Grundlæggende statistik

| Porteføljeværdi | $ 857.869.001 |

| Nuværende stillinger | 982 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

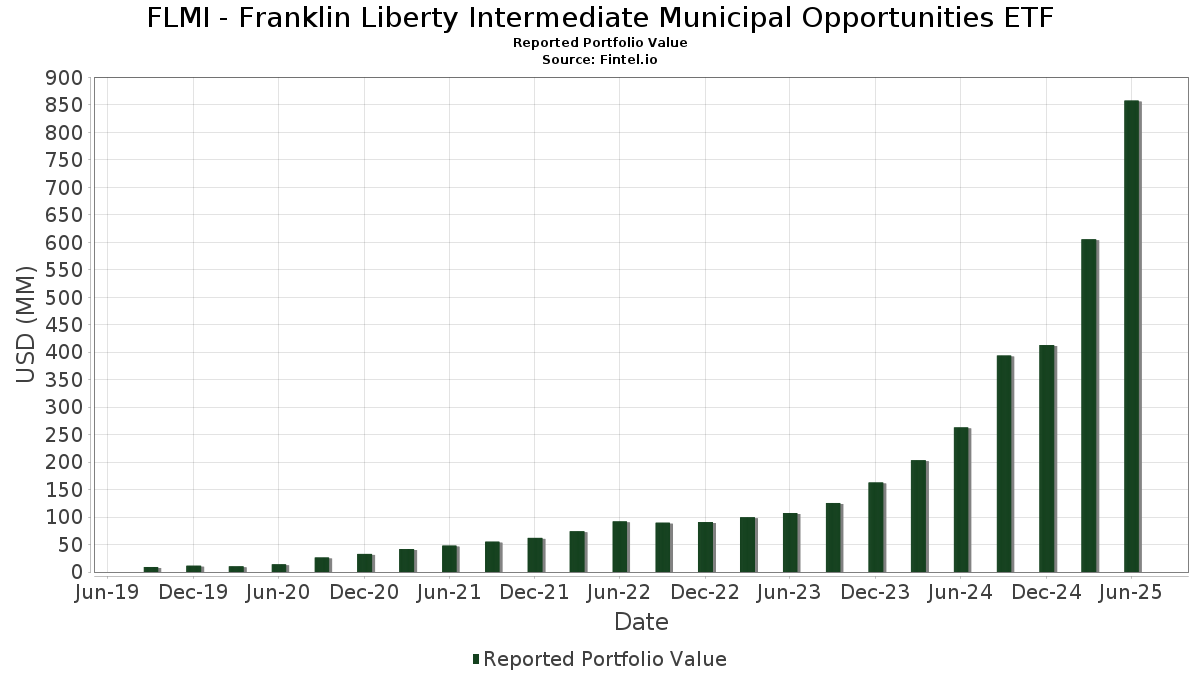

FLMI - Franklin Liberty Intermediate Municipal Opportunities ETF har afsløret 982 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 857.869.001 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). FLMI - Franklin Liberty Intermediate Municipal Opportunities ETFs største beholdninger er Health & Educational Facilities Authority of the State of Missouri (US:US60637AFM99) , California Community Choice Financing Authority (US:US13013JCM62) , NYC WTR VAR 6/15/2033 (US:US64972GZW76) , City of Chicago IL (US:US167486P609) , and Grand Canyon University (US:US38528UAE64) . FLMI - Franklin Liberty Intermediate Municipal Opportunities ETFs nye stillinger omfatter Health & Educational Facilities Authority of the State of Missouri (US:US60637AFM99) , California Community Choice Financing Authority (US:US13013JCM62) , NYC WTR VAR 6/15/2033 (US:US64972GZW76) , City of Chicago IL (US:US167486P609) , and Grand Canyon University (US:US38528UAE64) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 8,33 | 1,1497 | 1,1497 | ||

| 7,24 | 0,9995 | 0,9995 | ||

| 6,10 | 0,8418 | 0,8418 | ||

| 5,80 | 0,8002 | 0,8002 | ||

| 5,80 | 0,8002 | 0,8002 | ||

| 10,90 | 1,5039 | 0,7986 | ||

| 5,16 | 0,7126 | 0,7126 | ||

| 6,10 | 0,8416 | 0,6900 | ||

| 4,60 | 0,6352 | 0,6352 | ||

| 4,55 | 0,6277 | 0,6277 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,81 | 0,3877 | -1,5369 | ||

| 5,57 | 0,7686 | -0,9506 | ||

| 0,20 | 0,0276 | -0,8253 | ||

| 1,29 | 0,1776 | -0,6780 | ||

| 0,52 | 0,0717 | -0,6179 | ||

| 1,60 | 0,2208 | -0,5994 | ||

| 3,08 | 0,4253 | -0,4956 | ||

| 9,10 | 1,2555 | -0,4011 | ||

| 3,33 | 0,4594 | -0,3940 | ||

| 2,28 | 0,3151 | -0,3413 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US60637AFM99 / Health & Educational Facilities Authority of the State of Missouri | 10,90 | 153,49 | 1,5039 | 0,7986 | ||

| BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE / DBT (US09182TDL89) | 10,21 | 7,96 | 1,4090 | -0,1426 | ||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE / DBT (US84136HBT95) | 9,40 | 35,97 | 1,2973 | 0,1630 | ||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE / DBT (US84136HBT95) | 9,40 | 35,97 | 1,2973 | 0,1630 | ||

| US13013JCM62 / California Community Choice Financing Authority | 9,20 | 0,39 | 1,2693 | -0,2337 | ||

| US64972GZW76 / NYC WTR VAR 6/15/2033 | 9,10 | -9,90 | 1,2555 | -0,4011 | ||

| US167486P609 / City of Chicago IL | 8,71 | 12,69 | 1,2020 | -0,0660 | ||

| EL PASO CNTY TX HOSP DIST / DBT (US283590JX67) | 8,33 | 1,1497 | 1,1497 | |||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE / DBT (US84136HAU77) | 7,99 | 24,54 | 1,1028 | 0,0500 | ||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE / DBT (US84136HAU77) | 7,99 | 24,54 | 1,1028 | 0,0500 | ||

| US38528UAE64 / Grand Canyon University | 7,29 | 2,59 | 1,0062 | -0,1599 | ||

| US167510BJ40 / CHICAGO IL BRD OF EDU DEDICATE REGD B/E 5.75000000 | 7,24 | 0,9995 | 0,9995 | |||

| US650116CZ75 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 7,23 | 50,19 | 0,9980 | 0,2080 | ||

| US88044TAL35 / TENNESSEE ENERGY ACQUISITION CORP COMMODITY PROJECT REVENUE | 6,64 | -7,69 | 0,9162 | -0,2637 | ||

| MINNEAPOLIS-SAINT PAUL MN MET ARPTS COMMISSION ARPT REVENUE / DBT (US603827Q828) | 6,10 | 0,8418 | 0,8418 | |||

| US68608JXD89 / Oregon State Facilities Authority | 6,10 | 868,25 | 0,8416 | 0,6900 | ||

| ROCHESTER MN HLTH CARE FACS REVENUE / DBT (US771902HS55) | 5,80 | 0,8002 | 0,8002 | |||

| ROCHESTER MN HLTH CARE FACS REVENUE / DBT (US771902HS55) | 5,80 | 0,8002 | 0,8002 | |||

| US880397CF98 / Tennergy Corp. | 5,74 | 2,06 | 0,7925 | -0,1306 | ||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE / DBT (US84136HBC60) | 5,73 | -0,26 | 0,7904 | -0,1517 | ||

| ENERGY S E AL A COOPERATIVE DIST ENERGY SPLY REVENUE / DBT (US292723BN27) | 5,57 | -46,85 | 0,7686 | -0,9506 | ||

| COLUMBUS OH MET HSG AUTH GEN REVENUE / DBT (US19951AAW62) | 5,16 | 0,7126 | 0,7126 | |||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HH23) | 4,96 | 856,45 | 0,6850 | 0,5998 | ||

| EP LA PRIVADA PFC TX RSDL DEV REVENUE / DBT (US29416FAA12) | 4,76 | 14,83 | 0,6570 | -0,0232 | ||

| US13013JDC71 / CALIFORNIA CMNTY CHOICE FING AUTH CLEAN ENERGY PROJ REVENUE | 4,60 | 0,6352 | 0,6352 | |||

| HOUSTON TX ARPT SYS REVENUE / DBT (US442349HZ22) | 4,55 | 0,6277 | 0,6277 | |||

| HOUSTON TX ARPT SYS REVENUE / DBT (US442349HZ22) | 4,55 | 0,6277 | 0,6277 | |||

| US613603G608 / MONTGOMERY CNTY PA HGR EDU & HLTH AUTH | 4,51 | 0,6217 | 0,6217 | |||

| US59261AG435 / MET TRANSPRTN AUTH NY REVENUE | 4,42 | 0,6102 | 0,6102 | |||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HG40) | 4,19 | 17,03 | 0,5783 | -0,0092 | ||

| US928104MW54 / Virginia Small Business Financing Authority | 4,10 | 0,27 | 0,5659 | -0,1051 | ||

| US88256PAT75 / Texas Municipal Gas Acquisition & Supply Corp IV | 4,08 | 35,96 | 0,5633 | 0,0707 | ||

| US70342PAN42 / PATRIOTS ENERGY GROUP FING AGY SC GAS SPLY REVENUE | 4,05 | -23,11 | 0,5588 | -0,3052 | ||

| COLORADO ST HLTH FACS AUTH REVENUE / DBT (US19648FYT55) | 4,00 | 0,5519 | 0,5519 | |||

| US647370EK77 / NEW MEXICO ST HOSP EQUIPMENT LOAN COUNCIL HOSP REVENUE | 3,85 | 175,00 | 0,5312 | 0,3016 | ||

| HOUSTON TX ARPT SYS REVENUE / DBT (US442349HY56) | 3,78 | 89,70 | 0,5212 | 0,1946 | ||

| LOS ANGELES CA DEPT OF WTR & PWR REVENUE / DBT (US544532HU19) | 3,70 | -26,00 | 0,5105 | -0,3096 | ||

| US167486K402 / FX.RT. MUNI BOND | 3,70 | -0,11 | 0,5104 | -0,0971 | ||

| US20774YW521 / Connecticut State Health & Educational Facilities Authority | 3,68 | -4,06 | 0,5081 | -0,1216 | ||

| PENNSYLVANIA ST HSG FIN AGY SF MTGE REVENUE / DBT (US70879QV426) | 3,45 | 0,4760 | 0,4760 | |||

| MET PIER & EXPOSITION AUTH IL REVENUE / DBT (US592250FV19) | 3,39 | 0,4683 | 0,4683 | |||

| US56035DEN84 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 3,33 | -36,02 | 0,4594 | -0,3940 | ||

| US677525WV57 / Ohio Air Quality Development Authority | 3,25 | 8,65 | 0,4491 | -0,0422 | ||

| NEW JERSEY ST HGR EDU ASSISTANCE AUTH STUDENT LOAN REVENUE / DBT (US646080ZJ37) | 3,18 | 0,4385 | 0,4385 | |||

| EP CIMARRON VENTANAS PFC TX RSDL DEV REVENUE / DBT (US26879QAN51) | 3,13 | -0,19 | 0,4325 | -0,0826 | ||

| EP CIMARRON VENTANAS PFC TX RSDL DEV REVENUE / DBT (US26879QAN51) | 3,13 | -0,19 | 0,4325 | -0,0826 | ||

| INDIANA ST FIN AUTH REVENUE / DBT (US45506ENY58) | 3,13 | 0,4323 | 0,4323 | |||

| FW TEXAS STREET PUBLIC FAC CORP RSDL DEV REVENUE / DBT (US30322SAA42) | 3,11 | 0,4289 | 0,4289 | |||

| EP ESSENTIAL HOUSING WF PFC TX / DBT (US29416AAA25) | 3,10 | 0,75 | 0,4272 | -0,0769 | ||

| S E ALABAMA ST GAS SPLY DIST GAS SPLY REVENUE / DBT (US84131TBA97) | 3,08 | -45,10 | 0,4253 | -0,4956 | ||

| MISSION TX ECON DEV CORP SOL WST DISP REVENUE / DBT (US605155BW91) | 3,07 | 0,4233 | 0,4233 | |||

| ILLINOIS ST / DBT (US452153KF58) | 3,04 | 0,4200 | 0,4200 | |||

| ILLINOIS ST / DBT (US452153KF58) | 3,04 | 0,4200 | 0,4200 | |||

| US54241ABC62 / Long Beach Bond Finance Authority, California, Natural Gas Purchase Revenue Bonds, Series 2007B | 3,04 | 0,03 | 0,4189 | -0,0788 | ||

| MARICOPA CNTY AZ INDL DEV AUTH EDU REVENUE / DBT (US56681NJD03) | 3,03 | 0,36 | 0,4182 | -0,0772 | ||

| MARICOPA CNTY AZ INDL DEV AUTH EDU REVENUE / DBT (US56681NJD03) | 3,03 | 0,36 | 0,4182 | -0,0772 | ||

| ILLINOIS ST / DBT (US452153KE83) | 3,03 | 0,4181 | 0,4181 | |||

| ILLINOIS ST / DBT (US452153KE83) | 3,03 | 0,4181 | 0,4181 | |||

| US650116FR23 / New York Transportation Development Corp | 2,99 | 2,08 | 0,4123 | -0,0680 | ||

| US751814AA28 / RAMSEY MN CHRT SCH LEASE REVEN RAMEDU 06/32 FIXED OID 5 | 2,92 | 51,53 | 0,4033 | 0,0868 | ||

| VANCOUVER WA HSG AUTH / DBT (US921626PU57) | 2,91 | -0,89 | 0,4018 | -0,0801 | ||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FZN85) | 2,89 | 1,19 | 0,3987 | -0,0697 | ||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE / DBT (US84136HAH66) | 2,81 | -76,05 | 0,3877 | -1,5369 | ||

| IOWA ST HGR EDU LOAN AUTH REVENUE / DBT (US46247DBJ54) | 2,78 | 112,55 | 0,3833 | 0,1689 | ||

| IOWA ST HGR EDU LOAN AUTH REVENUE / DBT (US46247DBJ54) | 2,78 | 112,55 | 0,3833 | 0,1689 | ||

| US46246SAV79 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 2,75 | 0,51 | 0,3795 | -0,0694 | ||

| SELMA AL INDL DEV BRD REVENUE / DBT (US81647PAH64) | 2,67 | 0,3684 | 0,3684 | |||

| TEXAS ST MUNI GAS ACQUISITION & SPLY CORP V GAS SPLY REVENUE / DBT (US88256RAK23) | 2,66 | -30,74 | 0,3669 | -0,2628 | ||

| TEXAS ST MUNI GAS ACQUISITION & SPLY CORP V GAS SPLY REVENUE / DBT (US88256RAK23) | 2,66 | -30,74 | 0,3669 | -0,2628 | ||

| US88256HBH03 / FX.RT. MUNI BOND | 2,66 | 3,79 | 0,3668 | -0,0533 | ||

| US34061QBN60 / Florida Development Finance Corp. | 2,65 | 0,23 | 0,3663 | -0,0681 | ||

| US12574VAB80 / CMFA Special Finance Agency VIII | 2,54 | 3,46 | 0,3510 | -0,0523 | ||

| ONEIDA INDIAN NATION NY TAX REVENUE / DBT (US682504AB11) | 2,53 | -0,79 | 0,3488 | -0,0691 | ||

| US68608JXF38 / Oregon State Facilities Authority DV&DP | 2,50 | 212,50 | 0,3449 | -0,1411 | ||

| US74514L3J47 / PUERTO RICO CMWLTH | 2,47 | 12,83 | 0,3410 | -0,0183 | ||

| US167501WF81 / Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1999A | 2,43 | 0,3348 | 0,3348 | |||

| US650116DU79 / New York Transportation Development Corp. | 2,41 | -3,57 | 0,3320 | -0,0774 | ||

| US84129NML00 / Southcentral Pennsylvania General Authority Revenue (WellSpan Health Obligated Group) PUT | 2,40 | 380,00 | 0,3311 | 0,1763 | ||

| US452153AW91 / STATE OF ILLINO 5% 3/1/2046 | 2,39 | 0,3296 | 0,3296 | |||

| US167510BB14 / CHICAGO IL BRD OF EDU DEDICATED CAPITAL IMPT TAX | 2,38 | 4,65 | 0,3290 | -0,0446 | ||

| CHICAGO IL / DBT (US167486V979) | 2,37 | 0,3275 | 0,3275 | |||

| CHICAGO IL / DBT (US167486V979) | 2,37 | 0,3275 | 0,3275 | |||

| ILLINOIS ST HSG DEV AUTH MF REVENUE / DBT (US45202BSV98) | 2,37 | -1,70 | 0,3267 | -0,0683 | ||

| US292723AK96 / ENERGY S E AL A COOPERATIVE DI REGD V/R B/E 5.50000000 | 2,35 | -9,08 | 0,3248 | -0,0999 | ||

| US296110FW40 / ESCAMBIA CNTY FL HLTH FACS AUTH | 2,34 | 12,35 | 0,3226 | -0,0187 | ||

| US13013FAS39 / California Community Housing Agency | 2,32 | -0,77 | 0,3202 | -0,0634 | ||

| ADAMS CNTY PA GEN AUTH REV / DBT (US006114AC63) | 2,29 | -4,03 | 0,3160 | -0,0753 | ||

| KENTUCKY ST PUBLIC ENERGY AUTH GAS SPLY REVENUE / DBT (US74440DFC39) | 2,28 | -42,94 | 0,3151 | -0,3413 | ||

| US12574WAB63 / CMFA Special Finance Agency | 2,27 | 2,53 | 0,3133 | -0,0499 | ||

| US650116GP57 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 2,20 | 166,99 | 0,3036 | 0,1683 | ||

| US158862CA82 / Chandler Industrial Development Authority | 2,18 | 49,21 | 0,3012 | 0,0612 | ||

| COLUMBUS OH MET HSG AUTH AFFORDALE HSG REVENUE / DBT (US199518AR20) | 2,15 | -3,51 | 0,2964 | -0,0686 | ||

| US167505YX83 / CHICAGO BOE-A | 2,14 | 0,38 | 0,2949 | -0,0544 | ||

| PUBLIC FIN AUTH WI EDU REVENUE / DBT (US74442EMQ07) | 2,14 | -1,79 | 0,2946 | -0,0621 | ||

| PUBLIC FIN AUTH WI EDU REVENUE / DBT (US74442EMQ07) | 2,14 | -1,79 | 0,2946 | -0,0621 | ||

| US12574UAC80 / CMFA Special Finance Agency VII | 2,11 | 4,76 | 0,2914 | -0,0393 | ||

| US167505XP68 / CHICAGO IL BRD OF EDU | 2,10 | -0,48 | 0,2891 | -0,0564 | ||

| US939783Q588 / WASHINGTON STATE HOUSING FINANCE COMMISSION | 2,09 | -1,83 | 0,2884 | -0,0610 | ||

| US38546WDK36 / GRD FORKS ND HL 4% 12/1/2038 | 2,09 | -0,67 | 0,2883 | -0,0566 | ||

| NTHRN IL UNIV COPS / DBT (US665238DA66) | 2,06 | 0,2845 | 0,2845 | |||

| NTHRN IL UNIV COPS / DBT (US665238DA66) | 2,06 | 0,2845 | 0,2845 | |||

| US13013FAV67 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 2,06 | -3,02 | 0,2840 | -0,0641 | ||

| ALLENTOWN COMMERCIAL & INDL DEV AUTH / DBT (US01843AAK25) | 2,05 | -1,20 | 0,2835 | -0,0576 | ||

| ALLENTOWN COMMERCIAL & INDL DEV AUTH / DBT (US01843AAK25) | 2,05 | -1,20 | 0,2835 | -0,0576 | ||

| US13013FAF18 / California Community Housing Agency | 2,02 | 8,79 | 0,2783 | -0,0258 | ||

| US452153ET27 / ILLINOIS ST REGD OID B/E 5.25000000 | 2,01 | 0,2771 | 0,2771 | |||

| US19648FKR46 / Colorado Health Facilities Authority | 2,01 | 0,30 | 0,2768 | -0,0512 | ||

| GEORGIA ST HSG & FIN AUTH REVENUE / DBT (US37353PRH46) | 2,01 | 0,2768 | 0,2768 | |||

| VIRGINIA CLG BLDG AUTH EDUCTNL FACS REVENUE / DBT (US92778FLY78) | 2,01 | 0,2768 | 0,2768 | |||

| ANAHEIM CA HSG & PUBLIC IMPT AUTH REVENUE / DBT (US032556NJ70) | 2,00 | 0,2759 | 0,2759 | |||

| US57585KSV16 / Massachusetts Health and Educational Facilities Authority, Revenue Bonds, Massachusetts Institute of Technology, Series 2001J-2 | 2,00 | 0,2759 | 0,2759 | |||

| DEKALB CNTY GA HSG AUTH MF HSG / DBT (US240471PH97) | 1,95 | -0,10 | 0,2693 | -0,0512 | ||

| US650116GN00 / New York Transportation Development Corp | 1,95 | -0,97 | 0,2688 | -0,0539 | ||

| CALIFORNIA CMNTY CHOICE FING AUTH CLEAN ENERGY PROJ REVENUE / DBT (US13013JGF75) | 1,93 | 0,2668 | 0,2668 | |||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US65889BAZ76) | 1,92 | -39,22 | 0,2654 | -0,2538 | ||

| COLUMBUS OH MET HSG AUTH GEN REVENUE / DBT (US19951AAV89) | 1,90 | 1,44 | 0,2616 | -0,0450 | ||

| COLUMBUS OH MET HSG AUTH GEN REVENUE / DBT (US19951AAV89) | 1,90 | 1,44 | 0,2616 | -0,0450 | ||

| EP ROYAL ESTATES PFC TX RSDL DEV REVENUE / DBT (US29415NAA54) | 1,90 | -2,57 | 0,2615 | -0,0576 | ||

| MIDA MOUNTAIN VLG PUBLIC INFRASTRUCTURE DIST UT TAX ALLOCATI / DBT (US59561UAA88) | 1,87 | -1,73 | 0,2581 | -0,0541 | ||

| CHICAGO IL MIDWAY ARPT REVENUE / DBT (US167562TM91) | 1,76 | 0,2424 | 0,2424 | |||

| CHICAGO IL MIDWAY ARPT REVENUE / DBT (US167562TM91) | 1,76 | 0,2424 | 0,2424 | |||

| US48565KAB70 / KARL'S FARM MET DIST #2 CO | 1,75 | -0,68 | 0,2418 | -0,0476 | ||

| US167486M309 / Chicago, Illinois, General Obligation Bonds, Series 2021A | 1,75 | 14,24 | 0,2414 | -0,0098 | ||

| US74442ECS72 / PUBLIC FIN AUTH WIS ED REV | 1,73 | -2,65 | 0,2382 | -0,0527 | ||

| US13013FAA21 / California (State of) Housing Finance Agency (Verdant at Green Valley), Series 2019 A, RB | 1,72 | -3,92 | 0,2370 | -0,0562 | ||

| US24918EEL02 / DENVER CO HLTH & HOSP AUTH HLTHCARE REVENUE | 1,68 | 0,54 | 0,2318 | -0,0424 | ||

| SPOKANE CNTY WA ARPT REVENUE / DBT (US848661JQ86) | 1,67 | -1,53 | 0,2304 | -0,0479 | ||

| CHICAGO IL / DBT (US167486X389) | 1,65 | 0,2281 | 0,2281 | |||

| US140427BN43 / CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE | 1,63 | 0,68 | 0,2249 | -0,0406 | ||

| US38546WDN74 / CITY OF GRAND FORKS ND | 1,62 | -1,82 | 0,2237 | -0,0472 | ||

| INDIANA ST FIN AUTH REVENUE / DBT (US45506ENF69) | 1,61 | 0,2227 | 0,2227 | |||

| US162410EK61 / CHATTANOOGA TN HLTH EDUCTNL &HSG FAC BRD REVENUE | 1,60 | 3,76 | 0,2210 | -0,0323 | ||

| US19648FPT56 / Colorado Health Facilities Authority | 1,60 | -68,00 | 0,2208 | -0,5994 | ||

| US54628CDX74 / Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Westlake Chemical Corporation Projects, Refund | 1,57 | 0,77 | 0,2159 | -0,0389 | ||

| MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE / DBT (US56035DHK19) | 1,56 | 18,47 | 0,2152 | -0,0008 | ||

| PENNSYLVANIA HGR EDU ASSISTANCE AGY LOAN REVENUE / DBT (US70878CBR51) | 1,56 | 0,2150 | 0,2150 | |||

| COLORADO ST HLTH FACS AUTH REVENUE / DBT (US19648FZM93) | 1,54 | 0,2123 | 0,2123 | |||

| VANCOUVER WA HSG AUTH MF REVENUE / DBT (US92162PAH82) | 1,53 | -1,60 | 0,2117 | -0,0440 | ||

| ILLINOIS FIN AUTH SURFACE FREIGHT TRANSFER FACS REVENUE / DBT (US45203PAE43) | 1,52 | 0,2097 | 0,2097 | |||

| DETROIT MI DOWNTOWN DEV AUTH TAX INCREMENT REVENUE / DBT (US251135HU61) | 1,51 | 0,2087 | 0,2087 | |||

| ARKANSAS ST DEV FIN AUTH HOSP REVENUE / DBT (US04109FCL04) | 1,50 | 0,27 | 0,2076 | -0,0385 | ||

| ARKANSAS ST DEV FIN AUTH HOSP REVENUE / DBT (US04109FCL04) | 1,50 | 0,27 | 0,2076 | -0,0385 | ||

| SOUTH DAKOTA ST HSG DEV AUTH / DBT (US83756LCS25) | 1,50 | 0,2076 | 0,2076 | |||

| US6069014N38 / MO H/E-ST LOUIS-B-1 | 1,50 | 200,00 | 0,2070 | 0,0866 | ||

| CHICAGO IL O'HARE INTERNATIONAL ARPT SPL FAC REVENUE / DBT (US167590FE36) | 1,50 | 0,2069 | 0,2069 | |||

| US56035DGB29 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 1,49 | 6,35 | 0,2058 | -0,0243 | ||

| US92707SBB60 / VLG FL CDD 5 SPL ASSMNT REVENUE | 1,49 | -1,52 | 0,2055 | -0,0425 | ||

| MISSISSIPPI ST HOME CORP SF MTGE REVENUE / DBT (US60535QS430) | 1,47 | -1,34 | 0,2031 | -0,0415 | ||

| US53509AAA07 / Village of Lincolnwood Il | 1,47 | -1,80 | 0,2030 | -0,0427 | ||

| US167505XR25 / CHICAGO BOARD OF EDUCATION | 1,47 | -1,41 | 0,2030 | -0,0419 | ||

| RHODE ISLAND ST STUDENT LOAN AUTH LOAN REVENUE / DBT (US762323DT74) | 1,47 | 0,2029 | 0,2029 | |||

| US36829QAA31 / GDB DEBT RECOVERY AUTH OF CMWLTH PUERTO RICO | 1,47 | -2,07 | 0,2025 | -0,0433 | ||

| US38546WDC10 / GRAND FORKS ND HLTH CARE SYS R REGD N/C B/E 5.00000000 | 1,46 | 4,05 | 0,2020 | -0,0288 | ||

| PENNSYLVANIA ST HSG FIN AGY SF MTGE REVENUE / DBT (US70879QN662) | 1,46 | -2,87 | 0,2008 | -0,0450 | ||

| PENNSYLVANIA ST HSG FIN AGY SF MTGE REVENUE / DBT (US70879QN662) | 1,46 | -2,87 | 0,2008 | -0,0450 | ||

| US13058TLY46 / CA SCH FIN AUTH-UNREF | 1,45 | -0,07 | 0,2000 | -0,0378 | ||

| PENNSYLVANIA ST HSG FIN AGY SF MTGE REVENUE / DBT (US70879QXT56) | 1,44 | -2,37 | 0,1989 | -0,0433 | ||

| VANCOUVER WA HSG AUTH MF REVENUE / DBT (US92162PAJ49) | 1,44 | -4,51 | 0,1986 | -0,0487 | ||

| SOUTH DAKOTA ST HSG DEV AUTH / DBT (US83756LBF13) | 1,44 | -2,51 | 0,1982 | -0,0434 | ||

| SIERRA VISTA AZ INDL DEV AUTH AUTH ED FAC REV / DBT (US82652UAV44) | 1,43 | -2,72 | 0,1978 | -0,0439 | ||

| US469400EK70 / City of Jacksonville | 1,43 | -1,45 | 0,1972 | -0,0408 | ||

| US19648FJX33 / COLORADO ST HLTH FACS AUTH HOSP REVENUE | 1,42 | -0,42 | 0,1965 | -0,0381 | ||

| US650116CQ76 / New York Transportation Development Corp. (Delta Airlines, Inc.), Series 2018, RB | 1,40 | -1,41 | 0,1930 | -0,0397 | ||

| US60406UAN72 / MINNESOTA MUNI GAS AGY COMMODITY SPLY REVENUE | 1,40 | 0,22 | 0,1929 | -0,0360 | ||

| MICHIGAN ST FIN AUTH ACT 38 FACS SENIOR REVEUE / DBT (US59447NBB10) | 1,39 | 67,03 | 0,1915 | 0,0551 | ||

| STHRN UTE INDIAN TRIBE OF STHRN UTE INDIAN RESERVATION CO / DBT (US844090AD23) | 1,38 | 0,1901 | 0,1901 | |||

| STHRN UTE INDIAN TRIBE OF STHRN UTE INDIAN RESERVATION CO / DBT (US844090AD23) | 1,38 | 0,1901 | 0,1901 | |||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US13034A6B14) | 1,37 | -5,24 | 0,1897 | -0,0481 | ||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US13034A6B14) | 1,37 | -5,24 | 0,1897 | -0,0481 | ||

| US83786RAT32 / South Fork Community Development District, Florida, Capital Improvement Revenue Bonds, Refunding Series 2017 | 1,37 | 1,26 | 0,1889 | -0,0329 | ||

| PUBLIC FIN AUTH WI CHRT SCH REVENUE / DBT (US744396KF89) | 1,33 | -4,78 | 0,1842 | -0,0457 | ||

| US12574XAB47 / CMFA SPL FIN AGY XII CA ESSENTIAL HSG REVENUE | 1,33 | -1,04 | 0,1839 | -0,0369 | ||

| US51207MHZ14 / LAKES FRESH WTR SUPPLY DIST OF DENTON CNTY TX | 1,32 | -1,64 | 0,1822 | -0,0380 | ||

| US19648FJZ80 / COLORADO ST HLTH FACS AUTH HOS REGD B/E 4.00000000 | 1,31 | -2,09 | 0,1813 | -0,0387 | ||

| WHATCOM CNTY WA PUBLIC UTIL DIST #1 / DBT (US962468FR00) | 1,31 | -0,91 | 0,1804 | -0,0360 | ||

| US167486P526 / CHICAGO IL 5.50% 1/1/2039 | 1,29 | 19,18 | 0,1776 | -0,6780 | ||

| US56035DGC02 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 1,29 | -1,83 | 0,1775 | -0,0374 | ||

| US74440DDT81 / Kentucky Public Energy Authority | 1,28 | 0,39 | 0,1767 | -0,0325 | ||

| TULSA OK MUNI ARPT TRUST TRUSTEES / DBT (US899661EM05) | 1,28 | 0,1762 | 0,1762 | |||

| STERLING RANCH CMNTY AUTH BRD CO SPL ASSMNT REVENUE / DBT (US85950TAA51) | 1,27 | -5,00 | 0,1756 | -0,0441 | ||

| HARRIS CNTY TX MUNI UTILITY DIST #171 CONTRACT REVENUE / DBT (US41423TJZ30) | 1,22 | -0,89 | 0,1689 | -0,0337 | ||

| VANCOUVER WA HSG AUTH MF REVENUE / DBT (US92162PAC95) | 1,22 | 0,58 | 0,1682 | -0,0306 | ||

| US67756CFA18 / OHIO ST HOSP RE 4% 11/15/2039 | 1,22 | -0,98 | 0,1680 | -0,0337 | ||

| US650116DW36 / New York Transportation Development Corp. | 1,21 | -3,74 | 0,1669 | -0,0391 | ||

| US842471AZ79 / Southern California Public Power Authority, Natural Gas Project 1 Revenue Bonds, Series 2007A | 1,21 | 0,08 | 0,1667 | -0,0313 | ||

| US126292AA99 / CSCDA Community Improvement Authority | 1,20 | -3,99 | 0,1662 | -0,0396 | ||

| US167510BH83 / Dedicated Tax Bonds Series 2023 | 1,20 | 1.078,43 | 0,1659 | 0,1492 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400CW29) | 1,20 | 223,12 | 0,1659 | 0,1049 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400CW29) | 1,20 | 223,12 | 0,1659 | 0,1049 | ||

| BUILD NYC RESOURCE CORP NY REVENUE / DBT (US12008QAB59) | 1,19 | 0,1648 | 0,1648 | |||

| BUILD NYC RESOURCE CORP NY REVENUE / DBT (US12008QAB59) | 1,19 | 0,1648 | 0,1648 | |||

| VANCOUVER WA HSG AUTH MF REVENUE / DBT (US92162PAL94) | 1,18 | -1,42 | 0,1623 | -0,0335 | ||

| AVENTURA ISLES CMNTY DEV DISTFL SPL ASSMNT / DBT (US05357GAG73) | 1,17 | -2,34 | 0,1614 | -0,0352 | ||

| US57652TAV98 / Matagorda Cn Tx 5.12528 Bond | 1,16 | 1,31 | 0,1605 | -0,0278 | ||

| MASSACHUSETTS ST DEV FIN AGY REVENUE / DBT (US57585BJS88) | 1,14 | 0,1578 | 0,1578 | |||

| MASSACHUSETTS ST DEV FIN AGY REVENUE / DBT (US57585BJS88) | 1,14 | 0,1578 | 0,1578 | |||

| US45204ER597 / Illinois Finance Authority | 1,14 | 4,68 | 0,1575 | -0,0213 | ||

| NTHRN IL UNIV COPS / DBT (US665238CZ27) | 1,13 | -1,82 | 0,1565 | -0,0330 | ||

| US20774YW372 / CONNECTICUT ST HEALTH & EDL FACS AUTH REV | 1,13 | -1,48 | 0,1561 | -0,0322 | ||

| US126292AZ41 / CSCDA Community Improvement Authority, California, Essential Housing Revenue Bonds, Waterscape Apartments, Mezzanine Lien Series 2021B | 1,10 | -3,75 | 0,1524 | -0,0358 | ||

| HOMEWOOD AL EDUCTNL BLDG AUTH REVENUE / DBT (US437887HW56) | 1,10 | -1,88 | 0,1513 | -0,0320 | ||

| HOMEWOOD AL EDUCTNL BLDG AUTH REVENUE / DBT (US437887HW56) | 1,10 | -1,88 | 0,1513 | -0,0320 | ||

| HARRIS-WALLER CNTYS TX MUNI UTIL DIST #4 CONTRACT REVENUE / DBT (US41464CBX39) | 1,09 | 44,39 | 0,1508 | 0,0266 | ||

| HARRIS CNTY TX MUNI UTILITY DIST #502 / DBT (US41428EFU64) | 1,08 | -0,09 | 0,1496 | -0,0285 | ||

| KYLE TX SPL ASSMNT REVENUE / DBT (US50156CBS89) | 1,07 | 96,16 | 0,1481 | 0,0583 | ||

| KYLE TX SPL ASSMNT REVENUE / DBT (US50156CBS89) | 1,07 | 96,16 | 0,1481 | 0,0583 | ||

| EAST MONTGOMERY CNTY MUN UTILITY DIST NO 5 TEX CONTRACT REVE / DBT (US27373PHR01) | 1,07 | -1,92 | 0,1480 | -0,0314 | ||

| US45204FEH47 / ILLINOIS ST FIN AUTH REVENUE | 1,07 | 19,46 | 0,1475 | 0,0008 | ||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FYC30) | 1,07 | -2,11 | 0,1474 | -0,0315 | ||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FYC30) | 1,07 | -2,11 | 0,1474 | -0,0315 | ||

| CHICAGO IL O'HARE INTERNATIONAL ARPT SPL FAC REVENUE / DBT (US167590FF01) | 1,06 | 0,1469 | 0,1469 | |||

| CHICAGO IL O'HARE INTERNATIONAL ARPT SPL FAC REVENUE / DBT (US167590FF01) | 1,06 | 0,1469 | 0,1469 | |||

| HARRIS CNTY TX MUNI UTILITY DIST #171 CONTRACT REVENUE / DBT (US41423TJK60) | 1,06 | -0,93 | 0,1468 | -0,0293 | ||

| US13013JDD54 / California Community Choice Financing Authority | 1,06 | -46,03 | 0,1465 | -0,1760 | ||

| NEW ORLEANS LA AVIATION BRD / DBT (US64763HMK85) | 1,06 | 0,57 | 0,1464 | -0,0267 | ||

| US140427BL86 / CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE | 1,06 | 0,86 | 0,1461 | -0,0261 | ||

| US45528U6V86 / Indianapolis Local Public Improvement Bond Bank | 1,06 | -0,66 | 0,1458 | -0,0286 | ||

| US650116FM36 / New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, Terminal 4 John F Kennedy International Airport Project, Se | 1,06 | 194,15 | 0,1458 | 0,0868 | ||

| GALVESTON TX WHARVES & TERMINAL REVENUE / DBT (US364568JU09) | 1,05 | 0,1454 | 0,1454 | |||

| GALVESTON TX WHARVES & TERMINAL REVENUE / DBT (US364568JT36) | 1,05 | 0,1453 | 0,1453 | |||

| GALVESTON TX WHARVES & TERMINAL REVENUE / DBT (US364568JT36) | 1,05 | 0,1453 | 0,1453 | |||

| US67756CEW47 / OHIO ST HOSP RE 5% 11/15/2035 | 1,05 | 0,19 | 0,1448 | -0,0271 | ||

| US46246K3N05 / Iowa Finance Authority Revenue (Lifespace Communities Inc. Obligated Group) | 1,05 | -1,23 | 0,1446 | -0,0294 | ||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FXW03) | 1,05 | -0,95 | 0,1445 | -0,0290 | ||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FXW03) | 1,05 | -0,95 | 0,1445 | -0,0290 | ||

| US167510BC96 / CHICAGO IL BRD OF EDU DEDICATE REGD B/E 5.25000000 | 1,04 | -1,42 | 0,1442 | -0,0296 | ||

| US92707SAQ49 / VLG FL CDD 5 SPL ASSMNT REVENUE | 1,04 | -0,67 | 0,1439 | -0,0283 | ||

| SIENNA MUN UTIL DIST NO 6 TEX / DBT (US82622NGU37) | 1,03 | -1,90 | 0,1428 | -0,0302 | ||

| SIENNA MUN UTIL DIST NO 6 TEX / DBT (US82622NGU37) | 1,03 | -1,90 | 0,1428 | -0,0302 | ||

| US140427BQ73 / CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE | 1,03 | 0,39 | 0,1427 | -0,0263 | ||

| US167510AX43 / Chicago Board of Education Dedicated Capital Improvement Tax | 1,03 | 5,62 | 0,1427 | -0,0180 | ||

| RENO-TAHOE NV ARPT AUTH ARPT REVENUE / DBT (US759874CH11) | 1,03 | -1,06 | 0,1424 | -0,0286 | ||

| US483228DX77 / Kalamazoo Economic Development Corp | 1,03 | -4,00 | 0,1423 | -0,0340 | ||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PG414) | 1,03 | -1,63 | 0,1420 | -0,0296 | ||

| US140427BR56 / CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE | 1,03 | 0,19 | 0,1419 | -0,0265 | ||

| SUFFOLK REGL OFF-TRACK BETTING CORP NY REV / DBT (US86480TAB08) | 1,02 | 0,00 | 0,1411 | -0,0266 | ||

| SUFFOLK REGL OFF-TRACK BETTING CORP NY REV / DBT (US86480TAB08) | 1,02 | 0,00 | 0,1411 | -0,0266 | ||

| CHESTER CNTY PA INDL DEV AUTH / DBT (US165588FP49) | 1,02 | 0,00 | 0,1400 | -0,0266 | ||

| CHESTER CNTY PA INDL DEV AUTH / DBT (US165588FP49) | 1,02 | 0,00 | 0,1400 | -0,0266 | ||

| US24918EEH99 / DENVER CO HLTH & HOSP AUTH HLTHCARE REVENUE | 1,01 | 1,41 | 0,1394 | -0,0240 | ||

| VIRGINIA BEACH VA DEV AUTH RSDL CARE FAC REVENUE / DBT (US92774NBE94) | 1,01 | -1,27 | 0,1393 | -0,0285 | ||

| GALVESTON TX WHARVES & TERMINAL REVENUE / DBT (US364568JV81) | 1,01 | 0,1392 | 0,1392 | |||

| PENNSYLVANIA ST ECON DEV FINGAUTH EXEMPT FACS REVENUE / DBT (US708686ES52) | 1,01 | -0,10 | 0,1389 | -0,0264 | ||

| PENNSYLVANIA ST ECON DEV FINGAUTH EXEMPT FACS REVENUE / DBT (US708686ES52) | 1,01 | -0,10 | 0,1389 | -0,0264 | ||

| LEE CNTY FL INDL DEV AUTH HLTHCR FACS REVENUE / DBT (US52349EES54) | 1,00 | 0,20 | 0,1385 | -0,0258 | ||

| LOWRY CROSSING TX SPL ASSMNT REVENUE / DBT (US54877WAC01) | 1,00 | 0,1384 | 0,1384 | |||

| LOWRY CROSSING TX SPL ASSMNT REVENUE / DBT (US54877WAC01) | 1,00 | 0,1384 | 0,1384 | |||

| CALIFORNIA ST HLTH FACS FING AUTH REVENUE / DBT (US13032UJ825) | 1,00 | 0,00 | 0,1383 | -0,0261 | ||

| CALIFORNIA ST HLTH FACS FING AUTH REVENUE / DBT (US13032UJ825) | 1,00 | 0,00 | 0,1383 | -0,0261 | ||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US65889BCB80) | 1,00 | 0,1382 | 0,1382 | |||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US65889BCB80) | 1,00 | 0,1382 | 0,1382 | |||

| TEXAS ST DEPT OF HSG & CMNTY AFFAIRS RESDL MTG REVENUE / DBT (US882750G304) | 1,00 | 0,1382 | 0,1382 | |||

| DELAWARE ST HSG AUTH REVENUE / DBT (US246395R660) | 1,00 | 0,1382 | 0,1382 | |||

| US494762KG11 / KING CNTY WA HSG AUTH REGD B/E CNTY GT 5.50000000 | 1,00 | 0,00 | 0,1382 | -0,0260 | ||

| HORACE ND / DBT (US440365JC95) | 1,00 | 0,00 | 0,1380 | -0,0261 | ||

| HORACE ND / DBT (US440365JC95) | 1,00 | 0,00 | 0,1380 | -0,0261 | ||

| US292723AY90 / ENERGY S E AL A COOPERATIVE DIST ENERGY SPLY REVENUE | 1,00 | 38,75 | 0,1379 | 0,0198 | ||

| WASHINGTON ST HSG FIN COMMISSION NONPROFIT REVENUE / DBT (US93978LJL18) | 1,00 | 0,1378 | 0,1378 | |||

| US69651ABW36 / FL PALM BEACH 5% 11/1/2036 | 1,00 | 27,30 | 0,1377 | 0,0090 | ||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US6589097Z31) | 1,00 | 0,00 | 0,1375 | -0,0260 | ||

| CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE / DBT (US140427CN34) | 1,00 | -2,16 | 0,1374 | -0,0295 | ||

| E-470 CO PUBLIC HIGHWAY AUTH / DBT (US26822LMX90) | 0,99 | -0,60 | 0,1372 | -0,0270 | ||

| US74514L3L92 / PUERTO RICO CMWLTH | 0,99 | 0,81 | 0,1368 | -0,0246 | ||

| OHIO CNTY WV COMMISSION TAX INCR REVENUE / DBT (US677321BT78) | 0,99 | -1,88 | 0,1367 | -0,0290 | ||

| US13013FAM68 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 0,99 | -6,26 | 0,1364 | -0,0366 | ||

| US647370KJ31 / New Mexico Hospital Equipment Loan Council | 0,98 | 1,24 | 0,1355 | -0,0237 | ||

| PUBLIC FIN AUTH WI STUDENT HSG REVENUE / DBT (US74439YEX58) | 0,98 | -0,20 | 0,1352 | -0,0258 | ||

| PUBLIC FIN AUTH WI STUDENT HSG REVENUE / DBT (US74439YEX58) | 0,98 | -0,20 | 0,1352 | -0,0258 | ||

| VANCOUVER WA HSG AUTH / DBT (US921626PT84) | 0,97 | -1,52 | 0,1343 | -0,0278 | ||

| CENTRAL PARC CDD FL SPL ASSMNT REVENUE / DBT (US15477DAB91) | 0,97 | 293,52 | 0,1341 | 0,0935 | ||

| DENVER CO HLTH & HOSP AUTH HLTHCARE REVENUE / DBT (US24918EEM84) | 0,97 | 0,1339 | 0,1339 | |||

| FLOW WAY FL CMNTY DEV DIST SPL ASSMNT / DBT (US34347VBB71) | 0,97 | -2,62 | 0,1336 | -0,0295 | ||

| VENETIAN PARC CDD FL SPL ASSMNT / DBT (US92265AAJ34) | 0,97 | -2,62 | 0,1336 | -0,0295 | ||

| US64613CCU09 / New Jersey Transportation Trust Fund Authority | 0,97 | 0,1336 | 0,1336 | |||

| US35986CNC72 / FULSHEAR MUNI UTILITY DIST NO 3A TX | 0,96 | -1,43 | 0,1328 | -0,0274 | ||

| MAINE ST HSG AUTH MTGE PURCHASE / DBT (US56052FP415) | 0,96 | -2,34 | 0,1326 | -0,0289 | ||

| US742400BS26 / City of Princeton TX | 0,96 | -2,44 | 0,1326 | -0,0290 | ||

| US45204FKL84 / Illinois Finance Authority | 0,96 | 0,10 | 0,1320 | -0,0247 | ||

| SIENNA MUN UTIL DIST NO 6 TEX / DBT (US82622NGV10) | 0,95 | -1,85 | 0,1315 | -0,0279 | ||

| MASSACHUSETTS ST DEV FIN AGY REVENUE / DBT (US57585BBS60) | 0,95 | -6,31 | 0,1313 | -0,0352 | ||

| US15051PAP53 / CEDAR PORT NAV & IMPT DIST TX | 0,94 | -34,40 | 0,1298 | -0,1054 | ||

| MARBLE FALLS TX SPL ASSMNT REVENUE / DBT (US566035AN10) | 0,94 | -2,59 | 0,1297 | -0,0287 | ||

| US66585VBV62 / Northern Tobacco Securitization Corporation, Alaska, Tobacco Settlement Asset-Backed Bonds, Senior Series 2021A Class 1 | 0,94 | -1,99 | 0,1295 | -0,0275 | ||

| US66649THV98 / NORTHLAKE TX MUNI MGMT DIST #1 | 0,94 | -0,11 | 0,1295 | -0,0246 | ||

| US24918EEK29 / Denver (State of) Health & Hospital Authority, Series 2019 A, Ref. RB | 0,94 | 0,75 | 0,1294 | -0,0233 | ||

| US14054DAN75 / Capital Trust Agency, Florida, Educational Facilities Lease Revenue Bonds, South Tech Schools Project, Series 2020A | 0,94 | -12,76 | 0,1293 | -0,0469 | ||

| US646080XK28 / New Jersey Higher Education Student Assistance Authority, Student Loan Revenue Bonds, Refunding Series 2023B | 0,93 | 0,87 | 0,1285 | -0,0230 | ||

| MARION RANCH CDD FL SPL ASSMNT / DBT (US570001AB32) | 0,93 | 826,00 | 0,1278 | 0,1114 | ||

| MARION RANCH CDD FL SPL ASSMNT / DBT (US570001AB32) | 0,93 | 826,00 | 0,1278 | 0,1114 | ||

| US917467CC47 / Utah Infrastructure Agency | 0,92 | -2,03 | 0,1269 | -0,0270 | ||

| US97712JCL52 / WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE | 0,92 | -3,37 | 0,1266 | -0,0291 | ||

| US51778VAN47 / LAS VEGAS NV SPL IMPT DIST #81 CITY OF LAS VEGAS NV SPECIAL IMPROVEMENT DISTRICT | 0,91 | -2,36 | 0,1258 | -0,0274 | ||

| US650116FQ40 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 0,91 | 0,1257 | 0,1257 | |||

| US452153AV19 / State of Illinois | 0,91 | -3,00 | 0,1250 | -0,0281 | ||

| PUBLIC FIN AUTH WI MF HSG REVENUE / DBT (US74441XJD21) | 0,91 | 0,1249 | 0,1249 | |||

| US84136FBL04 / MUNI PUT BOND ACT | 0,90 | -42,18 | 0,1245 | -0,1315 | ||

| HARRIS CNTY TX MUNI UTILITY DIST #171 CONTRACT REVENUE / DBT (US41423TNC98) | 0,90 | -2,29 | 0,1236 | -0,0268 | ||

| HARRIS CNTY TX MUNI UTILITY DIST #171 CONTRACT REVENUE / DBT (US41423TNC98) | 0,90 | -2,29 | 0,1236 | -0,0268 | ||

| US126292CQ24 / CSCDA Community Improvement Authority | 0,89 | -0,11 | 0,1229 | -0,0234 | ||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JH15) | 0,87 | 18,59 | 0,1206 | -0,0004 | ||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JH15) | 0,87 | 18,59 | 0,1206 | -0,0004 | ||

| US246372AY25 / DELAWARE ST ECON DEV AUTH CHRT SCH REVENUE | 0,87 | -1,91 | 0,1206 | -0,0255 | ||

| IOWA ST FIN AUTH REVENUE / DBT (US46247SFD18) | 0,86 | 0,12 | 0,1193 | -0,0223 | ||

| WHATCOM CNTY WA PUBLIC UTIL DIST #1 / DBT (US962468FN95) | 0,86 | 0,00 | 0,1184 | -0,0223 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400DH43) | 0,85 | 0,1177 | 0,1177 | |||

| US13013FBF09 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 0,84 | -4,11 | 0,1160 | -0,0277 | ||

| MICHIGAN ST FIN AUTH LTD OBLIG REVENUE / DBT (US594479JG31) | 0,83 | 0,36 | 0,1150 | -0,0213 | ||

| MICHIGAN ST FIN AUTH LTD OBLIG REVENUE / DBT (US594479JG31) | 0,83 | 0,36 | 0,1150 | -0,0213 | ||

| US57665NAE58 / USVI FED EXCISE TAX 22A SF 5.0% 10-01-30 | 0,83 | 6,02 | 0,1143 | -0,0139 | ||

| US38327MAA53 / City of Goshen | 0,83 | -2,93 | 0,1141 | -0,0257 | ||

| US167562SA62 / CHICAGO IL MIDWAY ARPT REVENUE | 0,82 | -0,12 | 0,1125 | -0,0214 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400DL54) | 0,81 | 0,1118 | 0,1118 | |||

| US742400BW38 / PRINCETON TX SPL ASSMNT REVENUE | 0,81 | -2,42 | 0,1113 | -0,0243 | ||

| PUBLIC FIN AUTH WI CHRT SCH REVENUE / DBT (US744396JX15) | 0,80 | 1,01 | 0,1101 | -0,0195 | ||

| PUBLIC FIN AUTH WI CHRT SCH REVENUE / DBT (US744396JX15) | 0,80 | 1,01 | 0,1101 | -0,0195 | ||

| US917467CB63 / Utah Infrastructure Agency | 0,80 | -0,87 | 0,1099 | -0,0220 | ||

| FLORIDA ST DEV FIN CORP / DBT (US340618DK07) | 0,80 | -6,13 | 0,1098 | -0,0294 | ||

| FLORIDA ST DEV FIN CORP / DBT (US340618DK07) | 0,80 | -6,13 | 0,1098 | -0,0294 | ||

| US74514L3H80 / PUERTO RICO CMWLTH | 0,79 | 16,99 | 0,1084 | -0,0017 | ||

| US873816AB84 / TAHOE-DOUGLAS VISITORS AUTH NV REGD N/C B/E 4.00000000 | 0,77 | -0,13 | 0,1068 | -0,0202 | ||

| US67756CFB90 / STATE OF OHIO | 0,77 | -1,42 | 0,1057 | -0,0217 | ||

| RENO-TAHOE NV ARPT AUTH ARPT REVENUE / DBT (US759874CJ76) | 0,76 | 0,1055 | 0,1055 | |||

| HARRIS CNTY TX MUNI UTILITY DIST #490 / DBT (US41430EFU29) | 0,76 | -1,43 | 0,1048 | -0,0216 | ||

| US420894AN77 / County of Hays TX | 0,76 | 53,75 | 0,1047 | 0,0237 | ||

| ARLINGTON TX HGR EDU FIN CORP EDU REVENUE / DBT (US041807JT64) | 0,75 | -2,73 | 0,1033 | -0,0230 | ||

| PROVIDENCE VLG TX SPL ASSMNT REVENUE / DBT (US743816AF77) | 0,74 | -2,75 | 0,1024 | -0,0229 | ||

| PROVIDENCE VLG TX SPL ASSMNT REVENUE / DBT (US743816AF77) | 0,74 | -2,75 | 0,1024 | -0,0229 | ||

| PALERMO CDD FL SPL ASSMNT / DBT (US696280AE67) | 0,73 | 0,55 | 0,1012 | -0,0185 | ||

| PALERMO CDD FL SPL ASSMNT / DBT (US696280AE67) | 0,73 | 0,55 | 0,1012 | -0,0185 | ||

| FLORIDA ST DEV FIN CORP / DBT (US340618DZ75) | 0,72 | -0,96 | 0,0993 | -0,0200 | ||

| FLORIDA ST DEV FIN CORP / DBT (US340618DZ75) | 0,72 | -0,96 | 0,0993 | -0,0200 | ||

| BALCH SPRINGS TX SPL ASSMNT REREV / DBT (US05766QAB14) | 0,72 | 0,0991 | 0,0991 | |||

| PUBLIC FIN AUTH WI CHRT SCH REVENUE / DBT (US744396KE15) | 0,72 | -0,14 | 0,0987 | -0,0188 | ||

| PUBLIC FIN AUTH WI CHRT SCH REVENUE / DBT (US744396KE15) | 0,72 | -0,14 | 0,0987 | -0,0188 | ||

| MUSTANG RIDGE TX SPL ASSMNT REVENUE / DBT (US62822EAE59) | 0,71 | 0,0981 | 0,0981 | |||

| US31189RCM88 / City of Fate, Series 2023 | 0,71 | 26,79 | 0,0981 | 0,0061 | ||

| CAPITAL TRUST AUTH FL MF HSG REVENUE / DBT (US14054XAA19) | 0,71 | 1,29 | 0,0975 | -0,0169 | ||

| CAPITAL TRUST AUTH FL MF HSG REVENUE / DBT (US14054XAA19) | 0,71 | 1,29 | 0,0975 | -0,0169 | ||

| STONEGATE PRESERVE CDD FL SPL ASSMNT / DBT (US86182EAF51) | 0,70 | 0,0970 | 0,0970 | |||

| US71884SAC44 / Phoenix Industrial Development Authority, Arizona, Health Care Facilities Revenue Bonds, Mayo Clinic, Series 2014B | 0,70 | 0,0966 | 0,0966 | |||

| US035713AL09 / Anna, Texas, Special Assessment Revenue Bonds, Hurricane Creek Public Improvement District Area 2 Project, Series 2022 | 0,69 | 59,22 | 0,0954 | 0,0242 | ||

| US167510BA31 / Chicago Board of Education, Illinois, Dedicated Capital Improvement Tax Revenue Bonds, Series 2023 | 0,69 | 5,83 | 0,0953 | -0,0117 | ||

| RENO-TAHOE NV ARPT AUTH ARPT REVENUE / DBT (US759874CG38) | 0,68 | -0,73 | 0,0938 | -0,0185 | ||

| US51946PCA03 / Lavon, Texas, Special Assessment Revenue Bonds, Lakepointe Public Improvement District Areas 2-3 Project, Series 2022 | 0,68 | 16,30 | 0,0936 | -0,0021 | ||

| LA PLATA MD SPL OBLIG / DBT (US503825AB78) | 0,67 | -0,15 | 0,0929 | -0,0177 | ||

| LA PLATA MD SPL OBLIG / DBT (US503825AB78) | 0,67 | -0,15 | 0,0929 | -0,0177 | ||

| CALIFORNIA ST MUNI FIN AUTH SPL TAX REVENUE / DBT (US13051AFR41) | 0,67 | -1,03 | 0,0926 | -0,0185 | ||

| CALIFORNIA ST MUNI FIN AUTH SPL TAX REVENUE / DBT (US13051AFR41) | 0,67 | -1,03 | 0,0926 | -0,0185 | ||

| US4521503D55 / Illinois (State of), First Series 2001, GO Bonds | 0,67 | -0,59 | 0,0925 | -0,0181 | ||

| US594698QR67 / Michigan Strategic Fund, I-75 Improvement Project | 0,67 | 2,46 | 0,0920 | -0,0148 | ||

| MARYLAND ST ECON DEV CORP PRIV ACTIVITY REVENUE / DBT (US57422JBJ60) | 0,67 | -0,75 | 0,0919 | -0,0181 | ||

| MARYLAND ST ECON DEV CORP PRIV ACTIVITY REVENUE / DBT (US57422JBJ60) | 0,67 | -0,75 | 0,0919 | -0,0181 | ||

| CRANDALL TX SPL ASSMNT REVENUE / DBT (US224384AR84) | 0,66 | -2,78 | 0,0916 | -0,0205 | ||

| CRANDALL TX SPL ASSMNT REVENUE / DBT (US224384AR84) | 0,66 | -2,78 | 0,0916 | -0,0205 | ||

| US744396HR64 / PUBLIC FIN AUTH WI CHRT SCH REVENUE | 0,66 | -2,07 | 0,0913 | -0,0196 | ||

| US119126AC45 / Buena Lago Community Development District, Series 2022 | 0,66 | -1,64 | 0,0912 | -0,0192 | ||

| HARRIS-WALLER CNTYS TX MUNI UTIL DIST #4 CONTRACT REVENUE / DBT (US41464CAN65) | 0,66 | 4,42 | 0,0912 | -0,0127 | ||

| MONTGOMERY CNTY TX SPL ASSMNT REVENUE / DBT (US61371JAD37) | 0,66 | 0,30 | 0,0908 | -0,0168 | ||

| MONTGOMERY CNTY TX SPL ASSMNT REVENUE / DBT (US61371JAD37) | 0,66 | 0,30 | 0,0908 | -0,0168 | ||

| HUTTO TX SPL ASSMNT REVENUE / DBT (US448529AS68) | 0,66 | -3,38 | 0,0907 | -0,0208 | ||

| HUTTO TX SPL ASSMNT REVENUE / DBT (US448529AS68) | 0,66 | -3,38 | 0,0907 | -0,0208 | ||

| US19648FJY16 / COLORADO ST HLTH FACS AUTH HOSP REVENUE | 0,65 | 0,62 | 0,0899 | -0,0164 | ||

| US982707AA94 / WYANDOTTE CNTY/KANSAS CITY KS UNIF GOVT | 0,65 | -8,95 | 0,0898 | -0,0275 | ||

| SEAGOVILLE TX SPL ASSMNT REVENUE / DBT (US811829AF77) | 0,65 | 0,0897 | 0,0897 | |||

| SEAGOVILLE TX SPL ASSMNT REVENUE / DBT (US811829AF77) | 0,65 | 0,0897 | 0,0897 | |||

| MONTGOMERY CNTY TX SPL ASSMNT REVENUE / DBT (US61371JAB70) | 0,65 | -1,67 | 0,0894 | -0,0187 | ||

| US74514L3K10 / PUERTO RICO CMWLTH | 0,65 | -0,46 | 0,0894 | -0,0173 | ||

| US45506CBC01 / Indiana Housing and Community Development Authority, Vita of Marion Project | 0,65 | -10,88 | 0,0893 | -0,0299 | ||

| US083536AB89 / City of Berea KY DV&DP | 0,65 | -24,12 | 0,0890 | -0,0504 | ||

| US50156CBD11 / KYLE | 0,64 | 0,16 | 0,0889 | -0,0167 | ||

| US74514L3N58 / PUERTO RICO CMWLTH | 0,64 | 5,59 | 0,0887 | -0,0111 | ||

| CYPRESS BLUFF CDD FL SPL ASSMNT REVENUE / DBT (US23267AAB35) | 0,63 | -2,62 | 0,0874 | -0,0194 | ||

| KELLY PARK CDD FL SPL ASSMNT / DBT (US488141AE27) | 0,62 | -2,81 | 0,0861 | -0,0191 | ||

| US650116DS24 / New York Transportation Development Corp. | 0,62 | 93,46 | 0,0858 | 0,0330 | ||

| US74442PMS10 / PUBLIC FIN AUTH WI REVENUE | 0,62 | 1,14 | 0,0856 | -0,0150 | ||

| US696507TZ50 / Palm Beach County Health Facilities Authority | 0,62 | 21,61 | 0,0854 | 0,0019 | ||

| US97712JCM36 / WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE | 0,62 | -4,78 | 0,0853 | -0,0212 | ||

| WATERFORD CDD FL CAPITAL IMPT REVENUE / DBT (US941376AE54) | 0,61 | -2,54 | 0,0848 | -0,0186 | ||

| RIVER LANDING CDD FL CAP IMPT REVENUE / DBT (US76828JAL26) | 0,61 | -2,70 | 0,0845 | -0,0187 | ||

| RIVER LANDING CDD FL CAP IMPT REVENUE / DBT (US76828JAL26) | 0,61 | -2,70 | 0,0845 | -0,0187 | ||

| LAKES OF SARASOTA CDD 2 CAPITAL IMPT REVENUE / DBT (US51207BAG41) | 0,61 | -2,72 | 0,0839 | -0,0185 | ||

| WOODLAND PRESERVE CDD FL SPL ASSMNT / DBT (US97966AAB17) | 0,60 | -2,74 | 0,0834 | -0,0185 | ||

| US69651ABX19 / FL PALM BEACH 5% 11/1/2037 | 0,60 | -0,17 | 0,0833 | -0,0159 | ||

| SOUTH MANVEL DEV AUTH TX TAX INCR CONTRACT REV / DBT (US838793AB35) | 0,60 | 1,86 | 0,0832 | -0,0140 | ||

| SOUTH MANVEL DEV AUTH TX TAX INCR CONTRACT REV / DBT (US838793AB35) | 0,60 | 1,86 | 0,0832 | -0,0140 | ||

| BASTROP TX SPL ASSMNT REVENUE / DBT (US070341AC64) | 0,60 | -2,91 | 0,0831 | -0,0186 | ||

| BASTROP TX SPL ASSMNT REVENUE / DBT (US070341AC64) | 0,60 | -2,91 | 0,0831 | -0,0186 | ||

| US594479JL26 / MICHIGAN ST FIN AUTH LTD OBLIG REVENUE | 0,60 | -0,67 | 0,0824 | -0,0163 | ||

| GARDENS AT HAMMOCK BEACH CDD FL SPL ASSMNT / DBT (US36549DAB91) | 0,60 | 100,00 | 0,0823 | 0,0333 | ||

| US46246K3Q36 / Iowa Finance Auth. Rev. (Lifespace Communities, Inc.) | 0,59 | 4,22 | 0,0819 | -0,0114 | ||

| US103844AD80 / Bradburn Metropolitan District No. 2, Series 2018A | 0,59 | -1,66 | 0,0817 | -0,0171 | ||

| UTAH INFRASTRUCTURE AGY TELECOMUNICATION REVENUE / DBT (US917467DA71) | 0,59 | -1,01 | 0,0814 | -0,0164 | ||

| VARREA SOUTH CDD FL CAPIAL IMPT REVENUE / DBT (US92228DAF15) | 0,58 | 0,0801 | 0,0801 | |||

| RIVER HALL FL CDD CAPITAL IMPT REVENUE / DBT (US768247BB35) | 0,57 | -2,55 | 0,0793 | -0,0174 | ||

| LAKEWOOD RANCH FL STEWARDSHIP DIST SPL ASSMNT REVENUE / DBT (US51265KFY91) | 0,57 | -0,70 | 0,0786 | -0,0154 | ||

| US59564KAB52 / MIDCITY IMPT DIST AL SPL ASSMNT REVENUE | 0,56 | 0,53 | 0,0779 | -0,0143 | ||

| PALM GATE CDD FL SPL ASSMNT / DBT (US69663TAB52) | 0,56 | -2,76 | 0,0778 | -0,0172 | ||

| IOWA ST FIN AUTH REVENUE / DBT (US46247SFE90) | 0,56 | -0,88 | 0,0774 | -0,0155 | ||

| WESTPOINTE SPL IMPT DIST TX / DBT (US96124RBT59) | 0,56 | -1,24 | 0,0772 | -0,0157 | ||

| ALVARADO TX SPL ASSMNT REVENUE / DBT (US022360AB70) | 0,56 | 0,0768 | 0,0768 | |||

| US009730PQ92 / AKRON BATH COPLEY JT TWP OH HOSP DIST | 0,55 | 2,23 | 0,0760 | -0,0125 | ||

| VENICE FL / DBT (US922687AG31) | 0,55 | 0,36 | 0,0760 | -0,0140 | ||

| VENICE FL / DBT (US922687AG31) | 0,55 | 0,36 | 0,0760 | -0,0140 | ||

| US696507UE03 / PALM BEACH COUNTY HEALTH FACILITIES AUTHORITY | 0,55 | -1,26 | 0,0757 | -0,0154 | ||

| US57422JBQ04 / MARYLAND ST ECO 5% 6/30/2039 | 0,54 | 2,84 | 0,0751 | -0,0116 | ||

| WOODCREEK CDD FL / DBT (US97925TAF12) | 0,54 | -2,69 | 0,0750 | -0,0166 | ||

| VERANO #2 CDD FL SPL ASSMNT / DBT (US92337JBE82) | 0,54 | -2,34 | 0,0748 | -0,0162 | ||

| IBIS LANDING CDD FL SPL ASSMNT / DBT (US451075AC92) | 0,54 | 0,0742 | 0,0742 | |||

| IBIS LANDING CDD FL SPL ASSMNT / DBT (US451075AC92) | 0,54 | 0,0742 | 0,0742 | |||

| TERRENO CMNTY DEV DIST FL SPL ASSMNT / DBT (US88145KAE64) | 0,54 | -2,72 | 0,0741 | -0,0163 | ||

| PRESERVE AT LEGENDS POINTE CDD FL CAPITAL IMPT REVENUE / DBT (US74082JAB08) | 0,53 | 0,0730 | 0,0730 | |||

| US74514L3M75 / PUERTO RICO CMWLTH | 0,53 | 0,76 | 0,0728 | -0,0131 | ||

| US76827QHH92 / RIVER ISLANDS CA PUBLIC FING AUTH SPL TAX | 0,53 | 0,77 | 0,0726 | -0,0131 | ||

| US05616KBP49 / Babcock Ranch Community Independent Special District | 0,53 | -31,73 | 0,0726 | -0,0536 | ||

| PIONEER RANCH CDD FL SPL ASSMNT / DBT (US723846AB77) | 0,53 | -2,60 | 0,0725 | -0,0159 | ||

| DENTON CNTY TX SPL ASSMNT REVENUE / DBT (US24880GAM15) | 0,52 | 2,95 | 0,0724 | -0,0112 | ||

| DENTON CNTY TX SPL ASSMNT REVENUE / DBT (US24880GAM15) | 0,52 | 2,95 | 0,0724 | -0,0112 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400DE12) | 0,52 | -2,78 | 0,0723 | -0,0162 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400DE12) | 0,52 | -2,78 | 0,0723 | -0,0162 | ||

| CRAWFORD CNTY IA MEMORIAL HOSP REVENUE / DBT (US224832BA23) | 0,52 | 0,19 | 0,0719 | -0,0135 | ||

| SOUTHERN GROVE CMNTY DEV DIST #5 SPL ASSMNT / DBT (US843021AN68) | 0,52 | -1,14 | 0,0718 | -0,0146 | ||

| US51265KFH68 / LAKEWOOD RANCH FL STEWARDSHIP DIST SPL ASSMNT REVENUE | 0,52 | -1,14 | 0,0717 | -0,0145 | ||

| HOUSTON TX ARPT SYS REVENUE / DBT (US442349HX73) | 0,52 | -87,65 | 0,0717 | -0,6179 | ||

| US51946PBZ62 / Lavon, Texas, Special Assessment Revenue Bonds, Lakepointe Public Improvement District Areas 2-3 Project, Series 2022 | 0,52 | 65,92 | 0,0712 | 0,0202 | ||

| BLUE RIDGE TX SPL ASSMNT REVENUE / DBT (US096024AB07) | 0,51 | 0,0705 | 0,0705 | |||

| BLUE RIDGE TX SPL ASSMNT REVENUE / DBT (US096024AB07) | 0,51 | 0,0705 | 0,0705 | |||

| PUBLIC FIN AUTH WI MF HSG REVENUE / DBT (US74441XHY85) | 0,51 | 0,40 | 0,0702 | -0,0128 | ||

| PUBLIC FIN AUTH WI MF AFFORDABLE HSG / DBT (US74448FAA93) | 0,51 | -0,59 | 0,0702 | -0,0137 | ||

| PUBLIC FIN AUTH WI MF AFFORDABLE HSG / DBT (US74448FAA93) | 0,51 | -0,59 | 0,0702 | -0,0137 | ||

| PUBLIC FIN AUTH WI STUDENT HSG REVENUE / DBT (US74439YFT38) | 0,51 | -1,74 | 0,0700 | -0,0147 | ||

| FOX BRANCH RANCH CMNTY DEV DIST FL CAPITAL IMPT REVENUE / DBT (US351322AC61) | 0,51 | -2,69 | 0,0699 | -0,0155 | ||

| AUBREY TX SPL ASSMNT / DBT (US050197AT96) | 0,51 | -0,39 | 0,0698 | -0,0135 | ||

| PENNSYLVANIA ST ECON DEV FINGAUTH PKG SYS REVENUE / DBT (US70870EFA29) | 0,50 | -0,40 | 0,0696 | -0,0135 | ||

| US420894AM94 / County of Hays TX | 0,50 | 16,47 | 0,0694 | -0,0014 | ||

| JEFFERSON CNTY WA PUB HOSP DIST NO 2 / DBT (US473644AA09) | 0,50 | 2,45 | 0,0693 | -0,0112 | ||

| KYLE TX SPL ASSMNT REVENUE / DBT (US50156CBV19) | 0,50 | -3,09 | 0,0692 | -0,0156 | ||

| TWO RIDGES CDD FL SPL ASSMNT / DBT (US90207NAC56) | 0,50 | 0,0692 | 0,0692 | |||

| PUBLIC FIN AUTH WI MF HSG REVENUE / DBT (US74441XHW20) | 0,50 | 0,40 | 0,0685 | -0,0126 | ||

| US70870FAT30 / Pennsylvania Economic Development Financing Authority | 0,49 | 1,02 | 0,0681 | -0,0120 | ||

| US57563RTU31 / MASSACHUSETTS ST EDUCTNL FING REGD OID B/E AMT 4.25000000 | 0,49 | 1,24 | 0,0679 | -0,0118 | ||

| US167505WH51 / CHICAGO IL BRD OF EDU | 0,49 | 0,82 | 0,0678 | -0,0121 | ||

| HARVEST RIDGE CDD FL SPL ASSMNT / DBT (US41756PAB04) | 0,49 | -0,41 | 0,0674 | -0,0131 | ||

| HARVEST RIDGE CDD FL SPL ASSMNT / DBT (US41756PAB04) | 0,49 | -0,41 | 0,0674 | -0,0131 | ||

| JUNIPER COVE CDD FL CAPITAL IMPT REVENUE / DBT (US48203YAB56) | 0,49 | -2,40 | 0,0672 | -0,0147 | ||

| JUNIPER COVE CDD FL CAPITAL IMPT REVENUE / DBT (US48203YAB56) | 0,49 | -2,40 | 0,0672 | -0,0147 | ||

| COLUMBUS OH MET HSG AUTH GEN REVENUE / DBT (US19951AAR77) | 0,49 | -1,42 | 0,0671 | -0,0139 | ||

| COLUMBUS OH MET HSG AUTH GEN REVENUE / DBT (US19951AAR77) | 0,49 | -1,42 | 0,0671 | -0,0139 | ||

| US46247SBP83 / Iowa Finance Authority | 0,49 | 0,83 | 0,0669 | -0,0120 | ||

| WOODLAND RANCH ESTATES CDD FL SPL ASSMNT / DBT (US97967NAB29) | 0,48 | -2,62 | 0,0668 | -0,0148 | ||

| HARMONY ON LAKE ELOISE CDD FL CAPITAL IMPROVEMENT REVENUE / DBT (US413276AE63) | 0,48 | -2,62 | 0,0668 | -0,0149 | ||

| HARMONY ON LAKE ELOISE CDD FL CAPITAL IMPROVEMENT REVENUE / DBT (US413276AE63) | 0,48 | -2,62 | 0,0668 | -0,0149 | ||

| US167505XS08 / CHICAGO BOARD OF EDUCATION | 0,48 | 0,0667 | 0,0667 | |||

| V-DANA CDD FL SPL ASSMNT / DBT (US91822RAN52) | 0,48 | -2,63 | 0,0665 | -0,0147 | ||

| LAVON TX SPL ASSMT REVENUE / DBT (US51946PCD42) | 0,48 | -3,02 | 0,0665 | -0,0150 | ||

| US162410EJ98 / CHATTANOOGA TN HLTH EDUCTNL &HSG FAC BRD REVENUE | 0,48 | -0,41 | 0,0664 | -0,0128 | ||

| PACIFIC ACE CDD FL SPL ASSMNT / DBT (US693750AF80) | 0,48 | -3,03 | 0,0664 | -0,0150 | ||

| PACIFIC ACE CDD FL SPL ASSMNT / DBT (US693750AF80) | 0,48 | -3,03 | 0,0664 | -0,0150 | ||

| WINDING OAKS CDD FL SPL ASSMNT FL SPL ASSMT / DBT (US973389AB55) | 0,48 | -2,44 | 0,0662 | -0,0145 | ||

| CEDAR PORT NAV & IMPT DIST TX / DBT (US15051PAN06) | 0,48 | -28,93 | 0,0662 | -0,0444 | ||

| CEDAR PORT NAV & IMPT DIST TX / DBT (US15051PAN06) | 0,48 | -28,93 | 0,0662 | -0,0444 | ||

| CONNERTON EAST CDD FL SPL ASSMNT / DBT (US208185AG32) | 0,48 | 0,0661 | 0,0661 | |||

| MADEIRA FL CDD CAPITAL IMPT REVENUE / DBT (US556344AD19) | 0,48 | -2,65 | 0,0660 | -0,0146 | ||

| MADEIRA FL CDD CAPITAL IMPT REVENUE / DBT (US556344AD19) | 0,48 | -2,65 | 0,0660 | -0,0146 | ||

| LTC RANCH WEST RSDL CMNTY DEV DIST SPL ASSMNT REVENUE / DBT (US50218SAN18) | 0,48 | -3,64 | 0,0659 | -0,0153 | ||

| CEDAR CROSSINGS CDD FL SPL ASSMNT / DBT (US15018WAB37) | 0,47 | -2,47 | 0,0655 | -0,0143 | ||

| CEDAR CROSSINGS CDD FL SPL ASSMNT / DBT (US15018WAB37) | 0,47 | -2,47 | 0,0655 | -0,0143 | ||

| MESQUITE TX SPL ASSMNT REVENUE / DBT (US590771BF74) | 0,47 | -3,07 | 0,0655 | -0,0148 | ||

| PARRISH LAKES II CDD FL CAPITAL IMPT REVENUE / DBT (US70183HAB06) | 0,47 | -2,08 | 0,0649 | -0,0140 | ||

| PARRISH LAKES II CDD FL CAPITAL IMPT REVENUE / DBT (US70183HAB06) | 0,47 | -2,08 | 0,0649 | -0,0140 | ||

| US785756AL15 / Sachse, Texas, Special Assessment Bonds, Sachse Public Improvement District 1 Improvement Area 1 Project, Series 2022 | 0,47 | -1,48 | 0,0644 | -0,0132 | ||

| LAKES BY THE BAY S FL CDD ASSMNT / DBT (US51206QAP28) | 0,47 | 0,87 | 0,0642 | -0,0115 | ||

| LAKES BY THE BAY S FL CDD ASSMNT / DBT (US51206QAP28) | 0,47 | 0,87 | 0,0642 | -0,0115 | ||

| TRAVIS CNTY TX MUNI UTILITY DIST #22 / DBT (US89440MEU27) | 0,46 | 1,76 | 0,0639 | -0,0109 | ||

| TRAVIS CNTY TX MUNI UTILITY DIST #22 / DBT (US89440MEU27) | 0,46 | 1,76 | 0,0639 | -0,0109 | ||

| US13012TAF21 / California Community College Financing Authority, Series 2022 A | 0,46 | 0,43 | 0,0639 | -0,0118 | ||

| US93978LGM28 / WASHINGTON ST HSG FIN COMMISSION NONPROFIT REVENUE | 0,46 | -0,43 | 0,0638 | -0,0124 | ||

| ALLENTOWN COMMERCIAL & INDL DEV AUTH / DBT (US01843AAL08) | 0,46 | -2,54 | 0,0636 | -0,0141 | ||

| US51265KAU25 / LAKEWOOD RANCH FL STEWARDSHIP DIST SPL ASSMNT REVENUE | 0,46 | -51,12 | 0,0636 | -0,0908 | ||

| HICKORY TREE CDD FL SPL ASSMNT / DBT (US429079AA47) | 0,46 | 1,11 | 0,0629 | -0,0111 | ||

| HICKORY TREE CDD FL SPL ASSMNT / DBT (US429079AA47) | 0,46 | 1,11 | 0,0629 | -0,0111 | ||

| SOUTHEAST REGL MGMT DIST TX / DBT (US841493CV93) | 0,46 | -40,76 | 0,0628 | -0,0633 | ||

| SOUTHEAST REGL MGMT DIST TX / DBT (US841493CV93) | 0,46 | -40,76 | 0,0628 | -0,0633 | ||

| SIX MILE CREEK FL CDD CAPITAL IMPT REVENUE / DBT (US83005TBQ94) | 0,45 | -3,40 | 0,0627 | -0,0145 | ||

| SIX MILE CREEK FL CDD CAPITAL IMPT REVENUE / DBT (US83005TBQ94) | 0,45 | -3,40 | 0,0627 | -0,0145 | ||

| KEYS EDGE CDD FL SPL ASSMNT / DBT (US49333FAB76) | 0,45 | -2,60 | 0,0621 | -0,0137 | ||

| CREEKVIEW CDD FL SPL ASSMNT REVENUE / DBT (US225514AF54) | 0,45 | -2,60 | 0,0620 | -0,0136 | ||

| CREEKVIEW CDD FL SPL ASSMNT REVENUE / DBT (US225514AF54) | 0,45 | -2,60 | 0,0620 | -0,0136 | ||

| US23226MAH43 / County of Cuyahoga OH | 0,45 | -10,58 | 0,0619 | -0,0204 | ||

| ST AUGUSTINE LAKES CDD FL SPL ASSMNT / DBT (US787427AA13) | 0,45 | 22,93 | 0,0615 | 0,0020 | ||

| US97712JCG67 / WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE | 0,45 | -3,47 | 0,0615 | -0,0142 | ||

| US76827QJW42 / River Islands Public Financing Authority, Series 2023 | 0,44 | -0,45 | 0,0613 | -0,0120 | ||

| US74448AAA07 / Public Finance Authority | 0,44 | -0,23 | 0,0612 | -0,0117 | ||

| US650116DV52 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 0,44 | -4,12 | 0,0611 | -0,0147 | ||

| US717868HD81 / Redevelopment Authority of the City of Philadelphia | 0,44 | 1,15 | 0,0606 | -0,0106 | ||

| US920286AA93 / VALPARAISO IN MF HSG REVENUE | 0,44 | -2,89 | 0,0603 | -0,0136 | ||

| US57422JBK34 / MARYLAND ST ECON DEV CORP PRIV ACTIVITY REVENUE | 0,44 | -1,36 | 0,0603 | -0,0123 | ||

| CELINA TX SPL ASSESSMENT REVENUE / DBT (US15114CKQ68) | 0,44 | -2,90 | 0,0603 | -0,0135 | ||

| CELINA TX SPL ASSESSMENT REVENUE / DBT (US15114CKQ68) | 0,44 | -2,90 | 0,0603 | -0,0135 | ||

| US650116DR41 / New York Transportation Development Corp. | 0,44 | 0,00 | 0,0602 | -0,0114 | ||

| NORMANDY CDD FL CAPITAL IMPT REVENUE / DBT (US65618HAA77) | 0,44 | -11,59 | 0,0601 | -0,0207 | ||

| US97671VBN47 / WISCONSIN HEALTH & EDUCATIONAL FACILITIES AUTHORITY | 0,43 | -4,19 | 0,0599 | -0,0145 | ||

| GRANDE PINES CDD FL SPL ASSMNT REVENUE / DBT (US38656NAE67) | 0,43 | -15,92 | 0,0598 | -0,0247 | ||

| US13048VBM90 / CALIFORNIA ST MUNI FIN AUTH RE REGD B/E AMT 5.00000000 | 0,43 | 0,00 | 0,0597 | -0,0114 | ||

| CAPITAL TRUST AUTH FL EDUCTNL FACS REVENUE / DBT (US14054WBT18) | 0,43 | 0,0596 | 0,0596 | |||

| CAPITAL TRUST AUTH FL EDUCTNL FACS REVENUE / DBT (US14054WBT18) | 0,43 | 0,0596 | 0,0596 | |||

| FLORIDA HSG FIN CORP REVENUE / DBT (US34074NEN57) | 0,43 | 0,0594 | 0,0594 | |||

| CALIFORNIA ST MUNI FIN AUTH SPL TAX REVENUE / DBT (US13051AFU79) | 0,43 | -0,23 | 0,0591 | -0,0113 | ||

| CALIFORNIA ST MUNI FIN AUTH SPL TAX REVENUE / DBT (US13051AFU79) | 0,43 | -0,23 | 0,0591 | -0,0113 | ||

| DEL WEBB RVR RESERVE CDD FL SPL ASSMNT / DBT (US24550CAC10) | 0,43 | 0,0587 | 0,0587 | |||

| TRAVIS CNTY TX MUNI UTILITY DIST #22 / DBT (US89440MDQ24) | 0,42 | 15,85 | 0,0586 | -0,0015 | ||

| TRAVIS CNTY TX MUNI UTILITY DIST #22 / DBT (US89440MDQ24) | 0,42 | 15,85 | 0,0586 | -0,0015 | ||

| TOMBALL TX SPL ASSMNT REVENUE / DBT (US889858AU03) | 0,42 | 0,0581 | 0,0581 | |||

| US69651ACA07 / PALM BEACH CNTY FL HLTH FACS AUTH HOSP REVENUE | 0,42 | 44,33 | 0,0580 | 0,0102 | ||

| MASSACHUSETTS ST DEV FIN AGY REVENUE / DBT (US57585BMB17) | 0,42 | 0,0579 | 0,0579 | |||

| US167486M226 / CHICAGO IL REGD B/E 5.00000000 | 0,42 | 50,18 | 0,0574 | 0,0120 | ||

| W VLGS FL IMPT DIST / DBT (US956454CP52) | 0,42 | 0,0574 | 0,0574 | |||

| NEWPORT ISLES CDD FL SPL ASSMNT REVENUE / DBT (US651890AB18) | 0,42 | -2,58 | 0,0574 | -0,0126 | ||

| SUMMIT VIEW CDD FL SPL ASSMNT / DBT (US86633AAF84) | 0,41 | -13,03 | 0,0572 | -0,0210 | ||

| SUMMIT VIEW CDD FL SPL ASSMNT / DBT (US86633AAF84) | 0,41 | -13,03 | 0,0572 | -0,0210 | ||

| MANOR TX SPL ASSMNT REVENUE / DBT (US564099AU35) | 0,41 | 0,0568 | 0,0568 | |||

| MANOR TX SPL ASSMNT REVENUE / DBT (US564099AU35) | 0,41 | 0,0568 | 0,0568 | |||

| CHAPARRAL PALM BAY CDD FL CAPITAL IMPT REVENUE / DBT (US159419AF77) | 0,41 | 0,98 | 0,0568 | -0,0101 | ||

| ROYSE CITY TX SPL ASSMNT REVENUE / DBT (US780870BV22) | 0,41 | 7,05 | 0,0566 | -0,0064 | ||

| DORCHESTER CNTY SC ASSMNT REVENUE / DBT (US258149AD50) | 0,41 | 0,49 | 0,0563 | -0,0104 | ||

| DORCHESTER CNTY SC ASSMNT REVENUE / DBT (US258149AD50) | 0,41 | 0,49 | 0,0563 | -0,0104 | ||

| DARBY CDD FL SPL ASSMNT REVENUE / DBT (US23705PAD69) | 0,41 | -19,57 | 0,0562 | -0,0269 | ||

| LAKES OF SARASOTA CDD FL IMPT REVENUE / DBT (US51206YAS90) | 0,41 | -2,41 | 0,0559 | -0,0123 | ||

| LAKES OF SARASOTA CDD FL IMPT REVENUE / DBT (US51206YAS90) | 0,41 | -2,41 | 0,0559 | -0,0123 | ||

| NORTH CAROLINA ST MED CARE COMMISSION RETMNT FACS REVENUE / DBT (US65820YTQ97) | 0,41 | 0,25 | 0,0559 | -0,0105 | ||

| US2510936E56 / DETROIT MI | 0,40 | -1,94 | 0,0559 | -0,0118 | ||

| US668511BG23 / Northwood Municipal Utility District No. 1 | 0,40 | 1,79 | 0,0550 | -0,0092 | ||

| US010685HD09 / ALACHUA CNTY FL HFA SHANDS HOSP 07A FRN (L*0.67+87) SF 12-01-37 | 0,40 | 0,51 | 0,0547 | -0,0100 | ||

| DECATUR TX SPL ASSMNT REVENUE / DBT (US243340AD83) | 0,39 | -0,25 | 0,0543 | -0,0105 | ||

| US46246K4R00 / Iowa Finance Authority | 0,39 | -1,26 | 0,0543 | -0,0111 | ||

| IDAHO ST HSG & FIN ASSN NONPROFIT FACS REVENUE / DBT (US45129GLE34) | 0,38 | -0,26 | 0,0526 | -0,0101 | ||

| IDAHO ST HSG & FIN ASSN NONPROFIT FACS REVENUE / DBT (US45129GLE34) | 0,38 | -0,26 | 0,0526 | -0,0101 | ||

| US74527EFV56 / Puerto Rico Industrial Tourist Educational Medical & Envirml Ctl Facs Fing Auth | 0,38 | 322,22 | 0,0525 | 0,0377 | ||

| US45204E2L19 / VARIABLE RATE MUNI BOND | 0,38 | 0,00 | 0,0524 | -0,0099 | ||

| US23280KAA60 / CYPRESS RIDGE CDD FL SPL ASSMNT | 0,38 | -15,32 | 0,0519 | -0,0210 | ||

| US420894AL12 / County of Hays TX | 0,37 | 0,00 | 0,0512 | -0,0096 | ||

| US74444VAC46 / PUBLIC FIN AUTH WI RETMNT FAC REVENUE | 0,37 | -1,34 | 0,0510 | -0,0104 | ||

| WALDEN POND FRESH WTR SPLY DIST TX KAUFMAN CNTY / DBT (US931209AY62) | 0,36 | 61,33 | 0,0502 | 0,0131 | ||

| HARRIS-WALLER CNTYS TX MUNI UTIL DIST #4 CONTRACT REVENUE / DBT (US41464CBM73) | 0,36 | 30,29 | 0,0493 | 0,0043 | ||

| HARRIS-WALLER CNTYS TX MUNI UTIL DIST #4 CONTRACT REVENUE / DBT (US41464CBM73) | 0,36 | 30,29 | 0,0493 | 0,0043 | ||

| KYLE TX SPL ASSMNT REVENUE / DBT (US50156CBX74) | 0,36 | -0,28 | 0,0492 | -0,0095 | ||

| SPRINGS AT LAKE ALFRED CMNTY DEV DIST FL SPL ASSMNT / DBT (US85177PAB85) | 0,35 | -2,22 | 0,0487 | -0,0106 | ||

| SPRINGS AT LAKE ALFRED CMNTY DEV DIST FL SPL ASSMNT / DBT (US85177PAB85) | 0,35 | -2,22 | 0,0487 | -0,0106 | ||

| NORTH CAROLINA ST MED CARE COMMISSION RETMNT FACS REVENUE / DBT (US65820YSZ06) | 0,35 | 0,00 | 0,0483 | -0,0091 | ||

| US592250EW01 / MET PIER & EXPOSITION AUTH IL REVENUE | 0,35 | -1,97 | 0,0482 | -0,0103 | ||

| SOUTHERN GROVE CMNTY DEV DIST #5 SPL ASSMNT / DBT (US843021AS55) | 0,35 | -3,06 | 0,0481 | -0,0108 | ||

| WELLNESS RIDGE CDD FL SPL ASSMNT / DBT (US95004CAE93) | 0,34 | -2,62 | 0,0463 | -0,0102 | ||

| US74442EHM57 / Public Finance Authority | 0,34 | 0,90 | 0,0462 | -0,0083 | ||

| US37255MAD74 / George L Smith II Congress Center Authority | 0,33 | 1,21 | 0,0461 | -0,0080 | ||

| US650116FP66 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 0,33 | 162,20 | 0,0460 | 0,0251 | ||

| US785756AH03 / Sachse, Texas, Special Assessment Bonds, Sachse Public Improvement District 1 Improvement Areas 2-3 Project, Series 2022 | 0,33 | -1,49 | 0,0458 | -0,0095 | ||

| CAPITAL TRUST AUTH FL EDUCTNL FACS REVENUE / DBT (US14054WBU80) | 0,33 | 0,0456 | 0,0456 | |||

| PEACE CREEK VLG CDD FL SPL ASSMNT REV / DBT (US70459CAA09) | 0,33 | -11,35 | 0,0453 | -0,0156 | ||

| US50156CBC38 / KYLE | 0,33 | 63,00 | 0,0450 | 0,0121 | ||

| PEACE CROSSING CDD FL SPL ASSMNT REVENUE / DBT (US70459HAA95) | 0,33 | -12,16 | 0,0449 | -0,0159 | ||

| PEACE CROSSING CDD FL SPL ASSMNT REVENUE / DBT (US70459HAA95) | 0,33 | -12,16 | 0,0449 | -0,0159 | ||

| HARRIS CNTY TX MUNI UTILITY DIST #540 / DBT (US41430TAX81) | 0,33 | -3,27 | 0,0449 | -0,0103 | ||

| VERANDA CDD II FL SPL ASSMNT REVENUE / DBT (US92338HAZ55) | 0,32 | -10,53 | 0,0447 | -0,0147 | ||

| VERANDA CDD II FL SPL ASSMNT REVENUE / DBT (US92338HAZ55) | 0,32 | -10,53 | 0,0447 | -0,0147 | ||

| US69651ABS24 / Palm Beach County Health Facilities Authority | 0,32 | 0,94 | 0,0445 | -0,0079 | ||

| US494581AK73 / KINDRED FL CDD II SPL ASSMNT REVENUE | 0,32 | -1,23 | 0,0443 | -0,0091 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400CP77) | 0,32 | 0,32 | 0,0436 | -0,0080 | ||

| PRINCETON TX SPL ASSMNT REVENUE / DBT (US742400CP77) | 0,32 | 0,32 | 0,0436 | -0,0080 | ||

| US67756DD948 / Ohio Higher Educational Facility Commission | 0,32 | 0,96 | 0,0435 | -0,0078 | ||

| NORMANDY CDD FL CAPITAL IMPT REVENUE / DBT (US65618HAB50) | 0,31 | -2,48 | 0,0435 | -0,0094 | ||

| NORMANDY CDD FL CAPITAL IMPT REVENUE / DBT (US65618HAB50) | 0,31 | -2,48 | 0,0435 | -0,0094 | ||

| CLUB MUNI MGMT DIST #1 TX SPL ASSMNT REVENUE / DBT (US18948PAJ03) | 0,31 | -0,96 | 0,0430 | -0,0085 | ||

| CLUB MUNI MGMT DIST #1 TX SPL ASSMNT REVENUE / DBT (US18948PAJ03) | 0,31 | -0,96 | 0,0430 | -0,0085 | ||

| US45129GKZ71 / Facilities RB (White Pine Charter School) Series 2023A | 0,31 | -0,32 | 0,0429 | -0,0083 | ||

| WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE / DBT (US97712JJD63) | 0,31 | -3,12 | 0,0428 | -0,0098 | ||

| WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE / DBT (US97712JJD63) | 0,31 | -3,12 | 0,0428 | -0,0098 | ||

| SOMERSET BAY CDD FL CAPITAL IMPT REVENUE / DBT (US83461CAA99) | 0,31 | -2,86 | 0,0423 | -0,0094 | ||

| SOMERSET BAY CDD FL CAPITAL IMPT REVENUE / DBT (US83461CAA99) | 0,31 | -2,86 | 0,0423 | -0,0094 | ||

| US80620FAA66 / SCENIC TERRACE NORTH CDD FL SPL ASSMNT | 0,31 | -15,04 | 0,0422 | -0,0168 | ||

| US84454RAW51 / FX.RT. MUNI BOND | 0,30 | -1,94 | 0,0420 | -0,0089 | ||

| OAK POINT TX SPL ASSMNT REVENUE / DBT (US67176TAY91) | 0,30 | 0,33 | 0,0419 | -0,0077 | ||

| CURIOSITY CREEK CDD FL CAPITAL IMPT REVENUE / DBT (US23128SAA50) | 0,30 | 1,01 | 0,0415 | -0,0074 | ||

| US696507TW20 / PALM BEACH CNTY FL LIFESPACE 15C 5.0% 05-15-27 | 0,29 | 0,00 | 0,0403 | -0,0076 | ||

| PASSAIC CNTY NJ IMPT AUTH CHRT SCH REVENUE / DBT (US70275QAE35) | 0,29 | -0,69 | 0,0396 | -0,0077 | ||

| PASSAIC CNTY NJ IMPT AUTH CHRT SCH REVENUE / DBT (US70275QAE35) | 0,29 | -0,69 | 0,0396 | -0,0077 | ||

| US18655HAB87 / Cleveland Housing Authority | 0,29 | -2,39 | 0,0395 | -0,0087 | ||

| US46246K4S82 / Iowa (State of) Finance Authority (Lifespace Communities, Inc.), Series 2018 A, RB | 0,29 | 5,95 | 0,0394 | -0,0047 | ||

| ENTRADA CMNTY DEV DIST FL CAPITAL IMPT REVENUE / DBT (US29384HAJ68) | 0,28 | -2,41 | 0,0392 | -0,0085 | ||

| US217761AC96 / Coral Bay Lee County Community Development District | 0,28 | -1,05 | 0,0391 | -0,0079 | ||

| US19189EAB83 / Coddington Community Development District | 0,28 | -0,70 | 0,0389 | -0,0077 | ||

| US13051AFM53 / CALIFORNIA ST MUNI FIN AUTH SP CALIFORNIA MUNICIPAL FINANCE AUTHORITY | 0,28 | -0,70 | 0,0389 | -0,0078 | ||

| US594479HN00 / Michigan Finance Authority | 0,28 | 0,72 | 0,0384 | -0,0071 | ||

| DENTON CNTY TX SPL ASSMNT REVENUE / DBT (US24880GAR02) | 0,28 | 2,97 | 0,0382 | -0,0060 | ||

| US90207EAB74 / TWO LAKES CDD FL SPL ASSMNT TWLDEV 12/28 FIXED 4 | 0,28 | 0,73 | 0,0380 | -0,0069 | ||

| PUBLIC FIN AUTH WI STUDENT HSG REVENUE / DBT (US74439YFY23) | 0,27 | -1,79 | 0,0378 | -0,0080 | ||

| PUBLIC FIN AUTH WI STUDENT HSG REVENUE / DBT (US74439YFY23) | 0,27 | -1,79 | 0,0378 | -0,0080 | ||

| PARRISH LAKES CDD CAPITAL IMPT REVENUE / DBT (US70183FAG37) | 0,27 | -2,16 | 0,0376 | -0,0082 | ||

| PARRISH LAKES CDD CAPITAL IMPT REVENUE / DBT (US70183FAG37) | 0,27 | -2,16 | 0,0376 | -0,0082 | ||

| US448529AN71 / HUTTO TX SPL ASSMNT REVENUE | 0,27 | 0,37 | 0,0376 | -0,0070 | ||

| US13048VBR87 / CALIFORNIA ST MUNI FIN AUTH RE REGD B/E AMT 5.00000000 | 0,27 | 0,0374 | 0,0374 | |||

| ANNA TX SPL ASSMNT REVENUE / DBT (US035713AU08) | 0,27 | 0,00 | 0,0374 | -0,0070 | ||

| ANNA TX SPL ASSMNT REVENUE / DBT (US035713AU08) | 0,27 | 0,00 | 0,0374 | -0,0070 | ||

| TRAVIS CNTY TX DEV AUTH CONTRACT ASSMNT REVENUE / DBT (US89441ABA43) | 0,27 | -2,89 | 0,0372 | -0,0083 | ||

| TRAVIS CNTY TX DEV AUTH CONTRACT ASSMNT REVENUE / DBT (US89441ABA43) | 0,27 | -2,89 | 0,0372 | -0,0083 | ||

| EVERLANDS CDD FL SPL ASSMNT / DBT (US30034HAF64) | 0,27 | -2,55 | 0,0371 | -0,0081 | ||

| US956454CA83 / West Villages Improvement District | 0,27 | -18,29 | 0,0371 | -0,0167 | ||

| US14052WDS35 / CAPITAL TRUST AGY FL REVENUE | 0,27 | -1,11 | 0,0370 | -0,0075 | ||

| LOS CAYOS CDD FL SPL ASSMNT / DBT (US54546CAA99) | 0,27 | -11,00 | 0,0369 | -0,0123 | ||

| US873816AG71 / TAHOE-DOUGLAS V 5% 7/1/2031 | 0,27 | 0,76 | 0,0366 | -0,0066 | ||

| CELINA TX SPL ASSESSMENT REVENUE / DBT (US15114CJQ87) | 0,27 | -2,93 | 0,0366 | -0,0082 | ||

| CELINA TX SPL ASSESSMENT REVENUE / DBT (US15114CJQ87) | 0,27 | -2,93 | 0,0366 | -0,0082 | ||

| US917467CG50 / UTAH INFRASTRUCTURE AGY TELECOMUNICATION REVENUE | 0,27 | 0,76 | 0,0366 | -0,0066 | ||

| US650116GQ31 / New York Transportation Development Corp | 0,26 | -1,50 | 0,0364 | -0,0074 | ||

| ONEIDA INDIAN NATION NY TAX REVENUE / DBT (US682504AC93) | 0,26 | -2,59 | 0,0363 | -0,0080 | ||

| ONEIDA INDIAN NATION NY TAX REVENUE / DBT (US682504AC93) | 0,26 | -2,59 | 0,0363 | -0,0080 | ||

| US650116FL52 / NY TRANS CORP 5% 12/1/2036 @ | 0,26 | 0,00 | 0,0357 | -0,0067 | ||

| US45204FLE33 / Illinois Finance Authority, Social Bonds-Learn Chapter School Project | 0,26 | 1,18 | 0,0356 | -0,0062 | ||

| US70342PAS39 / Patriots Energy Group Financing Agency | 0,26 | 149,51 | 0,0355 | 0,0186 | ||

| US649852AT75 / MUNI PUT BOND ACT | 0,26 | -1,53 | 0,0355 | -0,0073 | ||

| US94186HAC51 / Waterset South Community Development District | 0,26 | 65,16 | 0,0354 | 0,0098 | ||

| CORPUS CHRISTI TX SPL ASSMNT REVENUE / DBT (US220233AA84) | 0,26 | 2,40 | 0,0353 | -0,0057 | ||

| NEW YORK CITY NY HSG DEV CORP MF MTGE REVENUE / DBT (US64966TGW80) | 0,26 | 0,79 | 0,0353 | -0,0063 | ||

| NEW YORK CITY NY HSG DEV CORP MF MTGE REVENUE / DBT (US64966TGW80) | 0,26 | 0,79 | 0,0353 | -0,0063 | ||

| HARRIS CNTY TX MUNI UTILITY DIST #540 / DBT (US41430TAR14) | 0,26 | 14,86 | 0,0353 | -0,0012 | ||

| HARRIS CNTY TX MUNI UTILITY DIST #540 / DBT (US41430TAR14) | 0,26 | 14,86 | 0,0353 | -0,0012 | ||

| US45204FLD59 / Illinois Finance Authority, Social Bonds-Learn Chapter School Project | 0,25 | 0,80 | 0,0350 | -0,0062 | ||

| PALM COAST PARK FL CDD SPL ASSMNT REVENUE / DBT (US69661TAT88) | 0,25 | -2,69 | 0,0350 | -0,0077 | ||

| US57422JBP21 / MARYLAND ST ECON DEV CORP PRIV ACTIVITY REVENUE | 0,25 | -1,56 | 0,0350 | -0,0073 | ||

| PROVIDENCE VLG TX SPL ASSMNT REVENUE / DBT (US743816AA80) | 0,25 | 0,40 | 0,0350 | -0,0064 | ||

| PROVIDENCE VLG TX SPL ASSMNT REVENUE / DBT (US743816AA80) | 0,25 | 0,40 | 0,0350 | -0,0064 | ||

| CELINA TX SPL ASSESSMENT REVENUE / DBT (US15114CJS44) | 0,25 | 1,62 | 0,0346 | -0,0060 | ||

| YARBOROUGH LANE CDD FL SPL ASSMNT / DBT (US984853AA92) | 0,25 | 0,81 | 0,0346 | -0,0061 | ||

| YARBOROUGH LANE CDD FL SPL ASSMNT / DBT (US984853AA92) | 0,25 | 0,81 | 0,0346 | -0,0061 | ||

| LONGLEAF CDD FL CAP IMPT REVENUE / DBT (US54306EAD94) | 0,25 | 1,22 | 0,0344 | -0,0060 | ||

| LONGLEAF CDD FL CAP IMPT REVENUE / DBT (US54306EAD94) | 0,25 | 1,22 | 0,0344 | -0,0060 | ||

| US90207HAB06 / Two Rivers West Community Development District, Pasco County, Florida, Special Assessment Bonds, 2022 Project, Series 2022 | 0,25 | -23,15 | 0,0344 | -0,0188 | ||

| US13058TQD53 / California School Finance Authority | 0,25 | 0,00 | 0,0344 | -0,0065 | ||

| WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE / DBT (US97712JJH77) | 0,25 | 0,00 | 0,0343 | -0,0064 | ||

| US512098AL85 / Lakeshore Villages Master Community Development District | 0,25 | 0,81 | 0,0342 | -0,0062 | ||

| US12139LAB80 / Burleigh (County of), ND (University of Mary), Series 2016, RB | 0,25 | -1,21 | 0,0339 | -0,0069 | ||

| US592247J504 / Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A | 0,25 | 1,66 | 0,0339 | -0,0058 | ||

| US14054CDD83 / Capital Trust Agency, Inc. | 0,24 | 0,83 | 0,0338 | -0,0059 | ||

| US60636AVZ38 / FX.RT. MUNI BOND | 0,24 | 0,0336 | 0,0336 | |||

| BRIGHTWATER CMNTY DEV DIST FL CAPITAL IMPT REVENUE / DBT (US10947YAF79) | 0,24 | -2,81 | 0,0335 | -0,0074 | ||

| CAYMAS CDD FL CAPITAL IMPT REVENUE / DBT (US14976TAA51) | 0,24 | -10,41 | 0,0333 | -0,0109 | ||

| US82652PAD50 / SIERRA VISTA AZ INDL DEV AUTH AUTH ECONOMIC DEV REV | 0,24 | 0,00 | 0,0333 | -0,0064 | ||

| MAGNOLIA ISLAND CDD FL CAPITAL IMPT REVENUE / DBT (US559613AB01) | 0,24 | -3,23 | 0,0332 | -0,0076 | ||

| LANGLEY SOUTH CDD FL SPL ASSMNT / DBT (US515816AB24) | 0,24 | -2,45 | 0,0330 | -0,0072 | ||

| LANGLEY SOUTH CDD FL SPL ASSMNT / DBT (US515816AB24) | 0,24 | -2,45 | 0,0330 | -0,0072 | ||

| DENTON CNTY TX SPL ASSMNT REVENUE / DBT (US24880GAH20) | 0,24 | -1,65 | 0,0328 | -0,0069 | ||

| VARREA SOUTH CDD FL CAPIAL IMPT REVENUE / DBT (US92228DAE40) | 0,24 | 0,0326 | 0,0326 | |||

| PASADENA RIDGE CDD FL CAPITAL IMPT REVENUE / DBT (US702300AB05) | 0,24 | -3,29 | 0,0325 | -0,0075 | ||

| PASADENA RIDGE CDD FL CAPITAL IMPT REVENUE / DBT (US702300AB05) | 0,24 | -3,29 | 0,0325 | -0,0075 | ||

| YARBOROUGH LANE CDD FL SPL ASSMNT / DBT (US984853AB75) | 0,23 | -2,51 | 0,0322 | -0,0071 | ||

| US91754TS533 / UTAH ST CHRT SCH FIN AUTH CHRT SCH REVENUE | 0,23 | -0,43 | 0,0321 | -0,0062 | ||

| MIDCITY IMPT DIST AL SPL ASSMNT REVENUE / DBT (US59564KAE91) | 0,23 | -2,93 | 0,0321 | -0,0071 | ||

| US74441XHR35 / PUBLIC FIN AUTH WI MF HSG REVENUE | 0,23 | -1,28 | 0,0321 | -0,0065 | ||

| US599772AD28 / Military Installation Development Authority | 0,23 | 0,00 | 0,0321 | -0,0060 | ||

| HILLCREST PRESERVE CDD FL SPL ASSMNT / DBT (US43153EAB02) | 0,23 | -3,36 | 0,0318 | -0,0074 | ||

| HILLCREST PRESERVE CDD FL SPL ASSMNT / DBT (US43153EAB02) | 0,23 | -3,36 | 0,0318 | -0,0074 | ||

| SALTMEADOWS CDD FL SPL ASSMNT / DBT (US79575GAF00) | 0,23 | 0,0318 | 0,0318 | |||

| US77571RAK32 / Rolling Oaks Community Development District, Osceola County, Florida, Special Assessment Bonds, 2022 Assessment Area, Series 2022 | 0,23 | -1,31 | 0,0313 | -0,0064 | ||

| HUNT CLUB GROVE CDD FL SPL ASSMENT / DBT (US445583AA59) | 0,23 | 8,13 | 0,0312 | -0,0031 | ||

| HUNT CLUB GROVE CDD FL SPL ASSMENT / DBT (US445583AA59) | 0,23 | 8,13 | 0,0312 | -0,0031 | ||

| WHARTON TX SPL ASSMNT REVENUE / DBT (US962423AB56) | 0,23 | 0,0311 | 0,0311 | |||

| WHARTON TX SPL ASSMNT REVENUE / DBT (US962423AB56) | 0,23 | 0,0311 | 0,0311 | |||

| US353180KL57 / County of Franklin, Health Care Facilities Bonds, Ohio Living Communities | 0,22 | 0,00 | 0,0310 | -0,0058 | ||

| WINDSOR CAY CMNTY DEV DIST FL SPL ASSMNT / DBT (US97352AAA51) | 0,22 | -11,51 | 0,0309 | -0,0105 | ||

| US87972MBQ42 / TEMPE AZ INDL DEV AUTH REVENUE | 0,22 | 0,45 | 0,0308 | -0,0057 | ||

| REGAL VLG CDD FL CAPITAL IMPT REVENUE / DBT (US75884SAB79) | 0,22 | 18,09 | 0,0307 | -0,0002 | ||

| REGAL VLG CDD FL CAPITAL IMPT REVENUE / DBT (US75884SAB79) | 0,22 | 18,09 | 0,0307 | -0,0002 | ||

| BASTROP CNTY TX SPL ASSMNT REVENUE / DBT (US07031MAD11) | 0,22 | 1,38 | 0,0306 | -0,0053 | ||

| FLORIDA ST MUNI LOAN COUNCIL CAPITAL IMPT REVENUE / DBT (US34281UAB89) | 0,22 | -2,26 | 0,0299 | -0,0064 | ||

| US26115PAG63 / Downtown Doral South Community Development District | 0,22 | 0,47 | 0,0298 | -0,0055 | ||

| US386247AU42 / CHRISTIAN HOME MI BEACON HILL EASTGATE PROJECT 17A SF 4.0% 11-01-27 | 0,22 | 0,47 | 0,0297 | -0,0055 | ||

| US64578CAH43 / New Jersey (State of) Economic Development Authority (Continental Airlines, Inc.), Series 1999, RB | 0,22 | 0,00 | 0,0297 | -0,0056 | ||

| US596681AB26 / Middleton Community Development Authority, Florida, Series 2022, (WI/DD, Settling 10/17/22) | 0,21 | 0,47 | 0,0294 | -0,0053 | ||

| SILVER OAKS CDD FL SPL ASSMNT / DBT (US828060AA17) | 0,21 | -9,79 | 0,0293 | -0,0094 | ||

| US50156CAX83 / KYLE TX SPL ASSMNT REVENUE | 0,21 | 0,47 | 0,0293 | -0,0054 | ||

| US650116FS06 / New York Transportation Development Corp | 0,21 | 0,0292 | 0,0292 | |||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FXT73) | 0,21 | 0,00 | 0,0292 | -0,0055 | ||

| REFLECTION BAY CDD FL SPL ASSMNT / DBT (US75865NAC92) | 0,21 | 0,0286 | 0,0286 | |||

| WILLOWBROOK CDD FL SPL ASSMNT / DBT (US971227AA15) | 0,21 | 0,49 | 0,0285 | -0,0051 | ||

| WILLOWBROOK CDD FL SPL ASSMNT / DBT (US971227AA15) | 0,21 | 0,49 | 0,0285 | -0,0051 | ||

| US00284AAB08 / Abbott Square Community Development District | 0,21 | 0,99 | 0,0284 | -0,0051 | ||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JK44) | 0,21 | -1,91 | 0,0283 | -0,0060 | ||

| US785756AK32 / City of Sachse TX | 0,20 | 0,00 | 0,0283 | -0,0052 | ||

| US34061WAW47 / Florida Development Finance Corp. | 0,20 | 0,00 | 0,0283 | -0,0052 | ||

| US57584Y2S77 / Massachusetts Development Finance Agency | 0,20 | 1,00 | 0,0280 | -0,0051 | ||

| US09182NBR08 / Black Belt Energy Gas District | 0,20 | -15,83 | 0,0279 | -0,0115 | ||

| ROCKDALE CNTY GA DEV AUTH MF REVENUE / DBT (US77300QAK31) | 0,20 | 0,0277 | 0,0277 | |||

| ROCKDALE CNTY GA DEV AUTH MF REVENUE / DBT (US77300QAK31) | 0,20 | 0,0277 | 0,0277 | |||

| PARRISH PLANTATION CMNTY DEV DIST FL SPL ASSMNT REVENUE / DBT (US701830AK70) | 0,20 | -1,96 | 0,0277 | -0,0057 | ||

| US69661TAK79 / PALM COAST PARK FL CDD SPL ASSMNT REVENUE | 0,20 | 0,00 | 0,0277 | -0,0051 | ||

| US4072722B80 / County of Hamilton OH | 0,20 | -96,15 | 0,0276 | -0,8253 | ||

| US939783Q661 / WASHINGTON STATE HOUSING FINANCE COMMISSION | 0,20 | 0,0276 | 0,0276 | |||

| US19645UKS23 / Colorado Educational & Cultural Facilities Authority | 0,20 | 1,54 | 0,0274 | -0,0048 | ||

| US018444CA51 / Allentown Neighborhood Improvement Zone Development Authority | 0,20 | 0,51 | 0,0273 | -0,0050 | ||

| HARRIS-WALLER CNTYS TX MUNI UTIL DIST #4 CONTRACT REVENUE / DBT (US41464CAQ96) | 0,20 | 5,35 | 0,0273 | -0,0034 | ||

| US564099AP40 / City of Manor TX | 0,20 | -2,50 | 0,0269 | -0,0059 | ||

| US69651ABZ66 / FL PALM BEACH 5% 11/1/2039 | 0,19 | 0,0267 | 0,0267 | |||

| US650116EZ57 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 0,19 | 0,00 | 0,0266 | -0,0051 | ||

| MARION RANCH CDD FL SPL ASSMNT / DBT (US570001AA58) | 0,19 | -10,70 | 0,0266 | -0,0088 | ||

| MARION RANCH CDD FL SPL ASSMNT / DBT (US570001AA58) | 0,19 | -10,70 | 0,0266 | -0,0088 | ||

| FRANKLIN CNTY OH HLTH CARE FACS REVENUE / DBT (US353180MF61) | 0,19 | 0,00 | 0,0266 | -0,0049 | ||

| US92715KAS78 / Villamar Community Development District, Winter Haven, Florida, Special Assessment Revenue Bonds, Area 5 Project, Series 2023 | 0,19 | -3,52 | 0,0265 | -0,0062 | ||

| HIGHLAND TRAILS CDD FL CAPITAL IMPT REVENUE / DBT (US430813AA38) | 0,19 | -13,18 | 0,0265 | -0,0097 | ||

| KELLY PARK CDD FL SPL ASSMNT / DBT (US488141AA05) | 0,19 | 0,53 | 0,0260 | -0,0048 | ||

| KELLY PARK CDD FL SPL ASSMNT / DBT (US488141AA05) | 0,19 | 0,53 | 0,0260 | -0,0048 | ||

| US15114CGG33 / CELINA TX SPL ASSESSMENT REVENUE | 0,19 | 0,00 | 0,0259 | -0,0049 | ||

| VILLAMAR CDD FL SPL ASSMNT / DBT (US92715KAU25) | 0,19 | -11,37 | 0,0259 | -0,0088 | ||

| ANTILLIA CDD FL SPL ASSMNT / DBT (US03706FAA57) | 0,19 | -13,02 | 0,0259 | -0,0095 | ||

| US13048VBY39 / California (State of) Municipal Finance Authority (Linxs APM), Series 2018 A, RB | 0,19 | 68,18 | 0,0256 | 0,0075 | ||

| US51779AAH23 / LAS VEGAS NV SPL IMPT DIST #616 | 0,18 | 1,10 | 0,0254 | -0,0046 | ||

| US83587TAB98 / Sorrento Pines Community Development District, Series 2023 | 0,18 | -1,10 | 0,0249 | -0,0051 | ||

| US76105VAB18 / Reserve at Van Oaks Community Development District, Series 2023 | 0,18 | -1,66 | 0,0247 | -0,0051 | ||

| HUNT CLUB GROVE CDD FL SPL ASSMENT / DBT (US445583AB33) | 0,18 | -2,75 | 0,0246 | -0,0054 | ||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FXZ34) | 0,18 | 0,0245 | 0,0245 | |||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FXZ34) | 0,18 | 0,0245 | 0,0245 | |||

| US768247AY47 / River Hall Community Development District, Series 2023 A | 0,18 | -1,12 | 0,0243 | -0,0050 | ||

| US74526Q2Q42 / PRCPWR 5.25 07/1/2032 | 0,17 | 1,16 | 0,0240 | -0,0043 | ||

| US90184FAE51 / TWISTED OAKS POINTE CDD FL SPL ASSMNT | 0,17 | -1,72 | 0,0237 | -0,0049 | ||

| BOYD TX SPL ASSMNT REVENUE / DBT (US103341AE38) | 0,17 | 0,0237 | 0,0237 | |||

| STUART CROSSING CDD FL SPL ASSMNT / DBT (US86368SAA15) | 0,17 | -11,86 | 0,0236 | -0,0083 | ||

| STUART CROSSING CDD FL SPL ASSMNT / DBT (US86368SAA15) | 0,17 | -11,86 | 0,0236 | -0,0083 | ||

| US74526QPL04 / Puerto Rico Electric Power Authority, Power Revenue Bonds, Series 2007VV | 0,17 | 0,00 | 0,0236 | -0,0044 | ||

| US51265KEC80 / LAKEWOOD RANCH FL STEWARDSHIP DIST SPL ASSMNT REVENUE | 0,17 | 1,20 | 0,0234 | -0,0041 | ||

| US15114CDM38 / City of Celina | 0,17 | 0,60 | 0,0233 | -0,0042 | ||

| US208185AA61 / CONNERTON EAST CDD FL SPL ASSMNT | 0,17 | -16,92 | 0,0230 | -0,0100 | ||

| US15114CDH43 / City of Celina | 0,17 | 0,61 | 0,0230 | -0,0040 | ||

| SEBASTIAN ISLES CDD FL CAPITAL IMPROVEMENT REVENUE / DBT (US81284AAB08) | 0,17 | -2,35 | 0,0229 | -0,0050 | ||

| SEBASTIAN ISLES CDD FL CAPITAL IMPROVEMENT REVENUE / DBT (US81284AAB08) | 0,17 | -2,35 | 0,0229 | -0,0050 | ||

| US51206LAE83 / Lakes at Bella Lago Community Development District, Series 2023-2 | 0,17 | -1,19 | 0,0229 | -0,0047 | ||

| VERANO 4 CDD FL SP ASSMNT / DBT (US92337SAE90) | 0,17 | 0,0229 | 0,0229 | |||