Grundlæggende statistik

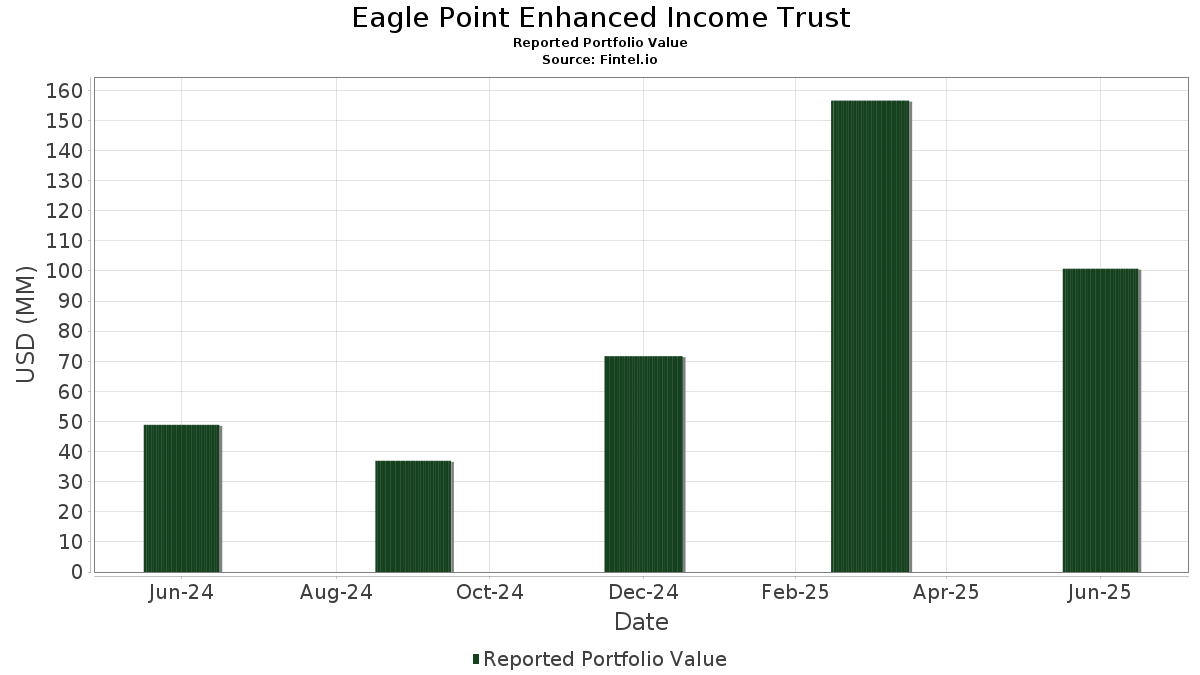

| Porteføljeværdi | $ 100.744.821 |

| Nuværende stillinger | 87 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Eagle Point Enhanced Income Trust har afsløret 87 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 100.744.821 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Eagle Point Enhanced Income Trusts største beholdninger er Asset Backed Security (DE:XS2525742982) , CLO Subordinated Note (KY:US14318EAC12) , CLO Income Note (KY:US143113AC24) , Marianne Credit Linked Note (FR:FR001400KS18) , and Trinity Capital Inc. (US:TRIN) . Eagle Point Enhanced Income Trusts nye stillinger omfatter Asset Backed Security (DE:XS2525742982) , CLO Subordinated Note (KY:US14318EAC12) , CLO Income Note (KY:US143113AC24) , Marianne Credit Linked Note (FR:FR001400KS18) , and Trinity Capital Inc. (US:TRIN) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,42 | 5,3847 | 5,3847 | ||

| 3,09 | 4,8685 | 4,8685 | ||

| 2,22 | 3,5025 | 3,5025 | ||

| 2,20 | 3,4736 | 3,4736 | ||

| 2,11 | 3,3197 | 3,3197 | ||

| 1,87 | 1,88 | 2,9673 | 2,9673 | |

| 1,69 | 2,6689 | 2,6689 | ||

| 0,00 | 1,52 | 2,3959 | 2,3959 | |

| 1,52 | 2,3931 | 2,3931 | ||

| 1,52 | 2,3891 | 2,3891 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -0,82 | -1,2992 | -1,2992 | ||

| 2,51 | 3,9505 | -0,9955 | ||

| 2,51 | 3,9519 | -0,7272 | ||

| 1,38 | 2,1707 | -0,5593 | ||

| 1,04 | 1,6472 | -0,5388 | ||

| 1,71 | 2,6930 | -0,4602 | ||

| 1,56 | 2,4556 | -0,4499 | ||

| 1,24 | 1,9544 | -0,4330 | ||

| 2,49 | 3,9312 | -0,3810 | ||

| 1,30 | 2,0469 | -0,3737 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-22 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Credit Linked Note / ABS-MBS (IT0005641193) | 4,59 | 8,94 | 7,2415 | -0,0515 | |||||

| Credit Linked Note / ABS-CBDO (XS3046340579) | 3,42 | 5,3847 | 5,3847 | ||||||

| XS2525742982 / Asset Backed Security | 3,11 | 30,52 | 4,8954 | 0,7797 | |||||

| Senior Secured Term Loan, DD / DBT (N/A) | 3,09 | 4,8685 | 4,8685 | ||||||

| Class AR Note / ABS-MBS (FR001400Y1W7) | 2,94 | 8,92 | 4,6420 | -0,0330 | |||||

| CLO Subordinated Note / ABS-O (US03166JAC62) | 2,56 | 22,35 | 4,0391 | 0,4163 | |||||

| Class B Note / ABS-MBS (XS2936127146) | 2,51 | -7,32 | 3,9519 | -0,7272 | |||||

| Credit Linked Note - Class R / ABS-MBS (US90357PBJ21) | 2,51 | -12,38 | 3,9505 | -0,9955 | |||||

| Class C Note / ABS-O (US91825NAJ00) | 2,49 | 0,04 | 3,9312 | -0,3810 | |||||

| US14318EAC12 / CLO Subordinated Note | 2,27 | 7,27 | 3,5817 | -0,0825 | |||||

| Class C Note / ABS-O (US463920AC29) | 2,26 | -0,18 | 3,5672 | -0,3543 | |||||

| Senior Secured Note, DD / DBT (N/A) | 2,22 | 3,5025 | 3,5025 | ||||||

| Senior Secured Term Loan, DD / LON (N/A) | 2,20 | 3,4736 | 3,4736 | ||||||

| Class E Note / ABS-MBS (XS2695400106) | 2,13 | 0,14 | 3,3567 | -0,3204 | |||||

| Credit Linked Note / ABS-MBS (N/A) | 2,11 | 3,3197 | 3,3197 | ||||||

| Partnership Interest / EC (N/A) | 1,87 | 1,88 | 2,9673 | 2,9673 | |||||

| Class G Note / ABS-O (FR001400I3F8) | 1,77 | -1,94 | 2,7911 | -0,3314 | |||||

| Class E2 Note / ABS-CBDO (XS2654103832) | 1,74 | -0,51 | 2,7494 | -0,2829 | |||||

| Subordinated Loan, DD / ABS-O (US00165VAG77) | 1,71 | -6,31 | 2,6930 | -0,4602 | |||||

| Environmental Improvement Revenue Bonds (Aymium Williams Project), Series 2022A / DBT (US130488AJ88) | 1,69 | 2,6689 | 2,6689 | ||||||

| CLO Income Note / ABS-O (US04020KAA16) | 1,56 | -7,32 | 2,4556 | -0,4499 | |||||

| Credit Linked Note / ABS-MBS (FR001400SCB5) | 1,55 | -4,22 | 2,4363 | -0,3541 | |||||

| US143113AC24 / CLO Income Note | 1,54 | 7,69 | 2,4281 | -0,0461 | |||||

| Convertible Preferred Shares / EP (N/A) | 0,00 | 1,52 | 2,3959 | 2,3959 | |||||

| Senior Secured Class C Note / LON (N/A) | 1,52 | 2,3931 | 2,3931 | ||||||

| CLO Income Note / ABS-O (US039958AA16) | 1,52 | 2,3891 | 2,3891 | ||||||

| Loan Accumulation Facility / ABS-O (N/A) | 1,49 | 2,3540 | 2,3540 | ||||||

| Credit Linked Note / ABS-MBS (IT0005656670) | 1,47 | 2,3210 | 2,3210 | ||||||

| Class R Note / ABS-O (US14076LAK98) | 1,40 | 1,45 | 2,2070 | -0,1801 | |||||

| Class A Note / DBT (XS2554135207) | 1,39 | -0,86 | 2,1866 | -0,2328 | |||||

| Senior Secured Term Loan, DD / LON (23942LAD8) | 1,38 | -12,74 | 2,1707 | -0,5593 | |||||

| Mezzanine Loan, DD / ABS-MBS (N/A) | 1,35 | 2,1247 | 2,1247 | ||||||

| Credit Linked Note - Class G / ABS-O (US80280BAG32) | 1,34 | -0,15 | 2,1181 | -0,2086 | |||||

| CLO Subordinated Note / ABS-O (US617926AC40) | 1,30 | -7,22 | 2,0469 | -0,3737 | |||||

| CLO Subordinated Note / ABS-O (XS2949616663) | 1,29 | 9,34 | 2,0315 | -0,0061 | |||||

| FR001400KS18 / Marianne Credit Linked Note | 1,24 | -10,22 | 1,9544 | -0,4330 | |||||

| Common Equity / EC (N/A) | 1,23 | 1,23 | 1,9450 | 1,9450 | |||||

| Floating Rate Note / DBT (US05603CAA18) | 1,21 | 0,42 | 1,9024 | -0,1755 | |||||

| Class EX5 Note / ABS-O (US14688XAN75) | 1,20 | -2,28 | 1,8935 | -0,2327 | |||||

| Subordinated Note, DD / LON (N/A) | 1,19 | 1,8745 | 1,8745 | ||||||

| Credit Linked Note / ABS-O (XS2727598984) | 1,16 | -0,69 | 1,8230 | -0,1902 | |||||

| Loan Accumulation Facility / ABS-O (N/A) | 1,15 | 1,8157 | 1,8157 | ||||||

| CLO Secured Note - Class D-R2 / ABS-CBDO (USG52784AD00) | 1,13 | -4,22 | 1,7879 | -0,2604 | |||||

| CLO Subordinated Note / ABS-O (US48254RAC60) | 1,10 | -0,90 | 1,7398 | -0,1865 | |||||

| TRIN / Trinity Capital Inc. | 0,07 | 1,05 | 1,6611 | 1,6611 | |||||

| Credit Linked Note / ABS-CBDO (FR001400OP09) | 1,04 | -17,41 | 1,6472 | -0,5388 | |||||

| CLO Subordinated Note / ABS-O (XS2982106739) | 0,97 | 4,21 | 1,5234 | -0,0806 | |||||

| Class B Note / DBT (XS2554144613) | 0,88 | -0,45 | 1,3827 | -0,1422 | |||||

| CLO Subordinated Note / ABS-O (XS2952454416) | 0,81 | 3,06 | 1,2739 | -0,0830 | |||||

| Class G Note / ABS-O (ES0305733067) | 0,80 | 0,00 | 1,2652 | -0,1228 | |||||

| Class B Note / ABS-MBS (778926691) | 0,79 | 0,64 | 1,2388 | -0,1103 | |||||

| CLO Subordinated Note / ABS-O (XS2868167383) | 0,77 | 1,58 | 1,2149 | -0,0971 | |||||

| Senior Secured Term Loan C, DD / LON (N/A) | 0,73 | 1,1570 | 1,1570 | ||||||

| CLO Class M-2 Note / ABS-O (XS2210217381) | 0,72 | -4,24 | 1,1412 | -0,1661 | |||||

| Environmental Improvement Revenue Bonds (Aymium Williams Project), Series 2022A / DBT (US130488AF66) | 0,72 | 1,1281 | 1,1281 | ||||||

| CLO Subordinated Note / ABS-O (US00871QAC24) | 0,71 | 3,22 | 1,1143 | -0,0689 | |||||

| Credit Linked Note / ABS-MBS (XS2779782965) | 0,70 | 6,36 | 1,1075 | -0,0344 | |||||

| CLO Class M-1 Note / ABS-O (XS2210216813) | 0,69 | -2,68 | 1,0873 | -0,1383 | |||||

| Senior Secured Term Loan, DD / LON (N/A) | 0,67 | 1,0525 | 1,0525 | ||||||

| CLO Subordinated Note / ABS-O (US04019GAC96) | 0,61 | 0,50 | 0,9546 | -0,0879 | |||||

| CLO Secured Note - Class ER / ABS-CBDO (US617926AE06) | 0,59 | 0,9276 | 0,9276 | ||||||

| CLO Subordinated Note / ABS-O (XS2559001610) | 0,58 | -0,17 | 0,9144 | -0,0908 | |||||

| US0389238504 / ARBOR REALTY TRUST INC SER F 6.25%/VAR PFD PERP | 0,03 | 0,00 | 0,54 | -3,25 | 0,8449 | -0,1126 | |||

| Environmental Improvement Revenue Bonds (Aymium Williams Project), Series 2022A / DBT (US130488AE91) | 0,52 | 0,8203 | 0,8203 | ||||||

| US67578DAC65 / Octagon Investment Partners 49 Ltd | 0,50 | 6,11 | 0,7955 | -0,0263 | |||||

| CLO Subordinated Note / ABS-O (XS2893033329) | 0,50 | 8,41 | 0,7942 | -0,0085 | |||||

| US26251KAC09 / Dryden 90 Clo Ltd | 0,49 | 0,00 | 0,7738 | -0,0738 | |||||

| US378654AG27 / Subordinated Loan, Delayed Draw | 0,48 | -9,43 | 0,7578 | -0,1589 | |||||

| US378654AC13 / Class B Loan, Delayed Draw | 0,41 | -0,73 | 0,6411 | -0,0678 | |||||

| US12551NAC11 / CIFC Funding 2017-V, Ltd. | 0,40 | 3,10 | 0,6292 | -0,0414 | |||||

| RCD / Ready Capital Corporation - Corporate Bond/Note | 0,02 | 0,00 | 0,36 | -3,48 | 0,5697 | -0,0780 | |||

| Environmental Improvement Revenue Bonds (Aymium Williams Project), Series 2022A / DBT (US130488AH23) | 0,35 | 0,5469 | 0,5469 | ||||||

| Loan Accumulation Facility / ABS-O (N/A) | 0,34 | 0,5300 | 0,5300 | ||||||

| Common Units / EC (N/A) | 0,00 | 0,32 | 0,4967 | 0,4967 | |||||

| US38741L3050 / Granite Point Mortgage Trust Inc | 0,01 | 0,00 | 0,21 | 3,48 | 0,3291 | -0,0194 | |||

| Warrants / (N/A) | 0,20 | 0,3218 | 0,3218 | ||||||

| US378654AE78 / Class C Loan, Delayed Draw | 0,19 | -1,59 | 0,2938 | -0,0342 | |||||

| Partnership Interest / EC (N/A) | 0,15 | 0,2334 | 0,2334 | ||||||

| Environmental Improvement Revenue Bonds (Aymium Williams Project), Series 2022A / DBT (US130488AK51) | 0,13 | 0,2053 | 0,2053 | ||||||

| Common Equity / EC (N/A) | 0,00 | 0,12 | 0,1968 | 0,1968 | |||||

| Warrants / (N/A) | 0,06 | 0,0900 | 0,0900 | ||||||

| Preferred Units / EP (N/A) | 0,00 | 0,05 | 0,0797 | 0,0797 | |||||

| Forward Contracts: EUR 07/31/2025 / DFE (N/A) | 0,02 | 0,0307 | 0,0307 | ||||||

| Warrants / (N/A) | 0,00 | 0,0003 | 0,0003 | ||||||

| Common Units / EC (N/A) | 0,00 | 0,00 | 0,0002 | 0,0002 | |||||

| Senior Secured Class C Note / DBT (N/A) | 0,00 | 0,0000 | 0,0000 | ||||||

| Forward Contracts: EUR 07/31/2025 / DFE (N/A) | -0,03 | -0,0425 | -0,0425 | ||||||

| Forward Contracts: EUR 07/31/2025 / DFE (N/A) | -0,82 | -1,2992 | -1,2992 |