Grundlæggende statistik

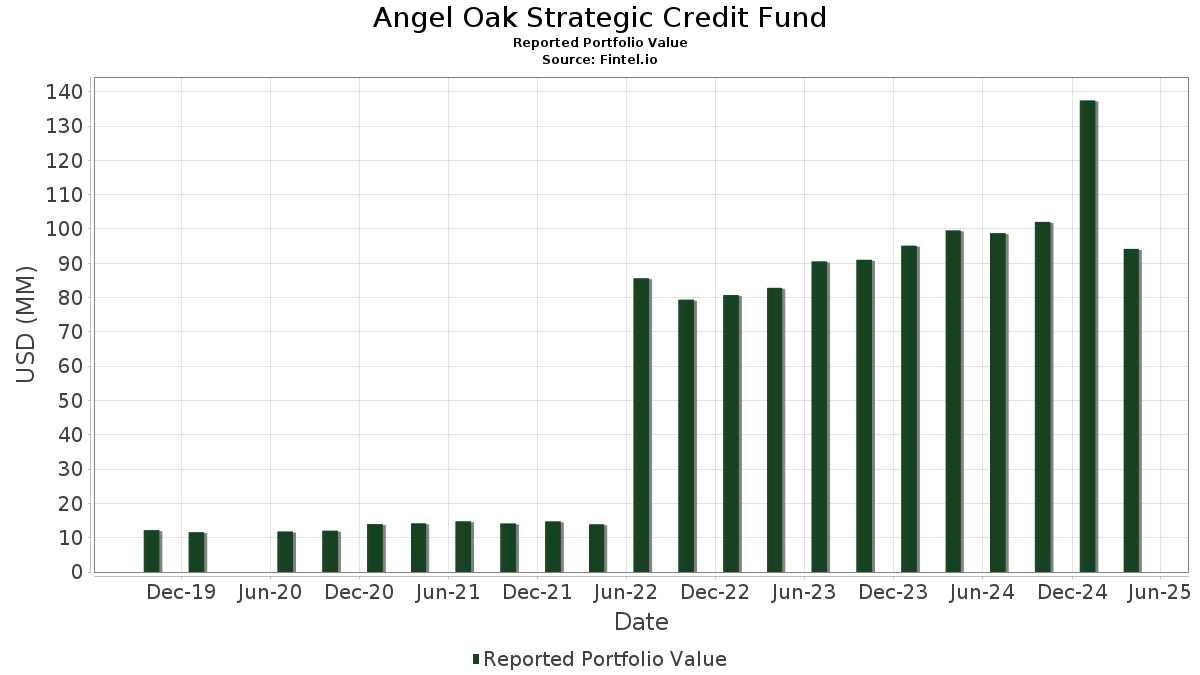

| Porteføljeværdi | $ 94.178.868 |

| Nuværende stillinger | 168 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Angel Oak Strategic Credit Fund har afsløret 168 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 94.178.868 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Angel Oak Strategic Credit Funds største beholdninger er FIRST EAGLE COMMERCIAL LOAN FUNDING 2016- SER 2016-1A CL CR V/R REGD 144A P/P 0.00000000 (US:US32010LAG95) , FIRST AM GOV OBLIG-U (US:US31846V2117) , GS Mortgage-Backed Securities Trust 2020-NQM1 (US:US36259WAF86) , J.P. Morgan Mortgage Trust 2022-6 (US:US46655KDG85) , and CSMCM 2022-ATH1 (US:US12660BAF85) . Angel Oak Strategic Credit Funds nye stillinger omfatter FIRST EAGLE COMMERCIAL LOAN FUNDING 2016- SER 2016-1A CL CR V/R REGD 144A P/P 0.00000000 (US:US32010LAG95) , GS Mortgage-Backed Securities Trust 2020-NQM1 (US:US36259WAF86) , J.P. Morgan Mortgage Trust 2022-6 (US:US46655KDG85) , CSMCM 2022-ATH1 (US:US12660BAF85) , and Western Mortgage Reference Notes Series 2021-CL2 (US:US95763PNE78) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 7,25 | 7,6088 | 7,6088 | ||

| 6,04 | 6,04 | 6,3425 | 3,6061 | |

| 2,01 | 2,1114 | 2,1114 | ||

| 1,16 | 1,2148 | 1,2148 | ||

| 1,01 | 1,0598 | 1,0598 | ||

| 1,00 | 1,0495 | 1,0495 | ||

| 0,92 | 0,9662 | 0,9662 | ||

| 0,98 | 1,0329 | 0,9360 | ||

| 10,51 | 11,0403 | 0,6086 | ||

| 0,52 | 0,5499 | 0,5499 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -2,55 | -2,6795 | -2,6795 | ||

| -1,70 | -1,7860 | -1,7860 | ||

| -0,37 | -0,3912 | -0,3912 | ||

| 0,81 | 0,8496 | -0,3266 | ||

| 0,81 | 0,8457 | -0,2175 | ||

| 0,40 | 0,4187 | -0,1270 | ||

| 0,22 | 0,2327 | -0,0789 | ||

| 0,15 | 0,1595 | -0,0780 | ||

| 0,32 | 0,3401 | -0,0623 | ||

| 0,37 | 0,3893 | -0,0600 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-27 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US32010LAG95 / FIRST EAGLE COMMERCIAL LOAN FUNDING 2016- SER 2016-1A CL CR V/R REGD 144A P/P 0.00000000 | 10,51 | -0,14 | 11,0403 | 0,6086 | |||||

| Selene 2024-1 / ABS-MBS (N/A) | 7,25 | 7,6088 | 7,6088 | ||||||

| US31846V2117 / FIRST AM GOV OBLIG-U | 6,04 | 118,69 | 6,04 | 118,68 | 6,3425 | 3,6061 | |||

| US36259WAF86 / GS Mortgage-Backed Securities Trust 2020-NQM1 | 3,02 | 1,51 | 3,1710 | 0,2230 | |||||

| Barings Clo Ltd 2023-I / ABS-CBDO (US06763EAA10) | 2,01 | 2,1114 | 2,1114 | ||||||

| US46655KDG85 / J.P. Morgan Mortgage Trust 2022-6 | 1,70 | 7,21 | 1,7814 | 0,2137 | |||||

| US12660BAF85 / CSMCM 2022-ATH1 | 1,52 | 1,06 | 1,5993 | 0,1057 | |||||

| Black Diamond CLO 2022-1 Ltd / ABS-CBDO (US09203GAA85) | 1,51 | -2,83 | 1,5896 | 0,0468 | |||||

| US95763PNE78 / Western Mortgage Reference Notes Series 2021-CL2 | 1,33 | -2,20 | 1,4015 | 0,0493 | |||||

| USG1300GAA07 / Birch Grove CLO 6 Ltd | 1,31 | -2,17 | 1,3737 | 0,0487 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKK94) | 1,16 | 1,2148 | 1,2148 | ||||||

| Radnor Re 2024-1 Ltd / ABS-MBS (US75049AAD46) | 1,14 | 1,43 | 1,1950 | 0,0831 | |||||

| JP Morgan Mortgage Trust Series 2024-8 / ABS-MBS (US46658GBJ04) | 1,12 | -0,62 | 1,1727 | 0,0597 | |||||

| Marlette Funding Trust 2023-1 / ABS-O (US57110PAD33) | 1,02 | 0,79 | 1,0678 | 0,0683 | |||||

| US57109NAD12 / Marlette Funding Trust 2022-3 | 1,01 | 1,0598 | 1,0598 | ||||||

| Pikes Peak CLO 14 2023 Ltd / ABS-CBDO (US72134DAA72) | 1,01 | -0,20 | 1,0594 | 0,0580 | |||||

| Katayma CLO I Ltd / ABS-CBDO (US48585KAA51) | 1,01 | -2,52 | 1,0578 | 0,0337 | |||||

| PARK BLUE CLO 2023-III LTD / ABS-CBDO (US70019BAA52) | 1,01 | -0,20 | 1,0570 | 0,0577 | |||||

| CARLYLE US CLO 2023-2 LTD / ABS-CBDO (US14318HAA86) | 1,01 | -1,76 | 1,0558 | 0,0416 | |||||

| Bryant Park Funding 2023-20 Ltd / ABS-CBDO (US117651AA77) | 1,00 | -1,96 | 1,0534 | 0,0393 | |||||

| PRPM 2024-NQM3 / ABS-MBS (US69381FAF71) | 1,00 | 1,31 | 1,0528 | 0,0722 | |||||

| Man US CLO 2024-1 Ltd / ABS-CBDO (US56167CAN48) | 1,00 | -1,18 | 1,0512 | 0,0469 | |||||

| Neuberger Berman Loan Advisers LaSalle Street Lending CLO II Ltd / ABS-CBDO (US64135QAA40) | 1,00 | -3,47 | 1,0508 | 0,0244 | |||||

| Sycamore Tree CLO 2024-5 Ltd / ABS-CBDO (US87122QAA04) | 1,00 | 1,0495 | 1,0495 | ||||||

| US69546MAC10 / Pagaya AI Debt Trust 2022-1 | 0,98 | 913,40 | 1,0329 | 0,9360 | |||||

| ADMT 2024-NQM6 / ABS-MBS (US00249YAJ55) | 0,95 | 2,27 | 0,9952 | 0,0776 | |||||

| EFMT 2024-NQM1 / ABS-MBS (US26845DAJ46) | 0,94 | 2,17 | 0,9876 | 0,0755 | |||||

| Pikes Peak CLO 5 / ABS-CBDO (US72133QAG64) | 0,92 | 0,9662 | 0,9662 | ||||||

| New Residential Mortgage Loan Trust 2015-1 / ABS-MBS (US64829CAT53) | 0,90 | -10,19 | 0,9442 | -0,0476 | |||||

| Carvana Auto Receivables Trust 2019-3 / ABS-O (US14686XAJ81) | 0,81 | -31,84 | 0,8496 | -0,3266 | |||||

| US91679JAC18 / UPST_21-5 | 0,81 | -24,98 | 0,8457 | -0,2175 | |||||

| KKR CLO 43 Ltd / ABS-CBDO (US48256BAD73) | 0,75 | -3,23 | 0,7862 | 0,0196 | |||||

| US46654KBU07 / JP Morgan Mortgage Trust 2021-11 | 0,74 | -9,95 | 0,7796 | -0,0373 | |||||

| JP Morgan Mortgage Trust Series 2024-8 / ABS-MBS (US46658GBH48) | 0,68 | 1,03 | 0,7183 | 0,0470 | |||||

| Bellemeade Re Ltd / ABS-MBS (US078915AE53) | 0,67 | -0,30 | 0,7087 | 0,0388 | |||||

| US21873AAL17 / Colony American Finance Limited Series 20-4 Class D | 0,66 | 1,87 | 0,6887 | 0,0516 | |||||

| US46655KDH68 / J.P. Morgan Mortgage Trust 2022-6 | 0,63 | 6,63 | 0,6590 | 0,0761 | |||||

| US89616KAF12 / TRICOLOR AUTO SECURITIZATION TRUST 2023-1 TAST 2023-1A F | 0,53 | -0,19 | 0,5538 | 0,0304 | |||||

| Prosper Marketplace Issuance Trust Series 2024-1 / ABS-O (US74363CAD11) | 0,52 | -0,76 | 0,5511 | 0,0280 | |||||

| US91838PAA93 / VT TOPCO INC REGD 144A P/P 8.50000000 | 0,52 | 0,5499 | 0,5499 | ||||||

| BXMT / Blackstone Mortgage Trust, Inc. | 0,52 | 0,5458 | 0,5458 | ||||||

| HTL Commercial Mortgage Trust 2024-T53 / ABS-MBS (US404300AL97) | 0,52 | 0,78 | 0,5432 | 0,0348 | |||||

| Upgrade Receivables Trust 2024-1 / ABS-O (US91533NAD66) | 0,51 | 0,00 | 0,5367 | 0,0303 | |||||

| US91679AAC09 / Upstart Securitization Trust 2023-1 | 0,51 | 0,20 | 0,5360 | 0,0316 | |||||

| Pagaya AI Debt Grantor Trust 2024-8 / ABS-O (US69548PAA66) | 0,51 | 1,00 | 0,5333 | 0,0352 | |||||

| GreenSky Home Improvement Trust 2024-1 / ABS-O (US39571MAE84) | 0,51 | -1,37 | 0,5311 | 0,0236 | |||||

| US57109LAD55 / Marlette Funding Trust 2023-2 | 0,51 | -0,39 | 0,5306 | 0,0277 | |||||

| GSY / goeasy Ltd. | 0,50 | 0,5298 | 0,5298 | ||||||

| Octane Recievables Trust 2024-RPT1 / ABS-O (US67578QAB95) | 0,50 | -0,40 | 0,5255 | 0,0274 | |||||

| Octane Receivables Trust 2024-RVM1 / ABS-O (US67579FAE60) | 0,50 | -0,99 | 0,5238 | 0,0255 | |||||

| Global Aircraft Leasing Co Ltd / DBT (US37960JAC27) | 0,50 | -3,11 | 0,5237 | 0,0142 | |||||

| Pagaya AI Debt Grantor Trust 2024-10 / ABS-O (US69546UAA79) | 0,50 | -2,54 | 0,5230 | 0,0158 | |||||

| US35640YAJ64 / Freedom Mortgage Corp. | 0,50 | -1,20 | 0,5216 | 0,0238 | |||||

| US89641QAJ94 / Trinitas CLO XIV Ltd | 0,50 | -1,20 | 0,5211 | 0,0237 | |||||

| BAMLL Commercial Mortgage Securities Trust 2024-NASH / ABS-MBS (US05555CAL54) | 0,50 | -1,00 | 0,5210 | 0,0244 | |||||

| PAGAYA AI Debt Trust 2022-2 / ABS-O (US69546VAC19) | 0,49 | 0,41 | 0,5195 | 0,0316 | |||||

| HRI / Herc Holdings Inc. | 0,49 | 0,5192 | 0,5192 | ||||||

| Credit Acceptance Corp / DBT (US225310AS06) | 0,49 | 0,5161 | 0,5161 | ||||||

| Jefferies Finance LLC / JFIN Co-Issuer Corp / DBT (US47232MAG78) | 0,49 | 0,5149 | 0,5149 | ||||||

| Momnt Technologies Trust 2023-1 / ABS-O (US608934AB16) | 0,49 | -2,00 | 0,5147 | 0,0185 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAC27) | 0,49 | 0,5140 | 0,5140 | ||||||

| Regatta XIX Funding Ltd / ABS-CBDO (US75888CAC64) | 0,49 | 0,5136 | 0,5136 | ||||||

| Raven Acquisition Holdings LLC / DBT (US75420NAA19) | 0,49 | 0,5134 | 0,5134 | ||||||

| ACHV ABS Trust 2024-3AL / ABS-O (US00092KAE47) | 0,49 | 2,31 | 0,5129 | 0,0399 | |||||

| Brundage-Bone Concrete Pumping Holdings Inc / DBT (US66981QAB23) | 0,49 | 0,5128 | 0,5128 | ||||||

| US02406PAU49 / American Axle & Manufacturing Inc | 0,49 | 0,5127 | 0,5127 | ||||||

| EFMT 2025-NQM1 / ABS-MBS (US26846CAF32) | 0,48 | 0,83 | 0,5086 | 0,0328 | |||||

| PHH Escrow Issuer LLC/PHH Corp / DBT (US716964AA94) | 0,48 | 0,5084 | 0,5084 | ||||||

| US12663QAC96 / CVR Partners LP / CVR Nitrogen Finance Corp | 0,48 | 0,5079 | 0,5079 | ||||||

| US74333QAN51 / Progress Residential Trust, Series 2021-SFR9, Class F | 0,48 | 1,90 | 0,5079 | 0,0375 | |||||

| US70932MAC10 / PennyMac Financial Services Inc | 0,48 | -0,83 | 0,5006 | 0,0249 | |||||

| Directv Financing LLC / Directv Financing Co-Obligor Inc / DBT (US25461LAD47) | 0,47 | 0,4976 | 0,4976 | ||||||

| US76009NAL47 / Rent-A-Center Inc/TX | 0,47 | -3,67 | 0,4961 | 0,0099 | |||||

| EFMT 2025-NQM1 / ABS-MBS (US26846CAG15) | 0,47 | 2,65 | 0,4889 | 0,0398 | |||||

| US12769GAA85 / Caesars Entertainment Inc | 0,46 | 0,4852 | 0,4852 | ||||||

| US30166QAG47 / EXETER AUTOMOBILE RECEIVABLES TRUST 2022-2 EART 2022-2A E | 0,46 | 0,4847 | 0,4847 | ||||||

| Pagaya AI Debt Grantor Trust 2024-6 And Pagaya AI Debt Trust 2024-6 / ABS-O (US69548LAA52) | 0,46 | -12,50 | 0,4787 | -0,0372 | |||||

| US22945AAH23 / CSMC 2017-RPL1 Trust | 0,45 | 0,90 | 0,4709 | 0,0306 | |||||

| US465989AN11 / JP Morgan Mortgage Trust 2023-5 | 0,44 | -4,97 | 0,4621 | 0,0028 | |||||

| US07876XAE31 / Bellemeade Re 2023-1 Ltd | 0,43 | -0,46 | 0,4524 | 0,0237 | |||||

| Venture Global LNG Inc / EP (US92332YAF88) | 0,43 | 0,4517 | 0,4517 | ||||||

| US390607AF62 / GREAT LAKES DRDG and DOCK CORP NEW 5.25% 06/01/2029 144A | 0,41 | -1,67 | 0,4318 | 0,0174 | |||||

| US644393AB64 / New Fortress Energy Inc | 0,41 | -15,81 | 0,4306 | -0,0529 | |||||

| Reach ABS Trust 2024-2 / ABS-O (US75525HAD26) | 0,41 | -3,30 | 0,4306 | 0,0101 | |||||

| US91679TAC99 / Upstart Securitization Trust 2022-2 | 0,40 | -7,41 | 0,4210 | -0,0071 | |||||

| US14686YAK38 / Carvana Auto Receivables Trust 2019-4 | 0,40 | -27,64 | 0,4187 | -0,1270 | |||||

| Pagaya Ai Debt Grantor Trust 2024-9 / ABS-O (US69548QAA40) | 0,40 | -2,46 | 0,4174 | 0,0139 | |||||

| US95763PNH00 / Western Mortgage Reference Notes Series 2021-CL2 | 0,40 | 0,00 | 0,4169 | 0,0236 | |||||

| US48128U2S73 / JPMorgan Chase Bank NA - CACLN | 0,39 | 0,4105 | 0,4105 | ||||||

| US20914UAF30 / Consolidated Energy Finance SA | 0,39 | 9,86 | 0,4101 | 0,0580 | |||||

| US95763PNG27 / Western Mortgage Reference Notes Series 2021-CL2 | 0,38 | -2,08 | 0,3961 | 0,0140 | |||||

| US12804BAB45 / CAL Receivables 2022-1 LLC | 0,37 | -18,32 | 0,3893 | -0,0600 | |||||

| US43732VAL09 / HOME PARTNERS OF AMERICA 2021-2 TRUST HPA 2021-2 F | 0,37 | 1,10 | 0,3849 | 0,0262 | |||||

| US389286AA34 / Gray Escrow II Inc | 0,36 | 0,00 | 0,3764 | 0,0214 | |||||

| US39525UAA51 / Greenfire Resources Ltd | 0,34 | -1,46 | 0,3549 | 0,0149 | |||||

| US14687HAF01 / Carvana Auto Receivables Trust | 0,33 | -11,70 | 0,3491 | -0,0236 | |||||

| Huntington Bank Auto Credit-Linked Notes Series 2024-1 / ABS-O (US44644NAD12) | 0,33 | -13,49 | 0,3434 | -0,0312 | |||||

| US38237AAB89 / Goodleap Sustainable Home Solutions Trust 2023-2 | 0,32 | -20,44 | 0,3401 | -0,0623 | |||||

| CPS Auto Receivables Trust 2024-B / ABS-O (US12627SAE63) | 0,31 | 0,32 | 0,3250 | 0,0194 | |||||

| SBNA Auto Receivables Trust 2024-A / ABS-O (US78437PAH64) | 0,31 | 1,64 | 0,3249 | 0,0237 | |||||

| US00792FAE88 / AFFRM 23-B E 144A 11.32% 09-15-28/05-15-26 | 0,30 | -1,30 | 0,3202 | 0,0148 | |||||

| LBA Trust 2024-BOLT / ABS-MBS (US50177BAQ05) | 0,30 | 0,00 | 0,3165 | 0,0178 | |||||

| Stena International SA / DBT (US85858EAD58) | 0,30 | 0,3112 | 0,3112 | ||||||

| US059487AN84 / BOAA 2006-6 CBIO | 0,29 | 1,03 | 0,3078 | 0,0200 | |||||

| US03842VAC19 / Aqua Finance Trust 2017-A | 0,27 | 4,25 | 0,2842 | 0,0273 | |||||

| US822538AH74 / Shelf Drilling Holdings Ltd | 0,27 | 3,86 | 0,2828 | 0,0257 | |||||

| Veros Auto Receivables Trust 2024-1 / ABS-O (US92512WAD92) | 0,26 | 0,00 | 0,2774 | 0,0152 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAB26) | 0,26 | 0,2751 | 0,2751 | ||||||

| Republic Finance Issuance Trust 2024-A / ABS-O (US76041RAD35) | 0,26 | 1,99 | 0,2696 | 0,0203 | |||||

| US86361HAT14 / SAMI 2006-AR7 X | 0,25 | 0,82 | 0,2595 | 0,0158 | |||||

| Pagaya AI Debt Grantor Trust 2025-1 / ABS-O (US69548VAA35) | 0,25 | -2,00 | 0,2574 | 0,0091 | |||||

| XS1626768730 / Ecuador Government International Bond | 0,24 | 0,2556 | 0,2556 | ||||||

| Pagaya AI Debt Grantor Trust 2025-1 / ABS-O (US69548VAB18) | 0,24 | 1,28 | 0,2496 | 0,0170 | |||||

| Strike Acceptance Auto Funding Trust 2023-1 / ABS-O (US862942AA77) | 0,24 | -21,07 | 0,2478 | -0,0492 | |||||

| Pagaya AI Debt Grantor Trust 2024-11 / ABS-O (US69548EAB92) | 0,23 | 0,43 | 0,2440 | 0,0146 | |||||

| Halseypoint Clo 6 Ltd / ABS-CBDO (US40639JAG85) | 0,23 | -4,55 | 0,2427 | 0,0025 | |||||

| US52607HAC43 / Lendingpoint Asset Securitization Trust | 0,22 | -29,62 | 0,2327 | -0,0789 | |||||

| US 5YR NOTE (CBT) Jun25 / DIR (N/A) | 0,22 | 0,2325 | 0,2325 | ||||||

| US52606WAC29 / Lendingpoint 2022-B Asset Securitization Trust | 0,21 | -18,94 | 0,2256 | -0,0361 | |||||

| X-Caliber Funding LLC / DBT (US98373XAW02) | 0,20 | -13,92 | 0,2152 | -0,0197 | |||||

| PowerPay Issuance Trust 2024-1 / ABS-O (US73934RAB42) | 0,20 | -0,97 | 0,2149 | 0,0103 | |||||

| Prestige Auto Receivables Trust 2024-1 / ABS-O (US74113QAL59) | 0,20 | 0,49 | 0,2145 | 0,0125 | |||||

| Purchasing Power Funding 2024-A LLC / ABS-O (US745935AE61) | 0,20 | 0,00 | 0,2145 | 0,0121 | |||||

| Affirm Asset Securitization Trust 2024-A / ABS-O (US00834BAE74) | 0,20 | -0,98 | 0,2122 | 0,0092 | |||||

| Flagship Credit Auto Trust 2024-1 / ABS-O (US33843VAN38) | 0,20 | 0,00 | 0,2110 | 0,0125 | |||||

| Octane Receivables Trust 2024-1 / ABS-O (US67571FAF18) | 0,20 | -1,98 | 0,2086 | 0,0085 | |||||

| US91681PAB58 / Upstart Pass-Through Trust Series 2021-ST3 | 0,20 | 0,2059 | 0,2059 | ||||||

| US913229AA80 / United Wholesale Mortgage LLC | 0,19 | -0,52 | 0,2036 | 0,0113 | |||||

| US588056BB60 / Mercer International Inc | 0,19 | 0,2033 | 0,2033 | ||||||

| US76042UAD54 / Republic Finance Issuance Trust, Series 2021-A, Class D | 0,19 | -0,52 | 0,2022 | 0,0107 | |||||

| Santander Bank Auto Credit-Linked Notes Series 2024-A / ABS-O (US80290CCN20) | 0,19 | -7,39 | 0,1976 | -0,0041 | |||||

| US05950BAV62 / BOAA 2006-5 CBIO | 0,16 | 0,00 | 0,1691 | 0,0092 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAA60) | 0,15 | -2,56 | 0,1606 | 0,0053 | |||||

| Saks Global Enterprises LLC / DBT (US79380MAA36) | 0,15 | -36,82 | 0,1595 | -0,0780 | |||||

| US30306KAC71 / FREMF Mortgage Trust, Series 2017-KF41, Class B | 0,13 | 0,00 | 0,1335 | 0,0068 | |||||

| US46591HAL42 / Chase Mortgage Reference Notes 2020-CL1 | 0,13 | -3,85 | 0,1314 | 0,0020 | |||||

| US74922EAV11 / RALI Series 2006-QS6 Trust | 0,12 | 0,1278 | 0,1278 | ||||||

| US76088LAA61 / RPM_21-2A | 0,12 | -13,33 | 0,1237 | -0,0109 | |||||

| US91679WAC29 / Upstart Securitization Trust, Series 2022-1, Class C | 0,12 | 3,60 | 0,1214 | 0,0111 | |||||

| RALI Series 2007-QS11 Trust / ABS-MBS (US74925GAD34) | 0,11 | 0,1134 | 0,1134 | ||||||

| US91327BAA89 / UNITI GROUP LP / UNITI GROUP FINANCE INC / CSL CAPITAL LLC 6.5% 02/15/2029 144A | 0,09 | 0,0962 | 0,0962 | ||||||

| US61764BAJ26 / Morgan Stanley Capital I Trust 2014-150E | 0,09 | 0,00 | 0,0894 | 0,0043 | |||||

| US91531XAC83 / Upgrade Master Pass-Thru Trust Series 2021-PT2 | 0,08 | -25,71 | 0,0819 | -0,0225 | |||||

| US46591HBQ20 / J.P. Morgan Wealth Management | 0,07 | -1,37 | 0,0759 | 0,0035 | |||||

| US91683MAB00 / Upstart Pass-Through Trust Series 2021-ST9 | 0,06 | -4,48 | 0,0681 | 0,0010 | |||||

| US69546RAC07 / PAID_21-3 | 0,05 | -29,87 | 0,0574 | -0,0191 | |||||

| US LONG BOND(CBT) Jun25 / DIR (N/A) | 0,05 | 0,0547 | 0,0547 | ||||||

| US69547JAC71 / PAID_21-1 | 0,04 | -21,82 | 0,0452 | -0,0093 | |||||

| Pagaya AI Debt Selection Trust 2020-2 / ABS-O (US69546J1043) | 0,04 | -57,45 | 0,0423 | -0,0513 | |||||

| US46591HBP47 / J.P. Morgan Wealth Management | 0,04 | -2,63 | 0,0397 | 0,0014 | |||||

| US91683NAB82 / Upstart Pass-Through Trust Series 2022-ST1 | 0,04 | 9,09 | 0,0383 | 0,0052 | |||||

| US36251SAU24 / GS Mortgage Securities Corp. Trust, Series 2018-TWR, Class G | 0,02 | 500,00 | 0,0261 | 0,0216 | |||||

| US52605F1066 / LendingClub Receivables Trust Series 2019-7 | 0,02 | -71,15 | 0,0163 | -0,0353 | |||||

| LendingClub Receivables Trust Series 2019-3 / ABS-O (US52603E1010) | 0,01 | -74,42 | 0,0118 | -0,0308 | |||||

| US90355FAA66 / USASF SERVICING LLC 3.98% 04/15/2025 | 0,01 | -40,00 | 0,0102 | -0,0056 | |||||

| US949771AC35 / Wells Fargo Credit Risk Transfer Securities Trust 2015 | 0,01 | 0,00 | 0,0100 | 0,0004 | |||||

| US98402TAC80 / XCALI 2020-1 Mortgage Trust | 0,01 | -11,11 | 0,0094 | 0,0005 | |||||

| US008684AF90 / American Home Mortgage Assets Trust 2006-6 | 0,01 | 0,00 | 0,0062 | 0,0010 | |||||

| US61946CAB81 / Mosaic Solar Loan Trust 2019-1 | 0,00 | -55,56 | 0,0047 | -0,0050 | |||||

| US61946FAC95 / Mosaic Solar Loan Trust 2018-1 | 0,00 | -72,73 | 0,0039 | -0,0080 | |||||

| US52604L1044 / LendingClub Receivables Trust Series 2019-1 | 0,00 | -100,00 | 0,0003 | -0,0013 | |||||

| DSLA / DSLA Mortgage Loan Trust 2005-AR2 | 0,00 | 0,0003 | 0,0001 | ||||||

| US90355FAD06 / USAUT_22-1A | 0,00 | 0,0000 | -0,0001 | ||||||

| US12669GJA04 / CHL Mortgage Pass-Through Trust 2004-29 | 0,00 | -100,00 | 0,0000 | -0,0034 | |||||

| US52605AAE73 / Lendingpoint 2022-A Asset Securitization Trust | 0,00 | 0,0000 | -0,0000 | ||||||

| CDX44IG CDS (BUY PROTECTION) / DCR (N/A) | -0,37 | -0,3912 | -0,3912 | ||||||

| REVREPO32010LAG9 / RA (N/A) | -1,70 | -1,7860 | -1,7860 | ||||||

| REVREPO32010LAG9 / RA (N/A) | -2,55 | -2,6795 | -2,6795 |