Grundlæggende statistik

| Porteføljeværdi | $ 1.351.631.240 |

| Nuværende stillinger | 322 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

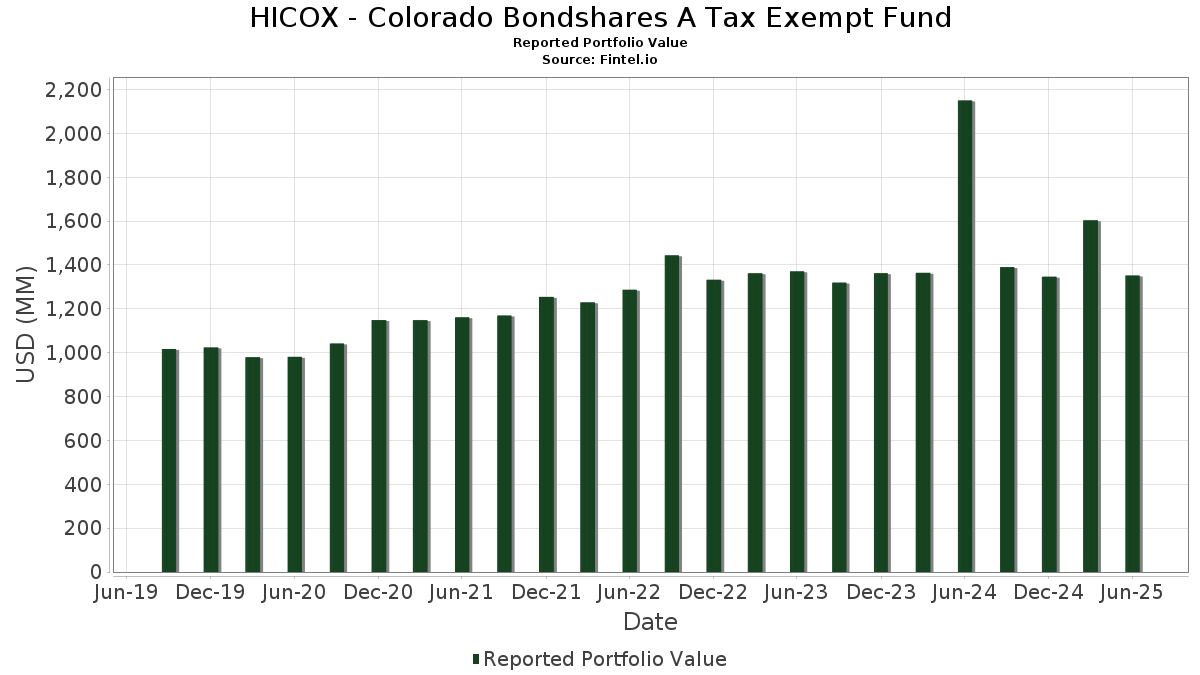

HICOX - Colorado Bondshares A Tax Exempt Fund har afsløret 322 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 1.351.631.240 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). HICOX - Colorado Bondshares A Tax Exempt Funds største beholdninger er SHERIDAN REDEV AGY COLO VAR REF BDS 2011A1 (US:US82382LAJ89) , MEADOWS MET DIST COLO REF-NO 1-SER A 1989 (US:US582903BU32) , Cherry Creek South Metropolitan District No 5 (US:US16456CAA62) , COLORADO INTL CTR MET DIST NO CO MET DIST #7 (US:US19650TAA79) , and Jefferson Center Metropolitan District No 1 (US:US47248EAC66) . HICOX - Colorado Bondshares A Tax Exempt Funds nye stillinger omfatter SHERIDAN REDEV AGY COLO VAR REF BDS 2011A1 (US:US82382LAJ89) , MEADOWS MET DIST COLO REF-NO 1-SER A 1989 (US:US582903BU32) , Cherry Creek South Metropolitan District No 5 (US:US16456CAA62) , COLORADO INTL CTR MET DIST NO CO MET DIST #7 (US:US19650TAA79) , and Jefferson Center Metropolitan District No 1 (US:US47248EAC66) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 10,02 | 0,5372 | 0,5372 | ||

| 8,77 | 0,4702 | 0,4702 | ||

| 7,21 | 0,3865 | 0,3865 | ||

| 5,20 | 0,2790 | 0,2790 | ||

| 5,02 | 0,2690 | 0,2690 | ||

| 4,54 | 0,2435 | 0,2435 | ||

| 4,01 | 0,2148 | 0,2148 | ||

| 2,87 | 0,1540 | 0,1540 | ||

| 2,51 | 0,1344 | 0,1344 | ||

| 3,36 | 0,1802 | 0,1242 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,46 | 0,1317 | -0,1525 | ||

| 37,99 | 2,0371 | -0,0993 | ||

| 1,28 | 0,0684 | -0,0400 | ||

| 23,36 | 1,2524 | -0,0385 | ||

| 1,20 | 0,0643 | -0,0376 | ||

| 27,58 | 1,4787 | -0,0364 | ||

| 9,39 | 0,5035 | -0,0355 | ||

| 10,37 | 0,5563 | -0,0341 | ||

| 1,69 | 0,0907 | -0,0335 | ||

| 9,61 | 0,5153 | -0,0325 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-29 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| CO COSEDU 5 07/01/2032 / DBT (US19645UMQ49) | 75,91 | 0,49 | 4,0703 | -0,0220 | ||

| CO COSEDU 5.12 01/01/2042 / DBT (US19645UMU50) | 37,99 | -3,66 | 2,0371 | -0,0993 | ||

| CO COSEDU 4.38 07/01/2027 / DBT (US19645UEJ97) | 34,04 | -0,17 | 1,8254 | -0,0220 | ||

| US82382LAJ89 / SHERIDAN REDEV AGY COLO VAR REF BDS 2011A1 | 31,66 | 0,00 | 1,6976 | -0,0175 | ||

| US582903BU32 / MEADOWS MET DIST COLO REF-NO 1-SER A 1989 | 30,40 | 0,08 | 1,6303 | -0,0155 | ||

| WI PUBEDU 5 06/01/2026 / DBT (US74442EEK29) | 27,58 | -1,39 | 1,4787 | -0,0364 | ||

| CO PICDEV 6.75 12/15/2050 / DBT (US72364TAA34) | 23,59 | 2,42 | 1,2648 | 0,0171 | ||

| CO MEAGEN 8 06/01/2029 / DBT (US582903BV15) | 23,58 | 0,08 | 1,2642 | -0,0120 | ||

| CO COSEDU 4.5 06/01/2027 / DBT (US19645UCG76) | 23,36 | -1,98 | 1,2524 | -0,0385 | ||

| CO COSEDU 4.38 07/01/2027 / DBT (US19645UET79) | 22,95 | 0,52 | 1,2306 | -0,0063 | ||

| US16456CAA62 / Cherry Creek South Metropolitan District No 5 | 19,91 | 5,81 | 1,0678 | 0,0483 | ||

| CO COSEDU 4.5 07/15/2028 / DBT (US19645UMA96) | 18,05 | 0,79 | 0,9680 | -0,0023 | ||

| CO COSEDU 6.12 07/01/2029 / DBT (US19645UNX80) | 17,80 | -0,10 | 0,9544 | -0,0108 | ||

| CO CLHDEV 5.5 12/01/2048 / DBT (US194691AB77) | 17,57 | 0,60 | 0,9418 | -0,0041 | ||

| CO COSEDU 4.5 06/01/2027 / DBT (US19645UCH59) | 17,04 | -1,43 | 0,9139 | -0,0228 | ||

| CO LKSFAC 5.5 12/01/2061 / DBT (US51206HAA59) | 16,90 | 0,85 | 0,9061 | -0,0016 | ||

| US19650TAA79 / COLORADO INTL CTR MET DIST NO CO MET DIST #7 | 16,35 | 2,99 | 0,8766 | 0,0166 | ||

| CO FLYGEN 7.25 12/15/2050 / DBT (US34407NBC02) | 15,37 | 6,21 | 0,8240 | 0,0402 | ||

| CO MEAGEN 8 06/01/2029 / DBT (US582903BW97) | 15,28 | 0,08 | 0,8191 | -0,0078 | ||

| US47248EAC66 / Jefferson Center Metropolitan District No 1 | 14,41 | -0,60 | 0,7726 | -0,0127 | ||

| US20731NAA19 / CONIFER MET DIST COLO | 12,79 | -3,39 | 0,6859 | -0,0314 | ||

| CO COSEDU 5.85 06/15/2029 / DBT (US19645UNT78) | 11,63 | -0,07 | 0,6236 | -0,0069 | ||

| US85950PAD78 / Sterling Ranch Metropolitan District 2, El Paso County, Colorado, General Obligation Bonds, Limited Tax Convertible Capital Appreciation Series 22 | 11,63 | 0,58 | 0,6234 | -0,0028 | ||

| CO MJMFAC 5.75 12/01/2051 / DBT (US61540FAA30) | 10,95 | 1,09 | 0,5874 | 0,0003 | ||

| CO MCMFAC 5.5 12/01/2051 / DBT (US927136AA90) | 10,80 | 0,60 | 0,5791 | -0,0025 | ||

| CO COSEDU 7 07/01/2030 / DBT (US19645UQQ03) | 10,76 | -0,07 | 0,5768 | -0,0064 | ||

| US17190EAA10 / CIELO MET DISTRICT CO 5.25% 12-01-50 | 10,37 | -4,80 | 0,5563 | -0,0341 | ||

| CO CHFHSG 9.75 10/01/2031 / DBT (US19648XAB10) | 10,36 | 0,22 | 0,5556 | -0,0045 | ||

| CO CHFHSG 7.25 10/01/2034 / DBT (US19648XAA37) | 10,33 | -0,31 | 0,5538 | -0,0075 | ||

| CO VRCFAC 5.88 12/01/2055 / DBT (US923722AA08) | 10,02 | 0,5372 | 0,5372 | |||

| CO WYNGWN 7.62 12/15/2049 / DBT (US98310UAX00) | 9,61 | 4,68 | 0,5154 | 0,0180 | ||

| US544084AA46 / Loretto Heights Community Authority | 9,61 | -4,95 | 0,5153 | -0,0325 | ||

| CO COSEDU 4.5 07/01/2051 / DBT (US19645UKQ66) | 9,39 | -5,62 | 0,5035 | -0,0355 | ||

| UT MLLDEV 10 12/15/2034 / DBT (US600066AA22) | 9,23 | -0,15 | 0,4948 | -0,0059 | ||

| US51654DAA19 / Lanterns Metropolitan District No 2 | 9,19 | -4,88 | 0,4929 | -0,0307 | ||

| CO SHRFAC 4.12 12/15/2041 / DBT (US84467PAJ30) | 9,16 | -2,06 | 0,4911 | -0,0155 | ||

| CO EHLDEV 6 12/01/2055 / DBT (US27649AAA51) | 8,77 | 0,4702 | 0,4702 | |||

| US44056CAA27 / HORIZON MET DIST NO 2 CO (144A/QIB) 4.5% 12-01-51 | 8,70 | 3,83 | 0,4665 | 0,0125 | ||

| CO MUGFAC 5.5 12/01/2051 / DBT (US62477NAA19) | 8,68 | -4,88 | 0,4652 | -0,0289 | ||

| FLNDRE 8.28 01/01/34 A / DBT (US338497BH20) | 8,32 | 0,46 | 0,4463 | -0,0025 | ||

| US10933PAC95 / BRIGHTON CROSSING MET DIST #6 CO | 8,23 | -4,54 | 0,4412 | -0,0258 | ||

| CO COSEDU 4.38 06/01/2027 / DBT (US19645UEB61) | 8,05 | -1,09 | 0,4316 | -0,0093 | ||

| CO COSEDU 4.5 07/01/2027 / DBT (US19645UME19) | 7,80 | -0,19 | 0,4181 | -0,0052 | ||

| FLNDRE 6.25 07/01/45 2020 / DBT (US338497BX79) | 7,76 | -3,20 | 0,4162 | -0,0182 | ||

| CO CLHDEV 5.25 12/01/2040 / DBT (US194691AA94) | 7,73 | -3,15 | 0,4144 | -0,0179 | ||

| US33829NAD12 / FITZSIMONS VLG MET DIST #3 CO | 7,70 | -2,23 | 0,4129 | -0,0138 | ||

| US07819PAA84 / Bella Mesa Metropolitan District | 7,54 | 1,24 | 0,4042 | 0,0008 | ||

| CO COSEDU 4.75 07/15/2029 / DBT (US19645UMC52) | 7,50 | 0,43 | 0,4020 | -0,0024 | ||

| OGLFAC 6 07/01/37 / DBT (US676629AC20) | 7,48 | -0,60 | 0,4012 | -0,0065 | ||

| CO BGMDEV 5.75 12/01/2054 / DBT (US082623AB51) | 7,21 | 0,3865 | 0,3865 | |||

| CO CTYGEN 4.38 12/01/2040 / DBT (US17878CAB28) | 7,11 | -3,29 | 0,3810 | -0,0170 | ||

| CO BYADEV 6.25 12/01/2052 / DBT (US118473AA55) | 6,39 | -4,94 | 0,3427 | -0,0215 | ||

| US73938BAA70 / Powhaton Community Authority | 6,31 | -2,05 | 0,3383 | -0,0106 | ||

| CO COSEDU 4.38 11/15/2027 / DBT (US19645UEM27) | 6,28 | 0,54 | 0,3365 | -0,0016 | ||

| US21765TAA51 / COPPERLEAF MET DIST #9 CO | 6,23 | -4,99 | 0,3338 | -0,0211 | ||

| US082160AA02 / Bennett Crossing Metropolitan District, Bennett, Adams County, Colorado, General Obligation Limited Tax Bonds, Series 2020A-3 | 6,19 | 1,31 | 0,3318 | 0,0009 | ||

| UT RANDEV 5.5 12/01/2053 / DBT (US88338YAA10) | 6,04 | -3,36 | 0,3241 | -0,0147 | ||

| FLNDRE 6 07/01/40 2020 / DBT (US338497BW96) | 6,01 | -1,70 | 0,3223 | -0,0090 | ||

| US62387TAA79 / Mountain Brook Metropolitan District, Longmont, Boulder County, Colorado, Limited Tax General Obligation Bonds, Series 2021 | 5,90 | -5,10 | 0,3163 | -0,0204 | ||

| OR MULMED 5.45 09/15/2020 / DBT (US62551PCB13) | 5,82 | 0,00 | 0,3118 | -0,0032 | ||

| US700890AB21 / FX.RT. MUNI BOND | 5,81 | 12,82 | 0,3114 | 0,0325 | ||

| US295272AA62 / ERIE HIGHLANDS MET DIST NO 2 COLO LTD TAX GO BDS 2018 A | 5,78 | -3,78 | 0,3102 | -0,0154 | ||

| CO COSEDU 4.75 07/01/2029 / DBT (US19645UMJ06) | 5,75 | 0,28 | 0,3081 | -0,0023 | ||

| US85950PAC95 / Sterling Ranch Metropolitan District 2, El Paso County, Colorado, General Obligation Bonds, Limited Tax Convertible Capital Appreciation Series 22 | 5,62 | 1,87 | 0,3012 | 0,0025 | ||

| US88423EAC75 / Third Creek Metropolitan District No. 1, Limited Tax | 5,53 | -5,05 | 0,2965 | -0,0190 | ||

| US24382CAA99 / Deer Creek Villas Metropolitan District, Series 2022 A, GO Bonds | 5,35 | -4,33 | 0,2869 | -0,0160 | ||

| CO COSEDU 4.25 07/01/2029 / DBT (US19645UKL79) | 5,22 | 0,66 | 0,2801 | -0,0010 | ||

| CO COSEDU 6.12 06/15/2032 / DBT (US19645UTV60) | 5,20 | 0,2790 | 0,2790 | |||

| FLNDRE 6 01/01/38 B / DBT (US338497AK67) | 5,14 | -0,92 | 0,2758 | -0,0054 | ||

| US62477MAA36 / Muegge Farms Metropolitan District No. 1 | 5,13 | -5,11 | 0,2749 | -0,0178 | ||

| US39679VAA70 / Greenways Metropolitan District No. 1 | 5,11 | 5,38 | 0,2741 | 0,0113 | ||

| CO ELODEV 6 12/01/2055 / DBT (US290141AA88) | 5,02 | 0,2690 | 0,2690 | |||

| US83011AAA88 / 64th Avenue ARI Authority, Adams County, Colorado, Special Revenue Bonds, Series 2020 | 4,95 | 0,04 | 0,2652 | -0,0027 | ||

| US957568AC27 / Westerly Metropolitan District No. 4, Series 2021 A, GO Bonds | 4,78 | -5,59 | 0,2561 | -0,0180 | ||

| US78110PAA57 / RRC Metropolitan District No 2 | 4,77 | -1,61 | 0,2559 | -0,0069 | ||

| CO REMDEV 5.62 12/01/2051 / DBT (US75972QAA67) | 4,63 | -4,85 | 0,2484 | -0,0153 | ||

| US249197BB93 / Denver International Business Center Metropolitan District No 1, Series 2019 B, GO Bonds | 4,59 | -1,44 | 0,2462 | -0,0062 | ||

| US96350BAA70 / White Buffalo Metropolitan District 3, Adams County, Colorado, Limited Tax General Obligation bonds, Convertible to Unlimited Tax Bonds, Series 2020 | 4,59 | -1,80 | 0,2460 | -0,0071 | ||

| FLNDRE 6 01/01/38 C / DBT (US338497AM24) | 4,58 | -0,93 | 0,2456 | -0,0049 | ||

| US338497AA85 / FLNDRE 5.75 01/01/36 | 4,58 | 0,11 | 0,2455 | -0,0022 | ||

| CO GLOFAC 6.12 12/01/2054 / DBT (US38115CAA36) | 4,54 | 0,2435 | 0,2435 | |||

| OGLFAC 6.5 09/01/41 2018 / DBT (US676629AE85) | 4,54 | -2,20 | 0,2434 | -0,0080 | ||

| CO PCDDEV 0 12/01/2053 / DBT (US70089CAA80) | 4,52 | -1,33 | 0,2425 | -0,0058 | ||

| CO SPCFAC 5 12/01/2051 / DBT (US82808FAA66) | 4,46 | -5,15 | 0,2392 | -0,0156 | ||

| US428112AA48 / Hess Ranch Metropolitan District 6, Parker, Colorado, Limited Tax General Obligation Bonds, Series 2020A-1 | 4,42 | -2,17 | 0,2368 | -0,0077 | ||

| US434610AA92 / Hogback Metropolitan District | 4,29 | -1,97 | 0,2299 | -0,0070 | ||

| CO CTYGEN 3.5 12/01/2030 / DBT (US17878CAA45) | 4,17 | 0,10 | 0,2238 | -0,0021 | ||

| US44908YAB20 / HYLAND VLG MET DIST COLO LTD GO BDS 2008 | 4,10 | 0,00 | 0,2200 | -0,0023 | ||

| UT JRIDEV 7.88 03/15/2055 / DBT (US480790AC87) | 4,01 | 0,2148 | 0,2148 | |||

| CO ANTDEV 4.88 12/01/2049 / DBT (US03675HAA86) | 3,97 | 0,23 | 0,2128 | -0,0017 | ||

| CO COSEDU 4.75 07/01/2029 / DBT (US19645UMG66) | 3,90 | 0,28 | 0,2089 | -0,0015 | ||

| CO COSEDU 4.25 07/01/2041 / DBT (US19645UKP83) | 3,88 | -3,69 | 0,2083 | -0,0102 | ||

| US33829NAC39 / FITZSIMONS VLG MET DIST #3 CO | 3,80 | -3,73 | 0,2036 | -0,0100 | ||

| CO COSEDU 4.88 01/01/2032 / DBT (US19645UMS05) | 3,76 | 0,05 | 0,2015 | -0,0020 | ||

| CO COSHSG 01/01/2032 / DBT (US19647WAA62) | 3,73 | 0,00 | 0,1997 | -0,0021 | ||

| US14860EAA73 / CASTLEVIEW MET DIST #1 CO | 3,70 | -4,77 | 0,1982 | -0,0121 | ||

| US19645YAB20 / Colorado Crossing Metropolitan District No. 2, Limited Tax | 3,67 | -3,57 | 0,1968 | -0,0094 | ||

| US19645YAD85 / Colorado Crossing Metropolitan District No. 2, Limited Tax | 3,59 | -3,98 | 0,1927 | -0,0100 | ||

| US045312AA30 / Aspen Street Metropolitan District | 3,48 | -1,39 | 0,1868 | -0,0046 | ||

| US077690AB18 / BELFORD NORTH MET DIST CO | 3,48 | 4,28 | 0,1868 | 0,0058 | ||

| CO COSEDU 5 01/01/2037 / DBT (US19645UMT87) | 3,47 | -1,76 | 0,1859 | -0,0053 | ||

| US077690AA35 / Belford North Metropolitan District, Douglas County, Colorado, General Obligation Limited Tax Bonds, Series 2020A | 3,45 | -1,40 | 0,1850 | -0,0046 | ||

| US74344YAB11 / Pronghorn Valley Metropolitan District | 3,43 | -5,67 | 0,1837 | -0,0130 | ||

| US26843GAA85 / E-86 Metropolitan District, Series 2021 A, GO Bonds | 3,37 | -1,61 | 0,1808 | -0,0048 | ||

| US39356MAA71 / GREEN VALLEY RANCH EAST MET DIST #6 CO | 3,37 | 1,66 | 0,1807 | 0,0011 | ||

| FLNDRE 5.75 07/01/34 2020 / DBT (US338497BU31) | 3,36 | 224,95 | 0,1802 | 0,1242 | ||

| US979841AB96 / Woodmen Heights Metropolitan District 2, El Paso County, Colorado, General Obligation Limited Tax Bonds, Refunding Subordinate Series 2020B-2 | 3,36 | 5,73 | 0,1801 | 0,0080 | ||

| CO TRMDEV 7 12/15/2051 / DBT (US89287MAP32) | 3,27 | 1,46 | 0,1751 | 0,0007 | ||

| US700890AA48 / FX.RT. MUNI BOND | 3,24 | 8,86 | 0,1739 | 0,0125 | ||

| CO SOL 7 12/01/2026 / DBT (US834257AA59) | 3,18 | -1,18 | 0,1705 | -0,0038 | ||

| US48565KAB70 / KARL'S FARM MET DIST #2 CO | 3,13 | -0,67 | 0,1680 | -0,0028 | ||

| CO RCCDEV 4 12/01/2031 / DBT (US772043AA35) | 3,12 | -0,26 | 0,1675 | -0,0022 | ||

| CO HNTFAC 5.5 12/01/2051 / DBT (US44578EAA73) | 3,12 | -5,09 | 0,1671 | -0,0107 | ||

| CO BRAGEN 7.5 12/15/2051 / DBT (US103844AG12) | 3,11 | 2,71 | 0,1667 | 0,0027 | ||

| UT ARWFAC 5.62 12/01/2054 / DBT (US04280BAA61) | 3,10 | -3,16 | 0,1662 | -0,0072 | ||

| US196476BW44 / COLORADO HOUSING & FINANCE AUTHORITY | 3,10 | -11,43 | 0,1662 | -0,0234 | ||

| CO PRYDEV 5.75 12/01/2054 / DBT (US72330FAA49) | 3,09 | -3,53 | 0,1657 | -0,0078 | ||

| CO COSEDU 5.35 11/15/2027 / DBT (US19645R6Y26) | 3,06 | 0,33 | 0,1639 | -0,0012 | ||

| FLNDRE 5.5 01/01/31 / DBT (US338497AE08) | 3,06 | 1,29 | 0,1639 | 0,0004 | ||

| CO SGLDEV 6.5 12/01/2053 / DBT (US809746AA84) | 3,04 | -4,22 | 0,1632 | -0,0090 | ||

| US39305PAT12 / Green Gables Metropolitan District No 2, Series 2023, GO Notes | 3,03 | -2,20 | 0,1624 | -0,0053 | ||

| US196345BJ08 / COLORADO CENTRE MET DIST COLO LTD TAX & SPL REV EXCHANGE BONDS 1992 | 2,97 | 0,00 | 0,1591 | -0,0016 | ||

| US184542AC29 / CLEAR CREEK TRANSIT MET DIST #2 CO | 2,91 | -4,53 | 0,1560 | -0,0091 | ||

| CO RCCDEV 4.75 12/01/2050 / DBT (US772042AB35) | 2,91 | -4,81 | 0,1559 | -0,0096 | ||

| UT PWEDEV 5.5 12/01/2053 / DBT (US73084NAA37) | 2,89 | -3,34 | 0,1550 | -0,0071 | ||

| CO CTVGEN 5 12/01/2050 / DBT (US14859RAA14) | 2,88 | -4,98 | 0,1545 | -0,0098 | ||

| US34407UAB70 / Flying Horse Metropolitan District No. 3, Series 2019, Ref. GO Bonds | 2,88 | -3,13 | 0,1544 | -0,0067 | ||

| CO LTLFAC 6.25 12/15/2055 / DBT (US53800HAA14) | 2,87 | 0,1540 | 0,1540 | |||

| US42951RAA95 / HIDDEN CREEK MET DIST CO (144A/QIB) 21A 4.625% 12-01-45 | 2,79 | -1,17 | 0,1496 | -0,0033 | ||

| US85009UAC99 / Spring Valley Metropolitan District No. 4, Series 2020 B, GO Bonds | 2,79 | 7,14 | 0,1496 | 0,0085 | ||

| US84454RAX35 / SOUTHLANDS CO MET DIST 1 | 2,77 | -5,13 | 0,1488 | -0,0096 | ||

| US069781AC63 / BASE VILLAGE MET DISTRICT 16B 6.50% 12-15-48 | 2,68 | -1,69 | 0,1439 | -0,0039 | ||

| CO CVRDEV 6.12 12/15/2054 / DBT (US22802CAX56) | 2,65 | -1,85 | 0,1423 | -0,0041 | ||

| CO CTYGEN 4.5 12/01/2045 / DBT (US17878CAC01) | 2,62 | -4,63 | 0,1404 | -0,0083 | ||

| CO RFADEV 5 12/01/2050 / DBT (US777041AA28) | 2,58 | -5,10 | 0,1386 | -0,0090 | ||

| UT FESDEV 5.25 12/01/2053 / DBT (US31657CAA27) | 2,55 | -3,44 | 0,1369 | -0,0063 | ||

| US700890AC04 / PARKDALE CMNTY AUTH CO | 2,51 | 2,24 | 0,1348 | 0,0016 | ||

| CO SJNFAC 6.12 12/01/2055 / DBT (US83408GAA67) | 2,51 | 0,1344 | 0,1344 | |||

| US626657AA89 / MURPHY CREEK MET DIST #5 CO | 2,49 | -5,10 | 0,1336 | -0,0086 | ||

| CO SKYDEV 6 12/01/2054 / DBT (US83086VAA26) | 2,48 | 0,85 | 0,1330 | -0,0002 | ||

| US88423EAB92 / THIRD CREEK MET DIST #1 CO THIRD CREEK METROPOLITAN DISTRICT NO 1 | 2,48 | -3,70 | 0,1328 | -0,0066 | ||

| US72818QAX16 / FX.RT. MUNI BOND | 2,46 | -53,18 | 0,1317 | -0,1525 | ||

| US08218DAB82 / Bennett Ranch Metropolitan District 1, Adams County, Colorado, General Obligation Limited Tax Bonds, Convertible to Unlimited Tax Series 2021A | 2,46 | -6,69 | 0,1317 | -0,0109 | ||

| US65442PAB94 / NINE MILE MET DIST CO | 2,44 | -2,55 | 0,1311 | -0,0048 | ||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 2,44 | -4,53 | 0,1311 | -0,0076 | ||

| US189243AA63 / Cloverleaf Metropolitan District | 2,32 | -0,77 | 0,1245 | -0,0023 | ||

| US066639AA32 / Banning Lewis Ranch Metropolitan District, Series 2018 A, GO Bonds | 2,32 | -4,97 | 0,1241 | -0,0079 | ||

| UT SOLDEV 5.88 03/01/2055 / DBT (US834201AA31) | 2,32 | -3,10 | 0,1241 | -0,0053 | ||

| CO PTRDEV 6.12 12/01/2055 / DBT (US70211AAC99) | 2,31 | 0,1241 | 0,1241 | |||

| CO CNFGEN 0 12/01/2031 / DBT (US20731NBA00) | 2,31 | -1,11 | 0,1238 | -0,0027 | ||

| US91886PAA03 / VALAGUA MET DIST COLO GO LTD TAX BDS 2008 | 2,30 | 0,00 | 0,1233 | -0,0013 | ||

| CO DRMFAC 6 12/01/2052 / DBT (US23426AAA34) | 2,28 | -3,35 | 0,1224 | -0,0056 | ||

| OGLFAC 4.5 10/01/27 2019 / DBT (US67662TAA25) | 2,25 | 0,85 | 0,1205 | -0,0002 | ||

| CO STRDEV 5.75 12/01/2054 / DBT (US85950NAY67) | 2,24 | -2,61 | 0,1200 | -0,0045 | ||

| CO CLHDEV 8.5 12/15/2043 / DBT (US194691AC50) | 2,19 | 6,61 | 0,1176 | 0,0062 | ||

| CO VRCFAC 8 12/15/2055 / DBT (US923722AB80) | 2,19 | 0,1174 | 0,1174 | |||

| CO TRMDEV 7.75 12/01/2054 / DBT (US89287PAA93) | 2,16 | -1,64 | 0,1156 | -0,0032 | ||

| US957568AB44 / Westerly Metropolitan District No. 4 | 2,14 | -4,17 | 0,1146 | -0,0062 | ||

| US194689AS49 / Colliers Hill Metropolitan District No. 2 | 2,11 | -3,66 | 0,1130 | -0,0055 | ||

| US52473TAD72 / Legato Community Authority | 2,06 | -2,96 | 0,1106 | -0,0045 | ||

| CO CNYFAC 6.5 12/15/2054 / DBT (US139071AZ74) | 2,06 | -2,28 | 0,1104 | -0,0037 | ||

| US10146BEG05 / BOULDER CNTY COLO DEV REV BD 2006 A/B | 2,03 | 0,00 | 0,1089 | -0,0011 | ||

| US94133FAC32 / Waterfall Metropolitan District 1, Larimer County, Colorado, Limited Tax General Obligation Bonds, Refunding Senior Series 2022A | 2,00 | -5,34 | 0,1074 | -0,0072 | ||

| US66176NAA63 / North Range Metropolitan District No. 3, Series 2020 A, GO Bonds | 1,97 | -0,96 | 0,1056 | -0,0022 | ||

| CO CCTFAC 0 01/01/2027 / DBT (US196345BK70) | 1,96 | 1,24 | 0,1051 | 0,0002 | ||

| CO COSEDU 4 07/01/2031 / DBT (US19645UKN36) | 1,96 | 0,46 | 0,1049 | -0,0006 | ||

| CO COSEDU 6 07/01/2029 / DBT (US19645UMR22) | 1,95 | 0,46 | 0,1046 | -0,0006 | ||

| CO MIRFAC 6.12 12/15/2049 / DBT (US60458HAX17) | 1,93 | -3,60 | 0,1035 | -0,0049 | ||

| CO COSEDU 6.12 07/01/2031 / DBT (US19645UMZ48) | 1,93 | 0,89 | 0,1034 | -0,0001 | ||

| US861723AD63 / Stone Ridge Metropolitan District 2, Colorado, General Obligation Bonds, Limited Tax Convertible to Unlimited, Series 2007 | 1,90 | 0,00 | 0,1021 | -0,0011 | ||

| US701038AC54 / Parker Automotive Metropolitan District (In the Town of Parker, Colorado), General Obligation Bonds, Refunding Series 2016 | 1,87 | -0,27 | 0,1001 | -0,0013 | ||

| US105111AA68 / BRAMMING FARM MET DIST NO 1 COLO CONV CAP APPREC BDS | 1,85 | 1,82 | 0,0991 | 0,0007 | ||

| US957568AD00 / Westerly Metropolitan District No. 4, Series 2021 A2, GO Bonds | 1,84 | 101,98 | 0,0985 | 0,0492 | ||

| CO ERHFAC 7.62 12/15/2048 / DBT (US295272AB46) | 1,82 | 3,47 | 0,0976 | 0,0023 | ||

| US17776QAA67 / City Center West Residential Metropolitan District No. 2 | 1,82 | -4,86 | 0,0976 | -0,0061 | ||

| CO EHLDEV 8.25 12/15/2055 / DBT (US27649AAB35) | 1,80 | 0,0967 | 0,0967 | |||

| US472043AA65 / Jay Grove Metropolitan District | 1,80 | -5,27 | 0,0963 | -0,0064 | ||

| CO RCCDEV 4.5 12/01/2041 / DBT (US772042AA51) | 1,78 | -3,47 | 0,0955 | -0,0044 | ||

| US51654GAB23 / Lanterns Metropolitan District 3, Douglas County, Colorado, General Obligation Bonds, Limited Tax Convertible Capital Appreciation Series 2023A-2 | 1,78 | -0,61 | 0,0954 | -0,0016 | ||

| CO LEGDEV 4 12/01/2036 / DBT (US52473TAA34) | 1,76 | -1,95 | 0,0944 | -0,0028 | ||

| US769432AB13 / Riverview Metropolitan District | 1,75 | -5,20 | 0,0938 | -0,0062 | ||

| OGLFAC 5.5 07/01/28 / DBT (US676629AA63) | 1,72 | 0,76 | 0,0921 | -0,0002 | ||

| CO MBUDEV 5.75 12/01/2054 / DBT (US60284AAA60) | 1,69 | -4,24 | 0,0908 | -0,0050 | ||

| CO GEADEV 4.5 12/01/2051 / DBT (US38089NAA19) | 1,69 | -26,21 | 0,0907 | -0,0335 | ||

| US979841AA14 / Woodmen Heights Metropolitan District No. 2, Series 2020 B-1, GO Bonds | 1,68 | -0,88 | 0,0903 | -0,0017 | ||

| US873472EH30 / Tacoma Consolidated Local Improvement District 65, Washington, Special Assessment Bonds, Series 2013 | 1,66 | -1,95 | 0,0889 | -0,0027 | ||

| US39572QAA67 / GREENSPIRE MET DIST #1 CO | 1,65 | -5,18 | 0,0884 | -0,0058 | ||

| US33829NAA72 / FITZSIMONS VLG MET DIST #3 CO | 1,64 | -0,24 | 0,0877 | -0,0011 | ||

| CO VVLFAC 5 12/01/2051 / DBT (US927300AA17) | 1,61 | -5,13 | 0,0863 | -0,0056 | ||

| US003102AA82 / ABERDEEN MET DIST NO 1 COLO LTD TAX 2005 | 1,60 | 0,00 | 0,0858 | -0,0009 | ||

| CO TCMFAC 0 12/01/2051 / DBT (US88423EAD58) | 1,59 | -1,49 | 0,0851 | -0,0022 | ||

| US210402AA15 / Constitution Heights Metropolitan District | 1,58 | -3,65 | 0,0850 | -0,0041 | ||

| CO BYADEV 9.25 12/15/2052 / DBT (US118473AB39) | 1,58 | 0,32 | 0,0845 | -0,0006 | ||

| CO MARFAC 7.75 12/01/2028 / DBT (US56804RAA86) | 1,57 | 0,00 | 0,0844 | -0,0009 | ||

| US75615TAA34 / Reata Ridge Village Metropolitan District No. 2 | 1,56 | -4,95 | 0,0835 | -0,0052 | ||

| CO PTRDEV 5.88 12/01/2045 / DBT (US70211AAB17) | 1,53 | 0,0823 | 0,0823 | |||

| CO ANTDEV 7.62 12/15/2049 / DBT (US03675HAB69) | 1,53 | 132,88 | 0,0821 | 0,0465 | ||

| CO WNMFAC 5.88 12/01/2055 / DBT (US948572AA06) | 1,50 | 0,0806 | 0,0806 | |||

| US85009UAB17 / Spring Valley Metropolitan District No. 4, Series 2020 A, GO Bonds | 1,49 | -4,92 | 0,0798 | -0,0050 | ||

| US10933PAB13 / Brighton Crossing Metropolitan District No 6 | 1,48 | -3,02 | 0,0791 | -0,0033 | ||

| US184542AB46 / CLEAR CREEK TRANSIT MET DIST #2 CO | 1,45 | -3,21 | 0,0776 | -0,0034 | ||

| CO PTRDEV 8.38 12/15/2055 / DBT (US70211AAD72) | 1,45 | 0,0775 | 0,0775 | |||

| CO FLRDEV 5.62 12/01/2055 / DBT (US50682FAA49) | 1,43 | -3,12 | 0,0766 | -0,0033 | ||

| US17776QAB41 / CITY CTR WEST RESIDENTIAL MET DIST NO 2 COLO SUB LTD TAX GO BDS 2019 B | 1,42 | 5,87 | 0,0764 | 0,0035 | ||

| US26943TAA97 / Eagle Brook Meadows Metropolitan District No. 3 | 1,42 | 1,07 | 0,0761 | 0,0000 | ||

| US583213AB96 / Meadowlark Metropolitan District | 1,41 | -5,25 | 0,0755 | -0,0050 | ||

| CO PCDDEV 9 12/15/2053 / DBT (US70089CAB63) | 1,40 | -0,28 | 0,0752 | -0,0010 | ||

| CO RPKFAC 6.38 12/01/2054 / DBT (US76883BAB36) | 1,40 | -2,30 | 0,0750 | -0,0026 | ||

| US207020AA62 / Conestoga Metropolitan District 2, Ault, Weld County, Colorado, Limited Tax General Obligation Bonds, Refunding & Improvement Series 2021A-3. | 1,39 | -5,13 | 0,0744 | -0,0048 | ||

| US88477EAB48 / Thompson Crossing Metropolitan District 4, Johnstown, Larimer County, Colorado, General Obligation Bonds, Limited Tax Convertible to Unlimited Tax, Re | 1,38 | -2,05 | 0,0742 | -0,0024 | ||

| US434610AB75 / Hogback Metropolitan District | 1,38 | -5,15 | 0,0741 | -0,0048 | ||

| CO GLOFAC 8.75 12/15/2054 / DBT (US38115CAB19) | 1,36 | 0,0727 | 0,0727 | |||

| US85950PAB13 / Sterling Ranch Metropolitan District 2, El Paso County, Colorado, General Obligation Bonds, Limited Tax Convertible Capital Appreciation Series 22 | 1,35 | 0,75 | 0,0723 | -0,0002 | ||

| US74529JRH04 / Puerto Rico Sales Tax Financing Corp., Series 2019 A-2, RB | 1,34 | -3,68 | 0,0716 | -0,0035 | ||

| US431043AA61 / Highlands-Mead Metropolitan District, Series 2020, GO Bonds | 1,31 | -1,13 | 0,0702 | -0,0016 | ||

| CO CCTFAC 9 01/01/2027 / DBT (US196345BL53) | 1,28 | 0,00 | 0,0686 | -0,0007 | ||

| FLNDRE 8.28 01/01/28 2028 / DBT (US338497BF63) | 1,28 | 0,71 | 0,0685 | -0,0003 | ||

| US693690AD10 / PV ERU Holding Trust 0% PIDI NTS 14/02/2039 USD (144A) | 1,28 | -36,25 | 0,0684 | -0,0400 | ||

| US85009UAA34 / Spring Valley Metropolitan District 4, Elbert County, Colorado, Limited Tax General Obligation Bonds, Convertible to Unlimited Tax Series 2020A | 1,26 | -3,22 | 0,0678 | -0,0030 | ||

| US114779AE10 / Broomfield Village Metropolitan District No. 2 | 1,26 | -4,97 | 0,0677 | -0,0042 | ||

| US164684AA05 / Cherry Hills City Metropolitan District, Arapahoe County, Colorado, General Obligation Limited Tax Bonds, Convertible to Unlimited Tax Series 2020A-3 | 1,24 | -5,05 | 0,0666 | -0,0043 | ||

| US08218DAC65 / Bennett Ranch Metropolitan District No. 1, Series 2021 B, GO Bonds | 1,21 | 7,16 | 0,0650 | 0,0037 | ||

| US84966NAA37 / SPRING HILL MET DIST NO 3 CO SPRING HILL METROPOLITAN DISTRICT NO 3 | 1,21 | -2,18 | 0,0650 | -0,0022 | ||

| US95752TAA43 / Westcreek Metropolitan District No. 2, Series 2019 A, GO Bonds | 1,21 | -4,27 | 0,0649 | -0,0036 | ||

| US693690AC37 / PV ERU Holding Trust 0% PIDI NTS 14/02/2039 USD (144A) | 1,20 | -36,26 | 0,0643 | -0,0376 | ||

| US48565KAA97 / Karl's Farm Metropolitan District No. 2 | 1,19 | -0,58 | 0,0640 | -0,0010 | ||

| FLNDRE 8.28 01/01/27 2027 / DBT (US338497BD16) | 1,18 | 0,42 | 0,0635 | -0,0004 | ||

| US88477EAC21 / Thompson Crossing Metropolitan District 4, Johnstown, Larimer County, Colorado, General Obligation Bonds, Limited Tax Convertible to Unlimited Tax, Re | 1,18 | -4,98 | 0,0635 | -0,0040 | ||

| US578287AA23 / MAYFIELD MET DIST CO | 1,17 | -1,93 | 0,0627 | -0,0019 | ||

| CO WNMFAC 7.88 12/15/2055 / DBT (US948572AB88) | 1,15 | 0,0617 | 0,0617 | |||

| US74529JQG30 / Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT | 1,14 | -2,98 | 0,0611 | -0,0025 | ||

| US65442PAA12 / NINE MILE MET DIST CO REGD B/E 4.62500000 | 1,13 | -0,27 | 0,0605 | -0,0007 | ||

| CO CCPDEV 5 12/01/2053 / DBT (US12520DAA54) | 1,13 | -3,68 | 0,0604 | -0,0030 | ||

| FLNDRE 8.28 01/01/26 2026 / DBT (US338497BB59) | 1,11 | 0,45 | 0,0593 | -0,0003 | ||

| US196632NP40 / COLORADO SPRINGS CO UTILITIESREVENUE | 1,10 | 0,00 | 0,0590 | -0,0006 | ||

| FLNDRE 5.75 07/01/35 2020 / DBT (US338497BV14) | 1,08 | 0,18 | 0,0581 | -0,0005 | ||

| CO NWCDEV 5.38 12/01/2054 / DBT (US65152HAA95) | 1,07 | -5,37 | 0,0576 | -0,0039 | ||

| FLNDRE 5.75 07/01/34 2020 / DBT (US338497BU31) | 1,04 | 0,58 | 0,0558 | -0,0002 | ||

| CO CLOFAC 9.25 12/15/2051 / DBT (US189243AB47) | 1,04 | -0,67 | 0,0557 | -0,0010 | ||

| US768696AB24 / Riverdale Peaks II Metropolitan District, Series 2005, GO Bonds | 1,02 | 0,00 | 0,0548 | -0,0006 | ||

| US47231RAA05 / JEFFCO BUSINESS CTR COLO MET DIST NO 1 GO LTD TAX BDS 2000 | 1,02 | -0,49 | 0,0547 | -0,0008 | ||

| CO STRDEV 6.5 12/01/2054 / DBT (US85950NAW02) | 1,01 | -1,17 | 0,0544 | -0,0012 | ||

| US769432AA30 / RIVERVIEW MET DIS COL 2021 5.000% Due 12/1/2041 | 1,01 | -3,53 | 0,0542 | -0,0026 | ||

| US583213AA14 / Meadowlark Metropolitan District | 1,01 | -2,61 | 0,0541 | -0,0020 | ||

| FLNDRE 5.75 07/01/33 2020 / DBT (US338497BT67) | 1,00 | 0,91 | 0,0538 | -0,0001 | ||

| US78517NAA90 / SABELL MET DIST CO | 0,98 | -4,21 | 0,0525 | -0,0029 | ||

| US88423EAA10 / Third Creek Metropolitan District No. 1 | 0,97 | -2,12 | 0,0520 | -0,0017 | ||

| FLNDRE 5.75 07/01/32 2020 / DBT (US338497BS84) | 0,96 | 0,94 | 0,0516 | -0,0000 | ||

| US222334AA21 / Country Club Highlands Metropolitan District, Series 2007, GO Bonds | 0,95 | 0,00 | 0,0508 | -0,0005 | ||

| US33829KAA34 / Fitzsimons Village Metropolitan District No. 1 | 0,95 | -5,03 | 0,0507 | -0,0032 | ||

| US74529JPW98 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,95 | -4,35 | 0,0507 | -0,0029 | ||

| CSA Buildings FAC LLC / Colo Skies Academy 8% NTS 01/07/2030 USD (144A) / DBT (US12674FAA49) | 0,94 | -0,43 | 0,0502 | -0,0007 | ||

| FLNDRE 5.75 07/01/31 2020 / DBT (US338497BR02) | 0,93 | 1,20 | 0,0499 | 0,0000 | ||

| CO RFADEV 8.75 12/15/2050 / DBT (US777041AB01) | 0,91 | 1,11 | 0,0489 | 0,0000 | ||

| US69578NAA46 / Painted Prairie Public Improvement Authority, Aurora, Colorado, Special Revenue Bonds, Series 2019 | 0,91 | -5,82 | 0,0486 | -0,0036 | ||

| FLNDRE 5.75 07/01/30 2020 / DBT (US338497BQ29) | 0,89 | 1,02 | 0,0479 | 0,0000 | ||

| FLNDRE 5.75 07/01/29 2020 / DBT (US338497BP46) | 0,86 | 0,94 | 0,0463 | -0,0000 | ||

| US52473TAC99 / Legato Community Authority, Commerce City, Colorado, Limited Tax Supported Revenue Bonds, District 1, 2, 3 & 7, Series 2021A-1 | 0,85 | -2,18 | 0,0458 | -0,0015 | ||

| CO FLRDEV 8 12/15/2055 / DBT (US50682FAB22) | 0,84 | 1,32 | 0,0452 | 0,0001 | ||

| US768696AA41 / RIVERDALE PEAKS II MET DIST COLO GO BDS 2005 | 0,84 | 0,00 | 0,0449 | -0,0005 | ||

| FLNDRE 5.75 07/01/28 2020 / DBT (US338497BN97) | 0,83 | 0,85 | 0,0443 | -0,0001 | ||

| US62387TAB52 / Mountain Brook Metropolitan District, Longmont, Boulder County, Colorado, Limited Tax General Obligation Bonds, Series 2021 | 0,81 | -3,45 | 0,0436 | -0,0020 | ||

| UT FESDEV 6.12 03/01/2055 / DBT (US316576AA51) | 0,80 | -2,91 | 0,0430 | -0,0017 | ||

| OGLFAC 8 10/01/26 2018 / DBT (US67662LAL53) | 0,80 | 0,13 | 0,0428 | -0,0004 | ||

| FLNDRE 5.75 07/01/27 2020 / DBT (US338497BM15) | 0,80 | 0,76 | 0,0428 | -0,0001 | ||

| FLNDRE 5.75 07/01/26 2020 / DBT (US338497BL32) | 0,77 | 0,52 | 0,0412 | -0,0002 | ||

| FLNDRE 5.75 07/01/25 2020 / DBT (US338497BK58) | 0,74 | 0,68 | 0,0397 | -0,0002 | ||

| CO ANTDEV 7.62 12/15/2049 / DBT (US03675HAB69) | 0,70 | 6,24 | 0,0374 | 0,0018 | ||

| CO SGLDEV 8.75 12/15/2053 / DBT (US809746AB67) | 0,70 | -0,14 | 0,0374 | -0,0004 | ||

| CO CNFGEN 7 12/01/2033 / DBT (US20731NAC74) | 0,68 | -2,15 | 0,0367 | -0,0012 | ||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,68 | -3,96 | 0,0365 | -0,0019 | ||

| US457723AB05 / Inspiration Metropolitan District, Douglas County, Colorado, Limited Tax General Obligation Bonds, Convertible to Unlimited Tax, Subordinate Series 20 | 0,66 | 0,00 | 0,0356 | -0,0004 | ||

| CO RITFAC 6.25 12/15/2057 / DBT (US76778TAT34) | 0,65 | -0,31 | 0,0346 | -0,0005 | ||

| CO CNFGEN 7 12/01/2032 / DBT (US20731NAB91) | 0,64 | -2,14 | 0,0344 | -0,0011 | ||

| US066639AB15 / Banning Lewis Ranch Metropolitan District, Series 2018 B, GO Bonds | 0,63 | 2,45 | 0,0336 | 0,0004 | ||

| US578287AB06 / Mayfield Metropolitan District, Series 2020 B, GO Bonds | 0,62 | 1,80 | 0,0334 | 0,0003 | ||

| CO NWCDEV 7.75 12/15/2054 / DBT (US65152HAB78) | 0,61 | 0,66 | 0,0325 | -0,0001 | ||

| US78517NAB73 / Sabell Metropolitan District, Series 2020 B-3, GO Bonds | 0,61 | 0,17 | 0,0325 | -0,0003 | ||

| US33829KAB17 / Fitzsimons Village Metropolitan District 1, Arapahoe County, Colorado, Limited Tax General Obligation and Special Revenue Bonds, Refunding Subordinat | 0,61 | 7,46 | 0,0325 | 0,0019 | ||

| FLNDRE 5 01/01/26 / DBT (US338497AC42) | 0,60 | 0,67 | 0,0322 | -0,0001 | ||

| CO CSTFAC 4.75 12/15/2054 / DBT (US19658CBC10) | 0,60 | -6,58 | 0,0320 | -0,0026 | ||

| US957568AA60 / Westerly Metropolitan District 4, Weld County, Colorado, General Obligation Limited Tax Bonds, Series 2021A-1 | 0,57 | -0,69 | 0,0307 | -0,0005 | ||

| CO KLFDEV 6.2 12/15/2044 / DBT (US48565KAC53) | 0,57 | -2,23 | 0,0305 | -0,0010 | ||

| CO WVYDEV 5.25 12/01/2054 / DBT (US94114TAA07) | 0,56 | -6,20 | 0,0300 | -0,0023 | ||

| US10933PAA30 / BRIGHTON CROSSING MET DIST #6 CO | 0,52 | -0,57 | 0,0281 | -0,0005 | ||

| CO MOUFAC 8 06/01/2043 / DBT (US62081AAC36) | 0,52 | 0,00 | 0,0279 | -0,0003 | ||

| US74529JRL16 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0,52 | -4,24 | 0,0279 | -0,0015 | ||

| US196501AJ90 / CO INTERNATIONAL CENTER DT #3 SF 4.625% 12-01-31 | 0,52 | -0,58 | 0,0278 | -0,0004 | ||

| CO COSEDU 7.5 07/01/2030 / DBT (US19645UQR85) | 0,51 | 0,20 | 0,0275 | -0,0002 | ||

| UT FESDEV 8.75 03/15/2055 / DBT (US316576AB35) | 0,49 | -1,20 | 0,0265 | -0,0006 | ||

| US84454RAW51 / FX.RT. MUNI BOND | 0,49 | -2,00 | 0,0263 | -0,0008 | ||

| UT MLLDEV 12 12/15/2025 / DBT (US600066AB05) | 0,49 | 1,24 | 0,0262 | 0,0001 | ||

| US62426NAF24 / Mountain Shadows Metropolitan District, Colorado, General Obligation Limited Tax Bonds, Refunding Series 2016 | 0,49 | -0,20 | 0,0262 | -0,0003 | ||

| US33829NAB55 / FITZSIMONS VLG MET DIST #3 CO | 0,49 | -0,61 | 0,0262 | -0,0004 | ||

| US76106RAA14 / Reserve Metropolitan District 2, Mount Crested Butte, Colorado, Limited Tax General Obligation Bonds, Refunding Series 2016A | 0,46 | -4,75 | 0,0248 | -0,0015 | ||

| US74344YAA38 / Pronghorn Valley Metropolitan District | 0,43 | -3,63 | 0,0228 | -0,0011 | ||

| US578287AC88 / Mayfield Metropolitan District, Series 2020 C, GO Bonds | 0,33 | 0,61 | 0,0178 | -0,0001 | ||

| US693690AB53 / PV ERU Holding Trust 0% PIDI NTS 14/02/2039 USD (144A) | 0,28 | -36,32 | 0,0152 | -0,0089 | ||

| US74529JPU33 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,28 | 0,36 | 0,0149 | -0,0001 | ||

| CO COSEDU 7.5 06/15/2031 / DBT (US19645UTW44) | 0,27 | 0,0145 | 0,0145 | |||

| US74529JQF56 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,27 | -0,74 | 0,0144 | -0,0003 | ||

| US74529JQE81 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,26 | 0,00 | 0,0141 | -0,0002 | ||

| US31394PKC67 / FEDERAL HOME LN MTG CORP MULTICLASS MTG PARTN CTFS GTD MTN USD (SEC REGD) | 0,25 | -1,97 | 0,0134 | -0,0004 | ||

| US74529JQC26 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,25 | 0,82 | 0,0132 | -0,0000 | ||

| US74514L3T29 / PUERTO RICO CMWLTH | 0,24 | -1,67 | 0,0126 | -0,0004 | ||

| US74529JQD09 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 0,22 | 0,45 | 0,0119 | -0,0000 | ||

| CO CSTFAC 4.5 12/15/2044 / DBT (US19658CBB37) | 0,20 | -6,51 | 0,0108 | -0,0009 | ||

| US873338AA50 / TABERNASH MEADOWS WTR & SANTN DIST COLO G.O. BDS 2000 | 0,19 | 0,00 | 0,0102 | -0,0001 | ||

| CO CSTFAC 4.12 12/15/2039 / DBT (US19658CBA53) | 0,18 | -2,22 | 0,0095 | -0,0003 | ||

| US74529JPV16 / Puerto Rico Sales Tax Financing Corporation, Sales Tax Revenue Bonds, Restructured 2018A-1 | 0,13 | -2,90 | 0,0072 | -0,0003 | ||

| US74514L3H80 / PUERTO RICO CMWLTH | 0,11 | -0,93 | 0,0057 | -0,0001 | ||

| US74514L3J47 / PUERTO RICO CMWLTH | 0,11 | -1,87 | 0,0056 | -0,0002 | ||

| US74514L3G08 / PUERTO RICO CMWLTH | 0,11 | 0,00 | 0,0056 | -0,0001 | ||

| US74514L3K10 / PUERTO RICO CMWLTH | 0,09 | 0,00 | 0,0048 | -0,0001 | ||

| US74514L3N58 / PUERTO RICO CMWLTH | 0,09 | -2,27 | 0,0046 | -0,0002 | ||

| US74514L3P07 / PUERTO RICO CMWLTH | 0,09 | -2,27 | 0,0046 | -0,0001 | ||

| US74514L3R62 / PUERTO RICO CMWLTH | 0,08 | 1,23 | 0,0044 | -0,0000 | ||

| US74514L3L92 / PUERTO RICO CMWLTH | 0,08 | 1,27 | 0,0043 | -0,0000 | ||

| US74514L3M75 / PUERTO RICO CMWLTH | 0,07 | 1,49 | 0,0036 | -0,0000 | ||

| US693690AA70 / PV ERU Holding Trust 0% PIDI NTS 14/02/2039 USD (144A) (2006) | 0,06 | -36,63 | 0,0035 | -0,0020 | ||

| US74514L3F25 / PUERTO RICO CMWLTH | 0,05 | 0,00 | 0,0028 | -0,0000 | ||

| US74529JRK33 / Puerto Rico Sales Tax Financing Corporation, Sales Tax Revenue Bonds, Taxable Restructured Cofina Project Series 2019A-2 | 0,04 | -7,50 | 0,0020 | -0,0002 |