Grundlæggende statistik

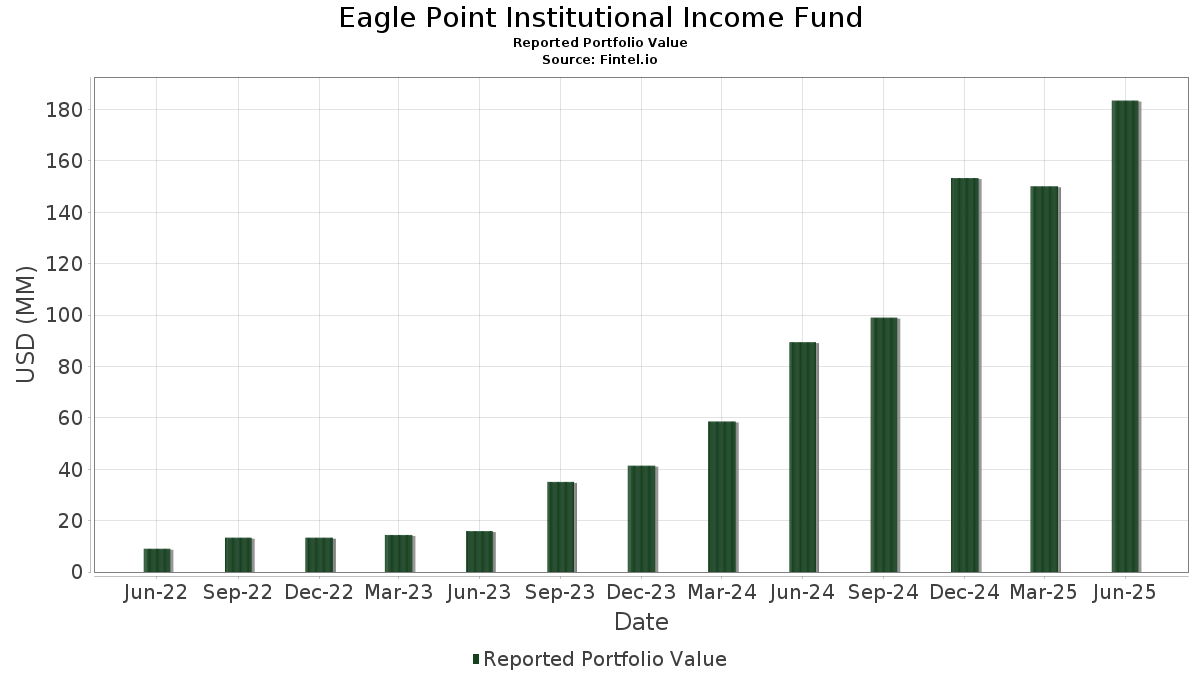

| Porteføljeværdi | $ 183.492.821 |

| Nuværende stillinger | 110 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Eagle Point Institutional Income Fund har afsløret 110 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 183.492.821 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Eagle Point Institutional Income Funds største beholdninger er CLO Income Note (KY:US12575DAA90) , CIFC Funding Ltd (KY:US12565HAC88) , Madison Park Funding XXVIII, Ltd. (KY:US55821BAE65) , Dryden 92 CLO Ltd (KY:US26251HAA14) , and BCC_21-5A (KY:US05682FAA84) . Eagle Point Institutional Income Funds nye stillinger omfatter CLO Income Note (KY:US12575DAA90) , CIFC Funding Ltd (KY:US12565HAC88) , Madison Park Funding XXVIII, Ltd. (KY:US55821BAE65) , Dryden 92 CLO Ltd (KY:US26251HAA14) , and BCC_21-5A (KY:US05682FAA84) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 4,05 | 3,3139 | 3,3139 | ||

| 4,01 | 3,2792 | 3,2792 | ||

| 3,84 | 3,1392 | 3,1392 | ||

| 3,22 | 2,6316 | 2,6316 | ||

| 3,20 | 2,6154 | 2,6154 | ||

| 2,99 | 2,4444 | 2,4444 | ||

| 2,95 | 2,4172 | 2,4172 | ||

| 2,88 | 2,3557 | 2,3557 | ||

| 2,11 | 1,7265 | 1,7265 | ||

| 2,04 | 1,6689 | 1,6689 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,88 | 2,3559 | -0,6627 | ||

| 3,25 | 2,6596 | -0,6312 | ||

| 3,42 | 2,7961 | -0,5644 | ||

| 2,76 | 2,2558 | -0,5542 | ||

| 2,97 | 2,4309 | -0,5294 | ||

| 2,84 | 2,3241 | -0,5136 | ||

| 2,37 | 1,9379 | -0,5000 | ||

| 2,88 | 2,3597 | -0,4882 | ||

| 2,46 | 2,0145 | -0,4595 | ||

| 2,93 | 2,3960 | -0,4573 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-27 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| CLO Income Note / ABS-O (US17182CAA53) | 4,47 | 8,18 | 3,6592 | -0,3591 | ||

| CLO Income Note / ABS-O (US509827AJ00) | 4,34 | 11,41 | 3,5482 | -0,2365 | ||

| CLO Subordinated Note / ABS-O (US22779DAE40) | 4,05 | 3,3139 | 3,3139 | |||

| Loan Accumulation Facility / ABS-O (N/A) | 4,01 | 3,2792 | 3,2792 | |||

| CLO Subordinated Note / ABS-O (US48661XAC02) | 3,84 | 3,1392 | 3,1392 | |||

| US12575DAA90 / CLO Income Note | 3,42 | -1,13 | 2,7961 | -0,5644 | ||

| CLO Subordinated Note / ABS-O (US03165YAC49) | 3,25 | -3,99 | 2,6596 | -0,6312 | ||

| US12565HAC88 / CIFC Funding Ltd | 3,22 | 2,6316 | 2,6316 | |||

| US55821BAE65 / Madison Park Funding XXVIII, Ltd. | 3,20 | 2,6154 | 2,6154 | |||

| CLO Subordinated Note / ABS-O (US14987UAC53) | 3,12 | 21,72 | 2,5546 | 0,0612 | ||

| CLO Subordinated Note / ABS-O (US67119VAC28) | 2,99 | 2,4444 | 2,4444 | |||

| CLO Subordinated Note / ABS-O (US14317EAC21) | 2,97 | 21,42 | 2,4316 | 0,0527 | ||

| CLO Subordinated Note / ABS-O (US67117QAC50) | 2,97 | -2,46 | 2,4309 | -0,5294 | ||

| CLO Secured Note - Class E-R / ABS-CBDO (US64134DAL01) | 2,95 | 2,4172 | 2,4172 | |||

| US26251HAA14 / Dryden 92 CLO Ltd | 2,95 | 0,51 | 2,4157 | -0,4398 | ||

| CLO Subordinated Note / ABS-O (US58286RAC79) | 2,93 | 2,95 | 2,3990 | -0,3704 | ||

| CLO Income Note / ABS-O (US067923AA01) | 2,93 | -0,24 | 2,3960 | -0,4573 | ||

| US05682FAA84 / BCC_21-5A | 2,90 | 1,22 | 2,3710 | -0,4118 | ||

| US48251GAC33 / KKR Clo 17 Ltd | 2,88 | -1,54 | 2,3597 | -0,4882 | ||

| CLO Income Note / ABS-O (US04020KAA16) | 2,88 | -7,28 | 2,3559 | -0,6627 | ||

| US758464AC57 / Reese Park CLO, Ltd | 2,88 | 2,3557 | 2,3557 | |||

| CLO Subordinated Note / ABS-O (US402564AC28) | 2,84 | 5,37 | 2,3282 | -0,2971 | ||

| CLO Subordinated Note / ABS-O (US04020GAC69) | 2,84 | -2,71 | 2,3241 | -0,5136 | ||

| CLO Income Note / ABS-O (US04020YAA10) | 2,76 | -4,60 | 2,2558 | -0,5542 | ||

| CLO Subordinated Note / ABS-O (US12554FAC59) | 2,68 | 0,90 | 2,1927 | -0,3885 | ||

| US67591XAC56 / Octagon Investment Partners 38 Ltd | 2,68 | 1,33 | 2,1902 | -0,3776 | ||

| US675934AA16 / CLO Income Note | 2,68 | 4,25 | 2,1898 | -0,3058 | ||

| CLO Subordinated Note / ABS-O (US06763JAC62) | 2,65 | 3,64 | 2,1694 | -0,3172 | ||

| CLO Subordinated Note / ABS-O (US70019EAC57) | 2,47 | -2,56 | 2,0255 | -0,4436 | ||

| CLO Subordinated Note / ABS-O (US67119NAC02) | 2,46 | -1,00 | 2,0166 | -0,4038 | ||

| US143134AC86 / CARLYLE US CLO 2021-6, Ltd. | 2,46 | 7,84 | 2,0152 | -0,2057 | ||

| CLO Preferred Share / ABS-O (US67113M2035) | 2,46 | -3,26 | 2,0145 | -0,4595 | ||

| US23605DAC65 / Danby Park CLO Ltd | 2,42 | -3,08 | 1,9822 | -0,4475 | ||

| US12556CAC01 / CLO Subordinated Note | 2,42 | 0,37 | 1,9775 | -0,3634 | ||

| USG8104PAB16 / SHACK 2019-14A SUB MTGE PREFERRED STOCK | 2,41 | 7,92 | 1,9752 | -0,2002 | ||

| US26248LAC46 / Dryden Senior Loan Fund | 2,39 | 23,40 | 1,9554 | 0,0726 | ||

| US26253JAC18 / CLO Subordinated Note | 2,38 | 9,08 | 1,9480 | -0,1730 | ||

| CLO Subordinated Note / ABS-O (US617937AC13) | 2,37 | -5,55 | 1,9379 | -0,5000 | ||

| CLO Subordinated Note / ABS-O (US75888DAC48) | 2,35 | -2,53 | 1,9228 | -0,4210 | ||

| CLO Subordinated Note / ABS-O (US00192XAC92) | 2,31 | -3,35 | 1,8895 | -0,4329 | ||

| CLO Subordinated Note / ABS-O (US46146WAG24) | 2,25 | 1,21 | 1,8452 | -0,3213 | ||

| US98625VAC46 / York Clo-3 Ltd | 2,21 | -3,99 | 1,8110 | -0,4304 | ||

| US14315KAC09 / CGMS 2017-2A SUB MTGE PREFERRED STOCK | 2,21 | 12,26 | 1,8063 | -0,1052 | ||

| CLO Subordinated Note / ABS-O (US00871QAC24) | 2,17 | 3,33 | 1,7799 | -0,2667 | ||

| Loan Accumulation Facility / ABS-O (N/A) | 2,11 | 1,7265 | 1,7265 | |||

| CLO Income Note / ABS-O (US039958AA16) | 2,04 | 1,6689 | 1,6689 | |||

| CLO Income Note / ABS-O (US080494AA52) | 2,02 | -1,66 | 1,6499 | -0,3430 | ||

| US14318EAC12 / CLO Subordinated Note | 1,98 | 124,94 | 1,6167 | 0,7623 | ||

| US67118JAC09 / OCP CLO 2021-22 Ltd | 1,92 | -2,09 | 1,5731 | -0,3355 | ||

| US143113AC24 / CLO Income Note | 1,92 | 7,68 | 1,5726 | -0,1628 | ||

| CLO Subordinated Note / ABS-O (US78111FAE88) | 1,90 | 0,69 | 1,5515 | -0,2787 | ||

| US26248GAA94 / CLO Income Note | 1,87 | 5,85 | 1,5269 | -0,1868 | ||

| CLO Subordinated Note / ABS-O (US03166JAC62) | 1,82 | 21,79 | 1,4913 | 0,0362 | ||

| US12551BAC72 / CIFC Funding 2017-I, Ltd. | 1,80 | -2,17 | 1,4768 | -0,3168 | ||

| US55822CAC73 / MDPK 2021-52A SUB 01/22/2035 | 1,78 | -5,73 | 1,4538 | -0,3786 | ||

| US12548KAC36 / CIFC Funding 2017-III, Ltd. | 1,74 | 0,40 | 1,4278 | -0,2621 | ||

| CLO Subordinated Note / ABS-O (US75888LAC63) | 1,62 | -7,67 | 1,3293 | -0,3820 | ||

| US12567XAE76 / CIFC Funding 2022-IV, Ltd. | 1,59 | 7,00 | 1,3017 | -0,1443 | ||

| US05684TAC27 / Bain Capital Credit CLO 2021-2, Ltd. | 1,58 | -5,45 | 1,2927 | -0,3316 | ||

| US05682JAC62 / CLO Subordinated Note | 1,54 | -1,41 | 1,2610 | -0,2585 | ||

| Loan Accumulation Facility / ABS-O (N/A) | 1,54 | 1,2571 | 1,2571 | |||

| US00142DAL47 / CLO Income Note | 1,42 | 25,35 | 1,1659 | 0,0604 | ||

| CLO Subordinated Note / ABS-O (US29002DAE85) | 1,41 | -0,84 | 1,1542 | -0,2290 | ||

| US278301AC04 / EATON VANCE CLO 2020-1 SERIES: 2020-1A CLASS: SUB | 1,34 | -1,54 | 1,1007 | -0,2273 | ||

| US670864AC19 / OCP CLO 2020-20, Ltd. | 1,17 | -2,66 | 0,9608 | -0,2111 | ||

| US73052WAC73 / Point Au Roche Park CLO Ltd | 1,06 | 1,24 | 0,8692 | -0,1508 | ||

| CLO Subordinated Note / ABS-O (US14318NAC11) | 1,01 | 0,8300 | 0,8300 | |||

| CLO Subordinated Note / ABS-O (US77340YAC66) | 1,00 | 2,78 | 0,8180 | -0,1281 | ||

| US97316GAC33 / CLO Income Note | 0,96 | 9,73 | 0,7853 | -0,0653 | ||

| US77341YAC57 / Rockford Tower CLO 2022-3 Ltd | 0,92 | 4,88 | 0,7565 | -0,1004 | ||

| US758969AC32 / Regatta XXII Funding Ltd | 0,89 | 23,68 | 0,7311 | 0,0288 | ||

| CLO Subordinated Note / ABS-O (US55822WAE93) | 0,86 | 0,7007 | 0,7007 | |||

| CLO Subordinated Note / ABS-O (US46145YAE41) | 0,74 | 8,33 | 0,6068 | -0,0585 | ||

| US55817JAE55 / CLO Subordinated Note | 0,69 | -10,07 | 0,5636 | -0,1806 | ||

| US98625WAC29 / York Clo-4 Ltd | 0,64 | 2,58 | 0,5209 | -0,0829 | ||

| US14318PAA03 / CLO Income Note | 0,62 | 1,80 | 0,5096 | -0,0846 | ||

| US04019NAC48 / Ares LXIV CLO Ltd | 0,60 | 24,90 | 0,4888 | 0,0240 | ||

| CLO Subordinated Note / ABS-O (US04019GAC96) | 0,59 | 0,51 | 0,4846 | -0,0885 | ||

| US55820HAC88 / Madison Park Funding XXXIV Ltd., Series 2019-34A, Class SUB | 0,58 | -7,01 | 0,4784 | -0,1332 | ||

| US07403LAA98 / CLO Income Note | 0,55 | -1,95 | 0,4525 | -0,0954 | ||

| US89300KAA34 / CLO Secured Note - Class E | 0,55 | 1,29 | 0,4501 | -0,0775 | ||

| CLO Subordinated Note / ABS-O (US55819UAQ13) | 0,53 | -3,99 | 0,4338 | -0,1030 | ||

| US12569BAE39 / CLO Income Note | 0,50 | 2,87 | 0,4108 | -0,0632 | ||

| US06762GAA76 / CLO Income Note | 0,50 | -0,40 | 0,4059 | -0,0775 | ||

| US29003XAE31 / Elmwood CLO 14, Ltd. | 0,49 | -9,36 | 0,4046 | -0,1261 | ||

| US67577NAC56 / CLO Subordinated Note | 0,47 | -18,25 | 0,3816 | -0,1737 | ||

| US12555GAC24 / CIFC Funding 2019-V, Ltd. | 0,46 | 4,55 | 0,3765 | -0,0521 | ||

| US07136QAA22 / CLO Income Note | 0,44 | -2,85 | 0,3633 | -0,0809 | ||

| USG3034PAB79 / EATON VANCE CLO 2020-2A SERIES: 2020-2A CLASS: SUB | 0,44 | 0,23 | 0,3606 | -0,0664 | ||

| US55819UAC27 / Madison Park Funding XX, Ltd. | 0,42 | -8,32 | 0,3435 | -0,1015 | ||

| US496097AC00 / Kings Park CLO Ltd | 0,41 | -5,08 | 0,3366 | -0,0852 | ||

| US12551NAC11 / CIFC Funding 2017-V, Ltd. | 0,40 | 3,10 | 0,3267 | -0,0504 | ||

| US75889TAC80 / Regatta XXIV Funding, Ltd. | 0,39 | -7,66 | 0,3165 | -0,0903 | ||

| US37147MAC10 / CLO Subordinated Note | 0,37 | 4,24 | 0,3026 | -0,0418 | ||

| US75889KAC71 / CLO Subordinated Note | 0,36 | -4,77 | 0,2941 | -0,0733 | ||

| US12547JAC71 / CLO Subordinated Note | 0,35 | 0,57 | 0,2896 | -0,0523 | ||

| US758464AG61 / Reese Park CLO, Ltd | 0,33 | 0,2672 | 0,2672 | |||

| Loan Accumulation Facility / ABS-O (N/A) | 0,31 | 0,2565 | 0,2565 | |||

| US06762KAC45 / Barings CLO Ltd 2021-II | 0,28 | 3,31 | 0,2302 | -0,0349 | ||

| Loan Accumulation Facility / ABS-O (N/A) | 0,27 | 0,2181 | 0,2181 | |||

| US09629XAC39 / CLO Subordinated Note | 0,26 | 11,02 | 0,2146 | -0,0151 | ||

| CLO Class R2 Note / ABS-O (US75888LAW28) | 0,20 | 91,43 | 0,1649 | 0,0624 | ||

| US92326HAC07 / CLO Subordinated Note | 0,18 | -27,38 | 0,1499 | -0,0960 | ||

| Loan Accumulation Facility / ABS-O (N/A) | 0,17 | 0,1377 | 0,1377 | |||

| CLO Class Y Note / ABS-O (US46146WAE75) | 0,17 | -3,47 | 0,1369 | -0,0318 | ||

| US97316HAA59 / CLO Income Note | 0,17 | 0,60 | 0,1369 | -0,0252 | ||

| US12547KAA88 / CIFC Funding 2020-II, Ltd. | 0,11 | 0,93 | 0,0894 | -0,0161 | ||

| US06744PAC68 / Bardot CLO, Ltd. | 0,08 | 1,20 | 0,0689 | -0,0119 | ||

| CLO Class Y Note / ABS-O (US46145YAC84) | 0,02 | -8,00 | 0,0188 | -0,0058 | ||

| CLO Class R1A Note / ABS-O (US75888LAS16) | 0,02 | 100,00 | 0,0183 | 0,0069 |