Grundlæggende statistik

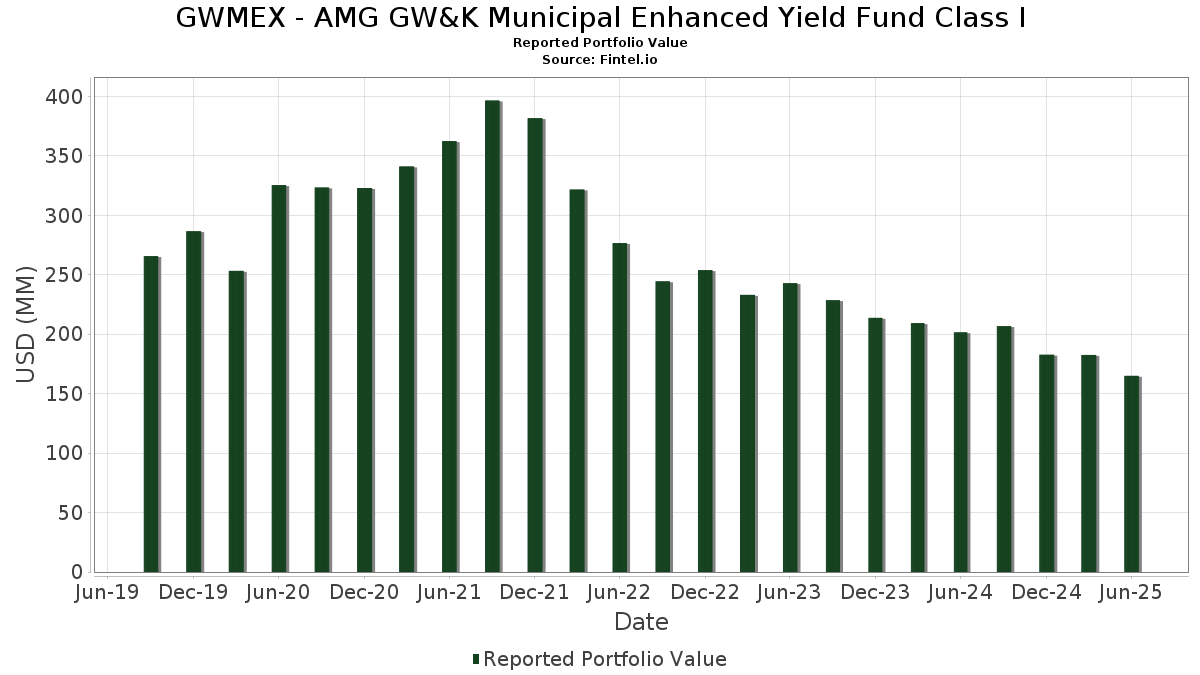

| Porteføljeværdi | $ 164.917.958 |

| Nuværende stillinger | 83 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

GWMEX - AMG GW&K Municipal Enhanced Yield Fund Class I har afsløret 83 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 164.917.958 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). GWMEX - AMG GW&K Municipal Enhanced Yield Fund Class Is største beholdninger er TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE (US:US882667AN81) , Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs Utilities, Series 2008 (US:US744387AD35) , Richland County School District No 2/SC (US:US763682R946) , Pennsylvania Economic Development Financing Authority (US:US70868YAW93) , and CENTRAL PLAINS ENERGY PROJECT (US:US154871CP00) . GWMEX - AMG GW&K Municipal Enhanced Yield Fund Class Is nye stillinger omfatter TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE (US:US882667AN81) , Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs Utilities, Series 2008 (US:US744387AD35) , Richland County School District No 2/SC (US:US763682R946) , Pennsylvania Economic Development Financing Authority (US:US70868YAW93) , and CENTRAL PLAINS ENERGY PROJECT (US:US154871CP00) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,45 | 0,8727 | 0,8727 | ||

| 1,24 | 0,7425 | 0,7425 | ||

| 1,05 | 0,6327 | 0,6327 | ||

| 1,02 | 0,6136 | 0,6136 | ||

| 1,01 | 0,6048 | 0,6048 | ||

| 0,98 | 0,5872 | 0,5872 | ||

| 0,95 | 0,5732 | 0,5732 | ||

| 0,92 | 0,5536 | 0,5536 | ||

| 6,34 | 3,8062 | 0,3129 | ||

| 5,03 | 3,0168 | 0,2034 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,12 | 1,2703 | -0,9297 | ||

| 1,03 | 0,6153 | -0,3633 | ||

| 2,77 | 1,6634 | -0,3290 | ||

| 0,98 | 0,5911 | -0,2063 | ||

| 0,90 | 0,5393 | -0,2016 | ||

| 4,63 | 2,7794 | -0,1805 | ||

| 0,97 | 0,5808 | -0,1133 | ||

| 5,28 | 3,1671 | -0,0920 | ||

| 1,81 | 1,0851 | -0,0856 | ||

| 1,89 | 1,1329 | -0,0463 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-29 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|

| US882667AN81 / TEXAS ST PRIV ACTIVITY BOND SURFACE TRANSPRTN CORP REVENUE | 6,59 | -3,66 | 3,9547 | 0,1897 | ||

| US744387AD35 / Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs Utilities, Series 2008 | 6,34 | -0,06 | 3,8062 | 0,3129 | ||

| US763682R946 / Richland County School District No 2/SC | 5,28 | -10,86 | 3,1671 | -0,0920 | ||

| US70868YAW93 / Pennsylvania Economic Development Financing Authority | 5,03 | -1,64 | 3,0168 | 0,2034 | ||

| US154871CP00 / CENTRAL PLAINS ENERGY PROJECT | 4,78 | -2,25 | 2,8675 | 0,1765 | ||

| US162393GC03 / City of Chattanooga TN Electric Revenue | 4,63 | -13,88 | 2,7794 | -0,1805 | ||

| US650110AE94 / New York Transportation Development Corp. | 4,61 | -2,39 | 2,7674 | 0,1667 | ||

| Rhode Island Health and Educational Building Corp / DBT (US762244MJ71) | 4,46 | -3,63 | 2,6761 | 0,1287 | ||

| US296110GF08 / FX.RT. MUNI BOND | 4,12 | -4,65 | 2,4722 | 0,0941 | ||

| US650116GP57 / NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE | 4,11 | -2,14 | 2,4676 | 0,1550 | ||

| US593211FN07 / Miami Beach Health Facilities Authority | 3,56 | -7,84 | 2,1398 | 0,0105 | ||

| US43233AFD37 / HILLSBOROUGH CNTY FL INDL DEVAUTH HOSP REVENUE | 3,52 | -3,43 | 2,1133 | 0,1064 | ||

| New York Transportation Development Corp / DBT (US650116HW99) | 3,50 | -3,79 | 2,1005 | 0,0978 | ||

| US57584YL648 / FX.RT. MUNI BOND | 3,42 | -0,35 | 2,0503 | 0,1630 | ||

| US956622X251 / West Virginia Hospital Finance Authority, Series 2023 B | 2,79 | -1,69 | 1,6756 | 0,1125 | ||

| US888808HR61 / Tobacco Settlement Financing Corp., Series 2018 A, Ref. RB | 2,77 | -0,14 | 1,6646 | 0,1352 | ||

| US592250DM38 / Metropolitan Pier & Exposition Authority | 2,77 | -23,41 | 1,6634 | -0,3290 | ||

| US888809BE95 / TOBACCO SETTLEMENT FING CORP RI | 2,75 | -0,07 | 1,6536 | 0,1358 | ||

| Louisiana Public Facilities Authority / DBT (US546399SZ00) | 2,57 | -2,17 | 1,5445 | 0,0962 | ||

| Louisiana Public Facilities Authority / DBT (US546399SY35) | 2,54 | -1,82 | 1,5231 | 0,1002 | ||

| US928097AC85 / Virginia Small Business Financing Authority, Private Activity Revenue Bonds, Transform 66 P3 Project, Senior Lien Series 2017 | 2,51 | -5,36 | 1,5042 | 0,0468 | ||

| US928104NX29 / Virginia Small Business Financing Authority | 2,33 | -1,93 | 1,4005 | 0,0905 | ||

| US928104NY02 / FX.RT. MUNI BOND | 2,28 | -2,73 | 1,3704 | 0,0781 | ||

| US57584Y4T33 / Massachusetts Development Finance Agency | 2,19 | -4,65 | 1,3158 | 0,0497 | ||

| US928104QJ08 / VIRGINIA SMALL BUSINESS FINANCING AUTHORITY | 2,15 | -2,01 | 1,2877 | 0,0824 | ||

| US613603G608 / MONTGOMERY CNTY PA HGR EDU & HLTH AUTH | 2,12 | -47,03 | 1,2703 | -0,9297 | ||

| US888808HQ88 / TOBACCO SETTLEMENT FING CORP NJ | 2,08 | -0,53 | 1,2492 | 0,0974 | ||

| US592250EY66 / Metropolitan Pier & Exposition Authority | 2,04 | -4,35 | 1,2267 | 0,0505 | ||

| US34061QBT31 / FLORIDA DEV FIN CORP HLTHCAREFACS REVENUE | 2,00 | -0,60 | 1,2029 | 0,0934 | ||

| US928097AB03 / VIRGINIA SMALL BUSINESS FING AUTH PRIV ACTIVITY REVENUE SR | 2,00 | -4,58 | 1,2020 | 0,0469 | ||

| US882667AY47 / TX Private Activity Bond Surface Trans Corp. Sr Lien Rev Rfdg Bonds (NTE Mobility Partn LLC North Tarrant Express Managed Lanes Proj) Ser 2019A | 1,91 | -0,98 | 1,1494 | 0,0852 | ||

| City of Houston TX Airport System Revenue / DBT (US442349HZ22) | 1,91 | -2,15 | 1,1480 | 0,0718 | ||

| US26444CHC91 / Duluth Economic Development Authority, Minnesota, Health Care Facilities Revenue Bonds, Essentia Health Obligated Group, Series 2018A | 1,89 | -11,86 | 1,1329 | -0,0463 | ||

| US650116GY64 / New York Transportation Development Corp | 1,81 | -15,00 | 1,0851 | -0,0856 | ||

| Ohio Higher Educational Facility Commission / DBT (US67756DS805) | 1,71 | -3,65 | 1,0294 | 0,0497 | ||

| US650116GN00 / New York Transportation Development Corp | 1,63 | -0,97 | 0,9794 | 0,0722 | ||

| City of Houston TX Airport System Revenue / DBT (US442349HX73) | 1,56 | -1,14 | 0,9351 | 0,0677 | ||

| US34061QBU04 / Florida Development Finance Corp. | 1,54 | -3,15 | 0,9242 | 0,0493 | ||

| Fayette County Development Authority / DBT (US31222PAW14) | 1,52 | -2,50 | 0,9145 | 0,0540 | ||

| Fayette County Development Authority / DBT (US31222PAX96) | 1,51 | -2,96 | 0,9069 | 0,0501 | ||

| New York Transportation Development Corp / DBT (US650116HM18) | 1,51 | -2,65 | 0,9062 | 0,0525 | ||

| Public Finance Authority / DBT (US74448EAA29) | 1,49 | 17,01 | 0,8921 | 0,1924 | ||

| Indiana Finance Authority / DBT (US45506ENZ24) | 1,45 | 0,8727 | 0,8727 | |||

| US65000BLQ94 / New York State Dormitory Authority | 1,45 | -7,75 | 0,8716 | 0,0046 | ||

| US65000BLP12 / NEW YORK ST DORM AUTH REVENUES NON ST SUPPORTED DEBT | 1,42 | -7,20 | 0,8508 | 0,0097 | ||

| Palm Beach County Health Facilities Authority / DBT (US69650MBB46) | 1,42 | -4,46 | 0,8497 | 0,0343 | ||

| US888808HT28 / TOBACCO SETTLEMENT FING CORP NJ | 1,36 | -6,96 | 0,8183 | 0,0113 | ||

| Ohio Higher Educational Facility Commission / DBT (US67756DS722) | 1,24 | -3,27 | 0,7452 | 0,0385 | ||

| Massachusetts Development Finance Agency / DBT (US57585BJT61) | 1,24 | 0,7425 | 0,7425 | |||

| Indiana Finance Authority / DBT (US45471FAZ45) | 1,21 | -2,49 | 0,7284 | 0,0431 | ||

| Indiana Finance Authority / DBT (US45471FAY79) | 1,18 | -1,99 | 0,7093 | 0,0457 | ||

| US882667BX54 / Texas Private Activity Bond Surface Transportation Corp | 1,15 | -2,30 | 0,6892 | 0,0419 | ||

| Massachusetts Development Finance Agency / DBT (US57585BBT44) | 1,11 | -8,07 | 0,6633 | 0,0014 | ||

| FIXED INCOME CLEARING CORPORATION / RA (000000000) | 1,05 | 0,6327 | 0,6327 | |||

| City of Houston TX Airport System Revenue / DBT (US442349HY56) | 1,03 | -1,81 | 0,6174 | 0,0408 | ||

| County of Jefferson AL Sewer Revenue / DBT (US472682ZS54) | 1,03 | -42,32 | 0,6153 | -0,3633 | ||

| Washington State Housing Finance Commission / DBT (US93978LHF67) | 1,02 | -3,31 | 0,6140 | 0,0321 | ||

| Suffolk Regional Off-Track Betting Corp / DBT (US86480TAB08) | 1,02 | 0,00 | 0,6136 | 0,0508 | ||

| New Hampshire Business Finance Authority / DBT (US63607YCZ16) | 1,02 | 0,6136 | 0,6136 | |||

| Public Finance Authority / DBT (US74442PK952) | 1,01 | -2,97 | 0,6082 | 0,0332 | ||

| Massachusetts Development Finance Agency / DBT (US57585BEX29) | 1,01 | -3,07 | 0,6061 | 0,0329 | ||

| US55123TBS06 / Lynchburg Economic Development Authority | 1,01 | -6,93 | 0,6053 | 0,0087 | ||

| Los Angeles Department of Water & Power / DBT (US544532PU27) | 1,01 | 0,6048 | 0,6048 | |||

| Colorado Health Facilities Authority / DBT (US19648FZH09) | 1,00 | -2,72 | 0,6021 | 0,0342 | ||

| Rhode Island Health and Educational Building Corp / DBT (US762244MH16) | 1,00 | -3,57 | 0,5994 | 0,0293 | ||

| US650116FR23 / New York Transportation Development Corp | 1,00 | -1,19 | 0,5982 | 0,0427 | ||

| Public Finance Authority / DBT (US74442PL372) | 1,00 | -3,02 | 0,5976 | 0,0324 | ||

| US59335KFB89 / Miami-Dade County, FL Seaport Rev. Refg. | 0,99 | -3,80 | 0,5923 | 0,0277 | ||

| County of Hamilton OH / DBT (US4072722W28) | 0,99 | -4,55 | 0,5919 | 0,0229 | ||

| US19648FKS29 / Colorado (State of) Health Facilities Authority (CommonSpirit Health), Series 2019 A-2, RB | 0,98 | -32,04 | 0,5911 | -0,2063 | ||

| Massachusetts Development Finance Agency / DBT (US57585BJU35) | 0,98 | 0,5872 | 0,5872 | |||

| US13049YBM21 / California Municipal Finance Authority | 0,97 | -23,25 | 0,5808 | -0,1133 | ||

| Indiana Finance Authority / DBT (US45471FAX96) | 0,96 | -2,75 | 0,5737 | 0,0328 | ||

| Massachusetts Development Finance Agency / DBT (US57585BKJ60) | 0,95 | 0,5732 | 0,5732 | |||

| Shelby County Health & Educational Facilities Board / DBT (US82170LAB18) | 0,92 | 0,5536 | 0,5536 | |||

| Village Community Development District No 15 / DBT (US92708KAK34) | 0,91 | -7,43 | 0,5463 | 0,0048 | ||

| US20775DPN65 / Connecticut State Health & Educational Facilities Authority | 0,90 | -33,23 | 0,5393 | -0,2016 | ||

| Massachusetts Development Finance Agency / DBT (US57585BEY02) | 0,90 | -3,35 | 0,5375 | 0,0273 | ||

| Capital Trust Authority / DBT (US14054YAC57) | 0,88 | -7,53 | 0,5311 | 0,0048 | ||

| New York State Dormitory Authority / DBT (US64985SBV43) | 0,88 | -5,91 | 0,5264 | 0,0135 | ||

| Capital Trust Authority / DBT (US14054YAD31) | 0,86 | -8,13 | 0,5157 | 0,0005 | ||

| US13048VZJ06 / California Municipal Finance Authority | 0,82 | -12,08 | 0,4894 | -0,0210 | ||

| South Carolina Jobs-Economic Development Authority / DBT (US83704HAM97) | 0,76 | -2,95 | 0,4545 | 0,0247 |