Grundlæggende statistik

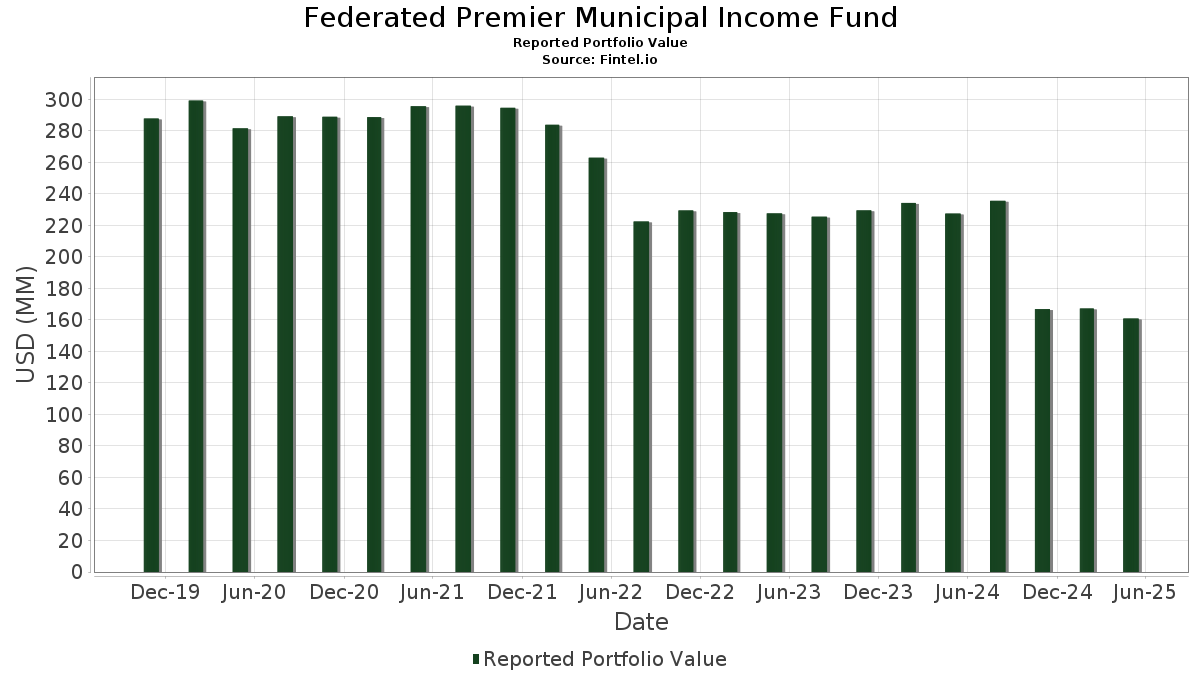

| Porteføljeværdi | $ 160.867.304 |

| Nuværende stillinger | 151 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Federated Premier Municipal Income Fund har afsløret 151 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 160.867.304 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Federated Premier Municipal Income Funds største beholdninger er Nuveen AMT-Free Quality Municipal Income Fund (US:US6706577748) , Indianapolis Local Public Improvement Bond Bank (US:US45528U6W69) , TOBACCO SETTLEMENT FING CORP NJ (US:US888808HL91) , Lower Alabama Gas District (The), Series 2016 A, RB (US:US547804AE44) , and PUBLIC AUTHORITY FOR COLORADO ENERGY (US:US744387AC51) . Federated Premier Municipal Income Funds nye stillinger omfatter Nuveen AMT-Free Quality Municipal Income Fund (US:US6706577748) , Indianapolis Local Public Improvement Bond Bank (US:US45528U6W69) , TOBACCO SETTLEMENT FING CORP NJ (US:US888808HL91) , Lower Alabama Gas District (The), Series 2016 A, RB (US:US547804AE44) , and PUBLIC AUTHORITY FOR COLORADO ENERGY (US:US744387AC51) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 4,00 | 4,3171 | 4,3171 | ||

| 2,36 | 2,5418 | 2,5418 | ||

| 2,13 | 2,3032 | 2,3032 | ||

| 2,09 | 2,2554 | 2,2554 | ||

| 2,08 | 2,2487 | 2,2487 | ||

| 2,03 | 2,1909 | 2,1909 | ||

| 1,97 | 2,1245 | 2,1245 | ||

| 1,90 | 2,0495 | 2,0495 | ||

| 1,89 | 2,0390 | 2,0390 | ||

| 1,44 | 1,5553 | 1,5553 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,88 | 2,0246 | -3,0399 | ||

| 0,10 | 0,1079 | -2,8686 | ||

| 0,10 | 0,1079 | -0,4975 | ||

| 0,41 | 0,4427 | -0,0620 | ||

| 0,86 | 0,9243 | -0,0468 | ||

| 0,85 | 0,9217 | -0,0421 | ||

| 1,49 | 1,6047 | -0,0352 | ||

| 0,72 | 0,7781 | -0,0243 | ||

| 0,58 | 0,6257 | -0,0238 | ||

| 0,46 | 0,4992 | -0,0211 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-07-22 for rapporteringsperioden 2025-05-31. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US6706577748 / Nuveen AMT-Free Quality Municipal Income Fund | 4,00 | 4,3171 | 4,3171 | |||

| US45528U6W69 / Indianapolis Local Public Improvement Bond Bank | 2,59 | -3,50 | 2,7993 | 0,0880 | ||

| US888808HL91 / TOBACCO SETTLEMENT FING CORP NJ | 2,56 | -1,73 | 2,7604 | 0,1342 | ||

| US547804AE44 / Lower Alabama Gas District (The), Series 2016 A, RB | 2,55 | -6,09 | 2,7474 | 0,0121 | ||

| State of North Carolina / DBT (US65829QFZ28) | 2,36 | 2,5418 | 2,5418 | |||

| DENVER CO SD#1- 5.5 12/44 / DBT (US249174ZE65) | 2,17 | -5,66 | 2,3406 | 0,0220 | ||

| US744387AC51 / PUBLIC AUTHORITY FOR COLORADO ENERGY | 2,16 | -0,60 | 2,3339 | 0,1389 | ||

| State of Oregon / DBT (US68609UPQ21) | 2,13 | 2,3032 | 2,3032 | |||

| Salt River Project Agricultural Improvement & Power District / DBT (US79574CGY30) | 2,09 | 2,2554 | 2,2554 | |||

| Fort Bend Independent School District / DBT (US346843XV20) | 2,08 | 2,2487 | 2,2487 | |||

| US452153ER60 / ILLINOIS ST | 2,06 | -4,58 | 2,2261 | 0,0451 | ||

| County of Miami-Dade FL Aviation Revenue / DBT (US593340AC66) | 2,05 | -4,97 | 2,2080 | 0,0365 | ||

| New York State Dormitory Authority / DBT (US64990AUD52) | 2,03 | 2,1909 | 2,1909 | |||

| US452153EP05 / State of Illinois | 2,03 | -4,61 | 2,1895 | 0,0436 | ||

| US167727C463 / City of Chicago IL Wastewater Transmission Revenue | 2,02 | -5,46 | 2,1855 | 0,0249 | ||

| US16514PAD15 / Chesapeake Bay Bridge and Tunnel District, Virginia, General Resolution Revenue Bonds, First Tier Series 2016 | 2,01 | -2,10 | 2,1653 | 0,0977 | ||

| US71885FDJ30 / INDUSTRIAL DEVELOPMENT AUTHORITY OF THE CITY OF PHOENIX/THE | 2,00 | -0,05 | 2,1592 | 0,1401 | ||

| State of Delaware / DBT (US246381UW55) | 1,97 | 2,1245 | 2,1245 | |||

| US982674KF96 / Wyandotte (County of) & Kansas City (City of), KS Unified Government, Series 2014 A, RB | 1,96 | -1,95 | 2,1172 | 0,0985 | ||

| US686087Y849 / State of Oregon Housing & Community Services Department | 1,95 | -3,90 | 2,1020 | 0,0570 | ||

| US66285WWD46 / N TX TOLLWAY AUTH REVENUE | 1,95 | -1,72 | 2,1001 | 0,1032 | ||

| County of Clark NV / DBT (US181000VC17) | 1,90 | 2,0495 | 2,0495 | |||

| Idaho Housing & Finance Association / DBT (US45130ADP75) | 1,89 | 2,0390 | 2,0390 | |||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 1,88 | -62,64 | 2,0246 | -3,0399 | ||

| US55374SAB60 / M-S-R Energy Authority | 1,77 | -3,76 | 1,9054 | 0,0548 | ||

| US59447PYT29 / MICHIGAN FINANCE AUTHORITY | 1,75 | -0,06 | 1,8896 | 0,1224 | ||

| US88256PAT75 / Texas Municipal Gas Acquisition & Supply Corp IV | 1,75 | -1,96 | 1,8875 | 0,0880 | ||

| US19648DAD12 / CO HIGH PERFORMANCE TRANSPRTN ENTERPRISE REVENUE | 1,72 | -4,77 | 1,8550 | 0,0338 | ||

| US66353RCC60 / NORTHAMPTON COUNTY GENERAL PURPOSE AUTHORITY | 1,70 | -5,98 | 1,8342 | 0,0109 | ||

| US12008ETY22 / Build NYC Resource Corp. | 1,62 | -4,47 | 1,7534 | 0,0375 | ||

| US641462SL15 / State of Nevada | 1,58 | -4,83 | 1,7032 | 0,0300 | ||

| Douglas County School District No Re-1 Douglas & Elbert Counties / DBT (US258885S788) | 1,57 | -4,57 | 1,6908 | 0,0350 | ||

| New York City Municipal Water Finance Authority / DBT (US64972GH989) | 1,56 | -4,25 | 1,6799 | 0,0397 | ||

| US88283NAZ50 / Texas Transportation Commission, State Highway 249 System Revenue Bonds, First Tier Toll Series 2019A | 1,54 | -1,84 | 1,6665 | 0,0791 | ||

| US010507CL34 / Alabama Corrections Institution Finance Authority | 1,53 | -4,51 | 1,6464 | 0,0345 | ||

| US59261AG500 / MET TRANSPRTN AUTH NY REVENUE | 1,52 | -2,94 | 1,6425 | 0,0610 | ||

| US592250BK99 / METROPOLITAN PIER & EXPOSITION AUTHORITY | 1,52 | -5,30 | 1,6394 | 0,0205 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZR71) | 1,51 | -5,43 | 1,6347 | 0,0190 | ||

| US64613CEG96 / New Jersey Transportation Trust Fund Authority | 1,51 | -5,55 | 1,6345 | 0,0168 | ||

| US79766DSC47 / SAN FRANCISCO CALIF CITY CNTY SFOAPT 05/50 FIXED 5 | 1,51 | -3,38 | 1,6337 | 0,0531 | ||

| US546410CX70 / Louisiana Stadium & Exposition District | 1,51 | -4,06 | 1,6312 | 0,0414 | ||

| US7962536U17 / SAN ANTONIO TX ELEC & GAS REVENUE | 1,50 | -1,58 | 1,6187 | 0,0820 | ||

| US59447TXH12 / MICHIGAN FIN AU 4% 12/1/2049 | 1,49 | -8,55 | 1,6047 | -0,0352 | ||

| US650010AZ41 / New York State Thruway Authority | 1,48 | -0,94 | 1,5992 | 0,0898 | ||

| Virginia Public School Authority / DBT (US92818HH871) | 1,44 | 1,5553 | 1,5553 | |||

| US414189AK69 / HARRIS CNTY TX INDL DEV CORP | 1,43 | -3,65 | 1,5410 | 0,0462 | ||

| US709224P526 / PENNSYLVANIA ST TURNPIKE COMMISSION TURNPIKE REVENUE | 1,36 | -3,20 | 1,4689 | 0,0500 | ||

| US59334PHV22 / County of Miami-Dade | 1,28 | -7,47 | 1,3779 | -0,0144 | ||

| US961017QS20 / Westmoreland County Municipal Authority | 1,20 | -0,41 | 1,2980 | 0,0798 | ||

| PORTLAND OR SWR-A 5 10/49 / DBT (US736742K632) | 1,15 | -5,11 | 1,2437 | 0,0184 | ||

| US46246SAV79 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 1,14 | -2,56 | 1,2307 | 0,0499 | ||

| US59447TVA86 / Michigan Finance Authority, Hospital Revenue Bonds, McLaren Health Care, Refunding Series 2019A | 1,12 | -5,23 | 1,2126 | 0,0167 | ||

| US46246SAU96 / IOWA ST FIN AUTH MIDWSTRN DISASTER AREA REVENUE | 1,12 | -2,60 | 1,2125 | 0,0492 | ||

| University of California / DBT (US91412HVY60) | 1,10 | 1,1857 | 1,1857 | |||

| 6444 / Sanden Corporation | 1,08 | 1,1696 | 1,1696 | |||

| US55374SAA87 / MSR ENERGY | 1,08 | -1,56 | 1,1615 | 0,0578 | ||

| US717817TP51 / PHILADELPHIA PA ARPT REVENUE | 1,07 | -2,45 | 1,1583 | 0,0481 | ||

| US717893Q468 / PHILADELPHIA PA WTR & WSTWTR REVENUE | 1,07 | -3,16 | 1,1563 | 0,0397 | ||

| US56035DFK37 / MAIN STREET NATURAL GAS INC GA REGD V/R B/E 5.00000000 | 1,04 | -1,60 | 1,1275 | 0,0568 | ||

| US71883PMN41 / CITY OF PHOENIX AZ WASTEWATER REVENUE 5.25% 07-01-47 | 1,04 | -5,19 | 1,1253 | 0,0156 | ||

| City of San Antonio TX Electric & Gas Systems Revenue / DBT (US79625GJR56) | 1,04 | -4,59 | 1,1232 | 0,0230 | ||

| US57582R5B89 / Commonwealth of Massachusetts | 1,04 | -4,16 | 1,1209 | 0,0275 | ||

| US79467BFA89 / SALES TAX SECURITIZATION CORP IL | 1,03 | -6,43 | 1,1161 | 0,0004 | ||

| South Carolina Jobs-Economic Development Authority / DBT (US837032CF65) | 1,03 | -6,11 | 1,1126 | 0,0049 | ||

| State of Washington / DBT (US93974EV523) | 1,03 | 1,1067 | 1,1067 | |||

| US45505MNH50 / INDIANA FIN AUTH-B 5.25 0 | 1,02 | -2,76 | 1,1047 | 0,0424 | ||

| US64577XED49 / New Jersey Economic Development Authority | 1,02 | -5,20 | 1,1024 | 0,0148 | ||

| State of Hawaii Airports System Revenue / DBT (US419794K769) | 1,02 | -4,94 | 1,1010 | 0,0182 | ||

| Florida Development Finance Corp / DBT (US34061QCT22) | 1,01 | -3,55 | 1,0858 | 0,0332 | ||

| Colorado Health Facilities Authority / DBT (US19648FYJ73) | 1,01 | -4,19 | 1,0853 | 0,0264 | ||

| US74442PYR09 / Public Finance Authority | 1,00 | -2,43 | 1,0846 | 0,0460 | ||

| US592190QE51 / Metropolitan Nashville Airport Authority/The | 1,00 | -4,11 | 1,0837 | 0,0268 | ||

| US161036MJ45 / Charlotte (City of), NC (Charlotte Douglas International Airport), Series 2017 A, RB | 1,00 | -1,96 | 1,0803 | 0,0511 | ||

| US13059TBY47 / CALIFORNIA SCHOOL FINANCE AUTHORITY | 1,00 | -0,30 | 1,0797 | 0,0674 | ||

| US626207H312 / FX.RT. MUNI BOND | 1,00 | -0,30 | 1,0794 | 0,0671 | ||

| US62620HAX08 / Municipal Electric Authority of Georgia | 0,98 | -4,57 | 1,0604 | 0,0220 | ||

| US01728A4A18 / Allegheny (County of), PA Hospital Development Authority (Allegheny Health Network Obligated Group Issue), Series 2018 A, Ref. RB | 0,97 | -4,32 | 1,0522 | 0,0245 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAL44) | 0,97 | -1,32 | 1,0511 | 0,0553 | ||

| New York City Housing Development Corp / DBT (US64972KEK79) | 0,97 | -4,24 | 1,0497 | 0,0253 | ||

| US649519DA03 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 1, Ref. RB | 0,97 | -3,00 | 1,0478 | 0,0382 | ||

| US162410FF67 / CHATTANOOGA TN HLTH EDUCTNL &HSG FAC BRD REVENUE | 0,96 | -5,21 | 1,0413 | 0,0150 | ||

| US49126PFE51 / KENTUCKY ECONOMIC DEVELOPMENT FINANCE AUTHORITY | 0,95 | -1,96 | 1,0251 | 0,0482 | ||

| US939783C950 / Washington State Housing Finance Commission | 0,94 | -6,08 | 1,0169 | 0,0044 | ||

| US650116EV44 / NY TRANS CORP 4% 12/1/2040 | 0,92 | -7,92 | 0,9916 | -0,0146 | ||

| Conroe Independent School District / DBT (US2084185M19) | 0,88 | 0,9544 | 0,9544 | |||

| US64971X7H51 / New York City Transitional Finance Authority Future Tax Secured | 0,88 | -7,97 | 0,9477 | -0,0157 | ||

| US74514L3N58 / PUERTO RICO CMWLTH | 0,86 | -11,02 | 0,9243 | -0,0468 | ||

| US915183X932 / UNIV OF UTAH UT REVEN | 0,85 | -10,58 | 0,9217 | -0,0421 | ||

| US19648FWT73 / Colorado Health Facilities Authority | 0,82 | -5,18 | 0,8900 | 0,0129 | ||

| Virginia Beach Development Authority / DBT (US92774NBB55) | 0,82 | -4,10 | 0,8849 | 0,0229 | ||

| US048251AX06 / CITY OF ATLANTIC BEACH FL | 0,82 | 0,00 | 0,8800 | 0,0569 | ||

| US62620HHQ83 / MUNI ELEC AUTH OF GA | 0,79 | -4,83 | 0,8507 | 0,0153 | ||

| US64577XEB82 / New Jersey Economic Development Authority | 0,78 | -5,91 | 0,8421 | 0,0056 | ||

| US4521526M81 / ILLINOIS ST | 0,78 | -3,47 | 0,8409 | 0,0257 | ||

| US628077CU16 / COUNTY OF MUSKINGUM OH | 0,76 | 0,00 | 0,8188 | 0,0532 | ||

| Stamford Housing Authority / DBT (US852640AJ09) | 0,75 | 0,8087 | 0,8087 | |||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JMC44) | 0,75 | -0,67 | 0,8049 | 0,0472 | ||

| Public Finance Authority / DBT (US74442PB530) | 0,74 | -0,40 | 0,8020 | 0,0489 | ||

| US48504MAC55 / Land Clearance for Redevelopment Authority of Kansas City, Missouri, Project Revenue Bonds, Convention Center Hotel Project - TIF Financing, Series 20 | 0,73 | -2,80 | 0,7860 | 0,0303 | ||

| US45204EC557 / ILLINOIS ST FIN AUTH REVENUE | 0,72 | -9,43 | 0,7781 | -0,0243 | ||

| US72178AAG76 / FX.RT. MUNI BOND | 0,66 | -3,23 | 0,7125 | 0,0236 | ||

| US83704EAF16 / SC JOBS ECO DEV AUTH | 0,65 | -0,15 | 0,7020 | 0,0446 | ||

| US83704EAE41 / KIAWAH LIFE PLAN VILLAGE INC 5.75% 11-15-29 | 0,65 | -0,62 | 0,6981 | 0,0420 | ||

| Wisconsin Health & Educational Facilities Authority / DBT (US97712JMD27) | 0,64 | -7,61 | 0,6944 | -0,0082 | ||

| Upper St Clair Township School District / DBT (US916507UG94) | 0,64 | 0,6863 | 0,6863 | |||

| US76882LAH96 / Rivers Edge II Community Development District, Florida, Capital Improvement Revenue Bonds, Series 2021 | 0,62 | -7,42 | 0,6743 | -0,0060 | ||

| City of Whiting IN / DBT (US96634RAZ55) | 0,62 | 0,6725 | 0,6725 | |||

| US373385MQ36 / STATE OF GEORGIA | 0,59 | 0,6399 | 0,6399 | |||

| US6461364F58 / New Jersey (State of) Transportation Trust Fund Authority, Series 2018 A, Ref. RB | 0,59 | -3,11 | 0,6394 | 0,0225 | ||

| US56681NAW74 / Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Paradise Schools Projects, Series 2016 | 0,58 | -1,02 | 0,6303 | 0,0350 | ||

| US64613CCL00 / New Jersey Transportation Trust Fund Authority | 0,58 | -2,02 | 0,6281 | 0,0293 | ||

| City of Houston TX / DBT (US442332EE86) | 0,58 | -9,95 | 0,6257 | -0,0238 | ||

| US790103AY10 / Parish of St James LA | 0,55 | -0,36 | 0,5936 | 0,0362 | ||

| California Public Finance Authority / DBT (US13057TAA97) | 0,52 | 2,98 | 0,5603 | 0,0509 | ||

| US51265KFH68 / LAKEWOOD RANCH FL STEWARDSHIP DIST SPL ASSMNT REVENUE | 0,52 | -3,18 | 0,5593 | 0,0192 | ||

| Suffolk Regional Off-Track Betting Co / DBT (US86480TAA25) | 0,52 | -0,39 | 0,5581 | 0,0344 | ||

| US48504MAD39 / Land Clearance for Redevelopment Authority of Kansas City, Missouri, Project Revenue Bonds, Convention Center Hotel Project - TIF Financing, Series 20 | 0,51 | -4,65 | 0,5544 | 0,0109 | ||

| City of New York NY / DBT (US64966SJZ02) | 0,51 | 0,5473 | 0,5473 | |||

| US052477QB53 / City of Austin TX Water & Wastewater System Revenue | 0,51 | -4,53 | 0,5464 | 0,0113 | ||

| US939783TG11 / WASHINGTON STATE HOUSING FINANCE COMMISSION | 0,50 | -0,79 | 0,5410 | 0,0305 | ||

| US360059AM10 / Fulton County GA Residential Care Facilities for the Elderly Authority Revenue (Lenbrook Square) | 0,50 | -0,60 | 0,5402 | 0,0323 | ||

| US19645RB342 / Colorado Educational & Cultural Facilities Authority | 0,50 | -0,40 | 0,5401 | 0,0332 | ||

| Atlanta Development Authority/The / DBT (US04780NMW47) | 0,50 | -2,17 | 0,5363 | 0,0240 | ||

| US646067FV57 / NEW JERSEY ST EDUCTNL FACS AUT NJSEDU 09/48 FIXED OID 4.625 | 0,49 | -3,14 | 0,5330 | 0,0186 | ||

| Maryland Economic Development Corp / DBT (US57421HAB96) | 0,49 | 0,5261 | 0,5261 | |||

| US25483VQX54 / DISTRICT OF COLUMBIA | 0,49 | -2,99 | 0,5252 | 0,0191 | ||

| US70870JFN37 / Pennsylvania Economic Development Financing Authority | 0,46 | -10,29 | 0,4992 | -0,0211 | ||

| New Hampshire Business Finance Authority / ABS-MBS (US63607WAQ78) | 0,46 | -5,58 | 0,4935 | 0,0045 | ||

| US2510934P22 / DETROIT MI | 0,45 | -2,78 | 0,4901 | 0,0181 | ||

| MICHIGAN FIN AUTH-RE 5.5 / DBT (US59447NBC92) | 0,45 | -4,07 | 0,4839 | 0,0124 | ||

| US167510BJ40 / CHICAGO IL BRD OF EDU DEDICATE REGD B/E 5.75000000 | 0,45 | -3,46 | 0,4833 | 0,0158 | ||

| James City County Economic Development Authority / DBT (US47029WEG87) | 0,42 | -4,30 | 0,4568 | 0,0103 | ||

| US59807PAE51 / MIDTOWN MIAMI COMMUNITY DEVELOPMENT DISTRICT | 0,41 | -18,00 | 0,4427 | -0,0620 | ||

| US960735AQ15 / CITY OF WESTMINSTER MD | 0,40 | 0,00 | 0,4319 | 0,0280 | ||

| US709225GL46 / Pennsylvania Turnpike Commission | 0,35 | -5,09 | 0,3829 | 0,0061 | ||

| New Hampshire Business Finance Authority / DBT (US63608TAJ97) | 0,32 | -1,23 | 0,3475 | 0,0194 | ||

| US05923TBY47 / BALTIMORE MD SPL OBLIG | 0,32 | -1,24 | 0,3448 | 0,0188 | ||

| Arizona Board of Regents / DBT (US040664LG77) | 0,31 | 0,3389 | 0,3389 | |||

| US48342YAR27 / CITY OF KALISPELL MT | 0,31 | -1,89 | 0,3361 | 0,0153 | ||

| US57582R2B17 / CWLTH OF MASSACHUSETT | 0,31 | 0,3300 | 0,3300 | |||

| Suffolk Regional Off-Track Betting Co / DBT (US86480TAB08) | 0,26 | -1,16 | 0,2761 | 0,0155 | ||

| US4521522J98 / ILLINOIS ST | 0,24 | -1,24 | 0,2588 | 0,0141 | ||

| US26350TAB35 / DU PAGE COUNTY SPECIAL SERVICE AREA NO 31 | 0,23 | -2,14 | 0,2475 | 0,0112 | ||

| US167736U961 / City of Chicago IL Waterworks Revenue | 0,20 | -5,16 | 0,2184 | 0,0027 | ||

| Cumberland County Municipal Authority / DBT (US230614TH27) | 0,15 | -1,33 | 0,1599 | 0,0084 | ||

| US13057GAD16 / CALIFORNIA PUBLIC FIN AUTH SENIOR LIVING REVENUE | 0,14 | -9,03 | 0,1525 | -0,0042 | ||

| US939783SD98 / Washington State Housing Finance Commission | 0,10 | 0,00 | 0,1081 | 0,0064 | ||

| US84129NML00 / Southcentral Pennsylvania General Authority Revenue (WellSpan Health Obligated Group) PUT | 0,10 | -83,33 | 0,1079 | -0,4975 | ||

| US245903AB55 / Delaware County PA Industrial Development Authority Airport Facilities Revenue (United Parcel Service Inc.) VRDO | 0,10 | -96,61 | 0,1079 | -2,8686 | ||

| US 10YR NOTE (CBT) / DIR (000000000) | 0,01 | 0,0130 | 0,0130 | |||

| US194638AD48 / COLLIER CO DEV-A | 0,00 | 0,0001 | 0,0000 |