Grundlæggende statistik

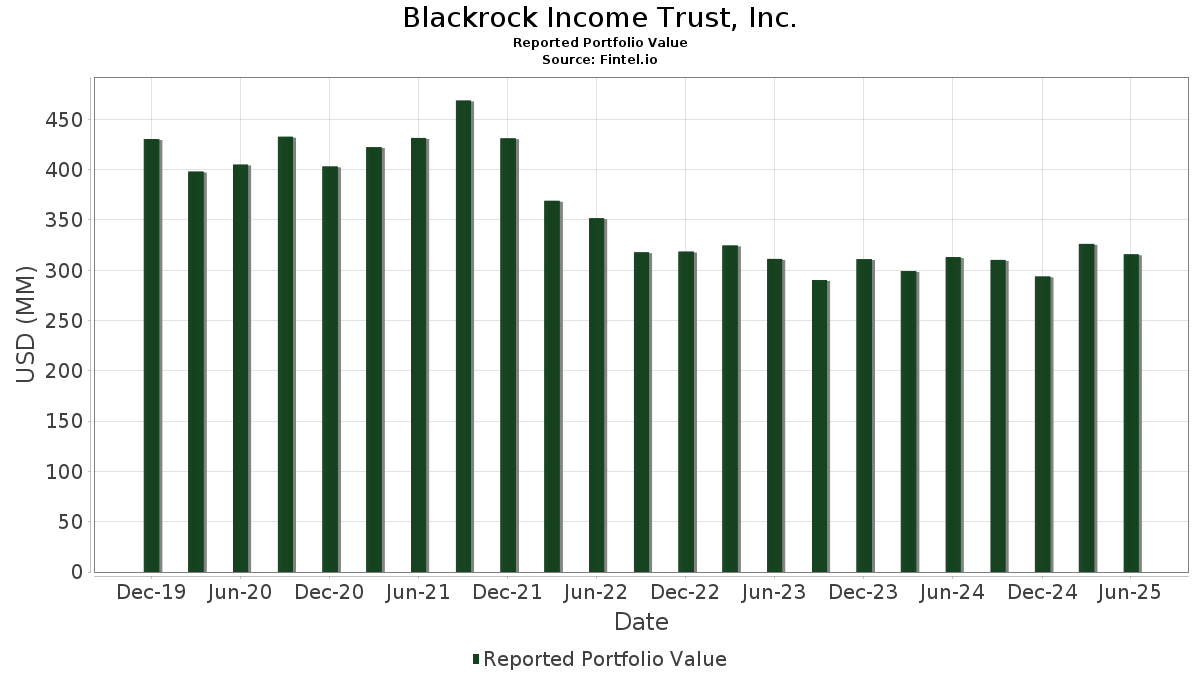

| Porteføljeværdi | $ 315.811.781 |

| Nuværende stillinger | 348 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Blackrock Income Trust, Inc. har afsløret 348 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 315.811.781 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Blackrock Income Trust, Inc.s største beholdninger er UMBS TBA (US:US01F0306781) , Fannie Mae REMICS (US:US3136A1LW36) , Fannie Mae Pool (US:US3140FXDJ88) , Fannie Mae REMICS (US:US3136A14G72) , and Freddie Mac REMICS (US:US3137AN5V38) . Blackrock Income Trust, Inc.s nye stillinger omfatter UMBS TBA (US:US01F0306781) , Fannie Mae REMICS (US:US3136A1LW36) , Fannie Mae Pool (US:US3140FXDJ88) , Fannie Mae REMICS (US:US3136A14G72) , and Freddie Mac REMICS (US:US3137AN5V38) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,30 | 1,1413 | 0,9000 | ||

| 2,47 | 0,8537 | 0,8537 | ||

| 1,20 | 0,4165 | 0,4165 | ||

| 1,17 | 0,4065 | 0,4065 | ||

| 0,93 | 0,3224 | 0,3224 | ||

| 0,88 | 0,3038 | 0,3038 | ||

| 0,85 | 0,2942 | 0,2942 | ||

| 0,81 | 0,2802 | 0,2802 | ||

| 0,75 | 0,2581 | 0,2581 | ||

| 0,70 | 0,2420 | 0,2420 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -16,65 | -5,7602 | -5,7602 | ||

| 26,62 | 9,2116 | -2,9034 | ||

| -7,29 | -2,5213 | -2,5213 | ||

| -5,15 | -1,7826 | -1,7826 | ||

| -4,93 | -1,7043 | -1,7043 | ||

| -4,91 | -1,6982 | -1,6982 | ||

| -4,83 | -1,6718 | -1,6718 | ||

| -4,78 | -1,6544 | -1,6544 | ||

| -3,76 | -1,3021 | -1,3021 | ||

| -0,03 | -0,0093 | -1,1506 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0306781 / UMBS TBA | 26,62 | -14,49 | 9,2116 | -2,9034 | |||||

| US3136A1LW36 / Fannie Mae REMICS | 22,95 | -4,08 | 7,9430 | -0,2758 | |||||

| US3140FXDJ88 / Fannie Mae Pool | 17,21 | -3,70 | 5,9550 | -0,1825 | |||||

| US3136A14G72 / Fannie Mae REMICS | 13,84 | 0,97 | 4,7884 | 0,0819 | |||||

| US3137AN5V38 / Freddie Mac REMICS | 13,74 | -1,80 | 4,7537 | -0,0507 | |||||

| US76116FAC14 / Resol Fnd Ser B 2030 Bonds Prin Comp 04/15/30 | 10,72 | 1,64 | 3,7093 | 0,0874 | |||||

| US38379MCQ50 / Government National Mortgage Association | 8,77 | 1,63 | 3,0346 | 0,0713 | |||||

| US3137B5KE23 / Freddie Mac REMICS | 8,27 | 0,62 | 2,8617 | 0,0389 | |||||

| US3140FXFZ03 / Fannie Mae Pool | 7,61 | -3,94 | 2,6345 | -0,0874 | |||||

| US3137BRYR07 / Freddie Mac REMICS | 6,37 | -2,88 | 2,2051 | -0,0483 | |||||

| US38377WSG05 / Government National Mortgage Association | 6,12 | -1,34 | 2,1191 | -0,0123 | |||||

| US38380XYC54 / Government National Mortgage Association | 5,85 | 0,74 | 2,0255 | 0,0302 | |||||

| US3137H8LQ22 / Freddie Mac REMICS | 5,72 | 0,14 | 1,9799 | 0,0178 | |||||

| US3137AAW824 / Freddie Mac REMICS | 5,40 | -2,16 | 1,8680 | -0,0268 | |||||

| US3133KPQ277 / Freddie Mac Pool | 5,39 | -2,06 | 1,8635 | -0,0246 | |||||

| US3133KPDJ49 / Freddie Mac Pool | 5,15 | -2,41 | 1,7805 | -0,0302 | |||||

| US3133KQW448 / Freddie Mac Pool | 5,12 | -1,88 | 1,7721 | -0,0203 | |||||

| US3133BVX346 / Freddie Mac Pool | 5,04 | -2,74 | 1,7435 | -0,0356 | |||||

| US3140XKP203 / Fannie Mae Pool | 4,99 | -2,77 | 1,7270 | -0,0355 | |||||

| US31398SPL15 / Fannie Mae REMICS | 4,75 | -3,14 | 1,6430 | -0,0408 | |||||

| US3137F4VK57 / Freddie Mac REMICS | 4,24 | -1,26 | 1,4678 | -0,0074 | |||||

| US38378DHX66 / Government National Mortgage Association | 4,24 | -2,49 | 1,4656 | -0,0262 | |||||

| US3136BHEV73 / Fannie Mae REMICS | 4,16 | -3,41 | 1,4390 | -0,0396 | |||||

| US3136BBCM23 / Fannie Mae REMICS | 3,95 | -1,35 | 1,3662 | -0,0085 | |||||

| US3140H37J95 / Fannie Mae Pool | 3,93 | -1,77 | 1,3601 | -0,0141 | |||||

| US38383REX17 / Government National Mortgage Association | 3,66 | -1,32 | 1,2672 | -0,0074 | |||||

| US3137H0YY82 / FHLMC CMO IO | 3,49 | -7,58 | 1,2072 | -0,0891 | |||||

| US31418NX218 / Fannie Mae Pool | 3,40 | -2,47 | 1,1760 | -0,0206 | |||||

| US3137FW3Q11 / FHLMC, Series 5013, Class JI | 3,33 | -2,91 | 1,1530 | -0,0260 | |||||

| US31335ARP56 / Freddie Mac Gold Pool | 3,31 | -3,35 | 1,1465 | -0,0308 | |||||

| EW / Edwards Lifesciences Corporation | 3,30 | 431,94 | 1,1413 | 0,9000 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3,30 | -2,80 | 1,1402 | -0,0243 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,17 | -3,06 | 1,0952 | -0,0263 | |||||

| US3136B1C698 / Fannie Mae REMICS | 3,07 | -3,16 | 1,0606 | -0,0264 | |||||

| US3140MQB658 / Fannie Mae Pool | 3,05 | -3,66 | 1,0558 | -0,0319 | |||||

| US38383PBF71 / Government National Mortgage Association | 2,98 | -2,10 | 1,0306 | -0,0144 | |||||

| US31397QJJ85 / Fannie Mae REMICS | 2,97 | -3,32 | 1,0284 | -0,0271 | |||||

| US3137A4U967 / Freddie Mac REMICS | 2,80 | -0,57 | 0,9677 | 0,0018 | |||||

| U.S. Treasury Notes / DBT (US91282CKP58) | 2,78 | 0,51 | 0,9635 | 0,0121 | |||||

| US3136BFRC99 / Fannie Mae REMICS | 2,76 | -3,26 | 0,9558 | -0,0248 | |||||

| US3137FCZ491 / Freddie Mac REMICS | 2,76 | -3,53 | 0,9548 | -0,0274 | |||||

| US3137BDKG02 / Freddie Mac REMICS | 2,74 | -4,17 | 0,9476 | -0,0338 | |||||

| US3137H2JG08 / Freddie Mac REMICS | 2,62 | -1,73 | 0,9069 | -0,0089 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDM84) | 2,47 | 0,8537 | 0,8537 | ||||||

| US3140X6JS19 / FNMA UMBS, 30 Year | 2,38 | -2,58 | 0,8240 | -0,0156 | |||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 2,36 | -53,59 | 2,36 | -53,59 | 0,8174 | -0,9306 | |||

| US31398STJ23 / Fannie Mae REMICS | 2,31 | -3,43 | 0,7988 | -0,0220 | |||||

| US3136A03W59 / Fannie Mae REMICS | 2,27 | -3,49 | 0,7841 | -0,0224 | |||||

| US35563PHF99 / Seasoned Credit Risk Transfer Trust | 2,25 | -4,06 | 0,7774 | -0,0267 | |||||

| US3137H0JN92 / Freddie Mac REMICS | 2,20 | -3,00 | 0,7622 | -0,0176 | |||||

| US3137FAP363 / Freddie Mac REMICS | 2,18 | -3,54 | 0,7557 | -0,0217 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2,12 | -5,81 | 0,7345 | -0,0396 | |||||

| US3136B2MC36 / Fannie Mae REMICS | 1,92 | -1,34 | 0,6632 | -0,0040 | |||||

| US3137A3QD48 / Freddie Mac REMICS | 1,91 | 0,95 | 0,6602 | 0,0111 | |||||

| US31418MPN64 / Fannie Mae Pool | 1,87 | -2,75 | 0,6476 | -0,0134 | |||||

| US3138WHDX75 / Fannie Mae Pool | 1,70 | -3,24 | 0,5889 | -0,0149 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618J8HP65) | 1,64 | -0,42 | 0,5685 | 0,0020 | |||||

| US3138A54P47 / Fannie Mae Pool | 1,64 | -2,32 | 0,5682 | -0,0092 | |||||

| US38383GBU40 / Government National Mortgage Association | 1,62 | -0,86 | 0,5593 | -0,0005 | |||||

| US3136A8DZ02 / Fannie Mae REMICS | 1,47 | -0,27 | 0,5098 | 0,0023 | |||||

| U.S. Treasury Notes / DBT (US91282CME83) | 1,46 | 0,07 | 0,5047 | 0,0041 | |||||

| US31393YBA29 / Fannie Mae REMICS | 1,45 | -5,40 | 0,5031 | -0,0250 | |||||

| US3136B8H361 / Fannie Mae REMICS | 1,43 | -1,99 | 0,4946 | -0,0064 | |||||

| US3136FGRR06 / Fannie Mae Interest Strip | 1,37 | -2,77 | 0,4744 | -0,0097 | |||||

| US3137AFMM19 / Freddie Mac REMICS | 1,31 | 0,62 | 0,4518 | 0,0061 | |||||

| US3138AFC245 / Fannie Mae Pool | 1,22 | -1,46 | 0,4214 | -0,0029 | |||||

| US3137A2AG69 / Freddie Mac REMICS | 1,21 | 1,26 | 0,4179 | 0,0085 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJC498) | 1,20 | 0,4165 | 0,4165 | ||||||

| US3138WRP204 / Fannie Mae Pool | 1,20 | -1,81 | 0,4142 | -0,0043 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDN67) | 1,17 | 0,4065 | 0,4065 | ||||||

| US3136FAT599 / Fannie Mae Interest Strip | 1,12 | -4,29 | 0,3860 | -0,0142 | |||||

| US912810TG31 / U.S. Treasury Bonds | 1,07 | -3,07 | 0,3714 | -0,0089 | |||||

| US3140Q9WT61 / Fannie Mae Pool | 1,07 | -2,91 | 0,3700 | -0,0083 | |||||

| US31398PPG80 / Fannie Mae REMICS | 1,07 | -9,34 | 0,3696 | -0,0353 | |||||

| US3136A2V671 / Fannie Mae REMICS | 1,05 | 2,93 | 0,3649 | 0,0131 | |||||

| US31419BBT17 / Fannie Mae Pool | 1,03 | -2,65 | 0,3567 | -0,0068 | |||||

| US3137FHSG97 / Freddie Mac REMICS | 1,00 | 0,70 | 0,3462 | 0,0048 | |||||

| US31394PCV31 / Freddie Mac REMICS | 0,97 | -2,92 | 0,3342 | -0,0073 | |||||

| US31416XJ921 / Fannie Mae Pool | 0,96 | -1,34 | 0,3315 | -0,0017 | |||||

| US3137B75D79 / Freddie Mac REMICS | 0,95 | 1,38 | 0,3303 | 0,0070 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDK29) | 0,93 | 0,3224 | 0,3224 | ||||||

| US3136BMXA11 / Federal National Mortgage Association, Series 2022-25, Class KL | 0,90 | -0,66 | 0,3115 | 0,0003 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJC316) | 0,88 | 0,3038 | 0,3038 | ||||||

| US31395MHU62 / Freddie Mac REMICS | 0,86 | -7,21 | 0,2985 | -0,0206 | |||||

| U.S. Treasury Notes / DBT (US91282CLS88) | 0,85 | 0,00 | 0,2949 | 0,0023 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDL02) | 0,85 | 0,2942 | 0,2942 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,83 | -6,52 | 0,2876 | -0,0179 | |||||

| US3138EJLW68 / Fannie Mae Pool | 0,82 | -2,02 | 0,2854 | -0,0034 | |||||

| COMM 2024-WCL1 MORTGAGE TRUST / ABS-MBS (US20047DAA28) | 0,81 | 0,2802 | 0,2802 | ||||||

| US3140GYG299 / Fannie Mae Pool | 0,81 | -3,12 | 0,2790 | -0,0070 | |||||

| US36202FB478 / Ginnie Mae II Pool | 0,80 | -3,02 | 0,2780 | -0,0065 | |||||

| US3140GSRP98 / Fannie Mae Pool | 0,80 | -0,50 | 0,2772 | 0,0006 | |||||

| US3138ADDL61 / Fannie Mae Pool | 0,78 | -0,89 | 0,2705 | -0,0004 | |||||

| US3140J9H951 / Fannie Mae Pool | 0,78 | -1,90 | 0,2688 | -0,0032 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,76 | -3,81 | 0,2626 | -0,0080 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJC563) | 0,75 | 0,2581 | 0,2581 | ||||||

| US912810QX90 / United States Treas Bds Bond | 0,73 | -2,02 | 0,2515 | -0,0032 | |||||

| US35563PJF71 / Seasoned Credit Risk Transfer Trust Series 2019-1 | 0,72 | -2,98 | 0,2483 | -0,0056 | |||||

| US31403DGY94 / Fannie Mae Pool | 0,72 | -3,24 | 0,2478 | -0,0066 | |||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 0,71 | 0,56 | 0,2473 | 0,0031 | |||||

| U.S. Treasury Notes / DBT (US91282CJW29) | 0,71 | 0,71 | 0,2444 | 0,0034 | |||||

| BB TREASURY BON / STIV (000000000) | 0,70 | 0,2420 | 0,2420 | ||||||

| US3137AJ4M38 / Freddie Mac REMICS | 0,70 | 2,96 | 0,2407 | 0,0088 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,67 | -14,63 | 0,2325 | -0,0377 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,66 | -1,92 | 0,2299 | -0,0027 | |||||

| US31418EQ948 / Federal National Mortgage Association | 0,65 | -3,25 | 0,2263 | -0,0059 | |||||

| GSAT Trust 2025-BMF / ABS-MBS (US36271XAA19) | 0,65 | 0,2233 | 0,2233 | ||||||

| US3140QNDE90 / UMBS | 0,64 | -1,23 | 0,2218 | -0,0010 | |||||

| US3136BNCX26 / Fannie Mae REMICS | 0,64 | 0,32 | 0,2200 | 0,0022 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJC233) | 0,64 | 0,2199 | 0,2199 | ||||||

| EW / Edwards Lifesciences Corporation | 0,63 | -2.519,23 | 0,2177 | 0,2270 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDP16) | 0,63 | 0,2172 | 0,2172 | ||||||

| US31335BUE46 / Freddie Mac Gold Pool | 0,62 | -1,73 | 0,2159 | -0,0023 | |||||

| US3137FFQC46 / Freddie Mac REMICS | 0,62 | -9,93 | 0,2138 | -0,0215 | |||||

| US912810SY55 / United States Treasury Note/Bond | 0,61 | -1,93 | 0,2111 | -0,0027 | |||||

| US55318EAA82 / MIRA Trust 2023-MILE | 0,59 | -0,34 | 0,2049 | 0,0008 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,59 | -3,76 | 0,2036 | -0,0064 | |||||

| BX Trust 2025-LUNR / ABS-MBS (US05594CAA27) | 0,58 | 0,1992 | 0,1992 | ||||||

| USU95065AA37 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2018-AUS | 0,57 | 1,06 | 0,1976 | 0,0033 | |||||

| US31402RCV96 / Fannie Mae Pool | 0,57 | -3,55 | 0,1975 | -0,0058 | |||||

| US31410KXZ29 / Fannie Mae Pool | 0,56 | -2,93 | 0,1950 | -0,0045 | |||||

| ILPT Commercial Mortgage Trust 2025-LPF2 / ABS-MBS (US451955AA65) | 0,56 | 0,1942 | 0,1942 | ||||||

| U.S. Treasury Notes / DBT (US91282CKW00) | 0,55 | 0,73 | 0,1903 | 0,0028 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,55 | -11,31 | 0,1900 | -0,0227 | |||||

| US3140MKFU12 / FNMA 30YR 3% 05/01/2052#BV5578 | 0,54 | -1,46 | 0,1869 | -0,0016 | |||||

| US31410KXM16 / Fannie Mae Pool | 0,54 | -3,24 | 0,1861 | -0,0047 | |||||

| US31418EW557 / FNMA POOL MA5167 FN 10/53 FIXED 6.5 | 0,53 | -7,79 | 0,1847 | -0,0140 | |||||

| U.S. Treasury Notes / DBT (US91282CKX82) | 0,51 | 0,59 | 0,1762 | 0,0024 | |||||

| INTOWN 2025-STAY Mortgage Trust / ABS-MBS (US46117WAA09) | 0,51 | 0,20 | 0,1757 | 0,0019 | |||||

| US055531AA59 / BLP COMMERCIAL MORTGAGE TRUST 2023-IND SER 2023-IND CL A V/R REGD 6.22700000 | 0,50 | 0,60 | 0,1732 | 0,0025 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,49 | -12,77 | 0,1703 | -0,0237 | |||||

| NCMF Trust 2025-MFS / ABS-MBS (US62887TAA25) | 0,49 | 0,1703 | 0,1703 | ||||||

| BAY 2025-LIVN Mortgage Trust / ABS-MBS (US072925AA82) | 0,48 | 0,1666 | 0,1666 | ||||||

| SDAL Trust 2025-DAL / ABS-MBS (US78437RAA77) | 0,48 | 0,1650 | 0,1650 | ||||||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAA66) | 0,47 | 1,50 | 0,1641 | 0,0034 | |||||

| US3132DWDS98 / Freddie Mac Pool | 0,46 | -1,93 | 0,1582 | -0,0021 | |||||

| U.S. Treasury Notes / DBT (US91282CKG59) | 0,46 | 0,66 | 0,1578 | 0,0021 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,45 | -3,00 | 0,1567 | -0,0034 | |||||

| 1345T 2025-AOA / ABS-MBS (US68271CAA09) | 0,45 | 0,1560 | 0,1560 | ||||||

| US31416BN614 / Fannie Mae Pool | 0,44 | -3,94 | 0,1521 | -0,0051 | |||||

| US31418DZ966 / Fannie Mae Pool | 0,43 | -5,52 | 0,1481 | -0,0075 | |||||

| US3140H8QD00 / Fannie Mae Pool | 0,42 | -2,09 | 0,1460 | -0,0022 | |||||

| US3136AP6K37 / Fannie Mae REMICS | 0,42 | 0,00 | 0,1447 | 0,0008 | |||||

| US3137AHVU99 / Freddie Mac REMICS | 0,41 | -2,40 | 0,1408 | -0,0021 | |||||

| US3138XYQL15 / Fannie Mae Pool | 0,41 | -2,40 | 0,1408 | -0,0024 | |||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,41 | 0,1403 | 0,1403 | ||||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDE68) | 0,39 | 0,1358 | 0,1358 | ||||||

| US3140J8SJ32 / Fannie Mae Pool | 0,39 | -2,74 | 0,1356 | -0,0026 | |||||

| PRM Trust 2025-PRM6 / ABS-MBS (US74277DAA00) | 0,39 | 0,1352 | 0,1352 | ||||||

| US35563PFG90 / Seasoned Credit Risk Transfer Trust Series 2018-2 | 0,38 | -4,05 | 0,1312 | -0,0046 | |||||

| US3133ENPP96 / Federal Farm Credit Banks Funding Corp | 0,38 | 1,07 | 0,1307 | 0,0024 | |||||

| US3136ACAB77 / Fannie Mae REMICS | 0,38 | -2,59 | 0,1302 | -0,0026 | |||||

| US3138EGUH51 / Fannie Mae Pool | 0,37 | -2,09 | 0,1296 | -0,0019 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust 2025-BHR5 / ABS-MBS (US46649WAA71) | 0,37 | 85,57 | 0,1291 | 0,0599 | |||||

| US3133EMNM01 / FFCB Funding Corp. | 0,37 | -2,11 | 0,1290 | -0,0018 | |||||

| BX Trust 2025-TAIL / ABS-MBS (US123912AA54) | 0,36 | 0,1255 | 0,1255 | ||||||

| US3138ETS566 / Fannie Mae Pool | 0,36 | -0,82 | 0,1252 | -0,0000 | |||||

| US17291NAA90 / Citigroup Commercial Mortgage Trust 2023-SMRT | 0,35 | 1,15 | 0,1215 | 0,0023 | |||||

| BFLD Trust 2025-EWEST / ABS-MBS (US05494JAA88) | 0,35 | 0,1195 | 0,1195 | ||||||

| US3137BERC08 / Freddie Mac REMICS | 0,34 | 0,88 | 0,1193 | 0,0020 | |||||

| US3136AYQY27 / Fannie Mae REMICS | 0,34 | -1,15 | 0,1189 | -0,0005 | |||||

| US3137H7WJ86 / Freddie Mac REMICS | 0,34 | -0,58 | 0,1186 | 0,0002 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDD85) | 0,34 | 0,1176 | 0,1176 | ||||||

| BX Trust 2025-LIFE / ABS-MBS (US05616HAA59) | 0,34 | 0,1163 | 0,1163 | ||||||

| US3137FPH574 / Freddie Mac REMICS | 0,33 | -5,38 | 0,1157 | -0,0057 | |||||

| NJ 2025-WBRK / ABS-MBS (US65486BAA98) | 0,33 | 0,1144 | 0,1144 | ||||||

| US31418EKR08 / FNMA 30YR 3.5% 11/01/2052#MA4803 | 0,32 | -1,83 | 0,1115 | -0,0014 | |||||

| US31402DC407 / Fannie Mae Pool | 0,32 | -3,90 | 0,1110 | -0,0036 | |||||

| US35563PKG36 / Seasoned Credit Risk Transfer Trust Series 2019-2 | 0,29 | -3,01 | 0,1005 | -0,0025 | |||||

| US31418ESQ43 / FNMA 30YR 3.5% 04/01/2053#MA5026 | 0,29 | -2,36 | 0,1003 | -0,0015 | |||||

| US91282CBL46 / United States Treasury Note/Bond | 0,29 | 1,79 | 0,0988 | 0,0023 | |||||

| US31418EWA45 / UMBS, 30 Year | 0,28 | -5,67 | 0,0983 | -0,0051 | |||||

| US36267CAA36 / GS Mortgage Securities Corp Trust 2023-FUN | 0,28 | 0,00 | 0,0971 | 0,0010 | |||||

| US05548WAA53 / BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2018 TALL A 144A | 0,27 | 52,22 | 0,0948 | 0,0330 | |||||

| US92538UAA97 / Verus Securitization Trust, Series 2022-3, Class A1 | 0,27 | -1,85 | 0,0920 | -0,0008 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,26 | -1,49 | 0,0916 | -0,0006 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618NJDC03) | 0,26 | 0,0894 | 0,0894 | ||||||

| US38378XYD73 / Government National Mortgage Association | 0,25 | -1,56 | 0,0876 | -0,0008 | |||||

| US31405SL771 / Fannie Mae Pool | 0,25 | -1,56 | 0,0875 | -0,0005 | |||||

| US31402RF871 / Fannie Mae Pool | 0,25 | -3,45 | 0,0872 | -0,0027 | |||||

| US3130AKRV05 / Federal Home Loan Banks | 0,25 | 2,07 | 0,0853 | 0,0023 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,24 | -2,46 | 0,0826 | -0,0012 | |||||

| WHARF Commercial Mortgage Trust 2025-DC / ABS-MBS (US92987LAA52) | 0,24 | 0,0815 | 0,0815 | ||||||

| US31418SZC69 / Fannie Mae Pool | 0,23 | -2,13 | 0,0799 | -0,0008 | |||||

| US3140H1XR69 / Fannie Mae Pool | 0,23 | -0,43 | 0,0797 | 0,0002 | |||||

| US3138AP5N49 / Fannie Mae Pool | 0,23 | -1,30 | 0,0788 | -0,0003 | |||||

| BX Commercial Mortgage Trust 2024-GPA3 / ABS-MBS (US123910AA98) | 0,22 | 0,00 | 0,0747 | 0,0008 | |||||

| ARES Trust 2025-IND3 / ABS-MBS (US039955AA76) | 0,21 | 0,0735 | 0,0735 | ||||||

| BPR 2025-ALDR Mortgage Trust / ABS-MBS (US05594EAA82) | 0,19 | 0,0666 | 0,0666 | ||||||

| US228925AA15 / CRSO Trust | 0,19 | 0,00 | 0,0642 | 0,0006 | |||||

| US31416KQB79 / Fannie Mae Pool | 0,18 | -0,54 | 0,0636 | 0,0002 | |||||

| US31400CEY66 / Fannie Mae Pool | 0,18 | -2,66 | 0,0634 | -0,0012 | |||||

| US85573GAD43 / STAR 2021 1 M1 144A | 0,18 | 2,33 | 0,0610 | 0,0018 | |||||

| Sequoia Mortgage Trust 2024-INV1 / ABS-MBS (US816939AC68) | 0,17 | -5,43 | 0,0603 | -0,0032 | |||||

| US3138ADC604 / Fannie Mae Pool | 0,17 | -0,58 | 0,0592 | 0,0000 | |||||

| US31573CAA36 / Ellington Financial Mortgage Trust 2022-1 | 0,17 | -2,86 | 0,0592 | -0,0011 | |||||

| US01F0224778 / UMBS TBA | 0,17 | 3,70 | 0,0581 | -0,0051 | |||||

| US3137F72R56 / FHMS K120 X1 | 0,17 | -4,62 | 0,0574 | -0,0023 | |||||

| US3136BCPR55 / Fannie Mae REMICS | 0,16 | -2,38 | 0,0569 | -0,0010 | |||||

| US31395DPW38 / Fannie Mae REMICS | 0,16 | -1,81 | 0,0567 | -0,0004 | |||||

| US12663GAA58 / COLT 2022-7 Mortgage Loan Trust | 0,16 | -3,01 | 0,0559 | -0,0013 | |||||

| KSL Commercial Mortgage Trust 2024-HT2 / ABS-MBS (US500937AA54) | 0,16 | 0,00 | 0,0553 | 0,0004 | |||||

| BSTN Commercial Mortgage Trust 2025-1C / ABS-MBS (US05615EAA38) | 0,16 | 0,0548 | 0,0548 | ||||||

| US31412RL548 / Fannie Mae Pool | 0,15 | -1,92 | 0,0531 | -0,0008 | |||||

| U.S. Treasury Notes / DBT (US91282CKD29) | 0,15 | 0,66 | 0,0528 | 0,0007 | |||||

| U.S. Treasury Notes / DBT (US91282CLY56) | 0,15 | 0,00 | 0,0522 | 0,0004 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0,15 | 0,0517 | 0,0517 | ||||||

| BX Trust 2024-BIO / ABS-MBS (US05612AAA43) | 0,14 | 0,0502 | 0,0502 | ||||||

| US31410F2Q77 / Fannie Mae Pool | 0,14 | -3,38 | 0,0496 | -0,0014 | |||||

| PMT Loan Trust 2024-INV1 / ABS-MBS (US73015BAC90) | 0,14 | -2,78 | 0,0486 | -0,0010 | |||||

| US31416NCW02 / Fannie Mae Pool | 0,14 | -2,80 | 0,0483 | -0,0010 | |||||

| US31402RJL42 / Fannie Mae Pool | 0,14 | -4,14 | 0,0483 | -0,0018 | |||||

| Provident Funding Mortgage Trust 2024-1 / ABS-MBS (US74389BAA98) | 0,14 | -3,55 | 0,0471 | -0,0015 | |||||

| BAMLL Trust 2024-BHP / ABS-MBS (US05493WAA09) | 0,14 | 0,00 | 0,0469 | 0,0005 | |||||

| US3140QQJE67 / Fannie Mae Pool | 0,13 | -5,15 | 0,0447 | -0,0021 | |||||

| US3132DWD674 / Freddie Mac Pool | 0,13 | -1,54 | 0,0443 | -0,0006 | |||||

| US33852FAA49 / Flagstar Mortgage Trust 2021-4 | 0,13 | -1,55 | 0,0442 | -0,0003 | |||||

| US38377VGR15 / Government National Mortgage Association | 0,13 | 0,00 | 0,0441 | 0,0002 | |||||

| US31417Y2B21 / Fannie Mae Pool | 0,13 | -7,30 | 0,0440 | -0,0032 | |||||

| US31402CPL09 / Fannie Mae Pool | 0,12 | -4,62 | 0,0431 | -0,0018 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,12 | -4,65 | 0,0429 | -0,0017 | |||||

| Verus Securitization Trust 2024-6 / ABS-MBS (US92540JAA07) | 0,12 | -6,87 | 0,0424 | -0,0028 | |||||

| US3133TNM686 / Freddie Mac REMICS | 0,12 | -12,95 | 0,0422 | -0,0056 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 0,12 | 0,00 | 0,0411 | 0,0004 | |||||

| US31403DPP86 / Fannie Mae Pool | 0,12 | -3,31 | 0,0408 | -0,0011 | |||||

| US3140QC2Z89 / Fannie Mae Pool | 0,12 | -1,69 | 0,0402 | -0,0007 | |||||

| US3140QGSN83 / Fannie Mae Pool | 0,11 | -1,75 | 0,0389 | -0,0003 | |||||

| SDR Commercial Mortgage Trust 2024-DSNY / ABS-MBS (US811304AA27) | 0,11 | 0,0384 | 0,0384 | ||||||

| US92539NAA46 / Verus Securitization Trust 2022-7 | 0,11 | -1,82 | 0,0375 | -0,0004 | |||||

| US3138AFW714 / Fannie Mae Pool | 0,11 | -1,83 | 0,0372 | -0,0005 | |||||

| US3138AD3K99 / Fannie Mae Pool | 0,11 | -0,93 | 0,0371 | -0,0000 | |||||

| US3132DNBL64 / Freddie Mac Pool | 0,11 | -3,64 | 0,0370 | -0,0008 | |||||

| US3138AMQY45 / Fannie Mae Pool | 0,11 | -0,93 | 0,0368 | -0,0001 | |||||

| BX Trust 2024-VLT4 / ABS-MBS (US05612TAA34) | 0,10 | 0,00 | 0,0363 | 0,0004 | |||||

| US3137FWG952 / FHMS K115 X1 | 0,10 | -4,59 | 0,0361 | -0,0014 | |||||

| US3140QQH995 / Fannie Mae Pool | 0,10 | -3,74 | 0,0359 | -0,0010 | |||||

| US3137FRUL37 / FHLMC CMO IO | 0,10 | -5,61 | 0,0351 | -0,0017 | |||||

| US3136AD3V90 / Fannie Mae REMICS | 0,09 | -3,09 | 0,0328 | -0,0006 | |||||

| US3140XAUR17 / Fannie Mae Pool | 0,09 | -1,05 | 0,0326 | -0,0000 | |||||

| US19685EAA91 / COLT 2022-2 Mortgage Loan Trust | 0,09 | -2,11 | 0,0324 | -0,0004 | |||||

| US87267TAA97 / TOORAK MORTGAGE CORP. TRK 2021 INV2 A1 144A | 0,09 | -3,16 | 0,0319 | -0,0011 | |||||

| US3138A9PP39 / Fannie Mae Pool | 0,09 | -2,20 | 0,0310 | -0,0005 | |||||

| BX Trust 2025-ROIC / ABS-MBS (US05593VAA17) | 0,09 | 0,0310 | 0,0310 | ||||||

| US46656AAA51 / J.P. Morgan Mortgage Trust 2022-DSC1 | 0,09 | -3,26 | 0,0309 | -0,0010 | |||||

| US3137FV5Q11 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K113, Class X1 | 0,09 | -5,49 | 0,0301 | -0,0013 | |||||

| Homes 2024-Nqm2 Trust / ABS-MBS (US43761CAA09) | 0,09 | -5,49 | 0,0298 | -0,0017 | |||||

| US12660BAM37 / Credit Suisse Mortgage Trust, Series 2022-ATH1, Class A1A | 0,09 | -4,49 | 0,0298 | -0,0010 | |||||

| US3140QQJB29 / Fannie Mae Pool | 0,08 | -10,64 | 0,0294 | -0,0031 | |||||

| US19688LAA08 / COLT_22-5 | 0,08 | -1,20 | 0,0286 | -0,0001 | |||||

| US95001JAY38 / Wells Fargo Commercial Mortgage Trust 2018-C44 | 0,08 | -8,43 | 0,0265 | -0,0023 | |||||

| US38375GYA39 / Government National Mortgage Association | 0,08 | -27,62 | 0,0264 | -0,0100 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,07 | -3,90 | 0,0258 | -0,0007 | |||||

| US3137FRZC82 / FHLMC Multifamily Structured Pass-Through Certificates, Series K107, Class X1 | 0,07 | -5,26 | 0,0250 | -0,0012 | |||||

| US31418VW734 / Fannie Mae Pool | 0,07 | -1,39 | 0,0248 | 0,0000 | |||||

| US58549JAF12 / Mello Mortgage Capital Acceptance, Series 2022-INV2, Class A3 | 0,07 | -1,43 | 0,0239 | -0,0002 | |||||

| US92538WAA53 / VERUS_22-1 | 0,07 | -1,47 | 0,0235 | -0,0001 | |||||

| US67116EAA73 / OBX Trust, Series 2022-INV3, Class A1 | 0,07 | -2,90 | 0,0233 | -0,0005 | |||||

| US74938WAA99 / RCKT Mortgage Trust 2022-2 | 0,07 | -2,94 | 0,0230 | -0,0004 | |||||

| US31412UQZ65 / Fannie Mae Pool | 0,07 | -1,49 | 0,0230 | -0,0001 | |||||

| US46593FAD42 / J.P. Morgan Mortgage Trust 2022-INV3 | 0,07 | -1,49 | 0,0229 | -0,0002 | |||||

| US36267EAD31 / GS MORTGAGE-BACKED SECURITIES CORP TRUST 202 SER 2022-PJ2 CL A4 V/R REGD 144A P/P 2.50000000 | 0,06 | -3,08 | 0,0219 | -0,0006 | |||||

| US3137F82T94 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,06 | -4,62 | 0,0216 | -0,0009 | |||||

| US3140QQJD84 / Fannie Mae Pool | 0,06 | -1,61 | 0,0214 | -0,0002 | |||||

| US36262LAB62 / GS Mortgage-Backed Securities Trust | 0,06 | -1,61 | 0,0212 | -0,0003 | |||||

| US3140QQJC02 / Fannie Mae Pool | 0,06 | -1,69 | 0,0202 | -0,0002 | |||||

| US3137FTG271 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,06 | -5,08 | 0,0194 | -0,0009 | |||||

| US45660L3P20 / Residential Asset Securitization Trust 2005-A15 | 0,06 | -3,51 | 0,0193 | -0,0006 | |||||

| US3137FREK38 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K104, Class X1 | 0,05 | -5,26 | 0,0189 | -0,0008 | |||||

| US38378KPD53 / Government National Mortgage Association | 0,05 | -5,36 | 0,0183 | -0,0010 | |||||

| US3140QQJA46 / Fannie Mae Pool | 0,05 | -7,27 | 0,0178 | -0,0013 | |||||

| US31418EXF23 / Fannie Mae Pool | 0,05 | -1,96 | 0,0176 | -0,0002 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,05 | -2,08 | 0,0164 | -0,0002 | |||||

| US31418AAR95 / Fannie Mae Pool | 0,05 | -4,17 | 0,0161 | -0,0004 | |||||

| US3138AD3D56 / Fannie Mae Pool | 0,05 | -2,17 | 0,0159 | -0,0000 | |||||

| US31412MKP22 / Fannie Mae Pool | 0,04 | 0,00 | 0,0146 | -0,0000 | |||||

| US31418V4Y59 / Fannie Mae Pool | 0,04 | -4,76 | 0,0141 | -0,0004 | |||||

| US3137FMU269 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,04 | -6,98 | 0,0141 | -0,0008 | |||||

| US38376PA594 / Government National Mortgage Association | 0,04 | 0,00 | 0,0123 | 0,0001 | |||||

| US31419AMU87 / Fannie Mae Pool | 0,04 | -10,26 | 0,0122 | -0,0015 | |||||

| US31403DDR70 / Fannie Mae Pool | 0,04 | -2,78 | 0,0122 | -0,0003 | |||||

| US31418RMG38 / Fannie Mae Pool | 0,03 | 0,00 | 0,0119 | -0,0001 | |||||

| US552754AA14 / MFA 2020-NQM1 TRUST SER 2020-NQM1 CL A1 V/R REGD 144A P/P 0.00000000 | 0,03 | -10,81 | 0,0117 | -0,0011 | |||||

| US31412RH595 / Fannie Mae Pool | 0,03 | -3,33 | 0,0103 | -0,0001 | |||||

| US10569TAA60 / BRAVO Residential Funding Trust 2021-NQM1 | 0,03 | -6,45 | 0,0100 | -0,0006 | |||||

| US16158RAN61 / Chase Home Lending Mortgage Trust 2019-ATR1 | 0,03 | -3,57 | 0,0095 | -0,0003 | |||||

| US12596GBB41 / CSAIL 2018-C14 Commercial Mortgage Trust | 0,03 | -6,90 | 0,0094 | -0,0006 | |||||

| US3138ADKK06 / Fannie Mae Pool | 0,03 | 0,00 | 0,0092 | -0,0000 | |||||

| US3140Q9VA89 / Fannie Mae Pool | 0,02 | -7,69 | 0,0086 | -0,0004 | |||||

| US93934FFP27 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2005-9 Trust | 0,02 | 0,00 | 0,0085 | 0,0000 | |||||

| US3137ANZV05 / Freddie Mac REMICS | 0,02 | -8,00 | 0,0081 | -0,0007 | |||||

| US3137FTZS90 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,02 | -4,17 | 0,0080 | -0,0004 | |||||

| US3140Q9U500 / Fannie Mae Pool | 0,02 | -4,35 | 0,0078 | -0,0005 | |||||

| US31394ED964 / Fannie Mae REMICS | 0,02 | -9,09 | 0,0071 | -0,0005 | |||||

| US3136A6FA76 / Fannie Mae REMICS | 0,02 | -4,76 | 0,0071 | -0,0004 | |||||

| US3140Q9U682 / Fannie Mae Pool | 0,02 | -5,00 | 0,0066 | -0,0003 | |||||

| US12566WAG50 / CitiMortgage Alternative Loan Trust Series 2007-A5 | 0,02 | -5,56 | 0,0062 | -0,0002 | |||||

| US3133KYXJ36 / FR RB5181 | 0,02 | -5,56 | 0,0062 | -0,0000 | |||||

| US3140HMP327 / Fannie Mae Pool | 0,02 | -5,88 | 0,0058 | -0,0002 | |||||

| US3133TDPY66 / Freddie Mac Structured Pass-Through Certificates | 0,02 | -25,00 | 0,0054 | -0,0016 | |||||

| US3140Q9U849 / Fannie Mae Pool | 0,01 | 0,00 | 0,0046 | -0,0001 | |||||

| US31418TWD52 / Fannie Mae Pool | 0,01 | 0,00 | 0,0037 | -0,0001 | |||||

| US31408AHA16 / Fannie Mae Pool | 0,01 | 0,00 | 0,0037 | -0,0000 | |||||

| US31418TDT16 / Fannie Mae Pool | 0,01 | 0,00 | 0,0035 | -0,0000 | |||||

| US31392B5G75 / Fannie Mae REMICS | 0,01 | -10,00 | 0,0034 | -0,0003 | |||||

| US3140HMPV06 / Fannie Mae Pool | 0,01 | 0,00 | 0,0032 | -0,0001 | |||||

| US31406UT992 / Fannie Mae Pool | 0,01 | 0,00 | 0,0027 | -0,0000 | |||||

| US3138A82M79 / Fannie Mae Pool | 0,01 | 0,00 | 0,0025 | -0,0000 | |||||

| US31417Y6Y87 / Fannie Mae Pool | 0,01 | 0,00 | 0,0021 | -0,0000 | |||||

| US31359VB288 / Fannie Mae REMIC Trust 1999-W4 | 0,01 | -37,50 | 0,0020 | -0,0010 | |||||

| US3140HMP400 / Fannie Mae Pool | 0,01 | 0,00 | 0,0020 | -0,0000 | |||||

| US31417YRW92 / Fannie Mae Pool | 0,01 | 0,00 | 0,0017 | -0,0000 | |||||

| US31419E6R50 / Fannie Mae Pool | 0,00 | -33,33 | 0,0010 | -0,0002 | |||||

| SWP: OIS 0.18350 FED 21-OCT-2025 / DIR (000000000) | 0,00 | 0,0010 | 0,0010 | ||||||

| US3138ALGM34 / Fannie Mae Pool | 0,00 | -71,43 | 0,0009 | -0,0018 | |||||

| US3137GADX24 / Freddie Mac REMICS | 0,00 | -75,00 | 0,0006 | -0,0008 | |||||

| US3138AEJQ77 / Fannie Mae Pool | 0,00 | 0,00 | 0,0005 | -0,0000 | |||||

| US36292GKA21 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0005 | -0,0000 | |||||

| US36205KZ397 / Ginnie Mae I Pool | 0,00 | 0,0003 | -0,0000 | ||||||

| US36207RFG56 / Ginnie Mae I Pool | 0,00 | 0,0003 | -0,0000 | ||||||

| US36207DLQ78 / Ginnie Mae I Pool | 0,00 | 0,0002 | -0,0001 | ||||||

| US31410RFH75 / Fannie Mae Pool | 0,00 | 0,0002 | -0,0000 | ||||||

| US3138AAS283 / Fannie Mae Pool | 0,00 | 0,0002 | -0,0000 | ||||||

| US31359VB361 / Fannie Mae REMIC Trust 1999-W4 | 0,00 | 0,0002 | -0,0000 | ||||||

| US31413CRN10 / Fannie Mae Pool | 0,00 | 0,0001 | -0,0000 | ||||||

| US36208DU298 / Ginnie Mae I Pool | 0,00 | 0,0001 | -0,0000 | ||||||

| US911760MW30 / Vendee Mortgage Trust 1999-2 | 0,00 | 0,0000 | -0,0000 | ||||||

| US45668JAM80 / IndyMac INDX Mortgage Loan Trust 2006-AR33 | 0,00 | 0,0000 | -0,0000 | ||||||

| US859245AA02 / STERLING COOFS TR 2004 1 PASSTHRU CTF 144A | 0,00 | 0,0000 | 0,0000 | ||||||

| US859245AB84 / Sterling COOFS Trust 2004-2 | 0,00 | 0,0000 | 0,0000 | ||||||

| SWP: OIS 0.17314 SOFR 21-OCT-2025 / DIR (000000000) | -0,00 | -0,0010 | -0,0010 | ||||||

| EW / Edwards Lifesciences Corporation | -0,03 | -100,79 | -0,0093 | -1,1506 | |||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | -0,05 | -0,0166 | -0,0166 | ||||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | -0,35 | -0,1220 | -0,1220 | ||||||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | -0,46 | -0,1597 | -0,1597 | ||||||

| US912810QY73 / United States Treas Bds Bond | -0,70 | -2,10 | -0,2417 | 0,0032 | |||||

| RRP FNMA 30YR / RA (000000000) | -1,80 | -0,6219 | -0,6219 | ||||||

| RRP FNMA 30YR U / RA (000000000) | -2,28 | -0,7878 | -0,7878 | ||||||

| RRP GNMA2 30YR / RA (000000000) | -2,38 | -0,8236 | -0,8236 | ||||||

| RRP FNMA 30YR U / RA (000000000) | -2,53 | -0,8739 | -0,8739 | ||||||

| US01F0426654 / Uniform Mortgage-Backed Security, TBA | -2,58 | -0,8937 | -0,8937 | ||||||

| RRP FHLMC GOLD / RA (000000000) | -3,19 | -1,1027 | -1,1027 | ||||||

| RRP FNMA 30YR / RA (000000000) | -3,26 | -1,1286 | -1,1286 | ||||||

| RRP FNMA 30YR F / RA (000000000) | -3,76 | -1,3021 | -1,3021 | ||||||

| RRP FNMA 30YR U / RA (000000000) | -4,78 | -1,6544 | -1,6544 | ||||||

| RRP FHLMC 30YR / RA (000000000) | -4,83 | -1,6718 | -1,6718 | ||||||

| RRP FHLMC 30YR / RA (000000000) | -4,91 | -1,6982 | -1,6982 | ||||||

| RRP FHLMC 30YR / RA (000000000) | -4,93 | -1,7043 | -1,7043 | ||||||

| RRP FHLMC 30YR / RA (000000000) | -5,15 | -1,7826 | -1,7826 | ||||||

| RRP FNMA 40YR R / RA (000000000) | -7,29 | -2,5213 | -2,5213 | ||||||

| RRP FNMA 40YR R / RA (000000000) | -16,65 | -5,7602 | -5,7602 |