Grundlæggende statistik

| Porteføljeværdi | $ 35.004.665 |

| Nuværende stillinger | 78 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

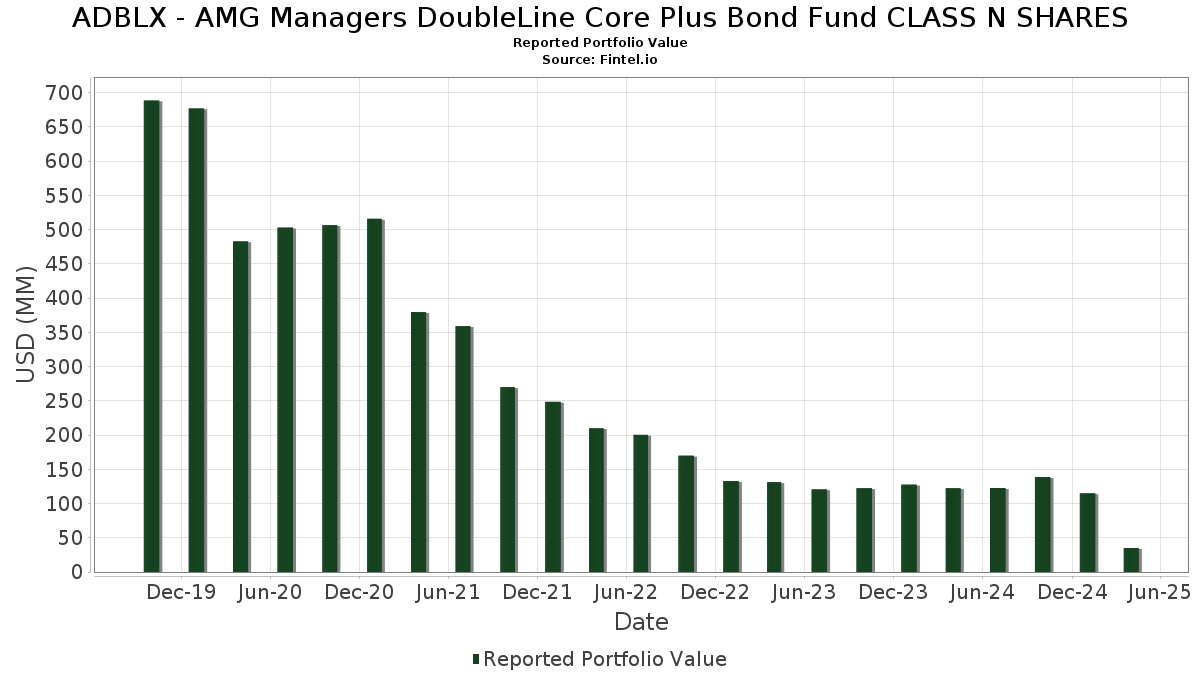

ADBLX - AMG Managers DoubleLine Core Plus Bond Fund CLASS N SHARES har afsløret 78 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 35.004.665 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). ADBLX - AMG Managers DoubleLine Core Plus Bond Fund CLASS N SHARESs største beholdninger er Fannie Mae Pool (US:US3140HV4E16) , Freddie Mac Pool (US:US3132DWAM55) , United States Treasury Note/Bond (US:US912810SW99) , Freddie Mac Pool (US:US3132DWEC38) , and Freddie Mac Gold Pool (US:US3128MJWU02) . ADBLX - AMG Managers DoubleLine Core Plus Bond Fund CLASS N SHARESs nye stillinger omfatter Fannie Mae Pool (US:US3140HV4E16) , Freddie Mac Pool (US:US3132DWAM55) , United States Treasury Note/Bond (US:US912810SW99) , Freddie Mac Pool (US:US3132DWEC38) , and Freddie Mac Gold Pool (US:US3128MJWU02) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 3,46 | 9,8910 | 9,8910 | ||

| 2,10 | 6,0102 | 4,2155 | ||

| 1,81 | 5,1604 | 4,1354 | ||

| 1,75 | 4,9925 | 3,4764 | ||

| 1,08 | 3,0991 | 3,0991 | ||

| 1,15 | 3,2783 | 2,2752 | ||

| 1,65 | 4,7159 | 1,8615 | ||

| 0,78 | 2,2433 | 1,5591 | ||

| 0,64 | 1,8402 | 1,2805 | ||

| 0,59 | 1,6901 | 1,1750 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,52 | 1,4849 | -6,6476 | ||

| 0,03 | 0,0736 | -3,4913 | ||

| 0,53 | 1,5061 | -3,2893 | ||

| 0,27 | 0,7839 | -2,8834 | ||

| 0,44 | 1,2680 | -2,4479 | ||

| 0,15 | 0,4333 | -1,9062 | ||

| 0,22 | 0,6214 | -1,7122 | ||

| 0,28 | 0,7885 | -1,7075 | ||

| 0,06 | 0,1774 | -0,8237 | ||

| 0,35 | 0,9904 | -0,7351 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-25 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Note/Bond / DBT (US91282CMM00) | 3,46 | 9,8910 | 9,8910 | ||||||

| US3140HV4E16 / Fannie Mae Pool | 2,10 | 2,24 | 6,0102 | 4,2155 | |||||

| United States Treasury Note/Bond / DBT (US91282CMA61) | 1,81 | 53,75 | 5,1604 | 4,1354 | |||||

| US3132DWAM55 / Freddie Mac Pool | 1,75 | 0,52 | 4,9925 | 3,4764 | |||||

| US912810SW99 / United States Treasury Note/Bond | 1,65 | -49,59 | 4,7159 | 1,8615 | |||||

| US3132DWEC38 / Freddie Mac Pool | 1,15 | -0,26 | 3,2783 | 2,2752 | |||||

| United States Treasury Note/Bond / DBT (US912810UE63) | 1,08 | 3,0991 | 3,0991 | ||||||

| US3128MJWU02 / Freddie Mac Gold Pool | 0,78 | 0,00 | 2,2433 | 1,5591 | |||||

| US29250NBS36 / Enbridge Inc | 0,78 | -63,27 | 2,2243 | 0,3761 | |||||

| US06051GKP36 / Bank of America Corp | 0,70 | -76,50 | 1,9977 | -0,5947 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 0,65 | -68,94 | 1,8539 | 0,0332 | |||||

| US3132DMBC82 / Freddie Mac Pool | 0,64 | 0,31 | 1,8402 | 1,2805 | |||||

| US3132DWAD56 / Freddie Mac Pool | 0,60 | -70,35 | 1,7247 | -0,0505 | |||||

| US3128MJWP17 / Freddie Mac Gold Pool | 0,59 | 0,17 | 1,6901 | 1,1750 | |||||

| US3132DWHT36 / FEDERAL HOME LOAN MORTGAGE CORP | 0,57 | -0,86 | 1,6412 | 1,1359 | |||||

| US61747YEV39 / Morgan Stanley | 0,55 | -64,86 | 1,5628 | 0,2060 | |||||

| US47214BAA61 / JBS USA LUX SA / JBS USA Food Co / JBS Luxembourg SARL | 0,54 | 1,88 | 1,5495 | 1,0851 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,54 | -73,53 | 1,5474 | -0,2364 | |||||

| United States Treasury Note/Bond / DBT (US912810TX63) | 0,53 | -90,43 | 1,5061 | -3,2893 | |||||

| US91282CES61 / U.S. Treasury Notes | 0,52 | -94,99 | 1,4849 | -6,6476 | |||||

| LNG / Cheniere Energy, Inc. | 0,50 | -0,40 | 1,4235 | 0,9874 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 0,49 | -74,62 | 1,3898 | -0,2819 | |||||

| United States Treasury Note/Bond / DBT (US91282CLW90) | 0,46 | 3,12 | 1,3250 | 0,9330 | |||||

| United States Treasury Note/Bond / DBT (US91282CLN91) | 0,44 | -89,60 | 1,2680 | -2,4479 | |||||

| US867229AC03 / Suncor Energy 7.15% Notes 2/1/32 | 0,43 | 0,00 | 1,2391 | 0,8610 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 0,39 | 1,1148 | 1,1148 | ||||||

| South Bow Canadian Infrastructure Holdings Ltd / DBT (US836720AF90) | 0,37 | -28,21 | 1,0566 | 0,6079 | |||||

| US89346DAH08 / TransAlta Corp | 0,36 | 1,0420 | 1,0420 | ||||||

| US36168QAQ73 / GFL Environmental Inc | 0,36 | -65,00 | 1,0400 | 0,1348 | |||||

| US209111GD93 / Consolidated Edison Co of New York Inc | 0,36 | -65,26 | 1,0373 | 0,1277 | |||||

| US0641598S88 / Bank of Nova Scotia/The | 0,36 | -65,75 | 1,0344 | 0,1143 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 0,36 | -65,42 | 1,0341 | 0,1224 | |||||

| US00914AAT97 / AIR LEASE CORPORATION | 0,36 | -64,91 | 1,0309 | 0,1355 | |||||

| US161175CM43 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0,36 | -65,06 | 1,0198 | 0,1303 | |||||

| Ginnie Mae II Pool / ABS-MBS (US36179YMM39) | 0,36 | -8,48 | 1,0185 | 0,6783 | |||||

| US01309QAA67 / Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC | 0,36 | -65,13 | 1,0164 | 0,1276 | |||||

| US247361ZZ42 / Delta Air Lines Inc | 0,35 | -65,40 | 1,0128 | 0,1199 | |||||

| US87166FAD50 / Synchrony Bank | 0,35 | -65,07 | 1,0008 | 0,1262 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 0,35 | -65,06 | 0,9945 | 0,1274 | |||||

| US92660FAK03 / Videotron Ltd | 0,35 | -65,09 | 0,9938 | 0,1260 | |||||

| Columbia Pipelines Holding Co LLC / DBT (US19828AAC18) | 0,35 | -82,50 | 0,9904 | -0,7351 | |||||

| Rogers Communications Inc / DBT (US775109DF56) | 0,34 | -64,50 | 0,9861 | 0,1398 | |||||

| K1RC34 / The Kroger Co. - Depositary Receipt (Common Stock) | 0,34 | -64,64 | 0,9806 | 0,1339 | |||||

| US92660FAN42 / Videotron Ltd | 0,33 | -64,59 | 0,9414 | 0,1307 | |||||

| US26442UAR59 / Duke Energy Progress LLC | 0,33 | -65,28 | 0,9335 | 0,1136 | |||||

| US31418DVB53 / FNMA UMBS, 30 Year | 0,29 | -83,30 | 0,8345 | -0,6859 | |||||

| AAL / American Airlines Group Inc. | 0,29 | -72,05 | 0,8329 | -0,0755 | |||||

| US3140HXCW80 / Fannie Mae Pool | 0,28 | -90,38 | 0,7885 | -1,7075 | |||||

| US3140HV4F80 / Fannie Mae Pool | 0,27 | -93,48 | 0,7839 | -2,8834 | |||||

| US06051GLU12 / Bank of America Corp | 0,26 | -74,76 | 0,7446 | -0,1549 | |||||

| NATWEST MARKETS SECURITIES INC / RA (000000000) | 0,25 | 0,7239 | 0,7239 | ||||||

| US3132DWEK53 / Freddie Mac Pool | 0,24 | -79,43 | 0,6800 | -0,3254 | |||||

| US31418EGK01 / Federal National Mortgage Association | 0,24 | -79,41 | 0,6764 | -0,3243 | |||||

| US3132DWES89 / FR SD8245 | 0,23 | -80,54 | 0,6444 | -0,3646 | |||||

| US13645RAD61 / Canadian Pac Ry Co New Debentures 7.125% 10/15/31 | 0,22 | -66,37 | 0,6408 | 0,0595 | |||||

| US91282CGM73 / United States Treasury Note/Bond | 0,22 | -91,88 | 0,6214 | -1,7122 | |||||

| US31429KAK97 / Federation des Caisses Desjardins du Quebec | 0,18 | -64,48 | 0,5126 | 0,0725 | |||||

| US19828TAC09 / CORPORATE BONDS | 0,18 | -65,97 | 0,5095 | 0,0523 | |||||

| US31322YVB46 / Freddie Mac Gold Pool | 0,18 | 0,57 | 0,5067 | 0,3530 | |||||

| US023771T402 / American Airlines, Inc. | 0,18 | 0,5040 | 0,5040 | ||||||

| US45823TAL08 / Intact Financial Corp | 0,18 | -82,36 | 0,5034 | -0,3675 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,17 | -65,71 | 0,4823 | 0,0539 | |||||

| US9128283W81 / United States Treasury Note/Bond | 0,15 | -94,37 | 0,4333 | -1,9062 | |||||

| Bell Telephone Co of Canada or Bell Canada / DBT (US0778FPAP47) | 0,15 | 0,4226 | 0,4226 | ||||||

| FARM CR CORP CDS- 0.0 16MAY25 / DBT (CA3079ZPEH66) | 0,08 | 0,2425 | 0,2425 | ||||||

| US31418EPC83 / FNMA 30YR 5% 02/01/2053#MA4918 | 0,06 | -94,59 | 0,1774 | -0,8237 | |||||

| DSVXX / Dreyfus Institutional Reserves Funds - Dreyfus Institutional Preferred Gov Money Market Fund Institutional | 0,05 | -36,93 | 0,05 | -37,35 | 0,1501 | 0,0775 | |||

| US36260TAJ43 / GSCG Trust 2019-600C | 0,05 | 1,96 | 0,1488 | 0,1036 | |||||

| US92857TAH05 / Vodafone Group PLC | 0,05 | 2,04 | 0,1448 | 0,1013 | |||||

| DGCXX / Dreyfus Government Cash Management Funds - Dreyfus Government Cash Management Fund Institutional Shares | 0,04 | -36,93 | 0,04 | -36,36 | 0,1001 | 0,0516 | |||

| US3140XH6N27 / FNMA POOL FS2676 FN 06/52 FIXED VAR | 0,03 | -99,39 | 0,0736 | -3,4913 | |||||

| US31417CB532 / Fannie Mae Pool | 0,02 | 0,00 | 0,0646 | 0,0451 | |||||

| United States Treasury Note/Bond / DBT (US91282CMP31) | 0,02 | 0,0490 | 0,0490 | ||||||

| US3128S1NH24 / Freddie Mac Gold Pool | 0,02 | 0,00 | 0,0442 | 0,0308 | |||||

| US3137A66C15 / Freddie Mac REMICS | 0,01 | 20,00 | 0,0350 | 0,0257 | |||||

| US3138WEET24 / Fannie Mae Pool | 0,01 | -97,69 | 0,0336 | -0,3820 | |||||

| US38374GPL04 / Government National Mortgage Association | 0,01 | -16,67 | 0,0162 | 0,0110 | |||||

| US91282CDY49 / United States Treasury Note/Bond | 0,00 | 0,0010 | 0,0007 | ||||||

| USG6688YAA22 / OAS Finance Ltd | 0,00 | 0,0000 | 0,0000 | ||||||

| US67104HAA41 / OAS FINANCE LTD | 0,00 | 0,0000 | 0,0000 | ||||||

| Foresight / EC (000000000) | 0,00 | 0,00 | 0,0000 | 0,0000 |