Grundlæggende statistik

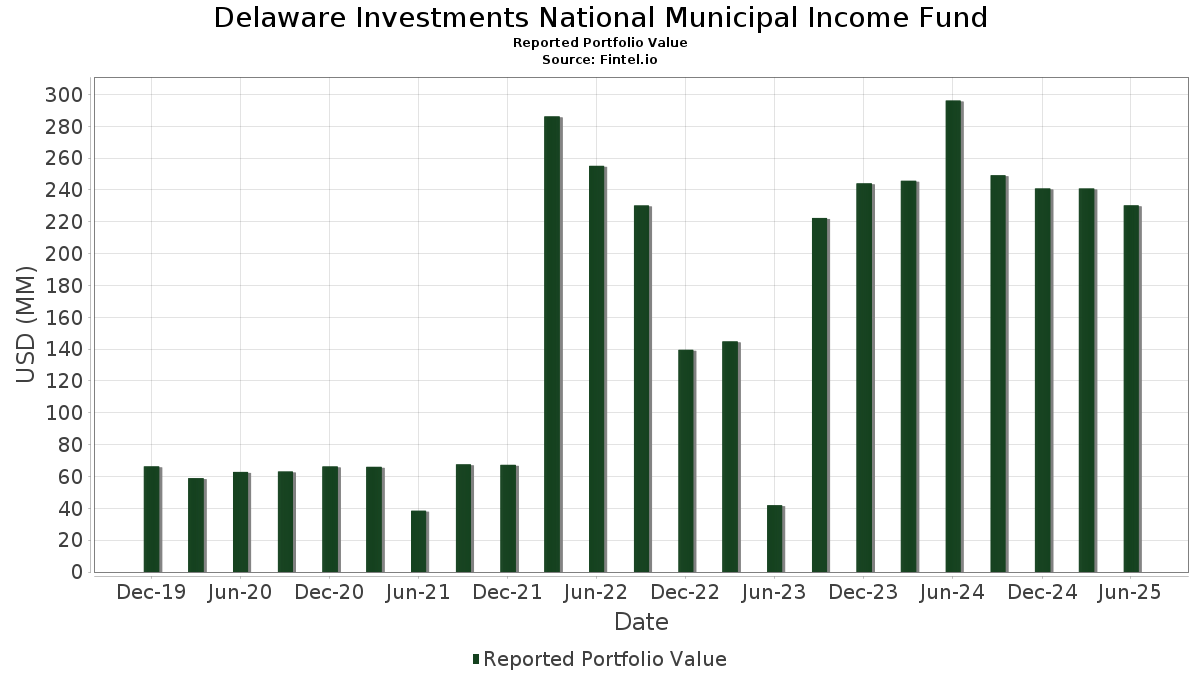

| Porteføljeværdi | $ 230.286.590 |

| Nuværende stillinger | 166 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Delaware Investments National Municipal Income Fund har afsløret 166 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 230.286.590 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Delaware Investments National Municipal Income Funds største beholdninger er GDB DEBT RECOVERY AUTH OF CMWLTH PUERTO RICO (US:US36829QAA31) , TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE (US:US882667AN81) , Greater Orlando Aviation Authority, Series 2019 A, RB (US:US3922742G05) , Municipal Electric Authority of Georgia (US:US62620HDK59) , and HILLSBOROUGH CNTY FL INDL DEVAUTH HOSP REVENUE (US:US43233AFE10) . Delaware Investments National Municipal Income Funds nye stillinger omfatter GDB DEBT RECOVERY AUTH OF CMWLTH PUERTO RICO (US:US36829QAA31) , TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE (US:US882667AN81) , Greater Orlando Aviation Authority, Series 2019 A, RB (US:US3922742G05) , Municipal Electric Authority of Georgia (US:US62620HDK59) , and HILLSBOROUGH CNTY FL INDL DEVAUTH HOSP REVENUE (US:US43233AFE10) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 5,06 | 3,7884 | 3,7884 | ||

| 3,40 | 2,5466 | 2,5466 | ||

| 3,15 | 2,3588 | 2,3588 | ||

| 2,96 | 2,2171 | 2,2171 | ||

| 2,67 | 1,9964 | 1,9964 | ||

| 2,48 | 1,8564 | 1,8564 | ||

| 2,46 | 1,8411 | 1,8411 | ||

| 2,42 | 1,8104 | 1,8104 | ||

| 2,03 | 1,5183 | 1,5183 | ||

| 1,84 | 1,3756 | 1,3756 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,29 | 1,7138 | -1,8083 | ||

| 0,47 | 0,3516 | -0,6849 | ||

| 2,84 | 2,1273 | -0,0854 | ||

| 3,60 | 2,6915 | -0,0560 | ||

| 0,24 | 0,1762 | -0,0264 | ||

| 3,14 | 2,3494 | -0,0169 | ||

| 0,13 | 0,0970 | -0,0143 | ||

| 0,33 | 0,2475 | -0,0130 | ||

| 0,81 | 0,6070 | -0,0113 | ||

| 0,36 | 0,2709 | -0,0084 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-28 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US36829QAA31 / GDB DEBT RECOVERY AUTH OF CMWLTH PUERTO RICO | 5,50 | -2,03 | 4,1146 | 0,1112 | |||||

| US882667AN81 / TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE | 5,24 | 32,62 | 3,9175 | 1,1018 | |||||

| US3922742G05 / Greater Orlando Aviation Authority, Series 2019 A, RB | 5,06 | 3,7884 | 3,7884 | ||||||

| US62620HDK59 / Municipal Electric Authority of Georgia | 4,98 | -1,68 | 3,7221 | 0,1136 | |||||

| US43233AFE10 / HILLSBOROUGH CNTY FL INDL DEVAUTH HOSP REVENUE | 4,96 | -4,63 | 3,7130 | 0,0022 | |||||

| US649519EG63 / New York Liberty Development Corp | 4,83 | -3,52 | 3,6111 | 0,0440 | |||||

| State of New York Mortgage Agency Homeowner Mortgage Revenue / DBT (US64988YZG50) | 4,80 | -2,24 | 3,5924 | 0,0899 | |||||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 4,55 | -3,91 | 3,4040 | 0,0271 | |||||

| US45204FQC22 / Illinois Finance Authority, Revenue Bonds, Northshore - Edward-Elmhurst Health Credit Group, Series 2022A | 4,35 | -2,66 | 3,2571 | 0,0677 | |||||

| US38122NB843 / GOLDEN ST TOBACCO SECURITIZATI REGD ZCP OID B/E 0.00000000 | 4,31 | -1,53 | 3,2248 | 0,1034 | |||||

| US167510BM78 / Chicago Board of Education Dedicated Capital Improvement Tax | 4,18 | -2,47 | 3,1251 | 0,0706 | |||||

| US650028ZN61 / NEW YORK ST THRUWAY AUTH PERSONAL INCOME TAX REVENUE | 4,05 | -2,01 | 3,0291 | 0,0831 | |||||

| US64990GZS47 / New York State Dormitory Authority | 3,89 | -3,53 | 2,9069 | 0,0352 | |||||

| California Statewide Communities Development Authority / DBT (US13079PAE34) | 3,79 | -0,60 | 2,8331 | 0,1165 | |||||

| New York Transportation Development Corp / DBT (US650116HS87) | 3,76 | -4,62 | 2,8088 | 0,0016 | |||||

| Newark Higher Education Finance Corp / DBT (US650346GN36) | 3,60 | -6,62 | 2,6915 | -0,0560 | |||||

| US613603YX12 / MONTGOMERY CNTY PA HGR EDU & HLTH AUTH | 3,52 | -1,32 | 2,6362 | 0,0899 | |||||

| US64988YSG34 / State of New York Mortgage Agency | 3,41 | -2,21 | 2,5534 | 0,0650 | |||||

| California Municipal Finance Authority / DBT (US13050WAB72) | 3,40 | 2,5466 | 2,5466 | ||||||

| US697528AP23 / Palomar Health 5.00% 11/01/2030 | 3,16 | 0,19 | 2,3655 | 0,1155 | |||||

| US68450LGQ23 / Orange County Health Facilities Authority | 3,15 | 2,3588 | 2,3588 | ||||||

| US451295D225 / Idaho Health Facilities Authority | 3,14 | -5,36 | 2,3494 | -0,0169 | |||||

| Public Finance Authority / DBT (US74441XHS18) | 3,05 | -1,26 | 2,2802 | 0,0790 | |||||

| US79574CEB54 / Salt River Project Agricultural Improvement & Power District | 3,04 | -1,90 | 2,2739 | 0,0643 | |||||

| US09182TAW71 / Black Belt Energy Gas District | 2,98 | -0,07 | 2,2274 | 0,1031 | |||||

| US167593L676 / CHICAGO IL O'HARE INTERNATIONAL ARPT REVENUE | 2,96 | 2,2171 | 2,2171 | ||||||

| Pennsylvania Housing Finance Agency / DBT (US70879QN829) | 2,91 | -2,15 | 2,1800 | 0,0566 | |||||

| New York Transportation Development Corp / DBT (US650116GZ30) | 2,90 | -2,39 | 2,1658 | 0,0506 | |||||

| US613603J917 / Montgomery County Higher Education and Health Authority, Pennsylvania, Revenue Bonds, Thomas Jefferson University, Series 2022B | 2,84 | -8,35 | 2,1273 | -0,0854 | |||||

| Southeast Energy Authority A Cooperative District / DBT (US84136HAU77) | 2,84 | 0,14 | 2,1251 | 0,1019 | |||||

| US605279GX05 / Mississippi Business Finance Corp | 2,81 | 0,00 | 2,0980 | 0,0983 | |||||

| Columbus Regional Airport Authority / DBT (US199546DC38) | 2,67 | 1,9964 | 1,9964 | ||||||

| US62620HFK32 / Municipal Electric Authority of Georgia | 2,49 | -1,66 | 1,8603 | 0,0571 | |||||

| US118217CX40 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 2,49 | -4,35 | 1,8592 | 0,0068 | |||||

| US645790FR26 / New Jersey Health Care Facilities Financing Authority | 2,48 | 1,8564 | 1,8564 | ||||||

| US88256PAT75 / Texas Municipal Gas Acquisition & Supply Corp IV | 2,47 | -0,08 | 1,8460 | 0,0857 | |||||

| US546395N757 / Louisiana Public Facilities Authority, Hospital Revenue Bonds, Franciscan Missionaries of Our Lady Health System, Series 2017A | 2,46 | 1,8411 | 1,8411 | ||||||

| US5374282P85 / Little Rock School District | 2,44 | -3,98 | 1,8228 | 0,0129 | |||||

| US650116AR77 / New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment), Series 2016 A, RB | 2,42 | 1,8104 | 1,8104 | ||||||

| Virginia Housing Development Authority / DBT (US92812WWU43) | 2,42 | -0,45 | 1,8100 | 0,0769 | |||||

| US46360XAQ79 / Irvine Facilities Financing Authority | 2,29 | -53,62 | 1,7138 | -1,8083 | |||||

| New York Transportation Development Corp / DBT (US650116HR05) | 2,25 | -1,66 | 1,6839 | 0,0516 | |||||

| US44586SBS68 / Huntingdon County General Authority | 2,23 | -3,17 | 1,6697 | 0,0263 | |||||

| Washington County School District No 13 Banks / DBT (US938350FS91) | 2,14 | -3,39 | 1,6004 | 0,0216 | |||||

| US13013JCM62 / California Community Choice Financing Authority | 2,10 | 0,29 | 1,5676 | 0,0777 | |||||

| Louisiana Public Facilities Authority / DBT (US546399SY35) | 2,03 | 1,5183 | 1,5183 | ||||||

| US74514L3P07 / PUERTO RICO CMWLTH | 2,00 | -1,96 | 1,4954 | 0,0412 | |||||

| US64972E4K24 / New York City Housing Development Corp | 1,96 | -3,44 | 1,4677 | 0,0190 | |||||

| US93978LGR15 / Washington State Housing Finance Commission, Series 2023 | 1,88 | -1,21 | 1,4077 | 0,0495 | |||||

| New Hampshire Business Finance Authority / DBT (US63607WAW47) | 1,84 | -1,50 | 1,3794 | 0,0447 | |||||

| US592647ME88 / MET WASHINGTON DC ARPTS AUTH ARPT SYS REVENUE | 1,84 | 1,3756 | 1,3756 | ||||||

| US7352402S16 / PORT OF PORTLAND OR ARPT REVENUE | 1,79 | 1,3405 | 1,3405 | ||||||

| US592250DB72 / MET PIER & EXPOSITION AUTH IL REVENUE | 1,70 | 42,06 | 1,2711 | 0,4675 | |||||

| State of Nevada Department of Business & Industry / DBT (US641455AB65) | 1,66 | -4,98 | 1,2431 | -0,0033 | |||||

| Illinois Finance Authority / DBT (US45203PAC86) | 1,52 | 1,1358 | 1,1358 | ||||||

| Metropolitan Transportation Authority / DBT (US59261A5F07) | 1,46 | 0,90 | 1,0914 | 0,0603 | |||||

| US19648FPQ18 / Colorado Health Facilities Authority | 1,45 | -3,33 | 1,0850 | 0,0155 | |||||

| US34061UJB52 / Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Imagine School at Broward Project, Series 2021A | 1,34 | -4,77 | 1,0016 | -0,0010 | |||||

| US63607YBJ82 / New Hampshire Business Finance Authority, Series 2023 A | 1,25 | -2,03 | 0,9383 | 0,0251 | |||||

| California Infrastructure & Economic Development Bank / DBT (US13034A6B14) | 1,23 | -5,18 | 0,9179 | -0,0048 | |||||

| US771906CV44 / Rochester (City of), MN (Homestead at Rochester, Inc.), Series 2013 A, RB | 1,22 | 0,00 | 0,9128 | 0,0425 | |||||

| City of Osceola AR / DBT (US688008AB76) | 1,17 | -0,09 | 0,8714 | 0,0400 | |||||

| Arlington Higher Education Finance Corp / DBT (US041807HA91) | 1,09 | -3,02 | 0,8159 | 0,0142 | |||||

| US709225EU62 / PENNSYLVANIA ST TURNPIKE COMMISSION TURNPIKE REVENUE | 1,08 | 0,8089 | 0,8089 | ||||||

| US19648AQ993 / COLORADO ST HLTH FACS AUTH REVENUE | 1,04 | -1,80 | 0,7763 | 0,0232 | |||||

| Public Finance Authority / DBT (US74442PL372) | 1,00 | -3,02 | 0,7446 | 0,0129 | |||||

| Washington State Housing Finance Commission / DBT (US93978LJQ05) | 0,98 | 0,7345 | 0,7345 | ||||||

| Maricopa County Industrial Development Authority / DBT (US56681NJJ72) | 0,98 | 0,7343 | 0,7343 | ||||||

| US2322655V62 / CUYAHOGA CNTY OH HOSP REVENUE | 0,97 | -3,39 | 0,7257 | 0,0098 | |||||

| Georgia Housing & Finance Authority / DBT (US37353PPV57) | 0,96 | -2,63 | 0,7195 | 0,0152 | |||||

| Mobile County Industrial Development Authority / DBT (US60733UAA97) | 0,96 | 0,7167 | 0,7167 | ||||||

| Skagit County Public Hospital District No 1 / DBT (US830227EP53) | 0,91 | -1,61 | 0,6843 | 0,0214 | |||||

| New Hampshire Business Finance Authority / DBT (US63607WAU80) | 0,91 | -0,66 | 0,6798 | 0,0276 | |||||

| Greater Ouachita Water Co / DBT (US392276BC45) | 0,91 | -3,51 | 0,6795 | 0,0084 | |||||

| US140427CC78 / CAPFA STUD HSG 5% 11/1/2058 | 0,89 | -3,46 | 0,6681 | 0,0080 | |||||

| US744387AD35 / Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs Utilities, Series 2008 | 0,88 | -0,11 | 0,6594 | 0,0305 | |||||

| US167510AM87 / CHICAGO IL BRD OF EDU DEDICATED CAPITAL IMPT | 0,88 | -2,87 | 0,6581 | 0,0123 | |||||

| Public Finance Authority / DBT (US74443DKZ32) | 0,85 | -5,56 | 0,6363 | -0,0060 | |||||

| US875146BC54 / TAMPA FL TAX 0% 9/1/2049 | 0,81 | -6,46 | 0,6070 | -0,0113 | |||||

| Florida Development Finance Corp / DBT (US340618DV61) | 0,80 | -1,97 | 0,5969 | 0,0161 | |||||

| US46247SBN36 / Iowa Finance Authority | 0,78 | 0,5825 | 0,5825 | ||||||

| North Carolina Medical Care Commission / DBT (US65820YSY31) | 0,77 | -3,26 | 0,5774 | 0,0086 | |||||

| US603787AL62 / Minneapolis, Minnesota, Senior Housing and Healthcare Revenue Bonds, Ecumen ? Abiitan Mill City Project, Series 2015 | 0,77 | -0,52 | 0,5771 | 0,0240 | |||||

| Arlington Higher Education Finance Corp / DBT (US041807KZ06) | 0,75 | -3,46 | 0,5639 | 0,0077 | |||||

| US744387AC51 / PUBLIC AUTHORITY FOR COLORADO ENERGY | 0,75 | -0,13 | 0,5638 | 0,0260 | |||||

| Public Finance Authority / DBT (US74442PL869) | 0,74 | -1,73 | 0,5526 | 0,0168 | |||||

| US650036CJ31 / NEW YORK ST URBAN DEV CORP REVENUE | 0,72 | 0,5391 | 0,5391 | ||||||

| US56678PBL04 / Maricopa County Industrial Development Authority | 0,69 | -3,25 | 0,5124 | 0,0073 | |||||

| US25483VXR04 / DIST OF COLUMBIA REVENUE | 0,68 | -3,26 | 0,5108 | 0,0082 | |||||

| US19648FHS65 / Colorado Health Facilities Authority | 0,68 | -4,26 | 0,5052 | 0,0024 | |||||

| Public Finance Authority / DBT (US744396JZ62) | 0,67 | -3,32 | 0,5011 | 0,0073 | |||||

| Public Finance Authority / DBT (US74442EMT46) | 0,64 | -2,60 | 0,4762 | 0,0105 | |||||

| US64542PCL76 / NEW HOPE CULTURAL EDU FACS FIN REGD OID B/E 5.50000000 | 0,62 | 0,00 | 0,4675 | 0,0219 | |||||

| US35069WAD56 / FOUNTAIN URBAN RENEWAL AUTHORITY | 0,62 | 0,32 | 0,4657 | 0,0230 | |||||

| US888804BA86 / Southern California (State of) Tobacco Securitization Authority, Series 2006 C, RB | 0,62 | -3,30 | 0,4606 | 0,0068 | |||||

| St Clair County Community Unit School District No 187 Cahokia / DBT (US788550MQ18) | 0,61 | -0,33 | 0,4540 | 0,0196 | |||||

| US852297AX80 / Saint Paul Housing & Redevelopment Authority, Minnesota, Charter School Lease Revenue Bonds, Twin Cities Academy Project, Series 2015A | 0,60 | -4,29 | 0,4506 | 0,0015 | |||||

| US650116GN00 / New York Transportation Development Corp | 0,54 | -1,09 | 0,4068 | 0,0152 | |||||

| Downtown Revitalization Public Infrastructure District / DBT (US26118TBU34) | 0,52 | 0,3905 | 0,3905 | ||||||

| US650116GY64 / New York Transportation Development Corp | 0,52 | -2,82 | 0,3863 | 0,0074 | |||||

| Maryland Economic Development Corp / DBT (US574205HG85) | 0,51 | -0,78 | 0,3792 | 0,0152 | |||||

| Los Angeles Department of Water & Power / DBT (US544532PV00) | 0,51 | 0,3786 | 0,3786 | ||||||

| US64542PCM59 / NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE | 0,50 | 0,00 | 0,3740 | 0,0175 | |||||

| US888804BB69 / Tobacco Securitization Authority of Southern California | 0,50 | -3,11 | 0,3730 | 0,0062 | |||||

| West Virginia Economic Development Authority / DBT (US95648VBV09) | 0,49 | 0,3686 | 0,3686 | ||||||

| New York Transportation Development Corp / DBT (US650116HA79) | 0,49 | -3,54 | 0,3667 | 0,0043 | |||||

| US64972E4H94 / New York City Housing Development Corp. | 0,49 | -2,40 | 0,3661 | 0,0088 | |||||

| Indiana Finance Authority / DBT (US45471FAZ45) | 0,49 | -2,41 | 0,3631 | 0,0081 | |||||

| US19645RC829 / Colorado Educational & Cultural Facilities Authority | 0,48 | -3,40 | 0,3619 | 0,0054 | |||||

| US906420CH58 / UNION CNTY OR HOSP FAC AUTH | 0,48 | -0,82 | 0,3614 | 0,0139 | |||||

| US79771HAL78 / City & County of San Francisco CA Special Tax District No 2020-1 | 0,48 | -0,21 | 0,3589 | 0,0165 | |||||

| Public Finance Authority / DBT (US74439YEZ07) | 0,47 | -2,47 | 0,3538 | 0,0077 | |||||

| Maryland Economic Development Corp / DBT (US574205HF03) | 0,47 | -0,42 | 0,3524 | 0,0150 | |||||

| Iowa Finance Authority / DBT (US46247SFV16) | 0,47 | -67,65 | 0,3516 | -0,6849 | |||||

| US74445GAQ55 / PUBLIC FIN AUTH WI EDUCTNL REVENUE | 0,47 | -3,11 | 0,3494 | 0,0057 | |||||

| US19645RB425 / COLORADO EDUCATIONAL & CULTURAL FACILITIES AUTHORITY | 0,47 | -3,53 | 0,3485 | 0,0043 | |||||

| New York Transportation Development Corp / DBT (US650116HX72) | 0,46 | -0,86 | 0,3464 | 0,0129 | |||||

| US08675TAM53 / CITY OF BETHEL MN HOUSING AND HEALTH CARE FACILITIES REVENUE | 0,46 | -4,94 | 0,3458 | -0,0010 | |||||

| US03789YDT01 / APPLE VLY SNR LVNG-D | 0,46 | -4,97 | 0,3439 | -0,0008 | |||||

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign / DBT (US120827EG13) | 0,45 | -4,65 | 0,3376 | -0,0002 | |||||

| Knox County Health Educational & Housing Facility Board / DBT (US499526AU52) | 0,44 | -3,10 | 0,3275 | 0,0054 | |||||

| New Jersey Housing & Mortgage Finance Agency / DBT (US646127FN55) | 0,43 | -0,46 | 0,3214 | 0,0140 | |||||

| US03789YDH62 / CITY OF APPLE VALLEY MN | 0,40 | -3,64 | 0,2973 | 0,0034 | |||||

| Public Finance Authority / DBT (US74442EMR89) | 0,40 | -1,74 | 0,2961 | 0,0091 | |||||

| Arlington Higher Education Finance Corp / DBT (US041807GZ51) | 0,39 | -2,99 | 0,2914 | 0,0055 | |||||

| Public Finance Authority / DBT (US74442EMS62) | 0,37 | -2,61 | 0,2794 | 0,0062 | |||||

| US19648FNG53 / Colorado Health Facilities Authority | 0,37 | 0,00 | 0,2768 | 0,0130 | |||||

| Burbank-Glendale-Pasadena Airport Authority Brick Campaign / DBT (US120827EE64) | 0,36 | -4,49 | 0,2710 | 0,0007 | |||||

| US875146BD38 / City of Tampa | 0,36 | -7,42 | 0,2709 | -0,0084 | |||||

| US74446HAD17 / Wisconsin (State of) Public Finance Authority (American Dream at Meadowlands), Series 2017, RB | 0,36 | -6,23 | 0,2700 | -0,0045 | |||||

| Public Finance Authority / DBT (US74439YEY32) | 0,36 | -1,10 | 0,2687 | 0,0096 | |||||

| US03789YDS28 / CITY OF APPLE VALLEY MN | 0,35 | -4,34 | 0,2647 | 0,0014 | |||||

| Shelby County Health & Educational Facilities Board / DBT (US82170LAB18) | 0,35 | -7,51 | 0,2587 | -0,0078 | |||||

| US421306AC54 / CITY OF HAYWARD MN | 0,34 | -5,26 | 0,2563 | -0,0017 | |||||

| Clifton Higher Education Finance Corp / DBT (US187145VQ71) | 0,33 | 0,2488 | 0,2488 | ||||||

| Public Finance Authority / DBT (US74442ELV01) | 0,33 | -9,59 | 0,2475 | -0,0130 | |||||

| Indiana Finance Authority / DBT (US45471FAY79) | 0,33 | -2,08 | 0,2475 | 0,0069 | |||||

| Capital Trust Authority / DBT (US14054WAR60) | 0,33 | -2,39 | 0,2446 | 0,0056 | |||||

| St Clair County Community Unit School District No 187 Cahokia / DBT (US788550MP35) | 0,33 | -0,31 | 0,2437 | 0,0111 | |||||

| US19648A5H44 / Colorado (State of) Health Facilities Authority (Sunny Vista Living Center), Series 2015 A, Ref. RB | 0,31 | -4,94 | 0,2310 | -0,0001 | |||||

| City of Venice FL / DBT (US922687AG31) | 0,31 | 0,33 | 0,2284 | 0,0117 | |||||

| US788326AD85 / Saint Cloud, Minnesota, Charter School Lease Revenue Bonds, Stride Academy Project, Series 2016A | 0,30 | -4,84 | 0,2214 | -0,0002 | |||||

| Public Finance Authority / DBT (US74443DKY66) | 0,29 | -4,87 | 0,2194 | -0,0008 | |||||

| Los Angeles Department of Water & Power / DBT (US544532PW82) | 0,25 | 0,1890 | 0,1890 | ||||||

| Public Finance Authority / DBT (US74439YFU01) | 0,25 | -1,96 | 0,1876 | 0,0054 | |||||

| US852297CH13 / Housing & Redevelopment Authority of The City of St Paul Minnesota | 0,24 | -1,24 | 0,1793 | 0,0067 | |||||

| Public Finance Authority / DBT (US74439YFT38) | 0,24 | -1,65 | 0,1782 | 0,0054 | |||||

| US45734TAG94 / Inland Empire Tobacco Securitization Corp | 0,24 | -17,25 | 0,1762 | -0,0264 | |||||

| West Virginia Economic Development Authority / DBT (US95648VBU26) | 0,23 | -0,43 | 0,1754 | 0,0076 | |||||

| US95737TFM36 / WESTCHESTER CNTY NY LOCAL DEV CORP REVENUE | 0,21 | -1,83 | 0,1603 | 0,0048 | |||||

| US603787AK89 / City of Minneapolis MN | 0,21 | 2,93 | 0,1585 | 0,0117 | |||||

| Capital Trust Authority / DBT (US14054WAQ87) | 0,21 | -2,37 | 0,1542 | 0,0036 | |||||

| Suffolk Regional Off-Track Betting Co / DBT (US86480TAC80) | 0,20 | -0,49 | 0,1528 | 0,0063 | |||||

| US64542PCP80 / NEW HOPE CULTURAL EDU FACS FIN REGD B/E 7.00000000 | 0,19 | 0,00 | 0,1414 | 0,0066 | |||||

| Clifton Higher Education Finance Corp / DBT (US187145UR63) | 0,18 | -5,15 | 0,1377 | -0,0012 | |||||

| South Carolina Jobs-Economic Development Authority / DBT (US83704HAM97) | 0,15 | -3,21 | 0,1133 | 0,0020 | |||||

| US45734TAH77 / Inland Empire Tobacco Securitization Corp., Series 2007 F, RB | 0,13 | -17,31 | 0,0970 | -0,0143 | |||||

| US64542PBX24 / NEW HOPE CULT EDU-B | 0,12 | -2,36 | 0,0933 | 0,0024 | |||||

| US64542PAW59 / NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE | 0,12 | 0,00 | 0,0911 | 0,0043 | |||||

| US09248U8412 / BlackRock Liquidity Funds: MuniCash, Institutional Shares | 0,10 | 70,18 | 0,10 | 70,49 | 0,0780 | 0,0355 | |||

| Public Finance Authority / DBT (US74446DAK46) | 0,10 | 0,98 | 0,0776 | 0,0045 | |||||

| New York State Dormitory Authority / DBT (US65000B7X05) | 0,10 | -0,99 | 0,0753 | 0,0026 | |||||

| Capital Projects Finance Authority/FL / DBT (US140427CP81) | 0,10 | -2,91 | 0,0749 | 0,0010 | |||||

| Arizona Industrial Development Authority / DBT (US04052TDD46) | 0,06 | 1,79 | 0,0429 | 0,0023 | |||||

| US040523AF98 / ARIZONA ST INDL DEV AUTH ECON DEV REVENUE | 0,02 | 0,00 | 0,0163 | 0,0008 | |||||

| Arizona Industrial Development Authority / DBT (US04052TDF93) | 0,01 | 0,00 | 0,0076 | 0,0003 |