Grundlæggende statistik

| Porteføljeværdi | $ 164.593.852 |

| Nuværende stillinger | 408 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

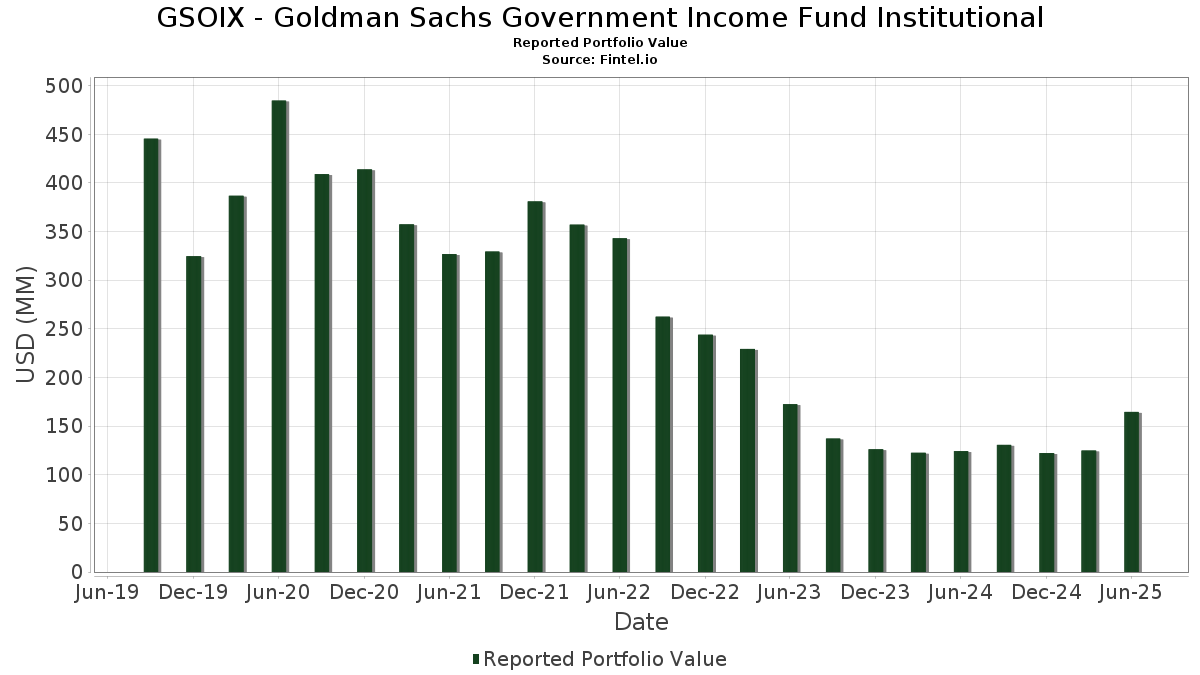

GSOIX - Goldman Sachs Government Income Fund Institutional har afsløret 408 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 164.593.852 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). GSOIX - Goldman Sachs Government Income Fund Institutionals største beholdninger er United States Treasury Note/Bond (US:US91282CCE93) , United States Treasury Note/Bond (US:US91282CHF14) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , and United States Treasury Note/Bond - When Issued (US:US912828ZQ64) . GSOIX - Goldman Sachs Government Income Fund Institutionals nye stillinger omfatter United States Treasury Note/Bond (US:US91282CCE93) , United States Treasury Note/Bond (US:US91282CHF14) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , and United States Treasury Note/Bond - When Issued (US:US912828ZQ64) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 10,78 | 8,3670 | 8,3670 | ||

| 6,10 | 4,7302 | 7,1985 | ||

| 1,96 | 1,5205 | 5,2298 | ||

| 1,96 | 1,5205 | 5,2298 | ||

| 6,47 | 5,0214 | 5,0214 | ||

| 6,47 | 5,0214 | 5,0214 | ||

| 6,46 | 5,0109 | 5,0109 | ||

| 6,46 | 5,0109 | 5,0109 | ||

| 7,00 | 5,4288 | 3,0012 | ||

| 1,68 | 1,3044 | 1,3044 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -4,78 | -3,7092 | -5,2298 | ||

| -2,65 | -2,0568 | -3,4876 | ||

| -1,66 | -1,2864 | -3,2160 | ||

| -1,86 | -1,4424 | -2,9630 | ||

| -4,78 | -3,7092 | -2,2080 | ||

| 2,59 | 2,0126 | -2,1764 | ||

| 2,00 | 1,5532 | -1,5175 | ||

| 1,03 | 0,8008 | -0,8692 | ||

| 0,36 | 0,2793 | -0,3904 | ||

| 8,07 | 6,2593 | -0,3581 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-19 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US91282CCE93 / United States Treasury Note/Bond | 10,78 | 8,3670 | 8,3670 | |||

| US91282CHF14 / United States Treasury Note/Bond | 8,07 | 0,85 | 6,2593 | -0,3581 | ||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 7,00 | 136,54 | 5,4288 | 3,0012 | ||

| U.S. Treasury Notes / DBT (US91282CLW90) | 6,47 | 5,0214 | 5,0214 | |||

| U.S. Treasury Notes / DBT (US91282CLW90) | 6,47 | 5,0214 | 5,0214 | |||

| U.S. Treasury Notes / DBT (US91282CKU44) | 6,46 | 5,0109 | 5,0109 | |||

| U.S. Treasury Notes / DBT (US91282CKU44) | 6,46 | 5,0109 | 5,0109 | |||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 6,10 | -302,66 | 4,7302 | 7,1985 | ||

| US912828ZQ64 / United States Treasury Note/Bond - When Issued | 5,21 | 1,72 | 4,0408 | -0,1952 | ||

| US21H0206753 / GINNIE MAE II POOL 30YR TBA (JULY) | 4,89 | 0,62 | 3,7927 | -0,1935 | ||

| US912810TL26 / TREASURY BOND | 4,26 | -3,03 | 3,3049 | -0,3284 | ||

| US3130AS2U28 / Federal Home Loan Banks | 3,47 | 1,05 | 2,6890 | -0,1482 | ||

| US21H0226710 / GNII II 2.5% 07/01/2050 #TBA | 3,40 | 1,07 | 2,6375 | -0,1225 | ||

| US912810RG58 / United States Treas Bds Bond | 3,37 | -2,23 | 2,6154 | -0,2368 | ||

| US3133KNGQ07 / Freddie Mac Pool | 3,23 | -2,33 | 2,5056 | -0,2298 | ||

| US01F0306781 / UMBS TBA | 2,59 | -49,19 | 2,0126 | -2,1764 | ||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 2,49 | 204,78 | 1,9296 | 1,2595 | ||

| U.S. Treasury Notes / DBT (US91282CKQ32) | 2,13 | 43,25 | 1,6550 | 0,4224 | ||

| U.S. Treasury Notes / DBT (US91282CKQ32) | 2,13 | 43,25 | 1,6550 | 0,4224 | ||

| US645913AA22 / NEW JERSEY ST ECON DEV AUTH LEASE REVENUE | 2,11 | 0,09 | 1,6388 | -0,1072 | ||

| US31418DTQ50 / Fannie Mae Pool | 2,07 | -2,22 | 1,6073 | -0,1449 | ||

| US31418DUG59 / Fannie Mae Pool | 2,07 | -2,04 | 1,6061 | -0,1424 | ||

| US3140QNCA87 / Fannie Mae Pool | 2,04 | -1,92 | 1,5864 | -0,1378 | ||

| US21H0526788 / Ginnie Mae | 2,00 | -59,80 | 1,5532 | -1,5175 | ||

| US3132DVLV52 / Freddie Mac Pool | 1,99 | -2,11 | 1,5473 | -0,1379 | ||

| EW / Edwards Lifesciences Corporation | 1,96 | -140,98 | 1,5205 | 5,2298 | ||

| EW / Edwards Lifesciences Corporation | 1,96 | -140,98 | 1,5205 | 5,2298 | ||

| US3140QEXS67 / Fannie Mae Pool | 1,95 | -2,21 | 1,5096 | -0,1363 | ||

| U.S. Treasury Notes / DBT (US91282CNJ61) | 1,68 | 1,3044 | 1,3044 | |||

| U.S. Treasury Notes / DBT (US91282CNJ61) | 1,68 | 1,3044 | 1,3044 | |||

| U.S. Treasury Notes / DBT (US91282CNK35) | 1,68 | 1,3007 | 1,3007 | |||

| U.S. Treasury Notes / DBT (US91282CNK35) | 1,68 | 1,3007 | 1,3007 | |||

| US912833XT25 / United States Treasury Strip Coupon | 1,51 | 1,82 | 1,1746 | -0,0551 | ||

| US36179U6U15 / Ginnie Mae II Pool | 1,49 | -2,87 | 1,1561 | -0,1131 | ||

| US3132DWA605 / Freddie Mac Pool | 1,40 | -2,03 | 1,0867 | -0,0959 | ||

| US912810RH32 / United States Treas Bds Bond | 1,40 | -2,24 | 1,0825 | -0,0982 | ||

| US912810RE01 / United States Treas Bds Bond | 1,39 | -2,18 | 1,0823 | -0,0972 | ||

| US91282CHJ36 / United States Treasury Note/Bond | 1,38 | 0,88 | 1,0681 | -0,0608 | ||

| US3132DMKF13 / Freddie Mac Pool | 1,38 | -3,10 | 1,0668 | -0,1077 | ||

| US912810QN19 / United Sates Treasury Bond Bond | 1,28 | 47,91 | 0,9899 | 0,2824 | ||

| U.S. Treasury Bonds / DBT (US912810UB25) | 1,15 | 0,8903 | 0,8903 | |||

| U.S. Treasury Bonds / DBT (US912810UB25) | 1,15 | 0,8903 | 0,8903 | |||

| US01F0626717 / Uniform Mortgage-Backed Security, TBA | 1,03 | -49,29 | 0,8008 | -0,8692 | ||

| US91282CCJ80 / United States Treasury Note/Bond | 1,03 | 0,79 | 0,7973 | -0,0464 | ||

| US89173UAB35 / TOWD POINT MORTGAGE TRUST 2017-4 SER 2017-4 CL A2 V/R REGD 144A P/P 3.00000000 | 0,97 | 1,57 | 0,7526 | -0,0380 | ||

| US36179VFP04 / Ginnie Mae II Pool | 0,96 | -2,85 | 0,7420 | -0,0727 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0,93 | -3,92 | 0,7225 | -0,0793 | ||

| US38382XAA37 / Government National Mortgage Association | 0,90 | -3,34 | 0,6962 | -0,0716 | ||

| US3133KGR837 / Freddie Mac Pool | 0,86 | -2,94 | 0,6669 | -0,0657 | ||

| US3132DVML61 / FR SD7563 | 0,82 | -2,86 | 0,6324 | -0,0623 | ||

| US3140QQGB55 / Fannie Mae Pool | 0,80 | -3,14 | 0,6225 | -0,0629 | ||

| US31418C6A71 / Federal National Mortgage Association | 0,79 | -3,30 | 0,6140 | -0,0632 | ||

| US80705XAA54 / Scholar Funding Trust, Series 2013-A, Class A | 0,78 | -1,89 | 0,6054 | -0,0528 | ||

| US36179XS988 / G2 MA8644 | 0,75 | -2,97 | 0,5829 | -0,0575 | ||

| US3140XK6T25 / Fannie Mae Pool | 0,72 | -3,22 | 0,5603 | -0,0572 | ||

| US26829GAA67 / ECMC Group Student Loan Trust 2018-2 | 0,70 | -1,40 | 0,5468 | -0,0444 | ||

| US9128337Q77 / U.S. Treasury STRIPS Bonds | 0,70 | 1,76 | 0,5393 | -0,0258 | ||

| US36179WTZ13 / GINNIE MAE II POOL P#MA7768 3.00000000 | 0,63 | -3,35 | 0,4925 | -0,0505 | ||

| US3140JAEL86 / Fannie Mae Pool | 0,63 | -3,36 | 0,4917 | -0,0507 | ||

| US3140QQUQ68 / Fannie Mae Pool | 0,63 | -3,40 | 0,4859 | -0,0509 | ||

| US3140JS3X57 / Fannie Mae Pool | 0,62 | -0,64 | 0,4825 | -0,0352 | ||

| US36179RGA14 / Ginnie Mae II Pool | 0,61 | -3,34 | 0,4722 | -0,0485 | ||

| US36179UML34 / Government National Mortgage Association | 0,60 | -3,24 | 0,4636 | -0,0473 | ||

| US3132DWBP77 / UMBS | 0,59 | -2,31 | 0,4598 | -0,0415 | ||

| US06540VBB09 / BANK BANK 2019 BN24 A3 | 0,56 | 1,63 | 0,4353 | -0,0219 | ||

| US912810QH41 / United States Treas Bds Bond | 0,56 | -1,59 | 0,4321 | -0,0358 | ||

| US06540LBF31 / BANK, Series 2021-BN37, Class A5 | 0,53 | 1,16 | 0,4081 | -0,0214 | ||

| US06541TBF57 / BANK, Series 2020-BN29, Class A4 | 0,52 | 1,97 | 0,4012 | -0,0184 | ||

| US912810SC36 / United States Treas Bds Bond | 0,52 | -2,65 | 0,4003 | -0,0375 | ||

| US36179UKZ48 / Ginnie Mae II Pool | 0,51 | -2,32 | 0,3928 | -0,0363 | ||

| US912810SD19 / United States Treas Bds Bond | 0,50 | -2,71 | 0,3902 | -0,0369 | ||

| BBCMS Mortgage Trust 2025-5C34 / ABS-MBS (US07337BAC81) | 0,47 | 0,3638 | 0,3638 | |||

| BBCMS Mortgage Trust 2025-5C34 / ABS-MBS (US07337BAC81) | 0,47 | 0,3638 | 0,3638 | |||

| US912810SK51 / United States Treasury Note/Bond | 0,46 | -2,73 | 0,3593 | -0,0346 | ||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAA80) | 0,46 | 1,32 | 0,3568 | -0,0183 | ||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAA80) | 0,46 | 1,32 | 0,3568 | -0,0183 | ||

| US3140J7UE34 / UMBS | 0,45 | -2,58 | 0,3521 | -0,0328 | ||

| BFLD Commercial Mortgage Trust 2024-UNIV / ABS-MBS (US08861RAA95) | 0,45 | 0,22 | 0,3494 | -0,0225 | ||

| BFLD Commercial Mortgage Trust 2024-UNIV / ABS-MBS (US08861RAA95) | 0,45 | 0,22 | 0,3494 | -0,0225 | ||

| US95003CAJ99 / Wells Fargo Commercial Mortgage Trust, Series 2021-C59, Class A5 | 0,44 | 2,55 | 0,3443 | -0,0137 | ||

| BX Trust 2024-BIO / ABS-MBS (US05612AAA43) | 0,42 | 0,00 | 0,3296 | -0,0215 | ||

| US36179UEB44 / Ginnie Mae II Pool | 0,42 | -2,31 | 0,3276 | -0,0302 | ||

| BANK5 2024-5YR12 / ABS-MBS (US06644XBG07) | 0,42 | 0,3255 | 0,3255 | |||

| BANK5 2024-5YR12 / ABS-MBS (US06644XBG07) | 0,42 | 0,3255 | 0,3255 | |||

| US3622ABJH66 / Ginnie Mae II Pool | 0,41 | -2,83 | 0,3200 | -0,0307 | ||

| US30023JAV08 / Evergreen Credit Card Trust Series 2018-2 | 0,41 | 0,3145 | 0,3145 | |||

| US30023JAV08 / Evergreen Credit Card Trust Series 2018-2 | 0,41 | 0,3145 | 0,3145 | |||

| IRV Trust 2025-200P / ABS-MBS (US45006HAA95) | 0,40 | 1,26 | 0,3133 | -0,0164 | ||

| IRV Trust 2025-200P / ABS-MBS (US45006HAA95) | 0,40 | 1,26 | 0,3133 | -0,0164 | ||

| US46654VAA17 / JP Morgan Mortgage Trust | 0,39 | 0,00 | 0,3008 | -0,0201 | ||

| US3140Q8QW81 / Fannie Mae Pool | 0,38 | -3,83 | 0,2930 | -0,0315 | ||

| US3138EPK942 / Fannie Mae Pool | 0,38 | -3,59 | 0,2920 | -0,0309 | ||

| US9128334S60 / United States Treasury Strip Coupon | 0,37 | 1,94 | 0,2850 | -0,0134 | ||

| US36179UH623 / Ginnie Mae II Pool | 0,36 | -2,95 | 0,2814 | -0,0278 | ||

| US912833XY10 / TREASURY STRIP (INT) | 0,36 | 1,98 | 0,2794 | -0,0129 | ||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 0,36 | -55,62 | 0,2793 | -0,3904 | ||

| U.S. Treasury Bonds / DBT (US912810UL07) | 0,36 | 0,2790 | 0,2790 | |||

| U.S. Treasury Bonds / DBT (US912810UL07) | 0,36 | 0,2790 | 0,2790 | |||

| US9128337N47 / U.S. Treasury STRIPS Bonds | 0,36 | 2,01 | 0,2762 | -0,0128 | ||

| US67115DAA00 / Onslow Bay Mortgage Loan Trust | 0,34 | 0,2626 | 0,2626 | |||

| US31417G4E31 / Fannie Mae Pool | 0,34 | -2,03 | 0,2618 | -0,0228 | ||

| US3138Y16W05 / Fannie Mae Pool | 0,33 | -0,60 | 0,2575 | -0,0184 | ||

| Ford Credit Auto Owner Trust 2024-REV1 / ABS-O (US34533BAA89) | 0,33 | 0,91 | 0,2570 | -0,0151 | ||

| Ford Credit Auto Owner Trust 2024-REV1 / ABS-O (US34533BAA89) | 0,33 | 0,91 | 0,2570 | -0,0151 | ||

| US03464JAA97 / Angel Oak Mortgage Trust 2021-7 | 0,33 | 0,2568 | 0,2568 | |||

| US3140Q8G584 / Fannie Mae Pool | 0,32 | -0,92 | 0,2501 | -0,0188 | ||

| US05593FAD06 / BMO 2023-C7 Mortgage Trust | 0,32 | 0,00 | 0,2498 | -0,0162 | ||

| JP Morgan Mortgage Trust Series 2025-NQM2 / ABS-MBS (US46590SAC17) | 0,32 | 0,2492 | 0,2492 | |||

| US36179UPC08 / Ginnie Mae II Pool | 0,32 | -2,74 | 0,2483 | -0,0243 | ||

| US36179VHS25 / Ginnie Mae II Pool | 0,31 | -2,79 | 0,2444 | -0,0233 | ||

| Wells Fargo Commercial Mortgage Trust 2025-5C4 / ABS-MBS (US949931AC32) | 0,31 | 0,2423 | 0,2423 | |||

| Wells Fargo Commercial Mortgage Trust 2025-5C4 / ABS-MBS (US949931AC32) | 0,31 | 0,2423 | 0,2423 | |||

| US9128334W72 / U.S. Treasury STRIPS Bonds | 0,31 | 1,63 | 0,2423 | -0,0123 | ||

| JP Morgan Mortgage Trust Series 2024-3 / ABS-MBS (US46657QAH48) | 0,31 | -1,89 | 0,2420 | -0,0208 | ||

| JP Morgan Mortgage Trust Series 2024-3 / ABS-MBS (US46657QAH48) | 0,31 | -1,89 | 0,2420 | -0,0208 | ||

| Wells Fargo Commercial Mortgage Trust 2024-MGP / ABS-MBS (US95003TAS24) | 0,30 | 0,00 | 0,2316 | -0,0156 | ||

| Wells Fargo Commercial Mortgage Trust 2024-MGP / ABS-MBS (US95003TAS24) | 0,30 | 0,00 | 0,2316 | -0,0156 | ||

| US3133KQDS21 / Freddie Mac Pool | 0,29 | -4,23 | 0,2287 | -0,0256 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,29 | -3,02 | 0,2249 | -0,0220 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,29 | -3,02 | 0,2249 | -0,0220 | ||

| US91282CGS44 / United States Treasury Note/Bond | 0,29 | 0,71 | 0,2215 | -0,0127 | ||

| Santander Drive Auto Receivables Trust 2025-1 / ABS-O (US80288DAC02) | 0,28 | 0,36 | 0,2141 | -0,0141 | ||

| Santander Drive Auto Receivables Trust 2025-1 / ABS-O (US80288DAC02) | 0,28 | 0,36 | 0,2141 | -0,0141 | ||

| US31574XAA63 / ELLINGTON FINL MTG TR 2021-1 0.797% 02/25/2066 144A | 0,27 | 0,2132 | 0,2132 | |||

| BANK5 2025-5YR15 / ABS-MBS (US065924AG73) | 0,26 | 0,1996 | 0,1996 | |||

| BANK5 2025-5YR15 / ABS-MBS (US065924AG73) | 0,26 | 0,1996 | 0,1996 | |||

| BSTN Commercial Mortgage Trust 2025-1C / ABS-MBS (US05615EAA38) | 0,26 | 0,1982 | 0,1982 | |||

| BSTN Commercial Mortgage Trust 2025-1C / ABS-MBS (US05615EAA38) | 0,26 | 0,1982 | 0,1982 | |||

| Morgan Stanley Residential Mortgage Loan Trust 2025-HX1 / ABS-MBS (US617942AA59) | 0,25 | 0,1932 | 0,1932 | |||

| Morgan Stanley Residential Mortgage Loan Trust 2025-HX1 / ABS-MBS (US617942AA59) | 0,25 | 0,1932 | 0,1932 | |||

| US3622ABJ945 / Ginnie Mae II Pool | 0,24 | -2,45 | 0,1859 | -0,0173 | ||

| US36213FHY25 / Ginnie Mae I Pool | 0,24 | -3,29 | 0,1825 | -0,0185 | ||

| US36179UGE64 / Ginnie Mae II Pool | 0,23 | -3,33 | 0,1801 | -0,0187 | ||

| US9128335A44 / United States Treasury Strip Coupon | 0,23 | 0,88 | 0,1785 | -0,0105 | ||

| US05610CAE49 / BMO 2023-C4 Mortgage Trust | 0,23 | 0,89 | 0,1765 | -0,0103 | ||

| US3132AD6P86 / Federal Home Loan Mortgage Corp. | 0,22 | -3,06 | 0,1723 | -0,0172 | ||

| US3140HBH764 / Fannie Mae Pool | 0,22 | -4,74 | 0,1722 | -0,0200 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0,22 | -8,37 | 0,1699 | -0,0282 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 0,22 | -8,37 | 0,1699 | -0,0282 | ||

| US3140Q9CT81 / Fannie Mae Pool | 0,22 | -2,26 | 0,1676 | -0,0157 | ||

| US55361AAU88 / MSWF Commercial Mortgage Trust 2023-2 | 0,21 | 0,94 | 0,1663 | -0,0098 | ||

| BLP Commercial Mortgage Trust 2024-IND2 / ABS-MBS (US05625AAA97) | 0,21 | 0,00 | 0,1658 | -0,0105 | ||

| BLP Commercial Mortgage Trust 2024-IND2 / ABS-MBS (US05625AAA97) | 0,21 | 0,00 | 0,1658 | -0,0105 | ||

| JP Morgan Mortgage Trust Series 2024-VIS1 / ABS-MBS (US465970AA90) | 0,21 | -4,55 | 0,1631 | -0,0194 | ||

| JP Morgan Mortgage Trust Series 2024-VIS1 / ABS-MBS (US465970AA90) | 0,21 | -4,55 | 0,1631 | -0,0194 | ||

| US06539LAA89 / BANK 2018-BNK13 | 0,21 | 0,48 | 0,1631 | -0,0098 | ||

| US06539LAA89 / BANK 2018-BNK13 | 0,21 | 0,48 | 0,1631 | -0,0098 | ||

| BANK5 2024-5YR11 / ABS-MBS (US06644WBD92) | 0,21 | 0,48 | 0,1625 | -0,0097 | ||

| BANK5 2024-5YR11 / ABS-MBS (US06644WBD92) | 0,21 | 0,48 | 0,1625 | -0,0097 | ||

| US06541ABP49 / BANK 2021-BNK31 | 0,21 | -0,48 | 0,1620 | -0,0111 | ||

| BANK5 2024-5YR10 / ABS-MBS (US06604AAF12) | 0,20 | 0,99 | 0,1589 | -0,0089 | ||

| BANK5 2024-5YR10 / ABS-MBS (US06604AAF12) | 0,20 | 0,99 | 0,1589 | -0,0089 | ||

| BX Commercial Mortgage Trust 2024-VLT5 / ABS-MBS (US05614JAA34) | 0,20 | 2,03 | 0,1565 | -0,0072 | ||

| BX Commercial Mortgage Trust 2024-VLT5 / ABS-MBS (US05614JAA34) | 0,20 | 2,03 | 0,1565 | -0,0072 | ||

| Exeter Automobile Receivables Trust / ABS-O (US30166XAC83) | 0,20 | 0,1558 | 0,1558 | |||

| Exeter Automobile Receivables Trust / ABS-O (US30166XAC83) | 0,20 | 0,1558 | 0,1558 | |||

| US67115QAA13 / OBX 2022-J2 A1 | 0,18 | -3,23 | 0,1402 | -0,0144 | ||

| US3138ET6A96 / Fannie Mae Pool | 0,18 | -2,23 | 0,1358 | -0,0129 | ||

| BX Commercial Mortgage Trust 2024-XL5 / ABS-MBS (US05612GAA13) | 0,17 | -10,31 | 0,1358 | -0,0252 | ||

| BX Commercial Mortgage Trust 2024-XL5 / ABS-MBS (US05612GAA13) | 0,17 | -10,31 | 0,1358 | -0,0252 | ||

| US31397S7M03 / FNMA, REMIC, Series 2011-52, Class GB | 0,17 | -4,00 | 0,1311 | -0,0140 | ||

| US31401DNK36 / Fannie Mae Pool | 0,17 | -2,35 | 0,1288 | -0,0121 | ||

| US31417GAX43 / Fannie Mae Pool | 0,16 | -2,38 | 0,1277 | -0,0120 | ||

| US87332PAA84 / TYSN 2023-CRNR A VAR 12/10/2038 144A | 0,16 | 0,62 | 0,1272 | -0,0073 | ||

| US3132DPHR29 / Freddie Mac Pool | 0,16 | -4,14 | 0,1257 | -0,0142 | ||

| US3136A1MA07 / Fannie Mae REMICS | 0,15 | -4,94 | 0,1200 | -0,0146 | ||

| Houston Galleria Mall Trust 2025-HGLR / ABS-MBS (US44216XAA37) | 0,15 | 0,66 | 0,1194 | -0,0065 | ||

| Houston Galleria Mall Trust 2025-HGLR / ABS-MBS (US44216XAA37) | 0,15 | 0,66 | 0,1194 | -0,0065 | ||

| Wells Fargo Commercial Mortgage Trust 2024-C63 / ABS-MBS (US94990FAE16) | 0,15 | 0,66 | 0,1188 | -0,0072 | ||

| Wells Fargo Commercial Mortgage Trust 2024-C63 / ABS-MBS (US94990FAE16) | 0,15 | 0,66 | 0,1188 | -0,0072 | ||

| BPR Trust 2024-PMDW / ABS-MBS (US05592VAA26) | 0,15 | 1,33 | 0,1180 | -0,0066 | ||

| BPR Trust 2024-PMDW / ABS-MBS (US05592VAA26) | 0,15 | 1,33 | 0,1180 | -0,0066 | ||

| US3140J7R988 / Fannie Mae Pool | 0,15 | -5,06 | 0,1168 | -0,0140 | ||

| BX Trust 2024-PAT / ABS-MBS (US05612FAA30) | 0,15 | 0,00 | 0,1163 | -0,0075 | ||

| BX Trust 2024-PAT / ABS-MBS (US05612FAA30) | 0,15 | 0,00 | 0,1163 | -0,0075 | ||

| US31402N2R85 / Fannie Mae Pool | 0,15 | -2,61 | 0,1162 | -0,0106 | ||

| US06427DAS27 / Banc of America Commercial Mortgage Trust, Series 2017-BNK3, Class A4 | 0,15 | 0,68 | 0,1148 | -0,0065 | ||

| US31418EEQ98 / Fannie Mae Pool | 0,15 | 0,00 | 0,1143 | -0,0081 | ||

| US3140E0EH47 / Fannie Mae Pool | 0,15 | -0,68 | 0,1131 | -0,0083 | ||

| US042855AA48 / ARRW 22-1 A1A 144A 2.495% 12-25-56 | 0,14 | -4,00 | 0,1123 | -0,0120 | ||

| US3140Q8DN20 / Fannie Mae Pool | 0,14 | -3,40 | 0,1106 | -0,0114 | ||

| US03465LAD73 / Angel Oak Mortgage Trust LLC | 0,14 | 2,21 | 0,1079 | -0,0051 | ||

| US3140Q9ME03 / Fannie Mae Pool | 0,14 | -2,88 | 0,1053 | -0,0101 | ||

| US36179QT501 / Ginnie Mae II Pool | 0,14 | -3,57 | 0,1050 | -0,0109 | ||

| US36179RXE43 / Ginnie Mae II Pool | 0,13 | -3,62 | 0,1039 | -0,0107 | ||

| US31417FU634 / Fannie Mae Pool | 0,13 | -2,94 | 0,1028 | -0,0099 | ||

| BBCMS Mortgage Trust 2024-C24 / ABS-MBS (US07336VAW19) | 0,13 | 2,34 | 0,1020 | -0,0045 | ||

| BBCMS Mortgage Trust 2024-C24 / ABS-MBS (US07336VAW19) | 0,13 | 2,34 | 0,1020 | -0,0045 | ||

| J.P. Morgan Chase Commercial Mortgage Securities Trust 2024-OMNI / ABS-MBS (US46593JAA25) | 0,13 | 0,79 | 0,0989 | -0,0060 | ||

| J.P. Morgan Chase Commercial Mortgage Securities Trust 2024-OMNI / ABS-MBS (US46593JAA25) | 0,13 | 0,79 | 0,0989 | -0,0060 | ||

| Exeter Automobile Receivables Trust 2025-1 / ABS-O (US30167MAB37) | 0,13 | -16,11 | 0,0972 | -0,0269 | ||

| Exeter Automobile Receivables Trust 2025-1 / ABS-O (US30167MAB37) | 0,13 | -16,11 | 0,0972 | -0,0269 | ||

| US36179NLE66 / Ginnie Mae II Pool | 0,12 | -3,20 | 0,0945 | -0,0095 | ||

| US3140GYKA60 / Fannie Mae Pool | 0,11 | -1,72 | 0,0885 | -0,0083 | ||

| US46655AAA60 / JPMCC 22-OPO A 144A 3.0242% 01-05-39/01-08-27 | 0,11 | -2,59 | 0,0883 | -0,0077 | ||

| US3140Q8KG95 / UMBS, 30 Year | 0,11 | -2,68 | 0,0849 | -0,0082 | ||

| US3136ABDT75 / Fannie Mae REMICS | 0,11 | -3,60 | 0,0836 | -0,0084 | ||

| US08161QAD25 / Benchmark 2022-B37 Mortgage Trust | 0,11 | 0,96 | 0,0820 | -0,0046 | ||

| US36179V4X53 / Ginnie Mae II Pool | 0,10 | -3,74 | 0,0806 | -0,0084 | ||

| US31418MUL44 / Fannie Mae Pool | 0,10 | -3,88 | 0,0774 | -0,0079 | ||

| US31403BAF04 / FANNIE MAE 3.41% 10/01/2033 FNMA ARM | 0,10 | -2,94 | 0,0771 | -0,0079 | ||

| US36200NTT80 / Ginnie Mae I Pool | 0,09 | -7,00 | 0,0727 | -0,0104 | ||

| US36179TSJ50 / Ginnie Mae II Pool | 0,09 | -2,11 | 0,0723 | -0,0066 | ||

| US31417GL201 / Fannie Mae Pool | 0,09 | -1,06 | 0,0722 | -0,0058 | ||

| US31417GFQ47 / Fannie Mae Pool | 0,08 | -1,20 | 0,0639 | -0,0052 | ||

| US31342A6D66 / Freddie Mac Non Gold Pool | 0,07 | -12,94 | 0,0576 | -0,0131 | ||

| US31410GDL41 / FANNIE MAE 3.608% 02/01/2035 FAR FNARM | 0,07 | -4,17 | 0,0541 | -0,0060 | ||

| US36200NXX47 / Ginnie Mae I Pool | 0,07 | -2,82 | 0,0541 | -0,0047 | ||

| US31407KRF83 / FANNIE MAE 3.242% 09/01/2035 FNMA ARM | 0,07 | -1,49 | 0,0513 | -0,0045 | ||

| US3132GFKT39 / Freddie Mac Gold Pool | 0,06 | 0,00 | 0,0490 | -0,0035 | ||

| US3138WMWQ09 / Fannie Mae Pool | 0,06 | -1,61 | 0,0477 | -0,0043 | ||

| US36200N3F65 / Ginnie Mae I Pool | 0,06 | -3,23 | 0,0470 | -0,0045 | ||

| US36210AT318 / Ginnie Mae I Pool | 0,06 | -1,64 | 0,0469 | -0,0042 | ||

| US3138M0XQ81 / Fannie Mae Pool | 0,06 | 0,00 | 0,0466 | -0,0036 | ||

| US3133TTRX18 / Freddie Mac REMICS | 0,06 | -12,12 | 0,0457 | -0,0090 | ||

| US3138ERH605 / Fannie Mae Pool | 0,06 | 0,00 | 0,0435 | -0,0030 | ||

| US92538GAA04 / Verus Securitization Trust 2021-8 | 0,05 | -3,64 | 0,0418 | -0,0044 | ||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0,05 | 0,0411 | 0,0411 | |||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0,05 | 0,0411 | 0,0411 | |||

| US3138WN5M72 / Fannie Mae Pool | 0,05 | 0,00 | 0,0390 | -0,0030 | ||

| US36179T7M16 / Ginnie Mae II Pool | 0,05 | -1,96 | 0,0390 | -0,0038 | ||

| US3138EP2E37 / Fannie Mae Pool | 0,05 | -2,17 | 0,0354 | -0,0032 | ||

| US3138MRK750 / Fannie Mae Pool | 0,04 | -2,27 | 0,0338 | -0,0032 | ||

| US3128P7LU52 / FG 03/29 FIXED 4.5 | 0,04 | -12,24 | 0,0337 | -0,0076 | ||

| US3138WHT447 / UMBS | 0,04 | -2,27 | 0,0335 | -0,0033 | ||

| US31417FY693 / Fannie Mae Pool | 0,04 | -4,65 | 0,0325 | -0,0034 | ||

| US31334XD481 / Freddie Mac Pool | 0,04 | -5,13 | 0,0291 | -0,0033 | ||

| Long: SR234278 IRS USD R F 3.62000 2 CCPOIS / Short: SR234278 IRS USD P V 00MSOFR 1 CCPOIS / DIR (000000000) | 0,03 | 0,0257 | 0,0257 | |||

| Long: SR234278 IRS USD R F 3.62000 2 CCPOIS / Short: SR234278 IRS USD P V 00MSOFR 1 CCPOIS / DIR (000000000) | 0,03 | 0,0257 | 0,0257 | |||

| US3137B4PT71 / Freddie Mac REMICS | 0,03 | -6,06 | 0,0243 | -0,0032 | ||

| US36209Q3H67 / Ginnie Mae I Pool | 0,03 | -9,09 | 0,0240 | -0,0035 | ||

| US3138ANZG11 / Fannie Mae Pool | 0,03 | -3,23 | 0,0238 | -0,0020 | ||

| US3128M7P918 / Freddie Mac Gold Pool | 0,03 | 0,00 | 0,0228 | -0,0019 | ||

| US3140EWUP81 / Fannie Mae Pool | 0,03 | 0,00 | 0,0224 | -0,0016 | ||

| US3138W3FS79 / Fannie Mae Pool | 0,03 | -9,68 | 0,0222 | -0,0038 | ||

| US31297KFM99 / Freddie Mac Gold Pool | 0,03 | 0,00 | 0,0220 | -0,0019 | ||

| US3138MKQH28 / Fannie Mae Pool | 0,03 | -3,57 | 0,0213 | -0,0026 | ||

| US3138WHGK28 / Fannie Mae Pool | 0,03 | -3,70 | 0,0209 | -0,0021 | ||

| US3138WVN490 / Fannie Mae Pool | 0,03 | -3,85 | 0,0200 | -0,0016 | ||

| US36225CPN01 / Ginnie Mae II Pool | 0,03 | -10,71 | 0,0197 | -0,0037 | ||

| US3136A9EA25 / Fannie Mae REMICS | 0,02 | -7,69 | 0,0194 | -0,0023 | ||

| US31418BZY54 / Fannie Mae Pool | 0,02 | 0,00 | 0,0179 | -0,0013 | ||

| US3138WRNS52 / Fannie Mae Pool | 0,02 | 0,00 | 0,0174 | -0,0013 | ||

| US3138WPGT52 / Fannie Mae Pool | 0,02 | 0,00 | 0,0168 | -0,0013 | ||

| US3138MN5G14 / Fannie Mae Pool | 0,02 | -4,55 | 0,0168 | -0,0018 | ||

| US3128M9UC41 / Freddie Mac Gold Pool | 0,02 | 0,00 | 0,0156 | -0,0013 | ||

| US36295PZ702 / Ginnie Mae I Pool | 0,02 | 0,00 | 0,0149 | -0,0010 | ||

| US36225CKJ44 / GNMA II POOL 080296 G2 07/29 FLOATING VAR | 0,02 | -5,00 | 0,0148 | -0,0018 | ||

| US59020UJR77 / Merrill Lynch Mortgage Investors Trust Series MLCC 2004-E | 0,02 | -14,29 | 0,0145 | -0,0034 | ||

| US3138WWKV04 / Fannie Mae Pool | 0,02 | 0,00 | 0,0143 | -0,0013 | ||

| US31292L6T70 / Freddie Mac Gold Pool | 0,02 | 0,00 | 0,0142 | -0,0014 | ||

| US36225CUK07 / Ginnie Mae II Pool | 0,02 | -5,26 | 0,0142 | -0,0016 | ||

| US3138W7WP51 / Fannie Mae Pool | 0,02 | -5,56 | 0,0138 | -0,0014 | ||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0,02 | 0,0137 | 0,0137 | |||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0,02 | 0,0137 | 0,0137 | |||

| US31371KA502 / Fannie Mae Pool | 0,02 | -5,56 | 0,0137 | -0,0013 | ||

| US3138MPDQ50 / Fannie Mae Pool | 0,02 | 0,00 | 0,0126 | -0,0009 | ||

| US3138WMKE07 / Fannie Mae Pool | 0,02 | -6,25 | 0,0123 | -0,0013 | ||

| US36225CN281 / Government National Mortgage Association | 0,02 | -11,76 | 0,0121 | -0,0022 | ||

| US3140GRYD03 / Fannie Mae Pool | 0,02 | 0,00 | 0,0121 | -0,0008 | ||

| US36201SQC60 / Ginnie Mae I Pool | 0,02 | 0,00 | 0,0120 | -0,0011 | ||

| US3138MQTN39 / Fannie Mae Pool | 0,02 | 0,00 | 0,0117 | -0,0009 | ||

| US3138WVH468 / Fannie Mae Pool | 0,01 | 0,00 | 0,0113 | -0,0009 | ||

| US3138W0FU86 / Fannie Mae Pool | 0,01 | -6,67 | 0,0109 | -0,0017 | ||

| US31297KC919 / Freddie Mac Gold Pool | 0,01 | -7,14 | 0,0107 | -0,0010 | ||

| US36210KDR32 / Ginnie Mae I Pool | 0,01 | -7,14 | 0,0106 | -0,0015 | ||

| US3138WXWH64 / Fannie Mae Pool | 0,01 | 0,00 | 0,0104 | -0,0007 | ||

| US3138MJGD50 / Fannie Mae Pool | 0,01 | 0,00 | 0,0102 | -0,0009 | ||

| US3138MRXV81 / Fannie Mae Pool | 0,01 | 0,00 | 0,0099 | -0,0008 | ||

| US36225CN364 / Ginnie Mae II Pool | 0,01 | -7,69 | 0,0098 | -0,0017 | ||

| US3138MQHG16 / Fannie Mae Pool | 0,01 | -8,33 | 0,0093 | -0,0008 | ||

| US3128KLSB41 / Freddie Mac Gold Pool | 0,01 | -8,33 | 0,0093 | -0,0008 | ||

| US3138NYAR68 / Fannie Mae Pool | 0,01 | -8,33 | 0,0093 | -0,0007 | ||

| U.S. Treasury Bonds / DBT (US912810UC08) | 0,01 | -8,33 | 0,0092 | -0,0009 | ||

| U.S. Treasury Bonds / DBT (US912810UC08) | 0,01 | -8,33 | 0,0092 | -0,0009 | ||

| US3138WMZQ71 / Fannie Mae Pool | 0,01 | -8,33 | 0,0090 | -0,0014 | ||

| US31391NCY58 / Fannie Mae Pool | 0,01 | 0,00 | 0,0089 | -0,0009 | ||

| US36291NPZ86 / Ginnie Mae I Pool | 0,01 | -9,09 | 0,0085 | -0,0010 | ||

| US3138W4AP68 / Fannie Mae Pool | 0,01 | -9,09 | 0,0084 | -0,0012 | ||

| US36201U5P56 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0081 | -0,0008 | ||

| US3132L5TH62 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0079 | -0,0007 | ||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | 0,01 | 0,0075 | 0,0075 | |||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | 0,01 | 0,0075 | 0,0075 | |||

| Long: SR234636 IRS USD R F 3.36762 2 CCPOIS / Short: SR234636 IRS USD P V 00MSOFR 1 CCPOIS / DIR (000000000) | 0,01 | 0,0074 | 0,0074 | |||

| Long: SR234636 IRS USD R F 3.36762 2 CCPOIS / Short: SR234636 IRS USD P V 00MSOFR 1 CCPOIS / DIR (000000000) | 0,01 | 0,0074 | 0,0074 | |||

| US31418CCW29 / Fannie Mae Pool | 0,01 | 0,00 | 0,0073 | -0,0008 | ||

| US3138WQQ394 / Fannie Mae Pool | 0,01 | 0,00 | 0,0072 | -0,0006 | ||

| US3138NXRK59 / Fannie Mae Pool | 0,01 | 0,00 | 0,0070 | -0,0006 | ||

| US3138NYHT51 / Fannie Mae Pool | 0,01 | 0,00 | 0,0070 | -0,0005 | ||

| US36201SSM25 / Ginnie Mae I Pool | 0,01 | -11,11 | 0,0069 | -0,0007 | ||

| US31418CAY03 / Fannie Mae Pool | 0,01 | 0,00 | 0,0063 | -0,0005 | ||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,01 | 0,0063 | 0,0063 | |||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,01 | 0,0063 | 0,0063 | |||

| US36225CQN91 / Ginnie Mae II Pool | 0,01 | -12,50 | 0,0062 | -0,0007 | ||

| US36291GXG62 / Ginnie Mae I Pool | 0,01 | -12,50 | 0,0061 | -0,0005 | ||

| US3138LSR854 / Fannie Mae Pool | 0,01 | -12,50 | 0,0061 | -0,0005 | ||

| US36213X3S13 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0060 | -0,0006 | ||

| US36225CNM46 / GNMA II POOL 080395 G2 04/30 FLOATING VAR | 0,01 | -12,50 | 0,0060 | -0,0008 | ||

| US31417GMA12 / Fannie Mae Pool | 0,01 | 0,00 | 0,0059 | -0,0004 | ||

| US36290XLG33 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0059 | -0,0005 | ||

| US36225CL467 / Ginnie Mae II Pool | 0,01 | 0,00 | 0,0058 | -0,0008 | ||

| US36225CB625 / GNMA II POOL 080060 G2 04/27 FLOATING VAR | 0,01 | -12,50 | 0,0058 | -0,0014 | ||

| US36225CE447 / Ginnie Mae II Pool | 0,01 | -12,50 | 0,0057 | -0,0010 | ||

| US31283Y5M62 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0056 | -0,0009 | ||

| US36225CNB80 / GNMA2 1YR CMT ARM | 0,01 | -14,29 | 0,0053 | -0,0006 | ||

| US36200KFF93 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0051 | -0,0005 | ||

| US3128M9NX60 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0051 | -0,0004 | ||

| US36225CB542 / Ginnie Mae II Pool | 0,01 | -25,00 | 0,0051 | -0,0016 | ||

| US36290QX755 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0050 | -0,0005 | ||

| US3138W1LY18 / Fannie Mae Pool | 0,01 | 0,00 | 0,0049 | -0,0004 | ||

| US3128LXFW53 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0048 | -0,0006 | ||

| US3138A46M25 / FNCL UMBS 4.5 AH3575 01-01-41 | 0,01 | 0,00 | 0,0048 | -0,0004 | ||

| US3138AFC245 / Fannie Mae Pool | 0,01 | 0,00 | 0,0048 | -0,0004 | ||

| Long: SR234635 IRS USD R F 4.09811 2 CCPOIS / Short: SR234635 IRS USD P V 00MSOFR 1 CCPOIS / DIR (000000000) | 0,01 | 0,0045 | 0,0045 | |||

| US3138MNJQ49 / Fannie Mae Pool | 0,01 | 0,00 | 0,0045 | -0,0005 | ||

| US36225CKX38 / GNMA II POOL 080309 G2 08/29 FLOATING VAR | 0,01 | -16,67 | 0,0044 | -0,0013 | ||

| US3140L7CR11 / Fannie Mae Pool | 0,01 | 0,00 | 0,0044 | -0,0003 | ||

| US31417MFB46 / Fannie Mae Pool | 0,01 | 0,00 | 0,0044 | -0,0004 | ||

| US3132HRPU85 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0043 | -0,0003 | ||

| US36225CLK08 / GNMA II POOL 080329 G2 10/29 FLOATING VAR | 0,01 | 0,00 | 0,0041 | -0,0007 | ||

| US36225CQH24 / Ginnie Mae II Pool | 0,01 | 0,00 | 0,0041 | -0,0004 | ||

| US3138MFW529 / Fannie Mae Pool | 0,01 | 0,00 | 0,0041 | -0,0003 | ||

| US36201SSU41 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0040 | -0,0004 | ||

| US3138MHKP78 / Fannie Mae Pool | 0,00 | 0,00 | 0,0038 | -0,0003 | ||

| US3138MRD243 / Fannie Mae Pool | 0,00 | 0,00 | 0,0038 | -0,0003 | ||

| US3138M6P769 / Fannie Mae Pool | 0,00 | 0,00 | 0,0037 | -0,0003 | ||

| US3138W02X69 / Fannie Mae Pool | 0,00 | 0,00 | 0,0036 | -0,0003 | ||

| US36225CL202 / Ginnie Mae II Pool | 0,00 | -20,00 | 0,0036 | -0,0006 | ||

| US3132L5TJ29 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0035 | -0,0003 | ||

| US31296LVE81 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0034 | -0,0003 | ||

| US3132GVL672 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0033 | -0,0003 | ||

| US3138WHBX93 / Fannie Mae Pool | 0,00 | 0,00 | 0,0030 | -0,0002 | ||

| US36225CMN38 / Ginnie Mae II Pool | 0,00 | -25,00 | 0,0029 | -0,0005 | ||

| US3138NXMW43 / Fannie Mae Pool | 0,00 | 0,00 | 0,0027 | -0,0002 | ||

| US36225CN778 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0026 | -0,0003 | ||

| US36202FY678 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0026 | -0,0003 | ||

| US3138MR5R87 / Fannie Mae Pool | 0,00 | 0,00 | 0,0026 | -0,0002 | ||

| US36202SBG21 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0025 | -0,0002 | ||

| US3132GTYG65 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0024 | -0,0002 | ||

| US36225CLM63 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0024 | -0,0006 | ||

| US36290NBS09 / Ginnie Mae I Pool | 0,00 | -33,33 | 0,0023 | -0,0002 | ||

| US3138MP2W46 / Fannie Mae Pool | 0,00 | 0,00 | 0,0023 | -0,0002 | ||

| US36225CFJ09 / GNMA II POOL 080168 G2 02/28 FLOATING VAR | 0,00 | -33,33 | 0,0022 | -0,0004 | ||

| US31416NFG25 / Fannie Mae Pool | 0,00 | -33,33 | 0,0022 | -0,0004 | ||

| US31292MA787 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0021 | -0,0002 | ||

| US36225CEP77 / GOVERNMENT NATIONAL MORTGAGE ASSOC. | 0,00 | -33,33 | 0,0021 | -0,0005 | ||

| US36225CCU80 / Ginnie Mae II Pool | 0,00 | -33,33 | 0,0020 | -0,0010 | ||

| US36225CA973 / GNMA II POOL 080031 G2 01/27 FLOATING VAR | 0,00 | 0,00 | 0,0019 | -0,0005 | ||

| US36225CNK89 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0019 | -0,0002 | ||

| US3128LXBH23 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0019 | -0,0002 | ||

| US36225CFU53 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0019 | -0,0005 | ||

| US36208CFB81 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0019 | -0,0003 | ||

| US31410GDN07 / Federal National Mortgage Association, Inc. | 0,00 | 0,00 | 0,0017 | -0,0002 | ||

| US36202FP676 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0016 | -0,0002 | ||

| US3132GEV560 / Freddie Mac Gold Pool | 0,00 | -50,00 | 0,0015 | -0,0001 | ||

| US312941Z424 / Freddie Mac Gold Pool | 0,00 | -50,00 | 0,0015 | -0,0001 | ||

| US36179QDZ19 / Ginnie Mae II Pool | 0,00 | -50,00 | 0,0015 | -0,0002 | ||

| US36225CK709 / GNMA II POOL 080317 G2 09/29 FLOATING VAR | 0,00 | 0,00 | 0,0015 | -0,0002 | ||

| US31296NV618 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US36225CMC72 / GNMA II POOL 080354 G2 12/29 FLOATING VAR | 0,00 | 0,00 | 0,0014 | -0,0002 | ||

| US36179MAY66 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US3138W02A66 / Fannie Mae Pool | 0,00 | 0,00 | 0,0013 | -0,0002 | ||

| US36225CBA36 / Ginnie Mae II Pool | 0,00 | -50,00 | 0,0013 | -0,0004 | ||

| US36179N5W43 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| US36225CNY83 / GNMA II POOL 080406 G2 05/30 FLOATING VAR | 0,00 | 0,00 | 0,0010 | -0,0001 | ||

| US36206JCT97 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0010 | -0,0003 | ||

| US31417KUM79 / Fannie Mae Pool | 0,00 | 0,00 | 0,0009 | -0,0001 | ||

| US36225CBN56 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0009 | -0,0002 | ||

| US36179MQQ68 / Ginnie Mae II Pool | 0,00 | 0,00 | 0,0009 | -0,0001 | ||

| US3128M4EM10 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0009 | -0,0001 | ||

| US36225CM291 / GNMA II POOL 080376 G2 02/30 FLOATING VAR | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| US36225CCG96 / GNMA II POOL 080070 G2 05/27 FLOATING VAR | 0,00 | 0,00 | 0,0008 | -0,0003 | ||

| US36225CEF95 / GNMA II POOL 080133 G2 11/27 FLOATING VAR | 0,00 | 0,00 | 0,0008 | -0,0002 | ||

| US36202KYL33 / GNMA II POOL 008815 G2 02/26 FLOATING VAR | 0,00 | -100,00 | 0,0007 | -0,0004 | ||

| US31371HDV78 / Fannie Mae Pool | 0,00 | 0,0006 | -0,0002 | |||

| US3128M7EX06 / Freddie Mac Gold Pool | 0,00 | 0,0006 | -0,0001 | |||

| US31296NDL82 / Freddie Mac Gold Pool | 0,00 | 0,0005 | -0,0001 | |||

| US31416CCH79 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US3138AMBC89 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US36202F2M77 / Ginnie Mae II Pool | 0,00 | 0,0004 | -0,0000 | |||

| US312943UP63 / FREDDIE MAC GOLD POOL P#A95090 4.50000000 | 0,00 | 0,0004 | -0,0000 | |||

| US3128LXBF66 / Freddie Mac Gold Pool | 0,00 | 0,0003 | -0,0000 | |||

| US31296LKE01 / Freddie Mac Gold Pool | 0,00 | 0,0002 | -0,0000 | |||

| US36225CME39 / GNMA II POOL 080356 G2 12/29 FLOATING VAR | 0,00 | 0,0001 | -0,0000 | |||

| US36200AGF03 / Ginnie Mae I Pool | 0,00 | 0,0001 | -0,0001 | |||

| US36202K3W33 / GNMA II POOL 008913 G2 07/26 FLOATING VAR | 0,00 | 0,0000 | -0,0000 | |||

| US36225CEL63 / Ginnie Mae II Pool | 0,00 | 0,0000 | -0,0000 | |||

| Long: BR219534 IRS USD R V 00MSOFR 1 CCPOIS / Short: BR219534 IRS USD P F 3.49000 2 CCPOIS / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| Long: BR219534 IRS USD R V 00MSOFR 1 CCPOIS / Short: BR219534 IRS USD P F 3.49000 2 CCPOIS / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US36202KTU96 / Ginnie Mae II Pool | 0,00 | 0,0000 | -0,0004 | |||

| US3128M7LA20 / Freddie Mac Gold Pool | 0,00 | 0,0000 | -0,0000 | |||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | -0,01 | -0,0081 | -0,0081 | |||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | -0,01 | -0,0081 | -0,0081 | |||

| Long: BR234637 IRS USD R V 00MSOFR 1 CCPOIS / Short: BR234637 IRS USD P F 3.59995 2 CCPOIS / DIR (000000000) | -0,02 | -0,0124 | -0,0124 | |||

| Long: BR234637 IRS USD R V 00MSOFR 1 CCPOIS / Short: BR234637 IRS USD P F 3.59995 2 CCPOIS / DIR (000000000) | -0,02 | -0,0124 | -0,0124 | |||

| Long: BR234275 IRS USD R V 00MSOFR 1 CCPOIS / Short: BR234275 IRS USD P F 3.62000 2 CCPOIS / DIR (000000000) | -0,07 | -0,0517 | -0,0517 | |||

| Long: BR234275 IRS USD R V 00MSOFR 1 CCPOIS / Short: BR234275 IRS USD P F 3.62000 2 CCPOIS / DIR (000000000) | -0,07 | -0,0517 | -0,0517 | |||

| Long: BR234277 IRS USD R V 00MSOFR 1 CCPOIS / Short: BR234277 IRS USD P F 3.60000 2 CCPOIS / DIR (000000000) | -0,08 | -0,0597 | -0,0597 | |||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | -0,12 | -0,0963 | -0,0963 | |||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | -0,12 | -0,0963 | -0,0963 | |||

| US21H0406734 / Ginnie Mae | -0,93 | 0,54 | -0,7210 | 0,0372 | ||

| US21H0506723 / Ginnie Mae | -0,98 | 0,82 | -0,7618 | 0,0370 | ||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | -1,66 | -166,67 | -1,2864 | -3,2160 | ||

| EW / Edwards Lifesciences Corporation | -1,86 | -194,90 | -1,4424 | -2,9630 | ||

| US21H0306744 / Ginnie Mae | -2,65 | -252,04 | -2,0568 | -3,4876 | ||

| EW / Edwards Lifesciences Corporation | -4,78 | -344,00 | -3,7092 | -5,2298 | ||

| EW / Edwards Lifesciences Corporation | -4,78 | 161,34 | -3,7092 | -2,2080 | ||

| US01F0206791 / UMBS, 30 Year, Single Family | -7,12 | 1,18 | -5,5250 | 0,2502 |