Grundlæggende statistik

| Porteføljeværdi | $ 489.058.267 |

| Nuværende stillinger | 224 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

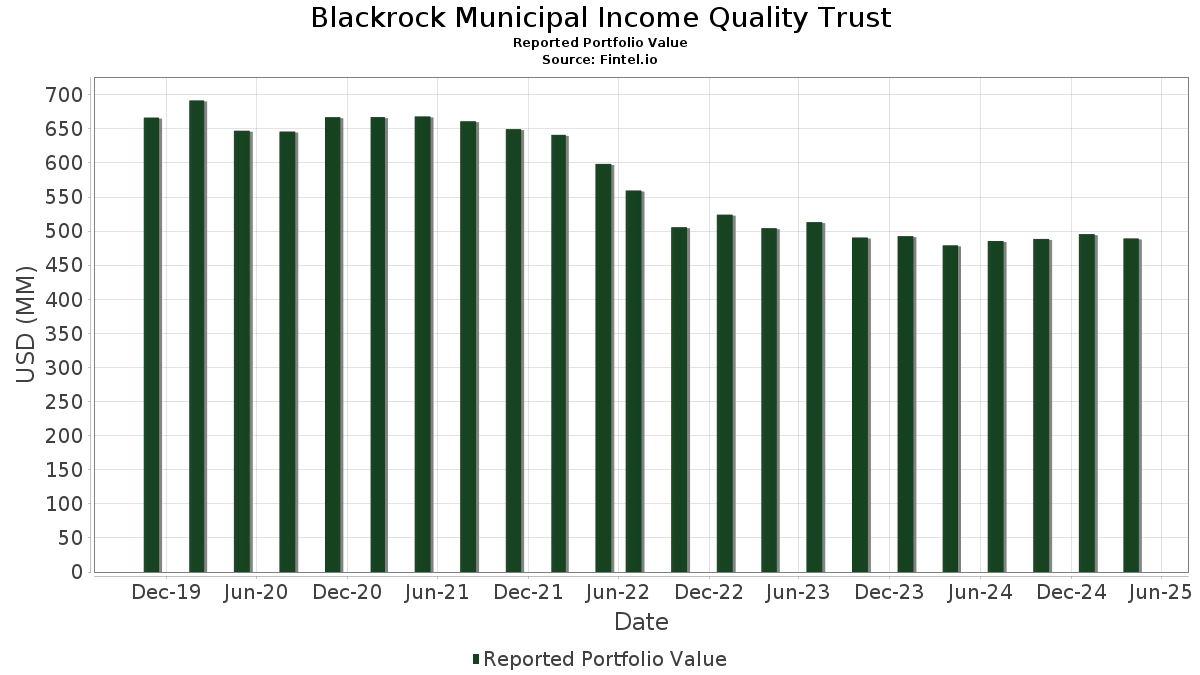

Blackrock Municipal Income Quality Trust har afsløret 224 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 489.058.267 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Blackrock Municipal Income Quality Trusts største beholdninger er BLACK BELT ENE 0% 10/1/2054 (US:US09182TDB08) , California Infrastructure & Economic Development Bank, Series 2003 A, RB (US:US13033WLB71) , Patriots Energy Group Financing Agency (US:US70342PAR55) , New York City Municipal Water Finance Authority (US:US64972GB602) , and WASHINGTON ST-A (US:US93974EJ494) . Blackrock Municipal Income Quality Trusts nye stillinger omfatter BLACK BELT ENE 0% 10/1/2054 (US:US09182TDB08) , California Infrastructure & Economic Development Bank, Series 2003 A, RB (US:US13033WLB71) , Patriots Energy Group Financing Agency (US:US70342PAR55) , New York City Municipal Water Finance Authority (US:US64972GB602) , and WASHINGTON ST-A (US:US93974EJ494) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 10,34 | 3,4094 | 3,4094 | ||

| 7,20 | 2,3743 | 2,3743 | ||

| 4,08 | 1,3462 | 1,3462 | ||

| 3,85 | 1,2690 | 1,2690 | ||

| 3,38 | 1,1158 | 1,1158 | ||

| 3,26 | 1,0758 | 1,0758 | ||

| 3,12 | 1,0287 | 1,0287 | ||

| 2,73 | 0,9001 | 0,9001 | ||

| 4,01 | 1,3226 | 0,6941 | ||

| 1,84 | 0,6054 | 0,6054 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,00 | 0,0000 | -3,3129 | ||

| 6,86 | 6,86 | 2,2621 | -1,8612 | |

| 0,00 | 0,0000 | -1,2027 | ||

| 1,39 | 0,4598 | -1,0714 | ||

| 0,67 | 0,2207 | -0,4088 | ||

| 4,76 | 1,5701 | -0,2336 | ||

| 1,12 | 0,3696 | -0,1520 | ||

| 0,41 | 0,1336 | -0,1129 | ||

| 1,39 | 0,4583 | -0,1088 | ||

| 7,94 | 2,6186 | -0,0757 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-26 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US09182TDB08 / BLACK BELT ENE 0% 10/1/2054 | 10,68 | -1,91 | 3,5229 | 0,1127 | |||||

| US13033WLB71 / California Infrastructure & Economic Development Bank, Series 2003 A, RB | 10,62 | -1,58 | 3,5009 | 0,1238 | |||||

| US70342PAR55 / Patriots Energy Group Financing Agency | 10,56 | -2,09 | 3,4838 | 0,1055 | |||||

| US64972GB602 / New York City Municipal Water Finance Authority | 10,47 | -2,37 | 3,4531 | 0,0951 | |||||

| US93974EJ494 / WASHINGTON ST-A | 10,36 | -2,68 | 3,4151 | 0,0834 | |||||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US64972JNQ75) | 10,34 | 3,4094 | 3,4094 | ||||||

| US57582R4D54 / MASSACHUSETTS ST | 10,27 | -2,88 | 3,3867 | 0,0755 | |||||

| US64972GE754 / New York City Municipal Water Finance Authority | 10,07 | -2,96 | 3,3219 | 0,0718 | |||||

| US517845SB09 / LAS VEGAS VALLEY WATER DISTRICT 5.0% 06-01-49 | 9,83 | -2,86 | 3,2428 | 0,0728 | |||||

| US414004MU25 / HARRIS CNTY TX | 9,79 | -0,06 | 3,2296 | 0,1613 | |||||

| US45470YCJ82 / Indiana (State of) Finance Authority (Franciscan Alliance, Inc.), Series 2016 A, RB | 9,05 | -5,80 | 2,9862 | -0,0234 | |||||

| US217489VN08 / COPPELL TX INDEP SCH DIST | 8,32 | -0,83 | 2,7430 | 0,1165 | |||||

| US64985TES69 / NEW YORK ST URBAN DEV CORP SALES TAX REVENUE | 8,21 | -3,27 | 2,7086 | 0,0499 | |||||

| US254842AK35 / DIST OF COLUMBIA TOBACCO SETTLEMENT FING CORP | 8,10 | -0,07 | 2,6720 | 0,1331 | |||||

| US64990GVJ83 / New York (State of) Dormitory Authority (Rockefeller University), Series 2019 C, Ref. RB | 7,94 | -7,72 | 2,6186 | -0,0757 | |||||

| US292723AY90 / ENERGY S E AL A COOPERATIVE DIST ENERGY SPLY REVENUE | 7,61 | -1,12 | 2,5106 | 0,1000 | |||||

| US347658ZY50 / FORT LAUDERDALE FL WTR & SWR REVENUE | 7,54 | -2,60 | 2,4868 | 0,0627 | |||||

| US414004MS78 / HARRIS CNTY TX | 7,42 | 0,54 | 2,4458 | 0,1361 | |||||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US64972JTG30) | 7,20 | 2,3743 | 2,3743 | ||||||

| US452252KS79 / Illinois (State of) Toll Highway Authority, Series 2015 A, RB | 7,02 | -0,20 | 2,3158 | 0,1126 | |||||

| US09248U8412 / BlackRock Liquidity Funds: MuniCash, Institutional Shares | 6,86 | -47,91 | 6,86 | -47,91 | 2,2621 | -1,8612 | |||

| US254845QA10 / District of Columbia Water & Sewer Authority, Series 2018 B, RB | 6,10 | -1,15 | 2,0122 | 0,0795 | |||||

| US74529JPW98 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 6,10 | -6,05 | 2,0111 | -0,0217 | |||||

| US70342PAN42 / PATRIOTS ENERGY GROUP FING AGY SC GAS SPLY REVENUE | 6,03 | -1,34 | 1,9890 | 0,0746 | |||||

| US987388DP73 / YOSEMITE CA CMNTY CLG DIST | 6,03 | -3,29 | 1,9879 | 0,0362 | |||||

| US64972GE424 / New York City Municipal Water Finance Authority | 5,37 | -4,94 | 1,7724 | 0,0021 | |||||

| US09182TCG04 / Black Belt Energy Gas District | 5,24 | -0,55 | 1,7286 | 0,0783 | |||||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 4,76 | -17,36 | 1,5701 | -0,2336 | |||||

| US42605QHM87 / HENRICO CNTY VA ECON DEV AUTH RSDL CARE FAC REVENUE | 4,65 | -1,53 | 1,5328 | 0,0550 | |||||

| US89602HDR57 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH PAYROLL MOBILITY TAX | 4,51 | -2,76 | 1,4868 | 0,0350 | |||||

| US56035DEN84 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 4,50 | -1,68 | 1,4832 | 0,0507 | |||||

| PENNSYLVANIA ST HSG FIN AGY SF MTGE REVENUE / DBT (US70879QWL30) | 4,39 | -1,92 | 1,4466 | 0,0463 | |||||

| US70917S6Y49 / Pennsylvania (State of) Higher Educational Facilities Authority (University of Pennsylvania Health), Series 2019, RB | 4,38 | -8,23 | 1,4448 | -0,0500 | |||||

| NEW YORK ST DORM AUTH ST PERSONAL INCOME TAX REVENUE / DBT (US64990KHA43) | 4,08 | 1,3462 | 1,3462 | ||||||

| US09182TCQ85 / BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE | 4,07 | -1,24 | 1,3438 | 0,0520 | |||||

| US68450LHL27 / Orange County Health Facilities Authority | 4,07 | -1,69 | 1,3409 | 0,0456 | |||||

| SOUTHEAST ENERGY AUTH COOPERATIVE DIST AL ENERGY SUPPLY REVE / DBT (US84136HBC60) | 4,01 | 99,80 | 1,3226 | 0,6941 | |||||

| US888808HT28 / TOBACCO SETTLEMENT FING CORP NJ | 3,87 | -4,54 | 1,2772 | 0,0068 | |||||

| US79642GQL94 / SAN ANTONIO WATER SYSTEM 5.25% 05-15-48 | 3,85 | 1,2690 | 1,2690 | ||||||

| US66285WXM36 / N TX TOLLWAY AUTH REVENUE | 3,81 | -1,30 | 1,2562 | 0,0477 | |||||

| HILLSBOROUGH CNTY FLA INDL DEVAUTH HEALTH SYS REVENUE / DBT (US43233KAV61) | 3,59 | -3,83 | 1,1850 | 0,0149 | |||||

| DALLAS-FORT WORTH TX INTERNATIONAL ARPT REVENUE / DBT (US23503CEK99) | 3,47 | -8,27 | 1,1448 | -0,0402 | |||||

| US167736V381 / City of Chicago IL Waterworks Revenue | 3,38 | 1,1158 | 1,1158 | ||||||

| S E ALABAMA ST GAS SPLY DIST GAS SPLY REVENUE / DBT (US84131TBT88) | 3,26 | 1,0758 | 1,0758 | ||||||

| MIAMI-DADE CNTY FL WTR & SWR REVENUE / DBT (US59334DNW01) | 3,25 | -7,27 | 1,0733 | -0,0257 | |||||

| US646136WK31 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 3,23 | -2,54 | 1,0642 | 0,0276 | |||||

| US70252AAW53 / County of Pasco FL | 3,15 | -3,53 | 1,0381 | 0,0164 | |||||

| LOWER COLORADO RIVER TX AUTH TRANSMISSION CONTRACT REVENUE / DBT (US54811BL331) | 3,12 | 1,0287 | 1,0287 | ||||||

| US880443JF46 / TENNESSEE ST ENERGY ACQUISITION CORP GAS REVENUE | 3,08 | -0,90 | 1,0142 | 0,0426 | |||||

| US45203HY309 / ILLINOIS ST FIN AUTH REVENUE | 2,92 | -2,96 | 0,9615 | 0,0206 | |||||

| US66285WHG42 / N TX TOLLWAY AUTH REVENUE | 2,88 | -4,13 | 0,9490 | 0,0091 | |||||

| MESQUITE TX HSG FIN CORP MF HSG REVENUE / DBT (US590747AA97) | 2,74 | -3,12 | 0,9020 | 0,0180 | |||||

| MARYLAND STADIUM AUTH BUILT TO LEARN REVENUE / DBT (US574294CV42) | 2,73 | 0,9001 | 0,9001 | ||||||

| US6461365Q05 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 2,68 | -5,14 | 0,8826 | -0,0010 | |||||

| US407272V346 / Hamilton County, Ohio, Hospital Facilities Revenue Bonds, TriHealth, Inc Obligated Group Project, Series 2017A | 2,67 | -1,22 | 0,8801 | 0,0342 | |||||

| US88044TAL35 / TENNESSEE ENERGY ACQUISITION CORP COMMODITY PROJECT REVENUE | 2,66 | -1,55 | 0,8786 | 0,0312 | |||||

| BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE / DBT (US09182TDL89) | 2,64 | 125,60 | 0,8693 | 0,5034 | |||||

| US646136WG29 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 2,62 | -1,39 | 0,8634 | 0,0322 | |||||

| US38611TAR86 / GRAND PARKWAY TRANSPRTN CORP TX SYS TOLL REVENUE | 2,47 | -3,71 | 0,8130 | 0,0113 | |||||

| US592041YQ41 / MET GOVT NASHVILLE & DAVIDSONCNTY TN HLTH & EDUCTNL FAC BRD | 2,45 | -1,53 | 0,8064 | 0,0288 | |||||

| WISCONSIN ST HSG & ECON DEV AUTH HOME OWNERSHIP REVENUE / DBT (US97689QTT30) | 2,44 | -2,52 | 0,8047 | 0,0208 | |||||

| IOWA ST FIN AUTH SF MTGE REVENUE / DBT (US46247EBQ70) | 2,39 | -4,97 | 0,7879 | 0,0009 | |||||

| LOUISIANA PUB FACS AUTH REVENUE / DBT (US546399RQ10) | 2,32 | -2,65 | 0,7641 | 0,0187 | |||||

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 2,28 | -4,25 | 0,7510 | 0,0062 | |||||

| BEXAR MGMT & DEV CORP TX MF HSG REVENUE / DBT (US08857FAA12) | 2,27 | 1,34 | 0,7486 | 0,0471 | |||||

| US57584XD571 / Massachusetts (State of) Development Finance Agency (Emerson College), Series 2016 A, RB | 2,25 | -5,82 | 0,7422 | -0,0060 | |||||

| US88046KBC99 / TENNESSEE HSG DEV AGY RSDL FIN PROGRAM REVENUE | 2,24 | -6,07 | 0,7401 | -0,0081 | |||||

| OREGON ST HSG & CMNTY SVCS DEPT MF REVENUE / DBT (US68608ENJ72) | 2,23 | -0,98 | 0,7342 | 0,0302 | |||||

| US6461364X64 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 2,20 | -2,31 | 0,7258 | 0,0206 | |||||

| US679111D279 / OKLAHOMA ST TURNPIKE AUTH | 2,08 | -2,35 | 0,6854 | 0,0190 | |||||

| US888808HR61 / Tobacco Settlement Financing Corp., Series 2018 A, Ref. RB | 2,06 | 121,11 | 0,6807 | 0,3987 | |||||

| US5465892B71 / LOUISVILLE & JEFFERSON CNTY KY MET SWR DIST SWR & DRAIN SYS | 2,06 | -3,11 | 0,6792 | 0,0137 | |||||

| US052398FD19 / AUSTIN TX ARPT SYS REVENUE | 2,00 | -1,13 | 0,6609 | 0,0261 | |||||

| US4521526L09 / ILLINOIS ST | 1,94 | -2,71 | 0,6384 | 0,0156 | |||||

| US70879QTX15 / PENNSYLVANIA H7(PA-WL 4/1/82) 5% 10/1/43 | 1,94 | -2,17 | 0,6382 | 0,0187 | |||||

| US45203MQB09 / Illinois Housing Development Authority | 1,92 | -0,57 | 0,6345 | 0,0288 | |||||

| US875301FP31 / Tampa-Hillsborough County Expressway Authority | 1,88 | -1,62 | 0,6208 | 0,0217 | |||||

| US593490NG65 / City of Miami FL, Series 2023, RB | 1,84 | 0,6054 | 0,6054 | ||||||

| PENNSYLVANIA ST HSG FIN AGY MF HSG REVENUE / DBT (US708797BF15) | 1,81 | -0,93 | 0,5984 | 0,0250 | |||||

| US2322655Q77 / CUYAHOGA CNTY OH HOSP REVENUE | 1,79 | -1,70 | 0,5900 | 0,0202 | |||||

| MARICOPA CNTY & PHOENIX AZ INDL DEV AUTHORITIES MTGE REVENUE / DBT (US566736EK60) | 1,76 | -4,45 | 0,5810 | 0,0037 | |||||

| FLORIDA ST HSG FIN CORP REVENUE / DBT (US34074M3P41) | 1,76 | -2,61 | 0,5789 | 0,0145 | |||||

| US57584YNB10 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 1,71 | -11,79 | 0,5651 | -0,0431 | |||||

| US490237AQ73 / Kent County, Delaware, Student Housing & Dining Facility Revenue Bonds, Collegiate Housing Foundation - Dover LLC Delaware State University Project, S | 1,70 | -6,60 | 0,5602 | -0,0090 | |||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WAQ78) | 1,68 | -2,83 | 0,5555 | 0,0128 | |||||

| US546410CY53 / Louisiana Stadium & Exposition District | 1,68 | 0,5544 | 0,5544 | ||||||

| US880397CF98 / Tennergy Corp. | 1,65 | -1,67 | 0,5442 | 0,0187 | |||||

| US59261AHL44 / Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Series 2016C-1 | 1,64 | -3,47 | 0,5410 | 0,0090 | |||||

| US167505XK71 / Chicago Board of Education | 1,62 | -1,82 | 0,5346 | 0,0179 | |||||

| US64613CAC29 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 1,58 | -6,74 | 0,5203 | -0,0092 | |||||

| US64972JAX63 / NEW YORK NY CITY TRANSITIONAL FIN AUTH REV | 1,57 | -2,96 | 0,5193 | 0,0112 | |||||

| HOUSTON TX / DBT (US442332EE86) | 1,57 | -7,36 | 0,5191 | -0,0130 | |||||

| US45129GKN42 / IDAHO ST HSG & FIN ASSN NONPROFIT FACS REVENUE | 1,55 | -1,27 | 0,5110 | 0,0196 | |||||

| TEXAS ST UNIV SYS FING REVENUE / DBT (US88278PJ881) | 1,51 | -6,44 | 0,4983 | -0,0071 | |||||

| US167505XR25 / CHICAGO BOARD OF EDUCATION | 1,50 | -3,16 | 0,4949 | 0,0098 | |||||

| US623040FW73 / Mt. San Antonio (City of), CA Community College District (Election 2008), Series 2013 A, GO Bonds | 1,50 | -6,77 | 0,4948 | -0,0091 | |||||

| US2322655T17 / CUYAHOGA CNTY OH HOSP REVENUE | 1,46 | -5,97 | 0,4829 | -0,0049 | |||||

| US64542QBK85 / NEW HOPE CULTURAL EDU FACS FINCORP TX EDU REVENUE | 1,46 | -0,55 | 0,4804 | 0,0218 | |||||

| US83703EMQ51 / FX.RT. MUNI BOND | 1,44 | -9,46 | 0,4735 | -0,0228 | |||||

| US167727C539 / City of Chicago IL Wastewater Transmission Revenue | 1,39 | -71,49 | 0,4598 | -1,0714 | |||||

| US74529JQG30 / Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT | 1,39 | -23,30 | 0,4583 | -0,1088 | |||||

| US597495AZ30 / MIDLAND CNTY TX FRESH WTR SPLY DIST 1 REVENUE | 1,38 | -0,65 | 0,4566 | 0,0203 | |||||

| ORANGE CNTY FL HLTH FACS AUTH REVENUE / DBT (US68450LJQ95) | 1,33 | -4,03 | 0,4402 | 0,0049 | |||||

| US452153HR34 / ILLINOIS ST REGD B/E 5.00000000 | 1,28 | -4,61 | 0,4231 | 0,0022 | |||||

| CMNTY DEV ADMIN MD MF DEV REVENUE / DBT (US20364NCJ46) | 1,28 | -5,74 | 0,4226 | -0,0030 | |||||

| US25476FA572 / DIST OF COLUMBIA | 1,27 | 0,4204 | 0,4204 | ||||||

| COOK CNTY IL CMNTY CONSOL SCHDIST #64 PARK RIDGE / DBT (US213669LC61) | 1,27 | 0,4199 | 0,4199 | ||||||

| IOWA ST FIN AUTH SF MTGE REVENUE / DBT (US4624677X38) | 1,27 | -0,55 | 0,4191 | 0,0192 | |||||

| US93878YDR71 / WASHINGTON DC MET AREA TRANSIT AUTH DEDICATED REVENUE | 1,25 | 0,4116 | 0,4116 | ||||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WAW47) | 1,24 | -2,75 | 0,4078 | 0,0098 | |||||

| US5946954R69 / MI ST TRUNK FD 5.50% 11/15/2049 | 1,23 | -3,76 | 0,4053 | 0,0057 | |||||

| HARRIS CNTY TX TOLL ROAD REVENUE / DBT (US41423PDY07) | 1,21 | -6,01 | 0,3976 | -0,0039 | |||||

| US64971XX942 / New York City Transitional Finance Authority Future Tax Secured Revenue | 1,20 | -5,29 | 0,3959 | -0,0011 | |||||

| US42605QHN60 / HENRICO CNTY VA ECON DEV AUTH RSDL CARE FAC REVENUE | 1,18 | -1,51 | 0,3887 | 0,0141 | |||||

| US59261AG500 / MET TRANSPRTN AUTH NY REVENUE | 1,15 | -2,37 | 0,3807 | 0,0105 | |||||

| US797355M841 / SAN DIEGO CA UNIF SCH DIST | 1,15 | -3,21 | 0,3784 | 0,0070 | |||||

| US797355Q313 / SAN DIEGO CA UNIF SCH DIST | 1,13 | -0,79 | 0,3733 | 0,0160 | |||||

| US89602HGG65 / TRIBOROUGH BRIDGE & TUNNEL AUTHORITY | 1,12 | -3,35 | 0,3709 | 0,0067 | |||||

| PENNSYLVANIA ST HGR EDUCTNL FACS AUTH REVENUE / DBT (US70917TRU78) | 1,12 | -32,73 | 0,3696 | -0,1520 | |||||

| JEFFERSON CNTY AL SWR REVENUE WARRANTS / DBT (US472682ZR71) | 1,11 | 0,3647 | 0,3647 | ||||||

| NORTH RIDGEVILLE OH CITY SCH DIST / DBT (US661870LV55) | 1,08 | -1,63 | 0,3573 | 0,0125 | |||||

| US88880NAU37 / TOBACCO SETTLEMENT FING CORP VA | 1,08 | -8,30 | 0,3572 | -0,0126 | |||||

| US296110GC76 / ESCAMBIA CNTY FL HLTH FACS AUTH | 1,06 | -1,85 | 0,3498 | 0,0115 | |||||

| US20775DVR06 / Connecticut Health and Educational Facilities Authority, Revenue Bonds, Connecticut Children?s Medical Center and Subsidiaries, Series 2023E | 1,04 | -6,37 | 0,3446 | -0,0048 | |||||

| US896035BD38 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH SALES TAX REVENUE | 1,04 | -2,62 | 0,3437 | 0,0086 | |||||

| US649519DA03 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 1, Ref. RB | 1,03 | -0,67 | 0,3408 | 0,0151 | |||||

| US296110GA11 / ESCAMBIA CNTY FL HLTH FACS AUTH | 1,02 | -1,74 | 0,3351 | 0,0111 | |||||

| US682001JU74 / OMAHA NE PUBLIC PWR DIST ELEC REVENUE | 1,00 | -3,19 | 0,3299 | 0,0064 | |||||

| NEW YORK ST DORM AUTH ST PERSONAL INCOME TAX REVENUE / DBT (US64990KHC09) | 0,99 | 0,3279 | 0,3279 | ||||||

| US66285WHD11 / North Texas Tollway Authority, Series 2011 B, RB | 0,99 | -3,42 | 0,3258 | 0,0055 | |||||

| WATERBURY CT HSG AUTH MF HSG REVENUE / DBT (US941260AB72) | 0,92 | 0,3046 | 0,3046 | ||||||

| US896035CD29 / Sales Tax RB Series 2023A | 0,92 | 0,3020 | 0,3020 | ||||||

| US837031ZN69 / SOUTH CAROLINA ST JOBS-ECON DEV AUTH ECON DEV REVENUE | 0,91 | -2,46 | 0,3007 | 0,0079 | |||||

| SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE / DBT (US8371514Y20) | 0,90 | 0,2973 | 0,2973 | ||||||

| US71883PMN41 / CITY OF PHOENIX AZ WASTEWATER REVENUE 5.25% 07-01-47 | 0,88 | -3,18 | 0,2917 | 0,0056 | |||||

| US74529JRH04 / Puerto Rico Sales Tax Financing Corp., Series 2019 A-2, RB | 0,88 | -5,40 | 0,2892 | -0,0008 | |||||

| US51778CAS52 / LAS VEGAS-REV | 0,87 | -9,00 | 0,2871 | -0,0124 | |||||

| US442332DG44 / CITY OF HOUSTON TX 5.25% 03-01-43 | 0,86 | -3,25 | 0,2847 | 0,0054 | |||||

| TEXAS ST A & M UNIV PERM UNIV FUND / DBT (US8821178Q05) | 0,85 | 0,2807 | 0,2807 | ||||||

| KANSAS CITY MO INDL DEV AUTH MF / DBT (US48504RAA86) | 0,84 | -6,35 | 0,2772 | -0,0038 | |||||

| ILLINOIS ST / DBT (US452153KF58) | 0,83 | 0,2729 | 0,2729 | ||||||

| US888808HQ88 / TOBACCO SETTLEMENT FING CORP NJ | 0,81 | -1,57 | 0,2687 | 0,0098 | |||||

| VOLUSIA CNTY FL EDUCTNL FAC AUTH / DBT (US928836NY72) | 0,81 | -4,38 | 0,2667 | 0,0020 | |||||

| US84136GAK13 / Southeast Energy Authority A Cooperative District, Series 2023 B | 0,78 | -1,26 | 0,2587 | 0,0098 | |||||

| US88034NGN84 / Tender Option Bond Trust Receipts/Certificates | 0,77 | -1,29 | 0,2534 | 0,0097 | |||||

| US490237AN43 / KENT CNTY DE STUDENT HSG & DINING FAC REVENUE | 0,76 | -2,57 | 0,2502 | 0,0063 | |||||

| DIST OF COLUMBIA HSG FIN AGY MF TAX EXEMPT MTGE BACKED BONDS / DBT (US25477UAD63) | 0,70 | -4,50 | 0,2315 | 0,0016 | |||||

| FORT BEND TX INDEP SCH DIST / DBT (US346843WQ44) | 0,68 | -4,10 | 0,2239 | 0,0021 | |||||

| US25477GWB75 / District of Columbia Income Tax, Series 2023 A | 0,67 | -66,72 | 0,2207 | -0,4088 | |||||

| SOUTH CAROLINA ST JOBS-ECON DEV AUTH HLTH FACS REVENUE / DBT (US837032CF65) | 0,64 | -3,60 | 0,2118 | 0,0032 | |||||

| US04052BJX38 / ARIZONA ST INDL DEV AUTH EDU REVENUE | 0,64 | -1,84 | 0,2112 | 0,0071 | |||||

| US72177MSV09 / PIMA CNTY AZ INDL DEV AUTH EDU REVENUE | 0,64 | -2,44 | 0,2110 | 0,0058 | |||||

| US592250CL63 / MET PIER & EXPOSITION AUTH IL REVENUE | 0,64 | -6,34 | 0,2097 | -0,0028 | |||||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US6589098C37) | 0,61 | -2,10 | 0,2001 | 0,0061 | |||||

| US04052BJN55 / ARIZONA ST INDL DEV AUTH EDU REVENUE | 0,60 | -5,80 | 0,1984 | -0,0015 | |||||

| US74442PPT65 / Public Finance Authority | 0,60 | -2,44 | 0,1978 | 0,0053 | |||||

| NATIONAL FIN AUTH NH MF AFFORDABLE HSG / DBT (US63610CAA18) | 0,60 | 0,1978 | 0,1978 | ||||||

| US179093HN22 / CLACKAMAS CNTY OR SCH DIST 12 NORTH CLACKAMAS | 0,59 | -4,55 | 0,1939 | 0,0009 | |||||

| US64945JAX00 / NEW YORK CNTYS NY TOBACCO TRUST VI | 0,55 | -0,54 | 0,1808 | 0,0080 | |||||

| TEXAS ST DEPT OF HSG & CMNTY AFFAIRS RESDL MTG REVENUE / DBT (US882750XW73) | 0,54 | -1,45 | 0,1793 | 0,0066 | |||||

| SAN ANTONIO TX HSG TRUST PUBLIC FAC CORP MF TAX EXEMPT BDS / DBT (US79626WAC10) | 0,54 | -3,07 | 0,1772 | 0,0036 | |||||

| US873816AS10 / TAHOE DOUGLAS VISITORS AUTH NV TADDEV 07/45 FIXED 5 | 0,53 | -2,21 | 0,1754 | 0,0053 | |||||

| KNOX CNTY TN HLTH EDUCTNL & HSG FAC BRD STUDENT HSG REVENUE / DBT (US499526AS07) | 0,52 | -0,76 | 0,1721 | 0,0076 | |||||

| TWO LAKES CDD FL SPL ASSMNT / DBT (US90207EAV39) | 0,52 | -4,95 | 0,1712 | 0,0004 | |||||

| US13281PAD96 / CAMDEN CNTY NJ IMPT AUTH SCH REVENUE | 0,51 | -3,21 | 0,1693 | 0,0033 | |||||

| US92812WGT53 / VIRGINIA ST HSG DEV AUTH | 0,51 | -1,35 | 0,1691 | 0,0066 | |||||

| US14054CCZ05 / CAPITAL TRUST AGY FL EDUCTNL FACS REVENUE | 0,51 | -4,32 | 0,1679 | 0,0012 | |||||

| US041807CF34 / ARLINGTON TX HGR EDU FIN CORP EDU REVENUE | 0,51 | -4,32 | 0,1679 | 0,0010 | |||||

| HOUSTON TX / DBT (US442332ED04) | 0,50 | 0,1645 | 0,1645 | ||||||

| MISSISSIPPI ST HOME CORP MF REVENUE / DBT (US60535NDQ79) | 0,50 | 0,1636 | 0,1636 | ||||||

| HILLSBOROUGH CNTY FLA INDL DEVAUTH HEALTH SYS REVENUE / DBT (US43233KAU88) | 0,49 | 0,1608 | 0,1608 | ||||||

| US74529JRP20 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0,48 | -6,67 | 0,1572 | -0,0025 | |||||

| US13067RCZ47 / CALIFORNIA ST ENTERPRISE DEV AUTH REVENUE | 0,46 | -4,94 | 0,1526 | 0,0002 | |||||

| US83704MCH79 / SOUTH CAROLINA ST JOBS-ECON DEV AUTH EDUCTNL FACS REVENUE | 0,46 | -5,71 | 0,1525 | -0,0010 | |||||

| US041807BH09 / ARLINGTON TX HGR EDU FIN CORP EDU REVENUE | 0,46 | -2,15 | 0,1504 | 0,0042 | |||||

| US64542QBP72 / NEW HOPE CULTURAL EDU FACS FIN NEW HOPE CULTURAL EDUCATION FACILITIES FINANCE COR | 0,45 | -16,36 | 0,1485 | -0,0202 | |||||

| US04052BJP04 / ARIZONA ST INDL DEV AUTH EDU REVENUE | 0,45 | -7,44 | 0,1478 | -0,0038 | |||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WBD56) | 0,45 | 0,1471 | 0,1471 | ||||||

| US97689QSN78 / WISCONSIN ST HSG & ECON DEV AUTH HOME OWNERSHIP REVENUE | 0,43 | -1,59 | 0,1433 | 0,0052 | |||||

| UNIV OF COLORADO CO ENTERPRISE SYS REVENUE / DBT (US91417NKR51) | 0,43 | -4,21 | 0,1425 | 0,0012 | |||||

| WASHINGTON ST HSG FIN COMMISSION / DBT (US93978UAA43) | 0,41 | -5,35 | 0,1345 | -0,0002 | |||||

| US74082PAH38 / PRESERVE AT S BRANCH CDD FL SPL ASSMNT REVENUE | 0,41 | -7,11 | 0,1338 | -0,0028 | |||||

| US873816AR37 / TAHOE DOUGLAS VISITORS AUTH NV TADDEV 07/40 FIXED 5 | 0,41 | -48,54 | 0,1336 | -0,1129 | |||||

| US91754TC768 / Utah Charter School Finance Authority | 0,40 | -3,61 | 0,1320 | 0,0018 | |||||

| San Antonio Housing Trust Public Facility Corp / ABS-MBS (US79626WAB37) | 0,40 | -1,00 | 0,1311 | 0,0053 | |||||

| US42934AAR14 / HIDALGO CNTY TX REGL MOBILITY AUTH TOLL & VEHICLE REGISTRATI | 0,37 | -1,58 | 0,1232 | 0,0044 | |||||

| US74529JQL25 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0,36 | -7,07 | 0,1173 | -0,0024 | |||||

| US572682TH52 / Marshall Independent School District, Series 2023 | 0,35 | -5,91 | 0,1156 | -0,0011 | |||||

| US744396FT49 / PUBLIC FIN AUTH WI CHRT SCH REVENUE | 0,33 | -6,74 | 0,1096 | -0,0019 | |||||

| NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE / DBT (US64972GL858) | 0,33 | 0,1086 | 0,1086 | ||||||

| US56681NEP87 / Maricopa (County of), AZ Industrial Development Authority (Legacy Traditional Schools), Series 2019, Ref. RB | 0,33 | -4,12 | 0,1076 | 0,0011 | |||||

| TARRANT CNTY TX CULTURAL EDU FACS FIN CORP REVENUE / DBT (US87638TJK07) | 0,32 | -4,20 | 0,1052 | 0,0007 | |||||

| US74529JRL16 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0,32 | -7,56 | 0,1052 | -0,0026 | |||||

| US414005Y857 / County of Harris, Series 2023 A | 0,32 | -6,76 | 0,1048 | -0,0019 | |||||

| US34061UFB98 / Florida Development Finance Corp. | 0,31 | -4,56 | 0,1038 | 0,0005 | |||||

| COLORADO HSG & FIN AUTH MF TAX-EXEMPT MTGE-BACKED SECURITIES / DBT (US19648WAD92) | 0,31 | -0,33 | 0,1011 | 0,0048 | |||||

| US744396GU03 / PUBLIC FIN AUTH WI CHRT SCH REVENUE | 0,30 | -9,37 | 0,0990 | -0,0048 | |||||

| US228130KH25 / CROWLEY TX INDEP SCH DIST | 0,29 | -4,29 | 0,0957 | 0,0007 | |||||

| US882275AC47 / Texas City Industrial Development Corporation, Texas, Industrial Development Revenue Bonds, NRG Energy, inc Project, Fixed Rate Series 2012 | 0,29 | -4,98 | 0,0943 | 0,0000 | |||||

| US92708KAE73 / Village Community Development District No 15 | 0,28 | -4,18 | 0,0908 | 0,0009 | |||||

| WISCONSIN ST HLTH & EDUCTNL FACS AUTH REVENUE / DBT (US97712JJE47) | 0,27 | -2,14 | 0,0905 | 0,0026 | |||||

| US51265KFJ25 / Lakewood Ranch Stewardship District | 0,27 | -3,24 | 0,0888 | 0,0017 | |||||

| NEW YORK NY / DBT (US64966SMF01) | 0,27 | 0,0887 | 0,0887 | ||||||

| NORTH DAKOTA ST HSG FIN AGY / DBT (US6589096Q41) | 0,26 | -2,95 | 0,0868 | 0,0018 | |||||

| IDAHO ST HLTH FACS AUTH REVENUE / DBT (US451295H283) | 0,26 | -3,38 | 0,0850 | 0,0015 | |||||

| US89602HAB33 / Triborough Bridge & Tunnel Authority | 0,23 | -2,50 | 0,0774 | 0,0022 | |||||

| US96149TAQ94 / WESTSIDE FL CDD SPL ASSMNT REVENUE | 0,23 | -3,70 | 0,0774 | 0,0011 | |||||

| US744396GT30 / PUBLIC FIN AUTH WI CHRT SCH REVENUE | 0,23 | -8,98 | 0,0771 | -0,0031 | |||||

| US96149TAR77 / WESTSIDE FL CDD SPL ASSMNT REVENUE | 0,23 | -4,13 | 0,0767 | 0,0008 | |||||

| VIRGINIA ST HSG DEV AUTH CMWLTH MTGE / DBT (US92812U6K97) | 0,22 | -2,64 | 0,0729 | 0,0016 | |||||

| US42934AAQ31 / HIDALGO CNTY TX REGL MOBILITY AUTH TOLL & VEHICLE REGISTRATI | 0,20 | -1,00 | 0,0658 | 0,0026 | |||||

| NATIONAL FIN AUTH NH AFFORDABLE HSG CTFS / DBT (US63607DAB29) | 0,19 | -3,59 | 0,0621 | 0,0008 | |||||

| CONNECTICUT ST HSG FIN AUTH HSG MTGE FIN PROGRAM / DBT (US20775HM268) | 0,18 | -1,62 | 0,0603 | 0,0022 | |||||

| US14054CFG96 / CAPITAL TRUST AGY FL EDUCTNL FACS REVENUE | 0,18 | -6,19 | 0,0601 | -0,0009 | |||||

| MISSOURI ST HSG DEV COMMISSION SF MTGE REVENUE / DBT (US60637B8G82) | 0,18 | -0,56 | 0,0593 | 0,0027 | |||||

| BLACK DESERT PUB INFRASTRUCTURE DIST UT SPL ASSMNT / DBT (US09204TAA97) | 0,18 | -3,31 | 0,0578 | 0,0008 | |||||

| US11861MBL90 / Bucks County Industrial Development Authority | 0,17 | -5,59 | 0,0560 | -0,0002 | |||||

| US802170AP53 / Santa Fe (City of), NM (El Castillo Retirement), Series 2019 A, RB | 0,17 | -5,68 | 0,0549 | -0,0003 | |||||

| US274502AA10 / East Point Business & Industrial Development Authority | 0,17 | -30,38 | 0,0545 | -0,0198 | |||||

| NORTH CAROLINA ST MED CARE COMMISSION RETMNT FACS REVENUE / DBT (US65820YSY31) | 0,11 | -0,90 | 0,0365 | 0,0016 | |||||

| US64966QL578 / City of New York NY | 0,11 | -1,87 | 0,0347 | 0,0009 | |||||

| US126292CQ24 / CSCDA Community Improvement Authority | 0,10 | -6,36 | 0,0342 | -0,0003 | |||||

| VIRGINIA ST HSG DEV AUTH CMWLTH MTGE / DBT (US92812U6J25) | 0,10 | -3,03 | 0,0317 | 0,0006 | |||||

| US34061ULD80 / Florida Development Finance Corp | 0,06 | 0,00 | 0,0209 | 0,0011 | |||||

| JEA FL WTR & SWR REVENUE / DBT (US46615SFP83) | 0,00 | -100,00 | 0,0000 | -1,2027 | |||||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US64972JPT96) | 0,00 | -100,00 | 0,0000 | -3,3129 |