Grundlæggende statistik

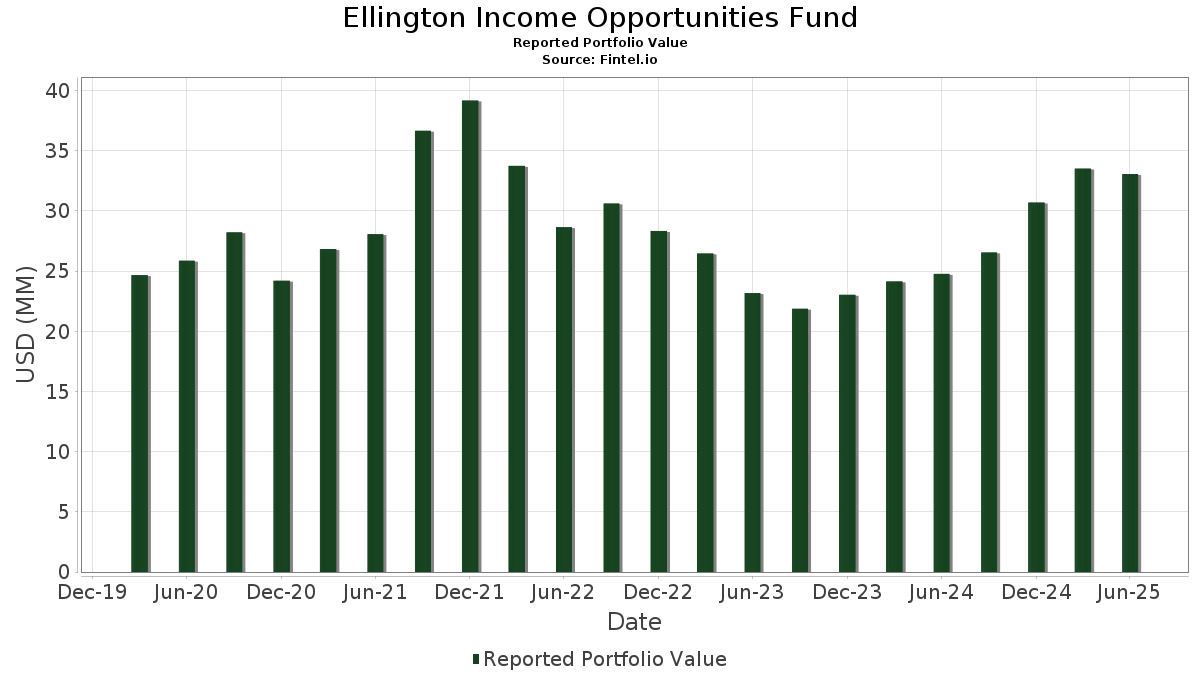

| Porteføljeværdi | $ 33.064.859 |

| Nuværende stillinger | 74 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Ellington Income Opportunities Fund har afsløret 74 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 33.064.859 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Ellington Income Opportunities Funds største beholdninger er STARWOOD MORTGAGE RESIDENTIAL TRUST 2021-4 TSFR1M+450 05/17/2024 144A (US:US78474PAN78) , DBGS 2021-W52 Mortgage Trust (US:US23308LAJ35) , AGNC Investment Corp. - Preferred Stock (US:AGNCP) , CARLYLE US CLO 2019-1 LTD (KY:US14316DAA90) , and BBCMS 2018-CHRS Mortgage Trust (US:US05491VAL09) . Ellington Income Opportunities Funds nye stillinger omfatter STARWOOD MORTGAGE RESIDENTIAL TRUST 2021-4 TSFR1M+450 05/17/2024 144A (US:US78474PAN78) , DBGS 2021-W52 Mortgage Trust (US:US23308LAJ35) , CARLYLE US CLO 2019-1 LTD (KY:US14316DAA90) , BBCMS 2018-CHRS Mortgage Trust (US:US05491VAL09) , and Atrium IX (KY:US04964LAJ89) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,24 | 3,2888 | 3,2888 | ||

| 1,10 | 2,9127 | 2,9127 | ||

| 1,10 | 2,9030 | 2,9030 | ||

| 0,99 | 2,6109 | 2,6109 | ||

| 0,98 | 2,5985 | 2,5985 | ||

| 0,82 | 2,1627 | 2,1627 | ||

| 0,82 | 2,1604 | 2,1604 | ||

| 0,72 | 1,9136 | 1,9136 | ||

| 0,62 | 1,6512 | 1,6512 | ||

| 0,61 | 1,6056 | 1,6056 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -1,52 | -4,0130 | -4,0130 | ||

| -0,90 | -2,3898 | -2,3898 | ||

| 0,12 | 0,3189 | -2,3352 | ||

| -0,88 | -2,3131 | -2,3131 | ||

| -0,81 | -2,1492 | -2,1492 | ||

| -0,79 | -2,0779 | -2,0779 | ||

| -0,76 | -1,9959 | -1,9959 | ||

| -0,71 | -1,8796 | -1,8796 | ||

| -0,63 | -1,6628 | -1,6628 | ||

| 0,52 | 1,3779 | -0,4946 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-29 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US78474PAN78 / STARWOOD MORTGAGE RESIDENTIAL TRUST 2021-4 TSFR1M+450 05/17/2024 144A | 2,02 | 0,90 | 5,3401 | -0,1662 | |||||

| Oportun Issuance Trust 2025-A / ABS-O (US68377TAD00) | 1,60 | 1,14 | 4,2246 | -0,1204 | |||||

| Santander Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US80280BAF58) | 1,48 | 0,61 | 3,9146 | -0,1320 | |||||

| A&D Mortgage Trust 2024-NQM1 / ABS-MBS (US00039GAE98) | 1,43 | -1,38 | 3,7873 | -0,2076 | |||||

| US23308LAJ35 / DBGS 2021-W52 Mortgage Trust | 1,26 | 2,20 | 3,3213 | -0,0598 | |||||

| Tralee Clo VI Ltd / ABS-CBDO (US89289EBW30) | 1,24 | 3,2888 | 3,2888 | ||||||

| AGNCP / AGNC Investment Corp. - Preferred Stock | 0,05 | 0,00 | 1,24 | -0,56 | 3,2872 | -0,1525 | |||

| US14316DAA90 / CARLYLE US CLO 2019-1 LTD | 1,24 | 0,90 | 3,2794 | -0,1023 | |||||

| Blackrock MT Hood CLO X LLC / ABS-CBDO (US09263GAU13) | 1,23 | 0,00 | 3,2425 | -0,1304 | |||||

| Stifel SBA IO Trust Series 2025-1 / ABS-MBS (US86063CAA45) | 1,21 | -5,38 | 3,2106 | -0,3196 | |||||

| US05491VAL09 / BBCMS 2018-CHRS Mortgage Trust | 1,18 | 0,43 | 3,1227 | -0,1137 | |||||

| Alinea CLO 2018-1 Ltd / ABS-CBDO (US016268AD65) | 1,17 | -0,84 | 3,1040 | -0,1533 | |||||

| US04964LAJ89 / Atrium IX | 1,12 | 0,27 | 2,9492 | -0,1101 | |||||

| BX Trust 2025-LUNR / ABS-MBS (US05594CAN48) | 1,10 | 2,9127 | 2,9127 | ||||||

| US12548FAS92 / CIFC Funding 2013-I Ltd | 1,10 | 2,9030 | 2,9030 | ||||||

| Crown Point CLO 8 Ltd / ABS-CBDO (US22846BAQ05) | 1,00 | 0,40 | 2,6533 | -0,0958 | |||||

| BDS 2024-FL13 LLC / ABS-CBDO (US05555MAL37) | 1,00 | -0,60 | 2,6376 | -0,1213 | |||||

| BCRK / Bean Creek CLO Ltd | 1,00 | 0,30 | 2,6335 | -0,0984 | |||||

| US05592AAQ31 / BPR Trust 2021-TY | 0,99 | 2,6109 | 2,6109 | ||||||

| LP LMS 2023-1 Asset Securitization Trust / ABS-O (US50214VAC28) | 0,98 | 2,39 | 2,6014 | -0,0420 | |||||

| MCF CLO IX Ltd / ABS-CBDO (US55282EAE23) | 0,98 | 2,5985 | 2,5985 | ||||||

| US78432WAJ27 / SFO_21-555 | 0,96 | -0,62 | 2,5505 | -0,1192 | |||||

| US05608BAS97 / BX TRUST 2019-IMC G 1ML+360 04/15/2034 144A | 0,94 | -3,11 | 2,4747 | -0,1824 | |||||

| US83438LAC54 / Lunar 2021-1 Structured Aircraft Portfolio Notes | 0,86 | -13,49 | 2,2721 | -0,4594 | |||||

| 830849105 / SKYAF III E (Westjet) | 0,85 | -0,35 | 2,2414 | -0,0973 | |||||

| Magnetite Xxx Ltd / ABS-CBDO (US55953VAC63) | 0,83 | -3,15 | 2,1968 | -0,1644 | |||||

| Raistone - First Brands Supply Chain Finance Program 10/01/25 / LON (N/A) | 0,82 | 2,1627 | 2,1627 | ||||||

| AVENTIV TECHNOLOGIES LLC NEW MONEY LOAN / LON (N/A) | 0,82 | 2,1604 | 2,1604 | ||||||

| US98887UAA34 / Zais Clo 6 Ltd | 0,75 | -15,70 | 1,9890 | -0,4655 | |||||

| US74333VAS34 / Progress Residential 2021-SFR3 | 0,74 | -1,08 | 1,9438 | -0,1013 | |||||

| Raistone - First Brands Supply Chain Finance Program 09/24/25 / LON (N/A) | 0,72 | 1,9136 | 1,9136 | ||||||

| US75383HAA95 / Raptor Aircraft Finance I LLC | 0,71 | -1,94 | 1,8669 | -0,1156 | |||||

| US09229CAB54 / Blackbird Capital Aircraft, Series 2021-1A, Class B | 0,62 | -1,42 | 1,6520 | -0,0897 | |||||

| SIRVA WORLDWIDE INC EXIT FACILITY / LON (N/A) | 0,62 | 1,6512 | 1,6512 | ||||||

| SBA_JVB_03 / LON (N/A) | 0,61 | 1,6056 | 1,6056 | ||||||

| Neuberger Berman Loan Advisers CLO 35 Ltd / ABS-CBDO (US64133CAE93) | 0,56 | -2,45 | 1,4731 | -0,0974 | |||||

| US52606YAC84 / LendingPoint 2020-REV1 Asset Securitization Trust | 0,52 | -23,38 | 1,3779 | -0,4946 | |||||

| US78433XAE04 / Stonepeak 2021-1 ABS | 0,36 | -9,30 | 0,9558 | -0,1397 | |||||

| Monroe Capital Mml Clo XII Ltd / ABS-CBDO (US61034VAN38) | 0,35 | 0,9162 | 0,9162 | ||||||

| US39810JAL08 / Greywolf CLO IV Ltd | 0,30 | -17,68 | 0,7904 | -0,2064 | |||||

| MFA.PRC / MFA Financial, Inc. - Preferred Stock | 0,01 | 0,00 | 0,27 | -5,34 | 0,7047 | -0,0682 | |||

| CENTURYLINK INC TERM B 1L GTD SR. SECD / LON (N/A) | 0,21 | 0,5600 | 0,5600 | ||||||

| US45660NXK61 / RAST 2003-A15 B1 | 0,19 | -7,04 | 0,4914 | -0,0585 | |||||

| NRZ.PRC / New Residential Investment Corp. 6.375% Series C Fixed-to-Floating Rate Cumulative Redeemable Prefer | 0,01 | 0,00 | 0,17 | -2,82 | 0,4569 | -0,0304 | |||

| US00038PAC41 / Aaset 2021-1 Trust | 0,12 | -87,56 | 0,3189 | -2,3352 | |||||

| US89300GAA22 / Tralee CLO V Ltd | 0,10 | 14,94 | 0,2644 | 0,0235 | |||||

| US92917BAC81 / Voya, Ltd. | 0,09 | -23,14 | 0,2472 | -0,0856 | |||||

| Structured Asset Securities Corp Mortgage Pass-Through Ctfs Ser 2003-9A / ABS-MBS (US86359ARP02) | 0,07 | 1,37 | 0,1982 | -0,0028 | |||||

| US12668EAD94 / CWALT 2006-J5 1A4 MTGE | 0,07 | 0,00 | 0,1964 | -0,0081 | |||||

| US01750DAC56 / Allegro CLO VII, Ltd. | 0,06 | -40,38 | 0,1649 | -0,1224 | |||||

| US67112NAC74 / OFSI Fund IX Ltd | 0,04 | -50,60 | 0,1099 | -0,1200 | |||||

| NLY.PRG / Annaly Capital Management, Inc. - Preferred Stock | 0,00 | 0,00 | 0,04 | -2,50 | 0,1043 | -0,0059 | |||

| US89300GAE44 / Tralee CLO V Ltd | 0,04 | 0,00 | 0,0994 | -0,0042 | |||||

| AVENTIV TECHNOLOGIES LLC SECOND OUT TL / LON (N/A) | 0,03 | 0,0848 | 0,0848 | ||||||

| CHL Mortgage Pass-Through Trust 2003-49 / ABS-MBS (US12669EF769) | 0,03 | -16,67 | 0,0797 | -0,0205 | |||||

| US92557RAC88 / Vibrant CLO VIII, Ltd. | 0,02 | -45,45 | 0,0476 | -0,0448 | |||||

| US466247E417 / JP Morgan Mortgage Trust 2006-A1 | 0,01 | -7,14 | 0,0362 | -0,0045 | |||||

| US92332EAB11 / Venture 34 CLO Ltd | 0,00 | -77,78 | 0,0124 | -0,0385 | |||||

| Prime Mortgage Trust 2003-3 / ABS-MBS (US74160MDA71) | 0,00 | -57,14 | 0,0079 | -0,0125 | |||||

| US09629WAE12 / BlueMountain CLO 2018-2 Ltd | 0,00 | -80,00 | 0,0026 | -0,0111 | |||||

| OFSBS-2018-1A-FEE / DBT (N/A) | 0,00 | 0,0004 | 0,0004 | ||||||

| US92330RAC25 / Venture XXIV CLO Ltd | 0,00 | -100,00 | 0,0003 | -0,0380 | |||||

| US92325RAE53 / Venture 32 CLO Ltd | 0,00 | -100,00 | 0,0002 | -0,0081 | |||||

| ANN 2/25/2027 @ 4.037500% / DIR (N/A) | -0,01 | -0,0250 | -0,0250 | ||||||

| ANN 6/17/2031 @ 3.888500% / DIR (N/A) | -0,01 | -0,0346 | -0,0346 | ||||||

| ANN 08/09/32 @ 2.61% / DIR (N/A) | -0,02 | -0,0547 | -0,0547 | ||||||

| USD REPO / RA (N/A) | -0,63 | -1,6628 | -1,6628 | ||||||

| USD REPO / RA (N/A) | -0,71 | -1,8796 | -1,8796 | ||||||

| USD REPO / RA (N/A) | -0,76 | -1,9959 | -1,9959 | ||||||

| USD REPO / RA (N/A) | -0,79 | -2,0779 | -2,0779 | ||||||

| USD REPO / RA (N/A) | -0,81 | -2,1492 | -2,1492 | ||||||

| USD REPO / RA (N/A) | -0,88 | -2,3131 | -2,3131 | ||||||

| USD REPO / RA (N/A) | -0,90 | -2,3898 | -2,3898 | ||||||

| USD REPO / RA (N/A) | -1,52 | -4,0130 | -4,0130 |