Grundlæggende statistik

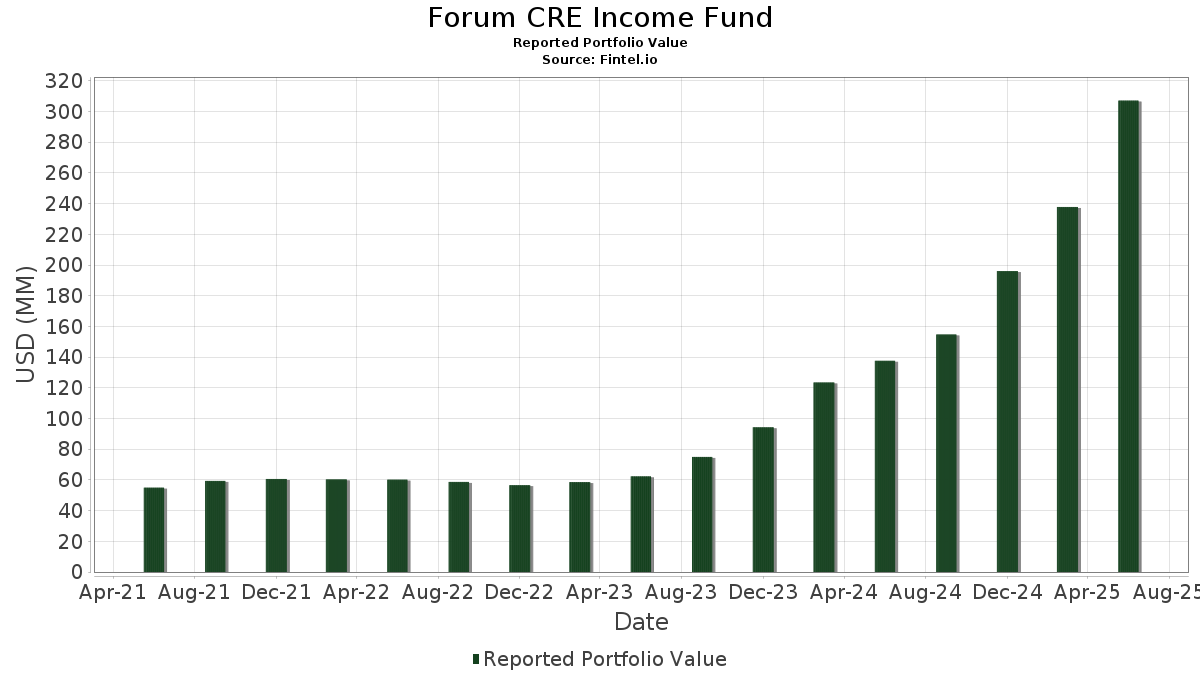

| Porteføljeværdi | $ 307.129.562 |

| Nuværende stillinger | 86 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Forum CRE Income Fund har afsløret 86 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 307.129.562 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Forum CRE Income Funds største beholdninger er Fidelity Treasury Portfolio (US:US3161755042) , BX TR 2021-ARIA G 1ML+320 10/15/2036 144A (US:US05608RAQ83) , BXHPP Trust 2021-FILM (US:US05609JAA07) , BX 2021-BXMF 1ML+359.02 10/15/2026 144A (US:US05609RAS31) , and Extended Stay America Trust (US:US30227FAN06) . Forum CRE Income Funds nye stillinger omfatter Fidelity Treasury Portfolio (US:US3161755042) , BX TR 2021-ARIA G 1ML+320 10/15/2036 144A (US:US05608RAQ83) , BXHPP Trust 2021-FILM (US:US05609JAA07) , BX 2021-BXMF 1ML+359.02 10/15/2026 144A (US:US05609RAS31) , and Extended Stay America Trust (US:US30227FAN06) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 15,98 | 5,6161 | 5,6161 | ||

| 11,61 | 4,0797 | 4,0797 | ||

| 10,11 | 3,5539 | 3,5539 | ||

| 10,06 | 3,5347 | 3,5347 | ||

| 10,01 | 3,5199 | 3,5199 | ||

| 10,01 | 3,5193 | 3,5193 | ||

| 8,64 | 3,0380 | 3,0380 | ||

| 7,67 | 2,6959 | 2,6959 | ||

| 7,67 | 2,6950 | 2,6950 | ||

| 7,67 | 2,6950 | 2,6950 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -11,25 | -3,9548 | -3,9548 | ||

| 14,14 | 4,9693 | -3,6608 | ||

| -7,46 | -2,6213 | -2,6213 | ||

| -7,20 | -2,5313 | -2,5313 | ||

| -6,05 | -2,1267 | -2,1267 | ||

| -4,30 | -1,5123 | -1,5123 | ||

| -3,50 | -1,2300 | -1,2300 | ||

| -3,35 | -1,1776 | -1,1776 | ||

| 2,63 | 0,9252 | -0,8726 | ||

| -2,30 | -0,8085 | -0,8085 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-28 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| WILLIAMS VILLAGE II LAND LOAN, 11.99% / / LON (999999999) | 15,98 | 5,6161 | 5,6161 | |||

| US3161755042 / Fidelity Treasury Portfolio | 14,14 | -32,48 | 4,9693 | -3,6608 | ||

| GM Palace BTS 16.000%, 05/31/2027 / / (999999999) | 11,61 | 4,0797 | 4,0797 | |||

| BX Commercial Mortgage Trust 2024-AIRC / ABS-MBS (US12433CAG06) | 10,72 | 78,62 | 3,7676 | 1,2943 | ||

| THE IVY MEZZ LOAN 05/08/2028 / / LON (999999999) | 10,11 | 3,5539 | 3,5539 | |||

| ARDN 2025-ARCP Mortgage Trust / ABS-MBS (US039961AL18) | 10,06 | 3,5347 | 3,5347 | |||

| GS Mortgage Securities Corp. Trust 2025-800D / ABS-MBS (US36273XAA90) | 10,04 | 0,40 | 3,5294 | -0,5928 | ||

| COMM 2024-WCL1 MORTGAGE TRUST / ABS-MBS (US20047DAA28) | 10,01 | 3,5199 | 3,5199 | |||

| ACRE Multifamily Housing Mortgage Loan Trust 2022-Q018 / ABS-MBS (US00091WAA71) | 10,01 | 3,5193 | 3,5193 | |||

| US05608RAQ83 / BX TR 2021-ARIA G 1ML+320 10/15/2036 144A | 8,74 | 48,71 | 3,0719 | 0,6496 | ||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAE93) | 8,64 | 3,0380 | 3,0380 | |||

| Great Wolf Trust 2024-WOLF / ABS-MBS (US39152MAG06) | 7,86 | 161,26 | 2,7619 | 1,5222 | ||

| US05609JAA07 / BXHPP Trust 2021-FILM | 7,67 | 2,6959 | 2,6959 | |||

| Blackbird Preferred 13.000%, 01/24/2030 / / (999999999) | 7,67 | 2,6950 | 2,6950 | |||

| Blackbird Preferred 13.000%, 01/24/2030 / / (999999999) | 7,67 | 2,6950 | 2,6950 | |||

| US05609RAS31 / BX 2021-BXMF 1ML+359.02 10/15/2026 144A | 7,21 | 0,97 | 2,5345 | -0,4094 | ||

| Citigroup Commercial Mortgage Trust 2021-PRM2 / ABS-MBS (US17291HAU86) | 7,01 | 2,4635 | 2,4635 | |||

| MADISON MIDTOWN 16.25%, 10/07/2027 / / (999999999) | 6,83 | 2,4015 | 2,4015 | |||

| US30227FAN06 / Extended Stay America Trust | 6,57 | -0,93 | 2,3105 | -0,4244 | ||

| VILLAS AT SUNDANCE 13.000%, 06/17/2029 / / (999999999) | 6,48 | 2,2784 | 2,2784 | |||

| US78485GAQ73 / STWD Trust 2021-FLWR | 6,41 | 0,79 | 2,2526 | -0,3684 | ||

| US26210YAA47 / DROP Mortgage Trust, Series 2021-FILE, Class A | 6,17 | 2,05 | 2,1682 | -0,3234 | ||

| ZEPHYR FLT RT, 06/14/2027 / / (999999999) | 5,96 | 2,0950 | 2,0950 | |||

| US05610MAA09 / BX_22-CSMO | 5,41 | 23,03 | 1,9005 | 0,0889 | ||

| US12659VAN01 / CSMC 2021-BHAR | 5,17 | -0,52 | 1,8162 | -0,3246 | ||

| US74166KAE01 / Prima Capital CRE Securitization 2019-1S Ltd | 5,14 | -0,64 | 1,8051 | -0,3254 | ||

| ILPT Commercial Mortgage Trust 2025-LPF2 / ABS-MBS (US451955AL21) | 5,04 | 1,7703 | 1,7703 | |||

| US62475WAL90 / MTN COML MTG TR 2022-LPFL F TSFR1M+393.47 03/15/2039 144A | 5,01 | 106,26 | 1,7622 | 0,4997 | ||

| BX Commercial Mortgage Trust 2024-BRBK / ABS-MBS (US05613NAN75) | 5,00 | 1,7580 | 1,7580 | |||

| US78457JAQ58 / SMRT 2022-MINI SOFR30A+330 01/15/2024 144A | 4,87 | 2,72 | 1,7133 | -0,2425 | ||

| US53218DAJ72 / LIFE MORTGAGE TRUST US SER 2022-BMR2 CL D V/R REGD 144A P/P 3.34191000 | 4,49 | 21,64 | 1,5791 | 0,0565 | ||

| FREMF 2020-KF78 Mortgage Trust / ABS-MBS (US302979AG41) | 4,44 | -8,53 | 1,5609 | -0,4402 | ||

| BX Commercial Mortgage Trust 2024-MF / ABS-MBS (US05612EAA64) | 4,44 | 0,20 | 1,5605 | -0,2657 | ||

| AVONDAPE 13.000%, 12/11/2029 / / (999999999) | 4,44 | 1,5603 | 1,5603 | |||

| AVONDAPE 13.000%, 12/11/2029 / / (999999999) | 4,44 | 1,5603 | 1,5603 | |||

| US87256GAC69 / 2023-MIC Trust/THE | 4,37 | 0,78 | 1,5348 | -0,2513 | ||

| DAWSON 13.000%, 04/02/2029 / / (999999999) | 4,30 | 1,5108 | 1,5108 | |||

| DAWSON 13.000%, 04/02/2029 / / (999999999) | 4,30 | 1,5108 | 1,5108 | |||

| US05608WAU80 / BX Trust | 4,01 | 1,80 | 1,4092 | -0,2139 | ||

| US98162JAA43 / Worldwide Plaza Trust 2017-WWP | 3,91 | 2,81 | 1,3744 | -0,1931 | ||

| US05609VAQ86 / BX Commercial Mortgage Trust, Series 2021-VOLT, Class F | 3,72 | -2,13 | 1,3061 | -0,2590 | ||

| US36262MAJ71 / GS Mortgage Securities Corp. II, Series 2021-IP, Class E | 3,66 | 0,60 | 1,2882 | -0,2134 | ||

| US05608KAN00 / BX COMMERCIAL MORTGAGE TRUST 2021 VINO G 1ML+389.82 05/15/2038 144A | 3,59 | -0,06 | 1,2609 | -0,2187 | ||

| KERF TRENT DEV QOZ FLT RT 08/23/2025 / / LON (999999999) | 3,32 | 1,1660 | 1,1660 | |||

| ILPT Commercial Mortgage Trust 2025-LPF2 / ABS-MBS (US451955AJ74) | 3,08 | 1,0837 | 1,0837 | |||

| US302960AH25 / FREMF 2018-KSW4 Mortgage Trust | 3,03 | 0,30 | 1,0645 | -0,1803 | ||

| Great Wolf Trust 2024-WOLF / ABS-MBS (US39152MAJ45) | 3,02 | 0,17 | 1,0608 | -0,1811 | ||

| FREMF 2020-KJ32 Mortgage Trust / ABS-MBS (US30317BAC46) | 3,02 | -0,99 | 1,0602 | -0,1952 | ||

| US62475WAC91 / MTN Commercial Mortgage Trust | 3,00 | 0,20 | 1,0547 | -0,1796 | ||

| US44422PBW14 / HUDSONS BAY SIMON JV TRUST HBCT 2015 HB10 B10 144A | 2,98 | 1,50 | 1,0470 | -0,1625 | ||

| Hudsons Bay Simon JV Trust 2015-HBS / ABS-MBS (US44422PBE16) | 2,95 | 1,0380 | 1,0380 | |||

| FREMF 2020-KF95 Mortgage Trust / ABS-MBS (US30318PAL22) | 2,74 | -0,33 | 0,9614 | -0,1699 | ||

| US68373BAA98 / OPEN TR 2023-AIR TSFR1M+308.92 10/15/2028 144A | 2,63 | -39,67 | 0,9252 | -0,8726 | ||

| US44422PBN15 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL A10 REGD 144A P/P 4.15450000 | 2,49 | 1,02 | 0,8746 | -0,1409 | ||

| US68373BAJ08 / OPEN TR 2023-AIR TSFR1M+942.948 10/15/2028 144A | 2,41 | -0,29 | 0,8489 | -0,1493 | ||

| ROYAL URBAN RENEWAL FLT RT 12/1/2025 / / LON (999999999) | 2,06 | 0,7234 | 0,7234 | |||

| ROYAL URBAN RENEWAL FLT RT 12/1/2025 / / LON (999999999) | 2,06 | 0,7234 | 0,7234 | |||

| US12433EAS00 / BX TR 2022-LBA6 SOFR30A+ 01/15/2039 144A | 2,00 | 1,58 | 0,7026 | -0,1085 | ||

| LEXINGTON SO TOTOWA FLT RT _09/15/2025 / / LON (999999999) | 1,93 | 0,6801 | 0,6801 | |||

| MARLOWE 15.000%, 02/09/2027 / / (999999999) | 1,93 | 0,6779 | 0,6779 | |||

| US44422PBY79 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL C10 V/R REGD 144A P/P 5.44700000 | 1,79 | 1,59 | 0,6289 | -0,0968 | ||

| US30298UAJ07 / FREMF Mortgage Trust, Series 2019-KF70, Class C | 1,77 | -1,34 | 0,6208 | -0,1171 | ||

| US44422PBC59 / Hudsons Bay Simon JV Trust | 1,76 | 7,33 | 0,6175 | -0,0569 | ||

| US55316PAN78 / MKT 2020-525M MTG TR CSTR 02/12/2040 144A | 1,62 | 14,05 | 0,5679 | -0,0160 | ||

| UMD Rambler Vertical Mezzanine 8/15/26 / / LON (999999999) | 1,40 | 0,4927 | 0,4927 | |||

| IOTA PREFERRED EQUIT DUE 04/01/2026 / / (999999999) | 1,05 | 0,3675 | 0,3675 | |||

| CRIMSON DEVCO, LLC / / (999999999) | 1,00 | 0,3515 | 0,3515 | |||

| CRIMSON DEVCO, LLC / / (999999999) | 1,00 | 0,3515 | 0,3515 | |||

| ANN ARBOR VERTICAL VAR 11/21/2028 / / LON (999999999) | 0,63 | 0,2225 | 0,2225 | |||

| ADVANTIS MCA FV, LLC FLT RT, 07/22/2025 / / LON (999999999) | 0,63 | 0,2206 | 0,2206 | |||

| ADVANTIS MCA HARBOR FLT RT, 04/18/2026 / / LON (999999999) | 0,62 | 0,2169 | 0,2169 | |||

| ADVANTIS MCA HARBOR FLT RT, 04/18/2026 / / LON (999999999) | 0,62 | 0,2169 | 0,2169 | |||

| US05609VAS43 / BX Commercial Mortgage Trust 2021-VOLT | 0,49 | -3,17 | 0,1716 | -0,0363 | ||

| US44422PBG63 / Hudsons Bay Simon JV Trust | 0,09 | 0,0325 | 0,0325 | |||

| BAMLL Commercial Mortgage Securities Trust 2016-ISQ / ABS-MBS (US05523GAC50) | 0,08 | -29,66 | 0,0295 | -0,0194 | ||

| US05546JAC27 / BBCMS Trust 2015-VFM | 0,05 | -30,26 | 0,0187 | -0,0131 | ||

| US98162JAQ94 / Worldwide Plaza Trust 2017-WWP | 0,02 | -10,00 | 0,0065 | -0,0019 | ||

| BAMLL Commercial Mortgage Securities Trust 2016-ISQ / ABS-MBS (US05523GAE17) | 0,02 | -28,57 | 0,0054 | -0,0034 | ||

| RBC REVERSE REPO 62475WAC9 / / RA (999999999) | -2,30 | -0,8085 | -0,8085 | |||

| LP REVERSE REPO 05610MAA0 / / RA (999999999) | -3,35 | -1,1776 | -1,1776 | |||

| RBC REVERSE REPO 05612EAA6 / / RA (999999999) | -3,50 | -1,2300 | -1,2300 | |||

| RBC REVERSE REPO 26210YAA4 / / RA (999999999) | -4,30 | -1,5123 | -1,5123 | |||

| LP REVERSE REPO 05609JAA0 / / RA (999999999) | -6,05 | -2,1267 | -2,1267 | |||

| LP REVERSE REPO 36273XAA9 / / RA (999999999) | -7,20 | -2,5313 | -2,5313 | |||

| RBC REVERSE REPO 20047DAA2 / / RA (999999999) | -7,46 | -2,6213 | -2,6213 | |||

| WILLIAMS VILLAGE II BANC OF CAL TL / / LON (999999999) | -11,25 | -3,9548 | -3,9548 |