Grundlæggende statistik

| Porteføljeværdi | $ 268.363.385 |

| Nuværende stillinger | 89 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

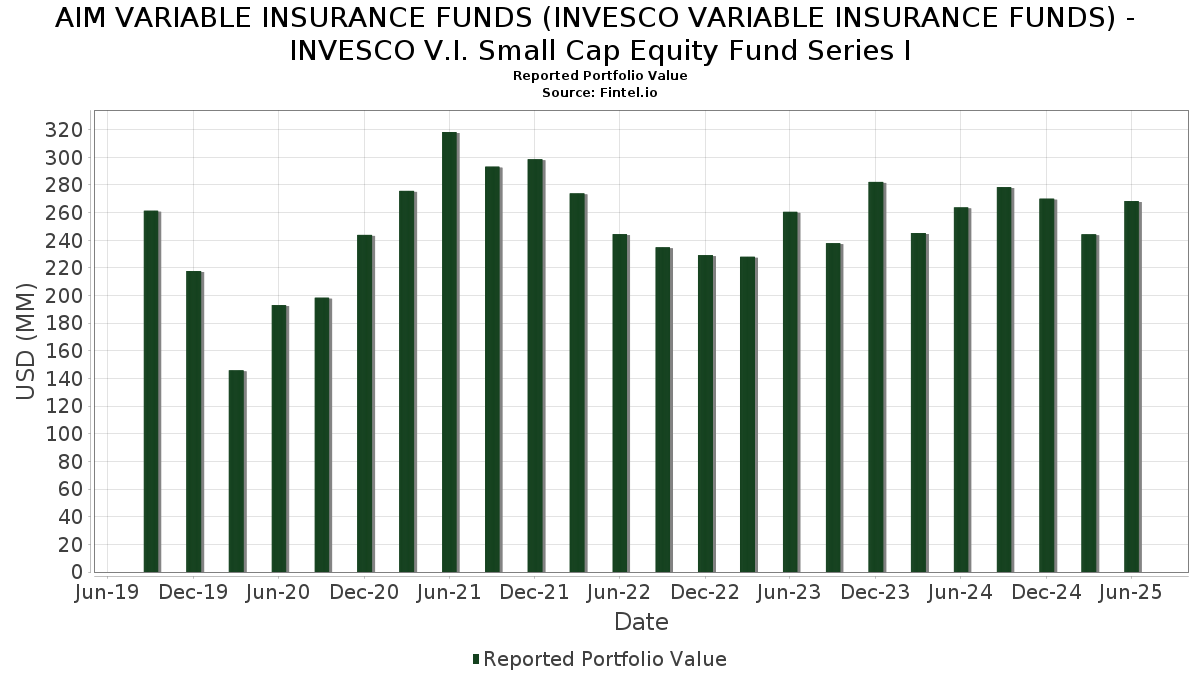

AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. Small Cap Equity Fund Series I har afsløret 89 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 268.363.385 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. Small Cap Equity Fund Series Is største beholdninger er Invesco Treasury Portfolio, Institutional Class (US:US8252524066) , Piper Sandler Companies (US:PIPR) , ITT Inc. (US:ITT) , Applied Industrial Technologies, Inc. (US:AIT) , and REV Group, Inc. (US:REVG) . AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. Small Cap Equity Fund Series Is nye stillinger omfatter AeroVironment, Inc. (US:AVAV) , Crane Company (US:CR) , Stifel Financial Corp. (US:SF) , Abercrombie & Fitch Co. (US:ANF) , and DT Midstream, Inc. (US:DTM) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 26,45 | 26,45 | 11,4135 | 11,4135 | |

| 10,14 | 10,14 | 4,3774 | 4,3774 | |

| 6,14 | 6,14 | 2,6498 | 2,0034 | |

| 0,01 | 3,87 | 1,6700 | 1,6700 | |

| 3,31 | 3,31 | 1,4267 | 1,0788 | |

| 0,01 | 2,49 | 1,0735 | 1,0735 | |

| 0,02 | 2,45 | 1,0565 | 1,0565 | |

| 0,03 | 2,44 | 1,0536 | 1,0536 | |

| 0,02 | 2,32 | 1,0021 | 1,0021 | |

| 0,01 | 2,18 | 0,9397 | 0,9397 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,01 | 2,19 | 0,9451 | -1,1811 | |

| 0,02 | 2,68 | 1,1548 | -0,7551 | |

| 0,05 | 2,40 | 1,0353 | -0,6865 | |

| 0,05 | 2,26 | 0,9745 | -0,4909 | |

| 0,03 | 2,31 | 0,9987 | -0,4260 | |

| 0,10 | 2,05 | 0,8837 | -0,3523 | |

| 0,02 | 1,91 | 0,8240 | -0,2913 | |

| 0,05 | 2,52 | 1,0860 | -0,2583 | |

| 0,00 | 1,91 | 0,8222 | -0,2558 | |

| 0,02 | 2,24 | 0,9664 | -0,2440 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-27 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Invesco Private Prime Fund / STIV (N/A) | 26,45 | 26,45 | 11,4135 | 11,4135 | |||||

| Invesco Private Government Fund / STIV (N/A) | 10,14 | 10,14 | 4,3774 | 4,3774 | |||||

| US8252524066 / Invesco Treasury Portfolio, Institutional Class | 6,14 | 352,68 | 6,14 | 352,88 | 2,6498 | 2,0034 | |||

| PIPR / Piper Sandler Companies | 0,02 | -2,72 | 4,43 | 9,17 | 1,9118 | -0,0220 | |||

| ITT / ITT Inc. | 0,03 | -2,72 | 4,30 | 18,12 | 1,8535 | 0,1206 | |||

| AIT / Applied Industrial Technologies, Inc. | 0,02 | -2,72 | 4,27 | 0,35 | 1,8439 | -0,1854 | |||

| REVG / REV Group, Inc. | 0,08 | -2,72 | 4,01 | 46,55 | 1,7321 | 0,4264 | |||

| EHC / Encompass Health Corporation | 0,03 | -2,72 | 4,01 | 17,79 | 1,7284 | 0,1079 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0,04 | -2,72 | 3,97 | 1,30 | 1,7150 | -0,1549 | |||

| AVAV / AeroVironment, Inc. | 0,01 | 3,87 | 1,6700 | 1,6700 | |||||

| TBBK / The Bancorp, Inc. | 0,07 | -2,72 | 3,86 | 4,89 | 1,6665 | -0,0882 | |||

| SKWD / Skyward Specialty Insurance Group, Inc. | 0,06 | -2,72 | 3,69 | 6,22 | 1,5920 | -0,0630 | |||

| FLEX / Flex Ltd. | 0,07 | -2,72 | 3,68 | 46,79 | 1,5882 | 0,3934 | |||

| BTSG / BrightSpring Health Services, Inc. | 0,15 | -2,72 | 3,54 | 26,87 | 1,5258 | 0,1975 | |||

| ATI / ATI Inc. | 0,04 | -2,72 | 3,49 | 61,46 | 1,5080 | 0,4764 | |||

| CVLT / Commvault Systems, Inc. | 0,02 | -2,72 | 3,49 | 7,49 | 1,5054 | -0,0411 | |||

| TLN / Talen Energy Corporation | 0,01 | -2,72 | 3,36 | 41,70 | 1,4516 | 0,3200 | |||

| XPO / XPO, Inc. | 0,03 | -2,72 | 3,35 | 14,17 | 1,4468 | 0,0477 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 3,31 | 352,84 | 3,31 | 352,88 | 1,4267 | 1,0788 | |||

| MTSI / MACOM Technology Solutions Holdings, Inc. | 0,02 | -2,72 | 3,28 | 38,89 | 1,4134 | 0,2894 | |||

| THC / Tenet Healthcare Corporation | 0,02 | -2,72 | 3,00 | 27,32 | 1,2934 | 0,1713 | |||

| CW / Curtiss-Wright Corporation | 0,01 | -35,46 | 2,99 | 16,32 | 1,2893 | 0,1040 | |||

| SANM / Sanmina Corporation | 0,03 | -2,72 | 2,96 | 24,91 | 1,2771 | 0,1481 | |||

| BGC / BGC Group, Inc. | 0,29 | -2,72 | 2,94 | 8,53 | 1,2683 | -0,0223 | |||

| HURN / Huron Consulting Group Inc. | 0,02 | -2,72 | 2,92 | -6,72 | 1,2584 | -0,2315 | |||

| WAL / Western Alliance Bancorporation | 0,04 | -2,72 | 2,90 | -1,29 | 1,2513 | -0,1483 | |||

| TNL / Travel + Leisure Co. | 0,06 | -2,72 | 2,86 | 8,44 | 1,2362 | -0,0225 | |||

| FTDR / Frontdoor, Inc. | 0,05 | -2,72 | 2,84 | 49,24 | 1,2271 | 0,3190 | |||

| CAKE / The Cheesecake Factory Incorporated | 0,05 | -2,72 | 2,84 | 25,30 | 1,2270 | 0,1453 | |||

| CWST / Casella Waste Systems, Inc. | 0,02 | -2,72 | 2,82 | 0,68 | 1,2152 | -0,1181 | |||

| MASI / Masimo Corporation | 0,02 | -2,72 | 2,77 | -1,77 | 1,1973 | -0,1488 | |||

| CNM / Core & Main, Inc. | 0,05 | -2,72 | 2,76 | 21,55 | 1,1930 | 0,1089 | |||

| STVN / Stevanato Group S.p.A. | 0,11 | -2,72 | 2,76 | 16,39 | 1,1923 | 0,0609 | |||

| GFF / Griffon Corporation | 0,04 | -2,72 | 2,76 | -1,54 | 1,1895 | -0,1446 | |||

| SLAB / Silicon Laboratories Inc. | 0,02 | 46,13 | 2,71 | 91,40 | 1,1712 | 0,4951 | |||

| AR / Antero Resources Corporation | 0,07 | -2,72 | 2,71 | -3,11 | 1,1712 | -0,1637 | |||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0,02 | -41,04 | 2,68 | -33,22 | 1,1548 | -0,7551 | |||

| SSB / SouthState Bank Corporation | 0,03 | -2,72 | 2,66 | -3,52 | 1,1482 | -0,1665 | |||

| QTWO / Q2 Holdings, Inc. | 0,03 | -2,72 | 2,66 | 13,80 | 1,1463 | 0,0338 | |||

| VIRT / Virtu Financial, Inc. | 0,06 | -2,72 | 2,65 | 14,27 | 1,1439 | 0,0387 | |||

| BANC / Banc of California, Inc. | 0,19 | -2,72 | 2,64 | -3,68 | 1,1393 | -0,1670 | |||

| STEP / StepStone Group Inc. | 0,05 | -2,72 | 2,63 | 3,38 | 1,1345 | -0,0775 | |||

| IESC / IES Holdings, Inc. | 0,01 | 56,11 | 2,60 | 180,17 | 1,1220 | 0,6796 | |||

| POWL / Powell Industries, Inc. | 0,01 | 87,81 | 2,60 | 132,20 | 1,1203 | 0,5871 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0,05 | -2,72 | 2,52 | -10,81 | 1,0860 | -0,2583 | |||

| SFM / Sprouts Farmers Market, Inc. | 0,02 | -2,72 | 2,50 | 4,90 | 1,0804 | -0,0567 | |||

| CR / Crane Company | 0,01 | 2,49 | 1,0735 | 1,0735 | |||||

| GTES / Gates Industrial Corporation plc | 0,11 | -2,72 | 2,46 | 21,67 | 1,0613 | 0,0982 | |||

| SF / Stifel Financial Corp. | 0,02 | 2,45 | 1,0565 | 1,0565 | |||||

| ANF / Abercrombie & Fitch Co. | 0,03 | 2,44 | 1,0536 | 1,0536 | |||||

| CDNA / CareDx, Inc | 0,12 | -2,72 | 2,40 | 7,09 | 1,0362 | -0,0324 | |||

| DRS / Leonardo DRS, Inc. | 0,05 | -53,03 | 2,40 | -33,60 | 1,0353 | -0,6865 | |||

| EGP / EastGroup Properties, Inc. | 0,01 | -2,72 | 2,37 | -7,73 | 1,0209 | -0,2007 | |||

| FOUR / Shift4 Payments, Inc. | 0,02 | -2,72 | 2,36 | 18,03 | 1,0171 | 0,0652 | |||

| DSGX / The Descartes Systems Group Inc. | 0,02 | -2,72 | 2,34 | -1,93 | 1,0086 | -0,1272 | |||

| DTM / DT Midstream, Inc. | 0,02 | 2,32 | 1,0021 | 1,0021 | |||||

| GOLF / Acushnet Holdings Corp. | 0,03 | -27,01 | 2,31 | -22,58 | 0,9987 | -0,4260 | |||

| KTB / Kontoor Brands, Inc. | 0,03 | -2,72 | 2,29 | 0,09 | 0,9875 | -0,1023 | |||

| ADMA / ADMA Biologics, Inc. | 0,12 | -2,72 | 2,27 | -10,68 | 0,9812 | -0,2324 | |||

| CHEF / The Chefs' Warehouse, Inc. | 0,04 | -2,72 | 2,27 | 14,01 | 0,9802 | 0,0305 | |||

| WCC / WESCO International, Inc. | 0,01 | -2,72 | 2,26 | 16,02 | 0,9750 | 0,0468 | |||

| X / TMX Group Limited | 0,05 | -36,74 | 2,26 | -26,55 | 0,9745 | -0,4909 | |||

| PATK / Patrick Industries, Inc. | 0,02 | -19,20 | 2,24 | -11,85 | 0,9664 | -0,2440 | |||

| APPF / AppFolio, Inc. | 0,01 | -2,72 | 2,22 | 1,88 | 0,9595 | -0,0807 | |||

| VCEL / Vericel Corporation | 0,05 | -2,72 | 2,22 | -7,23 | 0,9577 | -0,1824 | |||

| ASND / Ascendis Pharma A/S - Depositary Receipt (Common Stock) | 0,01 | -2,72 | 2,20 | 7,72 | 0,9513 | -0,0239 | |||

| STAG / STAG Industrial, Inc. | 0,06 | -2,72 | 2,19 | -2,28 | 0,9452 | -0,1231 | |||

| COOP / Mr. Cooper Group Inc. | 0,01 | -60,65 | 2,19 | -50,91 | 0,9451 | -1,1811 | |||

| GKD / Grand Canyon Education, Inc. | 0,01 | 2,18 | 0,9397 | 0,9397 | |||||

| MRX / Marex Group plc | 0,05 | 2,13 | 0,9182 | 0,9182 | |||||

| DFIN / Donnelley Financial Solutions, Inc. | 0,03 | -2,72 | 2,08 | 37,24 | 0,8985 | 0,1753 | |||

| RRC / Range Resources Corporation | 0,05 | 2,08 | 0,8965 | 0,8965 | |||||

| BWIN / The Baldwin Insurance Group, Inc. | 0,05 | -2,72 | 2,07 | -6,81 | 0,8917 | -0,1650 | |||

| GPK / Graphic Packaging Holding Company | 0,10 | -2,72 | 2,05 | -21,02 | 0,8837 | -0,3523 | |||

| KNF / Knife River Corporation | 0,03 | -2,72 | 2,04 | -11,94 | 0,8812 | -0,2242 | |||

| RGEN / Repligen Corporation | 0,02 | -2,72 | 2,04 | -4,90 | 0,8788 | -0,1417 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0,03 | -2,72 | 2,01 | -9,65 | 0,8689 | -0,1931 | |||

| WDFC / WD-40 Company | 0,01 | -2,71 | 1,98 | -9,10 | 0,8535 | -0,1830 | |||

| POWI / Power Integrations, Inc. | 0,04 | -2,72 | 1,97 | 7,67 | 0,8485 | -0,0217 | |||

| EXLS / ExlService Holdings, Inc. | 0,04 | 1,92 | 0,8271 | 0,8271 | |||||

| LNTH / Lantheus Holdings, Inc. | 0,02 | -2,72 | 1,91 | -18,42 | 0,8240 | -0,2913 | |||

| MUSA / Murphy USA Inc. | 0,00 | -2,72 | 1,91 | -15,78 | 0,8222 | -0,2558 | |||

| SPXC / SPX Technologies, Inc. | 0,01 | -2,72 | 1,89 | 26,66 | 0,8161 | 0,1046 | |||

| NMRK / Newmark Group, Inc. | 0,15 | -2,72 | 1,80 | -2,86 | 0,7765 | -0,1065 | |||

| MBIN / Merchants Bancorp | 0,05 | -2,72 | 1,65 | -13,03 | 0,7112 | -0,1921 | |||

| ENS / EnerSys | 0,02 | -2,72 | 1,46 | -8,90 | 0,6321 | -0,1341 | |||

| IOSP / Innospec Inc. | 0,02 | -2,72 | 1,44 | -13,66 | 0,6219 | -0,1736 | |||

| AXSM / Axsome Therapeutics, Inc. | 0,01 | -2,71 | 1,43 | -12,98 | 0,6166 | -0,1654 | |||

| HALO / Halozyme Therapeutics, Inc. | 0,02 | 1,04 | 0,4501 | 0,4501 |