Grundlæggende statistik

| Porteføljeværdi | $ 3.016.723.331 |

| Nuværende stillinger | 50 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

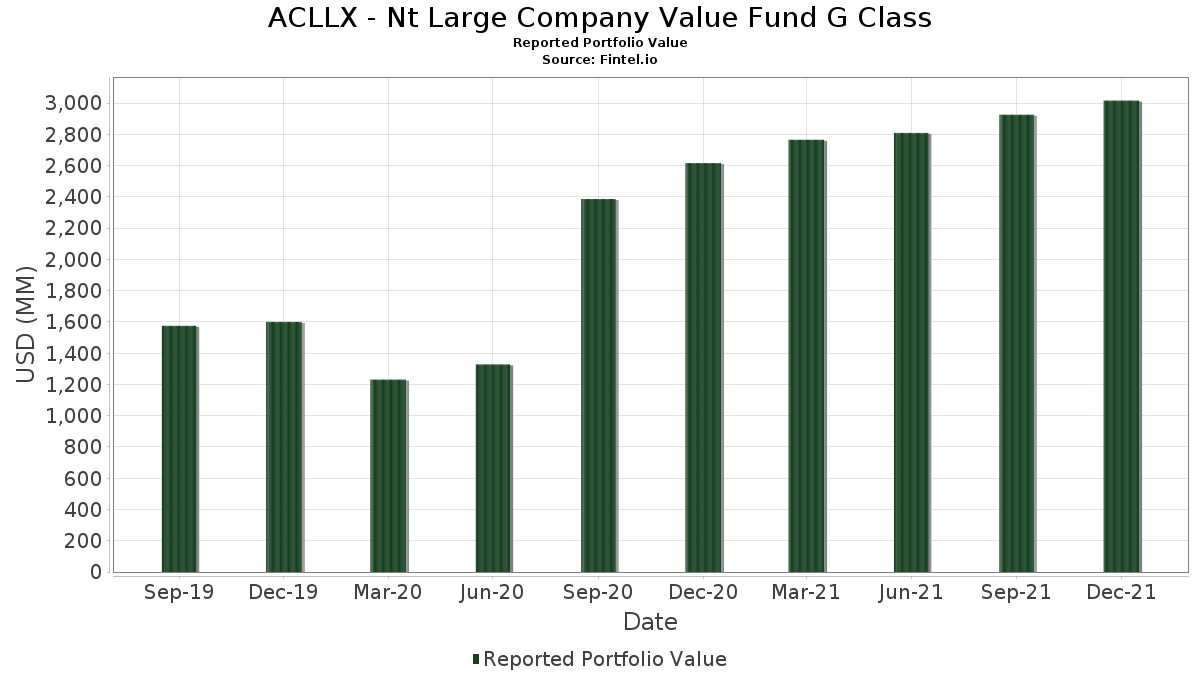

ACLLX - Nt Large Company Value Fund G Class har afsløret 50 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 3.016.723.331 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). ACLLX - Nt Large Company Value Fund G Classs største beholdninger er Johnson & Johnson (US:JNJ) , Medtronic plc (US:MDT) , Unilever PLC - Depositary Receipt (Common Stock) (US:UL) , Cisco Systems, Inc. (US:CSCO) , and Verizon Communications Inc. (US:VZ) . ACLLX - Nt Large Company Value Fund G Classs nye stillinger omfatter Sodexo S.A. - Depositary Receipt (Common Stock) (US:SDXAY) , Federal Home Loan Bank (FHLB) (US:US313385RH12) , .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,51 | 44,63 | 1,4761 | 1,4761 | |

| 0,83 | 35,62 | 1,1782 | 1,1782 | |

| 32,86 | 1,0868 | 1,0868 | ||

| 0,74 | 94,45 | 3,1240 | 1,0676 | |

| 0,59 | 69,87 | 2,3109 | 0,7901 | |

| 1,11 | 103,18 | 3,4127 | 0,7482 | |

| 1,28 | 131,94 | 4,3642 | 0,5145 | |

| 0,35 | 49,66 | 1,6425 | 0,3448 | |

| 9,85 | 0,3259 | 0,3259 | ||

| 0,99 | 65,33 | 2,1608 | 0,3006 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,00 | 0,00 | -0,9718 | ||

| 0,00 | 0,00 | -0,7179 | ||

| 0,26 | 44,83 | 1,4828 | -0,5749 | |

| 0,39 | 67,80 | 2,2427 | -0,5190 | |

| 0,26 | 50,79 | 1,6798 | -0,4885 | |

| 0,71 | 112,39 | 3,7174 | -0,4854 | |

| 0,16 | 29,81 | 0,9860 | -0,4368 | |

| 0,22 | 37,95 | 1,2553 | -0,3979 | |

| 0,07 | 14,68 | 0,4856 | -0,3395 | |

| 1,01 | 59,03 | 1,9525 | -0,3317 |

13F og Fondsarkivering

Denne formular blev indsendt den 2022-02-22 for rapporteringsperioden 2021-12-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JNJ / Johnson & Johnson | 0,99 | -0,74 | 169,97 | 5,14 | 5,6221 | 0,0356 | |||

| MDT / Medtronic plc | 1,28 | 43,51 | 131,94 | 18,44 | 4,3642 | 0,5145 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 2,37 | 5,99 | 127,57 | 5,15 | 4,2196 | 0,0272 | |||

| CSCO / Cisco Systems, Inc. | 1,89 | -8,51 | 119,54 | 6,52 | 3,9539 | 0,0761 | |||

| VZ / Verizon Communications Inc. | 2,29 | 13,34 | 118,81 | 9,04 | 3,9299 | 0,1646 | |||

| BRK.B / Berkshire Hathaway Inc. | 0,39 | -8,23 | 115,55 | 0,54 | 3,8219 | -0,1496 | |||

| JPM / JPMorgan Chase & Co. | 0,71 | -4,48 | 112,39 | -7,59 | 3,7174 | -0,4854 | |||

| CERN / Cerner Corp. | 1,11 | 1,60 | 103,18 | 33,81 | 3,4127 | 0,7482 | |||

| ATO / Atmos Energy Corporation | 0,91 | -3,61 | 95,84 | 14,50 | 3,1701 | 0,2777 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0,74 | 82,85 | 94,45 | 58,71 | 3,1240 | 1,0676 | |||

| BK / The Bank of New York Mellon Corporation | 1,49 | -8,52 | 86,82 | 2,49 | 2,8716 | -0,0554 | |||

| TTA / Time to Act Plc | 1,75 | -3,69 | 86,33 | -0,62 | 2,8555 | -0,1462 | |||

| RGA / Reinsurance Group of America, Incorporated | 0,71 | 17,84 | 77,87 | 15,97 | 2,5757 | 0,2553 | |||

| MRK / Merck & Co., Inc. | 0,92 | 6,18 | 70,76 | 8,35 | 2,3406 | 0,0837 | |||

| CVX / Chevron Corporation | 0,60 | -6,63 | 69,91 | 8,00 | 2,3123 | 0,0756 | |||

| ALL / The Allstate Corporation | 0,59 | 71,78 | 69,87 | 58,75 | 2,3109 | 0,7901 | |||

| BDX / Becton, Dickinson and Company | 0,28 | 5,22 | 69,58 | 7,64 | 2,3015 | 0,0678 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0,16 | -1,78 | 67,88 | 11,65 | 2,2451 | 0,1442 | |||

| SIEGY / Siemens Aktiengesellschaft - Depositary Receipt (Common Stock) | 0,39 | -19,89 | 67,80 | -15,16 | 2,2427 | -0,5190 | |||

| CAG / Conagra Brands, Inc. | 1,94 | 13,95 | 66,30 | 14,89 | 2,1930 | 0,1988 | |||

| MDLZ / Mondelez International, Inc. | 0,99 | 6,48 | 65,33 | 21,35 | 2,1608 | 0,3006 | |||

| RTX / RTX Corporation | 0,75 | 10,09 | 64,84 | 10,22 | 2,1447 | 0,1118 | |||

| EMR / Emerson Electric Co. | 0,65 | -7,75 | 60,46 | -8,95 | 1,9999 | -0,2949 | |||

| TFC / Truist Financial Corporation | 1,01 | -10,55 | 59,03 | -10,70 | 1,9525 | -0,3317 | |||

| PNW / Pinnacle West Capital Corporation | 0,77 | 6,54 | 54,08 | 3,94 | 1,7889 | -0,0092 | |||

| WMT / Walmart Inc. | 0,37 | 9,75 | 53,82 | 13,93 | 1,7800 | 0,1477 | |||

| AFL / Aflac Incorporated | 0,91 | -3,38 | 53,06 | 8,23 | 1,7551 | 0,0609 | |||

| UNH / UnitedHealth Group Incorporated | 0,11 | -19,93 | 53,05 | 2,89 | 1,7548 | -0,0269 | |||

| DUK / Duke Energy Corporation | 0,50 | 9,75 | 52,75 | 17,97 | 1,7447 | 0,1996 | |||

| CB / Chubb Limited | 0,26 | -27,37 | 50,79 | -19,07 | 1,6798 | -0,4885 | |||

| KMB / Kimberly-Clark Corporation | 0,35 | 22,54 | 49,66 | 32,23 | 1,6425 | 0,3448 | |||

| AMT / American Tower Corporation | 0,16 | -14,42 | 46,94 | -5,69 | 1,5525 | -0,1673 | |||

| OTEX / Open Text Corporation | 0,98 | 17,54 | 46,38 | 14,50 | 1,5340 | 0,1343 | |||

| SON / Sonoco Products Company | 0,79 | 26,90 | 45,81 | 23,31 | 1,5154 | 0,2314 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0,26 | -34,41 | 44,83 | -24,72 | 1,4828 | -0,5749 | |||

| SDXAY / Sodexo S.A. - Depositary Receipt (Common Stock) | 0,51 | 44,63 | 1,4761 | 1,4761 | |||||

| CL / Colgate-Palmolive Company | 0,52 | 13,81 | 44,28 | 28,50 | 1,4646 | 0,2739 | |||

| PEP / PepsiCo, Inc. | 0,22 | -31,31 | 37,95 | -20,67 | 1,2553 | -0,3979 | |||

| LUV / Southwest Airlines Co. | 0,83 | 35,62 | 1,1782 | 1,1782 | |||||

| FFIV / F5, Inc. | 0,14 | -25,90 | 33,66 | -8,77 | 1,1134 | -0,1616 | |||

| State Street Bank & Trust Co 0.01 01/03/2022 / RA (RPE336S66) | 32,86 | 1,0868 | 1,0868 | ||||||

| TXN / Texas Instruments Incorporated | 0,16 | -26,16 | 29,81 | -27,60 | 0,9860 | -0,4368 | |||

| HUBB / Hubbell Incorporated | 0,07 | -46,66 | 14,68 | -38,52 | 0,4856 | -0,3395 | |||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 9,85 | 0,3259 | 0,3259 | ||||||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 8,53 | -27,96 | 8,53 | -27,97 | 0,2820 | -0,1270 | |||

| US313385RH12 / Federal Home Loan Bank (FHLB) | 6,00 | 0,1985 | 0,1985 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,07 | 1.066,67 | 0,0023 | 0,0019 | |||||

| ORCL / Oracle Corporation | 0,00 | -100,00 | 0,00 | -100,00 | -0,7179 | ||||

| TEL / TE Connectivity plc | 0,00 | -100,00 | 0,00 | -100,00 | -0,9718 | ||||

| SOLD CHF/BOUGHT USD / DFE (N/A) | -0,64 | -10.783,33 | -0,0212 | -0,0216 | |||||

| SOLD EUR/BOUGHT USD / DFE (N/A) | -1,24 | -20.700,00 | -0,0409 | -0,0413 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -2,55 | -42.550,00 | -0,0843 | -0,0847 |