Grundlæggende statistik

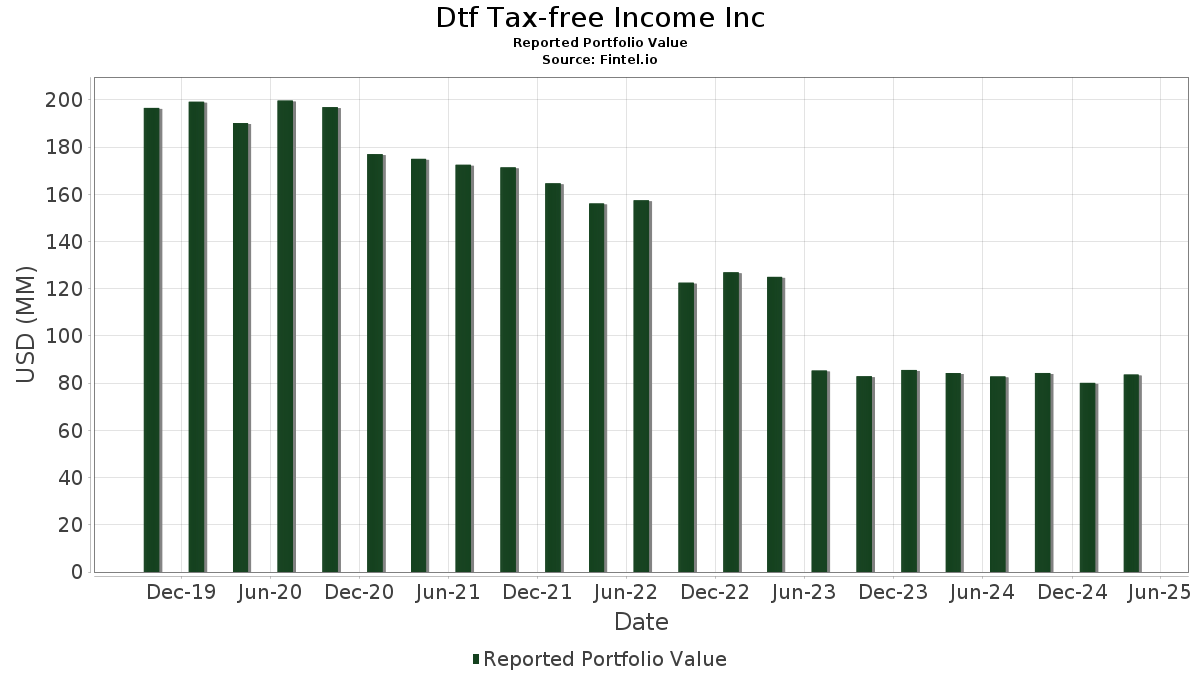

| Porteføljeværdi | $ 83.641.213 |

| Nuværende stillinger | 83 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Dtf Tax-free Income Inc har afsløret 83 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 83.641.213 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Dtf Tax-free Income Incs største beholdninger er Kentucky Turnpike Authority (US:US491552Q736) , County of Seminole FL Sales Tax Revenue (US:US816691EW50) , State of Illinois (US:US452151YD98) , City of Omaha NE (US:US681712PR08) , and PUBLIC AUTHORITY FOR COLORADO ENERGY (US:US744387AC51) . Dtf Tax-free Income Incs nye stillinger omfatter Kentucky Turnpike Authority (US:US491552Q736) , County of Seminole FL Sales Tax Revenue (US:US816691EW50) , State of Illinois (US:US452151YD98) , City of Omaha NE (US:US681712PR08) , and PUBLIC AUTHORITY FOR COLORADO ENERGY (US:US744387AC51) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,00 | 2,3653 | 2,3653 | ||

| 1,61 | 1,9071 | 1,9071 | ||

| 1,60 | 1,8902 | 1,8902 | ||

| 1,41 | 1,6648 | 1,6648 | ||

| 1,30 | 1,5381 | 1,5381 | ||

| 1,30 | 1,5358 | 1,5358 | ||

| 1,06 | 1,2515 | 1,2515 | ||

| 1,05 | 1,2487 | 1,2487 | ||

| 1,04 | 1,2263 | 1,2263 | ||

| 1,01 | 1,1917 | 1,1917 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,75 | 0,8887 | -0,8727 | ||

| 2,74 | 3,2415 | -0,0753 | ||

| 0,47 | 0,5539 | -0,0309 | ||

| 1,13 | 1,3359 | -0,0228 | ||

| 2,15 | 2,5413 | -0,0169 | ||

| 1,54 | 1,8280 | -0,0150 | ||

| 2,15 | 2,5499 | -0,0133 | ||

| 1,64 | 1,9381 | -0,0111 | ||

| 1,78 | 2,1113 | -0,0102 | ||

| 0,54 | 0,6421 | -0,0092 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-27 for rapporteringsperioden 2025-04-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US491552Q736 / Kentucky Turnpike Authority | 3,25 | -0,64 | 3,8533 | 0,0218 | ||

| New Jersey Transportation Trust Fund Authority / DBT (US64613CEK09) | 2,74 | -3,42 | 3,2415 | -0,0753 | ||

| US816691EW50 / County of Seminole FL Sales Tax Revenue | 2,21 | -1,34 | 2,6218 | -0,0035 | ||

| State of Louisiana / DBT (US546417JK30) | 2,15 | -1,73 | 2,5499 | -0,0133 | ||

| US452151YD98 / State of Illinois | 2,15 | -1,87 | 2,5413 | -0,0169 | ||

| Oklahoma Capitol Improvement Authority / DBT (US679088MR27) | 2,05 | -0,63 | 2,4213 | 0,0132 | ||

| US681712PR08 / City of Omaha NE | 2,01 | -0,89 | 2,3755 | 0,0071 | ||

| Minnesota Rural Water Finance Authority Inc / DBT (US60411PBE07) | 2,00 | 2,3653 | 2,3653 | |||

| Alachua County Housing Finance Authority / DBT (US01068LAS97) | 2,00 | -0,15 | 2,3630 | 0,0249 | ||

| US744387AC51 / PUBLIC AUTHORITY FOR COLORADO ENERGY | 1,87 | -0,69 | 2,2161 | 0,0117 | ||

| US66285WHF68 / North Texas Tollway Authority, Special Projects System Revenue Bonds, Convertible Capital Appreciation Series 2011C | 1,78 | -1,65 | 2,1113 | -0,0102 | ||

| Rhode Island Commerce Corp / DBT (US762232BX39) | 1,65 | -1,61 | 1,9586 | -0,0087 | ||

| TXS / Texas Capital Funds Trust - Texas Capital Texas Equity Index ETF | 1,64 | -1,74 | 1,9381 | -0,0111 | ||

| New York City Transitional Finance Authority / DBT (US64972JHS06) | 1,61 | 1,9071 | 1,9071 | |||

| Massachusetts Clean Water Trust/The / DBT (US575829JS66) | 1,60 | 1,8902 | 1,8902 | |||

| County of Cook IL Sales Tax Revenue / DBT (US213248EF00) | 1,54 | -1,97 | 1,8280 | -0,0150 | ||

| US20774Y3C91 / Connecticut State Health & Educational Facilities Authority | 1,49 | -1,26 | 1,7604 | -0,0021 | ||

| Carroll City-County Hospital Authority / DBT (US144709LM27) | 1,41 | 1,6648 | 1,6648 | |||

| Creek County Educational Facilities Authority / DBT (US225472AZ27) | 1,35 | -0,66 | 1,5998 | 0,0085 | ||

| US362848UE18 / GAINESVILLE FL UTIL SYS REV 17A 5.0% 10-01-32 | 1,30 | 1,5381 | 1,5381 | |||

| US38611TDR59 / Grand Parkway Transportation Corp., Series 2023 | 1,30 | -1,37 | 1,5366 | -0,0016 | ||

| US49151FNK20 / Kentucky (State of) Property & Building Commission (No. 112), Series 2016 B, Ref. RB | 1,30 | 1,5358 | 1,5358 | |||

| US735389ZU56 / PORT SEATTLE 0% 5/1/2032 AMT | 1,28 | -1,08 | 1,5119 | 0,0011 | ||

| US759151BC60 / Regional Transportation District | 1,24 | -1,12 | 1,4655 | 0,0013 | ||

| Oklahoma Water Resources Board / DBT (US67919PUJ01) | 1,22 | -0,81 | 1,4460 | 0,0061 | ||

| Salt River Project Agricultural Improvement & Power District / DBT (US79574CFV00) | 1,22 | -1,37 | 1,4454 | -0,0021 | ||

| US20772KRV34 / CONNECTICUT ST | 1,20 | -1,81 | 1,4169 | -0,0085 | ||

| Boulder Larimer & Weld Counties St Vrain Valley School District Re1J / DBT (US101565L723) | 1,13 | -2,84 | 1,3359 | -0,0228 | ||

| US249182SY37 / DENVER CITY & CNTY CO ARPT REV REGD N/C B/E AMT 5.50000000 | 1,10 | -0,27 | 1,3019 | 0,0125 | ||

| Central Texas Turnpike System / DBT (US88283KBW71) | 1,09 | 95,86 | 1,2901 | 0,6397 | ||

| US593211EW15 / Miami Beach (City of), FL Health Facilities Authority (Mount Sinai Medical Center), Series 2014, Ref. RB | 1,08 | 0,00 | 1,2788 | 0,0153 | ||

| US39081JAH14 / GREAT LAKES WATER MI SR LIEN 16C 5.0% 07-01-28 | 1,08 | -0,74 | 1,2731 | 0,0064 | ||

| State of California / DBT (US13063EDA10) | 1,06 | -1,30 | 1,2558 | -0,0008 | ||

| Commonwealth of Pennsylvania / DBT (US70914P3S92) | 1,06 | -1,30 | 1,2537 | -0,0015 | ||

| Metropolitan Government of Nashville & Davidson County TN Electric Revenue / DBT (US592030S505) | 1,06 | -1,03 | 1,2532 | 0,0019 | ||

| Inglewood Unified School District / DBT (US457110NS93) | 1,06 | 1,2515 | 1,2515 | |||

| Oregon State Lottery / DBT (US68607V6A83) | 1,05 | 1,2487 | 1,2487 | |||

| COUNTY OF SHELBY TN / DBT (US8216863D29) | 1,04 | 1,2263 | 1,2263 | |||

| US452152G881 / ILLINOIS ST | 1,03 | -0,87 | 1,2141 | 0,0035 | ||

| US31200CDK99 / FLORIDA ST ATLANTIC U | 1,02 | -0,58 | 1,2103 | 0,0072 | ||

| US586111PY64 / MEMPHIS-SHELBY C0-D | 1,02 | -0,68 | 1,2092 | 0,0059 | ||

| Regional Transportation District / DBT (US75913TKP83) | 1,02 | -0,78 | 1,2091 | 0,0048 | ||

| Monmouth County Improvement Authority/The / DBT (US60956PS786) | 1,01 | 1,1917 | 1,1917 | |||

| Rural Water Financing Agency / DBT (US781741AV51) | 1,00 | -0,20 | 1,1848 | 0,0122 | ||

| US56682HCG20 / Maricopa County Industrial Development Authority | 1,00 | -0,99 | 1,1803 | 0,0020 | ||

| US20772KEB17 / State of Connecticut | 0,97 | -1,42 | 1,1488 | -0,0031 | ||

| Auburn University / DBT (US050589SV31) | 0,84 | 0,9920 | 0,9920 | |||

| US646039YK78 / NEW JERSEY ST | 0,84 | -0,83 | 0,9909 | 0,0032 | ||

| New York State Dormitory Authority / DBT (US64990F5X84) | 0,79 | -1,50 | 0,9343 | -0,0033 | ||

| City of New Braunfels TX Utility System Revenue / DBT (US642577ZU72) | 0,78 | -1,02 | 0,9184 | 0,0015 | ||

| US944514SX74 / Wayne County Airport Authority, Michigan, Revenue Bonds, Detroit Metropolitan Wayne County Airport, Series 2015D | 0,75 | -50,17 | 0,8887 | -0,8727 | ||

| US56042RCN08 / Maine Health & Higher Educational Facilities Authority | 0,73 | 0,00 | 0,8588 | 0,0098 | ||

| US167736L218 / City of Chicago IL Waterworks Revenue | 0,69 | -1,15 | 0,8159 | -0,0004 | ||

| Raleigh Durham Airport Authority / DBT (US751073JT57) | 0,63 | -0,32 | 0,7409 | 0,0065 | ||

| New York State Dormitory Authority / DBT (US65000BX788) | 0,54 | -2,52 | 0,6421 | -0,0092 | ||

| US594615FU57 / Michigan State Building Authority | 0,54 | -0,55 | 0,6396 | 0,0035 | ||

| US491026UP32 / Kenton County Airport Board, Kentucky, Airport Revenue Bonds, Cincinnati/Northern Kentucky International Airport, Series 2016 | 0,54 | -0,74 | 0,6344 | 0,0039 | ||

| New York City Transitional Finance Authority / DBT (US64972JJJ88) | 0,52 | -1,13 | 0,6209 | 0,0006 | ||

| City of Bentonville AR Sales & Use Tax Revenue / DBT (US083422DP79) | 0,52 | -0,77 | 0,6138 | 0,0027 | ||

| Marion County School Board / DBT (US56879EGT01) | 0,52 | -0,96 | 0,6131 | 0,0021 | ||

| US373385AL76 / GEORGIA ST | 0,52 | -0,77 | 0,6123 | 0,0025 | ||

| New York State Dormitory Authority / DBT (US65000BW533) | 0,51 | -0,96 | 0,6095 | 0,0023 | ||

| State of Connecticut / DBT (US20772KUZ01) | 0,51 | -0,78 | 0,5993 | 0,0018 | ||

| US593237FQ87 / Miami Beach Redevelopment Agency, Florida, Tax Increment Revenue Bonds, City Center/Historic Convention Village, Series 2015A | 0,50 | 0,00 | 0,5948 | 0,0070 | ||

| US74447NAC92 / Public Finance Authority Wisconsin, Tax Exempt Pooled Securities, Class A Social Impact Certificates, Series 2023-1 | 0,49 | -0,40 | 0,5843 | 0,0051 | ||

| US167570PC89 / City of Chicago IL | 0,47 | -6,60 | 0,5539 | -0,0309 | ||

| Providence Public Building Authority / DBT (US74381MCV54) | 0,42 | -0,94 | 0,4975 | 0,0010 | ||

| County of York PA / DBT (US986370QY38) | 0,41 | -1,43 | 0,4890 | -0,0017 | ||

| South Carolina Public Service Authority / DBT (US8371513M90) | 0,37 | -0,80 | 0,4383 | 0,0010 | ||

| US041807EM66 / Arlington Higher Education Finance Corp | 0,36 | -0,83 | 0,4240 | 0,0013 | ||

| Fort Bend County Texas Public Facility Corp / DBT (US34687KAB08) | 0,35 | -0,58 | 0,4086 | 0,0019 | ||

| US20775C2M51 / Connecticut Housing Finance Authority | 0,34 | -1,99 | 0,4075 | -0,0038 | ||

| City of Pittsburgh PA / DBT (US725209RW20) | 0,32 | -0,62 | 0,3824 | 0,0017 | ||

| Upper Oconee Basin Water Authority / DBT (US916281CR79) | 0,32 | -1,23 | 0,3819 | -0,0001 | ||

| US13032UFL70 / California Health Facilities Financing Authority | 0,32 | -2,13 | 0,3802 | -0,0043 | ||

| US646039YQ49 / NJ ST 4% 6/1/2031 | 0,31 | -1,60 | 0,3638 | -0,0015 | ||

| Massachusetts Bay Transportation Authority Sales Tax Revenue / DBT (US575579T310) | 0,26 | -1,14 | 0,3087 | -0,0000 | ||

| US167736P847 / City of Chicago IL Waterworks Revenue | 0,26 | -1,16 | 0,3027 | 0,0003 | ||

| US167736E452 / FX.RT. MUNI BOND | 0,25 | -1,56 | 0,3007 | -0,0001 | ||

| US74445MAB54 / Public Finance Authority of Wisconsin, Solid Waste Disposal Revenue Bonds, Waste Management Inc, Refunding Series 2016A-2 | 0,24 | -0,41 | 0,2878 | 0,0020 | ||

| US45204FCE34 / Illinois Finance Authority | 0,17 | 0,00 | 0,2013 | 0,0014 | ||

| US452152Q617 / Illinois State, General Obligation Bonds, November Series 2017D | 0,16 | -0,61 | 0,1936 | 0,0006 | ||

| US60416S6R68 / Minnesota Housing Finance Agency | 0,14 | -2,72 | 0,1699 | -0,0023 |