Grundlæggende statistik

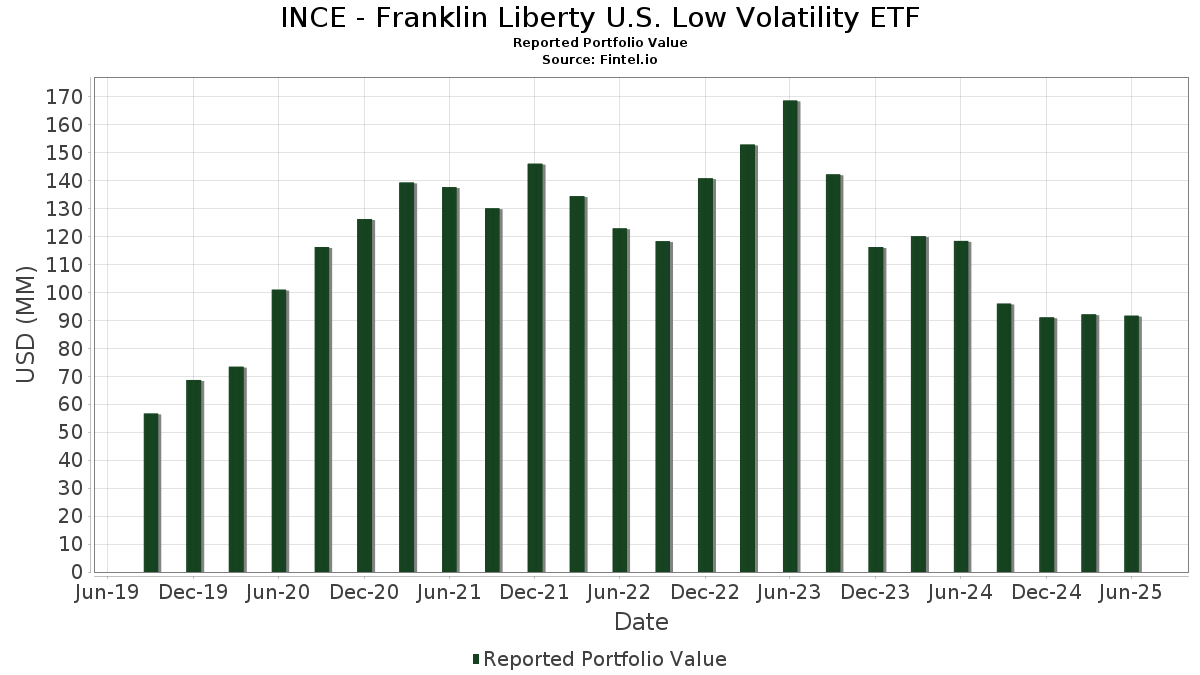

| Porteføljeværdi | $ 91.646.859 |

| Nuværende stillinger | 77 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

INCE - Franklin Liberty U.S. Low Volatility ETF har afsløret 77 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 91.646.859 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). INCE - Franklin Liberty U.S. Low Volatility ETFs største beholdninger er The Southern Company (US:SO) , Johnson & Johnson (US:JNJ) , Verizon Communications Inc. (US:VZ) , Chevron Corporation (US:CVX) , and PepsiCo, Inc. (US:PEP) . INCE - Franklin Liberty U.S. Low Volatility ETFs nye stillinger omfatter Federal Home Loan Bank Discount Notes (US:US313385HP48) , .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,01 | 1,0973 | 1,0973 | ||

| 0,02 | 1,84 | 1,9970 | 1,0626 | |

| 0,94 | 1,0210 | 1,0210 | ||

| 0,67 | 0,7310 | 0,7310 | ||

| 0,03 | 0,87 | 0,9408 | 0,4476 | |

| 1,36 | 1,4721 | 0,4193 | ||

| 2,28 | 2,4763 | 0,3307 | ||

| 1,93 | 2,0968 | 0,3070 | ||

| 0,01 | 1,57 | 1,7090 | 0,3034 | |

| 0,01 | 1,45 | 1,5712 | 0,2406 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,00 | 0,46 | 0,5041 | -1,7088 | |

| 0,00 | 1,11 | 1,2076 | -0,7224 | |

| 0,01 | 0,49 | 0,5333 | -0,5913 | |

| 0,06 | 2,46 | 2,6762 | -0,5697 | |

| 0,02 | 2,34 | 2,5417 | -0,4947 | |

| 0,03 | 2,71 | 2,9412 | -0,3844 | |

| 0,02 | 2,67 | 2,8995 | -0,3195 | |

| 0,01 | 1,16 | 1,2594 | -0,3038 | |

| 0,01 | 1,31 | 1,4204 | -0,1820 | |

| 0,01 | 1,70 | 1,8521 | -0,1737 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SO / The Southern Company | 0,03 | -12,19 | 2,71 | -12,31 | 2,9412 | -0,3844 | |||

| JNJ / Johnson & Johnson | 0,02 | -3,03 | 2,67 | -10,68 | 2,8995 | -0,3195 | |||

| VZ / Verizon Communications Inc. | 0,06 | -14,30 | 2,46 | -18,25 | 2,6762 | -0,5697 | |||

| CVX / Chevron Corporation | 0,02 | -3,03 | 2,34 | -17,00 | 2,5417 | -0,4947 | |||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 2,28 | 14,47 | 2,4763 | 0,3307 | |||||

| PEP / PepsiCo, Inc. | 0,02 | 17,67 | 2,25 | 3,64 | 2,4467 | 0,1053 | |||

| JCI / Johnson Controls International plc | 0,02 | -18,10 | 2,12 | 7,99 | 2,3071 | 0,1884 | |||

| Merrill Lynch BV / EC (US59027W2118) | 0,02 | 0,00 | 1,94 | 3,03 | 2,1063 | 0,0797 | |||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 1,93 | 16,20 | 2,0968 | 0,3070 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1,86 | -6,80 | 2,0252 | -0,1293 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 1,86 | -4,86 | 2,0217 | -0,0863 | |||||

| MRK / Merck & Co., Inc. | 0,02 | 140,29 | 1,84 | 112,00 | 1,9970 | 1,0626 | |||

| LMT / Lockheed Martin Corporation | 0,00 | -3,02 | 1,77 | 0,51 | 1,9215 | 0,0265 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 1,73 | 2,43 | 1,8780 | 0,0605 | |||||

| PG / The Procter & Gamble Company | 0,01 | -3,03 | 1,70 | -9,36 | 1,8521 | -0,1737 | |||

| JPM / JPMorgan Chase & Co. | 0,01 | -3,03 | 1,64 | 14,66 | 1,7838 | 0,2404 | |||

| APD / Air Products and Chemicals, Inc. | 0,01 | -3,03 | 1,63 | -7,24 | 1,7677 | -0,1222 | |||

| RTX / RTX Corporation | 0,01 | -3,03 | 1,62 | 6,93 | 1,7616 | 0,1275 | |||

| Wells Fargo Bank NA / STIV (US95003R7355) | 0,01 | 0,00 | 1,57 | 20,63 | 1,7090 | 0,3034 | |||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 1,52 | 11,59 | 1,6528 | 0,1844 | |||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0,03 | -3,03 | 1,46 | -5,87 | 1,5855 | -0,0844 | |||

| MS / Morgan Stanley | 0,01 | -3,02 | 1,45 | 17,09 | 1,5712 | 0,2406 | |||

| HD / The Home Depot, Inc. | 0,00 | -3,01 | 1,37 | -2,97 | 1,4892 | -0,0327 | |||

| ADI / Analog Devices, Inc. | 0,01 | -3,02 | 1,36 | 14,45 | 1,4803 | 0,1980 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1,36 | -3,68 | 1,4796 | -0,0444 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1,36 | 38,69 | 1,4721 | 0,4193 | |||||

| XOM / Exxon Mobil Corporation | 0,01 | -3,03 | 1,31 | -12,10 | 1,4204 | -0,1820 | |||

| UNP / Union Pacific Corporation | 0,01 | -3,02 | 1,28 | -5,59 | 1,3947 | -0,0696 | |||

| CSCO / Cisco Systems, Inc. | 0,02 | -3,03 | 1,25 | 9,11 | 1,3537 | 0,1225 | |||

| NEE.PRS / NextEra Energy, Inc. - Debt/Equity Composite Units | 0,03 | -3,03 | 1,24 | -4,46 | 1,3505 | -0,0516 | |||

| Mizuho Markets Cayman LP / DBT (US6068FR7252) | 1,24 | -3,36 | 1,3456 | -0,0346 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0,02 | -3,03 | 1,22 | 10,24 | 1,3211 | 0,1325 | |||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 1,20 | 3,17 | 1,3090 | 0,0514 | |||||

| IBM / International Business Machines Corporation | 0,00 | -3,03 | 1,20 | 14,96 | 1,3030 | 0,1791 | |||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 1,19 | 3,11 | 1,2965 | 0,0501 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 1,19 | -5,70 | 1,2943 | -0,0672 | |||||

| TXN / Texas Instruments Incorporated | 0,01 | -3,03 | 1,16 | 12,05 | 1,2631 | 0,1452 | |||

| PM / Philip Morris International Inc. | 0,01 | -30,38 | 1,16 | -20,12 | 1,2594 | -0,3038 | |||

| Wells Fargo Bank NA / STIV (US95003R8676) | 0,00 | 0,00 | 1,11 | -37,97 | 1,2076 | -0,7224 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0,02 | -3,03 | 1,07 | -7,99 | 1,1642 | -0,0902 | |||

| MCD / McDonald's Corporation | 0,00 | -3,03 | 1,06 | -9,28 | 1,1477 | -0,1071 | |||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 1,05 | 10,68 | 1,1382 | 0,1184 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 1,04 | 9,96 | 1,1285 | 0,1106 | |||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 1,04 | -5,38 | 1,1273 | -0,0534 | |||||

| LOW / Lowe's Companies, Inc. | 0,00 | -3,01 | 1,04 | -7,75 | 1,1251 | -0,0841 | |||

| HON / Honeywell International Inc. | 0,00 | -3,03 | 1,03 | 6,63 | 1,1187 | 0,0786 | |||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 1,02 | -5,01 | 1,1133 | -0,0489 | |||||

| KO / The Coca-Cola Company | 0,01 | -3,03 | 1,02 | -4,15 | 1,1029 | -0,0387 | |||

| Mizuho Markets Cayman LP / SN (US60701E3606) | 1,01 | 1,0973 | 1,0973 | ||||||

| BNP Paribas Issuance BV / SN (XS2828433743) | 1,00 | 25,35 | 1,0862 | 0,2273 | |||||

| USB / U.S. Bancorp | 0,02 | -3,03 | 0,96 | 3,92 | 1,0382 | 0,0476 | |||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0,03 | -3,03 | 0,95 | -12,68 | 1,0322 | -0,1400 | |||

| US313385HP48 / Federal Home Loan Bank Discount Notes | 0,94 | 1,0210 | 1,0210 | ||||||

| Merrill Lynch BV / SN (US59027W2944) | 0,92 | 18,86 | 0,9999 | 0,1657 | |||||

| SLB / Schlumberger Limited | 0,03 | 133,94 | 0,87 | 89,28 | 0,9408 | 0,4476 | |||

| Merrill Lynch BV / SN (US59027W3108) | 0,86 | 23,20 | 0,9291 | 0,1809 | |||||

| SRE / Sempra | 0,01 | -3,03 | 0,84 | 2,96 | 0,9074 | 0,0336 | |||

| DUK / Duke Energy Corporation | 0,01 | -3,03 | 0,80 | -6,12 | 0,8671 | -0,0494 | |||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 0,72 | 7,12 | 0,7852 | 0,0589 | |||||

| BNP Paribas Issuance BV / SN (XS2804852924) | 0,70 | -7,39 | 0,7635 | -0,0534 | |||||

| Wells Fargo Bank NA / DBT (US95003X3778) | 0,67 | 0,7310 | 0,7310 | ||||||

| UPS / United Parcel Service, Inc. | 0,01 | -3,02 | 0,61 | -11,05 | 0,6655 | -0,0760 | |||

| BNP / BNP Paribas SA - Depositary Receipt (Common Stock) | 0,60 | 18,76 | 0,6473 | 0,1070 | |||||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 0,58 | 8,40 | 0,6315 | 0,0532 | |||||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0,01 | -3,03 | 0,57 | 19,50 | 0,6203 | 0,1060 | |||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 0,56 | 0,54 | 0,6049 | 0,0087 | |||||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0,01 | -3,02 | 0,51 | -7,80 | 0,5528 | -0,0417 | |||

| PNC / The PNC Financial Services Group, Inc. | 0,00 | -3,03 | 0,50 | 2,87 | 0,5444 | 0,0195 | |||

| SBUX / Starbucks Corporation | 0,01 | -51,68 | 0,49 | -54,63 | 0,5333 | -0,5913 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0,00 | -3,02 | 0,48 | -4,75 | 0,5232 | -0,0217 | |||

| FITB / Fifth Third Bancorp | 0,01 | -3,02 | 0,48 | 1,71 | 0,5175 | 0,0132 | |||

| FCX / Freeport-McMoRan Inc. | 0,01 | -3,03 | 0,47 | 11,03 | 0,5148 | 0,0551 | |||

| ABBV / AbbVie Inc. | 0,00 | -82,04 | 0,46 | -80,56 | 0,5041 | -1,7088 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,46 | 2,47 | 0,4963 | 0,0166 | |||||

| BA / The Boeing Company | 0,00 | -3,00 | 0,30 | 19,22 | 0,3312 | 0,0556 | |||

| ALB / Albemarle Corporation | 0,00 | -3,01 | 0,28 | -15,57 | 0,3069 | -0,0537 | |||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 0,13 | 0,1423 | 0,1423 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,00 | 0,0000 | 0,0000 | ||||||

| WELLS FARGO BANK / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| ROYAL BK CDA / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| MERRILL LYNCH B V / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS ISSUANCE B.V. / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| WELLS FARGO BK / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| WELLS FARGO BANK / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0000 | 0,0000 | ||||||

| ROYAL BK CDA / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0000 | 0,0000 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,00 | 0,0000 | 0,0000 | ||||||

| ROYAL BK CDA / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MKTS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0000 | 0,0000 | ||||||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | 0,0000 | ||||||

| MIZUHO MARKETS CAYMAN LP / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| MERRILL LYNCH B V / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MKTS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS ISSUANCE B.V. / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MARKETS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| RYBD34 / Royal Bank of Canada (Brasil) S.A. - Depositary Receipt (Common Stock) | 0,00 | 0,0000 | 0,0000 | ||||||

| MIZUHO MARKETS CAYMAN LP / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| BNP PARIBAS ISSUANCE B.V. / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| MERRILL LYNCH B V / DBT (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| CITIGROUP GLOBAL MKTS / DBT (000000000) | 0,00 | 0,0000 | 0,0000 |