Grundlæggende statistik

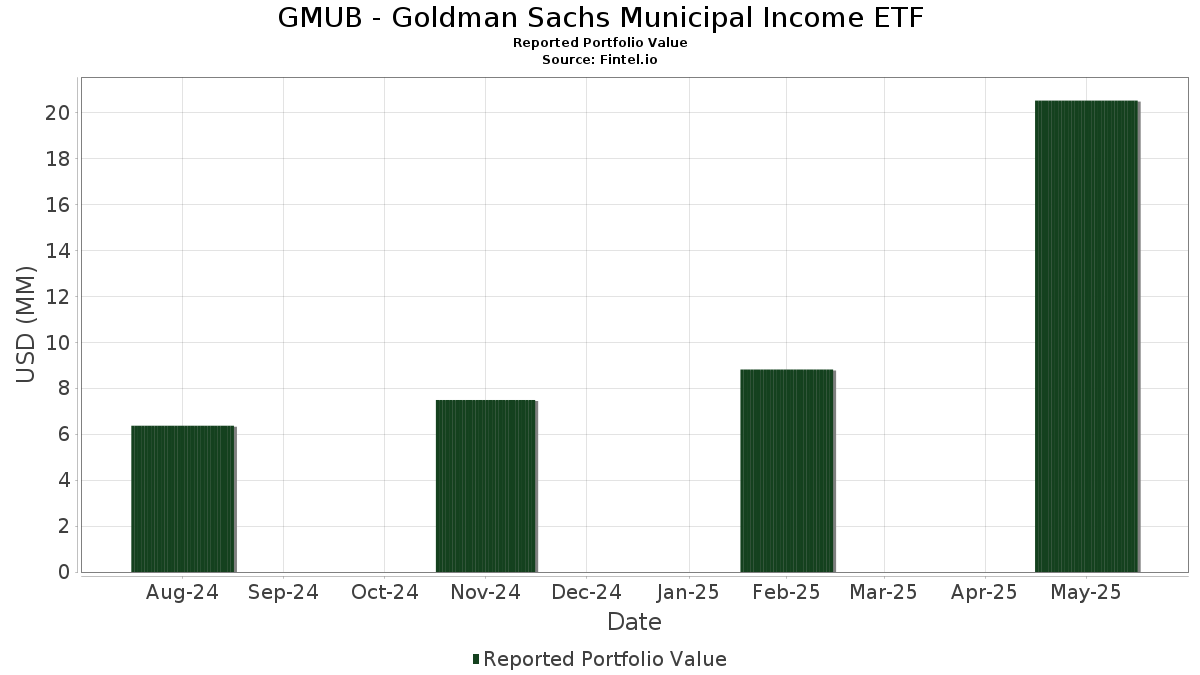

| Porteføljeværdi | $ 20.516.678 |

| Nuværende stillinger | 144 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

GMUB - Goldman Sachs Municipal Income ETF har afsløret 144 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 20.516.678 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). GMUB - Goldman Sachs Municipal Income ETFs største beholdninger er MISSOURI ST HLTH & EDUCTNL FAC HEALTH & EDUCATIONAL FACILITIES AUTHORITY OF THE S (US:US6069014P85) , MISSISSIPPI ST BUSINESS FIN CO REGD V/R B/E 1.26000000 (US:US60528ABK97) , Colorado Health Facilities Authority (US:US19648FPT56) , City of Gainesville FL Utilities System Revenue (US:US362848RR67) , and LA CA DWAP 02A5 Q=BA V1 (US:US544495DY71) . GMUB - Goldman Sachs Municipal Income ETFs nye stillinger omfatter MISSOURI ST HLTH & EDUCTNL FAC HEALTH & EDUCATIONAL FACILITIES AUTHORITY OF THE S (US:US6069014P85) , MISSISSIPPI ST BUSINESS FIN CO REGD V/R B/E 1.26000000 (US:US60528ABK97) , Colorado Health Facilities Authority (US:US19648FPT56) , City of Gainesville FL Utilities System Revenue (US:US362848RR67) , and LA CA DWAP 02A5 Q=BA V1 (US:US544495DY71) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,53 | 2,3658 | 2,3658 | ||

| 0,52 | 2,3208 | 2,3208 | ||

| 0,50 | 2,2532 | 2,2532 | ||

| 0,50 | 2,2532 | 2,2532 | ||

| 0,50 | 2,2532 | 2,2532 | ||

| 0,30 | 1,3532 | 1,3532 | ||

| 0,26 | 1,1743 | 1,1743 | ||

| 0,26 | 1,1730 | 1,1730 | ||

| 0,26 | 1,1724 | 1,1724 | ||

| 0,26 | 1,1507 | 1,1507 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,20 | 0,9175 | -1,4002 | ||

| 0,19 | 0,8352 | -1,2796 | ||

| 0,15 | 0,6685 | -1,0585 | ||

| 0,14 | 0,6202 | -1,0561 | ||

| 0,14 | 0,6257 | -1,0389 | ||

| 0,14 | 0,6132 | -0,9495 | ||

| 0,13 | 0,5780 | -0,9465 | ||

| 0,13 | 0,5891 | -0,9340 | ||

| 0,13 | 0,5637 | -0,9095 | ||

| 0,13 | 0,5784 | -0,9086 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-07-29 for rapporteringsperioden 2025-05-31. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US6069014P85 / MISSOURI ST HLTH & EDUCTNL FAC HEALTH & EDUCATIONAL FACILITIES AUTHORITY OF THE S | 0,53 | 2,3658 | 2,3658 | |||

| US60528ABK97 / MISSISSIPPI ST BUSINESS FIN CO REGD V/R B/E 1.26000000 | 0,52 | 2,3208 | 2,3208 | |||

| US362848RR67 / City of Gainesville FL Utilities System Revenue | 0,50 | 2,2532 | 2,2532 | |||

| US19648FPT56 / Colorado Health Facilities Authority | 0,50 | 2,2532 | 2,2532 | |||

| US544495DY71 / LA CA DWAP 02A5 Q=BA V1 | 0,50 | 2,2532 | 2,2532 | |||

| Oklahoma Housing Finance Agency / DBT (US67886UAU51) | 0,30 | 1,3532 | 1,3532 | |||

| US40934TAV52 / Hampton Roads Transportation Accountability Commission | 0,26 | 1,1743 | 1,1743 | |||

| Coatesville School District / DBT (US190684QY95) | 0,26 | 1,1730 | 1,1730 | |||

| City of Hartford CT / DBT (US416464AN59) | 0,26 | 1,1724 | 1,1724 | |||

| US576528DV28 / Matagorda County Navigation District No 1 | 0,26 | 1,1507 | 1,1507 | |||

| Florida Development Finance Corp / DBT (US340618DZ75) | 0,25 | 1,1471 | 1,1471 | |||

| US605155BR07 / MISSION TX ECON DEV CORP SOL W REGD V/R B/E AMT 0.40000000 | 0,25 | 1,1266 | 1,1266 | |||

| US59447TW585 / Michigan Finance Authority | 0,24 | 1,0993 | 1,0993 | |||

| County of Cook IL Sales Tax Revenue / DBT (US213248ER48) | 0,23 | 1,0396 | 1,0396 | |||

| California Community Choice Financing Authority / DBT (US13013JFR23) | 0,23 | 1,0258 | 1,0258 | |||

| King County School District No 216 Enumclaw / DBT (US495008SA36) | 0,22 | 1,0087 | 1,0087 | |||

| New Jersey Educational Facilities Authority / DBT (US646067KE77) | 0,22 | 0,9972 | 0,9972 | |||

| Volusia County Educational Facility Authority / DBT (US928836PJ87) | 0,21 | 0,9507 | 0,9507 | |||

| New Jersey Turnpike Authority / DBT (US646140JA26) | 0,21 | 0,9430 | 0,9430 | |||

| US115012AP11 / County of Broward FL Convention Center Hotel Revenue | 0,21 | 0,9359 | 0,9359 | |||

| Southeast Energy Authority A Cooperative District / DBT (US84136HBT95) | 0,21 | 0,9306 | 0,9306 | |||

| Aventura Isles Community Development District / DBT (US05357GAE26) | 0,20 | -0,49 | 0,9175 | -1,4002 | ||

| Ohio Housing Finance Agency / DBT (US676900XP36) | 0,20 | 0,9063 | 0,9063 | |||

| US113807BF73 / Brooklyn Arena Local Development Corp | 0,20 | 0,9063 | 0,9063 | |||

| US64972GCM42 / NEW YORK CITY NY MUNI WTR FIN REGD V/R B/E 1.18000000 | 0,20 | 0,9013 | 0,9013 | |||

| Salem Economic Development Authority / DBT (US794565BJ94) | 0,20 | 0,8953 | 0,8953 | |||

| Pinellas County School Board / DBT (US723203BL89) | 0,20 | 0,8853 | 0,8853 | |||

| US74529JRJ69 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0,19 | 0,8407 | 0,8407 | |||

| US610530FY83 / MONROE CNTY GA DEV AUTH POLL CONTROL REVENUE | 0,19 | -0,54 | 0,8352 | -1,2796 | ||

| US186347AC47 / CLEVELAND OH ARPT SPL REVENUE | 0,18 | 0,8115 | 0,8115 | |||

| US345648EE56 / City of Forest Grove | 0,18 | 0,8056 | 0,8056 | |||

| City of Chicago IL / DBT (US167486S678) | 0,18 | 71,84 | 0,7999 | -0,3771 | ||

| US650116CZ75 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 0,17 | 0,7802 | 0,7802 | |||

| Hammock Oaks Community Development District / DBT (US40834PAG72) | 0,17 | 0,7710 | 0,7710 | |||

| US646136WU13 / New Jersey (State of) Transportation Trust Fund Authority, Series 2009 A, RB | 0,17 | 0,7707 | 0,7707 | |||

| Onondaga Civic Development Corp / DBT (US682832KV18) | 0,17 | 0,7589 | 0,7589 | |||

| City of Chicago IL Wastewater Transmission Revenue / DBT (US167727K540) | 0,16 | 0,7368 | 0,7368 | |||

| US74529JRR85 / Puerto Rico Sales Tax Financing Corp., Series 2019 A, RB | 0,16 | 0,7180 | 0,7180 | |||

| US7352402C63 / Port of Portland | 0,16 | 0,7179 | 0,7179 | |||

| US19648FPF52 / Colorado Health Facilities Authority | 0,16 | 0,7139 | 0,7139 | |||

| US688031DZ35 / County of Osceola FL Transportation Revenue | 0,16 | 0,7075 | 0,7075 | |||

| New York State Dormitory Authority / DBT (US64990KGV98) | 0,15 | 0,6927 | 0,6927 | |||

| US79467BEH42 / Sales Tax Securitization Corp. | 0,15 | 0,6864 | 0,6864 | |||

| City of Chicago IL / DBT (US167570TW08) | 0,15 | 0,6751 | 0,6751 | |||

| US59333PR759 / Miami-Dade County, Florida, Aviation Revenue Bonds, Refunding Series 2015A | 0,15 | 0,6749 | 0,6749 | |||

| US09182NBR08 / Black Belt Energy Gas District | 0,15 | -2,63 | 0,6685 | -1,0585 | ||

| City of Norwood OH / DBT (US669681AA63) | 0,14 | 0,6503 | 0,6503 | |||

| State of Illinois / DBT (US452153KA61) | 0,14 | -5,48 | 0,6257 | -1,0389 | ||

| US64613CAD02 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 0,14 | -6,80 | 0,6202 | -1,0561 | ||

| US167593F314 / CHIC IL OHARE SER D 5% 1/1/35@ | 0,14 | -0,73 | 0,6132 | -0,9495 | ||

| US355612AD45 / County of Frederick | 0,13 | 0,5936 | 0,5936 | |||

| Southeast Alabama Gas Supply District/The / DBT (US84131TBT88) | 0,13 | -2,99 | 0,5891 | -0,9340 | ||

| Karnes County Hospital District / DBT (US485722AQ59) | 0,13 | -0,76 | 0,5861 | -0,9005 | ||

| US249182LV60 / DENVER CITY & CNTY CO ARPT REVENUE | 0,13 | 0,5800 | 0,5800 | |||

| US71883MPT52 / City of Phoenix Civic Improvement Corp | 0,13 | -2,29 | 0,5784 | -0,9086 | ||

| Jacksonville Public Educational Building Authority / DBT (US469480BT36) | 0,13 | -4,48 | 0,5780 | -0,9465 | ||

| Socorro Independent School District / DBT (US833715DD44) | 0,13 | -0,79 | 0,5658 | -0,8696 | ||

| Florida Development Finance Corp / DBT (US34061UMU96) | 0,13 | -3,10 | 0,5637 | -0,9095 | ||

| City & County of San Francisco CA / DBT (US79765PEG46) | 0,13 | 0,5636 | 0,5636 | |||

| US70869PMF17 / Pennsylvania Economic Development Financing Authority, Revenue Bonds, Pennsylvania-American Water Company, Refunding Series 2019 | 0,12 | 0,5571 | 0,5571 | |||

| US64971PLK92 / New York City Industrial Development Agency | 0,12 | 0,5508 | 0,5508 | |||

| US452152H616 / Illinois (State of) | 0,12 | 0,5507 | 0,5507 | |||

| County of Seminole FL Sales Tax Revenue / DBT (US816691EV77) | 0,12 | -0,84 | 0,5347 | -0,8220 | ||

| US167736F699 / City of Chicago IL Waterworks Revenue | 0,12 | -0,85 | 0,5314 | -0,8170 | ||

| Fircrest Properties / DBT (US318094AE98) | 0,11 | -1,77 | 0,5013 | -0,7832 | ||

| US2510936C90 / DETROIT MI | 0,11 | 0,4989 | 0,4989 | |||

| California Health Facilities Financing Authority / DBT (US13032UN876) | 0,11 | -0,90 | 0,4963 | -0,7689 | ||

| Indianapolis Local Public Improvement Bond Bank / DBT (US45528VEC90) | 0,11 | -0,92 | 0,4870 | -0,7507 | ||

| City of Springfield IL Electric Revenue / DBT (US850578UA12) | 0,11 | -0,93 | 0,4848 | -0,7506 | ||

| Providence Public Building Authority / DBT (US74381MDJ18) | 0,11 | -4,50 | 0,4787 | -0,7865 | ||

| City of Los Angeles Department of Airports / DBT (US5444452K44) | 0,11 | 0,4783 | 0,4783 | |||

| California Infrastructure & Economic Development Bank / DBT (US13035ADD81) | 0,11 | -2,78 | 0,4763 | -0,7500 | ||

| US68450LHF58 / ORLANDO HEALTH OBLIGATED GROUP 5.0% 10-01-38 | 0,11 | -5,41 | 0,4749 | -0,7889 | ||

| New Hope Cultural Education Facilities Finance Corp / DBT (US64542UGV08) | 0,11 | -2,78 | 0,4748 | -0,7583 | ||

| City of Celina TX / DBT (US15114CHU18) | 0,11 | 0,00 | 0,4746 | -0,7209 | ||

| Port of Seattle WA / DBT (US7353892A52) | 0,11 | -0,94 | 0,4746 | -0,7332 | ||

| Triborough Bridge & Tunnel Authority / DBT (US89602HHY62) | 0,11 | 0,4745 | 0,4745 | |||

| Central Texas Turnpike System / DBT (US88283KBQ04) | 0,11 | -1,87 | 0,4744 | -0,7400 | ||

| Pennsylvania Economic Development Financing Authority / DBT (US70870JGY82) | 0,11 | 0,4734 | 0,4734 | |||

| US74514L3K10 / PUERTO RICO CMWLTH | 0,10 | 108,00 | 0,4726 | -0,0989 | ||

| Trinity River Authority Central Regional Wastewater System Revenue / DBT (US89658HZR47) | 0,10 | -4,59 | 0,4724 | -0,7712 | ||

| US0418067A26 / Arlington Higher Education Finance Corp | 0,10 | -0,95 | 0,4711 | -0,7239 | ||

| Will County Forest Preserve District / DBT (US968661JN93) | 0,10 | -4,59 | 0,4696 | -0,7671 | ||

| Columbus-Franklin County Finance Authority / DBT (US19910XAJ54) | 0,10 | 0,00 | 0,4696 | -0,7185 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZM84) | 0,10 | 0,4685 | 0,4685 | |||

| South Carolina Jobs-Economic Development Authority / DBT (US83704HAD98) | 0,10 | -1,90 | 0,4683 | -0,7246 | ||

| Austin Affordable Pfc Inc / DBT (US05217TAU88) | 0,10 | -0,96 | 0,4678 | -0,7144 | ||

| Trails at Crowfoot Metropolitan District No 3 / DBT (US89286RAH12) | 0,10 | -1,90 | 0,4667 | -0,7299 | ||

| US897579BV93 / Toledo OH GO | 0,10 | -3,74 | 0,4657 | -0,7548 | ||

| Minneapolis-St Paul Metropolitan Airports Commission / DBT (US603827Q257) | 0,10 | -3,74 | 0,4652 | -0,7572 | ||

| Ohio Higher Educational Facility Commission / DBT (US67756DS490) | 0,10 | -4,67 | 0,4618 | -0,7561 | ||

| US158862CB65 / Chandler Industrial Development Authority | 0,10 | -0,98 | 0,4592 | -0,7078 | ||

| Port New Orleans Board of Commissioners / DBT (US734782ED33) | 0,10 | 0,4591 | 0,4591 | |||

| US57665NAD75 / USVI FED EXCISE TAX 22A 5.0% 10-01-28 | 0,10 | -2,88 | 0,4589 | -0,7230 | ||

| US836753LS01 / SOUTH BROWARD FL HOSP DIST 5.0% 05-01-28 | 0,10 | -0,98 | 0,4582 | -0,7039 | ||

| US19648FKQ62 / Colorado Health Facilities Authority | 0,10 | -3,81 | 0,4580 | -0,7374 | ||

| Public Finance Authority / DBT (US74442PK952) | 0,10 | 0,4571 | 0,4571 | |||

| US61360PCJ75 / Montgomery (County of), PA Industrial Development Authority (Acts Retirement-Life Communities), Series 2016, Ref. RB | 0,10 | -0,98 | 0,4559 | -0,7017 | ||

| US79467BCR42 / Sales Tax Securitization Corp. | 0,10 | -0,99 | 0,4551 | -0,6980 | ||

| US96634RAU68 / Whiting (City of), IN (BP Products North America), Series 2019, Ref. RB | 0,10 | -0,99 | 0,4547 | -0,6970 | ||

| US795576FV49 / Salt Lake City (City of), Series 2017 A, RB | 0,10 | -1,96 | 0,4539 | -0,7093 | ||

| US93976ACR14 / WASHINGTON ST CONVENTION CENTER PUBLIC FACS DIST | 0,10 | -0,99 | 0,4537 | -0,6973 | ||

| US602366WY88 / MILWAUKEE WI | 0,10 | -0,99 | 0,4535 | -0,6924 | ||

| Public Finance Authority / DBT (US74443DLU36) | 0,10 | 0,4531 | 0,4531 | |||

| Wagoner County Development Authority/OK / DBT (US93054CAF05) | 0,10 | 0,4518 | 0,4518 | |||

| US670500EY92 / Nueces River Authority, Texas, Water Supply Revenue Bonds, Corpus Christi Lake Texana Project, Refunding Series 2015 | 0,10 | 0,00 | 0,4516 | -0,6903 | ||

| Sauquoit Valley Central School District / DBT (US804515EW01) | 0,10 | 0,00 | 0,4511 | -0,6875 | ||

| Andover Central School District / DBT (US034345DD70) | 0,10 | 0,00 | 0,4509 | -0,6880 | ||

| US63607YBJ82 / New Hampshire Business Finance Authority, Series 2023 A | 0,10 | -3,85 | 0,4508 | -0,7343 | ||

| US121342MW66 / BURKE CNTY GA DEV AUTH POLL CONTROL REVENUE | 0,10 | 0,4506 | 0,4506 | |||

| Hillsborough County Housing Finance Authority / DBT (US43232EDB20) | 0,10 | -1,00 | 0,4501 | -0,6853 | ||

| Lowery Hills Community Development District / DBT (US548652AA49) | 0,10 | 0,4499 | 0,4499 | |||

| US24918EEJ55 / DENVER CO HLTH & HOSP AUTH HLTHCARE REVENUE | 0,10 | -4,81 | 0,4498 | -0,7366 | ||

| Peace Creek Village Community Development District / DBT (US70459CAD48) | 0,10 | 0,4497 | 0,4497 | |||

| US592643CY49 / MWAA DULLES TOL 4% 10/1/2035 | 0,10 | -1,98 | 0,4487 | -0,6995 | ||

| US5444956D10 / Los Angeles Department of Water & Power Power System Revenue | 0,10 | -2,94 | 0,4463 | -0,7119 | ||

| US6461367Z85 / NEW JERSEY TRANSPORTATION TRUST FUND AUTHORITY | 0,10 | -2,94 | 0,4463 | -0,7193 | ||

| City of Gunter TX / DBT (US40314PAA93) | 0,10 | 0,4447 | 0,4447 | |||

| Alabama Housing Finance Authority / DBT (US01030RLJ94) | 0,10 | -3,00 | 0,4372 | -0,7078 | ||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 0,10 | 0,4368 | 0,4368 | |||

| Metropolitan Pier & Exposition Authority / DBT (US592250FV19) | 0,10 | -7,69 | 0,4329 | -0,7502 | ||

| US19648FJJ49 / Colorado Health Facilities Authority | 0,10 | 0,4316 | 0,4316 | |||

| Tradition Community Development District No 9 / DBT (US89269NAF50) | 0,10 | 0,4310 | 0,4310 | |||

| State of Nevada Department of Business & Industry / DBT (US641455AB65) | 0,10 | -5,00 | 0,4300 | -0,7105 | ||

| US64578CCF68 / NEW JERSEY ST ECON DEV AUTH SPL FAC REVENUE | 0,10 | -5,94 | 0,4294 | -0,7189 | ||

| Crossings Community Development District / DBT (US22766NAF42) | 0,10 | -5,00 | 0,4293 | -0,7126 | ||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,09 | -7,00 | 0,4234 | -0,7151 | ||

| Commonwealth of Pennsylvania / DBT (US70914P4J84) | 0,09 | -6,06 | 0,4231 | -0,7081 | ||

| South Carolina Public Service Authority / DBT (US8371514U08) | 0,09 | -8,16 | 0,4087 | -0,7038 | ||

| US650116EX00 / NY TRANS CORP 4% 12/1/2042 | 0,09 | -8,25 | 0,4013 | -0,7049 | ||

| US40065NCR61 / Territory of Guam | 0,09 | -8,33 | 0,3985 | -0,6930 | ||

| US803301DK30 / MUNI ORIG ISSUE DISC | 0,09 | -6,52 | 0,3886 | -0,6577 | ||

| Metropolitan Transportation Authority / DBT (US59261A2H99) | 0,09 | -9,47 | 0,3884 | -0,6907 | ||

| Liberty Cove Community Development District / DBT (US530430AA53) | 0,08 | -16,00 | 0,3825 | -0,7551 | ||

| Athens-Clarke County Unified Government Development Authority / DBT (US047059KT63) | 0,08 | -7,69 | 0,3787 | -0,6561 | ||

| US113807BQ39 / BROOKLYN ARENA LOCAL DEVELOPMENT CORP | 0,07 | -8,86 | 0,3277 | -0,5778 | ||

| US167501VH56 / Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1998B-1 | 0,07 | 0,00 | 0,3226 | -0,4902 | ||

| Clifton Higher Education Finance Corp / DBT (US187145UC94) | 0,06 | 0,2855 | 0,2855 | |||

| US00301PAU49 / Aberdeen Community Development District | 0,05 | 0,2198 | 0,2198 | |||

| US74529JQG30 / Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT | 0,04 | -6,38 | 0,2025 | -0,3324 | ||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,02 | 91,67 | 0,1053 | -0,0360 | ||

| US295435CR08 / ERIE PA HGR EDU BLDG AUTH | 0,02 | 0,1040 | 0,1040 | |||

| US74514L3P07 / PUERTO RICO CMWLTH | 0,02 | -9,09 | 0,0927 | -0,1660 | ||

| US ULTRA BOND CBT / DIR (000000000) | -0,00 | -0,0049 | -0,0049 |