Grundlæggende statistik

| Porteføljeværdi | $ 131.541.591 |

| Nuværende stillinger | 128 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

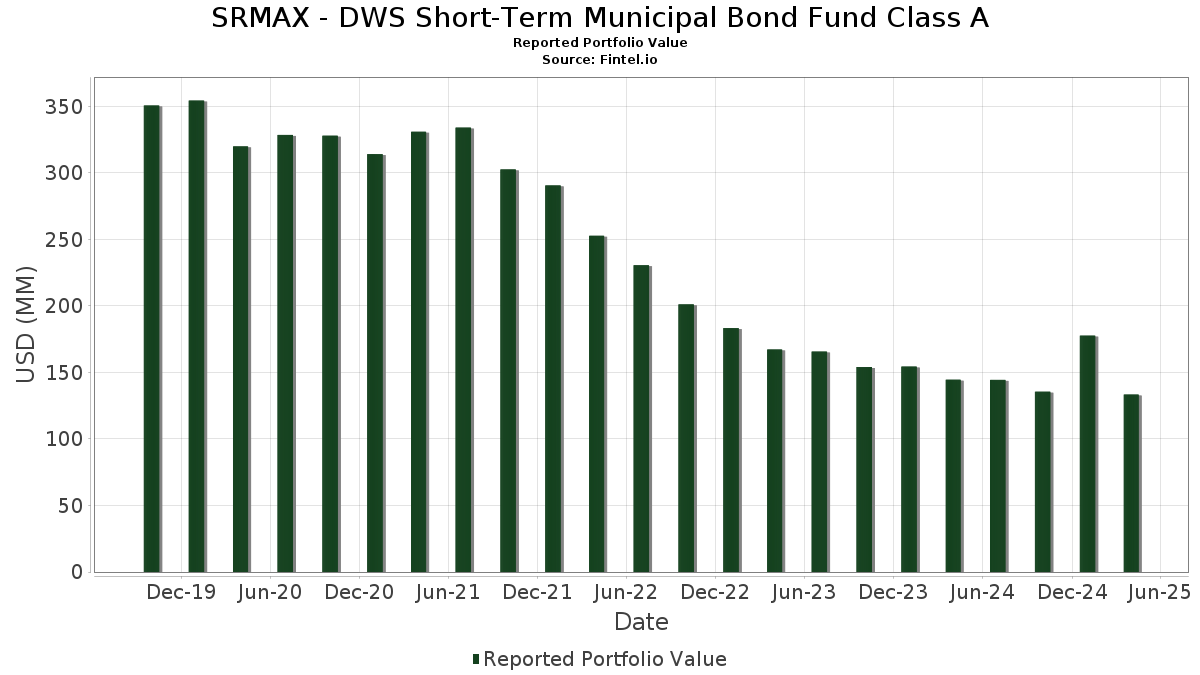

SRMAX - DWS Short-Term Municipal Bond Fund Class A har afsløret 128 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 131.541.591 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). SRMAX - DWS Short-Term Municipal Bond Fund Class As største beholdninger er Louisiana Public Facilities Authority (US:US54640TAK51) , BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE (US:US09182TBC09) , Louisville-Jefferson County Metropolitan Government, Kentucky, Pollution Control Revenue Bonds, Louisville Gas and Electric Company Project, Series 20 (US:US546749AU69) , MICHIGAN ST FIN AUTH REVENUE REGD N/C B/E 5.00000000 (US:US59447TQE63) , and Illinois State, General Obligation Bonds, November Series 2017D (US:US452152Q617) . SRMAX - DWS Short-Term Municipal Bond Fund Class As nye stillinger omfatter Louisiana Public Facilities Authority (US:US54640TAK51) , BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE (US:US09182TBC09) , Louisville-Jefferson County Metropolitan Government, Kentucky, Pollution Control Revenue Bonds, Louisville Gas and Electric Company Project, Series 20 (US:US546749AU69) , MICHIGAN ST FIN AUTH REVENUE REGD N/C B/E 5.00000000 (US:US59447TQE63) , and Illinois State, General Obligation Bonds, November Series 2017D (US:US452152Q617) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,61 | 1,2313 | 1,2313 | ||

| 1,10 | 0,8405 | 0,8405 | ||

| 1,06 | 0,8120 | 0,8120 | ||

| 1,01 | 0,7708 | 0,7708 | ||

| 0,98 | 0,7456 | 0,7456 | ||

| 0,72 | 0,5526 | 0,5526 | ||

| 0,54 | 0,4144 | 0,4144 | ||

| 0,10 | 0,0765 | 0,0765 | ||

| 0,10 | 0,0765 | 0,0765 | ||

| 0,20 | 0,1529 | 0,0501 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,30 | 0,2294 | -0,1713 | ||

| 0,13 | 0,0994 | -0,1322 | ||

| 0,06 | 0,0458 | -0,0694 | ||

| 0,22 | 0,1651 | -0,0562 | ||

| 0,02 | 0,0187 | -0,0428 | ||

| 0,22 | 0,1648 | -0,0357 | ||

| 0,11 | 0,0806 | -0,0351 | ||

| 0,25 | 0,1925 | -0,0278 | ||

| 0,82 | 0,6287 | -0,0243 | ||

| 3,01 | 2,3008 | -0,0223 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-09-23 for rapporteringsperioden 2025-07-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HALIFAX CNTY VA INDL DEV AUTH REVENUE / DBT (US40579PAE16) | 3,17 | 0,67 | 2,4258 | -0,0064 | |||||

| US54640TAK51 / Louisiana Public Facilities Authority | 3,01 | 0,00 | 2,3008 | -0,0223 | |||||

| US09182TBC09 / BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE | 2,90 | 1,01 | 2,2207 | 0,0014 | |||||

| US546749AU69 / Louisville-Jefferson County Metropolitan Government, Kentucky, Pollution Control Revenue Bonds, Louisville Gas and Electric Company Project, Series 20 | 2,85 | 2,48 | 2,1824 | 0,0322 | |||||

| OKLAHOMA ST INDUSTRIES AUTH EDL FACS LEASE REVENUE / DBT (US67910FAE43) | 2,69 | 1,44 | 2,0539 | 0,0100 | |||||

| DALLAS TX / DBT (US235219XE71) | 2,59 | 0,27 | 1,9818 | -0,0136 | |||||

| FORT BEND TX INDEP SCH DIST / DBT (US346843VT91) | 2,55 | 0,91 | 1,9515 | -0,0012 | |||||

| GREAT LAKES MI WTR AUTH SEWAGE DISPOSAL SYS REVENUE / DBT (US39081HFK32) | 2,36 | 1,03 | 1,8013 | 0,0006 | |||||

| MATANUSKA-SUSITNA BORO AK LEASE REVENUE / DBT (US576553CU36) | 2,22 | 1,28 | 1,6979 | 0,0056 | |||||

| WISCONSIN ST / DBT (US97705MM511) | 2,09 | 0,48 | 1,5991 | -0,0072 | |||||

| US59447TQE63 / MICHIGAN ST FIN AUTH REVENUE REGD N/C B/E 5.00000000 | 2,06 | 0,19 | 1,5752 | -0,0124 | |||||

| US452152Q617 / Illinois State, General Obligation Bonds, November Series 2017D | 2,05 | 0,44 | 1,5701 | -0,0078 | |||||

| US249182KZ83 / DENVER CO AIRPORT SUB 18A AMT 5.0% 12-01-26 | 2,05 | 0,15 | 1,5651 | -0,0132 | |||||

| US20282EAG17 / Commonwealth Financing Authority, Series 2018, RB | 2,03 | 0,35 | 1,5550 | -0,0093 | |||||

| US66285WM601 / N TX TOLLWAY AUTH REVENUE | 2,02 | -0,25 | 1,5448 | -0,0183 | |||||

| US79020FAW68 / SAINT JOHN THE BAPTIST PARISH LA REVENUE | 2,02 | 0,60 | 1,5421 | -0,0051 | |||||

| US650116CE47 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 2,01 | -0,05 | 1,5364 | -0,0158 | |||||

| US708692BZ09 / Pennsylvania Economic Development Financing Authority | 2,01 | 0,45 | 1,5345 | -0,0081 | |||||

| US56035DCR17 / Main Street Natural Gas, Inc., Series 2019 C, RB | 2,00 | 0,20 | 1,5327 | -0,0116 | |||||

| CALIFORNIA ST MUNI FIN AUTH REVENUE / DBT (US13048V2W76) | 2,00 | -0,25 | 1,5308 | -0,0187 | |||||

| UNIV OF TEXAS TX UNIV REVENUES / DBT (US91514AMU69) | 1,88 | 1,02 | 1,4372 | 0,0013 | |||||

| COLORADO ST HSG & FIN AUTH / DBT (US19648GPB22) | 1,84 | 1,15 | 1,4099 | 0,0027 | |||||

| US44237NKT80 / City of Houston TX Hotel Occupancy Tax & Special Revenue | 1,78 | 0,06 | 1,3611 | -0,0124 | |||||

| US59447T3W11 / Michigan Finance Authority | 1,74 | 0,06 | 1,3337 | -0,0121 | |||||

| PUBLIC FIN AUTH WI TAX EXEMPT POOLED SECURITIES / DBT (US74448HAA59) | 1,63 | 2,13 | 1,2474 | 0,0142 | |||||

| HARRIS CNTY TX CULTURAL EDU FACS FIN CORP MED FACS REVENUE / DBT (US414008CZ36) | 1,61 | 1,2313 | 1,2313 | ||||||

| PENNSYLVANIA ST ECON DEV FING AUTH UPMC REVENUE / DBT (US70870JGY82) | 1,60 | -0,37 | 1,2205 | -0,0161 | |||||

| LOS ANGELES CA DEPT OF WTR & PWR REVENUE / DBT (US544532NM29) | 1,58 | 3,55 | 1,2050 | 0,0297 | |||||

| HARRIS CNTY TX TOLL ROAD REVENUE / DBT (US41423PDE43) | 1,57 | 0,58 | 1,2031 | -0,0048 | |||||

| JEFFERSON CNTY AL SWR REVENUE WARRANTS / DBT (US472682YV92) | 1,54 | 0,13 | 1,1760 | -0,0099 | |||||

| US64577XET90 / NEW JERSEY ST ECON DEV AUTH REV | 1,53 | 0,20 | 1,1716 | -0,0093 | |||||

| VIRGINIA ST SMALL BUSINESS FING AUTH RSDL FAC CARE REVENUE / DBT (US928103BA70) | 1,53 | 2,76 | 1,1680 | 0,0204 | |||||

| US20775DUX82 / CONNECTICUT ST HLTH & EDUCTNL FACS AUTH REVENUE | 1,49 | 0,07 | 1,1427 | -0,0097 | |||||

| US84136FBB22 / Southeast Energy Authority A Cooperative District | 1,41 | 0,64 | 1,0791 | -0,0034 | |||||

| MIAMI-DADE CNTY FL SCH BRD COPS / DBT (US59333MW921) | 1,33 | 1,53 | 1,0181 | 0,0059 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH HOSP REVENUE / DBT (US56678PBT30) | 1,21 | 0,75 | 0,9241 | -0,0015 | |||||

| HAMILTON CNTY OH SWR SYS REVENUE / DBT (US407288H440) | 1,19 | 0,68 | 0,9104 | -0,0021 | |||||

| US59447TU688 / Michigan Finance Authority | 1,18 | 2,08 | 0,9027 | 0,0098 | |||||

| US594650UC56 / MICHIGAN ST HSG DEV AUTH MF REVENUE | 1,16 | 0,09 | 0,8868 | -0,0075 | |||||

| UTAH HSG CORP SF MTGE REVENUE / DBT (US917437TB12) | 1,14 | 1,07 | 0,8695 | 0,0009 | |||||

| DALLAS TX INDEP SCH DIST / DBT (US235308R542) | 1,10 | 1,66 | 0,8424 | 0,0061 | |||||

| NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE / DBT (US646140JX29) | 1,10 | 0,8405 | 0,8405 | ||||||

| MARYLAND ST HLTH & HGR EDUCTNL FACS AUTH REVENUE / DBT (US57421CHV90) | 1,10 | 1,20 | 0,8386 | 0,0026 | |||||

| MICHIGAN ST HOSP FIN AUTH / DBT (US59465HXE16) | 1,08 | 1,41 | 0,8265 | 0,0029 | |||||

| US13034AD230 / California (State of) Infrastructure & Economic Development Bank, Series 2019, Ref. VRD RB | 1,08 | 1,03 | 0,8260 | 0,0006 | |||||

| DALLAS TX INDEP SCH DIST / DBT (US235308Q635) | 1,07 | 1,42 | 0,8204 | 0,0036 | |||||

| CENTRL PLAINS ENERGY PROJ NE GAS SPLY REVENUE / DBT (US154872AY18) | 1,06 | 0,8120 | 0,8120 | ||||||

| NEW YORK NY / DBT (US64966SFQ49) | 1,05 | 0,86 | 0,8039 | -0,0006 | |||||

| ALASKA ST / DBT (US0117706C37) | 1,05 | 0,58 | 0,8025 | -0,0028 | |||||

| NEW YORK ST DORM AUTH REVENUES NON ST SUPPORTED DEBT / DBT (US65000B6P89) | 1,04 | 0,68 | 0,7949 | -0,0022 | |||||

| US7087964R50 / Pennsylvania Housing Finance Agency, Single Family Mortgage | 1,04 | 0,29 | 0,7922 | -0,0056 | |||||

| US550697VZ63 / Luzerne County, Pennsylvania, General Obligation Bonds, Refunding Series 2017A | 1,03 | 0,19 | 0,7893 | -0,0059 | |||||

| US73358XJU72 / Port Authority of New York & New Jersey | 1,03 | 0,49 | 0,7843 | -0,0033 | |||||

| US442349AH96 / HOUSTON TX ARPT SYS REVENUE REGD N/C B/E AMT 5.00000000 | 1,02 | 0,29 | 0,7800 | -0,0057 | |||||

| US928104NF13 / VIRGINIA ST SMALL BUSINESS FING AUTH REVENUE | 1,02 | 2,52 | 0,7794 | 0,0117 | |||||

| US798165LF18 / MUNI PUT BOND ACT | 1,02 | 0,20 | 0,7774 | -0,0058 | |||||

| CAMDEN CNTY NJ IMPT AUTH MF REVENUE / DBT (US13281RAF01) | 1,01 | -0,10 | 0,7735 | -0,0080 | |||||

| US897579BA56 / Troy NY Capital Resource Corp. Revenue (Rensselaer Polytechnic Institute Project) | 1,01 | 0,00 | 0,7722 | -0,0075 | |||||

| NEW YORK ST HSG FIN AGY AFFORDABLE HSG REVENUE / DBT (US64987J4L20) | 1,01 | 0,7708 | 0,7708 | ||||||

| US646080XA46 / New Jersey Higher Education Student Assistance Authority | 1,01 | -0,20 | 0,7696 | -0,0085 | |||||

| US13048VBE74 / CALIFORNIA ST MUNI FIN AUTH REVENUE | 1,01 | 0,00 | 0,7689 | -0,0072 | |||||

| US25477PPY50 / District of Columbia Housing Finance Agency, Multifamily Housing, Series 2023 | 1,00 | -0,20 | 0,7680 | -0,0092 | |||||

| US13077DSZ68 / MUNI PUT BOND ACT | 1,00 | 0,60 | 0,7664 | -0,0029 | |||||

| NEW HOPE CULTURAL ED FACS FIN CORP TX RETIREMENT FAC REVENUE / DBT (US64542UHK34) | 1,00 | 1,31 | 0,7661 | 0,0023 | |||||

| MASSACHUSETTS ST DEV FIN AGY REVENUE / DBT (US57585BDA35) | 1,00 | 0,20 | 0,7660 | -0,0054 | |||||

| CONNECTICUT ST HLTH & EDUCTNL FACS AUTH REVENUE / DBT (US20775DXK35) | 1,00 | 0,60 | 0,7652 | -0,0022 | |||||

| WEST VIRGINIA ST ECON DEV AUTH SOL WST DISP FACS / DBT (US95648VBV09) | 0,98 | 0,7456 | 0,7456 | ||||||

| US724791CF33 / PITTSBURGH & ALLEGHENY CNTY PA SPORTS & EXHIBITION AUTH HOTE | 0,94 | 1,08 | 0,7167 | 0,0011 | |||||

| VENICE FL / DBT (US922687AH14) | 0,90 | 1,12 | 0,6899 | 0,0014 | |||||

| US442349GB62 / HOUSTON TX ARPT SYS REVENUE HOUAPT 07/26 FIXED 5 | 0,88 | 0,00 | 0,6740 | -0,0064 | |||||

| US83703DAA54 / SOUTH CAROLINA JOBS-ECON DEV AUTH ENVRNMNTL IMPT REVENUE | 0,85 | 0,12 | 0,6520 | -0,0054 | |||||

| US606072LC83 / Missouri Higher Education Loan Authority | 0,82 | -2,72 | 0,6287 | -0,0243 | |||||

| KLICKITAT CNTY WA PUBLIC UTILITY DIST #1 / DBT (US498622LE70) | 0,81 | 0,25 | 0,6179 | -0,0045 | |||||

| NEW YORK ST DORM AUTH REVENUES NON ST SUPPORTED DEBT / DBT (US65000BW616) | 0,79 | 0,64 | 0,6049 | -0,0021 | |||||

| US121342PN31 / BURKE CNTY GA DEV AUTH POLL CONTROL REVENUE | 0,76 | 2,02 | 0,5808 | 0,0063 | |||||

| US098792AQ71 / BOONE CNTY KY POLL CONTROL REVENUE | 0,76 | 1,07 | 0,5785 | 0,0004 | |||||

| DENTON TX INDEP SCH DIST / DBT (US249002NL68) | 0,72 | 0,5526 | 0,5526 | ||||||

| ILLINOIS ST FIN AUTH REVENUE / DBT (US45204FG902) | 0,70 | 2,03 | 0,5371 | 0,0055 | |||||

| US37255MAA36 / GEO L SMITH II GA CONGRESS CTR AUTH | 0,70 | 2,64 | 0,5345 | 0,0083 | |||||

| US09182NCB47 / BLACK BELT ENERGY GAS DIST AL GAS SPLY REVENUE | 0,67 | 1,20 | 0,5138 | 0,0007 | |||||

| DAUPHIN CNTY PA GEN AUTH HLTHSYS REVENUE / DBT (US23825EDN13) | 0,66 | 0,00 | 0,5048 | -0,0047 | |||||

| US45506EDH36 / INDIANA ST FIN AUTH REVENUE | 0,63 | 0,16 | 0,4847 | -0,0043 | |||||

| US13048VL718 / California Municipal Finance Authority | 0,60 | 0,34 | 0,4551 | -0,0033 | |||||

| US646080WR89 / NJ STUD LOAN 5% 12/1/2025 @ | 0,58 | -0,17 | 0,4425 | -0,0049 | |||||

| ARIZONA ST INDL DEV AUTH MF HSG REVENUE / DBT (US04062PCA75) | 0,56 | 0,00 | 0,4270 | -0,0038 | |||||

| SOUTH CAROLINA ST JOBS-ECON DEV AUTH HOSP FACS REVENUE / DBT (US83703EMU63) | 0,54 | 0,4144 | 0,4144 | ||||||

| NEW YORK ST DORM AUTH REVENUES NON ST SUPPORTED DEBT / DBT (US65000B5X23) | 0,53 | 0,56 | 0,4088 | -0,0012 | |||||

| US897579BM94 / Troy Capital Resource Corp | 0,53 | 1,15 | 0,4042 | 0,0012 | |||||

| US88256HBE71 / FX.RT. MUNI BOND | 0,53 | 1,93 | 0,4038 | 0,0033 | |||||

| MIAMI-DADE CNTY FL WTR & SWR REVENUE / DBT (US59334DNY66) | 0,53 | 0,76 | 0,4030 | -0,0013 | |||||

| ENERGY N W WA ELEC REVENUE / DBT (US29270C6C45) | 0,52 | 0,38 | 0,4006 | -0,0020 | |||||

| US897579BL12 / Troy Capital Resource Corp | 0,52 | 0,58 | 0,3974 | -0,0009 | |||||

| US140427BG91 / CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE | 0,51 | 0,39 | 0,3893 | -0,0026 | |||||

| US795576LH80 / SALT LAKE CITY UT ARPT REVENUE | 0,51 | 0,20 | 0,3892 | -0,0031 | |||||

| US13048VBF40 / California Municipal Finance Authority | 0,51 | 0,20 | 0,3867 | -0,0028 | |||||

| US167562SK45 / CHICAGO IL MIDWAY ARPT REVENUE | 0,50 | -0,40 | 0,3861 | -0,0045 | |||||

| VILLAGE CDD NO 15 SPL ASSMNT REVENUE / DBT (US92708KAF49) | 0,50 | 1,62 | 0,3834 | 0,0026 | |||||

| US54877EAC03 / County of Lowndes MS | 0,49 | 0,82 | 0,3773 | -0,0006 | |||||

| US49130NFB01 / Kentucky Higher Education Student Loan Corporation Student Loan Rev. | 0,46 | -1,50 | 0,3513 | -0,0087 | |||||

| OKLAHOMA ST TURNPIKE AUTH / DBT (US679111F332) | 0,44 | 1,62 | 0,3350 | 0,0016 | |||||

| NEW HAMPSHIRE ST HLTH & EDU FACS AUTH REVENUE / DBT (US64461XJX49) | 0,41 | 0,74 | 0,3113 | -0,0008 | |||||

| US346843RY33 / FORT BEND TX INDEP SCH DIST | 0,38 | -0,53 | 0,2867 | -0,0044 | |||||

| US812643WU41 / SEATTLE WA MUNI LIGHT & PWR REVENUE | 0,35 | 0,29 | 0,2686 | -0,0020 | |||||

| US692160RT32 / Town of Oyster Bay | 0,33 | 0,93 | 0,2501 | -0,0002 | |||||

| US83756CQM00 / SD HDA SFM PAC (100-400) PSA GNMA/FNMA/FHLMC 17B SF 4.0% 11-01-47 | 0,33 | 0,31 | 0,2491 | -0,0015 | |||||

| US13048RAL15 / CALIFORNIA ST MUNI FIN AUTH SOL WST DISP REVENUE | 0,32 | 0,00 | 0,2447 | -0,0024 | |||||

| US13034DAC83 / CA HSG FIN AGY 5% 5/1/2054 | 0,31 | 0,33 | 0,2340 | -0,0018 | |||||

| US897579BK39 / Troy Capital Resource Corporation, New York, Revenue Bonds, Rensselaer Polytechnic Institute, Refunding Series 2020A Forward Delivery | 0,30 | -0,33 | 0,2297 | -0,0027 | |||||

| FLORIDA ST DEV FIN CORP / DBT (US340618DK07) | 0,30 | -42,20 | 0,2294 | -0,1713 | |||||

| MIAMI-DADE CNTY FL HSG FIN AUTH MF HSG REVENUE / DBT (US593344CA05) | 0,25 | 1,20 | 0,1942 | 0,0007 | |||||

| US6472007V09 / NM MFA SFM GNMA/FNMA/FHLMC PAC (100-400) PSA 18A-1 SF 4.0% 01-01-49 | 0,25 | -11,93 | 0,1925 | -0,0278 | |||||

| US610530FY83 / MONROE CNTY GA DEV AUTH POLL CONTROL REVENUE | 0,25 | 0,00 | 0,1919 | -0,0015 | |||||

| US191855BN47 / Coconino County Pollution Control Corp | 0,25 | 0,40 | 0,1915 | -0,0012 | |||||

| US59447TV835 / Michigan Finance Authority | 0,22 | -24,83 | 0,1651 | -0,0562 | |||||

| US658909MA19 / ND HFA PAC (100-400) 17A SF 4.0% 07-01-47 | 0,22 | -16,99 | 0,1648 | -0,0357 | |||||

| US04052EAH18 / Arizona Industrial Development Authority | 0,21 | 0,49 | 0,1583 | -0,0010 | |||||

| US57583RUZ62 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 0,20 | 48,15 | 0,1529 | 0,0501 | |||||

| US64578JBA34 / NEW JERSEY ST ECON DEV AUTH MTR VEHCL SURCHARGE REVENUE | 0,19 | 2,70 | 0,1460 | 0,0030 | |||||

| US20775CTX29 / CT ST HFA SFM PAC (75-500) PSA 17C-1 4.0% 11-15-47 | 0,18 | 0,56 | 0,1380 | -0,0008 | |||||

| US20775CQB36 / Connecticut Housing Finance Authority, Housing Mortgage Finance Program | 0,15 | 0,69 | 0,1112 | -0,0006 | |||||

| US259230KT66 / DOUGLAS CNTY NE HOSP AUTH 2 DOUMED 08/32 ADJUSTABLE VAR | 0,13 | -56,67 | 0,0994 | -0,1322 | |||||

| US658207TZ87 / NC SFM PAC (100-500) PSA 17-38-B GNMA/FNMA SF 4.0% 07-01-47 | 0,11 | -29,53 | 0,0806 | -0,0351 | |||||

| US20775DTS17 / YALE UNIV CT 16A-1 DFRN 07-01-42/BARC/BUS | 0,10 | 0,0765 | 0,0765 | ||||||

| US64971XFY94 / NEW YORK CITY NY TRANSITIONAL FIN AUTH REVENUE | 0,10 | 0,0765 | 0,0765 | ||||||

| US7087962J52 / PENNSYLVANIA ST HSG FIN AGY SF MTGE REVENUE | 0,08 | 0,00 | 0,0650 | -0,0004 | |||||

| US97689QDD51 / WI ST HSG & ECON SFM AMT PAC 16A SF 3.5% 03-01-46 | 0,06 | -60,40 | 0,0458 | -0,0694 | |||||

| US09248U8412 / BlackRock Liquidity Funds: MuniCash, Institutional Shares | 0,04 | -31,80 | 0,04 | -31,58 | 0,0302 | -0,0145 | |||

| US57563RRP63 / Massachusetts Educational Financing Authority | 0,02 | -69,62 | 0,0187 | -0,0428 |