Grundlæggende statistik

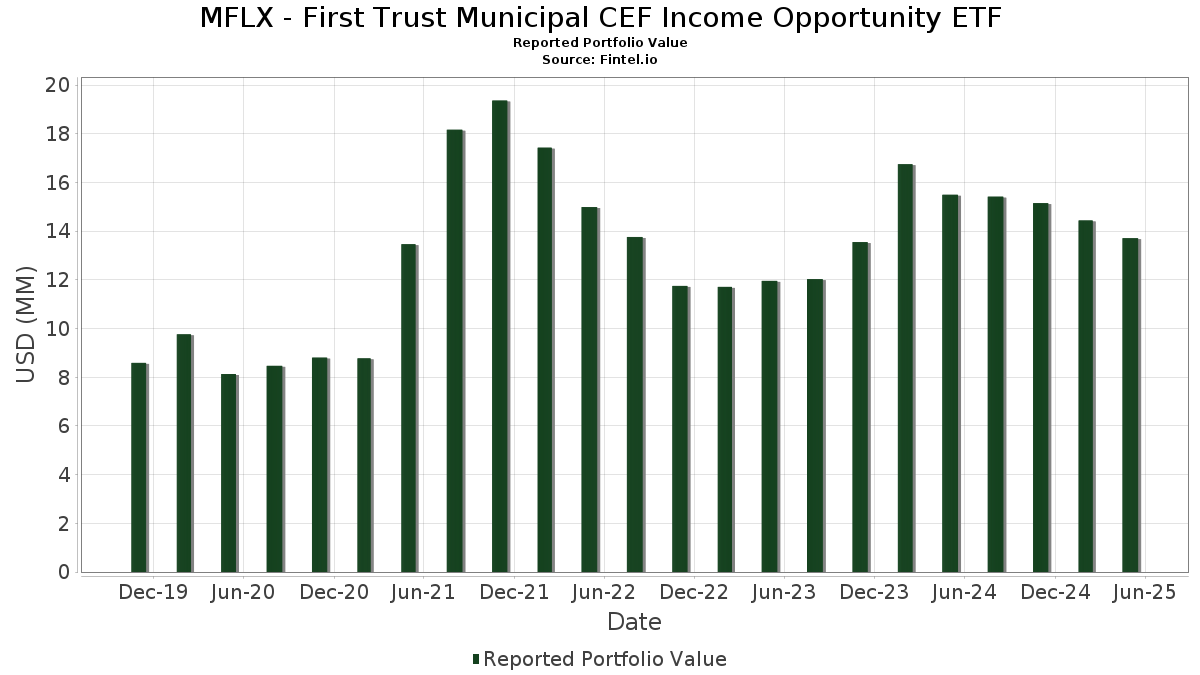

| Porteføljeværdi | $ 13.710.430 |

| Nuværende stillinger | 67 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

MFLX - First Trust Municipal CEF Income Opportunity ETF har afsløret 67 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 13.710.430 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). MFLX - First Trust Municipal CEF Income Opportunity ETFs største beholdninger er Indianapolis Local Public Improvement Bond Bank (US:US45528U6X43) , Chicago Board of Education, Series 2021 B, Ref. GO Bonds (US:US167505XV37) , DUTCHESS CNTY NY LOCAL DEV CORP MF (US:US26704AAA97) , IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE (US:US46246SAV79) , and Vermont Economic Development Authority, Revenue Bonds, Wake Robin Corporation Project, Series 2021A (US:US92415TCA88) . MFLX - First Trust Municipal CEF Income Opportunity ETFs nye stillinger omfatter Indianapolis Local Public Improvement Bond Bank (US:US45528U6X43) , Chicago Board of Education, Series 2021 B, Ref. GO Bonds (US:US167505XV37) , DUTCHESS CNTY NY LOCAL DEV CORP MF (US:US26704AAA97) , IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE (US:US46246SAV79) , and Vermont Economic Development Authority, Revenue Bonds, Wake Robin Corporation Project, Series 2021A (US:US92415TCA88) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,47 | 3,3483 | 3,3483 | ||

| 0,25 | 1,8159 | 1,8159 | ||

| 0,25 | 1,7711 | 1,7711 | ||

| 0,25 | 1,7626 | 1,7626 | ||

| 0,23 | 1,6672 | 1,6672 | ||

| 0,23 | 1,6434 | 1,6434 | ||

| 0,20 | 1,4015 | 1,4015 | ||

| 0,31 | 2,2174 | 0,0788 | ||

| 0,25 | 1,7878 | 0,0763 | ||

| 0,26 | 1,8317 | 0,0740 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,23 | 1,6399 | -0,0666 | ||

| 0,24 | 1,7141 | -0,0618 | ||

| 0,28 | 2,0398 | -0,0575 | ||

| 0,20 | 1,4608 | -0,0564 | ||

| 0,21 | 1,5329 | -0,0560 | ||

| 0,19 | 1,3572 | -0,0553 | ||

| 0,20 | 1,4539 | -0,0534 | ||

| 0,21 | 1,5358 | -0,0506 | ||

| 0,23 | 1,6144 | -0,0474 | ||

| 0,22 | 1,5637 | -0,0430 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-07-25 for rapporteringsperioden 2025-05-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| County of Jefferson AL Sewer Revenue / DBT (US472682ZM84) | 0,47 | 3,3483 | 3,3483 | ||||||

| US45528U6X43 / Indianapolis Local Public Improvement Bond Bank | 0,31 | -3,43 | 2,2253 | 0,0357 | |||||

| US167505XV37 / Chicago Board of Education, Series 2021 B, Ref. GO Bonds | 0,31 | -1,59 | 2,2174 | 0,0788 | |||||

| US26704AAA97 / DUTCHESS CNTY NY LOCAL DEV CORP MF | 0,31 | -6,40 | 2,1982 | -0,0333 | |||||

| Skagit County Public Hospital District No 1 / DBT (US830227EP53) | 0,31 | -3,48 | 2,1833 | 0,0306 | |||||

| Public Finance Authority / DBT (US74448EAA29) | 0,30 | -5,14 | 2,1145 | -0,0044 | |||||

| New Hampshire Business Finance Authority / DBT (US644684GJ50) | 0,28 | -7,79 | 2,0398 | -0,0575 | |||||

| US46246SAV79 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 0,28 | -2,43 | 2,0127 | 0,0502 | |||||

| Capital Projects Finance Authority/FL / DBT (US14043FAH91) | 0,28 | -4,14 | 1,9933 | 0,0175 | |||||

| US92415TCA88 / Vermont Economic Development Authority, Revenue Bonds, Wake Robin Corporation Project, Series 2021A | 0,28 | -5,82 | 1,9724 | -0,0199 | |||||

| US88256PAT75 / Texas Municipal Gas Acquisition & Supply Corp IV | 0,27 | -1,80 | 1,9572 | 0,0603 | |||||

| US837031WJ84 / SOUTH CAROLINA JOBS-ECONOMIC DEVELOPMENT AUTHORITY | 0,27 | -1,84 | 1,9154 | 0,0590 | |||||

| US70342PAR55 / Patriots Energy Group Financing Agency | 0,26 | -1,86 | 1,8960 | 0,0605 | |||||

| South Carolina Jobs-Economic Development Authority / DBT (US837032CD18) | 0,26 | -6,16 | 1,8549 | -0,0225 | |||||

| US09186FAF09 / Black Creek Community Development District | 0,26 | -1,15 | 1,8477 | 0,0671 | |||||

| Columbus Regional Airport Authority / DBT (US199546DD11) | 0,26 | -4,10 | 1,8439 | 0,0194 | |||||

| US40065NCL91 / Territory of Guam | 0,26 | -1,15 | 1,8419 | 0,0684 | |||||

| Indiana Finance Authority / DBT (US45471CCL00) | 0,26 | -3,76 | 1,8384 | 0,0241 | |||||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAB08) | 0,26 | -1,16 | 1,8317 | 0,0740 | |||||

| US98267VDK61 / WYANDOTTE CNTY-KANSAS CITY KS UNIFIED GOV SALES TAX REV (144A/QIB) 5.75% 09-01-39 | 0,26 | -2,67 | 1,8269 | 0,0384 | |||||

| Public Finance Authority / DBT (US74439YFV83) | 0,25 | 1,8159 | 1,8159 | ||||||

| Washington State Housing Finance Commission / DBT (US93978LHH24) | 0,25 | -5,24 | 1,8130 | -0,0037 | |||||

| US76571AAC09 / Ridge at Apopka Community Development District | 0,25 | -3,08 | 1,8079 | 0,0372 | |||||

| Virginia Small Business Financing Authority / DBT (US928103AY65) | 0,25 | -4,18 | 1,8053 | 0,0116 | |||||

| US09182TAM99 / BLACK BELT ENERGY GAS DIST AL REGD N/C V/R B/E 4.00000000 | 0,25 | -0,80 | 1,7878 | 0,0763 | |||||

| US56035DDX75 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 0,25 | -1,59 | 1,7749 | 0,0649 | |||||

| New York Transportation Development Corp / DBT (US650116HK51) | 0,25 | 1,7711 | 1,7711 | ||||||

| Public Finance Authority / DBT (US74439YGG08) | 0,25 | 1,7626 | 1,7626 | ||||||

| US04052BPQ13 / Arizona Industrial Development Authority | 0,24 | -8,43 | 1,7141 | -0,0618 | |||||

| US01728A4Y93 / Allegheny County Hospital Development Authority, Pennsylvania, Revenue Bonds, University of Pittsburgh Medical Center, Series 2019A | 0,24 | -5,16 | 1,7114 | -0,0037 | |||||

| US74514L3L92 / PUERTO RICO CMWLTH | 0,24 | -5,60 | 1,6903 | -0,0157 | |||||

| US66272REE80 / North Sumter County Utility Dependent District | 0,24 | -6,35 | 1,6896 | -0,0251 | |||||

| US74529JRJ69 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0,23 | -6,43 | 1,6691 | -0,0271 | |||||

| US452153AS89 / FX.RT. MUNI BOND | 0,23 | 1,6672 | 1,6672 | ||||||

| City of Rochester MN / DBT (US771902HP17) | 0,23 | 1,6434 | 1,6434 | ||||||

| US179027YN14 / Clackamas County Hospital Facility Authority | 0,23 | -8,40 | 1,6399 | -0,0666 | |||||

| St Charles County Public Water Supply District No 2 / DBT (US78764YFJ10) | 0,23 | -7,79 | 1,6144 | -0,0474 | |||||

| US19648FTD68 / COLORADO ST HLTH FACS AUTH HOSP REVENUE | 0,22 | -6,78 | 1,5768 | -0,0315 | |||||

| US23283YAL92 / Cypress Mill Community Development District, Series 2023 | 0,22 | -4,76 | 1,5755 | 0,0028 | |||||

| US65821DYF22 / NORTH CAROLINA ST MED CARE COMMISSION HLTH CARE FACS REVENUE | 0,22 | -7,63 | 1,5637 | -0,0430 | |||||

| US234554JG99 / DALLAS CENTER IA GRIMES CMNTY SCH DIST | 0,21 | -8,15 | 1,5358 | -0,0506 | |||||

| City of Georgetown TX Utility System Revenue / DBT (US373064Y242) | 0,21 | -8,15 | 1,5329 | -0,0560 | |||||

| US287254GS99 / CA ST ELK GROVE SPL TAX SF 4.0% 09-01-50 | 0,21 | -7,62 | 1,4762 | -0,0410 | |||||

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign / DBT (US120827EE64) | 0,20 | -8,52 | 1,4608 | -0,0564 | |||||

| US805517AD11 / Sawyers Landing Community Development District | 0,20 | -5,58 | 1,4547 | -0,0130 | |||||

| US744396FT49 / PUBLIC FIN AUTH WI CHRT SCH REVENUE | 0,20 | -8,14 | 1,4539 | -0,0534 | |||||

| US249271GV36 / Denver City and County, Colorado, Special Facilities Airport Revenue Bonds, United Airlines, Inc Project, Refunding Series 2017 | 0,20 | -0,50 | 1,4305 | 0,0696 | |||||

| Montana Board of Housing / DBT (US61212WHV00) | 0,20 | -7,08 | 1,4123 | -0,0346 | |||||

| US16080TAG04 / Charlotte County Industrial Development Authority/FL | 0,20 | 1,4015 | 1,4015 | ||||||

| US04052BMT88 / ARIZONA ST INDL DEV AUTH EDU REVENUE | 0,19 | -8,70 | 1,3572 | -0,0553 | |||||

| NEA / Nuveen AMT-Free Quality Municipal Income Fund | 0,01 | 0,00 | 0,16 | -6,51 | 1,1365 | -0,0171 | |||

| NVG / Nuveen AMT-Free Municipal Credit Income Fund | 0,01 | 0,00 | 0,11 | -8,20 | 0,8068 | -0,0236 | |||

| MMU / Western Asset Managed Municipals Fund Inc. | 0,01 | 0,00 | 0,11 | -5,31 | 0,7683 | -0,0068 | |||

| BLE / BlackRock Municipal Income Trust II | 0,01 | 0,00 | 0,11 | -7,08 | 0,7528 | -0,0205 | |||

| US04110FAA30 / Arkansas Development Finance Authority, Series 2022 | 0,10 | -3,88 | 0,7125 | 0,0061 | |||||

| NZF / Nuveen Municipal Credit Income Fund | 0,01 | 0,00 | 0,08 | -7,14 | 0,5634 | -0,0081 | |||

| VGM / Invesco Trust for Investment Grade Municipals | 0,01 | 0,00 | 0,08 | -6,25 | 0,5414 | -0,0040 | |||

| NAD / Nuveen Quality Municipal Income Fund | 0,01 | 0,00 | 0,07 | -6,49 | 0,5203 | -0,0058 | |||

| IQI / Invesco Quality Municipal Income Trust | 0,01 | 0,00 | 0,07 | -6,76 | 0,4992 | -0,0106 | |||

| MYI / BlackRock MuniYield Quality Fund III, Inc. | 0,01 | 0,00 | 0,07 | -8,22 | 0,4852 | -0,0139 | |||

| EVN / Eaton Vance Municipal Income Trust | 0,01 | 0,00 | 0,05 | -5,26 | 0,3932 | 0,0013 | |||

| BFK / BlackRock Municipal Income Trust | 0,00 | 0,00 | 0,05 | -6,12 | 0,3305 | -0,0042 | |||

| MQT / BlackRock MuniYield Quality Fund II, Inc. | 0,00 | 0,00 | 0,04 | -6,38 | 0,3162 | -0,0097 | |||

| VKQ / Invesco Municipal Trust | 0,00 | 0,00 | 0,03 | -8,11 | 0,2469 | -0,0080 | |||

| MHD / BlackRock MuniHoldings Fund, Inc. | 0,00 | 0,00 | 0,03 | -9,09 | 0,2215 | -0,0065 | |||

| MQY / BlackRock MuniYield Quality Fund, Inc. | 0,00 | 0,00 | 0,02 | -9,09 | 0,1450 | -0,0059 | |||

| BYM / BlackRock Municipal Income Quality Trust | 0,00 | 0,00 | 0,02 | -11,11 | 0,1214 | -0,0024 |