Grundlæggende statistik

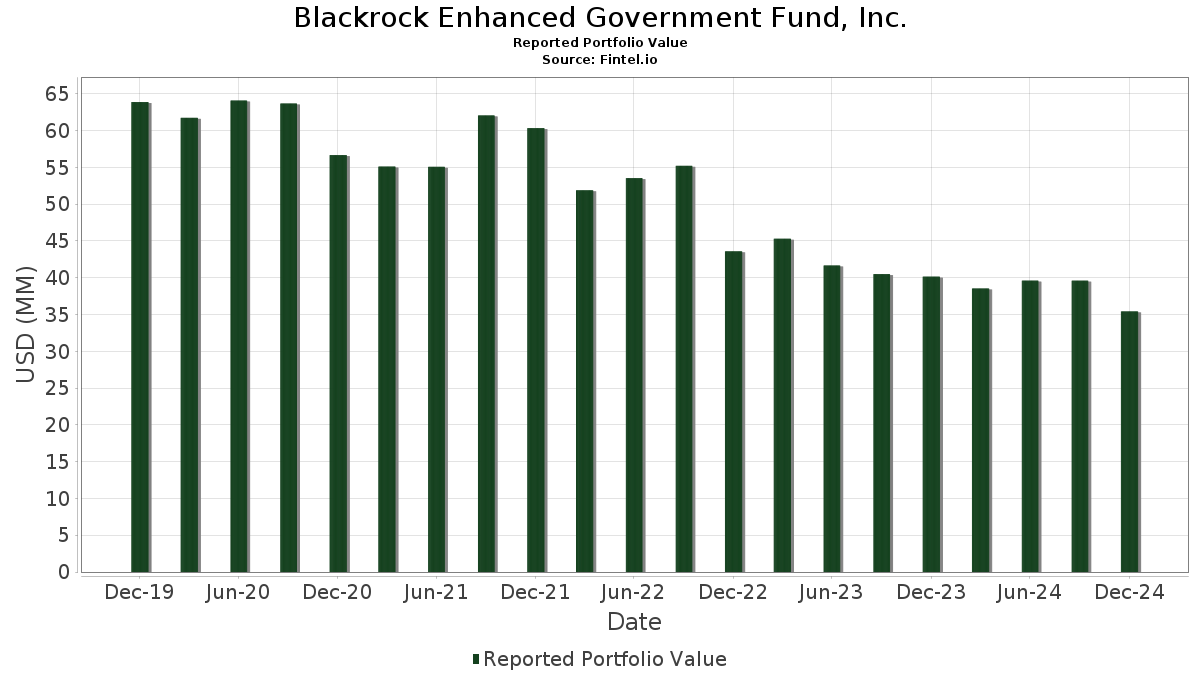

| Porteføljeværdi | $ 35.417.020 |

| Nuværende stillinger | 134 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Blackrock Enhanced Government Fund, Inc. har afsløret 134 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 35.417.020 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Blackrock Enhanced Government Fund, Inc.s største beholdninger er FNMA UMBS, 30 Year (US:US3140X6JS19) , Fannie Mae Pool (US:US3138WRP204) , Fannie Mae Pool (US:US31419BBT17) , U.S. Treasury Bonds (US:US912810TG31) , and Federal National Mortgage Association, Series 2022-25, Class KL (US:US3136BMXA11) . Blackrock Enhanced Government Fund, Inc.s nye stillinger omfatter FNMA UMBS, 30 Year (US:US3140X6JS19) , Fannie Mae Pool (US:US3138WRP204) , Fannie Mae Pool (US:US31419BBT17) , U.S. Treasury Bonds (US:US912810TG31) , and Federal National Mortgage Association, Series 2022-25, Class KL (US:US3136BMXA11) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,07 | 3,0236 | 3,0236 | ||

| 0,95 | 2,6872 | 2,6872 | ||

| 0,84 | 2,3883 | 2,3883 | ||

| 0,71 | 2,0235 | 2,0235 | ||

| 0,60 | 1,6900 | 1,6900 | ||

| 0,47 | 1,3243 | 1,3243 | ||

| 0,25 | 0,6962 | 0,6962 | ||

| 0,20 | 0,5669 | 0,5669 | ||

| 0,19 | 0,5448 | 0,5448 | ||

| 2,73 | 7,7281 | 0,4672 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,27 | 0,7721 | -3,3932 | ||

| 0,33 | 0,9332 | -2,3913 | ||

| 0,44 | 0,44 | 1,2389 | -1,5194 | |

| -0,04 | -0,1170 | -0,1170 | ||

| -0,03 | -0,0868 | -0,0868 | ||

| 0,46 | 1,2987 | -0,0792 | ||

| -0,03 | -0,0766 | -0,0766 | ||

| -0,03 | -0,0711 | -0,0711 | ||

| 0,60 | 1,6952 | -0,0656 | ||

| -0,02 | -0,0585 | -0,0585 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-02-25 for rapporteringsperioden 2024-12-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Notes / DBT (US91282CKP58) | 2,73 | -3,33 | 7,7281 | 0,4672 | |||||

| US3140X6JS19 / FNMA UMBS, 30 Year | 2,46 | -7,01 | 6,9628 | 0,1619 | |||||

| US3138WRP204 / Fannie Mae Pool | 1,21 | -7,84 | 3,4346 | 0,0490 | |||||

| US31419BBT17 / Fannie Mae Pool | 1,07 | -7,30 | 3,0269 | 0,0603 | |||||

| US912810TG31 / U.S. Treasury Bonds | 1,07 | 3,0236 | 3,0236 | ||||||

| U.S. Treasury Notes / DBT (US91282CLS88) | 0,95 | 2,6872 | 2,6872 | ||||||

| US3136BMXA11 / Federal National Mortgage Association, Series 2022-25, Class KL | 0,86 | -5,90 | 2,4450 | 0,0845 | |||||

| U.S. Treasury Bills / DBT (US912797KJ59) | 0,84 | 2,3883 | 2,3883 | ||||||

| US3140J9H951 / Fannie Mae Pool | 0,80 | -6,32 | 2,2684 | 0,0689 | |||||

| US912810QX90 / United States Treas Bds Bond | 0,71 | 2,0235 | 2,0235 | ||||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 0,70 | -2,91 | 1,9854 | 0,1274 | |||||

| U.S. Treasury Notes / DBT (US91282CJW29) | 0,69 | -2,95 | 1,9574 | 0,1242 | |||||

| US31418EQ948 / Federal National Mortgage Association | 0,68 | -5,53 | 1,9367 | 0,0736 | |||||

| US3140QNDE90 / UMBS | 0,65 | -6,24 | 1,8321 | 0,0561 | |||||

| US31335BUE46 / Freddie Mac Gold Pool | 0,63 | -6,77 | 1,7970 | 0,0459 | |||||

| US3136BNCX26 / Fannie Mae REMICS | 0,60 | -6,70 | 1,7000 | 0,0461 | |||||

| US31418EW557 / FNMA POOL MA5167 FN 10/53 FIXED 6.5 | 0,60 | -12,59 | 1,6952 | -0,0656 | |||||

| US912810SY55 / United States Treasury Note/Bond | 0,60 | 1,6900 | 1,6900 | ||||||

| US3140MKFU12 / FNMA 30YR 3% 05/01/2052#BV5578 | 0,55 | -6,81 | 1,5533 | 0,0412 | |||||

| U.S. Treasury Notes / DBT (US91282CKW00) | 0,53 | -4,65 | 1,5117 | 0,0720 | |||||

| U.S. Treasury Notes / DBT (US91282CKX82) | 0,50 | -3,31 | 1,4097 | 0,0844 | |||||

| US31418DZ966 / Fannie Mae Pool | 0,47 | -6,69 | 1,3440 | 0,0331 | |||||

| US31416BN614 / Fannie Mae Pool | 0,47 | -6,16 | 1,3382 | 0,0422 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,47 | 1,3243 | 1,3243 | ||||||

| US3132DWDS98 / Freddie Mac Pool | 0,47 | -6,81 | 1,3186 | 0,0329 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,46 | -14,39 | 1,2987 | -0,0792 | |||||

| U.S. Treasury Notes / DBT (US91282CKG59) | 0,45 | -3,26 | 1,2632 | 0,0780 | |||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 0,44 | -59,20 | 0,44 | -59,29 | 1,2389 | -1,5194 | |||

| US3138XYQL15 / Fannie Mae Pool | 0,42 | -7,78 | 1,1766 | 0,0167 | |||||

| US3133ENPP96 / Federal Farm Credit Banks Funding Corp | 0,37 | -3,17 | 1,0394 | 0,0654 | |||||

| US3133EMNM01 / FFCB Funding Corp. | 0,37 | -4,94 | 1,0380 | 0,0447 | |||||

| US3137FPH574 / Freddie Mac REMICS | 0,34 | -8,36 | 0,9656 | 0,0090 | |||||

| US3136AYQY27 / Fannie Mae REMICS | 0,33 | -6,96 | 0,9485 | 0,0225 | |||||

| US3137H7WJ86 / Freddie Mac REMICS | 0,33 | -6,21 | 0,9433 | 0,0299 | |||||

| US01F0406102 / Uniform Mortgage-Backed Security, TBA | 0,33 | -75,79 | 0,9332 | -2,3913 | |||||

| US31418EKR08 / FNMA 30YR 3.5% 11/01/2052#MA4803 | 0,33 | -6,88 | 0,9219 | 0,0225 | |||||

| US3137BERC08 / Freddie Mac REMICS | 0,32 | -4,72 | 0,9159 | 0,0408 | |||||

| US31418NX218 / Fannie Mae Pool | 0,32 | -6,16 | 0,9073 | 0,0275 | |||||

| US31418EWA45 / UMBS, 30 Year | 0,31 | -9,44 | 0,8720 | -0,0011 | |||||

| US31418ESQ43 / FNMA 30YR 3.5% 04/01/2053#MA5026 | 0,29 | -6,09 | 0,8329 | 0,0283 | |||||

| US92538UAA97 / Verus Securitization Trust, Series 2022-3, Class A1 | 0,27 | -4,86 | 0,7777 | 0,0341 | |||||

| US91282CBL46 / United States Treasury Note/Bond | 0,27 | -84,03 | 0,7721 | -3,3932 | |||||

| OCP Clo 2019-17 Ltd / ABS-CBDO (US67113LAY20) | 0,25 | 0,40 | 0,7130 | 0,0690 | |||||

| US15032QAC69 / CEDF 2022-15A B TSFR3M+180 04/20/2035 144A | 0,25 | 0,00 | 0,7114 | 0,0667 | |||||

| US846031AN28 / SOUTHWICK PARK CLO LLC STHWK 2019-4A A1R | 0,25 | 0,00 | 0,7102 | 0,0660 | |||||

| US26243EAB74 / DRYDEN 53 CLO LTD | 0,25 | 0,00 | 0,7093 | 0,0652 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,25 | 0,6962 | 0,6962 | ||||||

| US31418SZC69 / Fannie Mae Pool | 0,24 | -6,35 | 0,6703 | 0,0191 | |||||

| US3130AKRV05 / Federal Home Loan Banks | 0,23 | -5,31 | 0,6602 | 0,0286 | |||||

| U.S. Treasury Notes / DBT (US91282CLY56) | 0,20 | 0,5669 | 0,5669 | ||||||

| U.S. Treasury Notes / DBT (US91282CKD29) | 0,20 | -2,93 | 0,5644 | 0,0350 | |||||

| US55283FAD06 / MFA 2021-NQM1 Trust | 0,20 | -3,45 | 0,5575 | 0,0332 | |||||

| Sequoia Mortgage Trust 2024-INV1 / ABS-MBS (US816939AC68) | 0,19 | 0,5448 | 0,5448 | ||||||

| US31416KQB79 / Fannie Mae Pool | 0,18 | -5,67 | 0,5207 | 0,0206 | |||||

| US31573CAA36 / Ellington Financial Mortgage Trust 2022-1 | 0,18 | -5,32 | 0,5067 | 0,0218 | |||||

| US12663GAA58 / COLT 2022-7 Mortgage Loan Trust | 0,17 | -4,40 | 0,4950 | 0,0244 | |||||

| US3136BCPR55 / Fannie Mae REMICS | 0,17 | -5,00 | 0,4856 | 0,0204 | |||||

| US03759CAS98 / Apidos CLO XXIV | 0,16 | -10,44 | 0,4626 | -0,0064 | |||||

| US85573GAD43 / STAR 2021 1 M1 144A | 0,16 | -4,22 | 0,4523 | 0,0234 | |||||

| US31412RL548 / Fannie Mae Pool | 0,16 | -6,02 | 0,4423 | 0,0125 | |||||

| US31410F2Q77 / Fannie Mae Pool | 0,15 | -6,75 | 0,4334 | 0,0113 | |||||

| US31402RJL42 / Fannie Mae Pool | 0,15 | -7,41 | 0,4263 | 0,0071 | |||||

| US31416NCW02 / Fannie Mae Pool | 0,15 | -6,96 | 0,4173 | 0,0103 | |||||

| PMT Loan Trust 2024-INV1 / ABS-MBS (US73015BAC90) | 0,15 | 0,4112 | 0,4112 | ||||||

| Provident Funding Mortgage Trust 2024-1 / ABS-MBS (US74389BAA98) | 0,15 | 0,4111 | 0,4111 | ||||||

| US3140QQJE67 / Fannie Mae Pool | 0,14 | -7,19 | 0,4032 | 0,0081 | |||||

| Verus Securitization Trust 2024-6 / ABS-MBS (US92540JAA07) | 0,14 | 0,3986 | 0,3986 | ||||||

| US31402CPL09 / Fannie Mae Pool | 0,14 | -7,53 | 0,3853 | 0,0077 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,13 | 0,3775 | 0,3775 | ||||||

| US3132DWD674 / Freddie Mac Pool | 0,13 | -7,19 | 0,3683 | 0,0095 | |||||

| US33852FAA49 / Flagstar Mortgage Trust 2021-4 | 0,13 | -6,57 | 0,3645 | 0,0098 | |||||

| US31403DPP86 / Fannie Mae Pool | 0,13 | -6,02 | 0,3559 | 0,0120 | |||||

| US3140QC2Z89 / Fannie Mae Pool | 0,12 | -7,58 | 0,3467 | 0,0058 | |||||

| US92539NAA46 / Verus Securitization Trust 2022-7 | 0,12 | -4,17 | 0,3276 | 0,0164 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 0,11 | -6,56 | 0,3257 | 0,0113 | |||||

| US3140QGSN83 / Fannie Mae Pool | 0,11 | -5,79 | 0,3256 | 0,0117 | |||||

| US3132DNBL64 / Freddie Mac Pool | 0,11 | -7,56 | 0,3133 | 0,0043 | |||||

| US3140QQH995 / Fannie Mae Pool | 0,11 | -3,51 | 0,3122 | 0,0185 | |||||

| US3140QQJB29 / Fannie Mae Pool | 0,10 | -8,18 | 0,2867 | 0,0025 | |||||

| US87267TAA97 / TOORAK MORTGAGE CORP. TRK 2021 INV2 A1 144A | 0,10 | -5,71 | 0,2831 | 0,0102 | |||||

| Homes 2024-Nqm2 Trust / ABS-MBS (US43761CAA09) | 0,10 | 0,2792 | 0,2792 | ||||||

| US81375WCT18 / Securitized Asset Backed Receivables LLC Trust 2005-OP1 | 0,09 | -4,08 | 0,2692 | 0,0160 | |||||

| US12660BAM37 / Credit Suisse Mortgage Trust, Series 2022-ATH1, Class A1A | 0,09 | -5,05 | 0,2678 | 0,0114 | |||||

| US3140XAUR17 / Fannie Mae Pool | 0,09 | -9,62 | 0,2666 | -0,0014 | |||||

| US19685EAA91 / COLT 2022-2 Mortgage Loan Trust | 0,09 | -7,00 | 0,2663 | 0,0088 | |||||

| US46656AAA51 / J.P. Morgan Mortgage Trust 2022-DSC1 | 0,09 | -6,06 | 0,2639 | 0,0085 | |||||

| US19688LAA08 / COLT_22-5 | 0,08 | -3,45 | 0,2386 | 0,0142 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,08 | 0,2259 | 0,2259 | ||||||

| US78448YAD31 / SMB Private Education Loan Trust 2021-A | 0,08 | -3,70 | 0,2231 | 0,0126 | |||||

| US58549JAF12 / Mello Mortgage Capital Acceptance, Series 2022-INV2, Class A3 | 0,07 | -6,67 | 0,1992 | 0,0054 | |||||

| US92538WAA53 / VERUS_22-1 | 0,07 | -5,56 | 0,1952 | 0,0075 | |||||

| US67116EAA73 / OBX Trust, Series 2022-INV3, Class A1 | 0,07 | -6,85 | 0,1940 | 0,0050 | |||||

| US74938WAA99 / RCKT Mortgage Trust 2022-2 | 0,07 | -6,94 | 0,1926 | 0,0051 | |||||

| US31412UQZ65 / Fannie Mae Pool | 0,07 | -11,84 | 0,1921 | -0,0040 | |||||

| US46593FAD42 / J.P. Morgan Mortgage Trust 2022-INV3 | 0,07 | -7,04 | 0,1893 | 0,0054 | |||||

| US3140QQJC02 / Fannie Mae Pool | 0,07 | -2,94 | 0,1883 | 0,0110 | |||||

| US36267EAD31 / GS MORTGAGE-BACKED SECURITIES CORP TRUST 202 SER 2022-PJ2 CL A4 V/R REGD 144A P/P 2.50000000 | 0,06 | -7,25 | 0,1833 | 0,0050 | |||||

| US3140QQJD84 / Fannie Mae Pool | 0,06 | -3,08 | 0,1791 | 0,0108 | |||||

| US36262LAB62 / GS Mortgage-Backed Securities Trust | 0,06 | -6,06 | 0,1763 | 0,0059 | |||||

| US3140QQJA46 / Fannie Mae Pool | 0,06 | -3,45 | 0,1594 | 0,0085 | |||||

| US31418EXF23 / Fannie Mae Pool | 0,05 | -5,56 | 0,1463 | 0,0047 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,05 | 0,1397 | 0,1397 | ||||||

| US31412MKP22 / Fannie Mae Pool | 0,04 | -16,00 | 0,1216 | -0,0086 | |||||

| US552754AA14 / MFA 2020-NQM1 TRUST SER 2020-NQM1 CL A1 V/R REGD 144A P/P 0.00000000 | 0,04 | -9,09 | 0,1146 | 0,0007 | |||||

| US31403DDR70 / Fannie Mae Pool | 0,04 | -5,13 | 0,1054 | 0,0043 | |||||

| US31418RMG38 / Fannie Mae Pool | 0,03 | -5,56 | 0,0984 | 0,0040 | |||||

| US10569TAA60 / BRAVO Residential Funding Trust 2021-NQM1 | 0,03 | -8,57 | 0,0934 | 0,0025 | |||||

| US16158RAN61 / Chase Home Lending Mortgage Trust 2019-ATR1 | 0,03 | -9,68 | 0,0803 | 0,0001 | |||||

| US3140Q9VA89 / Fannie Mae Pool | 0,03 | -6,90 | 0,0769 | 0,0021 | |||||

| US3140Q9U500 / Fannie Mae Pool | 0,03 | -7,41 | 0,0719 | 0,0010 | |||||

| US3136A6FA76 / Fannie Mae REMICS | 0,02 | -4,17 | 0,0665 | 0,0039 | |||||

| US69688XAS09 / Palmer Square CLO 2014-1 Ltd | 0,02 | -50,00 | 0,0608 | -0,0494 | |||||

| US3140Q9U682 / Fannie Mae Pool | 0,02 | -9,09 | 0,0584 | 0,0014 | |||||

| US3133KYXJ36 / FR RB5181 | 0,02 | 0,0512 | 0,0512 | ||||||

| US3140HMP327 / Fannie Mae Pool | 0,02 | -10,53 | 0,0505 | 0,0014 | |||||

| US3140Q9U849 / Fannie Mae Pool | 0,01 | -6,67 | 0,0413 | 0,0005 | |||||

| US05948XYC90 / Banc of America Mortgage 2003-J Trust | 0,01 | -7,14 | 0,0388 | 0,0027 | |||||

| US31408AHA16 / Fannie Mae Pool | 0,01 | -9,09 | 0,0307 | 0,0018 | |||||

| US3140HMPV06 / Fannie Mae Pool | 0,01 | -10,00 | 0,0281 | 0,0003 | |||||

| US12566WAG50 / CitiMortgage Alternative Loan Trust Series 2007-A5 | 0,01 | 0,00 | 0,0260 | 0,0012 | |||||

| US LONG BOND(CBT) MAR25 / DIR (000000000) | 0,01 | 0,0239 | 0,0239 | ||||||

| US38376PA594 / Government National Mortgage Association | 0,01 | -22,22 | 0,0227 | -0,0029 | |||||

| US 10YR NOTE (CBT)MAR25 / DIR (000000000) | 0,01 | 0,0207 | 0,0207 | ||||||

| US3140HMP400 / Fannie Mae Pool | 0,01 | -16,67 | 0,0167 | 0,0006 | |||||

| US36292GKA21 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0039 | 0,0002 | |||||

| US31410RFH75 / Fannie Mae Pool | 0,00 | 0,0018 | 0,0001 | ||||||

| US 2YR NOTE (CBT) MAR25 / DIR (000000000) | 0,00 | 0,0013 | 0,0013 | ||||||

| US38373MVL17 / Government National Mortgage Association | 0,00 | 0,0000 | -0,0000 | ||||||

| US 5YR NOTE (CBT) MAR25 / DIR (000000000) | -0,01 | -0,0385 | -0,0385 | ||||||

| US 10YR ULTRA FUT MAR25 / DIR (000000000) | -0,02 | -0,0522 | -0,0522 | ||||||

| 30Y RTR 3.920000 30-JAN-2025 / DIR (000000000) | -0,02 | -0,0585 | -0,0585 | ||||||

| 10Y RTR 4.050000 30-JAN-2025 / DIR (000000000) | -0,03 | -0,0711 | -0,0711 | ||||||

| 5Y RTR 4.020000 30-JAN-2025 / DIR (000000000) | -0,03 | -0,0766 | -0,0766 | ||||||

| 2Y RTR 4.060000 30-JAN-2025 / DIR (000000000) | -0,03 | -0,0868 | -0,0868 | ||||||

| US ULTRA BOND CBT MAR25 / DIR (000000000) | -0,04 | -0,1170 | -0,1170 |