Grundlæggende statistik

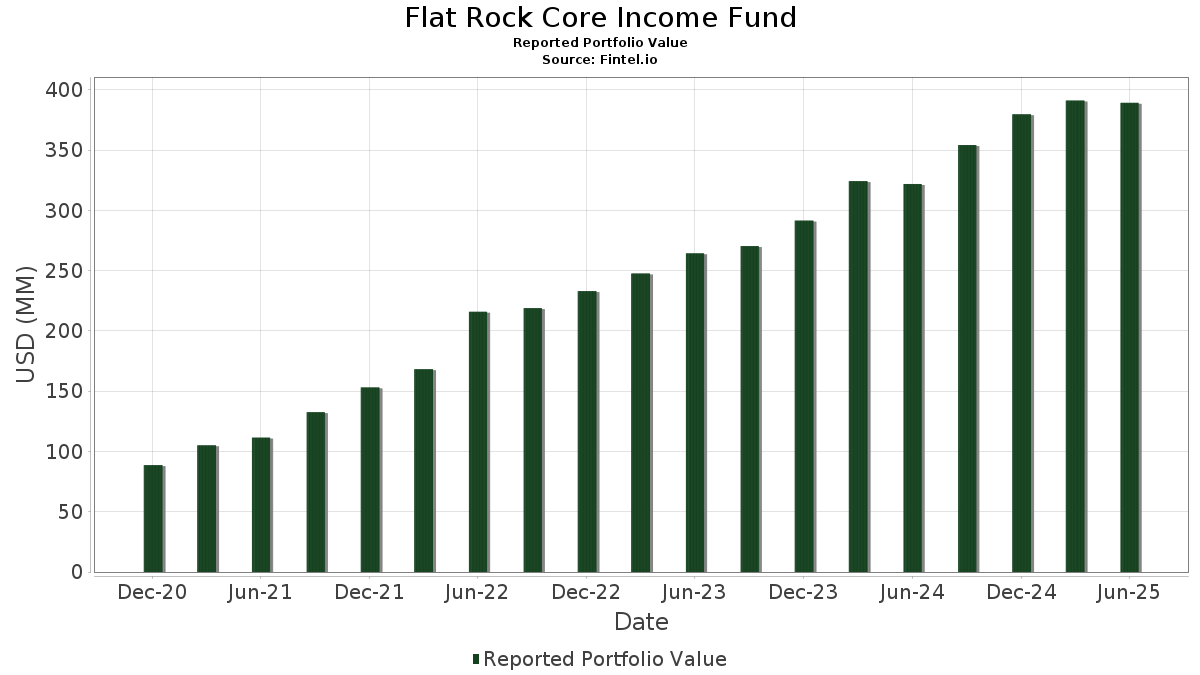

| Porteføljeværdi | $ 389.228.700 |

| Nuværende stillinger | 101 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Flat Rock Core Income Fund har afsløret 101 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 389.228.700 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Flat Rock Core Income Funds største beholdninger er Brightwood Capital MM CLO 2023-1, Ltd. (JE:US108928AN29) , Mount Logan Funding 2018-1 LP (KY:US62188AAA97) , MONROE CAPITAL MML CLO VIII LTD (KY:US61034TAE82) , ABPCI DIRECT LENDING FUND ABS II LLC SER 2022-2A CL B REGD 144A P/P 4.98650000 (US:US00090NAE04) , and Barings Middle Market CLO Ltd 2021-I (KY:US06761EAC93) . Flat Rock Core Income Funds nye stillinger omfatter Brightwood Capital MM CLO 2023-1, Ltd. (JE:US108928AN29) , Mount Logan Funding 2018-1 LP (KY:US62188AAA97) , MONROE CAPITAL MML CLO VIII LTD (KY:US61034TAE82) , ABPCI DIRECT LENDING FUND ABS II LLC SER 2022-2A CL B REGD 144A P/P 4.98650000 (US:US00090NAE04) , and Barings Middle Market CLO Ltd 2021-I (KY:US06761EAC93) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 16,63 | 16,85 | 5,2075 | 5,2075 | |

| 1,32 | 13,75 | 4,2481 | 4,2481 | |

| 10,77 | 10,39 | 3,2094 | 3,2094 | |

| 8,39 | 2,5916 | 2,5916 | ||

| 7,88 | 2,4363 | 2,4363 | ||

| 7,88 | 2,4350 | 2,4350 | ||

| 7,45 | 2,3023 | 2,3023 | ||

| 7,36 | 2,2752 | 2,2752 | ||

| 6,88 | 2,1264 | 2,1264 | ||

| 6,80 | 2,1000 | 2,1000 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,14 | 0,0425 | -1,0191 | ||

| 5,07 | 1,5662 | -0,3094 | ||

| 6,17 | 1,9057 | -0,1677 | ||

| 9,76 | 3,0144 | -0,1399 | ||

| 2,66 | 0,8215 | -0,1078 | ||

| 0,90 | 0,2772 | -0,0983 | ||

| 6,60 | 2,0390 | -0,0684 | ||

| 5,19 | 1,6051 | -0,0650 | ||

| 4,87 | 1,5058 | -0,0560 | ||

| 7,96 | 2,4585 | -0,0291 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-28 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HERCULES PRIVATE GLOBAL VENTURE GROWTH FUND I / DBT (N/A) | 16,63 | 16,85 | 5,2075 | 5,2075 | |||||

| TRIPLEPOINT PRIVATE VENTURE CREDIT / DBT (N/A) | 1,32 | 13,75 | 4,2481 | 4,2481 | |||||

| BCP GREAT LAKES FUND LP II / DBT (N/A) | 10,77 | 10,39 | 3,2094 | 3,2094 | |||||

| Fortress Credit Opportunities XXI CLO LLC / ABS-CBDO (US34964UAY29) | 9,76 | -3,63 | 3,0144 | -0,1399 | |||||

| Vehicle Management Services TL / LON (N/A) | 8,39 | 2,5916 | 2,5916 | ||||||

| US108928AN29 / Brightwood Capital MM CLO 2023-1, Ltd. | 7,96 | -0,34 | 2,4585 | -0,0291 | |||||

| Xenon Arc, inc. Term Loan - Funded / LON (N/A) | 7,88 | 2,4363 | 2,4363 | ||||||

| PTSH Intermediate Holdings, LLC - Term Loan / LON (N/A) | 7,88 | 2,4350 | 2,4350 | ||||||

| Fortress Credit Opportunities XIX CLO LLC / ABS-CBDO (US34964RAY99) | 7,63 | 52,19 | 2,3572 | 0,7953 | |||||

| Crane Engineering TL / LON (N/A) | 7,45 | 2,3023 | 2,3023 | ||||||

| Viapath Technologies / LON (N/A) | 7,36 | 2,2752 | 2,2752 | ||||||

| New Mountain Guardian IV Feeder III, Ltd. / (N/A) | 6,88 | 2,1264 | 2,1264 | ||||||

| Cyber Advisors TL / LON (N/A) | 6,80 | 2,1000 | 2,1000 | ||||||

| SGA Dental Partners TL / LON (N/A) | 6,62 | 2,0444 | 2,0444 | ||||||

| Oil Changer Holding Corporation / LON (N/A) | 6,60 | 2,0408 | 2,0408 | ||||||

| US62188AAA97 / Mount Logan Funding 2018-1 LP | 6,60 | -2,43 | 2,0390 | -0,0684 | |||||

| Congruex Group TL / LON (N/A) | 6,49 | 2,0058 | 2,0058 | ||||||

| Zavation Medical Products TL / LON (N/A) | 6,48 | 2,0038 | 2,0038 | ||||||

| Diversified Risk Holdings TL / LON (N/A) | 6,35 | 1,9630 | 1,9630 | ||||||

| US61034TAE82 / MONROE CAPITAL MML CLO VIII LTD | 6,33 | 1,04 | 1,9571 | 0,0038 | |||||

| Amerit Fleet Parent LLC - Term Loan / LON (N/A) | 6,29 | 1,9435 | 1,9435 | ||||||

| Capitol Imaging TL / LON (N/A) | 6,27 | 1,9367 | 1,9367 | ||||||

| US00090NAE04 / ABPCI DIRECT LENDING FUND ABS II LLC SER 2022-2A CL B REGD 144A P/P 4.98650000 | 6,17 | -7,30 | 1,9057 | -0,1677 | |||||

| Monroe Capital Mml Clo X Ltd. / ABS-CBDO (US61034UBA25) | 6,00 | 1,8541 | 1,8541 | ||||||

| Nellson Neutraceutical US TL / LON (N/A) | 5,67 | 1,7509 | 1,7509 | ||||||

| Accordion Partners / LON (N/A) | 5,55 | 1,7142 | 1,7142 | ||||||

| ABPCI Direct Lending Fund CLO / ABS-CBDO (US00085LAC54) | 5,32 | 0,91 | 1,6440 | 0,0012 | |||||

| Jefferies Credit Partners DL CLO 2024-II Ltd / ABS-O (US471913AC70) | 5,29 | 6,51 | 1,6342 | 0,0869 | |||||

| US06761EAC93 / Barings Middle Market CLO Ltd 2021-I | 5,19 | -3,08 | 1,6051 | -0,0650 | |||||

| Maranon Loan Funding Ltd. / ABS-CBDO (US56577NBA19) | 5,11 | 1,5800 | 1,5800 | ||||||

| US55281FAS92 / MCF CLO VII LLC SER 2017-3A CL ER V/R REGD 144A P/P 9.29143000 | 5,08 | 1,20 | 1,5685 | 0,0057 | |||||

| US510803AA70 / LAKE SHORE MM CLO I MATURITY: 04/15/2033 | 5,07 | 0,48 | 1,5678 | -0,0057 | |||||

| US55280HBE62 / MCF CLO IV LLC | 5,07 | 1,06 | 1,5669 | 0,0035 | |||||

| US61034PAA49 / Monroe Capital Mml Clo XI Ltd | 5,07 | 1,02 | 1,5668 | 0,0027 | |||||

| US09262NAS27 / BlackRock Maroon Bells CLO XI LLC | 5,07 | -15,80 | 1,5662 | -0,3094 | |||||

| Brightwood Capital MM CLO Ltd. / ABS-CBDO (US10950BAL80) | 5,03 | -0,10 | 1,5541 | -0,0148 | |||||

| Barings Middle Market CLO Ltd / ABS-CBDO (US067922AA28) | 5,00 | -0,44 | 1,5451 | -0,0198 | |||||

| Allium Buyer TL / LON (N/A) | 4,97 | 1,5357 | 1,5357 | ||||||

| Spencer Spirit TL / LON (N/A) | 4,93 | 1,5220 | 1,5220 | ||||||

| Great Lakes CLO 2019-1 Ltd. / ABS-CBDO (US39057PAG90) | 4,87 | -2,77 | 1,5058 | -0,0560 | |||||

| Perennial Services Group TL / LON (N/A) | 4,84 | 1,4953 | 1,4953 | ||||||

| Watchguard Technologies TL / LON (N/A) | 4,83 | 1,4925 | 1,4925 | ||||||

| Maranon Loan Funding 2023-1 Ltd. / ABS-CBDO (US56575VAY48) | 4,80 | 1,4833 | 1,4833 | ||||||

| Trulite Holding Corp TL / LON (N/A) | 4,70 | 1,4537 | 1,4537 | ||||||

| US31935HAG20 / First Brands Group, LLC, Senior Secured First Lien Term Loan | 4,69 | 1,32 | 1,4499 | 0,0068 | |||||

| Bounteous TL / LON (N/A) | 4,25 | 1,3127 | 1,3127 | ||||||

| PennantPark CLO V Ltd. / ABS-CBDO (US70806CBE12) | 4,06 | 1,15 | 1,2536 | 0,0039 | |||||

| Guggenheim Invest Private Dbt Fd IV Feeder LLC / (US40190AAU79) | 4,00 | 1,2361 | 1,2361 | ||||||

| Inmar TL / LON (N/A) | 3,95 | 1,2221 | 1,2221 | ||||||

| Drive Automotive Services TL / LON (N/A) | 3,79 | 1,1725 | 1,1725 | ||||||

| Magnate Worldwide TL / LON (N/A) | 3,74 | 1,1571 | 1,1571 | ||||||

| MAG DS Corp TL / LON (N/A) | 3,63 | 1,1204 | 1,1204 | ||||||

| HV Watterson TL / LON (N/A) | 3,55 | 1,0967 | 1,0967 | ||||||

| Galactic Litigation Partners TL / LON (N/A) | 3,50 | 1,0813 | 1,0813 | ||||||

| Oak Point Partners TL / LON (N/A) | 3,47 | 1,0720 | 1,0720 | ||||||

| Xanitos TL / LON (N/A) | 3,46 | 1,0688 | 1,0688 | ||||||

| Consor TL / LON (N/A) | 3,23 | 0,9984 | 0,9984 | ||||||

| USG41644AE85 / GREAT LAKES CLO LTD SERIES: 2014-1A CLASS: FR | 2,94 | 2,09 | 0,9074 | 0,0109 | |||||

| Magnate Worldwide LLC - Incremental TLB / LON (N/A) | 2,93 | 0,9054 | 0,9054 | ||||||

| Flagship Oral Surgery Partners TL / LON (N/A) | 2,84 | 0,8761 | 0,8761 | ||||||

| Profile Products TL / LON (N/A) | 2,82 | 0,8724 | 0,8724 | ||||||

| US87240GAK76 / TCP Whitney CLO, Ltd. | 2,66 | -10,87 | 0,8215 | -0,1078 | |||||

| Perennial Services Group DDTL - Funded / LON (N/A) | 2,45 | 0,7574 | 0,7574 | ||||||

| Unfunded DDTL - Flagship Oral Surgery / LON (N/A) | 2,15 | 0,6644 | 0,6644 | ||||||

| US09263GAY35 / Blackrock MT Hood CLO X LLC | 2,14 | -2,42 | 0,6607 | -0,0223 | |||||

| Thryv, Inc TL / LON (N/A) | 2,10 | 0,6493 | 0,6493 | ||||||

| Consor Intermedia II, LLC - DDTL - Unfunded / LON (N/A) | 2,01 | 0,6221 | 0,6221 | ||||||

| ABPCI Direct Lending Fund ABS IV LP / ABS-CBDO (US00092FAG00) | 2,00 | 0,25 | 0,6180 | -0,0039 | |||||

| US87240PAQ46 / TCP Waterman Clo LLC | 1,90 | 0,21 | 0,5880 | -0,0037 | |||||

| Bain Capital Global Direct Lending Fund U II RN LP / (US05682DAJ46) | 1,69 | 0,5235 | 0,5235 | ||||||

| US61033XAA81 / Monroe Capital MML CLO IX, Ltd. | 1,65 | 1,04 | 0,5096 | 0,0010 | |||||

| Brightwood Capital MM CLO Ltd. / ABS-CBDO (USG16455AG59) | 1,51 | -0,33 | 0,4668 | -0,0055 | |||||

| Solaray TL x3 / LON (N/A) | 1,50 | 0,4648 | 0,4648 | ||||||

| ETC Group TL / LON (N/A) | 1,44 | 0,4464 | 0,4464 | ||||||

| Solaray TL x1 / LON (N/A) | 1,42 | 0,4397 | 0,4397 | ||||||

| Unfunded DDTL - SGA Dental Partners / LON (N/A) | 1,33 | 0,4118 | 0,4118 | ||||||

| Solaray TL x2 / LON (N/A) | 1,25 | 0,3857 | 0,3857 | ||||||

| US09260YAD31 / BlackRock Elbert CLO V, Ltd. | 0,90 | -25,56 | 0,2772 | -0,0983 | |||||

| Amerit Fleet Parent LLC - Rev - Unfunded / LON (N/A) | 0,88 | 0,2709 | 0,2709 | ||||||

| Accordion Partners DDTL - Unfunded / LON (N/A) | 0,76 | 0,2338 | 0,2338 | ||||||

| Nellson Neutraceutical Revolver - Unfunded / LON (N/A) | 0,66 | 0,2025 | 0,2025 | ||||||

| Amerit Fleet Parent LLC - DDTL - Unfunded / LON (N/A) | 0,61 | 0,1876 | 0,1876 | ||||||

| Accordion Partners DDTL - Unfunded Revolver / LON (N/A) | 0,60 | 0,1855 | 0,1855 | ||||||

| Isagenix International TL / LON (N/A) | 0,58 | 0,1785 | 0,1785 | ||||||

| Consor Intermediate II, LLC Revolver / LON (N/A) | 0,53 | 0,1651 | 0,1651 | ||||||

| Zavation Funded Revolver / LON (N/A) | 0,42 | 0,1302 | 0,1302 | ||||||

| Nellson Neutraceutical DDTL - Unfunded / LON (N/A) | 0,34 | 0,1055 | 0,1055 | ||||||

| Unfunded Revolver - Capitol Imaging / LON (N/A) | 0,26 | 0,0803 | 0,0803 | ||||||

| Unfunded DDTL - Capitol Imaging / LON (N/A) | 0,26 | 0,0803 | 0,0803 | ||||||

| Nellson Neutraceutical Revolver / LON (N/A) | 0,23 | 0,0717 | 0,0717 | ||||||

| Amerit Fleet Parent LLC - Revolver / LON (N/A) | 0,20 | 0,0625 | 0,0625 | ||||||

| Bain Capital Global Direct Lending Fund U II RN LP / (US05682DAG07) | 0,20 | 0,0612 | 0,0612 | ||||||

| Unfunded DDTL - Perennial Services Group DDTL / LON (N/A) | 0,19 | 0,0575 | 0,0575 | ||||||

| Diversified Risk Holdings Revolver - Funded / LON (N/A) | 0,17 | 0,0533 | 0,0533 | ||||||

| US171518AC75 / Churchill Middle Market CLO III, Ltd. | 0,14 | -95,98 | 0,0425 | -1,0191 | |||||

| Unfunded Revolver - Consor / LON (N/A) | 0,13 | 0,0413 | 0,0413 | ||||||

| Unfunded DDTL - Cyber Advisors / LON (N/A) | 0,13 | 0,0412 | 0,0412 | ||||||

| Unfunded Revolver - Diversified Risk Holdings / LON (N/A) | 0,11 | 0,0355 | 0,0355 | ||||||

| Capitol Imaging - Revolver / LON (N/A) | 0,09 | 0,0292 | 0,0292 | ||||||

| NSO Group TL / LON (N/A) | 0,09 | 0,0284 | 0,0284 | ||||||

| Unfunded Revolver - Zavation Medical Products / LON (N/A) | 0,05 | 0,0145 | 0,0145 | ||||||

| Isagenix Equity / EC (N/A) | 0,09 | 0,00 | 0,0000 | 0,0000 |