Grundlæggende statistik

| Porteføljeværdi | $ 191.033.000 |

| Nuværende stillinger | 98 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

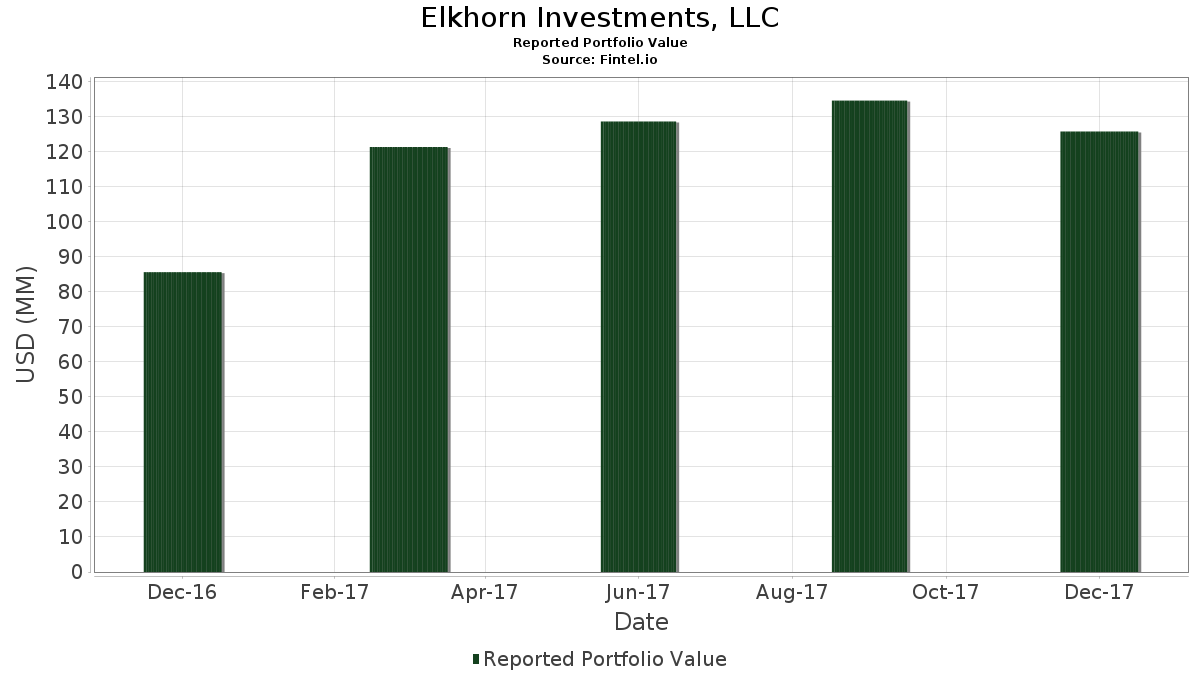

Elkhorn Investments, LLC har afsløret 98 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 191.033.000 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Elkhorn Investments, LLCs største beholdninger er Honeywell International Inc. (US:HON) , The Coca-Cola Company (US:KO) , PepsiCo, Inc. (US:PEP) , Republic Services, Inc. (US:RSG) , and Waste Management, Inc. (US:WM) . Elkhorn Investments, LLCs nye stillinger omfatter Fortive Corporation (US:FTV) , American Express Company (US:AXP) , Abbott Laboratories (US:ABT) , Accenture plc (US:ACN) , and American Water Works Company, Inc. (US:AWK) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,02 | 2,59 | 1,3537 | 1,3537 | |

| 0,06 | 2,53 | 1,3228 | 1,3228 | |

| 0,02 | 2,49 | 1,3029 | 1,3029 | |

| 0,04 | 2,43 | 1,2715 | 1,2715 | |

| 0,02 | 2,38 | 1,2480 | 1,2480 | |

| 0,03 | 2,28 | 1,1935 | 1,1935 | |

| 0,03 | 2,28 | 1,1930 | 1,1930 | |

| 0,03 | 2,25 | 1,1799 | 1,1799 | |

| 0,04 | 2,21 | 1,1579 | 1,1579 | |

| 0,02 | 2,21 | 1,1563 | 1,1563 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,00 | 0,00 | -0,9532 | ||

| 0,01 | 1,89 | 0,9867 | -0,0892 | |

| 0,03 | 1,87 | 0,9768 | -0,0880 | |

| 0,03 | 1,78 | 0,9328 | -0,0777 | |

| 0,03 | 1,82 | 0,9527 | -0,0236 | |

| 0,03 | 2,43 | 1,2699 | -0,0223 | |

| 0,05 | 1,80 | 0,9443 | -0,0104 |

13F og Fondsarkivering

Denne formular blev indsendt den 2018-03-19 for rapporteringsperioden 2017-12-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HON / Honeywell International Inc. | 0,02 | 63,47 | 2,59 | 77,24 | 1,3537 | 1,3537 | |||

| KO / The Coca-Cola Company | 0,06 | 50,09 | 2,53 | 51,77 | 1,3228 | 1,3228 | |||

| PEP / PepsiCo, Inc. | 0,02 | 45,48 | 2,49 | 54,12 | 1,3029 | 1,3029 | |||

| RSG / Republic Services, Inc. | 0,04 | 38,54 | 2,43 | 39,60 | 1,2715 | 1,2715 | |||

| WM / Waste Management, Inc. | 0,03 | 26,95 | 2,43 | 39,59 | 1,2699 | -0,0223 | |||

| BRK.B / Berkshire Hathaway Inc. | 0,01 | 35,35 | 2,42 | 45,61 | 1,2668 | 0,0310 | |||

| ECL / Ecolab Inc. | 0,02 | 47,58 | 2,38 | 54,30 | 1,2480 | 1,2480 | |||

| PG / The Procter & Gamble Company | 0,03 | 55,60 | 2,28 | 55,00 | 1,1935 | 1,1935 | |||

| GL / Globe Life Inc. | 0,03 | 30,77 | 2,28 | 47,22 | 1,1930 | 1,1930 | |||

| AFL / Aflac Incorporated | 0,03 | 42,11 | 2,25 | 53,54 | 1,1799 | 1,1799 | |||

| L / Loews Corporation | 0,04 | 50,32 | 2,21 | 56,66 | 1,1579 | 1,1579 | |||

| FISV / Fiserv, Inc. | 0,02 | 48,75 | 2,21 | 50,37 | 1,1563 | 1,1563 | |||

| APH / Amphenol Corporation | 0,02 | 31,04 | 2,18 | 35,87 | 1,1422 | 1,1422 | |||

| XOM / Exxon Mobil Corporation | 0,03 | 58,78 | 2,18 | 64,65 | 1,1412 | 1,1412 | |||

| HD / The Home Depot, Inc. | 0,01 | 39,08 | 2,16 | 59,88 | 1,1307 | 1,1307 | |||

| YUM / Yum! Brands, Inc. | 0,03 | 40,64 | 2,13 | 55,89 | 1,1155 | 1,1155 | |||

| RTX / RTX Corporation | 0,02 | 24,36 | 2,13 | 37,31 | 1,1155 | 1,1155 | |||

| MCD / McDonald's Corporation | 0,01 | 32,29 | 2,09 | 46,22 | 1,0946 | 0,0313 | |||

| MMM / 3M Company | 0,01 | 16,08 | 2,09 | 30,30 | 1,0941 | 1,0941 | |||

| ALL / The Allstate Corporation | 0,02 | 15,35 | 2,08 | 27,90 | 1,0893 | 1,0893 | |||

| HSY / The Hershey Company | 0,02 | -64,01 | 2,08 | 66,80 | 1,0888 | 0,1616 | |||

| ROP / Roper Technologies, Inc. | 0,01 | 30,52 | 2,05 | 39,77 | 1,0726 | 1,0726 | |||

| FIS / Fidelity National Information Services, Inc. | 0,02 | 39,90 | 2,04 | 40,30 | 1,0679 | 1,0679 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0,03 | 30,63 | 2,03 | 25,29 | 1,0632 | 1,0632 | |||

| DIS / The Walt Disney Company | 0,02 | 19,43 | 2,02 | 35,48 | 1,0595 | 1,0595 | |||

| AJG / Arthur J. Gallagher & Co. | 0,03 | 33,42 | 2,02 | 34,78 | 1,0590 | 1,0590 | |||

| ITW / Illinois Tool Works Inc. | 0,01 | 26,37 | 2,02 | 41,10 | 1,0585 | 1,0585 | |||

| LMT / Lockheed Martin Corporation | 0,01 | 62,49 | 2,02 | 66,75 | 1,0553 | 1,0553 | |||

| CLX / The Clorox Company | 0,01 | 40,14 | 2,01 | 54,02 | 1,0537 | 0,0819 | |||

| NDAQ / Nasdaq, Inc. | 0,03 | 33,50 | 2,00 | 32,01 | 1,0448 | 1,0448 | |||

| VRSK / Verisk Analytics, Inc. | 0,02 | 28,97 | 1,99 | 48,54 | 1,0396 | 1,0396 | |||

| FTV / Fortive Corporation | 0,03 | 1,98 | 1,0375 | 1,0375 | |||||

| PGR / The Progressive Corporation | 0,04 | 18,87 | 1,98 | 35,85 | 1,0354 | 1,0354 | |||

| AXP / American Express Company | 0,02 | 1,97 | 1,0333 | 1,0333 | |||||

| KMB / Kimberly-Clark Corporation | 0,02 | 53,62 | 1,97 | 55,41 | 1,0307 | 1,0307 | |||

| CVX / Chevron Corporation | 0,02 | 43,25 | 1,96 | 55,59 | 1,0270 | 1,0270 | |||

| CBOE / Cboe Global Markets, Inc. | 0,02 | 31,56 | 1,96 | 49,96 | 1,0260 | 1,0260 | |||

| PNW / Pinnacle West Capital Corporation | 0,02 | 61,71 | 1,96 | 60,36 | 1,0250 | 1,0250 | |||

| AEP / American Electric Power Company, Inc. | 0,03 | 50,06 | 1,96 | 54,70 | 1,0244 | 1,0244 | |||

| CB / Chubb Limited | 0,01 | 23,72 | 1,95 | 23,43 | 1,0202 | 1,0202 | |||

| KDP / Keurig Dr Pepper Inc. | 0,02 | 51,27 | 1,95 | 62,90 | 1,0181 | 1,0181 | |||

| NOC / Northrop Grumman Corporation | 0,01 | 25,14 | 1,94 | 32,76 | 1,0140 | 1,0140 | |||

| ES / Eversource Energy | 0,03 | 49,00 | 1,93 | 55,59 | 1,0124 | 1,0124 | |||

| TRV / The Travelers Companies, Inc. | 0,01 | 26,99 | 1,93 | 36,83 | 1,0113 | 1,0113 | |||

| DUK / Duke Energy Corporation | 0,02 | 54,03 | 1,93 | 52,69 | 1,0087 | 1,0087 | |||

| DTE / DTE Energy Company | 0,02 | 51,81 | 1,93 | 53,34 | 1,0082 | 1,0082 | |||

| V / Visa Inc. | 0,02 | 26,43 | 1,92 | 37,55 | 1,0066 | 1,0066 | |||

| NEE / NextEra Energy, Inc. | 0,01 | 52,48 | 1,92 | 61,38 | 1,0061 | 0,1205 | |||

| LHX / L3Harris Technologies, Inc. | 0,01 | 26,76 | 1,92 | 36,75 | 1,0051 | 1,0051 | |||

| UPS / United Parcel Service, Inc. | 0,02 | 34,51 | 1,92 | 38,46 | 1,0045 | 1,0045 | |||

| USB / U.S. Bancorp | 0,04 | 40,34 | 1,91 | 41,46 | 1,0019 | 1,0019 | |||

| AON / Aon plc | 0,01 | 38,03 | 1,90 | 24,14 | 0,9962 | 0,9962 | |||

| MCO / Moody's Corporation | 0,01 | 39,15 | 1,90 | 46,08 | 0,9956 | 0,9956 | |||

| XEL / Xcel Energy Inc. | 0,04 | 56,41 | 1,90 | 57,90 | 0,9935 | 0,9935 | |||

| DHR / Danaher Corporation | 0,02 | 22,17 | 1,89 | 31,66 | 0,9904 | 0,9904 | |||

| APD / Air Products and Chemicals, Inc. | 0,01 | 19,05 | 1,89 | 30,27 | 0,9867 | -0,0892 | |||

| CMS / CMS Energy Corporation | 0,04 | 53,51 | 1,88 | 55,63 | 0,9841 | 0,9841 | |||

| PPL / PPL Corporation | 0,06 | 77,12 | 1,88 | 42,77 | 0,9820 | 0,0050 | |||

| WMT / Walmart Inc. | 0,02 | 25,04 | 1,87 | 57,77 | 0,9778 | 0,9778 | |||

| EXPD / Expeditors International of Washington, Inc. | 0,03 | 20,06 | 1,87 | 30,31 | 0,9768 | -0,0880 | |||

| CNP / CenterPoint Energy, Inc. | 0,07 | 63,22 | 1,86 | 56,55 | 0,9752 | 0,9752 | |||

| C.WSA / Citigroup, Inc. | 0,00 | 31,93 | 1,86 | 50,12 | 0,9752 | 0,0525 | |||

| ABT / Abbott Laboratories | 0,03 | 1,86 | 0,9737 | 0,9737 | |||||

| 74005P104 / Praxair, Inc. | 0,01 | 17,31 | 1,85 | 31,12 | 0,9705 | 0,9705 | |||

| OPI / Office Properties Income Trust | 0,01 | 31,05 | 1,85 | 40,88 | 0,9705 | 0,9705 | |||

| ED / Consolidated Edison, Inc. | 0,02 | 53,31 | 1,85 | 58,70 | 0,9695 | 0,1017 | |||

| SO / The Southern Company | 0,04 | 38,16 | 1,85 | 32,54 | 0,9679 | 0,9679 | |||

| ACN / Accenture plc | 0,01 | 1,84 | 0,9648 | 0,9648 | |||||

| EQR / Equity Residential | 0,03 | 57,20 | 1,83 | 51,36 | 0,9595 | 0,0591 | |||

| WEC / WEC Energy Group, Inc. | 0,03 | 51,58 | 1,83 | 58,77 | 0,9574 | 0,9574 | |||

| AWK / American Water Works Company, Inc. | 0,02 | 1,83 | 0,9574 | 0,9574 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0,03 | 39,05 | 1,82 | 38,61 | 0,9527 | -0,0236 | |||

| BAX / Baxter International Inc. | 0,03 | 1,82 | 0,9511 | 0,9511 | |||||

| MA / Mastercard Incorporated | 0,01 | 16,62 | 1,81 | 25,45 | 0,9496 | 0,9496 | |||

| UNH / UnitedHealth Group Incorporated | 0,01 | 35,45 | 1,81 | 52,87 | 0,9475 | 0,9475 | |||

| PFE / Pfizer Inc. | 0,05 | 37,73 | 1,80 | 40,50 | 0,9443 | -0,0104 | |||

| RTN / Raytheon Co. | 0,01 | 35,16 | 1,80 | 34,91 | 0,9407 | 0,9407 | |||

| MSFT / Microsoft Corporation | 0,02 | 15,84 | 1,79 | 33,61 | 0,9386 | 0,9386 | |||

| AME / AMETEK, Inc. | 0,02 | 1,79 | 0,9365 | 0,9365 | |||||

| D / Dominion Energy, Inc. | 0,02 | 45,99 | 1,78 | 52,35 | 0,9339 | 0,0632 | |||

| PAYX / Paychex, Inc. | 0,03 | 16,88 | 1,78 | 31,13 | 0,9328 | -0,0777 | |||

| AVB / AvalonBay Communities, Inc. | 0,01 | 63,46 | 1,78 | 62,35 | 0,9323 | 0,1166 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0,01 | 1,77 | 0,9286 | 0,9286 | |||||

| SWK / Stanley Black & Decker, Inc. | 0,01 | 14,54 | 1,77 | 27,85 | 0,9276 | 0,9276 | |||

| VRSN / VeriSign, Inc. | 0,02 | 1,75 | 0,9187 | 0,9187 | |||||

| UDR / UDR, Inc. | 0,05 | 1,75 | 0,9166 | 0,9166 | |||||

| PEG / Public Service Enterprise Group Incorporated | 0,03 | 1,74 | 0,9129 | 0,9129 | |||||

| LNT / Alliant Energy Corporation | 0,04 | 1,74 | 0,9129 | 0,9129 | |||||

| GD / General Dynamics Corporation | 0,01 | 37,16 | 1,74 | 33,72 | 0,9114 | 0,9114 | |||

| ETR / Entergy Corporation | 0,02 | 36,95 | 1,73 | 48,03 | 0,9051 | 0,9051 | |||

| AEE / Ameren Corporation | 0,03 | 43,66 | 1,73 | 44,88 | 0,9040 | 0,0177 | |||

| PM / Philip Morris International Inc. | 0,02 | 56,13 | 1,71 | 46,78 | 0,8951 | 0,8951 | |||

| TEL / TE Connectivity plc | 0,02 | 1,71 | 0,8930 | 0,8930 | |||||

| ESS / Essex Property Trust, Inc. | 0,01 | 57,28 | 1,70 | 48,56 | 0,8920 | 0,8920 | |||

| NI / NiSource Inc. | 0,07 | 1,65 | 0,8658 | 0,8658 | |||||

| AIV / Apartment Investment and Management Company | 0,04 | 1,63 | 0,8548 | 0,8548 | |||||

| EIX / Edison International | 0,02 | 54,63 | 1,55 | 26,72 | 0,8119 | 0,8119 | |||

| WTW / Willis Towers Watson Public Limited Company | 0,01 | 1,54 | 0,8056 | 0,8056 | |||||

| RE / Everest Re Group Ltd | 0,00 | -100,00 | 0,00 | -100,00 | 0,0000 | ||||

| JNJ / Johnson & Johnson | 0,00 | -100,00 | 0,00 | -100,00 | 0,0000 | ||||

| DOW / Dow Inc. | 0,00 | -100,00 | 0,00 | -100,00 | -0,9532 | ||||

| EL / The Estée Lauder Companies Inc. | 0,00 | -100,00 | 0,00 | -100,00 | 0,0000 | ||||

| INFO / Harbor ETF Trust - Harbor PanAgora Dynamic Large Cap Core ETF | 0,00 | -100,00 | 0,00 | -100,00 | 0,0000 |