Grundlæggende statistik

| Porteføljeværdi | $ 3.169.575.280 |

| Nuværende stillinger | 1.006 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

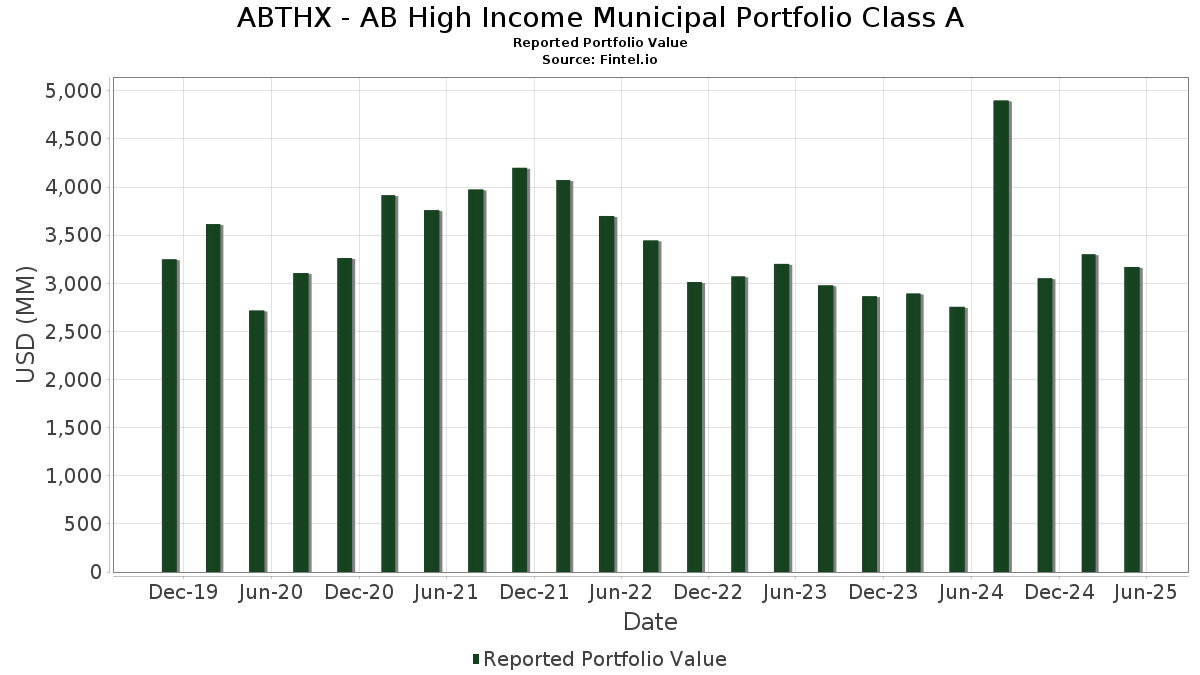

ABTHX - AB High Income Municipal Portfolio Class A har afsløret 1.006 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 3.169.575.280 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). ABTHX - AB High Income Municipal Portfolio Class As største beholdninger er AB Fixed Income Shares, Inc. - Government Money Market Portfolio (US:US0186167484) , TOBACCO SETTLEMENT FING CORP NJ (US:US888808HT28) , THE CHILDRENS TRUST FUND PR TOBACCO SETTLEMENT REVENUE (PR:US16876QBM06) , TOBACCO SETTLEMENT FING CORP VA (US:US88880NAU37) , and PUBLIC FIN AUTH WI REVENUE (US:US74442PSF35) . ABTHX - AB High Income Municipal Portfolio Class As nye stillinger omfatter TOBACCO SETTLEMENT FING CORP NJ (US:US888808HT28) , THE CHILDRENS TRUST FUND PR TOBACCO SETTLEMENT REVENUE (PR:US16876QBM06) , TOBACCO SETTLEMENT FING CORP VA (US:US88880NAU37) , PUBLIC FIN AUTH WI REVENUE (US:US74442PSF35) , and PUERTO RICO CMWLTH (US:US74514L3T29) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 57,95 | 57,95 | 2,1193 | 0,9746 | |

| 11,35 | 0,4150 | 0,4150 | ||

| 11,35 | 0,4150 | 0,4150 | ||

| 10,68 | 0,3905 | 0,3905 | ||

| 10,68 | 0,3905 | 0,3905 | ||

| 10,37 | 0,3792 | 0,3792 | ||

| 10,37 | 0,3792 | 0,3792 | ||

| 10,37 | 0,3791 | 0,3791 | ||

| 10,37 | 0,3791 | 0,3791 | ||

| 10,19 | 0,3727 | 0,3727 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -8,33 | -0,3047 | -0,3047 | ||

| -8,33 | -0,3047 | -0,3047 | ||

| 2,05 | 0,0750 | -0,2820 | ||

| 2,05 | 0,0750 | -0,2820 | ||

| 2,20 | 0,0805 | -0,2776 | ||

| 2,20 | 0,0805 | -0,2776 | ||

| 2,31 | 0,0843 | -0,2772 | ||

| 2,48 | 0,0906 | -0,2692 | ||

| 2,48 | 0,0906 | -0,2692 | ||

| 2,53 | 0,0924 | -0,2667 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-07-25 for rapporteringsperioden 2025-05-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 57,95 | 68,33 | 57,95 | 68,33 | 2,1193 | 0,9746 | |||

| US888808HT28 / TOBACCO SETTLEMENT FING CORP NJ | 42,97 | -10,63 | 1,5716 | -0,0273 | |||||

| US16876QBM06 / THE CHILDRENS TRUST FUND PR TOBACCO SETTLEMENT REVENUE | 25,05 | -9,05 | 0,9162 | 0,0004 | |||||

| US88880NAU37 / TOBACCO SETTLEMENT FING CORP VA | 24,87 | -12,43 | 0,9094 | -0,0348 | |||||

| US74442PSF35 / PUBLIC FIN AUTH WI REVENUE | 23,90 | -4,19 | 0,8739 | 0,0446 | |||||

| US74514L3T29 / PUERTO RICO CMWLTH | 23,15 | -4,58 | 0,8466 | 0,0400 | |||||

| US118217CZ97 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 20,11 | -19,73 | 0,7354 | -0,0976 | |||||

| US74529JQG30 / Puerto Rico Sales Tax Fing Corp Sales 0.00 8/1/2056 Bond DBT | 18,31 | -4,82 | 0,6696 | 0,0299 | |||||

| US11023PAA21 / Bristol Industrial Development Board, Tennessee, State Sales Tax Revenue Bonds, Pinnacle Project, Series 2016A | 17,88 | -4,48 | 0,6540 | 0,0315 | |||||

| US03880NAC20 / ARC70 II TR CA | 17,71 | -1,89 | 0,6476 | 0,0474 | |||||

| US650116AQ94 / NEW YORK ST TRANSPRTN DEV CORPSPL FAC REVENUE | 17,11 | 0,00 | 0,6257 | 0,0568 | |||||

| US63607WAC82 / NATIONAL FIN AUTH NH MUNI CTFS | 15,85 | -3,94 | 0,5797 | 0,0310 | |||||

| US74529JRH04 / Puerto Rico Sales Tax Financing Corp., Series 2019 A-2, RB | 15,30 | -6,38 | 0,5594 | 0,0161 | |||||

| US154871CP00 / CENTRAL PLAINS ENERGY PROJECT | 15,02 | -6,62 | 0,5493 | 0,0145 | |||||

| US605156AC20 / MISSION TX ECON DEV CORP REVENUE | 14,97 | -0,41 | 0,5474 | 0,0477 | |||||

| US74514L3R62 / PUERTO RICO CMWLTH | 14,79 | -4,45 | 0,5408 | 0,0262 | |||||

| US04108WCF77 / ARKANSAS ST DEV FIN AUTH INDL DEV REVENUE | 14,10 | -2,48 | 0,5155 | 0,0349 | |||||

| US74526QPP18 / Puerto Rico (Commonwealth of) Electric Power Authority, Series 2007 VV, Ref. RB | 13,98 | -1,90 | 0,5114 | 0,0374 | |||||

| US38122NB843 / GOLDEN ST TOBACCO SECURITIZATI REGD ZCP OID B/E 0.00000000 | 13,96 | -8,69 | 0,5104 | 0,0022 | |||||

| US59447PYT29 / MICHIGAN FINANCE AUTHORITY | 13,59 | -0,04 | 0,4969 | 0,0449 | |||||

| US01631GAA76 / ALIGN CAP SER 2021-3 TRUST | 13,13 | -3,26 | 0,4803 | 0,0289 | |||||

| US4423487H50 / HOUSTON TX ARPT SYS REVENUE | 12,84 | -0,07 | 0,4697 | 0,0424 | |||||

| US167505RN84 / Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, Refunding Series 2017B | 12,10 | -0,97 | 0,4425 | 0,0363 | |||||

| US976595GP72 / WISCONSIN CENTER DIST WI TAX REVENUE | 12,06 | -6,69 | 0,4411 | 0,0113 | |||||

| NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE / DBT (US646140FU26) | 11,90 | -3,90 | 0,4353 | 0,0235 | |||||

| NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE / DBT (US646140FU26) | 11,90 | -3,90 | 0,4353 | 0,0235 | |||||

| US74442PTL93 / PUBLIC FIN AUTH WI REVENUE | 11,89 | -11,37 | 0,4350 | -0,0112 | |||||

| US63607WAA27 / National Finance Authority | 11,56 | -2,91 | 0,4227 | 0,0269 | |||||

| MISSOURI ST HLTH & EDUCTNL FACS AUTH HLTH FACS REVENUE / DBT (US60637AXE71) | 11,35 | 0,4150 | 0,4150 | ||||||

| MISSOURI ST HLTH & EDUCTNL FACS AUTH HLTH FACS REVENUE / DBT (US60637AXE71) | 11,35 | 0,4150 | 0,4150 | ||||||

| US67884XCN57 / Oklahoma (State of) Development Finance Authority (OU Medicine), Series 2018 B, RB | 11,01 | -4,61 | 0,4026 | 0,0189 | |||||

| US13013FAL85 / FX.RT. MUNI BOND | 10,86 | -7,45 | 0,3972 | 0,0070 | |||||

| LOS ANGELES CA WSTWTR SYS REVENUE / DBT (US53945CMS60) | 10,68 | 0,3905 | 0,3905 | ||||||

| LOS ANGELES CA WSTWTR SYS REVENUE / DBT (US53945CMS60) | 10,68 | 0,3905 | 0,3905 | ||||||

| MIAMI-DADE CNTY FL EDUCTNL FACS AUTH REVENUE / DBT (US59333APN53) | 10,64 | -6,81 | 0,3891 | 0,0095 | |||||

| MIAMI-DADE CNTY FL EDUCTNL FACS AUTH REVENUE / DBT (US59333APN53) | 10,64 | -6,81 | 0,3891 | 0,0095 | |||||

| OKLAHOMA ST TURNPIKE AUTH / DBT (US679111E913) | 10,63 | -4,53 | 0,3888 | 0,0185 | |||||

| US938154DX60 / County of Washington, Ohio, Hospital Facilities Revenue Bonds, Series 2022 | 10,61 | -3,35 | 0,3880 | 0,0230 | |||||

| US64461XFV29 / NEW HAMPSHIRE ST HLTH & EDU FACS AUTH REVENUE | 10,56 | -11,23 | 0,3864 | -0,0093 | |||||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US13034A6B14) | 10,56 | -13,55 | 0,3861 | -0,0199 | |||||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US13034A6B14) | 10,56 | -13,55 | 0,3861 | -0,0199 | |||||

| US155048DL24 / CENTRL PUGET SOUND WA REGL TRA REGD N/C B/E 5.00000000 | 10,50 | -9,37 | 0,3839 | -0,0012 | |||||

| SAN ANTONIO TX ELEC & GAS REVENUE / DBT (US79625GMF71) | 10,37 | 0,3792 | 0,3792 | ||||||

| SAN ANTONIO TX ELEC & GAS REVENUE / DBT (US79625GMF71) | 10,37 | 0,3792 | 0,3792 | ||||||

| TRIBOROUGH NY BRIDGE & TUNNEL AUTH SALES TAX REVENUE / DBT (US896035DF67) | 10,37 | 0,3791 | 0,3791 | ||||||

| TRIBOROUGH NY BRIDGE & TUNNEL AUTH SALES TAX REVENUE / DBT (US896035DF67) | 10,37 | 0,3791 | 0,3791 | ||||||

| US592250AP95 / MET PIER & EXPOSITION AUTH IL REVENUE | 10,36 | -11,78 | 0,3790 | -0,0116 | |||||

| US13013JCM62 / California Community Choice Financing Authority | 10,35 | -1,89 | 0,3785 | 0,0277 | |||||

| SOUTH CAROLINA ST JOBS-ECON DEV AUTH HLTH FACS REVENUE / DBT (US837032BX80) | 10,32 | -5,88 | 0,3775 | 0,0129 | |||||

| US882667BX54 / Texas Private Activity Bond Surface Transportation Corp | 10,24 | -4,62 | 0,3746 | 0,0175 | |||||

| MASSACHUSETTS ST / DBT (US57582TCS96) | 10,19 | 0,3727 | 0,3727 | ||||||

| MASSACHUSETTS ST / DBT (US57582TCS96) | 10,19 | 0,3727 | 0,3727 | ||||||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US64972JTT50) | 10,18 | 0,3723 | 0,3723 | ||||||

| NEW YORK NY CITY TRANSITIONAL FIN AUTH REV / DBT (US64972JTT50) | 10,18 | 0,3723 | 0,3723 | ||||||

| US71885FDK03 / PHOENIX AZ INDL DEV AUTH EDU REVENUE | 10,15 | -5,05 | 0,3712 | 0,0157 | |||||

| INDIANA ST FIN AUTH HLTH FAC REVENUE / DBT (US45471CCR79) | 10,13 | -3,83 | 0,3706 | 0,0202 | |||||

| INDIANA ST FIN AUTH HLTH FAC REVENUE / DBT (US45471CCR79) | 10,13 | -3,83 | 0,3706 | 0,0202 | |||||

| JEFFERSON CNTY AL SWR REVENUE WARRANTS / DBT (US472682ZR71) | 10,10 | 0,3693 | 0,3693 | ||||||

| JEFFERSON CNTY AL SWR REVENUE WARRANTS / DBT (US472682ZR71) | 10,10 | 0,3693 | 0,3693 | ||||||

| WASHINGTON DC MET AREA TRANSIT AUTH DEDICATED REVENUE / DBT (US93878YDV83) | 10,07 | 0,3682 | 0,3682 | ||||||

| WASHINGTON DC MET AREA TRANSIT AUTH DEDICATED REVENUE / DBT (US93878YDV83) | 10,07 | 0,3682 | 0,3682 | ||||||

| TARRANT CNTY TX CULTURAL EDU FACS FIN CORP RETMNT FAC REVENU / DBT (US87638RKM87) | 10,04 | -9,27 | 0,3670 | -0,0007 | |||||

| TARRANT CNTY TX CULTURAL EDU FACS FIN CORP RETMNT FAC REVENU / DBT (US87638RKM87) | 10,04 | -9,27 | 0,3670 | -0,0007 | |||||

| US74514L4C84 / PUERTO RICO CMWLTH | 10,02 | -4,11 | 0,3665 | 0,0190 | |||||

| PUERTO RICO INDL TOURIST EDUCTNL MED & ENVRNMNTL CONTROL FAC / DBT (US74528KAB98) | 9,93 | -0,12 | 0,3633 | 0,0326 | |||||

| PUERTO RICO INDL TOURIST EDUCTNL MED & ENVRNMNTL CONTROL FAC / DBT (US74528KAB98) | 9,93 | -0,12 | 0,3633 | 0,0326 | |||||

| US6459182A08 / New Jersey (State of) Economic Development Authority (The Goethals Bridge Replacement), Series 2013, RB | 9,78 | -0,07 | 0,3578 | 0,0323 | |||||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US13034A5Z90) | 9,77 | -7,41 | 0,3572 | 0,0065 | |||||

| CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE / DBT (US13034A5Z90) | 9,77 | -7,41 | 0,3572 | 0,0065 | |||||

| US67884XCX30 / OKLAHOMA ST DEV FIN AUTH HLTHSYS REVENUE | 9,76 | -4,33 | 0,3570 | 0,0177 | |||||

| US54639TBT88 / Louisiana (State of) Public Facilities Authority (Provident Group-Flagship Properties LLC- Louisiana State University Nicholson Gateway), Series 2016, | 9,62 | -4,00 | 0,3520 | 0,0187 | |||||

| US74529JQH13 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 9,38 | -5,36 | 0,3432 | 0,0135 | |||||

| US74529JPX71 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 9,38 | -10,85 | 0,3430 | -0,0068 | |||||

| US05164HAV50 / Aurora Highlands Community Authority Board, Adams County, Colorado, Special Tax Revenue Bonds, Refunding & Improvement Series 2021A | 9,14 | -4,69 | 0,3342 | 0,0154 | |||||

| US63607WAE49 / NATIONAL FIN AUTH NH MUNI CTFS | 9,07 | -4,16 | 0,3317 | 0,0170 | |||||

| US93978TS593 / WASHINGTON ST HSG FIN COMMISSION | 8,84 | -2,22 | 0,3234 | 0,0227 | |||||

| ATLANTA GA DEV AUTH / DBT (US04780NMY03) | 8,68 | -0,05 | 0,3176 | 0,0287 | |||||

| ATLANTA GA DEV AUTH / DBT (US04780NMY03) | 8,68 | -0,05 | 0,3176 | 0,0287 | |||||

| US708692BW77 / PENNSYLVANIA ST ECON DEV FING AUTH SOLID WASTE DISPOSAL REV | 8,65 | -1,15 | 0,3164 | 0,0254 | |||||

| US74447DAF42 / PUBLIC FIN AUTH WI HOTEL REVENUE | 8,60 | -3,47 | 0,3145 | 0,0183 | |||||

| US72342GAB68 / PINGREE GROVE IL SPL SVC AREA 7 SPL TAX REVENUE | 8,57 | -3,64 | 0,3134 | 0,0177 | |||||

| US928106AS29 / VIRGINIA ST SMALL BUSINESS FING AUTH SOL WST DISP FAC REVENU | 8,55 | -3,25 | 0,3127 | 0,0188 | |||||

| US04052ABH86 / Arizona Industrial Development Authority, Series 2019-2, Class A | 8,53 | -2,26 | 0,3118 | 0,0218 | |||||

| US254842BD82 / District of Columbia Tobacco Settlement Financing Corp., Series 2006 C, RB | 8,51 | -8,77 | 0,3113 | 0,0011 | |||||

| US64542UGN81 / NEW HOPE CULTURAL ED FACS FIN CORP TX RETIREMENT FAC REVENUE | 8,44 | -0,28 | 0,3088 | 0,0273 | |||||

| US96810LAA98 / Wild Rivers Water Park | 8,40 | -2,43 | 0,3074 | 0,0210 | |||||

| US56035DDP42 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 8,30 | -0,04 | 0,3035 | 0,0275 | |||||

| US45204FHC23 / ILLINOIS ST FIN AUTH REVENUE | 8,19 | 24,32 | 0,2994 | 0,0804 | |||||

| US13054WAC10 / California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, Poseidon Resources Channelside LP Desalination Project, Series 2012 | 8,12 | -5,53 | 0,2971 | 0,0112 | |||||

| US96634RAW25 / City of Whiting | 8,10 | -1,99 | 0,2961 | 0,0214 | |||||

| US74442PCQ63 / Wisconsin (State of) Public Finance Authority (Bancroft Neurohealth), Series 2016 A, RB | 8,05 | -8,22 | 0,2946 | 0,0028 | |||||

| US95648VBQ14 / WEST VIRGINIA ST ECON DEV AUTH SOL WST DISP FACS | 8,02 | -3,49 | 0,2932 | 0,0170 | |||||

| US74447DAG25 / PUBLIC FIN AUTH WI HOTEL REVENUE | 8,01 | -3,19 | 0,2930 | 0,0178 | |||||

| US225004AQ33 / CRAWFORD COUNTY HOSPITAL AUTHORITY | 7,98 | -0,62 | 0,2918 | 0,0248 | |||||

| NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE / DBT (US646140GB36) | 7,80 | -6,09 | 0,2852 | 0,0091 | |||||

| NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE / DBT (US646140GB36) | 7,80 | -6,09 | 0,2852 | 0,0091 | |||||

| US126292CM10 / CSCDA Community Improvement Authority | 7,78 | -7,46 | 0,2843 | 0,0050 | |||||

| SOUTHEAST ENERGY AUTH COOPERATIVE DIST AL ENERGY SUPPLY REVE / DBT (US84136HAU77) | 7,73 | -2,91 | 0,2829 | 0,0180 | |||||

| SOUTHEAST ENERGY AUTH COOPERATIVE DIST AL ENERGY SUPPLY REVE / DBT (US84136HAU77) | 7,73 | -2,91 | 0,2829 | 0,0180 | |||||

| ARIZONA ST INDL DEV AUTH MF HSG REVENUE / DBT (US04062PCT66) | 7,71 | -5,70 | 0,2820 | 0,0101 | |||||

| ARIZONA ST INDL DEV AUTH MF HSG REVENUE / DBT (US04062PCT66) | 7,71 | -5,70 | 0,2820 | 0,0101 | |||||

| US649441AB81 / New York (Counties of), NY Tobacco Trust V, Series 2005 S-2, RB | 7,68 | -8,89 | 0,2809 | 0,0006 | |||||

| US04052FCV58 / ARIZONA ST INDL DEV AUTH NATIONAL CHRT SCH REVOLVING LOAN FD | 7,63 | -12,60 | 0,2792 | -0,0112 | |||||

| US126292AP68 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 7,55 | -7,39 | 0,2763 | 0,0050 | |||||

| US479706AA19 / JOHNSTOWN PLAZA MET DIST CO | 7,54 | -8,44 | 0,2756 | 0,0019 | |||||

| US25889FAB58 / DOUGLAS CNTY CO HSG PARTNERSHIP | 7,50 | 0,00 | 0,2743 | 0,0249 | |||||

| US546282H726 / Louisiana (State of) Local Government Environmental Facilities & Community Development Authority, Series 2015 A, Ref. RB | 7,37 | -3,46 | 0,2695 | 0,0157 | |||||

| US23529CAA53 / City of Dallas Housing Finance Corp. | 7,27 | -7,41 | 0,2659 | 0,0048 | |||||

| US12574WAJ99 / CMFA Special Finance Agency | 7,26 | -7,44 | 0,2656 | 0,0047 | |||||

| US00832UAA51 / AFFORDABLE HSG TAX-EXEMPT BOND PASS-THRU TRUST | 7,25 | -4,60 | 0,2650 | 0,0125 | |||||

| US928106AR46 / VIRGINIA ST SMALL BUSINESS FING AUTH SOL WST DISP FAC REVENU | 7,23 | -0,58 | 0,2645 | 0,0227 | |||||

| US13013FAU84 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 7,16 | -12,07 | 0,2620 | -0,0089 | |||||

| US02936TAB70 / American Samoa (Territory of) Economic Development Authority, Series 2015 A, Ref. RB | 7,14 | -0,71 | 0,2612 | 0,0220 | |||||

| US64542UDW18 / New Hope Cultural Education Facilities Finance Corp. (Longhorn Village), Series 2017, Ref. RB | 7,12 | -5,31 | 0,2602 | 0,0104 | |||||

| US64577QAG64 / New Jersey Economic Development Authority, Energy Facilities Revenue Bonds, UMM Energy Partners, LLC Project, Series 2012A | 7,11 | -5,32 | 0,2602 | 0,0103 | |||||

| US10604PAE34 / Brazoria County Industrial Development Corp | 7,07 | -2,19 | 0,2585 | 0,0182 | |||||

| US23409VFM72 / DAKOTA CNTY MN CMNTY DEV AGY MF HSG REVENUE | 7,04 | -5,88 | 0,2574 | 0,0087 | |||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HQ22) | 7,01 | -4,89 | 0,2563 | 0,0113 | |||||

| US198409AF10 / COLUMBIA SC HSG AUTH MF HSG REVENUE | 7,00 | -5,49 | 0,2558 | 0,0097 | |||||

| US574296CR87 / Maryland Stadium Authority | 6,98 | -23,44 | 0,2552 | -0,0479 | |||||

| US126292AS08 / CSCDA Community Improvement Authority | 6,89 | -8,12 | 0,2520 | 0,0026 | |||||

| US74447DAC11 / PUBLIC FIN AUTH WI HOTEL REVENUE | 6,87 | -7,04 | 0,2511 | 0,0055 | |||||

| NATIONAL FIN AUTH NH SPL REVENUE / DBT (US63608TAC45) | 6,84 | -1,01 | 0,2500 | 0,0204 | |||||

| NATIONAL FIN AUTH NH SPL REVENUE / DBT (US63608TAC45) | 6,84 | -1,01 | 0,2500 | 0,0204 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PB613) | 6,79 | -1,15 | 0,2485 | 0,0200 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PB613) | 6,79 | -1,15 | 0,2485 | 0,0200 | |||||

| US126292BR16 / CSCDA Community Improvement Authority | 6,78 | -6,46 | 0,2478 | 0,0069 | |||||

| US01630QAA67 / ALIGN CAP SER 2022-1 TRUST VIRGINIA | 6,72 | -7,22 | 0,2456 | 0,0049 | |||||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 6,67 | 3,11 | 0,2440 | 0,0288 | |||||

| US499534AC96 / Knox County Industrial Development Board, Series 2022, RB | 6,56 | -2,89 | 0,2400 | 0,0153 | |||||

| US74441XHQ51 / PUBLIC FIN AUTH WI MF HSG REVENUE | 6,55 | -1,95 | 0,2396 | 0,0174 | |||||

| US172967PC98 / Citigroup, Inc. | 6,51 | -0,32 | 0,2381 | 0,0209 | |||||

| US649519DA03 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 1, Ref. RB | 6,49 | -29,37 | 0,2375 | -0,0682 | |||||

| US14052WDN48 / CAPITAL TRUST AGY FL REVENUE | 6,47 | -41,47 | 0,2367 | -0,1310 | |||||

| US49126TAJ16 / KENTUCKY ST ECON DEV FIN AUTH HLTH CARE REVENUE | 6,44 | -2,73 | 0,2354 | 0,0154 | |||||

| NEVADA DEPT OF BUSINESS & INDUSTRY NV REVENUE / DBT (US641455AB65) | 6,41 | -5,15 | 0,2346 | 0,0097 | |||||

| NEVADA DEPT OF BUSINESS & INDUSTRY NV REVENUE / DBT (US641455AB65) | 6,41 | -5,15 | 0,2346 | 0,0097 | |||||

| US03717PAA03 / ANTIOCH VLG IL SPL SVC AREAS NO 1 & 2 SPL TAX | 6,29 | -2,48 | 0,2300 | 0,0156 | |||||

| US452152GS43 / Illinois, General Obligation Bonds, Taxable Build America Bonds | 6,25 | -2,77 | 0,2285 | 0,0148 | |||||

| US97689REQ39 / WISCONSIN ST HSG & ECON DEV AUTH MF HSG | 6,22 | -5,85 | 0,2276 | 0,0078 | |||||

| FAYETTE CNTY GA DEV AUTH REVENUE / DBT (US31222PAX96) | 6,14 | -5,05 | 0,2247 | 0,0095 | |||||

| FAYETTE CNTY GA DEV AUTH REVENUE / DBT (US31222PAX96) | 6,14 | -5,05 | 0,2247 | 0,0095 | |||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HW99) | 6,02 | 183,75 | 0,2203 | 0,1497 | |||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HW99) | 6,02 | 183,75 | 0,2203 | 0,1497 | |||||

| US74514L4D67 / PUERTO RICO CMWLTH | 5,88 | -4,71 | 0,2152 | 0,0099 | |||||

| US04877YAA55 / Atlantic Park Community Development Authority, Virginia, Revenue Bonds, Series 2023 | 5,84 | -5,47 | 0,2136 | 0,0082 | |||||

| OKLAHOMA ST TURNPIKE AUTH / DBT (US679111F415) | 5,79 | -4,52 | 0,2116 | 0,0101 | |||||

| US90355QAA22 / US BANK TRUST CO NA VA | 5,76 | -8,47 | 0,2106 | 0,0014 | |||||

| US15200XAF06 / Centerra Metropolitan District 1, Loveland, Colorado, Special Revenue Bonds, Refunding & Improvement Series 2017 | 5,71 | -0,45 | 0,2087 | 0,0181 | |||||

| LOUISIANA PUB FACS AUTH REVENUE / DBT (US546399SZ00) | 5,67 | 4,32 | 0,2075 | 0,0266 | |||||

| LOUISIANA PUB FACS AUTH REVENUE / DBT (US546399SZ00) | 5,67 | 4,32 | 0,2075 | 0,0266 | |||||

| US126292AM38 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 5,54 | -7,48 | 0,2025 | 0,0035 | |||||

| ILLINOIS ST HSG DEV AUTH MF HSG REVENUE / DBT (US45203LES88) | 5,53 | -5,08 | 0,2021 | 0,0085 | |||||

| ILLINOIS ST HSG DEV AUTH MF HSG REVENUE / DBT (US45203LES88) | 5,53 | -5,08 | 0,2021 | 0,0085 | |||||

| US494794FC97 / King County Public Hospital District No. 4 | 5,52 | -3,21 | 0,2020 | 0,0123 | |||||

| US74526QKX96 / PUERTO RICO ELEC PWR AUTH PWR REVENUE | 5,49 | -2,02 | 0,2007 | 0,0145 | |||||

| US74526QVX77 / Puerto Rico (Commonwealth of) Electric Power Authority, Series 2010 XX, RB | 5,48 | -2,02 | 0,2005 | 0,0145 | |||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HA79) | 5,47 | -3,95 | 0,1999 | 0,0107 | |||||

| US74442PA961 / PUBLIC FIN AUTH WI REVENUE | 5,40 | -5,71 | 0,1976 | 0,0071 | |||||

| US74442PA888 / PUBLIC FIN AUTH WI REVENUE | 5,40 | -5,76 | 0,1974 | 0,0070 | |||||

| US837031F570 / SOUTH CAROLINA ST JOBS-ECON DEV AUTH ECON DEV REVENUE | 5,37 | -3,31 | 0,1964 | 0,0117 | |||||

| US251093S844 / City of Detroit MI | 5,35 | 1,58 | 0,1956 | 0,0205 | |||||

| US889259AL17 / TOLEDO-LUCAS CNTY OH PORT AUTH PARKING SYS REVENUE | 5,34 | -15,94 | 0,1953 | -0,0159 | |||||

| US167505QP42 / CHICAGO IL BRD OF EDU | 5,33 | -1,52 | 0,1948 | 0,0150 | |||||

| US788400AA79 / Saint Croix Chippewa Indians of Wisconsin, Revenue Bonds, Refunding Senior Series 2021 | 5,32 | -6,04 | 0,1946 | 0,0063 | |||||

| US09182TCH86 / Black Belt Energy Gas District, Alabama, Gas PrePay Revenue Bonds, Project 7 Series 2022C-2 | 5,31 | -1,03 | 0,1941 | 0,0158 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JH15) | 5,28 | -7,24 | 0,1932 | 0,0038 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JH15) | 5,28 | -7,24 | 0,1932 | 0,0038 | |||||

| US167505ZG42 / CHICAGO IL BRD OF EDU | 5,22 | -3,44 | 0,1908 | 0,0112 | |||||

| US745160SJ13 / Puerto Rico Commonwealth Aqueduct & Sewer Authority | 5,21 | -6,63 | 0,1906 | 0,0050 | |||||

| US463794KH90 / IRVING TX HOSP AUTH | 5,21 | -3,47 | 0,1904 | 0,0111 | |||||

| US167505ZF68 / CHICAGO IL BRD OF EDU | 5,19 | -3,39 | 0,1899 | 0,0112 | |||||

| US45528U6X43 / Indianapolis Local Public Improvement Bond Bank | 5,18 | -3,41 | 0,1894 | 0,0111 | |||||

| US167505RM02 / CHICAGO IL BRD OF EDU | 5,12 | -2,64 | 0,1872 | 0,0124 | |||||

| US903768AG41 / ULSTER CNTY NY CAPITAL RESOURCE CORP REVENUE | 5,10 | -5,12 | 0,1864 | 0,0078 | |||||

| US45528U7K13 / INDIANAPOLIS IN LOCAL PUBLIC IMPT BOND BANK | 5,09 | -4,33 | 0,1860 | 0,0093 | |||||

| BROOKLYN PARK MN MF HSG REVENUE / DBT (US11423TAB89) | 5,03 | -3,07 | 0,1838 | 0,0114 | |||||

| BROOKLYN PARK MN MF HSG REVENUE / DBT (US11423TAB89) | 5,03 | -3,07 | 0,1838 | 0,0114 | |||||

| US491312EQ34 / KENTUCKY ST HSG CORP MF REVENUE | 5,02 | -4,55 | 0,1834 | 0,0087 | |||||

| COLBY KS HOSP LOAN ANTICIPATION REV / DBT (US19277TAA07) | 5,01 | -0,22 | 0,1831 | 0,0163 | |||||

| COLBY KS HOSP LOAN ANTICIPATION REV / DBT (US19277TAA07) | 5,01 | -0,22 | 0,1831 | 0,0163 | |||||

| US126292AH43 / CSCDA Community Improvement Authority | 5,01 | -8,38 | 0,1831 | 0,0014 | |||||

| FLORIDA ST DEV FIN CORP SOL WST DISP REVENUE / DBT (US34061XAG79) | 4,98 | -1,58 | 0,1820 | 0,0139 | |||||

| FLORIDA ST DEV FIN CORP SOL WST DISP REVENUE / DBT (US34061XAG79) | 4,98 | -1,58 | 0,1820 | 0,0139 | |||||

| LOUISIANA PUB FACS AUTH REVENUE / DBT (US546399TA40) | 4,97 | -18,98 | 0,1817 | -0,0222 | |||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HM18) | 4,97 | -4,81 | 0,1816 | 0,0081 | |||||

| US45470CAE93 / Indiana Finance Authority | 4,96 | 0,38 | 0,1815 | 0,0171 | |||||

| US74529JRJ69 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 4,91 | -6,49 | 0,1797 | 0,0050 | |||||

| US126292BQ33 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 4,91 | -7,18 | 0,1797 | 0,0037 | |||||

| US735389J338 / Seattle (Port of), WA, Series 2019, RB | 4,88 | -6,50 | 0,1784 | 0,0049 | |||||

| US74442PMU65 / PUB FIN AUTH W 5% 10/1/2039 | 4,86 | -5,21 | 0,1777 | 0,0073 | |||||

| COLUMBUS MN MF HSG REVENUE / DBT (US19934QAA13) | 4,86 | -4,91 | 0,1776 | 0,0078 | |||||

| COLUMBUS MN MF HSG REVENUE / DBT (US19934QAA13) | 4,86 | -4,91 | 0,1776 | 0,0078 | |||||

| US74442PSG18 / PUBLIC FIN AUTH WI REVENUE | 4,85 | -5,55 | 0,1773 | 0,0066 | |||||

| GTR ORLANDO FL AVIATION AUTH ARPT FACS REVENUE / DBT (US392275FG30) | 4,82 | -4,00 | 0,1764 | 0,0093 | |||||

| GTR ORLANDO FL AVIATION AUTH ARPT FACS REVENUE / DBT (US392275FG30) | 4,82 | -4,00 | 0,1764 | 0,0093 | |||||

| US167505UY03 / CHICAGO IL BRD OF EDU | 4,82 | -2,13 | 0,1761 | 0,0125 | |||||

| US592250AQ78 / Met Pier & Exposition Auth Il Proj Bds Callable Bond DBT | 4,81 | -15,31 | 0,1760 | -0,0129 | |||||

| US524292AR05 / LEES SUMMIT MO INDL DEV AUTH SENIOR LIVING FACS REVENUE | 4,81 | -8,50 | 0,1760 | 0,0011 | |||||

| US13033DAC92 / California Housing Finance, Class A | 4,80 | -1,82 | 0,1755 | 0,0130 | |||||

| PUERTO RICO CMWLTH / DBT (US74514L4E41) | 4,79 | -0,91 | 0,1752 | 0,0145 | |||||

| PUERTO RICO CMWLTH / DBT (US74514L4E41) | 4,79 | -0,91 | 0,1752 | 0,0145 | |||||

| US594751AM15 / MICHIGAN TOBACCO SETTLEMENT FINANCE AUTHORITY | 4,77 | -15,91 | 0,1746 | -0,0142 | |||||

| US44952RAB24 / I-470 Western Gateway Transportation Development District, Series 2019 A, RB | 4,76 | -4,87 | 0,1742 | 0,0077 | |||||

| BROOKLYN PARK MN MF HSG REVENUE / DBT (US11423TAC62) | 4,75 | -5,45 | 0,1739 | 0,0067 | |||||

| BROOKLYN PARK MN MF HSG REVENUE / DBT (US11423TAC62) | 4,75 | -5,45 | 0,1739 | 0,0067 | |||||

| US254842BE65 / District of Columbia Tobacco Settlement Financing Corp, Series 2006 D, RB | 4,73 | -8,66 | 0,1732 | 0,0008 | |||||

| US64542UGH14 / NHPFAC 6.875 10/1/2057 | 4,73 | -7,09 | 0,1730 | 0,0037 | |||||

| US44237NHW56 / Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Refunding Series 2015 | 4,72 | -0,04 | 0,1725 | 0,0156 | |||||

| TULSA OK MUNI ARPT TRUST TRUSTEES / DBT (US899661EM05) | 4,65 | 0,1701 | 0,1701 | ||||||

| US84136FBT30 / Southeast Energy Authority A Cooperative District | 4,65 | -9,72 | 0,1699 | -0,0012 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PF671) | 4,60 | 134,85 | 0,1681 | 0,1030 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PF671) | 4,60 | 134,85 | 0,1681 | 0,1030 | |||||

| US073201AD74 / BAYTOWN MUNI DEV DIST TX | 4,58 | -6,34 | 0,1676 | 0,0049 | |||||

| US13013FBH64 / California Community Housing Agency | 4,56 | -6,53 | 0,1669 | 0,0045 | |||||

| US167570TK69 / CHICAGO IL MF HSG REVENUE | 4,54 | -3,59 | 0,1660 | 0,0095 | |||||

| US64578CBW01 / New Jersey Economic Development Authority, Special Facilities Revenue Bonds, Continental Airlines Inc, Series 2000A & 2000B | 4,53 | -0,09 | 0,1656 | 0,0149 | |||||

| US118217DA38 / BUCKEYE OH TOBACCO SETTLEMENT FING AUTH | 4,47 | -10,09 | 0,1636 | -0,0018 | |||||

| MOBILE CNTY AL INDL DEV AUTH SOL WST DISP REVENUE / DBT (US60733UAB70) | 4,46 | -8,64 | 0,1632 | 0,0008 | |||||

| MOBILE CNTY AL INDL DEV AUTH SOL WST DISP REVENUE / DBT (US60733UAB70) | 4,46 | -8,64 | 0,1632 | 0,0008 | |||||

| US45528U7L95 / Indianapolis Local Public Improvement Bond Bank | 4,44 | -3,31 | 0,1622 | 0,0097 | |||||

| US939783QX70 / Washington State Housing Finance Commission, Revenue Bonds, Riverview Retirement Community, Refunding Series 2012 | 4,44 | -8,93 | 0,1622 | 0,0002 | |||||

| US396484AA54 / GREENVILLE SC HSG AUTH RSDL DEV REVENUE | 4,42 | -7,20 | 0,1617 | 0,0033 | |||||

| US888805CJ51 / TOBACCO SETTLEMENT AUTH IA TOBACCO SETTLEMENT REVENUE | 4,41 | 55,63 | 0,1614 | 0,0671 | |||||

| US45470ECC75 / INDIANA FIN AUTH EDUCTNL FACS REVENUE | 4,39 | -7,66 | 0,1605 | 0,0025 | |||||

| US68450LGM19 / ORANGE CNTY FL HLTH FACS AUTH REVENUE | 4,38 | -7,96 | 0,1603 | 0,0020 | |||||

| US12574VAA08 / CMFA SPL FIN AGY VIII CA ESSENTIAL HSG REVENUE | 4,37 | -8,00 | 0,1598 | 0,0019 | |||||

| US972178AD92 / WILSON CNTY TN HLTH & EDUCTNL FACS BRD MF REVENUE | 4,35 | -6,08 | 0,1592 | 0,0051 | |||||

| US40065HDV96 / Guam (Territory of) (Section 30), Series 2016 A, Ref. RB | 4,31 | -2,29 | 0,1576 | 0,0109 | |||||

| US60527MBB46 / MISSISSIPPI ST BUSINESS FIN CORP SOL WST DISP REVENUE | 4,29 | 0,51 | 0,1570 | 0,0150 | |||||

| US837031D914 / South Carolina Jobs-Economic Development Authority, Economic Development Revenue Bonds, Patriots Place Apartments Project, Series 2022A-1 | 4,29 | -7,26 | 0,1570 | 0,0031 | |||||

| US4624607S97 / IOWA ST HGR EDU LOAN AUTH | 4,28 | -7,50 | 0,1565 | 0,0027 | |||||

| US12008EGJ91 / Build New York City Resource Corporation, New York, Revenue Bonds, Metropolitan College of New York, Series 2014 | 4,23 | 0,00 | 0,1547 | 0,0140 | |||||

| US12008ELT19 / BUILD NYC RESOURCE CORP NY REVENUE | 4,21 | -0,36 | 0,1538 | 0,0135 | |||||

| US13013FAR55 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 4,19 | -8,38 | 0,1532 | 0,0012 | |||||

| US92810TAA16 / Virginia Small Business Financing Authority, Sports and Entertainment Facilities Revenue Bonds, P3 VB Holdings LLC, Senior Series 2023A | 4,18 | -6,82 | 0,1530 | 0,0037 | |||||

| US524292BH14 / LEES SUMMIT MO INDL DEV AUTH SENIOR LIVING FACS REVENUE | 4,17 | -10,39 | 0,1527 | -0,0022 | |||||

| US70868YAZ25 / Pennsylvania Economic Development Financing Authority | 4,13 | -4,47 | 0,1509 | 0,0073 | |||||

| US12574WAA80 / CMFA SPL FIN AGY CA ESSENTIAL HSG REVENUE | 4,12 | -7,12 | 0,1507 | 0,0032 | |||||

| US126292BU45 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 4,11 | 11,44 | 0,1503 | 0,0277 | |||||

| SUFFOLK REGL OFF-TRACK BETTING CORP NY REV / DBT (US86480TAC80) | 4,09 | -1,47 | 0,1495 | 0,0116 | |||||

| SUFFOLK REGL OFF-TRACK BETTING CORP NY REV / DBT (US86480TAC80) | 4,09 | -1,47 | 0,1495 | 0,0116 | |||||

| US56681NCW56 / MARICOPA CNTY AZ INDL DEV AUTH EDU REVENUE | 4,07 | -1,86 | 0,1488 | 0,0109 | |||||

| US74526QKW14 / Puerto Rico Elec Pwr Auth Bond Long Muni | 4,06 | -2,03 | 0,1483 | 0,0107 | |||||

| 49126KGR6 / Kentucky Economic Dev Fin Auth Rev Bds 5.00 6/1/2018 Bond | 4,06 | -1,67 | 0,1483 | 0,0112 | |||||

| US126292AN11 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 4,03 | -6,39 | 0,1473 | 0,0042 | |||||

| COLORADO EDUCTNL & CULTURAL AUTH REVENUE / DBT (US19645UQZ02) | 4,02 | -2,64 | 0,1470 | 0,0097 | |||||

| COLORADO EDUCTNL & CULTURAL AUTH REVENUE / DBT (US19645UQZ02) | 4,02 | -2,64 | 0,1470 | 0,0097 | |||||

| NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE / DBT (US64542PGF62) | 4,02 | -3,00 | 0,1469 | 0,0092 | |||||

| NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE / DBT (US64542PGF62) | 4,02 | -3,00 | 0,1469 | 0,0092 | |||||

| US74441XHR35 / PUBLIC FIN AUTH WI MF HSG REVENUE | 4,02 | -3,18 | 0,1469 | 0,0090 | |||||

| US45130CAB72 / IDAHO HOUSING & FINANCE ASSOCIATION | 4,01 | -0,02 | 0,1465 | 0,0133 | |||||

| US23529CAB37 / City of Dallas Housing Finance Corp. | 4,00 | -16,43 | 0,1463 | -0,0128 | |||||

| US283590GS00 / EL PASO CNTY TX HOSP DIST | 4,00 | -0,77 | 0,1462 | 0,0122 | |||||

| US13016NFC39 / MUNI. ZERO | 3,99 | -10,59 | 0,1460 | -0,0025 | |||||

| US80329UBC27 / SARASOTA CNTY FL HLTH FACS AUTH RETMNT FAC REVENUE | 3,99 | -10,21 | 0,1458 | -0,0018 | |||||

| US74526QVC31 / Puerto Rico Electric Power Authority | 3,98 | -2,02 | 0,1455 | 0,0105 | |||||

| US745160TE17 / PUERTO RICO CMWLTH AQUEDUCT &SWR AUTH REVENUE | 3,95 | -2,27 | 0,1446 | 0,0101 | |||||

| US939783TJ59 / WASHINGTON ST HSG FIN COMMISSION | 3,94 | -8,73 | 0,1441 | 0,0005 | |||||

| PUB FIN AUTH WI TAX INCREMENT REVNUE / DBT (US74448EAA29) | 3,93 | -5,23 | 0,1438 | 0,0058 | |||||

| PUB FIN AUTH WI TAX INCREMENT REVNUE / DBT (US74448EAA29) | 3,93 | -5,23 | 0,1438 | 0,0058 | |||||

| US810694K816 / SCRANTON-LACKAWANNA PA HLTH & WELFARE AUTH | 3,92 | -4,16 | 0,1434 | 0,0074 | |||||

| US126292BD20 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 3,89 | -11,18 | 0,1424 | -0,0034 | |||||

| US11861MBM73 / BUCKS CNTY PA INDL DEV AUTH HOSP REVENUE | 3,87 | -10,17 | 0,1415 | -0,0017 | |||||

| US903768AD10 / ULSTER CNTY NY CAPITAL RESOURCE CORP REVENUE | 3,83 | -1,80 | 0,1399 | 0,0104 | |||||

| VANCOUVER WA HSG AUTH / DBT (US921626PU57) | 3,78 | 0,1384 | 0,1384 | ||||||

| VANCOUVER WA HSG AUTH / DBT (US921626PU57) | 3,78 | 0,1384 | 0,1384 | ||||||

| US13033DAE58 / CALIFORNIA HSG FIN AGY MUNI CTFS | 3,77 | -5,20 | 0,1380 | 0,0056 | |||||

| US71781PBL31 / PHILADELPHIA PA AUTH FOR INDL REGD OID B/E 6.62500000 | 3,77 | -2,76 | 0,1378 | 0,0090 | |||||

| ARIZONA ST INDL DEV AUTH SENIOR LIVING REVENUE / DBT (US04052TDL61) | 3,76 | 0,1374 | 0,1374 | ||||||

| ARIZONA ST INDL DEV AUTH SENIOR LIVING REVENUE / DBT (US04052TDL61) | 3,76 | 0,1374 | 0,1374 | ||||||

| US45505VAE65 / INDIANA ST FIN AUTH POLL CONTROL REVENUE | 3,74 | 0,30 | 0,1367 | 0,0128 | |||||

| US225004AR16 / Crawford (County of), PA Hospital Authority | 3,69 | -1,05 | 0,1348 | 0,0110 | |||||

| US49126KKE00 / Kentucky Economic Dev Fin Auth Rev Bds 5.00 6/1/2018 Bond DBT | 3,65 | -1,54 | 0,1336 | 0,0102 | |||||

| US690278CE47 / Overland Park Development Corporation, Kansas, Revenue Bonds, Convention Center Hotel, Refunding & improvement Series 2019 | 3,64 | -5,41 | 0,1329 | 0,0051 | |||||

| US126292BT71 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 3,62 | -11,21 | 0,1324 | -0,0032 | |||||

| HOUSTON TX ARPT SYS REVENUE / DBT (US442349HY56) | 3,62 | -4,94 | 0,1323 | 0,0058 | |||||

| US842472CB66 / STHRN CA LOGISTICS ARPT AUTH | 3,62 | -0,47 | 0,1323 | 0,0115 | |||||

| SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE / DBT (US8371514C00) | 3,61 | -6,57 | 0,1321 | 0,0035 | |||||

| SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE / DBT (US8371514C00) | 3,61 | -6,57 | 0,1321 | 0,0035 | |||||

| US126292BY66 / CSCDA Community Improvement Authority | 3,58 | -7,97 | 0,1310 | 0,0016 | |||||

| US34061ULK24 / FLORIDA ST DEV FIN CORP EDUCTNL FACS REVENUE | 3,58 | -8,14 | 0,1308 | 0,0013 | |||||

| US64578CAH43 / New Jersey (State of) Economic Development Authority (Continental Airlines, Inc.), Series 1999, RB | 3,55 | -0,11 | 0,1299 | 0,0117 | |||||

| US09182TCT25 / BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE | 3,52 | -1,07 | 0,1289 | 0,0104 | |||||

| US745160TB77 / PUERTO RICO CMWLTH AQUEDUCT &SWR AUTH REVENUE | 3,51 | -0,26 | 0,1283 | 0,0113 | |||||

| US041807CE68 / Arlington Higher Education Finance Corporation, Texas, Education Revenue Bonds, Magellan International School, Series 2022 | 3,51 | -3,31 | 0,1283 | 0,0077 | |||||

| NATIONAL FIN AUTH NH SPL REVENUE / DBT (US63608TAS96) | 3,51 | 0,1282 | 0,1282 | ||||||

| NATIONAL FIN AUTH NH SPL REVENUE / DBT (US63608TAS96) | 3,51 | 0,1282 | 0,1282 | ||||||

| US72177MTM90 / Pima County Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Edkey Charter Schools Project, Refunding Series 2020 | 3,50 | 0,00 | 0,1280 | 0,0116 | |||||

| US13033DAJ46 / CALIFORNIA HSG FIN AGY MUNI CTFS | 3,47 | -2,50 | 0,1270 | 0,0086 | |||||

| US13059TCR86 / California School Finance Authority, School Facility Revenue Bonds, Alliance for College-Ready Public Schools Project, Series 2016A | 3,47 | -1,03 | 0,1269 | 0,0103 | |||||

| US49126PFG00 / KENTUCKY ST ECON DEV FIN AUTH | 3,46 | -8,00 | 0,1266 | 0,0015 | |||||

| US64542UGB44 / New Hope Cultural Education Facilities Finance Corp. | 3,44 | -10,89 | 0,1257 | -0,0026 | |||||

| US72178AAG76 / FX.RT. MUNI BOND | 3,43 | -3,32 | 0,1255 | 0,0075 | |||||

| US93978LGR15 / Washington State Housing Finance Commission, Series 2023 | 3,43 | -2,61 | 0,1254 | 0,0083 | |||||

| US64542UFR05 / EW HOPE CULTURAL ED FACS FIN C | 3,41 | -4,72 | 0,1248 | 0,0057 | |||||

| CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE / DBT (US140427CQ64) | 3,33 | -4,86 | 0,1218 | 0,0054 | |||||

| CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE / DBT (US140427CQ64) | 3,33 | -4,86 | 0,1218 | 0,0054 | |||||

| US13013JCC80 / CALIFORNIA CMNTY CHOICE FING AUTH CLEAN ENERGY PROJ REVENUE | 3,31 | -0,42 | 0,1210 | 0,0105 | |||||

| US45202HAN35 / ILLINOIS ST FIN AUTH REVENUE SOL WST REVENUE | 3,31 | -48,50 | 0,1209 | -0,0925 | |||||

| US810694L491 / SCRANTON-LACKAWANNA PA HLTH & WELFARE AUTH | 3,31 | 0,00 | 0,1209 | 0,0110 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PD361) | 3,30 | -2,62 | 0,1208 | 0,0080 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PD361) | 3,30 | -2,62 | 0,1208 | 0,0080 | |||||

| US744826AW80 / Pueblo Urban Renewal Authority | 3,30 | -1,14 | 0,1206 | 0,0097 | |||||

| US13058TEQ94 / California School Finance Authority Charter School Revenue Bonds, California, ACE Charter Schools, Obligated Group, Series 2016A | 3,27 | -8,24 | 0,1197 | 0,0011 | |||||

| US13013FBB94 / California Community Housing Agency | 3,26 | -7,80 | 0,1193 | 0,0017 | |||||

| US67884XCE58 / OKLAHOMA ST DEV FIN AUTH HLTHSYS REVENUE | 3,24 | -1,22 | 0,1184 | 0,0094 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JJ70) | 3,21 | -7,31 | 0,1173 | 0,0022 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JJ70) | 3,21 | -7,31 | 0,1173 | 0,0022 | |||||

| CHICAGO IL O'HARE INTERNATIONAL ARPT REVENUE / DBT (US1675935S79) | 3,20 | -3,03 | 0,1168 | 0,0073 | |||||

| GALLATIN CNTY MT INDL DEV REVENUE / DBT (US363671BP26) | 3,19 | 0,1168 | 0,1168 | ||||||

| GALLATIN CNTY MT INDL DEV REVENUE / DBT (US363671BP26) | 3,19 | 0,1168 | 0,1168 | ||||||

| US13048TNG49 / California Municipal Finance Authority, Revenue Bonds, Goodwill Industries of Sacramento Valley & Northern Nevada Project, Series 2012A | 3,18 | -3,82 | 0,1161 | 0,0063 | |||||

| US451295D977 / IDAHO ST HLTH FACS AUTH REVENUE | 3,15 | -3,11 | 0,1151 | 0,0071 | |||||

| NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE / DBT (US64542PGQ28) | 3,15 | -10,35 | 0,1150 | -0,0016 | |||||

| NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE / DBT (US64542PGQ28) | 3,15 | -10,35 | 0,1150 | -0,0016 | |||||

| NATIONAL FIN AUTH NH AFFORDABLE HSG CTFS / DBT (US63607DAB29) | 3,14 | -7,01 | 0,1150 | 0,0025 | |||||

| NATIONAL FIN AUTH NH AFFORDABLE HSG CTFS / DBT (US63607DAB29) | 3,14 | -7,01 | 0,1150 | 0,0025 | |||||

| US34073TMJ33 / FLORIDA ST HGR EDUCTNL FACS FINANCIAL AUTH REVENUE | 3,14 | -7,09 | 0,1149 | 0,0024 | |||||

| US36829QAA31 / GDB DEBT RECOVERY AUTH OF CMWLTH PUERTO RICO | 3,12 | -1,79 | 0,1141 | 0,0085 | |||||

| US167505QY58 / CHICAGO IL BRD OF EDU | 3,11 | -0,95 | 0,1139 | 0,0094 | |||||

| US898526FR48 / TSASC, Inc., Series 2016 B, Ref. RB | 3,10 | 59,56 | 0,1133 | 0,0487 | |||||

| US85950NAR17 / Sterling Ranch Community Authority Board | 3,10 | -2,67 | 0,1133 | 0,0075 | |||||

| US09182NCT54 / BLACK BELT ENERGY GAS DIST AL GAS SPLY REVENUE | 3,09 | -5,72 | 0,1128 | 0,0040 | |||||

| US03717PAB85 / ANTIOCH VLG IL SPL SVC AREAS NO 1 & 2 SPL TAX | 3,08 | 0,03 | 0,1127 | 0,0103 | |||||

| MIAMI-DADE CNTY FL AVIATION REVENUE / DBT (US59333P7M43) | 3,08 | -11,24 | 0,1127 | -0,0028 | |||||

| MIAMI-DADE CNTY FL AVIATION REVENUE / DBT (US59333P7M43) | 3,08 | -11,24 | 0,1127 | -0,0028 | |||||

| US14043FAE60 / CAPITAL PROJS FIN AUTH FL EDUCTNL FACS REVENUE | 3,08 | -1,06 | 0,1127 | 0,0091 | |||||

| CALIFORNIA PUBLIC FIN AUTH SENIOR LIVING REVENUE / DBT (US13057GAY52) | 3,08 | 0,1125 | 0,1125 | ||||||

| CALIFORNIA PUBLIC FIN AUTH SENIOR LIVING REVENUE / DBT (US13057GAY52) | 3,08 | 0,1125 | 0,1125 | ||||||

| US23529CAC10 / DALLAS TX HSG FIN CORP RSDL DEV REVENUE | 3,06 | -7,32 | 0,1120 | 0,0021 | |||||

| US9277817M00 / VIRGINIA ST CLG BLDG AUTH EDUCTNL FACS REVENUE | 3,06 | -5,47 | 0,1119 | 0,0043 | |||||

| US358413AB83 / FRIDLEY MN MF HSG REVENUE | 3,05 | 0,53 | 0,1115 | 0,0107 | |||||

| MINNEAPOLIS-SAINT PAUL MN MET ARPTS COMMISSION ARPT REVENUE / DBT (US603827Q414) | 3,04 | -4,31 | 0,1112 | 0,0055 | |||||

| MINNEAPOLIS-SAINT PAUL MN MET ARPTS COMMISSION ARPT REVENUE / DBT (US603827Q414) | 3,04 | -4,31 | 0,1112 | 0,0055 | |||||

| US74442PTM76 / PUBLIC FIN AUTH WI REVENUE | 3,02 | -10,68 | 0,1104 | -0,0020 | |||||

| US57584YQE22 / Massachusetts Development Finance Agency | 3,01 | -1,47 | 0,1102 | 0,0085 | |||||

| US89602RHT59 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH REVENUES | 2,99 | -12,68 | 0,1093 | -0,0045 | |||||

| US810694K998 / SCRANTON-LACKAWANNA PA HLTH & WELFARE AUTH | 2,97 | -4,28 | 0,1087 | 0,0055 | |||||

| Align Capital Series Trust 2025-1 / DBT (US01632JAA07) | 2,97 | 0,1084 | 0,1084 | ||||||

| Align Capital Series Trust 2025-1 / DBT (US01632JAA07) | 2,97 | 0,1084 | 0,1084 | ||||||

| MARICOPA CNTY AZ INDL DEV AUTH HOSP REVENUE / DBT (US56678PCH82) | 2,96 | -6,09 | 0,1083 | 0,0035 | |||||

| US67884XCK19 / OKLAHOMA DEVELOPMENT FINANCE AUTHORITY | 2,95 | -3,87 | 0,1080 | 0,0059 | |||||

| US84136FBM86 / SOUTHEAST ENERGY AUTH AL COMMODITY SPLY REVENUE | 2,95 | -1,27 | 0,1078 | 0,0085 | |||||

| US13048VBY39 / California (State of) Municipal Finance Authority (Linxs APM), Series 2018 A, RB | 2,92 | -3,82 | 0,1068 | 0,0058 | |||||

| US920286AA93 / VALPARAISO IN MF HSG REVENUE | 2,91 | -3,58 | 0,1064 | 0,0061 | |||||

| US517732DS94 / LAS VEGAS REDEVELOPMENT AGENCY | 2,90 | -3,59 | 0,1062 | 0,0061 | |||||

| US745160TF81 / PUERTO RICO CMWLTH AQUEDUCT &SWR AUTH REVENUE | 2,90 | -3,75 | 0,1061 | 0,0059 | |||||

| US60534XLP95 / MISSISSIPPI DEV BK SPL OBLIG | 2,90 | -1,36 | 0,1060 | 0,0083 | |||||

| US04108WCE03 / ARKANSAS DEVELOPMENT FINANCE AUTHORITY | 2,89 | -2,56 | 0,1058 | 0,0071 | |||||

| US50826FAB94 / Lake County, Florida Retirement Facility Revenue Bonds, Lakeside at Waterman Village Project, Series 2020A | 2,88 | -5,33 | 0,1053 | 0,0042 | |||||

| US93978HUN33 / WASHINGTON ST HLTH CARE FACS AUTH | 2,88 | -0,93 | 0,1053 | 0,0087 | |||||

| US74526QYZ98 / PUERTO RICO ELEC PWR AUTH PWR PUERTO RICO ELECTRIC POWER AUTHORITY | 2,87 | -2,01 | 0,1050 | 0,0076 | |||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAQ78) | 2,84 | -7,92 | 0,1038 | 0,0013 | |||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAQ78) | 2,84 | -7,92 | 0,1038 | 0,0013 | |||||

| PUBLIC FIN AUTH WI SPL REVENUE / DBT (US74447TAD46) | 2,82 | -0,35 | 0,1030 | 0,0090 | |||||

| PUBLIC FIN AUTH WI SPL REVENUE / DBT (US74447TAD46) | 2,82 | -0,35 | 0,1030 | 0,0090 | |||||

| US46247SBU78 / IOWA ST FIN AUTH REVENUE | 2,80 | -12,52 | 0,1023 | -0,0040 | |||||

| ARIZONA ST INDL DEV AUTH SENIOR LIVING REVENUE / DBT (US04052TDM45) | 2,78 | 0,1018 | 0,1018 | ||||||

| ARIZONA ST INDL DEV AUTH SENIOR LIVING REVENUE / DBT (US04052TDM45) | 2,78 | 0,1018 | 0,1018 | ||||||

| US53340EAB39 / LINCOLN CNTY SD ECON DEV REVENREV | 2,78 | -7,08 | 0,1018 | 0,0022 | |||||

| US71780CBH25 / PHILADELPHIA PA AUTH FOR INDL REGD B/E 4.00000000 | 2,77 | -9,35 | 0,1015 | -0,0003 | |||||

| GRAPEVINE WASH LOCAL DIST UT SPL ASSMNT / DBT (US38860FAA30) | 2,77 | -3,92 | 0,1014 | 0,0055 | |||||

| GRAPEVINE WASH LOCAL DIST UT SPL ASSMNT / DBT (US38860FAA30) | 2,77 | -3,92 | 0,1014 | 0,0055 | |||||

| US88256PAG54 / Texas Municipal Gas Acquisition & Supply Corp. IV, Series 2023 A | 2,77 | -5,03 | 0,1014 | 0,0043 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH HOSP REVENUE / DBT (US56678PCL94) | 2,77 | -6,36 | 0,1013 | 0,0029 | |||||

| US463794KE69 / IRVING TX HOSP AUTH | 2,77 | -1,32 | 0,1012 | 0,0080 | |||||

| US82169JAP84 / Shelby County Health Educational & Housing Facilities Board | 2,74 | -9,03 | 0,1002 | 0,0000 | |||||

| US165588FL35 / Chester County Industrial Development Authority, Pennsylvania, Revenue Bonds, Collegium Charter School Project, Series 2022 | 2,74 | -3,93 | 0,1001 | 0,0054 | |||||

| NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE / DBT (US64542PGP45) | 2,73 | -8,66 | 0,0999 | 0,0005 | |||||

| NEW HOPE CULTURAL EDU FACS FIN CORP TX SENIOR LIVING REVENUE / DBT (US64542PGP45) | 2,73 | -8,66 | 0,0999 | 0,0005 | |||||

| US45470DAA54 / INDIANA ST FIN AUTH EXEMPT FAC INSGEN 03/39 FIXED OID 7 | 2,71 | -0,92 | 0,0990 | 0,0081 | |||||

| US46247SBS23 / IOWA ST FIN AUTH REVENUE | 2,69 | -7,43 | 0,0985 | 0,0018 | |||||

| US45506DRA53 / INDIANA ST FIN AUTH REVENUE | 2,68 | 0,00 | 0,0978 | 0,0089 | |||||

| DIST OF COLUMBIA TAX INCR REVENUE / DBT (US254840EC17) | 2,67 | -3,22 | 0,0977 | 0,0059 | |||||

| DIST OF COLUMBIA TAX INCR REVENUE / DBT (US254840EC17) | 2,67 | -3,22 | 0,0977 | 0,0059 | |||||

| US74514L4G98 / Commonwealth of Puerto Rico | 2,66 | -5,06 | 0,0974 | 0,0041 | |||||

| US473318AA12 / JEFFERSON CNTY OH PORT AUTH ECECON DEV REVENUE | 2,66 | -7,74 | 0,0972 | 0,0014 | |||||

| UTAH ST HSG CORP MF REVENUE / DBT (US917434CS98) | 2,64 | -5,71 | 0,0966 | 0,0034 | |||||

| UTAH ST HSG CORP MF REVENUE / DBT (US917434CS98) | 2,64 | -5,71 | 0,0966 | 0,0034 | |||||

| US13013FAV67 / CALIFORNIA CMNTY HSG AGY ESSENTIAL HSG REVENUE | 2,63 | -7,00 | 0,0961 | 0,0021 | |||||

| US09182TDB08 / BLACK BELT ENE 0% 10/1/2054 | 2,62 | -10,29 | 0,0960 | -0,0013 | |||||

| PORT OF PORTLAND OR ARPT REVENUE / DBT (US7352404A89) | 2,62 | 0,0960 | 0,0960 | ||||||

| PORT OF PORTLAND OR ARPT REVENUE / DBT (US7352404A89) | 2,62 | 0,0960 | 0,0960 | ||||||

| US63607YAJ91 / New Hampshire Business Finance Authority | 2,62 | -5,31 | 0,0959 | 0,0038 | |||||

| US650116GY64 / New York Transportation Development Corp | 2,62 | -2,67 | 0,0959 | 0,0063 | |||||

| Long: BS2Z7Q6 IRS USD R V 00MSOFR IS2Z7R7 CCPOIS / Short: BS2Z7Q6 IRS USD P F 3.19400 IS2Z7Q6 CCPOIS / DIR (000000000) | 2,61 | 0,0955 | 0,0955 | ||||||

| US745160TD34 / PUERTO RICO CMWLTH AQUEDUCT &SWR AUTH REVENUE | 2,61 | -1,84 | 0,0954 | 0,0070 | |||||

| US463794KF35 / IRVING TX HOSP AUTH | 2,60 | -2,04 | 0,0949 | 0,0068 | |||||

| NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE / DBT (US646140GC19) | 2,59 | -5,48 | 0,0946 | 0,0036 | |||||

| NEW JERSEY ST TURNPIKE AUTH TURNPIKE REVENUE / DBT (US646140GC19) | 2,59 | -5,48 | 0,0946 | 0,0036 | |||||

| ENERGY S E AL A COOPERATIVE DIST ENERGY SPLY REVENUE / DBT (US292723BN27) | 2,58 | -10,63 | 0,0944 | -0,0016 | |||||

| ENERGY S E AL A COOPERATIVE DIST ENERGY SPLY REVENUE / DBT (US292723BN27) | 2,58 | -10,63 | 0,0944 | -0,0016 | |||||

| US769504AB73 / Riverwalk Metropolitan District 2, Glendale, Arapahoe County, Colorado, Special Revenue Bonds, Series 2022A | 2,58 | -7,33 | 0,0944 | 0,0018 | |||||

| US625693JN75 / MULTNOMAH CNTY OR SCH DIST #40 | 2,57 | -2,65 | 0,0940 | 0,0062 | |||||

| US49126PFH82 / KENTUCKY ST ECON DEV FIN AUTH | 2,56 | -9,15 | 0,0937 | -0,0001 | |||||

| US745160TG64 / PUERTO RICO CMWLTH AQUEDUCT &SWR AUTH REVENUE | 2,56 | -3,47 | 0,0935 | 0,0054 | |||||

| REDTAIL RIDGE MET DIST CO / DBT (US75773CAA80) | 2,55 | -1,96 | 0,0934 | 0,0068 | |||||

| REDTAIL RIDGE MET DIST CO / DBT (US75773CAA80) | 2,55 | -1,96 | 0,0934 | 0,0068 | |||||

| Bridgewater Castle Rock ALF LLC / DBT (US108623AA71) | 2,55 | -1,16 | 0,0934 | 0,0075 | |||||

| Bridgewater Castle Rock ALF LLC / DBT (US108623AA71) | 2,55 | -1,16 | 0,0934 | 0,0075 | |||||

| US52349EEL02 / LEE CNTY FL INDL DEV AUTH HLTHCR FACS REVENUE | 2,55 | -10,28 | 0,0932 | -0,0013 | |||||

| NATIONAL FIN AUTH NH SPL REVENUE / DBT (US63608TAQ31) | 2,55 | 0,0932 | 0,0932 | ||||||

| TEXAS ST MUNI GAS ACQUISITION & SPLY CORP V GAS SPLY REVENUE / DBT (US88256RAK23) | 2,53 | -76,61 | 0,0924 | -0,2667 | |||||

| TEXAS ST MUNI GAS ACQUISITION & SPLY CORP V GAS SPLY REVENUE / DBT (US88256RAK23) | 2,53 | -76,61 | 0,0924 | -0,2667 | |||||

| US56035DGC02 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 2,52 | -7,96 | 0,0922 | 0,0011 | |||||

| ATLANTA GA DEV AUTH / DBT (US04780NMX20) | 2,51 | -2,67 | 0,0919 | 0,0061 | |||||

| ATLANTA GA DEV AUTH / DBT (US04780NMX20) | 2,51 | -2,67 | 0,0919 | 0,0061 | |||||

| US74529JPV16 / Puerto Rico Sales Tax Financing Corporation, Sales Tax Revenue Bonds, Restructured 2018A-1 | 2,51 | -4,96 | 0,0919 | 0,0040 | |||||

| US649519DC68 / NEW YORK ST LIBERTY DEV CORP LIBERTY REVENUE | 2,50 | -0,16 | 0,0914 | 0,0082 | |||||

| US74442PMT92 / PUBLIC FIN AUTH WIS BDS 2019 A | 2,50 | -1,77 | 0,0914 | 0,0068 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PH321) | 2,49 | -4,71 | 0,0911 | 0,0042 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PH321) | 2,49 | -4,71 | 0,0911 | 0,0042 | |||||

| US03880NAA63 / ARC70 II TR CA | 2,49 | -5,40 | 0,0910 | 0,0035 | |||||

| BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE / DBT (US09182TEN37) | 2,48 | -77,10 | 0,0906 | -0,2692 | |||||

| BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE / DBT (US09182TEN37) | 2,48 | -77,10 | 0,0906 | -0,2692 | |||||

| KENTUCKY ST PUBLIC ENERGY AUTH GAS SPLY REVENUE / DBT (US74440DFN93) | 2,48 | -66,77 | 0,0906 | -0,1573 | |||||

| KENTUCKY ST PUBLIC ENERGY AUTH GAS SPLY REVENUE / DBT (US74440DFN93) | 2,48 | -66,77 | 0,0906 | -0,1573 | |||||

| US167505RP33 / CHICAGO IL BRD OF EDU | 2,47 | -2,98 | 0,0905 | 0,0057 | |||||

| US13013JCS33 / California Community Choice Financing Authority | 2,47 | -4,53 | 0,0902 | 0,0043 | |||||

| US903768AF67 / ULSTER CNTY NY CAPITAL RESOURCE CORP REVENUE | 2,47 | -4,82 | 0,0902 | 0,0040 | |||||

| BLOOMINGTON MN MF REVENUE / DBT (US094806BR64) | 2,43 | -5,64 | 0,0888 | 0,0032 | |||||

| CALIFORNIA CMNTY CHOICE FING AUTH CLEAN ENERGY PROJ REVENUE / DBT (US13013JEB89) | 2,41 | -12,19 | 0,0883 | -0,0031 | |||||

| CALIFORNIA CMNTY CHOICE FING AUTH CLEAN ENERGY PROJ REVENUE / DBT (US13013JEB89) | 2,41 | -12,19 | 0,0883 | -0,0031 | |||||

| US84136GAK13 / Southeast Energy Authority A Cooperative District, Series 2023 B | 2,40 | 8,24 | 0,0880 | 0,0067 | |||||

| LOS ANGELES CA DEPT OF ARPTS ARPT REVENUE / DBT (US5444452Y48) | 2,40 | 0,0879 | 0,0879 | ||||||

| LOS ANGELES CA DEPT OF ARPTS ARPT REVENUE / DBT (US5444452Y48) | 2,40 | 0,0879 | 0,0879 | ||||||

| US656178EG11 / NORMAN OK REGL HOSP AUTH HOSP REVENUE | 2,40 | -2,20 | 0,0877 | 0,0062 | |||||

| BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE / DBT (US09182TDU88) | 2,40 | -12,11 | 0,0876 | -0,0030 | |||||

| BLACK BELT ENERGY GAS DIST AL GAS PROJECT REVENUE / DBT (US09182TDU88) | 2,40 | -12,11 | 0,0876 | -0,0030 | |||||

| US56035DFC11 / Main Street Natural Gas Inc | 2,39 | -7,44 | 0,0873 | 0,0015 | |||||

| US74442PYR09 / Public Finance Authority | 2,38 | -2,38 | 0,0871 | 0,0060 | |||||

| US9277816F67 / VIRGINIA ST CLG BLDG AUTH EDUCTNL FACS REVENUE | 2,38 | -5,45 | 0,0870 | 0,0033 | |||||

| SAN FRANCISCO CALIF CITY &CNTY ARPTS COMMN INTL ARPT REV / DBT (US79766DWU98) | 2,37 | 0,0867 | 0,0867 | ||||||

| SAN FRANCISCO CALIF CITY &CNTY ARPTS COMMN INTL ARPT REV / DBT (US79766DWU98) | 2,37 | 0,0867 | 0,0867 | ||||||

| US56035DEN84 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 2,37 | -5,28 | 0,0866 | 0,0035 | |||||

| KENTUCKY ST PUBLIC ENERGY AUTH GAS SPLY REVENUE / DBT (US74440DEL47) | 2,37 | -8,72 | 0,0866 | 0,0003 | |||||

| KENTUCKY ST PUBLIC ENERGY AUTH GAS SPLY REVENUE / DBT (US74440DEL47) | 2,37 | -8,72 | 0,0866 | 0,0003 | |||||

| NATIONAL FIN AUTH NH MF AFFORDABLE HSG / DBT (US63610CAA18) | 2,36 | 0,0864 | 0,0864 | ||||||

| NATIONAL FIN AUTH NH MF AFFORDABLE HSG / DBT (US63610CAA18) | 2,36 | 0,0864 | 0,0864 | ||||||

| US56035DFT46 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 2,36 | -5,38 | 0,0862 | 0,0034 | |||||

| US499534AB14 / KNOX CNTY TN INDL DEV BRD SOL WST DISPOSAL REVENUE | 2,35 | -2,49 | 0,0858 | 0,0058 | |||||

| US71781PBP45 / PHILADELPHIA PA AUTH FOR INDL REGD OID B/E 6.50000000 | 2,34 | -2,17 | 0,0856 | 0,0060 | |||||

| US34061ULY28 / FLORIDA ST DEV FIN CORP EDUCTNL FACS REVENUE | 2,33 | -1,60 | 0,0854 | 0,0065 | |||||

| US19648FSV75 / COLORADO ST HLTH FACS AUTH HOSP REVENUE | 2,33 | -7,58 | 0,0852 | 0,0014 | |||||

| LAST STEP RECYCLING LLC / DBT (US518118AA24) | 2,31 | 0,0847 | 0,0847 | ||||||

| LAST STEP RECYCLING LLC / DBT (US518118AA24) | 2,31 | 0,0847 | 0,0847 | ||||||

| HILLSBOROUGH CNTY FL AVIATION / DBT (US432308X251) | 2,31 | -78,79 | 0,0843 | -0,2772 | |||||

| US04110FAA30 / Arkansas Development Finance Authority, Series 2022 | 2,28 | -4,27 | 0,0835 | 0,0042 | |||||

| US64542UDV35 / New Hope Cultural Education Facilities Corp. (Longhorn Village), Series 2017, RB | 2,27 | -1,48 | 0,0831 | 0,0064 | |||||

| CALIFORNIA PUBLIC FIN AUTH SENIOR LIVING REVENUE / DBT (US13057GAX79) | 2,27 | 0,0830 | 0,0830 | ||||||

| CALIFORNIA PUBLIC FIN AUTH SENIOR LIVING REVENUE / DBT (US13057GAX79) | 2,27 | 0,0830 | 0,0830 | ||||||

| US126292BG50 / CSCDA CMNTY IMPT AUTH CA ESSENTIAL HSG REVENUE | 2,27 | -8,07 | 0,0830 | 0,0009 | |||||

| US72342GAD25 / PINGREE GROVE IL SPL SVC AREA 7 SPL TAX REVENUE | 2,26 | -0,04 | 0,0825 | 0,0075 | |||||

| US80329UBB44 / SARASOTA CNTY FL HLTH FACS AUTH RETMNT FAC REVENUE | 2,24 | -8,45 | 0,0821 | 0,0006 | |||||

| US89602HDS31 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH PAYROLL MOBILITY TAX | 2,24 | -17,23 | 0,0820 | -0,0081 | |||||

| US167593Y489 / Chicago O'Hare International Airport | 2,24 | -12,70 | 0,0819 | -0,0034 | |||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAP95) | 2,24 | -6,24 | 0,0818 | 0,0025 | |||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAP95) | 2,24 | -6,24 | 0,0818 | 0,0025 | |||||

| PUERTO RICO INDL TOURIST EDUCTNL MED & ENVRNMNTL CONTROL FAC / DBT (US74528LAC54) | 2,22 | -6,67 | 0,0814 | 0,0021 | |||||

| PUERTO RICO INDL TOURIST EDUCTNL MED & ENVRNMNTL CONTROL FAC / DBT (US74528LAC54) | 2,22 | -6,67 | 0,0814 | 0,0021 | |||||

| US84136GAK13 / Southeast Energy Authority A Cooperative District, Series 2023 B | 2,22 | -13,21 | 0,0812 | -0,0039 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PG588) | 2,22 | 0,82 | 0,0812 | 0,0080 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PG588) | 2,22 | 0,82 | 0,0812 | 0,0080 | |||||

| US898526FQ64 / TSASC Inc, New York, Tobacco Asset-Backed Bonds, Series 2006 | 2,20 | -7,36 | 0,0806 | 0,0015 | |||||

| MIAMI-DADE CNTY FL AVIATION REVENUE / DBT (US593340AB83) | 2,20 | -79,57 | 0,0805 | -0,2776 | |||||

| MIAMI-DADE CNTY FL AVIATION REVENUE / DBT (US593340AB83) | 2,20 | -79,57 | 0,0805 | -0,2776 | |||||

| US353180JX15 / FRANKLIN CNTY OH HLTH CARE FACS REVENUE | 2,19 | -8,94 | 0,0801 | 0,0001 | |||||

| MASSACHUSETTS ST DEV FIN AGY REVENUE / DBT (US57585BBJ61) | 2,19 | -0,50 | 0,0800 | 0,0069 | |||||

| MASSACHUSETTS ST DEV FIN AGY REVENUE / DBT (US57585BBJ61) | 2,19 | -0,50 | 0,0800 | 0,0069 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH HOSP REVENUE / DBT (US56678PCK12) | 2,18 | -6,45 | 0,0796 | 0,0022 | |||||

| US939783TH93 / WASHINGTON ST HSG FIN COMMISSION | 2,17 | -2,30 | 0,0792 | 0,0055 | |||||

| US00344PAB58 / Abilene Convention Center Hotel Development Corp | 2,16 | -7,21 | 0,0791 | 0,0016 | |||||

| BLACK DESERT PUB INFRASTRUCTURE DIST UT SPL ASSMNT / DBT (US09204TAA97) | 2,16 | -3,28 | 0,0789 | 0,0047 | |||||

| US74442CDG69 / PUBLIC FIN AUTH WI HOSP REVENUE | 2,15 | -6,39 | 0,0788 | 0,0023 | |||||

| TULSA OK MUNI ARPT TRUST TRUSTEES / DBT (US899661EN87) | 2,15 | 0,0786 | 0,0786 | ||||||

| TULSA OK MUNI ARPT TRUST TRUSTEES / DBT (US899661EN87) | 2,15 | 0,0786 | 0,0786 | ||||||

| US12574VAB80 / CMFA Special Finance Agency VIII | 2,14 | -6,06 | 0,0783 | 0,0025 | |||||

| US837031F737 / SOUTH CAROLINA ST JOBS-ECON DEV AUTH ECON DEV REVENUE | 2,14 | -4,21 | 0,0783 | 0,0040 | |||||

| JACKSONVILLE FL TRANSPTRN AUTH LOCAL OPTION GAS TAX REVENUE / DBT (US469494CB21) | 2,14 | 0,23 | 0,0781 | 0,0073 | |||||

| JACKSONVILLE FL TRANSPTRN AUTH LOCAL OPTION GAS TAX REVENUE / DBT (US469494CB21) | 2,14 | 0,23 | 0,0781 | 0,0073 | |||||

| US010684BJ67 / ALACHUA CNTY FL HLTH FACS AUTH CCRC | 2,13 | -5,05 | 0,0778 | 0,0033 | |||||

| NEW JERSEY ST ECON DEV AUTH DOCK & WHARF FAC REVENUE / DBT (US64578TAB08) | 2,11 | 0,0771 | 0,0771 | ||||||

| NEW JERSEY ST ECON DEV AUTH DOCK & WHARF FAC REVENUE / DBT (US64578TAB08) | 2,11 | 0,0771 | 0,0771 | ||||||

| US64542UDY73 / NEW HOPE CULTURAL ED FACS FIN CORP TX RETIREMENT FAC REVENUE | 2,09 | -7,85 | 0,0764 | 0,0010 | |||||

| STAMFORD CT HSG AUTH / DBT (US852640AK71) | 2,09 | 0,0764 | 0,0764 | ||||||

| US74442PYS81 / Public Finance Authority | 2,09 | -2,39 | 0,0764 | 0,0052 | |||||

| US72178AAH59 / Industrial Development Authority of the County of Pima/The | 2,08 | -3,88 | 0,0761 | 0,0041 | |||||

| US49126TAU60 / Kentucky Economic Development Finance Authority, Kentucky, Healthcare Facilities Revenue Bonds, Rosedale Green Project, Refunding Series 2015 | 2,08 | -4,55 | 0,0759 | 0,0036 | |||||

| US378286JM18 / Glendale (City of), AZ Industrial Development Authority (The Beatitudes Campus), Series 2017, Ref. RB | 2,08 | -20,16 | 0,0759 | -0,0106 | |||||

| US45528U6W69 / Indianapolis Local Public Improvement Bond Bank | 2,07 | -3,49 | 0,0759 | 0,0044 | |||||

| US85950NAQ34 / STERLING RANCH CMNTY AUTH BRD CO SUPPORTED REVENUE | 2,07 | -2,49 | 0,0758 | 0,0051 | |||||

| LEE CNTY FL ARPT REVENUE / DBT (US523470HY13) | 2,05 | -80,90 | 0,0750 | -0,2820 | |||||

| LEE CNTY FL ARPT REVENUE / DBT (US523470HY13) | 2,05 | -80,90 | 0,0750 | -0,2820 | |||||

| US917393DD93 / UT CNTY UT HOSP 0% 5/15/2050 | 2,05 | -12,01 | 0,0750 | -0,0025 | |||||

| US56681NCV73 / Maricopa County Industrial Development Authority | 2,05 | -2,01 | 0,0749 | 0,0054 | |||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAS35) | 2,05 | -0,49 | 0,0748 | 0,0065 | |||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAS35) | 2,05 | -0,49 | 0,0748 | 0,0065 | |||||

| US34062FAC41 / FLORIDA ST DEV FIN CORP EDUCTNL FACS LEASE REVENUE | 2,04 | -3,14 | 0,0745 | 0,0046 | |||||

| US74526QWD05 / Puerto Rico Electric Power Authority | 2,03 | -2,02 | 0,0744 | 0,0054 | |||||

| CAPITAL TRUST AUTH FL EDUCTNL FACS REVENUE / DBT (US14054WAM73) | 2,03 | -2,77 | 0,0744 | 0,0048 | |||||

| US19648FWU47 / COLORADO ST HLTH FACS AUTH REVENUE | 2,03 | -11,58 | 0,0743 | -0,0021 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH EDU REVENUE / DBT (US56681NHQ34) | 2,03 | -3,11 | 0,0741 | 0,0046 | |||||

| LOS ANGELES CA DEPT OF WTR & PWR REVENUE / DBT (US544532PV00) | 2,02 | 0,0740 | 0,0740 | ||||||

| US74526QVA74 / Puerto Rico Electric Power Authority | 2,02 | -1,99 | 0,0739 | 0,0053 | |||||

| SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE / DBT (US8371514D82) | 2,02 | -6,22 | 0,0739 | 0,0022 | |||||

| SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE / DBT (US8371514D82) | 2,02 | -6,22 | 0,0739 | 0,0022 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH EDU REVENUE / DBT (US56681NHP50) | 2,02 | -3,17 | 0,0739 | 0,0045 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH EDU REVENUE / DBT (US56681NHP50) | 2,02 | -3,17 | 0,0739 | 0,0045 | |||||

| US041806HK90 / Arlington Higher Education Finance Corporation, Texas, Education Revenue Bonds, Uplift Education, Series 2016A | 2,02 | -7,43 | 0,0738 | 0,0013 | |||||

| VAIL HOME PARTNERS CORP CO HSG FACS REVENUE / DBT (US91879VAC28) | 2,02 | 0,0738 | 0,0738 | ||||||

| VAIL HOME PARTNERS CORP CO HSG FACS REVENUE / DBT (US91879VAC28) | 2,02 | 0,0738 | 0,0738 | ||||||

| US83703DAA54 / SOUTH CAROLINA JOBS-ECON DEV AUTH ENVRNMNTL IMPT REVENUE | 2,00 | -0,45 | 0,0733 | 0,0064 | |||||

| US473318AB94 / JEFFERSON CNTY OH PORT AUTH EC REGD V/R B/E AMT 5.00000000 | 2,00 | -1,62 | 0,0732 | 0,0055 | |||||

| US64578CCE93 / New Jersey (State of) Economic Development Authority (Port Newark Container Terminal LLC), Series 2017, Ref. RB | 1,99 | -2,88 | 0,0728 | 0,0046 | |||||

| US888794CA04 / Tobacco Securitization Authority of Northern California | 1,99 | -13,21 | 0,0726 | -0,0034 | |||||

| US524292AS87 / LEES SUMMIT INDUSTRIAL DEVELOP LEEFAC 08/51 FIXED 5 | 1,98 | -9,76 | 0,0723 | -0,0006 | |||||

| US650116GX81 / NEW YORK ST TRANSPRTN DEV CORP REGD OID B/E AMT AGM 5.00000000 | 1,98 | -4,26 | 0,0723 | 0,0036 | |||||

| US524292AQ22 / LEES SUMMIT MO INDL DEV AUTH SENIOR LIVING FACS REVENUE | 1,97 | -2,04 | 0,0721 | 0,0052 | |||||

| US234662DY76 / Dallas (County of), TX Flood Control District No. 1, Series 2015, Ref. GO Bonds | 1,96 | -1,16 | 0,0718 | 0,0057 | |||||

| US276519AB15 / ESTRN IL ECON DEV AUTH BUSINESS DIST | 1,96 | -4,48 | 0,0717 | 0,0034 | |||||

| US960735AS70 / CITY OF WESTMINSTER MD | 1,96 | -2,05 | 0,0717 | 0,0052 | |||||

| US93978T4N62 / Washington State Housing Finance Commission | 1,95 | -3,04 | 0,0712 | 0,0044 | |||||

| US12574WAD20 / CMFA SPL FIN AGY CA ESSENTIAL HSG REVENUE | 1,94 | -57,66 | 0,0711 | -0,0815 | |||||

| US45471CBV90 / INDIANA ST FIN AUTH HLTH FAC REVENUE | 1,94 | -5,95 | 0,0711 | 0,0024 | |||||

| US13048TTR40 / California Municipal Finance Authority Revenue (Azusa Pacific University) | 1,94 | -2,95 | 0,0710 | 0,0045 | |||||

| US929335AA53 / Wohali Public Infrastructure District 1, Utah, Special Assessment Revenue Bonds, Assessment Area 1 Series 2023 | 1,94 | -4,30 | 0,0709 | 0,0035 | |||||

| US187145RF62 / CLIFTON TX HGR EDU FIN CORP ED REGD OID B/E 6.25000000 | 1,92 | -5,42 | 0,0702 | 0,0027 | |||||

| US74440DDS09 / Kentucky Public Energy Authority | 1,91 | -7,94 | 0,0699 | 0,0009 | |||||

| US97712JED19 / Wisconsin Health & Educational Facilities Authority | 1,91 | -9,14 | 0,0698 | -0,0000 | |||||

| US762244FK28 / RHODE ISLAND ST HLTH & EDUCTNL BLDG CORP REVENUE | 1,90 | -0,47 | 0,0696 | 0,0060 | |||||

| US87539QAB59 / TANEY CNTY MO INDL DEV AUTH SALES TAX REVENUE | 1,90 | -5,47 | 0,0695 | 0,0027 | |||||

| US088570AD83 / BEXLEY CDD FL SPL ASSMNT REVENUE | 1,88 | -6,13 | 0,0689 | 0,0022 | |||||

| HAWAII ST ARPTS SYS REVENUE / DBT (US419794L429) | 1,87 | -5,11 | 0,0686 | 0,0029 | |||||

| HAWAII ST ARPTS SYS REVENUE / DBT (US419794L429) | 1,87 | -5,11 | 0,0686 | 0,0029 | |||||

| NEW YORK ST TRANSPRTN DEV CORP SPL FAC REVENUE / DBT (US650116HS87) | 1,87 | -72,98 | 0,0685 | -0,1619 | |||||

| US976595JE98 / Wisconsin Center District | 1,87 | -7,10 | 0,0684 | 0,0014 | |||||

| US45471CBT45 / INDIANA ST FIN AUTH HLTH FAC REVENUE | 1,87 | -4,79 | 0,0683 | 0,0031 | |||||

| US14052WDR51 / CAPITAL TRUST AGY FL REVENUE | 1,87 | -8,12 | 0,0683 | 0,0007 | |||||

| WOLF CREEK INFRASTRUCTURE FING DIST #1 UT SPL ASSMNT / DBT (US977695AA31) | 1,87 | 0,0682 | 0,0682 | ||||||

| WOLF CREEK INFRASTRUCTURE FING DIST #1 UT SPL ASSMNT / DBT (US977695AA31) | 1,87 | 0,0682 | 0,0682 | ||||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAR51) | 1,86 | -9,49 | 0,0680 | -0,0003 | |||||

| PORT BEAUMONT TX NAV DIST DOCK& WHARF FAC REVENUE / DBT (US73360CAR51) | 1,86 | -9,49 | 0,0680 | -0,0003 | |||||

| GRAPEVINE WASH LOCAL DIST UT / DBT (US38860EAA64) | 1,86 | -6,91 | 0,0680 | 0,0016 | |||||

| US54316AAA16 / LONGS PEAK MET DIST CO | 1,85 | -7,91 | 0,0677 | 0,0009 | |||||

| VALPARAISO IN EXEMPT FACS REVENUE / DBT (US92028RAF29) | 1,85 | -9,45 | 0,0677 | -0,0003 | |||||

| VALPARAISO IN EXEMPT FACS REVENUE / DBT (US92028RAF29) | 1,85 | -9,45 | 0,0677 | -0,0003 | |||||

| US64542UFQ22 / NEW HOPE CULTURAL ED FACS FIN CORP TX RETIREMENT FAC REVENUE | 1,85 | -1,65 | 0,0675 | 0,0051 | |||||

| US57421CBT09 / Maryland Health & Higher Educational Facilities Authority | 1,83 | -2,34 | 0,0670 | 0,0046 | |||||

| BELLWOOD IL MUNI HSG CORP MUNI HSG REVENUE / DBT (US08003AAA51) | 1,83 | -7,02 | 0,0669 | 0,0015 | |||||

| US74526QZZ89 / Puerto Rico Electric Power Authority, Power Revenue Bonds, Refunding Series 2012A | 1,83 | -1,98 | 0,0668 | 0,0048 | |||||

| US59447TM263 / MICHIGAN ST FIN AUTH REVENUE | 1,81 | -13,95 | 0,0664 | -0,0038 | |||||

| US762244FJ54 / RHODE ISLAND ST HLTH & EDUCTNL BLDG CORP REVENUE | 1,81 | -0,49 | 0,0662 | 0,0057 | |||||

| NATIONAL FIN AUTH NH SPL REVENUE / DBT (US63608TAB61) | 1,81 | -1,79 | 0,0661 | 0,0049 | |||||

| NATIONAL FIN AUTH NH SPL REVENUE / DBT (US63608TAB61) | 1,81 | -1,79 | 0,0661 | 0,0049 | |||||

| US575896TL93 / Massachusetts (State of) Port Authority, Series 2019 A, Ref. RB | 1,79 | -78,81 | 0,0656 | -0,2158 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JK44) | 1,75 | -3,16 | 0,0640 | 0,0039 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JK44) | 1,75 | -3,16 | 0,0640 | 0,0039 | |||||

| US13034AQ869 / CALIFORNIA ST INFRASTRUCTURE & ECON DEV BANK REVENUE | 1,73 | -9,56 | 0,0633 | -0,0003 | |||||

| US48504LAD55 / Kansas City Industrial Development Authority | 1,73 | -4,37 | 0,0633 | 0,0031 | |||||

| US04052BCS16 / ARIZONA ST INDL DEV AUTH EDU REVENUE | 1,73 | -8,28 | 0,0632 | 0,0005 | |||||

| US61022CAG42 / MONONGALIA CNTY WV COMMISSION SPL DIST EXCISE TAX REVENUE | 1,73 | -8,05 | 0,0631 | 0,0007 | |||||

| US12008EGK64 / BUILD NYC RESOURCE CORP NY REVENUE | 1,73 | 0,00 | 0,0631 | 0,0057 | |||||

| US649519DD42 / New York Liberty Development Corp. (3 World Trade Center), Series 2014, Class 3, Ref. RB | 1,71 | -0,12 | 0,0624 | 0,0056 | |||||

| US25113PAM77 / DETROIT MI RETIREMENT SYS FUNDING TRUST 2005 COPS | 1,70 | 6,11 | 0,0623 | 0,0089 | |||||

| US696547GK88 / Palm Beach County, Florida, Revenue Bonds, Provident Group - PBAU Properties LLC - Palm Beach Atlantic University Housing Project, Series 2019A | 1,70 | -7,85 | 0,0622 | 0,0008 | |||||

| US13059TCT43 / CALIFORNIA SCH FIN AUTH SCH FAC REVENUE | 1,70 | -3,14 | 0,0621 | 0,0038 | |||||

| US74442PAV76 / PUBLIC FIN AUTH WI REVENUE | 1,69 | -1,86 | 0,0619 | 0,0046 | |||||

| US64542UFA79 / New Hope Cultural Education Facilities Finance Corp. (Wesleyan Homes, Inc.), Series 2019, Ref. RB | 1,69 | -9,64 | 0,0617 | -0,0004 | |||||

| US463794KB21 / IRVING TX HOSP AUTH | 1,68 | -1,12 | 0,0613 | 0,0049 | |||||

| US45203KAP03 / ILLINOIS ST FIN AUTH STUDENT HSG & ACADEMIC FAC REVENUE | 1,66 | -7,41 | 0,0608 | 0,0011 | |||||

| US46247SBT06 / IOWA ST FIN AUTH REVENUE | 1,66 | -10,59 | 0,0605 | -0,0010 | |||||

| INDIANA ST FIN AUTH STUDENT HSG REVENUE / DBT (US45471FAY79) | 1,65 | -6,09 | 0,0604 | 0,0019 | |||||

| INDIANA ST FIN AUTH STUDENT HSG REVENUE / DBT (US45471FAY79) | 1,65 | -6,09 | 0,0604 | 0,0019 | |||||

| ARIZONA ST INDL DEV AUTH MF HSG REVENUE / DBT (US04062PCU30) | 1,65 | -5,73 | 0,0602 | 0,0021 | |||||

| ARIZONA ST INDL DEV AUTH MF HSG REVENUE / DBT (US04062PCU30) | 1,65 | -5,73 | 0,0602 | 0,0021 | |||||

| US74447TAA07 / Public Finance Authority | 1,64 | 1,05 | 0,0599 | 0,0060 | |||||

| US696507VL37 / Palm Beach County Health Facilities Authority | 1,63 | -8,97 | 0,0597 | 0,0001 | |||||

| US126292AY75 / CSCDA Community Improvement Authority | 1,63 | -8,07 | 0,0596 | 0,0007 | |||||

| US762244FM83 / Rhode Island Health & Educational Building Corp | 1,61 | -0,50 | 0,0588 | 0,0051 | |||||

| US14054CDA45 / CAPITAL TRUST AGY FL EDUCTNL FACS REVENUE | 1,59 | -8,26 | 0,0581 | 0,0005 | |||||

| PUBLIC FIN AUTH WI CHRT SCH REVENUE / DBT (US744396KF89) | 1,58 | -8,61 | 0,0578 | 0,0003 | |||||

| PUBLIC FIN AUTH WI CHRT SCH REVENUE / DBT (US744396KF89) | 1,58 | -8,61 | 0,0578 | 0,0003 | |||||

| WISCONSIN HLTH EDL FACS AUTH SENIOR LIVING REVENUE / DBT (US97671VCP85) | 1,57 | -8,96 | 0,0576 | 0,0001 | |||||

| WISCONSIN HLTH EDL FACS AUTH SENIOR LIVING REVENUE / DBT (US97671VCP85) | 1,57 | -8,96 | 0,0576 | 0,0001 | |||||

| US65821DTH43 / NORTH CAROLINA MEDICAL CARE COMMISSION | 1,57 | -3,14 | 0,0576 | 0,0035 | |||||

| US13048TSY00 / California Municipal Finance Authority | 1,55 | -4,31 | 0,0568 | 0,0028 | |||||

| US34061UHZ49 / Florida Development Finance Corp | 1,54 | -8,79 | 0,0562 | 0,0002 | |||||

| Long: IS1WUB4 IRS USD R V 01MMUNIP IS1WUC5 VANILLA / Short: IS1WUB4 IRS USD P F 1.12500 IS1WUB4 VANILLA / DIR (000000000) | 1,53 | 0,0559 | 0,0559 | ||||||

| Long: IS1WUB4 IRS USD R V 01MMUNIP IS1WUC5 VANILLA / Short: IS1WUB4 IRS USD P F 1.12500 IS1WUB4 VANILLA / DIR (000000000) | 1,53 | 0,0559 | 0,0559 | ||||||

| US19648FTG99 / Colorado Health Facilities Authority | 1,53 | -4,68 | 0,0559 | 0,0026 | |||||

| US903768AE92 / ULSTER CNTY NY CAPITAL RESOURCE CORP REVENUE | 1,53 | -3,72 | 0,0558 | 0,0031 | |||||

| US78669HAB69 / SAGEBRUSH FARM MET DIST #1 CO | 1,52 | -3,98 | 0,0556 | 0,0029 | |||||

| US83756DAA19 / SOUTH DAKOTA ST HSG DEV AUTH MF HSG REVENUE | 1,50 | -3,78 | 0,0549 | 0,0031 | |||||

| US312810FS85 / FAYETTEVILLE NC ST UNIV | 1,50 | -4,40 | 0,0548 | 0,0027 | |||||

| US58977PAC59 / Meridian Ranch Metropolitan District 2018, Subdistrict, El Paso County, Colorado, General Obligation Limited Tax Bonds, Series 2022 | 1,49 | -3,56 | 0,0544 | 0,0031 | |||||

| US46247SBR40 / IOWA ST FIN AUTH REVENUE | 1,49 | -7,82 | 0,0543 | 0,0007 | |||||

| US696506AT19 / PALM BEACH CNTY FL EDUCTNL FACS AUTH | 1,43 | -7,61 | 0,0524 | 0,0008 | |||||

| Long: SS31EU6 IRS USD R F 4.08750 IS31EU6 CCPOIS / Short: SS31EU6 IRS USD P V 00MSOFR IS31EV7 CCPOIS / DIR (000000000) | 1,42 | 0,0520 | 0,0520 | ||||||

| US959321AB63 / WESTERN REGL OFF-TRACK BETTING CORP REVENUE | 1,42 | -6,89 | 0,0519 | 0,0012 | |||||

| NEW JERSEY ST ECON DEV AUTH DOCK & WHARF FAC REVENUE / DBT (US64578TAA25) | 1,42 | 0,0518 | 0,0518 | ||||||

| NEW JERSEY ST ECON DEV AUTH DOCK & WHARF FAC REVENUE / DBT (US64578TAA25) | 1,42 | 0,0518 | 0,0518 | ||||||

| US09659MAS52 / Board of Managers, Joint Guadalupe County-Seguin City Hospital, Texas, Hospital Mortgage Revenue Bonds, Refunding & Improvement Series 2015 | 1,41 | -5,73 | 0,0517 | 0,0018 | |||||

| US48503SGQ66 / Kansas City (City of), MO Industrial Development Authority | 1,41 | -6,05 | 0,0517 | 0,0017 | |||||

| US92708HAK05 / Village Community Development District No. 13 | 1,41 | -9,56 | 0,0515 | -0,0003 | |||||

| US010684BK31 / ALACHUA CNTY FL HLTH FACS AUTH CCRC | 1,40 | -8,49 | 0,0513 | 0,0003 | |||||

| US759861EJ20 / Reno (City of), NV (ReTRAC - Reno Transportation Rail Access Corridor), Series 2018 C, Ref. RB | 1,40 | 9,98 | 0,0512 | 0,0089 | |||||

| US74526QYY24 / PUERTO RICO ELEC PWR AUTH PWR PUERTO RICO ELECTRIC POWER AUTHORITY | 1,39 | -2,04 | 0,0509 | 0,0037 | |||||

| US593347AH07 / MIAMI-DADE CNTY FL HSG FIN AUTH MF MTGE REVENUE | 1,39 | -8,38 | 0,0508 | 0,0004 | |||||

| US960735AQ15 / CITY OF WESTMINSTER MD | 1,39 | -7,73 | 0,0507 | 0,0008 | |||||

| Long: SS31TF6 IRS USD R F 4.08200 IS31TF6 CCPOIS / Short: SS31TF6 IRS USD P V 00MSOFR IS31TG7 CCPOIS / DIR (000000000) | 1,38 | 0,0504 | 0,0504 | ||||||

| Long: SS31TF6 IRS USD R F 4.08200 IS31TF6 CCPOIS / Short: SS31TF6 IRS USD P V 00MSOFR IS31TG7 CCPOIS / DIR (000000000) | 1,38 | 0,0504 | 0,0504 | ||||||

| US25483VUV43 / DIST OF COLUMBIA REVENUE | 1,38 | -3,84 | 0,0504 | 0,0027 | |||||

| US45204E7E21 / ILLINOIS FIN AUTH REF BDS 2019 | 1,38 | -6,01 | 0,0504 | 0,0016 | |||||

| VILLAGE CDD NO 15 SPL ASSMNT REVENUE / DBT (US92708KAK34) | 1,37 | -8,52 | 0,0503 | 0,0003 | |||||

| VILLAGE CDD NO 15 SPL ASSMNT REVENUE / DBT (US92708KAK34) | 1,37 | -8,52 | 0,0503 | 0,0003 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JD01) | 1,37 | -2,08 | 0,0500 | 0,0036 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JD01) | 1,37 | -2,08 | 0,0500 | 0,0036 | |||||

| PRCPWR / Puerto Rico Electric Power Authority | 1,37 | -2,01 | 0,0499 | 0,0036 | |||||

| US97689RER12 / WISCONSIN ST HSG & ECON DEV AUTH MF HSG | 1,37 | -5,54 | 0,0499 | 0,0019 | |||||

| US64542UFJ88 / NEW HOPE CULTURAL ED FACS FIN CORP TX RETIREMENT FAC REVENUE | 1,36 | -10,51 | 0,0498 | -0,0008 | |||||

| US646136WU13 / New Jersey (State of) Transportation Trust Fund Authority, Series 2009 A, RB | 1,36 | -7,73 | 0,0498 | 0,0007 | |||||

| US49126TAK88 / KENTUCKY ST ECON DEV FIN AUTH HLTH CARE REVENUE | 1,35 | -3,85 | 0,0494 | 0,0027 | |||||

| US696507VM10 / PALM BEACH CNTY FL HLTH FACS AUTH REVENUE | 1,35 | 2,20 | 0,0494 | 0,0054 | |||||

| US140427BJ31 / Capital Projects Finance Authority/FL | 1,35 | -0,74 | 0,0493 | 0,0041 | |||||

| Long: SS2VZV5 IRS USD R F 4.05900 IS2VZV5 CCPOIS / Short: SS2VZV5 IRS USD P V 00MSOFR IS2VZW6 CCPOIS / DIR (000000000) | 1,33 | 0,0488 | 0,0488 | ||||||

| Long: SS2VZV5 IRS USD R F 4.05900 IS2VZV5 CCPOIS / Short: SS2VZV5 IRS USD P V 00MSOFR IS2VZW6 CCPOIS / DIR (000000000) | 1,33 | 0,0488 | 0,0488 | ||||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WBE30) | 1,33 | 0,0485 | 0,0485 | ||||||

| NATIONAL FIN AUTH NH MUNI CTFS / DBT (US63607WBE30) | 1,33 | 0,0485 | 0,0485 | ||||||

| US917393DB38 / UT CNTY UT HOSP 0% 5/15/2043 | 1,33 | -13,68 | 0,0485 | -0,0026 | |||||

| US312810FQ20 / FAYETTEVILLE NC ST UNIV | 1,32 | -4,57 | 0,0481 | 0,0023 | |||||

| US924166LH25 / VERMONT ST EDUCTNL & HLTH BLDGS FING AGY REVENUE | 1,31 | -5,88 | 0,0480 | 0,0017 | |||||

| US888804AZ47 / Southern California Tobacco Securitization Authority (San Diego County Tobacco Asset Securitization Corp.), Series 2006, RB | 1,31 | -7,08 | 0,0480 | 0,0010 | |||||

| US888804CU32 / Southern California Tobacco Securitization Authority (San Diego County Asset Securitization Corp.), Series 2019, Ref. RB | 1,31 | -0,76 | 0,0479 | 0,0040 | |||||

| HOMEWOOD AL EDUCTNL BLDG AUTH REVENUE / DBT (US437887HY13) | 1,31 | -4,10 | 0,0479 | 0,0025 | |||||

| HOMEWOOD AL EDUCTNL BLDG AUTH REVENUE / DBT (US437887HY13) | 1,31 | -4,10 | 0,0479 | 0,0025 | |||||

| PUERTO RICO INDL TOURIST EDUCTNL MED & ENVRNMNTL CONTROL FAC / DBT (US74528KAA16) | 1,31 | -0,08 | 0,0478 | 0,0043 | |||||

| PUERTO RICO INDL TOURIST EDUCTNL MED & ENVRNMNTL CONTROL FAC / DBT (US74528KAA16) | 1,31 | -0,08 | 0,0478 | 0,0043 | |||||

| US126292AR25 / CSCDA Community Improvement Authority | 1,30 | -9,11 | 0,0475 | 0,0000 | |||||

| US708692BQ00 / Pennsylvania (State of) Economic Development Financing Authority (Covanta Holding Corp.), Series 2019 A, RB | 1,30 | -3,93 | 0,0474 | 0,0026 | |||||

| US74526QYC04 / Puerto Rico Electric Power Authority | 1,29 | -2,04 | 0,0473 | 0,0034 | |||||

| US111571AB19 / Broadway Station Metropolitan District No. 3, Series 2019, GO Bonds | 1,29 | -7,70 | 0,0473 | 0,0007 | |||||

| US74529JQD09 / Puerto Rico Sales Tax Financing Corp., Series 2018 A-1, RB | 1,29 | -1,53 | 0,0471 | 0,0036 | |||||

| US71781PBK57 / PHILADELPHIA PA AUTH FOR INDL DEV | 1,29 | -1,15 | 0,0470 | 0,0038 | |||||

| US167505TK28 / Chicago (City of), IL Board of Education, Series 2017 H, GO Bonds | 1,25 | 0,0459 | 0,0459 | ||||||

| US74526QWE87 / Puerto Rico Electric Power Authority | 1,25 | -2,05 | 0,0455 | 0,0033 | |||||

| US56681NAT46 / Maricopa County Industrial Development Authority, Arizona, Education Revenue Bonds, Reid Traditional School Projects, Series 2016 | 1,24 | -9,07 | 0,0455 | -0,0000 | |||||

| STAMFORD CT HSG AUTH / DBT (US852640AL54) | 1,23 | 0,0449 | 0,0449 | ||||||

| MARICOPA CNTY AZ INDL DEV AUTH HOSP REVENUE / DBT (US56678PCM77) | 1,20 | -6,23 | 0,0440 | 0,0013 | |||||

| MARICOPA CNTY AZ INDL DEV AUTH HOSP REVENUE / DBT (US56678PCM77) | 1,20 | -6,23 | 0,0440 | 0,0013 | |||||

| US74442CDH43 / PUBLIC FIN AUTH WI HOSP REVENUE | 1,20 | -7,81 | 0,0440 | 0,0006 | |||||

| US74526QA779 / Puerto Rico Electric Power Authority | 1,20 | -2,04 | 0,0439 | 0,0032 | |||||

| US59447PYU91 / MICHIGAN ST FIN AUTH REVENUE | 1,20 | 0,00 | 0,0439 | 0,0040 | |||||

| MIAMI-DADE CNTY FL AVIATION REVENUE / DBT (US59333P7L69) | 1,20 | -12,42 | 0,0439 | -0,0017 | |||||

| MIAMI-DADE CNTY FL AVIATION REVENUE / DBT (US59333P7L69) | 1,20 | -12,42 | 0,0439 | -0,0017 | |||||

| WASHINGTON ST HSG FIN COMMISSION / DBT (US93978UAA43) | 1,19 | -6,14 | 0,0436 | 0,0014 | |||||

| US23529CAD92 / DALLAS TX HSG FIN CORP RSDL DEV REVENUE | 1,19 | -6,47 | 0,0434 | 0,0012 | |||||

| FLORIDA ST DEV FIN CORP / DBT (US34062AAH41) | 1,17 | -2,98 | 0,0429 | 0,0027 | |||||

| FLORIDA ST DEV FIN CORP / DBT (US34062AAH41) | 1,17 | -2,98 | 0,0429 | 0,0027 | |||||

| US599772AC45 / Military Installation Development Authority | 1,17 | -9,82 | 0,0427 | -0,0004 | |||||

| US599772AF75 / Military Installation Development Authority | 1,16 | -8,56 | 0,0426 | 0,0002 | |||||

| US765411AB99 / Richmond Redevelopment and Housing Authority, Virginia, Multi-Family Housing Revenue Bonds, American Tobacco Apartments, Series 2017 | 1,16 | -3,88 | 0,0425 | 0,0023 | |||||

| US13013FBJ21 / California Community Housing Agency | 1,16 | -15,59 | 0,0424 | -0,0033 | |||||

| US19648FWP51 / COLORADO ST HLTH FACS AUTH REVENUE | 1,16 | -11,12 | 0,0424 | -0,0010 | |||||

| US312810FN98 / FAYETTEVILLE NC ST UNIV | 1,16 | -4,78 | 0,0423 | 0,0019 | |||||

| CAPITAL PROJS FL FIN AUTH STUDENT HSG REVENUE / DBT (US140427CK94) | 1,15 | -0,17 | 0,0421 | 0,0038 | |||||

| US837151A411 / SOUTH CAROLINA ST PUBLIC SVC AUTH REVENUE | 1,15 | -7,87 | 0,0420 | 0,0005 | |||||

| US89602HDR57 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH PAYROLL MOBILITY TAX | 1,15 | -17,32 | 0,0419 | -0,0042 | |||||

| US57584XPV72 / Massachusetts Development Finance Agency, Revenue Bonds, Emmanuel College, Series 2016A | 1,14 | -0,53 | 0,0416 | 0,0036 | |||||

| US790103AV70 / SAINT JAMES PARISH LA REVENUE | 1,13 | 7,62 | 0,0413 | 0,0064 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PF424) | 1,13 | 0,72 | 0,0412 | 0,0040 | |||||

| PUBLIC FIN AUTH WI REVENUE / DBT (US74442PF424) | 1,13 | 0,72 | 0,0412 | 0,0040 | |||||

| PUBLIC FIN AUTH WI EDU REVENUE / DBT (US74442EMS62) | 1,12 | 0,0408 | 0,0408 | ||||||

| PUBLIC FIN AUTH WI EDU REVENUE / DBT (US74442EMS62) | 1,12 | 0,0408 | 0,0408 | ||||||

| US45506CBA45 / INDIANA ST HSG & CMNTY DEV AUTH MF HSG REVENUE | 1,10 | -6,68 | 0,0404 | 0,0010 | |||||

| US731120NQ00 / POLK CNTY FL INDL DEV AUTH | 1,10 | -27,56 | 0,0404 | -0,0103 | |||||

| US11861MBJ45 / BUCKS PA HOSP 5% 7/1/2040 | 1,10 | -3,08 | 0,0404 | 0,0025 | |||||

| STAMFORD CT HSG AUTH / DBT (US852640AE12) | 1,10 | 0,0403 | 0,0403 | ||||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JL27) | 1,10 | -3,93 | 0,0403 | 0,0022 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JL27) | 1,10 | -3,93 | 0,0403 | 0,0022 | |||||