15,29 | -4,16 | 0,1306 | -0,0016 | ||

| US74529JRL16 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 15,18 | 5,10 | 0,1297 | 0,0100 | ||

| US4423487S16 / FX.RT. MUNI BOND | 15,10 | -0,02 | 0,1290 | 0,0038 | ||

| City of New Braunfels TX Utility System Revenue / DBT (US642577B667) | 15,03 | -4,74 | 0,1284 | -0,0024 | ||

| City of New Braunfels TX Utility System Revenue / DBT (US642577B667) | 15,03 | -4,74 | 0,1284 | -0,0024 | ||

| City of New Braunfels TX Utility System Revenue / DBT (US642577B667) | 15,03 | -4,74 | 0,1284 | -0,0024 | ||

| US599772AC45 / Military Installation Development Authority | 14,99 | -6,92 | 0,1281 | -0,0054 | ||

| US961488NU37 / Westside Union School District, Series 2008 B | 14,98 | -0,62 | 0,1280 | 0,0030 | ||

| US378287BA35 / GLENDALE AZ ID 5% 5/15/2056 | 14,80 | -7,35 | 0,1265 | -0,0060 | ||

| US13013FAG90 / California Community Housing Agency | 14,49 | -10,67 | 0,1238 | -0,0106 | ||

| US744826AW80 / Pueblo Urban Renewal Authority | 14,38 | 19,71 | 0,1228 | 0,0233 | ||

| US167486XF14 / Chicago, Illinois, General Obligation Bonds, Refunding Series 2016C | 14,34 | -0,55 | 0,1225 | 0,0030 | ||

| New York State Dormitory Authority / DBT (US64990F6W92) | 14,30 | -6,04 | 0,1222 | -0,0040 | ||

| State of Nevada Department of Business & Industry / DBT (US641455AB65) | 14,28 | -4,94 | 0,1220 | -0,0025 | ||

| State of Nevada Department of Business & Industry / DBT (US641455AB65) | 14,28 | -4,94 | 0,1220 | -0,0025 | ||

| City of Houston TX Airport System Revenue / DBT (US442349HY56) | 14,25 | 504,63 | 0,1217 | 0,1022 | ||

| City of Houston TX Airport System Revenue / DBT (US442349HY56) | 14,25 | 504,63 | 0,1217 | 0,1022 | ||

| City of Houston TX Airport System Revenue / DBT (US442349HY56) | 14,25 | 504,63 | 0,1217 | 0,1022 | ||

| New Hampshire Business Finance Authority / DBT (US63610JAA60) | 14,15 | -6,83 | 0,1209 | -0,0050 | ||

| New Hampshire Business Finance Authority / DBT (US63610JAA60) | 14,15 | -6,83 | 0,1209 | -0,0050 | ||

| New Hampshire Business Finance Authority / DBT (US63610JAA60) | 14,15 | -6,83 | 0,1209 | -0,0050 | ||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAB08) | 14,11 | 0,01 | 0,1205 | 0,0036 | ||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAB08) | 14,11 | 0,01 | 0,1205 | 0,0036 | ||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAC80) | 14,09 | -0,59 | 0,1204 | 0,0029 | ||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAC80) | 14,09 | -0,59 | 0,1204 | 0,0029 | ||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAC80) | 14,09 | -0,59 | 0,1204 | 0,0029 | ||

| US26362VTG31 / Dublin Unified School District | 14,01 | -5,96 | 0,1196 | -0,0038 | ||

| City of Marion IL Sales Tax Revenue / DBT (US569498AB42) | 13,90 | -0,02 | 0,1187 | 0,0035 | ||

| City of Marion IL Sales Tax Revenue / DBT (US569498AB42) | 13,90 | -0,02 | 0,1187 | 0,0035 | ||

| US05921PCG28 / BALTIMORE MD CONVENTION CENTER HOTEL REVENUE | 13,80 | -3,47 | 0,1179 | -0,0006 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAA97) | 13,80 | -2,99 | 0,1179 | -0,0000 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAA97) | 13,80 | -2,99 | 0,1179 | -0,0000 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAA97) | 13,80 | -2,99 | 0,1179 | -0,0000 | ||

| Public Finance Authority / DBT (US74448EAA29) | 13,72 | -2,54 | 0,1172 | 0,0005 | ||

| Public Finance Authority / DBT (US74448EAA29) | 13,72 | -2,54 | 0,1172 | 0,0005 | ||

| Public Finance Authority / DBT (US74448EAA29) | 13,72 | -2,54 | 0,1172 | 0,0005 | ||

| US45200FCN78 / Illinois (State of) Finance Authority (Roosevelt University), Series 2007, RB | 13,70 | 1,39 | 0,1171 | 0,0050 | ||

| US26822LEN01 / E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Series 2004A | 13,59 | 1,52 | 0,1161 | 0,0051 | ||

| US888808HT28 / TOBACCO SETTLEMENT FING CORP NJ | 13,58 | -7,13 | 0,1160 | -0,0052 | ||

| US592250CK80 / Metropolitan Pier and Exposition Authority, Illinois, McCormick Place Expansion Project Bonds, Series 2017A | 13,41 | 3,42 | 0,1146 | 0,0071 | ||

| US387816DB41 / Grant County Public Hospital District No 2 | 13,38 | -3,94 | 0,1143 | -0,0011 | ||

| US74443DGE58 / Public Finance Authority | 13,30 | -1,66 | 0,1136 | 0,0015 | ||

| US167505KG07 / CHICAGO IL BRD OF EDU | 13,29 | -0,87 | 0,1136 | 0,0024 | ||

| US419800LY19 / HAWAII ST DEPT OF BUDGET & FIN SPL PURPOSE REVENUE | 13,23 | 1,04 | 0,1130 | 0,0045 | ||

| Triborough Bridge & Tunnel Authority / DBT (US89602HHC43) | 13,17 | -74,67 | 0,1125 | -0,3309 | ||

| Triborough Bridge & Tunnel Authority / DBT (US89602HHC43) | 13,17 | -74,67 | 0,1125 | -0,3309 | ||

| Triborough Bridge & Tunnel Authority / DBT (US89602HHC43) | 13,17 | -74,67 | 0,1125 | -0,3309 | ||

| US64985TEU16 / NEW YORK ST URBAN DEV CORP SALES TAX REVENUE | 13,05 | 36,19 | 0,1115 | 0,0321 | ||

| Atlanta Development Authority/The / DBT (US04780NMX20) | 12,95 | -1,13 | 0,1106 | 0,0021 | ||

| Atlanta Development Authority/The / DBT (US04780NMX20) | 12,95 | -1,13 | 0,1106 | 0,0021 | ||

| Atlanta Development Authority/The / DBT (US04780NMX20) | 12,95 | -1,13 | 0,1106 | 0,0021 | ||

| US419800LX36 / Hawaii Department of Budget and Finance, Special Purpose Revenue Bonds, Hawaii Pacific University, Series 2018 | 12,93 | 0,02 | 0,1105 | 0,0033 | ||

| Triborough Bridge & Tunnel Authority Sales Tax Revenue / DBT (US896035DG41) | 12,92 | -4,25 | 0,1104 | -0,0015 | ||

| Triborough Bridge & Tunnel Authority Sales Tax Revenue / DBT (US896035DG41) | 12,92 | -4,25 | 0,1104 | -0,0015 | ||

| Triborough Bridge & Tunnel Authority Sales Tax Revenue / DBT (US896035DG41) | 12,92 | -4,25 | 0,1104 | -0,0015 | ||

| US74443DGD75 / Public Finance Authority | 12,66 | 2,58 | 0,1082 | 0,0059 | ||

| US38122NB843 / GOLDEN ST TOBACCO SECURITIZATI REGD ZCP OID B/E 0.00000000 | 12,66 | -12,49 | 0,1081 | -0,0117 | ||

| Massachusetts Development Finance Agency / DBT (US57585BKB35) | 12,64 | 0,1080 | 0,1080 | |||

| Cabot Citrus Farms Community Development District / DBT (US127052AA63) | 12,61 | 0,31 | 0,1077 | 0,0035 | ||

| Cabot Citrus Farms Community Development District / DBT (US127052AA63) | 12,61 | 0,31 | 0,1077 | 0,0035 | ||

| Cabot Citrus Farms Community Development District / DBT (US127052AA63) | 12,61 | 0,31 | 0,1077 | 0,0035 | ||

| US687241AL32 / Oroville (City of), CA (Oroville Hospital), Series 2019, RB | 12,51 | -2,16 | 0,1069 | 0,0009 | ||

| US23825JAG85 / Dauphin County General Authority | 12,50 | -4,24 | 0,1068 | -0,0014 | ||

| New Jersey Turnpike Authority / DBT (US646140JF13) | 12,47 | 0,1066 | 0,1066 | |||

| New Jersey Turnpike Authority / DBT (US646140JF13) | 12,47 | 0,1066 | 0,1066 | |||

| New Jersey Turnpike Authority / DBT (US646140JF13) | 12,47 | 0,1066 | 0,1066 | |||

| US353180LY69 / FRANKLIN CNTY OH HLTH CARE FACS REVENUE | 12,34 | -2,02 | 0,1054 | 0,0010 | ||

| Massachusetts Development Finance Agency / DBT (US57585BEY02) | 12,27 | -3,36 | 0,1048 | -0,0004 | ||

| Massachusetts Development Finance Agency / DBT (US57585BEY02) | 12,27 | -3,36 | 0,1048 | -0,0004 | ||

| US650116GY64 / New York Transportation Development Corp | 12,22 | 5,17 | 0,1044 | 0,0081 | ||

| New York State Dormitory Authority / DBT (US64990KHC09) | 12,16 | -12,27 | 0,1039 | -0,0110 | ||

| Arizona Industrial Development Authority / DBT (US04052EBV92) | 12,07 | -0,16 | 0,1031 | 0,0029 | ||

| Arizona Industrial Development Authority / DBT (US04052EBV92) | 12,07 | -0,16 | 0,1031 | 0,0029 | ||

| Arizona Industrial Development Authority / DBT (US04052EBV92) | 12,07 | -0,16 | 0,1031 | 0,0029 | ||

| US38122ND823 / Golden State Tobacco Securitization Corp | 12,04 | -18,47 | 0,1028 | -0,0195 | ||

| US13054WAC10 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, Poseidon Resources Channelside LP Desalination Project, Series 2012 | 12,00 | -4,80 | 0,1025 | -0,0020 | ||

| US74442PSG18 / PUBLIC FIN AUTH WI REVENUE | 11,95 | -2,18 | 0,1021 | 0,0008 | ||

| US35317DAN57 / Franklin County Convention Facilities Authority, Ohio, Hotel Project Revenue Bonds, Greater Columbus Convention Center Hotel Expansion Project, Series | 11,89 | -3,94 | 0,1015 | -0,0010 | ||

| City of Chicago IL / DBT (US167486U724) | 11,86 | 0,1014 | 0,1014 | |||

| City of Chicago IL / DBT (US167486U724) | 11,86 | 0,1014 | 0,1014 | |||

| City of Chicago IL / DBT (US167486U724) | 11,86 | 0,1014 | 0,1014 | |||

| US13080SVN16 / CALIFORNIA STWD CMNTYS DEV AUTH REVENUE | 11,80 | 14,94 | 0,1008 | 0,0157 | ||

| US69753RCY80 / Palomar Pomerado Health, California, General Obligation Bonds, Series 2009A | 11,77 | -0,71 | 0,1006 | 0,0023 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAB70) | 11,75 | -2,60 | 0,1004 | 0,0004 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAB70) | 11,75 | -2,60 | 0,1004 | 0,0004 | ||

| Mobile County Industrial Development Authority / DBT (US60733UAB70) | 11,75 | -2,60 | 0,1004 | 0,0004 | ||

| US64971PKK02 / NEW YORK CITY NY INDL DEV AGY REVENUE | 11,70 | -2,33 | 0,1000 | 0,0007 | ||

| US13048VCA44 / California Municipal Finance Authority, Revenue Bonds, Linxs APM Project, Senior Lien Series 2018A | 11,67 | -5,11 | 0,0997 | -0,0022 | ||

| US63166MCE75 / Nassau County Tobacco Settlement Corp., Series 2006 D, RB | 11,51 | -7,13 | 0,0983 | -0,0044 | ||

| US46246K4S82 / Iowa (State of) Finance Authority (Lifespace Communities, Inc.), Series 2018 A, RB | 11,51 | -2,88 | 0,0983 | 0,0001 | ||

| US134340AB45 / Campbell County, Wyoming Solid Waste Facilities Revenue Bonds, Basin Electric Power Cooperative, Dry Fork Station Facilities, Series 2019A | 11,38 | -0,63 | 0,0972 | 0,0023 | ||

| Baldwin County Industrial Development Authority / DBT (US05786PAA12) | 11,34 | 0,0969 | 0,0969 | |||

| Baldwin County Industrial Development Authority / DBT (US05786PAA12) | 11,34 | 0,0969 | 0,0969 | |||

| Baldwin County Industrial Development Authority / DBT (US05786PAA12) | 11,34 | 0,0969 | 0,0969 | |||

| US167505QR08 / Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, Project Series 2015C | 11,26 | 11,41 | 0,0962 | 0,0124 | ||

| US353180LL49 / County of Franklin | 11,24 | -5,62 | 0,0960 | -0,0027 | ||

| US167505PS99 / CHICAGO IL BRD OF EDU | 11,20 | 2,55 | 0,0957 | 0,0052 | ||

| US13050RAA05 / California (State of) Municipal Finance Authority (United Airlines, Inc.), Series 2019, Ref. RB | 11,19 | -1,07 | 0,0956 | 0,0018 | ||

| Capital Trust Authority / DBT (US14055AAA07) | 11,14 | 10,10 | 0,0952 | 0,0113 | ||

| US45204FQP35 / Illinois Finance Authority | 11,03 | 2,57 | 0,0942 | 0,0051 | ||

| US57665NAG07 / MATCHING FUND SPL PURPOSE SECURITIZTN CORP | 10,84 | 32,46 | 0,0926 | 0,0248 | ||

| US626656AA07 / Murphy Creek Metropolitan District No. 4 | 10,80 | -1,65 | 0,0923 | 0,0013 | ||

| US956622S541 / Hospital Refunding RB (Cabell Huntington Hospital) Series 2018A | 10,76 | -2,37 | 0,0919 | 0,0006 | ||

| Metropolitan Transportation Authority / DBT (US59261A2G17) | 10,63 | -1,17 | 0,0908 | 0,0017 | ||

| Metropolitan Transportation Authority / DBT (US59261A2G17) | 10,63 | -1,17 | 0,0908 | 0,0017 | ||

| Port of Beaumont Navigation District / DBT (US73360CAS35) | 10,58 | -1,64 | 0,0904 | 0,0012 | ||

| Port of Beaumont Navigation District / DBT (US73360CAS35) | 10,58 | -1,64 | 0,0904 | 0,0012 | ||

| Port of Beaumont Navigation District / DBT (US73360CAS35) | 10,58 | -1,64 | 0,0904 | 0,0012 | ||

| US74443DGB10 / PUBLIC FIN AUTH WI EDUCTNL FAC REVENUE | 10,58 | -6,12 | 0,0904 | -0,0030 | ||

| US84136GAK13 / Southeast Energy Authority A Cooperative District, Series 2023 B | 10,53 | 0,22 | 0,0900 | 0,0029 | ||

| US09182TCG04 / Black Belt Energy Gas District | 10,52 | 0,50 | 0,0898 | 0,0031 | ||

| US167593L593 / CHICAGO O'HARE INTERNATIONAL AIRPORT | 10,49 | 36,52 | 0,0896 | 0,0259 | ||

| US452152P213 / State of Illinois | 10,34 | -0,29 | 0,0883 | 0,0024 | ||

| Kremmling Memorial Hospital District / DBT (US500795AK53) | 10,29 | -2,94 | 0,0879 | 0,0000 | ||

| Kremmling Memorial Hospital District / DBT (US500795AK53) | 10,29 | -2,94 | 0,0879 | 0,0000 | ||

| Kremmling Memorial Hospital District / DBT (US500795AK53) | 10,29 | -2,94 | 0,0879 | 0,0000 | ||

| US74526QVE96 / PUERTO RICO ELEC PWR AUTH PWR PUERTO RICO ELECTRIC POWER AUTHORITY | 10,22 | -1,57 | 0,0873 | 0,0012 | ||

| US479706AA19 / JOHNSTOWN PLAZA MET DIST CO | 10,20 | -4,90 | 0,0872 | -0,0018 | ||

| US592247J926 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 10,09 | 1,22 | 0,0862 | 0,0036 | ||

| US26822LLS15 / E-470 CO PUBLIC HIGHWAY AUTH | 10,09 | 0,59 | 0,0862 | 0,0031 | ||

| US594751AM15 / MICHIGAN TOBACCO SETTLEMENT FINANCE AUTHORITY | 10,07 | -11,27 | 0,0861 | -0,0080 | ||

| US67756DWU61 / Ohio Higher Educational Facility Commission, Senior Hospital Parking Revenue Bonds, University Circle Incorporated 2020 Project, Series 2020 | 10,04 | -1,80 | 0,0858 | 0,0010 | ||

| US4423485T17 / Houston (City of), TX (Continental Airlines, Inc.), Series 2011 A, Ref. RB | 10,02 | -0,75 | 0,0856 | 0,0019 | ||

| US13048TS204 / California (State of) Municipal Finance Authority (Community Medical Centers), Series 2017 A, Ref. RB | 10,00 | -0,19 | 0,0854 | 0,0024 | ||

| US70917RKD60 / Pennsylvania Higher Educational Facilities Authority | 10,00 | 0,52 | 0,0854 | 0,0030 | ||

| US64971PLK92 / New York City Industrial Development Agency | 9,95 | -4,67 | 0,0850 | -0,0015 | ||

| US546399CN44 / Louisiana Public Facilities Authority, Revenue Bonds, Ochsner Clinic Foundation Project, Refunding Series 2017 | 9,94 | -1,51 | 0,0849 | 0,0013 | ||

| US04052BMG67 / ARIZONA ST INDL DEV AUTH EDU REVENUE | 9,93 | -6,64 | 0,0849 | -0,0033 | ||

| US37255MAC91 / GEO L SMITH II GA CONGRESS CTR AUTH | 9,92 | -5,30 | 0,0848 | -0,0021 | ||

| Lake County Community Consolidated School District No 34 Antioch / DBT (US508516GQ86) | 9,82 | 0,0839 | 0,0839 | |||

| Lake County Community Consolidated School District No 34 Antioch / DBT (US508516GQ86) | 9,82 | 0,0839 | 0,0839 | |||

| US650116CQ76 / New York Transportation Development Corp. (Delta Airlines, Inc.), Series 2018, RB | 9,81 | -1,39 | 0,0838 | 0,0014 | ||

| US74514L3M75 / PUERTO RICO CMWLTH | 9,77 | 0,82 | 0,0835 | 0,0031 | ||

| US650116CW45 / New York Transportation Development Corp. | 9,75 | -1,17 | 0,0833 | 0,0015 | ||

| US696507VM10 / PALM BEACH CNTY FL HLTH FACS AUTH REVENUE | 9,68 | 3,11 | 0,0827 | 0,0049 | ||

| US452152T686 / ILLINOIS ST | 9,68 | -0,57 | 0,0827 | 0,0020 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JKM44) | 9,63 | -1,24 | 0,0823 | 0,0015 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JKM44) | 9,63 | -1,24 | 0,0823 | 0,0015 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JKM44) | 9,63 | -1,24 | 0,0823 | 0,0015 | ||

| US13080SML50 / California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center), Series 2016 A, RB | 9,61 | -4,29 | 0,0821 | -0,0011 | ||

| US67754AAE47 / OHIO ST AIR QUALITY DEV AUTH EXEMPT FACS REVENUE | 9,57 | -2,73 | 0,0818 | 0,0002 | ||

| US745160UD15 / PUERTO RICO CMWLTH AQUEDUCT & SWR AUTH REVENUE | 9,53 | -0,18 | 0,0814 | 0,0023 | ||

| Metropolitan Government of Nashville & Davidson County TN Water & Sewer Revenue / DBT (US5920983Q86) | 9,53 | 0,0814 | 0,0814 | |||

| Metropolitan Government of Nashville & Davidson County TN Water & Sewer Revenue / DBT (US5920983Q86) | 9,53 | 0,0814 | 0,0814 | |||

| Metropolitan Government of Nashville & Davidson County TN Water & Sewer Revenue / DBT (US5920983Q86) | 9,53 | 0,0814 | 0,0814 | |||

| Virginia Beach Development Authority / DBT (US92774NBC39) | 9,50 | -2,39 | 0,0812 | 0,0005 | ||

| Virginia Beach Development Authority / DBT (US92774NBC39) | 9,50 | -2,39 | 0,0812 | 0,0005 | ||

| Virginia Beach Development Authority / DBT (US92774NBC39) | 9,50 | -2,39 | 0,0812 | 0,0005 | ||

| Los Angeles Department of Water & Power / DBT (US544532PU27) | 9,45 | 0,0807 | 0,0807 | |||

| Los Angeles Department of Water & Power / DBT (US544532PU27) | 9,45 | 0,0807 | 0,0807 | |||

| Los Angeles Department of Water & Power / DBT (US544532PU27) | 9,45 | 0,0807 | 0,0807 | |||

| US628077CK34 / Muskingum County, Ohio, Hospital Facilities Revenue Bonds, Genesis HealthCare System Obligated Group Project, Series 2013 | 9,39 | -4,27 | 0,0802 | -0,0011 | ||

| New Jersey Economic Development Authority / DBT (US64578TAB08) | 9,32 | 0,0796 | 0,0796 | |||

| New Jersey Economic Development Authority / DBT (US64578TAB08) | 9,32 | 0,0796 | 0,0796 | |||

| New Jersey Economic Development Authority / DBT (US64578TAB08) | 9,32 | 0,0796 | 0,0796 | |||

| US45204EB989 / ILLINOIS FINANCE AUTHORITY | 9,30 | -8,35 | 0,0794 | -0,0047 | ||

| New Jersey Economic Development Authority / DBT (US64578TAA25) | 9,30 | 0,0794 | 0,0794 | |||

| New Jersey Economic Development Authority / DBT (US64578TAA25) | 9,30 | 0,0794 | 0,0794 | |||

| New Jersey Economic Development Authority / DBT (US64578TAA25) | 9,30 | 0,0794 | 0,0794 | |||

| US4423487H50 / HOUSTON TX ARPT SYS REVENUE | 9,25 | -0,03 | 0,0790 | 0,0023 | ||

| US19648DAD12 / CO HIGH PERFORMANCE TRANSPRTN ENTERPRISE REVENUE | 9,24 | -1,91 | 0,0789 | 0,0009 | ||

| US927676TM83 / Virgin Islands Public Finance Authority, Gross Receipts Taxes Loan Note, Refunding Series 2014C | 9,23 | -1,35 | 0,0789 | 0,0013 | ||

| US63608SAM44 / NATIONAL FIN AUTH NH SENIOR LIVING REVENUE | 9,21 | -5,45 | 0,0786 | -0,0021 | ||

| US64579F7Q09 / New Jersey Health Care Facilities Financing Authority, Revenue Bonds, University Hospital Issue, Refunding Series 2015A | 9,20 | -1,91 | 0,0786 | 0,0009 | ||

| US745160TV32 / PUERTO RICO CMWLTH AQUEDUCT & SWR AUTH REVENUE | 9,08 | 0,75 | 0,0776 | 0,0029 | ||

| New Jersey Turnpike Authority / DBT (US646140FY48) | 9,08 | -5,03 | 0,0775 | -0,0017 | ||

| New Jersey Turnpike Authority / DBT (US646140FY48) | 9,08 | -5,03 | 0,0775 | -0,0017 | ||

| New Jersey Turnpike Authority / DBT (US646140FY48) | 9,08 | -5,03 | 0,0775 | -0,0017 | ||

| Illinois Housing Development Authority / DBT (US45203MK266) | 9,07 | -1,36 | 0,0775 | 0,0013 | ||

| Illinois Housing Development Authority / DBT (US45203MK266) | 9,07 | -1,36 | 0,0775 | 0,0013 | ||

| Illinois Housing Development Authority / DBT (US45203MK266) | 9,07 | -1,36 | 0,0775 | 0,0013 | ||

| County of Palm Beach FL / DBT (US696547HX90) | 9,06 | 0,0774 | 0,0774 | |||

| County of Palm Beach FL / DBT (US696547HX90) | 9,06 | 0,0774 | 0,0774 | |||

| County of Palm Beach FL / DBT (US696547HX90) | 9,06 | 0,0774 | 0,0774 | |||

| US74443UCD37 / Public Finance Authority | 9,06 | -6,74 | 0,0774 | -0,0031 | ||

| Public Finance Authority / DBT (US74442PL869) | 9,01 | -1,69 | 0,0770 | 0,0010 | ||

| Public Finance Authority / DBT (US74442PL869) | 9,01 | -1,69 | 0,0770 | 0,0010 | ||

| US837151U567 / SC PUB SVC 5% 12/1/2052 | 9,01 | -2,15 | 0,0770 | 0,0007 | ||

| Kingston One Community Development District / DBT (US496631AD44) | 8,96 | 0,0765 | 0,0765 | |||

| Kingston One Community Development District / DBT (US496631AD44) | 8,96 | 0,0765 | 0,0765 | |||

| Kingston One Community Development District / DBT (US496631AD44) | 8,96 | 0,0765 | 0,0765 | |||

| US896035CD29 / Sales Tax RB Series 2023A | 8,93 | -4,85 | 0,0763 | -0,0015 | ||

| US452153AW91 / STATE OF ILLINO 5% 3/1/2046 | 8,93 | -2,13 | 0,0763 | 0,0007 | ||

| US7621962B80 / RHODE ISLAND ST HLTH & EDUCTNL BLDG CORP PUBLIC SCHS REVENUE | 8,92 | -3,69 | 0,0762 | -0,0006 | ||

| Arlington Higher Education Finance Corp / DBT (US041807GV48) | 8,90 | -5,91 | 0,0760 | -0,0024 | ||

| Arlington Higher Education Finance Corp / DBT (US041807GV48) | 8,90 | -5,91 | 0,0760 | -0,0024 | ||

| Arlington Higher Education Finance Corp / DBT (US041807GV48) | 8,90 | -5,91 | 0,0760 | -0,0024 | ||

| US687241AM15 / OROVILLE CA REVENUE | 8,88 | -2,32 | 0,0758 | 0,0005 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JHF30) | 8,87 | -0,12 | 0,0758 | 0,0022 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JHF30) | 8,87 | -0,12 | 0,0758 | 0,0022 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JHF30) | 8,87 | -0,12 | 0,0758 | 0,0022 | ||

| US93976AEL26 / WASHINGTON ST CONVENTION CENTER PUBLIC FACS DIST | 8,85 | -8,02 | 0,0756 | -0,0041 | ||

| US650116CX28 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 8,84 | -0,91 | 0,0756 | 0,0016 | ||

| US745160TW15 / PUERTO RICO CMWLTH AQUEDUCT & SWR AUTH REVENUE | 8,84 | 0,76 | 0,0755 | 0,0028 | ||

| US452152U338 / Illinois State, General Obligation Bonds, December Series 2017A | 8,83 | -2,56 | 0,0755 | 0,0003 | ||

| US88256HBG20 / TEXAS ST MUNI GAS ACQUISITION& SPLY CORP III GAS SPLY REVEN | 8,82 | 1,46 | 0,0753 | 0,0033 | ||

| US167486DR71 / CHICAGO IL GO 08C 0.0% 01-01-32 | 8,81 | 2,41 | 0,0753 | 0,0040 | ||

| US138871AA69 / CANYON PINES MET DIST CO SPL IMPT DIST #1 SPL ASSMNT REVENUE | 8,81 | -4,63 | 0,0752 | -0,0013 | ||

| US87638RHJ95 / Tarrant County Cultural Education Facilities Finance Corp. (Air Force Village Obligated Group), Series 2016, Ref. RB | 8,80 | -4,42 | 0,0752 | -0,0011 | ||

| Berks County Municipal Authority/The / DBT (US084538JK44) | 8,79 | -1,96 | 0,0751 | 0,0008 | ||

| Berks County Municipal Authority/The / DBT (US084538JK44) | 8,79 | -1,96 | 0,0751 | 0,0008 | ||

| Berks County Municipal Authority/The / DBT (US084538JK44) | 8,79 | -1,96 | 0,0751 | 0,0008 | ||

| Arizona Industrial Development Authority / DBT (US04052TDC62) | 8,77 | 0,62 | 0,0749 | 0,0027 | ||

| Arizona Industrial Development Authority / DBT (US04052TDC62) | 8,77 | 0,62 | 0,0749 | 0,0027 | ||

| US2322655S34 / Cuyahoga (County of), OH (Metrohealth System), Series 2017, Ref. RB | 8,77 | -2,11 | 0,0749 | 0,0007 | ||

| US82706TAC53 / SILICON VALLEY TOBACCO SECURITIZATION AUTHORITY 82706TAC5 | 8,71 | -6,29 | 0,0744 | -0,0026 | ||

| US11861MBM73 / BUCKS CNTY PA INDL DEV AUTH HOSP REVENUE | 8,70 | -5,88 | 0,0743 | -0,0023 | ||

| City of New York NY / DBT (US64966SBB16) | 8,68 | -6,50 | 0,0741 | -0,0028 | ||

| US66285WG751 / N TX TOLLWAY AUTH REVENUE | 8,65 | -3,21 | 0,0739 | -0,0002 | ||

| US442349DJ26 / City of Houston TX Airport System Revenue | 8,62 | -1,37 | 0,0736 | 0,0012 | ||

| US151145YA15 / Celina Independent School District | 8,61 | -5,99 | 0,0736 | -0,0023 | ||

| US126292BP59 / CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, 777 Place-Pomona, Senior Lien Series 2021A-1 | 8,59 | 10,18 | 0,0734 | 0,0088 | ||

| US797355Q230 / SAN DIEGO CA UNIF SCH DIST | 8,58 | 1,96 | 0,0733 | 0,0035 | ||

| US54628CDX74 / Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Westlake Chemical Corporation Projects, Refund | 8,53 | 0,77 | 0,0729 | 0,0027 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAS96) | 8,48 | 0,0724 | 0,0724 | |||

| US59261AD952 / Metropolitan Transportation Authority | 8,47 | -4,54 | 0,0723 | -0,0012 | ||

| US88880NAX75 / Tobacco Settlement Financing Corp/VA | 8,47 | -6,57 | 0,0723 | -0,0028 | ||

| US63607YAJ91 / New Hampshire Business Finance Authority | 8,46 | -5,12 | 0,0723 | -0,0016 | ||

| US126292AR25 / CSCDA Community Improvement Authority | 8,46 | -3,51 | 0,0722 | -0,0004 | ||

| US45734TAE47 / Inland Empire Tobacco Securitization Authority, Series 2007 C-2, RB | 8,44 | -16,10 | 0,0721 | -0,0113 | ||

| US13054WAQ06 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, San Diego County Water Authoriity Desalination Project Pipeline, Ref | 8,42 | -2,16 | 0,0719 | 0,0006 | ||

| US646136WU13 / New Jersey (State of) Transportation Trust Fund Authority, Series 2009 A, RB | 8,38 | -1,61 | 0,0716 | 0,0010 | ||

| US650116AW62 / New York Transportation Development Corporation, Special Facilities Bonds, LaGuardia Airport Terminal B Redevelopment Project, Series 2016A | 8,33 | -2,87 | 0,0712 | 0,0001 | ||

| US646136ET42 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 8,33 | 1,72 | 0,0711 | 0,0033 | ||

| US16456CAA62 / Cherry Creek South Metropolitan District No 5 | 8,32 | 5,81 | 0,0711 | 0,0059 | ||

| US646136EW70 / New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006C | 8,23 | 1,67 | 0,0703 | 0,0032 | ||

| US650116AR77 / New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment), Series 2016 A, RB | 8,23 | -2,48 | 0,0703 | 0,0004 | ||

| US64542QCK76 / New Hope Cultural Education Facilities Finance Corp | 8,20 | -5,62 | 0,0701 | -0,0020 | ||

| US745160SH56 / Puerto Rico Commonwealth Aqueduct & Sewer Authority | 8,17 | 0,05 | 0,0698 | 0,0021 | ||

| US81685AAA79 / Senac South Metropolitan District No 1 | 8,16 | -2,04 | 0,0698 | 0,0007 | ||

| US88880NAT63 / TOBACCO SETTLEMENT FING CORP VA | 8,15 | -5,91 | 0,0696 | -0,0022 | ||

| US874067AJ07 / TAKODA CO MET DIST TAKMET 12/50 FIXED 6 | 8,15 | -0,90 | 0,0696 | 0,0015 | ||

| US50376JAB52 / LA PAZ CNTY AZ INDL DEV AUTH R LAPDEV 08/40 FIXED 6.25 | 8,06 | 0,00 | 0,0689 | 0,0021 | ||

| US58468LAB27 / Medical School Campus Public Infrastructure District | 8,04 | -3,65 | 0,0687 | -0,0005 | ||

| US62947YAK73 / NEW YORK COUNTIES TOBACCO TRUST IV 62947YAK7 | 8,03 | -24,01 | 0,0686 | -0,0190 | ||

| US650110AE94 / New York Transportation Development Corp. | 7,96 | -2,40 | 0,0680 | 0,0004 | ||

| US059151DK30 / RIDERWOOD VILLAGE OB GROUP MD SF 4.0% 01-01-50 | 7,96 | -5,26 | 0,0680 | -0,0016 | ||

| US386211BC94 / Grand Rapids Charter Township Economic Development Corp. | 7,96 | 2,17 | 0,0680 | 0,0034 | ||

| US67884XCK19 / OKLAHOMA DEVELOPMENT FINANCE AUTHORITY | 7,90 | -2,70 | 0,0675 | 0,0002 | ||

| Berks County Municipal Authority/The / DBT (US084538JJ70) | 7,89 | -5,17 | 0,0674 | -0,0015 | ||

| Berks County Municipal Authority/The / DBT (US084538JJ70) | 7,89 | -5,17 | 0,0674 | -0,0015 | ||

| Berks County Municipal Authority/The / DBT (US084538JJ70) | 7,89 | -5,17 | 0,0674 | -0,0015 | ||

| US13013FAR55 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 7,87 | -4,58 | 0,0673 | -0,0011 | ||

| US889560DX30 / Tolomato Community Development District | 7,86 | -1,22 | 0,0672 | 0,0012 | ||

| US55374SAG57 / M-S-R ENERGY AUTHORITY | 7,84 | -0,53 | 0,0669 | 0,0017 | ||

| US167501VG73 / Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1998B-1 | 7,83 | 2,03 | 0,0669 | 0,0033 | ||

| US74446HAD17 / Wisconsin (State of) Public Finance Authority (American Dream at Meadowlands), Series 2017, RB | 7,77 | 30,46 | 0,0663 | 0,0170 | ||

| US38611TAR86 / GRAND PARKWAY TRANSPRTN CORP TX SYS TOLL REVENUE | 7,76 | -33,02 | 0,0663 | -0,0297 | ||

| US13012TAG04 / California Community College Financing Authority | 7,75 | -4,39 | 0,0662 | -0,0010 | ||

| Louisiana Public Facilities Authority / DBT (US546395W345) | 7,75 | 0,0662 | 0,0662 | |||

| Louisiana Public Facilities Authority / DBT (US546395W345) | 7,75 | 0,0662 | 0,0662 | |||

| US59261AG351 / MET TRANSPRTN AUTH NY REVENUE | 7,75 | -2,87 | 0,0662 | 0,0001 | ||

| Orange County Health Facilities Authority / DBT (US68450LJR78) | 7,70 | -5,70 | 0,0658 | -0,0019 | ||

| Orange County Health Facilities Authority / DBT (US68450LJR78) | 7,70 | -5,70 | 0,0658 | -0,0019 | ||

| Orange County Health Facilities Authority / DBT (US68450LJR78) | 7,70 | -5,70 | 0,0658 | -0,0019 | ||

| US74526QA696 / Puerto Rico Electric Power Authority, Power Revenue Bonds, Series 2013A | 7,68 | -1,58 | 0,0656 | 0,0009 | ||

| US452152T843 / State of Illinois | 7,65 | -1,07 | 0,0653 | 0,0013 | ||

| US15005CAB28 / Cedar Bayou Navigation District | 7,64 | -2,50 | 0,0652 | 0,0003 | ||

| US56035DGB29 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 7,62 | -0,42 | 0,0651 | 0,0017 | ||

| US924166LL37 / VERMONT ST EDUCTNL & HLTH BLDGS FING AGY REVENUE | 7,61 | -2,87 | 0,0650 | 0,0001 | ||

| US66176MAF77 / North Range Metropolitan District No. 2, Series 2017 A, Ref. GO Bonds | 7,59 | -3,32 | 0,0649 | -0,0002 | ||

| US650116AQ94 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 7,59 | 0,00 | 0,0648 | 0,0019 | ||

| US52349EEL02 / LEE CNTY FL INDL DEV AUTH HLTHCR FACS REVENUE | 7,50 | -5,67 | 0,0641 | -0,0018 | ||

| Arizona Industrial Development Authority / DBT (US04052EBU10) | 7,48 | -0,29 | 0,0639 | 0,0017 | ||

| State of Illinois / DBT (US452153KE83) | 7,47 | 0,0638 | 0,0638 | |||

| State of Illinois / DBT (US452153KE83) | 7,47 | 0,0638 | 0,0638 | |||

| State of Illinois / DBT (US452153KE83) | 7,47 | 0,0638 | 0,0638 | |||

| US40065AAH86 / GUAM GOVT DEPT OF EDU COPS | 7,41 | -1,33 | 0,0633 | 0,0011 | ||

| US05921PCF45 / BALTIMORE MD CONVENTION CENTER HOTEL REVENUE | 7,38 | -2,45 | 0,0631 | 0,0003 | ||

| US56035DFC11 / Main Street Natural Gas Inc | 7,38 | 0,35 | 0,0630 | 0,0021 | ||

| US906352AA75 / Union County Improvement Authority | 7,36 | -1,07 | 0,0629 | 0,0012 | ||

| STC Metropolitan District No 2 / DBT (US85780TBD46) | 7,34 | 0,0627 | 0,0627 | |||

| STC Metropolitan District No 2 / DBT (US85780TBD46) | 7,34 | 0,0627 | 0,0627 | |||

| STC Metropolitan District No 2 / DBT (US85780TBD46) | 7,34 | 0,0627 | 0,0627 | |||

| US64990GZS47 / New York State Dormitory Authority | 7,34 | -3,52 | 0,0627 | -0,0003 | ||

| US167593F801 / Chicago (City of) (O'Hare International Airport), Series 2017 D, RB | 7,32 | -1,84 | 0,0625 | 0,0007 | ||

| Allentown Neighborhood Improvement Zone Development Authority / DBT (US018444CC18) | 7,32 | -5,89 | 0,0625 | -0,0019 | ||

| Public Finance Authority / DBT (US74448EAB02) | 7,31 | -1,44 | 0,0625 | 0,0010 | ||

| Public Finance Authority / DBT (US74448EAB02) | 7,31 | -1,44 | 0,0625 | 0,0010 | ||

| Public Finance Authority / DBT (US74448EAB02) | 7,31 | -1,44 | 0,0625 | 0,0010 | ||

| US74442PRH00 / Public Finance Authority (Rider University), Series 2021 A, Ref. RB | 7,30 | -4,83 | 0,0623 | -0,0012 | ||

| US649519EH47 / New York Liberty Development Corp | 7,26 | -3,21 | 0,0620 | -0,0001 | ||

| US92708HAE45 / Village Community Development District No. 13 | 7,26 | -6,23 | 0,0620 | -0,0021 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAE01) | 7,25 | 0,10 | 0,0620 | 0,0019 | ||

| US2322655Q77 / CUYAHOGA CNTY OH HOSP REVENUE | 7,25 | -1,33 | 0,0619 | 0,0010 | ||

| US406802AA64 / HAMDEN CT REVENUE | 7,25 | -2,32 | 0,0619 | 0,0004 | ||

| US13048VBY39 / California (State of) Municipal Finance Authority (Linxs APM), Series 2018 A, RB | 7,22 | -2,63 | 0,0617 | 0,0002 | ||

| US650116CP93 / New York Transportation Development Corp. (Delta Air Lines, Inc. LaGuardia Airport Terminal C&D Redevelopment), Series 2018, RB | 7,21 | -0,89 | 0,0616 | 0,0013 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAV26) | 7,16 | 0,0611 | 0,0611 | |||

| New Hampshire Business Finance Authority / DBT (US63608TAV26) | 7,16 | 0,0611 | 0,0611 | |||

| New Hampshire Business Finance Authority / DBT (US63608TAV26) | 7,16 | 0,0611 | 0,0611 | |||

| US70868YAY59 / Pennsylvania Economic Development Financing Authority | 7,15 | -2,11 | 0,0611 | 0,0005 | ||

| US24918EEB20 / DENVER COLO HEALTH & HOSP AUTH HEALTHCARE REVE | 7,15 | 2,22 | 0,0611 | 0,0031 | ||

| US345105HZ62 / Foothill-Eastern Transportation Corridor Agency, Series 2015, Ref. RB | 7,12 | 2,91 | 0,0608 | 0,0035 | ||

| County of Palm Beach FL / DBT (US696547HW18) | 7,12 | 0,0608 | 0,0608 | |||

| County of Palm Beach FL / DBT (US696547HW18) | 7,12 | 0,0608 | 0,0608 | |||

| County of Palm Beach FL / DBT (US696547HW18) | 7,12 | 0,0608 | 0,0608 | |||

| US167510BJ40 / CHICAGO IL BRD OF EDU DEDICATE REGD B/E 5.75000000 | 7,08 | -2,45 | 0,0605 | 0,0003 | ||

| US73360CAN48 / Port Beaumont Navigation District | 7,07 | -7,15 | 0,0604 | -0,0027 | ||

| US48020NAA28 / JONES DIST CMNTY AUTH BRD CO | 7,06 | -1,56 | 0,0603 | 0,0009 | ||

| US6461364X64 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 7,06 | -1,77 | 0,0603 | 0,0007 | ||

| US24918EEC03 / DENVER COLO HEALTH & HOSP AUTH HEALTHCARE REVE | 7,05 | 1,92 | 0,0603 | 0,0029 | ||

| US546399CM60 / LA PUB FACS AUTH-REF | 7,05 | -5,01 | 0,0602 | -0,0013 | ||

| New York State Dormitory Authority / DBT (US65000BPT97) | 7,02 | -4,10 | 0,0600 | -0,0007 | ||

| US74514L3L92 / PUERTO RICO CMWLTH | 6,93 | 0,78 | 0,0592 | 0,0022 | ||

| US167505TH98 / Chicago Board of Education | 6,93 | -9,56 | 0,0592 | -0,0043 | ||

| Rhode Island Housing & Mortgage Finance Corp / DBT (US76221SBL43) | 6,93 | -3,12 | 0,0592 | -0,0001 | ||

| Rhode Island Housing & Mortgage Finance Corp / DBT (US76221SBL43) | 6,93 | -3,12 | 0,0592 | -0,0001 | ||

| Black Desert Public Infrastructure District / DBT (US09204TAA97) | 6,92 | -1,33 | 0,0591 | 0,0010 | ||

| Black Desert Public Infrastructure District / DBT (US09204TAA97) | 6,92 | -1,33 | 0,0591 | 0,0010 | ||

| Black Desert Public Infrastructure District / DBT (US09204TAA97) | 6,92 | -1,33 | 0,0591 | 0,0010 | ||

| US2322655R50 / CUYAHOGA CNTY OH HOSP REVENUE | 6,82 | -2,63 | 0,0583 | 0,0002 | ||

| West Virginia Economic Development Authority / DBT (US95648VBV09) | 6,82 | 0,0583 | 0,0583 | |||

| US39160CBN65 / Greater Asheville, NC Regional Airport Auth. Rev. (AGM Insured) | 6,80 | -14,22 | 0,0581 | -0,0076 | ||

| US769123LZ16 / Riverside County Redevelopment Successor Agency, Series 2011 B | 6,75 | 1,81 | 0,0576 | 0,0027 | ||

| US346786AH99 / Fort Bend County Industrial Development Corporation, Texas, Revenue Bonds, NRG Energy Inc Project, Series 2012B | 6,75 | -2,57 | 0,0576 | 0,0002 | ||

| US346426AA76 / City of Forney TX | 6,65 | -3,03 | 0,0568 | -0,0000 | ||

| US92708HAK05 / Village Community Development District No. 13 | 6,65 | -6,18 | 0,0568 | -0,0019 | ||

| Public Finance Authority / DBT (US74448GAB59) | 6,64 | -0,69 | 0,0567 | 0,0013 | ||

| Public Finance Authority / DBT (US74448GAB59) | 6,64 | -0,69 | 0,0567 | 0,0013 | ||

| Public Finance Authority / DBT (US74448GAB59) | 6,64 | -0,69 | 0,0567 | 0,0013 | ||

| US650116CV61 / New York Transportation Development Corp. | 6,63 | -1,28 | 0,0566 | 0,0010 | ||

| Florida Development Finance Corp / DBT (US34061QCT22) | 6,63 | 7,55 | 0,0566 | 0,0055 | ||

| Florida Development Finance Corp / DBT (US34061QCT22) | 6,63 | 7,55 | 0,0566 | 0,0055 | ||

| Florida Development Finance Corp / DBT (US34061QCT22) | 6,63 | 7,55 | 0,0566 | 0,0055 | ||

| US430688BS96 / Highland Park Independent School District/Potter County | 6,61 | -5,15 | 0,0565 | -0,0013 | ||

| US65442PAB94 / NINE MILE MET DIST CO | 6,61 | 14,38 | 0,0565 | 0,0086 | ||

| US311617BB93 / Farmville Industrial Development Authority | 6,58 | -3,11 | 0,0562 | -0,0001 | ||

| US038926BC48 / Arborwood Community Development District | 6,57 | -0,35 | 0,0561 | 0,0015 | ||

| US1675012T17 / CHICAGO IL BRD OF EDU | 6,56 | 1,14 | 0,0560 | 0,0023 | ||

| US592247L401 / MET PIER & EXPOSITION AUTH IL DEDICATED ST TAX REVENUE | 6,55 | 0,29 | 0,0560 | 0,0018 | ||

| US956622S475 / WEST VIRGINIA ST HOSP FIN AUTH | 6,50 | -15,49 | 0,0556 | -0,0082 | ||

| Pennsylvania Economic Development Financing Authority / DBT (US708686ET36) | 6,50 | 0,02 | 0,0556 | 0,0017 | ||

| Pennsylvania Economic Development Financing Authority / DBT (US708686ET36) | 6,50 | 0,02 | 0,0556 | 0,0017 | ||

| Pennsylvania Economic Development Financing Authority / DBT (US708686ET36) | 6,50 | 0,02 | 0,0556 | 0,0017 | ||

| US650116BP03 / New York Transportation Development Corp. (American Airlines, Inc.), Series 2016, Ref. RB | 6,48 | 0,0553 | 0,0553 | |||

| Virginia Housing Development Authority / DBT (US92812WWT79) | 6,46 | -3,70 | 0,0552 | -0,0004 | ||

| Virginia Housing Development Authority / DBT (US92812WWT79) | 6,46 | -3,70 | 0,0552 | -0,0004 | ||

| Virginia Housing Development Authority / DBT (US92812WWT79) | 6,46 | -3,70 | 0,0552 | -0,0004 | ||

| US46246K3P52 / IOWA ST FIN AUTH REVENUE | 6,43 | -4,47 | 0,0549 | -0,0009 | ||

| City of Friendswood TX / DBT (US358591AA39) | 6,43 | -0,83 | 0,0549 | 0,0012 | ||

| City of Friendswood TX / DBT (US358591AA39) | 6,43 | -0,83 | 0,0549 | 0,0012 | ||

| City of Friendswood TX / DBT (US358591AA39) | 6,43 | -0,83 | 0,0549 | 0,0012 | ||

| City of Kalispell MT / DBT (US48343AAA07) | 6,39 | 0,0546 | 0,0546 | |||

| City of Kalispell MT / DBT (US48343AAA07) | 6,39 | 0,0546 | 0,0546 | |||

| City of Kalispell MT / DBT (US48343AAA07) | 6,39 | 0,0546 | 0,0546 | |||

| US51265KAN81 / Lakewood Ranch Stewardship District | 6,38 | -1,21 | 0,0545 | 0,0010 | ||

| US74439YDX67 / PUBLIC FIN AUTH WI STUDENT HSG REVENUE | 6,37 | -6,13 | 0,0545 | -0,0018 | ||

| City of Los Angeles Department of Airports / DBT (US5444453B36) | 6,36 | 0,0544 | 0,0544 | |||

| City of Los Angeles Department of Airports / DBT (US5444453B36) | 6,36 | 0,0544 | 0,0544 | |||

| City of Los Angeles Department of Airports / DBT (US5444453B36) | 6,36 | 0,0544 | 0,0544 | |||

| US15114CFR07 / City of Celina TX | 6,36 | -2,99 | 0,0543 | -0,0000 | ||

| South Carolina Jobs-Economic Development Authority / DBT (US837032CE90) | 6,32 | -5,48 | 0,0540 | -0,0014 | ||

| South Carolina Jobs-Economic Development Authority / DBT (US837032CE90) | 6,32 | -5,48 | 0,0540 | -0,0014 | ||

| South Carolina Jobs-Economic Development Authority / DBT (US837032CE90) | 6,32 | -5,48 | 0,0540 | -0,0014 | ||

| US739476AE93 / Prairie Center Metropolitan District No. 3, Series 2017 A, Ref. RB | 6,29 | -3,21 | 0,0538 | -0,0001 | ||

| US899650AB13 / Tulsa Authority for Economic Opportunity | 6,29 | -1,32 | 0,0537 | 0,0009 | ||

| US249182LN45 / CITY & COUNTY OF DENVER CO AIRPORT SYSTEM REVENUE | 6,29 | -2,30 | 0,0537 | 0,0004 | ||

| US645002XK74 / NEW HAVEN CALIF UNI SCH DIST | 6,28 | 2,75 | 0,0536 | 0,0030 | ||

| Columbus-Franklin County Finance Authority / DBT (US19909PAL04) | 6,27 | -3,67 | 0,0536 | -0,0004 | ||

| Columbus-Franklin County Finance Authority / DBT (US19909PAL04) | 6,27 | -3,67 | 0,0536 | -0,0004 | ||

| Columbus-Franklin County Finance Authority / DBT (US19909PAL04) | 6,27 | -3,67 | 0,0536 | -0,0004 | ||

| US74447DAF42 / PUBLIC FIN AUTH WI HOTEL REVENUE | 6,27 | -1,65 | 0,0535 | 0,0007 | ||

| US02936TAH41 / American Samoa Economic Development Authority | 6,26 | -0,98 | 0,0535 | 0,0011 | ||

| US649519DB85 / NEW YORK ST LIBERTY DEV CORP LIBERTY REVENUE | 6,25 | -0,27 | 0,0534 | 0,0015 | ||

| US217558AB11 / Copper Ridge Metropolitan District, Series 2019, RB | 6,24 | 1,93 | 0,0533 | 0,0026 | ||

| Public Finance Authority / DBT (US74442PF424) | 6,24 | 1,42 | 0,0533 | 0,0023 | ||

| Public Finance Authority / DBT (US74442PF424) | 6,24 | 1,42 | 0,0533 | 0,0023 | ||

| Public Finance Authority / DBT (US74442PF424) | 6,24 | 1,42 | 0,0533 | 0,0023 | ||

| US51265KBB35 / LAKEWOOD RANCH FL STEWARDSHIP DIST SPL ASSMNT REVENUE | 6,23 | -0,72 | 0,0532 | 0,0012 | ||

| Metropolitan Government of Nashville & Davidson County TN Water & Sewer Revenue / DBT (US5920983R69) | 6,22 | 0,0532 | 0,0532 | |||

| Metropolitan Government of Nashville & Davidson County TN Water & Sewer Revenue / DBT (US5920983R69) | 6,22 | 0,0532 | 0,0532 | |||

| Metropolitan Government of Nashville & Davidson County TN Water & Sewer Revenue / DBT (US5920983R69) | 6,22 | 0,0532 | 0,0532 | |||

| US928104PX01 / Virginia Small Business Financing Authority | 6,21 | -4,99 | 0,0530 | -0,0011 | ||

| US167505YB63 / CHICAGO IL BOE 5% 12/1/2047 | 6,15 | -3,07 | 0,0525 | -0,0001 | ||

| US969268AW13 / William S. Hart Union High School District California GO | 6,14 | 2,95 | 0,0524 | 0,0030 | ||

| Public Finance Authority / DBT (US74447TAF93) | 6,13 | 0,00 | 0,0524 | 0,0016 | ||

| US12008ESS62 / Build NYC Resource Corp | 6,11 | -2,11 | 0,0522 | 0,0005 | ||

| US74444VAV27 / Public Finance Authority | 6,10 | -4,30 | 0,0521 | -0,0007 | ||

| US74444VAW00 / Public Finance Authority | 6,05 | -5,45 | 0,0517 | -0,0013 | ||

| Firefly Public Infrastructure District No 1 Assessment Area No 1 / DBT (US31816CAA09) | 6,03 | -5,46 | 0,0515 | -0,0014 | ||

| Firefly Public Infrastructure District No 1 Assessment Area No 1 / DBT (US31816CAA09) | 6,03 | -5,46 | 0,0515 | -0,0014 | ||

| Firefly Public Infrastructure District No 1 Assessment Area No 1 / DBT (US31816CAA09) | 6,03 | -5,46 | 0,0515 | -0,0014 | ||

| US077690AB18 / BELFORD NORTH MET DIST CO | 6,01 | 4,28 | 0,0514 | 0,0036 | ||

| US91754TS798 / Utah Charter School Finance Authority | 6,01 | -5,80 | 0,0513 | -0,0015 | ||

| US167505PL47 / CHICAGO BOARD OF EDUCATION | 5,98 | 3,89 | 0,0511 | 0,0034 | ||

| US05616KAD28 / Babcock Ranch Community Independent Special District, Charlotte County, Florida, Special Assessment Bonds, Series 2015 | 5,90 | -1,49 | 0,0504 | 0,0008 | ||

| US74443QAD43 / Public Finance Authority, Wisconsin, Exempt Facilities Revenue Bonds, Celanese Project, Refunding Series 2016C | 5,87 | 0,24 | 0,0502 | 0,0016 | ||

| US59447TH974 / MICHIGAN ST FIN AUTH REVENUE | 5,86 | -13,35 | 0,0501 | -0,0060 | ||

| US05616KBR05 / BABCOCK RANCH CMNTY INDEP SPL DIST FL SPL ASSMNT REVENUE | 5,85 | -1,88 | 0,0500 | 0,0006 | ||

| US790417AR02 / SAINT JOHNS CNTY FL INDL DEV AUTH REVENUE | 5,85 | -5,57 | 0,0499 | -0,0014 | ||

| Build NYC Resource Corp / DBT (US12008QAG47) | 5,82 | 0,0497 | 0,0497 | |||

| US67754AAD63 / Ohio (State of) Air Quality Development Authority (Pratt Paper LLC), Series 2017, RB | 5,82 | -1,26 | 0,0497 | 0,0009 | ||

| US018444CA51 / Allentown Neighborhood Improvement Zone Development Authority | 5,81 | -2,78 | 0,0496 | 0,0001 | ||

| US130923BN43 / CALIFORNIA ST STWD FING AUTH T CASGEN 06/46 ZEROCPNOID 0 | 5,80 | -3,02 | 0,0496 | -0,0000 | ||

| Public Finance Authority / DBT (US74442PD932) | 5,78 | -0,38 | 0,0494 | 0,0013 | ||

| Public Finance Authority / DBT (US74442PD932) | 5,78 | -0,38 | 0,0494 | 0,0013 | ||

| Public Finance Authority / DBT (US74442PD932) | 5,78 | -0,38 | 0,0494 | 0,0013 | ||

| US118217CW66 / Buckeye Tobacco Settlement Financing Authority | 5,72 | -2,90 | 0,0489 | 0,0000 | ||

| US15343TAC45 / CENTRL ETOWAH CNTY SOL WST DIS CENTRAL ETOWAH COUNTY SOLID WASTE DISPOSAL AUTHORI | 5,72 | -0,68 | 0,0489 | 0,0011 | ||

| US34073TKB25 / Florida Higher Educational Facilities Financial Authority | 5,71 | -4,39 | 0,0488 | -0,0007 | ||

| US65000BNG94 / NEW YORK ST DORM AUTH REVENUES NON ST SUPPORTED DEBT | 5,70 | -7,22 | 0,0487 | -0,0022 | ||

| Colorado Bridge & Tunnel Enterprise / DBT (US19633TAE10) | 5,69 | 253,20 | 0,0486 | 0,0353 | ||

| Colorado Bridge & Tunnel Enterprise / DBT (US19633TAE10) | 5,69 | 253,20 | 0,0486 | 0,0353 | ||

| Colorado Bridge & Tunnel Enterprise / DBT (US19633TAE10) | 5,69 | 253,20 | 0,0486 | 0,0353 | ||

| US34073TLP02 / FLORIDA HIGHER EDUCATIONAL FACILITIES FINANCIAL AUTHORITY | 5,65 | -4,58 | 0,0483 | -0,0008 | ||

| US167505RM02 / CHICAGO IL BRD OF EDU | 5,65 | -2,05 | 0,0483 | 0,0005 | ||

| US592250DD39 / METRO PIER/EXPO IL SF CAB AGM 0.0% 12-15-56 | 5,65 | 202,46 | 0,0482 | 0,0328 | ||

| US64542PGE97 / NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE | 5,64 | 35,50 | 0,0482 | 0,0137 | ||

| New Hampshire Business Finance Authority / DBT (US63610JAB44) | 5,63 | -11,72 | 0,0481 | -0,0048 | ||

| New Hampshire Business Finance Authority / DBT (US63610JAB44) | 5,63 | -11,72 | 0,0481 | -0,0048 | ||

| New Hampshire Business Finance Authority / DBT (US63610JAB44) | 5,63 | -11,72 | 0,0481 | -0,0048 | ||

| Los Angeles Department of Water & Power / DBT (US544532PV00) | 5,57 | 0,0476 | 0,0476 | |||

| US19645UBH68 / Colorado Educational & Cultural Facilities Authority | 5,52 | -5,79 | 0,0471 | -0,0014 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAG58) | 5,50 | 0,64 | 0,0470 | 0,0017 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAG58) | 5,50 | 0,64 | 0,0470 | 0,0017 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAG58) | 5,50 | 0,64 | 0,0470 | 0,0017 | ||

| US63607YAH36 / NATIONAL FIN AUTH NH REVENUE | 5,47 | -3,29 | 0,0467 | -0,0001 | ||

| Plaquemines Port Harbor & Terminal District / DBT (US727521AA48) | 5,47 | -13,30 | 0,0467 | -0,0056 | ||

| Plaquemines Port Harbor & Terminal District / DBT (US727521AA48) | 5,47 | -13,30 | 0,0467 | -0,0056 | ||

| Plaquemines Port Harbor & Terminal District / DBT (US727521AA48) | 5,47 | -13,30 | 0,0467 | -0,0056 | ||

| US16080TAE55 / Charlotte County Industrial Development Authority, Florida, Utility System Revenue Bonds, Town & Country Utilities Project, Series 2019 | 5,47 | -4,99 | 0,0467 | -0,0010 | ||

| US74526QZA39 / PUERTO RICO ELEC PWR AUTH PWR PUERTO RICO ELECTRIC POWER AUTHORITY | 5,46 | -1,59 | 0,0467 | 0,0007 | ||

| Public Finance Authority / DBT (US74442PH321) | 5,45 | -1,34 | 0,0465 | 0,0008 | ||

| Public Finance Authority / DBT (US74442PH321) | 5,45 | -1,34 | 0,0465 | 0,0008 | ||

| Public Finance Authority / DBT (US74442PH321) | 5,45 | -1,34 | 0,0465 | 0,0008 | ||

| US45471FAH47 / Indiana Finance Authority | 5,44 | -2,16 | 0,0465 | 0,0004 | ||

| US64461XDY85 / NEW HAMPSHIRE ST HLTH EDU FA NHSMED 08/37 FIXED 5 | 5,42 | -1,06 | 0,0463 | 0,0009 | ||

| US108624AR89 / Bridgewater Community Development District | 5,42 | -6,73 | 0,0463 | -0,0019 | ||

| US74526QKW14 / Puerto Rico Elec Pwr Auth Bond Long Muni | 5,41 | -1,57 | 0,0462 | 0,0007 | ||

| US83704MCE49 / South Carolina Jobs-Economic Development Authority | 5,40 | -5,54 | 0,0462 | -0,0013 | ||

| US89149CAF59 / TOSCANA ISLES CMNTY DEV DIST F TOIDEV 11/49 FIXED OID 5.5 | 5,40 | -1,55 | 0,0461 | 0,0007 | ||

| US46246K6X59 / IOWA ST FIN AUTH REVENUE | 5,39 | 57,85 | 0,0461 | 0,0177 | ||

| US041807AZ16 / Arlington Higher Education Finance Corp | 5,39 | -3,85 | 0,0460 | -0,0004 | ||

| Florida Development Finance Corp / DBT (US340618DV61) | 5,36 | -41,51 | 0,0458 | -0,0302 | ||

| Florida Development Finance Corp / DBT (US340618DV61) | 5,36 | -41,51 | 0,0458 | -0,0302 | ||

| Florida Development Finance Corp / DBT (US340618DV61) | 5,36 | -41,51 | 0,0458 | -0,0302 | ||

| US46246K4T65 / IOWA ST FIN AUTH REVENUE | 5,35 | -4,63 | 0,0457 | -0,0008 | ||

| US593856AC13 / Miami World Center Community Development District, Series 2017, RB | 5,34 | -0,47 | 0,0456 | 0,0012 | ||

| US45204EJ339 / Illinois (State of) Finance Authority (Roosevelt University), Series 2019 A, RB | 5,33 | -70,19 | 0,0456 | -0,1027 | ||

| US91414PAB94 / University City Industrial Development Authority | 5,33 | -2,25 | 0,0456 | 0,0003 | ||

| US267045NK45 / Dutchess County Local Development Corp. | 5,32 | -7,84 | 0,0455 | -0,0024 | ||

| US452152Y702 / State of Illinois | 5,30 | -0,82 | 0,0453 | 0,0010 | ||

| US38122ND906 / Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Revenue Bonds, Series 2022A-1 | 5,29 | -2,72 | 0,0452 | 0,0001 | ||

| US452152Y884 / State of Illinois | 5,29 | -0,84 | 0,0452 | 0,0010 | ||

| Adams County General Authority / DBT (US00611PBR55) | 5,28 | 0,0451 | 0,0451 | |||

| Adams County General Authority / DBT (US00611PBR55) | 5,28 | 0,0451 | 0,0451 | |||

| Adams County General Authority / DBT (US00611PBR55) | 5,28 | 0,0451 | 0,0451 | |||

| Mida Mountain Village Public Infrastructure District / DBT (US59561UAD28) | 5,28 | -2,58 | 0,0451 | 0,0002 | ||

| Mida Mountain Village Public Infrastructure District / DBT (US59561UAD28) | 5,28 | -2,58 | 0,0451 | 0,0002 | ||

| US592643DR88 / Metropolitan Washington Airports Authority Dulles Toll Road Revenue | 5,28 | -4,52 | 0,0451 | -0,0007 | ||

| US452153AV19 / State of Illinois | 5,27 | -4,37 | 0,0450 | -0,0006 | ||

| US95737TCD63 / Westchester County Local Development Corporation, New York, Revenue Bonds, Westchester Medical Center Obligated Group Project, Refunding Series 2016 | 5,24 | -3,00 | 0,0448 | -0,0000 | ||

| US54628CG634 / Louisiana Local Government Environmental Facilities & Community Development Auth | 5,24 | -3,75 | 0,0448 | -0,0004 | ||

| US306748AD60 / Fallschase Community Development District | 5,20 | -3,62 | 0,0444 | -0,0003 | ||

| US19645UBJ25 / COLORADO EDUCTNL & CULTURAL AUTH REVENUE | 5,19 | -6,45 | 0,0444 | -0,0016 | ||

| US928097AB03 / VIRGINIA SMALL BUSINESS FING AUTH PRIV ACTIVITY REVENUE SR | 5,18 | -4,54 | 0,0442 | -0,0007 | ||

| US6461364K44 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 5,17 | 0,96 | 0,0441 | 0,0017 | ||

| US59333P4B15 / County of Miami-Dade FL Aviation Revenue | 5,16 | -2,03 | 0,0441 | 0,0004 | ||

| US13051AEK07 / CALIFORNIA ST MUNI FIN AUTH SPL TAX REVENUE | 5,16 | -3,10 | 0,0441 | -0,0001 | ||

| US645002XM31 / New Haven Unified School District, California, General Obligation Bonds, Refunding Series 2009 | 5,14 | 2,95 | 0,0439 | 0,0025 | ||

| US594751AH20 / Michigan Tobacco Settlement Finance Authority | 5,13 | -5,21 | 0,0438 | -0,0010 | ||

| US167501VH56 / Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1998B-1 | 5,11 | 2,28 | 0,0436 | 0,0022 | ||

| US139705JZ12 / Capistrano Unified School District, Series 2005 | 5,10 | 3,05 | 0,0436 | 0,0026 | ||

| US13013FAL85 / FX.RT. MUNI BOND | 5,09 | -6,68 | 0,0435 | -0,0017 | ||

| Washington State Housing Finance Commission / DBT (US93978LJR87) | 5,09 | 0,0434 | 0,0434 | |||

| Washington State Housing Finance Commission / DBT (US93978LJR87) | 5,09 | 0,0434 | 0,0434 | |||

| Washington State Housing Finance Commission / DBT (US93978LJR87) | 5,09 | 0,0434 | 0,0434 | |||

| US81321CAB19 / Second Creek Farm Metropolitan District No. 3 | 5,08 | -3,77 | 0,0434 | -0,0004 | ||

| US90207EAE14 / TWO LAKES CDD FL SPL ASSMNT TWLDEV 12/47 FIXED 5 | 5,07 | -3,20 | 0,0434 | -0,0001 | ||

| US082148AA58 / Benloch Ranch Improvement Association No. 1, Series 2020 | 5,06 | -4,53 | 0,0432 | -0,0007 | ||

| US650028ZP10 / FX.RT. MUNI BOND | 5,06 | -2,07 | 0,0432 | 0,0004 | ||

| US424685BB00 / Hempstead Town Local Development Corp | 5,05 | -3,74 | 0,0431 | -0,0003 | ||

| County of Denton TX / DBT (US24880GAS84) | 5,04 | 3,20 | 0,0430 | 0,0026 | ||

| County of Denton TX / DBT (US24880GAS84) | 5,04 | 3,20 | 0,0430 | 0,0026 | ||

| County of Denton TX / DBT (US24880GAS84) | 5,04 | 3,20 | 0,0430 | 0,0026 | ||

| US59261AH425 / MET TRANSPRTN AUTH NY REVENUE | 5,03 | -1,00 | 0,0429 | 0,0009 | ||

| Cape Girardeau County Industrial Development Authority / DBT (US139424AB19) | 5,02 | -3,22 | 0,0429 | -0,0001 | ||

| Cape Girardeau County Industrial Development Authority / DBT (US139424AB19) | 5,02 | -3,22 | 0,0429 | -0,0001 | ||

| Cape Girardeau County Industrial Development Authority / DBT (US139424AB19) | 5,02 | -3,22 | 0,0429 | -0,0001 | ||

| US701403AD92 / PARKLAND PRESERVE CDD FL SPL A PAPDEV 05/50 FIXED OID 5.375 | 5,02 | -2,01 | 0,0429 | 0,0004 | ||

| Tulsa Municipal Airport Trust Trustees/OK / DBT (US899661EN87) | 5,02 | 0,0429 | 0,0429 | |||

| Tulsa Municipal Airport Trust Trustees/OK / DBT (US899661EN87) | 5,02 | 0,0429 | 0,0429 | |||

| Tulsa Municipal Airport Trust Trustees/OK / DBT (US899661EN87) | 5,02 | 0,0429 | 0,0429 | |||

| Astoria Hospital Facilities Authority / DBT (US046279CU74) | 5,02 | -5,22 | 0,0428 | -0,0010 | ||

| Astoria Hospital Facilities Authority / DBT (US046279CU74) | 5,02 | -5,22 | 0,0428 | -0,0010 | ||

| Astoria Hospital Facilities Authority / DBT (US046279CU74) | 5,02 | -5,22 | 0,0428 | -0,0010 | ||

| County of Washoe NV / DBT (US940865BH01) | 5,01 | -0,44 | 0,0428 | 0,0011 | ||

| County of Washoe NV / DBT (US940865BH01) | 5,01 | -0,44 | 0,0428 | 0,0011 | ||

| County of Washoe NV / DBT (US940865BH01) | 5,01 | -0,44 | 0,0428 | 0,0011 | ||

| US621196XD13 / Mount Diablo Unified School District, Contra Costa County, California, General Obligation Bonds, Series 2010A | 5,01 | -0,56 | 0,0428 | 0,0010 | ||

| US837151K402 / SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE | 5,00 | -0,38 | 0,0427 | 0,0011 | ||